6 minute read

Australia Officially in Recession

Special Edition:

Australia Officially In Recession As GDP Tanks In June Quarter

Denita Wawn | CEO

MASTER BUILDERS AUSTRALIA

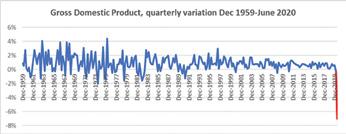

As foreshadowed earlier this week, the national accounts for the June quarter show that GDP fell 7.0 per cent. It’s the largest quarterly fall since GDP records began in 1959, and far more significant than the second largest GDP contraction of 2.0 percent in the June 1974 quarter. The latest fall follows a decrease of 0.3 per cent in the March quarter 2020 and means Australia is officially in a recession.

Private demand collapses

Private demand detracted 7.9 percentage points from GDP, driven by a 12.1 per cent fall in household final consumption expenditure. The quarter saw a 17.6 per cent fall in spending on services reflecting altered behaviour and restrictions due to COVID. Household saving to income ratio rose to 19.8 per cent from 6.0 per cent, driven by the fall in consumption expenditure.

Building and construction industry

The construction industry added over $30 billion to the Australian economy in the June 2020 quarter, down 8.2 per cent from the March 2020 quarter. The construction industry contracted 4.7 per cent in 2019-20 to $130 billion, its contribution as a share of total GDP dropped 0.3 per cent in 2019-20 from 7.2 per cent in 2018-19 to 6.9 per cent in 2019-20. The contribution of civil construction to the Australian economy increased 1.9 per cent in the June 2020 quarter to $6.6 billion, but due to contractions in the other quarters for 201920 is down 4.6 per cent ($1.3 billion) over the financial year.

Construction services contribution to the economy dropped 12.9 per cent in the June quarter to $16.1 billion and building construction fell 5.5 per cent to $7.5 billion. Housing sales were hit hard in the June quarter, reflected in an 18.5 per cent decrease in ownership transfer costs (stamp duty) and a

15.9 per cent fall in the contribution of rental, hiring and real estate services since the March 2020 quarter. Private expenditure on housing construction fell 7.3 per cent in the June quarter, and 12.6 per cent over the financial year. The renovations market is down 6.0 per cent for the June 2020 quarter and 1.5 per cent in 2019-20. Commercial construction contracted 2.3 per cent in the June quarter, but overall was up 3.7 per cent for the financial year. Civil construction slumped 5.5 per cent in 201920, however, this reflects quarterly reductions in expenditure from a high in the December 2018 Compliance Inspections Electronic Leak Detection Ultrasonic Thickness Testing quarter, troughing in December 2019 before increase 1.5 per cent in the March 2020 quarter and 1.9 per cent in the June 2020 quarter.

State and territory economic conditions

New South Wales and Victoria are carrying the load when it comes to economic contraction, with state final demand down 8.6 per cent and 8.5 per cent, respectively, in the June quarter. All other states and territories also experienced reduced state final demand in the June 2020 quarter, with the Australian Capital Territory

WE PUT THE PR F IN WATERPROOFING

Are you achieving waterproofing compliance?

Waterproofing is listed as a key focus in the Design and Building Practitioners Act 2020 and carries significant duty of care obligations for all parties involved in the design and building process. In modern construction water ingress is the single largest source of construction defects and it has never been more important to get it right the first time.

Waterproofing Integrity provides quality control services for waterproofing membrane systems to ensure compliance with design specifications, manufacturers recommendations, Australian Standards and construction regulations is achieved.

We currently provide the following services in order to ensure the highest level of waterproofing is delivered for our clients:

seeing the least decline 2.2 per cent.

Coating Adhesion Testing

Thermal Diagnostics

Design Reviews

COVID-19 has had a dramatic economic impact in Australia and globally which will take many years to recover from.

While some work in the construction industry has continued, our Cbus members have felt the economic impact through reduced work hours and projects being put on hold. It’s acknowledged the construction industry will play a leading role in Australia’s economic recovery. And it’s Cbus, the $52 billion super fund representing the construction industry, which’ll contribute to this recovery at many points along the way. The fund sees opportunities in keeping current projects going and aiming to build a decent pipeline of work over the next few years. Cbus believes its investments are likely to contribute to the creation of around 100,000 Australian jobs through this recovery.

Investing in the recovery

Cbus has a strong history of job creation through Cbus Property*. We will focus on more than just large-scale property projects to achieve a similar number of jobs through the recovery. The fund will play a leading role in industry and government forums, identifying ways the super industry can assist in the recovery. Through a close relationship with sponsoring organisations, such as the MBA, Cbus will use industry insights to help prioritise ‘shovel ready’ and future projects. Cbus can invest capital in a range of ways that can contribute to the creation of jobs. These include:

• Direct debt and corporate opportunities

Within our Alternative Growth and Mid-risk alternative asset classes Cbus looks for direct investments in corporate opportunities with Australian listed companies and direct lending, respectively. Cbus is already a provider of debt facilities for smaller to medium tier construction projects, offering more flexible time horizons than traditional bank financing. In this space Cbus may also consider opportunities that provide funding for social and affordable housing. We support MBA’s leadership in advocating for an affordable housing stimulus package to drive new residential construction which will help sustain the wider building industry and create jobs. The fund believes there’ll be recapitalisation opportunities with distressed Australian companies; companies that will be here for the longer term.

• New developments

Cbus’ current exposure to greenfields development is mostly through directly owned investment in Cbus Property and Bright Energy Investments. Cbus Property recently announced an anchor tenant for its Pirie Street development that’s about to commence in Adelaide and will create 2,000 jobs. Cbus will continue to provide capital to Cbus Property for their pipeline of highly sustainable, quality commercial and residential developments across Australia. In our infrastructure portfolio, we’re investing in the construction of the 180MW Warradarge Wind Farm in WA through Bright Energy Investments. This project will create 200 jobs.

• Expansion of existing assets

One of the most effective ways of increasing the value of existing property and infrastructure assets is to upgrade existing facilities or undertake further development. Many of Cbus’ infrastructure assets have future development pipelines in their business plans and the fund will participate in providing capital towards these when they’re approved as priority projects.

Cbus contributes to a stronger economy

Cbus members understand super is a longterm investment. The Fund builds members’ retirement savings while also creating jobs in the industry and as a result provides decent work. This all contributes to the recovery and a stronger economy.

*Cbus Property Pty Ltd is a wholly-owned subsidiary of United Super Pty Ltd and has responsibility for the development and management of Cbus’ direct property investments. This information is about Cbus and figures are correct as at 5 May 2020. It does not take into account your specific needs. You should look at your own financial position, objectives and requirements before making any financial decisions. Read the relevant Cbus Product Disclosure Statement to decide if Cbus is right for you. Call 1300 361 784 or visit www.cbussuper.com.au for a copy.