4 minute read

WNF 2023: Sustainable animal and aquaculture production for a brighter future

Rabobank’s Brebda de Swart, said that opinions of bankers matter as she looked at the economics of sustainability. Rabobank has the target of net zero by 2050 but it is not to stop financing but include sustainability into the financial commitment. The financial sector has a serious challenge in changing its business strategy to be a player that integrates data, agriculture expertise and supply chain traceability solutions.”

Mycotoxins and their mitigation

Since 2004, the World Nutrition Forum (WNF), an invitation-only summit, has been the go-to event for the global animal science, livestock and aquaculture production and feed manufacturing sectors. It is an opportunity for knowledge sharing and networking with top executives, experts, scientists and opinion leaders to explore a broad set of key issues in the food and feed industry. The Forum was held biennially up to 2018; the last WNF was held in Cape Town, South Africa. The 2023 program covered the realm of animal science and recent innovations, to update livestock producers and processors as well as feed manufacturers.

In 2023, DSM, took over this summit and held it in exotic Cancún, Mexico from May 8-10. On May 9 2023, DSM merged with Firmenich and took the new name, dsmfirmenich. “Against a backdrop of volatility and uncertainty, we cannot restrain the progress of scientific innovation or our industry’s calling to feed the world sustainably,” said Ivo Lansbergen Executive Vice President, Animal Nutrition and Health as he welcomed around 700 participants and described the new company (see page 4 AAP May/ June 2023).

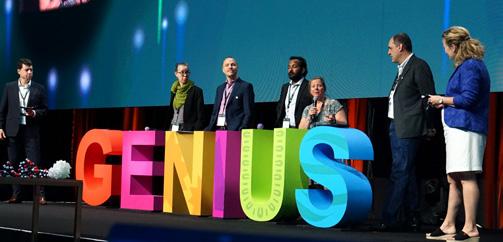

GENIUS sparks ideas

This was the theme throughout the conference. Eva Maria Binder, Head of Translational Science said that this summit embraced science governance and translational science for customers’ use.

Journey to sustainability

The ‘s’ in Genius is sustainability and the summit started with Bob Langert, Former VP of sustainability at McDonald’s describing the evolution of corporate sustainability. His message was: if we wait too long for an issue to trigger, amidst media and politics, the company can make rash decisions. The future requires transparency, commitment and doubling of expectations.

On the grand challenge of livestock production on the environment, Frank Mitloehner , University of California, Davis, USA, said that the impact of livestock includes 56% carbon dioxide and 18% methane and this amplifies the potential of global warming with regards to greenhouse gas (GHG) emissions. Predicting GHGs and how they warm the planet and not their CO 2 equivalent will provide information critical to developing short- and long-term climate solutions.

Scientific presentations on mycotoxin mitigation related mainly to livestock production but remain relevant for aquafeeds. A poster by Rosen et al. on ‘Beyond binding – a deeper look into mycotoxins mitigation strategies for aquatic species” discussed enzymatic detoxification of fumonisins and zearalenone by biotransformation in rainbow trout. On the impact of mycotoxins on health and nutrition, Todd Applegate , University of Georgia, USA, said that nutrient dense diets lessen the severity of mycotoxins in swine and mycotoxins have a role in protein synthesis. Veronika Nagl , dsm-firmenich, Austria discussed how omics and other technologies have unravelled the molecular mechanisms of mycotoxins and their effects in the rumen.

Omics and gut microbiomes research

The microbiome strategy is to focus on beneficial functions encoded by key species and create best in class microbial references. A data platform will integrate multi-omics data, trials and performance data with experimental and screening data. Mick Watson , dsm-firmenich described how metagenomics enables precision characterisation of microbiomes. Maia Segura-Wang, dsm-firmenich showed the steps in developing a gut microbiome precision service and said, “By combining data from multiple sites, we have cross regional comparisons in terms of microbial and pathway abundance and prevalence. This collection is the first effort towards building a commercial database of gut microbiome antibiotic resistant genes and functional pathways.”

The full report is available at www.aquaasiapac.com

Aquaculture at WNF 2023

Global outlook on finfish and shrimp aquaculture and challenges with aquafeeds, from formulations, ANFs, mycotoxins to sustainability.

The breakout session on aquaculture at this World Nutrition Forum (WNF) on May 9 was moderated by Benedict Standen, Head, Global Aqua Marketing and Ester Santigosa, Global Innovation Lead, Aquaculture at dsmfirmenich. Five experts discussed farmed finfish and shrimp production and recent challenges in aquafeed production, mainly rising feed costs, balancing optimum nutrition in a volatile ingredient market, ANFs and mycotoxin contamination, and meeting the sustainable feed agenda.

Global finfish aquaculture: Outlook and challenges

Ragnar Nystoyl, Kontali, Norway, said global farmed finfish production showed an average compound annual growth rate (CAGR) at 7% over the last 20 years but only 3% in the last 2 years. Aligning with the nutrition focus at WNF, Nystoyl noted that the volume of fed white fish is less than 17 million tonnes out of the total production of 27 million tonnes. Global aquafeed production showed a declining growth rate. Finfish accounts for 75% of aquafeed demand. The rising costs of feed, such as those for the salmon increasing from USD1.50/kg in 2015 to more than USD2.00/kg in Q1 2023 is a real challenge.

Tilapia has a CAGR of 2% over the last 2 years driven by the rise in whitefish consumption. Production of pangasius and other catfish is stagnating at around 5 million tonnes. Tilapia and pangasius face limited access to markets and low consumer confidence. Prices are low and competitive although there has been a recent rise of USD1/kg in Q1 2023 for fillet.

Within the salmonid segment, growth has been led by the Atlantic salmon with a CAGR of 14% over 1990 to 2000 with a production of 840,000 tonnes. CAGR was less during 2000 to 2020 at 5%. Production was estimated at 1.12 million tonnes for 2022. CAGR is predicted to be lower at 3% over 2020 to 2030. Over the past two decades, volumes have tripled, and value is six times higher. The salmon is unique in terms of colour.