Logistics

Logistics and Industrial Boom Continues

With industrial and logistics demand remaining high and vacancy at record lows, the boom in the sector is continuing. Analysts say the Greater Budapest area is in a favorable position given the growing demand for logistics, e-commerce and light industrial space. 12

Provincial Hubs Beginning to Grow in Secondary Cities

Developer-led industrial development is finally extending to regional hubs across Hungary as in other Central European countries. Total stock for the sector has reached 4.58 million sqm in Hungary, 70% of it in the Greater Budapest area. 14

Guardians of the American Way

SOCIALITE

Discovering Local Garden of Eden at the S.U.N. Festival

Midway through summer, and it’s festival season in Hungary. As ever, it feels like we’re spoiled for choice without being truly excited. One event with a difference you may not have heard of is the S.U.N., which is taking place this weekend. 22

Inflation Slowing, Single-digits on the Horizon

Although the rate of inflation continued to slow in June, it remained above 20%. According to analysts, disinflation will accelerate significantly during the summer, and inflation will be in the single-digits territory by the end of the year. 3

AmCham has promoted U.S. business ethics in Hungary for 30 years, but are those values still relevant today? CEO Írisz Lippai-Nagy and president Zoltán Szabó discuss this and much else. 9

Parliament Passes 2024 Budget Despite Many Uncertainties

The government majority has passed the country’s annual budget amidst widespread criticism from the political opposition and doubts voiced by market analysts. The plans predict that 2024 will see a significant rebound from the depths of the current year. 6

NEWS

HUNGARY’S PRACTICAL BUSINESS BI-WEEKLY SINCE 1992 | WWW.BUDAPESTBUSINESSJOURNAL.COM

SPECIAL REPORT INSIDE THIS ISSUE BUSINESS

HUF 2,100 | EUR 5 | USD 6 | GBP 4 VOL. 31. NUMBER 14 | JULY 14 – JULY 27, 2023

FOCUS

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Luca Albert, Balázs Barabás, Zsófia Czifra, Kester Eddy, Bence Gaál, Gergely Herpai, David Holzer, Gary J. Morrell, Nicholas Pongratz, Gergő Rácz.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES: Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center 1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu

The Budapest Business Journal, HU ISSN 1216-7304, is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in any manner is prohibited. ©2017 BUSINESS

NEW SILK ROAD LIKELY TO KEEP LOGISTICS IN DEMAND

Real estate takes in so many fields that it is not surprising that as one rises, another falls. Residential was on something of a tax-rebate roll until the government ended its 5% VAT break on new home building.

Retail was once the place where everyone wanted to be. Until they didn’t. The slow rise of e-commerce (given a massive boost by the pandemic, of course) led to uncertainty about how much time shoppers would want to spend in bricks and mortar buildings. The government’s “plaza stop” legislation didn’t help, nor does the fact that sizeable plots with good public transport and road links, not to mention high pedestrian footfall, aren’t exactly two-a-penny. More than a decade separated the opening of Corvin Plaza in 2010 and Etele Plaza in September 2021. Lord alone knows when the next mall might open. Hotels were the next big thing, propelled by growing tourism numbers, which seemed to break records year after year until the COVID-19 outbreak. Its time will undoubtedly come again, and the latest luxury entrant, the W Budapest, only officially opened on July 10. Let’s hope pandemic-induced lockdowns really are a once-in-a-century event.

the office published in the first days of lockdown were premature in the extreme. That the office is here to stay is certain. How and when we use it is not.

The subject of our Special Report this issue, logistics, has been on an upward trajectory for some time, however. Let’s cycle back to the growth in e-commerce that has been problematic for bricks and mortar retail: all those goods need to be housed somewhere before being sent on their way. Then there’s the growth in e-mobility and the rush of Asian battery and battery parts manufacturers to Hungary. Even the shortening of supply chains and the reshoring of some business units have benefited logistics and its wider industrial sector. It’s a slightly crude description, but logistics is growing in the west of Hungary (think of all those big box buildings you can see being built as you travel along the M0 orbital motorway around Budapest) and light industrial in the east.

VISIT US ONLINE: WWW.BBJ.HU

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

For more information visit budapestbusinessjournal.com

COVID also made its presence felt in the office market, and while no one is predicting a collapse, neither is anyone denying that the market is uncertain right now. High-interest rates are making finance more expensive, and unknowable issues like who will need how much space on the back of changed work patterns and the rise of home office are making it harder to get. Most people agree the obituaries for

Black Swan sightings to one side (I know, who foresaw the pandemic or the war in Ukraine?), there doesn’t appear to be anything in the immediate future that could disrupt this happy scene. As long as Hungary’s government continues to snuggle up to China (Minister of Economic Development Márton Nagy has just returned from a five-day trip), and China is happy to use Hungary as part of its Belt and Road initiative to create a new Silk Road connecting Eastern goods with Western markets, perhaps this is one real estate sector that will continue to grow.

Robin Marshall Editor-in-chief

THEN & NOW

In the black-and-white picture on the left from the Fortepan public archive, people look to cool off at the Palatinus Lido on Margitsziget in 1980 as two policemen walk by. In the color photo on the right from state news agency MTI, children seek refuge from the heat at a fountain in Budapest’s Széllkapu Park on July 10, 2023.

2 | 1 News www.bbj.hu Budapest Business Journal | July 14 – July 27, 2023

MEDIA SERVICES LLC with all rights reserved.

What We Stand For: The Budapest Business Journal aspires to be the most trusted newspaper in Hungary. We believe that managers should work on behalf of their shareholders. We believe that among the most important contributions a government can make to society is improving the business and investment climate so that its citizens may realize their full potential.

IMPRESSUM BBJ-PARTNERS

THE EDITOR SAYS

Photo by Róbert Hegedüs / MTI

Photo by Fortepan / Magyar Rendőr

Inflation Continues to Slow, Single-digit Data on the Horizon

Although the rate of inflation continued to slow in June, it remained above 20%. According to analysts, disinflation will accelerate significantly during the summer, and inflation will be in the single-digits territory by the end of the year.

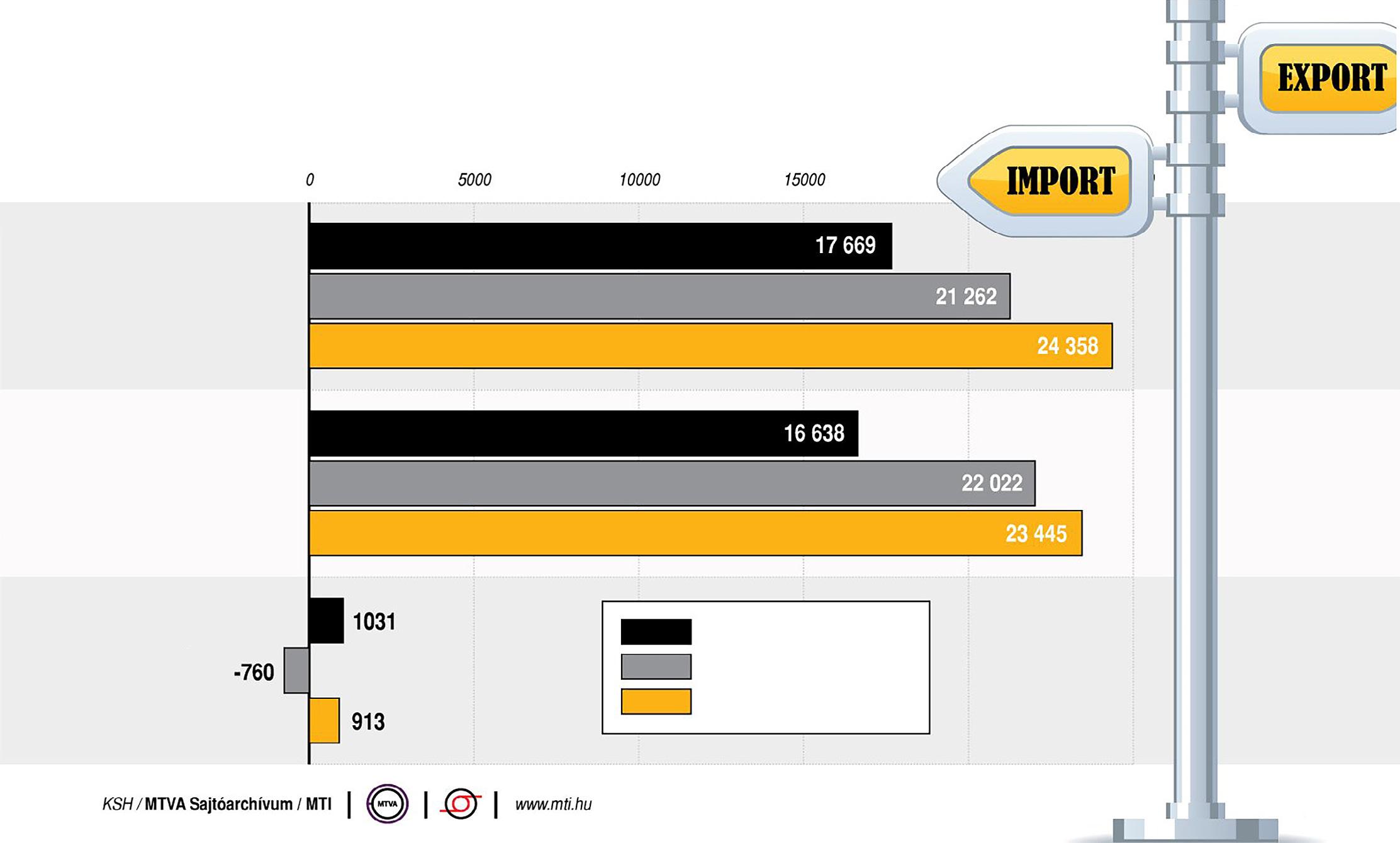

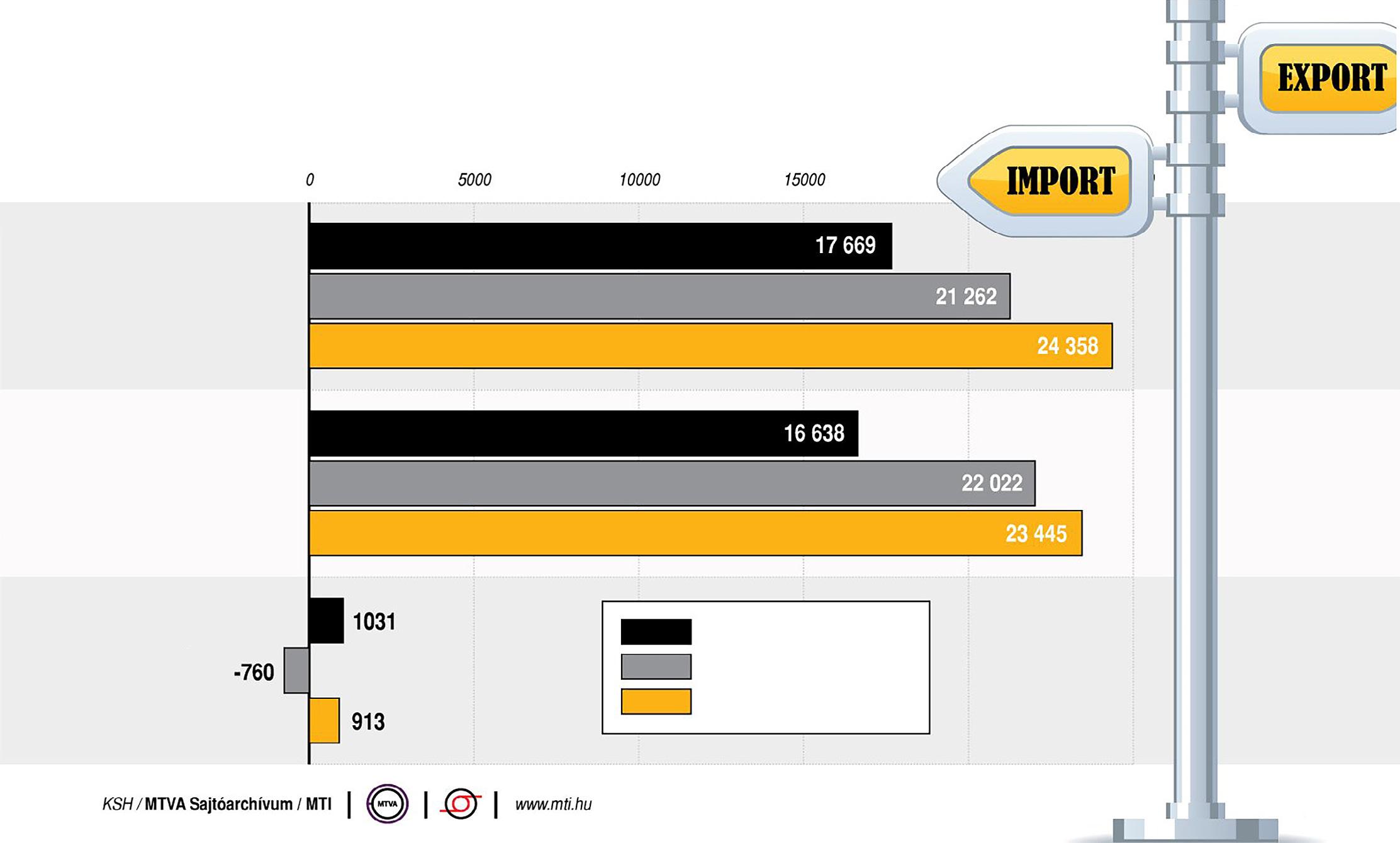

Export Import Balance

Since September of last year, the rate of price increases has not been as low as was recorded in June, and food prices also decreased compared to the previous month, which had not been seen for two years. However, inflation remained above 20% in June, albeit slightly.

Consumer prices were 20.1% higher on average last month than in 2022. The highest price rises were measured for electricity, gas and other fuels, and food over the previous 12 months, according to the latest report by the Central Statistical Office.

On a monthly basis, consumer prices were up by 0.3% on average. Food prices decreased by 0.4% on average.

“As expected, inflation decreased to 20.1% in June from

21.5%

in April,

which was contributed by almost all factors except the prices of clothing, other items, fuel and service providers,” Gergely Suppan, head analyst at MBH Bank, said.

“Food price increases moderated as expected, household energy prices continued to decrease due to lower energy consumption, durable consumer goods prices decreased due to the strengthening of the forint and the decrease in the prices of industrial goods, the prices of spirits rose less than expected, but the prices of fuel and other items increased, as well as the prices of the services,” he detailed.

According to Suppan, the seasonal drop in summer food prices also contributed to the effects of the ever-widening price reductions, which may continue in the coming months due to the decline in raw material prices and production costs.

He emphasized that the easing of inflationary pressure is reflected by the

EU Trade in Goods in Hungary

(January-May 2021, 2022, and 2023)

Source:

fact that core inflation also decreased to 20.8% from 22.8% in the previous month.

Expected Structure

The structure of inflation more or less corresponded to expectations, according to Erste Bank’s macroeconomic analyst János Nagy. He expects disinflation to accelerate in the coming months. The reduction may continue in 2024 as a whole, but according to his current expectations, inflation will return to the central bank’s 2-4% target range only in 2025.

All of this suggests a persistently strict monetary policy and a forward-looking real interest rate remaining in the positive range in the coming period, he says.

According to Péter Kiss, investment director at fund management company Amundi, the still-ailing household consumption could significantly influence inflation in the medium term, and the government-mandated discounts in food stores will only make up for this to a small extent.

“We expect a greater slowdown in the consumer price index in July and September due to base effects, so the elimination of food price caps in August is not expected to break the favorable trend,” he said. He still expects the inflation rate to be under 10%

by the end of the year.

Analysts unanimously agree that single-digit inflation is achievable

January–May, 2021

January–May, 2022

January–May, 2023

by December. Suppan of MBH Bank expects a sharp decrease in inflation in the second half of the year due to base effects and the increasingly widespread price reductions announced for food products.

The base effects could be strengthened by the fact that international raw material, product and energy prices and transport costs have fallen significantly, mainly to 2021 levels, in recent months, so he does not expect any new external price shocks. In fact, it is possible that inflation could decrease faster than expected, he argued.

Single-digits in Sight

“From October, we expect single-digit inflation, which may decrease to close to 6% by the end of the year. Due to the increasingly favorable trends and the growing downside risks, we maintain our average inflation expectation of 17.5% this year, while next year’s may decrease to 3.9% despite the increase in the excise tax on fuels at the beginning of next year,” Suppan said.

But while inflation data shows favorable improvements, other figures suggest a less rosy picture. The volume of industrial production dropped in May by 6.9% year-on-year, following an even more significant 8.3% drop in April. Based on working-day adjusted data, production declined by 4.6%. The majority of the manufacturing subsections contributed to the decline.

In the first five months of the year, production was 4.8% lower than in the same period of 2022. One positive sign was that, according to seasonally and working-day adjusted indices, industrial output in May was 1.6% above the level of the previous month.

Further bad news is the continued fall of retail sales: in May, alongside a significant base effect, the volume of sales in retail trade decreased by 12.7% according to raw data and by 12.3%

when adjusted for calendar effects compared to the same period of the previous year. In January–May 2023, compared to the same fivemonth period in 2022 and adjusted for calendar effects, the volume of retail trade decreased by 10.8%.

In the coming months, due to the ever-lower base effect, the rate of decline in retail sales may moderate, so the sector may even be beyond the bottom, according to Suppan.

“From the second half of the year, the expected fall in inflation and, as a result, real wages rising again, may bring a revival; the recently announced price reductions for an increasingly wide range of food products, as well as retail promotions, may also contribute to the gradual improvement of turnover,” he concluded.

www.bbj.hu Budapest Business Journal | July 14 – July 27, 2023 1

• macroscope

News

Industry and retail sales are yet to rebound.

ZSÓFIA CZIFRA

H 2Offices Awarded a Record Hungarian Leed ‘Platinum’ Score

The first phase of H 2Offices, the latest Budapest development by Skanska, has been awarded a Leed “Platinum” rating with what is currently the highest score in Hungary, according to the developer.

The project scored 84 points in gaining its Leadership in Energy and Environmental Design Core and Shell version 4 certification. The developer says this achievement sets a new standard in sustainable office space development and confirms Skanska’s commitment to sustainability and care for the environment. The building has also obtained the highest Access4You certification.

“We shape sustainable places to support healthy living beyond our lifetime, and this milestone underscores our commitment towards such aspiration,” says András Ábrahám, project director of Skanska’s commercial development business unit in Hungary. “Achieving the highest Leed Core and Shell version

4 certification score in Hungary is proof of the thoughtful design and construction of H 2 Offices and of our overall mission to build for a better society.”

The development earned additional recognition for features such as a light pollution reduction strategy, significant reductions in irrigation of up to 98%

for outdoor water use, and an innovative all-LED design that includes no mercury. This recently completed first 27,000 sqm phase fully complies with ESG principles, according to Skanska.

“H 2 Offices is designed to optimize energy efficiency, contributing to reduced operational costs. The complex was designed with sustainabilityenhancing features including 40% water savings, an annual reduction of 540 tonnes of carbon emissions as well as a 37% decrease in energy consumption,” Ábrahám says.

Real Estate Matters

A biweekly look at real estate issues in Hungary and the region

“Based on their standardized assessment, they provide reliable and detailed data on the locations’ accessibility to people with special mobility, visual, hearing, and cognitive needs for free. This is good for business and a benefit for society. Certified accessibility information helps companies in many ways,” comments Regina Kurucz, an architect and Well assessor.

“The architectural design concept was created by the Danish firm Arrow Architects, with general design work developed by Studio IN-EX and landscape design by Lépték-Terv. In addition to environmental solutions, accessibility is also an essential element and vital feature of the project, with H 2 Offices Skanska has created a truly inclusive environment and received the ‘Gold’ certification of Access4You, which evaluates accessibility features of the built environment,” the project director adds.

The Importance of Accessibility

Accessibility information is becoming more important for developers, landlords and owners. Access4you is a relatively new certification that doesn’t just aim to make life easier for those with special access needs. It also helps property owners and companies gain insights into their building’s accessibility and to reach their business goals.

Orbán Calls for Peace, Stoltenberg Hails Ratification

Prime Minister Viktor Orbán again reiterated Hungary’s stance regarding the war in Ukraine, emphasizing the need for a ceasefire and initiating peace talks, at a NATO summit in Vilnius, Lithuania, on July 11, according to a video message posted on Facebook.

appears to have been resolved on the eve of the summit. According to NATO secretary-general Jens Stoltenberg, Turkish President Recep Tayyip Erdoğan “has agreed to forward the accession protocol for Sweden to the grand national assembly as soon as possible.”

Ending Neutral Stance

ESG-compliant processes and sustainability accreditation are basic requirements from tenants in the leasing market and a regulatory expectation from the EU and national governments. Combined, that makes them the norm at the higher end of a growing number of real estate sectors and all stages from planning, permitting, and financing to construction, leasing, PM & FM and investment. The industry and related industries are expected to reduce CO 2 emissions, lower energy and natural resource usage (and therefore costs) and increase sustainable construction material usage.

Regional and Hungarian office developers such as Atenor, ConvergenCE, CPI, Futureal, GTC, HB Reavis, Horizon Development, Skanska, and Wing have sustainable development policies across their portfolios with accreditation from a third-party system such as the U.K.-based Breeam or the U.S.-based Leed and, from an interior and well-being perspective, increasingly from Well as well.

Further, from a market perspective, building owners need to react to demands from tenants and building users for the provision of space that enhances well-being through interior and locational elements.

Roundup Crisis

its blessing, finally paving the way for Sweden to join the Western defense bloc. Szijjártó has since described closing the lengthy ratification process in Hungary’s Parliament as a mere “technical matter.”

“The Hungarian position remains unchanged, and we will represent it: instead of bringing weapons to Ukraine, we should bring peace,” Orbán said in the video message. “A ceasefire is necessary, and instead of war, peace negotiations should start as soon as possible.”

He stated that Hungary’s perspective is clear: war is “in our neighborhood,” and due to the sizable minority of ethnic Hungarians living in Transcarpathia, just across the border in the southwest of Ukraine, tens of thousands of Hungarian lives were in immediate danger.

Orbán further argued that the North Atlantic organization should not change its previous position. “NATO is a military defense alliance,” Orbán explained. “It was created to protect its member states, not to carry out military actions on the territory of other countries.” He added that Hungary had agreed with NATO’s position “at the start of negotiations” not to send weapons, troops, or even train combat military units, but instead “strengthen the defense capabilities of its own member states. [….] This is necessary and right and Hungary will support it,” the PM concluded.

Meanwhile, the lingering issue of Sweden’s bid to join the military alliance

Alongside its neighbor Finland, Sweden applied to join NATO last summer after Russia invaded Ukraine earlier in February, ending the countries’ longstanding stance of neutrality. But while Finland was granted NATO membership earlier this year in April, the process requires unanimous approval from its member states, and that had been withheld for Sweden by Türkiye and Hungary.

Earlier this month, Minister of Foreign Affairs and Trade Péter Szijjártó said that Hungary would support Sweden’s bid to join the NATO military alliance once Türkiye had indicated that it was ready to do so. With Türkiye’s ostensible approval, Hungary is thus also primed to grant

But while Stoltenberg had said Erdoğan would “work closely with the assembly to ensure ratification,” the NATO secretary-general neglected to give a date for when the Turkish parliament, the Grand National Assembly, would decide on the exact timing.

Following the announcement, Erdoğan appeared to imply that the assembly’s conclusive ratification of Sweden’s NATO bid would be conditional on the European Union granting Türkiye membership it has been seeking since talks began in 2005.

“I am calling from here on these countries that are making Türkiye wait at the door of the European Union,” Erdogan said. “First, come and open the way for Türkiye to the European Union and then we will open the way for Sweden, just as we did for Finland.”

4 | 1 News www.bbj.hu Budapest Business Journal | July 14 – July 27, 2023

GARY J. MORRELL

Ukraine

NICHOLAS PONGRATZ

Xxxxxxxxxxxxxx

An interior at the H2Offices development.

Hungarians Studying Abroad Will Return if Conditions are Right

that there is something to be built, and they want to build it,” he enthuses.

“Looking at the statistics on building enterprises, if we do the maths, with 20,000 students abroad, if 54%

want to start a business, we’re talking about 10,000 [new companies], 5,000 of which specifically aim to fill a market gap. This means real market growth,” he argues.

Karagich agrees, stressing the responses to questions in the survey highlighted an intense desire among many students to fulfill a longing for achievement.

Only 26% of Hungarian students at universities outside Hungary “definitely intend” to return to their homeland to work after graduation, with 48% yet to decide their future country of residence, according to the Youth Affluent Finance Survey 2022, undertaken by Blochamps Private Banking Advisory and the Hungarian Youth Association (HYA), an independent student advocacy body.

intended to work abroad, either in their country of study (14%) or elsewhere (12%) upon graduation.

“We have these myths lingering in the public sphere,” Martin Pászti, a director of HYA and co-organizer of the survey, told the Budapest Business Journal in an interview. “Decision makers generally think in terms of brain-gain and braindrain, and they believe that the students who leave never want to return to Hungary, [but] 26% said they will return in the five to 10 years after they finish their studies. There is also 48% who are undecided, but they are absolutely open to coming back.”

Indeed, since the survey revealed that 94% of respondents believe that holding a degree from a Western university is more advantageous than a domestic qualification in the Hungarian job market, it is likely that a good proportion of the 48% currently undecided will return home after graduation.

This is important, given that those gaining degrees abroad are likely to acquire a broader set of skills, including entrepreneurial nous, plus better knowledge of a foreign language than their compatriots at domestic universities, says Bálint Karagich, executive director of HYA and also a survey co-organizer.

For some, remuneration is key: when asked about minimum salary expectations immediately after graduation, the average response for jobs abroad was the equivalent of HUF 1.1 million, more than double the HUF 510,000 expected in Hungary. (This compares to the HUF 330,000 starting salary hopes of students at Hungarian universities.)

Five years into a career, the difference in expectations is even more stark, with a foreign-based graduate expecting a minimum salary equivalent to

HUF 2.47 mln,

almost triple the HUF 860,000 for those who return to Hungary.

“I’ve been very keen to tell everyone [….] that these students are primarily driven by impact, and not necessarily money [….]. Whether their salary is HUF 700,000 or HUF 800,000, it doesn’t really make a difference as long as they feel like what they are doing can have a societal or economic impact,” he says.

And while “one in a million” may make it big in London or Amsterdam, “it’s really hard to stand out,” he argues, adding that, in contrast, “if you come back to Hungary, there are just so many things to do and achieve that it’s much easier to [create] an impact-driven company culture.”

The study (in Hungarian only) is not available online. Inquiries for access should be made to: karagich@blochamps.hu

Survey Facts and Figures

The study, which HYA believes is unique within Central Europe, quizzed some 300 Hungarian students in 11 European countries, plus the United States, via face-to-face interviews. It also revealed 26% of respondents

Moreover, the number of Hungarians studying abroad has more than tripled, from 6,300 to some 20,000, since Hungary joined the European Union in 2004, HYA estimates.

Should I Stay or Should I Go?

Nonetheless, the question remains: What are the principal factors influencing these students’ final decision to return?

Hungarians shy of U.K. Unis Post-Brexit

While the United Kingdom remained part of the European Union, Hungarian and other EU students flocked to the country to take advantage of its higher education facilities. But postBrexit, facing soaring costs, that has all changed says Balint Karagich, who holds a master’s from the London School of Economics and Political Science.

“In 2020-21, the last year when students could enjoy pre-Brexit conditions, there were 1,050 Hungarian students applying to U.K.

universities, with 705 accepted and starting their studies,” he says.

One year later, the numbers slumped to 480 applicants, with 320 accepted, but only 168 could take up their place.

“Many of those accepted applied for funding [through scholarships and bursaries], but were unsuccessful,” Karagich says.

The big winners from this have been the Netherlands, with 1,979 Hungarian freshers joining their student ranks in 2021-22, followed by Germany (1,878) and Austria (1,823).

“There is a correlation between students’ willingness to return to Hungary and their starting-salary expectations. Those who would not return even if they were offered a job immediately after graduation tend to have higher average salary expectations,” says Karagich.

He also notes that the possibility of being zero-rated for personal income tax (dependent on age) made Hungary’s seemingly low starting salary rates more attractive than first meets the eye.

Yet the survey found salary hopes were far from the only factor as students ponder their futures.

Inevitably, family and friends play a role, but the study revealed that the individual’s “potential professional impact” is another major factor.

The Risk Takers

Students who study abroad tend to be more risk-taking and entrepreneurial: 54% of respondents stated that they intend to start a business (6% already had).

Similarly, 54% of those seeking to start their own businesses are specifically targeting a market gap, a result which energizes Pászti.

“It means these students do not want to build their enterprises just to be their own boss and avoid taking orders or to get rich. It’s because they see a gap in the market, an opportunity. They see

According to Hungarian Youth Association (HYA) executive director Bálint Karagich, there are no official government statistics on the number or location of Hungarian students studying abroad. By researching the higher education statistics of the principal countries which host Hungarian students, the HYA estimates the total number studying abroad today to be around 20,000, or 8% of the entire Hungarian student population.

The largest contingent of respondents for the survey studied in the United Kingdom (36%), followed by the Netherlands (25%), Austria (14%) and Germany (8%). France and Sweden tied for the fifth most respondents at 5% each.

Some 97% of respondents believed the quality of education at universities abroad is better than in Hungary. Just under one-third of the sample (32%) believe companies that prefer foreign degrees offer better career prospects and more competitive salaries.

While 18% of respondents held a bank account only abroad, 78% had accounts in Hungary and abroad. A mere 4% had an account only in Hungary.

The gender balance of respondents was 54% male, 46% female. Of the sample, 37% studied natural sciences, 32% economics and 31% social sciences.

1 News | 5 www.bbj.hu Budapest Business Journal | July 14 – July 27, 2023

KESTER EDDY

A study reveals only one in four Hungarian students studying abroad intends to return home to work: However, twice that number are undecided on their future residence.

Bálint Karagich, NYA executive director

Martin Pászti, HYA director

Business

Parliament Passes 2024 Budget Despite Many Uncertainties

The government majority has passed the country’s annual budget amidst widespread criticism from the political opposition and numerous doubts voiced by market analysts. The plans predict that 2024 will see a significant rebound from the depths of the current year; however, concerns abound that structural issues dragging over from 2023 will weigh heavily, and the government appears to have made its calculations through rose-tinted glasses, according to its critics.

Hungary’s economy will see a growth of 4%, with inflation moderating to a manageable 5-6% range, public debt dropping, and the budget gap (which crept close to 10% in the first quarter of 2023) narrowing, according to the assumptions contained in the country’s newly passed annual budget for 2024.

Minister of Finance Mihály Varga stated that the plan is focused on defense, both in terms of preemptive military spending as well as shoring up the economy. The priorities include contingencies to keep energy supplies secure and slashing inflation, which reached a 25-year high this year on the back of soaring fuel and food prices.

Next year will see a dynamic shift in the Hungarian economy, and the

structure of expansion will also grow healthier, says Mariann Tripponn, the senior economist at CIB Bank. Nonetheless, she warned of the risks that stem from the spillover effects of 2023, for which she forecasts 0.5% growth, with downside risks on the table when asked by the Budapest Business Journal

There is a broad range of different forecasts for 2023, as well as what may come next year. The Fidesz government led by Prime Minister Viktor Orbán expects growth of 1.5%, which is the top of the 0-1.5% forecast range published in the latest National Bank of Hungary (MNB) inflation report.

Although the MNB usually releases less broad forecasts, deputy governor Barnabás Virág said it is justified this time, given the spectrum of uncertainties, such as the war in Ukraine, energy supplies or any other global developments that could emerge. When prompted by the BBJ, he declined to take a position regarding which end of the forecast band he expects to materialize.

Amendments Expected

Politicians on the opposition side of the aisle are already critical of the government for its practice of drafting the oncoming year’s budget in the spring.

Zoltán Vajda, the Socialist (MSzP) head of Parliament’s budgetary committee, said the 2024 plan, like those before it, would have to go through amendment after modification since the government’s calculations are entirely ungrounded.

Ferenc Dávid (DK), deputy head of the house economy committee, also claimed that all the figures contained in the plan are unfounded, reflect wishful thinking and provide no solid footing for participants of the economy to make any plans for even the immediate future.

There are many doubts regarding the balance planned for 2024. To highlight just two, there is still no agreement between the government and the European Commission on the release of some HUF 2 trillion in funding held back due to EU objections regarding Hungary’s adherence to the rule of law and a potential other

HUF 2 tln

in losses accrued by the MNB on high interest and a weak forint, which the state is required to cover by law.

The main issue for 2023, which is set to drag over to next year, is high inflation, with government and central bank measures enacted to halt the drastic rise in prices. PM Orbán explicitly stated earlier that despite high inflation causing major problems in several areas of the economy, the government would not introduce any measures to orient households into restricting their consumption.

The government instead introduced mandatory price regulation on staple food products, an approach that analysts and opposition politicians criticized when asked by the BBJ due to their distortive effects.

Surprise Correction

Despite the government’s approach, a correction came anyway, the extent

of which, as Minister of Economic Development Márton Nagy admitted, surprised the government. The latest retail data from the Central Statistical Office (KSH) shows that turnover dropped 12.5% year-on-year in May, and there was also a month-on-month drop of 0.8%.

Nagy said the figures clearly show that households cut back in terms of the quantity of retail products they bought, and there is also a trend of quality downgrading, with many consumers opting for store-brand alternatives to what they would typically purchase.

The minister stressed that this is a problem for the central budget as well, given how the government is counting on household spending to compensate for the growth gap left by state stringency, cost-cuts and the postponement of several investments.

There are many doubts regarding the balance planned for 2024. To highlight just two, there is still no agreement between the government and the European Commission on the release of some HUF 2 trillion in funding held back due to EU objections regarding Hungary’s adherence to the rule of law and a potential other HUF 2 trillion in losses accrued by the MNB on high interest and a weak forint, which the state is required to cover by law.

As such, the head of the Prime Minister’s Office Gergely Gulyás recently announced that Szép card allowances, which employers could give to their workforce as in-kind benefits, can now also be used in retail. They were originally restricted to the hospitality sector, essentially giving employees a cheaper way to go on a family holiday. Nagy conceded that this is a blow for hoteliers and restaurants, but for the time being, the priority has to be boosting household consumption to fuel growth and the state being able to collect the VAT it needs for its operation.

Gergely Suppan of MBH Bank is optimistic regarding the stabilization or even the rebound of food sales. He expects greater output from the agriculture sector, which is set to bring stabilization and possibly even a reduction in food prices in the second half of the year, and points to favorable terms in the runup to 2024. There are some vaguely encouraging signs that complement Suppan’s forecast. The latest inflation statistics from KSH show the rise in food prices slowed in June to 0.3%, and prices actually dropped 0.4% month-on-month.

www.bbj.hu Budapest Business Journal | July 14 – July 27, 2023 2

GERGŐ RÁCZ

Minister of Finance Mihály Varga at the final vote on the 2024 Central Budget Act at the extraordinary plenary session of Parliament on July 7. The legislation was approved by 121 votes to 44. Photo by Zoltán Máthé / MTI.

Former Drechsler Palace Officialy Opens as W Budapest Hotel

Eight bespoke cocktails pay homage to various eras, people and buildings within the city, each including a mysterious ingredient, overseen by head bartender Stefano Ripiccini. The Illusionist, for example, is named after the great Harry Houdini; Brew Bop is a nod to Budapest’s Fin de siècle coffee golden age, and Geranium, which Drechsler Palace itself inspires. The hotel’s Away Spa is just next door to Society25.

“The debut of W Hotels in Budapest marks a monumental milestone and signals a new era of design ethos for our iconic brand,” said George Fleck, vice president and global brand leader for W Hotels. “We look forward to connecting our guests to this timeless and inspiring city through inviting yet unexpected design, imaginative dining and unparalleled guest programming.”

Housed in the historic Drechsler Palace, previously home to the Institute of Ballet, W Budapest is located on Andrássy út, a UNESCO World Heritage Site and arguably the city’s most luxurious shopping street. The hotel features 151 guestrooms, including 45 suites, and three dining concepts, all influenced by Budapest’s history, creativity and diversity.

The team behind the renewal of the palace says the interior design draws inspiration from the Drechsler Palace’s rich cultural history and multiple former identities as a café, social hub and home to the Hungarian State Ballet Academy, and from the grand French Renaissance architectural aesthetic throughout the city. Hungary’s vibrant and eclectic cultural scene, including the city’s famous love of chess and its deep-rooted connection to ballet, can also be seen throughout the new hotel.

The hotel’s “destination restaurant,” Nightingale by Beefbar, is the gastronomic heart of the hotel. A spinoff of the Beefbar concept, it offers Asian cuisine, pairing fresh traditional Asian flavors with a selection of Beefbar’s signature meat dishes.

Spearheading the Nightingale by Beefbar’s kitchen is Fabio Polidori, who has curated a menu of small plates designed to be shared with friends. Dishes include crispy carpaccio drizzled in a piquant chipotle dressing, yellowtail sashimi with yuzu truffle sauce, and the intriguinglynamed Miss Bao, which invites diners to dip caramelized banana into a dark chocolate sauce. The bar at Nightingale by Beefbar offers a host of creative cocktails, from bourbon-based Nightingale Boulevardier to the gin and sweet winebased cocktail Budapest Calling.

The hotel also has what it calls a “speakeasy” located in the basement, called Society25. “It takes inspiration from the creative conversations and secret table societies that frequented the space in its past life,” the W Budapest says.

Learning Skills Instead of Memorizing Facts

Debrecen has been attracting many foreign investments in the last decade. This means new families and children arrive, creating the need for an educational facility in the area. This is the International School of Debrecen, with a different approach to teaching.

The local government founded the ISD with the primary goal of creating an internationally competitive educational sphere within the city. It opened in 2019, and the City of Debrecen considers it one of the keys to the region’s economic development. The ISD focuses on life skills that help students prepare for future challenges and to be risk-takers in their learning.

The Budapest Business Journal talked to ISD Director Tom McLean about how the school started and where it is heading.

Tom McLean: This region aims at attracting foreign investment into an area that does not have the same level of economic maturity as Budapest. This is an attempt to stimulate economic growth in a part of the country which needs it. The school is an essential component of the development plan to attract foreign investment. With FDI come international workers and, with them, international families and children. It is crucial for these children to have continuity; they cannot attend Hungarian schools and spend years catching up with the language. Another group we aimed at was Hungarian families

open to international education. In the beginning, most of our students were Hungarian; now, the rate is 50-50 between Hungarians and foreign students. Last year we had 170 pupils at the beginning of the year; now, we have 300, so we have seen nearly 100% growth. Of course, the new facilities like the BMW factory and others brought a foreign workforce (Korean, Chinese, Turkish, German), so the school’s history has been quite challenging. We started during the pandemic, and have obtained International Baccalaureate (IB) accreditation for all three programs (Primary Years, Middle Years and the Diploma), the most widely recognized international accreditation. ISD is Hungary’s first

Located on the ground floor, and blending into the Nightingale restaurant, is W Lounge, described as “the social epicenter of the hotel.” The hotel also boasts several meeting and event spaces, including the Great Room, ideal for grand celebrations, and two Studio Rooms for business meetings and more intimate gatherings.

The hotel also promises programming that will integrate it into the life of the city. “Faces of Budapest,” kicking off in August in celebration of Budapest Fashion Week, is a series of roundtable discussions that “will shine a light on the inspiring faces of Budapest who represent the energized city, sharing insights and fostering connections.” Dávid Ráday, music curator at W Budapest, will create the sounds of the city through musical explorations paired with cocktails and bites at “Sunset Sessions,” “The Warm-up,” and “Afterdark.”

IB Continuum School offering education from kindergarten to graduation.

BBJ: How are you preparing your students for labor force market challenges?

TM: The IB approach focuses on conceptual knowledge and skills rather than content memorization. There is a high emphasis on critical and creative thinking, and I think that is the best way to prepare the students. We focus on research, communication and collaboration skills, and self-management skills. Of course, we do content teaching too, but we look at the local and global context, fostering inquiry rather than answers and memorizing, with an emphasis on collaboration.

BBJ: What is the teacher mindset at ISD?

TM: When I look for teachers, I look for certain qualities. The first is to be student-centered, the approach being that “I teach people” rather than “I teach history.” The second is collaboration. The idea behind an international school is respect and embracing differences; that other people can have different opinions to yours but still can be correct. In Debrecen, ISD students develop their ability to adapt to new and challenging situations and communicate effectively with others. These qualities are of great value in our ever-changing, globalized age.

2 Business | 7 www.bbj.hu Budapest Business Journal | July 14 – July 27, 2023

BBJ STAFF PRESENTED CONTENT

The much anticipated official debut of W Budapest, the brand’s first opening in Hungary, took place on July 10.

BALÁZS BARABÁS

Tom McLean, director of the ISD.

ISD students learn to communicate effectively with others.

Europe’s Worrying Declining Relative Competitiveness

Finance Matters

A biweekly look at financial issues in Hungary and the region

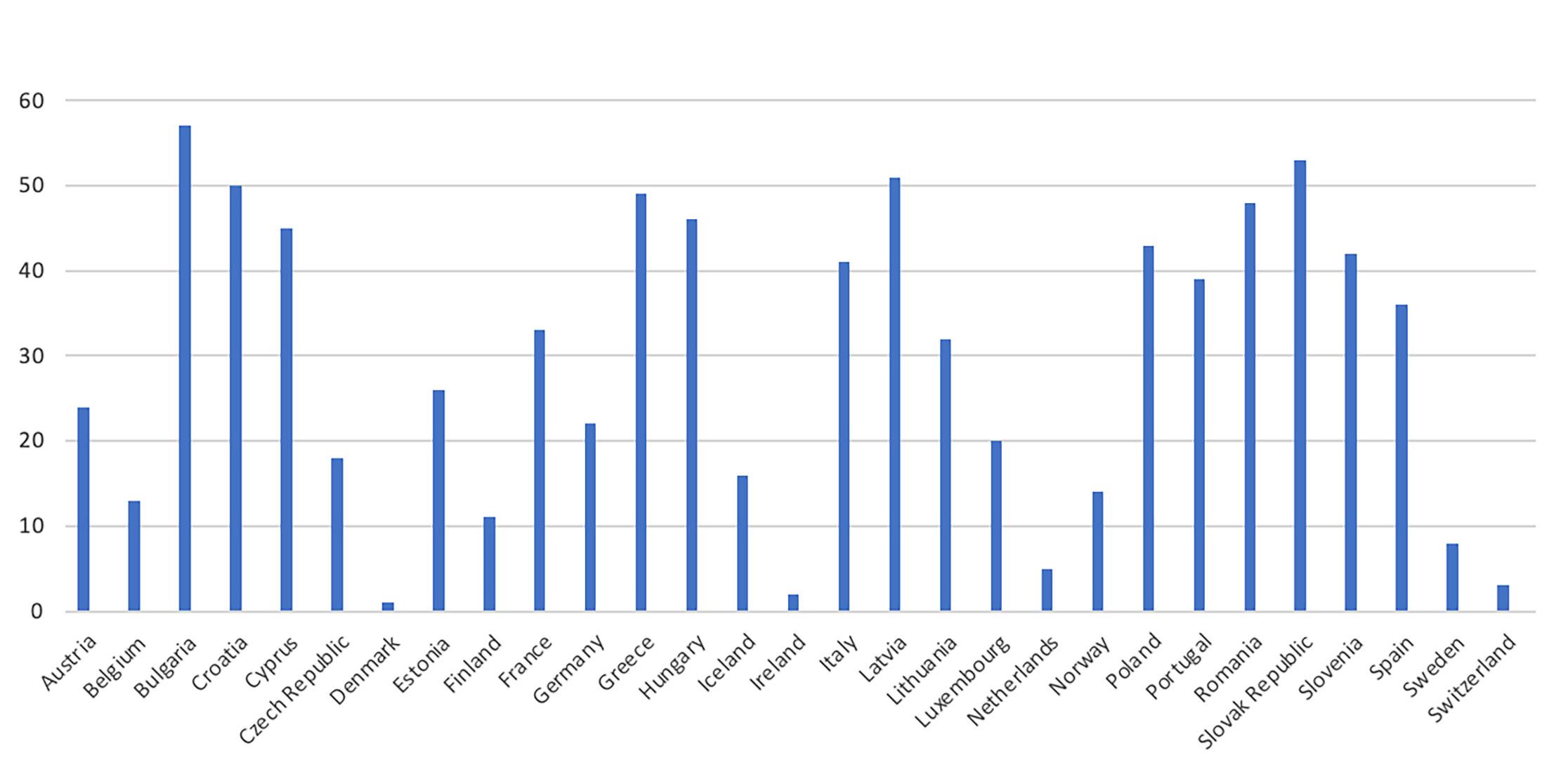

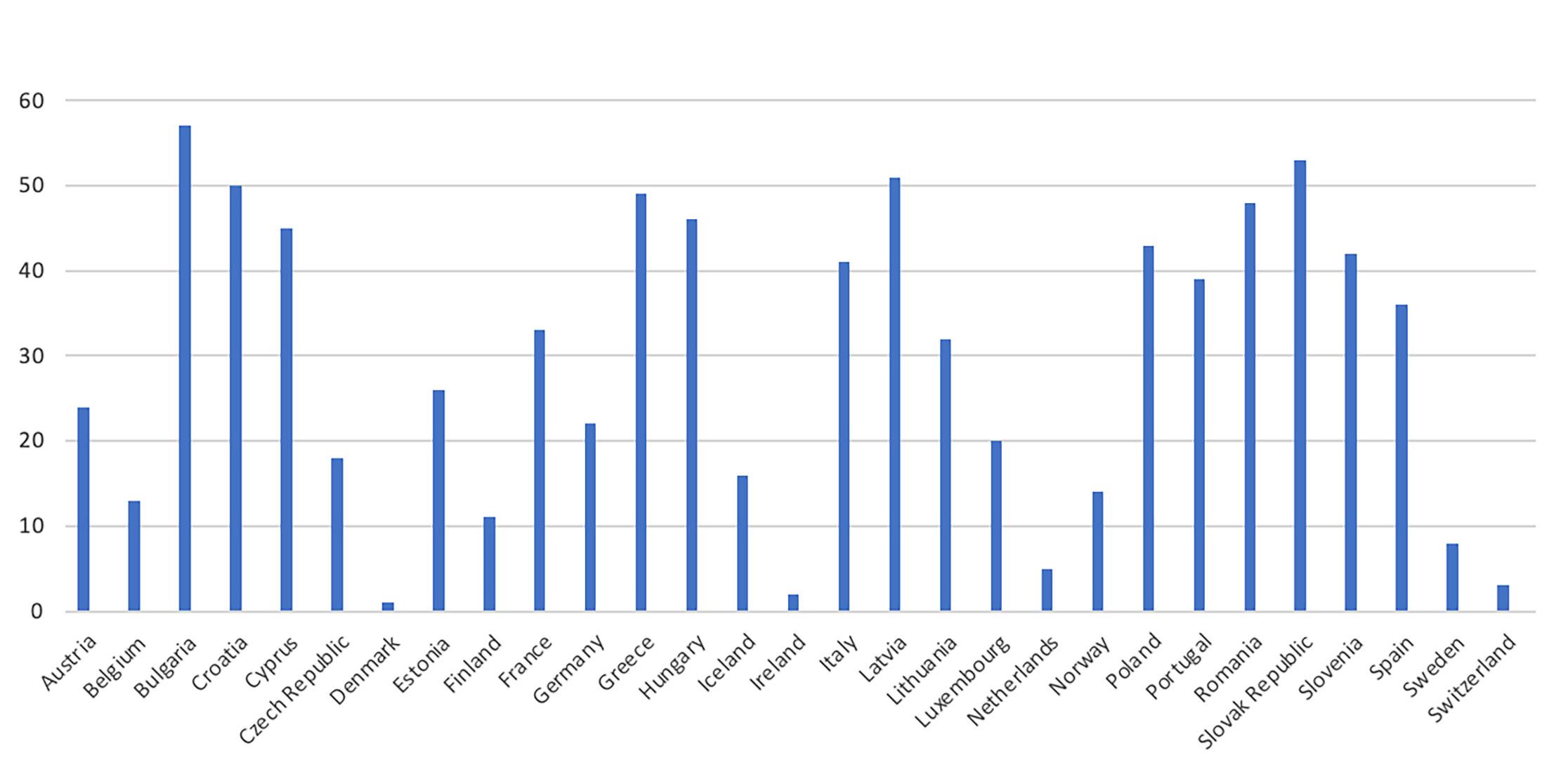

2023 EU Competitiveness Rankings

This article breaks down the subject of Europe’s declining relative competitiveness into four areas: how to define competitiveness?, what stats might be used and what do they actually show?, what might explain this decline? And, finally, what is the prognosis for the future and how might this decline be reversed?

Defining Competitiveness

There is no standard definition of competitiveness. In researching this article, I came across quite a few. The one I liked best was: “Competitiveness, at regional and/or country level, is based on the ability to compete in the global market. It can be understood as a set of institutions, policies and factors, embedded in networks of innovation and entrepreneurship, able to determine the level of productivity of an economy, wealth creation, job creation, capture and return of investment, economic growth and social welfare.”

What Stats?

There are many stats often used to describe competitiveness; here are some of the most popular.

The Global Competitiveness Score (GCI), as calculated by the World Economic Forum, declined from 70.9 in 2011 to 66.8 in 2020.

GDP growth over a longer time period is an indication of competitiveness.

According to the World Bank, GDP growth from 2011-2020 was as follows:

• Eurozone: 0.8%

• US: 2.1%

• China: 6.6%.

The Global Innovation Index (GII) overall ranking for Europe decreased from 58.9 in 2010 to 54.7 in 2021 (although Switzerland, Sweden and Germany scored well).

Startup activity: In 2020, there was USD 149.2 billion investment into U.S. start-ups, USD 67.9 bln in China, and only USD 42.8 bln in Europe. Europe greatly lags in the number of unicorns (startups that reach market capitalization of More than USD 1 bln).

It is interesting to note that there are some fairly broad variations of competitiveness among European countries. See the chart below, noting that lower scores mean higher competitiveness.

Explaining the Decline

The reason perhaps most often given for declining European competitiveness is the decreasing participation of Europe in global value chains (GVCs). This seems to be mostly at the expense of China’s increase. Furthermore, China’s vertical integration seems to be diminishing Europe’s ability to export into China. In many areas, such as automobiles, China has moved from merely supplying inputs to a fully finished product.

Here’s one amazing statistic: the number of graduates in STEM (science, technology, engineering and mathematics) subjects in China equals those in Europe, the United States and Japan combined.

A 2023 document by the European Commission comes to some pretty serious conclusions.

“Since the mid-1990s, the average productivity growth in the EU has been weaker than in other major economies, leading to an increasing gap in productivity levels. Demographic change adds further strains. Analyses show that the EU is also not at par with other parts of the world in some transversal technologies, trailing in all three dimensions of innovation, production and adoption and losing out on the latest technological developments that enable future growth.”

Future Prognosis

The same document by the EC is optimistic that Europe’s relative competitiveness may begin to improve

“Since the mid-1990s, the»average productivity growth in the EU has been weaker than in other major economies, leading to an increasing gap in productivity levels. Demographic change adds further strains. Analyses show that the EU is also not at par with other parts of the world in some transversal technologies, trailing in all three dimensions of innovation, production and adoption and losing out on the latest technological developments that enable future growth.”

after 2030. Is this well-founded?

The factors listed in the previous paragraph are pretty hard to reverse, and the report is thin on specifics. Moreover, much of its strategy relies on deeper European integration (deepening and broadening the Single Market, creating a unified capital market, and so on). This may well happen, but it is a politically fraught exercise.

Meanwhile, we continue to read about examples where China eats European market share for breakfast. PwC, for example, recently forecast that due to China’s advances in electric vehicles and the increasing market share of EVs, Europe may become a net importer of cars by 2025.

It is true that the purchasing power of the European market is vast and that

Europe has an excellent competition policy. In my opinion, these are necessary but insufficient conditions for competitiveness. There are both top-down and bottom-up requirements to improve competitiveness.

The top-down element involves the EU and governments enabling education, capital markets, legislative framework, and so on.

The bottom-up element involves entrepreneurs creating winning innovation-based strategies accompanied by superb productivity gains and execution, a kind of industry-by-industry trench warfare to claw back market share. I do not see adequate discussion of the latter in the EC’s document, hence I cannot share the commision’s optimism about a post-2030 renaissance of competitiveness. (Meanwhile Europe could lose its car industry by 2025.)

Unfortunately, if Europe’s relative competitiveness to China improves over the decade, it is likelier this would be due to a slowing of or implosion by China (see my earlier article on whether we are seeing Peak China), than a dramatic improvement in European competitiveness.

8 | 2 Business www.bbj.hu Budapest Business Journal | July 14 – July 27, 2023

Gross Domestic Product growth (hence wealth creation and improved standards of living) are not possible without competitiveness. That makes the European track record a genuine cause for concern, warns Finance Matters columnist Les Nemethy.

Les Nemethy is CEO of EuroPhoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www. businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

3 Country Focus

United States

AmCham: Building Relevance by Adding Value

conference in the United States in May. How important is this network, and what came from the trip to the States?

ROBIN MARSHALL

BBJ: As the leading business organization advocating for and representing the interest of U.S. businesses in Hungary, what are the key areas where AmCham is talking to the government?

Írisz Lippai-Nagy: Maintaining a dialogue with the government to represent the interests of our membership and improve the country’s competitiveness is part of our mission and has long been on our agenda. Lately, we have formulated positions and sent them to the government on three major policy areas: Education, healthcare and taxation. On education, we highlight the need to modernize public education, whereas in healthcare, we talk about the need for a predictable business environment for life science companies. We are proud that our positions were supported by several other international chambers of commerce, further enhancing the voice of AmCham.

Zoltán Szabó: On taxation, AmCham has stressed the importance of negotiations for a new U.S.-Hungarian Double Taxation Treaty. Furthermore, we sent a position letter on windfall taxes to critical policymakers about the harmful economic effects of an unpredictable business environment, focusing on tax increases on innovative pharmaceuticals. We look forward to discussing the issues further with the respective decision-makers at our Business Forums planned for the autumn.

BBJ: Do you see any movement on the replacement double-taxation treaty?

Írisz Lippai-Nagy: Since the U.S. announced the termination of the treaty in July 2022, AmCham has emphasized

the importance of the renewal or to start negotiating on the possibilities of a new convention on several platforms (Business Forums, position letters, in meetings, and through interviews) and engaged in a dialogue with both the U.S. and Hungarian decisions makers. However, the existing convention will be phased out from January 2024 as we have already passed the date when it could have been renewed. Laying the foundations of a new agreement takes several years, based on previous practice. Therefore, we must face the reality of no agreement for at least a specific period. Next year there will be a presidential election in the United States, which we cannot ignore; that could also affect the treaty’s future.

Zoltán Szabó: Negotiating a new treaty now appears to be a relatively longterm goal. However, the absence of a treaty could be a disadvantage in several respects, such as the country’s international reputation, especially from a business perspective. From next year, Hungary would be the only European country without an agreement in force. Furthermore, the absence of such a treaty could increase uncertainty about Hungary as an investment destination. We will keep the issue on the agenda and strive for discussions with both sides. The absence of the treaty will also impact Hungarian investments in the States and individuals who have assets there.

BBJ: What are the main challenges faced by U.S. businesses in Hungary?

Írisz Lippai-Nagy: The biggest challenge is the unpredictable economic and regulatory environment. A company can only perform well, especially in the medium- and long-term, if it can prepare and plan ahead, which requires a certain level of stability. Regarding the U.S.-Hungarian Tax Treaty, its absence may also create uncertainty among

investors as, without it, they might see Hungary as a place where a special tax, i.e., a withholding tax, could be levied on income paid from the country at any time, which could jeopardize the return on investment.

Zoltán Szabó: This could lead to further adverse effects such as a contraction or absence of investments or a shift of business service functions to other countries. In addition, it also entails additional taxes and potentially administrative burdens for American citizens working in Hungary since American-sourced income also becomes taxable in Hungary. Moreover, if an American parent company wishes to grant shares or stock options to employees working in Hungary, the benefits might be subject to a 30% U.S. withholding tax.

BBJ: Certain elements of the Hungarian media seem pretty hostile to U.S. Ambassador David Pressman. Does this undermine the bilateral relationship?

Zoltán Szabó: We are fortunate to have an excellent and close working relationship with the Ambassador and discussions are under way to welcome him to AmCham in the fall. We have been working closely with the embassy and the U.S. Chamber of Commerce for years, and, despite recent global challenges, the numbers suggest a robust bilateral business relationship. Currently, nearly 1,700 U.S.-based companies are operating in Hungary, employing around 106,000 people. Our aim at AmCham Hungary is to improve the country’s competitiveness, including business competitiveness, to ensure that bilateral relations can be maintained in the upcoming years.

BBJ: AmCham Hungary CEO Írisz Lippai-Nagy, a member of the AmChams in Europe network, participated at the ACE annual

Írisz Lippai-Nagy: With a presence in 44 countries, ACE is the largest network of international chambers of commerce in Europe and celebrates its 60th anniversary this year. ACE operates as a cross-country support network that represents added value to the AmChams and our members. There is an AmCham in almost every European country, where international member companies can register their local subsidiary, ensuring they can receive practical support from their chamber with comprehensive knowledge of local business specifics. Regarding the trip and the key takeaways, the conference provided an excellent opportunity for cross-chamber best-practice sharing and knowledge exchange. Furthermore, the meeting pointed out that, in today’s challenging world, it is essential to have a unified voice focusing on transatlantic relations and the timeless values that apply to all of us, regardless of our country of origin.

BBJ: Are American values still recognized and welcomed in Hungary, or is the country, with its “Opening to the East” policy, drifting away from the U.S. sphere?

Zoltán Szabó: There is undoubtedly an opening towards the East, but at the same time, as a European country, Hungary holds Western and American values that have become part of our culture over the years, including our business culture. Values such as diversity, equality, integrity, transparency, and partnerships all respond to the expectations of today’s generations and point toward progress, so they must stay with us for the long term. Our business community stands by them, and we hope their example will motivate other companies and citizens of this country.

BBJ: Aside from the embassy and ACE, do you work with other U.S. organizations?

Írisz Lippai-Nagy: We strive to cooperate with partners in Hungary and America. Our main partners in this regard are the American-Hungarian Chamber of Commerce and the U.S.Hungary Business Council. The first is present in the States and mainly offers support to Hungarian companies wishing to enter the U.S. market; the other is a platform connecting Hungarian government leaders and U.S. business executives, who can then support the Hungarian subsidiary of their company through partnerships and information developed with the help of the council. We also collaborate with the Hungarian Investment Promotion Agency, which can support U.S. companies by introducing investment opportunities here in Hungary.

www.bbj.hu Budapest Business Journal | July 14 – July 27, 2023

The American Chamber of Commerce in Hungary has been the guardian of the U.S. business ethos in this country for 30 years, but are those values still relevant today?

The Budapest Business Journal sat down with AmCham’s president and CEO to discuss this and much else besides.

AmCham CEO Írisz Lippai-Nagy and president Zoltán Szabó.

Budapest Affiliate Plays key Roles in ExxonMobil’s Energy Operations, Transition

it’s very critical,” says Kim. “You can’t just be operating a process; you need a problem-solving mindset. Some of these challenges are very complex.”

This, in turn, means scouring the universities to find the right talent, with new starters usually requiring at least a bachelor’s, if not a master’s degree.

“We hire from some of the best universities in Hungary,” says Kim. “We have targeted approaches to look at how we attract the kind of skills and capabilities that we need. But there are very good universities that generate a good pipeline of talent.”

But ExxonMobil Hungary isn’t only targeting students; it is also hiring experienced professionals for the most complex roles.

ExxonMobil is a corporation the public may associate with “big oil” and images of donkey pumps and toughlooking workers wearing hard hats and protective industrial clothing. But there is nothing of the sort in the entrance hall of ExxonMobil’s one-year-old Pillar Building, where employees passing through are typically in casual business dress, and some of whom, it turns out, are involved in the energy transition to a net-zero future.

“We talk about powering ExxonMobil’s global business from ExxonMobil Hungary,” Byung Kim, lead country manager for the operation, tells the Budapest Business Journal in an interview.

It’s a bold statement, but the 43-year-old American, in charge of the U.S.-headquartered multinational’s operations in Budapest for almost a year, is eager to back it up. True, he admits that for the first few years after ExxonMobil’s Budapest Business Support Center was established in 2004, work focused on “traditional” backoffice services. But nearly two decades on, much has changed.

“For example, we have opportunities in supply logistics, pricing, and

analytics for regional and global operations. We support cyber security activities from here,” he says.

So, while a large portion of the

2,000-strong

workforce remains dedicated to accounting services, invoicing, and financial statement preparation, much of the talent deals with more complex tasks.

“This is no longer just a back-office operation: We’re actually involved in running the business. We are doing roles that impact business results, and also the measurement of business performance, here in Budapest,” Kim asserts. Budapest is well placed to do so, being roughly halfway between ExxonMobil’s AsiaPacific operations and those of the United States, meaning, in terms of time zones, it is ideal for supporting global operations.

But to grasp the whys and wherefores behind all this, one must understand ExxonMobil’s corporate objectives

in meeting society’s evolving energy needs and playing a leading role in the energy transition.

The Energy Trilemma

“We have the energy trilemma [...]; we want to progress in the energy transition, be a leader in that space, but we also understand that modern society needs more energy supplies that are both reliable and affordable. It’s not easy; you need innovative solutions to get there,” he says. To achieve its goals, ExxonMobil is today organized into three main value chains.

“We have the Upstream, which is focused on more traditional oil and gas and LNG resourcing. Then we have Product Solutions, which is taking our fuels, lubricants, and our chemical businesses and creating one company that delivers innovative solutions for customers,” Kim explains.

Finally, the Low Carbon Solutions business is part of the corporation’s drive to become a leader in the energy transition.

“This is focused on carbon capture and storage, bio- and low-emission fuels, and hydrogen. These are areas that, given our history and our competencies, we can do at scale and help society on that transition to net zero; we aim to play a leading role in the energy transition,” he argues.

Not that there are any chemistry boffins running around in white coats waving pipettes in the Pillar.

“We don’t have any physical operations in Hungary, but the activities that don’t require you to be next to the ground [...] we can do from here,” Kim says. Naturally, these operations need intelligent, focused employees.

“You need to be able to solve problems, so whenever there are supply disruptions, getting logistics to take the right products to the right customers at the right time,

“We are also passionate about supporting science and technologyrelated education and raising awareness of energy challenges. As part of our commitment to supporting students, for the second year, we hosted the SciTech Challenge competition in Hungary, inspiring students to use their STEM [science, technology, engineering and mathematics] skills to tackle some of society’s biggest challenges,” Kim says.

“After the national competition held in our office, this year’s final challenged high school students from Hungary, Belgium, Cyprus, the Czech Republic and the Netherlands to develop a product or service that supports sustainable plastic usage and waste management at the upcoming 2024 Olympic Games in Paris,” he adds.

Career Development

The varied activities in ExxonMobil’s Budapest operation, coupled with the company’s proactive approach to career development, mean employees have a breadth of opportunities in a rewarding career.

“We hire people for the long term. Our vision is ‘Where can we get those people by the end of their career?’” says Kim. “It’s not about this job; it’s not about the next job, per se. You have to look at those things because you must continue developing, but we take a long-term career view.”

To back up his assertion, he points to employees who have been with the Hungarian affiliate since it was founded 19 years ago.

“We have managing directors that are local employees who have been with us and have seen all types of assignments. Many of them have had opportunities to go overseas, to the U.S. and Belgium, as part of their development,” he notes.

Kim, who has been with the company for 20 years, says he believes in leading through direct contact and building relationships with personnel.

Indeed, engagement has been the highlight of his first year in charge. Meeting people and understanding them, regardless of their time with the company, is “really such a powerful tool to be able to connect and help collectively move in the same direction,” he says. “That to me has been a tremendous learning [experience], and I’m sure that’s part of why they’ve sent me here, to understand how to be effective in those areas.”

10 | 3 Focus www.bbj.hu Budapest Business Journal | July 14 – July 27, 2023

KESTER EDDY

Prominent on a purpose-built tall office block and in bright red letters, the name ExxonMobil greets thousands of travelers leaving the Dózsa György út metro station in Budapest every day.

Byung Kim addresses students during the Sci-Tech Challenge competition ExxonMobil Hungary hosted this year.

Byung Kim, lead country manager of ExxonMobil Hungary.

U.S. Firms Deem Hungary as Strategic Location to Support Global Operations

E-fuel Opening

Now that electrification is leading the charge to reach net zero, stakeholders like ExxonMobil need to adapt quickly and efficiently to stay ahead of the competition.

The fact that EU legislators have left the door open for the use of so-called e-fuels (synthetic fuels generated by using decarbonized power sources, such as wind, solar or wave) gives more room for oil companies for development.

Now, demand for low-emission fuels is expected to increase, driven by the need for energydense, lower-carbon fuels for hardto-decarbonize transportation sectors such as aviation, marine and heavy-duty trucking, Kim notes. And low-emission fuels have the high energy density required to meet commercial transportation needs while significantly reducing CO2 emissions.

“We are focused on growing our lowemission fuels business by leveraging current technology and infrastructure, in addition to continuing research for any potential additional solutions; there is no one solution to reach our climate goals, but a mix of technologies,” he adds.

Many people don’t know that topranking Fortune 500 company ExxonMobil runs a massive business service center in Hungary that has grown to become its largest office in Europe over almost 20 years. As Byung Kim, ExxonMobil Hungary’s lead country manager, explains, the growth is not only about numbers but also the quality and complexity of operations.

“We support the business in areas such as sales, marketing, logistics, digital and cyber, collaborating with our colleagues in the Americas and Asia Pacific regions in addition to supporting our local European operations,” he says.

He adds that critical to its success has been its investment in people. Accordingly, last year the American giant launched an ambitious digital innovation program with the help of Hipa to improve the digital skills of its employees and facilitate the strengthening of innovative corporate culture.

“We prioritize long-term rewarding career and professional development with a breadth of upskilling opportunities, leveraging numerous training programs in leadership, technical and digital competencies,” Kim notes. “We have seen an increasing trend in the high value-added positions, and we are also upskilling and preparing our employees for the future.”

ExxonMobil is far from the only American company that relies on Hungary-based talent for business

services centers. Between 2016 and the first half of 2023, Hipa guided 25 BSCrelated projects of U.S. firms that should create nearly 5,100 jobs.

ExxonMobil Hungary alone committed to hiring 200 employees when it moved into a new state-of-the-art office complex in Budapest last summer.

American Significance

The significance of American investors in general is hard to overemphasize. They form the third-largest investor community in Hungary, accounting for 7.5% of total FDI. According to the latest data from the Hungarian Central Statistical Office, more than 1,300 American-owned businesses employ 88,000-plus people in Hungary. And although political relations between the two countries have been better, business is booming, with bilateral trade hitting a record last year.

Apart from BSCs, U.S.-based investors have made the headlines on many occasions in the recent past. To name but a few examples, leading auto parts manufacturer Dana announced it would add new capacities worth EUR 96 million at its sites in Győr to meet EV-induced demand, while global MedTech giant Becton Dickinson is to invest EUR 188 mln in its syringe production in Tatabánya. Coca-Cola is extending its production lines at a cost of EUR 82 mln in Dunaharaszti. HTEC’s newly established IT hubs all over the country plans to create

610

jobs

in 2022. That alone propelled the United States to fourth place in the job creation chart that year.

The uninterrupted investment in the BSC sector is all the more critical as HIPA is committed to shifting the

focus from energy- and labor-intensive projects to knowledge-focused ones. For a global oil company like ExxonMobil, investing in people is playing an ever-bigger role as this will be essential to delivering on the challenging opportunities ahead, particularly due to the energy transition.

“The perception about ExxonMobil has been that we need to choose to either meet the world’s evolving energy needs or play a leading role in the energy transition,” Kim says. “In reality, it is an ‘and’ equation, and we are well-positioned to both help provide the energy society needs and reduce greenhouse gas emissions to support a net-zero future.” The company plans to invest USD 17 bln globally in lower-emission initiatives through 2027.

Hipa CEO István Joó is confident that companies like ExxonMobil will continue to invest in the country despite the current economic challenges. Even during the pandemic, up to 21

U.S.-related investments were launched thanks to various competitiveness-improving subsidy schemes, he recalls.

“Investment promotion remains a priority in Hungary, while the country adapts to the current economic context. What you can take for granted is that Hungary will continue to provide the best possible environment for foreign investors, including American ones, so that they can find their way and make the maximum of their presence in our country. And Hipa is certainly more than happy to guide them every step of the way,” Joó concludes.

3 Focus | 11 www.bbj.hu Budapest Business Journal | July 14 – July 27, 2023

BBJ STAFF

American businesses are increasingly considering Hungary as a flagship venue to provide support to their global operations through business service centers. Insights from the Hungarian Investment Promotion Agency reveal more about the trend.

PRESENTED CONTENT Photo

/ Shutterstock.com U.S.-Hungarian Bilateral Trade USD 8.2 bln PLUS 16% growth year-on-year, 2021-2022 Hungarian exports to U.S. PLUS 27% growth year-on-year, 2021-2022 Hipa Supported U.S. Investments (2016- H1 2023) 84 U.S. Ranking Among Hungary’s Trade Partners In Terms of Volume 12

by esfera

4Special Report

Logistics

Budapest’s Logistics and Industrial Boom Continues

one with a development potential of 74,000 sqm in Herceghalom, the other a 65,000 sqm project in Gyál.

Big Box Projects

“We still see strong demand for both big box warehouses as well as for last mile space. We are also pitching on BTS projects connected to the car and battery production/ manufacturing industries,” says László Kemenes, managing director of Panattoni Hungary.

“We have a good balance between logistics and light industrial at about 50-50. In terms of the location, most of the logistics requirements are for the Budapest area, notably the Western part, while production is focused around eastern Hungary,” he explains.

for the Greater Budapest area this year at 446,000 sqm, according to CBRE. Vacancy has increased to 6%

on the back of strong supply. The regional industrial developer and operator CTP has started a 120,000 sqm project at CTPark Szigetszentmiklós.

is highest for distribution centers close to the city center, with easy access to airports and international transport routes,” comments Zsuzsanna Hunyadi, leasing and customer experience director at Prologis Hungary.

Another increasingly seen trend identified by Halász-Csatári is the demand for so-called “puffer,” or shortterm, space. The Budapest market offers many options for these requirements as sub-leases, or 3PL (third-party logistics) services, at a slight premium due to the shorter-than-average contractual period and the occasional services included.

The industrial and logistics market is increasingly the sector of choice for developers, attracting both specialist industrial park operators and those previously focused on other fields such as offices or hotels.

Ongoing developments indicate evermore sophisticated tenant requirements, with sustainability-accredited product being delivered in response. The sector’s challenges include increasing development costs, rising rents and a lack of workforce, according to consultancy Cushman & Wakefield.

Total industrial stock in Hungary has reached 4.7 million sqm, of which 3.2 million sqm is located in the Greater Budapest area as of the first quarter of 2023, according to CBRE. The area around the capital continues to dominate the logistics market as developers and park operators establish complexes at locations with direct access to the MO orbital motorway, providing a direct highway connection to the city, Ferenc Liszt International Airport, major regional Hungarian hubs and international road links.

The logistics market is expanding at pace, with forecast completions

The firm says it currently has more than 200,000 sqm of space under construction in Hungary.

More than 600,000 sqm of logistics space is under construction across Hungary, Cushman & Wakefield estimates, with a pre-let proportion of 30%.

“Leading developers are Prologis, CTP, Hello Parks, VGP, Wing and Biggeorge/Logstar, in no order of significance. Logicor is the most active developer,” says Gábor HalászCsatári, head of industrial agency at Cushman & Wakefield.

“Others such as Panattoni and Weerts are making their first marks on the market and have ambitious growth plans. There are some regionally active local players, too, who have a significant presence in their respective submarkets, such as Infogroup or Xanga,” he adds.

Budapest-centric

Prologis sees Hungary as lacking a strong secondary industrial market in its provincial cities; therefore, it concentrates on the area around the capital.

“All Prologis buildings in Hungary are located in the Budapest area, close to the M0 ring road. We believe demand

“These attributes also make our warehouses more sustainable, aligning with our environmental goals. In the current market situation, we are focusing more on BTS developments in order to provide the best possible service to our customers. At the same time, our latest speculative development was handed over just a few months ago in Szigetszentmiklós, at Prologis Park Budapest-Sziget II,” she added.

Generally, the Budapest-based stock tends to be more speculative-led, while in the countryside, developers prefer BTS projects due to the higher investment risk involved. In 2022, just 29%

of all developments around Budapest were BTS-based, compared to 63% in the countryside, Halász-Csatári notes.

The prolific European industrial park operator and developer Panattoni had been a notable absence from the Hungarian market in recent years but has now secured two 100,000 sqm sites in the Budapest area.

The company has developed its first 17,000 sqm of speculative space across four buildings at Panattoni City Dock Törökbálint. It is also developing two speculative “big box” projects in Greater Budapest,

Kemenes adds that Panattoni is looking to add energy-efficient solutions to its products, such as solar panels, electric vehicle charging facilities and heat pump systems. He believes that these will soon become standard. The company has Breeam “Excellent” New Construction accreditation as a standard for its products in Hungary. New demands from tenants tend to be related to ESG, and many require energyefficient solutions.

CTP is similarly committed to developing Breeam-accredited buildings across its Central European logistics portfolio, while Prologis is developing its parks to at least the “Very Good” standard.

HelloParks was only founded two and a half years ago as a member of the Futureal Group but is currently one of the most active developers in Hungary. The

46,000 sqm

MG3

in Maglód is the first Breeam “Outstanding” accredited logistics building in Hungary, according to the company.

“Since our establishment in 2020, we have been developing our warehouses exclusively to the highest categories of the Breeam sustainability standards,” says CEO Rudolf Nemes. “Currently, all of our developments under construction are already built to the highest ‘Outstanding’ certification criteria and EU Taxonomy requirements. HelloParks wants to set a forward-looking green industry benchmark in the country and the region.”

www.bbj.hu Budapest Business Journal | July 14 – July 27, 2023

GARY J. MORRELL

With industrial and logistics demand remaining high and vacancy at record lows, the boom in the sector is continuing. Analysts say the Greater Budapest area is in a favorable position given the growing demand for logistics, e-commerce and light industrial space.

CTPark Budapest West.

Essentially, different.

Essentially, a complete warehouse solutions platform for every phase of your journey, sustainably now and in the future.

prologisessentials.eu

Provincial Hubs Beginning to Grow in Secondary Cities

Developerled industrial development is finally extending to regional hubs across Hungary as in other Central European countries. With total stock for the sector having reached 4.58 million sqm in Hungary, 70% of it is located in the Greater Budapest area, according to Cushman & Wakefield.