Letter from the editor...

Dearest Readers,

What is the cost of living? When you hear this question, you probably start to calculate a specific amount of money you would need to make. The cost of rent, food, gas, and even tuition has gone up exponentially in the last few years while the wages of workers have stayed the same. As we begin to adapt to the new virtual and in-person work and school environments on top of rising prices, we realize that it’s a universally overwhelming experience. It makes you think beyond the number.

What effects does the cost of living cause? The price to live may cost you your relationships with the people you care about. It can cause you to put your mental health aside to focus on other responsibilities Or may be it costs you to lose your dream job. The effects that happen as we navigate through our lives are different for everyone.

This semester, the Access team and I wanted to explore our community’s answers to this ques tion. We wanted to give a platform for people in our communities to voice their stories, while also offering advice and programs that can help with the cost of living.

This is Access Magazine’s big comeback after a year-long hiatus and It has been an amazing opportunity to be this semester’s editor-in-chief. I would like to thank my team for working so hard and for being willing to learn new skills to help with the design process. To my writers, thank you for focusing on stories that are so important and necessary to talk about. To my social media team and photographers, thank you for creating media that is so detail orient ed and entertaining. To my illustrators and designers, thank you for being the backbone of this magazine and working day and night to make this publication the best it can be. Finally, I would like to thank our instructor Jennifer Christgau for giving me this opportunity and for believing in us.

With that, I am honored to welcome you to the Fall 2022 publication of Access Magazine!

-Joanna ChavezAccess Magazine is a student-run publication at San Jose State University. It is conceptualized, edited, designed, published and distributed by students. Our goal is to create informative, relatable and honest content for our campus and surrounding communities. Our team consists of hardworking,

ACCESS MAGAZINE TEAM

Dylan Nichols is a fourth-year student at SJSU who’s earning his bachelor’s degree in journalism. His last big purchase was SJSU tuition fees.

Tracy Escobedo is a third-year jour nalism major. Her last big purchase were Shawn Mendes concert tickets.

Diana Velazquez is a fourth-year majoring in Communication Stud ies and minoring in Journalism. Her last big purchase was concert tickets to see one of her favorite artists.

Brandon Twomey is a graduating senior who’s earning his bachelor’s degree in journalism. His last big purchase was a MacBook Pro.

Lesley Rodriguez is a fourth-year journalism major and RTVF minor. Her last big purchase was concert merchandise.

Breana Waterloo is a fourth-year journalism major who’s minoring in Professional and Technical Writing. Her last big purchase was concert tickets for a festival.

FALL 2022

Shruthi Lakshmanan is a senior journalism major at SJSU. Her last big purchase was her summer trip to Europe.

Mike Corpos is a third-year graduate student at SJSU earning a master’s degree in mass communi cations. His last big purchase was a Sony Playstation 5.

Carlos Reyes is a third-year journalism major at SJSU. His last big purchase was a trip to the World Cup in Qatar.

Sam Dietz is a third-year journalism major. Her last big purchase were tickets to FAN EXPO San Francisco.

Irene Adeline Milanez is a second-year journalism major. Their last big purchase was Mitski concert tickets.

Making ends ‘meat’

Photos and Story by Dylan Nichols Staff WriterNick Litros dreamed of owning his own restaurant since he was a kid.

That dream has come true seven times in his life.

Today, however, owning your own restaurant is hard er than ever. Inflation has taken a huge bite out of the pocketbooks of restaurant owners like Litros and others in the Bay Area. Paying rent and offering tasty menu options is just the tip of the iceberg.

Many people dream of running their own restaurant. Few, however, actually spend the time to figure out what that process entails. A restaurant owner has to budget every thing from their employees’ paychecks to refrigerator

maintenance. Inflation has only exacerbated these crucial tasks.

Downtown San Jose restaurants have struggled due to skyrocketing rent and food prices. So what’s the secret recipe to staying successful?

San Jose State students play a huge role in the success of eateries in the surrounding area. Some establishments like Nemea and 4th Street Pizza went out of business permanently, despite their advantageous locations in the heart of downtown San Jose.

Needless to say, running a successful restaurant these days is harder than it seems.

According to the National Restaurant Association, 60% of new restaurants go out of business within their first year of opening and 80% fail within five years.

How your favorite restaurants are coping with inflation.

Third-generation restau rant owner Nick Litros has been in the business since he was 12 and knows the industry inside and out. Litros has opened and managed seven estab lishments throughout Cal ifornia and Arizona. He says it’s never been easy.

“Everybody thinks they can do it,” Litros said as to why he thinks most new restaurants fail within their first year.

Inflation doesn’t just affect food prices, it also impacts employees’ paychecks and the quality of food they’re able to afford. Litros’ business, like all restaurants, is also hampered by supply-chain issues. Restaurant owners face challenges like this every day: Should New York steak stay on the menu or should a lesser quality meat be offered? Can the restau rant afford air conditioning? Will the business hours have to be adjusted in order to stay afloat?

“It makes you want to cut corners without cutting the quality,” emphasized Litros, who currently owns and oper ates “Niko’s Grill and Pub” in Lake Havasu, Arizona. As inflation rises higher, restaurants go under. Running one isn’t easy and it’s a shame when your favorite local pizza joint falls victim to it. Family-run establishments suffer greatly under the weight of inflation. Some are gone forever, so the next time you go out to eat, be sure to leave a tip.

Local San Jose restaurants Flames and Peanuts have endured inflation’s financial consequences as well. Managers Joseph Huh of Peanuts and Joel Castro of Flame’s recently discussed their own challenges in run ning restaurants.

Q: How has inflation impacted your business?

Peanuts manager Joseph Huh: The cost of goods has gone up. I think pre-covid it’s gone up about 60% by now. Especially with school coming back there’s a higher need for employees as well.

Flames manager Joel Castro: A lot. We almost went out of business since the pandemic started. The worst part was finding workers. It was a big problem … It’s still a problem. Nobody wants to work. The government gives them money, so why work?

Q: Have you had to adjust your prices/menu options because of inflation?

Huh: Absolutely. At Peanuts we’re known for our cheap prices and good food, so I’m trying to keep that going. Even with this inflation which is really hard to juggle.

Castro: We haven’t gone in that direction. Everything has stayed the same.

Q: Have you offered any deals or promotions that you didn’t offer before?

Huh: This first semester I’m giving all students a stu dent discount on all food orders as well as city employ ees.”

Castro: We’re trying to get our happy hour back. We haven’t done it because of this. We still have a 10% food discount for students.

Q: Have you gotten any direct feedback about your prices?

Huh: Of course the regular customers that come in on a day to day basis have spoken up. Those customers that don’t get the discount definitely say something but they usually understand because of the situation.

Castro: No.

Q: Do you expect you’ll have any more price in creases before the end of the year?

Huh: I mean it really depends on inflation because it seems like it’s going up every quarter. So now I’m just waiting to see what happens next quarter. Hopefully it steadies out because I don’t want to change the prices again.

Castro: We have to think about that because we don’t want to scare the people away.

Left: Joel Castro struggled to stay in buis ness as a result of inflation and Covid-19.

Right: Peanuts manager Joseph Huh take a customer’s order. Huh says he works sev en days a week to keep his buisness afloat.

The quality cost of an Indian international student

Indian international students on their economic difficulties

By Shruthi Lakshmanan Staff WriterRashmeet Kaur Bagga, a senior undergraduate student and member of the Indian Student Organization, found herself coming home in tears every day when she transferred to San Jose State University in Fall 2020. If she wasn’t going to companies with a physical copy of her resumé, she spent her time between her classes applying to

they have to be a U.S. citizen),” wrote Keri Toma, the International Programs Manager at ISSS, in an email. “They [also] do not qualify for financial aid or work-study programs, so there are certainly financial challenges for international students.”

Many Indian students try to obtain part-time jobs to ensure a certain degree of financial security, but they

often apply to no avail.

International students have the ability to work on Curricular Practical Training (CPT), which only allows them to train in positions, “relat[ing] directly to the student’s major area of study,” according to the United States Homeland Security.

“Being international you cannot work outside apart from CPT,” said senior undergraduate international student, Rashmeet Kaur Bagga. “We can work 40 hours but only during the summer, otherwise it’s 20 hours only. However, companies simply reject you because you need a visa sponsorship.”

It took her nearly three years of applying to acquire an on-campus position. She’s also been applying for scholarships but has not been able to obtain any Bagga’s struggle is a shared experience as many students struggle to navigate the federal workstudy requirement.

Sujan Rao, a computer engineering graduate student

at SJSU, relentlessly applied to more than 40 on-campus positions before starting his teacher associate job.

“It’s one of the toughest things to get parttime on campus. We as international students cannot work outside legally. Our only chance is to work on campus,” said Rao. “But 90% of the positions are for federal work-study, which international students are not eligible [for].”

Rao applied to SJSU with hopes to work in Silicon Valley. His intentions are now to move back to Telangana, India due to California’s unaffordable cost of living.

To cope with the living expenses in San Jose, many Indian students have resorted to tight living restrictions, hoping to save money as they continue to struggle with job insecurity.

Mahenaz Amreen, a first-semester graduate student studying computer engineering, anticipated that her savings would provide a financial cushion during her time at SJSU but has since recognized the difficulties behind inexpensive options.

“Even though the tuition fees are very affordable [for me], the living expenses are not affordable at all. Because of the expenses, we live [with] five to six

people in a two-bedroom,” said Amreen.

This financial battle doesn’t seem to fade postgraduation as students are also worried about securing jobs after receiving their degrees.

As America slowly finds its way into a recession, many companies are starting to limit hiring too, which now poses a threat to international students who hope to work in the Bay Area.

“I am actually worried a lot because if I don’t get a job right [after graduation], it will put me in a position where I may have to leave the country,” said Bagga, Social Media Vice President of the Indian Student Organization at SJSU. “My visa will be done. So, if I don’t get hired, no one will be able to sponsor my visa.”

As inflation marks its territory in 2022, posing as an indomitable opponent to students across California, it’s proved to be an especially invincible rival to Indian international students at San Jose State.

Mike’s Story

Subhead Struggling in the shadows

By Mike Corpos Staff Writer

By Mike Corpos Staff Writer

Being undocumented makes everything more dif ficult. And a lot of times it’s also more expensive.

Whether it’s finding work, paying for school, paying for legal assistance or just affording a place to live. This is especially true for San Jose State’s undocu mented student population as those students not only face the same issues that their undocumented breth ren face across the country, they have to find a way to make it in one of the most expensive places to live in the country.

In her six years at SJSU –five of those as the director of the Undocuspartan Re source Center – Ana Na varrete has seen students with any number of strug gles come through her of fice, although they’re not always eager to share their stories.

In any given year, SJSU is home to between 500 and 600 undocumented stu dents who have access to financial aid, but there is another population of un documented students who don’t qualify for anything, including in-state tuition, but Navarrete said there’s no way of tracking those individuals.

Navarrete said that the students she deals with do struggle with inflation and the high cost of living, but it’s just another hurdle in

the continuous grind for many of SJSU’s undocu mented students.

“We do have services and programs where we’ve worked with a certain number of students . . . for example, with our legal ser vices, which is one of the big services that we offer on campus. And that service is open to students and also we supported with the legal services, there was a repre sentation of 21 countries within that.”

Nationwide, undocu mented students struggle to cover their tuition expenses. Some states have attempted to alleviate at least some of the burden. According to the National Conference of

State Legislatures, Califor nia is one of 19 states that offer in-state tuition to at least some undocumented immigrants.

“Well, I think for the un documented community, regardless of whether or not they get financial aid, there’s always been a high need for financial resources just to pay for tuition alone,

of people who came to the U.S. as children – they may be the only ones in their families with the ability to work legally. DACA bene fits have remained in limbo after the Trump adminis tration tried to end the pro gram in 2017 and the case continues to work its way through federal courts.

“And the thing with DACA is that some of our students may be the only ones in their families with a work permit,” Navarre te continued. “Sometimes they themselves may be the only undocumented (per son) in their family, while everyone else is a resident or a citizen. And so it real ly depends. But what I have seen, at least in the last year, is that some students are ei ther taking breaks because they’re tired, or too, it’s just too expensive. And so sometimes they just – they need to take a break from classes so they can continue working, because that’s not going to stop.”

That puts added stress on individual undocumented students as many wear mul tiple hats in their lives. For some students who have the protection of Deferred Action for Childhood Ar rivals – the Obama-era im migration policy that gives limited protection from de portation to a small number

That students are forced to pause their education shows how difficult it is to make ends meet in Silicon Valley and for many stu dents, something has to give. Also, Navarrete said, the longer a student stays away, the less likely they are to return.

“If they come back within one semester, it’ll be fine. I think the challenge is, when

they’re out more than one semester, just getting access to those resources,” she said, adding that the universi ty may need to revisit its financial aid structures in light of the stresses certain students are experiencing.

“I think it is going to be important for just the uni versity as a whole, to really look into the impact of fi nancial aid and the contin uation of the studies for the students,” Navarrete contin ued. “Like being in poor ac ademic standing. How does that impact their aid and so forth? How does that trick le down to them being able to access housing and other basic needs? And so I don’t think we have enough data. . . . But I think that when it comes to our students, and them coming back, it real ly has to do (with) whether they’re going to have the financial aid to be able to continue.”

It’s also telling, Navar rete said, that applications for financial aid from un documented students have decreased recently. That decrease was seen in both California Dream Act fi nancial aid and for the Free Application for Federal Stu dent Aid (FAFSA). Califor nia is one of the few states that also offers financial aid to undocumented students. In many states they have to seek private scholarships to fund their education.

“And that’s just a statewide issue that we’ve been seeing. And last year, there was an expansion for the Califor nia Dream Act deadline. So instead of March 2, it was pushed to April 1,” she said. “But yeah, but I’m sure, like, within this year, we’re gon na continue to see more reports come out as to, like, what happened to patterns of financial aid.”

That drop in applications could be in response to multiple factors. For some, it’s just not having the time or energy to fill out another form and for a lot of undoc umented students its the fear of giving their informa tion to the government.

“The other reason is fear, right? People are scared about what if I give my in formation, right? What are they going to do with it? Sometimes it’s also just not having, you know, not hav ing done taxes or not know ing how to report that in formation,” Navarrete said, adding that there is a lot to learn about these emerg ing patterns in the coming years.

In the last couple of years, undocumented students in California have gotten some much needed breaks when it comes to paying for school. In May 2021 Ed ucation Secretary Miguel Cardona lifted a ban put in place by his predecessor, Betsy DeVos, on undocu

mented and international students receiving feder al pandemic relief grants. That decision by the Biden administration opened up a path for undocument ed students who were en rolled in college during the COVID-19 pandemic to be eligible to receive part of the $35 billion congress ear marked for for emergency student aid since 2020.

That combined with the benefits provided by the 2011 California Dream Act give undocumented stu dents the opportunity to apply and qualify for finan cial aid.

Paying for college is just one difficulty facing SJSU’s undocumented students.

A lot of undocumented students and their families face food insecurity as well. Recent expansions of the California Food Assistance Program have helped alle viate some of that burden, but it’s not enough. A recent report from the Food4All campaign in partnership with the UCLA Center for Health Policy Research found that as many as 45% of undocumented Califor nians face food insecurity.

Food4All also reports that up to 64% of undoc umented children in Cali fornia are affected by Food insecurity. Also, close to 500,000 undocumented adults live in households struggling with food inse

curity, and while Food4All states that the majority of those are ages 27-49, a sig nificant number are also likely college students.

In response to those ris ing numbers, SJSU Cares has stepped up to help fill the void for all of SJSU’s disadvantaged students, including undocument ed students. According to its website, SJSU Cares has provided food assistance via the Spartan Food Pantry to 2,308 students in 7,540 visits.

“Just having SJSU Cares on campus has been really helpful. They’ve been a key partner with providing our students with support – ev erything from, you know, food insecurity to housing, emergency housing when needed,” Navarrete said. “But like I said, like most of the time, our students that, you know, they’re in other places, and they don’t al ways talk about, like, what are the things that they’re struggling with?”

Is Biden doing enough for students?

SJSU students give their take on the Student Loan Forgiveness plan.

By Tracy Escobedo Staff Writer

By Tracy Escobedo Staff Writer

Graduating from college is one of those mo ments everyone treasures for the rest of their lives. However, students with loan debts may find it difficult to fully enjoy the moment knowing that they will have to pay ev ery cent back eventually.

Thankfully Biden has got them covered! Well … some of them.

Biden announced the Student Loan Forgive ness plan in August, which is meant to deal with the student debt cri sis that has been circling since the ’80s. This an nouncement sparked im mense controversy after students found out exactly who was qualified for it.

According to the Fed eral Student Aid web site, non-Pell Grant re cipients with loans can receive up to $10,000 in debt cancellation while Pell Grant recipients can receive up to $20,000. Another requirement is that the individual must make less than $125,000 or $250,000 for house holds.

Some students at San Jose State University have expressed that the plan does not provide enough and is simply un fair. “I think there should

be some adjustments to be taken into consideration since not every low income family gets Pell Grants,” says Adriana Perez, who graduated SJSU last spring.

Students were also held back on payments due to the pandemic. Earning money on time to pay tu ition fees was not prom ising for a lot of students like Perez.

“Income was so wishywashy during COVID,” she said.

Perez spoke about how these requirements have personally affected her loved ones.

“A friend of mine has a Pell Grant but doesn’t qualify because her parents still claimed her on taxes, despite the fact that she pays for every thing herself,” Pe rez said. “I’m sure a hand ful of people are in that same boat.”

Students like Perez had sim ilar respons es. These specific

qualifications have made students feel hopeless. On the other hand, Perez was able to qualify for $10,000 while her broth er qualified for $20,000 in relief funds.

Students like Paola Ro driguez, who graduated from San Jose State Uni versity last spring with a degree in applied nutri tional and food sciences, was excited to be free from loans.

“I cried because I owed a lot of money,” she said.

Rodriguez owed over $18,000 dollars in loans while her sister had tak en out $15,000. She felt as if they were digging themselves a deep hole. They both found out they qualified for forgiveness

“I don’t have to stress about it anymore,” Rodriguez said. “I can actually Rodriguez talk ed about the diffi culty of manag ing money after graduation because half of

her paycheck would go to rent while the other half paid for other bills and essentials. Paying back loans seemed im possible for a while.

“Money to this, mon ey to that, all just to sur vive.” she said.

Rodriguez said her anx iety spiked at the thought of having to work up to three jobs. All just to avoid the interest fees that were slowly accu mulating on her account.

Many students an swered similarly because they felt embarrassed to ask others for financial help.

Rodriguez explains how she believes that the loans will continue to haunt her although she is supposedly “free” from them.

“A lot of free money … they’re going to get that money back somehow,” she said.

Rodriguez shopped for essentials recently and noticed a price raise on many products she usually buys. These new pric es have made her alter her decisions on the way she spends money nowa days.

“I have to choose be tween eating food or buying deodorant,” she sighed.

$ aving tips that won’t break your bank

Photo collage by Joanna Chavez | Source Canva

Photo collage by Joanna Chavez | Source Canva

Tip #1: Bring your own homemade lunch. The cost of eating out can add up over time, so try bringing a lunch or snack from home to get you through the day.

Tip #2: Always assume you have less money than you actu ally do. This will help you decide what you need to buy versus what you want.

Tip #3: Make sure you unsubscribe from sevices you no longer use. Go through all your subscription services at the end of the month and cancel those that you no longer use.

Tip #4: The process of budgeting can be intimidating, so try using the 50/30/20 rule. The 50/30/20 method divides your monthly income into three categories: 50% for needs, 30 for wants, and 20% for saving/paying off debts.

Tip #5: Ask for extras at restaurants. (Extra sauce, napkins, utensils etc.)

Make the Most of your Tuition

Useful Campus Resources are Always Available

By Breana Waterloo Staff WriterWhile enrolled in university, the cost of being a student can quickly become overwhelming.

However, the various campus resources available to San Jose State University students are tools that students should definitely take the time to explore.

A few of the multiple departments that can supplement student growth include Financial Aid, Career Counseling, Mental Health Counseling, and Health and Wellness offices. These services provide necessary assistance and supplemental tools in order to aid members of the campus community.

The goals for these facilities is to contribute to the long-term suc cess of students by accommodating their needs along their academic journey. In doing so, students can better prioritize their goals and maintain focus on graduating.

Being able to tap into educational resources is also a way to be proactive in taking advantage of tuition costs.

The high cost of living affects every student individually. By utilizing the various resources available on campus, every tuition dollar can be productively used on services that ultimately benefit the main goal of achieving a diploma.

Here are some departments at San Jose State University that are always operational and open for students to take advantage of

Career Counseling

A main key to success is keeping a steady eye on the prize. By keeping track of long term aspirations and goals, students can better prepare for their futures. Career counselors are readily available to aid in the planning of a roadmap for both academic and professional careers.

Depending on the needs of the student, there are multiple specialized counselors who are experienced in different areas. Some of the various categories of appointments include job/internship search, network ing, exploring majors and general career advising.

These professionals can also refer students to useful school applications such as Handshake, VMock, Focus2 and Big Interview.

Extensive resources and guidance provided by the university are always available to students who seek to enrich their knowledge about opportunities in their major.

“Building professional experience starts during school. Students should start thinking about internships as soon as they can. There are many career apps and tools such as Handshake that post fresh job opportunities that stu dents can browse through,” said Judith Garcia, a Career Counselor at San Jose State University.

Counseling and Psychological Services

One of the most vital aspects of student life is being able to maintain a healthy well-being. The Counsel ing and Psychological Services department, or CAPS, is composed of certified psychologists and trained advisors who are more than qualified to support student needs. This department ensures that students are able to thrive in their personal lives in addition to their academic lives. In being a dependable back bone of support on campus, the CAPS facility demon strates their dedication for students. Through provid ing the tools and guidance needed to be continually successful as not only a student, but a person, the CAPS department is open to walk-ins and appointments.

Peer Connections

By offering the tools to enhance learning, Peer Con nections is a program that aims to strengthen the skills of students. Various services are provided by the Division of Student Affairs include tutoring, mentoring and sup plemental learning for students who take the initiative to enhance their personal learning experiences.

The connections made through learning alongside peers also proves to be fruitful in exchanging knowl edge from others.

Academic guidance from tutors in every field of study ensures that every topic is covered at a pace that is aligned with the needs of the student.

Another useful feature of this campus resource is the Spartan Support Network, an early warning program that refers students to the resources that they need to get back on track with their academic success.

Transportation Solutions

Half the battle in being a successful student is being present in class and maintaining consistent attendance. In sharing this goal with students, SJSU’s Transportation Solutions specializes in a variety of transportation needs.

Funded in part by the Associated Students organiza tion, there are multiple features to check out that can save gas money. Transit resources include the SmartPass Program, Trip Plan services and the newly introduced Evening Lyft Program, to name a few. In partnership with Lyft, this program allows students to use 3 free rides up to $10 each per month within boundaries near campus. In addition, Commute Resource Guides are available on line and assist in suggesting options for traveling to SJSU for both students and employees.

“We have a lot of different incentives for students to help get them out of their cars and use alternative modes of transit,” said Tiffany Marinez, a TDM Coordina tor for TS Solutions. “A lot of times students don’t know about the services that they have access to that they pay in their tuition.”

There is no doubt that as humans we experi ence stress quite often throughout our lives. Pursuing higher educa tion can make students feel stressed for extend ed periods of time.

There are various stressors including inter personal relationships, jobs and the high cost of living.

Most college students aim for a healthy worklife balance but the real ity is that circumstances are different. Depending on the job each student

The burdens the work-life

has, it might require them to shift more of their time and atten tion towards their main source of income.

Mental Health America reports that the average college student enrolled full time should only work 10-15 hours per week. Unfortunately, the cost of living prevents this for current students.

Third–year sociology major, Jazmin Solorzano, is a part time employee that works in the optical department at Costco. Balancing both work and school takes a toll on her.

“I get a lot more

stressed out trying to bal ance my school assign ments and work,” said Solorzano.

With peak rental costs, San Jose is one of the most expensive cities in the country. According to the first quarter report of the 2022 housing market of the City of San Jose, renters must earn $56 hourly to afford an av erage month’s rent for a two-bedroom apartment.

“The cost of living has put pressure on me to work extra hours. I must pay my own rent, gas and food since I live on my own,” Solorzano said.

Having the responsibil ity of covering your own expenses puts a huge burden on students that are trying to pursue their degree and also impacts their relationships.

Third–year kinesiology major Alejandro Caceres Jurado shared that work ing while going to school has impacted his person al relationships.

“My wife and I have opposite schedules. She works in the mornings and I work at nights and our days off do not coin cide,” said Jurado. “Be cause of this I see her only early in the morning

burdens of work-life balance

to have breakfast or late at night when we are go ing to bed.”

He said that his academic performance is af fected significantly since he is obligated to work more hours.

“Costco is a good com pany but they have a rule now, at least in my warehouse, that you can’t work less than 5 days a week,” Jurado said. “So I have to spend more time at work and I don’t have as much time to study as other students.”

Ongoing efforts are necessary to prevent the negative impact these

stressors cause students.

While students are trying to overcome these worries, the thought of financial stress and academic expectations can be overbearing.

Third year business major Kevin Baltazar is stressed with balancing these responsibilities.

“I do feel like the job responsibilities do overpower my academic performance,” Baltazar said.

Conversations and con tinuing research of jobs are creating a supportive environment for college students but coopera -

tion from companies is needed.

Students managing the workload of college credits while meeting their work expectations is simply exhausting.

In a 2019, study by the American Council on Education (ACE) it was found that one in three students “meet the criteria for a clinically significant mental health problem – this translates to nearly 7 million stu dents nationwide.”

“There have been many times I had to stay lon ger at work to be able to finish some of my tasks

I was backed up on,” Baltazar said.

San Jose State students live and go to school in one of the most expen sive cities in the country. They try exceptionally hard to excel in different areas of their lives but creating a balance while being a student is defi nitely not an easy task.

Students share that some of their hobbies include going out to con certs, working out and spending time with their loved ones. The sacrifice and dedication of these hardworking students does not go unnoticed.

Still reeling from global supply chain issues, local restaurants continue to deal with climbing costs and now they’re faced with the unpleasant choice of raising consumer prices or being forced out of business. According to the Bureau of Labor Statistics, food prices have jumped around 13% since last year. Rising prices also hit college students hard. Here we take a look at a few places close to campus where you can get lunch for under $15. There are any number of places close to campus that cater to the college student on a budget. Some of the best deals can be found within a block of campus. We saved you some legwork and collected those deals here.

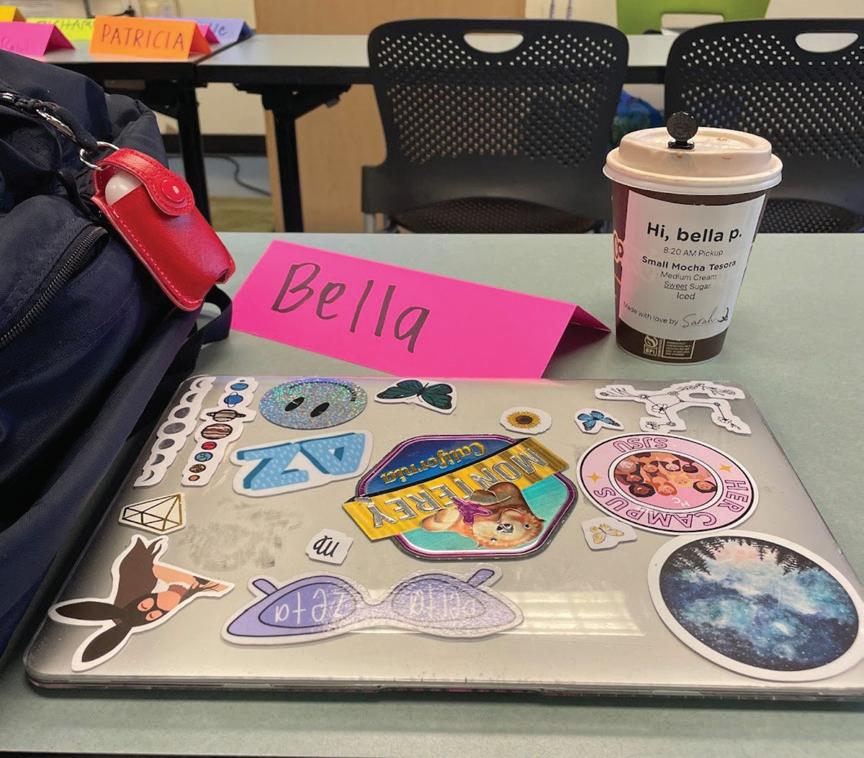

A day in the life of an SJSU commuter

Isabella Phan invests more than time into her education. Rising gas prices affect Phan on a daily basis and account for a significant part of her budget. Texas-based oil company Valero made $2.82 billion dollars from July to September 2022, which is roughly a 500% increase in profits from the same quarter in 2021, according to ca.gov. California in particular has higher gas prices on average than any other state in the US, according to AAA.com. Accommodating for increasing gas prices along with food and tuition fees can financially make or break a college student. Balancing work, school and a daily budget isn’t easy. Phan is one of many students who do so on an everyday basis. Here’s what an average day looks like for her in her own words.

I start my day around 7:30 a.m. and I leave for coffee around 8:15 a.m. Once I got my coffee (Philz Mocha Tesora), I drove to school which took around 20 minutes today. It can take up to 45 minutes before I get to the parking garage some days. I live in San Jose about 6 miles south of campus.

I have class (Envi ronmental Health) at 9 a.m. today in the Boccardo Business Center.

After class, I went to House of Bagels before I went to go babysit from 11a.m. to 3 p.m. I babysit for a three year old child regularly.

I usually have an online class Mondays 3:00 p.m. to 5:45 p.m., but I got an email saying that class was canceled less than 30 minutes before it was sup posed to begin. I ended up having free time, so I ate some food at home and then went to Joann’s to get supplies to make one of my Halloween costumes, which is going to be the Grinch!

I was in class with my laptop/Philz ready to go by 8:55 a.m. Some days I can run late since traffic and finding a parking spot can make the commute unpredictably long, but today I was right on time. I got out of class at 10:15 a.m. and drove straight from the parking garage.

I had to drive back to campus for a sorority chapter meeting. I had this at 7 p.m. and then went home afterwards to do some homework!

Outfit details: top is from H&M, bottoms from Abercrombie & Fitch, shoes from Ross. After I got back, I made a survey for a Her Campus article I’m writing about commuting at SJSU. I’ll be sending this survey out so that I can write about the highs and lows of commuting!

I ended my day by watching some That ’70s Show and eating some of my sister’s leftover birthday cake!

Build a career or stay in school?

and story by Brandon Twomey Staff WriterHigh schooler seniors face a life changing decision when they apply for college: what major will they choose that could possibly alter their lives? It can be stressful because this decision determines your career following college graduation.

According to a May 20, 2013 Washington Post article, only 27% of college graduates find work related to their field of study.

As college brings on a lot of changes, the choice to change fields isn’t abnormal for many students. While exploring your degree, it’s inevitable to discover el ements you may not have known before; some information may suit a student while others can signal future difficulties.

Afterall, something as simple as not enjoying your cur rent undergraduate major or finding out that jobs in your field of study don’t pay well, can deter you from the once chosen career path.

However, many students may not care about the salary and want to do what makes them happy.

Whatever the cause is, it’s important to take a look at the pros and cons before making the decision to stay within your field of study or branching into something new.

Jenny Nguyen, San Jose State University alumna, re ceived her degree in business management and decided it was important to work within her field of study.

“I didn’t feel comfortable doing anything else than business management,” said Nguyen. “I studied [business management] every single day for my four years of college . . . I see where others come from, but from my point of view, I have the best possibility to make a life doing what I practiced during my time in college.”

She had an internship with Amazon, which introduced her to the potential lifestyle she would experience in the profession.

“It definitely allowed me to gain an understanding of what a position as a manager would be like,” Nguyen said. “Obviously, I preferred to find a job doing some thing that I’m comfortable with, and having studied busi ness management, I was hoping the internship would be well.”

Nguyen is now a full-time employee at Amazon over seeing the business department in a managerial capacity.

Meanwhile, Zach Lum, SJSU alumnus, waited towards the end f of his college career to make his decision.

Lum said he was a digital art major because he enjoyed practicing art but it wasn’t something he saw himself doing as a job post graduation because he had other pri orities that took precedence.

“Working remotely was a major priority for me when weighing my options,” said Lum. “I never wanted to be in an office, never saw myself sitting at a desk for the entire day and doing that on repeat 5 days a week.”

Remote work is one of the many topics that needs to be discussed when thinking about work. For some, lo cation is a vital component when accepting a new job. Many others, including Lum, prefer not to worry about a commute and instead like to stay in the comfort of their home.

Another factor is money because it defines so much of a person’s lifestyle in today’s world. Currency has such a large impact on society that finding a job that pays well is one of the main priorities for college graduates.

“I never really thought about it too much,” Lum said.. “I was open to job opportunities that were remote, so I guess in that case, money wasn’t as important of a factor compared to where my work would take me.”

There will never be a definitive answer on the best path to take for finding a job after college because people have different preferences and factors that take specific priority over others..

Whether it’s money or location, there are pros and cons to finding work in your field of study, as well as finding work that you’ve never done before.

A story of two individuals: One who stayed in their field and the other who strayed.Photos

Zach Lum working remotely. A typical day at work looks exactly like this for Lum. Doing something he didn’t study in college brings obstacles by itself so work ing from home helps him concentrate on his work.

Jenny Nguyen getting ready to head to work. Late night shifts are common for large corporations like Ama zon. Nguyen’s experience in studying area management helps her take lead in her shift.

Do you practice self care?

Do you practice self care? Answer these questions based on how often you do the following statements. Keep track of your points to figure out your results on the next page.

Questions Alway (3 points) Sometimes (2 points) Never (1point) No Answer (0 points)

Question 1: I try to regularly eat 3 meals a day.

Question 2: I get enough sleep (8 hours +).

Question 3: I set time in my day to reflect on my thoughts.

Question 4: I try not to take on more work than I can handle.

Question 5: I take breaks from social media.

Question 6: I socialize with others when I can.

Question 7: I ask for help when I need it.

Question 8: I maintain a daily routine to help me organize my day.

Question 9: I drink water everyday.

Question 10: I allow myself to show and express my emotions.

s

0-10 points 21- 30 points

You might not be practicing enough self care but don’t worry, here are some ways you can start.

Take a break! By taking breaks you give yourself time to recharge and collect your thoughts. There is no “right way” to take a break. You can take as short as five minutes to just collect yourself or one hour to spend time on an activity you like.

Go for a walk. According to The Physical Activity Guide lines for Americans, adults should be getting around 150 minutes of exercise a week. Much like taking a break, going for a walk helps relieve stress and gather thoughts.

Listen to music. Music is used as a calming tool for many. Getting lost in a good song can help you relieve stress easily.

11-20 points

You’re starting to get the hang of it! You’re implement ing these self care tips to your everyday life and that’s great. There is still much to learn about yourself and how to ad just your self care routine to fit your needs.

A recommendation for learn ing more about self care and how to find out what your needs are is listening to a podcast. The Hardcore Self Help Podcast, as their spotify about section states, “This is a podcast dedicated to answer ing your questions about mental health, anxiety, depression, relationships, sex, and life WITH OUT psychobabble BS.”

Run by Dr. Robert Duff, a California psychologist, this podcast will give you better insight and advice to help you strengthen your self care skills.

You are a self care master! You know what skills help you in your everyday life and you stick to them. While having a routine is great, make sure to shift your skills to match what your needs are. As we grow as humans, so do our needs. Listen to your body and mind, it will always tell you what you need.

Stand up for yourself. This may be something you fear to do but standing up for yourself will help you feel more con fident and help you with self love.

Hidden Finds

The art of thrifting

By Lesley Rodriguez Staff WriterSecondhand shopping has taken center stage, leaving retail behind.

With the expenses that come with being a college student, some have ditched fast fashion and are pick ing up pre-loved clothing. Thrifting has gone from digging for vintage clothing on the racks to scrolling on second hand resale apps.

Many San Jose State students have taken their love for thrifting and fashion and made their own small businesses, catering to students around them while making some extra cash.

Studio 1015 is a vintage and upcycling business started by SJSU design studies student, Johanna Sien. Sien started her business in the midst of the pandemic and hasn’t looked back since.

Sien’s passion for thrifting started when she was younger, when she realized wearing one-of a-kind pieces was always fitting to her personal style.

“It’s nice to think that one time this piece had a life in some other place and you’re changing it to be something that fits your life in a way, and you’re styling it to your own aesthetic,” said Sien.

Reselling thrifted clothes is becoming progressive ly more popular. The nascent industry is expected to double in size, reaching $82 billion by 2026, according to a 2022 sales report by ThredUP.

Rocio Perez and Daisy Perez started their own thrift and jewelry business, Pretty Girl Findz. The sisters began working together on this business endeavor after Rocio finally convinced Daisy to help her. Ro cio had a passion for fashion and looking for clothes for other people.

“We are focused on finding new homes for clothes that have been thrown out,” said Daisy.

College students are now more than ever wear ing secondhand clothing, with accessible resale apps

it makes it easier to thrift from the comfort of your own bed.

Wila Mae Navarro, SJSU advertising student, thrifts the majority of her clothes, buying from vintage markets or using secondhand resale apps.

“I think that thrifting allows people to express themselves more uniquely, just because a lot of these clothes aren’t being made anymore, but they are be ing resold and in the original condition,” said Navarro. “Thrifting is fun!”

As many as 62% of Gen Z and Millenials look for items in secondhand condition before buying it brand new, according to the 2022 sales report by ThredUP.

Thrifting has become popular over recent years and with the influx of people coming into stores, it may be hard to find popular brands and trendy pieces.

Justin Catalano, SJSU graphic design student, has been thrifting since his freshman year of high school and has been able to find his personal style through trial and error. With his experience in thrifting, he has seen the popularity of thrifting on the rise.

“If you’re trying to start out thrifting you gotta go with the intentions of, ‘What am I going to look good in, not what’s trending right now?’ ” said Catalano. “You have to think about, ‘What am I going to look good in? How can I incorporate my own personality, my own ideas into what I wear?’ ”

Thrifting has become an outlet for students to express themselves with fashion with a low price tag. But with the rising cost of living, small businesses have been forced to adjust pricing.

“The cost of living affects how we price certain items. Especially, if we go sourcing at the Bins,” said Daisy. “The drive to the bins can be up to two hours, then we spend about six hours there and then two more hours to drive back. There’s a lot of time that goes into sourcing and other expenses like gas, that affects how we price our items. We try our hardest to be affordable but we take into account how

much time we spent on curating.”

While students like to ball on a budget, small business owners have to decide how to pay themselves for their time.

“I price my bags at a higher price because I do spend a lot of time on it, and I’m still paying myself only probably $5 to $10 an hour working on it, which is still not even minimum wage,” said Sien. “I tried to make it affordable that way, but it’s also the sacrifice on my time.”

Gen Z is changing the fashion market by making vintage clothing into their own personal style, bringing back old trends but making new ones.

Experimenting with a new style can be daunting for college students, but luckily thrifting allows them to express themselves in clothing and try new pieces that they would have never tried if the clothes were full price.

“If someone tells you, you’re doing too much, tell them you’re not doing enough,” said Catalano. The future of fashion is vintage and the admiration that Gen Z has for nostalgia is here to stay.

By Lesley Rodriguez

By Lesley Rodriguez

Where are your pieces from?

Totah: “ My dress was one cent from the Goodwill bins in Salinas. My jacket or my shawl is from Depop, I got it for $30 but it’s definitely a one of a kind piece. It’s beautiful. It’s embroidered with beads, super cute. Then my bag is from Joshua Tree from the Crochet Museum, my shoes are Doc Martens. They are not thrifted but they’re so cute.”

What is your fashion inspiration?

Totah: “ I feel like a lot of my fashion inspiration comes from breaking fashion barriers by combining different styles into my own to attain my unique personality.

But most of my stuff I feel like I look at ideas from Pinterest or I see things swiping through my Instagram feed and I’m like “oh, I like that accessory, it would go well with this piece that I have.” I just like finding unique pieces and tying them all together, and com bining different patterns that I think can flow together.”

Where do you usually shop for your pieces?

Totah: “ I usually shop on Depop or I thrift them at local shops like Goodwill. There’s Black and Brown in San Jose. Wherever I travel, I al ways go thrifting and I get pieces from there.”

What is one of your favorite pieces you’ve thrifted?

Totah: “ My favorite pieces that I’ve

thrifted are my Fenty Puma sneakers from Crossroads. It was such a great deal and while I have so many other amazing vin tage thrifted pieces, this one a Why should others start to thrift their outfits?

Totah: “Thrifting is a great alternative if you’re on a budget and enjoy incorporating vintage into your style or closet.”

CRISTIAN REYES

By Carlos ReyesWhere are your pieces from?

Reyes: “My vest is Orvis and I got it at the bins in Goodwill for $10. My jeans are Carhartt and I got them off eBay for another $10. I got my sneakers for $150 from Grailed and they’re the Air Jordan 5 Retro ‘Stealth 2.0.’ To top it off, I am wearing the Marc Jacobs friendship necklace set that I was able to buy from Grailed for $70.”

What are some of your favorite places to go thrifting? Where do you source your clothes from?

Reyes: “To be honest, I source most of my clothes from eBay. I think it’s really underrated because there’s a lot of people who carry this stigma that eBay has a high potential of ripping you off or selling you fake goods. In many cases, it’s the complete opposite, I actually got these Carhartt jeans for $10 after sending the seller an offer. It’s steals like those that constantly bring me back to eBay.”

How do you feel about the rise of thrift boutiques in San Jose?

Reyes: “Honestly, I am not a fan. In many cases, these places al ready have curated pieces that fit a certain aesthetic. Part of the fun that comes with thrifting is sort ing through bins and finding those pieces that specifically cater to your individual style. Most of these places source their clothes from Goodwill and upscale their prices to a ridiculous amount. This is seen in apps like Depop and Grailed, hence why I only go to those places as a last resort.”

What do you like about thrifting?

Reyes: “It’s a lot more sustainable, if you buy clothes from places like H&M, who specialize in fast fashion, you often get clothes that are worse in terms of quali ty. Not to mention that these huge retailers always end up having a surplus of clothes that don’t end up getting sold. Overall, thrifting enables the recycling of clothes and gives pieces a longer life span.”

What’s your inspiration in terms of or ganizing an outfit?

Reyes: “I don’t look for a specific piece, I just envision what best suits my style and how I like to dress. I am inspired by a lot of old Pharrell Williams. More specifical ly, his skateboarding aesthetic. It’s very simple, when you look at his old music videos he’d just be wearing a black tee, baggy jeans, and some sneakers. I think that is such an easy style to pull off and can be worn daily. Odd Futures is also another really big influence in terms of skate wear.”

story by Carlos Reyes Staff Writer

story by Carlos Reyes Staff Writer

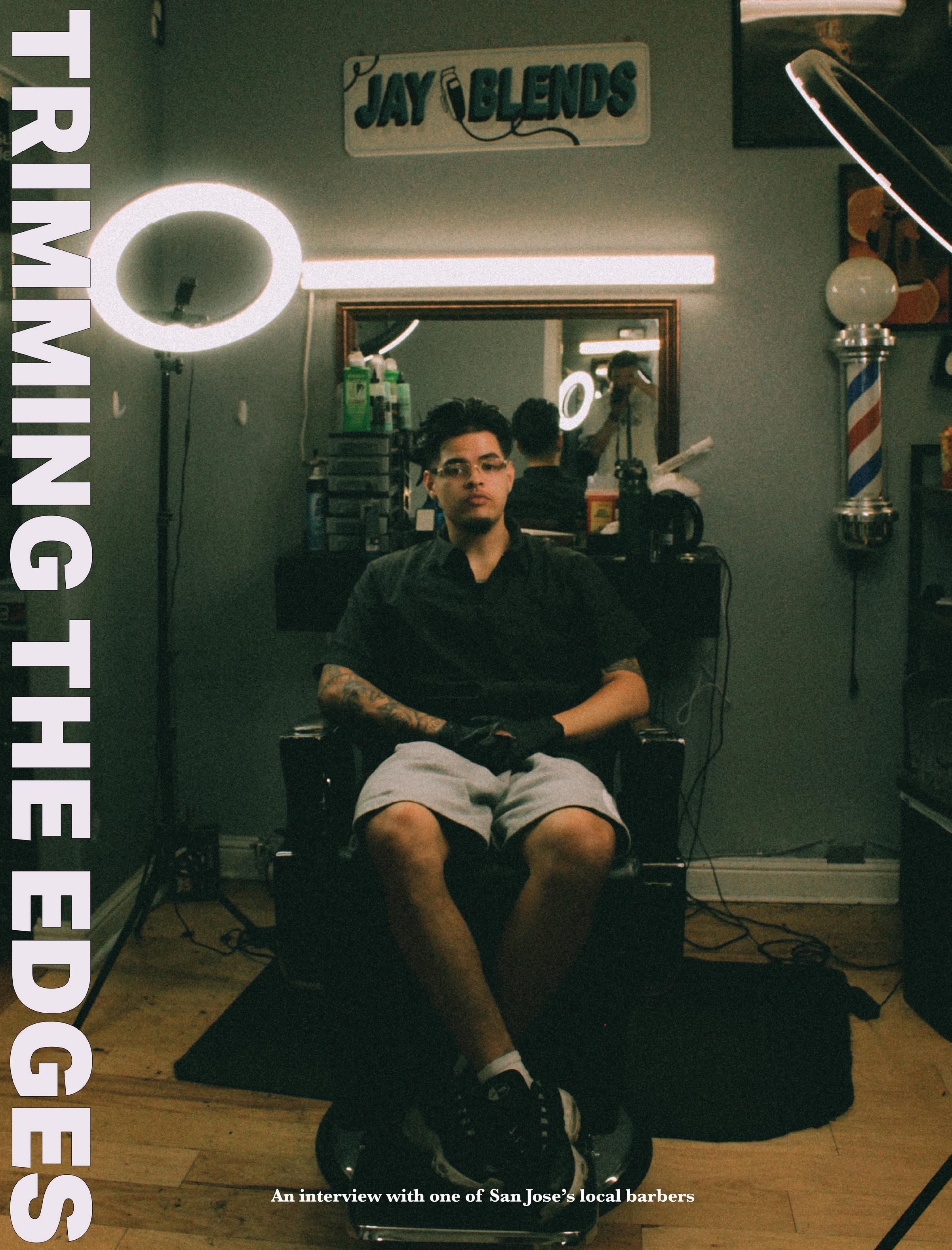

As the repercussions of global inflation start to set in, more and more people are starting to realize how drastically small aspects of our everyday lives have changed. Whether it be your favorite sandwich at your local deli or the extra ten cents you have to pay at the pump, price increases are everywhere and don’t seem to show any signs of stopping.

While huge corporations scramble to find ways in which they can maximize their profits, small businesses have been left to take desperate measures in order to keep their livelihoods afloat.

For barber Jonathan, “Jay Blends” inflation has posed new challenges for his business. At the same time, he’s embraced

these new obstacles and rebounded in an inspiring fashion.

Jay Blends shows a true sense of devotion and commitment to the barbering craft, characteristics that were noted in a conversation he shared with Access.

Q: How long have you been cutting at Lifted Barber Shop?

Blends: “Coming up on four years now.”

Q: What are some of the haircuts you specialize in?

Blends: “We specialize in ordinary fades, bald fades, and tapers as well. We can also do designs if that is what the customer would like. Straight razor line-ups are also provided as an option with every haircut. But generally, fades and tapers are our specialty.”

Q:What does your availability look like? Do you accept walk-ins?

Blends: “I am typically available from 9 to 6. Walk-ins depend on the barber themselves because if you are fully booked on a consistent

basis, you don’t really have space to take a walkin. We do accept walk-ins but it’s really hard to fit them in our schedule. It is always more convenient to book in advance.”

Q: What has your relationship been like with the San Jose community?

Blends: “I think that in this line of work, you are truly granted the opportunity to connect with your city. A lot of people come in through those doors. We’ve had some San Jose Earthquakes players come in here for haircuts. It’s just really cool to be able to talk to different walks of life and just share stories with people from your community.”

Q: How has the rise of inflation affected your line of work?

Blends: “As a barber,

and any job really, as the cost of living goes up, you also have to adjust your prices accordingly so that you can sustain a living here in San Jose. At the same time, it is crucial that if you raise your prices as a barber the quality of your service also has to increase. It’s just a matter of having to adjust to the circumstances.”

Inflation is just one of the many obstacles that small businesses have been forced to overcome since the beginning of the pandemic. Jay Blends is no stranger to adversity and has thrived when times are tough. As a reputable barber in San Jose, his booth will continue to remain open to those in need of a haircut and a chat.

From cheap to big spender,

By Tracy Escobedo Staff WriterTired of sitting around in your dorm all day? Check out these events happening near campus and don’t forget to bring a friend!

SPORTS

San Jose State University sports games – Make sure to show off your school spirit at upcoming sports events on campus! Students get in for free and can bring a plus one. Check out the calendar for any changes to schedule.

San Jose Sharks games – Support the San Jose

-Sharks at their ice hockey games! It is the busiest time of the year at the SAP center. Tickets start at $22.50 and can be purchased from Ticketmaster or at the box office.

CONCERTS

ROLE MODEL will be performing at the Fox Theater in Oakland on December 8, 2022. Tickets start at $29 and can be purchased from Ticketmaster or the box office.

Kane Brown announced his Drunk or Dreaming world tour! The “Heaven” singer will be perform ing at the SAP center on April 27, 2023. Tickets start at $50 and can be purchased from Ticketmaster the box office.

Vance Joy announced his In Our Own Sweet Time tour! The “Riptide” singer will be performing at the Fox Theater in Oakland on March 9, 2023. Tickets start

spender, check out these events!

at $65 and can be purchased from Ticketmaster or the box office.

OTHER EVENTS

South First Friday has free events on the first Friday of every month. Enjoy walking through a self-guided nighttime tour through galleries, museums and independent creative businesses from 5-10pm.

Nirvana Soul has open mic events every Thursday from 7pm to 9pm. Enjoy a nice coffee while listening to some rad live performanc es from local artists. More information can be found through their Instagram: @nsafterdark

San Pedro Social is a fun social setting to bring friends and enjoy bowling, karaoke, arcade games and some great food! Check for prices and reserva tions at https://sanpedrosocial.com/entertainment/

If you are looking for an event on campus make sure to stay updated by using the SAMMY app! Other resources are available at the Student Union and events calendar online.

EXECUTIVE EDITOR

Joanna Chavez

STAFF WRITERS

Mike Corpos

Tracy Escobedo

Shruthi Lakshmanan

Dylan Nichols

Carlos Reyes

Lesley Rodriguez

Brandon Twomey Diana Velazquez Breana Waterloo

DESIGNERS Sam Dietz Irene Milanez

ADVISOR

Jennifer Aquino

Access Magazine is a student-run magazine and is published twice a year (Spring and Fall) in the School of Journalism and Mass Communications, in Dwight Bentel Hall.