8 minute read

NTM Gold

NTM GOLD A unique proposition in the Australian junior gold exploration sector

In search of mineralisation

Advertisement

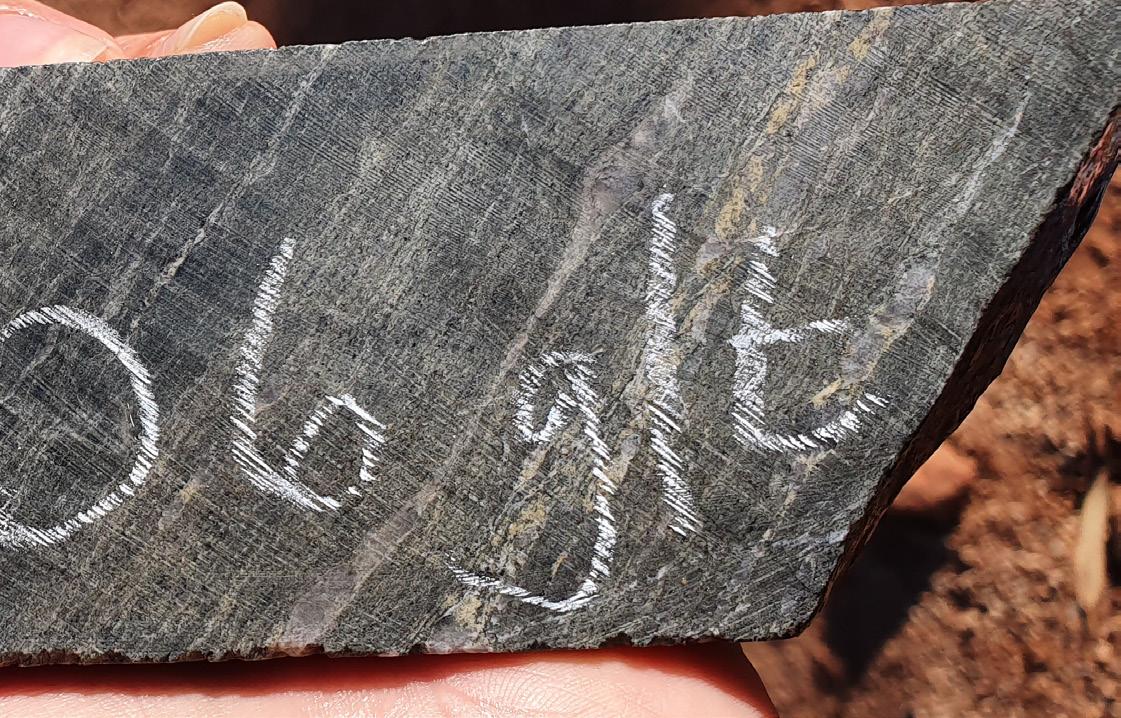

NTM has been involved in the Redcliffe project for the best part of 20 years through various company guises but it was wasn’t until around 2015 that it became the primary focus for the Australian gold junior. “We’ve been quite successful in our exploration,” says NTM’s managing director Andrew Muir. “In 2017, we found a deposit called Bindy, then in 2018 we found one called Hub and in 2019 we found Redcliffe East. “We’ve been going pretty well of late and it’s a highly prospective area. Given the history of the region, it’s still relatively underexplored. The Redcliffe project largely tracks the Northern end of the Mertondale shear. The vast majority of our exploration to date has focused on that zone.” In April 2020, ASXlisted NTM Gold Limited acquired a 426 km² gold tenement package called the Wells Group in the Leonora region of Western Australia (WA). This deal expanded its vast footprint within the Redcliffe Gold Project to over 720 km². The Redcliffe project is centred around the Mertondale Shear Zone – a geological linking structure between two regional shear systems stretching across WA’s Eastern Goldfields. NTM considers the Wells Group, located in the Northern extension of the Mertondale Shear, to be a highly prospective early greenfields stage opportunity and will focus its initial work on further geological and data review followed by targeting studies prior to on-ground work.

Consistent drilling over the last few years has allowed NTM to increase the Redcliffe resource to over half a million ounces of

gold - 537,862 oz to be precise – while making a name for itself on the junior exploration market in Australia with the results of its recent drilling campaigns.

“It’s interesting right now because the market is definitely rewarding exploration success, even with the uncertainty relating to the COVID-19 outbreak overhanging the market. There has been an unusually high number of discoveries made in Australia over the last six months and they are being rewarded with investment.

An exploration Hub

NTM’s most notable exploration success of late was the discovery of the Hub

“We’ve been quite successful in our exploration. In 2017, we found a deposit called Bindy, then in 2018 we found one called Hub and in 2019 we found Redcliffe East” Andrew Muir, managing director NTM Gold

deposit in October 2018. The company has been steadily drilling the deposit out since then and delivered some fantastic grades close to surface in June and July last year. terms of ounces, or we could toll treat through the existing plants nearby. And any one of the companies that own those plants might want to take us over to feed our ore through their facilities.”

Near surface grades as high as 468 g/t Au at the Hub deposit seem to have caught the attention of the investor market, which has resulted in rises in both the share price and market capitalisation of the company over the last nine months. Following the exciting drill results of last year, NTM aims to publish a resource estimate for the Hub deposit by the middle of 2020 and remains confident of achieving this despite the state restrictions in place to prevent the spread of COVID-19 since March.

Having gained the attention of the market with attractive grades, Muir believes that interest has been retained by the recognition of the Redcliffe project’s strategic location, within trucking distance to four existing processing plants in the region. “Our strategic location gives us optionality on how we monetise Redcliffe. We could build our own plant if we get enough critical mass in

Business as usual

The location of the Redcliffe project in the vast expanses of WA’s Eastern Goldfields – where the nearest inhabited area is the historic mining town Leonora 40 km away – has meant that NTM’s operations haven’t been significantly impacted by social distancing measures and drilling has continued as normal.

However, the company has put an infectious diseases policy in place, has modified some of its commuting procedures and is continually assessing the risks as Australia and the world faces up to the threat of a global pandemic.

Although the company is still working on the numbers for the Hub deposit ahead of the maiden resource, Muir reveals that the deposit has the potential to be not just the biggest deposit in the Redcliffe project, but also the highest grade.

NTM has relied on several drilling outfits to undertake its exploration activities over the last few years, including ASX200 mining services group Ausdrill (now part of the Perenti Group) as part of a drill-for-equity arrangement.

“The company most consistently on-site has been Challenge Drilling. They have provided excellent RC and AC drilling services. We’ve

Broadening the horizons

After completing RC and DD campaigns for the Hub deposit earlier this year, NTM is now looking to step away from intense resource-style drill outs in favour of a wider regional AC drilling campaign looking for new deposits. The company hopes this kind of grassroots exploration will be key to achieving its total exploration target of 1.38- 2.24 million ounces (Moz) at Redcliffe. also recently used Precision Exploration Drilling (PXD) and our diamond drillers are normally Westralian Diamond Drillers (WDD). “All our drilling contractors have done a great job despite some of the ground at Hub being quite tricky at times. It’s something we need to try and understand to see if we can use some different techniques to overcome those issues.”

“In our current AC programme, we are testing some of the major structures that aren’t on the Mertondale Shear and may provide a different style of deposit. A lot of these targets haven’t ever been drilled so we are doing some higher risk exploration but hopefully we will be rewarded.

“We could go and drill out the deposits we already have at depth to increase the resource

base, but that drilling is getting a lot more expensive due to the depths of the holes and we don’t think any of these will be gamechangers. “Instead we can get better bang for our buck by finding new deposits as we think the ground has potential. We found the Hub deposit through AC drilling and that’s made a huge difference to the awareness of the company. So, the aim is to find more of those deposits and the only way you can do that is by testing new areas, and that’s we’ll do.”

Finding a niche in the elevated gold market

The gold spot price has strengthened in recent weeks and months amid the global uncertainty and market volatility brought about by the COVID-19 pandemic. A high gold price can only mean good news for all players in the gold mining sector, including early stage explorers like NTM.

As existing producers operate under higher margins in an elevated gold market, a well-located outfit like NTM may be ripe for the picking according to Muir. Indeed, many analysts are already predicting increased levels of M&A in the gold sector as established players making higher returns look to cherry pick smaller assets to bolster their portfolios.

Alternatively, should NTM want to go it alone, higher gold prices will make it easier to start up the operation, because margins are going to be higher and the company will make better returns. Ultimately, a high gold price is good for sentiment, says Muir.

“Whether you’re a producer or an explorer, if the gold price is continuing to go up, people are going to want to invest in the gold sector.”

So, how does NTM differentiate itself from the sea of explorers and producers

ANDREW MUIR, NTM GOLD MANAGING DIRECTOR

market? Muir believes that the combination of sustained exploration success over the last three years and the optionality on monetising the Redcliffe project is key in making NTM a unique proposition.

“Regionally, we have high grade oxide mineralisation close to surface that can be

mined and processed cheaply. The downstream optionality of the project is a key feature, as are the high grades we have seen, which are always a good thing.”

NTM GOLD

AT A GLANCE

STOCK TICKER

ASX:NTM

MARKET CAPITALISATION

US$34.2 million (as of May 01, 2020) j

EVENTS

International Mining and Resources Conference (IMARC) + EXPO Where global mining leaders connect with technology, finance and the future October 27-29, 2020, Melbourne, Australia

IMARC is set to return to Melbourne at the end of October for its seventh year, having quickly grown to become the largest international annual mining event in Australia. Powered by Beacon Events, the organisation behind the hugely successful Mines and Money series, IMARC will hope to build on a stellar event in 2019 which welcomed 7,000 attendees from more than 100 countries, with a total of 4,600 meetings requested through IMARC Connect. Key themes in 2020 will be collaboration and engagement, commodity trends, ethical investment and the clean energy transition.

Register Here

Africa Oil Week Fuelling the future of African energy 02-06 November, 2020 Cape Town, South Africa

Brought to you by the Hyve Group – the company behind the Investing in African Mining Indaba - Africa Oil Week is still going ahead as planned in November despite the ongoing impact of the COVID-19 pandemic on large scale gatherings and business conferences. The 2020 event will deliver a range of new offerings for attendees, including a central networking hub, OFS technology showcase and a revamped PetroAfricanus gala dinner. In addition, Total chairman of the board and CEO Patrick Pouyanné has been confirmed as a speaker, with further speaker announcements to follow over the coming months.