Dying malls—gifts from an earlier economy and time

Jim Paulmann FAICP

Stantec Consulting Services Inc.

Vice President

Community Development

U.S. Planning

Discipline Leader

David Dixon FAIA

Stantec Consulting Services Inc.

Stantec’s Urban

Places Fellow

Vice President

Tiffany David AICP

Tiffany David, LLC Principal

Robert Horne Torburn Partners Principal

AICP

Sarasota County

Planner III

Planning and Development Services Department

• First shopping mall – Southdale, Edina, Minnesota –1956, Victor Gruen

o Transformed shopping experience (social gathering, arts, entertainment)

• Suburban mall explosion – 2,500 by 1980

• First mega mall – Mall of America, Bloomington, Minnesota –5.6 million sq. ft.

o Experiential destination for exciting entertainment (theme park, aquarium, wedding chapel)

• Shifted the center of commerce from downtown to the suburban mall

•Devastated downtowns for decades

o 80% of retail was on Main Street

o 5% after mall development

FL

•Overbuilding—oversaturated market resulted in intense competition for retailers (winners and losers)

• One-stop shop hypermarket (Target, Walmart, Costco)

• Online shopping (Amazon)

•2008 Recession

•Cheaper retailers (T.J.Max, Ross, Marshalls, outlet malls)

• Decline of department store anchors (JCPenny, Sears, Macys)

•COVIDPandemic

•Aging structures—most malls are more than 30 years old and need upgrading

• Mall numbers continue to decline:

Peak: 2,500 | Today: 700 | Next 10 to 15 Years: 200

David Dixon FAIA • Stantec’s Urban Places

Families with kids dominated US growth for decades

For the next two decades ~80% of net new households (think North America’s housing market) will be singles and couples without kids.

The US housing supply no longer aligns with demand—creating an unprecedented urban housing opportunity—in cities and suburbs alike.

62% of US housing is single-family, detached

Most of the demand is for mixed-use, walkable

In a world of rapidly evolving retail, 1000 units of additional housing within a five-minute walk will attract the critical mass of retailers to bring a block of Main Street to life as a new destination

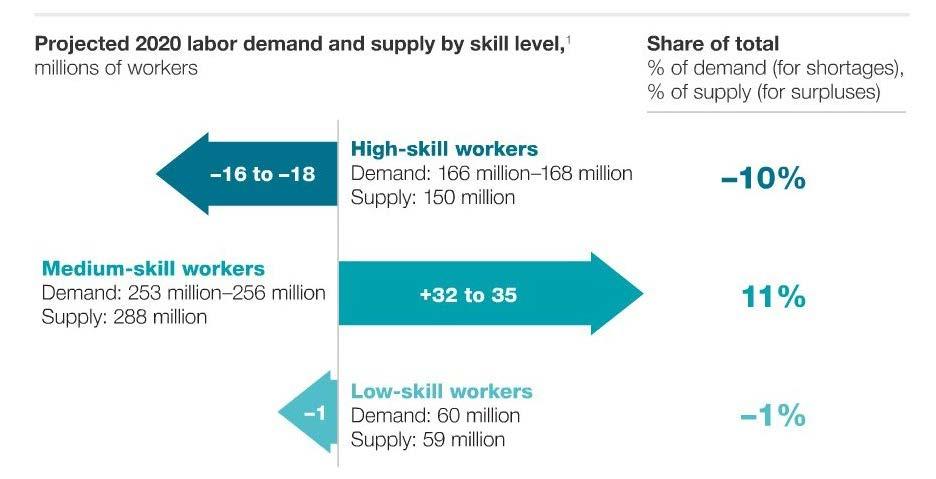

The New Norm 101: Economic Development Imperative Knowledge innovation jobs will “drive” economic growth going forward

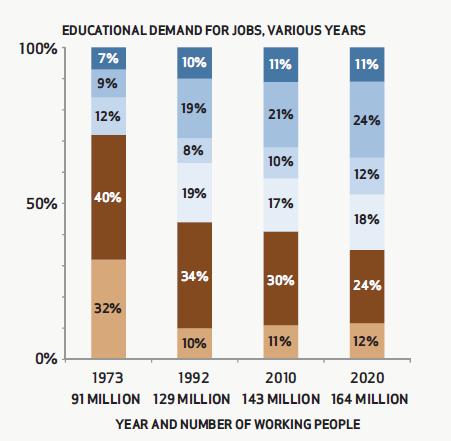

Virtually all net new jobs created in the past decade require at least some higher education—a trend projected to continue over the next two decades.

Global knowledge and innovation industry growth is constrained by a shortage of educated workforce—“talent.”

Virtually every region across North America is competing to attract and retain talent.

Global workforce demand 2020

. . . younger, educated households also disproportionately prefer mixed-use, walkable places.

The Wall Street Journal

“The Joys of Urban Tech”

“Goodbye, office parks. Drawn by amenities and talent, tech firms are opting for cities.”

More educated 28–49-year-olds prefer living and working in mixed-use, walkable places.

Education

< 4 years of college

Education > 4 years of college

Traditional suburbs

Mixed-use, walkable places

2.3M SF inspired by Nashville’s living culture

The synergy between community engagement and political will in urban planning

Building stronger, more resilient communities through collaborative decision-making

Tiffany David AICP | Principal, Tiffany David, LLC

Public Support

Leadership

Resources

Policy Advocacy

Create regular opportunities to hear from residents.

Share concerns and opportunities widely.

Many downtowns include communities that have historically been excluded from planning discussions.

Provide community members with best practices and information related to their aspirations and concerns.

Using data tools, share the impacts of possible changes.

Share information in different languages when appropriate.

Allow community members to evaluate options and establish priorities.

Meet stakeholders where they are.

Create space for questions AND follow up with answers.

Meaningful change requires trust.

Proactive community engagement fosters commitment.

Trust creates the foundation for elected officials and stakeholders to share the risk of changing their communities.

• Two or fewer uncontrolled Big-Box retailers (Sears, Macy’s, JCPenney)

• Minimal small shop tenancy term

• Tenant with durable in-place income—covered land play

• REA less than five years

• Identifying markets with a tailwind—population and job growth

• Markets that can absorb significant amount of land in as few cycles as possible

• Governmental dynamics / partnership—cooperation is critical

• Choosing a planning firm with national mall experience

•Site layouts with various land uses and densities

• Public benefit

•Optimal site circulation—access

• Stormwater strategies

•Utility considerations

•Early meetings with planning staff to understand their priorities

•Meetings with higher-level officials

•Meeting with elected officials

• What tools may be available?

o TIF

o Impact fee credits

o Infrastructure partnerships

Understanding the Reciprocal Easement Agreement (REA)

• Good legal counsel

•Stakeholders

•Expiration

Acquisition —Complex Assemblage

•Understanding leverage of stakeholders

•Understanding rent roll of what you are acquiring

• Financing challenges

Assembling the Team

•Zoning

• Civil Engineering / Planning

•Architecture

•Leasing

• Market Studies

•Construction Management

•Demolition

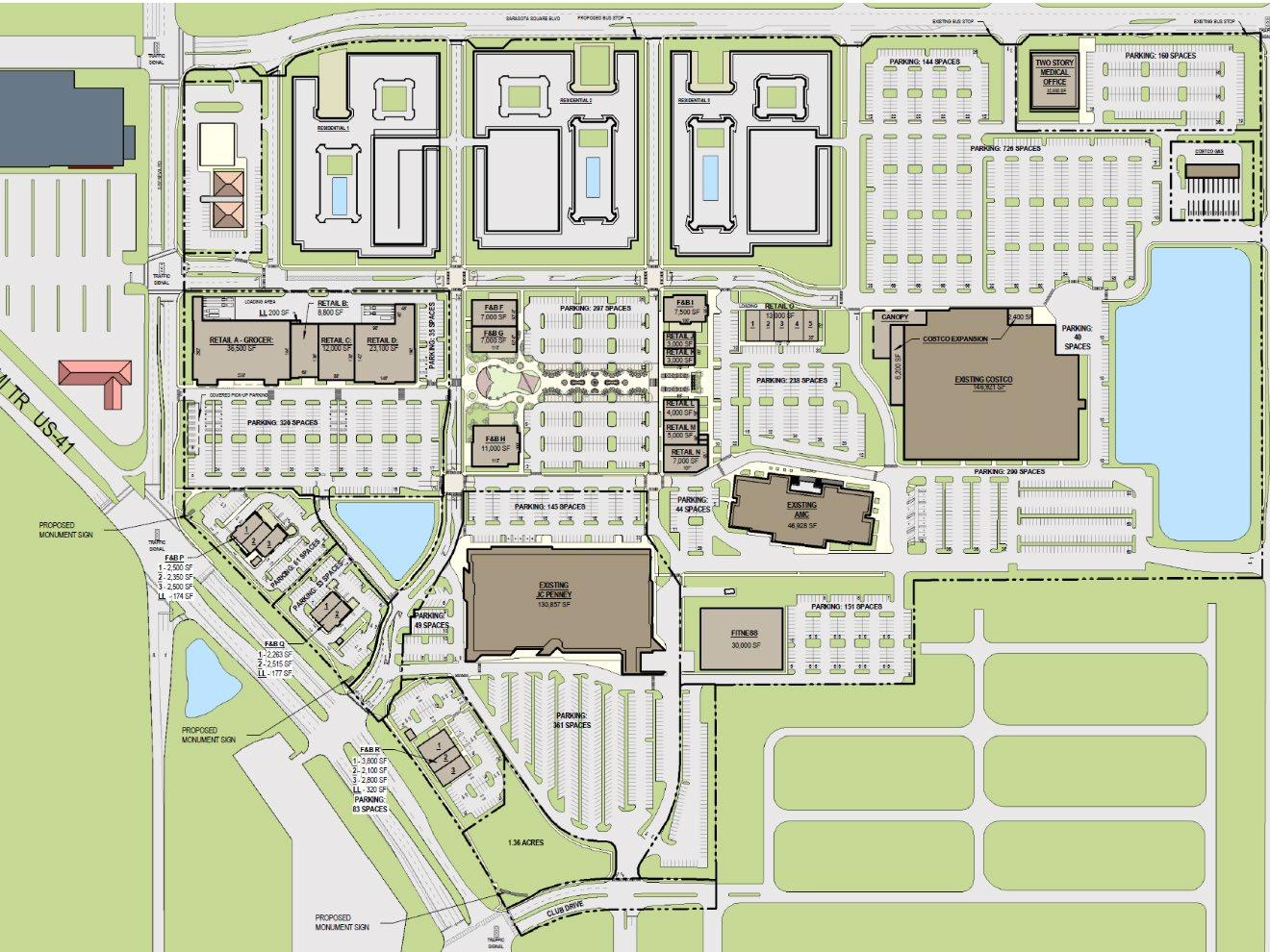

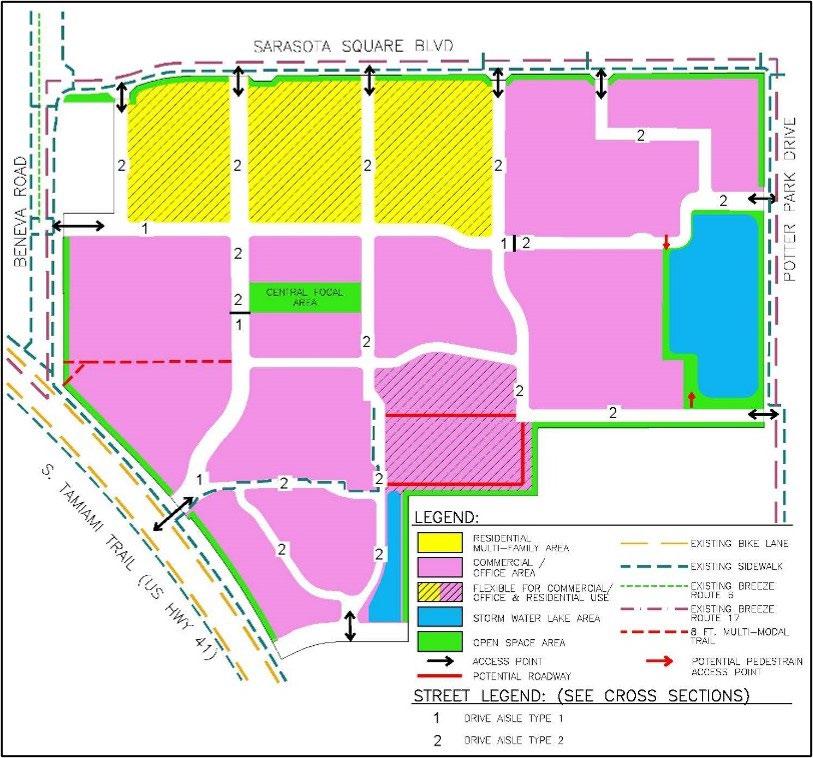

(For illustrative purposes only)

Focus: Redevelop the site into a mixed-use town center.

Important elements to redevelop the site:

1. Mixed-use development

2. Focal point area / green space area

3.Pedestrian connectivity + vehicular mobility

4. Limit of three “Big-Box” retailers

5.Community participation and mitigation

Deliverables:

1. Mobility Plan (pedestrian + vehicular connection)

2. Block Structure Plan (Big-Box retailers)

3. Updated Vision Plan

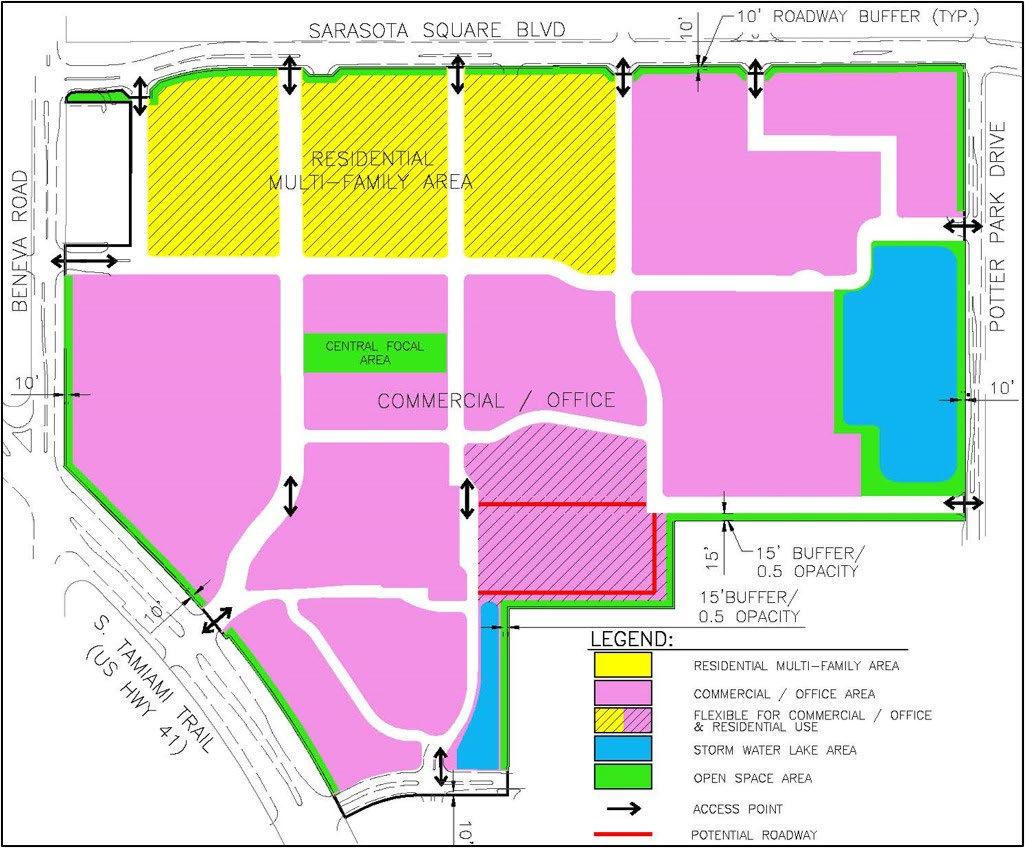

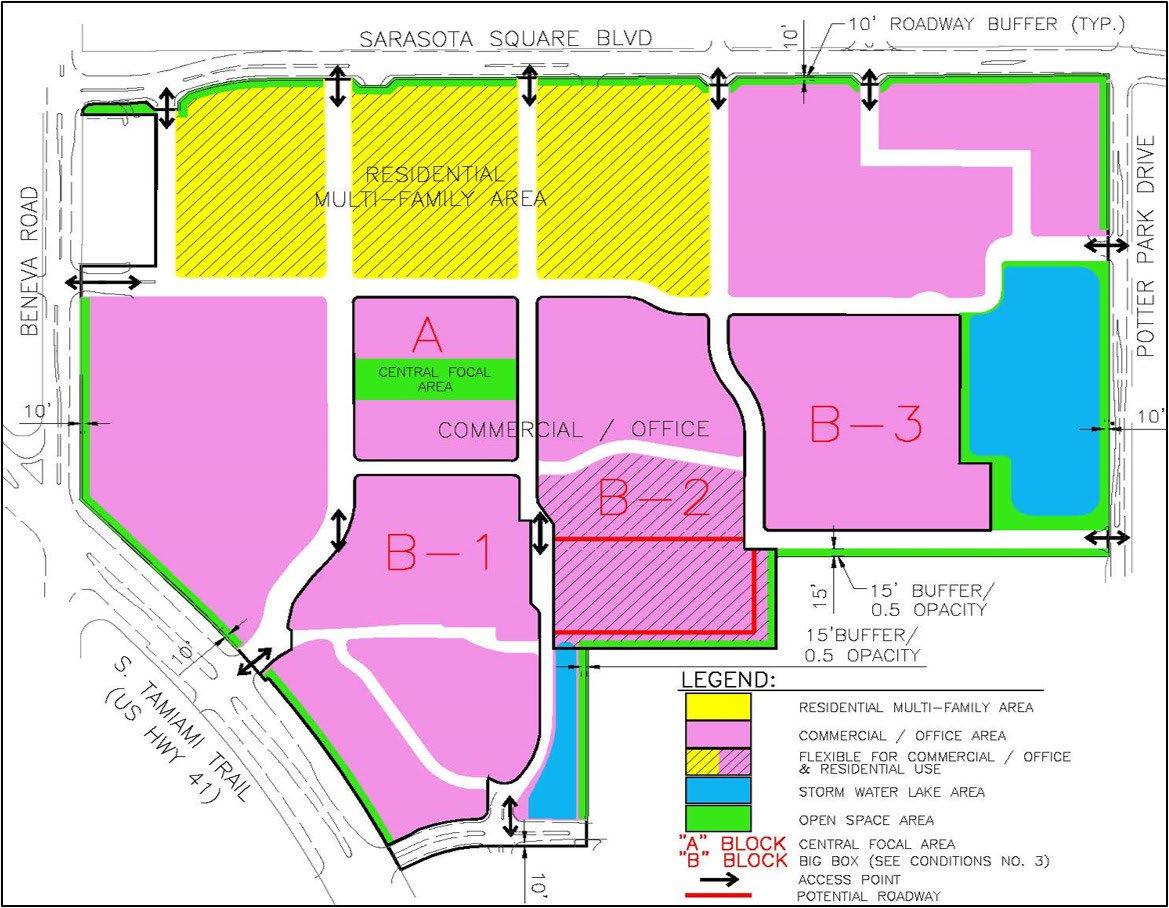

Envisioned project not allowed under current Sarasota County regulations. (For illustrative purposes only)

1. Residential / Office / Commercial uses

2.Minimum 500 residential units

3. Increased density above Code

4. Central Focal Area

5. Flexibility with design standards

6. Integration of uses

7. Flexibility to exchange uses

8. Excluded uses

9. Redevelop to new standards Tools

1. Located in center of the site

2.Minimum 0.8 acres

3.Required community use

4.8-foot sidewalks

5.Restaurants

6. Entertainment / Recreation / Events

7. Family-friendly Tools Used: 1. Special Exception

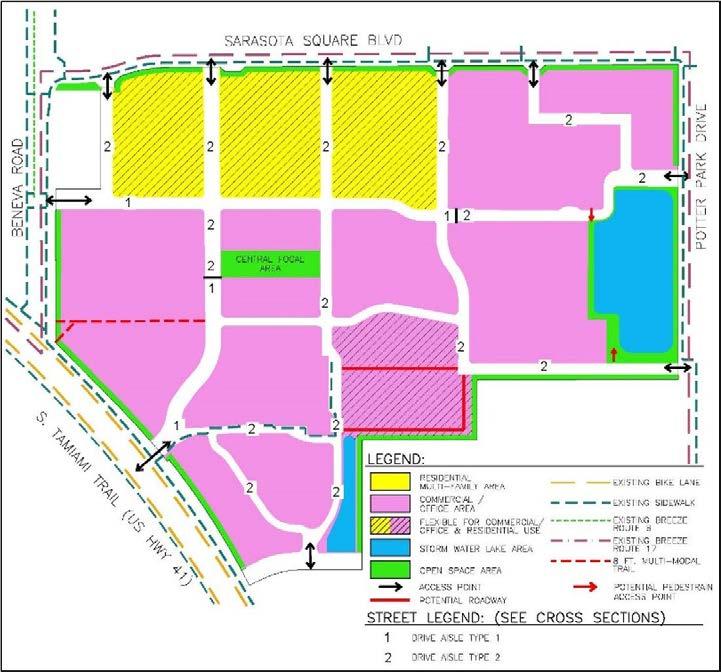

1. Grid pattern drive aisles

2. Internal capture

3. Boulevard concept

4.Multimodal trail

5.Sharrows

6. ADA transit stop

Tools Used:

1.DRI

1. Limit to only three “Big-Box” stores

2. “Big-Box” means >60,000 sf

3.More “little” stores

Tools Used:

1.Rezone

Community Concerns:

1.Entertainment / Recreation / Event noise

2.Access to central focal point area from US 41

3.Nesting birds within stormwater area

Tools Used:

1. Special Exception

2.DRI

(For illustrative purposes only)

1. Collaborative effort between County staff, developer, and community

2.Concerns from all three parties involved were mitigated with conditions and stipulations

3. Adoption public hearing went smoothly because of the up-front effort

Looking forward to this project coming to fruition!