2 minute read

Five year summary

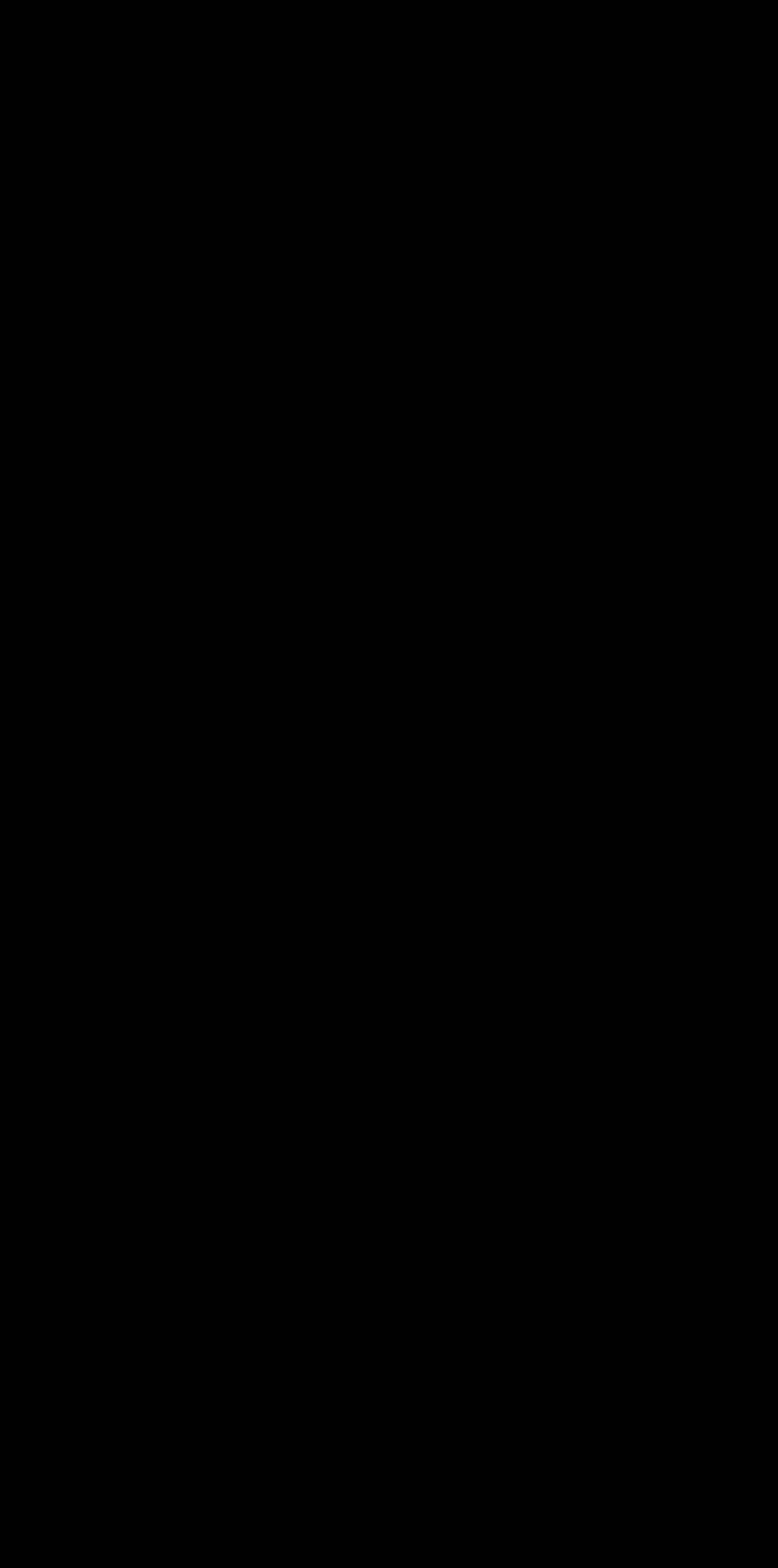

Amounts in DKKm

INCOME STATEMENT Revenue Share of profit in associated companies Profit/loss before financial items (EBIT) Financial items, net Profit/loss for the year A.P. Møller Holding A/S' share of profit/loss

Average number of employees

BALANCE SHEET Total assets as of 31 December Equity as of 31 December

CASH FLOW STATEMENT Cash flow from operating activities Purchase of property, plant and equipment

FINANCIAL RATIOS Proposed dividend to the A.P. Moller Foundation Return on equity Equity ratio 2020 2019 2018 2017 2016

276,958 275,032 262,613 220,930 207,171 2,016 3,944 2,201 4,863 502 19,115 15,187 10,325 - 5,276 - 9,318 - 6,674 - 5,281 - 2,891 - 4,290 - 4,003 9,987 6,577 22,464 - 2,991 - 11,051 4,737 4,772 10,942 1,388 - 1,349

88,191 88,006 86,113 82,306 83,737

421,819 462,222 413,113 435,298 464,366 249,202 262,940 255,758 229,502 256,376

55,177 43,846 24,795 25,011 11,715 - 9,957 - 16,037 - 19,857 - 38,927 - 15,818

600 400 500 500 500 3.9% 2.5% 9.3% - 1.2% - 4.2% 59.1% 56.9% 61.9% 52.7% 55.2%

The five-year key figures are based on the consolidation for A.P. Moller Holding group and have been adjusted for discontinued operations (Maersk Oil).

IFRS 16 Leases have been applied from 1 January 2019 in accordance with the modified retrospective approach. Therefore, comparative figures from previous periods (2016-2018), are not adjusted.

HIGHLIGHTS

A.P. Moller - Maersk accelerated its transformation during 2020 to become a global integrator of container logistics by completing a number of M&A transactions in the non-ocean segments. The digital product platform offerings (e.g. Maersk Spot and Twill) experienced significant growth.

Danske Bank has continued to progress on the strategy ‘Better Bank 2023’ with a number of initiatives including a reorganisation to reduce complexity and to ensure a better and more digital customer experience.

Maersk Drilling and the offshore drilling industry were negatively impacted by COVID-19 and subsequent Brent oil price drop, leading to early termination of contracts and reduced activity across the industry. Maersk Drilling continues to build strong customer relationships through their “Smarter Drilling for Better Value” strategy.

Maersk Tankers now operates more than 230 vessels and continues to build its product offering. During 2020, Maersk Tankers spun off ZeroNorth, a company aiming at reducing the tramp shipping industry’s CO2 emissions, while optimising earnings for the vessel owners. To date, ZeroNorth has attracted 1,500 vessels to its platform.

For Maersk Product Tankers the year has been impacted by significant volatility in time charter rates. Maersk Product Tankers continued its active asset management strategy and reached agreement with Asian buyers to divest part of its fleet.

KK Wind Solutions, the global leader in the wind turbine supply industry, showed solid operational performance throughout the year delivering above 10% revenue growth benefiting from the continued green energy transition.

In December 2020, A.P. Moller Holding signed an agreement to acquire Faerch Group, a global leader in sustainable and circular packaging for the food industry. The acquisition was completed in March 2021.