7 minute read

Financial Matters

from SE23 November 2022

by SE Magazines

With Akwasi Duodu | akwasi@sterlingandlaw.com | www.sterlingandlaw.com

Should I Overpay My Mortgage?

Interest rates are on the up. Quite rightly, many people with mortgages are concerned about affordability. If you have extra money to spare each month, you could make overpayments on your mortgage. This would reduce both the mortgage amount and the overall mortgage term, thereby reducing the interest you’d pay overall. It would also reduce your loan to value, meaning you may be able to get a better deal next time around than if you hadn’t overpaid. Is this the right approach for you in the current climate? Well, it depends.

Saving V Overpaying Your Mortgage

Whilst there is a strong argument for overpaying your mortgage putting your extra cash or savings into your mortgage would tie up your capital. With inflation on the rise, some would argue that having liquid cash available was more important. There are pros and cons for both approaches. This largely depends on the mortgage deal you’re currently on and how long it’s fixed for. Those with a low, fixed interest rate may be better off saving – especially if their rate was fixed for a long time. You are more likely to be on a higher rate if you took out a mortgage recently. Overpaying would therefore likely be the better option. If you were lucky enough to fix your mortgage before interest rates went up, it may be wiser to save the money in a savings vehicle with a higher potential rate of return.

Should You Use Your Savings To Pay Off Your Debts?

If your other debts are costing you more in interest than your mortgage, it would make sense to pay them off first before considering making overpayments on your mortgage. For example, paying off a credit card debt with an interest rate of over 15% would make much more sense than paying off mortgage debt with an interest rate of 4%. Although mortgage rates are on the up, mortgages are still likely to remain the cheapest form of credit. However, stress testing your mortgage would be a financially astute thing to consider. The best way to do this would be to picture your mortgage on a particular interest rate and work out what your monthly repayments would be on that rate – a useful way of gauging the affordability of your mortgage at a future given interest rate.

Alternatives To Overpaying Your Mortgage

Arguably, your priority before considering overpaying your mortgage should be building an emergency cash surplus. This should be around 6 months net income. If you decided against repaying your mortgage you could consider saving or investing for the longer term. The advantage here is that you could always use your savings to reduce your mortgage at a future date if it suited you. Alternatively, you could consider putting the extra cash into your pension. Remember however that money invested in a pension would be tied up until your retirement age. Ultimately, it comes down to the risk you’re willing to take. If you have a big mortgage and are worried about budgeting when interest rates rise, you might prioritise reducing your mortgage. If affordable, a clever combination of all options, (saving, investing, putting more into a pension and overpaying) may be the best option for most people. After all, you wouldn’t want to put all your eggs in one basket, would you?

Thursday 17 November: Talk on the history of Jazz (with music) - Dulwich & District u3a

2pm – 4pm. Introduction to the history of Jazz (with musical interludes). An intergenerational session from Pat Wright and her grandson Max, a professional jazz drummer.u3a members and non-members welcome. Tickets via:

www.u3asites.org.uk/dulwich/events

Saturday 19 November: The Illusioneer: Magic Mix

7.30pm-10pm. Puzzlements, Curiosities, Parlor, Street and Cabaret Magic from The Illusioneer team and guests in a fun and relaxed setting: A seated theatre style show back by popular demand. Bring your own liquid refreshments. We have the drinking vessels. Sorry no food allowed in the venue but there are a variety of eating places close by. Performers are from our resident team and guest artists, they will vary each show. All artists give their performances free and profits are donated to our special children's charity Breathe. Tickets via eventbrite. co.uk. Fison Fitness Centre 280 Milkwood Road, Herne Hill Railway Arches, Herne Hill, SE24 0EZ

Saturday 19 November: Smartphone Filmmaking

10am – 4pm. A one-day workshop, ‘Smartphone Filmmaking’ will introduce people to the fundamental concepts of filmmaking and provide them with the tools they need to be able to shoot their own films on their smartphone Places are £80 or £50 if you are in full-time education. Tickets: www.bellhouse.co.uk/events Bell House Dulwich, 21 College Road, SE21 7BG.

Sunday 20 November - Mid-century Modern®

10am – 4pm. 65 top mid-century dealers and 28 contemporary designers come together at this celebrated interior show. Expect an eclectic mix of collectables with all you need for your home and more including furniture, ceramics, glassware, industrial, metal smalls, vintage posters, art, Danish silver jewellery, lighting, fabrics, rugs and more. Make a day of it with Dulwich Picture Gallery, Dulwich Park and village all within walking distance. Tickets via: www.modernshows.com. Dulwich College, Dulwich Common, Dulwich SE21 7LD.

Sunday 20 November: Classic Orchestral Concert

7.30pm – 9:00pm. Join us in the lovely surroundings of St Stephen’s Church for this beautiful concert, given by the local professional musicians of the Tamino Orchestra. The programme includes tuneful works by Purcell and Boyce and Finzi’s evocative Romance. Douglas Reith (as seen in Downton Abbey) will introduce dances from Stravinsky’s ballet Apollon Musagète and a new work by local composer Nicholas AnsdellEvans, who conducts, with mezzo-soprano Stephanie Marshall. Tickets £15 on the door and online: www.ststephensdulwich.org/concerts. St Stephen’s Church, College Road SE21 7HW.

Monday 21 November: Change your mindset to lead a happier, healthier life -

online event

7pm – 8pm. It’s not what happens to us in life that really matters, it’s how we react to it. We can all learn from unwelcome challenges and, more often than not, become better as a result of them. By learning strategies to change our mindset we can build resilience, gratitude and humility. The session will include practical tools to utilise in your everyday life which can lead to lasting change. Tickets are £5. There are bursary places available. Email info@bellhouse.co.uk. Tickets: www.bellhouse.co.uk/events Bell House Dulwich, 21 College Road, Dulwich SE21 7BG.

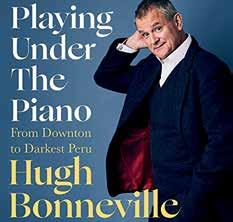

7.30pm – 8.30pm. Village Books and The MCT at Alleyn’s are delighted to announce An Evening with Hugh Bonneville! Tickets can be purchased from https://mct.alleyns.org.uk. Alleyn’s School, Alleyn’s School, Townley Road, SE22 8SU, UK.

Friday 25 November: Creative Arts Club for Older Adults (60+): a Burst of Colour

10am -12pm Hanging tissue Pom Poms can transform a space for any occasion. Simple, effective and fun to make, it always feels like a party when making these so come and join in! Tickets: www.eventbrite.co.uk. Bell House Dulwich, 27 College Road, Dulwich SE21 7BG.

Friday 25 November: Mark Evison Foundation Carol Concert @6pm

With the Dulwich College choir, celebrity readers Celia and Angus Imrie, Julian Ovenden, Iain Glen, and Lesley Sharp, and singers Kate Royal and Clare Presland (with help from Julian Ovenden). There will be a champagne reception afterwards in the Linley Room at Dulwich Picture Gallery. Tickets are £15 a head, under 16s free, book tickets at events@markevisonfoundation.org.

www.markevisonfoundation.org/events.

Christ’s Chapel, SE21 7AD

Friday 25 November: Granny’s Attic, Liam Cooper, Phil Stevens 7pm – 11pm

With exceptional musicianship and boundless energy, Granny’s Attic are going from strength to strength. Cohen Braithwaite-Kilcoyne (melodeon, anglo concertina, vocals), George Sansome (guitar, vocals) and Lewis Wood (violin, vocals) have honed their skills touring the UK and Europe since 2009. The Ivy House, 40 Stuart Road, Nunhead, SE15 3BE Tickets at:

www.wegottickets.com/thegooseisout

Saturday 26 November: Love West Dulwich Christmas Fair

10am – 4pm Enjoy Santa’s grotto at Wigwam Toy Shop, the arts & crafts market, a kids Christmas trail, kids story time, face painting and much more! There will also be lots of offers and promotions at the West Dulwich shops and businesses. The fair takes place throughout West Dulwich on Croxted and Rosendale Roads, SE21. Wigwam, 109

Rosendale Road, SE21 8EZ. Dulwich Christmas Market

11am – 4pm. SoLo Craft Fair is delighted to be back in the heart of beautiful Dulwich for their Christmas market this year. Start your Christmas shopping by supporting small businesses and finding unique gifts. St. Barnabas Parish Hall, 23 Dulwich Village, SE21 7BT. ww.solocraftfair.com

Saturday 26 November: Dulwich Choral Society

7.30pm – 9:30pm - The Dulwich Choral Society is very pleased to bring you a performance of J.S. Bach’s wonderful and exuberant Christmas Oratorio, originally written for the yuletide of 1734. So come along and start the Christmas season with us in style with the abiding beauty of Bach. St. John the Evangelist Church, 1 Sylvan Road SE19 2RX. Tickets in advance via ticket source and: http://www.dulwichchoral.com

Wednesday 30 November: Cooking with Scissors

6.45pm-8pm. An opportunity for local business professionals to meet, make new contacts and gain new business. www.cookingwithscissors.co.uk.