13 minute read

Professional Services

APPAREL OFFER

Advertisement

5 EMBROIDERED POLO SHIRTS +1 FREE ONLY £144

10 EMBROIDERED POLO SHIRTS +2 FREE ONLY £244

GET INTOUCH TO FIND OUT MORE

01773 317 148

hello@artliffdesign.com artliffdesign.com

Your Local Business Insurance Specialists

Competitive Premiums /Professional Advice / Account Managed Support

9 Construction 9 Distributors 9 Engineering 9 Hauliers 9 Hotels 9 IT & Media Business 9 Landlords 9 Manufacturers 9 Fabrication Services 9 Motor Fleet 9 Motor Trade 9 Offices 9 Professional Services 9 Public Houses 9 Restaurants 9 Retailers (Including

Online) 9 Sports & Leisure

Clubs 9 Tradespersons &

Contractors 9 Wholesaler

Get in touch

Please call your local expert Scott Miles on 07522 812 145 for an appointment and visit our website www.smilesrisk.co.uk for more information.

Smiles Risk Solutions Ltd is an appointed representative of Momentum Broker Solutions Limited which is authorised and regulated by the Financial Conduct Authority.

Classic Polo Shirt - Spec for

Offer: 50% Polyester 50% Cotton, Knitted Collar, Taped Neck, Hemmed Sleeve & Bottom Colour Available: Bottle Green, Black, Charcoal, French Navy, Heather Grey, Hot Pink, Kelly Green, Maroon, Navy, Orange, Purple, Red, Royal Blue, Sky Blue, Sapphire Blue, White or Yellow Sizes Available: XS - XXL (3XL & higher will incur extra charges)

Pension options for over 55-'s

What alternatives do you have at retirement?

Raiding your pension before retirement remains a popular option, with more than 1.3 million savers taking flexible payments from their pensions in the three years since 2015. While the premise of withdrawing 25% of your pension pot tax-free is nothing new, the options you have when you reach the age of 55 have increased. If you're considering taking money out of your pension pot, you've got lots to weigh up, but first of all you need to know what type of pension you have.

Pension types

Pensions usually fall into two different types: occupational or private schemes. Private pensions, such as a stakeholder pension, personal pension or selfinvested personal pension (SIPP), are money purchase schemes. Occupational pension schemes are further divided into defined contribution and defined benefit schemes - but pension freedoms only apply to defined contribution pensions. Defined benefit pensions - also known as final salary pensions - are seen as the Rolls Royce of pensions as what you receive depends on your earnings when you retire and is not dependent upon investment performance and growth. They are set up by your employer and provide you with a percentage of your final salary at retirement. While final salary pensions do not qualify for pension freedoms, it is possible to convert them into a pot of cash - but beware this is area targeted by scammers and is a high-risk strategy as you will be giving up valuable guarantees. Pension freedoms also do not apply to your state pension.

Options at 55 Leave it untouched

Continuing to save into your pension until the time comes to retire is the default position for most retirement savers in the UK. You can contribute up to £40,000 of your annual earnings towards your pension pot in 2018/19 without paying tax, subject to taper rules which may apply to high earners and which reduce the annual allowance. This cap remains in place for 2019/20 at the time of writing. Doing nothing is usually the best option unless you need the money for something in particular, whether that's to pay off your mortgage or help your grown-up child get on to the property ladder. Take several lump sums - ....

Another option is to take 25% of your pension pot tax-free and leave the other 75% exactly where it is, continuing to grow as an investment into your existing pensions. Whether you pay income tax on taking several lump sums depends on your total annual income in any financial year and the personal allowance. You could withdraw up to £11,850 from your pension pot in 2018/19 without paying income tax on your withdrawals so long as you have received no other income in the tax year. Any amount over this threshold will be taxed at your marginal rate of income tax. This may be useful if you want to stagger your withdrawals over a period of time, such as to the point at which you retire.

Lump sum and drawdown

You could opt to take 25% tax-free after reaching the age of 55, and use the rest to buy a flexible income drawdown product. As this is an investment, you should be aware that the value of your product can rise and fall at any time and you should accept the element of risk involved.

Lump sum and an annuity

Buying an annuity works in a similar way to buying a flexible income drawdown product in that you can withdraw 25% of your pension pot without paying tax and purchase an annuity with the rest. The concept of buying an annuity is sound as they usually pay you a fixed annual income up until you die, but they have fallen out of favour with retirement savers in recent years. If the idea of having a fixed annual income for the rest of your life appeals to you, be sure to shop around for the best annuity rates.

Mix and match

It's possible to consider mixing and matching your pension options, such as using some of your pension pot to buy a flexible income drawdown product and some to purchase an annuity. Various other combinations are available but be sure to seek professional advice before doing so as this is by far the most complex option.

Withdraw everything

If you did take this extreme step, the first 25% of your retirement savings would be free from tax and the remaining 75% would be taxed at your marginal rate of income tax. This is still the case in 2018/19 - but be aware that doing so could nudge you into a higher income tax band and see you paying 40% as a higher-rate taxpayer or 45% as an additional-rate taxpayer.

pshireHill Advice to complement your Lifestyle Seek help with your decision

When the time comes to retire, what you do with your pension savings is one of the most important decisions you will make as it will affect the rest of your life. The Government offers free guidance for over-50s through its Pension Wise initiative, which was introduced after the pension freedoms were brought in. However, the guidance merely outlines your options in a similar way to this brief guide and you should speak to our experts for tailor-made advice to suit your situation. Professional advice is also compulsory if you want to transfer defined benefit or safeguarded benefits worth £30,000 or more.

Speak to us about your retirement plans www.hampshirehill.co.uk Hampshire Hill Group Limited 18-20 Low Street, Sutton-in-Ashfield Nottinghamshire NG17 1DG

Apartments Available to Purchase From £75,000 Bungalows Available to Purchase From £90,000

1 Bedroom Rental Options Available from £525 per calender month (inclusive of service charge) Bond Deposit Required. Care Packages can be facilitated

AT WE ARE KEEPING OUR CUSTOMERS SAFE!

2020 - 2021

LETTING AGENT IN ALFRETON

We can conduct a full digital walk through tour of your property which then allows viewers to view your property from the comfort of their own home.

Our Virtual Tours Are: •Professional •Interactive •Excellent Quality

FREE with all New Sales and Lettings Listings

Call: 01773 609446 Email: enquiries@rfoproperties.co.uk To advertise please call 01773 549 035www.rfoproperties.co.uk

BEAUTIFUL & EFFECTIVE WEBSITE DESIGN

Fully designed & tailored to your business Bespoke and unique to you Search Engine Optimisation

GET IN TOUCH FOR MORE INFORMATION ❤ Ecommerce or simple 4/5 page sites

t: 01773 549 035 • m: 07891 639638 • e: info@voicemagazines.co.uk

GET IN TOUCH FOR MORE INFORMATION t: 01773 549 035 e: info@voicemagazines.co.uk

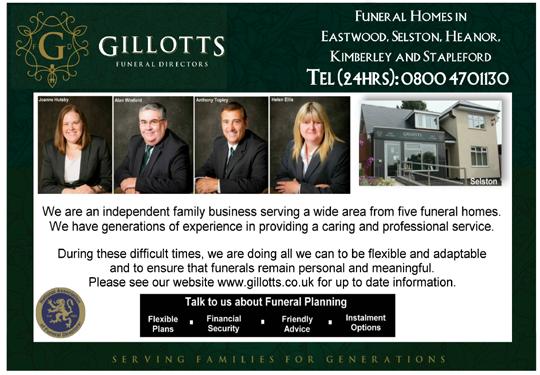

Independent Family Funeral Directors

Est. 1952

A completely professional 24 hour service, covering all areas Private Chapel of Rest in peaceful surroundings We will provide you with a personal and sympathetic service, looking after all your needs an wishes Pre-arranged Funeral Plans, tailored to your specific wishes, are available

Our Family Looking After Your Family Email: info@wilkinsonbros.co.uk Web: wwwwilkinsonbros.co.uk TEL: 01773 811371

10 Church Hill, Old Blackwell, DE55 5HN

Rotary Club of Alfreton Donate Laptops to Local School

The Rotary Club of Alfreton were delighted to help support Woodbridge Junior School in Alfreton during lockdown by providing 4 HP Chromebook laptops. With the pandemic placing additional strain on schools limited resources, the demand for laptops has far outstripped the availability. Up to three quarters of pupils have been learning from home often without the right equipment, placing additional strain on pupils, teachers and parents alike. With the club keen to help they generously agreed to fund the purchase of the laptops to help ensure pupils don’t fall further behind. The club has been involved with Woodbridge School for quite some years and has provided an Eco Greenhouse, been Santa for Christmas Parties, Class reading involvement work and experience talks and hopes to continue in the future when restrictions are lifted.

With schools returning the laptops will still be much coveted as they will be used to support children’s wider learning, making use of online reading programmes and digital maths study tools. If you want to get involved or find out more about the club visit the website at www.alfretonrotaryclub.org.uk or find them on facebook @ rotaryalfreton

WILLS AND THE FAMILY HOME

A recent change that should be taken into consideration when drafting your Will is the additional Inheritance Tax Residential Nil Rate Band (RNRB) for passing on the family home to your children on death. We can assist in ensuing that your Will is tax e cient for this purpose. The additional RNRB relief provides an extra £175,000 in addition to the current £325,000 Nil Rate Band for Inheritance Tax available to all individuals.

Where an allowance of £175,000 is unused on the death of the rst spouse, the unused allowance is available on the death of the surviving spouse, allowing a married couple (or civil partners) to potentially pass on assets of up to £1 million to children without paying IHT. The rules are fairly complicated but we can review your personal circumstances to ensure that you take advantage of all the reliefs that you are entitled to. This relief is even available when you downsize to a smaller property.

Mirrored Wills £234 (inclusive of VAT) Single Wills £156 (inclusive of VAT)

ALL OF OUR WILLS ARE FIXED FEE WITH NO HIDDEN CHARGES.

We are able to see you safely and assist you in accordance with current government rules in relation to COVID-19. Contact us today to arrange an appointment.

Changing the way you see lawyers.

01773 540 480 enquiries@chapsol.com

Don’t forget to mention Voice Magazines www.chapsol.com when responding to the Ads

Campaign Group Exploring ‘Cutting Edge’ Alternative to Solar Farm Proposal

COMMUNITY FOCUS

CAMPAIGNERS against a massive solar farm between Alfreton, Oakerthorpe and Shirland are working on proposals for an alternative green energy scheme for the area. Save Our Countryside Action Group (SOCAG) is opposing plans by Kronos, a UK subsidiary of a German energy company, to build a 325-acre solar farm with panels up to 2.8 metres high.

CUTTING EDGE ALTERNATIVE

As an alternative, SOCAG has engaged experts to carry out an audit of buildings around Alfreton to discover which buildings could be suitable for lightweight ‘solar film’ which could be installed on rooftops. The new technology is ‘cutting edge’ and being developed by British companies. SOCAG, which now has more than 1,300 supporters on Facebook, wants to work with local councils and other interested parties on ‘environmentally responsible’ green energy schemes – rather than the proposal by Kronos. John Cleary, chairman of SOCAG, said: “We’re very keen to work with the local authorities and British-based cutting edge technology companies to promote environmentally responsible community energy projects that deliver economic and green energy benefits directly to the local community. “Whilst opposing the Kronos development on legitimate planning grounds reflecting local people’s concerns, we will also be undertaking an audit of the built environment around Alfreton to provide empirical evidence of the potential for lightweight solar film to be deployed on roofs and buildings. ‘Once the (local) councils see the data we’re convinced they’ll take up the challenge county-wide and deliver the solar energy output local people want without ruining our landscape, heritage and biodiversity for generations to come.’ Mr Cleary added: “The feedback we’ve had from the local community clearly indicates that everyone understands the role solar can play in the renewable energy mix.” As part of its work, SOCAG has engaged with three heritage, landscape and ecology experts. Their concerns include how the proposal would have a ‘considerable adverse impact on Alfreton Hall – a grade II listed building’ – as well as harming ‘the landscape character of Alfreton Park’. It would also be visible from the Grade I listed ruins of Wingfield Manor, a site among the most important 2.5% of nationally-significant buildings, and is likely to cause ‘substantial harm to wildlife’. Awaiting So far, there have been more than 625 objections against the proposed solar farm, which is split into separate planning applications being considered by Amber Valley and North East Derbyshire Council. INFO The scheme is opposed by Alfreton Town Council, Shirland and Higham Parish Council, South Wingfield Parish Council, Derbyshire County Council leader, Cllr Barry Lewis, and Amber Valley MP Nigel Mills. Amber Valley and North East Derbyshire are continuing to take account of objections and are advising anyone with further comments to upload them via the online planning portals, or send them by email or post. Application reference AVA/2020/1224 Contact: Save Our Countryside Action Group by emailing socenquiries@gmail.com