21 minute read

Report of the Chairman

REPORT

INTRODUCTION

In t In t In t In t In t he face of ongoing chal he face of ongoing chal he face of ongoing chal he face of ongoing chal he face of ongoing chal lenges lenges lenges lenges lenges due to the continued COVID-19 due to the continued COVID-19 due to the continued COVID-19 due to the continued COVID-19 due to the continued COVID-19 pandemic, Carib Brewery pandemic, Carib Brewery pandemic, Carib Brewery pandemic, Carib Brewery pandemic, Carib Brewery (Grenada) Limited (CBG) (Grenada) Limited (CBG) (Grenada) Limited (CBG) (Grenada) Limited (CBG) (Grenada) Limited (CBG) del del del del del iver iver iver iver iver ed str ed str ed str ed str ed str ong r ong r ong r ong r ong r esul esul esul esul esul ts in fiscal ts in fiscal ts in fiscal ts in fiscal ts in fiscal year 2021. year 2021. year 2021. year 2021. year 2021.

These results reflect the resilience of our Company, the strength of our business strategies and the dedication of our employees. We remained focused on our strategy, leveraging our superior brands, retail execution and excellent customer service while ensuring the wellbeing of our employees.

For the financial year, sales grew by 5% while profit before tax improved by 16%. These are strong results in challenging circumstances. Our CBG family continued to step forward, not only by delivering year on year growth and adding value to all our stakeholders, but also by demonstrating their commitment to keeping each other safe while serving our customers and supporting the communities in which we operate. We are very proud, that these results were achieved without any COVID19 subsidies and the retainment of the full complement of employees.

ECONOMIC OUTLOOK

The IMF reported that the Grenadian economy is gradually recovering from the pandemic with a growth of 5.6% in 2021 with that recovery being fuelled by the Construction and Agricultural Sectors and Tourism which responded positively to the lifting of domestic quarantine requirements in late 2021. Food, fuel, and transport prices are expected to continue pushing up inflation, reflecting the impact of strained global supply chains. 2022 local economic growth is forecast at 4.3%, based on the enhanced domestic value added by tourism, strengthening of agricultural sector linkages, investments in skills development and training, the shift toward renewable energy and the many links provided with the resumption of in-person learning at the St. George’s University.

COMPANY PERFORMANCE

I am pleased to report another year of good performance with sales and earnings growth, portfolio expansion and continued cash returns to shareholders exceeding expectations. While we are pleased with these results, and the overall strength of our business, the external environment continues to be volatile and difficult to predict, and we remain cognizant of the many challenges we face and actions we need to implement to continue on an upward trajectory. 2021 was a year of extreme global turbulence with high raw material, transport and freight costs, and countries being affected by new variants of COVID-19 which led to continued supply chain disruptions. In spite of this, CBG remained focused on protecting the interest of shareholders, ensuring the wellbeing of all employees and supporting our loyal customers and local communities.

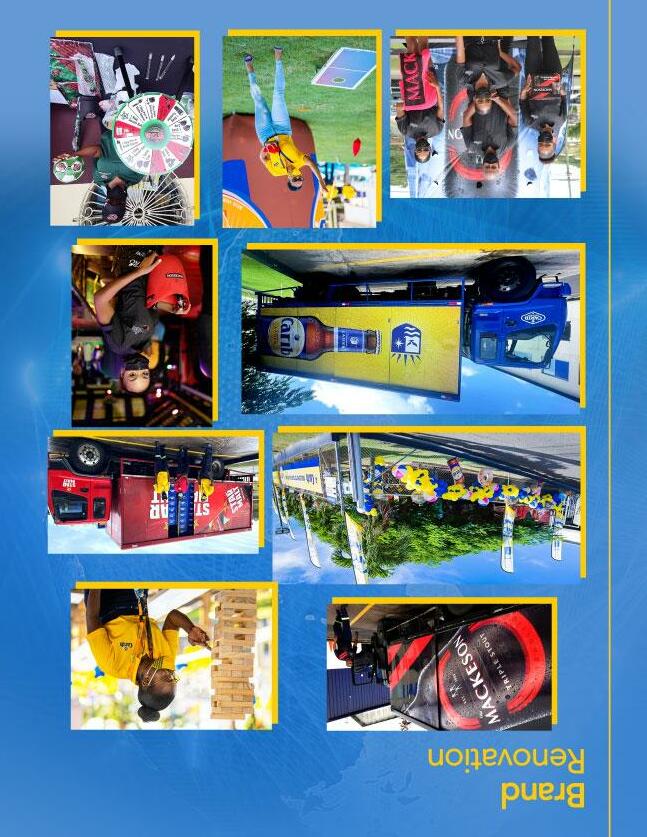

As we navigated the second year of the pandemic, our results demonstrate resilience, with improved performance during a very difficult year, generating year on year growth in both sales revenues and profit before tax. Sales revenues grew by 5%, from $58.323M to $61.265M, a reflection of our continued investment in our brands to strengthen their long-term health and competitiveness, combined with the collaborative spirit across the organization and our many customers. 2021, saw growth on the local market, a direct result of our high quality products and excellent customer service which were complemented by significant brand equity enhancements, including the renovation of: Carib, Mackeson Stout and Shandy Carib which generated tremendous excitement. Further, CBG is convinced that continued evolution of our portfolio is key to accelerating the Company’s longterm growth profile and to delivering enhanced value to our shareholders. In support of this conviction, our portfolio was expanded with the addition of Pink Ting, which has been enthusiastically received and widely accepted by the market. Our export market contracted marginally because of the pandemic coupled with other natural disasters in our main markets. Notwithstanding this, history was made with our first export to Europe - a shipment of

REPORT

Shandy Carib to the United Kingdom. This augurs well for the future of our Company.

Cost of sales percentage increased over prior year due to spiralling costs, inclusive of energy, packaging and raw materials, combined with significant repair and maintenance to plant and machinery. This resulted in a contraction of gross margins as our ability to implement significant price increases to adjust for this higher cost was impacted by inflationary factors in the marketplace. Nothwithstanding, the financial outlay in our brands and consumers, savings were generated in sales, distribution and administrative expense including reductions in impairment of receivables. All these resulted in a net profit before tax of $11.390M, a 16% improvement on 2020 ($9.785M). Achieving these financial results in an extremely challenging environment is a testament to our quality of product, the unwavering support of our employees and the combination of strategies in support of long-term value creation.

Cash generated improved by $2.616M, growing from $5.464M to $8.080M while cash balances stood at $28.366M against a prior year balance of $20.284M. Our healthy cash position will facilitate the implementation of focused capital investment projects whilst allowing for the shareholders who had steadfastly stood with us over the years.

pursuit of increased shareholder value. The Statement of Financial Position remained strong with shareholders equity and total assets increasing to $44.332M and $66.879M, respectively.

DIVIDEND DECLARATION

CBG has a history of creating value for shareholders, paying dividends that are sustainable and superior over time having regard to its cash flow generation, reinvestment options and balance sheet strength. Today, we continue to generate strong cash flows, and our capital allocation strategy governs how we prioritize the utilization of the strong cash flow we generate. This strategy also guides our continued investment in organic growth, payment of a progressive dividend. Maintaining a strong balance sheet gives us headroom to make further investments and supports our commitment to return any excess capital to Shareholders.

Given CBG’s strong performance, your Board of Directors is pleased to declare an ordinary dividend of $1.00 per share, a 17.6% increase on the prior year. Additionally, a special dividend of $1.00 has also been declared which brings the total dividend to $2.00, a reward to our embedded in all our decision-making processes enhancing the economic, social, and environmental well-being of all our stakeholders.

We have made great strides forward in the last year by: implementing electronic authorization of documents wherever feasible, thereby reducing our paper and stationery use, working towards minimizing our carbon footprint by carpooling, and reducing air travel with the use of digital platforms for virtual meetings. Also, CBG continued to manage its water usage, maintained 100% production in glass bottles and has also begun the exciting journey of performing feasibility studies into installing a large array of solar panels which will offset our demand for gridsourced electricity. This will allow us to reduce our carbon footprint and venture into green sustainable renewable technology for our buildings. CBG uses a large amount of energy to power our network of offices and equipment, and we recognize that the generation and consumption of energy has a significant impact on the environment, through the use of finite resources and the emission of greenhouse gases.

CAPITAL INVESTMENTS

We have continued to invest in the future of our Company which includes the advancement of our innovation agenda and the substantial expansion of our production capacity thus strengthening our basis for long-term growth. A total capital investment of EC$6.079M was spent on upgrades in support of revenue growth, product quality maintenance, customer service and delivery. Investments were also made in computer hardware and information technology in support of our digital transformation strategy to create more efficient ways of working.

In 2021, CBG’s deepened its support of both community and country. We remain committed to the long-term health of the communities in which we operate and where our employees live and work. Amidst one of the worst humanitarian and economic crises of our time, we worked to address multiple challenges unfolding in our communities by supporting health workers and non-profit organizations by providing refreshments and hand sanitizers among other much needed items.

As the country and world begin to return to a sense of normality, we are eager to continue supporting various sport and cultural events and education programmes within the communities.

We are dedicated to being a sustainable business by striving to do business in a financially, environmentally, and socially responsible way. The need to reduce the impact on the environment has never been more urgent and CBG continues to strive to reduce energy demand, minimizing waste sent to the landfill and reduce our carbon footprint. Our vision remains to be a Company where the sustainable use of resources and environmental issues are GOVERNANCE AND COMPLIANCE

CBG is committed to conducting business with integrity and honesty, in accordance with the highest ethical standards and in full compliance with the law. Everyone at CBG is responsible for the prevention of all forms of bribery, corruption, fraud and to perform business in accordance with the highest standards of ethical behavior at all times. We give high priority to compliance, ethics and governance and are mindful of our responsibility to promote the long-term interest of the company for all our stakeholders.

REPORT

Strong personal and collective ownership is critical for ensuring the accuracy of information we produce, driving improvements and holding ourselves accountable for our actions.

The Board is confident that there are sufficient processes and internal systems of control to fully meet its obligations together with appropriate systems and processes in place to allow it to identify, manage, mitigate, and review its risks. The strength of our Board drives and delivers our ambitions for improved performance through its leadership capabilities, transparency and governance arrangements. We uphold the highest standards of transparency and openness in performing our functions and dealing with all stakeholders.

CBG has access to a wide range of experts who provide advice and support when needed. Our internal audit function provides assurance, primarily within internal controls of financial processes, IT security and business ethics. We are committed to ensuring the accuracy of our reports. In addition to internal audit, our financial reporting and internal controls of financial reporting processes are audited by an independent audit firm elected at the Annual Meeting of Shareholders. This report, together with the annual financial statements are thoroughly analyzed by the Audit Committee.

HEALTH AND SAFETY COMPLIANCE

As we endured the biggest global health challenge of our generation, CBG remained unwavering in its fight against the pandemic, focusing on reducing the risk of Covid-19 in the workplace. CBG like most companies, was impacted by the Covid pandemic and we were mindful of the strain this placed on the health and wellbeing of our employees. We are extremely grateful for the continued resilience and commitment of our employees who have kept their focus firmly on serving our customers and ensuring business continuity and growth. All COVID-19 protocols continued to be enforced and free testing was provided to employees. Employees who tested positive for COVID-19 were closely monitored on a daily basis by both our HSE teams and qualified medical professionals. We continue to view vaccination as the best way to preserve lives and livelihoods and through various initiatives ensured that our employees had accurate and easy access to information about the benefits of vaccines.

A company can only be successful in the longterm if it ensures that its employees remain healthy. At CBG, we address not only safe operations of machines and vehicles, but also mental health issues including stress, depression, emotional and financial wellbeing. During 2021 we intensified our focus on mental health, through our Employee Assistance Programme (EAP) which is confidential, manned by trained personnel and is free of charge for each employee and their immediate family.

CBG adheres to the highest health and safety standards in the workplace. Safety audits are performed continuously, and corrective actions are taken immediately. Employees are encouraged to report unsafe conditions and behaviours (UC-UB) to foster a culture of safety.

HUMAN RESOURCE

A CBG, we believe that developing talent is paramount to building a flexible and agile organization. In support of this, employees were empowered through training in advanced Human Resource techniques, leadership and management skills, data analysis and digital transformation, brewing and quality assurance. Additional training was completed in customer service, marketing and electronics and instrumentation, equipping employees with the need competencies to maximize value creation.

As a Board we are committed to ensuring strong diversity and having the right competences to meet future challenges by unlocking the full potential of our people through investment in talent and capabilities. We support, attract, and retain high-performing employees who fit our positive, can-do culture, are committed to serving the community, and upholding our Company’s values. We do this by providing competitive, equitable benefits; resources for personal and professional development; and set high expectations for high ethical conduct so that employees can be successful in their work - and enjoy doing it.

CONCLUSION

While we are pleased with these results and the overall strength of our business, the external environment continues to be volatile and difficult to predict. We remain cognizant of the many challenges we will face. Raw material and freight costs have risen sharply and continue to rise due to increased supply chain disruptions. While the near term will be challenging, we are moving forward focused on our integrated strategy and our immediate priorities to grow even in the face of the current difficulties. The ongoing unrest in Europe has created a new period of uncertainty about the global economy as inflationary pressures worsen due to increases in world energy markets.

In 2022, the Company will focus on value creation through accelerated organic growth driven by portfolio expansion in the year we refer to as “The Year of Innovation”. We will concentrate on revitalizing and renewing our Lagers while innovating and exploring beyond beer. For instance, we will expand into low calorie “light” beer, launching Carib Pilsner Light to capture this growing market segment. Outside of the beer category, CBG will also enter the tonic wine segment with the introduction of its brand, Rockstone, while both the Hard Cider and Indian Pale Ale portfolios will be expanded with the launch of new variants. We will focus on deepening our presence in the OECS territory through increased activity in our existing as well as new export markets.

To facilitate these expansions and in keeping with our value creation strategy, significant capital investment will be made in plant and equipment to increase production capacity and enhance export. This investment will be headlined by the installation of a new Bottle Washer, Boiler and Filter Plant.

We will continue our focus on improving employee engagement and investing in strengthening our human resource capital with high quality training programmes and

REPORT

by filling vacancies in key technical and commercial positions.

It has been a great privilege and honour for me to be part of the growth and development of the Company. I would like to thank my fellow directors for their counsel, commitment, and valuable guidance during this past year, which has been exceptionally challenging. I am also grateful to our many partners, customers and stakeholders for their support and confidence in CBG as we navigated these uncharted waters. To our valued shareholders, I extend a heartfelt thank you for your confidence in us during these most turbulent times. Finally, my appreciation goes to our dedicated employees for their hard work, focus and resilience. These results would not have been possible without you. While the global economic outlook remains uncertain, we have a clear vision of the future we want to create, generating value for our shareholders and other stakeholders. We have a strong Company which is well placed to deliver sustainable growth for many years.

In closing, I am hopeful that our Annual Shareholders Meeting this year will be back to normal, an open face to face meeting, and I look forward to meeting as many of you who can attend.

ANTHONY N. SABGA III CHAIRMAN CHAIRMAN CHAIRMAN CHAIRMAN CHAIRMAN

INFORMATION

BOARD OF DIRECTORS

Mr. Anthony N. Sabga III - Chairman Mr. Peter Hall - Beverage Sector Head Mr. Ron Antoine - Managing Director Mrs. Aldyn Henry-Bishop - Financial Comptroller/Company Secretary Mr. Andrew Bierzynski - Chairman of Audit Committee Mr. Mark Wilkin Mr. Averne Pantin Mr. Adrian Sabga Mr. Akash Ragbir

AUDIT COMMITTEE

Mr. Andrew Bierzynski - Chairman Mr. Ron Antoine Mr. Averne Pantin

SECRETARY/FINANCIAL COMPTROLLER

Mrs. Aldyn Henry-Bishop - Bsc. (Hons), FCCA, MBA

REGISTERED OFFICE

Grand Anse, St. George’s, Grenada, West Indies.

AUDITORS

PKF Accountants and Business Advisers Grand Anse, St. George’s, Grenada.

BANKERS

CIBC FirstCaribbean International Bank (Barbados) Limited Church Street, St. George’s, Grenada.

RBTT Bank (Grenada) Limited Grand Anse, St. George’s, Grenada.

SOLICITORS

Mitchell & Co. Units 14-16 Excel Plaza Grand Anse, St. George’s Grenada.

REGISTRARS AND TRANSFER OFFICE

Aldyn Henry-Bishop, Company Secretary Carib Brewery (Grenada) Limited Grand Anse, St. George’s Grenada.

OF THE DIRECTORS

The Directors have pleasure in presenting their Report to the Members together with the Financial Statements for the year ended December 31, 2021.

RESULTS FOR THE YEAR 2021

Income Attributable to Shareholders of the Company Deduct:

Dividends Paid (2020 Final) 85 cents per share Retained Income for the Year

Retained Earnings (b/f as previously reported Other Movements in Retained Earnings (Note 26) Balance as at December 31st 2021 $000 8,311

(3,532) 4,779

39,870 (317) 44,332

Subsequent to year end, a dividend of $1.00 per share in respect of 2021 was declared by the Directors. Additionally, a special dividend of $1.00 per share was also declared by the Directors. These would be paid on May 23rd 2022 to Shareholders on the Register of Ordinary Members on May 3rd 2022.

DIRECTORS DIRECTORS DIRECTORS DIRECTORS DIRECTORS

The Directors listed on page 3 served during the year.

In accordance with By-Law No 1 Section 4.5, Mr. Andrew Bierzynski and Mr. Averne Pantin are the Directors retiring by rotation and being eligible, offer themselves for re-election.

AUDITORS AUDITORS AUDITORS AUDITORS AUDITORS

The Auditors Messrs. PKF Accountants and Business Advisers retire and being eligible, offer themselves for re-appointment at a fee to be agreed with the Directors.

Shares According to the Company’s Register, the interests of the Directors on the dates indicated are as follows:

Mr. Andrew Bierzynski Mrs. Aldyn Henry-Bishop Mr. Ron Antoine Shares (31.12. 2021) 134,130 1,560 11,250

The following companies held more than 5% of the stated capital of the Company: ANSA McAL 2,307,068 National Insurance Board 389,336

On behalf of the Board

Aldyn Henry-Bishop Company Secretary April 18th, 2022

OF ANNUAL MEETING OF SHAREHOLDERS

Carib Brewery (Grenada) Limited (“the Company”) wishes to advise its shareholders that the Sixty-Second Annual Meeting of the Company will be held at the Grenada Room, Radisson Grenada Beach Resort, St. George’s on Monday 23rd May, 2022 from 4.30 pm.

The meeting is being held for the following purposes:

Or Or Or Or Or d d d d d inary Business inary Business inary Business inary Business inary Business 1. To receive the Audited Financial Statements for the year ended December 31st, 2021 and the Reports of the Directors and Auditors thereon. 2. To re-elect Directors.

3. To re-appoint Auditors and authorize the Directors to fix their remuneration.

ALL shareholders are required to follow Radisson Grenada’s established COVID-19 protocols and any other protocols that may be in effect at the time of the meeting.

The 2021 Annual Report can be viewed electronically at www.ansamcal.com.

Dated this 18th day of April, 2022

Aldyn Henry-Bishop Company Secretary Notes: Notes: Notes: Notes: Notes:

1. In accordance with Section 108 (1) and (2) of the Company Act #35 of 1994, the Directors have fixed May 3rd, 2022 as the record date for determining the Shareholders who are entitled to receive dividend payments for the period ending December 31st 2021 and notice of the Annual Meeting for the period ended December 31st 2021. Only

Shareholders on record at the close of business on May 3rd, 2022 are therefore entitled to receive such. A list of such Shareholders will be available for examination by the

Shareholders at the Company’s Registered Office during usual business hours and at the Annual Meeting.

2. A Shareholder entitled to attend the Annual Meeting and vote is entitled to appoint one or more proxies to attend and vote instead of him/her; a proxy need not be a

Shareholder. Attached is a Proxy Form for your convenience which must be completed and signed in accordance with the Notes on the Proxy Form and then deposited with the Company Secretary at the Registered Office of the Company no later than 48 hours before the time appointed for holding the meeting.

3. The Transfer Books and Register of members will be closed from May 3rd - 23rd 2022, inclusive.

Net Sales Revenues 2017 2018 2019 2020 2021 2021 2021 2021 2021

51,987 58,629 64,430 58,323 61,265 61,265 61,265 61,265 61,265

Profit Before Exceptional Items & Tax 12,343 13,869 13,662 9,785 11,390 11,390 11,390 11,390 11,390

Income Attributable to Shareholders 8,775 9,621 9,837 7,097 8,311 8,311 8,311 8,311 8,311

Earnings per share $2.11 $2.32 $2.37 $1.71 2.00 2.00 2.00 2.00 2.00

Dividends Amount - Ordinary $1.06 $1.16 $1.18 $0.85 1.00 1.00 1.00 1.00 1.00

Cash 16,115 17,009 14,811 20,284 28,366 28,366 28,366 28,366 28,366

AUDITOR’S REPORT

Carib Brewery (Grenada) Limited (formerly Grenada Breweries Limited) Carib Brewery (Grenada) Limited (formerly Grenada Breweries Limited) Carib Brewery (Grenada) Limited (formerly Grenada Breweries Limited) Carib Brewery (Grenada) Limited (formerly Grenada Breweries Limited) Carib Brewery (Grenada) Limited (formerly Grenada Breweries Limited)

Pannell House P.O. Box 1798 Grand Anse St. George’s Grenada West Indies Tel (473) 440-2562/3014/2127/0414 Fax (473) 440-6750 Email pkf@Spiceisle.com Accountants & business advisers

IIII INDEPENDENT AUDITOR’S REPORT TO THE SHAREHOLDERS OF NDEPENDENT AUDITOR’S REPORT TO THE SHAREHOLDERS OF NDEPENDENT AUDITOR’S REPORT TO THE SHAREHOLDERS OF NDEPENDENT AUDITOR’S REPORT TO THE SHAREHOLDERS OF NDEPENDENT AUDITOR’S REPORT TO THE SHAREHOLDERS OF

CARIB BREWERY (GRENADA) LIMITED CARIB BREWERY (GRENADA) LIMITED CARIB BREWERY (GRENADA) LIMITED CARIB BREWERY (GRENADA) LIMITED CARIB BREWERY (GRENADA) LIMITED (FORMERLY GRENADA BREWERIES LIMITED) (FORMERLY GRENADA BREWERIES LIMITED) (FORMERLY GRENADA BREWERIES LIMITED) (FORMERLY GRENADA BREWERIES LIMITED) (FORMERLY GRENADA BREWERIES LIMITED)

Report on t Report on t Report on t Report on t Report on t he Aud he Aud he Aud he Aud he Aud it of t it of t it of t it of t it of t he Financial Statements he Financial Statements he Financial Statements he Financial Statements he Financial Statements

Opinion Opinion Opinion Opinion Opinion We have audited the financial statements of Carib Brewery (Grenada) Limited (formerly Grenada Breweries Limited) (‘the Company’) which comprise the statement of financial position as at 31st December, 2021, and the statement of comprehensive income, statement of changes in equity and the statement of cash flows for the year then ended and notes to the financial statements, including a summary of significant accounting policies.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company as at 31st December, 2021 and its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards (“IFRSs”).

Basis for Opinion Basis for Opinion Basis for Opinion Basis for Opinion Basis for Opinion We conducted our audit in accordance with International Standards on Auditing (“ISAs”). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Company in accordance with the ethical requirements that are relevant to our audit of the financial statements in Grenada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Ot Ot Ot Ot Ot her infor her infor her infor her infor her infor mat mat mat mat mat ion included in t ion included in t ion included in t ion included in t ion included in t he Company’ he Company’ he Company’ he Company’ he Company’s 2021 Annual Report s 2021 Annual Report s 2021 Annual Report s 2021 Annual Report s 2021 Annual Report Other information consists of the information included in the Company’s 2021 Annual Report, other than the financial statements and our auditor’s report thereon. Management is responsible for the other information.