1 minute read

Business Services Directory

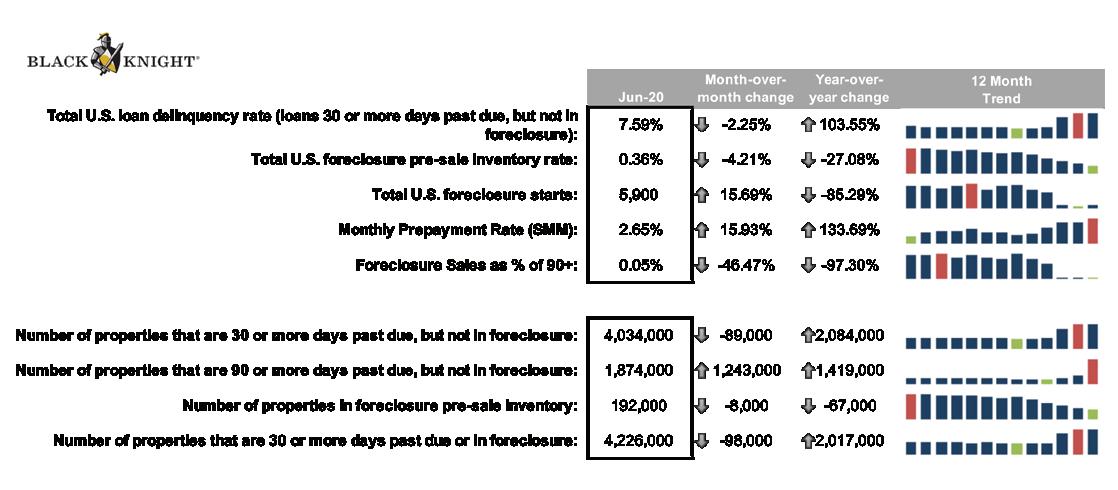

After rising from 3.2% in January to 7.8% in May, the national delinquency rate improved for the first time in five months, falling to 7.6% in June as the overall number of pastdue mortgages declined by 98,000

Serious delinquencies—those 90 or more days past due – rose by more than 1.2 million as the initial wave of borrowers financially impacted by COVID-19 missed their third mortgage payment

At 1.87 million, the number of seriously delinquent mortgages is now at its highest level since early 2011 With federal foreclosure moratoriums still in place, active foreclosure inventory continues to dwindle; June’s 192,000 active foreclosures were the fewest on record, dating back to 2000

Prepayment activity hit its highest level in 16 years in June, fueled by record-low 30-year interest rates and surging refinance incentive

Totals are extrapolated based on Black Knight’s loan-level database of mortgage assets. All whole numbers are rounded to the nearest thousand, except foreclosure starts, which are rounded to the nearest hundred.

About Black Knight

As a leading fintech, Black Knight is committed to being a premier business partner that clients rely on to achieve their strategic goals, realize greater success and better serve their customers by delivering best-in-class software, services and insights with a relentless commitment to excellence, innovation, integrity and leadership. For more information on Black Knight, please visit www.blackknightinc.com.

Black Knight is a leading provider of integrated software, data and analytics solutions that facilitate and automate many of the business processes across the homeownership lifecycle.