Many renters dream about eventually owning their own home. There can be many perks to becoming a homeowner—from having more control over your space to building equity and potentially benefiting from rising home values. But it also might be one of the biggest financial commitments you’ll ever make, and it’s not the right move in every situation.

Read on for key questions to consider as you’re weighing this momentous decision. 1

Are you truly in a financial position to buy?

If buying overstretches your finances, you might be less able to cope with a financial emergency or save for other important goals like retirement. Plus, an inadequate down payment or subpar credit score might leave you at a disadvantage if you’re trying to get an offer accepted in today’s competitive buying market.

The relevant aspects of your finances include:

• Your income: If you don’t have stable, sufficient income, it might not be the right time.

• Your down payment: Remember that you typically need a down payment of at least 20 percent to avoid paying for private mortgage insurance (which protects your lender if you’re unable to make your mortgage payments).

• Your credit score: Without solid credit, you might not qualify for a favorable mortgage rate or even be approved for a loan in the first place.

• Your other debts: One guideline is that your total monthly debt payments

shouldn’t exceed 36 percent of your pretax income. If you have other debt, there may be less room in your finances for mortgage payments. 2

Will you stay for at least a few years?

When you buy, you’ll face a boatload of one-time expenses, like broker fees, mortgage origination fees, and title insurance. The longer you stay put, the more time you have to spread out those costs and for your home to potentially rise in value.

If you’re planning to stay less than three years, it likely doesn’t make financial sense to buy. Staying less than two years can come with particular tax disadvantages, because you generally won’t qualify for a capital gains tax exclusion. This means you’ll owe capital gains tax on the full amount of any increase in your home’s value.

3

The price-to-rent ratio: Take a monthly rent figure and multiply it by 12, so it’s an annual number. Divide the purchase price of a similar property by that annual rent number. A ratio greater than 20 generally weighs in favor of renting, while a figure less than 20 generally favors buying.

4

Which offers better value in your area?

You might assume buying is a better value because it lets you build equity in a home. But that may not be the case if rents are low relative to purchase prices in your area.

In any comparison, first make sure you’re looking at similar properties in the same area (i.e., don’t weigh renting your city studio against buying that country cottage).

Would you still want to buy if your home’s value doesn’t rise?

Although home prices have historically risen over long periods, there’s no guarantee that they will in any given time frame or in any particular area. Plus, what matters for you will be the value of your specific property, which can be influenced by everything from the local economy to whether your neighbors take good care of their lawns.

Think about how you’d feel if your home’s value didn’t budge in more than 10 years or didn’t rise as much as inflation. If you buy, you’ll need to accept the possibility that your home won’t be a great investment.

5 What does your heart say?

Buying a home isn’t just a financial transaction. It’s also a source of added responsibility, and for many people, pride and satisfaction. You want to make a decision that you can feel good about years down the line.

Ask yourself if you feel ready for the level of commitment that owning a home entails. If being on the hook when the basement floods or the roof leaks terrifies you, it could be you’re not quite there yet. On the other hand, if you know you want to put down more permanent roots, then you might be ready to take the next step.

Ultimately, the numbers can help you decide, but they can’t decide for you.

Looking to bring your homeownership dreams closer to reality? Consider setting up a savings goal to help you build your down payment or learn more about the steps in the homebuying process.

—Fidelity Investments

We all feel re-energized with the onset of spring. Seeing the emergence of new life blossoming from the ground and the promise of possibilities to start anew. A wonderful way to evoke these feelings is to refresh your home. There are so many ways to accomplish this with minimal spending and time-consuming projects.

Trade out your textiles. Change your window treatments with soft airy materials like cottons, linens and sheer organza. Swap out an area rug or add a layer to your existing one. Opt for a sisal for earthy texture or introduce a new palette or theme to transform your space. Sky blues, minty greens, sunny yellows and warm whites and creams will usher in spring simply and effortlessly.

Your bedroom is your sanctuary and should be calm, serene and peaceful. Swap out your heavy comforter for a lighter new duvet cover or coverlet. Combine whites, tone-on-tones, and crisp linens and soft cottons for a light airy feel. Add some neutral wovens or a pretty pale spring color for subtle unexpected contrast.

Try to repeat one color throughout the house to create continuity and harmony. Try adding an unexpected pop of color to liven up your home. Be bold. Spring is a

wonderful opportunity to explore different styles, textures, and colors.

Accessorize. You’ll be amazed at how easy, simple changes can work wonders in transitioning your home from season to season. Artwork, trays, pillows and throws in softer, lightweight fabrics and color can bring big results. Scented candles, soaps and diffusers in citrusy, floral, eucalyptus and lavender scents will immediately let you know spring is in the air, and will uplift your spirits every time you walk through your front door.

Bring on the greenery. Plants, flowers, earthy textures and organic materials bring the outside in. Add some fresh flowers in a pretty vase or ceramic pitcher and pop ferns in a rattan vessel or basket. Don’t have a green thumb or often forget to refresh the flowers? No worries, add a mix of faux flowers. (No one will ever know.)

Spruce up your outdoor space or deck by

adding a console cart with pretty colored barware and floral accents. Change the fabric on your furniture cushions or better yet just add some fresh new pillows and accessories to freshen your space.

Don’t forget your front door entrance. Add an inviting and welcoming feeling for your guests with a springtime wreath of forsythia and pussy willow on your front door. Add additional pops of color with

daffodils and tulips in a pot or little wood wagon that you can swap out when the heat sets in. If there’s some room, put a small seat or bench on your porch so you and your friends can visit outside and enjoy the fresh spring and summer air.

Kristine Pugach is an interior designer for Safavieh Home Furnishings Glen Cove.

Tucked neatly approximately five blocks off Camp Avenue in North Merrick, on Central Avenue, are the remnants of “Tiny Town,” once a Methodist church campground in the mid-1800s.

In the 1860s Methodist churchgoers from around the state congregated in Merrick each year. The campgrounds attracted about 300 worshipers, but it was noted that some of the meetings were attended by up to 10,000 Methodists during the annual summer revivals.

The circular streets of Fletcher and Asbury avenues were designed to host the church in the center of the campsite. In the earlier years, it was noted by some historians that the pie-shaped lots were tented and caravan campsites which eventually evolved into permanent little structured cottages.

Today, the area is known as “Tiny Town,” although very few of the original tiny homes remain. Old timers simply call it “the campgrounds.”

The handful of remaining tiny cottages are quaint and charming and are merely feet from the street’s edge, but blink and you are sure to miss these pint-sized treasures.

The streets are terribly narrow, not suitable for inconspicuous sightseeing. You are better off parking on one of the outer circles and taking a respectable stroll through to truly appreciate the historic value and character of these once-religious celebratory grounds.

Homeowners 62 and older saw their housing wealth grow by 1.95 percent or $226 billion in the third quarter to a record $11.81 trillion from Q2 2022, according to the latest quarterly release of the National Reverse Mortgage Lenders Association (NRMLA)/ RiskSpan Reverse Mortgage Market Index (RMMI).

The RMMI rose in Q3 2022 to 413.22, another all-time high since the index was first published in 2000. The increase in older homeowners’ wealth was mainly driven by an estimated 1.95 percent or $268 billion increase in home values, offset by a 1.93 percent or $42 billion increase in senior-held mortgage debt.

“Multiple studies published over the past couple of years highlight the challenges faced by women to save for retirement because of competing priorities, such as caring for children or an aging parent or relative,” said NRMLA President Steve Irwin. “Nevertheless, they own a substantial asset, their home. Therefore, when meeting with a financial planner, or other trusted advisor, it’s very important to consider home equity as a strategic asset that can be used to help enhance retirement security.”

Reverse mortgages are available to homeowners who are 62 and older with significant home equity. They are a versatile financial tool that seniors can use to borrow against the equity in their home without having to make monthly principal or interest payments as with a traditional “forward” mortgage or a home equity loan. Under a reverse mortgage, funds are advanced to the borrower and interest accrues, but the outstanding balance is not due until the last borrower leaves the home, sells or passes away.

To date, more than 1.3 million households have utilized an FHA-insured reverse mortgage to help meet their financial needs. For more information, visit www. ReverseMortgage.org

While some New Yorkers are currently feeling those first false spring feels, others are staring out into a frozen, snow-covered backyard. Either way, it can be hard to imagine your landscape in full bloom during these days, but spring will be here soon enough.

There are several essential steps to take in your garden in the winter months to make sure that you have optimal conditions once the planting season comes around. Take the following steps in the wintertime to ensure you have a beautiful, lush spring garden.

These things are always better to complete in the fall before the first freeze, but if you haven’t done them yet, it’s better to tackle them now than never.

Remove dead or diseased parts of plants to prevent further decay, which also prevents pests from staying around and encourages new growth for spring.

If the soil isn’t frozen in your local area, test the pH to determine if you need to amend the soil with acidic- or alkaline-building materials. Limestone additives help neutralize acidic soil while adding compost helps balance alkaline soil. Since soil pH can take time

to adjust, starting in the winter is ideal.

Cover cold-sensitive plants with mulch, plant cones, or burlap wraps.

Take inventory of garden tools and equipment. Ensure all your tools are clean and organized and take your existing tools to be repaired or replaced. The lawnmower repair shops are generally much less busy this time of year, so turnaround times are much quicker.

Be prepared for freezes. Even though it may feel in some parts of New York that we may never feel the freeze, we will likely still have more nights of frost. Ensure the irrigation system is drained and turned off to prevent extensive damage. Remove the hose from the spigot and store hoses and sprinklers in a dry area. Stock up on garden tarps to cover any plants that need additional protection from the cold or wind.

Use this time to plan for spring. Meet with your landscape architect or gardener, or start researching what plants you’re hoping to make room for to enhance your

garden. Price out any equipment you may need, and visit your local nursery to make connections and discuss options for the coming spring.

With springtime approaching, plant hardier plants indoors and prepare to transfer them outdoors to the ground once the threat of frost has turned to an

assured thaw in early spring.

Maintaining your garden during winter months will make you feel like you’re ahead of the game when the spring gardening season rolls around, and will help you maintain your feeling of being an attentive and thoughtful homeowner.

—One Key MLS

Unpredictable winter weather like we’ve been having can feel gloomy and gray. One minute the sun is shining, and the next minute an icy rain is clattering on the roof. Many people need a little something to lift their mood and spirits. This is where flowering house plants—a colorful addition to any home—can help. Indoor plants help regulate humidity and increase positive feelings. They also improve concentration and productivity, enough to reduce stress levels and help boost your mood.

Research has shown that indoor plants are good for your health. They release oxygen and absorb carbon dioxide, freshening the air and eliminating harmful toxins, making them a wonderful addition to your home and workspace. Here are a few indoor flowering plants that are easy to find and easy to care for. If you have curious pets, do your research on the potential dangers and make sure that these plants are out of

reach. Many houseplants are toxic for pets to ingest.

1. African Violets

One of the most satisfactory flowering plants, this compact plant featuring attractive dark green leaves bears lovely little flowers just above its foliage. With

just enough watering to keep the soil moist, they flower almost always continuously and do well in diffuse natural light.

2. Orchids

Among the most popular indoor flowering plants, the many available orchid hybrids are easy to grow and will reward you with gorgeous flowers under most home or office conditions with little but consistent watering.

3. Anthurium

Also known as laceleaf, this common indoor flowering plant is known for its tall, brightly colored, long-lasting flowers and shiny, ornamental leaves. They do best with a bit of indirect light and consistently moist soil.

4. Oxalis

This dramatic, low-growing plant, featuring spritely bouquets of white flowers and vibrant purple leaves, is fun to grow and to keep an eye on because the blooms open and close in response to light.

5. Bromeliad

This colorful tropical plant is slow-growing and needs bright, indirect sunlight to thrive. Once established, however, it can grow to be very tall and provide beachy vibes, reminding you of warm climates.

Improve your winter mood and liven up your home with plants that flower all year round.

—One Key MLS

National Safe Digging Month has begun, and PSEG Long Island takes the occasion to remind customers, contractors and excavators to always call 811 before digging to ensure underground pipelines, conduits, wires and cables are properly marked out.

Every digging project, even a small project like planting a tree or building a deck, requires a call to 811. It’s the law. The call is free and the mark-out service is free. The call must be made whether the job is being performed by a professional or a do-it-yourselfer. Striking an underground electrical line can cause serious injury and outages, and result in repair costs and fines.

“Spring’s warmer temperatures make it a perfect time for starting improvements to our homes and businesses. Calling 811 ahead of time helps protect underground utility lines and, more importantly, the safety of anyone digging,” said Michael Sullivan, PSEG Long Island’s vice president of transmission and distribution operations. “We are glad to see that our customers are getting the message. Last year there were more than 240,000 mark-out requests in our service area, and so far this year, there have been more than 48,000 requests to 811.”

According to Common Ground Alliance, a member-driven association of nearly 1,800 individuals and 250 member companies in every facet of the underground utility industry, 40 percent of active diggers in North America do not call 811 because they think their project is too shallow to require it. All digging projects require a call to 811.

A free call to 811 in the service area automatically connects the caller to the local New York one-call center, which collects information about digging projects. The one-call center then provides the information to the utility companies, which send representatives to mark the locations of nearby underground lines with flags, paint or both. Once lines have been properly marked and confirmation from all of the utility owners is received, projects may proceed as long as caution is used around the marked areas.

• Calling 811 before digging reduces the chances of damaging an underground line to less than one percent.

• Underground gas and electric lines are everywhere, even on private properties. These facilities can be easily damaged if dug into, with the potential to cause serious injuries. Digging into these lines can also disrupt vital utility services, resulting

in costly delays, expensive repairs and environmental or property damage.

• Whether the job is a major home improvement project or something as simple as a fence or mailbox post, a call to 811 must be placed beforehand to determine where it’s safe to dig.

• Call 811 at least two business days before the commencement of each job to have underground pipes, wires and equipment located. Each facility owner must respond by providing the excavator with a positive confirmation indicating that marks are in place where utility lines are buried or that there are no existing facilities in the area of the proposed work. This service is free of charge.

• Be sure to wait until all of the utilities have responded. Don’t dig until lines have been marked or you have received confirmation that the area is clear of facilities.

• Property owners must maintain and respect the marks. Always hand dig within two feet of marked lines to find the existing facilities before using mechanized equipment.

• If gas lines are damaged or there is a gas smell when excavating, call 911 immediately from a safe area.

Calling before you dig is more than a good idea—it’s the law. Additional information, including a booklet on safe excavating practices and the protection of underground facilities, can be found on the PSEG Long Island website (www.psegliny.com).

380 Chestnut Drive, East Hills .......................Pending (both sides)

12 Beechwood Drive, East Hills .....................Pending 165 Elm Drive, East Hills ....................................Pending, Off Market, (both sides)

Parcel A, Remsens Road, Muttontown .......Pending 151 Milburn Drive, East Hills ..............................Pending 73 Tara Drive, East Hills .....................................Pending 105 Stratford S, Roslyn Heights ......................Pending

The bathroom might be the smallest room in a house, but it’s one of the most complex to remodel. After all, most bathtubs won’t fit through a finished doorway. Yet, by taking a few simple steps upfront, homeowners can set up their bathroom for a straightforward remodel that will get done on time and under budget. Check off these five essential steps before starting.

A savvy first step for any home renovation project is figuring out how much to spend. For most projects, the budget will be a range to accommodate unknown situations and unexpected costs that are inevitable. When building the budget, plan for essential materials, like bathroom flooring, fixtures, and any eco-friendly upgrades, but be sure to leave space for labor if a contractor will help complete the job.

Keep in mind that having a smaller budget doesn’t mean homeowners can’t tick off all the items on their list. It just might mean there’s extra room for creativity and plenty of opportunities to DIY.

When planning a remodel, decide what’s the priority. For example, if a bathroom remodel is intended to create a space for an aging relative, a full renovation may be in order. However, sometimes simple fixes can freshen up a space with much less effort.

For example, do the bathroom walls need shiplap or could a fresh coat of paint do just as well? And is a brand new clawfoot tub absolutely critical or will refinishing the current bathtub at a much lower price suffice? Remember, remodels can always be a mix of big and small changes, and not everything in the space needs to be wow-worthy.

DIY renovations can save a lot of money. However, if done incorrectly, DIY can become costly later on. For example, refinishing a tub usually costs about $500 for a professional, while a DIY bathtub refinishing kit is a fraction of the cost. However, a professional can offer a better paint job, a nonslip finish, and a warranty. On the other hand, tasks like installing a new faucet or vanity are quick and simple to handle without a pro.

Homeowners should think about the primary person who will be using the space. Whether that’s a small child or older adult with mobility issues may warrant choosing different materials. Features like stain resistance or anti-slip could better accommodate certain groups. Then, if specialty materials are needed, plan to put them where they matter most, like flooring and lower fixtures.

A reasonable plan and timeline can help homeowners frame a remodel realistically. Before embarking on any remodel, think through the renovation from A to Z. Start with obvious issues, such as large objects that should be removed from the bathroom, and what materials to order. Then, figure out what tasks need to be completed and how long each one will take. Having a plan in place is the best way to set practical expectations and keep the project moving forward. It may also help head off any bathroom remodel surprises that have a way of cropping up.

—National Association of Realtors

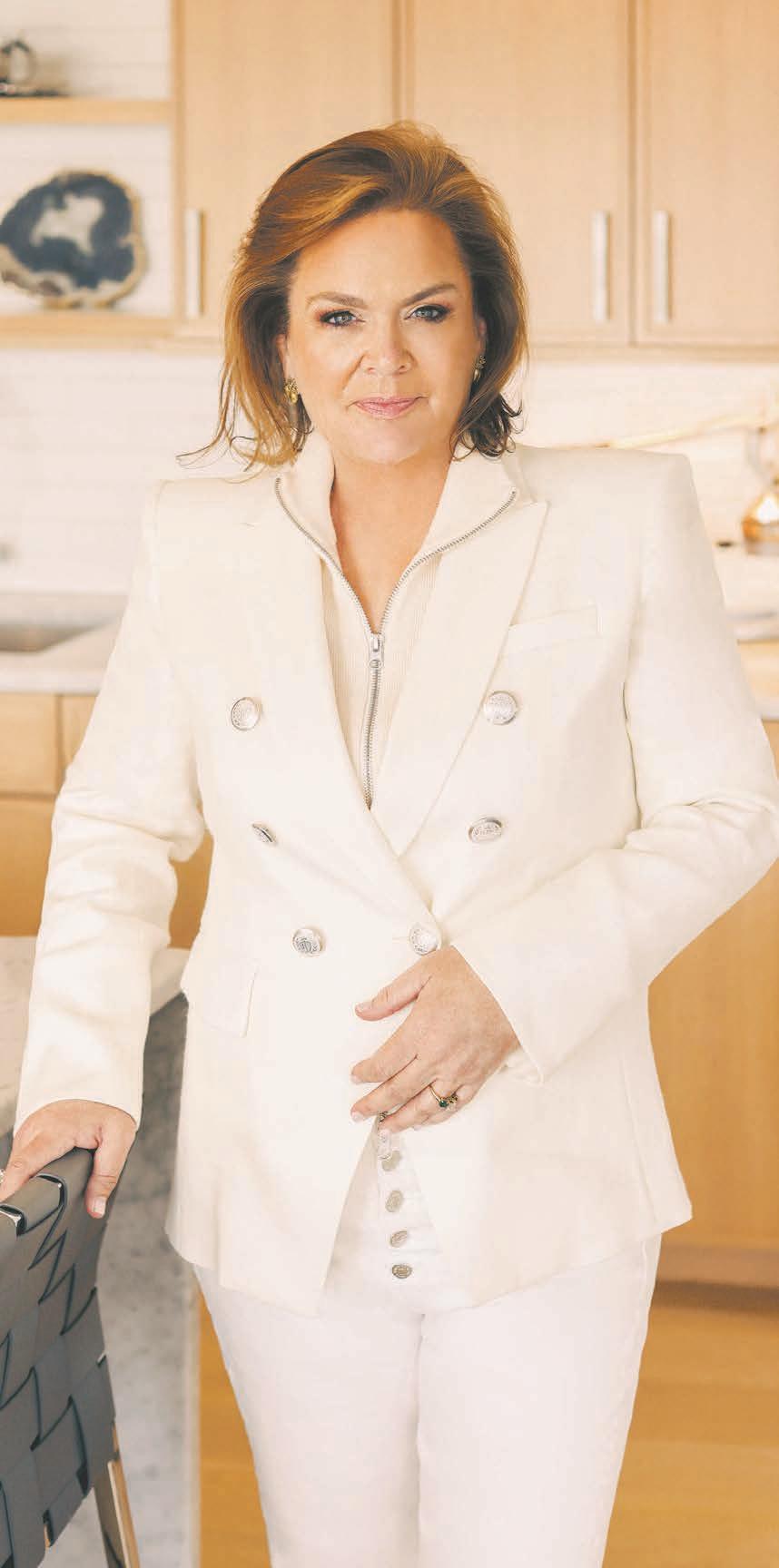

What I do is so much more to me than just selling a home. I have truly found my passion in life and have been very grateful to be able to love the work I do. I hold my clients and customers in the highest regard and make it my mission to surpass their expectations by providing top level service at every price point.

I understand that your home is one of your most valuable assets and I take that responsibility with the greatest sincerity. Great communication, honesty, integrity, and the ability to put my clients at ease - to take the worry and stress out of the equation - is what I aim to do.

Treating your home as if it were my own is the mantra I always live by. I look forward to each and every home I represent and make it my mission to make your home stand out above the rest.

Beth Beth Catrone

Beth Beth Catrone

Associate Real Estate Broker | Gold Circle of Excellence

Associate Real Estate Broker | Gold Circle of Excellence

516.883.2900, c.516.647.1729 | bethcatrone@danielgale.com

PATRICIA SANTELLA Gold Award RACHEL SHA Gold Award LORI SHEEHAN Gold Award

DIANE ANDERSEN #4 Rental Agent by GCI #3 Agent for Rental Transactions Presidents Circle Award

THE LUCIANO STALZER TEAM Presidents Circle Award

MADELINE MORITZ Presidents Circle Award

MARIA ARDUINI Presidents Circle Award TONG TONG (POLLY) CHEUNG Presidents Circle Award

MOLLIE GROSSMAN Presidents Circle Award

GABRIELLA ROTH-ZOFCHAK Presidents Circle Award

MARIA ROVEGNO Presidents Circle Award

MARIA SEREMETIS Presidents Circle Award RACHEL TABIBOV Presidents Circle Award

AILI TRACEY Presidents Circle Award

Howard Hanna Real Estate Services (HHRES) has announced that it will be joining forces with Coach Realtors, a strong, well-respected real estate firm based on Long Island, forming Howard Hanna | Coach Realtors.

“The partnership of two industry powerhouses will transform into even more amazing opportunities for our agents and clients,” said Howard “Hoby” Hanna IV, president of HHRES. “Our combined strength, talents and resources will be such an advantage in the industry.”

The two family-owned companies set up shop in the 1950s, with Howard Hanna opening its doors in Pittsburgh in 1957 and Coach Realtors opening its on Long Island in 1954. Since then, the two firms have developed from homegrown firms into heavy hitters in the national real estate market.

Over the last seven years, HHRES has grown its presence throughout New York and is now the largest real estate firm in the state by units sold. The merger will further strengthen HHRES’s position in the New York market.

“We are thrilled to join forces with Howard Hanna,” said Whitney Finn LaCosta, broker and owner of Coach Realtors. “We’re still the same Coach Realtors people have come to know and love, and you can expect the same top-quality service from our team. We

just have a stronger real estate network for our clients now.”

As part of the merger, Coach Realtors will retain its existing leadership and direction, and Finn LaCosta will be CEO of Howard Hanna | Coach Realtors.

Agents with Coach Realtors will gain access to Howard Hanna’s innovative buying and selling programs like Rate Reducer and Buy Before You Sell. They will also gain an expanded referral network, as the HHRES brand reaches across 13 states. The partnership will help extend the HHRES footprint across New York state and expand its growing network of more than 15,000 agents and staff.

Like HHRES, Coach Realtors has a strong presence in the luxury market, and the two companies look forward to pooling their resources to continue growing in this market. Currently, the Hanna Luxury program offers agents a variety of specialized tools to manage high-end listings.

“They’re a company that we share a lot of important values with,” said LP Finn, operating officer for Coach Realtors. “Their leadership team operates with integrity, and they’ve shown a commitment to do right by their employees and by their community

too.

The merger will combine the best of both companies to better support agents, buyers and sellers across their markets.

“This partnership allows us to take Coach Realtors to the next level,” said LaCosta. “I’m looking forward to working with

Nassau County reported a residential closed median sale price of $660,000 in January 2023, which is an increase of 1.50% from the reported figure of $650,000 in January 2022. There were 709 closed residential sales transactions and 652 pending transactions reported in January 2023, following 902 closed and 650 pending transactions reported in December 2022.

Suffolk County reported a residential closed median sale

price of $535,000 in January 2023, which represents a 2.90% increase from the $520,000 reported the prior year in January 2022. There were 894 closed sales transactions and 823 pending transactions reported in January 2023, following 1,215 closed and 914 pending transactions reported in the month prior.

The OneKey MLS Regional Area reported a closed median sale price of $575,000 in January 2023, representing an

increase of 1.80 percent as compared to the reported $565,000 in January 2022. Across the regional coverage area, there were 3,551 closed residential transactions, and 3,278 pending transactions, following the reported 4,363 closed and 3,469 pending the month prior. Visit www.onekeymls.com for the full report including comprehensive coverage of adjacent counties.

—Courtesy of One Key MLS

Howard Hanna and continuing our legacy of excellence.”

About Howard Hanna: The Hanna Family of Companies proudly provide real estate, title, insurance and mortgage services to clients across 13 states. Visit www. HowardHanna.com to learn more.

—Coach Realtors

While most investors start with stocks and bonds, there are any number of ways to invest money. As an investor’s skill and comfort level grows, they may find themselves branching out into additional types of asset classes. One popular investment: real estate. Here are three ways everyday investors can include real estate in their investment strategies.

Abusiness partner, or multiple business partners, can be ideal for investors who cannot afford an investment property on their own. It may also make sense for investors who fear that putting too much cash into a single investment might cause an imbalance in their portfolio, especially if the money used to buy a property represents a substantial share of their investable cash.

The process of buying a property with a business partner isn’t much more complex than purchasing one alone. However, investors who purchase property with a business partner will need to take the additional step of clarifying roles, responsibilities, and financial decision-making in the partnership. What happens if one partner wants to sell their share of the property? How will the property be managed? Does the business

need to be incorporated? If the property needs major renovations, how will those decisions be made? Investors buying real estate with partners will need to clarify those details, preferably in writing, before jumping into the market.

Unlike investors who purchase a rental property as part of a partnership, solo real estate investors have complete control over their business. This can work well for investors who have enough money to easily afford a property on their own, feel comfortable handling all financial and logistical aspects of their investment, and would like to have the final say in decisions about investment property.

Before buying on their own, investors should take an honest look at their skills. An investment property isn’t as passive as some would have you believe, and investors

shouldn’t go into the process thinking that owning a rental property will be a hands-off venture. Owning and renting out a property might require skills as diverse as repairs, maintenance, tenant relations, organization, marketing, money management, and tax preparation.

Even investors who don’t have the cash on hand to purchase a property outright can still take advantage of the real estate market by investing in REITs. REIT stands for Real Estate Investment Trust, a type of investment that buys and manages rental properties and pays dividends to shareholders based on the rental properties’ returns. REITs require much less cash up front than purchasing a property, and REIT investors don’t have to deal with the hassle of tenants or maintenance.

It’s also possible to buy real estate mutual funds and real estate ETFs, which are a collection of many different REITs, if you’re looking to diversify even more.

Before adding these funds to their

portfolios, buying a property alone, or investing with a business partner, potential real estate investors might find it helpful to talk to a financial advisor to see if they fit into their overall investment strategy.

Whether you are an industry pro or just breaking into the real estate and investing market, staying in-the-know will keep you at the top of the game. Check out some of these new titles.

1

or more per month in passive income with dividend yields of up to nine percent.

6

Wealth Without Cash

by Pace Morby

Creative deals are the fastest and cheapest way to supercharge your real estate investment portfolio, and Pace Morby—TV host of A&E’s Triple Digit Flip and a real estate investing influencer with more than a million followers—will guide you through these innovative strategies. From seller finance and subject-to, creative finance helped him acquire more than 1,000 properties and $150 million in assets without using his own cash.

2

SCALE by David M. Greene

Many real estate agents hit their stride only to realize that they became a slave to the business they worked so hard to build, but it doesn’t have to be this way. You can run an extremely profitable real estate business that is still highly enjoyable—you just need to understand the structure, system, and sequence of building a rock-solid team.

7

The Agent’s Edge by Jordan Cohen

Jordan Cohen started out selling entry-level houses in Southern California for more than 30 years ago, before transitioning to the luxury market. Always working alone as an individual agent without a partner or a team, he consistently sets new sales records year after year, including 2021 where he closed over $314 million in residential real estate.

3

Real Estate Rookie by Ashley Kehr

Your first investment property will no doubt be the hardest. Even choosing an investing strategy and coming up with a plan can seem impossible. Then you add in finding the right market, conducting property analysis, and the many facets of funding—and you’ve got yourself a classic case of analysis paralysis. At 26 years old, Ashley Kehr was deep in debt and working at a career she no longer loved. Now, less than a decade later, she manages a portfolio of more than 30 properties with complete financial freedom.

4

Apartment Alchemy by Lance A. Edwards

Apartment Alchemy lays out the recipes by which any multifamily owner can quickly boost the performance of their apartments. You’ll discover the Laws of Apartment Alchemy to predictably improve your cash flow and wealth, as well as make undoable deals doable. Proven in the field, these secrets are the game changer to the serious small apartment owner or syndicator.

5 REIT Investing for Beginners by Freeman Publications

This book will not only show you why REITs are the easiest way to leverage real estate investing.

You’ll also see how you can earn $1,000

The Insider’s Edge to Real Estate Investing by James Nelson

The real estate investment market is worth nearly $21 trillion, and almost half of the properties are purchased by individual investors. There’s space available for anyone who’s willing to play—and The Insider’s Edge to Real Estate Investing shows exactly how to get in the game and create lasting wealth.

8 The Optimum State Guide to Tax Liens and Deeds by George M. Howard, Jr.

Tax lien and deed investing are powerful ways to generate passive income but navigating the complex laws and regulations of each state can be a daunting task. That’s where this state-by-state guide comes in. Inside, you’ll find detailed information on the process of buying and investing in tax liens and deeds, including an overview of the legal and financial aspects of the investment.

9 The Art of Flipping Bricks by Douglas Parson, Jr.

Are you willing to sacrifice certain luxuries in your life for a while? If so, you too can become a professional brick flipper as well as a real estate mogul like myself. Turn your street dollars, brick dollars, exotic dancer dollars, and smoke dollars, and all that’s in between into bricks...that is real estate brick dollars.

10

Airbnb For Beginners by Simon Gold

Everyone’s signing up on Airbnb, not necessarily to travel or enjoy the experiences, but to make money. One of the best things about Airbnb is the endless opportunities to earn income. In fact, once you start listing on Airbnb, there’s no limit to how much you can earn from the platform. Think six-figure earnings or even higher. Once you start listing on Airbnb, you are only limited by your imagination. Airbnb is currently one of the best sources of passive income. The best thing about it is that you can start from anywhere, from as simple as listing your rental property to buying and renting out your own property.

—Descriptions and images courtesy of the respective publisher or Amazon. Compiled by Christy Hinko.

Morton J. Lemkau Moving and Storage has been moving Long Islanders since 1949 both locally and long distance. We have literally moved thousands of customers, and multi generations. The vast majority of our business has come from referrals from our loyal customer base.

Lemkau Moving is now in a larger o ce and truck yard, as our company has grown. We are conveniently located in Syosset, which allows us to better serve the Long Island community in our centralized location.

If you have not utilized our relocation and moving services in the past, we ask to consider us. We are an A+ Rated Accredited Better Business Bureau Member, and we have a Five Star review rating, which is posted on our website through ReviewStars.

We invite you to call us today for a free, no commitment in-house estimate. We’ll discuss all of your moving and relocation requirements and we’ll provide you with a detailed estimate. We’ll also provide you with some helpful information on preparing for your move, and being ready on your moving day.

• Free Home (In-House) Estimates

• Free Moving Preparedness Tip Sheet

Provided During Estimate

• Fully Licensed and Insured

• Local and Long Distance Moving

• Simple Hourly Rates For Local Moves

(DOT Registered)

• Long Distance Moves By Weight and Mileage

• Expert Boxing, Packing, Wrapping and Crating

• Free Delivery of Boxing and Packing Supplies w/Purchase

• Short and Long Term Storage

• In-House Moves

• POD/Storage Container Loading and Unloading

• Loading and Unloading of (DIY) Rental Trucks

• Frequent and Preferred Movers to North Shore Towers

• Expert Piano and Organ Movers

• Storage Facility Partnership Referrals

• Frequent Moves to Senior Living Facilities

• Frequent Moves To North Carolina

• Referred by Real Estate Agents

• Five Star Rated In Feedback and Reviews

• A+ Accredited Better Business Bureau Member

• Full Complimentary Consultation Services Upon Hire

Please call us at 516-333-1340.

In early January, Governor Kathy Hochul delivered her first State of the State Address, in which she announced her statewide strategy to address the housing crisis in New York. The proposal calls for 800,000 new homes to be built over the next decade and requires local participation to achieve housing growth in every community.

The New York Housing Compact is a multipronged strategy that includes removing obstacles to approvals and incentivizing construction. One part of the plan that sticks out to many Long Island residents is the plan’s requirement that local governments with MTA train stations must locally rezone for higher-density residential development.

According to New York State’s website, Governor Hochul’s plan “will require that localities with rail stations run by the MTA undertake a local rezoning or higher density multifamily development within half a mile of the station unless they already meet the density level. By expanding housing potential in these transit-oriented communities, more families will be able to enjoy improved access to jobs and thriving sustainable communities.”

For Long Island’s North Shore, where suburbia and proximity to the city are cherished, this housing plan makes residents and local officials worry. Places like the Town of North Hempstead and the Town of Oyster Bay pride themselves on having access to one of the largest LIRR branches on the island while maintaining their suburban neighborhoods.

Local officials have begun to speak out against Governor Hochul’s housing plan to save the North Shore’s suburban neighborhoods from becoming overpopulated.

Seven Long Island State Senators released statements regarding their disapproval of the housing plan. In the statement, the senators call for changes to be made so local government can have a voice in their community’s growth.

Senator Jack Martins (District 7) said: “The Governor’s proposal is nothing less than an existential threat to our way of life that cannot be overstated or ignored. Although we acknowledge that there is a housing crisis in New York, the Governor needs to understand that she cannot mandate, legislate or regulate her way through this. Nor can she expect our communities to sit idly by while bureaucrats in Albany demolish the pillars of our suburban quality of life. I urge the

Governor to turn away from this foolish and clumsy proposal, to work with our communities and local leaders to incentivize not just growth but smart growth. I know firsthand the power and innovation that local governments can bring to this issue without State interference. While Mayor of Mineola, we worked with the community to develop a master plan that allowed for transit-oriented, residential development around Mineola’s LIRR station. The result is over 1,000 units of housing built in Mineola over the past 10 years. Collaboration and shared best practices will work where this proposal will not.”

The Town of North Hempstead board recently sent a letter to Governor Hochul asking her to reconsider certain aspects of her proposal, “most notably the three percent new home growth over three years and transit-oriented local rezoning mandates.”

Those familiar with the Town of North Hempstead board know that for the past year, there has been a large divide between the democratic majority and the republican minority on the board, leading to public

disagreements. Partisanship has been pushed aside when it comes to Governor Hochul’s housing plan as all seven members of the board, including the Town Supervisor Jennifer DeSena, have signed the letter. Below is an excerpt from the Town of North Hempstead letter.

“Local governments must maintain a certain level of autonomy when it comes to appropriately preserving the suburban aesthetic of their communities. We are hopeful you will make appropriate modifications that allow for that. Our residents deserve to have a seat at the table, as they always have, and we are concerned that this new initiative, as currently constituted, may hinder our ability to work proactively and collaboratively with them.”

“It is my belief that development and zoning changes should be the decision of local municipalities,” said Glen Cove City Mayor Pamela Panzenbeck in a statement. “The New York Housing Compact requires local participation and seemingly will provide incentives to achieve housing growth in every community of the State! Municipalities with

MTA railroad stations will be required to rezone to allow for higher density residential development! Residential zoning change decisions will no longer be the decision of local governments but will be decided by Governor Hochul’s mandate! This will destroy our suburban way of life!”

Oyster Bay Town Supervisor Joseph Saladino stated in a release, “We must Save Our Suburbs from this ill-conceived plan as it would overcrowd classrooms, greatly increase traffic and cars parked on our streets, strain emergency services, and threaten the environment. Removing the rights of residents to have a say over the future of their communities is a direct threat to democracy, especially when you silence the voices of residents and replace their say over development projects with an unaccountable, bureaucratic board located hundreds of miles away in Albany. We call on all New Yorkers to stand with us in demanding that single-family zones remain intact throughout our State.”

BY JESSICA LAUTZ specialsections@antonmediagroup.com

BY JESSICA LAUTZ specialsections@antonmediagroup.com

Multi-generational home buying is a way for families to care for one another, support one another, and often buy a home that may have been previously out of reach. Multigenerational buying may be a home where families live in the same home with elderly parents, children who have boomeranged back home, or other extended family members. While this is not a new concept of living, it is one which has gained recent popularity.

This past year, NAR collected data in the Profile of Home Buyers and Sellers, which shows that multi-generational buying is back near an all-time high at 14 percent. This is up from 11 percent in the 2021 report. In 2020, the report found a low before the COVID-19 pandemic of 11 percent, followed by an immediate gain to 15 percent of all buyers. Reasons to purchase a multi-generational home vary among first-time and repeat buyers. However, the shares purchasing a multi-generational home are nearly identical: 15 percent of first-time buyers purchase a multi-generational home, as did 14 percent of repeat buyers. For first-time buyers, who struggled to enter last year’s housing market, perhaps it is unsurprising that they are more likely

to purchase a multi-generational home due to cost savings and for a larger home that multiple incomes could buy together. Firsttime buyers, who have a median age of 36, also are more likely to say their adult children have not yet left the nest. On the other hand, repeat buyers, who have a median age of 59, are more likely to say their adult children are now boomeranging back.

For both first-time and repeat buyers, about 30 percent report that caretaking or spending time with aging relatives is important. First-time buyers are more likely to state that spending time with aging relatives is important versus caregiving. While the data is not collected, it is possible this could mean assistance with childcare for parents, as well. Among generations, it is most common for Gen Xers (born between 1965-1979) to

purchase a multi-generational home. This may not be surprising as they may both be caring for aging parents and experiencing young adults boomeranging back at the same time. In the midst of this, it is not hard to imagine a Gen Xer needing to buy a larger home for all generations of the family to happily cohabit in one home.

It is also more common for minority home buyers to purchase a multi-generational home in comparison to White/Caucasian home buyers. Thus 18-19 percent of Black/ African-American, Asian/Pacific Islander, and Hispanic/Latino buyers purchased a multi-generational home in comparison to

10 percent of White/Caucasian buyers. The most common reason for all buyers, regardless of race, was for caretaking and spending more time with aging relatives.

As we see the transition of the large Baby Boomer generation age into retirement, it will be interesting to see if they move in with their Millennial and Gen Z children or if they stay put in their own homes. The trend of multi-generational buying appears to be firmly established and one that could expand in the future.

—Dr. Jessica Lautz is the deputy chief economist and vice president of research at the National Association of REALTORS.

Like many Americans, when Will Seippel started to think about where he might want to live for retirement, Florida was at the top of his list. In 2021 Seippel, the founder of WorthPoint, the world’s largest provider of information about art, antiques and collectibles, bought a house in Cape Coral, Florida. When Hurricane Ian reached Florida in September, his new house was left standing—but waterlogged.

“We hadn’t had a hurricane down there of any severity for 100 years,” said Seippel. “And lo and behold, the second hurricane season I’m down there, a hurricane comes, and the storm’s center is where I live. We had eight and a half hours of 100 mph-plus wind.”

The house remained intact, but wind and water saturated the walls, causing mold. The resulting damage will require the home to be gutted and rebuilt.

Seippel isn’t alone. According to FEMA, 40 percent of Americans live in a disaster zone or state. Add to this the fact that 80 percent of Americans file insurance claims caused by weather, to the tune of $152 billion a year.

As for the possessions in the house, Seippel said it’s ironic that he owns a company with a database “vault” that allows users to capture the items they own with images and text as evidence for insurance.

“There are a few ways to lose your stuff in a natural disaster. They can be stolen, they can be washed out with the storm, or they can have water damage. If the water damage is not taken care of, mold can set in,” said Seippel.

Seippel has hundreds of collectibles, art and other possessions that were damaged in the storm.

“I’m glad I had a photo of them and description in the vault, as concrete evidence for the insurance,” he said.

Seippel offers his steps for preparing your house and the stuff in it in case disaster strikes.

Do a walk-through and create an inventory. Inventory your possessions by going through every closet, drawer, shed and garage. List each item, including clothing, accessories, electronics, appliances, furniture, decorations, linens, artwork, hobby items, collectibles and heirlooms.

Take photos and add notes. Once your list is made, go back over the items, take a picture of each article or group of objects, and any relevant notes, including make, model, serial number and dollar value if you know it. List the store and year purchased.

Gather your documents. For larger purchases such as furniture, appliances, jewelry, art and collectibles, scan the documents and save them to a specific folder on your computer.

Record a video. Go through and take a video of everything as further proof of your ownership and its condition.

Compare your list to your current insurance policy and work with your agent to make sure you have the type of insurance and enough coverage for what you own in the event of a disaster.

Update your inventory. As you acquire new possessions, be sure to update your inventory record. Learn more at Visit www.worthpoint. com to learn more. —WorthPoint

The Traci Conway Clinton Team designs a curated luxury experience for each of our clients across all price points.

We have a very different, refreshing approach to marketing each of the properties we represented, which has resulted in incredible success stories & record sales for our clients.

TRACI CONWAY CLINTON

Long Island Founding Agent

Luxury Division — Council Member, Long Island Licensed Real Estate Salesperson

M: 516.857.0987 | O: 516.517.4751

traci.clinton@compass.com

RANKED THE NO 1 BROKERAGE IN THE U.S.