3 5 7 9 15 Scholarship Winners Annual Meeting Minutes Ascend in the Community Checking Accounts Identity Theft ascend.org Summer 2024

From the President & CEO, Matt Jernigan

From the President & CEO, Matt Jernigan

quick reads

safe deposit renewals

Don’t forget, rental fees for all safe deposit boxes are due September 1. The fee will be transferred automatically from your specified checking or savings account. If you have questions regarding the fee, please give us a call at 800-342-3086 before September 1.

tax-free weekend

Tennessee tax-free weekend will take place Friday, July 26 – Sunday, July 28. During this annual tax holiday, clothing, school supplies, and computers may be purchased tax-free. Certain restrictions apply. Visit tn.gov for more information.

virtual appointments

Members can now meet virtually with one of our Ascend Services Specialists or Business Banking Advisors. Visit ascend.org and click “Schedule Appointment” at the top of our website to get started.

holiday closures

All Ascend branches and offices will be closed on Thursday, July 4, in observance of Independence Day and Monday, September 2, for Labor Day.

It’s hard to believe we are already halfway through the year. As we savor the last few weeks of summer before the hustle and bustle of back-to-school season begins, I am reminded of what truly distinguishes Ascend – our steadfast commitment to being your lifelong financial partner, celebrating each achievement and milestone alongside you.

From opening your first account to saving for college, buying your dream home, planning for retirement, and more, our team strives to be by your side every step of the way, offering tailored solutions to help you reach your personal financial goals.

Our pledge to your financial wellness goes beyond simply providing great products and services; it’s rooted in building a relationship founded on trust, reliability, and shared values. Regardless of your stage of life, Ascend aims to be with you through it all, providing the guidance and resources you need to navigate your financial journey with confidence.

In this issue of Possibilities, we further highlight what sets us apart from other financial institutions, including how we give our time and resources to uplift our Middle Tennessee communities and make a tangible impact. We are also proud to announce the recipients of this year’s scholarship program, an initiative designed to support the educational pursuits of our members.

As always, thank you for your membership with Ascend. Your trust and loyalty inspire us to continually strive for excellence and exceed your expectations in everything we do.

Regards,

Matt Jernigan President & CEO

2

Ten Ascend Scholarships Awarded for 2023

For over 20 years, Ascend has proudly provided scholarships to students attending accredited colleges, universities, technical, and trade schools. In 2024, Ascend is providing 10 $2,500 scholarships.*

Winners of the 2024 Ascend Federal Credit Union Scholarship include the following:

LaDaysha Ayers Nashville Belmont University

Jordyn Cedeno Nolensville Tennessee State University

LaNyiah Clemons Lascassas Austin Peay State University

Ashley Cope Bell Buckle University of Tennessee Southern

Cynthia Gray Tullahoma Emory University

Marisol Hernandez Belvidere Motlow State Community College

Esther Huai Nashville University of Pennsylvania

Dawna McGinnis Maynardville University of Tennessee – Knoxville

Sophie Rettinger Mount Pleasant University of North Alabama

Zainab Shonibare Nashville Vanderbilt University

Details for Ascend’s 2025 scholarship will be posted at ascend.org/scholarships later this year. Scholarship winners may reapply for the next academic year if they still meet program requirements.

* Ascend employees, officials and any of their family members are excluded from eligibility

concert season is in full swing

Did you know that as an Ascend member, you get exclusive pre-sale codes for all concerts and shows at Ascend Amphitheater in downtown Nashville? You can find the 2024 pre-sale code inside digital banking so you can access tickets to select events before they go on sale to the public.

Plus, keep an eye on our social media pages so you don’t miss our weekly posts during the concert season as part of our #TicketTuesday giveaway series. Be sure to follow us on all social media platforms @ascendfcu to ensure you never miss a chance to score free concert tickets!

3

73rd Annual Meeting

April

6, 2024

Opening Remarks

Chairman Mark Rigney welcomed attendees to Ascend Federal Credit Union’s 73rd Annual Meeting. On behalf of Ascend’s Board of Directors, Chairman Rigney expressed his sincere appreciation to the membership for trusting Ascend to continually strive to enhance their experience and build their loyalty. Additionally, he expressed his gratitude to the more than 600 employees who continue to put the members’ needs first, especially during this economically challenging year the country has experienced.

Ascend remains a financially stable organization operating in an industry that is essential to everyday life. Dedication to Ascend’s members is evident through the outstanding performance in customer satisfaction as measured by the Net Promoter Score (NPS), an index ranging from -100 to +100, which is used to gauge the customer’s overall satisfaction with a company’s product or service and the customer’s loyalty to the brand. Generally, a score of 50 or more is considered excellent. While scores vary widely by industry, in 2023, Ascend averaged a score of 68, far above the consumer banking industry average of 33. In addition, Ascend has increased assets by more than $379 million since last year, which is a testament to Ascend’s commitment to the members' satisfaction and the success of our endeavors.

Prior to officially calling the meeting to order, Chairman Rigney reminded meeting attendees of the door prizes being presented following this meeting.

Call to Order

The annual meeting was called to order by Chairman Rigney on April 6, 2024, at 1:03 p.m. in the Apollo conference room at Ascend's corporate headquarters in Tullahoma, Tennessee.

Introduction of Officials

Chairman Rigney began by introducing the officials in attendance as follows:

Board of Directors

Mark Rigney, Chairman

Janet Marshall, Vice Chairman

Andy Flatt, Treasurer

David Elrod, Secretary

Pat Eagan

Ray Guzman

Valerie Molette

Tonya Quarles

Anthony Taylor

Supervisory Committee

Josh Johns, Chairman

Charlie Dillingham

Anthony Taylor

In addition, Chairman Rigney recognized Ascend’s President and CEO, Mr. Matt Jernigan.

Quorum

Mr. Josh Johns, Supervisory Committee Chairman, reported a quorum was present and in attendance for this meeting.

Approval of Minutes

Chairman Rigney announced the minutes of the Annual Meeting held on March 18, 2023, were distributed in the summer issue of Possibilities. The floor was opened for questions and/or comments. There being none, a motion was made by Mr. Eagan and seconded by Dr. Elrod to approve the minutes

4

dated March 18, 2023, as written. The motion carried unanimously.

Reports of Chairman, Treasurer, and Supervisory Committee

Chairman Rigney directed meeting attendees’ attention to the 2023 Annual Report where the officials' reports could be found, noting copies of the 2023 Annual Report are available at this meeting, online at ascend.org, and at all Ascend financial centers.

Old Business

None.

New Business Election Results

– Chairman Rigney reported there were no qualifying petitions received this year; therefore, in accordance with the credit union's Bylaws, the nominees presented by the Nominating Committee were elected by acclamation. Officials elected for a three-year term were Mr. Pat Eagan, Mr. Andy Flatt, and Ms. Janet Marshall. Elected for a one-year term was Ms. Tonya Quarles.

Adjournment

The floor was opened for questions and/or comments. There being no questions or further business, Chairman Rigney asked for a motion to adjourn the meeting at 1:07 p.m. A motion was made by Mr. Taylor and seconded by Ms. Quarles to adjourn the 73rd Annual Meeting of Ascend Federal Credit Union. The motion carried unanimously.

Door Prizes

Upon arrival at the meeting, members were given a numbered ticket qualifying them for door prizes. Following adjournment of the meeting, drawings were held to award four (4) prizes,

including two (2) charcuterie boards and two (2) grand prizes totaling $100 each.

Closing Remarks

Chairman Rigney expressed his appreciation to Ascend’s staff and management for their dedication to ensuring Ascend can continue to serve members safely and effectively. Chairman Rigney noted Ascend continues to exemplify the mantra of “people helping people” through education, community service across Middle Tennessee, and embodies the core values — integrity, respect, excellence, generosity, relationships, and service — every day. A vital part of Ascend’s mission is to serve and uplift the communities it serves by giving time and resources. Ascend has been fortunate to make lasting and meaningful partnerships with local organizations, and in 2023, donated more than $500,000 back to the communities it serves.

In addition, Chairman Rigney expressed his appreciation to Ascend’s Board of Directors. Last year, the Board voted to return $5 million to the memberowners. Over the past 19 years, Ascend’s volunteer, unpaid Board of Directors has voted to return over $109 million to credit union member-owners.

On behalf of the volunteers and staff, Chairman Rigney thanked everyone for their attendance, support, and membership.

Members were excused from the meeting.

5

Ascend in the Community

We’re Making an Impact in the Most Important Place We Can — Home

At Ascend, we strive to always be there for our members and our communities. This spring, we remained true to our commitment by supporting various causes and organizations in Middle Tennessee that we believe contribute to making the Volunteer State a better place.

American Red Cross

Ascend proudly supported the American Red Cross by sponsoring the Heart of Tennessee Chapter’s Heroes Luncheon and the Nashville Area Chapter’s Lifesaver Luncheon. Both events celebrated and honored local leaders and volunteers for their acts of compassion, bravery, and service to their communities. Funds raised from the events will help the American Red Cross deliver critical services to the communities being served by each chapter.

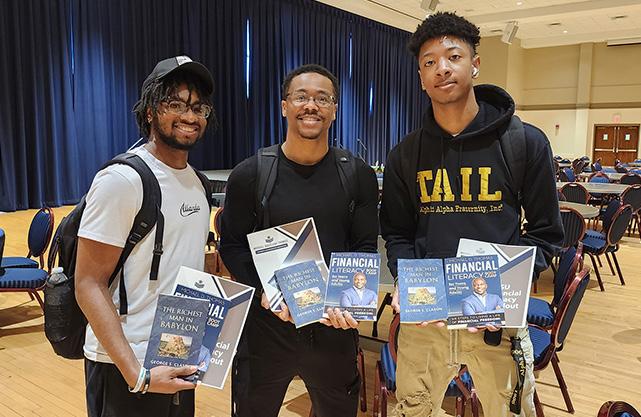

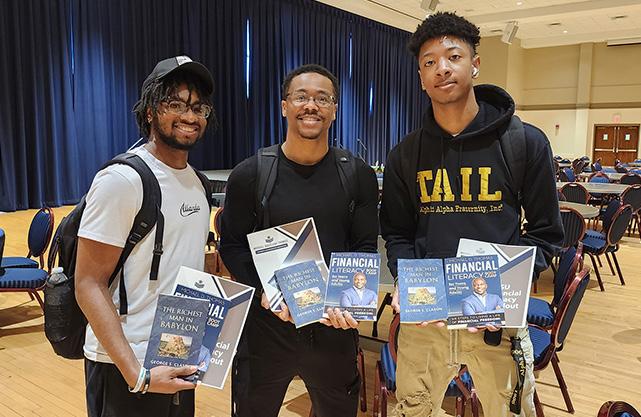

Fisk and TSU First-Generation Student Scholarships

In line with our commitment to supporting diverse communities, Ascend recently awarded four scholarships to first-generation college students attending local Historically Black Colleges and Universities — Tennessee State University and Fisk University. The scholarships, totaling $20,000, aim to create opportunities for higher education and employment.

6

Fisk scholarship recipient, Jayla Bibbs, pictured with Charlotte Ave. Assistant Branch Manager Destiny Tillman.

Girl Scouts of Middle Tennessee

Ascend continued its support of the Girl Scouts of Middle Tennessee by partnering with the Tennessee Environmental Council to donate 100 trees to the Scouts. Through Ascend's partnership with Banzai we are providing troop leaders free access to interactive K-12 financial education courses — teaching skills like budgeting, saving, understanding debt, using the internet safely, and more.

Financial Literacy Month

In April, Ascend partnered with Middle Tennessee State University’s Jones College of Business to sponsor their Financial Literacy Month events. The month included financial education seminars and on-campus events that taught students about everything from basic finance to debt management, budgeting, and more.

7

How to Have Summer Fun on a Budget

When kids are out of school for the summer, having options for cheap or free family fun is essential. Luckily, Middle Tennessee has plenty of possibilities for entertainment on a budget.

Get Outside and Move

Middle Tennessee isn’t lacking in outdoor recreation. Several state and municipal parks in the area offer fantastic hiking opportunities, playgrounds, or even splash pads, and pools.

Attend a Festival

Summertime is festival season in Middle Tennessee, and not just around the July Fourth holiday. County fairs dot the calendar in July and August, including the Wilson County – Tennessee State Fair from August 17-26, and there are countless other celebrations all summer long. The best part is most of them are free to attend.

Start a Puzzle or Play a Game

If the heat’s too tough to beat outside,

stay indoors with a puzzle or a board game that the whole family can play.

Have Some Educational Fun

Public libraries have tons of free educational options for kids during the summer. Also, there are free activities for kids held regularly at the Adventure Science Center and Frist Art Museum in Nashville.

Learn About Budgeting and More

Ascend offers free access to a range of financial education tools that you can share with your kids during the summer. Short videos and interactive lessons are located on our website that teach you about financial basics, budgeting, checking and savings accounts, and more.

8

Ascend is proud to offer checking accounts tailored to suit your needs and to help you achieve your financial goals. Members with our Interest Earning and Rewards Checking accounts also receive access to complimentary benefits, including Telehealth Services, Fuel Savings, Mobile Phone Protection, and more!1

Interest Earning Rewards

Earn 3.56% APY2 on balances up to $15,000.

Earn 10 ¢ with every qualifying3 purchase.

1Some benefits require registration and activation. Additional terms and conditions may apply. Please visit ascend.eclubonline.net for more details.

2Annual Percentage Yield (APY)

310¢ cash back on debit card purchase transactions of $5.00 or more. Payment transactions, money transfers to nonfinanacial institutions (such as person-to-person), tax payments, and fraudulent purchase transactions are excluded.

Awards Spotlight

Ascend Receives Training Magazine’s Apex Award

For the 10th consecutive year, Ascend has received Training Magazine’s Apex Award which celebrates companies that are making a difference in their employees' lives through best-in-class training and development programs. Ascend is the highest-ranking company headquartered in Tennessee and ranked 10th nationally.

Anthony Taylor Inducted into AACUC Hall of Fame

Longtime Board Member Anthony Taylor was inducted into the African American Credit Union Coalition (AACUC) Hall of Fame.

Anthony was inducted along with four other credit union industry leaders during a ceremony held on March 5 as part of the Governmental Affairs Conference in Washington, D.C.

The African American Credit Union Hall of Fame, established by AACUC, acknowledges individuals for their contributions to advancing the credit union movement, particularly in providing financial services and facilitating access to financial capital for African Americans and people of color.

Caren Gabriel Inducted into TCUL Hall of Fame

Former Ascend President and CEO Caren Gabriel has been inducted into the Tennessee Credit Union League (TCUL) Hall of Fame. The award recognizes Caren’s impact and leadership during her 38 years at Ascend, including 19 served as the credit union’s top executive. The honor was announced at the TCUL awards dinner, part of the 2024 Tennessee Credit Union League Convention and Expo held April 16-18 at the Gatlinburg Convention Center.

10

Ascend Voted Tullahoma's Finest Mortgage Company

Ascend was recently named Tullahoma’s Finest Mortgage Company by the Tullahoma News. This recognition, determined through a public vote, was announced in the annual Tullahoma’s Finest publication.

Ascend Wins Dora Maxwell Social Responsibility Award

Ascend has won the 2023 Dora Maxwell Social Responsibility Community Service Award from the Tennessee Credit Union League (TCUL). The awards committee selected Ascend from applicants across Tennessee as part of the Credit Union National Association’s (CUNA) Award Program. Ascend was presented with the award at TCUL’s annual conference held at the Gatlinburg Convention Center from April 16-18, 2024.

The Dora Maxwell Award honors credit unions for outstanding social responsibility projects and activities in their community. The award is named after Dora Maxwell, a community activist who committed her life to credit union development, her community, and serving the underserved.

11

Beyond Retirement: Consider Your Other Goals

Retirement savings aren’t the only financial goal you should consider. There are other milestones to account for as well.

When it comes to financial stability, people tend to focus on paying off debt and saving for retirement. However, many other financial goals can pop up during your lifetime, and it’s important to look beyond retirement when setting targets, no matter how old you are.

Identify Future Objectives

While it is never too early to start planning for retirement, waiting until you reach 65 years or older to truly live is a mistake many people come to regret. Exciting possibilities are waiting, like owning a home and raising a family, starting a business, or growing passive income.

Consider Income

While some people start their careers making six figures or more, this is rare. The median salary for those 20-24 years old is $706 per week — or $36,712 per year, according to the Bureau of Labor Statistics. Those in the 25-34 age range have a median salary of $52,156 per year. If your salary increases follow the historical rate and you have no major employment gaps, you should earn close to $2 million by the time you’re ready for retirement.

Create a Plan

If you’re starting to feel discouraged, the good news is that money isn’t a static asset. It has the potential to grow and do some of the work for you by creating passive income. People who begin to invest early can better position themselves in the pursuit of their retirement goals. You can employ several different strategies to help your money go further, like designating a portion of raises for savings and investments, buying wisely, and utilizing financial products and accounts that grow over time.

Reduce Debt

Be wise in how you use debt. Consider payment terms, interest rates, and the types of debt you accrue. Whenever possible, pay down debt as quickly as you can while not neglecting your savings.

Need help figuring out where to get started? Our financial professionals at LPL Financial can help. Contact us at Ascend Retirement & Investment Services for more information today.

12

We Can Help With Your 401(k) Options

Changing jobs? What should you do with the 401(k) money you’ve accumulated? You may have up to four options (and may engage in a combination of these options): leave the money where it is, roll it over to your employer’s new plan, roll it into an Individual Retirement Account (IRA), or cash it out. Call an advisor to learn more or to schedule a consultation.

*Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Ascend Federal Credit Union and Ascend Retirement and Investment Services are not registered as a

or investment advisor. Registered representatives of LPL offer products and services using Ascend

and Investment Services, and may also be employees of Ascend Federal Credit Union. These

through

or Ascend

or

Please visit www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

broker-dealer

Retirement

Ascend Federal Credit

Retirement

Services.

insurance offered

its affiliates are: Not Insured by NCUA or Any Other Government Agency Not Credit Union Guaranteed Not Credit Union Deposits or Obligations May Lose Value Randall W. Harris, ChFC® CFP® VP, Wealth Management 931-454-1307 Dan Sheible, LUTCF® CRPC® Financial Advisor 931-454-1355 Stephen Yun Financial Advisor 931-454-2915 Josh Wells, CRPC® Associate Financial Advisor 931-461-8779 Kristy Harris, CRPC® Associate Financial Advisor 931-461-8749 Lee Baker Associate Financial Advisor 931-454-2925 Ascend Federal Credit Union

Institution") provides referrals to financial professionals of LPL Financial LLC ("LPL") pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for

Financial Institution to make

conflict

interest.

services.

products and services are being offered

LPL

its affiliates, which are separate entities from, and not affiliates of,

Union

and Investment

Securities and

through LPL or

("Financial

the

these referrals, resulting in a

of

The Financial Institution is not a current client of LPL for advisory

Welcome New Select Employee Groups

Calvary Chapel Franklin – Brentwood, TN

DePriest Center – Murfreesboro, TN

International Guards Union of America Local 173 – Nashville, TN

Moms Loving Moms – Murfreesboro, TN

Poplar Grove HOA – Smyrna, TN

Snuggle Inn Small Dog Rescue Limited – Livingston, TN

Workwear Outfitters, LLC – Nashville, TN

Email bizdev@ascend.org to learn how employees and members of your organization can partner with Ascend Federal Credit Union.

2024 Labor Day Giveaway

With September just around the corner, we are excited to announce our 2024 Labor Day Giveaway! This year, we are giving away a Blackstone grill and assorted accessories, so you can make your final cookouts of the year bigger and better than ever.

Beginning Monday, August 12, members can enter by commenting on our 2024 Labor Day Giveaway Facebook post or by visiting a local Ascend branch to fill out the entry form in person. The entry period will run from Monday, August 12, 2024, at 9 a.m. CST through Friday, August 16, 2024, at 5 p.m. CST.

Important notice: Please beware of scammers with fake Facebook pages posing as Ascend. We will not send you a link to click or ask you to provide any account information.

If the winner enters through Facebook, they will be notified via Facebook Messenger from Ascend’s verified page. Messages from Ascend will not contain any links to click. If the winner enters in-branch, they will be notified via phone.

Visit ascend.org/official-rules to learn more.

14

Protect Yourself from Identity Theft

We live in an increasingly digital world and while accessibility helps make activities quick and convenient, having so much of our personal information online leaves us vulnerable to cyber criminals. Here are a few things you can do to keep your identity safe:

Keep a close eye on your credit report. Monitoring your credit report frequently can go a long way in preventing identity theft. At Ascend, we offer our members a free credit score monitoring and analysis program available inside digital banking called SavvyMoney, which provides real-time access to their credit score and credit report. You can also get a free credit report at annualcreditreport.com. If you do find fraudulent activity in your credit report, you can file a dispute with the appropriate credit reporting agency.

Consider a credit freeze or fraud alert.

Credit freezes and fraud alerts add an extra layer of protection, all at no cost to you. A credit freeze restricts access to your credit report, preventing any new credit account from being established in your name. A fraud alert is similar, but instead of completely restricting new credit accounts, it notifies creditors to take extra security measures before offering credit.

It’s important to note that freezing your credit does not freeze your credit score. Any credit accounts established pre-freeze can still alter your credit score. While your credit is frozen, any time a hard credit inquiry is needed

(shopping for a car, mortgage, etc.) you will need to unfreeze your credit.

Protect your personal information. Be vigilant about sharing personal information, especially if you get a suspicious call, email, or text message claiming to be from a trusted individual or financial institution. If you are an Ascend member and receive a suspicious message that appears to be from Ascend, call 800-342-3086 to confirm the validity of the message before responding. Do not call the phone number listed in the message or click any links.

It's also important to limit the personal information you share on social media. This includes answers to common security questions, such as your mother's maiden name or the make and model of your first car, your address, and images of sensitive documents like your driver's license or passport.

With these tips, you’ll be able to proactively guard yourself from attempts at identity theft. If you believe you’ve fallen victim to a scam, contact us immediately at 800-342-3086.

15

P.O. Box 1210 Tullahoma, TN 37388 We do business in accordance with the Federal Fair Housing Laws and the Equal Credit Opportunity Act. All loans subject to credit approval. Ascend Federal Credit Union and the Flying-A logo are registered trademarks of Ascend Federal Credit Union. © 2024 Ascend Federal Credit Union. Federally insured by NCUA. All Rights Reserved. @ ascendfcu ascend.org memberservice@ascend.org 800-342-3086 STAR: 800-342-8663 For

The best place to bank isn’t a bank.

more information about all of our locations, visit ascend.org/locations.

From the President & CEO, Matt Jernigan

From the President & CEO, Matt Jernigan