Creating Affordable Housing and Resilient Community Land Trusts

Sept 7, 12:00-1:00, 2023

Who’s Here?

Sept 7, 12:00-1:00, 2023

1.

2.

3.

4.

5. Q&A

CJ Reynolds Director of Resiliency & Disaster Recovery Florida Housing Coalition

MatthewWyman Manager, Community Land Trust Institute Florida Housing Coalition

Mandy Bartle Chief Executive Officer South Florida Community Land Trust

Welcome& Introductions

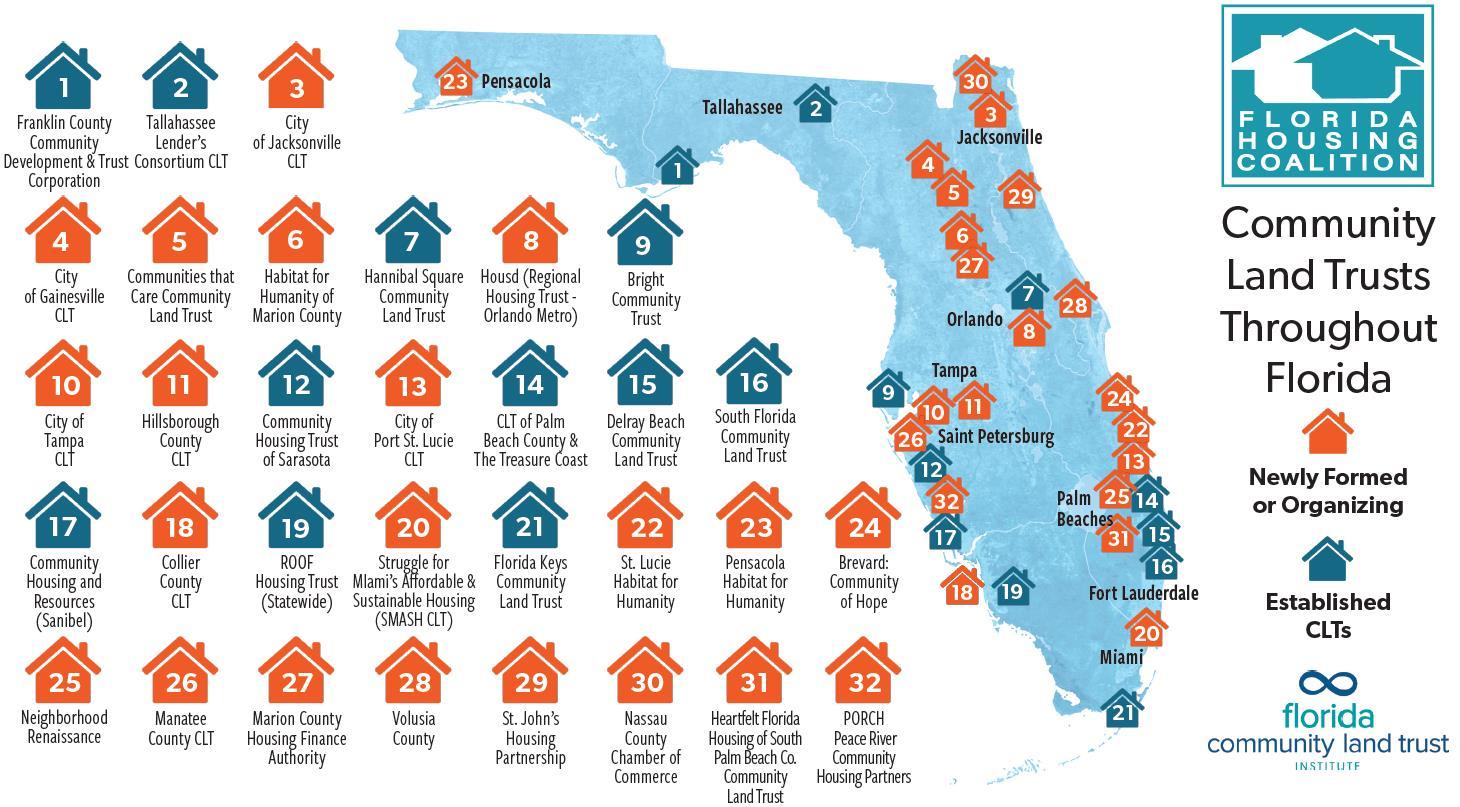

Permanent Affordabilityand CLTs

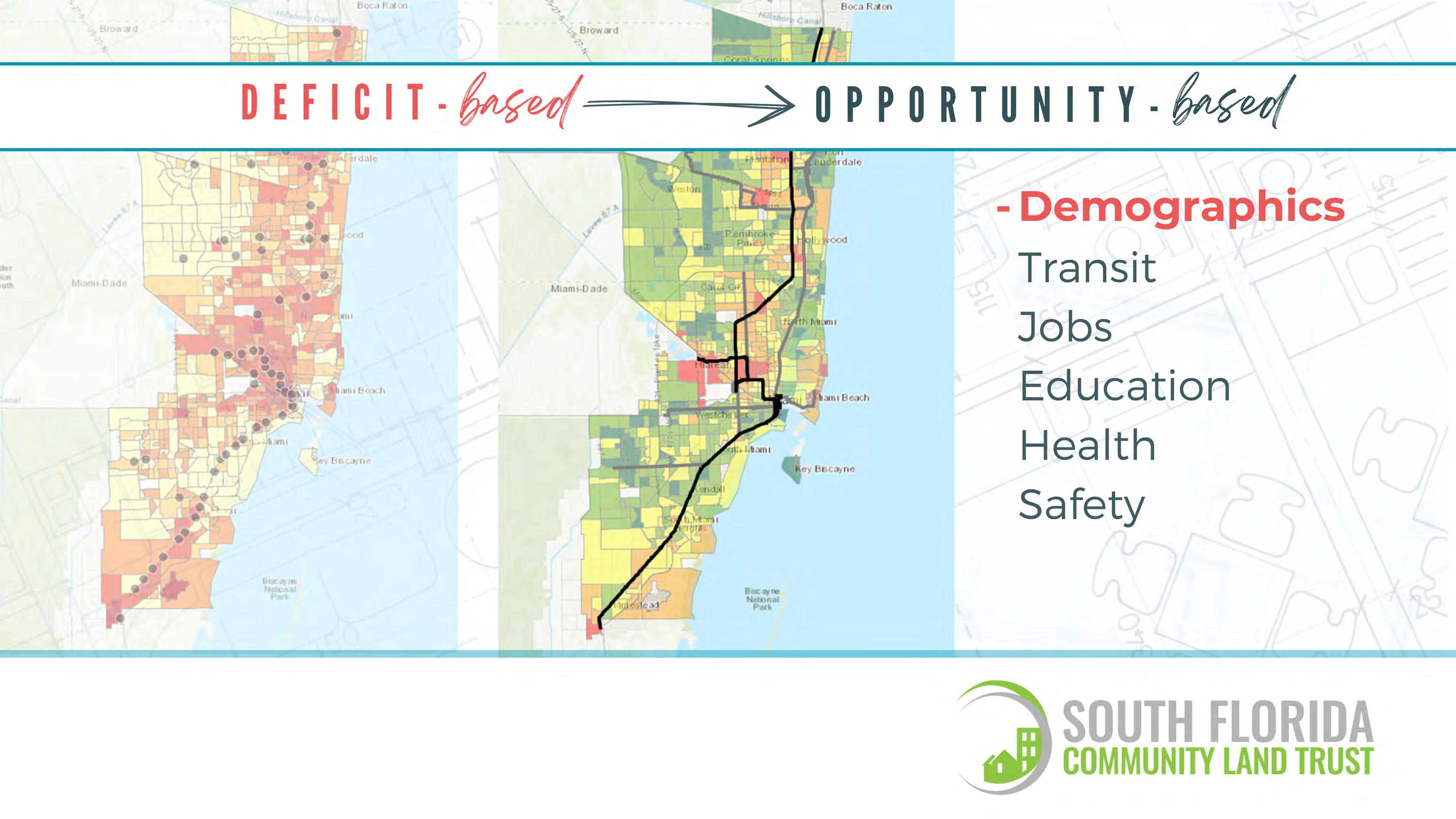

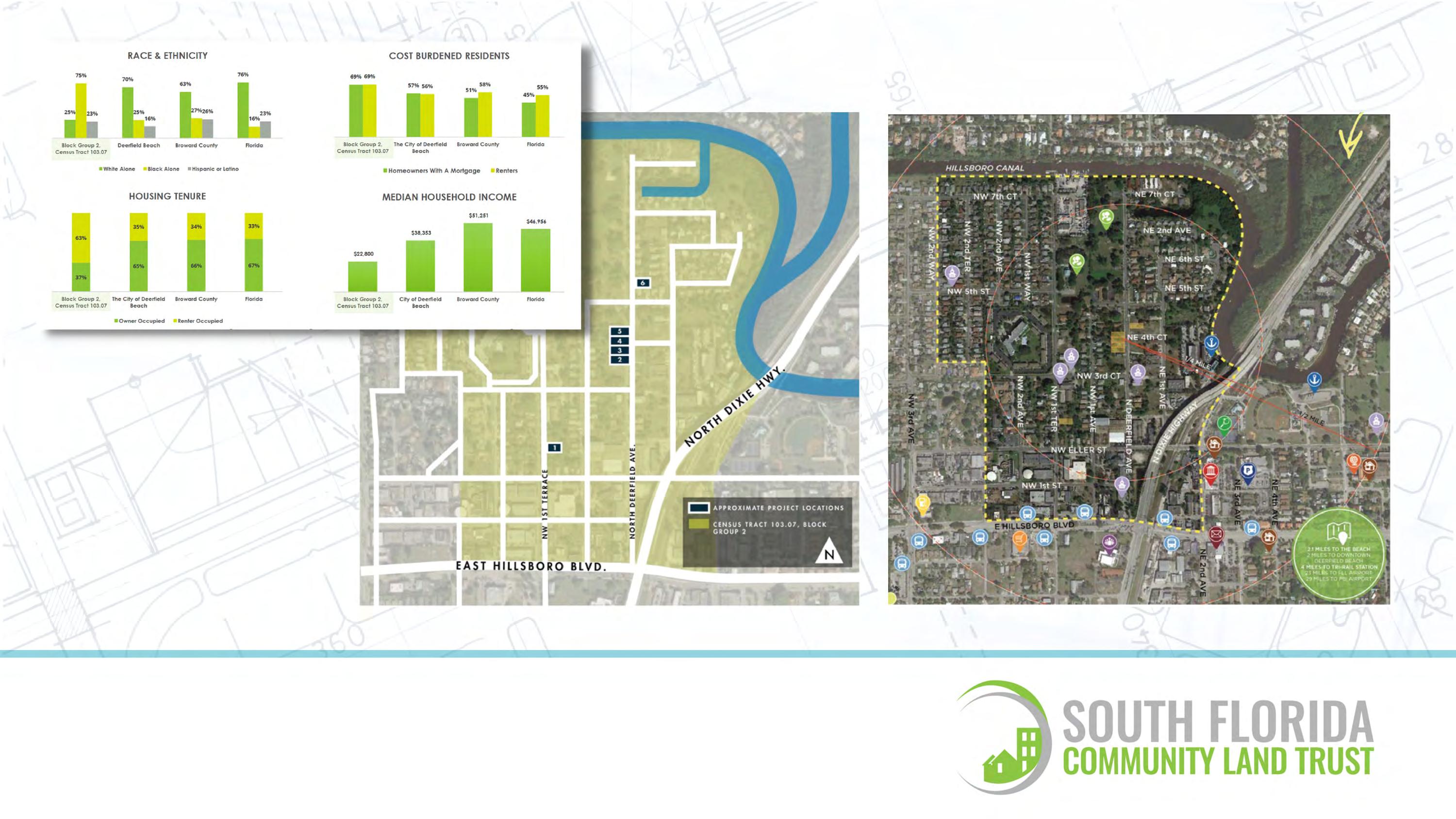

SouthFlorida CLTProcessfor Assessing Sites

New FHCResourcesfor Selecting Sites

CJ Reynolds Director of Resiliency & Disaster Recovery Florida Housing Coalition

MatthewWyman Manager, Community Land Trust Institute Florida Housing Coalition

Mandy Bartle Chief Executive Officer South Florida Community Land Trust

Welcome& Introductions

Permanent Affordabilityand CLTs

SouthFlorida CLTProcessfor Assessing Sites

New FHCResourcesfor Selecting Sites

Zillow Home Value Index reflects home values between the 35th to 65th percentile

• Lack of affordability has created a greater demand for more assisted units requiring

• higher subsidy that need fostered,

• intentionally selected sites (including publicly owned land) to manage building costs & produce density,

• bigger more impactful outcomes,

• shared equity programs and permanent affordability solutions to protect investments

Support local government, non-profits & developers to create a housing stock that is affordable and livable for 100 years or more

• Sharing of equity between the seller and the community

• Sometimes used synonymously with “shared appreciation”, but not the same

• Includes both the amount of public assistance and increase in value of the home (appreciation)

• Unrestricted Deed - sell at market rate & use proceeds (includes portion of appreciation) to fund future affordable housing activity e.g. Housing Trust Fund

• Restricted Deed - via land use restriction agreement (LURA) and/or deed restrictions including:

• Limits on resale price; Income eligibility of subsequent purchaser; Affordability period; Households served; Reversion clause; Transferability provisions; Right of First Refusal; Enforcement & penalties

• Long Term Lease - Use provisions similar to deed restrictions and LURA; Owner or partner stewards land, user and long-term affordability.

• Community Land Trusts

2020 – New Home Org. Price $250,000 - Subsidy $50,000 = Base Price to Recipient $200,000

Subsidy Retained & 25% of Appreciation to Seller

Unrestricted Resale; 25% of Appreciation to Program

Subsidy Retained $50,000 (or more) Base Price in 2020 $200,000

+Authorized Appreciation (25%) $37,500

2023 Price to New Buyer $237,500

Households assisted – 4 owning for 7 years over 30 years

Base price increased 19%

2023 Price to New Buyer $400,000

Households assisted - 1

Base price increased 50%

• The vehicle of separating ownership of the land from the improvements building

• Nonprofit organization that holds title to the land, administers the 99-year ground lease assuring

• rights of owner of improvements to use the land,

• one-time, relatively large (but smaller over time)public subsidy is retained in the housing unit,

• future low-income households will afford the unit.

The community land trust model is a best practice permanent affordability solution that CAN:

• Foster BIG subsidy necessary to develop more needed units

• Minimize displacement associated with community development

• Assure that occupants are successful and act as a safety net

• Be a trusted partner in the development of perpetually attainable housing in sought after areas

• Offer an opportunity to leverage [publicly owned] parcels, especially those intentionally selected for housing

The keystone of a strategy to create a PERMANENTLY AFFORDABLE and LIVABLE HOUSING STOCK

We have a huge shortage of housing that is affordable

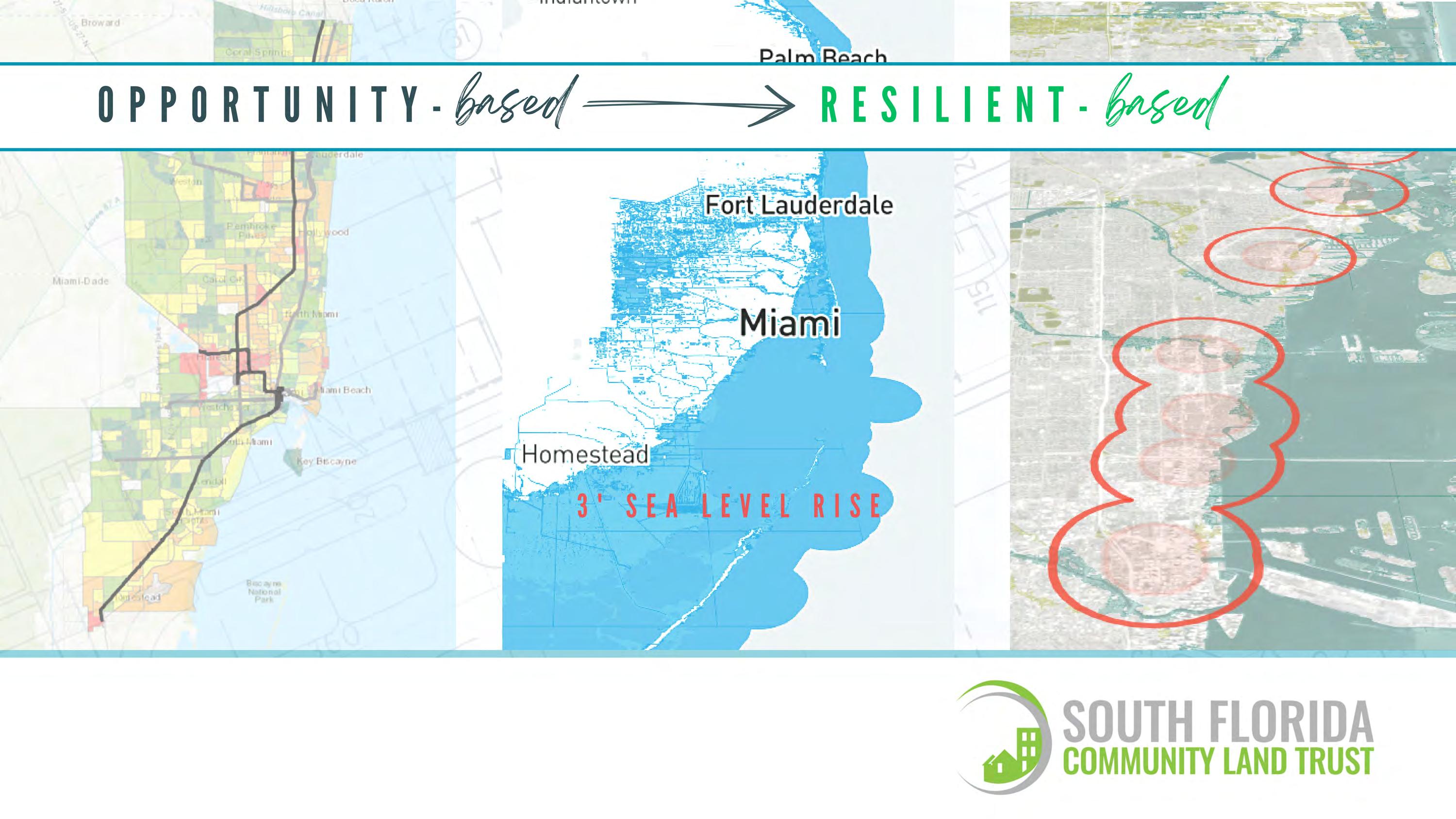

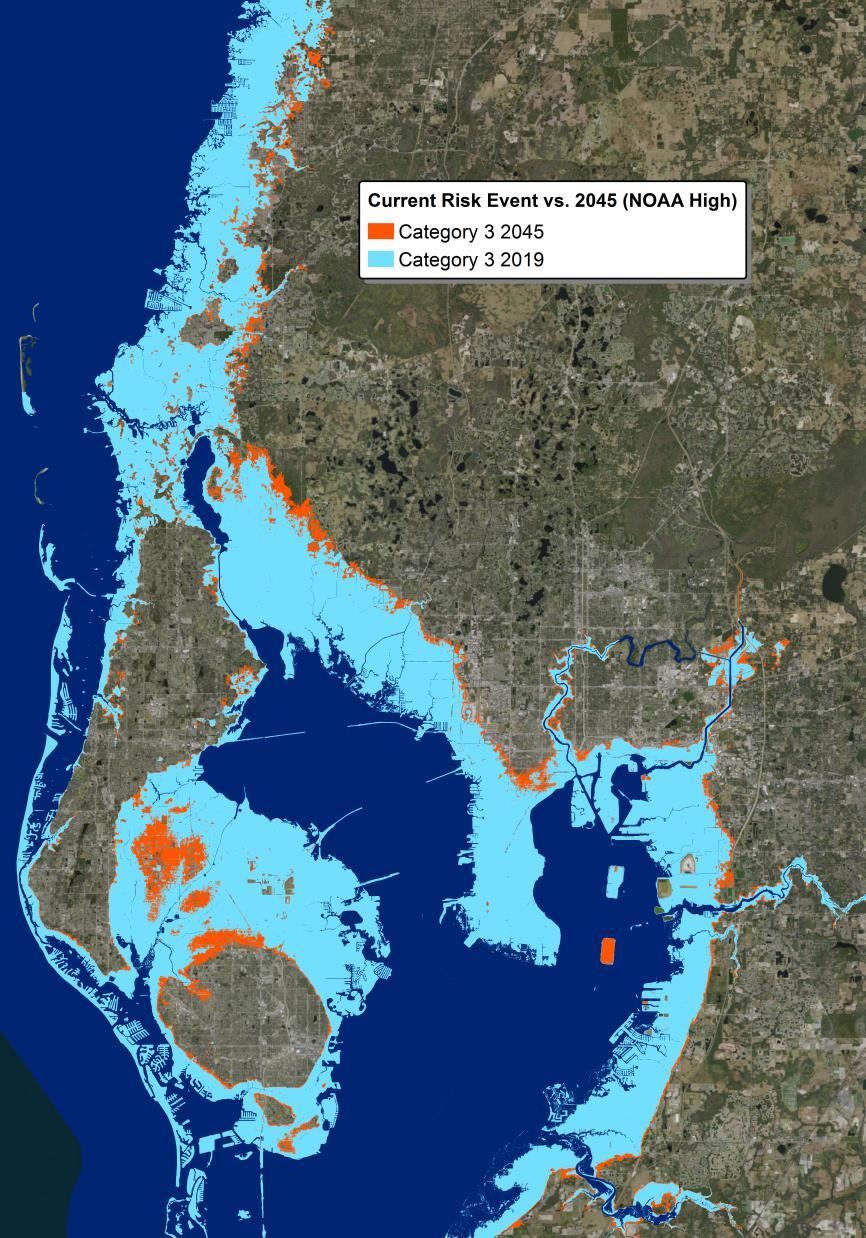

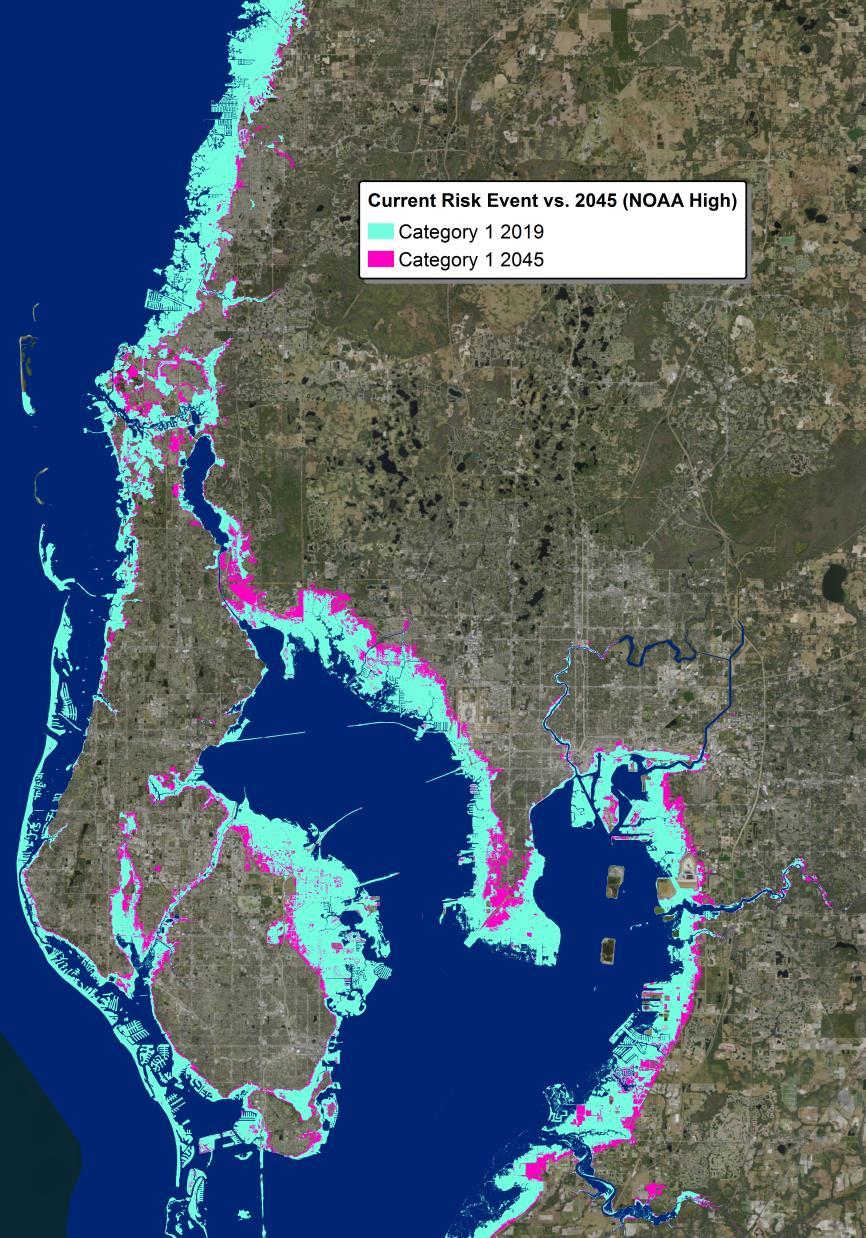

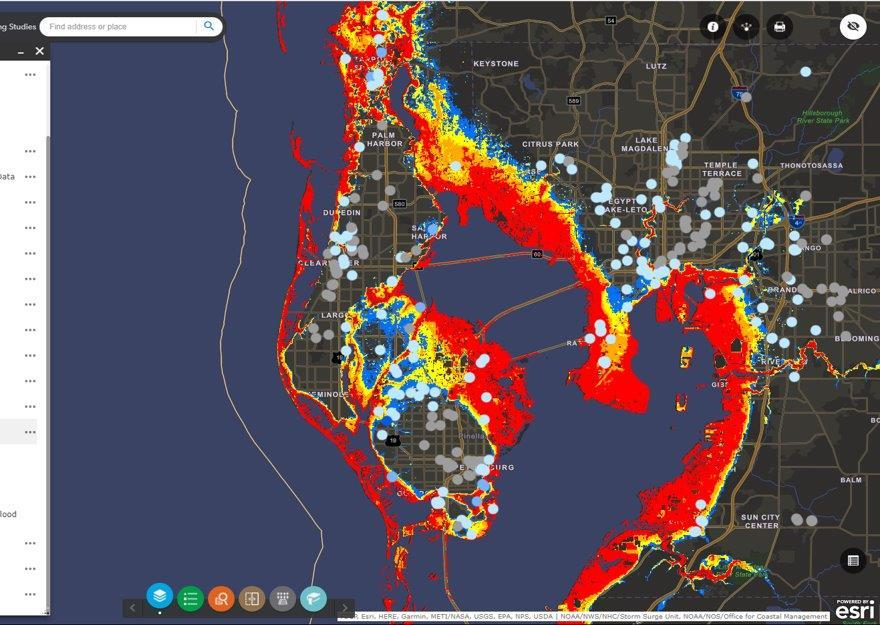

Millions of homes and multi-family properties are at risk for flooding

Housing development and resilience planning are not well integrated

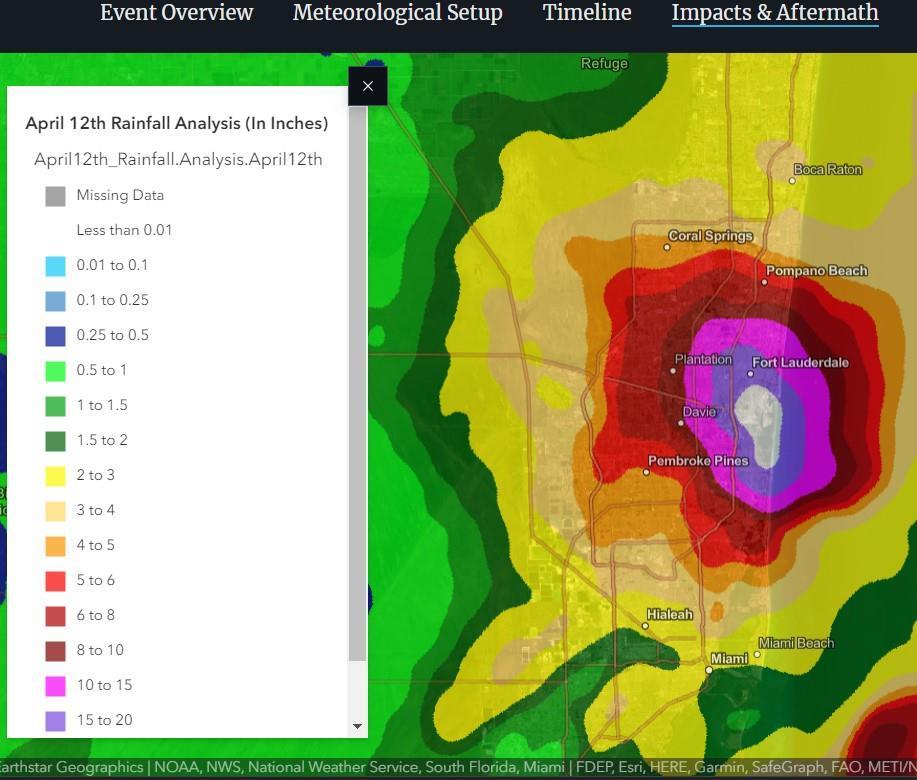

• Hurricane Ian dropped 17+ inches of rain in Orlando area

• April 2023 storm in Fort Lauderdale, Hollywood, and Dania Beach dropped 25+ inches of rain in less than 24 hours

99-year ground lease = Sept. 2122

More Damaging Flooding

• Sea level rise will create a profound shift in coastal flooding over the next 30 years: causing tide and storm surge heights to increase and reach further inland.

• By 2050, “moderate” flooding is expected to occur, on average, more than 10 times as often as it does today and can be intensified by local factors.

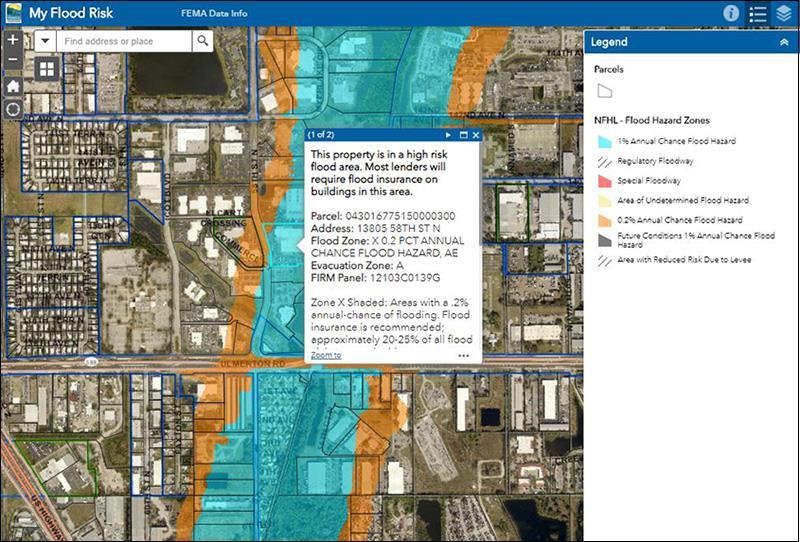

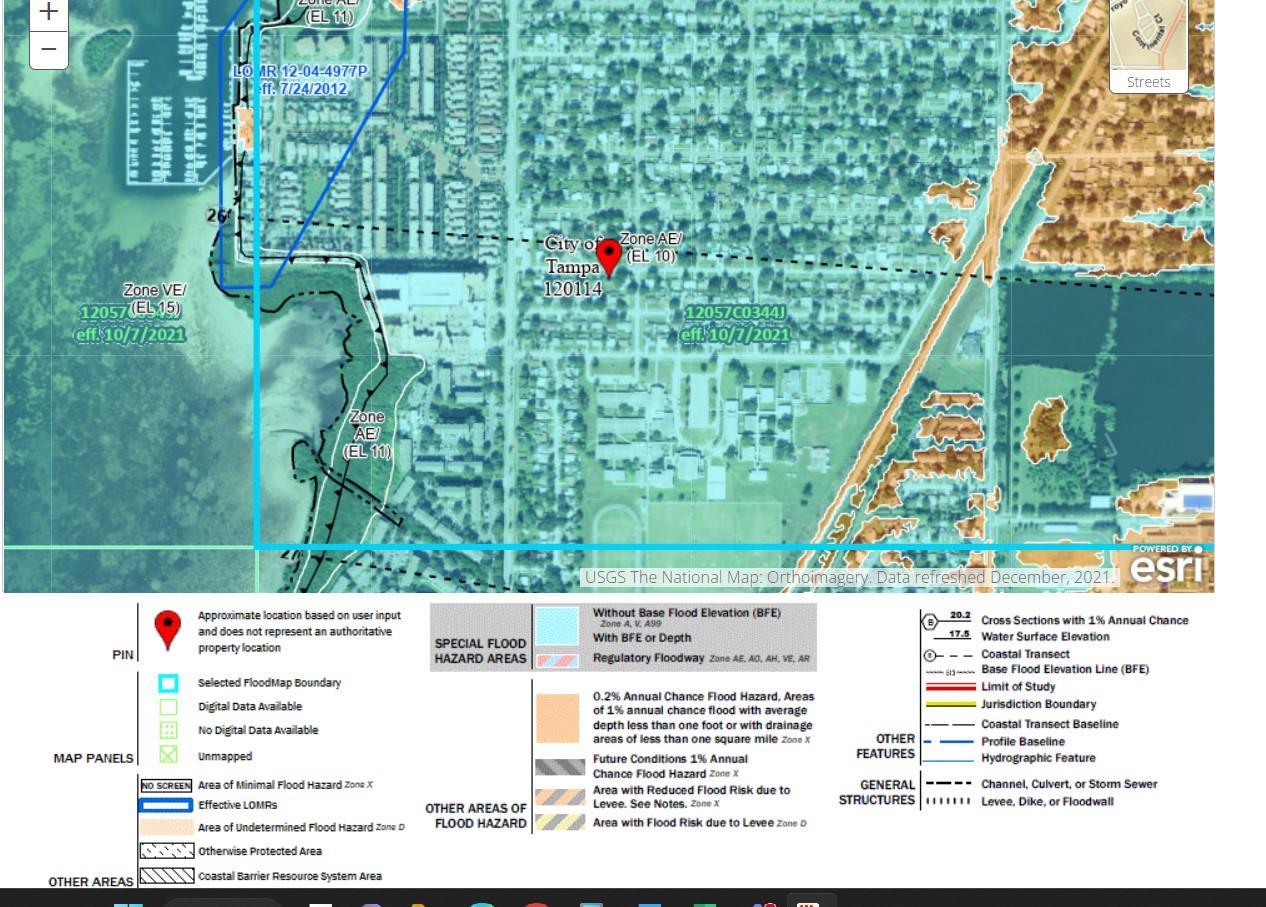

Special Flood Hazard Areas

• Flood insurance is required with federally backed mortgages

Non-SFHA / Moderate Risk

• Flood insurance recommended

Non-SFHA /Low Risk

More than 20 percent of NFIP flood claims are from lowto moderate-risk areas, according to the National Association of Insurance Commissioners.

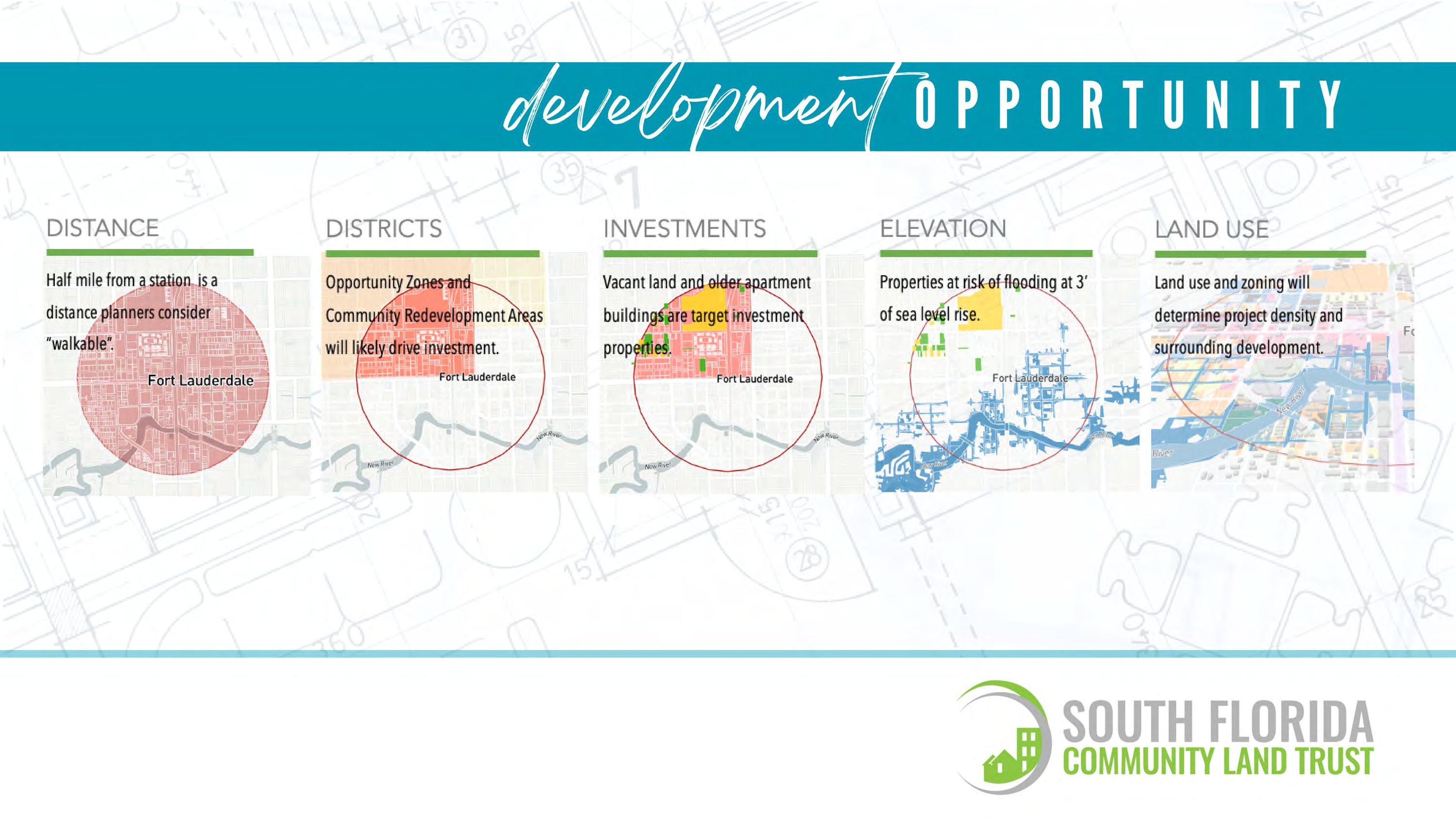

Commercial developers have departments and consultants to identify ideal locations and define current and future risks.

FHC is making it possible for smaller nonprofit developers and local governments to do the same.

New Resources in Development

• Site Selection Playbook with recommendations and links to mapping tools

• Due Diligence Checklist

• Webinars and Training

• Resources available May 2024, supported by a grant from Fannie Mae

• Technical advisory services available now

• Zoning, land-use

• Desirable Location Factors

• Necessities: groceries, schools, medical and dental services

• "Amenities": green spaces, recreational facilities

• Hazard Factors

• Flood risks – zones, surge, SLR, extreme rain

• Urban heat

• Other environmental issues – wetlands, landfill, air pollution, sink holes

• Considerations for Property You Already Own

1. Convene your team -- floodplain manager, Planning Department, housing, community development and Resilience/Sustainability Manager to identify upland or lower risk areas that align with desired amenities

2. Review local vulnerability assessments, flood maps and discuss infrastructure issues and other risks to those neighborhoods

3. Look at the vulnerable populations/needs

4. Do the math – define future projected losses against housing growth projections

Assisted Multifamily Properties at risk to storm surge in Hillsborough, Pasco, and Pinellas. UF/TBRPC/FHC REACH project 2022

• Community Land = Community Resilience

• Georgetown Climate Center recognizes affordable housing CLTs as powerful legal and policy tools for supporting equitable adaptation and community planning

• Form a CLT workgroup to develop plans, defining funding program strategies

• Develop a long-range plan for voluntary buyouts and leverage CDBG and other funding;

• Engage and partner with marginalized, underrepresented residents in disaster impacted or RFL communities to identify social perspectives on future voluntary buy-outs and CL