IS YOUR BUSINESS PREPARED TO GROW IN A DRIER WORLD?

Illiquid: Why water is the strategic business issue you can't ignore

With intensifying weather events, ageing infrastructure, and population growth putting global water resources – and economic growth – at risk, how can businesses prepare for a future that is likely to be drier and unpredictable than ever?

By: Bill Malarkey

By: Bill Malarkey

Water's digital divide: Bridging the gap between willing buyers and solution providers

The need for digital solutions more urgent than ever in the water sector but adoption remains low. How can we accelerate tech adoption among US water utilities?

By: Vinod Jose

By: Vinod Jose

The climate tech race: The hidden opportunities emerging from recent climate legislation

We're looking beyond mainstream climate tech to spot the opportunities ripe for the taking following the passage of landmark climate-focused legislation in the US.

By: Sky Filippi and Laura ChamberlainThe beauty and harsh reality of water is its necessity; while not every company ‘sells’ water, water is indeed everyone’s business.

- Bill Malarkey, Illiquid: Why water is the strategic business issue you can't ignore (Story on page 5)

We look ahead to Amane's plans for the 2023 Global Water Summit in Berlin and other upcoming industry events!

Top investors weigh in: Will the world ever see a 'water' unicorn?

The future of bioplastics: Hope or hype?

By: Phoebe Thomas and Laura ChamberlainBioplastics have emerged as a green alternative to traditional plastic, but questions remain as to their true potential to accelerate the transition to a more sustainable economy.

Featuring:

Brian Iversen, Managing Partner, Cimbria Capital

Fredrik Östbye, CEO, Aliaxis Next

John Robinson, Partner, Mazarine Ventures

Ginger Rothrock, Senior Director, HG Ventures

Featuring: Suejean Asato, Principal

Meet the newest Project Manager to join our growing, global team and learn more about the Amane Internship program.

Amane leaders to explore the nexus of water, climate change, and growth at the Global Water Summit

Key takeaways from the 11th American Water Summit

A look ahead at the future of water with Amane and RBC Capital Markets

Highlights from the Water Tech Innovation Summit

At a time marked by economic volatility and uncertainty, it may seem impractical to talk about growth. But periods of upheaval are also ripe with opportunity – not just to capitalize on short term gains but also to take back the wheel and proactively prepare for the future. In this jam-packed issue of currents, we explore the concept of growth from a variety of angles

First, intensifying droughts and floods coupled with ageing infrastructure and population growth is putting the quantity and quality of global water resources –and economic growth – at risk. And the UN Water Conference in March made clear that corporations will be expected to play a large part in providing solutions.

Our lead story urges businesses, particularly in ‘thirsty’ industries such as agriculture, manufacturing, mining, and food and beverage production, to view water for what it is – a critical boardroom issue that cannot be ignored.

Meanwhile, recent climate-focused legislation in the US is opening the door for a swath of exciting ‘green’ growth opportunities.

In fact, public and private spending on climate impact initiatives could exceed one trillion dollars by 2030. While much of that funding will focus on advancing core technologies such as electric vehicles (EVs) and traditional renewable energy sources, we will explore some of the interesting incentives and opportunities for technologies and applications that have yet to reach the mainstream.

Additionally, we will look at the growth potential of digital technology providers serving US water utilities. There’s no question that digital solutions can unlock new levels of efficiency, productivity, quality, and safety within water utilities. But despite the upside, digital adoption remains low. Principal Vinod Jose considers some of the factors driving the digital divide.

In our 'Ask the Experts' segment, leading investors debate whether the world is likely to see a water ‘unicorn’ (a new company valued at $1 billion or higher).

We continue with our new ‘Explainer’ segment; this time looking at the growing market for bioplastics as a green alternative to traditional plastics Here, we'll consider some of the tailwinds and headwinds facing this emerging market

And finally, we’ll preview the sessions Amane leaders are leading at this year’s Global Water Summit in Berlin, introduce you to our newest Project Manager, and share more people and events news from across the Amane team.

As always, thank you for reading.

Sincerely,

Bill Malarkey Managing Partner, North America

Laura Chamberlain

Senior Consultant, Amane Advisors

The climate tech race: The hidden growth opportunities emerging from new climate legislation, & The future of bioplastics: Hope or hype?

Based in: Philadelphia

Email: lchamberlain@amaneadvisors.com

Sky Filippi

Project Manager, Amane Advisors

The climate tech race: The hidden growth opportunities emerging from new climate legislation

Based in: Philadelphia

Email: sfilippi@amaneadvisors.com

Vinod Jose

Principal, Amane Advisors

Water's digital divide: Bridging the gap between willing buyers and solution providers

Based in: Philadelphia

Email: vjose@amaneadvisors.com

Bill Malarkey

Managing Partner, Amane Advisors

Illiquid: Why water is the strategic business issue you can't ignore

Based in: Philadelphia

Email: bmalarkey@amaneadvisors.com

Phoebe Thomas

Consultant, Amane Advisors

The future of bioplastics: Hope or hype?

Based in: Oxford

Email: pthomas@amaneadvisors.com

How would your business cope in a world with 50% less water? With government leaders taking steps to protect dwindling water resources in the face of climate change and water stress, water is emerging as one of the most important strategic issues of our time In this article, we explore how businesses, particularly in ‘thirsty’ industries, can prepare for a future that is likely to be drier and more unpredictable than ever.

By: Bill Malarkey, Managing PartnerFrance experienced its worst drought on record in 2022. Usually, the wet winter months can make up for a summer drought. But following a record 32 days without rain over the winter months, reservoirs were left at 80 percent below normal levels. The country’s unprecedented extended dry spell prompted President Emmanuel Macron to declare an ‘end to abundance’ and in March, he unveiled a water crisis plan aimed at bringing ‘sobriety’ to the country’s water use practices.

For large businesses paying close attention, the message is indeed ‘sobering’.

The developments in France highlight how governments and businesses are being forced to confront the real impacts of climate change unfolding today; many of which involve water. From droughts to floods and other severe weather events, as well as degraded water quality, many of those changes put water resources and infrastructure at risk.

With that in mind, we can expect other countries to follow suit –creating ‘water crisis’ plans of their own to reduce consumption and promote reuse, with a range of potential business impacts.

For businesses, particularly in ‘thirsty’ industries such as agriculture, manufacturing, mining, and food and beverage production, the writing is on the wall: water is a strategic business issue that can no longer be ignored.

While major corporations have spent the last decade focused on shrinking their carbon footprint, the world’s water resources have grown increasingly scarce.

Now, more than four billion people experience severe water scarcity for at least a month each year, and this year’s UN Water Conference made clear that corporations will be expected to play a large part in providing solutions.

The beauty and harsh reality of water is its necessity; while not every company ‘sells’ water, water is indeed everyone’s business. Organizations must begin addressing the growing risk of water-related impacts to their global operations today – and prepare for a future that is likely to be drier and more unpredictable than ever.

The gap between water supply and demand is widening – with climate change increasingly driving a wedge between the two. At the current pace of industrial activity, we can expect a 53% shortfall in global water supply by 2050.

For businesses, water stress will manifest itself in multiple – often interconnected, and financially material – ways.

Market Risk: Inconsistencies or reductions in the supply of raw materials and/or ingredients could result in price volatility and/or loss of contracts or market access.

Operational Risk: Changes in production zones could reduce outputs, increase transport costs, or result in stranded assets.

Regulatory Risk: Changing regulations, a failure to anticipate future government action (e.g., reallocation of water rights or increased tariffs), or even compliance violations, legal action, and sanctions for failing to address negative environmental or human rights outcomes could have lasting negative impacts.

Reputational Risk: Consumer concerns over the company’s inaction (real or perceived) could damage brand equity.

Source: McKinsey Water 2030 Global Water Supply and Demand model; agricultural production based on IFPRI IMPACT-WATER base case; World Water Development Report, World Research Institute, United Nations University Institute for Water, Environment and Health

As demand for water grows, scarcity will impact companies' bottom line as well as the ability to operate.

Astute business leaders can already see this unfolding in real-time. In fact, the number of companies disclosing on their water risk to the CDP almost tripled between 2015 and 2021 and nearly a quarter of the industrial respondents to CDP’s most recent Global Water Report reported high water risk is already directly impacting operations.

One consequence on the horizon for many businesses is that it may become increasingly difficult to secure new capital and customers. Today, over 700 financial institutions and investors are now using climate or water security data to inform their investment decisions. At the same time, 90% of large purchasing organizations say they are engaging with their suppliers to benchmark and improve on their environmental performance – including both water and wider climate metrics.

In total, experts estimate more than $300 billion is at risk due to water stress, with at least ~$50 billion in investment needed to address it. The cost of inaction, however, is expected to be five times higher than that of taking action – making it even more surprising that no more than ~30% of the CDP respondents have reported that they have developed plans to set water targets and address water risk.

While the risk levels and solutions to reduce risk will differ greatly across regions, companies and industries, the steps toward greater water security are similar for most.

The first step is getting a clear understanding of nature and severity of your water risk at a global leveland its potential impact on your bottom line.

Specifically, you want to be able to assess water availability in terms of quantity and quality within the context of your current business operations, as well as your projected water requirements and availability for at least 10 years into the future.

For many, the goal will be to identify your highest priority sites; namely, your operational, sourcing, or production and manufacturing areas that may be facing the most acute water risk and generate a high-level estimate of the economic risk faced, both per site and in total.

Understandably, this step involves gathering and analyzing a wide variety and volume of data – including data about your current operations, water sources, water withdrawal volumes, the level of on-site treatment and reuse, the nature and duration of your permits, access to infrastructure, such as external water treatment facilities or piping and more.

It may also be necessary to consider the water risk for entire watersheds, catchment areas, or basins which are connected to your operational site or water sources.

With a firm understanding of these and other factors, a ‘risk matrix’ begins to emerge, providing an overview of the likelihood, impact, and velocity of water risks you may encounter – whether they include physical risks, such as flooding, operational or regulatory risks or other brand and reputational risks –as well as insights enabling you to benchmark your risk level against that of competitors.

However, as we saw in many events during the recent UN Water Week, there is also increasing pressure on corporates to take a broader approach to their water issues, and to actively identify water-related opportunities to make a positive social and environmental impact in those same “at risk” localities.

From this position, businesses can next begin designing plans to reduce water risk across their entire operation. For many, it means digging deeper into the high priority / at-risk sites. The goal here is to develop a “lever library” of available measures from which one can evaluate the fit of various technologies and solutions, and determine which specific solutions have the greatest potential to improve water efficiency at each site – and how those actions can be best implemented.

At this stage we also begin setting short and mid-term targets, including pragmatic operational KPIs, and budgets.

Budgets should estimate not only the cost of the necessary actions but also a projected return for each site that includes not merely the savings achieved through reduced water usage, but more importantly the overall risk that can be mitigated through such measures (including both operational and other risks).

For those who also consider additional measures on the social and/or economic front, this phase also involves estimating the potential for delivering the greatest impact for the local community (e.g., through water supply or reuse/irrigation projects, or WASH programs) and/or the environment (e.g., promoting biodiversity or natural regeneration in the local watershed).

The same “lever library” can be used to identify solutions which can produce the best win-win-win approach for the company, the community, and the local environment. This is also a great opportunity to partner with DFIs, government agencies, and local community stakeholders.

Lastly, in the implementation stage, the water risk mitigation plan is rolled out globally, according to your design roadmap, and measured against the metrics you have developed.

Success in this stage will often hinge on the quality of execution in prior stages. By that, we mean that it is critical for companies to be implementing a concrete plan with a set of measurable metrics to demonstrate and track progress

both within the business and from a social and/or environmental perspective.

With water now being recognized as the frontline in climate impact and climate adaptation, we expect to see an increasing number of corporations across nearly all sectors move to address the growing water risk to their operations. For many, this will mean not only avoiding disruptions or additional costs but preserving their very license to operate.

Experts estimate more than $300 billion is at risk due to water stress, with at least ~$50 billion in investment needed to address it.

The cost of inaction, however, is expected to be five times higher than that of taking action."

Digital solutions have the potential to unlock new levels of efficiency, productivity, quality, and safety within water utilities Yet, despite the upside, adoption of digital tech remains low In this article, we consider some of the factors that have contributed to this digital divide, as well as potential actions for digital water solution providers in the US that could help accelerate adoption.

By Vinod Jose, Principal

By Vinod Jose, Principal

Why do some companies experience ‘hockey stick’ growth while others fall flat? At its simplest, the answer typically distils to how well the company is addressing an unmet need and how many (and how much) customers are willing to pay to fill that need.

There are, however, many factors that influence these drivers. And in this article, we wanted to explore the current trajectory of digital technology providers targeting water utilities – and specifically, why so many companies are struggling to grow quickly.

First, let’s look at a few of the ‘needs’ that many companies address in this sector – for there’s no shortage of them. Chronic water challenges and the consequences unfolding due to rising global temperatures necessitate that utilities leaders do more with less on every front.

Digital solutions enable utilities to collect and make sense of the data they need to respond to these challenges. They create a pathway to greater efficiency, cost savings and productivity, and support utilities in meeting the expectations of customers who are accustomed to fast, personalized, on-demand online services.

Next, looking at the potential customer base, there’s also a strong market opportunity. The digital utility solutions market was worth roughly $6 billion in the US alone in 2022. And many utilities, particularly at the smaller end of the market, are only just beginning their digital journey – a greenfield for technology providers.

But while the pandemic upped the sense of urgency on adopting digital technologies, globally water utilities

remain a digital laggard compared to other industries such as power, agriculture, mining. And despite the need and growing interest among their targets, many solution providers are struggling to convert them into paying customers.

What we've found is there are several hurdles that digital tech companies encounter in gaining market share within the water utilities sector.

First, let’s look at some of the key hurdles that might be preventing digital solution providers from realizing exponential growth.

One key challenge for technology providers is whether the solution aligns with utility leaders’ top organizational priorities.

Water utilities are responsible for the world’s most precious resource and leaders are juggling significant

challenges – from managing aging infrastructure to keeping pace with stringent regulations. Much of their focus is on executing the day-to-day tasks needed to ‘keep the water flowing’ – and digital transformation tends to rank lower on the priority list, particularly for smaller Tier 3 and 4 utilities.

Furthermore, water utilities are historically known to be quite reactive and may lack a well-defined process to proactively implement changes – even if they would lead to improvements. For instance, a survey by the American Water Works Association (AWWA) showed that once a need for an infrastructure improvement had been identified, 60% of water utility leaders would take the next step when they suspect something is about to break or fail.

If your solution is not directly solving a critical pain point that is front-of-mind for utility leaders, providers should expect (and plan for) longer sales cycles.

Mini fiefdoms limit collaboration right choice – prevents leaders from signing on the dotted line.

We also find that many water utilities still work in silos – which adds further complexity and can further stymie the procurement process for solution providers. Outdated, disparate data and siloed people, budgets, and decision-making processes can limit collaboration and can prevent many utilities from making and implementing strategic, data-based decisions.

Most utilities are still working with outdated SCADA and CMMS asset management systems that offer little-to-no integration with newer tools. Since most digital solutions need data to work, selling one tool involves talking to multiple stakeholders in various departments. Concerns over integration or the potential for obsolescence, as well as how to assess which of the 1,400+ digital tools out there today is the

Overcoming workforce challenges

As baby boomers edge closer to retirement, many industries are also grappling with how to manage the impact on their workforce. Water utilities today may have fewer workers to replace their ageing workforce and operational expertise can be lost.

Leaders often expect to lean on digital solutions to close the gap and enable newer staff to function at a similar level with less operational expertise. But when experienced decision-makers are not as accustomed to leveraging digital tools, there can be a disconnect in how tech providers communicate their value proposition and establish a clear business case for their solution.

These are just a few of the challenges that can grind the sales cycle to a halt – which, in turn, delivers a blow to technology providers’ unit economics. Lengthy sales cycles drain resources and over time, customer acquisition costs simply become much too high compared to the customers’ lifetime value. Slowly, but surely, the digital divide widens.

The reality is that there are already hundreds of digital solution providers building great products and services with the potential to make a real, significant impact on water utilities operations, customer experience, and bottom line. The challenge for solution providers, therefore, is getting the right product, to the right customer segment, at the right price point – essentially, nailing your go-tomarket (GtM) strategy.

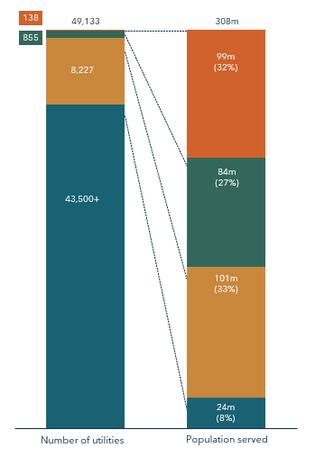

The US water utility market is large and fragmented, with approximately 50,000 water utilities. Around 2% would be considered ‘Tier 1’ and ‘Tier 2’, according to the size of the population they serve, but ~40% of the population is served by 40,000+ Tier 3 and Tier 4 utilities.

Strategic priorities, leadership bandwidth and attitudes towards digital solutions vary greatly across these tiers. In general, Tier 1 and Tier 2 utilities have adopted more digital solutions due to their bigger size and availability of funds, whereas Tier 3 and Tier 4 utilities are typically at the beginning of their technology transformation.

What we’ve found from our conversations with technology companies, however, is that many lack a clear picture of their ‘ideal’ customer.

Many are designing products, services and features to appeal to Tier 1 and 2 utilities – the coveted ‘whale’ customers that large, established tech players are also targeting with comprehensive smart water platforms at enterprise price points.

New entrants find it difficult to gain a foothold in this crowded and sophisticated market – and even harder to maintain a high margin.

On the other hand, there is abundant ‘white space’ to cater to Tier 3 and 4 utilities – albeit with a simpler and more cost-effective product.

We’ve yet to see many companies hitting this market effectively but it could offer tech providers the potential to scale faster – perhaps by pitching more agile and streamlined ‘as a service’ pricing models and products or by leveraging channel partnerships the enable access to a greater number of Tier 3 and 4 utilities.

However, the onus isn’t solely on technology providers Water utility leaders cannot afford to ignore the value that digital solutions can provide.

Rising to the challenges ahead demands agile and data-informed decision-making. Digital is no longer a ‘nice to have’ and leaders must be proactive in exploring and considering the solutions that are right for them.

Greater cooperation among utilities, such as in sharing the results of pilot programs or agreeing to parameters through which results can be validated and acted upon with more speed, would go a long way in not only accelerating digital adoption, but also improving efficiency and driving costs savings across the board.

If your solution is not directly solving a critical pain point that is front-of-mind for [water] utility leaders, providers should expect a longer sales cycle."Total number of US water utilities by size and population

The passage of landmark legislation in the US has sparked renewed competition – focused on the fast-tracking the development and implementation of climate-focused technologies. While much of that funding centers on well-known tech such as electric vehicles and solar and wind power, there are also interesting incentives and opportunities for green technologies and applications that have yet to reach the mainstream

By Sky Filippi, Project Manager, and Laura Chamberlain, Senior ConsultantThere’s an old saying, ‘a little competition goes a long way.’ While it has many applications, this phrase is particularly apt for humanity’s ability to realize step-change developments in technology.

Just look at the ‘Space Race’ in the 1950s through 70s, for example. While rooted in geopolitical tension, the competition between two superpowers produced groundbreaking technologies that advanced (and even created) a wide range of critical industries – from telecommunications and computer science to micro-technology, materials science, and renewables.

Today, we face the collective threat of climate change. While the EU has historically positioned itself as a global climate leader, with strong emissions reduction targets and heavy investments in clean energy, the US has stepped up to the plate. Within the last 18 months, it has passed two significant pieces of legislation aimed at showing its potential to lead on climate action.

Together, the Infrastructure Investment and Jobs Act (IIJA) and The Inflation Reduction Act (IRA) aim to boost funding, incentives, technology developments, and jobs in critical infrastructure, green technology, energy security and more – which could see the US emerge as a climate leader. In fact, the IRA alone could see an estimated public and private spending of more than one trillion dollars on climate impact initiatives by 2030.

While much of that funding will focus on advancing core climate technologies such as electric vehicles (EVs), and traditional renewable energy sources including solar and wind, there are interesting incentives

and opportunities for green technologies and applications that have yet to reach the mainstream.

Here’s a look at a few of the ‘overlooked’ opportunity areas poised for growth as a result of these landmark pieces of legislation.

Both pieces of legislation include measures to bolster diversify and resilience of the US energy market by incentivizing the use of cleaner solutions, but the inclusive language of the IRA leaves the door open for the growth of more ‘alternative’ green energy solutions. This includes renewable natural gas, otherwise known as biogas, as well as microgrids, and energy-from-waste facilities.

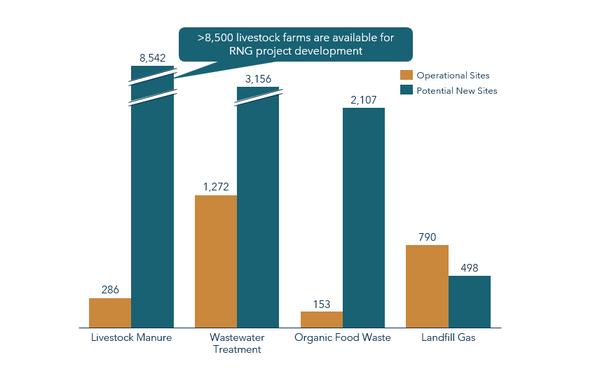

For example, there are currently around 2,500 biogas systems in the US. However, that number already had been projected to increase by 10,000 or more and new tax credits of up to 50% under the IRA could accelerate the rate of growth.

One group that could stand to benefit is the country’s 34,000 dairy farmers –who could leverage existing sites to generate biogas as an additional source of revenue. States such as California, Texas, and Idaho, where the concentration of dairy farms is highest, would have thousands of potential methane feedstock sources waiting to be leveraged for new biogas/RNG projects.

According to the EPA’s AgStar program, only 20 of the ~200 largest dairy farms (>5,000 heads of cattle) have existing anaerobic digesters with RNG capabilities – leaving much potential for new development.

Using livestock waste alone as a feedstock, there are potentially some 8,500 new biogas sites that could be developed, as well as an additional 990 animal processing sites which could supply animal waste feedstock. The American Biogas Council estimates that tens of billions of dollars of capital could be deployed resulting in hundreds of thousands of short-term jobs and tens of thousands of permanent jobs.

Livestock manure is the largest application areas for new biogas systems

(Operational Biogas Gas Systems vs Potential Sites to Develop)

The IRA provides up to a 50% investment tax credit (ITC) for qualified green energy properties placed into service by 2025, of which the first 6%-to-30% is the base ITC for ‘Project Requirements’ (meeting various wage and apprenticeship requirements). An additional 10% ITC is provided for a ‘Domestic Content’ bonus (for steel, iron, and manufactured products made in the USA). Plus, there is up to an additional 10% ITC for an ‘Energy Community’ bonus credit (for underserved communities).

The IRA also extends and increases Production Tax Credits (PTCs) for new qualified clean energy facilities that commence production before 2025, but you cannot claim in both ITCs and PTCs for the same property.

In addition to biogas or other biofuels, these green incentives also benefit projects involving real estate properties used for distributed energy or microgrid resources like fuel cells, energy storage, or combined heat and power (CHP). Across America’s urban and suburban communities, this expanded green energy ITC/PTC framework could enable many resilient energy transition projects, by lowering the total cost of ownership or operation.

Carbon capture has gained a lot of attention in recent years – becoming an exciting area of development as well as a source of debate as it doesn’t disincentivize the original production of greenhouse gas (GHG) emissions. Nevertheless, carbon capture, use, and sequestration (CCUS) is an important part of the wider climate action solution and is likely to accelerate in the coming years as a result of the legislation.

CCUS technologies offer significant strategic value during the transition to net-zero:

Removing CO2 by combining it with bioenergy or direct air capture to balance emissions that are unavoidable or technically difficult to abate

Enabling least-cost/low-carbon hydrogen production

Tackling emissions in industrial sectors where other options are limited, such as in the production of cement, iron, steel, or chemicals, and in the production of synthetic fuels for longdistance transport, notably aviation

Enabling retrofitting of existing power plants that would otherwise emit 8Gt of CO2 in 2050

Combined, the IRA and IIJA total more than $26 billion in transferable tax breaks for CCUS business initiatives during the short-term transition to net-zero, through 2030.

In the IRA, close to $10 billion is set aside to improve or retrofit rural electric cooperative generation and transmission systems for zeroemission systems like CCUS or to make energy efficiency upgrades. Another $5 billion in energy infrastructure reinvestment financing is allocated for projects that retool, repower, or replace existing energy infrastructure that has ceased operations (or will be retired) in order to be repurposed to avoid anthropogenic GHG emissions, including CCUS. And in the IIJA, there is nearly $7 billion over five years for the Department of Energy’s Advanced Fossil Energy Projects to support research and development of advanced fossil energy technologies, including CCUS.

The deployment of CCUS to date has been concentrated in the US, which is home to almost half of all operating facilities. This is due in large part to the availability of an extensive CO2 pipeline network and demand for CO2 for enhanced oil recovery. What’s more is that in recent years, dozens of conventional US power plants have been retired. The DOE’s EIA reports that 16 GW of utility-scale coal and natural gas generating capacity is set to be retired in 2023, meaning there would be no shortage of retrofitting opportunities.

CCUS project financiers, developers, consulting engineers, and technology players can benefit by working with rural electric cooperatives as well as other owners of retiring fossil fuel power plants to brownfield CCUS projects at these sites.

While the US fares better than many countries in terms of water resilience, it is not without significant water challenges. High-profile water crises such as in Flint, Michigan and Jackson, Mississippi, persistent drought conditions in the Colorado River, and recent extreme weather events and flooding across California have also called wider attention to the threats posted by ageing water infrastructure and climate change.

The IRA and IIJA include grants, contracts, and financial assistance programs to boost the quality and resilience of and access to domestic water supplies and promote water reuse and other efforts to address climate mitigation and climate adaptation. Additional funding, specifically the commitment of up to $49 billion to support climateresilient water and sanitation infrastructure and services made during the UN Water Conference in March, is bringing further attention to the critical role water will play in the decades to come.

One noteworthy inclusion in the IRA is $2.6 billion in funding to boost climate adaptation in coastal areas through September 2026. Under the law, the National Oceanic and Atmospheric Association (NOAA) will provide coastal states, municipalities, higher education institutions, and non-profits with funding to adapt to extreme storms and other changing climate conditions. Communities impacted by regular flooding or seeking to improve stormwater management could utilize this funding to better manage runoff and extreme wet weather events.

As a result, there may be commercial opportunities for technology and equipment providers to assist these communities and organizations – and the tight timing for the funds to be utilized could encourage players to move quickly. The EPA has stated that stormwater runoff is the number one cause to water pollution in urban areas, so urgency is warranted.

Another $550 million in funding is available over the next eight years to ensure better access to domestic water supplies among disadvantaged communities, or households without reliable access to water. The World Economic Forum estimates that more than two million Americans lack access to running water and basic indoor plumbing and another 44 million have inadequate water systems – meaning there are water access project opportunities to be explored, such as water reuse processing, pipeline expansions, or infrastructure builds in remote areas – with the potential that Uncle Sam could foot the bill.

The initial international response to these landmark US acts was strong –with French President Emmanuel Macron stating protectionist features of the IRA would be “super aggressive” toward European businesses. Several major companies moved quickly to take advantage of the change in US policy including German chemicals giant BASF SE, steelmaker ArcelorMittal, and Swedish battery maker Northvolt AB.

But so far, it appears European leaders are opting to streamline existing policies as opposed to introducing new initiatives or funding packages.

In February, the EU put forward the Green Deal Industrial Plan with the aim to simplify regulations, speed up access to financing, develop skills for green industries, and create a “more supportive environment” for manufacturing.

A few weeks later, leaders announced the Net-Zero Industry Act and Critical Raw Materials Act, aimed at ensuring the bloc can compete in making clean tech products and access the raw materials needed to support the green transition, such as lithium, copper, and nickel.

A recent joint statement by President Biden and Ursula von der Leyen, President of the European Commission is now setting a more cooperative tone, stating that both powers are "committed to addressing the climate crisis, accelerating the global clean energy economy, and building resilient, secure, and diversified clean energy supply chains. Both parties recognize that these objectives are at the heart of the U.S. Inflation Reduction Act and the EU Green Deal Industrial Plan."

In an uncertain political climate, the full impact of these legislative moves is yet to be seen. It’s promising, however, to see both the US and EU ramping up efforts to re-establish and re-shore manufacturing capabilities in support of the climate transition. While it may not be a new ‘Space Race’, we can expect this renewed focus will open new market opportunities for investors, manufacturers, and technology providers, all while accelerating the global response to climate change. ###

Unicorns, (new companies valued at $1 billion or higher) were so named because of their rarity. While certain industries, such as finance and software have each generated 200+ unicorns to date, a water industry unicorn has yet to emerge.

We asked leading investors: Will the world ever see a ‘water’ unicorn?

Brian Iversen

Founder & Managing Partner, Cimbria Capital

Fredrik Östbye

CEO

Aliaxis Next

John Robinson

Partner

Mazarine Ventures

Ginger Rothrock

Senior Director

HG Ventures

There will be no water unicorns – at least in the traditional ‘10x’ sense.

The water industry and its incumbents (water-focused Fortune 500 companies, OEMs, service companies, general contractors, municipalities, etc.) are deliberate and conservative. Not because they are lazy, overly administrative in nature, or because they ‘don’t get it’, but because they serve and master the most important and delicate sector in our global system. Conservative decision-making is the standard because disrupting the processes and systems that reliably provide clean water is a sensitive endeavor – even if supported by the best of intentions.

Water investing is still in its adolescence, and so far, it has, narrowly and wrongly, been defined mostly as ‘water technology’ investment. As a result, the first wave of venture capital investment firms ‘hit the ground running’ by pouring (pun intended) capital into earlystage water tech companies – most of which failed.

In addition to the typical hype and ‘over-reaching’ (and under-thinking)

when investing into new investment categories and asset classes (Think: dotcom, renewable energy, blockchain, cannabis, anything-as-aservice, etc.), we must be aware of the ‘returns reality’. The 5 to 10x investment multiple does not exist in the water industry as a repeatable event. This is because neither the incumbents nor the (very few) financial investors are incentivized, nor have the money, to overpay for ‘up-and-coming’ water technologies or business models.

This conclusion rules out the traditional venture capital investment model as a viable investment approach in water (and with it, the hunt for unicorns), since venture capital portfolio management relies on one or several high multiple exits to make up for the losses expected in a risky portfolio of this kind. In other words, the overall risk-return profile of the water industry deals a lopsided hand – in the wrong direction – to venture capitalists.

So, what type of investment and finance model works given the water industry’s pressing need to renew itself and improve its chances against population growth, aging infrastructure, and tightening regulatory requirements?

In my view, the growth equity and private equity investment model seems more suitable. The private equity model – especially the ‘handson’ version of it – aims to invest in business models and true commercial value propositions rather than technologies.

It reviews investment opportunities across the entire value chain of water – not just technology investments – and it is more conservative (more risk-averse).

It aims for investments with riskreturn profiles investment structures that consistently returns its entire capital investment, and in most cases receive a 2-4x investment multiple over 3-6 years. Therefore, the private equity investment approach suits the water industry well because the return expectations are more aligned with the sector’s traditional growth patterns and are also more representative of the exit multiples currently available in the industry.

In my view, the water industry is similar to most other commoditybased industries with an upstream, midstream, downstream and service component – but with steadily increasing water prices allowing for investment opportunities across this value chain. The unhurried, calculated, and traditional cycles of the water sectors are fairly set despite a dire need for the industry to reinvent itself. Successful water investing requires subject matter expertise, appropriate financial partners and models, and realistic prospects. If executed correctly, a level-headed investor will be able to yield from this ‘slow moving tsunami’ of investment opportunities in the water economy for years and years to come.

The 5 to 10x investment multiple does not exist in the water industry as a repeatable event "

- Brian IversenFredrik Östbye CEO, Aliaxis Next

Unicorns are created by entrepreneurs. When something is perceived as a free, and endless resource, it doesn’t attract entrepreneurs. But both the perception and the reality of water as a free and endless resource is changing.

Humanity is realizing that if we continue using our most precious resource the way we do, we will run out of it in big areas of the world, already within a decade. Half the population is predicted to live in water stressed areas by 2030.

If you are running out of something, you either must reduce consumption, add more, or do both. Tech can do this, and entrepreneurs love to use tech to build new businesses, and we see lots of new companies around the world are being built to manage water in more sustainable ways.

In agriculture, using 70% of the freshwater withdrawal, we see solutions reducing need of water for irrigation in outdoor farming with 30%.

New ways of growing crops in controlled environments like greenhouses, containers, and vertical farms, reducing need of water with 95%. And new ways of growing proteins, reducing need of water with 90%.

In industrial processes, using 20% of the freshwater withdrawal, we see solutions reducing and reusing water, but also completely taking out the need for water in water intense processes.

In buildings and municipalities, using remaining 10%, we see solutions reducing and reusing water, but also solutions to build smarter and more resilient infrastructures to transport water.

And solutions to capture and manage rain- and stormwater, turning it into an asset instead of a problem.

Water is also a carrier of manmade forever chemicals (PFAS), ending up in our bodies through the water we drink and the food we eat, with big health risks as result. New solutions to take out PFAS are emerging and may become a big thing.

An interesting exercise to do is to imagine yourself sitting on the moon, looking down at planet Earth. Then you most likely will think that water can never be an issue, as 70% of the planet is covered of it. New solutions to add more freshwater into the equation are also emerging, within desalination and atmospheric water.

New, fast-growing companies will also emerge, bringing water to the 1.4billion people who have money to buy safely managed water, but no reliable infrastructure bringing it to their homes. And solutions to the 800 million people with no, or limited, financial means, who today are using untreated water straight from nature.

Most of these emerging companies are using digital tech, and they are going for exponential growth, enabled by recurring business models, digital marketing, and full focus on customer experience, why I am 100% convinced that we will see the first `water´ unicorns emerge within the next decade. I can see them growing up out there already.

- FredrikI am 100% convinced that we will see the first 'water' unicorns emerge within the next decade."

ÖstbyeJohn Robinson Partner, Mazarine Ventures

The world will never see a ‘water’ unicorn.

What we will see is a company that achieves unicorn status by leveraging technology to help its customers address water-related risks.

Unicorns like Planet Labs (earth observation tech) and soon-to-be unicorn Tomorrow.io (weather tech) would never describe themselves using terms like ‘water company’ or ‘water industry’ but their tools are helping their customers manage water-related risks, which span customers in agriculture, aquaculture, finance, insurance, real estate, mineral processing, manufacturing, utilities, and public health and safety.

Examples from the Mazarine portfolio include software company SimpleLab, which helps their customers manage water-quality risks, and Agcor, a finance company that is helping their customers manage quantity risks. Neither would ever say they are in ‘the water industry, as you frame it.

Is Liquid Death, a ‘water unicorn’?

As Blackrock CEO, Larry Fink, so famously said, the next 1,000 billiondollar startups (unicorns) will be in ClimateTech, which will include companies that help industry and society manage climate-changeinduced water risks.

A company that can bring to market Point of Use filtration with an app that tells you if the filter media is working could become a unicorn, but we filter our water at home for family health, making that company a 'health-tech' unicorn, not a so-called ‘water’ unicorn.

That's why there will never be a ‘water’ unicorn.

The world will never see a ‘water’ unicorn.

What we will see is a company that achieves unicorn status by leveraging technology to help its customers address water-related risks.

- John Robinson

Venture capital models have historically focused on digital businesses with predictable growth trajectories, time to market, and capital need. “Hardtech” startups don’t fit this playbook and fewer venture funds have invested in this category. Limited partners (LPs) perceive hardtech to be high-risk and question their capacity to source and diligence these investments. As expected, therefore, industries rich with investment capital have thrived and produced unicorns.

The climate crisis has resulted in innovation, attention, and investment in the environmental hardtech sector. Yet the action is concentrated on carbon. Water, the other essential global cycle, remains invisible. Water has been an inexpensive, low volatility, consistent utility. However, recent events including the overtapped Colorado river, lake levels, and California flooding have accentuated the necessity of water security and management.

The industrial sector consumes up to 40% of the world’s water supply, yielding extensive exposure to resource risk. Water is (pun intended) a blue ocean for industrial innovation

that solves supply chain risk and corporate resiliency, creating the environment for a water unicorn. For example, industrial wastewater processing hasn’t substantially changed in over a century: facilities pay to haul contaminated water offsite or hire technicians to perform time-intensive manual testing and treatment.

I predict the combination of economic impact, public pressure, and technology innovation will drive multiple water companies to unicorn status within 5-7 years. Labor shortages and supply chain pressures have led businesses to accelerate automation technologies like robots and smarter software combined with hardware that is more powerful, user friendly and affordable. Emerging automated, onsite solutions monitor and treat contamination, enabling compliant discharge and economical recycling of industrial water.

For example, Electramet removes heavy metals from wastewater using an automated membrane-free and chemical-free process. ZwitterCo is deploying fouling-resistant membranes that treat challenging organic streams, focusing on product purification and chemical reuse.

The digital transition continues to permeate legacy industries, and digital water products have material unicorn potential. Assets and reporting compliance is largely digitized, with water quality monitoring and waste at a nascent stage.

Design automation is emerging in public and private sectors; asset owners want to understand and weigh options in risk, carbon footprint, and cost before they build facilities.

One company, Transcend, offers software that automates the engineering design process for water treatment facilities.

Investments in the water sector are becoming more attractive as the business models adapt. Rather than large scale, CapEx-intensive facilities, industrial water monitoring and treatment innovations are moving towards decentralized automated units.Pricing models include leasing and software monitoring in a recurring fee, mimicking the high margin “as-a-service” models traditionally found in the tech industry. Customers value the reduced workforce needs, exchange of CapEx and irregular supply purchases to a predictable operational expense, and measurable sustainability benefits.

It takes industry expertise and collaboration to build these nascent opportunities in water to unicorn status. Market trends in sustainability, economics, and regulations all signal coming industry-disruptive growth for water startups that detect and remove contaminants, provide circular solutions for value, and yield efficiencies for industrial companies.

....the combination of economic impact, public pressure, and technology innovation will drive multiple water companies to unicorn status within 5-7 years.

- Ginger Rothrock

G R O W T H | S P R I N G 2 0 2 3

amanecurrents

The future of bioplastics: Hope or hype?

Bioplastics are viewed as a more sustainable alternative to traditional plastics, primarily as they can be produced locally with little to no fossil fuels. Considering that some 98% of single-use plastics are produced from fossil fuels, bioplastics have the potential to play a role in decarbonization efforts.

However, the benefits are not without trade-offs. Production costs could be as much as three times higher than traditional plastics, and with land and plant materials required to produce feedstock for bioplastics, widespread production could increase water stress and food insecurity.

Despite these challenges, the global bioplastics market is growing, with global bioplastic production capacities is set reach 6.3 million tons by 2027.

New innovations, including biotechnological processes aimed at creating bioplastics from nonedible by-products resulting from the production of food crops such as straw, corn stover or bagasse could help improve cost efficiencies and alleviate resource strain – further accelerating the sector’s growth.

23

Bio-based

Not

are

Conventional plastics (PE, PP, PET)

Bioplastics (PLA, PHA, PBS, starch blends) Bioplastics (PBAT, PCL)

Fossil-based

Agro-based (Carbohydrate-rich plants such as corn, sugar cane)

Source:EuropeanBioplastics

Ligno-cellulosic (Plants not suitable for food or feed production)

Other Organic waste feedstocks

1% of plastic today is considered bioplastic

US$14.9B

Estimated value of the global bioplastic market in 2023

2.2 million tons

Global bioplastics production capacity in 2022, with Asia leading the way.

23% Growth in production capacity by 2027

Global production capacities of bioplastics in 2022 by region

Source:EuropeanBioplastics,nova-Institute(2022)

Packaging remains the largest application for bioplastics with 48% of the total bioplastics market in 2022.

It is also currently used to make:

Catering & tableware

Clothing & accessories

Global production capacities of bioplastics in 2022 (by region)

Source:EuropeanBioplastics,nova-Institute(2022)

Reduces reliance on fossil fuels

Potential for local production

Releases less carbon as they degrade

Utilizes fewer toxic chemicals in production

Breaks down into useful materials

Supports circular economic practices

Marketability of ‘green’ products

Electronics & office equipment

Shopping bags & packaging

Toys

Sports equipment

Coffee capsules

Bedding

Production cost could be 2-3x higher

Managing bioplastic waste is difficult, limited industrial composting facilities

Bioplastics could provide several environmental and health benefits compared to traditional plastics, but their use is not without challenges

Products may still end up in landfill

Can still harm ocean environments

Requires heat to breakdown

Production requires land, could increase food insecurity

Production could increase water stress

When did you know you wanted to work in the water and broader sustainability sector?

You might say that I fell into this sector by chance, but I’m glad that I did!

I had moved to Switzerland from Japan, and I was learning German so I could secure a good job. One of the other students in my class had a friend who was looking for a person who could speak English, Japanese or another Asian language to help in starting up their new business. This happened to be A. Vaccani & Partner (AVP) and the role did not require fluency in German.

In this role, I was tasked with building up the business’s strategic partnership and technology transfer offering with clients across Asia. Eventually, we acquired several longterm mandates to scout and evaluate new technologies, business opportunities, and licensing opportunities for a wide range of specified areas within the sustainability, cleantech, and environmental industries. This experience help us stay up-to-date with developments in a wide range of sectors to supplement our expertise in resource recovery.

Our world’s resources are finite so within this industry, there is a constant flow of ideas, new technologies, and improvements aimed at better utilizing those resources. This keeps the work very diverse and interesting.

What do you like best about your job and why?

I love having the opportunity to work with different people from all over the world. I grew up as an American living overseas and I’ve spent most of my life living in different countries, so I’ve been fortunate to build a diverse network of friends and colleagues from all walks of life.

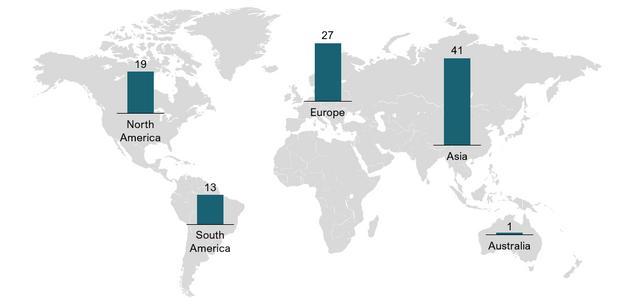

My role at AVP, and now Amane Advisors, allows me to tap into my experience having worked across different regions and cultures. And with eight different offices spread across the world, Amane provides the opportunity to learn from people who are from those places.

Learning about different cultures is always fascinating but it’s even more interesting when you can learn about it from people who are actually from there.

I’ve enjoyed getting to know the Amane team and discovering all the little aspects that make our team diverse and unique.

What has been the biggest surprise about working at Amane Advisors?

It’s been great to see how well the team works together across borders and time zones while also building strong cultures within each office location. It is amazing that a Principal or Project Manager can be located in the Middle East, oversee Consultants in Asia, Europe, or North America (sometimes even in several locations) and despite the time differences and not being able to sit down together, the project works smoothly and clients are continuously happy.

It seems that Amane Advisors had the “art” of collaborative work mastered even before it became a necessity during COVID.

Get to know Suejean

Role: Principal / Business Intelligence

Office: Zurich, Switzerland

Joined Amane: 2022

(Following the merger with AVP)

Nationality: US / Swiss

What are your favorite activities outside work?

Outside of work, I enjoy traveling, scuba diving, snowboarding, and reading.

I would describe Amane as:

Name something about you that most people would find surprising.

I started scuba diving over 30 years ago. Before having a child, most of my travel revolved around scuba diving. I caught the bug while traveling through Australia and New Zealand and since then, I've have had the pleasure to scuba dive in Fiji, Galapagos Islands, Belize, Mexico, Maldives, Bonaire, Hawaii and more.

What three words would your colleagues use to describe you?

I think others would describe me as:

What three words would you use to describe Amane Advisors? Friendly Helpful

A Night Owl

I hated researching things in school and hardly ever went to the library during my studies. If someone had told me that I would have a job as “Head of Business Intelligence” and that my role would involve conducting a large volume of research, I would never have believed it!

I am still in search of the whale shark, which has been on my bucket list for some time now. I even planned my honeymoon around it! I am planning a trip next year to (hopefully) see one finally.

Snowboarding came into the picture after moving to Switzerland in 1992. I am a “good weather” snowboarder so if the snow is good and it’s sunny, I’m happy to be on the slopes, which is not too difficult in Switzerland!

Coming off our biggest year yet, Amane continues to add depth and breadth to its global team of 60+ professionals.

Joel Burgos

In February, Amane welcomed Joel as a Project Manager, based out of our Paris office. Originally from the US, Joel has lived in France since 2017, where he worked as Senior Project Lead at ShARE; a consulting/education hybrid enterprise; and most recently as Engagement Director at Pivot & Co; a data science consultancy.

Joel began his career in the legal sector, working as a commercial litigator at Kirkland & Ellis before switching to management consulting. He served as an Associate at McKinsey before taking on several roles including Senior Director of Strategy at Lexis Nexis. His experience spans strategy, project management, and client engagement across several industries.

Joel completed his undergraduate studies at the University of California at Berkeley, where he majored in Economics and then received his law degree from Harvard Law School.

Nurturing new talent with a passion for the water sector is critical to creating a more sustainable future. And one of the ways in which Amane supports the development of emerging talent is through its internship program.

Each year, we place three to four interns in Amane offices around the world – providing the opportunity to gain experience working in a leading strategic advisory firm.

A particularly rewarding aspect of the program is when former interns return to Amane in new ways. One recent example is that of Hanshita Rongali, who interned with our Philadelphia office in 2022.

When Hanshita, who is currently pursuing her Masters at the

University of Pennsylvania, requested a mentor to support with her final thesis, Mairi Dean, a Consultant with our Paris team, volunteered to help.

Hanshita’s thesis, Net Positive Water for Cities: Strategies and Solutions explores the challenges that prevent cities from engaging with the net positive water concept and innovative solutions being implemented.

Over the past year, Mairi held monthly virtual check-ins with Hanshita to assess her progress and also connected her with industry professionals to provide additional insights.

"Mairi has been a constant source of support and encouragement. She

took the time out of her schedule to help manage the thesis, read my drafts, and provide feedback with great patience,” said Hanshita.

“Supervising Hanshita has been rewarding, and I have enjoyed supporting her research journey. My role has been very light touch compared to her heavy lifting!" said Mairi.

For more information about Amane’s internship program, contact Resourcing Manager Mwai Exartier.

On Day 2, Partner Bill Malarkey will participate in a panel discussion on the outlook for the water industry, alongside SKion Water GmbH CEO Reinhard Hübner, Frederick JeskeSchoenhoven of SUEZ Group, Michael Lesniak of Aquatech and Samrat Karnik, of Houlihan Lokey.

Members of Amane’s leadership team will join other water industry experts and leaders from around the world at the Global Water Summit in Berlin next month. This year’s event centers on ‘Creating a Climate for Growth’ –specifically on how investment in water technology and infrastructure is necessary to in adapting and responding to the challenge of climate change as well as a doorway to new levels of economic growth.

Several Amane leaders are slated to share their insights on topics including desalination, water reuse and water industry trends during several different panel sessions and roundtable events over two, jampacked days.

On Day 1, Partner Bastien Simeon will serve as a panelist in the “New Rules for Desalination Finance” event. The market for desalination is growing beyond the GCC and development finance institutions (DFIs) are playing a bigger role in financing new capacity and ensuring plants represent the best value for money for the end users. The panel will bring together DFI and desalination leaders to discuss the ‘new rules’ aimed at nurturing growth.

Amane Principal Dorothee Chabredier will have a front row seat to the best and brightest ideas in desalination and water reuse when she serves as a judge for the Water Technology Idol competition – also happening on Day 1.

Five leaders will pitch their ‘big ideas’ to shape the future of desalination and water reuse to the judging panel. While only one can take home the ‘Idol’ title, it’s sure to be an exciting opportunity to discover the latest innovations in this space.

In the context of rising inflation and interest rates, the climate imperative, pressure for localization, lavish public spending in the GCC and the Middle East, and pressure on budgets in Europe and the developing world, the panel will explore what it all means for the business of water.

Last but not least, Partner Geoff Gage will lead a roundtable discussion to share trends and insights on recent M&A activity across the water sector.

If you’re planning to attend this year’s event, be sure to contact our team. We’ll be sharing more on social media throughout the event and publish a full recap of the top insights and learnings in our next issue of currents.

Event runs May 8 - 10 in Berlin, Germany

Water Technology Idol Competition

Featuring: Amane Principal Dorothee Chabredier as a competition judge

Tues. May 9 2:00 – 3:30pm

New Rules for Desalination Finance

Featuring: Amane Partner Bastien Simeon as panelist

Tues. May 9 4:00 – 5:30pm

Water Business Outlook panel

Featuring Amane Partner Bill Malarkey as panelist

Wed. May 10 1:45 – 3:15pm

Insights on M&A and profitability in the water sector

Featuring Amane Partner Geoff Gage Date & Time: TBD

For more information visit www.watermeetsmoney.com

The Global Water Summit isn’t the only event keeping us busy this spring.

Here’s a look at some of the events taking place across water, resource recovery, and energy recovery and where you may be able to spot some of our team members.

Upcoming events

2425 A P R

Berlin Conference on Waste Management & Energy

Berlin Germany

RNG Summit 2023

Houston, USA

IFAT Eurasia

Istanbul, Türkiye 2729 A P R

Berlin, Germany 0810 M A Y

Global Water Summit

Singapore International Water Week

Singapore

AquaTech China

Shanghai, China

REGATEC 2023

Berlin, Germany 1516 M A Y

Chicago, USA 1518 M A Y

Biogas Americas

Copenhagen, Denmark 1617 M A Y

CO2 Capture, Storage & Reuse 2023

American Waterworks Association ACE23

Toronto, Canada

10th CEWEP Waste-to-Energy Congress

Berlin, Germany

Be sure to get in touch with our team if you would like to connect at an upcoming event!

Amane Advisors is once again teaming up with RBC Capital Markets to host the 2023 Future of Water Conference in New York City next month. The invite-only investor event will feature a combination of informative panel sessions and opportunities for one-on-one meetings with leading global water companies.

With sessions geared toward institutional, private equity, and infrastructure investors, attendees will discover differentiated investment insights from panels covering the biggest themes and trends across major facets of the water sector.

The 11th American Water Summit, held in Los Angeles in January, focused on ‘rethinking’ the water sector, particularly in the context of drought, inflation, climate change, new legislation, funding opportunities, and more. Amane Partner Bill Malarkey and Principal Vinod Jose were in attendance and shared some of the key takeaways from the event.

“One interesting insight was that US utilities are starting to take measures to diversify their water sources to improve resiliency. In addition to surface water and groundwater, utilities are exploring ways to incorporate storm water, rainwater, and wastewater. However, seawater is still considered a last resort source, as it remains cost prohibitive for many,” said Vinod.

“Utilities are hopeful that regulations allowing the use of wastewater as a source will come into place in the near future, but managing public perception is likely to remain a challenge.”

One session explored how companies beyond the traditional water sector are beginning to pay closer attention how water may pose a strategic risk to their business in the future – both at operational sites and further upstream in their value chains.

“As stakeholders become more aware of the value at risk, conversations are moving away from return on investment and towards taking action to avoid an existential crisis. There was wide acceptance that the impact of climate change (in the context of climate adaptation) is not only limited to volume, but also quality, due to higher surface water temperatures which triggers higher microbial activity,” added Vinod.

“Similarly, it was clear that industrial water users are beginning to take their water stewardship roles more seriously, laying out ambitions to become ‘responsible water management’ companies. Likewise, many oil & gas companies believe they can be ‘water positive’ if they can find a way to economically treat and redirect it to reuse applications in their local communities.”

Amane Principal Vinod Ramachandran took part in the World Water Tech Innovation Summit in London this February, with panel discussions, presentations, and networking events focused on topics including climate change, water scarcity, advanced water treatment solutions, water reuse, smart water networks, and the digital transformation of the water industry.

“Apart from the significant focus on smart networks and leak detection, I also found it interesting to learn more about the importance of decentralized water treatment systems for rural and remote communities as well as the potential for wastewater treatment and reuse for agricultural, industrial, and municipal purposes,” said Vinod.

“It was also encouraging to learn more about the “Spring” initiative, a knowledge-sharing and project showcase platform aimed at facilitating collaborative innovation amongst UK utilities.”

FRANCE

44 rue Lucien Sampaix

75010 Paris

Tel: +33 (0) 1 75 43 17 00

UNITED KINGDOM

Summertown Pavilion

18 – 24 Middle Way

Oxford, OX2 7LG

Tel: +44 (0) 1865 655 715

USA

85 Old Eagle School Road

Suite 204

Strafford, PA 19087

Tel: +1 610 906 2916

BAHRAIN

Office 116, Platinum Tower, Building 190, Road 2803, Block 428, Seef District

Tel: +97 377 110 110

CHINA

11/F Tomson Commercial Building

No.710 Dongfang Road

Pudong District, Shanghai, 200122

Tel: +86 21 58818236

SINGAPORE

1541 Orchard Road Liat Towers, #20-04

Singapore 238881

Tel: +65 6515 07256

SWITZERLAND

A. Vaccani & Partner AG

Zürichbergstrasse 66 CH-8044

Zürich

SPAIN

Atrium Business Center Avenida

General Perón 29, Floor 16 28020

Madrid

contactus@amaneadvisors.com

amaneadvisors.com