The Growth and Sustainability Loan Scheme supports strategic investments in the growth and resilience of the business or in environmentally friendly technology with long-term low-cost finance up to €3 million.

The Growth and Sustainability Loan Scheme supports strategic investments in the growth and resilience of the business or in environmentally friendly technology with long-term low-cost finance up to €3 million.

Editor: Denise Maguire

Designer: Alan McArthur

Creative Director: Jane Matthews

Production Executive: Nicole Ennis

Managing Director: Gerry Tynan

Chairman: Diarmaid Lennon

Email: info@ashville.com or write to: Better Business, Ashville Media, Unit 55, Park West Road, Park West Industrial Estate, Dublin 12, D12 X9F9. Tel: (01) 432 2200

All rights reserved. Every care has been taken to ensure that the information contained in this magazine is accurate. The publishers cannot, however, accept responsibility for errors or omissions. Reproduction by any means in whole or in part without the permission of the publisher is prohibited. © Ashville Media Group 2024. All discounts, promotions and competitions contained in this magazine are run independently of Better Business. The promoter/advertiser is responsible for honouring the prize. ISSN 2009-9118 SFA is a trading name of Ibec.

Welcome to Better Business, a magazine dedicated to the small business community.

In this edition of Better Business, the SFA highlights a busy period of engagement with political stakeholders amid a change of Government leadership and elections in June. e SFA published its policy priorities document which called for, among other things, a PRSI rebate to assist small businesses with the transition towards the Living Wage rates.

Furthermore, the SFA is calling for a reduction in Capital Gains Tax rate from 33% to 20% and wants to introduce a National Training Voucher Scheme, which has the potential to boost in-company training and widen participation in upskilling and reskilling employees.

In response, the Government announced a range of measures aimed at assisting small businesses, such as an increase in the employer PRSI threshold and a doubling of ICOB payment introduced for businesses in the retail and experience sectors. is was a step in the right direction, but there’s a lot more to do.

At the end of May, the SFA published its Cost of Business survey which showed that one in three small businesses will run out of liquidity within six months without additional funding. e survey also showed that average business costs increased by over 16%, with 83% of small businesses experiencing rising costs. With 57% of small businesses reporting increased labour costs in the past 12 months, it highlights the need for a PRSI rebate.

In this issue, the HR pages focus on the forthcoming autoenrolment requirements for all businesses, while the health pages deal with issues related to tiredness and burnout. e entrepreneurs section takes a look at tech rms and our sector spotlight shines a light on Ireland’s life sciences sector.

Going forward, the SFA will be making its budget submission to Government which will align with our policy priorities document. Hopefully, the new local councils, the Harris administration and the new European Commission will produce legislation that will bene t small businesses. e SFA will continue to ensure that small businesses are considered by legislators in the months and years to come.

As always, Better Business contains stories that will both inform and inspire. is issue has a particular focus on public policy. Many of the businesses featured in this publication are the heartbeat of communities and the lifeblood of the wider economy.

Better Business is the magazine of the small business community. We welcome your feedback, suggestions and ideas to info@sfa.ie or on Twitter @SFA_Irl.

David Broderick Director, Small Firms Association

Big News for Small Business News, views and profiles from SFA members and small businesses in Ireland

18

Sector Spotlight

Ireland’s life sciences sector is creating an ecosystem that’s ripe for start-ups to thrive

28

Cover Story

Joining the Backing Business Community at Virgin Media Business gives small firms a platform to learn and grow

52 Health

Implementing wellbeing supports helps minimise the risk of employee burnout

10

Interview

James Loughran at Leinster Environmentals on taking stock of success 14

Top Tips

Increase your sales and business success with The Business Works LACE framework

22

Green Investments

The Growth and Sustainability Loan Scheme can benefit a small firm’s bottom line

48 Policy

Exports of agri-food goods into GB are now subject to Border Control Post (BCP) checks

56 Arts and Culture

Traditional bookshops are doing all they can to fend off tough competition from online retailers

24

Mediation

Before engaging in litigation, businesses should look to mediation and independent intervention

50 HR

A mandatory Auto-enrolment Pension Scheme is due to come into force in January 2025

60

Travel

Businesses exporting to the UK need to be mindful of new requirements coming into force

FROM TOP LEFT: James Loughran at Leinster Environmentals is committed to environmental sustainability, page 10 // Sonia Neary at Wellola on how Dublin is becoming a digital health hub, page 18 // Debbie Behan at Virgin Media Business explains why joining the Backing Business Community is a good idea for small firms, page 28 // John O’Shanahan at LeanBPI wants to help small businesses make the most of technology, page 44

In March 2024, Azets Ireland merged with PKF O’Connor, Leddy & Holmes. Catherine McGovern (Tax Partner), who has worked with the SFA, said the merger has doubled the size of Azets’ Irish business to a workforce of 220. In addition, the merger creates a firm of national scale with the depth of expertise to deliver quality, partner-led services to entrepreneurial, owner managed and family owned businesses in Ireland. Azets Ireland is one of the country’s fastest growing professional services firms, providing a range of services including audit, tax, valuations, M&A, restructuring, due diligence, corporate governance, financial service, outsourcing, payroll and fund management. The combined firm will be based at Azets’ new offices at 40 Mespil Road, Dublin 4 with a regional South East presence in Enniscorthy and Waterford.

In April, the SFA published its policy priorities document ahead of the local and European election campaign. The policy document focuses on four key pillars aimed at creating better conditions for businesses to survive and grow. The pillars are – tackling business costs, easing the tax burden, upskilling the workforce and enabling prosperity through better national infrastructure. Among the various recommendations is the introduction of a PRSI rebate to assist small businesses with the transition towards the incoming Living Wage rates.

The SFA wants implementation to be swift as small businesses do not have the luxury of time and resources that larger businesses might have. The PRSI rebate is more pressing for the retail and experience economy as many businesses in these sectors are most impacted by seasonal demands.

Prior to the launch, the SFA was encouraged by the words of the new Taoiseach Simon Harris during his maiden speech to the Fine Gael Ard Fheis, where he stated that his administration will prioritise small businesses before the general election. At the Fianna Fail Ard Fheis, Tánaiste Micheál Martin made a commitment to changes in employers’ PRSI, which will help small businesses cope with rising costs. Furthermore, the new Minister of Enterprise, Trade and Employment, Peter Burke acknowledged the many concerns facing small businesses in a statement to the Seanad. Since last year, the Small Firms Association (SFA) has been calling for additional assistance for small businesses.

Software company FARMEYE is collaborating with the European Space Agency (ESA) on ‘Purlieu’, a project creating tools to quantify regenerative agriculture. Supported by ESA funding, Purlieu sets out to revolutionise the conservation and management of hedgerows, vital elements of Ireland’s agricultural landscape and fundamental to sustainable agriculture practices. FARMEYE’s Purlieu combines ground-based data capture with satellite imagery and advanced modelling techniques to deliver precise insights into hedgerow measurement and composition. Dr Eoghan Finneran, FARMEYE’s Co-Founder and CEO, said: “Purlieu demonstrates our commitment to innovating cutting-edge technology for the greater good, giving valuable metrics to stakeholders while preserving our natural heritage.”

Palletised freight distribution network company Pall-Ex Group has enhanced its operation by opening a network in Ireland. Operating from its Dublin facility, Pall-Ex Ireland already has 16 members and is actively recruiting more quality logistics businesses to join its membership and take advantage of its sector-leading technology and diverse range of pallet dimensions. The official launch of Pall-Ex Ireland took place in May 2024 with a ceremony held in one of its warehouses. The Minister of State at the Department of Transport with special responsibility for International and Road Transport and Logistics, Jack Chambers, spoke at the event and joined the teams in celebrating the launch of Pall-Ex Ireland.

Financial Wellbeanz has launched a new service – Tax Return Pro by Financial Wellbeanz. Tax Return Pro is a comprehensive and userfriendly platform that simplifies the tax return process. Once you register, you have access to a secure digital portal where you can review up to four years of tax history to see what refund you are due. After completing a short online form, the team will review your details and submit your return to Revenue for the years you are due a refund. Once the refund is received, it will be transferred to the customer on the same day. If you’re not due a refund, there is no fee. Firms who join Financial Wellbeanz will benefit from its lowest commission rate of 6.5%.

Financial Wellbeanz has a comprehensive suite of financial services solutions for employees. This includes free advice on mortgages and mortgage protection, a variety of private wealth options, discounts on car and home insurance and numerous financial wellness resources. The company prides itself on its experienced team of advisors, ensuring tailored solutions for every client’s unique financial situation.

For SFA members, it’s free to join Financial Wellbeanz so register your company at https:// employer. nancialwellbeanz.ie/ signup

Clonakilty Distillery has announced the debut of its first Single Pot Still Irish Whiskey, which hit the shelves nationwide in May. The occasion signified a historic milestone as the hometown-distillery unveiled its first maiden distillate crafted from barley grown on the family farm next to the Atlantic Ocean. The first cask was filled back on May 1st 2019 and within a year, it had secured the title of the ‘World’s Best Irish New Make’ at the World Whiskies Awards. The distillery was also shortlisted for ‘Best Food & Drink Exporter of the Year’ in the IEA’s 2024 Export Industry Awards.

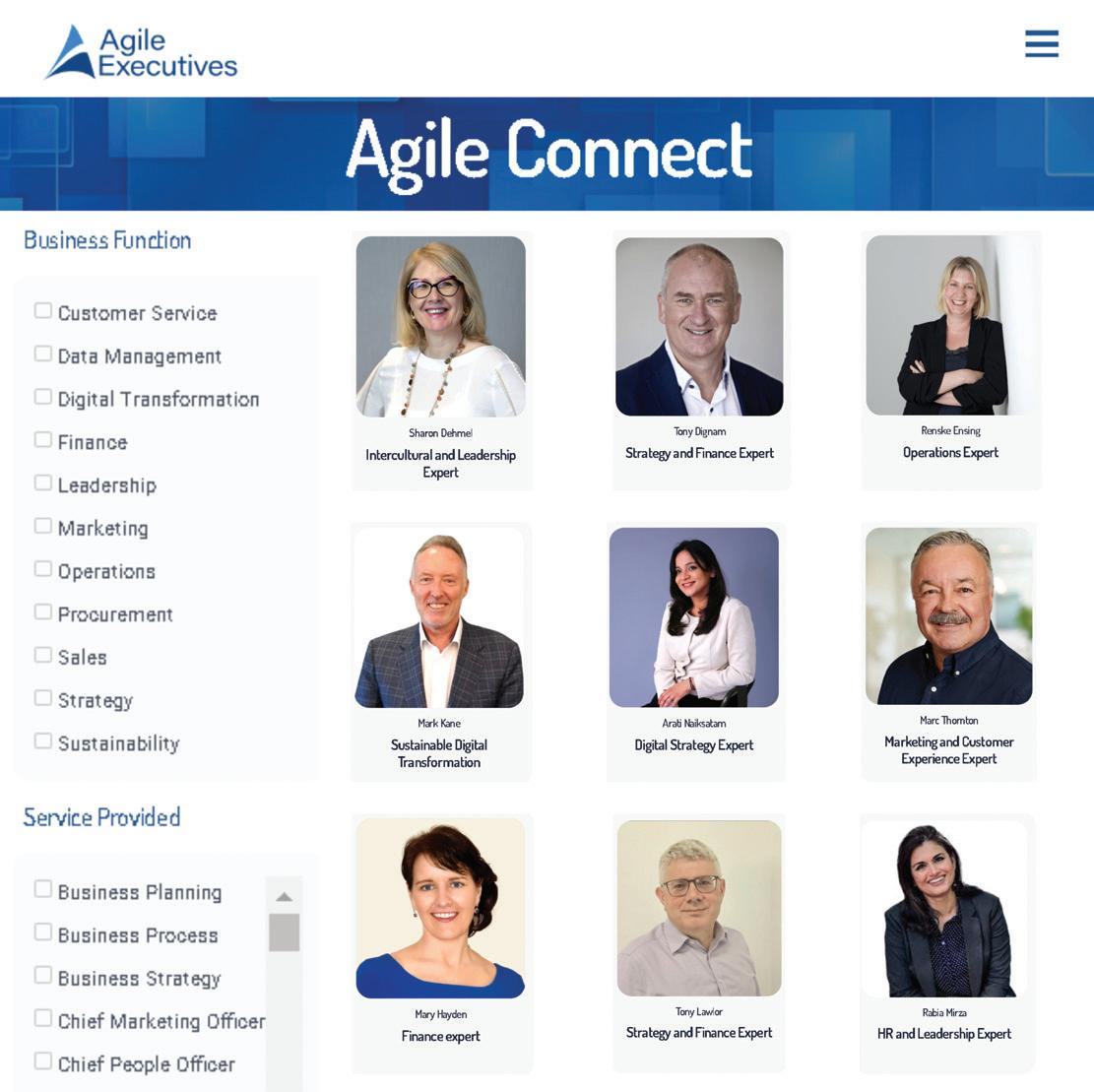

Agile Executives has gone international and added associates from the UK, US, Canada, mainland Europe, Middle East and Asia Pacific to its network which already includes 120 experts in strategy, finance, sales, marketing, digital, automation, HR, operations, data protection, sustainability and procurement. The move provides Irish businesses with a great network to scale into these international markets.

“Small businesses do not have the luxury of time and resources that larger businesses might have.”

David Broderick, Director of

the SFA (in the Irish Examiner)

Unveiled at Whiskey Live 2024, Blackwater Irish Whisky’s ‘The Full Irish’ showcases the three styles of Irish whiskey – grain, single malt and pot still. So far, the West Waterford based distillery has released a single malt, a pot still (highly non-compliant) and a rye – this is their first blend. Blackwater wants to bring some love back to the category, which is sadly neglected in Ireland, so neglected you will even struggle to find the category ‘Blended’ on a bottle. The term is not obligatory as the multinationals are slightly ashamed to look it in the eye. Blackwater is not. The new whiskey contains 45% Blackwater produced single malt, 45% Blackwater produced pot still (both five years old) and 10% seven-year-old grain whiskies, finished in stout casks from local firm, Hopfully Brewing Company.

“Our small businesses are the backbone of our local economy and provide much valued employment in communities across the country.”

Peter Burke

TD,

Minister

for Enterprise, Trade and Employment

“You can’t know everything. And there are people out there who are experts in their field and are willing to help you. So don’t be afraid to ask.”

Aine Kennedy, Founding Director and CEO, The Smooth Company

@SFA_Irl

SFA Cost of Business Survey 2024: 83% of small businesses face rising costs. 35% can’t trade beyond six months without additional funding. Supporting our small businesses is essential! For full insights, visit: https://ow.ly/ wbiL50S429Q #SFA #SmallBusiness #BusinessCosts

@peterburkefg

Good engagement with the #SME Taskforce today, positive reaction to Business support package

New SME test National Enterprise Hub, being launched July 10

Important for Government to keep in touch with industry and seek feedback on new measures.

@WMBMagazine MentorsWork, an initiative of @SkillnetIreland and Small Firms Association (@SFA_Irl), offers an expert business #mentoring programme to #SMEs from all sectors with 1-250 employees. This 12-week #MentorsWork programme is now open for applications.

Repak has announced that its Plastic Pledge Signatories have successfully been working towards supporting a circular economy for plastic packaging in Ireland. The announcement was made during the launch of Repak’s sixth annual Plastic Pledge Report, which showcases the accomplishments of those Signatories who have contributed to the 2023 Plastic Pledge report, successfully reducing and eliminating plastic packaging from their operations. The Plastic Pledge Report measures the impact of the Plastic Pledge initiative on Signatories’ behaviours and design choices, tracking their progress in reducing plastic waste and adopting sustainable packaging solutions. It highlights the work done by Signatories who have removed significant volumes of plastic from their operations and supply chains. In 2023, Plastic Pledge Signatories reported an average recycling rate of 72% for plastic packaging at their premises, well above the EU Circular Economy Package recycling targets of 50% by 2025 and 55% by 2030. The submissions also showed that Signatories achieved an average recycled content of 43% across various projects, with some products attaining 100% recycled plastic content.

Two emerging start-ups, Clia and Orgo, have been announced as winners of the 2024 NovaUCD Student Enterprise Competition, an intensive four-week accelerator programme for student entrepreneurs at UCD. Following pitches to a judging panel at the culmination of the competition, Clia, an emerging medtech start-up, was named winner of the €3k Tech Sustainability Prize sponsored by Terra Solar and Orgo, an emerging edtech start-up, was named winner of the €3k One to Watch Prize, sponsored by NovaUCD. Founded by physiotherapists Rory Lambe and Ben O’Grady, Clia is developing softwareas-a-service which plugs into existing cardiac rehabilitation services to improve support and treatment for people at risk of cardiac disease. Using wearable health data Clia aims to track and provide insights in heart health, offering links to structured exercise services and give check-ups with cardiac specialist physiotherapists. Orgo, a mobile e-learning platform focused on organic chemistry to enable students across the academic spectrum to become comfortable with the subject, was founded by Zackary Musumeci. The mobile app will help students with bite-size lessons and revision questions to ensure success throughout their college careers.

Founded by sisters Evie and Eliza Ward, Irish peanut butter company Nutshed has expanded its flavoured peanut butter range while reporting significant growth of 230% in the past four years. New Oat & Maple Crunch Peanut Butter joins the range, which is available in over 600 shops including Dunnes Stores, Tesco and SuperValu, as well as further afield. The business recently expanded into South Korea, with plans to further increase exports over the next three years. “We chose to go outside the box, driving the business into new territories. Conducting tasting events and cookery demos in South Korea throughout the year has been key in building a loyal customer base there,” said Nutshed Co-Founder Evie Ward.

James Loughran, Managing Director, Leinster Environmentals

Where did you get the idea to start Leinster Environmentals?

James Loughran (JL): I grew up near a seaside village on a family farm just outside Dundalk in County Louth. My childhood upbringing was very much based on the natural world and the world around us and this really created a deep and long-lasting connection with the environment we live in. When I graduated from university after I had studied cultural science, I wanted to do something connected to the environmental landscape and make things a little bit better. I grew up around a family business and my dad and I decided to use our agricultural knowledge and resources to explore opportunities in the environmental sector and take it from there. We wanted to see what difference we could make around the core competencies we had. This led us to start recycling farm plastics, specifically black silage plastic, in the early 2000s when we founded the company.

What services does Leinster Environmentals offer?

JL: We are very passionate about diverting scrap plastic from landfills and oceans and preventing environmental pollution. Leinster Environmentals

recycles waste plastic into low-carbon, high-quality raw materials, preventing this waste from entering our oceans or landfills. This raw material is used to make sustainable, lightweight and efficient parts for world-leading automotive and aerospace brands. By recycling enough waste plastic to fill almost 1000 Olympic-sized swimming pools, the company is saving 80,000 tonnes of carbon emissions. These materials are ideal for manufacturing parts in industries that value sustainability, low carbon footprint and high quality. We know many industries appreciate these features and our products work really well for them as a feedstock.

When did you realise you were filling a significant gap in the industry?

JL: The industry changed almost overnight in 2016/17 and it changed on the back of David Attenborough’s Blue Planet after it had a segment at the end of one episode highlighting ocean plastics. That absolutely revolutionised the conversation around scrap and waste plastics across Europe, as well as Ireland. So, it was very much a tipping point. It meant the recycling targets for plastics and the use of recycled plastics became more significant due to new regulations coming from

Brussels and other jurisdictions. For example, the Single-Use Packaging Directive has reduced throwaway plastics, which means we have much less weight of plastic being thrown away. There are now many important schemes supporting these efforts, which is essential as we go forward.

What does winning the SFA Award mean for the company?

JL: It was absolutely unexpected. This is the third time we’ve been a finalist in the SFA Awards and it was just fabulous to take part. We weren’t expecting to win our category and certainly did not expect to win overall, especially in a room with such incredible businesses. These are the backbone of the Irish economy, fueled by incredibly passionate people who drag themselves out of bed 360 days a year to put every ounce of effort into the business and for our activities to be considered as the best among those was extraordinarily humbling.

And it clearly meant a lot to your team

JL: Yes, the other aspect of it was from our team’s perspective. We employ 45 people and very few of them are customer-facing and get to experience how we are perceived in the world. So the accolade and the esteem that they get from realising and being aware of their efforts contributed to our business being recognised as one of the best in the country, which has been enormous. I’ve seen how many of the team are just that little bit more engaged – they’re more

confident about their work, they’re even more proud of what they do and that’s a real boost.

For those early entrepreneurs wanting to make a mark, what words of wisdom can you share?

JL: Anyone who starts a business, whether it’s in the environmental sector or any sector, is incredibly brave and deserves a huge amount of support and applause because taking the first steps is really hard. But nobody starts without taking those first steps. So I suppose one piece of advice is to, as Nike says, Just Do It – you’ve got to get going. You have to start making your mistakes and learning from them. Effectively, business is just a bunch of experiences where there’s slightly fewer mistakes than positive outcomes. You keep going, learn from them and try to make incremental progress. We’re celebrating 20 years of business this year and we were probably 15 years in before we could look at it and go, that’s a solid, sustainable business that can take care of itself. So it takes a long time for things to mature.

Can you share details about what’s next for the company?

JL: Just doing more of what we do, adding additional value to products and processes to make them more appealing to our customers. This is everything from trying to find additional strings of material that might be leaking into rented disposal routes and recovering them and recycling software, to trying to make our

“BY RECYCLING ENOUGH WASTE PLASTIC TO FILL ALMOST 1000 OLYMPIC-SIZED SWIMMING POOLS, THE COMPANY IS SAVING 80,000 TONNES OF CARBON EMISSIONS.”

operations more efficient and more productive. For example, by the end of the year, 50% of our energy will be generated from an onsite solar array. We will have upgraded our finished product by sorting it optically into various colour fractions, which is a new process we haven’t had before. We also want to upgrade our laboratory and testing centre so that we can provide our customers with a greater level of confidence in what we produce. So we’ve got quite big plans for the rest of the year. And then, in 2025 and 2026, we have a new building scheduled to begin construction. We’re very much looking forward to a busy couple of years. We have a great team around us who very much want to drive this business and these projects forward. We look forward to being here and in another four or five years’ time, having progressed the business to a significant degree.

Suppo r t loc a l to l i ft us a l l

All Ri s e All Ri s e

Ch am p i o n G r ee n . i e

Marina Bleahen CEO, Business Works

INCREASE YOUR SALES, PROFIT, BUSINESS SUCCESS AND TALENT RETENTION WITH THE BUSINESS WORKS LACE FRAMEWORK, WRITES MARINA BLEAHEN

In the fast-paced and competitive world of business, staying ahead of the game is crucial for long-term success. e Business Works LACE framework is a proven methodology to deliver results, combining strategy and culture to deliver stress-free success. Focus on Leadership, Alignment, Accountability, Culture and Engagement so that you and your team Execute with Excellence.

E ective leadership is the cornerstone of business success. By embracing transformational leadership, business leaders can inspire and motivate their teams to excel. Transformational leaders empower their employees, foster a culture of innovation and creativity and encourage continuous learning and development. By embodying these characteristics, leaders can drive positive change, increase productivity and boost sales and pro ts. As a leader, you get what you tolerate. Are you being assertive in the drive for results?

In today’s rapidly evolving business landscape, with remote working the new norm, ensuring your team is aligned to clari ed targets, results and culture is critical. To have Alignment, working to a documented operational plan backed up with sales and pro t targets set out for monthly and quarterly review, is essential. We help clients create their 90-day plan, setting out the plan for sales and marketing, where we test and measure the number of leads, calculate conversion rates by salesperson and product/ service, measure average spends and complete pro t analysis so that we can create a plan for predictable pro t. Clarity and communication of the plan will deliver success. Understanding how you and your team communicate is important. At least half the population are indirect communicators, meaning no one is on the same page, which impedes success. Build a team pro le of communication styles and watch your business ourish as people work better together.

Do not stress if you do not have your operational plan documented and communicated; now is the perfect time to start. “BE” the leader, act today, know your numbers, share with your team and Align. Can you imagine watching a match or sport of any kind and not know the score? If you and your team do not review real-time information, you have a wonderful opportunity to transform your business success.

A strong and positive organisational culture is essential for success. Cultivate a culture that values integrity, collaboration and accountability. Encourage communication, recognise and reward outstanding performance and prioritise employee well-being. By creating a supportive and inclusive environment, businesses can attract top talent, enhance employee satisfaction and drive overall success.

Engaged employees are more motivated, productive and committed to their organisation’s success. Implement strategies to enhance employee engagement, such as providing opportunities for professional growth, soliciting and acting on feedback and promoting a healthy work-life balance. By prioritising employee engagement, businesses can reduce turnover, foster loyalty and improve their bottom line. 34% of labour cost is wasted through poor employee engagement (Gallup), o en the result of weak leadership. As a leader, you get what you tolerate, so set the standard and BE the BEST you can BE.

By leveraging the Business Works LACE framework, you can set your business on a path to sustainable growth, increased sales, higher profits and greater employee retention. Through e ective leadership of positive organisational culture and robust employee engagement, businesses can navigate challenges, seize opportunities and emerge as industry leaders.

IN MAY, THE SFA ATTENDED A CONFERENCE ON ACHIEVING EQUALITY AT WORK ORGANISED BY THE IRISH HUMAN RIGHTS AND EQUALITY COMMISSION

The purpose of the ‘Achieving Equality at Work and Promoting Socio-Economic Equality in Employment’ Conference was to gather public and private employers and employees, civil society organisations and rights-holder groups, trade unions, policy-makers and researchers, to discuss how to promote more inclusive workplaces, free from discrimination.

Speakers of note included Adam Harris (pictured), Chief Executive Officer, AsIAm, Dr Ebun Joseph, Director, Institute of Antiracism and Black Studies, Bríd O’Brien, Head of Policy and Media, Irish National Organisation of the Unemployed, Senator Lynn Ruane and Professor Olivier De Schutter, UN Special Rapporteur on Extreme Poverty and Human Rights (via a video).

Zaynab Lawal, SFA HR Executive, hosted a panel discussion featuring representatives from the Department of Social Protection for members and non-members of the Small Firms Association (SFA). The discussion centred on the Pension Auto-enrolment Scheme, due to commence next year. With expert guidance and an in-depth Q&A session, attendees were equipped with essential knowledge and advice to navigate preparation for auto-enrolment. The dynamic session not only empowered attendees with significant updates, but also generated discussion within the business community. The SFA will continue to keep our members informed on upcoming changes and announcements concerning pension auto-enrolment.

David Broderick represented the Small Firms Association at the National Economic Dialogue (NED) in Dublin Castle in May. The National Economic Dialogue is the annual meeting of the Government and stakeholders representing business, unions, academia and environmental groups, amongst others. In his address to the NED, he stated that two businesses a day went bust last year as firms struggled to cope with rising costs. David Broderick also said small businesses accounted for 85% of “all shutdowns”. At the NED, Taoiseach Simon Harris promised tax cuts and welfare increases in the forthcoming budget.

IRELAND’S SUCCESSFUL LIFE

SECTOR IS CREATING AN ECOSYSTEM THAT’S RIPE FOR START-UPS AND RELATED BUSINESSES TO THRIVE

has been thriving for years, with thanks in no small part to the tenacity of IDA Ireland in attracting foreign direct investment – nine of the world’s top 10 pharmaceutical companies have a home here, as well as 14 of the top 15 medtech companies. The sector employs 40,000 people and notable clusters have sprung up across the country, from Galway’s medtech scene (boasting 39% of the regional distribution of medical device employees in Ireland) to the M1 Corridor (which is home to a plethora of major life sciences players from Abbbott to WuXi Biologics).

While most people are already aware that the vast majority of the world’s supply of Viagra is

manufactured by Pfizer in Co Cork, here’s a lesserknown fun fact for your next table quiz – 33% of the global supply of contact lenses is made in Ireland, thanks to Waterford’s Bausch & Lomb.

The pandemic brought further boom times to Ireland’s life sciences sector with Pfizer, Janssen, AstraZeneca, Sanofi and MSD facilities in Ireland all contributing (to varied extents) to vaccine production.

With all the major activity in Ireland, a thriving scene has grown up around adjacent businesses and start-ups, which would otherwise not exist, without this vibrant ecosystem and supportive environment.

With 20 years’ experience building within the life sciences sector, Wexford man Gary O’Sullivan set up Oseng in 2018 in Claremorris, Co Mayo, to service the thriving cluster on that side of the country. “I found there were no companies servicing the West of Ireland other than ones from Dublin or Cork, so we found a very nice home for ourselves here,” O’Sullivan says. Now, 90% of the company’s work is in the life sciences sector.

“Most of our growth is from the life sciences sector and their investment over the last number of years,” he says. “A lot of it was driven by Covid and we saw a lot of investment over the pandemic. We’re seeing a lot of R&D projects develop further into large scaleup projects. We’re trying to grow our team around that within this sector in Ireland, but also to follow our clients across to Europe or back to the US, which is the long-term plan.”

It’s a plan that has been successful for many Irish companies who have impressed FDI clients in Ireland and won contracts across multiple international sites on the back of it.

Now that the pandemic vaccine development race has subsided, he says: “A lot of our clients have products in clinical stages at the moment and they are now starting to develop into actual projects, so we’re seeing some major investment from our clients here in Ireland.”

Other major issues for his clients in the sector are utility infrastructure and power, as well as delays in expansion due to planning permission hold-ups. “We as a country need to develop our infrastructure to allow our clients to continuously grow.”

For both them and their clients, staffing to allow for continued expansion is a challenge. “The speed of delivery of projects is increasing. Our clients are looking to get projects completed faster so they can get their products to market faster. That’s a staffing and resourcing issue – we’re a small country and everyone is pulling from the same pool.”

Using 3D design software and AR headsets to review designs is already part of how they work, but Oseng is taking it one step further. “We’re developing our own tools for project management, design and construction management to support what our clients need. We decided rather than wait, we would build it ourselves. To speed up delivery we have to be digital, we have to have our documentation available at the click of a mouse.”

They’re also supporting clients with more stringent ISO standards around clean rooms,

“OUR CLIENTS ARE LOOKING TO GET PROJECTS COMPLETED FASTER SO THEY CAN GET THEIR PRODUCTS TO MARKET FASTER. THAT’S A STAFFING AND RESOURCING ISSUE – WE’RE A SMALL COUNTRY AND EVERYONE IS PULLING FROM THE SAME POOL.”

improving infection control, air quality and energy consumption of their plants.

“We’re involved in the ASHRAE society, which is developing standards on infection control, and we’re trying to bring that knowledge from the US to our clients here by assisting with CPDs and webinars, as well as increasing our knowledge base in that space.”

“We’ve had a pandemic, we may have future strains and we have to be able to evaluate how our designs are capable of providing sufficient air quality for infection control – that’s critical for our clients.”

Having just returned from a European health summit when she spoke to Better Business magazine, Sonia Neary, founder of digital health company Wellola, was enthused about the ecosystem her company operates within. “From medtech to pharmatech, none of the components live alone,” she says. It’s an advantage we have as a small country, that clusters are quick to form.

Neary says the east coast is catching up on Galway’s BioInnovate Fellowship programme now. “Little by little, Dublin is becoming more of a digital health hub.” She namechecks Carl Power, the Programme Director of the recently launched DigiBio Healthtech Innovation Fellowship in Dundalk Institute of Technology as an influential figure in the space.

“HEALTHCARE IS STILL IN THE 1950s BUT THE TECH THAT’S AVAILABLE IS IN 2050!”

Sonia Neary, Co-Founder and CEO, Wellola

“It’s the same model as BioInnovate where people with healthcare backgrounds, engineers, scientists and academia come to the table and brainstorm around the key needs in this space that aren’t being met and come up with solutions in that arena,” she explains. “I think Dundalk and Leinster are starting to solidify themselves more in the digital health arena.”

With Galway’s hardware and medtech history and the presence of “all the key players – the Pfizers and the Roches and all of these amazing life sciences companies across the country”, Ireland has a presence on a global scale.

Wellola’s own presence is expanding, with a subsidiary in the UK based out of Leeds, on the grounds of the University Hospital. To Neary, “that northern powerhouse region is seen as a space for emerging technological scale-ups” which matched the energy of their Dublin home in the Guinness Enterprise Centre (GEC). “We actively tried to find a place in the UK that would be an exciting melting pot for us to grow from; both in Ireland and the UK, that’s been our experience, with the GEC healthcare cluster.

“With Trinity College, St James’ and the new children’s hospital right on our doorstep, Paul Anglim and a handful of other experts in GEC are trying to solidify opportunities for start-ups to export from that supported hub.”

She likens the importance of clustering for life sciences companies to a patient’s personal healthcare. “Most of us have dependencies on a multidisciplinary team in some way, shape or form; you’ve got your GP and your pharmacist,” she notes. “It’s not an arena where anyone really survives alone; it’s an ecosystem.

“From analogue care, digital care, pharmacological care, device supported, monitoring, diagnostics, treatments – it’s very codependent,” she says. “You never really thrive alone.”

Looking forward to how the industry will evolve, she says, at this point, “Healthcare is still in the 1950s but the tech that’s available is in 2050!”

Neary sees the capabilities and limitations of using advanced technologies to change healthcare. “AI in diagnostics is a no-brainer,” she says.

Aggregating the data, standardising how it’s structured and using that diagnostically can do more with greater accuracy than humans, but she is still wary that we are not yet at a stage to deliver treatment via AI.

To best leverage available technologies in order to improve healthcare, Neary says we need to shift models of care from treatment to prevention. “It’s a whole cultural shift in thinking and behavioural change.”

Sustainability isn’t just good for the planet – it can also be good for business. From optimising resource use to integrating energy-efficient technologies, savvy business owners are finding ways to cut their costs and boost their bottom line. Suzanne Leamy, Product Development Manager with the Strategic Banking Corporation of Ireland (SBCI), is keen to pass on the message to small business owners that the SBCI is funding business investment in sustainability, which will ultimately decrease operational expenses, enhance your market competitiveness and drive substantial economic growth.

The SBCI’s raison d’être is to make it easier for Irish businesses to get the funding they need, when they need it. “We bring more affordable credit to small- and medium-sized businesses and increase competition and choice for borrowers,” says Leamy.

“Sustainability has become increasingly relevant for Irish SMEs and adopting sustainable practices can result in significant benefits, including cost savings and an enhanced reputation with customers.”

In 2023, the SBCI launched the Growth and Sustainability Loan Scheme (GSLS) in collaboration with the Department of Enterprise, Trade and Employment and the Department of Agriculture, Food and the Marine. The Scheme has been designed to enable businesses across all sectors, including agriculture, to make longer term investments in sustainable measures as well as in growth opportunities, such as the development of new products and practices and the acquisition of machinery or equipment.

The Growth and Sustainability Loan Scheme will channel €500 million of lending to the SME market

through the SBCI’s lending partners. The Scheme has a specific target of at least 30% for investments in climate action and environmental sustainability.

The Scheme is available to Irish SMEs and small midcaps, including those in agriculture. It is designed to bridge the gap in longer-term financing, as well as accelerating the environmental sustainability of Irish businesses.

There are also options for businesses to qualify as a green enterprise where they meet the criteria in one of the following categories:

1. The SME is engaged primarily in sustainable activities, meaning it generated at least 90% of its revenue from eligible, sustainable activities

2. Farmers classified as a holder of a Green Eco Label, meaning that they are a certified organic farmer participating in the Department of Agriculture’s Organic Farming Scheme, or they are a farmer participating in both ACRES and Bord Bia’s sustainable farming programme, Origin Green.

Scheme loan rates vary between participating onlenders, with each lender providing a discounted interest rate to standard market rates. An additional 0.25% discount will be applied to businesses eligible in the category of climate action and environmental sustainability.

Businesses also benefit from the guarantee through other preferential terms, with loan repayment periods of seven to 10 years and reduced collateral requirements, with no security requirements on loans up to €500,0000. The availability of unsecured loans aims to promote financial inclusion, particularly for segments of the market that lack collateral which may block them from accessing finance.

SMEs can borrow amounts from €25,000 up to €3,000,000, enabling them to implement strategic changes and invest in the growth of their business.

Loans under this Scheme can fund investments in tangible or intangible assets, machinery or equipment, research and development, business expansion, premises improvement and innovation. Irish businesses investing in sustainability can increase their competitiveness, reduce their energy consumption and enhance their brand reputation by focusing on several key areas fundable through this Scheme, such as the following:

Projects related to renewable energy such as solar panels, small-scale wind turbines and geothermal heat pumps, alongside related components and installation expenses

Construction or renovation of commercial buildings to improve energy efficiency, including insulation, window and/or door replacements, energy-efficient heating, ventilation and air conditioning systems, as well as smart meters

Investments in technology, equipment or machinery aimed at significantly reducing energy consumption and greenhouse gas emissions, including electrical equipment, variable speed drives and modernisation of irrigation networks

Investments in low and zero-emission transport assets, including the acquisition of electric and hybrid commercial and passenger vehicles and the implementation of transport infrastructure for clean energy vehicles.

There is a two-step application process whereby SMEs apply for eligibility to the Scheme with the SBCI and following this, make their loan application with a participating lender.

An automotive dealership in Munster began implementing their environmental strategy by leveraging the Growth and Sustainability Loan Scheme. The discounted interest rates and longer loan term of 10 years has enabled them to invest in sustainable measures to grow and evolve their business model, such as the installation of solar panels and the integration of EV charging stations. Installation of solar panels resulted in considerable operational and environmental savings, estimated to save €8,000 a year and 26,555kg of CO2 emissions. The incorporation of EV charging stations also allowed them to support their electric vehicle inventory and promote the use of EVs to both employees and customers.

Overall, the Growth and Sustainability Loan Scheme has enabled the business to invest in their environmental strategy, doing their part to lower emissions, cutting costs for their business and providing a better service to their customers.

A clothing rental business in Leinster dedicated to combating fast fashion and waste through the circular economy utilised the Growth and Sustainability Loan Scheme to expand their business. The business qualified as a Green Enterprise as the income generated is concentrated in eligible sustainable activities, allowing them to access the more attractive loan terms and discounted interest rates.

They made an investment in new equipment that will allow them to maintain the pre-used clothing that is rented to their clients, increase rental inventory and grow their workforce by hiring two additional employees.

The Growth and Sustainability Loan Scheme has facilitated both business growth and the promotion of sustainable practices within the fashion industry, reinforcing the benefits of the circular economy model.

The application form will ask you for information such as the number of people you employ, your annual turnover, your CRO or VAT number and if you are a farmer, you will need to input your herd number. You will also be asked to input a description of the project you plan to finance and an estimate of relevant costs.

Once the online eligibility application has been completed, qualifying businesses will be issued with an eligibility code (valid for six months) that they need to provide to the lender as part of the loan application.

For more information, visit sbci.gov.ie

Legalbattles are an expensive and stressful process to enter into and for a small business it can prove ruinous. It’s often said that even a bad agreement is better than a good lawsuit and for a small business with a dispute, whether that be with a current or former employee or against another party, mediation can be a more cost-effective way of sorting out the issue. It’s also not the only option – there is another process, called independent intervention, which can also prove useful in sensitive matters and conflict resolution.

According to HR compliance and governance expert Carol Ann Casey, founder of CA Compliance, “Mediation and independent intervention are both methods used to address and resolve conflicts or issues – however they differ in their processes, roles and scope. Depending on the matter, business owners could choose mediation where parties voluntarily engage in the dispute resolution process or have a more facilitated process where an independent intervenor ultimately proffers a decision and recommendations on the matter.”

“Mediation is a structured, voluntary process in which an independent and impartial third party, known as a mediator, facilitates communication and negotiation between disputing parties to help them reach a mutually acceptable agreement,” Casey outlines.

In the UK, almost 80% of commercial disputes are settled using mediation and it is growing in popularity across Europe. Since the Mediation Act 2017 came into operation, solicitors are obliged to advise clients to consider mediation in advance of issuing legal proceedings. A court can also invite parties to consider it as an option.

“Mediation offers a range of benefits that make it an attractive option for resolving disputes. It is costeffective, time-efficient, confidential and allows parties to maintain control over the outcome while preserving relationships and reducing stress.”

According to the Irish Commercial Mediation Association (ICMA), it’s estimated that the cost of mediation is approximately 20% of the cost of going to court.

The mediator does not have any decision-making power – they facilitate dialogue but cannot impose solutions. “Their role is to assist the parties in identifying issues, exploring options and finding common ground,” says Casey.

Participation in mediation is voluntary, with parties agreeing to engage in the process and work towards a resolution. “The sessions are usually confidential, encouraging open communication without fear of

repercussions,” Casey notes. “It is often used in disputes such as family conflicts, workplace issues, community disputes and commercial disagreements on which the parties agree to mediate.”

The best-case scenario from going through the mediation process is a mutually agreed-upon resolution. “This may or may not be legally binding, depending on the agreement between the parties,” says Casey.

Independent intervention differs from mediation in that it can be mandated in some situations and the decisions may be enforceable. Casey explains: “Independent intervention involves actions taken by an independent and impartial third party to address a conflict or issue that may empower authority to investigate, provide recommendations or enforce decisions.”

The “intervenor” may be a recognised expert or independent body and may have the authority to make decisions, provide binding resolutions or offer recommendations. Their role can vary from advisory to authoritative, depending on the context.

“Independent interventions can be initiated by an external body with the mandate to act impartially,” says Casey. “This can include regulators, auditors or international bodies. Independent interventions can also be mandated to a specialist to disseminate facts and provide a structured decision with recommendations to resolve the conflict or deadlocked situation.”

Unlike mediation, participation in an independent intervention is not always voluntary for the parties involved. It can be mandated by law, governing frameworks or organisational policy such as terms of reference agreed by the directors of the company.

“Independent interventions often involve formal processes with established protocols, ensuring transparency and accountability,” says Casey, while outcomes can include binding decisions, recommendations for action or formal reports. “The intervenor’s findings and actions can have significant implications,” she notes.

Independent intervention is commonly resorted to in workplace matters, especially where mediation has not been acceded to by parties or where a more structured facilitated approach is considered advantageous, Casey explains. Other contexts include matters of regulatory compliance, corporate governance or legal disputes.

“Independent intervention offers significant benefits by providing impartial, expert and credible solutions to conflicts and issues,” says Casey. “It enhances trust, ensures compliance and can lead to sustainable, longterm resolutions. Whilst it can be more expensive than self-decided mediation it is less expensive than legal proceedings, providing a credible impartially-decided course of action that can be time-efficient, confidential and stress-reducing.”

In summary, while both mediation and independent intervention aim to resolve conflicts, mediation emphasises voluntary facilitated negotiation that is commonly used, whereas independent intervention can involve more decisive or authoritative actions by an impartial third party. “It is advantageous for all parties to resolve the conflict or have a structured facilitated approach,” says Casey, noting that if these approaches fail, the next step is likely to be costly legal proceedings, be it in a tribunal or court.

The perennial question of what to look for in a mediator often arises – some err on the side of sector-specific knowledge, while others argue for the importance of demonstrated ability to resolve cases, regardless of industry. There are a wide range of factors to take into account, according to Casey. “Choosing the right mediator or independent intervenor requires careful consideration of their expertise, impartiality, reputation, communication skills, problem-solving abilities, process, confidentiality, cost, outcome focus and compliance knowledge. By thoroughly evaluating these factors, a business owner can select the best equipped person to handle their specific situation effectively and equitably.”

Carol Ann Casey is a HR Compliance and Governance Specialist who expertly handles sensitive matters such as resolving con ict, conducting independent interventions, mediation and independent investigations on matters such as protected disclosures, grievances, harassments, governance, board con icts and HR compliance www.cacompliance.ie

Carol Ann Casey outlines the key differences between mediation and independent intervention

Decision-Making Power Mediators facilitate dialogue without making decisions, while intervenors provide their decisions and may, depending on the matter, have the authority to make binding decisions or enforce outcomes.

Voluntariness

Mediation is voluntary, whereas independent intervention can be mandated.

Process Mediation focuses on mutual agreement through facilitated negotiation, while independent intervention may involve investigation, recommendations or authoritative decisions.

Confidentiality Mediation is often confidential, while independent interventions may be more formal and transparent.

1 2

Angela Ennis Managing Director, Ennis Safety Wear Ltd

Start on your entrepreneurial journey with genuine passion and commitment. Our business originated from an unwavering desire to make a positive impact. Focused on excellence, we aimed to deliver exceptional services, letting customers experience the transformative difference. This demanded a dedicated team sharing our core ideology. Always recognise the collective contributions of every individual – customers and employees – as the foundation of a successful enterprise.

Eamon Gallagher Founder and Managing Director, IT.ie

When your business starts to grow, it gets very easy to stray too far from the product or service that brought you the success you are now enjoying and which sets you apart from your competition in the first place. Align your growth journey to the ear of your customer at all times and never lose sight of these values which differentiate your offering.

3

Shane McQuaid Portfolio Marketing Manager, Deep RiverRock

There will be times where you will have to navigate the balance between your own intuition versus the feedback of others. Trust your instincts but don’t overlook the potency of unbiased external feedback. Your biggest critic often provides the strongest insights. Seek it out – it fuels positive action.

Failure is the condiment that gives success its flavour

4 5 6

John O’Shanahan Managing Director, LeanBPI

Digital in small businesses is essential for survival and growth - but there are many challenges to its implementation. Measuring personal digital readiness is an important step in identifying the best way to go Digital and understanding readiness levels helps select the right tools and an appropriate pace of implementation. A digital champion should be appointed, to lead efforts to implement systems based on readiness levels and to foster a growth mindset and a positive attitude to technology.

Maeve Dorman Senior Vice President, Global Merchant Services, PayPal

Success for any business starts with knowing your audience. Today, people crave convenience and prioritise security. That means being able to browse, select and purchase goods or services at the touch of a button. It also means businesses need to deliver superior shopping experiences, which means a frictionless checkout combined with personalised offers and incentives. This has the power to nurture satisfaction, loyalty and growth.

Paul Phelan CEO, Data Edge

Spread your company’s risk and don’t put all your eggs in one basket. Remember the customer relationship is your real value – your supplier won’t ever have that, so keep in mind how important it is when you’re pushing for bigger margins. Always Be Brave – make quick informed ‘gut’ decisions and keep the key decision making process down to a minimum number of team members.

JOINING THE BACKING BUSINESS COMMUNITY GIVES SMALL FIRMS A PLATFORM TO LEARN AND GROW.

DEBBIE BEHAN AT VIRGIN MEDIA BUSINESS TALKS TO BETTER BUSINESS ABOUT THE INITIATIVE AND WHY IT’S PROVING A GAMECHANGER FOR SO MANY SMALL FIRMS ACROSS THE COUNTRY

That’s why the company established the ‘Backing Business Community’, an initiative conceived during Covid to empower small firms to move forward and thrive, despite a shifting, unpredictable economic landscape. From the off, the initiative has achieved exactly what it set out to do, namely give small firms a platform to market their goods or services and create a community where businesses can share experiences and knowledge and gain access to invaluable resources.

“During the pandemic, we could see how much our small business customers were struggling. It was such a challenging time for small firms, who were finding it difficult to get their message out there while keeping their business afloat. It was then that we established the Backing Business Community, which immediately

created a hub for over 850 small firms to gather, to talk about their experiences and to benefit from our support. Our members, who are also Virgin Media Business customers, have had the chance to appear in dedicated slots on Virgin Media Television or have featured for free in digital and print media, which for most people is a once in a lifetime opportunity,” says Debbie Behan, Business Products, Sales and Marketing Manager at Virgin Media Business. Providing these small firms with a national platform has been a gamechanger, says Debbie. “Their businesses have come on in leaps and bounds. For many of them, their products or services are now available nationwide. We’re in the business of being a business ourselves and so we know what the landscape is like and how difficult it can be to grow and really develop. We can offer small firms this unique platform, which is something our competitors can’t do. Through our TV station, we’ve been able to boost a significant number of businesses and that’s something we want to continue.”

Virgin Media Business is inviting more small firms to join the community and take advantage of the many benefits it provides.

“This is a free initiative and you don’t have to be a Virgin Media Business customer to join the community. We will provide as many experiences, events, opportunities and resources to members as we possibly can.” With the Backing Business Community, everyone is a winner, says Debbie. “For us, we’re getting our name out there. We’re having a positive impact on small firms and doing something good in the community, which is really important to us. For small businesses, there are so many opportunities to publicise themselves, increase their market presence and really get their name out there.”

At the heart of the initiative is the creation of a vibrant community network, where SMEs can foster connections, share experiences and learn from each other. It’s a network that exists both online and inperson; a series of virtual events, webinars and panel discussions keep the conversation going between members, facilitating the exchange of advice and knowledge. All

At the Backing Business Community launch event earlier this year, three small firms took to the stage to talk about the impact the initiative has had on their business.

Shannon Forrest, co-founder of Rívesci, talked about turning a food truck into an award-winning condiment company. Rívesci products are now stocked in Super Valu, while Shannon has also opened a coffee shop in Clonmel.

Stephen Jiang of interior homeware brand Fervor+Hue has partnered with Expert Group, where his products are sold in over 55 of their shops across the country.

Susan Furniss-Radley, founder of Dust and Rock, has secured a deal with Brown Thomas and Arnotts to stock her wrist pockets and other products.

online and in-person events are recorded, easily accessible by members who might have missed a get-together or simply want to experience it for a second time. On the back of joining the Backing Business Community, members receive exclusive discounts on broadband services from Virgin Media Business, while monthly newsletters and updates ensure they don’t miss out on any news and events.

Increasing costs continue to impact small businesses. According to a recent survey carried out by the Small Firms Association, one in three small businesses will run out of liquidity within six months without additional funding. The research also showed an estimated increase of 16.6% in average business costs, while 51% said energy costs had risen in the past year. The

For almost 20 years, Virgin Media Business has been providing its customers with a top-class service. The company continues to roll out its full fibre network to business customers across the country and through a partnership with Siro and National Broadband Ireland, that reach will extend to even more areas of the country. “We can offer up to 2GB broadband on our full fibre network and we also provide full technical support to our customers. I think it’s that end-toend attention to detail that sets us apart from the competition and gives our clients peace of mind when they partner with us.”

This year, Virgin Media Business will be launching new products for its business customers. A WiFi extension will guarantee uninterrupted service for

“FOR US, WE’RE GETTING OUR NAME OUT THERE. WE’RE HAVING A POSITIVE IMPACT ON SMALL FIRMS AND DOING SOMETHING GOOD IN THE COMMUNITY, WHICH IS REALLY IMPORTANT TO US.”

“These three businesses are great examples of the impact the initiative can have. They’re all doing exceptionally well on the back of the assistance we gave them and we want to extend that help to as many small business owners as we possibly can.”

Debbie Behan, Business Products, Sales and Marketing Manager, Virgin Media Business

Paul McCarthy

effects of these increasing costs are being felt across the small business community, but they’re not the only challenge that small firms are grappling with. “Our customers are telling us they’re struggling with marketing. In the vast majority of cases, small firms are sole traders. They don’t have big teams and they don’t have the resources to devote to marketing. While they have a lot of faith and confidence in their business and products, they’re struggling to get the message out about who they are.” An in-person event in June focused on exactly that; how small businesses can leverage social media and other marketing techniques to increase their presence and grow their business. “We want to equip small firms with the knowledge they need to get their business and brand out there and stand out from the crowd.”

customers, while a new streaming box for B2B customers will also hit the market.

“Some of our residential customers will be familiar with those types of products, but we’re putting a business spin on them and they’ll be rolled out on our full fibre network.”

Signing up to the Backing Business Community is a no-brainer, says Debbie. “It just makes sense. One draw is that it’s free; there are no charges associated with becoming a member. It provides small businesses with the opportunity to become part of the conversation, to share their struggles and learn from their peers. Our Virgin Media Business customers that have appeared on the Ireland AM couch have really felt the impact; they’ve had their phones ringing off the hook. We’re so excited to see the impact we’ll have on the next batch of small firms.”

NAMED LAWYER OF THE YEAR AT THE 2024 DYE & DURHAM IRISH LAW AWARDS, AOIFE MCCARTHY AT DOUGLAS LAW SOLICITORS TALKS ABOUT DISTINGUISHING HERSELF IN THE LEGAL WORLD

What does it mean to be named Lawyer of the Year?

I am extremely honoured and thrilled to receive the award for Lawyer of the Year 2024 at the Dye & Durham Irish Law Awards and I am very grateful to have been chosen by such an esteemed judging panel. It’s all a bit surreal to be honest!

What do you attribute the win to?

I attribute the win to a number of great people in my life. My husband, Richie Cunningham, is my main champion so I must give him due credit. Without his support and encouragement along the way, I would not have gotten to where I am today. My two business partners, Gráinne O’Donovan and Teresa

O’Sullivan, have been integral to the success of the practice and my winning the award, as have the entire team at Douglas Law, including Juliane Ramos dos Passos, Legal Executive, who works very closely with me and is like a ray of sunshine every day. My clients entrust me to achieve successful outcomes for them during what can be very stressful times in their lives. I often work with barristers, including Cian Cotter BL who is excellent in his approach and instrumental in working with me to achieve the best results for clients. Also, of course, my own hard work but it is definitely a combined effort!

Can you tell me about your career so far?

I qualified as a solicitor in 2010. Gráinne O’Donovan, Teresa O’Sullivan and I established Douglas Law Solicitors in 2015, having worked together for many years prior to that. We moved to a new office premises at the end of 2023 to accommodate our expanding business and increasing team. The firm won the prestigious Munster Law Firm of the Year in 2023, another great achievement and an acknowledgment of the fact that we have become one of the leading private client firms.

What led you to specialise in employment law and personal injuries litigation?

I have always predominately worked in litigation and employment law as I particularly enjoy dispute resolution and each case brings its own challenges. Over the past number of years, I have focused more and more on employment law, vindicating the rights of professionals from all different sectors, both in the public and private sector. Often, the employer/ defendant is a State entity or a large multinational with significant resources, which can be daunting for clients embarking on potential legal action. I reassure clients in relation to the process and give clear and practical advice in relation to realistic outcomes and timeframes. Our team at Douglas Law Solicitors ensure that there is an equality of arms in terms of the advice given and resources and time put into each case. My aim is to find the best outcome for the particular client. If it can be achieved, a relatively swift conclusion is of great benefit to employees who have had workplace issues for some time as it allows clients to move on with their lives. All of that can be challenging, but I get a great sense of achievement when we achieve the result in the end.

What do you love about your job?

My clients motivate me. Many of my clients have been through a difficult time in a work situation and are reliant on me to try and sort out their difficulties. This can often be a complex and delicate situation, but I always take the attitude that the vast majority of problems can be rectified and if you keep a

positive frame of mind and have the drive to see it through, that’s half the battle. I am incredibly lucky to have found a career where I feel energised by my work. My partners, Gráinne O’Donovan and Teresa O’Sullivan, inspire me and motivate me along the way and have been great mentors to me throughout my career. Despite the work being quite serious, we do manage to have some much needed lighthearted conversations during the course of the day!

What advice would you give a young person thinking about a career in law?

I would say surround yourself with people who will lift you up, encourage you and motivate you. Honesty and integrity is extremely important as your reputation is everything. Also, I believe that these days a good knowledge of running a business and valuing your time is also important, particularly if you have ambitions to work at partner level within a firm or run you own firm.

Is there a person that you feel has inspired you in your career?

My parents, Geoff and Eileen McCarthy, are both very entrepreneurial and run their own successful business in Fossa, Killarney, Co Kerry. I go to them regularly for both personal and business advice and have always felt extremely well supported and encouraged by them. My brother, Eoin McCarthy, is also an entrepreneur and sold his tech company in Australia a number of years ago having achieved huge success. Operating a law firm is as much about running a business as it is about advising clients and if you can do both well, you can distinguish yourself in the legal world.

Our ambitions for Douglas Law Solicitors are to establish ourselves as the leading private client firm in Munster and nationwide. Along with employment law, our other expanding areas are probate litigation (dispute about inheritance), family law, commercial law and medical negligence. We plan on expanding the practice and growing these areas further. We also plan to keep delivering excellence in the quality of our service and to expand our own knowledge so that we can continue to provide the best service to our clients.

Ag cur ardchaighdeáin d’iompar corparáideach chun cinn trí dhlí na gcuideachtaí a fhorfheidhmiú.

Promoting high standards of corporate behaviour through the enforcement of company law.

Tabhair cuairt ar ár suíomh gréasáin agus lean muid ar na meáinshóisialta le haghaidh eolas maidir leis an méid seo a leanas:

• do chuid dualgas agus oibleagáidí mar stiúrthóir na cuideachta,

• do chuid cearta mar bhall den chuideachta / mar scairshealbhóir,

• conas gearán, léiriú imní nó nochtadh cosanta a chur faoinár mbráid, agus

• deiseanna gairme linn atá ar na bacáin.

Visit our website and follow us on social media for information on:

• your duties and obligations as a company director,

• your rights as a company member / shareholder,

• how to submit a complaint, expression of concern or protected disclosure to us, and

• upcoming career opportunities with us.

OVER 400 FINALISTS AND WINNERS WERE IN ATTENDANCE AT THE INAUGURAL IRISH INVESTOR AWARDS, IN ASSOCIATION WITH MAZARS (NOW RENAMED FORVIS MAZARS AS OF 1 JUNE 2024)

IN MAY, members of the finance world gathered at the Irish Investor Awards, created by Mazars (which has since rebranded to Forvis Mazars), which took place in the Round Room at The Mansion House Dublin, to celebrate and recognise excellence in the world of private equity and venture capital investment.

The event was hosted by Irish radio and television presenter Anton Savage and speeches were delivered on the night by Minister for Public Expenditure Paschal Donohoe and Tom O’Brien, Managing Partner at Forvis Mazars. Both spoke highly of the trailblazing winners on the night and commented on how the Irish Investor Awards are set to become a regular fixture in the investment calendar, thanks to the quantity and quality of submissions received in the first year.

Finalists and winners were decided by an executive board of 24 judges, made up of some of the most established and wellknown names in the finance world.

Commenting on the prestigious event, John Bowe, Partner at Forvis Mazars, said: “We were delighted to establish the Irish Investor Awards. Irish and international

“At Forvis Mazars, we believe this awards programme was long overdue as a way to celebrate their achievements and the invaluable contributions of other stakeholders such as advisors, debt providers, diligence professionals, and corporate lawyers, whose collective expertise is instrumental in making deals happen.”

John Bowe, Partner, Forvis Mazars

private equity and venture capital funds play a pivotal role as crucial funding sources and value-add partners for Irish companies and entrepreneurs seeking to cultivate leading enterprises within Ireland. At Forvis Mazars, we believe this awards programme was long overdue as a way to celebrate their achievements and the invaluable contributions of other stakeholders such as advisors, debt providers, diligence professionals and corporate lawyers, whose collective expertise is instrumental in making deals happen.”

Companies such as The Maples Group, who took home the ‘’Corporate Law Firm of the Year’’ award, stated they were “delighted to have been recognised for the sheer volume, value and scale of the transactions we advise

on. Congratulations to the team and all our clients”. Other attendees in the room, such as Elevate Partners, said: “It is great to see the investment and advisory space thriving in the Irish market and the emerging talent in the sector.”

Tom O’Brien, Managing Partner, Forvis Mazars, said: “The Irish Private Equity awards was an overwhelming success and a very fitting acknowledgement of the hugely important role that the private equity community plays in supporting indigenous Irish businesses. Institutional investors bring much more to the table than pure investment; they help to mentor business owners and leaders

across an array of issues from innovation to managing growth and scaling. It was fantastic to get the deals, investor and advisor community together for the night. There was a fantastic energy in the room that bodes well for the sector and the awards going forward.”

The Irish Investor Awards were sponsored by Duport Capital, Development Capital, The Business Post and headline sponsor and hosts Mazars. On the night, Mazars presented the Lifetime Achievement award to Michael Murphy, who held the role of Managing Director at Investec for over two decades and is currently a Non-Executive Adviser at the company.

“Institutional investors bring much more to the table than pure investment; they help to mentor business owners and leaders across an array of issues from innovation to managing growth and scaling. It was fantastic to get the deals, investor and advisor community together for the night. There was a fantastic energy in the room that bodes well for the sector and the awards going forward.”

Tom O’Brien, Managing Partner, Forvis Mazars

Environmental, Social and Governance Deal of the Year Sponsored by Development Capital BEACH

Many Irish businesses are now repaying Warehoused Tax Debt to Revenue following the 1st May deadline. With this additional outflow, it’s important to review cashflow needs to ensure they maintain enough cash in their business. Running out of money is one of the most common causes of business failure –even a profitable venture will struggle if it runs short.

Businesses should continuously update cashflow forecasts showing all projected expenses and income for the next 12 months to clearly understand when they might face potential cashflow shortages. Otherwise, they risk spending cash now that will be needed to pay suppliers or Revenue in the future. In

addition, unforeseen events (such as loss of a key customer or an unexpected bad debt) can negatively impact cash flows. A cushion will ensure businesses can successfully trade through any disruption. This can be cash reserves, or access to bank lines of credit, overdrafts and short-term loans.

A strong relationship with your bank and understanding the documentation they require can facilitate faster approval of credit facilities, and it is essential to maintain accurate financial records and forecasts to demonstrate your repayment capacity. Presenting a clear business plan with cash flow projections will help ensure a timely approval of the credit you require.

Having difficulty getting a new business loan or restructuring your existing debt with your bank?

Established by the Minister for Finance, Credit Review is here to help.

Talk to the credit experts today on 0818 211 789 or visit creditreview.ie

If your credit application is declined by your bank, Credit Review can help. We provide an appeals mechanism for borrowers who have had their credit applications rejected by an Irish bank (AIB, BOI and PTSB). Our track record is strong: 8 out of 10 businesses we support get a credit solution from their bank. Our appeal process is informal, affordable, and available to all Irish SME and farm businesses. We can review requests for credit facilities such as overdrafts, term loans, invoice or asset finance up to a value of €3 million.

For more information visit creditreview.ie or call the helpline directly on 0818 211789

JENNIFER MCSHANE TALKS TO THREE LEADERS IN THE TECH SPACE ABOUT THEIR DIGITAL TOOLS OF THE TRADE AND MAKING STRIDES IN THE SECTOR

Founder and CEO, Target Integration

started Target Integration in 2008 with a vision to be an honest and independent CRM (Customer Relationship Management) and ERP (Enterprise Resource Planning) company. With 16 years of experience working in various industries including manufacturing, customer services, repair and telecom, he’s worked in all facets of the tech trade. Cloud-based systems might be a must in the tech space now, but back in 2008, they were in their infancy and Rohit quickly identified the gap he wanted to fill.

“The advantages of cloud were and are enormous – that was a big gap in the market back then,” he says. “Of course, Cloud has become the standard at this stage. Nobody talks about anything ‘not cloud’ anymore. Nobody wants on-premise servers at all, which is good.” And this is effectively what Target

Integration, now with offices in multiple countries around the world, does. They help businesses get up in the clouds, as it were. “We help any small business to implement their own cloud-based software and train them on it.”

And naturally, it wasn’t as easy to convince potential customers to get on board with an advancing software as it is now. “It was difficult. Initially, it wasn’t plain sailing. I still remember you would mention the concept of cloud computing or software and people used to say, ‘no, no, no, I want something in my office’ – a physical piece of tech they could see because they felt it was safer, it was more secure.”

With cloud being a must for businesses big and small in 2024, the challenges now are less about convincing customers and more about the people behind it. Specifically, the team needed for continued success.

“Market challenges change and business challenges change,” he agrees. “Because back then, of course, I was the single consultant. Now, at this stage, the challenges are not as much external. The market has accepted cloud, but now the challenges are more

“FOR THE MOMENT WE ARE SMALL AND NIMBLE, BUT WE WOULD LIKE TO BE AT A STAGE WHERE WE ARE GENERATING QUITE A LOT OF BUSINESS AND SALES AND, OF COURSE, SUPPORTING AND GROWING COMMUNITIES AND THE PEOPLE AROUND US SO THEY CAN CONTINUE TO GROW AS WELL.”

internal. Looking at the team, there are 135 people working with us around the globe. So, you’re trying to juggle between 20 here in terms of who is working on what and thinking, where do we hire our next recruit from? We’re looking for graduates to come in and work with us to get the experience, for starters. And we have the challenge of the global market and Microsoft and the biggest software companies here as well; they’re trying to attract talent and that becomes a different challenge from the task you have when you start the business.”

Target Integration has big plans and in the immediate future, quite a goal. “At some stage we want to launch our own IPO,” he continues. “For the moment we are small and nimble, but we would like to be at a stage where we are generating quite a lot of business and sales and, of course, supporting and growing communities and the people around us so they can continue to grow as well.”

CEO, Vertigenius