2 minute read

The enigma of the cult-creators

In-N-Out. H&M. Trader Joe’s. H-E-B. White Castle.

Each of these companies has a loyal following in Dallas, almost cult-like, even though each has yet to open a store here. Their secret to preemptive success is not just a great product (though some neighbors might swear by the tastiness of a Double-Double or the ability to don this season’s faux fur on a budget). The other quality they share is that each is a family-owned private company that keeps its practices close to its vest.

“Family-owned companies don’t share a lot of information, and that’s part of the reason they get that cult following — not just the food or the product, but that there’s not a lot of information out there,” David Shelton says.

The fact that “the world is getting smaller every day” helps these companies, too, Robert Young says. Travel within the United States is accessible, and as more Dallasites dine at an In-NOut on the West Coast or shop at H&M on the East Coast, more customers are created. Dallas also is home to a number of coastal emigrants, and these new residents who miss their homelands may be these companies’ best advertisers.

It’s not that these companies are ignoring Dallas. Commerical real estate experts agree that if they haven’t yet made plans to move here, they will eventually, if for no other reason than to make more money in one of the country’s retail hubs.

However, “with the precious nature of capital and money, they’re all very careful about expansions — all of them,” Young says. “No one with any major concept would come to town and go into any neighborhood or key trade area unless they felt very comfortable that they can

Meet The Experts

MIKE GEISLER, VENTURE COMMERCIAL FOUNDING PARTNER have an efficient distribution of what they do.”

Brokerage and property management company Venture Commercial lists roughly 17 million square feet of shopping centers and represents more than 120 retailers and restaurants. It has a presence from Oak Lawn and Uptown to Burleson and Rockwall, and has leased the Plaza at Preston Center for almost 20 years.

In-N-Out, for example, built its empire on “a fry that tastes a certain way, a burger that tastes a certain way,” Kent Arnold says. “You’ve gotta have the exact same product whether it’s here or Las Vegas.” The company has announced two locations in Dallas one at Central and Caruth Haven, another at Coit near the junction of 75 and 635 — plus a few more in suburbs and ring cities.

OTHERS WISH THEY HAD ‘EM

“A company like that, doing one store doesn’t add to the moxie or panache of the brand. They need to pop up in what we’ll call ‘home run sites’ — where there’s density, access and incomes,” Young says.

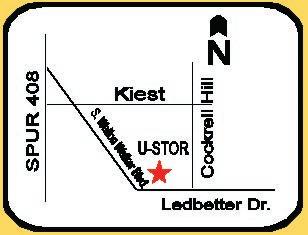

And in order to open more than one store, In-N-Out needs a Texas distribution center. (The company says it will lease space west of Dallas along I-30 until it finds a permanent home.) Any other company would also need a nearby distribution center because none of them will come to Dallas and open only one store, or even just a couple.

But that’s another plus about Dallas, by the way.

“If you think about where Dallas is located, it’s the natural point for expansion,”Arnold says. “From a supply point, it’s in central America, so from here they can serve a wide area.”

ROBERTE. YOUNG JR., MANAGING DIRECTOR OF THE WEITZMAN GROUP

The Weitzman Group is a commercial retail estate brokerage firm leasing 41 million square feet of retail properties throughout Texas. Cencor Realty Services, its property management and development arm, manages 20.5 million square feet of retail space throughout Texas’ major markets of Dallas, Fort Worth, Austin, Houston and San Antonio.