10 minute read

Andromeda Metals

ANDROMEDA METALS

Advertisement

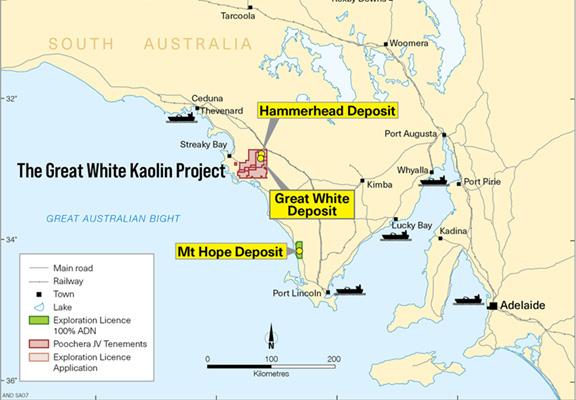

Andromeda Metals is a slightly misleading name and the result of a hangover from a previous life, according to the company’s managing director James Marsh. A more appropriate name, he says, would be Andromeda Minerals, on account of the ASXlisted outfit’s focus on the industrial minerals space. Andromeda’s projects are located in South Australia, but its ambitions are global in that it seeks to become the world’s largest producer of a specialised industrial mineral called halloysite-kaolin. Halloysite is a rare ‘tubular shaped’ derivative of the typical industrial mineral kaolin, which has been used in the manufacture of porcelain products around the world for over 1,000 years. This mature market will provide an attractive, low-risk base for Andromeda to tap into, while there is a growing list of new applications for the halloysite-kaolin minerals that the company will extract from its flagship Great White Kaolin Project. Cutting-edge research into halloysitekaolin has identified uses in concrete, high purity alumina (HPA) production and in nanotechnology, which encompasses a range of exciting blue-sky technologies in high growth areas.

Andromeda’s 75%-owned Great White project is located in close proximity to vital infrastructure within the Eyre Peninsula of South Australia and is widely regarded as one of the world’s largest known high purity halloysite-kaolin resources, with total ore resources well over 100 million tonnes (Mt) when the nearby 100%-owned Mount Hope Project is factored in.

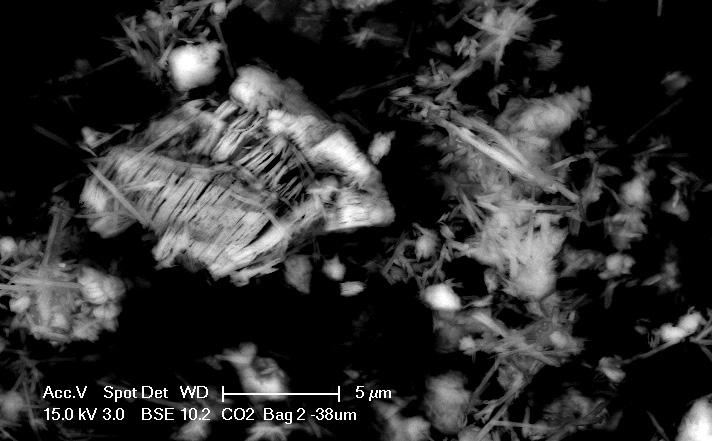

The Great White resource is a naturally occurring blend of halloysite tubes and kaolinite plates at a ratio of approximately 40:60 respectively, although Marsh tells RGN that the company is seeking to grow the higher value halloysite segment of the resource, particularly in areas containing very high purity halloysite.

“We’ve also found areas of super high purity nonhalloysite type kaolin,” he says. “Normally this would be lower value, but it’s the purest material I’ve seen in over 30 years of working in the industry. This has opened a whole new market to us, which is comprised of the coatings market and some very high performance polymer applications.

“I joined the company just over two years ago. I was brought in because I’ve worked in dozens of countries around the world on kaolin and kaolin derivative projects, and this is a very specialised, high value form of kaolin. There wasn’t much kaolin expertise in Australia, so I was brought in to get this project up and going.”

During the last two-and-a-bit years, Marsh’s highly competent team have pushed the project through the scoping and prefeasibility study (PFS) stages and are currently working on the definitive feasibility study (DFS) and elements of the bankable study, which should be delivered in early 2021.

Sweetening project economics

Last year’s PFS contained some very encouraging numbers that would even put some gold projects to shame, according to Marsh. The study expanded the LoM to 26 years and revealed a 35% increase to the pre-tax NPV to A$736 million, using an 8% discount rate. The IRR remained unchanged at 175%.

Project economics were sweetened by a switch in the mining method from a dry to a wet process. The original plan was to generate cash flow from an initial direct shipping ore phase, but substantial growth in Andromeda’s market capitalisation over the last six months has provided the bandwidth for an on-site process plant that will produce a refined product of higher value.

“The decision to go straight to a final product was a big step forward in the value of the project. It also means we aren’t transporting a lot of waste material overseas to have it processed somewhere else in a second stage.

“We also feel much better off going straight to a plant onsite while the world situation is a little bit uncertain at the moment. We’d be far wiser to keep everything in our own control, including production and our sales.”

Towards the end of 2020, Andromeda updated its mineral resource estimate for the Great White resource by 33% to 34.6 Mt of bright white kaolinised granite, following a series of successful drill

programmes.

Fellow ASX-listed firm Minotaur Exploration holds the remaining 25% interest in the Great White project and is a trusted JV partner of Andromeda’s, owing to longterm ties with Marsh. “I was a consultant for Minotaur about 12 years ago, so I knew them very well before I got involved with Andromeda.

“We are very lucky with our resource because there are other halloysites around the world, but not all halloysites are equal and some don’t work in certain applications. What we have is the perfect shape and structure” James Marsh, Andromeda Metals managing director

“We’re the managing operator of the project and have been driving the whole process forward, but they listen and make comments where required. Together, we have factored the latest resource upgrade into our current work on the DFS.”

Offtake orders

Since 2018, Andromeda has been busy securing nonbinding offtake agreements for its halloysite-kaolin products with customers from multiple industries. The company started by targeting the high end of the ceramics market, where customers value the high quality halloysite component.

“Customers in this market have used halloysite for decades, but current producers of the high value material have fallen by the wayside. They’ve either run out of material due a natural depletion of resources or they’ve been shut down.”

Until recently, China was one of the leading global halloysite producers, but a recent government crackdown on polluting mines led to closures of several operating mines. These shutdowns have created a gap in the market that Andromeda has been quick to capitalise on.

“We targeted those customers who will be using the fully refined product, which sells for around A$700 per tonne, and we’ve got over 200,000 tonnes per annum (pa) of nonbinding offtake agreements for this product.”

In addition, the company looked at the market for semiprocessed material, which requires the removal of sand from the orebody (50% of the material that comes out the ground is sand) using the simple wet process to produce a product worth around A$400 per tonne. Andromeda has agreed offtake for up to 400,000 tonnes pa of this material.

This is combined with around 300,000 tonnes pa of unprocessed ore which has been signed up for offtake with customers who have had their own mines shut down, and who appreciate that Andromeda’s product conforms to the typically high standards of the Australian minerals sector.

“All in all, we have just under 1 Mt of offtake signed up and we are in the process of converting them to binding offtakes. We also have about six tonnes of final product that has been completed and packaged for us in Japan. We will now use that to convert our customers and any new ones to binding offtakes, which will take us through the bankable feasibility study stage.” Fortunately, Andromeda is benefitting from increasing global attention towards areas such as hydrogen production and storage, carbon capture storage, lithium-ion batteries and water purification – all of which depend on nanotube technologies, according to latest research.

In fact, Andromeda and Minotaur recently formed a 50:50 JV research and

Educating investors

While investors on the ASX have a good grasp of the uses of kaolin in established markets, such as ceramics and paper, Andromeda has been doing its best to educate shareholders on the higher value markets for halloysitekaolin and in the myriad new applications across several high growth sectors.

YOUR EXPERT PARTNER FOR THE BENEFICIATION OF KAOLIN AND SILICA SAND

Technical Laboratory & Trials Engineering Equipment & Process Units

Plant Realization Spare Parts & Service

We address your specific needs, by developing highly customized solutions based on test works performed in our own technical laboratory, and leveraging more than 55 years of practical experience, worldwide!

We provide you with first-class engineered process units, treatment plants and services, that deliver outstanding and steady benefits over years!

#WetTreatmentAtItsBest

Dienhof 26 92242 Hirschau Germany Phone: +49 (0)9622 7039-0 Telefax: +49 (0)9622 7039-376

www.akwauv.com

ANDROMEDA METALS

AT A GLANCE

STOCK TICKER

ASX:AND

MARKET CAPITALISATION

A$656.5 million (as of January 5, 2020)

a j

development (R&D) company called Natural Nanotech in order to capitalise on the opportunity to become a world leader in associated nanotechnology.

“Our R&D company will focus on pushing these new applications through to intellectual property and hopefully commercialising those opportunities for the halloysite from the Great White resource,” Marsh proclaims. “We are very lucky with our resource because there are other halloysites around the world, but not all halloysites are equal and some don’t work in certain applications because the shape and structure is not quite right. What we have is the perfect shape and structure. We are lucky we have these materials and our research is progressing quickly.”

Carbon Capture Technology (CCT) is one form of nanotube

technology that has been proven and is being adopted by the Indian navy for carbon capture in submarine emissions. The material required for this technology is selling for an eyewatering A$3 million a tonne, and Marsh believes that the halloysite version of this technology will be further multiples of that.

In addition to nanotube technology, Andromeda is also guiding investors towards the uses of halloysite-kaolin in concrete, where its potential value could be anywhere between A$1,000-4,000 per tonne, while Andromeda’s production costs would centre on simply removing the sand from the ore.

12-month countdown

Andromeda is targeting first commercial production from the Great White project in early 2022, provided that the company is granted environmental and mining permits by the South Australian state government within the next 12 months.

Marsh anticipates no major barriers with regards to the final government processes: “We have strived to choose a model that is simple and low impact. The mining is very shallow and will only go around 30 metres down and there will be no nasty chemicals or tailings dams.

“We are going to backfill and rehabilitate the project mining area as we progress to minimise the footprint,” he continues. “The environmentals are now complete, we are just waiting for sign off by the consultants.

“We see our value proposition as us being the biggest, possibly the world’s only, producer of high purity halloysite and halloysitekaolin. And we’ll be supplying it into three different market segments, starting with the mature base market,” says Andromeda’s boss. The existing market – comprised primarily of high quality ceramics – provides a low volatility base for the company to comfortably service with its products, ahead of the transition into higher value mid-term opportunities in concrete, coatings and polymer applications, amongst others.

“Looking to the longer term - but coming through quite rapidly now - is the potential for a halloysite nanotechnology business. This is extremely exciting as it could completely overshadow the already attractive numbers we have in our PFS.

“We feel that we have something here of great interest,” Marsh concludes. “By 2022 we should be into revenue. Shortly after we can expand into other areas and start bringing through these exciting new high value technologies.”

Specialist Bank

Bringing security to frontier markets

INVESTEC INVESTECFrom Pakistan to Thailand, Bangladesh and practically everywhere in between, it’s never been easier to trade in frontier market securities. Investec’s Corporate and Institutional Banking division has the research and ability to execute a wide range of local and international security transactions. Our skilled traders, advanced technology and strong, established relationships, can give your investment the edge in a brand new market.

Call us, and see what we can bring to your table.

Execution

Simon Reid simon.reid@investec.com +27 11 286 4885

Ryan Bell ryan.bell@investec.com +27 11 286 4732

Ziv Okun ziv.okun@investec.com +27 21 416 3337

Sales and Strategy

Andrew Schultz andrew.schultz@investec.com +21 24 416 3339 Research

Yeukai Gavaza yeukai.gavaza@investec.com +27 11 291 3044

Kuda Kadungure kudakwashe.kadungure@investec.com +27 11 291 3092

Anthony Geard anthony.geard@investec.co.za +27 21 416 1431

Chris Becker chris.becker@investec.com +27 11 286 9104