President’s message destination: new orleans

claims division

the technological evolution of insurance claims handling: then, now, and beyond

attorney division a young attorney’s journey from prosecutor to aviation litigator safety report owner/pilot associations: valuable resources for our aircraft policy holders

VOL. 49 NO. 1 — spring 2024

3 19 aia history Celebrating the Life of AIA’s Founding President: E.R. “Butch” Kinnebrew III 20 aia conference cle preview 23 agent/broker division fostering collaboration for enhanced education in the aviation insurance industry 26 safety roundtable recap industry professionals discuss bizav challenges at nbaa, aia workshop 28 safety report owner/pilot associations: valuable resources for our aircraft policy holders EDITOR KIM ROSENLOF Aeroink Incorporated The ideas and opinions expressed by authors of articles published in The Binder are wholly their own and do not necessarily represent those of the Aviation Insurance Association. The articles are not provided as legal advice. www.aiaweb.org Published by the Aviation Insurance Association 2365 Harrodsburg Road Suite A325 Lexington, KY 40504 table of contents 04 PRESIDENT’S MESSAGE destination: new orleans 07 underwriters division eliminating the email merry-go-round: you say “urgent”; we say “need more info” 10 attorney division a young attorney’s journey from prosecutor to aviation litigator 12 claims division the technological evolution of insurance claims handling: then, now, and beyond 16 young professionals spotlight sam langevin, avion insurance agency

PRESIDENT’S MESSAGE

Destination: New Orleans

chris morin, managing Shareholder, Murray, Morin & Herman, P.A. aia president 2023–2025

By the time you’re reading this, the earlybird registration deadline has passed for the AIA 2024 conference. I’m hopeful you’ve already registered and booked your room at our conference hotel, the New Orleans Marriott. We’ve done our very best to spread the word, but our 2024 conference dates, May 3-6, fall over the final week of the New Orleans Heritage & Jazz Festival, also known as JazzFest. New Orleans will be very busy while we’re there!

If you haven’t made up your mind to join us yet, maybe this letter will convince you.

The foundation of every AIA conference is its education: always aviation-focused, relevant to the insurance industry, and providing takeaways to every segment of the industry we serve. Claims, attorneys, underwriters . . . we strive to provide value to all.

Friday’s Continuing Legal Education segment will offer four hours of top-notch programming organized by Mike McGrory, Director of the Attorney Division. Topics covered will include mock juries, runway incursions, and issues arising from the Advanced Air Mobility (AAM) market. As an attorney myself, I always learn something new from AIA’s legal programming and I’m sure this year will be no different.

Sunday’s Continuing Insurance Education is developed primarily by the Education Committee with support from the Safety Committee. Topics include FBO risks and coverages, grounds claims, property insurance, and data-driven risk modeling. We’re trying something new this year with a few of the topics split into multiple sessions (think Part 1/ Part 2) to take a deeper dive into the content. We’ll look forward to hearing what our attendees think.

Monday’s programming is a combination of AIA business, education, and entertainment. During the morning General Session, we’ll recognize eight new Certified Aviation Insurance Professionals (CAIP) and unveil the 2024 Pinnacle Award recipient. Industry keynoters will include Gary Churchill, Chief Operating Officer Aerospace with Old Republic; and Jodi Baker, Deputy Assistant Administrator for Aviation Safety, Federal Aviation Administration

We always try to end the General Session with an entertaining speaker or topic relevant to our industry, and it’s going to be hard to beat this year’s lineup. Joining us in NOLA will be three of the principal pilots who worked on the movie Top Gun: Maverick, the latest Tom Cruise blockbuster

4

PRESIDENT’S MESSAGE

that has already earned close to $1.5 billion worldwide. They’ll tell us how they approached aerial safety and protected millions of dollars of fighter jets while working with some of the biggest names in the industry.

Although education is vital to every AIA conference, we also allow ample time for reconnecting with industry friends, whether in meetings or social events. We’ll again offer golf and sporting clays, and we’re taking the Welcome Receptions across the street from the Marriott to the gorgeous Sazerac House. Four floors of food, drink, tastings, history and more. What a great way to kick off your NOLA experience!

The Women’s Initiative event will transition back to being a breakfast meeting, which is how the program began in 2019. There

will be time for other women in the aviation industry to meet, share experiences and advice, and enjoy a short presentation from AIA Board member and Director of Reinsurance, Raffaella Basile of Swiss Re.

Our final event takes place at Mardi Gras World, where you can experience a bit of Mardi Gras without the craziness and chaos of the real thing. Guests will enter through the Float Den, where the characters are created that make up the Mardi Gras floats. Grab a cocktail as you stroll through the den and marvel at the creativity. The second part of Mardi Gras World is set as the grounds of a stunning Southern mansion, but you’re actually indoors, meaning no worries about bugs or gators!

Although the AIA conference has a lot planned for you, be sure to add time to truly

5

PRESIDENT’S MESSAGE

experience New Orleans. Enjoy dinner at famous restaurants like Galatoire’s or Commander’s Palace. Grab a beignet and coffee from Café du Monde. If time allows, hop a trolley to the Garden District, where you can enjoy the quiet part of NOLA with its mighty oaks and grand mansions. Above all else, do not miss the World War II Museum. It’s an absolute must for anyone visiting New Orleans and consistently ranks as one of the top sights to see in the city.

If you weren’t already registered when you started reading this, I hope I’ve been able to change your mind. New Orleans is a city like no other, and the AIA offers a conference like no other.

I look forward to welcoming you to The Big Easy!

Chris Morin is the managing Shareholder at Murray, Morin & Herman, P.A., with offices in Tampa and Miami, Florida. Chris is Board Certified in Aviation Law by the Florida Bar and has defended aviation matters for over two decades, regularly counseling local, regional and international clients in the defense of aviation accidents and disputed civil matters. He has tried both civil and criminal cases, including numerous bench trials and jury trials. A licensed pilot, Chris has owned and operated several aircraft, the last being an A-36 Bonanza. He assumed the role of AIA President in May 2023.

6

Eliminating the Email MerryGo-Round: You Say “URGENT”; We Say “Need More Info”

Peter Barnes, AVP/Underwriter, London Aviation Underwriters, and Kathleen Vogel Schwartz, AVP/Underwriter, London Aviation Underwriters

Information is gold! From an underwriter’s perspective, it helps us to underwrite risks more accurately and may even help to eliminate having an errors and omissions (E&O) claim at some point or to end up in a courtroom or mediation to resolve a lawsuit. Good, solid information equals time well-saved, which then equates to closed deals for brokers and underwriters. Now if we can only get the clients and insureds to speed up their end of things, we will have reached a harmony of interests!

Here’s a common anecdote from underwriters:

The computer pings to announce the arrival of a new email. The underwriter shifts their gaze from their other monitor to read the new email marked “URGENT” in big, bold letters. They look at their watch and take a deep breath. It is a Friday before a long holiday weekend and early closing is in about 45 minutes.

The risk is not new business, but another carrier’s renewal being shopped at the 11th hour. The underwriter

reads through the email cover page offering just basic information — Named Insured, Pilot Names and Flight Hours, Aircraft Type, Value, and Requested Liability Limits. There is no substantiated reason for the URGENT request. The broker’s email says that their agency is closing early for the holiday weekend in about 15 minutes. The underwriter considers warning their spouse that they may have to work late to accommodate this urgent quote request but decides against it after noticing the sheer lack of information concerning the risk. This underwriter knows they still need to ask for all the pertinent information to help them structure a quote, so they type up all their questions and send it back to the broker, along with some required documents that must be completed prior to finishing the quote. This underwriter wonders if the broker has enough time to collect all of the requested information before their office closes for the weekend.

Upon receipt of that email, the broker fires back that if the underwriter would just send the quote at a particular premium amount, all of the information

7

underwriters division

underwriters division

concerning the risk would be forwarded five days later after the long holiday weekend (which is after the risk is bound). This does not follow the underwriter’s best practices, so the underwriter declines the risk, explaining the lack of underwriting information to manage this risk as the reason.

The broker then amicably replies that the risk was bound a day earlier, but they were tasked by their account manager to make sure all markets had been approached on the account. The client had engaged another agent to cross-market the account for a better premium, and this broker is simply canvassing the market. This broker then bounces out from this exchange and leaves for the long weekend. The underwriter shakes their head — they feel that they wasted their time in a circle of correspondence with this broker to arrive back at a decision to decline the risk based on a sheer lack of account information.

Does this story sound familiar to you?

It likely does. We asked several aviation insurance underwriters to share their thoughts on issues that hamper the underwriter/broker relationship. Although aviation underwriters tend to have different niches and appetites for risks they write, submissions lacking in detail yet desperately pleading for an URGENT quote was a common frustration that continued to be expressed amongst multiple underwriting markets.

The five questions on the next page for brokers also may help relate to our anecdote. If you are a broker, please consider the story above from the underwriter’s perspective, then take a moment to reflect:

8

underwriters division

Are your submissions complete?

Are they consistent?

Are they accurate?

If the risk is identified in the email as URGENT/ASAP, is it truly URGENT with a specific reason, or are you just blocking a market?

Is there a “back-story” that could help the underwriter make an appropriate decision?

Our aviation insurance community is fast-paced; all of our time is critical and limited. When we work together and brokers provide more complete, consistent and accurate submissions, underwriters can more quickly and efficiently make those critical underwriting

decisions. Ultimately we want to match pilots and aircraft with the best insurance coverage possible. Let us work together to get solid information upfront to save everyone time and get the results we all want.

Peter Barnes has been working in the aviation insurance industry now for over 35 years. He joined LAU in August 2020 and is an Assistant VP/Underwriter operating the company’s East Coast branch office located in Frederick, MD.

Kathleen Vogel has been working in insurance for over 10 years, both as a broker and as an underwriter. She joined LAU in December 2019 and is an Assistant VP/Underwriter working out of LAU headquarters in Federal Way, WA.

9

A Young Attorney’s Journey from Prosecutor to Aviation Litigator

Lorianna Anderson Young, Associate Attorney, Amundsen Davis LLC

I am just nine months into a new journey as an associate attorney focusing on aviation law. I am a first-generation lawyer, only licensed since November 2022, and a product of the vibrant South Side of Chicago.

I initially entered the legal profession as a criminal prosecutor for the Cook County State’s Attorney’s Office. Joining Amundsen Davis last summer was a pivot into an entirely new realm — one that is quite different than the path I had been on.

However, the shift to aviation came with a steep learning curve, including navigating an unfamiliar legal framework, learning technical aspects of aviation, and understanding the new jargon. There are a few things I’ve learned along the way that are making my transition into the field easier.

This transition, though challenging, has been an exhilarating journey that has enriched my legal expertise in ways that I never imagined in such a short time. Prosecution hones your ability to build a compelling case, analyze evidence, and present arguments convincingly — skills that seamlessly translate into the aviation legal landscape. Understanding the nuances of criminal investigations has proven invaluable when dealing with aviation incidents and accidents where attention to detail is vital.

For young attorneys venturing into aviation law, networking is key. Joining organizations like the Aviation Insurance Association and other industry-specific groups is important to your growth and success in the field. These platforms have provided invaluable opportunities to connect with seasoned professionals, gain insights, and stay updated on the latest developments in aviation law.

Attending conferences and workshops and meeting the people there to build a robust network has served me well. The aviation legal community is tight-knit and being an active participant in these organizations opens doors to mentorship opportunities and chances for collaboration within the field.

attorney division

10

Another vital aspect of acclimating to aviation law is understanding the discovery and legal rules specific to the field. You must familiarize yourself with the protocols related to aviation accident investigations, evidence preservation, and data collection. This knowledge is important to build a strong case and navigating the intricacies of aviation litigation.

I also discovered how important it is to seek out mentors in the field who can provide guidance based on their experience. Learning from seasoned aviation attorneys accelerated my understanding of the industry, especially with respect to practical insights that you may not find in books and journals. Mentors can offer a unique perspective, share lessons learned, and help avoid common pitfalls or mistakes they may have made as young aviation attorneys.

Lastly — and this was quite a departure from the fast pace of criminal law — I have realized that patience is key. Aviation cases are often intricate, and resolving legal and factual issues can take a long time.

Transitioning from a prosecutor to an aviation litigation attorney has been a transformative experience. I know if I continue to embrace the challenges, leverage my prior skills, stay curious, and actively engage with the aviation legal community, I will continue to find success here.

Lorianna Anderson Young is an associate attorney in Amundsen Davis’ Aerospace practice group. She is a graduate of IIT/Chicago-Kent College of Law and the University of Illinois. Lorianna is a former prosecutor with the Cook County State’s Attorney’s Office, and is active in the Cook County Bar Association and the Black Women Lawyer’s Association of Greater Chicago.

11 attorney division

The Technological Evolution of Insurance Claims Handling: Then, Now, and Beyond

David Gourgues, Regional Manager, McLarens General Aviation AIA Director, Claims Division

When I started in the aviation insurance business in 1990, I was not issued a mobile phone or laptop computer. Instead I received a 35mm film camera and a tape recorder for dictation and taking recorded statements. I got a legal pad, too. And notes for my claims were kept in a paper folder.

Insurance claims handling has undergone a tremendous transformation since I joined the industry more than 30 years ago and the primary reason is technology. This article explores the technological evolution of claims handling from pen-and-paper to artificial intelligence (AI) and beyond.

usually conducted via landline telephones, U.S. mail, and fax if the recipient had a fax machine. Many did not. Looking back, the process was time-consuming and arduous.

The Computer Age

In the late 1990s desktop computers became commonplace, marking a significant shift from manual to digital processes. Insurance companies and some claims organizations began collecting and storing claimrelated data. Digitalization improved data accuracy and accessibility, thus opening the doors to improved systems.

The Early 1990s: Pen-and-Paper Era

In the early 1990s, insurance claims handling was predominantly a manual process. Claims adjusters like me relied heavily on pen and paper to document information, assess damages, and process claims. Communication with policyholders, witnesses, and other stakeholders was

Mobile Phones and Laptops

The early 2000s saw the widespread adoption of mobile phones and laptops, reshaping the way claims were handled. Adjusters could now access information remotely, enabling them to respond swiftly to claims, even while in the field. Today mobile apps and laptop software seamlessly collect data, store documentation, and aid in communication. My mobile phone replaced all the tools issued to me in 1990. My current mobile phone is more powerful than my first desktop computer.

claims division

12

claims division

Data Analytics and Automation

In the early 2010s, insurance companies began harnessing the power of data analytics and automation to optimize claims processing. Advanced algorithms reviewed vast amounts of data to identify trends and patterns, detect fraud, and assess risk more effectively. Automated workflows streamlined repetitive tasks such as data entry and documentation verification, freeing up resources and reducing processing times.

The Rise of Artificial Intelligence

AI is ushering in a new era of innovation and revolutionizing how insurance claims are handled.

Digital Imaging and GPS Technology

Today, digital imaging and Global Positioning System (GPS) technology have become integral parts of insurance claims handling. Film cameras have been replaced by digital cameras and smart phones that allow adjusters to capture and upload images immediately. Most claim files are now completely electronic. The claim process has become more efficient. Claims are settled quicker.

Insurance companies have long struggled with the challenge of efficiently processing and resolving claims while maintaining high standards of accuracy and customer satisfaction. However, artificial intelligence (AI) is ushering in a new era of innovation and revolutionizing how insurance claims are handled. From automating manual tasks to enhancing decision-making process, AI is changing the way we do business.

One of the primary ways insurance companies are leveraging AI in claims is through automation. AI-powered systems can automatically receive, categorize, and prioritize incoming claims, reducing the burden on human resources and accelerating the time it takes to process a claim. The automation not only expedites the initial stages of claims handling, but it also frees up human employees to focus on more complex tasks that require human judgement and expertise.

13

claims division

Despite the significant advancements in technology, challenges persist in the adoption of AI and emerging technologies in insurance claims handling. Concerns regarding data privacy, ethical use of AI, and regulatory compliance require careful consideration. Additionally, the human element remains crucial in the handling of complex claims that demand empathy, judgement, and expertise beyond algorithmic capabilities.

The evolution of insurance claims handling from pen-and-paper to AI reflects a journey of technological innovation and transformation. However, as noted above, all the technological advances in the world cannot replace the human component. As has been so often discussed in the pages of this magazine, communication and human interaction are the keys to successful claims handling and settlement resolution.

Passing The Torch

I was born and raised in New Orleans, and I got my start in aviation in The Big Easy, so it is fitting that my hometown is the place where I turn over the reins of the AIA Director of Claims. Jeff Sheets of Applied Underwriters Aviation will become the next Director of Claims. Jeff brings a vast amount of claims handling experience and leadership to the

position. His expertise promises continued excellence in handling the duties and responsibilities of the job. Jeff has already contributed greatly and I have no doubt that he will be an outstanding spokesperson and advocate for the AIA Claims Division.

Thank You

I would like to thank the AIA Board of Directors and the AIA Administrative Staff for assisting me with my duties as Director of Claims for the past two years. I would also like to thank the AIA members for their input and support. I could not have managed without the guidance and support of everyone. I enjoyed every minute and I look forward to continuing to contribute to the organization as an AIA member.

David Gourgues is Regional Manager for McLarens General Aviation. An instrument-rated private pilot, he enjoys flying his 1965 Mooney M20C. His aviation insurance career began in 1990 in his hometown of New Orleans, Louisiana. Most of his 32 years as an aviation insurance claims adjuster have been spent doing field work. From his office in Orlando, Florida, he manages a team of aviation adjusters that cover the eastern part of the United States. He assumed the duties and responsibilities of AIA Director of Claims from Eric Weidner on May 3, 2022. His term will end in May 2024.

14

FLY SAFE.

AUSTIN, TX | BEAUFORT, SC | SAVANNAH, GA | WALTERBORO, SC (843) 521-9412

nine simulators, four locations, and

experienced

Executive Flight Training is proud to be expanding while ensuring individualized, custom instruction for our clients.

TRAIN SMART.

With

20+

instructors,

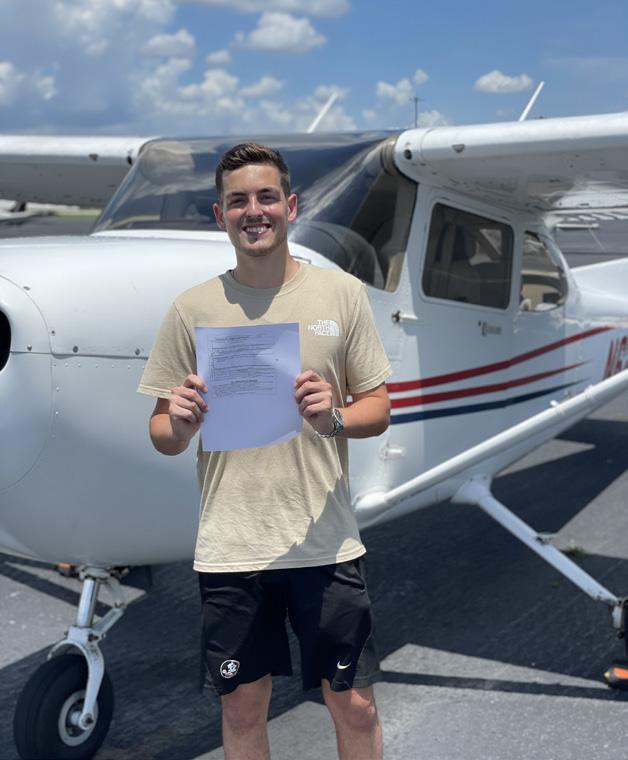

Navigating the Skies of Aviation Insurance: A Third-Generation Professional’s Journey

Sam Langevin, Assistant Account Manager, AVION Insurance Agency

In the world of aviation insurance, most professionals stumble upon our great industry after graduating from an aviationfocused university — perhaps originally with the intention of becoming a professional pilot — or from a risk management/ insurance (RMI) degree track, heavily focused on property & casualty (P&C). Either beginning often still results in the need to learn the other half of the industry “on the fly.”

As a third-generation aviation insurance broker, I dedicated myself to a career in aviation insurance early on. I aimed

to seamlessly blend my familial expertise with a strategic academic foundation to put myself in the best position for a successful, rewarding, and enjoyable career.

Aviation Insurance Heritage

The legacy of my family’s agency began with my grandfather, Robert “Bob” Langevin. A decorated war veteran, he flew L-19 Bird Dogs in Vietnam, was shot at regularly, and was even rumored to have a $10,000 bounty on his head by the Viet Cong.

Young professionals Spotlight

16

Young professionals Spotlight

In 1974 Bob became an airline pilot for United Airlines but was furloughed a few years later. While on furlough Bob became an underwriter at USAIG-Chicago, using his RMI degree earned from the University of Rhode Island prior to his service. After being recalled by United, Bob became an aviation insurance broker and began writing aviation insurance in 1977. In 1985, Bob began Avion Insurance Agency while still a full-time airline pilot at United.

the same time built lifelong relationships — true genuine friendships — with so many of his insureds, underwriters, and even other brokers.

This legacy continued with my father, Scott Langevin, who earned his RMI degree from Florida State University in 1995. Growing up in an airline pilot’s household, Scott had a passion for aviation. However, he prioritized pursuing a more family-centric career to avoid the heavy travel schedule associated with being a professional pilot.

Under Scott’s leadership over the last 30 years, Avion grew from a small mom and pop shop to one of the ten largest independent aviation insurance specialty brokerages in the industry. Scott remains as active as ever at Avion, and I am honored to be able to work with my own father each day. I’m blessed to have the opportunity to learn how he has mastered his craft and at

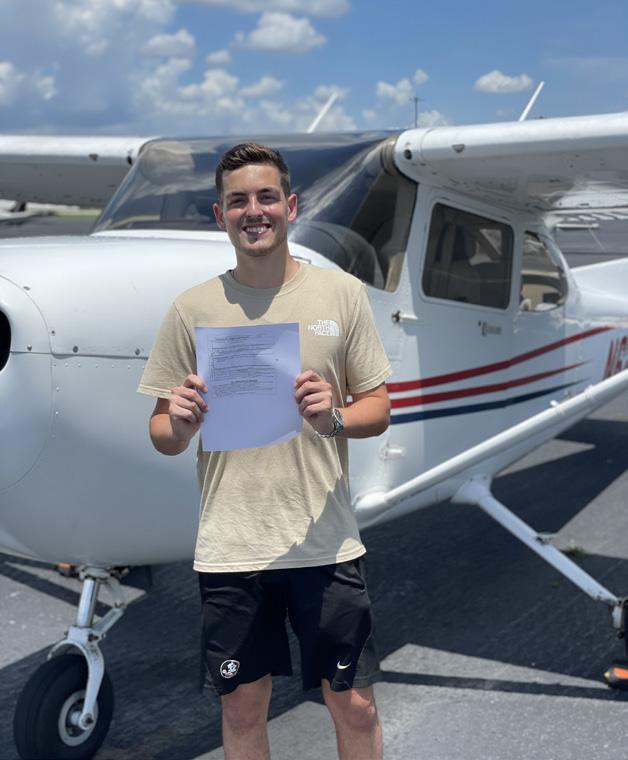

Cockpit to Classroom

Guided by this rich aviation insurance heritage, I too embarked on my academic journey by attending Florida State University, graduating Magna Cum Laude with dual degrees in RMI and Marketing with a major in Professional Sales and a minor in Commercial Entrepreneurship. Graduating from the top-ranked RMI program in the country, I was able to build a solid insurance fundamentals foundation beneficial to building a career. While attending FSU, I remained heavily involved in the studentrun Seminole Flying Club as well as Gamma Iota Sigma insurance fraternity.

While back home in Orlando during summer breaks from college, I shifted my focus to aviation, earning my Private ASEL certificate before my senior year at Florida State. I fully immersed myself in aviation, and somewhere along the way, got bit hard by the aviation bug, an addiction I hope to never kick. The entire experience learning as a student pilot not only greatly enhanced my understanding of general aviation and

17

Young professionals Spotlight

FAR’s, but also showed me aviation risk management in practice and the importance of checklists, remaining situationally aware, and staying proficient with everything in life that is important.

Navigating the Crossroads

Entering the industry with aviation and insurance foundations, I now have realized the importance of the third piece to this puzzle: relationships. Working with different carriers; learning about their appetites, underwriter personalities and preferences; determining my own style; and applying all that I have learned has been such a tremendous ongoing experience and journey.

to life: be kind, be intentional, and be personable to foster comfort with the people you meet, whether inside or outside the aviation community. Recognizing the value of enduring relationships and reputation, I’ve learned it takes years to build, seconds to break, and forever to repair.

Looking to the Horizon

All in all, success in aviation insurance is not solely about amassing knowledge but understanding the intricate dance of trends and relationships. I am eager to build on these foundations as I navigate the skies of the aviation insurance industry, propelled by a legacy of excellence and a commitment to continuous growth.

Having just turned 25 and celebrating my two-year anniversary at Avion, I feel like I am well on my way. Of course, I still feel like I’m drinking from a firehose most days, but somewhere along the way, I feel like I am getting “it.” It feels like my persistence is paying off as I find myself growing exponentially, both personally and professionally.

In this industry, as in life, knowledge is vital but relationships, trust, and rapport are equally paramount. My career outlook is really no different than my personal approach

As a third-generation aviation insurance broker, Sam Langevin has seamlessly blended a lifelong passion for aviation with a commitment to delivering premier comprehensive coverage for clients’ aviation risk transfer needs. The aviation insurance legacy runs deep in Sam’s family, with his grandfather founding AVION Insurance Agency in 1985, and his father currently serving as the President & CEO. In December 2021, Sam graduated Magna Cum Laude from Florida State University, earning dual degrees in Risk ManagementInsurance and Marketing.

18

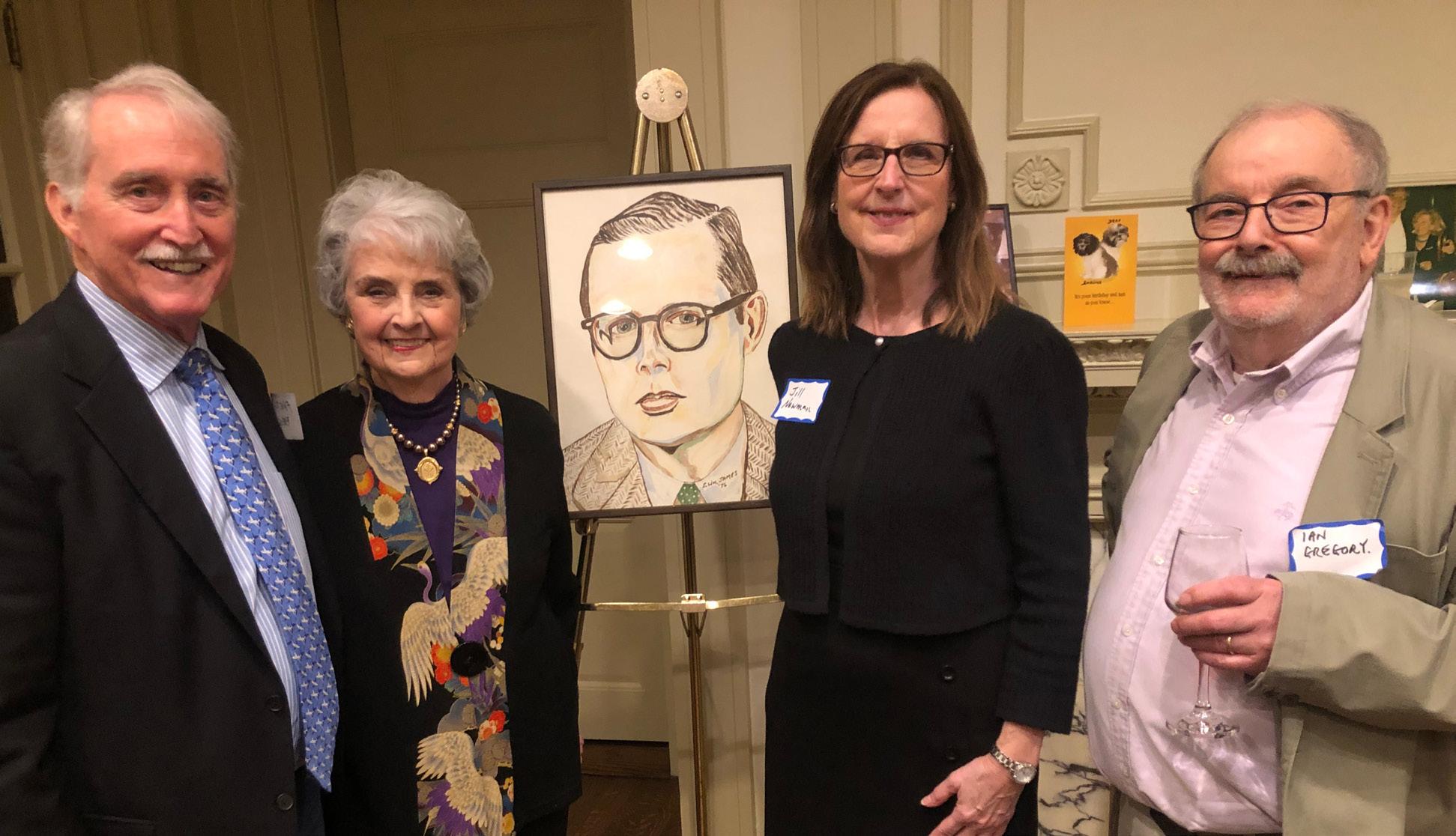

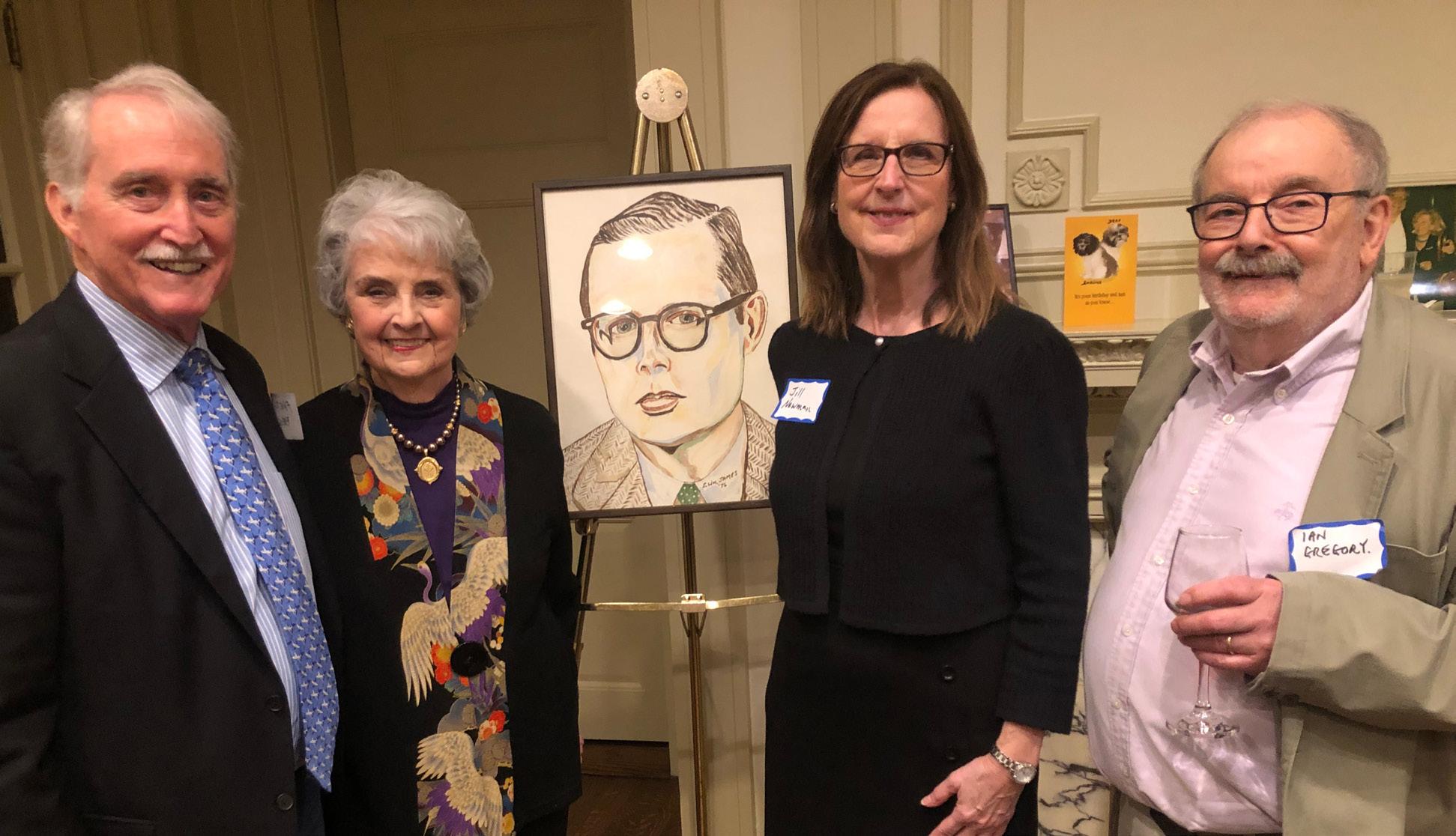

Celebrating the Life of AIA’s Founding President: E.R. “Butch” Kinnebrew III

On March 9, 2024, a Celebration of Life for AIA founder E.R. “Butch” Kinnebrew III, who passed away on July 23, 2023, was held at the Junior League Club in Memphis, Tennessee. Butch was a giant in the aviation insurance industry, serving as President of Crump Aviation Underwriters and Continental Aviation Underwriters. He founded the AIAI in 1976, alongside Ian Gregory, Fred Begy, and others; and was its first President. AIAI was renamed the AIA a few years after its founding.

Ian addressed the Celebration of Butch’s life and described the foundation of the AIA and its growth and success over its first 48 years.

Pictured (left to right) at the Celebration with a drawing of Butch from 1976 are:

Fred C. Begy III — formerly a partner in LB&B and Adler, Kaplan & Begy

Jane Battle Kinnebrew — wife of Butch Kinnebrew

Jill P. Newman — former Claims Manager of both Crump and Continental Aviation Underwriters; now with Federal Express in Memphis

Ian Gregory — formerly of Lloyds, Crump and Continental Aviation Underwriters, and Houston Casualty Company

aia history

19

Continuing Legal Education at AIA 2024

Michael McGrory, Partner, Amundsen Davis, LLC AIA Director, Attorney Division

I hope to see many of you in New Orleans for the 2024 AIA Annual Conference. And I hope all attendees take some time on Friday, May 3, to take in the excellent topics and speakers we have for the CLE portion of the conference. We will get rolling at 1:00 pm, so all should be well-rested after enjoying the Rolling Stones at JazzFest the night before.

Our first session will look at mock trials and focus groups. Mock juries can be a significant expense but can also provide valuable data on key issues in a particular case. Our panelists — Chris Watkins of Starr, Don Swaim of Cunningham Swaim, and Judge Kristi Harrington of First Court — have great tips on planning for mock trials and how best to use the information learned from these tools.

of breakdowns that can cause runway incursions, and how to best defend clients ensnared in runway incursion litigation.

We have applied for professional responsibility (i.e., ethics) credit for the third panel, which will advise us on the law practice management issues we all must navigate day-in and day-out. Debra Shaffer with American Airlines, Shauna Wright of Kelly Hart & Hallman, and Krystal Champlin-Gerage of RJH Consulting will address topics such as succession planning, business development, recruiting, and diversity.

The next group will talk about an issue that has been in the news often in recent years: runway incursions. Sompo’s Bill Coachman, Dave Gourgues from McLarens, and TJ Keevins from Lewis Brisbois will walk us through the rules governing airports and air traffic control operations, the types

Our final group of presenters, Stephanie Short of Great American, Alistair Blundy of Skyrisks, and Tim Ravich of Tressler LLP, will teach us about the burgeoning Advanced Air Mobility (AAM) segment of the aviation world. They will explain what AAM is, what AAM’s growth means for existing aviation infrastructure and systems, and the regulatory and legislative approaches to integrating AAM into the larger world of aviation.

20

cle preview

We will also learn about how insurers are approaching AAM, as well as what types of legal disputes lawyers can expect to handle as AAM proliferates.

See you all on the afternoon of May 3 at the New Orleans Marriott (and maybe also that evening on Bourbon Street)!

Mike McGrory is co-chair of Amundsen Davis’s Aerospace Practice Group in Chicago, where he represents all variety of aviation industry businesses in tort and commercial litigation. Owner/Pilot Associations: Valuable Resources for our Aircraft Policy Holders

21

cle preview

Elevate Your Coverage From Takeoff to Landing

The only specialized resource for aviation excess liability, empowering you to offer elevated coverage limits to your clients.

Learn more at mengerus.com

Fostering Collaboration for Enhanced Education in the Aviation Insurance Industry

Kristen Suarez, Executive Manager, BWI Aviation Insurance Agency, Inc. AIA Director-Elect, Agent/Broker Division

As I embark on my journey as the Agent/ Broker Director for the AIA, one issue resonates with me deeply: industry education. I am acutely aware of the pressing need to fortify education within the aviation insurance sector. As someone who did not initially pursue a career in the aviation industry, I intimately understand the steep learning curve and knowledge gap prevalent in our industry. This presents challenges not only to individual professionals but also to the industry’s overall health and sustainability.

Over the next two years, I aim to highlight the importance of aviation insurance education, not only for current industry members but also to entice newcomers. Despite (or perhaps because of?) the abundance of promising job prospects for pilots and aviation mechanics, it’s a challenge to attract young talent to consider aviation insurance careers. Without readily available education, our otherwise stable industry could appear daunting to those unfamiliar with aviation’s inner workings.

Therefore, I am extending my hand to fellow aviation insurance professionals, advocating for collaborative efforts to enhance education initiatives.

I am extending my hand to fellow aviation insurance professionals, advocating for collaborative efforts to enhance education initiatives.

The Aviation Insurance Association, with the steadfast efforts of its committed Education Committee, has been actively engaged in crafting supplementary training courses and online resources to tackle the educational gap prevalent within our industry. Nevertheless, to ensure that these endeavors resonate effectively with our stakeholders, I implore each of you to reach out to me directly and share your invaluable feedback. Your input will be instrumental in shaping the direction and effectiveness of our educational initiatives.

As we all know, aviation insurance is a complex and dynamic field, requiring deep understanding of aviation operations, risk assessment, regulatory compliance,

23 AGENT/BROKER DIVISION

and emerging trends. Recognizing the deficiencies in current educational offerings that often fail to provide comprehensive coverage of critical areas, the AIA is dedicated to pinpointing specific gaps that require attention. Our aim is to transform training from being solely the responsibility of agency owners and managers to becoming a resource accessible to all valued AIA Members.

Content Relevance

I invite you to share your thoughts

What specific topics or areas do you believe should be prioritized in aviation insurance education? Are there emerging trends or technological advancements that require greater focus, such as fundamentals of aviation, types of coverages, aviation risk management, emerging risks and trends, professional ethics and standards, etc.?

I invite you to share your thoughts on the following aspects:

24 AGENT/BROKER DIVISION

Practical Application

How can we ensure that education initiatives incorporate practical, realworld scenarios to better prepare professionals for the challenges they may encounter in their roles? For example, internships and work placements or guest speakers and industry experts.

Accessibility

What measures can be implemented to ensure these educational resources are accessible to a diverse range of professionals, including those from different geographical locations or with varying levels of experience? E.g., online platform, on-demand content, and in-person training.

Your feedback will serve as a guiding light in shaping the future of aviation insurance education

Your feedback will serve as a guiding light in shaping the future of aviation insurance education. Please don’t hesitate to share your thoughts with me via email at Kristen.suarez@bwifly.com or reach out to me directly at 951.399.2691. I eagerly await your feedback. Together we can foster a culture of continuous learning and professional development, ensuring that our industry remains resilient and adaptive in the face of evolving challenges.

Collaboration Opportunities

How can industry stakeholders, including insurers, brokers, and regulatory bodies collaborate more effectively to enhance aviation insurance education? E.g., join the AIA Education Committee and share best practices and insights.

Through improved aviation insurance education, we can effectively pave a career path for individuals beyond our specialized niche industry. As the incoming Director of Agents and Brokers, I am committed to championing your voices and advocating for the implementation of impactful education initiatives that empower professionals and strengthen the aviation industry as a whole.

Kristen Suarez has been serving the aviation industry for eight years as of May 2024. She is currently the executive manager of BWI Aviation Insurance Agency, Inc., and a proud AIA member since 2018. She currently serves as AIA’s Director-Elect of the Agent/ Broker Division.

25

AGENT/BROKER DIVISION

Industry Professionals Discuss Bizav Challenges at NBAA, AIA Workshop

More than 70 aviation professionals recently met for an engaging, interactive workshop, hosted by the National Business Aviation Association (NBAA) and the Aviation Insurance Association, to focus on the issues most important to today’s business aviation industry, including workforce challenges, safety concerns and ownership and leasing liabilities.

“Our goal in developing this new collaborative event was to allow insurance experts, operators and other industry professionals to share their perspectives on industry workforce trends, safety risks and leasing and ownership liabilities, while brainstorming solutions to some of today’s biggest challenges,” Brian Koester, CAM, NBAA director of flight operations and regulations, said of the 2024 AIA/NBAA Joint Safety Roundtable.

“The roundtable structure led to engaging discussions from professionals with a wide range of expertise in a setting that is uncommon in traditional conference or seminar settings,” he added.

The first breakout session focused on workforce trends. Attendees noted an increase in “second career” job candidates, or individuals leaving other industries to begin new careers in aviation, and discussed cultural differences between different generations, as retiring Part 121 pilots join younger business aviation pilots.

High turnover in all positions in the industry emphasizes the value of robust change management procedures to mitigate safety, operational and business risks. Attendees also discussed opportunities for developing new pilot talent, including the FAA’s Second-in-Command Professional Development Program (SIC-PDP), which offers unique opportunities for a pilot employed by a Part 135 air carrier to log SIC time during operations that do not require a second pilot.

The second session discussed training as a risk mitigation tool, with a focus on standardization in aviation training and the importance of “train as you fly, fly as you train” in mitigating risk.

26

safety roundtable recap

safety roundtable recap

Koester shared the current status of the FAA’s Standardized Curriculum initiative, which develops standardized training curriculum for Part 142 training centers to provide to Part 135 operators, a collaborative FAA/industry approach to developing quality, consistent training.

The final session focused on leasing and ownership liabilities. Attendees generally agreed that recent educational outreach efforts have been effective in mitigating inadvertent

illegal charter activities but intentional noncompliance by bad actors remains ongoing.

Underwriters and other insurance experts shared “red flags” they use to evaluate policy applications and potentially identify illegal charter activity, but also emphasized how correctly implemented dry leasing and other costsharing or reimbursement models may be legitimate and effective tools.

Reprinted with permission from the National Business Aviation Association.

27

Owner/Pilot Associations: Valuable Resources for our Aircraft Policy Holders

Charlie Precourt, Chairman, Citation Jet Pilots Safety Committee

Owner/pilot associations (OPA) are working hard to strengthen and promote safety within their respective communities. In addition to sharing information and best practices, some demonstrate a strong safety leadership role that the insurance industry needs to leverage as much as possible to inform its policy holders and lower risk across the board. The Citation Jet Pilots Association (CJP) is a leading OPA when it comes to proactive safety guidance for its members.

The CJP supports approximately 900 aircraft owner operators, most of whom fly single-pilot to support their businesses and families. Until recently, CJP’s accident and incident rates were in line with the business jet community at large. However, in the last three years, CJP members have had an unprecedented zero in-flight accidents or incidents. At this juncture it is useful to examine how CJP has achieved these levels of safety.

28 safety report

The only exceptions to CJP’s otherwise perfect flying record since September 2020 occurred on the ground: two minor taxi incidents on the parking ramp and the significant, recent ground collision at Houston Hobby airport, where a Citation Mustang was struck during landing rollout by a Hawker departing without clearance on an intersecting runway. While not the fault of the Mustang operator, CJP is already crafting Standard Operating Practice (SOP) changes focused on simultaneous runway operations.

a Gold Standard Safety Award training program, flight data monitoring, and its Safe to LandSM program focused on runway excursions.

The content of most of these six initiatives is self-explanatory. Standdowns and SOPs are common practices as are tailored training programs and flight data monitoring.

The fact they are well developed within an owner/pilot association is somewhat unique, but the Safe to LandSM program

According to the Flight Safety Foundation (FSF), runway excursions are the leading cause of jet accidents, accounting for 41% of all accidents between 2017 and 2022. That percentage had been the CJP experience as well, yet in the last three years CJP operators have had zero runway excursions. There is no single driver for the strong record, but CJP has created six initiatives that have combined to yield this result: an annual safety standdown, member forums for information sharing, published SOPs,

deserves some further explanation, as it has several attributes that are transformative for pilots.

Safe to LandSM leverages an FSF 2017 study on go-around decision making. The report’s conclusion was that separate go-around criteria are needed that complement but are separate from the traditional stable approach criteria. The reason? Traditional stabilized approach criteria have failed to curtail these

29 safety report

accidents. In fact, unstable approaches result in a go-around only 3% of the time. Why?

The FSF study found that pilots didn’t find the criteria a credible reason to go around. They believed they still had time to correct their situation. Often true . . . except when it isn’t!

This resonated with CJP’s Safety Committee, who engaged the Presage Group (through the FSF) to conduct a study of its own members. As pilots we know when we aren’t meeting the “goals” of a stable approach (airspeed, glidepath, configuration, etc.), but we also judge in many cases we have time to correct outof-tolerance parameters and avoid going around needlessly.

The Safe to LandSM initiative breaks the paradigm by adding a “yellow zone,” a period of time beyond the traditional 1,000 and 500 ft stable approach gates, where pilots can “fix it,” while committing to a new “limit” point beyond which we commit to go around. This concept results in new green-yellow-red zones on approach.

A yellow zone comports with the way our brains work naturally… “I know I have an issue, I’m fixing it, but I have a bail out point that I’m committed to.”

The CJP study involved 40 member pilots conducting simulator trials that resulted in a final gate at 200 feet, resulting in a “yellow zone” between 500 and 200 feet.

The other key attribute of Safe to LandSM introduces a touchdown point limit (TPL). Many excursions were in fact stable on short final but became unstable in the landing zone. An unexpected float is a common example. The touchdown point limit is a visual reference point that pilots establish (based on runway length and required stopping distance), beyond which touching down would result in an excursion. A go-around is the only option if the aircraft is still in the air as it crosses the TPL. Using the TPL, no pilot should ever touch down and then wonder if they can stop in the remaining runway.

30

safety report

Flight Safety International has now created a CJP Safe to LandSM simulator training session that stresses these criteria in highly realistic scenarios. The program, along with the other CJP initiatives, are indeed delivering results.

While all OPAs may not have the same level of safety expertise and/or resources as CJP, the work that CJP is doing demonstrates that these associations are looking out for their members in ways that strive to reduce risk and make aviation as safe as possible. It is important that our policy holders take advantage of the important guidance and resources that OPAs can provide.

More information about CJP Safe to LandSM is available at https://www.citationjetpilots.com/stl.

The Flight Safety Foundation report on Go Around Decision Making can be https://flightsafety.org/wp-content/ uploads/2017/03/Go-around-study_final.pdf

A retired U.S. Air Force colonel and former NASA astronaut, Charlie Precourt has logged over 12,000 hours in more than 100 different types of aircraft, including four Space Shuttle flights. He is a graduate of the U.S. Air Force Test Pilot School and held several leadership roles at NASA, including deputy program manager for the International Space Station and chief of the Astronaut Corps. Precourt is also a member of the board of the National Business Aviation Association (NBAA) and vice chairman of the board for the Experimental Aircraft Association (EAA).

31

safety report

Board of Directors

President

Christopher S. Morin

Murray, Morin & Herman, PA Tampa, FL cmorin@mmhlaw.com

Vice President

Ian Wrigglesworth

Guy Carpenter London, United Kingdom ian.wrigglesworth@guycarp.com

Secretary

Luke Uithoven

Kimmel Aviation Insurance Agency, Inc. Greenwood, MS luke@kimmelinsurance.com

Treasurer

Nicole Wolfe Stout

Strawinski & Stout, P.C. Atlanta, GA nws@strawlaw.com

Director, Agent/Broker Division

David Hampson

Schrager Hampson Aviation Insurance Agency Bedford, MA

david@planeinsurance.com

Director-Elect, Agent/Broker Division

Kristen Suarez

BWI Aviation Insurance Agency, Inc. Canyon Lake, CA

kristen.suarez@bwifly.com

Director, Attorney Division

Michael McGrory

Amundsen Davis, LLC Chicago, IL mmcgrory@amundsendavislaw.com

Director, Claims Division

David Gourgues

McLarens General Aviation Celebration, FL

david.gourgues@mclarens.com

Director-Elect, Claims Division

Jeff Sheets

Applied Underwriters Aviation

Los Angeles, CA

jdsheets@auw.com

Director, Reinsurance Division

Raffaella Basile

Swiss Reinsurance Company Ltd

Zurich, Switzerland

raffaella_basile@swissre.com

Director, Underwriter Division

Jeffrey t. Sutton

London Aviation Underwriters, Inc. Federal Way, WA

jtsutton@londonaviation.net

International Director

Andy Trundle

Starr Aviation

London, United Kingdom andy.trundle@starrcompanies.com

Director-at-Large

Chris Arnold

King Insurance Partners Hartford, CT

chris.arnold@king-insurance.com

Director-at-Large

Wes Collier

Old Republic Aerospace Kennesaw, GA

wcollier@ORaero.com

International Director-at-Large

David Watts

Everest International, Everest Insurance London, United Kingdom david.watts@everestglobal.com

Immediate Past President

Greg Sterling

AIG Aerospace Atlanta, GA

greg.sterling@aig.com

AIA General Counsel

Bob Williams

Victor Rane PLC

Pittsburgh, PA rwilliams@victorrane.com

Executive Director

Mary Gratzer

Aviation Insurance Association

Lexington, KY

mary.gratzer@aiaweb.org

32

Glossary of Common Aviation and Insurance Acronyms

AIA — Aviation Insurance Association

AOPA — Aircraft Owners and Pilots Association

ASAP — Aviation Safety Action Program (FAA)

ASEL — Airplane, Single Engine, Land

ASIAS — Aviation Safety Information Analysis and Sharing system (FAA)

CASA — Civil Aviation Safety Authority (Australia)

CAAC — Civil Aviation Administration of China

COPA — Cirrus Owners and Pilots Association

EAA — Experimental Aircraft Association

EASA — European Union Aviation Safety Agency

E6B — A type of manual or electronic flight computer

FAA — Federal Aviation Administration (U.S.)

FAR — Federal Aviation Regulations

FBO — Fixed base operator (service station for aircraft and pilots)

FDM/FOQA — Flight Data Monitoring / Flight Operations Quality Assurance

GA — General Aviation

GAMA — General Aviation Manufacturers Association

IATA — International Air Transport Association

IBAC — International Business Aviation Council

ICAO — International Civil Aviation Organization

IFR — Instrument Flight Rules

IMC — Instrument Meteorological Conditions

IS-BAO — International Standard for Business Aircraft Operations

IS-BAH — International Standard for Business Aircraft Handling

MRO — Maintenance Repair Organization

NBAA — National Business Aviation Association

NTSB — National Transportation Safety Board (U.S.)

P&C — Property and Casualty

SMS — Safety Management System

VFR — Visual Flight Rules

WAI — Women in Aviation International

This is an abridged list of aviation insurance terms that appear in current and previous editions of the AIA’s Binder magazine.

33 Aviation insurance glossary