5 minute read

How did Ghana get to its severe economic problems?

GHANA is facing severe economic crises, driven mainly by debt and balance of payment problems. The foremost question on the lips of many Ghanaians is how their country got to this tipping point.

Government officials argue that they have done absolutely nothing wrong, blaming the situation on the effects of Covid-19 and the Russia-Ukraine war, and referring to social assistance that was provided during the pandemic. But a significant portion was contributed by foreign and local organisations.

Advertisement

However, many economic experts have blamed the wanton borrowing and unconstitutional printing of money by the Bank of Ghana, at the request of the New Patriotic Party (NPP) administration, for the cause of the debt quagmire, record high inflation and balance of payments deficit.

The recently released AuditorGeneral’s report found almost 50 per cent of all Covid-19 related financial resources raised went on unaccountable government budget support. The fundamental cause of the problem is the absence of an economic blueprint for development by the administration.

The government relied on sloganeering such as “one district, one factory” and “planting for food and jobs”. There are no accessible policy documents and guidelines for implementation of these slogans, yet millions of cedis have been spent on these. Even worse is the jettisoning of the plan by the National Development Planning Commission that operates under the presidency.

A closer look at Ghana’s debt situation prior to 2020, and at present, tells a different story. It is a divergent tale from the official narrative by the NPP administration and its supporters.

Unpacking data available from official sources, the various debt sustainability indicators point to precariously unsustainable levels prior to 2020. By the end of the 2017 fiscal year, total debt stock climbed from GH¢122.5 billion in 2016 to GH¢142.5 billion (equivalent of 69.8 per cent of GDP).

Also, the total debt to export, total debt to revenue, debt service to export, and debt service to revenue were at 233.99 per cent, 398.71 per cent, 31.87 per cent and 54.31 per cent respectively. This was a clear indication that Ghana was on the verge of a debt default and economic crises prior to the pandemic. These figures, except for debt to GDP ratio, are all above the minimum IMF/World Bank debt burden thresholds and benchmarks for lowincome countries.

In the 2018 fiscal year, the authorities took the decision to rebase the economy by some 24 percentage points, which broadened the GDP base while the key debt sustainability indicators remained virtually above the debt burden thresholds. This suggested that Ghana was facing imminent and ever-increasing unsustainable debt levels and financial crises.

The fiscal year ended with debt to export at 244.23 per cent, debt to revenue at 442.16 pr cent, debt service to export at 35.31 per cent, while debt service to revenue recorded 63.92 per cent, according to official records. These figures exposed the administration’s poor management of the economy by outdoing all the debt sustainability parameters – without tangible references to policy implementations for which benefits were likely to accrue.

A careful study of the numbers show Ghana was taking in more debt than it could sustain and pay off. The situation was akin to a Ponzi style of debt management. In short, the government was only fixated on borrowing more to pay off existing obligations while doing little to raise enough revenue to match the mounting debt.

Just as with any Ponzi scheme, once the source of new funds dried up, everything came tumbling down. Once Ghana was locked out of the International Eurobond market by the last quarter of 2021, the extent of the real debt situation was exposed, as there were no new loans coming in to rollover and service the old and maturing ones.

This development started Ghana’s balance of payments challenges, as more foreign holders of its domestic bonds began pulling out and refusing rollover offers. The consequence has been to fall back on the country’s international reserves in order to meet these obligations.

This, in turn, meant a significant chunk of much-needed foreign exchange, which should have gone into supporting domestic imports, was being used to meet obligations to foreign creditors. The direct effect was pressure being brought on the cedi, which saw one of its fastest depreciations in recorded history.

A fast-depreciating currency for a country that is heavily import dependent only means fast appreciating prices resulting in high levels of inflation, again one of the highest in Ghana’s history. Inflation rose to more than a threedecade high in December 2022 at a rate of 54.1 per cent. January and February 2023 saw a gradual easing of escalating inflation at 53.6 per cent and 52.8 per cent respectively.

The hope is to see more decline once global inflation eases and a fruitful agreement is reached with China over debt restructuring, and a subsequent IMF Board approval of Ghana’s pending programme with the Breton Woods Institution. This will see the Bank of Ghana easing its policy rate hikes that were meant to fight inflation.

Another reason for Ghana’s economic crisis is the fact that the government had significantly cut down on investment in capital expenditure, and by extension the productive sectors of the economy. Capital expenditure between 2017 and 2020 averaged 1.3 per cent of the total compared to an average of 5.4 per cent prior to 2017.

What this meant, is that more than 90 per cent of all borrowing went on consumption, leaving little to be invested in ventures that would have generated enough revenue to pay-off the initial capital investments. Not surprisingly, Ghana is now lumbered with a debt overhang.

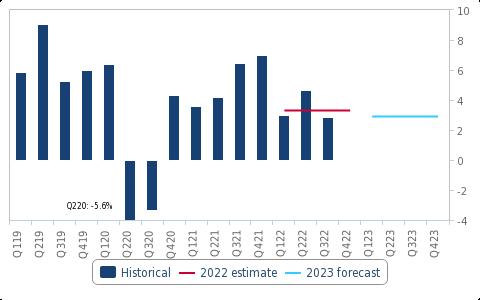

In all this, the government has been busy trying to show how good GDP figures are looking while borrowing huge amounts that have resulted in the massive debt figures.

It did this by manipulating and classifying some debt-related figures as above the line items while others were classified as below the line items, with no need for such figures to be added to the overall debt stock. This was done ostensibly to conceal the real debt picture and to make the debt situation look good on the surface while the undercurrents were telling a different story.

Addressing the consequences of such bad policies would demand bold and painful actions with concrete internally generated benchmarks by any new government. This must be kicked-off with actions to unpack the actual picture of the debt and economic situation of the country before proceeding with the approach that will be effective in ameliorating the situation.

The situation is indeed dire, and the NPP administration must take immediate steps to drastically reduce expenditure by first cutting down the size of the government. Virtually every Ghanaian agrees that it is too big for the size of the economy.

A critical look at the current wage bill and staff of the public sector is equally important. The government must similarly realign expenditure with priority being placed on essential and productive sectors of the economy than the continued focus on spending on consumption. The government must also find innovative ways of increasing revenue above the current low levels. This again calls for focusing on pushing more finances into productive sectors to engender growth in revenue and the economy as a whole.

The authorities must also be bold to set and maintain strict fiscal targets that will drastically bring down Ghana’s high debt levels. Achieving sustainable fiscal surpluses must be the new target. Achieving this in the short- to mediumterm will establish a strong fundamental for Ghana to maintain its debt within sustainable levels.

The authorities must place serious focus on the financial sector to avoid a meltdown and another crisis caused by the domestic debt exchange programme. The GH¢15 billion financial sector stabilisation fund established by the government may not be adequate for a sector that was expecting revenue from these government instruments in excess GH¢30 billion to fund its programmes in 2023. The government should also channel a significant amount of inflow expected from the IMF programme into the financial sector to ensure its stability.