3 minute read

Why Housing Market Potential Remains High

By Mark Fleming, First American

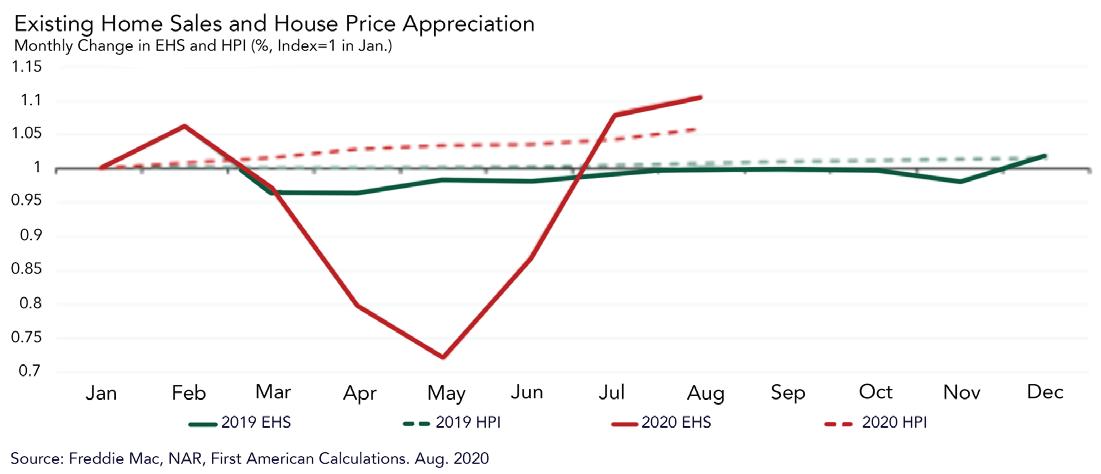

The housing market’s impressive “V-shaped” recovery has thus far shown significant resilience to the economic impacts of the coronavirus pandemic. Demographicallydriven millennial demand has continued unabated, low rates have fueled house-buying power, and historically low inventory has increased competition, leading to rising prices.

Weekly mortgage applications started the first quarter of the year approximately 10 percent above year-ago levels. After reaching a pandemic-induced low point in April, mortgage applications began to accelerate and, starting in late May, have surpassed their levels from one year ago for 21 straight weeks. In September, housing market potential continued to impress, even outpacing last month’s record. Housing market potential increased to its highest level in over 13 years, largely driven by strong house price appreciation in September.

HOUSING MUSICAL CHAIRS BOOSTS MARKET POTENTIAL

In today’s housing market, fast rising demand against the limited supply of homes for sale has

resulted in faster house price appreciation. There were 1.49 million homes for sale at the end of August, down 18.6 percent annually to a 3-month supply. Homes that do come to market are often met with multiple bids, further escalating prices, but are still selling quickly. The rapid escalation of house prices has a mixed impact on home buyers, fueling strong equity gains for existing homeowners, but dampening affordability for potential first-time homebuyers.

Homeowners in areas where house prices are rising feel wealthier. American homeowners today have near-record levels of equity, and, as their equity grows, they are more likely to consider using that equity to purchase a larger or more attractive home, the wealth effect of rising equity. In August’s existing-home sales report, the increase in home sales was strongest at the upper end of the market, as sales of homes priced at more than $1 million rose 44 percent nationally, followed closely by homes in the $750,000 to $1 million range, which increased 34.5 percent. Existing homeowners are playing “housing musical chairs” by selling to each other. In September, the growing wealth effect of rising equity caused by house price appreciation increased housing market potential by 26,570 potential home sales relative to one month ago, and 129,430 compared with one year ago. Accelerating house price appreciation had its greatest yearover-year contribution to the market potential for existing-home sales since 2014.

WHAT’S AHEAD FOR FIRST-TIME AND REPEAT BUYERS?

Inventory in today’s housing market is so tight and demand so strong that in last month’s existing home sales report, 70 percent of all homes listed for sale were sold within the month, with days on market falling to 22 in August, down from 31 days in August 2019. The ongoing supply shortage continues to put upward pressure on house price appreciation as buyers compete to buy what little inventory is for sale. You can’t buy what’s not for sale, but you can compete for what is.

The lack of inventory and increase in house price appreciation is problematic for potential first-time home buyers, who tend to be younger and do not have the equity from the sale of an existing home to bring to the closing table. On the contrary, existing homeowners can use the equity from the sale of their current home to purchase a bigger or better home. Rapid house price appreciation and its impacts on existing and first-time home buyers will persist until the supply and demand imbalance begins to improve. In the game of housing musical chairs, it’s clear the housing market needs more chairs. MBM