8 minute read

Financial Matters

from SE21 May 2021

by SE Magazines

With David Frederick FCCA | Marcus Bishop Associates | marcus-bishop.com

Mistake or Not?

Our language is littered with sayings about mistakes. On the one hand there’s Einstein with “a person who never made a mistake never tried anything new.” Whereas at the other extreme, “there’s nothing wrong with making mistakes. What’s wrong is letting a mistake stay a mistake, without putting in effort to make it right.” These are all equally valid and provide hours of reflection but let’s look at a mistake in the context of personal taxes and an individual’s failure to notify HMRC or the late notification of income tax liability. The importance of taxpayers making mistakes in a failure to notify HMRC of taxable income continues to drive HMRC to reduce their tax loss. This has been seen recently with the resurgence of HMRC’s attention to taxpayers who they believe or suspect have failed to notify them of taxable income and gains from overseas. This follows from the closure on 30th September 2018 of the Worldwide Disclosure Facility and the dawn of the new penalties under Requirement to Correct from 1st October 2018. In summary, HMRC granted taxpayers an opportunity with any worldwide earnings and gain to make a declaration by 30th September 2018. Thereafter, HMRC may levy penalties up to 300% of the unpaid income tax. In short, it can be an expensive mistake for the taxpayer who has mistakenly failed to declare to HMRC any overseas income or gains. Whilst it may be easy to assert that how can one forget? Or how does this arise? Let’s consider a recent case. UK tax resident Cleopatra who was responsible for her mother’s probate on her death overseas had opened an estate account to handle the mother’s estate in 2013. Following the successful conclusion of the matter, several years later Cleopatra changed the account into a personal account, in her sole name. Such behaviour consists of no behaviour to avoid UK taxes, or does it? Fast forward January 2021 and Cleopatra receives a letter from HMRC Worldwide Disclosure Service. Why? HMRC had been notified by the overseas tax authorities of Cleopatra’s account and her receipt of interest for several years. On checking her Self-Assessment account, HMRC found no declaration of the overseas income being declared. HMRC have immediately identified a person who has failed to make a declaration of their overseas earnings. Or have they? How many taxpayers may be or are in this position, because as a UK taxpayer, are you fully aware that your worldwide income and gains are subject to declaration and liable to UK income tax, irrespective of whether the money arrives in the UK or not? A large number of taxpayers are and maybe unaware of the UK tax system let alone how it handles overseas income and gains, if they have any such luxuries. Whilst HMRC, may have in place a robust piece of legislation to address tax evasion, which nobody can doubt is required, the real concern is how many ordinary taxpayers may be making that mistake that may lead to HMRC’s reclassification of them. Taxpayers like Cleopatra, who are behaving without any regard or awareness to UK income tax rules can easily and do readily find themselves making these mistakes. All too often, through no fault of their own. Given HMRC’s eagerness to tackle global tax evasion some may think they are starting with the low lying fruits and ignoring the real fruit tree or fruit basket. Irrespective of your thoughts, taxpayers are reminded to be mindful of their overseas behaviour as they may be oblivious to walking into unforeseen income tax problems. Whilst, our Cleopatra, was able to address her mistake. The real question is, how many other taxpayers await that unexpected letter from HMRC Worldwide Disclosure or its other disclosure teams for the failure to notify.

tessa parikian garden design

~ Resilient Gardens ~

Right Plant, Right Place - give your plants a long life

I specialise in planting to support wildlife in your garden

I can redesign your borders this Spring so you can have a garden full of flowers to support birds, bees and butterflies this year

I’m local. Let’s talk

Friday 7 – Sunday 16 May: Bell House Sculpture Park

11:30am-6pm. Join us this May as we take part in Dulwich Festival’s Artist Open House with the Bell House Sculpture Park! The Bell House gardens are open during the Dulwich Festival exhibiting works of 11 artists and 3 dancers. Forged metal, carved monoliths, playful perspex, resonant ceramics and woven alloys are but some of the forms that assemble to shape the pieces in the Sculpture Park. See how the artist’s have made new works in response to the architecture and history of the house or how existing works find new context in situ. This is our first public event since restrictions began and we are looking forward to welcoming you all! We will be operating in line with the latest government Covid safety measures. As such pre-booking is advised to help us manage social distancing. Walk-up’s are welcome but you may have to wait a little if we are busy! By booking you will be agreeing for us to hold your information for Track & Trace. We will keep this information in line with GDPR regulations. Alternatively, on arrival you can either scan the QR code at the entrance or we are more than happy to take your details with good old pen and paper! For full details of opening times and how to book please go to

www.bellhouse.co.uk.

Notice

Please note that all this information was correct at the time of going to press. However please do check details ahead, as the lockdown may be extended and this could affect some events.

Monday 10 May: Exclusive Live Cook-Along with Rukmini Iyer

6.30pm-7.30pm. Join us for a night-in like no other: a virtual cook-along with best-selling author of The Roasting Tin series, Rukmini Iyer. Follow live at home as Rukmini leads you through one of her wildly popular recipes – with step-by-step instructions and expert tips, it’s the next best thing to having her in your kitchen! The cook-along will be a masterclass in Rukmini’s trademark style of fuss-free, flavour-focussed food. Hazel loves cooking from Rukmini’s books and The Roasting Tin Around the World has been one of our bestselling books at the bookshop too! Tickets from £10. www.village-books.co.uk

Wednesday 12 May: Dulwich & District u3a Open meeting: Introducing Link Age Southwark

2pm-3.30pm. Link Age Southwark has been operating in the borough since 1993. The charity's vision is of friendly, vibrant local communities where older people thrive. In this talk the Charity's Director, Sophie Wellings, who previously worked for the Third Age Trust (the u3a national umbrella body), will outline the work of the charity as well as exploring opportunities for collaborating with the u3a.

https://u3asites.org.uk/dulwich/events.

Thursday 13 May: Filmmaking 101: The Camera with Dan Robb

7pm - 9pm. What does a director actually do? What makes a good script? Why is editing so important? Every month, an industry professional will host an online tutorial, where they will delve into the fundamentals of a specific filmmaking discipline. The cost of this tutorial is £15. We have 2 free/bursary tickets available for those unable to pay the full price.

www.bellhouse.co.uk.

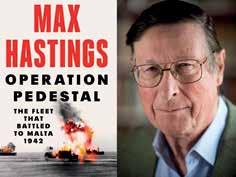

Thursday 13 May: Operation Pedestal by Max Hastings

7.30pm-8.30pm. An epic, intimate new account of one of the greatest naval dramas of World War II, from number one bestselling historian Max Hastings. Tickets from £10. **We have been allocated a number of books which Max Hastings has kindly agreed to dedicate and sign.**

www.village-books.co.uk

Thursday 13 May: Ancient Egyptian Art - Three Thousand Years of Treasures

8pm-9pm. Lecture will look in depth at these treasures, examining techniques used, who commissioned them, their purpose and meaning. These are for members only. To join or book tickets: www.theartssocietydulwich.org.uk

Monday 17 May: Change your habits - change your life

7pm-8pm. Have you ever tried to build a new habit or routine only to find yourself slipping back in old patterns? The habits and routines we chose daily impact not only our current situation but our future path. You will never change your life until you change your habits. There’s a tiny difference between thinking ‘I could never do that’ and realising ‘I can totally see how that’s possible,’ As successful habits are formed your brain is rewired and it builds a wave of positivity and motivation. In this session, you will learn how to create habits that stick, embrace change, and move towards the life you wish to lead.

www.bellhouse.co.uk.

Monday 17 May: An Evening with Sophie Hannah and Adele Geras

7.30pm-8.30pm. Join mother and daughter Adele and Sophie as they talk about their new books, writing careers, changing direction and how to insert a murder into a story. Based on a reallife voyage, Dangerous Women by Hope Adams (Adele Geras) is a sweeping tale of confinement, hope and the terrible things we do to survive. The Killings of Kingfisher Hall by Sophie Hannah see Poirot return to solve another muder mystery. Tickets from £6. www.village-books.co.uk