The winds of CHANGE

ISSUE 60 | 2023 Economy GREEN journal

AGRICULTURE 14 SUPPLY CHAIN 22 MANUFACTURING 30

Sodium-sulphur batteries (NAS® Batteries), produced by NGK Insulators Ltd., and distributed by BASF, with almost 5 GWh of installed capacity worldwide, is the perfect choice for large-capacity stationary energy storage.

A key characteristic of NAS® Batteries is the long discharge duration (+6 hours), which makes the technology ideal for daily cycling to convert intermittent power from renewable energy into stable on-demand electricity.

NAS® Battery is a containerised solution, with a design life of 7.300 equivalent cycles or 20 years, backed with an operations and maintenance contract, factory warranties, and performance guarantees.

Superior safety, function and performance are made possible by decades of data monitoring from multiple operational installations across the world. NAS® Battery track record is unmatched by any other manufacturer.

Provide for your energy needs from renewable energy coupled with a NAS® Battery.

Contact us right away for a complimentary pre-feasibility modelling exercise to find out how a NAS® Battery solution can address your energy challenges!

Battery energy storage powered by renewable energy is the future, and it is feasible in South Africa right now!

Altum Energy: BASF NAS Battery Storage Business Development Partner – Southern Africa

info@altum.energy www.altum.energy

To access the full report in our Thought [ECO]nomy report boxes: Click on the READ REPORT wording or image in the box and you will gain access to the original report. Turn to the page numbers (example below) for key takeouts of the report.

Economy GREEN journal CONTENTS 4 NEWS AND SNIPPETS ENERGY 6 The winds of fortune: interview with SAWEA CEO 9 Wind grabs more provinces as demand grows 22 Supply chain resilience can propel the power sector through the energy transition – and please investors in the process AGRICULTURE 12 Food crisis in Africa 14 Automation and precision farming are crucial for food security BLUE ECONOMY 18 Connecting the blue to the earth PRODUCTION 27 Eco-innovation for textile companies by NCPC-SA MANUFACTURING 28 The road to sustainability: case studies by Triveni Turbines 30 Smart Manufacturing Great Convergence: Industry 4.0 INFRASTRUCTURE 36 The city/state infrastructure nexus. Part 2 AIR 40 Many upsides to better managing air quality in South Africa WASTE 42 Creating a culture of responsible consumption READ REPORT THOUGHT [ECO]NOMY greeneconomy/report recycle key takeouts of the report key takeouts of the report key takeouts of the report 02 01 03

1 14 19 36

Dear Reader,

Despite taking up their commitment to help customers, the banks are actually making financing solar PV installations more difficult for customers and EPCs. How so?

1. Miss-matching payment terms

EPCs on commercial and industrial projects are fortunate to earn a 15% margin, and the bulk of their costs are capital in nature. As such, typical industry payment terms are 50% deposit, 30% on delivery of equipment to site, 15% on completion and 5% on handover. Some banks want to pay 40% deposit, 40% once under construction (whatever that means) and 20% final payment. Under these terms, EPCs will have to co-fund the project.

2. Linking final tranche payments to Eskom “approval” on SSEG “applications”

But that’s reasonable, right? Wrong!

Eskom can take years to approve SSEG applications, and the amount withheld of 20% to the contractor typically exceeds their margin in the project. The practice in the industry is to file the SSEG and then switch it on with no export of power to the grid. This is the customer’s decision and should not affect payment to the EPC. By getting involved and being pedantic about such matters the banks are being obstructive, not constructive.

But are these systems illegal and therefore uninsurable?

Not in my opinion. But this should be clarified and is something the industry and the banks should get to the bottom of. The law, as I understand it, is that it is a requirement that Eskom and the municipalities “register” SSEGs, but in typical fashion this registration process has been turned into an “application for approval” process. This is an administrative over-reach in my view and the industry should challenge it in the courts.

The fact remains, despite all the verbiage, that implementing for-own-use energy projects in South Africa is like boxing Mike Tyson with one hand tied behind your back.

Complaint ends here. For now.

Regards,

Publisher

EDITOR’S NOTE

The South African wind sector is following a natural evolution, indicating the same trajectory as its global market counterparts, with a shift from resourcerich areas to regions attractive for their ideal transmission connections. This is further underpinned by a downward pricing curve for the cost of energy, more powerful and bigger turbine generators as well as increased market competitiveness. Don’t miss our interview with SAWEA CEO on page 6.

In the US, the rise of the tractor between 1910 and 1960 replaced an estimated 24-million draught animals. Now, more than a century after the tractor first gained traction, automation and digitisation threaten to put many agricultural workers out to pasture. Commercial agriculture in SA remains labour-intensive and would employ more people were it not for the technological trends already in play, but these have boosted production, profits and food security (page 14).

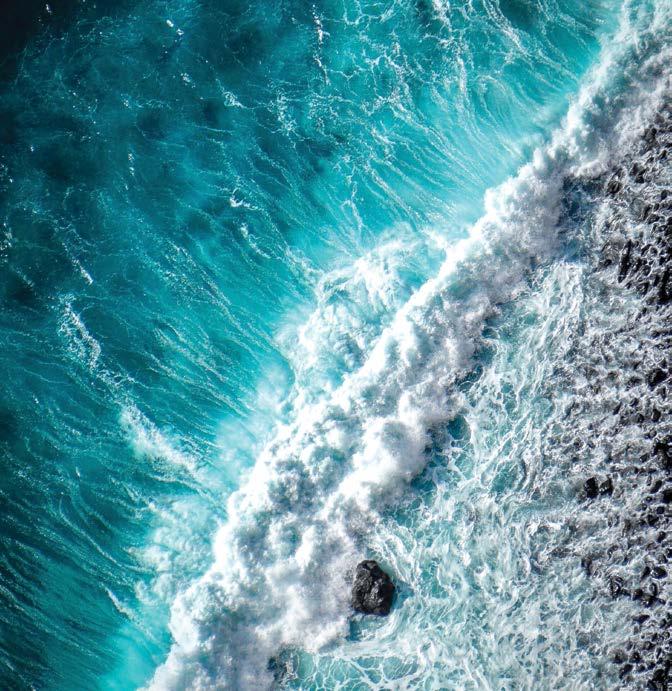

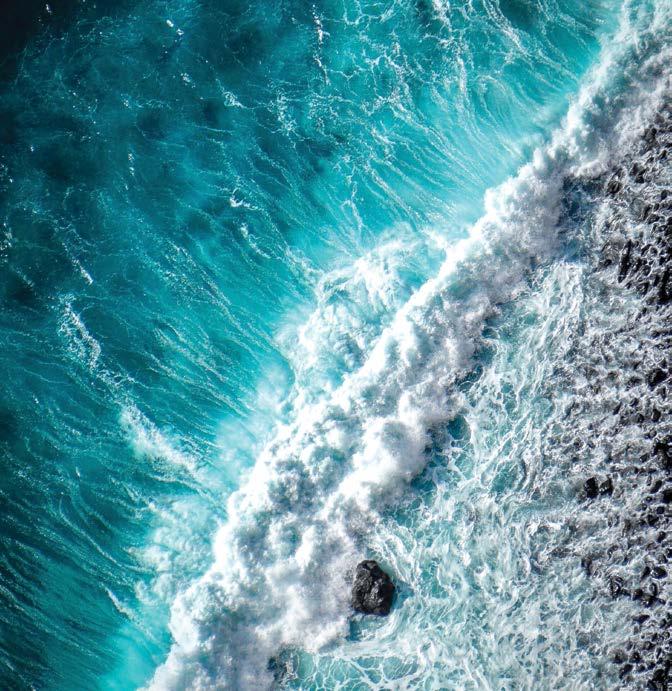

Professor Fabio Fava says that more than half of all oxygen is produced by the hydrosphere (oceans, seas and inland waters). We obtain much of what we need for our sustenance from the hydrosphere, starting with food. Therefore, an overall vision of taking care of the land must also include the blue economy (page 18).

The power sector is on the verge of an existential transformation as it works to achieve an inclusive energy transition. However, it must do so while resuscitating ageing infrastructure, battling more frequent weather events and defending against security threats (both cyber and physical). Externally, critical materials and skilled workers are in short supply, and their costs are rising. Internally, utilities’ traditionally rigid processes run counter to the agility they will need to build a resilient and reliable grid while being nimble enough to withstand supply chain shocks cost-effectively (page 22).

There is a long road ahead, but the winds of change are blowing! Enjoy!

Alexis Knipe Editor

EDITOR: Alexis Knipe alexis@greeneconomy.media

CO-PUBLISHERS: Gordon Brown gordon@greeneconomy.media

Alexis Knipe alexis@greeneconomy.media

Danielle Solomons danielle@greeneconomy.media

LAYOUT AND DESIGN: CDC Design

OFFICE ADMINISTRATOR: Melanie Taylor

WEB, DIGITAL AND SOCIAL MEDIA: Steven Mokopane

SALES: Gerard Jeffcote

Glenda Kulp

Mark Geyer

Michali Evlambiou

Nadia Maritz

Tanya Duthie

Vania Reyneke

PRINTERS: FA Print

GENERAL ENQUIRIES: info@greeneconomy.media

ADVERTISING ENQUIRIES: alexis@greeneconomy.media

REG NUMBER: 2005/003854/07

VAT NUMBER: 4750243448

PUBLICATION DATE: October 2023

www.greeneconomy.media

2 All Rights Reserved. No part of this publication may be reproduced or transmitted in any way or in any form without the prior written permission of the Publisher. The opinions expressed herein are not necessarily those of the Publisher or the Editor. All editorial and advertising contributions are accepted on the understanding that the contributor either owns or has obtained all necessary copyrights and permissions. The Publisher does not endorse any claims made in the publication by or on behalf of any organisations or products. Please address any concerns in this regard to the Publisher.

Economy GREEN journal

PUBLISHER’S NOTE

With close to 45 years of experience in the waste management industry, collaboration with customers is how we drive the circular economy. We implement agile and innovative waste solutions, proudly ensuring environmental peace of mind through our commitment to industry standards. www.enviroserv.co.za | 0800 192 783 FIND OUT MORE

From unwanted to wanted

TECH INTELLIGENCE IN ONSHORE WIND SECTOR

With years of operation in the Asia markets and currently ranked among the top 10 global wind turbine suppliers, SANY Renewable Energy (SANY RE) remains resolute in offering top-tier wind power solutions to the African market.

SANY RE who makes its debut Windaba appearance this year, recently unveiled the latest 919 wind turbine platform. The 919 platform adopts a more integrated design with shared structural components such as hub, main shaft and front bedplate. Blades, gearboxes and electrical systems are designed as modular systems to cover 8.5MW to 11MW products with rotor diameters ranging from 214m to 230m through different combinations, significantly enhancing the reliability of R&D.

Looking ahead, SANY RE will remain focused on its technological vision to develop industry-leading wind turbines with stronger intelligent capabilities and providing cost-effective wind energy solutions to lower the costs of wind farms.

BELIEVE IN BETTER

WWF South Africa is proud to announce its latest Believe in Better campaign, an inspiring call to action designed to ignite hope for a brighter, more sustainable future in our cherished nation. As South Africa approaches the 2024 elections, this campaign serves as a powerful reminder of our shared national vision – to heal the wounds of the past and pave the way for a brighter, more promising future for our country.

WWF South Africa wishes to inspire its compatriots to be heartened by its stories of success and embrace hope rather than despair. It wants everyone to Believe in Better, three words that serve as a balm against the constant barrage of negativity we face from all directions and an uplifting reminder of the value of believing in something good.

At the heart of WWF’s mission lies the protection of our invaluable natural heritage and the ambition to build a future in which we all live in harmony with nature. The multimedia campaign, #BelieveInBetter, not only celebrates some of WWF’s major conservation milestones but also illustrates the positive leaps that are possible when people from different walks of life come together.

Restoring Springs, Reviving Communities

WWF’s partnerships have yielded a wide range of accomplishments to safeguard the natural systems vital for clean drinking water, food production, fisheries, and ecosystem health. Despite challenges such as a growing population, ageing infrastructure, and increasing industrial demands that threaten our ecosystems, WWF tirelessly works to protect our land, wildlife and vital water sources.

One noteworthy initiative is the focus on natural springs in the Drakensberg areas of the Eastern Cape and KwaZulu-Natal, where communities struggle to access clean water due to inadequate municipal infrastructure and the impact of invasive alien trees. By bringing together a range of donors and working with communities and partners, WWF has helped secure 44 natural springs in the

grasslands of the Eastern Cape and has expanded this work to the Enkangala Drakensberg Water Source Area.

On the wildlife front, WWF’s Black Rhino Range Expansion Project is celebrating its 20th anniversary this year, having worked tirelessly over the last two decades to grow the populations of this critically endangered species in partnership with landowners and communities. WWF’s Land and Biodiversity programme has also added extensively to the country’s network of national parks and other protected areas.

Dr Morné du Plessis, CEO of WWF South Africa, comments: “Environmentalists are, by their very nature, agents of hope. In our work, we have plenty of evidence that hope, supported by action, is far more powerful than the strangely seductive slide into despair. Just as we need to remember how far we’ve come as a society; we need reminding of just how exceptional South Africa’s natural and social endowments are. We need to keep faith in each other and appreciate that together we can transform our vision of a more sustainable future into a reality.”

4 NEWS & SNIPPETS

LOCALISATION IS LEKKER

By Mamiki Matlawa, ACTOM

SA has been involved in the green economy space since 2011 when the government introduced the REIPPPP. Thus, local organisations have a wealth of experience in manufacturing the balance of plant for renewable energy products, including in the areas of EPC, financing, operation and maintenance.

These homegrown skills could be harnessed to overcome our lag in the space and be exported to the rest of the continent. However, to successfully develop SA’s domestic manufacturing capabilities and reduce dependence on foreign suppliers, a comprehensive approach is vital for companies providing end-to-end services.

Key to this are mechanisms such as the African Continental Free Trade Agreement (AfCFTA), which aims to achieve the free movement of physical goods throughout the African Union. Recently, the five member states of the Southern African Customs Union (SACU) ratified the AfCFTA agreement. SACU has also submitted its joint offer of tariff concessions, which is currently being verified by AfCFTA.

The AfCFTA agreement is expected to open trade opportunities between African manufacturers, increasing regional demand for

SAPVIA ANNOUNCES PARTNERSHIP

equipment and services and driving access to new markets. This will enable African manufacturers to develop economies of scale, which will position them to effectively compete with foreign companies in the renewables space.

According to Trade and Industrial Policy Strategies senior economist, Gaylor Montmasson-Clair, SA has imported R35-billion worth of solar panels since 2010. Montmasson-Clair says that SA has imported R12-billion worth of solar panels so far in 2023 –equivalent to 2 200MW of generation capacity. It is estimated that South African households and businesses have installed 4 400MW of rooftop solar to date.

The scope for African manufacturers in the green economy is vast, but the continent needs to expand the supply chain in this space by effectively harnessing initiatives such as the AfCFTA agreement to build economies of scale. It is only through the localisation of the renewable energy industry that local manufacturers can hope to compete with large-scale and wellestablished foreign suppliers.

As SA’s solar industry gains unprecedented momentum, concerns over the quality of solar PV installations have also become more common. Addressing this pressing issue head-on, SAPVIA is redoubling its efforts to instil public confidence.

SAPVIA has recently announced its strategic partnership with Bravo Scan, an Approved Inspection Authority (AIA) endorsed by the Department of Employment and Labour, thereby reinforcing its commitment to quality assurance and compliance monitoring in the bourgeoning solar PV installation sector.

The Association’s PV Green Card Programme stands as an industry hallmark for quality assurance, states Dr Rethabile Melamu, CEO of SAPVIA. “The SA public has come to trust our PVGC-accredited members for solar PV installations that adhere to the highest quality standards.

“Collaborating closely with our new quality assurance partner, Bravo Scan, we aim to further intensify the objectivity and rigour with which we oversee the activities of our certified PV Green Card installation companies,” Melamu says.

She explains that Bravo Scan will be integral to skills development within the PV Green Card ecosystem and will also assist with inspections of installations.

“This will allow us to further improve quality and compliance, making sure that we’re making the most of our abundant solar energy resources at every installation site. Bravo Scan’s endorsement by both the Department of Labour and SANAS gives an additional layer of credibility and authority to the PV Green Card,” Dr Melamu adds. This partnership also aspires to enlighten end-users about their responsibilities in selecting credible solar power installation companies.

NEW CLOUD CARBON CALCULATOR

IBM has launched a new tool to help enterprises track GHG emissions across cloud services and advance their sustainability performance throughout their hybrid, multicloud journeys. The IBM Cloud Carbon Calculator – an AI-informed dashboard – can help clients access emissions data across a variety of IBM Cloud workloads such as AI, high-performance computing and financial services.

Based on technology from IBM Research and through a collaboration with Intel, the tool uses machine learning and advanced algorithms to help organisations uncover emissions hot spots in their IT workload and provides them with the insights to inform their emissions mitigation strategy.

5

NEWS & SNIPPETS

Dr Rethabile Melamu, CEO of SAPVIA.

WINDS

The of FORTUNE FORTUNE

The South African Wind Energy Association’s focus is to enable a thriving commercial wind power industry in South Africa that is recognised as a major contributor to social, environmental and economic security. Green Economy Journal speaks to the Association’s CEO, Niveshen Govender.

Please talk to us about SAWEA’s position regarding the interim grid allocation rules and the development thereof.

We have supported the development of the interim grid capacity allocation (IGCAR) rules as an effective mechanism for integrating additional renewable energy to address the ongoing energy crisis. While the industry found some challenges within the first iteration, we’ve worked well with Eskom to resolve those matters to ensure that the rules are conducive to industry requirements.

We applaud Eskom for their efforts, continuously striving for equitability and transparency in the allocation of the limited available grid capacity in a structured and coordinated approach, as well as allowing us to engage them on our concerns and making the necessary adjustments. This will no doubt enable the country to better realise a balanced and reliable energy mix. As reported, concessions to the IGCAR include:

• Applicants no longer need to have a water-use licence, but must be able to show that they have already applied for it.

• They also no longer need permission from the Civil Aviation Authority. Proof of an application for this is enough.

• An option on the lease or purchase of land for the generation facility will do, instead of a concluded lease or purchase contract and permission from the Minister of Agriculture, Forestry and Fisheries for its subdivision.

• One year’s data on the wind conditions on the premises is enough and for solar farms satellite data will be accepted.

• If there are more projects ready for construction than can be connected to the network, priority will be given to those who applied first.

What are some of the industry’s challenges when it comes to increasing localisation?

Some of the key challenges include policy uncertainty, consistency of procurement and local skills required for manufacturing capabilities. Collectively, these are key drivers of investment into localisation in the renewable energy sector. And, through the South African Renewable Energy Masterplan (SAREM), we believe

6 ENERGY

Niveshen Govender, CEO of SAWEA.

An industrialised agenda in South Africa’s wind energy sector can bring numerous benefits.

that government is on the right path to create an attractive investment destination by working with industry to realise possibilities within local manufacturing.

As is widely known, our Association together with sector stakeholders strongly advocate for the industrialisation of the renewable energy sector to extrapolate the enormous potential across the value chain, thereby unlocking both the economic power of the renewable energy industry and delivering broader benefits to the people of this country.

Transformation goes hand-in-hand with the industrialisation of the wind power sector. And market certainty is the most important aspect of building a local manufacturing industry.

The country’s power sector procurement model started evolving over a decade ago, with major policy shifts. This has accelerated over the last two years, with the lifting of the cap on the new generation capacity requirement for a generation licence and government’s continued commitment to rolling procurement. This is in line with the global uptake of renewable energy to increase energy security and achieve climate goals.

Transformation goes hand-in-hand with the industrialisation of the wind power sector.

South Africa’s energy roadmap, IRP2019, requires 3 600 wind turbines, underpinning the industrialisation plan and demonstrating a noteworthy opportunity for local employment and GDP contribution through annual production across the value chain. By maximising the use of the current industrial capacity to supply materials and components into the sector’s demand areas, additional investments in capacity and capability will be stimulated.

SAWEA supports the various government stakeholders, labour, civil society, researchers, industry contributors and various advisory groups, which are currently drafting the SAREM that addresses exactly how we can industrialise the renewable energy value chain in our electricity sector to enable inclusive participation in the energy transition, serving the needs of society and contributing to economic revival.

The draft SAREM – which is expected to be finalised in the next two months by the Department of Trade, Industry and Competition is a result of a rigorous process, including input from SAWEA’s Manufacturing and Local Content Working Group. Stakeholders have been invited to review and provide comments on the draft masterplan document.

This framework aligns with SAWEA’s advocacy for sector industrialisation, through increased local manufacturing. As such, the Association reviews this framework’s key pillars as effective interventions to create a better environment for local manufacturing, which will no doubt result in increased employment opportunities,

investment, social inclusion and acceleration of our industry’s participation in a global wind supply chain.

It is designed to stimulate the industrial and inclusive development of renewable energy and battery storage value chains and contribute to the broader development needs of the country.

Along with setting clear local content targets for future private and public procurement, the SAREM’s focus on driving industrial development outlines existing public sector programmes and policy support with localisation objectives.

Despite initial localisation targets reflected in the 2022 draft, the most recent draft includes revisions to exclude specific targets, which is to be obtained through an inclusive negotiation process, between the social partners.

How will an industrialisation agenda benefit the wind sector?

An industrialised agenda in South Africa’s wind energy sector can bring numerous benefits. We believe that an industrialisation agenda, which is rooted in robust local manufacturing capabilities, will allow the wind power sector to deliver the necessary new generation power needed for the country to thrive. By establishing localised value chains and capitalising on economies of scale, cost reductions can be achieved. This will ultimately result in decreased dependence on global economies and mitigate potential impacts stemming from uncertain political climates on local production.

To this end, the SAREM will provide a clear framework, necessary for both local and global investors, seeking an investment destination to manufacture renewable and new-generation technology components, as part of the global supply chain.

Furthermore, local manufacturing has the potential to create increased employment opportunities, investment, social inclusion and acceleration of our industry’s participation in a global wind supply chain.

These positive outcomes contribute to sustainable development and enhance the country’s energy security.

Government’s public procurement vehicle, REIPPPP, is expected to continue to provide a stable and consistent pipeline with foreseeable and predictable timelines between procurement rounds remains necessary to attract significant investments in order to rebuild the manufacturing sector and create a local market based on its competitiveness and value-add.

CAREER BIOGRAPHY

2022 to present: Chief Executive Officer | SAWEA

2019-2021: Chief Operating Officer | South African Photovoltaic Industry Association (SAPVIA)

2016-2019: Programme manager | SAPVIA

2015-2016: Project manager | Department of Energy

2012-2015: Specialist: green economy | The Innovation Hub

SOUTH AFRICAN RENEWABLE ENERGY MASTERPLAN | Draft version for review

7 July 2023 | Department of Mineral Resources and Energy | Department of Science and Innovation | Department of Trade, Industry and Competition | [July 2023]

An industrial and inclusive development plan for the renewable energy and storage value chains by 2030. The South African Renewable Energy Masterplan (SAREM) articulates a vision, objectives and an action plan for South Africa to tap into current opportunities.

It aims to leverage the rising demand for renewable energy and storage technologies with a focus on solar energy, wind energy, lithium-ion battery and vanadium-based battery technologies to unlock the industrial and inclusive development of associated value chains in the country. This initial technological focus is aligned with global and domestic demand dynamics as well as South Africa’s supply-side capabilities. In time, other technologies (such as offshore wind or rechargeable alkaline batteries) will receive increased focus, as they mature and industrial capabilities are developed. The Masterplan builds on the Draft SAREM document released in March 2022.

Visit www.greeneconomy.media to download the full report in the digital version of Green Economy Journal Issue 60.

ENERGY 7

THOUGHT [ECO]NOMY greeneconomy/report recycle READ REPORT

DEMAND GROWS WIND grabs more provinces as

BY NORDEX ENERGY SOUTH AFRICA

The natural evolution is further underpinned by a downward pricing curve for the cost of energy, more powerful and bigger turbine generators as well as increased market competitiveness.

In South Africa, this geographic shift outside of the Cape provinces is driven by the region’s constrained grid capacity, clearly demonstrated by the government’s last procurement round, REIPPPP’s Bid Window 6, which failed to secure a single wind project.

However, areas such as the Mpumalanga province have available grid capacity and with more coal generation facilities reaching the end of their lifetime resulting in their decommissioning, additional grid capacity in this thermal-power region will open.

The market intelligence clearly indicates that by 2027 new wind power generation projects will become concentrated in grid-rich areas, with KwaZulu-Natal and Mpumalanga emerging as important wind jurisdictions, within the next five years. The South African Renewable Energy Grid Survey, released in June 2023, shows stable and constant growth in wind projects being developed in these new zones, which is vital for the industry – especially if the country is to be successful in its plan to industrialise the renewable energy sector.

“Original equipment manufacturers (OEMs) such as ourselves, as well as both local and global investors, prefer a consistent pipeline of projects for long-term investment decision-making. While we are able to meet the technology needs of lower wind-resourced areas, it is challenging to operate within a market that isn’t reinforced by clear supportive policy and consistent closure of projects without delays,” says Compton Saunders, managing director of Nordex Energy South Africa.

In preparation to meet market needs, Nordex Energy South Africa introduced technology offering an increase in unitary power, which means improved cost of energy, as well as a reduction in land usage and visual impact.

In addition to more powerful generating platforms, taller towers are necessary to capture better wind conditions at higher altitudes, in areas such as Mpumalanga. To date, most wind turbine towers in South Africa have been 80 to 120 metres tall, but as we shift into new regions, this will need to increase.

Looking at the global market, OEMs such as Nordex are working on projects with hybrid towers of 168m hub height with this technology available to the local South African market. There are also various tower technologies between 120m to 200m that are either available or under development.

These 168m hybrid towers that could be offered in this market comprise around 100m concrete sections that would be locally manufactured, and the balance of (68m) steel sections that can be manufactured locally or imported.

“Our industry is going to require large volumes of wind turbine components in a relatively short space of time and the potential overlapping construction programmes could result in greater

logistical considerations. The majority of the components will arrive on a vessel before being offloaded and then stored close to the port before road transportation to the final installation destination commences. We already know that the availability of land in ports or close to ports could be a challenge and that the ability to handle large volumes through single entry and exit gates will be hindered by congestion,” says Saunders.

He continues, “Another consideration is that the longer blade lengths that we’ll need to bring into the country require specialised trailer sets, which will need to be sourced abroad and will then require licensing locally. And, with the uncertainty and continuous delays in our country’s renewables market, the timing of investment decisions is very tricky.”

South Africa can also begin to see the pairing of wind and solar power plants, meaning that a single transmission connection point may be used to provide Eskom with the increased uptake of power at a particular point.

It has been proven in global energy markets that the co-location of wind, solar PV and energy storage technologies offers more stable, predictable and dispatchable power output, and the option of shared grid connections makes sense in the efforts to optimise the current grid infrastructure.

“Hybridisation of facilities brings extra value in terms of grid utilisation. It is especially remarkable when the generation of both wind and solar PV technologies are complementary, and the combined curve matches the power demand. Our global counterparts have experience for us to draw on, and we will do so in new South African regions if this brings value to our customers,” Saunders concludes.

Case studies in the country show that the generation peak hours of wind facilities are early in the morning and late evening time, which combined with the generation curve of solar facilities, bring an overall curve matching quite well with the demand.

9 ENERGY

The South African wind sector is following a natural evolution, demonstrating the same trajectory and adjustments as its global market counterparts, with a shift from resource-rich areas to regions attractive for their ideal transmission connections.

Members of the Nordex Energy South Africa Services team on top of one of the wind turbines at Dorper Wind Farm in Molteno, Eastern Cape.

WINDS OF CHANGE

Empowering South Africa’s renewable energy workforce

South Africa’s wind energy sector has rapidly expanded, cementing its place on the global renewable energy stage. However, this growth has unveiled a significant challenge: a widening skills gap within the industry.

Energy and Water Sector Education and Training Authority (EWSETA) and the South African Wind Energy Association (SAWEA) have collaborated to explore how addressing the operational skills and qualification gap will advance wind energy in South Africa and contribute to the nation’s climate goals.

The skills gap challenge

The surge in wind energy projects across South Africa has created an increased demand for skilled professionals. This demand encompasses a wide array of expertise, ranging from engineers and technicians to project developers and environmental specialists. Unfortunately, there are insufficient skills to meet the demand in the South African context. Currently, the actual challenge is that there are not enough skilled and experienced workforce.

Several factors contribute to this skills gap, including the historical focus on coal in the energy sector, insufficient wind energy qualifications and skills development providers as well as a shortage of experienced professionals in the field. These factors have led to a shortage of skilled workers capable of supporting the growth of renewable energy in South Africa.

Opportunities abound

Despite the challenges posed by the skills gap, it presents a unique opportunity for South Africa to cultivate a workforce capable of driving the wind energy sector forward. Initiatives aimed at closing this gap have the potential to offer substantial benefits to the nation’s economy and its transition to a sustainable energy future.

A promising avenue to address this challenge is the collaboration between EWSETA and SAWEA. EWSETA, which is responsible for skills development in the energy and water sectors, has partnered with SAWEA to create tailored training programs and apprenticeships designed to meet the specific needs of the wind energy industry. These programs encompass a wide range of skills, spanning installation and maintenance to project development and management.

Empowering women and youth

South Africa must empower women and youth by actively involving them in the wind energy sector. Encouraging their participation addresses gender and youth unemployment disparities and fosters diversity and innovation within the industry.

SAWEA and EWSETA have already taken significant steps in this direction by launching the Renewable Energy Management Advancement Programme aimed at advancing women to middle –senior management positions in the sector through Wits Business School. The intervention seeks to transform the sector and address gender disparity. In addition, the partnership in the Wind Industry Internship Programme which is currently in its second year provides work experience to young graduates who are interested in pursuing careers in wind energy. This initiative was successful through the participation of the employers who have opened their workplaces to enable this mentorship initiative. These initiatives provide access to education and hands-on experience, paving the way for a more inclusive and dynamic workforce.

10 ENERGY

To advance wind energy in South Africa, it is imperative to invest in training and development programmes that produce highly skilled operational technicians and engineers.

Companies operating in the wind energy sector must play a pivotal role by actively promoting diversity and inclusion, dismantling barriers and fostering a welcoming environment for all.

“A collaborative approach is essential, bringing together government, industry and training providers to establish effective training capacity for renewable energy. Traditional market-driven strategies may not be suitable for this context. It’s also crucial to construct pathways for training and employment that cater to a diverse labour force, including marginalised groups outside the workforce. Furthermore, a holistic perspective should be adopted, treating renewable energy as part of an interconnected workforce “ecosystem” that enables seamless transitions between renewable energy and adjacent sectors like resources, infrastructure and manufacturing, says Khetsiwe Mtiyane, EWSETA’s Energy Specialist.

Value-chain skills gap: advancing wind energy

While the skills gap mentioned earlier relates to the development and construction phases of wind energy projects, addressing the operational skills gap is equally crucial. Skilled workers are needed to ensure the efficient and reliable operation of wind farms.

Operational skills encompass areas such as maintenance, troubleshooting and performance optimisation. Without a well-trained operational workforce, wind farms can suffer from downtime, reduced efficiency and increased operational costs.

To advance wind energy in South Africa, it is imperative to invest in training and development programmes that produce highly skilled

operational technicians and engineers. These professionals play a pivotal role in maximising the energy output of wind farms and ensuring their long-term sustainability.

As South Africa’s wind energy sector continues to expand, the skills gap poses a multifaceted challenge that must be addressed strategically. Collaboration between EWSETA and SAWEA is a promising step in the right direction. By developing tailored training programmes and apprenticeships, the nation can equip its workforce with the skills needed to support the growth of renewable energy.

It is essential for the efficient and reliable operation of wind farms, which contributes to South Africa’s climate goals and the long-term success of its wind energy sector. By seizing the opportunities presented by these skills gaps, the nation can unlock its wind energy potential and contribute to a sustainable and prosperous future. The rewards for achieving these goals extend far beyond emissions reduction, encompassing economic growth, energy security and a cleaner, more sustainable future.

11 ENERGY

in FOOD CRISIS AFRICA

Global fertiliser suppliers have made incredibly high profits in 2022/23 on the back of price spikes attributed to the Russia-Ukraine war. The profits of the world’s top nine producers trebled in 2022 from two years previously. The margins and impacts have been even greater on fertiliser supplies to African farmers.

BY SIMON ROBERTS AND NTOMBIFUTHI TSHABALALA*

Moreover, the super-high profit margins are being sustained in 2023 in many African countries even while international prices have come down (see figure 1). The harvest season has recently come to an end in most countries in southern Africa with farmer margins and production being squeezed by high input costs.

The wide gaps between fertiliser prices in the region and international fertiliser prices point to major issues within the supply chain with excess margins of some 30% to 80% being earned on sales to many African countries.

South Africa has the benefit of robust competition enforcement meaning prices in this country have come down. This only serves to highlight the disadvantages being faced by farmers in other countries such as Malawi and Zambia.

High fertiliser prices undermine production, contribute to high food prices and exacerbate food insecurity.

Our work on fertiliser and agri-food markets in the African Market Observatory points to major problems with how international and regional markets work, including the market power of large international suppliers. High prices for fertiliser inputs are squeezing African farmers who are cutting back on fertiliser use meaning low yields and supply, and high food prices.

International action is therefore urgently required on fertiliser prices to improve food security in Africa.

12 AGRICULTURE Article

of The Conversation

courtesy

Figure 1. [Next page] The graph on the opposite page shows urea prices in East and Southern Africa. World price is from the World Bank; South African price is inland, from Grain SA. East Africa is the average of Kenya, Rwanda, Tanzania and Uganda. Prices are given before any government subsidies. Source: Compiled from different sources by the African Market Observatory.

IMPACT ON IMPORT AND INPUT

African countries are dependent on imported fertiliser and usage is relatively low. For example, Kenya and Zambia use around 70kg/ha, compared with 365kg/ha in Brazil.

There’s evidence that high input costs are squeezing farmer margins and production. High costs and low application are a factor in maize yields in Zambia being less than half of those in South Africa and a third of Argentina (according to the FAO).

In 2022, Kenya imported almost 30% less fertiliser and production fell. Maize output in 2022/23 was 18% lower than the average for the previous five years, with yields and area planted both being lower, compounding the effect of poor rains. This has meant a substantial deficit relative to local demand and very high prices.

Continued high fertiliser prices will constrain production, even while there is a great need to expand agriculture output to meet regional demand.

For example, Zambia has abundant arable land and water for agriculture to increase production. Of the country’s 42-million hectares of arable land, only 15% (or around 6-million) is under cultivation, including for pasture, with only 1.5-million of this cultivated for crop production. Zambia has around 40% of the water resources available for agriculture in the entire SADC region.

If farmers earned better returns with cheaper input costs then production could be a multiple of the current levels.

Approximately 73-million people in the East and Southern Africa region are experiencing acute food insecurity. People in low- and middle-income countries bear the harshest burden – both in terms of the importance of small-holder farmers and in the vulnerability of low-income urban households to high food prices.

Most countries on the continent rely on food imports. Countries such as Kenya which have been affected by drought are struggling to source imports which has worsened food security in the country.

This has been exacerbated by export restrictions on maize imposed by Zambia and Tanzania, which have suppressed prices to farmers in those countries, even while input costs, notably fertiliser, have increased.

UNEVEN PLAYING FIELD

International fertiliser prices more than doubled in two months –from September to November 2021. The peak continued into early 2022, reaching an average price of US$915/t for the benchmark urea fertiliser between March and April 2022. This compares with around US$226 in the previous five years. This was driven by the world’s largest fertiliser companies taking advantage of the rise in the price of natural gas, an important input for nitrogen-based fertiliser, as well as supply disruptions associated with the Russia-Ukraine war. The fertiliser companies exploited the shocks and raised prices by more than the increase in costs.

By March 2023, the international price of urea had fallen back to close to $300/t. With additional costs to import to coastal countries which should be no more than $150/t and to inland regions no more than $250/t including a trader margin, South Africa’s inland prices now reflect fair prices but in other African countries super profits are continuing.

WHAT NEEDS TO BE DONE

To ease the adverse impacts of high fertiliser prices, governments in the region have tried to implement fertiliser subsidy programmes. For example, prices in Tanzania with the government subsidy have been reduced from around $1100/t to US$600-700/t.

But the subsidies have huge costs for governments which many African countries have not been able to incur, while the programmes have generally not been working well. In Malawi, for example, a large portion of the Affordable Inputs Programme (AIP) targeted beneficiaries did not receive fertiliser under the 2022/2023 programme.

International action is therefore urgently required on fertiliser prices to improve food security in Africa. First, competition authorities in Africa should investigate signs of anti-competitive conduct. Second, investments are required in logistics, storage and advice on optimal usage. Third, a fertiliser market observatory as the EU is currently setting up would provide ongoing data about fertiliser markets, factors affecting them, and exchange experiences and good practices for optimal usage.

13 AGRICULTURE

*Simon Roberts is professor of economics and lead researcher, and Ntombifuthi Tshabalala is economist at Centre for Competition, Regulation and Economic Development, University of Johannesburg.

South Africa has the benefit of robust competition enforcement.

Most countries on the continent rely on food imports.

Automation and are for PRECISION FARMING CRUCIAL CRUCIAL FOOD SECURITY

In the US, the rise of the tractor between 1910 and 1960 replaced an estimated 24-million draught animals, according to the UN’s Food and Agriculture Organization. Now, more than a century after the tractor first gained traction, automation and digitisation threaten to put many agricultural workers out to pasture.

BY ED STODDARD

Aaron Smith, a professor of agricultural economics at the University of California, phrases it this way: “The relevant question is not whether we will have mass unemployment, but what will happen to the specific workers who are replaced. Can they retrain and find new jobs? And what of their communities?” His focus is on the US, where commercial farmers are having a tough time filling vacancies.

“Most people don’t like doing agricultural labour. It’s hard work and often bad for your health. For this reason, and due to increasing employment opportunities elsewhere in the economy, fewer workers are available for farmers to hire. They are choosing jobs in other sectors,” Smith writes, citing a 2020 survey that found 45% of California farmers had problems finding enough employees.

The US unemployment rate surged that year to – wait for it – over 8% because of the economic disruptions triggered by the Covid-19 pandemic. It now stands at a 50-year low of 3.4%, so one imagines that California farmers are finding field hands are even more scarce. But the need for such hands is increasingly being reduced and some of the technology behind this trend is being developed in California.

14 AGRICULTURE

Article courtesy Daily Maverick

Guss, which stands for Global Unmanned Spraying System, looks like something out of a sci-fi movie. Shaped like a horizontal cylinder on four wheels, as the name suggests it is an autonomous system for herbicide and other kinds of crop spraying. Guss is also the name of the privately-held company behind the system. Its application is for vineyards, macadamia nuts, citrus and stone fruit such as peaches.

“It has GPS but we have quite a few other sensors because GPS becomes pretty degraded among large trees such as pecans. Anywhere you have a canopy of leaves that block the GPS signal from the satellites,” says Guss chief technology officer Chase Schapansky, who is the brains behind the system.

Aside from being unmanned, which eliminates the need for a driver, Guss sprays in a targeted or precise manner, which eliminates wastage. It is among the latest tools in the precision farming revolution which uses GPS and other technologies to precisely apply inputs to boost yields and productivity while cutting costs.

“Herbicide Guss is built with cutting-edge technology to detect, target and spot spray weeds, reducing chemical usage and drift for increased safety for the operator, environment and food produced,” the company says on its website.

“Guss allows ag businesses to reskill workers – training them to use sophisticated technology that will open up future opportunities and positioning them for success in the economy of tomorrow.”

15 AGRICULTURE

Meet Guss

This technological furrow is only going to get ploughed further and jobs will get mulched up in the process.

South Africa’s unemployment rate is almost 33%, and more than 42% under the expanded definition which includes discouraged jobseekers, according to the latest Quarterly Labour Force Survey. The survey also found that South Africa’s agricultural sector employed 888 000 people. And unlike in the US, South Africa’s mostly lowskilled and poorly educated farmworkers will be hard-pressed to find jobs in other sectors.

Commercial agriculture in South Africa remains labour-intensive. Simultaneously, it is highly capital-intensive and hi-tech. It would employ more people were it not for the technological trends already in play, but these have boosted production, profits and food security.

South Africa is currently reaping its third-highest maize harvest on record, which is testimony to technology and the rains of La Niña that have now ended. If it were not for this abundant harvest, food inflation would be running at an even faster pace than the 14-year high of 14% it reached in March.

THOUGHT [ECO]NOMY

Jobs will be mulched up

This technological furrow is only going to get ploughed further and jobs will get mulched up in the process. But the alternative would be falling behind the rest of the world, rendering an agricultural sector that accounts for about 11% of South Africa’s exports. And with the rand on the ropes, South Africa needs all the forex it can get its hands on.

There are many legitimate concerns and criticisms regarding big agriculture, ranging from environmental impacts to wealth concentration to price manipulation by traders in sometimes opaque supply chains.

Technology is also raising the threshold for entry into the commercial farming space, blocking the path for aspirant emerging farmers who lack the capital and know-how to enter this fast-changing field. But precision farming can also mitigate ecological consequences by growing more on less land and with fewer inputs used with increased efficiency. There are various initiatives in play to adapt such technologies for smaller-scale farmers. The costs of new technologies tend to fall as they ripen in the market.

At the end of the day, you don’t want to be stuck with a horse when your neighbour has a tractor.

THE FUTURE OF THE WESTERN CAPE AGRICULTURAL SECTOR IN THE CONTEXT OF THE FOURTH INDUSTRIAL REVOLUTION | The Western Cape Department of Agriculture | University of Stellenbosch Business School | [2018]

Despite significant growth in food production over the past half-century, one of the most critical challenges facing society today is how to feed an expected population of some nine billion by the middle of the 21st century. It is estimated that 70% to 100% more food needs to be produced to meet the growing demand for food without significant price hikes. This must happen within the context of climate change and take into account concerns over energy security and regional dietary changes.

With the dramatic advancements in technology, a tipping point is fast approaching for the dawn of a new era in agriculture. In agriculture, information and communication technologies (ICTs) have grown significantly in recent times in both scale and scope. The use of the Internet of Things, cloud computing, enhanced analytics, precision agriculture in convergence with other advancements such as AI, robotic technologies, and “big data” analysis have revolutionised agriculture.

Today, the use of digital technologies – including smartphones, tablets, infield sensors, drones and satellites – are widespread in agriculture, providing a range of farming solutions such as remote measurement of soil conditions, better water management and livestock and crop monitoring.

Enhanced analytics, affordable devices and innovative applications are further contributing to the digitalisation of farming.

Visit www.greeneconomy.media to download the full report in the digital version of Green Economy Journal Issue 60

16 AGRICULTURE

greeneconomy/report recycle The future of the Western Cape agricultural sector in the context of the Fourth Industrial Revolution Synthesis report READ REPORT

Drivers and megatrends set to disrupt farming

Change accelerators that drive agriculture innovation 32 13 40 43

The path ahead: shaping the future of farming

Change management to support 4IR possibilities

This is certainly one of the upshots of technological advancement. But South Africa is not the US, and while any advance in farm technology is welcome – especially given mounting concerns about food security – it will be viewed with trepidation by some, given the precarious social context that obtains here.

YE A RS O F PROG RE SS IN A FRI CAN MININ G 30 5-8 February 2024CTICC, Cape Town, South Africa @miningindaba | #MI 24 | mi ning i ndaba .co m Jo in u s t o ce le brate the 3 0 th anni ver sa r y o f I nve sting i n A fri c an Mining Indaba n ex t y ea r. Register now to be part of the landmark event. REG I S T ER NOW

CELE BRATE

CONNECTING the

BLUE

TO THE EARTH

Look at a “Spilhaus projection” map and it might be easier to understand their central role in life on the planet that we call Earth, even though 70% of its surface is covered by water. The map drawn by the South African oceanographer in 1942, puts Antarctica at the centre so that the “seven seas”, enclosed by the coastline of the continents, are instantly seen as one huge blue mass.

The year 2023 could be remembered as the year when we really started to take care of the oceans thanks to the agreement reached on 4 March at the United Nations to create marine protected areas in the high seas, in other words, in international waters 200 miles from the coast. Ecomondo , the Italian Exhibition Group event due to open its 26th edition in Rimini from 7th to 10th November, sees more and more blue in the green economy.

Professor Fabio Fava, some time ago you asked us to look at the ground in order to reduce CO 2 in the atmosphere. Restoring biodiversity and terrestrial agro-forestry ecosystems means reducing the effects of climate-changing gas pollution. This year, the main themes at Ecomondo suggest adding a great deal of water to this recipe.

More than half of all oxygen is produced by the hydrosphere, or rather, all the oceans, seas and inland waters put together. There are other numbers that we need to take into consideration. This large blue portion of our planet contains 80% of the biodiversity we are aware of today, even though we only know about 230 000 species of marine life. That’s about 11%, according to an estimate by the World Register of Marine Species. The hydrosphere traps 25% of carbon dioxide emissions. Not only that, by dissipation, it reduces 90% of the heat we produce with our activities on land.

We obtain much of what we need for our sustenance from the hydrosphere, starting with food. Therefore, an overall vision of taking care of the land must also include the blue economy.

The hydrosphere produces food of prime nutritional value, contains critical rare materials such as copper, manganese and cobalt, and energy sources like gas and hydrocarbons as well as renewables. Merchant and passenger ships cross the seas. The Mediterranean alone has 450 ports/terminals, hosting 30% of global maritime transport and half of the European fishing fleet.

Then there is tourism: 150-million people arrive on the Mediterranean coasts during the summer, also attracted by the 400 UNESCO sites and 265 protected areas in the macro-region. In Europe, all this that we call the blue economy is worth 650-billion euros in annual turnover and 4.5-million jobs. In Italy: 50-billion euros in annual turnover and 900 000 jobs. So, it certainly is an issue that needs our close attention.

Let’s extend the idea of looking down at the ground and integrate

18 BLUE ECONOMY

More than half of the oxygen we breathe comes from the oceans. It is time to take care of marine biodiversity, we have the means. Green Economy Journal speaks to Professor Fabio Fava, president of Ecomondo’s Scientific Technical Committee.

Professor Fabio Fava, President of Ecomondo’s Scientific Technical Committee.

More than half of all oxygen is produced by the hydrosphere, or rather, all the oceans, seas and inland waters put together.

attention to the hydrosphere, its economy and regenerative potential with activities on land. Ecomondo 2023 will connect the blue to the earth.

How?

Let’s start from the end. Information without engagement is not enough. Institutions, as well as research and innovation representatives – I am mainly thinking of the European ones – must inform citizens about environmental risks, about the reasons for setting highly ambitious goals in terms of environmental protection and regeneration, and about future innovation. But then the time must come for involvement and participation in activating policy development and innovation.

Especially among the younger generations. We have a strong European presence at Ecomondo, which should also be seen as a window of opportunity for companies that want to play an increasingly important role in the circular economy and, in this case, in the blue and green circular economy.

Speaking of engagement, how does a European project tie in with efforts to protect biodiversity?

Take the EUSAIR project, for example, which made a stop in Rimini on 7 July. This macro-regional initiative covers the Adriatic and Ionian seas with nine countries involved, including Serbia, which has no coastline. We sometimes think of EU activities as vertical, but in initiatives like EUSAIR or WestMed, it is the horizontal sharing of best practices among local administrations that really makes the difference. Moreover, we should bear in mind that these projects move geographical areas that often involve non-EU countries. I mentioned Serbia, but I am also thinking of Albania and Bosnia Herzegovina.

We need uniformity in practices and therefore in choices, and to go deep into the territories, to co-design actions. I believe that this common language creates engagement. When we see the results of projects started years ago and understand that sharing is the best way to go green. Then, of course, these visions, best practices and their results need to be divulged. Ecomondo is certainly an extraordinary communication platform for achieving this aim. en.ecomondo.com

BLUE ECONOMY 19

When we see the results of projects started years ago and understand that sharing is the best way to go green.

Information without engagement is not enough.

Your Path to Purpose: Choosing a Sustainability Career to Reshape South Africa’s Future

Choosing a career in sustainability is not merely a job; it’s a commitment to addressing social issues, fostering equitable growth, and securing a sustainable future. When individuals choose to embark on sustainability careers in South Africa, they embark on a transformative journey, wherein their actions become part of a global movement with a singular purpose: preserving and safeguarding our precious planet for present and future generations.

Sustainability is an urgent and global imperative, touching every facet of South African society, from businesses to government agencies and nonprofits. Beyond addressing local concerns, it is a worldwide priority with far-reaching benefits. Opting for sustainability careers in South Africa is to be part of a global movement committed to preserving our planet.

Ten Key Reasons Why Sustainability Professionals Are Vital:

• Meeting Stakeholder Expectations: Investors, customers, and regulators now demand transparency and a firm commitment to sustainability. Sustainability practitioners align companies with these expectations and effectively communicate sustainability efforts.

• Mitigating Risks: Sustainability experts identify and mitigate environmental, social, and governance (ESG) risks, safeguarding a company’s reputation and ensuring long-term resilience.

• Cost Savings: Sustainability professionals identify cost-saving opportunities through energy efficiency, waste reduction, and sustainable supply chain management, enhancing a company’s sustainability profile.

• Navigating Regulations: Sustainability regulations are constantly evolving and complex. Businesses need experts who can navigate this landscape and ensure compliance.

• Driving Innovation and Competitive Edge: Sustainability practitioners drive innovation through sustainable product development, eco-friendly processes, and green market opportunities, giving companies a competitive edge.

• Attracting and Retaining Talent: Modern workers value sustainability, and businesses committed to it are more appealing to potential employees. Sustainability professionals help companies become employers of choice.

• Meeting Market Demand: Consumer preferences favor sustainable products and services. Hiring sustainability practitioners helps businesses meet these demands and access the growing market for eco-conscious products.

• Future-Proofing: Companies recognise the need to adapt to a changing world, including environmental challenges. Sustainability practitioners help businesses future-proof their operations and supply chains.

• Enhancing Investor Relations: Sustainable companies often attract socially responsible investors. Sustainability professionals assist in creating reports and strategies appealing to these investors, potentially increasing access to capital.

• Ethical and Moral Commitment: For many businesses, sustainability reflects a moral and ethical obligation. Hiring sustainability practitioners demonstrates a commitment to making a positive impact on the environment and society

The Historical Development of Sustainability Challenges in South Africa:

In the aftermath of South Africa’s transition to democracy in 1994, the nation embarked on a transformative journey marked by significant progress in addressing social inequalities and improving access to education, healthcare, and basic amenities for its citizens. However, these positive changes also revealed vulnerabilities within the country’s natural environment, posing substantial sustainability challenges. South Africa’s abundant natural resources, unparalleled biodiversity, vast solar energy potential, and stunning landscapes coexisted with a range of pressing sustainability issues.

These challenges include:

• Rapid Urban Expansion: The burgeoning urban areas, driven by population growth, strain resources and spawn informal settlements, exacerbating the housing crisis. Government-led urban development projects aim to create sustainable cities, but achieving equilibrium between development, environmental preservation, and resource equity remains intricate.

• Wealth Disparity: Widening income inequality influences environmental matters. Affluent segments access cleaner energy and better living conditions, while marginalised communities grapple with disproportionate pollution and limited adaptation resources.

• Biodiversity Decline: Biodiversity loss persists due to habitat destruction, poaching, and invasive species. Ongoing conservation efforts seek to balance economic growth with biodiversity preservation.

• Water Pollution: Water pollution, largely stemming from industrial and agricultural activities, poses a substantial threat. Despite government initiatives to enhance water quality, enforcing regulations remains a challenge.

• Inefficient Land Use: Inefficient land use practices, particularly in agriculture, impede land productivity and sustainability.

• Air Quality Deterioration: Declining air quality, notably in urban centers, raises health concerns. Stricter emissions standards and cleaner energy are being promoted, albeit with gradual progress.

In light of these severe challenges facing South Africa’s future, the significance of choosing a career dedicated to sustainability cannot be overstated. Addressing these sustainability challenges hinges on the implementation of policies, regulations, and the expertise and oversight of professionals. Striking a harmonious balance between economic development and environmental preservation is crucial for South Africa’s future and the global ecosystem. Sustainability professionals play pivotal roles in advancing sustainable development and safeguarding the environment, ultimately contributing to South Africa’s well-being and future prosperity.

Such careers not only offer individuals an opportunity for personal and professional growth but also empower them to actively participate in addressing South Africa’s pressing environmental and societal issues. By opting for a sustainability career, individuals become catalysts for positive change, contributing their expertise and passion to create a more sustainable and equitable future. Their collective efforts, alongside government initiatives and global collaboration, will be instrumental in ensuring that South Africa and the world move towards a future that is not only prosperous but also environmentally and socially responsible.

AA1000 Online Training with DQS Academy

Becoming a Certified Sustainability Practitioner!

The AA1000 Online Training consists of just three modules, each designed to empower you with the knowledge and skills needed to advance sustainability initiatives. This is an exclusive and comprehensive e-learning program offered by DQS Academy, one of the few accredited training bodies in the world with the capacity to provide AA1000 Online Training.

Module A - Building the Foundation

Module A serves as the essential introduction to the AA1000 Online Training program. This module focuses on the AA1000AP (2018) and AA1000SES (2015) standards, which are fundamental to the practice of sustainability assurance.

Learning Outcomes:

• Gain a deep understanding of the AA1000 standards, which are globally recognised in the sustainability field.

• Explore the principles of accountability and stakeholder engagement, which form the core of sustainability practices.

Module B - Becoming a Sustainability Practitioner

This module is known as the Sustainability Practitioner Certificate, and focuses on the application and reporting of each AccountAbility Principle. Completing this course, in conjunction with Module A, earns participants the title of Sustainability Practitioner.

Learning Outcomes:

• Develop practical skills in applying sustainability principles to real-world scenarios.

• Learn how to assess, report on, and enhance sustainability performance within organisations.

• Gain insights into sustainability best practices and how they can drive positive change.

Module C - The ACSAP Certification

This module is designed to equip you with the hands-on expertise needed to make a tangible impact on sustainability practices and is the practitioner-level training in sustainability assurance. This module focuses on foundational sustainability assurance knowledge using the AA1000AS v3 standard.

Learning Outcomes:

• Deepen your understanding of sustainability assurance practices and principles.

• Gain expertise in assessing and reporting on sustainability performance in a comprehensive and credible manner.

• Learn how to provide valuable insights and recommendations to organisations seeking to improve their sustainability practices.

Upon successful completion of this program, you will achieve the Associate Certified Sustainability Assurance Practitioner (ACSAP) qualification. This achievement represents a substantial milestone on your path toward acquiring more advanced certifications, including the prestigious Practicing Certified Sustainability Assurance Practitioner (PCSAP) and the esteemed Lead CSAP Practitioner (LCSAP) qualifications. These higher-level certifications open doors to rewarding career opportunities and leadership roles in the field of sustainability, equipping you to make a meaningful impact on organisations, communities, and the environment in South Africa, and abroad.

AA1000 Online Training with DQS Academy

www.dqsglobal.com Scan Here to Enrol in Module A Scan Here to Enrol in Module C Scan Here to Enrol in Module B

Supply chain resilience can

PROPEL THE POWER SECTOR POWER SECTOR PROPEL THE

through the energy transition – and please investors in the process

The power sector is on the verge of an existential transformation as it works to achieve a comprehensive energy transition. But it must do so while resuscitating ageing infrastructure, battling more severe and more frequent weather events, and defending against security threats (both cyber and physical).

BY KEARNEY CONSULTING*

Huge barriers could thwart progress if left unaddressed. Externally, critical materials and skilled workers are in short supply, and their costs are rising. Internally, utilities’ traditionally rigid processes run counter to the agility they will need to build a resilient and reliable grid while being nimble enough to withstand supply chain shocks cost-effectively.

Power companies that stick to the status quo won’t survive easily. The successful ones will fundamentally shift how their supply chain and procurement functions work to reserve more money to spend on transformation goals. Sourcing strategy will supersede pricing tactics. Targeted savings will replace rigid budgets. And both leadership and procurement will adopt what will seem like radical new sourcing and supplier options, even though, yes, we realise they have stringent technical qualifications.

In short, to meet the expectations of investors, society and customers, power utilities will reimagine capital efficiency and make their supply chains truly resilient, reliable and agile. Several outside forces have led us to this point.

What pressures utility supply chains now

Various factors make it difficult for utilities’ supply chains to operate efficiently and at full value. First, there’s the material shortage. A scarcity of crucial items, such as electric steel, electronic components and cable are disrupting supply. Utilities have acutely felt the

persistent lack of transformers, many of which are manufactured overseas. Delivery times stretch to a year-plus and could be even longer if geopolitical tensions rise.

Suppliers recognise the gap between demand and their supply of transformers, but even if they can increase production or bring it onshore, new facilities take time to build. Many shortages show no sign of letting up, with manufacturers struggling to fill orders during emergencies or cancelling them altogether (see figure 1).

22 ENERGY

Figure 1. Worringly, shortages of critical equipment and materials do not show signs of abatement.

Lead times: transformers

Lead times: electric cables

Increased demand has prices rising, too. Where a transformer’s price sat unchanged through 2020, it has risen 134% since then (see figure 2).

Ageing infrastructure is another factor, as historical underinvestment in maintenance and modernisation catches up with current needs. Weak cables run short distances and transformers currently in place are, on average, five to 15 years older than their intended lifespan.

And there are the ESG pressures that impact utilities. The growing demand for EVs and an interconnected grid to charge them means utilities will need even more infrastructure, including transformers, whose production capacity lags projected growth of the EV market (at a compound annual growth rate of 25%). ESG issues keep arising in the minds of the public and governments as well, with increasingly frequent natural disasters, from wildfires to heat waves straining the power system.

These factors might have meant utilities could raise their rates to cover escalating costs to build the required infrastructure. But large rate increases during the past three years, ranging from 8% to 11% or more across residential, commercial and industrial customers don’t leave much room to gain revenue in this way now. 1

THE RISKS OF TRADITION

A recent Kearney survey revealed that just 27% of utilities have standard processes to identify and prioritise risks consistently across capital projects. 2

When another natural disaster hits or an extensive replacement or upgrade project is urgently needed, does the utility have enough detailed insight into its supply and demand to prioritise projects? Can it shift quickly from one project to another as circumstances change? And during this process, does it know the impact on operations and earnings from spending rands in one place versus another, spending rands in the wrong place or not at all?

We see utilities’ related risks falling into three categories: Demand planning. Without a clear understanding of supply and demand across a utility’s business areas, it is challenging to manage increasing or varied lead times for supply materials and equipment. Longer term, more precise demand planning can help determine time horizons. There’s also the shift to consider from reactionary to precautionary planning that takes a longer-term view beyond solely the next rate case. Supplier reliability. An optimal and reliable selection of suppliers can help overcome shortages and ensure a resilient supply chain. The transformer production process, for example, is highly dependent on raw materials, including copper, electric steel and aluminium. Even as commodity prices fluctuate, having suppliers that can lock in timely acquisition is crucial. Still, the current environment indicates that equipment availability and resource scarcity are significant challenges, and utilities have not yet fully fleshed out the solutions. Agile governance. With a complete picture of the supply and demand fields, a utility can shift from one area to another, anticipating required lead times. For instance, if there is a major delay in transformer replacement, an agile utility has enough data and resources to be able to shift investments to another upgrade project.

Longer forecast periods (beyond the next rate increase) help utilities and their suppliers plan more effectively. The bottom line here is that utilities now require supply chains that are responsive, reliable and agile.

THINK IN TERMS OF REINVENTION

We believe supply will become even more challenging. The supplier base has shrunk, and the suppliers that remain are in the driver’s seat, able to pick and choose which utility they will prioritise. Without intervening in some way, utilities will simply not be able to secure enough supplies, such as transformers, for years to come.

23 ENERGY

1 US Energy Information Administration and Kearney analysis

2 Kearney ExCap III survey of utility companies

Power

PPI (January 2019 through March 2023) 1

The bottom line here is that utilities now require supply chains that are responsive, reliable and agile.

transformer

Figure 2. Lead times only paint part of the picture. We also see equipment prices trending up significantly. 1 Similar overall trend for electric wires and cable costs (in other words, steady and sharp increase in prices that have remained elevated) since 2021.

FRED

economic data; Kearney analysis

Manufacturers are trying to fill the void by expanding onshore capacity and developing more advanced equipment, but new facilities and innovations take time.

Suppliers have told us, in fact, that utilities will need to work with them more closely than ever to expand production. But how to do this? Suppliers will have to continue raising prices to cover the expense of additional manufacturing lines, which means the rands utilities have won’t go as far. If some utilities don’t meet the higher prices or other terms that suppliers can set, then they won’t get contracts, whereas more cooperative utilities will.

Utilities, then, are in a new and unaccustomed position of having to rethink supplier relationships: from tactical buys to strategic partnerships. Either find ways to invest in suppliers to ensure future needs or roll the dice and hope that supplies will be there when you need them.

A dependable supply chain, in other words, will be about trade-offs. It will be flexible while maintaining an optimal balance between cost and performance. Where it has focused on cost to preserve capital,

it will now depend as much on drivers, including time-to-market, ESG impact and service levels. It will mitigate risks by adjusting for them, quantifying financial impacts and changing course as priorities shift (see figure 3).

This dynamic of trade-off and exchange – where utilities will have to understand demand in operations, match it with supply, and go to external sources – effectively calls for a procurement and supply chain clearinghouse.

The clearinghouse approach brings structure to unknowns. Utilities progress from reactive event management to business continuity planning, where they gain a much clearer understanding of weak links in the supply chain. Redundancies are implemented to manage gaps and responses to unexpected events are planned.

Once those steps are taken, a utility can prepare its supply chain for the future using forward-looking models to forecast potential events, prioritise risk and likelihood with sensing systems, and use manual intervention and decision-making for recovery when adverse events occur.

CONTROL TO MITIGATE CHALLENGES

The constant reevaluation of a clearinghouse structure offers distinct advantages by allowing a utility to see what it needs and spends at a granular level.

Determine demand. The utility determines demand by honing its planning capabilities – turning what it needs to do into units of labour and materials. This leads to decisions on accomplishing tasks internally or externally and what the product platforms will be (the groups of products, such as transformers, and their classes based on solution). It also helps determine which platforms will be interchangeable for use at one plant or facility or another. The operational footprint becomes clear.

Evaluate supply and logistics. On the supply side, there will be regular evaluation of supplier landscape, logistics and the external workforce. The utility will have a clear view into and control over the inbound transportation of supplies and rapid, accurate distribution of them into the field through its own or a dedicated, contracted fleet.

24 ENERGY

A dependable supply chain, in other words, will be about trade-offs.

Kearney analysis