Hungary Among Front Runners in ESG Regs

With the EU pushing its European Green Deal, Hungary is proving itself among the frontrunners in the process to speed up the green transition with the Hungarian National Bank (MNB) leading the charge. 13

Magyar Bankholding Pushing Sustainable Finance Agenda

András Puskás, the chief advisor to the president of Magyar Bankholding, talks to the BBJ about the leading role the lender wants to carve out for itself in the forefront of the ESG transition. 16

Charting the ESG way Forward

SOCIALITE

1st Time Release Outside Hungary for Cult Zalatnay Album

On the 50th anniversary of the original album release of Sarolta Zalatnay’s cult hit “Hadd Mondjam El” (“Let Me Tell You”), Finnish label Svart Records has put out a digitally remastered edition. 21

Automotive Industry Driving the Way Forward

The performance of the Hungarian industry in 2022 was a positive surprise; however, it was mainly the automotive sector driving the improved output. The energy crisis and the war in neighboring Ukraine still pose significant risks. 3

What makes ESG so important? What opportunities does it represent for businesses? What are the risks of failing to consider it in the short-, medium- and long-term? Gergely Ferenczi, director of Opten’s Company Information Division, gives us his take. 15

Hungarian CEOs not Planning pay Cuts or Layoffs

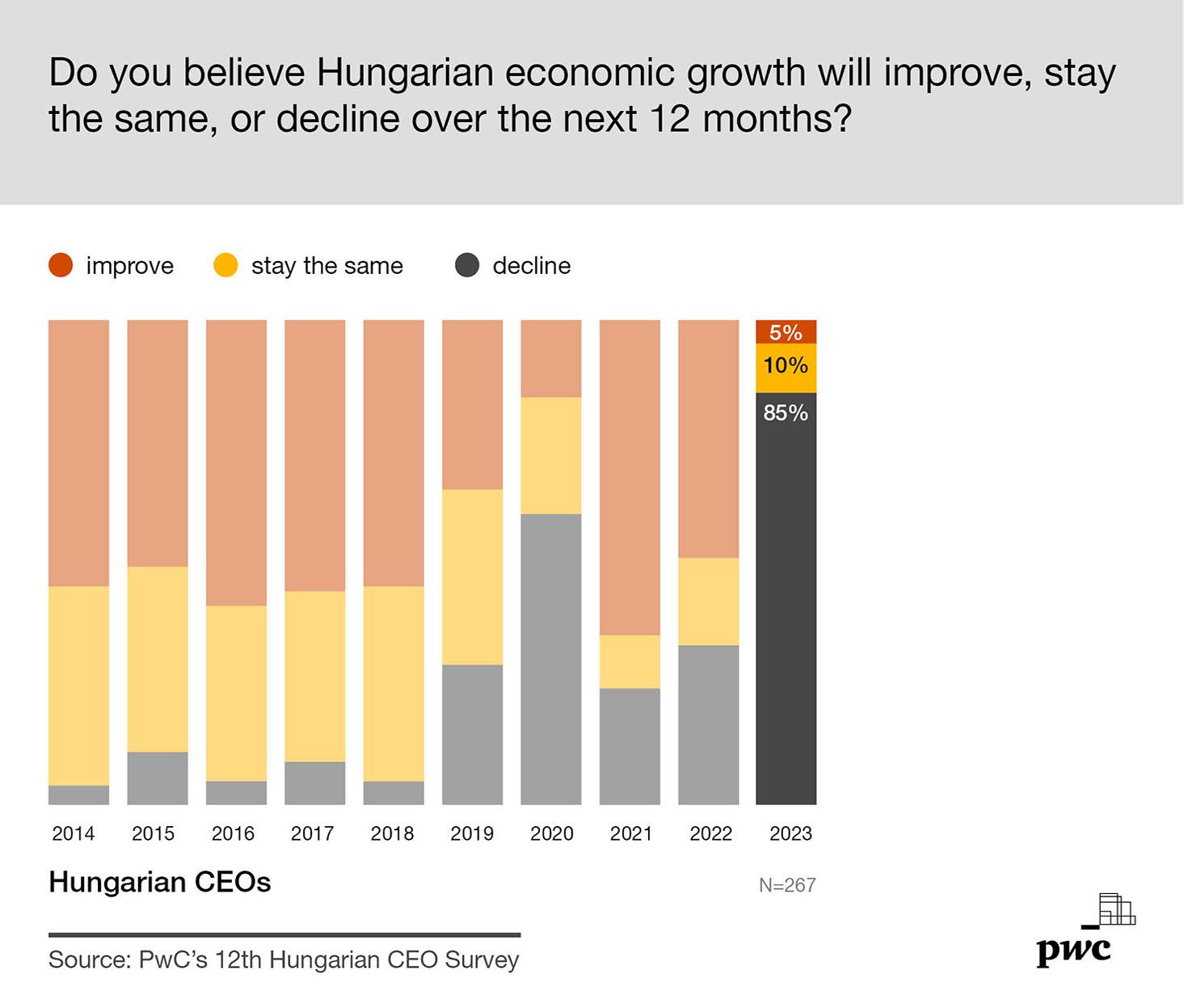

Some 85% of Hungarian CEOs predict the local economy will decline in 2023, while 76% think there will be a global slowdown. PwC’s 12th annual Hungarian CEO Survey, launched on February 8, ranks the energy crisis the top threat to economic growth. 10

NEWS BUSINESS

HUNGARY’S PRACTICAL BUSINESS BI-WEEKLY SINCE 1992 | WWW.BUDAPESTBUSINESSJOURNAL.COM HUF 2,100 | EUR 5 | USD 6 | GBP 4 VOL. 31. NUMBER 3 | FEBRUARY 10 – FEBRUARY 23, 2023 SPECIAL REPORT

ESG SPECIAL REPORT INSIDE THIS ISSUE

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Balázs Barabás, Zsófia Czifra, Kester Eddy, Bence Gaál, Gergely Herpai, David Holzer, Christian Keszthelyi, Gary J. Morrell, Nicholas Pongratz, Robert Smyth.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES: Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center 1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu

What We Stand For: The Budapest Business Journal aspires to be the most trusted newspaper in Hungary. We believe that managers should work on behalf of their shareholders. We believe that among the most important contributions a government can make to society is improving the business and investment climate so that its citizens may realize their full potential.

The Budapest Business Journal, HU ISSN 1216-7304, is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in any manner is prohibited. ©2017 BUSINESS MEDIA SERVICES LLC with all rights reserved.

CSR AND ESG MORE THAN GOOD PR

Over the years, the Budapest Business Journal must have written countless articles on what used to be called CSR, corporate and social responsibility. It was a nebulous term, hard to pin down. People intrinsically knew it was supposed to be a good thing. We knew that it often involved painting fences and furniture at orphanages or schools. Companies that professed to follow it were often greeted with outright skepticism. Long before “greenwashing” was an almost everyday term, there was the profoundly dismissive “It’s just another form of PR.” For some, CSR was about something much more, but those words had teeth because they were also, sometimes, true.

I attended my first CSR-branded events not long after arriving in Budapest, in the late Nineties and early Noughties. I recall one example of CSR I was told at the time, a tobacco company that sponsored the municipal ashtrays in the town where it was headquartered. Well, those were different days in many ways. The modern understanding of CSR probably goes back to the 1950s, but the website Thomas Insights, which publishes news and analysis “to keep our readers up to date on what’s happening in industry,” says you can trace it back to the Industrial Revolution. “In the mid-to-late 1800s, there was growing concern about worker well-being and productivity among industrialists.” So, CSR has a long history, but almost no one talks about it now.

issue. But as developers often tell us, the idea has long since moved from “nice to have” to “must have.” Increasingly, that is also the case for property investors. It is impossible to seriously consider a modern “A”-class office being built in Budapest today without at least one set of certificates, and frequently, two. To Breeam and Leed, you can add the likes of Well, dealing with office interiors and staff well-being, or Access4you, which was established in 2019 and assesses and certifies the “accessibility of businesses, stores, buildings, public spaces and the man-made environment in general,” according to its LinkedIn profile.

VISIT US ONLINE: WWW.BBJ.HU

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

For more information visit budapestbusinessjournal.com

That’s not something you could say about the third-party green certifying bodies. Breeam says it has been around since 1990. Online encyclopedia Britannica says the Leed standards were devised in 1994. Both have drawn criticism from skeptics who have dismissed them as yet more PR. In the 2010s, I sat in an office opposite a senior real estate professional who assured me no client would ever choose a green-certified office over something that was non-certified if cost were an

Although we might not talk much about CSR, it hasn’t really gone away; it has evolved to take in broader issues. Like those green certifications, it is now part of ESG. That’s another nebulous term covering environmental, social and governance matters, and one it seems we all discuss (along with sustainability), on a near-constant basis. So, it is high time that we presented our first Special Report dedicated to ESG matters, though we have long covered the themes. Indeed, so strong has been the response to it that we are already planning a second edition later this fall. If you have a story to tell or a message you want to share with your business partners or the wider world, do drop us a line. The skeptics can talk about greenwashing and debate push and pull factors. But the truth is, it doesn’t matter if business leads the way or public opinion (and investors) drag it kicking and screaming into a more sustainable future. Our health, and that of our planet, means there is no alternative; either way, we end up heading in the right direction.

Robin Marshall Editor-in-chief

THEN & NOW

2 | 1 News www.bbj.hu Budapest Business Journal | February 10 – February 23, 2023

IMPRESSUM BBJ-PARTNERS THE EDITOR SAYS

In the color photo by state news agency MTI, a model is prepared to appear at the 11th Budapest Central European Fashion Week at the ELTE University Library and Archives on February 5. The black and white image from the Fortepan public photography archive shows a woman in Hungary modeling a contemporary dress from the 1880s.

Photo by MTI / Zoltán Balogh

Photo by Fortepan / Péter Karabélyos

1News • macroscope

Automotive Industry Driving the Way Forward

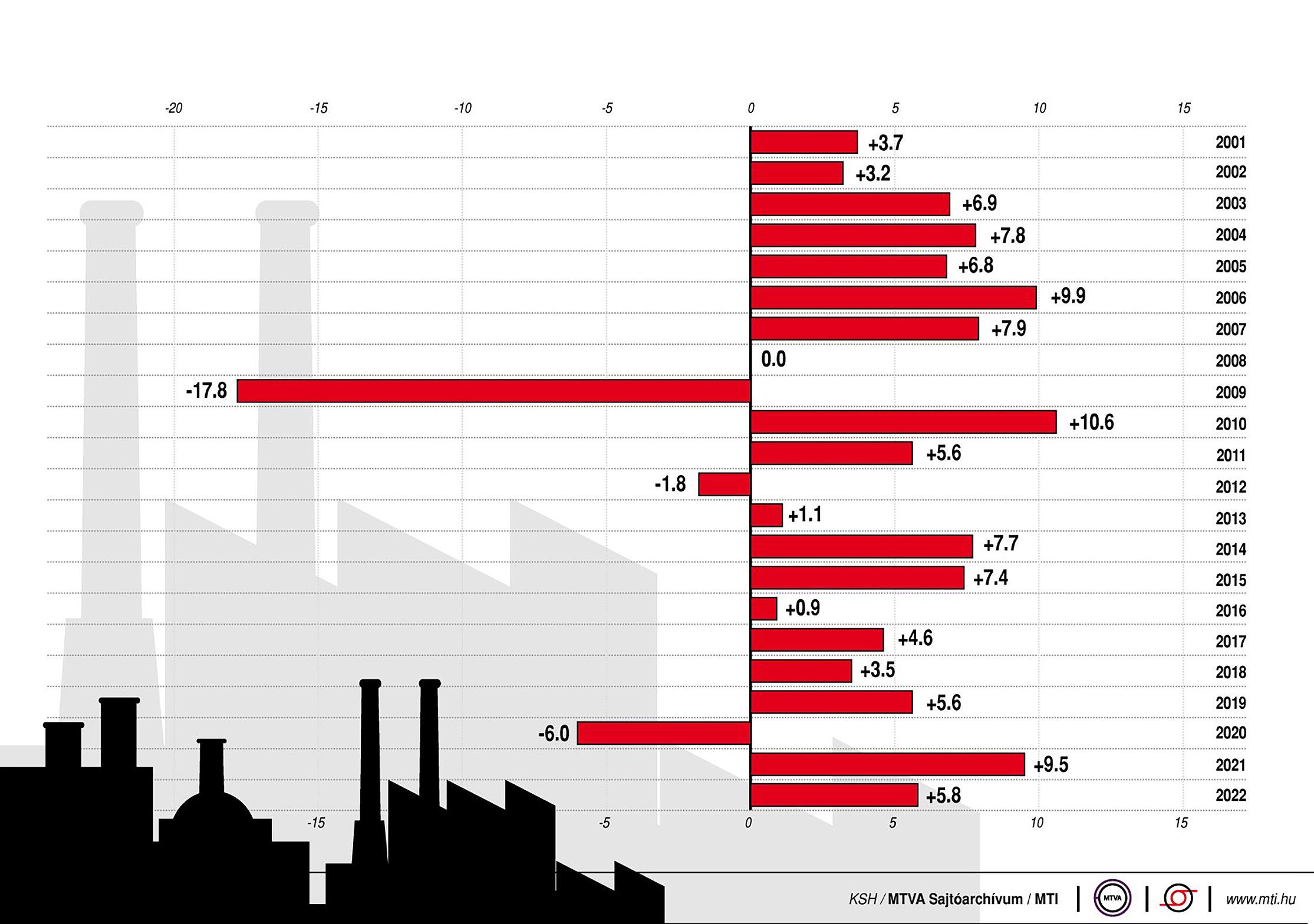

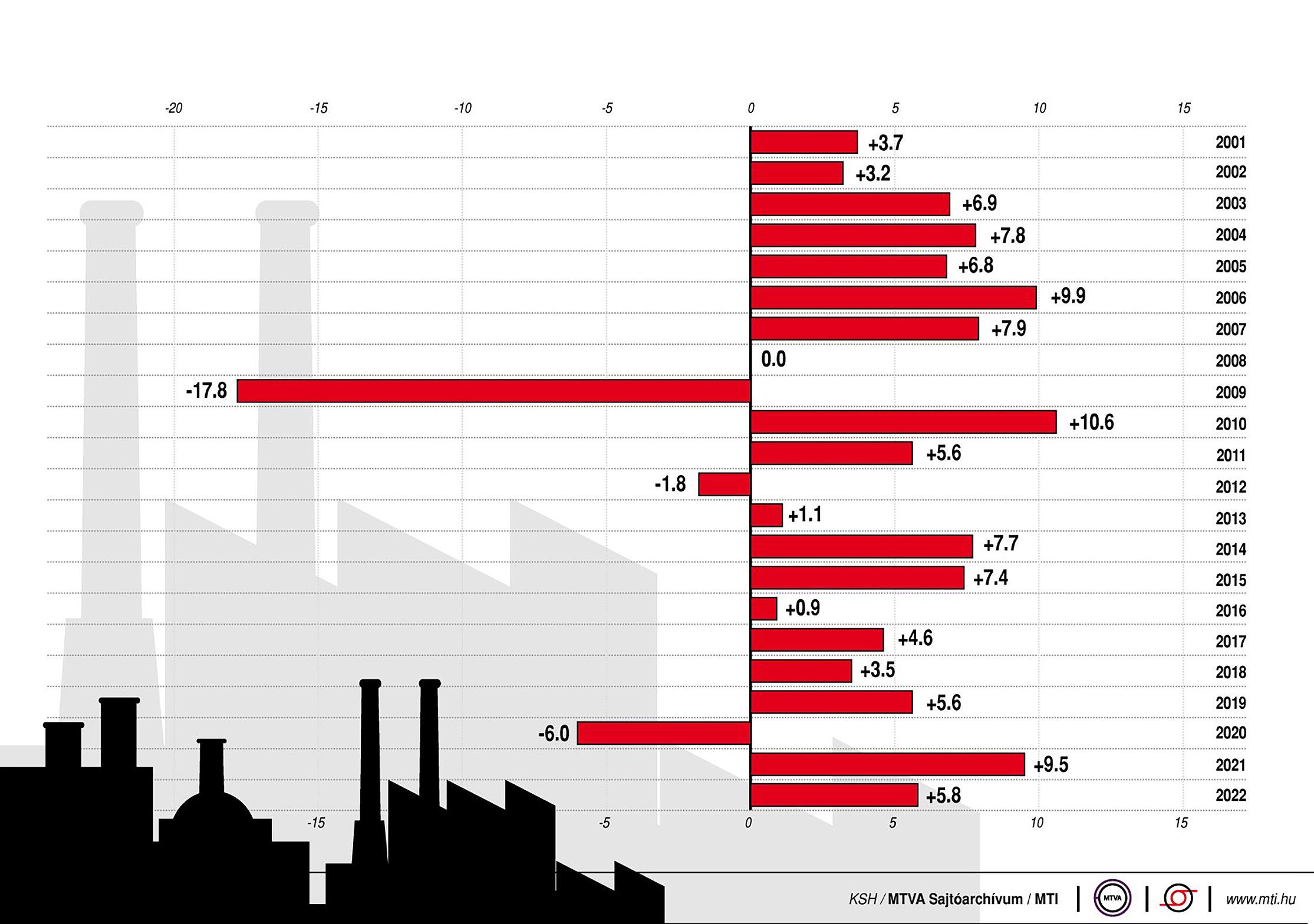

The volume of industrial production exceeded the previous year by 2% last December. The working-day adjusted data shows that production rose by 5.7%. The significant difference compared to the raw data is caused by the fact that there were two fewer working days in December 2022 than in December 2021, the Central Statistical Office (KSH) reported on February 7, based on its first estimate.

Working with seasonally and working day-adjusted data, industrial output expanded by 3.8% as of December 2022, an improvement from the November data when there was a 0.7% decrease compared to October. As for the entire year of 2022, the volume of industrial production was up by 5.8% from 2021.

The output of the manufacture of transport equipment, having the most significant weight, and that of electrical equipment increased markedly. At the same time, the volume of production dropped in the majority of manufacturing subsections, including computer, electronic and optical products, as well as food products, beverages and tobacco products, the KSH data reveals.

Expectations Exceeded

The fresh data far exceeded analysts’ expectations. The stagnation of industrial production at the beginning of the fourth quarter was mainly caused by the reduction in or halting of production in energy-intensive sectors as a result of the explosion of energy prices. In November, problems related to oil refining also

worsened industrial performance (and partly contributed to the fuel supply disruptions at the end of November and the beginning of December); however, production at the domestic oil refinery was subsequently restored, Magyar Bankholding chief analyst Gergely Suppan commented on the data.

Domestic industrial order stocks are still at a high level, exceeding those from a year ago by about 20%,

so easing supplier problems may result in further recovery, Suppan summarized. The performance of the domestic industry in recent years has sharply diverged from that of Germany due to the numerous capacity increases, the inflow of record amounts of working capital, and the economic policy of the government that explicitly supports investments, he emphasized.

In the third quarter of the last year, the growth of industrial production accelerated significantly due to the weak base of a year ago due to the chip shortage and the easing of that shortage in 2022; however, the Russo-Ukrainian war may still pose a number of risks, the analyst warned.

Skyrocketing energy prices forced several sectors to curtail production in the fourth quarter of last year; now, several producers are back in operation thanks to the recent drop in energy prices. External demand may be worsened by the inflation-driven increases in food and energy prices, leading to a decrease in purchasing power, Suppan noted. At the same time, industry could still be stimulated by the very high order stock, which was 19.9% higher last November than a year ago.

Gradual Revival

“After the temporary fluctuations caused by the energy crisis, we expect a gradual revival in the industrial production from the middle of this year, which could be supported by the expected commissioning of new capacities, mainly related to battery production and the automotive industry, as well as the food industry, the chemical industry, and the defense industry,” he added.

Following weak October and November data, industry caused an extremely positive surprise in December, said Péter Virovácz, senior analyst at ING Bank, in his commentary. The growth in December was so strong that the industry was able to compensate for

its decline in the previous two months, and the level of production is back close to the level measured in September.

At the same time, according to Virovácz, the Hungarian industry overall is still characterized by being Janus-faced in nature. On the one hand, the production of the heaviest vehicles, as well as that of electrical equipment (thanks to the booming production of battery factories), boosted industrial performance.

On the flip side, production volume decreased in other sectors, such as the dominant food industry and electronics manufacturing. Overall, therefore, the strengthening performance of the automotive and related supplier areas corrected the performance of the industry at the end of the year, according to Virovácz.

“Analyzing the quarterly performances, unfortunately, the fourth quarter still performed poorly. Compared to the third quarter, according to ING Bank’s estimate, industrial output fell by nearly 2% on a quarterly basis. All of this indicates that, in the last quarter, the performance of the industry as a whole may have held back the economy,” the analyst explained.

www.bbj.hu Budapest Business Journal | February 10 – February 23, 2023

The performance of the Hungarian industry in 2022 was a positive surprise; however, it was mainly the automotive sector driving the improved output. The energy crisis and the war in neighboring Ukraine still pose significant risks.

ZSÓFIA CZIFRA

Industrial Production in Hungary, 2001-2022 Producer volume index, same period of the previous year equals 100

Source:

Hungary Continues to Push for Peace and Sanctions Debate Roundup Crisis Ukraine

Prime Minister

Viktor Orbán held a three-day strategic cabinet meeting in Sopron (210 km west of Budapest) earlier this week, between February 7 and 9, Bertalan Havasi, the PM’s press chief, told news portal Origo. hu on February 3. The prime minister called the meeting to discuss the war in Ukraine and its impact on the economy, along with European Union sanctions and, consequently, Hungary’s energy strategy, with a focus on countering inflation.

However, recent events in Türkiye unexpectedly rose to the top of the agenda after a magnitude 7.8 earthquake occurred there on February 6, near the country’s border with Syria, followed by a magnitude 7.5 aftershock. In addition to the collapse of some 6,000 buildings, according to Turkish officials, the death toll in Türkiye had reached roughly 11,700 at the time of going to print on February 8. One earthquake expert, Ovgun Ahmet Ercan, told The Economist he estimates that 180,000 people or more may be trapped under the rubble.

Both Hungarian President Katalin Novák and Prime Minister Viktor Orbán expressed their condolences to the

families of the victims of the earthquake and pledged immediate assistance toward relief efforts on Monday.

“We are praying for the families of the victims,” Orbán said. “I have instructed the Hungarian authorities to provide immediate assistance to Türkiye.” After a team of 55 rescue workers, along with two rescue dogs, arrived in two buses, along with four trucks, in Hatay Province on Monday evening, Minister of Foreign Affairs and Trade Péter Szijjártó said that Hungary would send more search and rescue teams.

Coincidentally, Türkiye and Hungary are the only two countries in NATO that have yet to approve membership for Sweden and Finland, who broke with their long-standing military nonalignment by applying to join last year following Russia’s invasion of Ukraine. Although the Hungarian parliament is expected to approve the bids in February, Turkish President Recep Tayyip Erdoğan signaled on January 29 that Ankara might accept just Finland into NATO.

While Erdoğan’s main contention with Sweden has been its refusal to extradite dozens of people with links to the banned Kurdistan Workers’ Party (PKK), Ankara recently suspended NATO accession talks with the two countries after a protest in Stockholm on January 21, during which a far-right politician burned a copy of the Quran. Sweden’s government should “act differently” if it hoped to receive Turkish support,

Szijjártó remarked after talks with his Turkish counterpart Mevlüt Çavuşoğlu on January 31, adding that the Quranburning incident was “unacceptable.”

The parties discussed the war in Ukraine, Europe’s economic difficulties, and illegal migration ahead of a summit in Brussels, Havasi said. Orbán reiterated his stand on working towards an immediate ceasefire and peace talks and pressed for a “meaningful” policy debate on the anti-Russia sanctions. He also repeated a call for Brussels to pick up some border defense costs, noting that “fences protect all of Europe.”

Squeezed between the threeday cabinet meeting and a twoday summit in Brussels scheduled for Thursday and Friday, Orbán found time to participate in a video conference with his counterparts

from Belgium, Finland, Malta, and Poland, the president of Bulgaria, and European Council President Charles Michel on February 7.

Havasi told the state news agency MTI that the parties discussed the war in Ukraine, Europe’s economic difficulties, and illegal migration ahead of a summit in Brussels, Havasi said. Orbán reiterated his stand on working towards an immediate ceasefire and peace talks and pressed for a “meaningful” policy debate on the anti-Russia sanctions. He also repeated a call for Brussels to pick up some border defense costs, noting that “fences protect all of Europe.”

Meanwhile, Brussels has rejected overtures for support from grain growers in Hungary, alongside Bulgaria, the Czech Republic, Poland, Romania and Slovakia, as “millions of tonnes” of grain from Ukraine, priced around EUR 70 per tonne, undercuts the locally produced crops.

Although Hungary had supported the release of this grain for its intended destinations in North Africa and the Middle East, a “significant portion” is instead flooding European markets. Consequently, Hungary will subject Ukrainian grain bound for markets in Hungary to “strict checks” to ensure compliance “with all food safety regulations,” according to Minister of Agriculture István Nagy.

He added that Hungary would offer any assistance it could to see Ukrainian grain reach its “original destination.”

4 | 1 News www.bbj.hu Budapest Business Journal | February 10 – February 23, 2023

NICHOLAS PONGRATZ

State Secretary for National Policy János Árpád Potápi of the Prime Minister’s Office greets Transcarpathian students from war-torn Ukraine at the camp of the Rákóczi Alliance in Sátoraljaújhely (260 km northeast of Hungary, near the border with Slovakia) on January 26. Next to him is Csongor Csáky, president of the Rákóczi Association. Photo by János Vajda / MTI.

Hungary’s Adventum Agrees to Purchase Wola Retro in Warsaw

The Hungarian Adventum Group has agreed to purchase Wola Retro, a prime office building in Warsaw, from Develia. The settlement price is around EUR 69.8 million, with the deal expected to close by the end of April, according to Avison Young, who co-represented the vendor with JLL. The buyer was advised by CBRE.

The property provides around 26,000 sqm of space in three buildings, one of which was built in the 1930s. The plan is for them to be redeveloped into offices that merge with the historical surroundings.

The prominence of local capital has become a notable trend in the Central and Eastern European region.

“Investors from the Czech Republic, Hungary, Romania and Slovakia, in particular, [have] proved that local market knowledge and presence are the keys to success.

Approximately 35%

of the investment volume in 2022 came from CEE-based investors,” comments Colliers.

Last year, Adventism’s acquisition of the 273,000 sqm Tesco portfolio, including 13 Hungarian assets,

was seen as a significant deal in Hungary in terms of magnitude.

Rarely Seen

“We rarely see such large ticket deals happen in Hungary, and the complexity of the deal (14 multi-tenanted assets at various locations in Hungary and additional Czech properties) makes it even more significant,” comments Rita Tuza, head of capital markets at JLL Hungary, on the deal.

In an earlier significant CEE crossborder acquisition previously reported by the Budapest Business Journal that is evidence of that domestic capital trend, the Hungarian investor Indotek Group purchased GTC’s Belgrade office portfolio for EUR 267.6 million. The agreement covered the sale of 11

buildings

within five business parks with a total of 122,000 sqm of gross leasable area. The portfolio is located in the New Belgrade area, the Central Business District of the city.

Despite a few high-profile deals closed by international buyers, local capital remains the driving force in the Hungarian market. The weight of home

“We expect this adjustment phase to take shape in the first semester of 2023 with subdued volumes. Whilst Hungary has been a strong issuer of capital towards the CEE region (and beyond towards the U.K. and EU markets) until now, inward investments have been limited, with CEE money accounting for 9% of the total volume in 2021 and 4% in 2022.”

capital remained dominant, with about 65% of investment activity for 2022, compared to 68% in 2021.

Dry H2

A dry second half year limited the total transaction volume to EUR 900 mln. That compares with EUR 1.6

billion in 2021 and EUR 1.2 bln in 2020, according to Benjamin PerezEllischewitz, principal at Avison Young Hungary. The consultancy estimates current prime yields at 5.75% for office, with industrial at 6% and shopping centers at 6.5%.

“In terms of yield, it is not a general move. Prime assets are not significantly repriced, but on the riskier end of the spectrum, development and value-add opportunities are clearly moving out by more than 100 basis points,” comments Perez-Ellischewitz.

Experts say that price corrections are now expected across all asset classes and have already started to materialize.

“We expect this adjustment phase to take shape in the first semester of 2023 with subdued volumes. Whilst Hungary has been a strong issuer of capital towards the CEE region (and beyond towards the U.K. and EU markets) until now, inward investments have been limited, with CEE money accounting for 9% of the total volume in 2021 and 4% in 2022,” PerezEllischewitz comments on prospects for the Hungarian investment market this year.

“It will be interesting to see the evolution in the different markets in the context of 2023. The importance of ESG will keep growing for investors and occupiers in 2023 and will become a more critical element in the pricing of assets,” he concludes.

1 News | 5 www.bbj.hu Budapest Business Journal | February 10 – February 23, 2023

GARY J. MORRELL

The Wola Retro office building in Warsaw, purchased by Adventum.

Fresh Partners Announced at Mazars

International audit and advisory firm Mazars has announced the appointment of two new partners.

The appointment of Andrea Molnár ’ is a recognition of her 20 years of dedicated and successful work at Mazars, her professional knowledge, and her professional successes, which are also widely recognized in the audit profession, the firm says.

Having originally joined Mazars in Hungary as a junior assistant, she is now a registered auditor, consolidation specialist, and Association of Chartered Certified Accountants (ACCA) member. As a registered auditor, she has qualifications in insurance audits, international financial reporting standards (IFRS), and stock issues. She is also in charge of the quality control and risk management processes of Mazars’ audit and advisory department.

Molnár is a well-known expert for the Audit Oversight Body and serves as a quality control officer for both

the Hungarian Chamber of Auditors and the international Mazars Group.

Dániel H. Nagy joined Mazars’ Hungarian office in 2016 and has been actively involved in the business and organizational development of the firm’s tax and legal services.

The firm notes that his appointment as a partner reflects his significant professional accomplishments as well as his active business development and marketing efforts to promote the Mazars brand both on a local and regional level.

He publicly represents Mazars by regularly contributing to prominent business media, using his extensive expertise on Hungarian and international tax issues. He is also the editor of the Mazars domestic online tax newsletter and coordinator of the Mazars CEE Tax Guide, a publication on the tax environment in 22 countries in the CEE region.

Nagy earned a Master’s degree in international tax law in 2022 in a program jointly organized by Mazars Group and King’s College London.

Former HIPA Deputy CEO Joins PwC Hungary

Former deputy CEO of the Hungarian Investment Promotion Agency (Hipa), Tünde Kis, joined PwC Hungary as a director on January 1, 2023.

In her new position, she will lead advisory projects on significant investments and manage complex advisory activities related to site selection and the implementation of service and research and design centers.

After obtaining a degree in economics, she joined PwC, where she worked for 16 years as a leader in the field of state aid and incentives in Budapest and Munich. She joined Hipa in January 2016, where she played a crucial role in transforming the agency’s industry structure and strengthening its client-focused operations as deputy CEO for investment promotion. In recent years, Kis was involved in negotiating several major investment projects in Hungary and has managed the comprehensive advisory activity related to their successful implementation.

Mondelez Hungary Names Managing Director

Polish national Grzegorz Lis has taken over the position of managing director of Mondelez Hungária, which manufactures and distributes Milka, Sport bars, and Győri Édes, the company announced, according to hrportal.hu.

The specialist joined what is described as one of the world’s leading snack companies two years ago. Before his latest appointment, he was the regional marketing director responsible for the Baltic, Czech, Hungarian, Polish, and Slovak confectionery markets.

Lis has more than two decades of experience in the sector. He joined Mondelez from Coca-Cola HBC, but over the past two decades, he has also held senior positions at global companies such as Procter & Gamble, Reckitt Benckiser and Kraft Heinz.

In her new position, building on her experience in investment promotion and PwC’s expertise, she will focus on promoting Hungary and the CEE region as an investment location and on supporting high value-added projects. Kis will thus contribute to bolstering competitiveness, fostering economic development, and further increasing the role of PwC in both Hungary and the region, the Big Four company tells the Budapest Business Journal

CEO to Take Helm at Kifli.hu

Gabriel Makki is set to take over as CEO of kifli.hu, replacing Péter Klekner, the company says.

Makki most recently served as regional vice president and commercial officer at Procter & Gamble Central Europe and brings with him more than 20 years of

experience in the international fast-moving consumer goods business and senior management.

Olin Novák, CEO of leading European e-grocery retailer and kifli. hu parent company Rohlik Group International said, “I am grateful to Péter for his help over the past two years. He led Kifli through the difficult period of COVID, and he is now handing over a stable company to Gabriel, whom I know personally, and I am sure of his knowledge and expertise.”

Outgoing CEO Klekner added: “I would like to thank all our customers for helping us to become better every day, as well as for their honest feedback and appreciation. I wish Gabe and the team all the best and much success as they continue to improve the lives of kifli.hu customers.”

Makki has lived in Hungary for 10 years, and speaks Arabic and Czech to a native or bilingual proficiency, and English at full professional proficiency, according to his LinkedIn page.

“I admire what Kifli.hu has achieved so far, and I appreciate the entrepreneurial culture, the customercentric operations, and the passionate, competent team,” Makki notes.

“I am confident that our best years are ahead of us. We will continue to focus on driving rapid growth by delighting Hungarian customers with our service and range on the path of transforming the industry.”

Kifli.hu was launched three years ago from a warehouse in Kőbánya as part of the Rohlik Group, founded by Tom Cupr. The company has become a strong and stable player in the Hungarian online FMCG market. Under Klekner’s leadership, the company exceeded the three million fulfilled orders mark, significantly increased its delivery area, offered secure jobs to couriers who were in a difficult situation due to the Kata tax system changes in Hungary, and achieved new order records in December.

6 | 1 News www.bbj.hu Budapest Business Journal | February 10 – February 23, 2023

WHO’S NEWS Do you know someone on the move? Send information to news@bbj.hu

Andrea Molnár

Dániel H. Nagy

Grzegorz Lis

Tünde Kis

Gabriel Makki

Łukasz Kamiński/Senat RP

Medical Imaging Machine Revolution Inches Towards Hungary

While modern imaging equipment is already revolutionizing public healthcare in neighboring countries, it can still be a tedious affair to receive a diagnosis involving a CT or MRI scan in Hungary. However, these devices are becoming more affordable, and the range of services offered is expanding in leaps and bounds.

Artificial intelligence is one of the most exciting tech fields of the 2020s, bringing revolutionary innovations to many areas. AI-enabled processing of big data and images could increase accuracy and efficiency in healthcare, lifting a significant burden from the shoulders of medical professionals.

“The latest multifunctional models, launched in 2022, can, depending on their settings and software capabilities, perform everything from neurological and skeletal examinations to the detection of circulatory disorders and colonoscopy without external intervention, using low-dose, circular X-ray scanning of all body regions, organs and tissues,” says Péter Lányi, CEO of Humantech Solution Zrt., a domestic partner of the Shanghai-based United Imaging Healthcare brand, a recent entrant in the Hungarian market.

He argues that the new tech is producing faster and more accurate images than ever before.

In 2011 there were 73 registered CT machines in the country; by 2021, the number had reached 100. While that growth is good news, it is far below that of the neighboring countries. In Hungary, there is only one CT machine for every 106,228 inhabitants; in Slovenia, Slovakia and Croatia, the figure is one for every 50,000-60,000 people.

Moreover, perhaps in the context of the stricter management of device inventories during the pandemic, the Hungarian stock decreased slightly from 2019 to 2020. By comparison, United Imaging Healthcare has installed nearly

brand new high-end CT, MRI, digital X-ray, and mammography machines in the region since it entered the European market in 2020, the company says.

Health Matters

A significant proportion of Hungarian equipment is in public institutions where it is used both for outpatient on-call hospital duties and for services on an appointment basis. This leads to much lower efficiency due to many unplanned changeovers, such as waiting to prepare a patient injured in an accident for examination or cleaning the machine afterward. The situation is not necessarily any better in private clinics: most of them have second-hand, refurbished Western machines, which need a lot of maintenance.

However, the return on investment depends to a large extent on whether the revenue from examinations covers the leasing fees, staff and additional costs. In the same way low-cost airlines do their utmost to reduce turnaround times and increase occupancy, clinics are also trying to maximize the use of their machines in every shift. Emerging manufacturers are also supporting CT and MRI clinics in these efforts.

Improving Efficiency

“The latest generation of machines will automatically pre-position for the patient arriving for an appointment, saving up to 5-10 minutes for a scan,” explains János Laczi, application specialist at Humantech Solution Zrt.

“While one guest is getting dressed and the other is undressing, the machine prepares and ‘adjusts’ based on a digital referral so that the patient can lie in a position and in a way prescribed for the required radiological scan,” he adds.

With these modern devices, images can be taken from any part of the body, from various angles, with different slice densities and resolutions, and with a fraction of the radiation exposure of conventional lung X-ray machines.

In addition, the tech is becoming more autonomous, requiring no specialist

radiologist in charge, only an operator. The specialists who evaluate the findings can even work remotely to analyze images constantly coming in from several clinics.

Unfortunately, the statistics show that their work is much needed. For example, in gastrointestinal screening tests, as many as

7-8%

of stool samples indicate abnormalities that require attention or intervention. A colonoscopy procedure with CT is not only much faster and more comfortable but its return on investment can be measured in human lives.

Given this, it’s no wonder that the European CT market is set to grow at an average annual rate of 5.8%, from USD 2.1 billion in 2021 to USD 3.1 bln by 2028, according to market researcher DataBridge. At the same time, the sector may see a price evolution typical of IT goods: each year, these machines will be able to do more while prices will hold steady or begin to decrease.

The only factor holding back growth could be a lack of chips, although Humantech Solution Zrt. says that this does not threaten the United Imaging Healthcare machines it sells. The company notes that market development is more intense for Far Eastern manufacturers than for Western European ones.

High Standards

According to experts, the situation is somewhat similar to the rise of South Korean car brands: in a relatively few years, they have caught up or even overtaken their competitors technically and have gained trust in their brands through reliability, high equipment standards, and lower prices than their competitors.

For example, the new machines from United Imaging Healthcare are barely more expensive than second-hand Western machines, while the standard equipment includes several software add-ons for various screening tests, such as those for common diseases, which are usually sold as an extra by Western manufacturers.

In addition to the spill-over of technological trends, the Hungarian private healthcare boom could be a significant driver of growth.

“In Hungary, paying for a CT or MR scan is still a luxury. Yet a professionally prepared and evaluated image of a herniated disc is no more expensive than a few hours at a chiropractor’s, who might even worsen the patient’s condition in the absence of a real diagnosis,” says Angéla Belcsug, owner of the Várkert Clinic in Keszthely. It replaced its old CT scanner with a new United Imaging machine in

2022.

“The time from order to commissioning was just over two months, and the supplier was able to provide full implementation, warranty back-up, training, and Hungarian-language user interfaces,” Belcsug explains.

The new device is 50% faster than the previous one, produces excellent images with lower radiation, and is processed more accurately by AI software.

“Of course, all this is mainly exciting for our radiologists, but things like a virtual colonoscopy, which can examine the intestines without the need for an invasive instrument, or low-dose chest imaging, which allows regular monitoring of the improvement of people who have undergone COVID, are already understandably good news for patients,” she notes.

1 News | 7 www.bbj.hu Budapest Business Journal | February 10 – February 23, 2023

100

BENCE GAÁL

A monthly look at health issues in Hungary and the region

Transparency International Study Finds Hungary Most Corrupt Country in EU

Transparency International has revealed the findings of its 2022 Corruption Perceptions Index this month. According to the study, Hungary is the most corrupt country in the EU, down one point and four places compared to 2021. The government has rejected the findings.

In 2022, Hungary scored 42 points on a scale from zero (most corrupt) to 100 (least corrupt), ranking 77th out of 180 countries. The results are worse than those of its direct regional competitors. The Czech Republic and Slovenia reached 41st place with 56 points. Poland ranked 45th with 55 points, Slovakia 49th with 53 points, and Croatia 57th on 50 points.

However, the Government Information Center dismissed TI’s findings, saying, “It is interesting that Transparency International did not investigate the Brussels bureaucracy or the European Parliament; they were left off the list.”

It also labeled TI a member of the “Soros network,” which it accuses of being behind the corruption scandals in Brussels and funneling money to the Hungarian opposition.

“This network finances the campaign of the domestic and international left and serves it with all its lying reports,” the center said.

TI, however, says there has been a clear downward trend. In the 2012 report, Hungary was ranked

19th.

By last year, Hungary had lost the minimal lead it held from 2020 against the poorest performing country of the EU: Bulgaria improved somewhat, while Hungary’s position worsened. Overall, Hungary’s ranking in the world corruption index has decreased the most in the last 10 years.

“Corruption is making the world we live in a more dangerous place. Weak government action against corruption has also increased the risk of violence, putting citizens at risk. The only way out of the current situation is for governments to take up the fight against corruption, standing up to

Corruption Perception Index scores in Central and Eastern Europe, 2012–2022

are the deterioration of the rule of law and systemic corruption, TI says.

In reaction to TI’s findings, the Organization for Economic Cooperation and Development (OECD) called on Hungary to step up its fight against corruption.

OECD says that Hungary must report to the organization’s Working Group on Bribery by June 2023 that it has made significant progress in addressing outstanding recommendations relating to its implementation and enforcement of the OECD Anti-Bribery Convention, or the Working Group will send a high-level mission to Budapest.

The organization also remains seriously concerned about Hungary’s low level of foreign bribery enforcement, noting that no significant foreign bribery case has been detected or investigated since March 2012.

Corruption

Index scores in the EU, 2022

guarantee the well-being of society as a whole, not just a narrow elite,” said Delia Ferreira Rubio, chair of TI.

Comprehensive Analysis

In parallel with the presentation of the Corruption Perception Index, TI Hungary also published its annual report on corruption, which comprehensively analyzes the state of the rule of law, public procurement, and the use of EU funds, as well as the impact of corruption on economic performance.

Among the most significant developments in 2022, for the first time in the history of the EU, the European Commission launched a rule of law procedure against Hungary after the parliamentary elections in April, tying the availability of EU funds to conditions, the report notes.

It also states that the steps taken under EU pressure and designed to curb the misuse of EU funds can be considered the only serious anti-corruption measures of Hungary’s NER (System of National Cooperation) period.

“If the commission rigorously monitors the implementation of the new rules, misuse of EU funds can be expected to decrease in the future, but the institutional destruction of the last decade will not be undone, and the rule of law will not be restored ‘in one fell swoop,’” said József Péter Martin, executive director of TI Hungary.

Although Hungary has been one of the largest beneficiaries of the EU budget, the inflow of money has not contributed to increased efficiency or economic activity measured by the

number of businesses; inequalities have not decreased either, but corruption has increased, TI Hungary argues.

The organization says that the economic weight of public procurement in Hungary remains significant, while the system’s exposure to corruption is high. The European Commission has repeatedly drawn attention to the high rate of single-bid tenders in public procurement, which significantly reduces the intensity of competition.

Target Missed

The 35% rate of single-bid tenders in procurements above the EU threshold remains well above the EU target of 15%. The competitive conditions for obtaining public contracts are further worsened by the government regularly exempting the most important procurements from traditional public procurement procedures, TI claims.

Hungary became the most corrupt country in the EU despite robust economic growth in the seven years leading up to the coronavirus epidemic, according to the chapter on economic trends in TI Hungary’s report.

As in previous years, there remains a strong correlation between national income and corruption in the EU. Hungary is stuck in the EU’s lower league of member states with low national income by EU standards, even though its gross domestic product (GDP) per capita increased by some 39%

between 2013 and 2022. The main reasons Hungary failed to improve its position among the EU countries

8 | 1 News www.bbj.hu Budapest Business Journal | February 10 – February 23, 2023

GAÁL CPI 2012 CPI 2013 CPI 2014 CPI 2015 CPI 2016 CPI 2017 CPI 2018 CPI 2019 CPI 2020 CPI 2021 CPI 2022 1 Estonia 64 68 69 70 70 71 73 74 75 74 74 2 Lithuania 54 57 58 61 59 59 59 60 60 61 62 +8 3 Latvia 49 53 55 55 57 58 58 56 57 59 59 4 Slovenia 61 57 58 60 61 61 60 60 60 57 56 - 5 5 Czechia 49 48 51 56 55 57 59 56 54 54 56 +7 6 Poland 58 60 61 62 62 60 60 58 56 56 55 - 3 7 Slovakia 46 47 50 51 51 50 50 50 49 52 53 +7 8 Croatia 46 48 48 51 49 49 48 47 47 47 50 +4 9 Romania 44 43 43 46 48 48 47 44 44 45 46 +2 10 Bulgaria 41 41 43 41 41 43 42 43 44 42 43 +2 11 Hungary 55 54 54 51 48 45 46 44 44 43 42 - 13 2012 Change 2021 Country Ranking in the Region +10 +10

BENCE

= = Slovakia Country Score = = = 15 16 19 20 21 23 24 25 26 1 2 3 4 5 6 8 9 10 11 12 14 Latvia Czechia Italy Slovenia Poland Cyprus Greece Malta Croatia Romania Bulgaria Denmark Finland Sweden Netherlands Germany Ireland Luxembourg Estonia Belgium France Austria Lithuania Portugal Spain 59 56 56 56 55 53 52 52 51 50 46 43 90 87 83 80 79 77 77 74 73 72 71 62 62 60 42 27 Hungary Ranking in the EU Source: TI Hungary calculations based on the Corruption Perceptions Index 2022. The column showing the ranking of countries shows the ranking within the European Union, not the global ranking, and the arrows indicate the direction of change relative to the country’s score in the Corruption Perceptions Index in 2021.

Perception

Source: TI Hungary calculations based on the Corruption Perceptions Index 2012–2022. Note: The higher the score, the better the perception of corruption. The number in the last column represents the difference between the country’s score in the Corruption Perceptions Index in 2012 and 2022. The ranking in the first column shows the relative – not global – ranking of countries in the region.

2 Business

Hungarian Startup Ecosystem has High Potential, With Room for Improvement

Although Hungary has a solid basis for building a strong startup ecosystem that can drive the economy, it lags behind its European and regional competitors. A McKinsey study has identified seven areas that would lead to a more robust startup sector, accelerated digital transformation, increased employment, and public revenues.

If domestic startups could grow at a rate and scale comparable to other European countries, they could attract up to EUR 5 billion of additional resources to the sector. A significant share of this, EUR 0.6 bln-1.3 bln, would be used in the local economy, McKinsey told a conference on January 31. A more developed startup ecosystem would increase tax revenues, help the uptake of digital solutions and boost the digital transformation of the economy.

According to the study, Hungary is well placed to achieve the goals outlined in the above forecast: it has a sufficient number of startups, the venture capital available is within the average of the Visegrád countries, and there is a skilled workforce. In addition, the number of professionals in the IT sector exceeds the regional average, with 3.6% of the total workforce employed in the IT sector compared to 2.8% in the region.

Despite this, Hungary lags behind its neighbors in the number of so-called “unicorn” startups with a company value of at least USD 1 bln:

unicorns have reached this level in the Czech Republic and 11 in Poland, while only one, LogMeIn, has done so in Hungary.

The number of startups reaching the mature stage of their development in Hungary is also significantly below that of developed European economies, with half the number of startups per capita seen in Germany.

McKinsey found seven factors that significantly influence the number of startups that are formed and how many of them succeed in reaching a mature stage, possibly becoming unicorns.

Founding Businesses

Transparent, simple regulation that facilitates business creation and raising capital while preventing abuses is essential for a flourishing startup ecosystem. In this respect, domestic practices are not in line with international examples: in the World Bank’s “Starting a Business” ranking, Hungary was placed 87th in the world. Bureaucratic difficulties also play a role in the fact that more than a quarter of domestic startups are registered abroad.

Around 16% of Hungarian startups receive foreign investment, compared to the European average of 40%; by comparison, Germany and Israel, which have the world’s most successful startup ecosystems, see up to 70% of companies receiving foreign working capital investment.

“Israel has achieved significant economic success over the past decade in part due to its impressive startup ecosystem,” McKinsey partner Márta Matécsa told the conference. “Hungary has the potential to show similar results and catch up with the countries with the

most successful startup ecosystems: it can build on Hungary’s internationally recognized scientific innovation and its highly skilled workforce.”

The second factor is the supply of experts. The involvement of professionals with the right skills who can identify with the founders’ mission is essential for the development of startups. Knowledge of foreign markets and language skills will quickly become critical, as growth ambitions are unlikely to be achieved without international expansion. However, this often requires innovative solutions: for example, startups can compete with multinationals in terms of compensation by offering an equity stake. A good example of ensuring skilled labor is the French “tech visa,” which facilitates the establishment of startups by professionals from outside the EU.

Another essential factor is a favorable tax environment for founders and investors. A tax system that encourages business creation and venture capital investment should increase the number of startups. There are successful practices in several European countries: in the United Kingdom, investing in startups is partly tax deductible from income tax. In Hungary, similar incentives are limited for founders or people working in startups.

Incentives to foster an entrepreneurial culture are also necessary. Research by McKinsey has shown that, while there is often a willingness to start a business, it is much more difficult for entrepreneurs from specific social groups to reach the mature stage.

By contrast, potential mid-career founders, who often have both the experience and the financial backing

to launch a successful startup, are often risk-averse and find it harder to start a new business with their families. Specific mentoring programs and campaigns to promote entrepreneurial diversity can significantly increase the number of successful startups.

The State’s Stake

Zoltán Birkner, president of the National Research, Development and Innovation Office, told the conference the state could play a role in boosting risk-taking and could also play an umbrella role in smoothing the ecosystem. Still, the market will decide what will be commercially successful. He also highlighted the Israeli model, where it now seems that the state has started to retreat after an initial “enrichment” of seed money.

Strategic allocation of public funding is also a significant factor. In addition to venture capitalists, the state typically plays a role in recapitalizing startups. One successful example is the Polish Growth Fund of Funds; the state does not intervene directly but through private equity funds based on strict return principles, thus indirectly financing the ecosystem.

“Israel has achieved significant economic success over the past decade in part due to its impressive startup ecosystem. Hungary has the potential to show similar results and catch up with the countries with the most successful startup ecosystems: it can build on Hungary’s internationally recognized scientific innovation and its highly skilled workforce.”

Transparent knowledge sharing is another essential element. A common feature of the most successful startup ecosystems is full transparency, such as databases and digital platforms that provide reliable and credible information about startups and practical assistance in creating and developing new businesses. An example of this is the Startup Estonia platform, which has significantly boosted the ecosystem in that country.

To achieve success, coaching for founders and professionals needs to be available. In successful ecosystems, founders have access to a wide range of digital and business training, while startup skills are part of the curriculum at the high school and university levels. In Hungary, such education would be particularly important because Hungarians are extremely riskaverse, and Magyar startups are reluctant to compete internationally.

“If we can make progress in the areas we have identified, with close cooperation between the stakeholders in the sector, Hungary has the potential to create a thriving startup culture that will drive the whole economy,” Matécsa added.

40

www.bbj.hu Budapest Business Journal | February 10 – February 23, 2023

BENCE GAÁL

The McKinsey startup ecosystem conference on January 31.

Hungarian CEOs not Planning pay Cuts, Layoffs

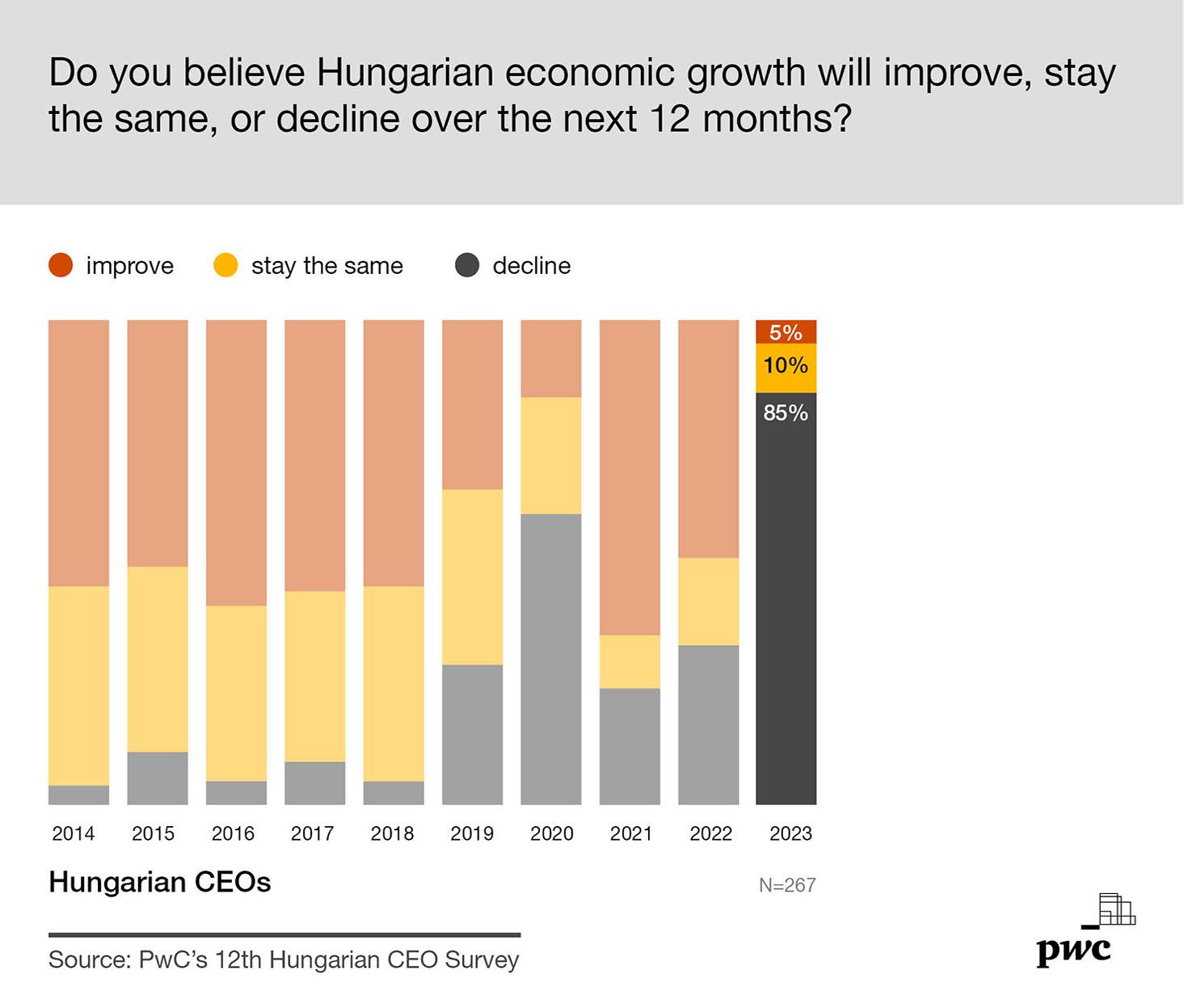

Some 85% of Hungarian business leaders predict the local economy will decline in 2023, while 76% think there will be a global slowdown.

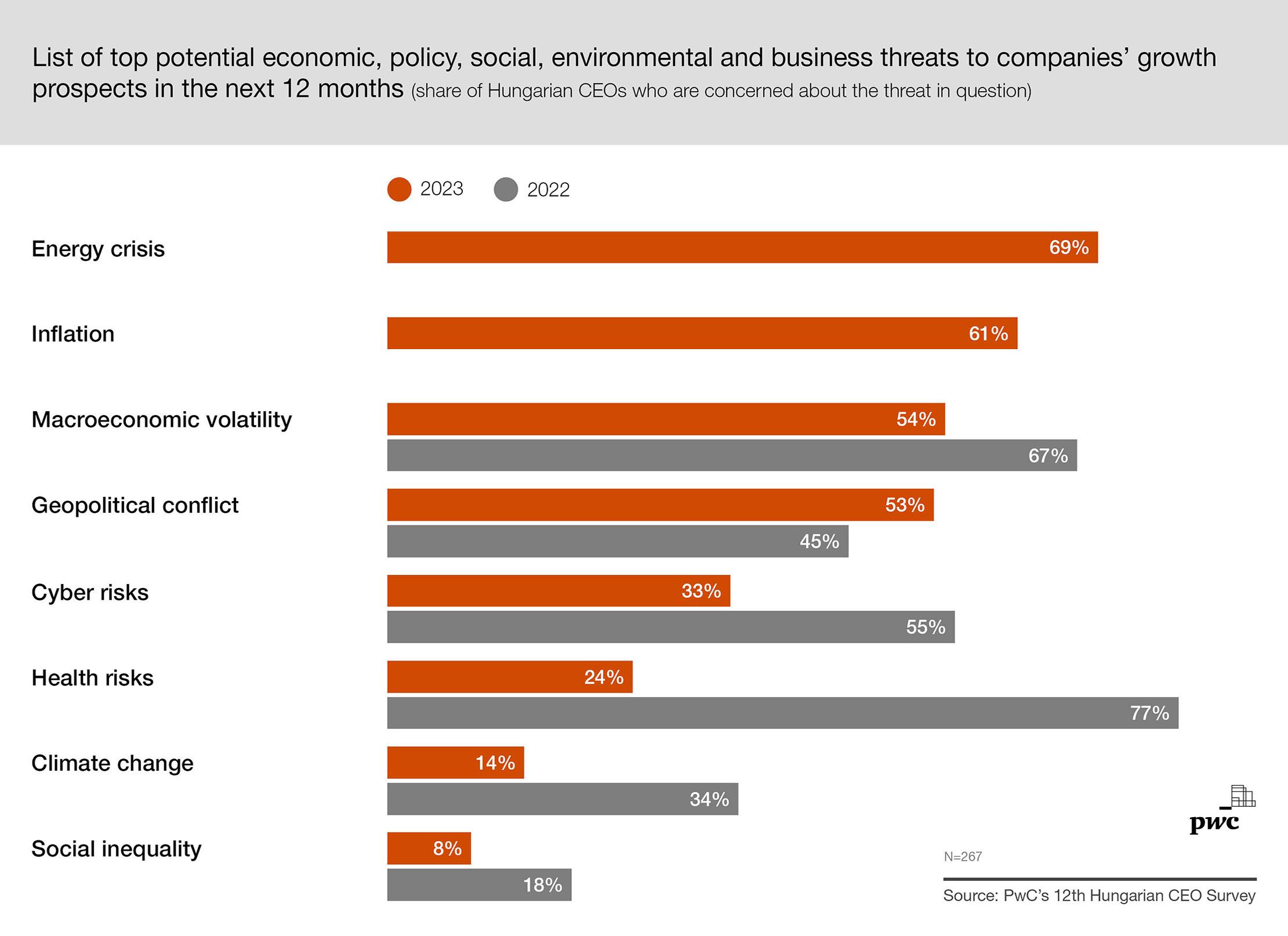

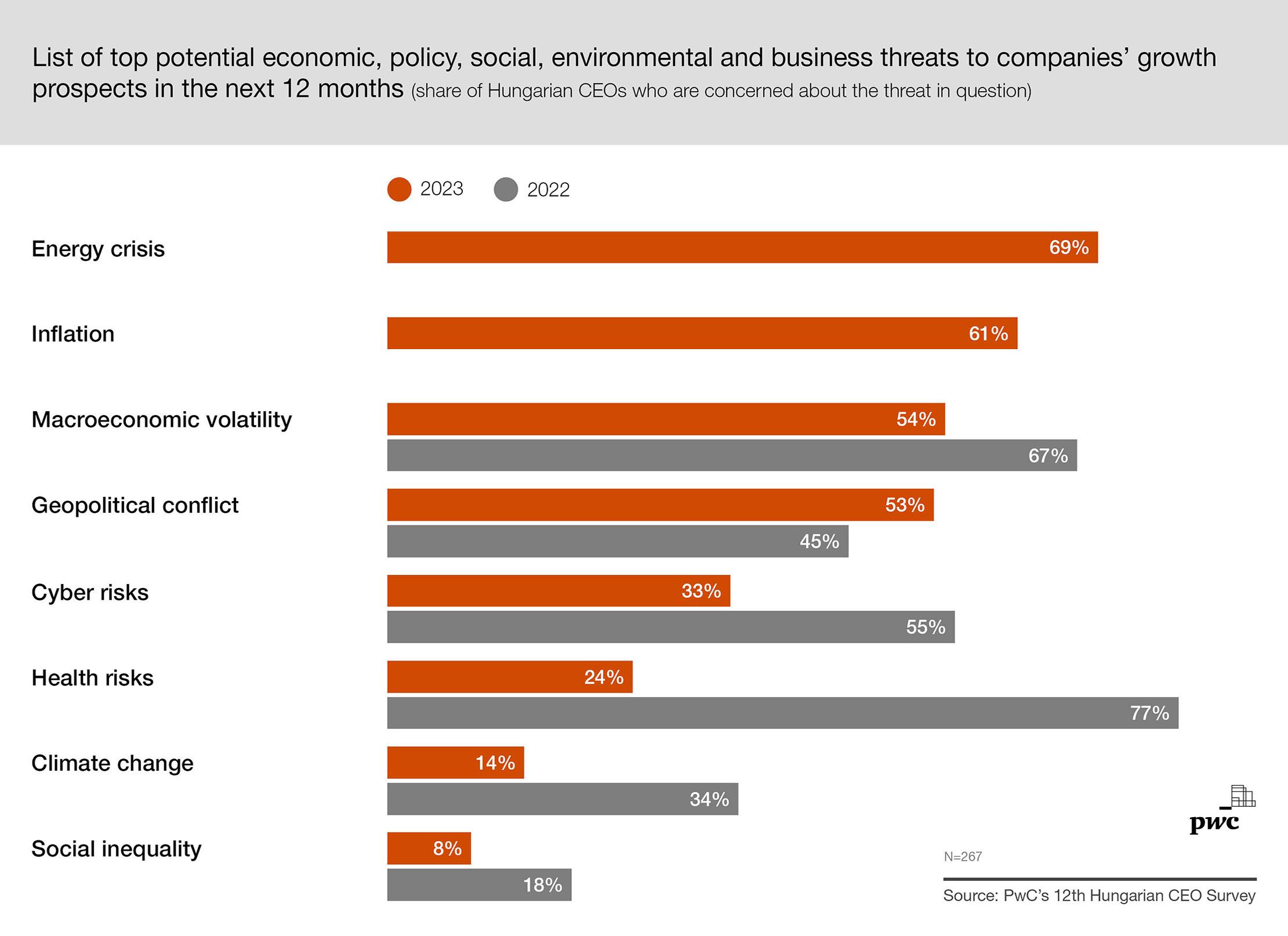

According to PwC’s 12th annual Hungarian CEO Survey, officially launched on Wednesday (February 8), Magyar CEOs rank the energy crisis as the top threat to economic growth, followed by inflation and macroeconomic volatility.

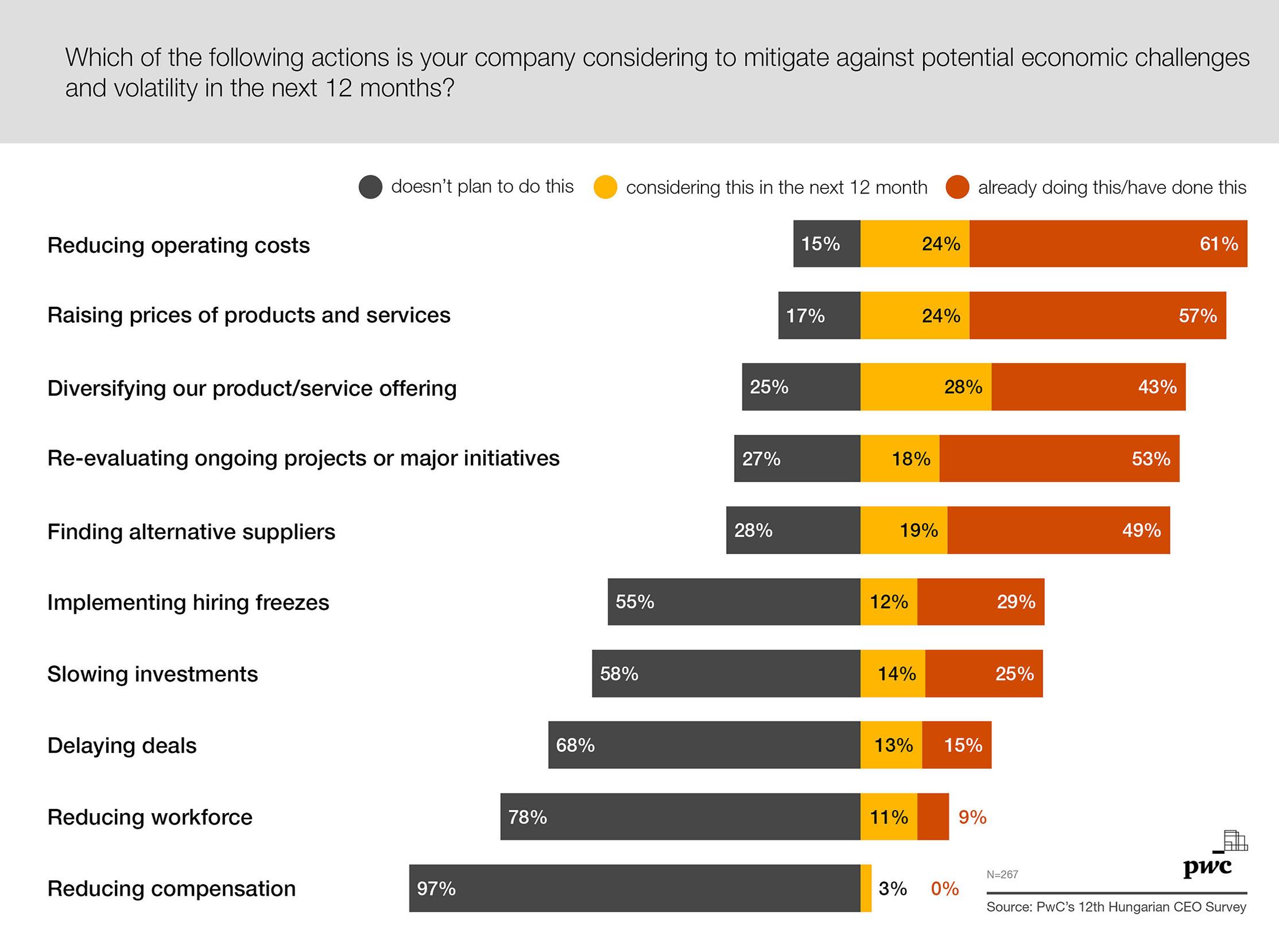

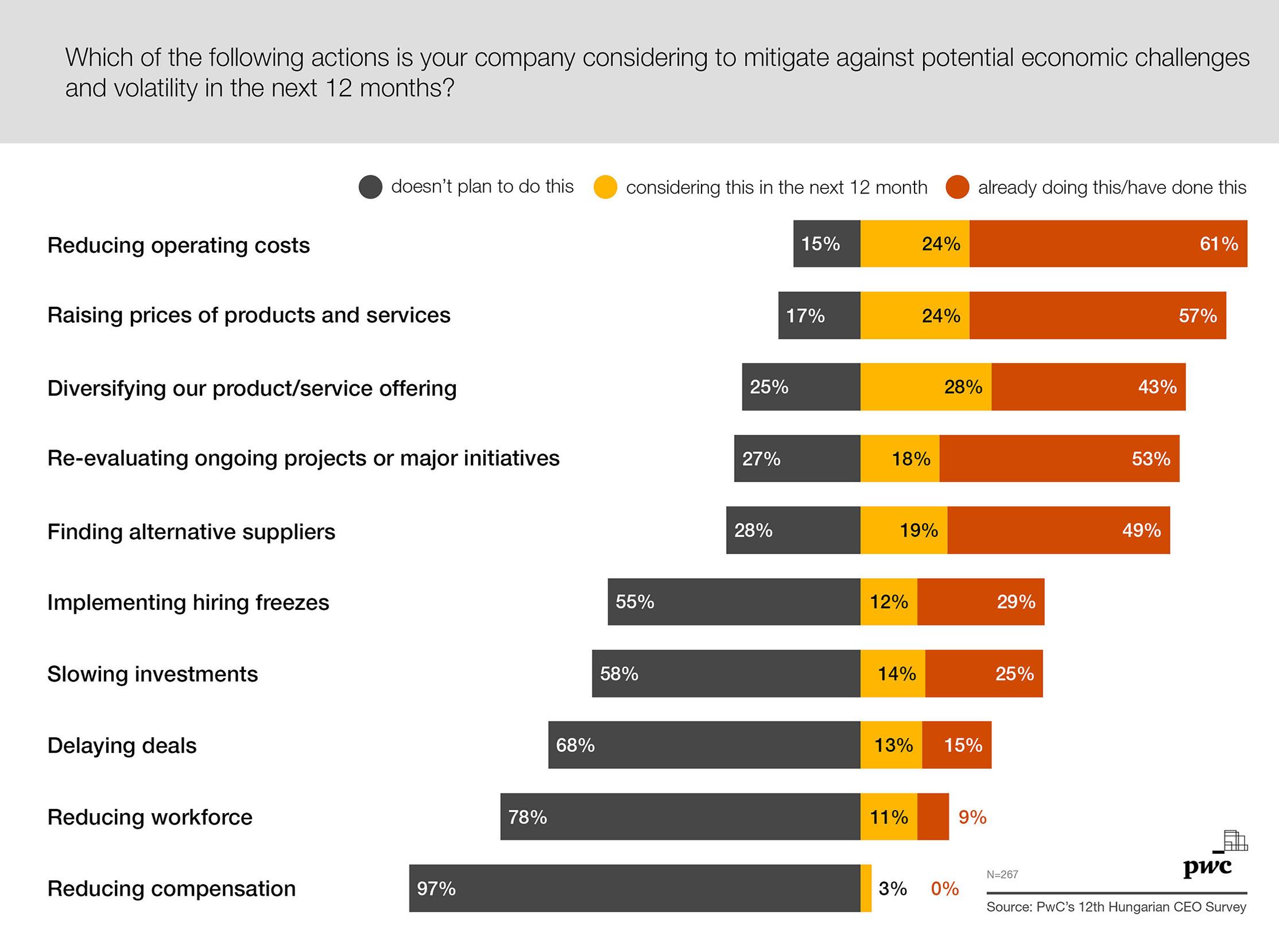

Bosses’ predictions for 2023 include annual inflation at 15% and an exchange rate of 421 forints to the euro. Despite the headwinds, however, Hungarian CEOs are not planning to lay off staff or cut pay; instead, they see cutting operating costs and raising prices as possible solutions.

The PwC Hungary survey was conducted with the participation of 267

local CEOs between October and December 2022 in parallel with the international

study. The expectations for a decline in the rate of global (76%) and Hungarian (85%) economic growth in 2023 is the gloomiest yet seen in the survey’s 12-year history.

PwC says the predictions of economic decline are not surprising given the highly volatile economic and geopolitical environment. However, in a break with recent tradition, Hungarian CEOs

(along with their peers from the United Kingdom, France and Germany) see their country’s situation as more vulnerable than that of the global economy. Looking ahead to 2023, they forecast an average GDP growth of 0.5% in Hungary compared to the previous year.

Revenue Growth

Hungarian CEOs are less pessimistic about their own companies’ financial performance: although confidence in their company’s profitability has fallen from 75% last year to levels last seen in 2013, the majority (60%) are still optimistic about prospects for revenue growth over the next 12 months, and 78% are confident for the next three years.

Most Hungarian CEOs aim to reduce operating costs and raise the price of products and services to steer through the recession. Only a fifth of the companies surveyed are considering redundancies – 9% have already done so, and a further 11% are preparing to do so: 78% are not planning to reduce their workforce, while 97%

have no plans to cut salaries. Both figures are higher than for CEOs globally. Meanwhile, the “Great Resignation,” which began with COVID, is expected to continue, with 20% anticipating a further increase.

Compared to last year’s survey, bosses believe companies’ exposure to health and cyber risks has eased. Unsurprising

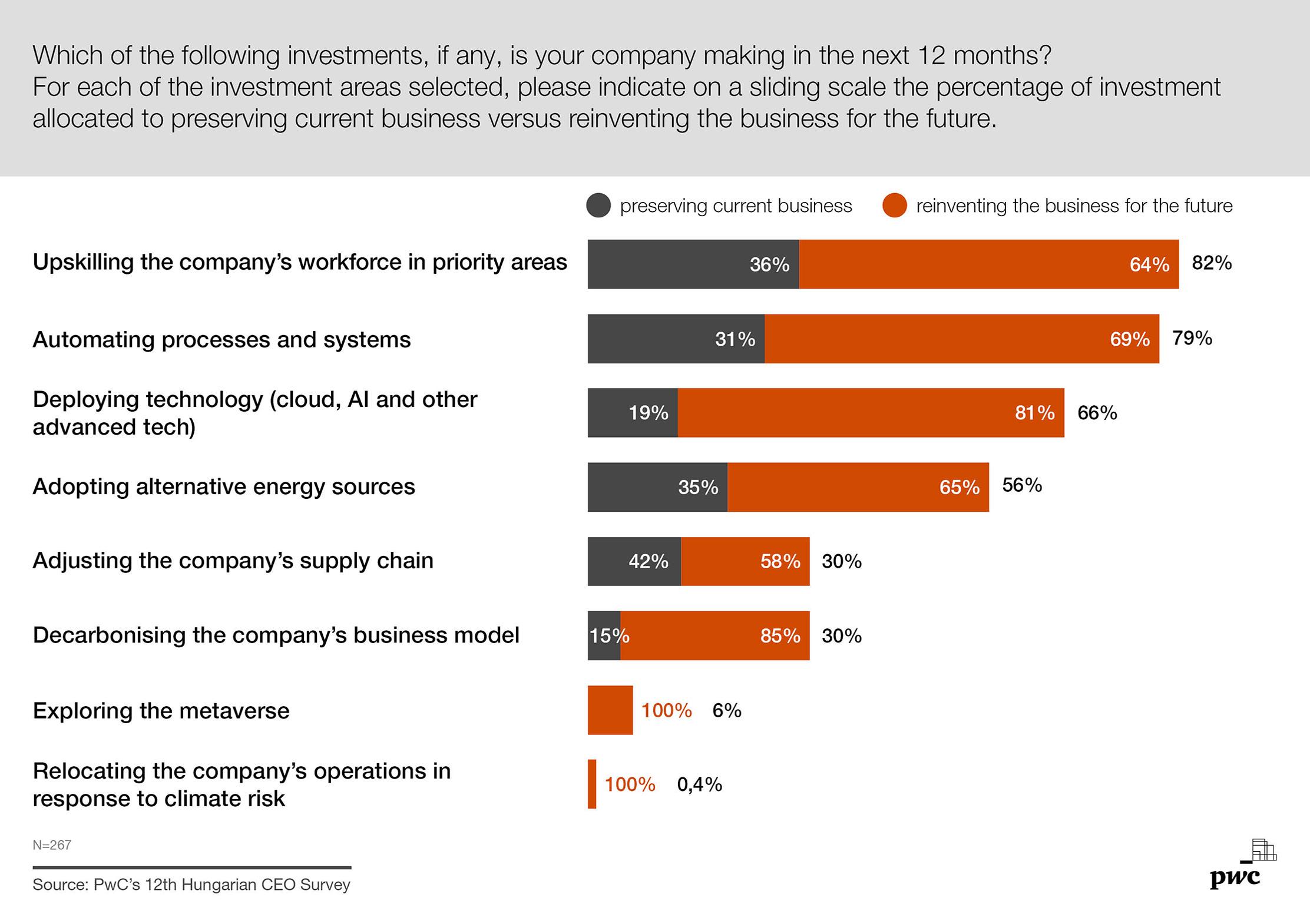

“More than a third of Hungarian CEOs recognize that transformation will be necessary for future success: 43% think their organizations will not be economically viable in 10 years’ time if they continue on their current course,” says Barbara Koncz , partner at PwC Hungary’s Tax and Legal Services. “The proportion is similar globally, with 39% of CEOs worldwide saying the same. In Hungary, new technologies and skills shortages are the main factors CEOs think will affect their profitability in the coming years, followed by regulatory change and altered customer preferences. Globally, changing customer preferences are at the top of the list of factors potentially disrupting the market position of companies.”

10 | 2 Business www.bbj.hu Budapest Business Journal | February 10 – February 23, 2023

BBJ STAFF

new threats have emerged to replace them: 69% of Hungarian CEOs are worried about the energy crisis in the short term, and 61% about inflation. These are followed by macroeconomic volatility (54%) and geopolitical conflict (53%). Cyber risks (39%) are still among the top threats over a five-year horizon.

The war in Ukraine, which 86% of respondents think could end in 2024, and growing concern about geopolitical conflicts in other parts of the world, have caused a rethink of some business model aspects. To mitigate the impact of geopolitical risks, company leaders are primarily focusing on expanding

into new markets, investing in cybersecurity and/or data protection, and adjusting supply chains.

Renewable Energy

More than one-third of CEOs have already recognized the crucial role of adopting alternative energy sources.

When asked about the forces most likely to impact their company’s profitability over the next 10 years, more CEOs cited the adoption of renewable energy sources than the potential for new entrants to their industry. At the same time, 80% of CEOs expect Hungary won’t switch to green energy before 2048.

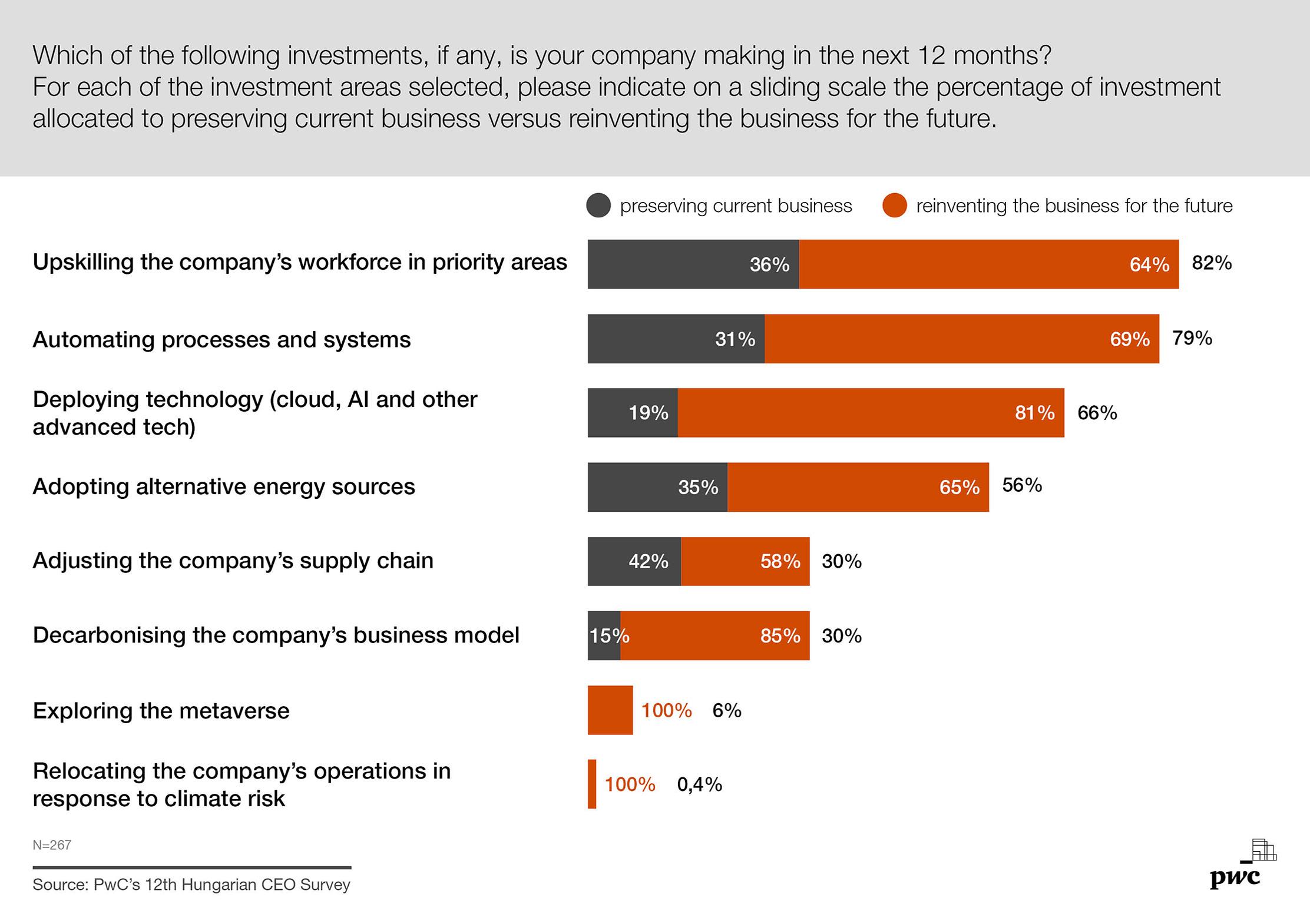

To prepare for the future, 82% of companies say they will invest in upskilling their workforce in 2023; 79% will automate processes and systems; 66% will deploy technology; and 56%

alternative energy sources. Most CEOs believe that almost all of these investments will help make their company future-proof.

Where companies and other market players cooperate, the aim is primarily to develop new products rather than solve societal issues. A quarter of respondents do not collaborate with anyone to address societal challenges.

Business-oriented partnerships are mostly made with governments (at the national or local level), academic institutions, and other companies. Where it does occur, collaboration towards societal ends is most common with NGOs. Indeed, some CEOs see this as a way to ensure companies’ future viability, with education the main area of focus (72%), followed by sustainable development (50%).

The full results are presented in detail on PwC’s Hungarian CEO Survey website: www.pwc.com/ hu/en/ceo.html

2 Business | 11 www.bbj.hu Budapest Business Journal | February 10 – February 23, 2023

According to Tamás Lőcsei , CEO of PwC Hungary, this year’s survey results also show that transformation is based on creating a corporate culture that puts equal emphasis on entrepreneurship and responsibility. Companies that have committed and empowered people are able to innovate and react quickly. The key to all this is trust, and most of the surveyed CEOs think that their employees almost always act in accordance with the company’s values. Moreover, three-quarters of CEOs feel their management encourages divergent opinions and healthy debate.

Finance Matters

A bi-weekly look at the corporate financial issues affecting the markets

Ever more signs point to a significant Russian offensive in Ukraine in the spring, including another possible attack on Kyiv. Corporate finance columnist Les Nemethy discusses how a major Russian campaign or an outright Russian victory would challenge the European Union.

tactical nuclear weapons. Should any of the above scenarios materialize, the trillion-dollar question will be whether the West will step up its supply of weapons and financial aid to Ukraine. Several multiples of past levels of assistance could be required just to maintain the existing balance.

Political Tensions?

Stepping up support would strengthen the antagonism between those who supported Ukraine in the past and would wish to defend the already substantial investment made against the pacifists (not least, some of the German opposition) and those who were more

have always resisted centralization within the EU and pacifists who will claim it is not worth paying the price to keep Ukraine from being absorbed into the Russian sphere.

This struggle between what I call the centripetal versus the centrifugal forces has already been evident during the first year of the war; in the event of a major offensive, the political arguments may be about to become even stronger.

A Russian victory would constitute a wake-up call for the European Union, as the Russians may not stop at Ukraine. The Russian Foreign Minister recently stated that Moldova might

sufficiently reliable?

• Does the EU need to integrate its armed forces to form a more credible deterrent to Russian aggression?

• Does the EU need to increase its defense spending dramatically?

(It currently spends about one-third of what the U.S. spends).

Doubling Down?

If the answers to the above questions take it in a centripetal direction, this will likely require a further transfer of sovereignty from nation states to the center, with a much higher share of tax collection, spending (particularly military spending), and indebtedness happening at a centralized level.

To paraphrase historian A.J.P. Taylor about the 1848 revolutions that swept Europe, will the Ukraine war prove to be a “turning point in history that failed to turn?” Or will George Washington’s vision prevail? He predicted: “Some day, following the example of the United States of America, there will be a United States of Europe.”

of America, there will be a United States of Europe.”

Les Nemethy is CEO of EuroPhoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www. businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

Graphic by Adam Radosavljevic / Shutterstock.com

Environmental, Social and Governance 3 Special Report

Hungary Among Front Runners in Regulation to Enforce ESG

Europe strives to be a legislative trendsetter in many areas, not least in the mission to speed up the green transition on the continent, and indirectly, worldwide. Hungary is among the frontrunners in the process with the Hungarian National Bank (MNB) leading the charge.

The European Union has proven that it doesn’t lack ambition when it comes to putting together legislative frameworks on contemporary matters with a global impact. Whether on data protection or artificial intelligence, European standards aim for legal supremacy with reason, considering the pioneer nature of well-crafted sets of rules.

The enforcement of environment, social, and governance principles may well earn a similar trendsetting reputation thanks to the Sustainable Finance Agenda, which aims to support the European Green Deal. As part of the package, the EU is creating an EU-wide classification system for sustainable activities, the so-called taxonomy, to reorient capital flows toward a more sustainable economy, integrate sustainability into risk management and foster transparency and long-termism.

One of the cornerstones of this process is a new reporting regime that obliges European companies, except for micro-enterprises and non-listed SMEs, to disclose sustainability-related information of their operations.

As a result, 49,000 EU companies will be required to report in the future, compared with 11,600 today,

and for some of these newly obligated firms, compliance is due as early as

January 2024. There won’t be too much time to adapt, not least because the first set of reporting standards are expected to be adopted by the commission by June 30 this year.

While the EU is rushing ahead to provide a reliable legal framework, governments can also do their part to make the transition to Net Zero as smooth as possible. PwC’s Global Investor Survey 2022 found that more than three-quarters of investors say that managing regulatory risks is an important factor in including sustainability in their investing decisions. In fact, 54% of them even view targeted government actions, typically in the form of taxes, as a way to encourage corporate action on sustainability.

Practice what you Preach

However, administrations worldwide have shown widely different degrees of willingness to practice what they preach about transforming their economies along green lines. As KMPG’s Net Zero Readiness Index (NZRI) 2021 found, only nine of the 32 countries assessed have so far made binding Net Zero commitments under their national laws. More pertinently, those who have done so, represent just 8% of global emissions; their less active peers represent two-thirds of global emissions.

The NZRI considers 103 indicators assessing what legal action is taken, how the financial sector handles the issue and to what extent businesses are ready to cut carbon-dioxide emissions fully.

A key finding is that, while investors and banks are increasingly factoring climate risk and the Net Zero transition into their investment and lending decisions, governments still tend to fail to implement crucial measures such as sustainability financing strategies, policy or regulatory frameworks, and related tax incentives.

Hungary is doing surprisingly well in this comparison. It was ranked 13th

overall in the NZRI, and was among just five countries that received the maximum score in terms of legislative action.

Indeed, the pace of adopting relevant measures has been accelerating. For one, the climate protection law amended as of June 2020 set the target to reach Net Zero by 2050. As the KMPG NZRI report points out, the government is trying to decarbonize transport through tax benefits and cash support for electric vehicles, and encouraging intermodal freight junctions for cities, so containers can be transported mostly by rail with road used for the last few kilometers.

Regarding industry, a number of multinational manufacturers have large Hungarian factories which are run to high environmental standards, and the country’s EU membership means all have to meet its standards. Furthermore, domestically focused companies can potentially benefit from available EU funds and green lending products to make a smooth transition in the following years, it adds.

Fine-tuning Support

Even the framework of investment promotion is being altered to reflect environmental aspects. As István Joó, CEO of the Hungarian Investment Promotion Agency told the Budapest Business Journal in an earlier interview, HIPA has reviewed the state subsidy scheme under which companies are currently able to apply for funding when building a new factory. Currently, up to 25% of the renewably energyrelated costs are eligible, but that number is set to increase to 50%. (See “Record Investments Booked for 2022, With Chance to Beat it in 2023” in the January 27 issue of the print BBJ.)

The government’s Factory Rescue program, which was launched in late 2022, also follows an approach of embracing ESG awareness by subsidizing energy efficiency and renewable energy generation-related investments of large firms.

However, it is truly finance, and more specifically in Hungary the national bank, that is the main driver of change. The MNB is eager to reshape the mindset of the sector not only through regulations, but also with positive solutions. Take its measures to promote green mortgage lending or the introduction of a discounted interest rate program for buying or building energy efficient residential properties. It was among the first regulators in the EU to issue green guidelines for banks.

In fact, it updated these in 2022, specifying a timeline and a set of expected measures to be taken by stakeholders. According to the document, expectations need to be met in three waves, the latest as of January

2025,

while stakeholders must identify, handle, measure and disclose risks related to climate change and the environment.

Among other steps, a detailed methodology must be crafted that enables lending institutions to control and check whether customers truly use loans for sustainably purposes. They must further analyze and quantify how climate risks affect their “traditional” risks related to lending, operation or liquidity. Compliance is facilitated by a public compilation of green legislation.

This proactive approach by MNB is of key importance for the speed of large-scale implementation of ESG goals because, as the Net Zero Readiness Index points out, if finance supports the green transition, the real economy must follow suit.

www.bbj.hu Budapest Business Journal | February 10 – February 23, 2023

BÁLINT SZŐNYI

Photo by d.ee_angelo / Shutterstock.com

Building a Framework for Sustainability and ESG

While the Big Four consultancies and larger accountancy firms deal with the specialties of sustainability reporting, Budapestbased PR and communications firm Capital Communications concentrates on what it

Impact Branding, which supports companies in creating an ESG framework and communicating sustainability efforts to avoid greenwashing.

So, how does Hungary compare with its peers?

ROBIN MARSHALL

BBJ: Although you are Budapestbased, you work regionally and globally. When it comes to corporate environmental, social and governance awareness, how far ahead or behind the curve is Hungary?

Gábor Hegyi: Western European and U.S. companies are currently more advanced in introducing and operating transparent ESG policies. However, even they face enormous challenges to make their operations more sustainable. The critical issue is how to establish a healthy balance between profitability and sustainability, how to shift from shareholder capitalism to stakeholder capitalism, where all stakeholders (including employees, customers and investors) can benefit, and goals like fighting poverty or reaching net zero are possible. As for Hungary, I see a significant change in corporate attitudes toward ESG and sustainability. More Hungarian managers have realized that going sustainable will be the new business as usual. In recent years, an increasing number of Hungarian

companies have developed their sustainability strategies and introduced solid and transparent ESG standards and policies. Hungarian companies trade with Western European and U.S. partners, many are part of extended supply chains, and if they want to remain competitive, they can’t miss the boat. Investors, banks, business partners, and even customers watch for ESG factors and demand much more compliance with ESG standards, which Hungarian companies should meet to avoid losing markets and business opportunities.

BBJ: Is the field driven more by legislative (whether EU or national) or corporate agendas?

Paul Mackintosh: Both, but the balance varies at different levels. The EU Corporate Sustainability Reporting Directive (CSRD) has been called a game changer. It won’t initially affect smaller companies (as many are in Hungary), but its effects will feed through, not least because many major MNCs and banks are pushing their own ESG policies and refusing to work with or fund non-compliant companies.

BBJ: Does the cynicism engendered by greenwashing present a threat or an opportunity for brand-building?

GH: It is definitely an opportunity. Our Impact Branding service helps management to avoid greenwashing and become more transparent instead, building trust based on facts among crucial company stakeholders. As a corporate and financial PR agency, we understand boardroom mentality very well. With Impact Branding, we support management in creating a well-established ESG framework

at the company, building a brand, and effectively communicating sustainable efforts and achievements both inside and outside the company. We are talking about a framework, not simply an ESG strategy, because it should be fully integrated throughout the organization in order to make it part of the company’s DNA. In this case, it will not be possible for the company to run into greenwashing problems simply because its own set of rules will not let it happen. Sooner or later, trust will replace cynicism in most cases. The main reason we are focusing on Geneva and planning to open an office there is simply because Geneva is a key hub for sustainability and sustainable finance. As we have become part of the Geneva sustainability community, we can offer state-of-the-art solutions to our clients, should they be in Hungary, Europe, or elsewhere.

BBJ: It used to be said there was deep public suspicion in Hungary around corporate and social responsibility. Has that transferred to ESG?

GH: That’s been the case everywhere, not just in Hungary, but it’s slowly changing now thanks to some good examples from major companies. Hopefully, ESG will avoid most of the past suspicion towards CSR. ESG is much broader than CSR, covering all company activities, from operations to HR. This is a huge difference, so with a sound ESG framework, companies can build trust among their stakeholders and the public and avoid suspicion. Obviously, this will take time. This is why we base our Impact Branding approach on solid, measurable ESG improvements.

BBJ: How much of your business comes to you (i.e., companies asking for your help), and how much do you have to be proactive? Do you see signs this is changing?

PM: We do have to be proactive because many smaller businesses, especially, still need to be educated, and the data-based nature of our Impact Branding service needs to be explained. But we do see this changing as more businesses are having to adapt.

BBJ: Is the argument that sustainable businesses also offer investors commercial benefits won by now, or is that still a battle playing out across corporate boardrooms?

PM: It’s still being argued, not least because situations differ in different businesses. But with the whole economic, financial, and regulatory landscape moving that way, the drawbacks of not being sustainable are fast outweighing any possible advantage.

BBJ: What do you think the next great trend in sustainability and ESG will be?

PM: Convergence in ESG standards will likely be the next big breakthrough. With the EU CSRD, the FASB, the SASB, and the rating agencies all heading for the same goal, we can expect a future where ESG ratings drive a company’s performance just as their agency ratings do now. We based Impact Branding on precise, provable measurements to overcome skepticism around greenwashing, and now the whole market is arriving at that destination. GH: When it comes to sustainability, investors would certainly welcome a more unified measurement and reporting system, enabling them to make faster and better investment decisions.

14 | 3 Special Report www.bbj.hu Budapest Business Journal | February 10 – February 23, 2023

calls

Gábor Hegyi, managing director of Capital Communications

Paul Mackintosh, senior advisor at Capital Communications

ESG a Must-have for big Players, With a Range of Benefits for SMEs

ESG considerations and sustainability are gaining increasing traction in the business world, both internationally and in Hungary. What makes ESG so important? What opportunities does it represent for businesses? What are the risks of failing to consider it in the short-, medium- and longterm? The Budapest Business Journal speaks with Gergely Ferenczi, director of Opten’s Company Information Division.

BBJ: What are the origins of ESG?

Gergely Ferenczi: ESG has become mainstream in recent years, but it developed several decades ago. Decision-makers in developed countries have been considering ESG since the late 1980s, although then it was referred to as sustainable development. The acronym itself comes from the world of investment because it was investors who first demanded to see frameworks that prioritized future-proofing and sustainability. Another significant milestone was the UN’s 2006 initiative to get investment companies to compile a set of criteria against which businesses could be evaluated. These included

not just sustainability but also social activities and how corporate governance was set up. Today, these factors have become essential, reflected in the fact that the business world and consumers have also developed an interest in them.

BBJ: How far have Hungarian companies progressed?

GF: The largest companies, especially publicly traded ones, are under particular scrutiny in this respect. They can be dropped from investment funds, which they obviously want to avoid. It is also increasingly evident that retail customers want to make sure they invest their money in companies that prioritize ESG. These large businesses have to publish their accounts transparently and are evaluated on them by the big rating companies because their stocks are widely traded.

Hungarian companies that have a multinational parent also take ESG seriously. Many MNCs publish annual reports, typically in languages other than Hungarian, and the Hungarian company makes up one chapter of these reports if that. Sometimes, only

ESG: How can a business check its progress?

Company information provider

Opten launched the first Hungarian ESG index in January 2022. The index rates Hungarian businesses’ ESG activities based on more than 75 factors. The index provides separate scores for environmental, social and governance metrics to give

as detailed a picture as possible of each company’s current status. Opten has also created a free-touse platform that companies can use to audit their own operations. By filling in a form, they can record their ESG activities and performance and use the results to improve their ESG index. The platform is now live,

aggregate data is published. There is still much room for improvement because statutory regulations will soon start applying to companies that employ more than 500 people and then to those with a headcount above 250. This change will come relatively soon due to the CSR Directive. This means Hungarian companies will have to start focusing on ESG even if they don’t have a foreign parent company that already requires this of them. Our data shows these companies currently have less interest in and commitment to the topic than those with multinational connections.

BBJ: What is the key to piquing their interest?

GF: I see two ways to reach Hungarian SMEs and incentivize them to consider ESG. One is regulation: strict requirements must be introduced as soon as possible. It will take a while, however, for the direct impact of these to be felt by Hungarian SMEs. Large companies that employ more than 500 people will have to report on their 2024 financial year in 2025, and those with more than

and as of this January, there is also an option to purchase an ESG report, which provides an automated online alternative to the legacy reporting service based on manual consulting. All three solutions aim to empower Hungarian businesses to achieve a step change in ESG and thereby become more competitive, efficient and sustainable. For more information, visit esg.opten.hu

250 following suit a year later. Regulations for SMEs could only be introduced in Hungary sometime after that.

BBJ: What is the alternative?

GF: The other way is to influence companies through their wallets. ESG factors have a tangible impact on financing, profitability and growth. Since 2022, the so-called taxonomy regulation requires banks to rate companies based on ESG metrics for financing or investment arrangements. The European Central Bank and the National Bank of Hungary (MNB) set this requirement. The MNB is really strong in this area, with outstanding experts working on the issue. Simply put, a business that prioritizes ESG may find it cheaper to obtain credit than one that pays less attention to these considerations. In time, this competitor may find it impossible to attract external capital.

BBJ: Can SMEs disregard ESG?