The Waldorf School of Garden City (WSGC) begins its 75th school year with an all-woman leadership team.

For the first time in the school’s history, an alumna holds the position of board chair. Anne Murray, class of 1985, and board member since 2018, was elected to the position of board chair on July 1, succeeding Lance Cheney, who held the position since 2016.

“With the support of our incredible leadership team, our school is prepared to meet the needs of our parents, students, employees, and alumni in this ever-changing educational landscape. I am excited and inspired during this, our school’s 75th year, as we work to chart the course for the next chapter of The Waldorf School of Garden City,” said Murray.

As chair, Murray will work closely with school administrator Nicole S. Littrean, and faculty chair Kelly O’Halogan, to direct the course for the school during this Diamond Anniversary after major shifts facing independent schools across the country. This includes overseeing the school’s Capital Campaign, as well as long-term strategic plans to further support the school and community.

“It is such an honor to be working with Anne on collaboratively building the future of our school,” said Nicole Littrean, school administrator. “Her experience, insight, and knowledge of the Waldorf community will be indispensable as we continue to face the challenges of our ever-changing world.”

An accomplished litigation partner with Rivkin Radler LLP, Murray counsels insurance companies on first- and third-party claims, including toxic tort, environmental,

product liability, general liability, professional liability, construction defect, employee benefits liability, labor law, bad faith, and other emerging issues. On behalf of her insurance clients, Murray has won summary judgment in a variety of matters, including cases of first impression in New York and elsewhere. She also co-authored the chapter on

environmental and toxic tort insurance coverage issues for New Appleman Law of Liability Insurance and is a frequent speaker on coverage issues. Murray has been active in Rivkin Radler’s pro bono program, assisting the Volunteer Lawyers Project of Nassau County in representing poor and underserved tenants in housing disputes. She was named one of Long Island Business News’ “40 Rising Stars Under 40” and Top 50 Most Influential Women in Business. She also serves on her firm’s executive committee and is co-chair of Rivkin Radler’s Women’s Initiative Committee.

“Anne brings such an inviting and enthusiastic energy to our school,” said O’Halogan, faculty chair. “I know that her vision and dedication to The Waldorf School of Garden City will be crucial to helping us further our mission for many years to come.”

Founded in 1947 and located at 225 Cambridge Ave. adjacent to Adelphi University, The Waldorf School of Garden City offers Parent-Child sessions and classes from nursery, including a brand-new Sweet Peas Program for two-year-old students, through grade 12. It is accredited by the New York State Association of Independent Schools (NYSAIS) and the Association of Waldorf Schools of North America (AWSNA). Visit www.waldorfgarden.org or call 516-742-3434 for more information.

—The Waldorf School of Garden City

Molloy University has announced that Gina M. Florio, Ph.D., has accepted the position of Dean of the Schoo l of Arts & Sciences following a national search. Her appointment began on August 1, 2022.

Florio served as interim dean of St. John’s College of Liberal Arts and Sciences at St. John’s University from July 2020 to May 2022. As dean, she was responsible for nearly 4,000 students, 240 full-time and more than 400 part-time faculty across 17 different academic departments, programs, and institutes, two clinics, an art gallery and three campus locations. She also was responsible for more than 70 administrators and staff. As dean, she facilitated development of new interdisciplinary programs in Critical Race and Ethnic Studies, Engineering, and Machine Learning. She initiated college-wide antiracism, equity, and inclusion efforts, including development of strategic goals, supported introductory STEM curricular reform, created a student advisory board, and provided leadership on campus climate projects. She is a strong advocate for faculty and while dean helped identify resources both internal and external in support of faculty work. Prior to her appointment as interim dean, Florio led university-wide strategic planning and institutional effectiveness efforts at St. John’s from September 2014 to June 2020.

“Dr. Florio has a deep understanding of, and commitment to, the central ity of the liberal arts in Catholic higher education,” said C. Michelle Piskulich, Ph.D., Provost and Vice President for Academic Affairs at Molloy University. “She brings a collaborative approach to working with both the faculty and administration, as well as a data-informed, mission-driven approach to decision making. I have confidence in her ability to work with the faculty, staff and students in the School of Arts & Sciences to develop a shared vision for the future and a roadmap to achieve it.”

Over the course of her career at St. John’s, Florio served on numerous committees and was an active participant in governance. She served on the University Personnel Committee, the University Senate, the Graduate Council, the Liberal Arts Faculty Council, the Liberal Arts Faculty Council Curriculum Committee,

and the Academic and Administrative Committee, among others. She served two terms on the Provost’s Council and was a member of the President’s Advisory Council for eight years. She received the New York American Chemical Society Outstanding Chemistry Teaching Award in 2020 and its Salutes to Excellence Award: Chemigation in 2016. She also was a nominee for the Council on Undergraduate Teaching, Chemistry Division, Outstanding Mentorship award. She has mentored more than 60 undergraduate, graduate, and high school students in research during her career. Florio currently is PI on an NSF ADVANCE Catalyst award, co-PI on an NSF Noyce Teacher Scholarship Program grant and has had numerous other grant awards totaling more than $2.2 million. She has 24 peer-reviewed publications, numerous invited seminars, conference,

Source facebook.com/GoNolloy/

and poster presentations.

Florio received her Ph.D. in Physical Chemistry from Purdue University, and an A.B. cum laude in Chemistry from Vassar College. She was a Dreyfus Foundation Postdoctoral Fellow in the Department of Chemistry and the Environmental Molecular Sciences Institute at Columbia University and a Postdoctoral Research Fellow in the Department of Chemistry and the NSF Center for Electron Transport in Molecular Nanostructures (NSEC) also at Columbia. She joined St. John’s University as the Clare Boothe Luce Assistant Professor of Chemistry in 2005, was promoted to Associate

Professor of Chemistry and Physics in 2010 and to Professor of Chemistry and Physics in September 2021.

Molloy University, an independent Catholic University based in Rockville Centre, was founded in 1955 by the Sisters of Saint Dominic in Amityville. The university serves a student population of approximately 4,800 undergraduate and graduate students. Molloy students can earn degrees in a variety of outstanding academic programs, including nursing, business, education, social work, music therapy, computer studies and many more.

—Molloy

UniversitySource facebook.com/ GoNolloy/

With student loan debt in the United States currently estimated to total $1.762 trillion, the price of higher education is quickly taking its toll on many households. Borrowers may be wondering if they need to consider their student loans when purchasing life insurance coverage. The answer to this depends on what type of loan the borrower has and who signed for it.

Many people believe that student loan debt is forgiven if the borrower passes away. However, this is not always the case. It depends on a few factors, including whether the loan was federal or private, and whether the borrower had a co-signer.

Federal student loans (without a co-signer) are the most straightforward case. By law, these loans are forgiven upon death or total disability, and family members or the estate are not responsible for paying them back. In this case, there is no need for any party involved to increase their life insurance coverage based on the loan.

On the other hand, private student loans may have different terms. Because private loans are issued through a private lender, the lender can dictate their own rules including the terms of death or disability. The best way to know for sure is to read the fine print.

If someone with unpaid private student loans and no

co-signers were to pass away, their estate may have to repay the debt. A judge may order the sale of assets the borrower planned to leave to others (such as a house or car) to pay back the lender. In this situation, having an adequate amount of life insurance would help to eliminate this burden and leave those items to go to their original heirs.

Co-signing is when a parent or other adult agrees to be responsible for the loan should the borrower default. Co-signing is common for many different types of loans, including student loans.

For some federal loans, a co-signer must continue

making payments even if the borrower passes away. This depends on the type of federal loan.

For private loans, the co-signer may have to continue making payments. The loan contract may also include an acceleration clause. This could mean the lender can make the balance of the loan due immediately if the borrower dies.

Like co-signers, spouses may also be on the hook for making payments after the borrower dies. This will largely depend on:

1. The state where the loan was taken out.

2. If the couple was married at the time of the loan.

In some states, loans are considered shared or community property. Even if the surviving spouse did not co-sign, places with community property laws will require that they continue to make payments. This is another instance when having life insurance—and, thus, a death benefit—can help alleviate this burden.

Whether a borrower should take out life insurance or get additional coverage to potentially repay student loan debt depends on whether they had a co-signer, the type of loan, and what state they live in. Borrowers and co-signers should look carefully at their loan terms and decide whether they need additional life insurance coverage.

—Northwestern Mutual

The U.S. Department of Education has recently announced a final extension of the pause on student loan repayment, interest, and collections through Dec. 31, 2022. Borrowers should plan to resume payments in January 2023. While the economy continues to improve, COVID cases remain at an elevated level, and the Biden-Harris Administration has made clear that pandemic-related relief should be phased out responsibly so that people do not suffer unnecessary financial harm.

To address the financial harms of the pandemic by smoothing the transition back to repayment and helping borrowers at highest risk of delinquencies or default once payments resume, the department will provide targeted student debt cancellation to borrowers with loans held by the Department of Education. Borrowers with annual income during the pandemic of under $125,000 (for individuals) or under $250,000 (for married couples or heads of households) who received a Pell Grant in college will be eligible for up to $20,000 in debt cancellation. Borrowers who met those income standards but did not receive a Pell Grant will be eligible for up to $10,000 in relief. The department will be announcing further details on how borrowers can claim this relief in the weeks ahead. The application will be available no later than when the pause on federal student loan repayments terminates at the end of the year. Nearly eight million borrowers may be eligible to receive relief automatically because relevant income data is already available to the department. The department is also making available a legal memorandum regarding its authority for these discharges.

The Department of Education is also proposing a rule to create a new income-driven repayment plan that will substantially reduce future monthly payments for lower- and middle-income borrowers. The proposed rule would protect more income from loan payments. It would cut in half—from 10 percent to five percent of discretionary income—the amount that borrowers have to pay each month on their undergraduate loans, while borrowers with both undergraduate and graduate loans will pay a weighted average rate. It would also raise the amount of income that is considered nondiscretionary income and therefore protected from repayment. The rule would also forgive loan balances after 10 years of payments, instead of the current 20 years under many income-driven repayment plans, for borrowers with original loan balances of $12,000 or less. Additionally,

the proposed rule would fully cover the borrower’s unpaid monthly interest, so that—unlike with current income-driven repayment plans—a borrower’s loan balance will not grow so long as they are making their required monthly payments. The plan would also simplify borrowers’ choices among loan repayment plans. The proposed regulations will be published in the coming days on the Federal Register and the public is invited to comment on the draft rule for 30 days.

“Earning a college degree or certificate should give every person in America a leg up in securing a bright future. But for too many people, student loan debt has hindered their ability to achieve their dreams—including buying a home, starting a business, or providing for their family. Getting an education should set us free; not strap us down. That’s why, since Day One, the Biden-Harris administration has worked to fix broken federal student aid programs and deliver unprecedented relief to borrowers,” said U.S. Secretary of Education Miguel Cardona. “Today,

we’re delivering targeted relief that will help ensure borrowers are not placed in a worse position financially because of the pandemic, and restore trust in a system that should be creating opportunity, not a debt trap.”

The department is proposing longterm changes to the Public Service Loan Forgiveness (PSLF) program that will make it easier for borrowers working in public service to gain loan forgiveness. The department proposed allowing more payments to qualify for PSLF including partial, lump sum, and late payments, and allowing certain kinds of deferments and forbearances—such as those for Peace Corps and AmeriCorps service, National Guard duty, and military service—to count toward PSLF. These proposed regulatory changes build on the progress made with the temporary changes announced last year by the department that expire on Oct. 31, 2022. Since the start of the temporary changes, the department has approved more than $10 billion in loan discharges for 175,000 public servants.

The department is also taking steps to reduce the cost of college for students and their families and hold colleges accountable for raising costs, especially when failing to deliver good outcomes to students. The department has already re-established the enforcement unit in the Office of Federal Student Aid and recently withdrew authorization for the accreditor that oversaw schools responsible for some of the worst for-profit scandals. The agency will also propose to reinstate and improve a rule to hold career programs accountable for leaving their graduates with unaffordable debt. New steps will be taken against colleges that have contributed to the student debt crisis. These include publishing an annual watch list of the programs with the worst debt levels in the country and requesting institutional improvement plans from colleges with the most concerning debt outcomes that outline how the college intends to bring down debt levels.

Visit www.ed.gov for more information. —U.S. Department of Education

Dr. Christopher Korolczuk has been promoted to assistant director of Nassau BOCES Department of Regional Schools and Instructional Programs (RSIP). He brings nearly 25 years of educational experience to the position, including more than 15 years as principal of the agency’s Center for Community Adjustment (CCA). He is a revered leader in the field of alternative education, having served in the most diverse and demanding learning environments.

Korolczuk’s first order of business as assistant director is to learn all he can about RSIP. He intends to explore each unique program, educate himself on ways to build and strengthen the agency’s relationships with local industry partners, and determine how he can best meet the needs of all students in his charge.

“Seventeen years as principal of a complex high school has prepared me for the vital task of continuing the evolution of our regional schools,” said Korolczuk. “I have been, and continue to be, surrounded by so many caring and compassionate people here at Nassau BOCES. Together, we will prepare our students for college, careers, and to be contributing members of their communities, which is a critical component of the agency’s mission.”

Korolczuk began his educational journey in the most challenging classrooms

imaginable, as a special education teacher at the Ranch San Antonio Juvenile Detention Facility in Los Angeles, then as a health teacher at Riker’s Island Jail. These respective experiences laid the foundation for a career devoted to teaching students with unique needs, who require support beyond the traditional school setting.

From the correctional system, Korolczuk moved to the New York City school system, before joining the administrative team at the Nassau BOCES Center for Community Adjustment. Soon after his appointment as CCA assistant principal, Korolczuk took the helm as principal and began the task of transforming the school into the thriving learning community it is today.

In addition to improving the academic curriculum and implementing a schoolwide behavior plan, Korolczuk worked to improve morale and to create a sense of community within the center. To that end, he launched a monthly awards ceremony, recognizing students who are meeting overall expectations while achieving their own personal goals. He also prioritized family events to promote parental involvement.

Korolczuk helped to develop collaborative relationships between CCA and local colleges. Through a partnership with Farmingdale State College, the school’s

students have the opportunity to take university-level courses, learning about the expectations of a college curriculum while in the supportive and therapeutic environment of CCA. A similar partnership with Nassau Community College (NCC) empowers students to attend courses at NCC, giving them a firsthand, real-life experience of college life.

Korolczuk raised the bar on professional accountability at the center while simultaneously improving staff morale. During his tenure, CCA enjoyed the highest graduation rates in its history, with students earning both Regents and

Advanced Regents diplomas. He also developed and fostered connections between graduates with countless adult service agencies to support their transition to adulthood.

Korolczuk served for five years as president of the Nassau BOCES Educational Administrators Association, where he represented more than 80 school administrators, collaborating closely with them to improve working conditions and meet educational goals. He was selected by the School Administrators Association of New York State and the Board of Regents to meet with the Commissioner of the State Education Department to discuss the importance of educational reform. In 2020, he received the Nassau BOCES Education Partner award.

Korolczuk has a doctorate in educational leadership from St. John’s University. He holds a master’s degree in school administration from The College of Saint Rose, and a master’s in special education from California State University. He has earned certification as a teacher of special education from New York City, New York State and California State, and he is a New York State certified school administrator and supervisor.

Visit www.nassauboces.org or www. facebook.com/nassauboces to learn more.

—Nassau BOCES

With the back-to-school season in full swing and COVID-19 restrictions loosening in New York and elsewhere, the start of this academic year may feel relatively routine.

That includes a return to in-person learning and activities, including the opportunity to schedule recommended health exams that some families may have skipped since the COVID-19 pandemic emerged.

In fact, nearly one in five parents skipped preventive care visits for their children due to COVID-19. Before schedules become packed with classes, homework and extracurricular activities,

review this back-to-school health checklist with actions to take to help give children a better chance to succeed inside and outside the classroom:

Proper vision is crucial for success at school, both in the classroom and when playing sports. While school-based vision screenings are valuable, these exams can miss certain conditions, such as poor eye alignment, focusing issues and farsightedness. That’s why it is recommended children get their first comprehensive eye exam by age one and another prior to starting kindergarten. If no vision issues are detected, then it is recommended children have an exam at least once every two years. Unfortunately, an estimated 600,000 children and teens are blind or have a vision disorder, underscoring the importance of a visit to the eye doctor.

Even after receiving a comprehensive eye exam, it is important to monitor for digital eye strain. This condition can be caused by the overuse of digital devices, such as computers or smartphones, and can contribute to headaches, dry eyes and neck or shoulder pain. Some tips to help avoid digital eye strain include keeping computer screens at

least 30 inches away, taking breaks every 20 minutes, or investing in screen protectors that help limit exposure to blue light. Some health plans offer discounts on these types of protectors or computers with built in blue-light filtering properties. In part due to the increased time in front of screens, nearsightedness today affects 41 percent of Americans—up from 25 percent in 1970.

Proper dental health can help your kids stay confident and smiling, and also benefit their overall well-being. That’s because oral health contributes to overall health, helping the body protect itself from infections, systemic inflammation and various types of diseases such as diabetes and heart disease. While tooth decay is largely preventable, it unfortunately ranks as the most common chronic disease among children. In fact, by age five, nearly 50 percent of children have at least one cavity. To help prevent that, consider scheduling a dental exam at the start of the school year and every six months after that.

In addition to routine cleanings, maintaining proper oral health at home is important year-round. That includes brushing your teeth (and tongue) for up to two minutes, after meals and before

With over 70 undergraduate, graduate and doctoral degree programs, we combine academic excellence and leadership with personal mentoring.

If no vision issues are detected, then it is recommended children have an exam at least once every two years.

Here, you’ll think about your future in a whole new way.

Molloy College is now Molloy University.

Most schools provide hearing screenings, often every other year beginning in kindergarten or first grade. If a hearing issue is identified, such as hearing loss due to a middle ear infection, or hearing loss in a single ear, a referral for a comprehensive audiologic evaluation is generally the next step. It is important to not delay this more comprehensive testing with a health professional, as hearing loss can affect a child’s ability to develop speech, language and social skills.

Early intervention is key to identifying the most appropriate treatment as quickly as possible,

which can help support the best possible outcome.

At the same time, parents should help children adopt safe listening strategies and avoid excessive exposure to loud sounds, which can contribute to hearing loss over time. In fact, nearly 50 percent of people between ages 12 and 35 are at risk of developing hearing loss due to environmental factors, including listening to music through personal audio devices. Strategies to consider include using ear protection (earplugs or earmuffs) when attending sporting events or music concerts; following the 60-60 rule, which means limiting the use of earbuds or headphones to no more than 60 minutes at a time and at no more than 60 percent of the player’s maximum volume; and investing in noise-canceling earbuds or headphones to avoid the temptation to crank up the volume to overcome background noise.

Back-to-school season is an exciting time, filled with friends and fun activities. To help make the most of this time of year, consider adding these three appointments to your family’s to-do list.

bedtime; using a soft-bristled toothbrush; rinsing for 30 seconds with a mouthwash, which may help kill bacteria and clean parts of the mouth brushing might miss;

flossing daily, plus adding a water flosser; and staying hydrated to help avoid issues with dry mouth, while limiting sugary snacks and drinks.

Nearly 50 percent of people between ages 12 and 35 are at risk of developing hearing loss due to environmental factors.

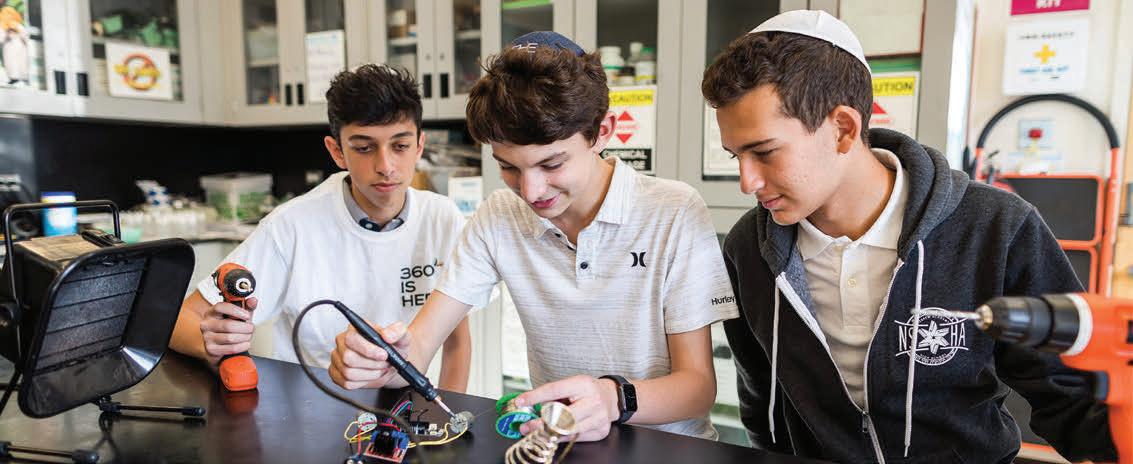

at North Shore Hebrew Academy High School 400 N. Service Road, Great Neck, NY 11020

SUNDAY, OCTOBER 30, 2022 | 10:00am - 1:00pm

Students design an individualized, academically rigorous course of study that expands their knowledge and inspires them to rise to the challenge – building their intellectual curiosity, playing to their personal strengths, and establishing foundational skills for lifelong success.

An extensive, high-level Judaic Studies core curriculum in Talmud, Tanach, Machshava, and Jewish history instills a strong foundation and love of Jewish life –enhanced by advanced Talmud seminars, Hebrew language, and advocacy for Israel.

An extraordinary Yeshiva high school where students are empowered to pursue their passions and reach higher

is the chief medical officer of population health at UnitedHealthcare.

Signature Programs empower students to pursue their passions and set themselves up for success in cutting-edge fields. Opportunities include 360 STEAM; Business and Entrepreneurship; Data Science; Science Research; Art, Architecture, and Fashion Design; Co-ed Beit Midrash; Independent Studies; and more.

Our school builds a community of achrayut by making a commitment to helping others through meaningful chesed experiences – from causes that affect our school and Jewish community, to nationwide and global issues.

School is now back in full swing. The NYS Division of Consumer Protection (DCP) is providing targeted scam prevention and shopping tips for parents and children.

“Back-to-school shopping is the second largest spending event for parents, after the holidays, which makes it critically important for parents to know how to safeguard against scams to protect their privacy and finances,” said Secretary of State Robert J Rodriguez. “And as more and more schools use technology as a teaching tool, parents should know what information is being obtained from their student and how to protect their children’s identity and privacy. Children should not have to give up their privacy rights just to do their homework. I urge parents to use these tips so students from elementary school to high school stay safe this school year.”

Below is some guidance on how to start the new school year safely.

Under New York State’s Education Law, if you are a parent of a child in the New York State schools, you have rights regarding the privacy and security of your child’s personal information and data. State law requires each educational agency to publish its Data Privacy and Security Policy to its website. Technology has become a permanent fixture of the education experience. The Federal Trade Commission (FTC) recently issued a policy statement that put educational technology on notice about children’s privacy. In other words, educational tech companies can’t require parents and schools to agree to the comprehensive surveillance of children for kids to use those learning tools. Thus, parents and guardians need to place close attention to the technology children use, what information they collect, and how they use it.

Some highlights to know about this law:

• Your child’s personal information cannot be sold or released for any commercial purposes.

• If your child is under age 18, you have the right to inspect and review the complete contents of your child’s education records.

• If you have questions about student data, please see information available for parents from The New York State Department of Education.

Other ways to pay close attention to your child’s personal information:

• Protect documents that contain a child’s personal information. Understand where your child’s information is stored. Ask how after-school organizations and sports clubs secure their records: Are digital records connected to the internet and, if so, are they encrypted? Are physical records in locked filing cabinets? Who has access?

• Be careful when providing identifying information to after-school activities and sports clubs upon registration. If asked for a Social Security number (SSN), inquire why it is needed and insist on using another identifier. Oftentimes organizations include the SSN request as a formality, and it may not be mandatory.

• Only label books, backpacks and lunches with the student’s full name and any other information on the inside! Using initials on the outside is okay, but names, even just first names, on the outside can create an unsafe situation.

• Discuss internet safety tips with children and remind them to be careful about opening attachments and suspicious emails.

• Both parents and students should be careful on all social media platforms: don’t overshare. Any information you post can be seen and utilized by identity thieves. Avoid sharing personal information

including full names, addresses, phone numbers, Social Security numbers, or even where they go to school. Social media posts often reveal sensitive information unintentionally. Cybercriminals look for content that can reveal answers to security questions used to reset passwords, making accounts vulnerable to identity theft.

Back-to-school shopping is the second largest spending event for parents (behind holiday shopping). Often, a shopping scam starts with a fake website, mobile app or, increasingly, a social media ad. This year, smartphone shopping is on the rise as people are on the move again. DCP urges consumers to take note of common scams while shopping. Scammers may try to exploit the backto-school rush through fraudulent ads or through other forms of solicitations.

• Protect your identity when shopping online: Ensure transactions are conducted over a secure connection. Make sure the website is secure by identifying a padlock symbol by the URL or the https and avoid using public Wi-Fi to log in to online accounts.

• Download retail apps only from trusted sources. Cybercriminals are now creating apps that look and might even function like legitimate retail apps but are actually malware designed to steal your personal and financial information, send text messages without your knowledge, or even track your location using your phone’s GPS capabilities.

• Beware of fake ads and websites: As fraudsters continue to advance in sophistication, fake websites frequently resemble legitimate sites with credible looking logos, pictures, and payment options. If the website is advertising extremely low

prices, or discounts beyond 50 percent, consumers should be wary and diligently verify the legitimacy of the seller.

• Learn how to spot phishing emails: Scammers may send phishing emails to students and parents saying that they missed a delivery of school supplies. These emails request that the recipients click on a link to reschedule this delivery. That link either floods victims’ computers with malware or sends them to fake websites that request their personal and payment information.

• Ensure you know who the seller is. Some major retailers allow third party sellers to list items on their site, and those items can be hard to distinguish from the rest. Read all the fine print to ensure you are comfortable with the seller.

• Use a credit card for online purchases, if possible. Credit cards offer the most protection against fraud, including the right to dispute charges if there are problems with your purchase.

• Watch out for fake coupons on social media: If the coupon doesn’t come from a recognized coupon distributor, the manufacturer, or a specific store, be wary. The New York State Division of Consumer Protection provides resources and education materials to consumers on product safety, as well as voluntary mediation services between consumers and businesses. The Consumer Assistance Helpline 800-697-1220 is available Monday to Friday from 8:30 a.m. to 4:30 p.m., excluding state holidays, and consumer complaints can be filed at any time at www.dos.ny.gov/consumer-protection.

For more consumer protection tips, follow the Division on social media at Twitter: @NYSConsumer and Facebook: www.facebook.com/nysconsumer.

—NYS Division of Consumer Protection