4 minute read

~ Part One: Something For Everyone ~

Five Buckets, Four Shovels, a Beach and a Map is a simplified approach to financial planning that uses drawings, charts, and a quasi-true story to help give anyone the start that they need to better plan for their financial future. The Buckets, the Shovels, the Beach and the Map are all metaphors for the various aspects of financial planning that anyone can understand. The drawings and charts are easy to understand and follow.

Financial security, as described in this book, is a combination of tax, retirement, cash flow, estate, investment and insurance planning. These concepts are linked together with the goal of protecting one’s assets throughout one’s life, while planning for a rewarding retirement once one stops working.

For most people, the idea of trying to link taxes, retirement, cash flow, insurance, estate and investments planning can be frightening and confusing. It seems like a long, complicated process and as a result most people have a dif ficult time getting started.

This approach—Five Buckets, Four Shovels, a Beach and a Map—makes financial security a visual process and creates a systematic approach to use throughout one’s life meant to protect from sudden misfortunes and save for a rewarding retirement.

Just like there are different types of beaches—those with white sand, brown sand, rocky features, and steep with cliffs to name a few of them—there are different types of people—young, old, working, retired, married with kids, married without kids, unmarried, domestic partners, etc. The concepts in this book apply to any “family unit”, regardless of circumstances or specifics.

By using the map and help from the shovels, you will learn how to fi ll and transfer sand from the various buckets during your life while protecting you and your family from sudden and unexpected events . This will enable you to live your life with the knowledge that you have created a plan that will ensure your fi nancial security.

The Five Buckets, Four Shovels, a Beach and a Map is a concept that I have used throughout my career, both personally and for my clients . It is easy to understand; easy to follow and like the tides that come in and out each day, it will give you some predictability in a very unpredictable world . A B C E

The diagram to the right gives an overview of everything covered in this book . To help get you started, let’s outline the main concepts shown in the diagram:

D

1 . The timeline at the top A shows a life span from birth to age 70+ years . It also shows that, for most people, the timeline contains periods for education, career, having a family, saving, buying, borrowing and retirement . Of course we understand that everyone’s timelines are diff erent and each plan is custom to the individual.

2 . The concept of fi nancial security B is introduced as a combination of tax planning, retirement planning, estate planning, investments, insurance, cash fl ow budgeting and other concepts. It is critical that people understand that having a solid plan for these components is vital to reaching fi nancial security.

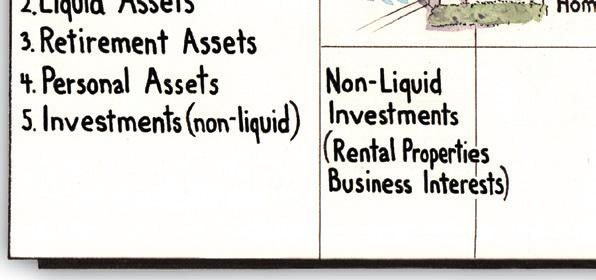

3 . The fi ve buckets D are introduced as the main categories of assets that one will acquire during their lifetime . The buckets are: Liquid Assets Bucket, Insurance Assets Bucket, Retirement Assets Bucket, Personal Assets Bucket, and Investment Assets Bucket. Not all people will use all fi ve of the buckets, but having them explained will help you properly focus on fi lling them.

4 . The shovels C include the Public Accountant Shovel, an Insurance Shovel, an Attorney Shovel, and an Investment Shovel. Obviously, throughout one’s life, other advisors such as real estate professionals and bankers will be used, as well as for the purposes of this book, but the four shovels are the key advisors .

5 . As you look at the diagram you can see that the liquid asset buckets (in the second row) are fi lled from one’s paycheck . Most of this money is spent on regular family living expenses . At the point of retirement E , the paycheck stops and the other buckets need to have accumulated assets that can be “dumped” into the liquid asset bucket to cover these ongoing expenses .

The diagram gives a very basic overview of each bucket through the timeline of one’s life. The buckets will be explained in much more detail throughout the book.

A few general thoughts before we start:

1) I am often asked when is the best time to begin the process of achieving financial security. Obviously, the earlier you start the more time you have to accumulate assets but if you haven’t started yet then the correct answer is today.

2) Another question that comes up frequently is how much money do I need to retire. My answer is a question back to them, “How long is a piece of string?” Obviously unless you go through the process of evaluating where you are and where you want to go, you won’t know.

3) Perhaps the most difficult question is where do I find competent advisors. I think this is the hardest thing to achieve. Most of us have had 50-100 teachers by the time we finish school, but few would say more than 3 or 4 were truly outstanding. Finding the right advisors is tough and we will spend some time discussing how to do that later in the book.