7 minute read

Large Tankers

Specialised tankers appear to be the only ‘highlight’ in recent deliveries

Torrid time for large tanker owners

Advertisement

Owners of big tankers have been lamenting their misfortune as operating in the sector recently has meant red figures for many, just as other sectors set new records. Despite a brief recovery in April, more misery has now set it, with earnings back in loss-making territory. They have undergone major misfortune, first with the pandemic wreaking havoc on industrial demand and transport, then Putin’s invasion of Ukraine which is causing further disruption to major global oil trades.

Not all analysts are on the same page, however. There are those who believe that China’s strict lockdown strategy will keep rates in the doldrums for months to come. The country’s March imports of crude shipped by sea were about nine million barrels a day, a 16% decline on the corresponding period in 2021. Tougher and extended lockdowns since March are expected to have worsened these numbers during April although this cannot be confirmed at the time of writing. Elsewhere, weak demand and high energy prices are likely to dampen oil demand more generally, they say.

On the other side, Putin’s invasion of Ukraine is shifting longestablished oil trades as many countries wean themselves off Russian energy and replace crude supplies with long-haul cargoes from the Middle East and the US. Recent analysis by Clarkson Research assumed a 30% decline in Russian crude exports this year and sourcing oil from other locations was estimated to boost tonne-mile numbers by 7.3%.

But the assumptions have sensitive outcomes - A greater uptake of Russian crude in Asia, for example, could limit the fall in crude exports and generate more tonne-mile growth, perhaps to 8% of more. Some analysts believe that a tanker super-cycle is likely, based on sharply higher tonnemile demand and the phasing out of large numbers of older vessels.

However, there are many potential variables including, but not limited to, the course of the pandemic in key locations, especially China - the impact of high energy prices on economic activity, the scale and frequency of stock draws, possible lifting of sanctions on Iran, uncertainty in Libya, and perhaps most importantly, Putin’s future strategy in Ukraine and how the West responds.

Against this uncertain and mostly serious unprofitable backdrop, it’s no surprise that most tanker owners have been biding their time. April rates returned to profitable levels for the first time in months, largely as a result of more long-haul crude shipped to Europe from the US Gulf, Middle East and West Africa. This pattern could continue for the rest of the year as more European countries seek to distance themselves from Russia and wind down imports from there. Meanwhile, despite stunning demo prices which until May had exceeded $600/light displacement ton on the Indian subcontinent for many weeks, recycling sales have fallen right back. A typical VLCC would have yielded an end-of-life cash bonus of $25-30m at these prices. However, Clarkson recorded only 2.2m dwt of tanker tonnage heading for the beaches between January and April. There has been very little contracting either, with the last 12 months showing the lowest level of contracting since 2009 and no new crude tankers ordered during this year’s first quarter.

Scale and muscle are particularly important in the tramp trades, and major tanker owners provide a good example of the fact that size does matter. So, a possible merger between two of the sector’s largest owners is potentially a big deal. A combination of Belgium’s Euronav, currently ranked number two in fleet size, and John Frederiksen’s Frontline, number seven, would create the world’s largest tanker owner, controlling about 7% of VLCCs and 8% of the Suezmax fleet.

At the time of writing, both companies’ executives were promoting the possible merger to shareholders some of whom were not convinced of the benefits and the mix of two different business cultures. The situation was further complicated by a move by Belgium’s CMB and its controlling Saverys family to combine Euronav and its decarbonisation setup, CMB Tech.

Euronav directors were not keen on the move and, according to reports, embarked on a drive to assure shareholders that a tie-up with Frontline made more sense. By and large, analysts also held this view, adding independent weight to the Euronav message. Brussels investment bank, DeGroof Petercam, went public and said that the proposal would phase out Euronav’s tanker business and invest instead in ammonia and hydrogen technology and ships, according to reports. The bank said it could see little merit in the plan.

There are daily developments in the merger story, and we can only provide a snapshot here. However, like other potentially high-profile transactions involving prominent shipping executives, there is probably a long way to go before the possible merger has run its course.

Safety in numbers

A combination of Belgium’s Euronav and John Frederiksen’s Frontline, would create the world’s largest tanker owner

Several deals in the older large tanker sector suggest a revival of interest in shipbreaking

Decarb drive could cut fleet capacity

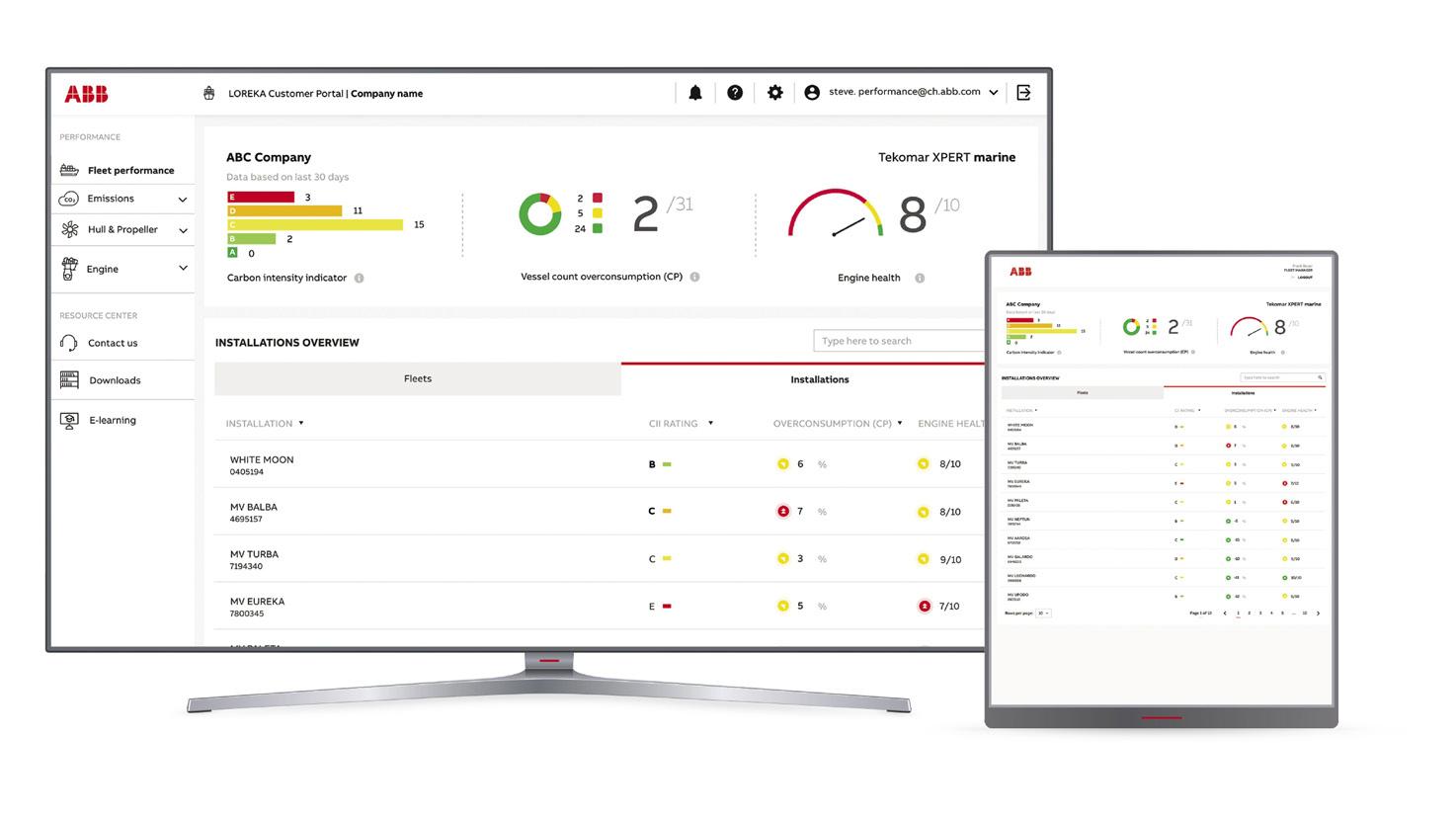

Some 67 VLCCs and 51 Suezmax tankers are more than 20 years old. A further 141 vessels and 119 ships in these respective categories lie in the 15-20 year age bracket, according to Clarkson statistics. Roughly a quarter of both these fleet sectors are more than 15 years old and most of them were built to designs developed before the introduction of IMO’s Energy Efficiency Design Index in 2013. They are unlikely to fare well when they undergo carbon intensity indicator (CII) assessments from January 2023 onwards.

Engine power limitation (EPL) is likely to be the first strategy adopted by operators to assure that their tankers fall into the three acceptable CII categories – A, B, or C. But even reducing carbon emissions by slowing down proves a suitable course of action at the outset, CII requirements will tighten steadily over the second half of the decade. Ships that are initially rated C could well fall into D or even E later in the decade.

If or when EPL fails to ensure an acceptable rating, tanker owners will be faced with a more challenging issue – whether or not to shell out for another special survey and invest in decarbonisation technologies to ensure another five years of operation. The capital investment on these large vessels would be substantial and the payback periods by this stage would be limited.

Whether or not such an investment makes sense will, of course, depend on prevailing market conditions. The recent past can offer little encouragement for tanker owners there. Although the market recovered briefly in April, with Suezmax tankers earning more than $60,000 a day over a brief spell, they had fallen again by early May while VLCC rates remained in negative territory.

However, brokers have noted growing interest in older tankers in both categories, so it is conceivable that potentially fundamental changes in the tanker trades is underpinning new optimism on the longevity of older vessels. Reports indicate that the 18-year old 159,100 dwt Suezmax, Cap Pierre, changed hands earlier this year for $21.5m. Several other deals in the older large tanker sector suggest a revival of interest.

The deals are all the more puzzling because demo rates have remained consistently high so far this year. Latest figures from the world’s largest buyer of end-of-life ships, GMS, indicate that recycling prices paid for tanker tonnage are typically around $650/light displacement ton on the Indian subcontinent and a firm $400 in Turkey.

However, European tanker owners face a conundrum. Current regulations prevent the sale of ships for recycling to buyers on the Indian subcontinent because such transactions breach regulations in the Basel Convention. These cover the export of waste from OECD countries to other nations. So perhaps the sale of older large tankers by owners in Europe is a smart strategy to bypass the disposal of such vessels when it comes time for recycling. SORJ

We supply products & solutions for all your tank management requirements.

Tank Cleaning Equipment Tank Level Gauging Gas Freeing Fan P/V Valves Electropneumatic Gauging

www.scanjet.se