Relevant environmental, social and governance content

There’s a lot of noise around climate change. The Sixth Assessment Report (AR6) provides the most comprehensive, best available scientific assessment of climate change. Here are the basics.

Most countries are struggling to reach their climate goals. South Africa is by no means in the green yet, but from a policy perspective, we deserve a pat on the back.

If South African businesses don’t adapt to climate change, they will be left behind and ultimately become redundant in a net-zero global economy. However, like any challenge, a host of opportunities await.

In 2015 the United Nations established its most important global call to action yet: the 17 Sustainable Development Goals (SDGs). These goals aim to tackle global challenges and inspire action in areas of critical importance for humanity and the planet. The goals were agreed upon by 193 member countries, including South Africa.

South Africa faces multiple risks from climate change. It will impact our natural resources and built environments to the way we do business.

From a glass-half-full perspective, the climate challenge offers the opportunity to build a better South Africa for all: our citizens, the environment and the planet.

There’s a lot of noise around climate change. The Sixth Assessment Report (AR6) provides the most comprehensive, best available scientific assessment of climate change. Here are the basics.

1. Human-driven climate change is confirmed.

Human activities, mainly through emissions of greenhouse gases (GHG), have unequivocally caused global warming, with the global surface temperature reaching 1.1°C above 1850-1900 levels in 2011-2020. This is largely due to the unsustainable way we consume and produce goods and use energy and land.

2. If we continue business as usual, we are likely to reach 1.5 °C by 2030.

To prevent the worsening and potentially irreversible effects of climate change, 195 parties signed the Paris Agreement at COP21 in 2015 and pledged that the world’s average temperature should not exceed that of 1850-1900 levels by more than 1.5 °C.

It is not just another natural climate cycle like in the past. Check the stats.

The Sixth Assessment Report (AR6), released on 20 March 2023, provides the most comprehensive scientific assessment of climate change. The report was compiled by the Intergovernmental Panel on Climate Change (IPCC), a body of the United Nations.

Four South Africans were part of the IPCC team:

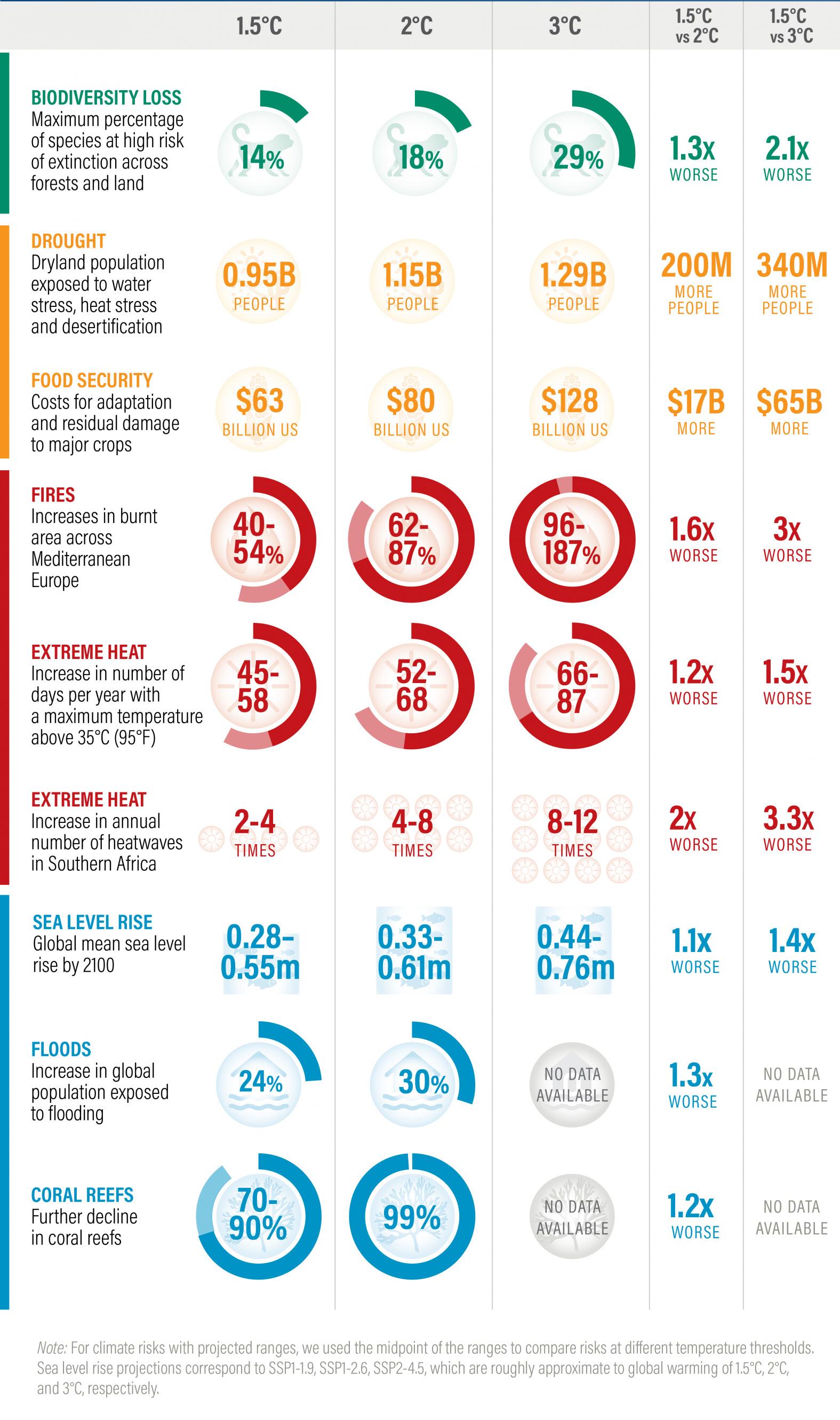

Currently, the earth’s global surface temperature is 1.1°C above preindustrial times, and we are already experiencing the impacts. Every increment of global warming – from 1.5 °C – exponentially increases the frequency, spread and severity of extreme weather as shown on the table.

3. The burning of fossil fuels is the number one cause of the climate crisis.

Burning fossil fuels (coal, oil and gas) releases large amounts of GHG into the atmosphere. Carbon dioxide (CO2) accounts for the largest percentage of GHG emissions. If we want to keep the Earth’s temperature below the 1.5 °C limit, we can only release about 510 billion tons of CO2 into the air before we have to stop completely around the early 2050s.

However, the emissions expected from the fossil fuel infrastructure that’s already in place or planned, could go beyond this limit by another 340 billion tons, reaching a total of 850 billion tons of CO2.

4. This is the decisive decade to change this around.

If we act now, and reduce GHG emissions, we can limit global warming to 1.5 °C. GHG emissions will peak immediately and before 2025 at the latest, and then drop rapidly, declining by 43% by 2030 and 60% by 2035, relative to 2019 levels.

5. We must stop emitting and remove carbon from the atmosphere.

Rapid decarbonization won’t be enough to achieve global climate goals. Carbon removal is also essential to limit a global temperature rise to 1.5 °C. There are natural solutions, such as sequestering and storing carbon in trees and soil, as well as innovative technologies that pull carbon dioxide directly from the air.

6. There is enough global capital to rapidly reduce GHG emissions.

Although there is sufficient global capital, tracked climate finance falls short of closing the gap between the money available and the money needed to achieve long-term climate goals. This is while finance flows for fossil fuels are still greater than those for climate action.

Various barriers, within and outside the financial sector, are contributing to this gap. Internally short-term thinking, lack of information, and preference for local investment inhibit the flow of capital while external barriers such as the absence of proper pricing for environmental impacts, and regulatory frameworks that encourage climatefriendly investments remain obstacles. Developing countries face additional challenges, such as limited institutional capacity.

Another worrying factor is that, according to a report by the Organisation for Economic Cooperation and Development (OECD), almost 50% of the public funding is still given in the form of loans rather than grants. This can increase the debt burden of poorer nations.

7. A just response to climate change can benefit all.

Climate change is coupled with much inequality. The lowest emitters often pay the highest price. Households in the top 10% emit upwards of 45% of the world’s GHGs, while the bottom 50% account for 15% at most. Already it is clear that poor communities suffer more from extreme weather.

USD100

BILLION A YEAR

After CO2, methane is the secondlargest contributor to climate change. Methane is largely produced by humans (in the energy and agricultural sector) and dissipates quicker than CO2, so its reduction is considered the low-hanging fruit of climate mitigation. Methane reduction is a possible short-term solution while we work on longer-term solutions. Cutting methane emissions by 45% by 2030 could help us limit global warming to 1.5°C.

The solutions could also harm the poor. Retiring coal-fired power plants, for example, may harm local economies and unravel the social fabric of communities.

However, it also offers the opportunity to establish a more equitable world in general. In the words of IPCC Chair Hoesung Lee: “Mainstreaming effective and equitable climate action will not only reduce losses and damages for nature and people, but it will also provide wider benefits.”

8. There are solutions to reduce emissions by at least 43% over the next seven years.

The time to implement a just transition is here. One way of achieving this is by changing social welfare programmes to include adaptation measures such as cash transfers to people in need and public works intervention during and in the aftermath of extreme weather events. Policymakers should design mitigation strategies that equitably distribute the costs and benefits of reducing GHG emissions. Governments can simultaneously phase out the use of coal, for example, and set up training programmes to upskill people for jobs in clean energy, like wind or solar power.

The amount wealthier countries pledged to developing countries by 2020 for climate action. According to the OECD’s latest figures, USD89,6 billion was provided in 2021.

GOOD NEWS

The Renewables 2022 report finds that renewables are set to account for over 90% of global electricity expansion, overtaking coal to become the largest source of global electricity by early 2025.

According to Envision Racing, in 2025 the cost of making electric cars will reach parity with internal combustion cars in developed countries.

RETIRE coal plants 1. 6. 2. 7. 3. 8. 4. 9. 5. 10.

INVEST in clean energy & efficiency

RETROFIT and DECARBONISE buildings

DECARBONISE cement, steel & plastic

SHIFT to electric vehicles

Source: World Resources Institute

INCREASE public transport, biking & walking

• Intergovernmental Panel on Climate Change: AR6 Synthesis Report; Urgent climate action can secure a liveable future for all

DECARBONISE aviation & shipping

HALT deforestation & RESTORE degraded lands

REDUCE food loss and waste & IMPROVE agricultural practices

EAT more plants & less meat

• Organisation for Economic Cooperation and Development: Climate Finance Provided and Mobilised by Developed Countries in 2013-2021 Report

• World Economic Forum: Climate change: The IPCC just published its summary of 5 years of reports – here’s what you need to know

• World Resources Institute: 10 Big Findings from the 2023 IPCC Report on Climate Change

Most countries are struggling to reach their climate goals. South Africa is by no means in the green yet, but from a policy perspective, we deserve a pat on the back.

10.7B

South Africa produces 1,13% of global greenhouse gas (GHG) emissions. Our economy is the most coal-dependent of all the countries in the G20. Fossil fuels still make up around 90% of the energy mix.

4.7B

Climate change has dealt South Africa a double whammy. In fact, a threefold blow. Firstly we have a coal-dependent economy that makes us one of the largest polluters globally.

Secondly, our economy is dependent on the export of commodities such as platinum, gold and iron. As countries and international companies transition to net zero or net neutral, these commodities could lose market share, threatening South Africa’s ability to service national debt and import the necessary goods and services.

Thirdly, in South Africa, almost 20% of the population live in extreme poverty. Climate change will disproportionately affect those living in poverty and is already doing so.

Then there’s also the physical risks such as heat waves, severe flooding and droughts. South Africa is currently ranked 95 out of 182 countries assessed under the Notre Dame Global Adaptation Initiative Index, which ranks countries according to their vulnerability to climate change and their preparedness to enhance resilience.

It’s crucial that South Africa views these climate challenges as an opportunity to come up with innovative solutions to keep our resources relevant in a net-zero trade environment and to establish new globally sought-after technologies.

Since signing the Paris Agreement in 2015 the government has been hard at work to address the social and economic impacts of climate change and to play its role in global efforts to stabilise and reduce GHG emissions.

2.4B

1.6B 1.0B

Source: visualcapitalist.com

745M

442M

The Paris Agreement is a legally binding international treaty on climate change. It was adopted by 195 parties at the UN Climate Change Conference (COP21) in Paris, France, on 12 December 2015. It came into force on 4 November 2016.

Under the Paris Agreement, countries are required to establish a climate action plan to cut emissions and adapt to climate impacts, also called a Nationally Determined Contribution (NDC).

South Africa’s net GHG emissions in CO2 equivalent were estimated at 442 million tonnes (Mt) in 2020. In October 2021, the government reviewed its initial targets and set more ambitious climate targets (see graph) in an updated NDC.

Source: UNFCCC

The updated NDC also includes our first adaptation component (A-NDC), which will be refined over time. The A-NDC sets out adaptation measures for the country around how we’re aiming to achieve those adaptation goals. The updated A-NDC envisions that Government will build climate resilience by prioritising vulnerable systems such as water systems, biodiversity and agriculture, health and human settlements.

To achieve the targets, climate financing is required, and consequently the updated NDC has identified the need for National Treasury, the South African Reserve Bank, financial sector regulators and the Department of Forestry, Fisheries and Environment to work collaboratively to achieve said goals.

Carbon tax is another important, and often heavily debated, policy lever the government has put in place to help achieve the NDC. The Carbon Tax Act was passed in 2019 and is based on the “polluter pays” principle, shifting the responsibility back to the emitting entity. Carbon tax was set at a low base rate of R120 per ton of carbon dioxide equivalent (tCO2e) emissions to give companies enough time to prepare and ease into the system. From 2026, Government is expected to raise the carbon price sharply every year thereafter.

2024

2025

2026

2027 R347

2028 R358

2029 R424

2030 R426

Source: Deloitte South AfricaA just transition aims to achieve a quality life for all South Africans, in the context of increasing the ability to adapt to the adverse impacts of climate, fostering climate resilience, and reaching net-zero greenhouse gas emissions by 2050, in line with best available science.

– PCC, 2022

In October 2023, the National Assembly passed the Climate Change Bill. Upon presidential approval, it will become the country’s inaugural Climate Change Act, rendering the NDC legally binding and enforceable. It will force all provinces and municipalities to align their policies and laws with the government’s climate change response.

In 2020 the multi-stakeholder body, the Presidential Climate Commission (PCC), was formed by President Cyril Ramaphosa to oversee South Africa’s transition to a low-emissions and climate-resilient economy in a fair and equitable manner. The Commission is also responsible for monitoring and evaluating progress towards our mitigation and adaptation goals. Key items on which the Commission has progressed since its establishment are the development of South Africa’s Just Transition Framework and South Africa’s Just Energy Transition Investment Plan, both of which have been received with mixed reactions from various stakeholder groupings.

One of the first tasks of the PCC was to design a just transition framework for South Africa. Climate change exacerbates South Africa’s triple challenges of poverty, unemployment, and inequality. The PCC engaged with various communities across the country, identifying the many hardships and inequalities they are facing.

From a glass-half-full perspective, the climate challenge offers the opportunity to build a better South Africa for all: our citizens, the environment and the planet. The Just Transition Framework sets out a pathway on how this can be achieved.

South Africa’s climate action strategy is commendable and on par with that of its peers such as Brazil and Australia, but the targets don’t yet fully align with the Paris Agreement.

However, the government has demonstrated its commitment to addressing our contribution to global emissions and the vulnerabilities South Africa faces.

climateactiontracker.org climatescorecard.org

Centre for Environmental Law: The Life After Coal campaign welcomes progress on the Climate Change Bill but more needs to be done

Climate Scorecard: South Africa

Deloitte: South Africa’s carbon tax: Changes and implications for taxpayers

JustShare: Comment on proposed amendments to the Carbon Tax Act, 2019

Mail & Guardian: Carbon tax: How it affects households

National Business Initiative: NBI Insights for Members 2021

PCC: ANNUAL REPORT 2021 – 2022; A Framework for a Just Transition in South Africa; South Africa’s NDC targets for 2025 and 2030

UNDP Climate Promise: South Africa

UNFCCC: South Africa’s first nationally determined contribution under the Paris Agreement

Social

Six Capitals ESG Advisory empowers organisations seeking positive impact through decision-useful ESG information, tools and resources.

ESG Advisory

• Annual investor reporting & communications

• Strategy formulation & implementation

• ESG policy development & technical review

• ESG Toolkit for SMEs

• Independent assurance on non-financial reports

Climate Change

• Climate-related reporting

• Climate change strategies

• Net-zero pathways

• Carbon & water footprinting

Sustainable Finance

• ESG framework development

• Design, set-up, management & monitoring of ESG-focused impact investment funds

• ESG Due Diligence

• 3rd party opinions

ESG Education

• ESG communications

• Creation & design of education content

• Interactive learning

• Monitoring & reporting

In an era defined by rapid change and evolving financial landscapes, retirement funds face a critical question:

longer sufficient, and the need to adapt and innovate has become paramount.

The answer to this question holds immense significance for the sustainability and success of retirement funds and their members in the long run.

We have amplified our focus on creating a sustainable future: leading our clients through emerging and future changes to ensure their resilience and safeguard their ability to deliver suitable retirement outcomes for their members.

We know that retirement funds play a vital role in the financial markets both locally and globally, contributing to the creation of household wealth and acting as a driving force in the economy. Retirement funds have a profound impact on individuals, industries and the broader financial ecosystem. However, the landscape is not without its challenges. Past failures in retirement funds have demonstrated the catastrophic consequences of inadequate governance and oversight.

Our market research suggests that the majority of retirement fund trustees have not kept pace with a rapidly changing landscape, acknowledging that their retirement funds are not future-fit. The status quo is no

To thrive in the future, retirement funds must embrace sustainable ways of thinking and adapt to emerging megatrends that are likely to drive change in our economies, societies and environments.

Globalisation, predicted changes in geopolitics, population dynamics, technological advancements, climate change and shifting generational expectations, for example, are driving fundamental changes in mindsets, risks and opportunities for funds. Retirement funds will need to be agile to proactively embrace change; however, the duty placed on retirement funds to achieve suitable risk-adjusted returns over the long term also presents a significant opportunity to think more strategically, and to not only respond to the factors that will influence the future, but to play a significant role in creating it.

Retirement funds must transcend traditional retirement planning approaches if they are to survive, thrive and deliver on their mandates to members. By seriously considering what risks and opportunities the future might hold, retirement funds can ensure their fitness for the future and unlock numerous benefits.

As leaders in the industry, we understand the urgency and importance of this paradigm shift. We believe that now is the time to act boldly and decisively.

What does the retirement fund of the future look like?

With this in mind, we have established an Impact Advisory that focuses on delivering forward-thinking sustainability and environmental, social and governance insights and advice to retirement funds, as well as corporate clients.

The Impact Centre of Excellence focuses on sustainability comprising the brightest sustainability minds in the business and has accountability to deliver Alexforbes’ own sustainability objectives and impactful solutions for clients.

In delivering on the Impact Advisory retirement fund focus, the CoE has designed a maturity journey towards becoming a Retirement Fund of the Future™. It represents the ideal retirement fund that is aspirational in its design, and that sets the industry standard for a best-in-class, leading and future-fit retirement fund - The Retirement Fund of the Future™. Our intended impact is to set the new industry standard for leading and future-fit retirement funds. Some design components are being incorporated as future-fit enhancements to our standard solutions suite, while others require bespoke interventions depending on a retirement fund’s position on the maturity curve. The solutions suite, includes, but is not limited to:

• Sustainability, ESG and megatrends-focused trustee training, including virtual reality training capabilities

• Maturity gap analyses and bespoke improvement plan

• Enhanced responsible investing policy

• Enhanced risk management policy and approach

• Digital member enablement

• Member impact reporting

• ESG performance reporting

• Portfolio stress testing

• Materiality assessments

• Stakeholder assessments and bespoke stakeholder management plans

• Fund-integrated reports

We have drawn on our extensive experience in fund advisory and management, as well as this leading insight on sustainability best practices to develop our future-fit Solutions suite for retirement funds.

In line with our commitment to using our insights to deliver the best advice and solutions to our clients, our approach and our advice will continue to evolve as our CoE identifies and analyses emerging trends and their potential impact on retirement funds.

By embracing a future-fit approach we can ensure longterm resilience, sustainable growth and positive impact.

Avishal Seeth

Head: Retirement Consulting

Email: seetha@alexforbes.com

Telephone: +27 84 325 0989

Lee Swan

Head: Sustainability

Email: swanl@alexforbes.com

Telephone: +27 72 812 0751

Carina Wessels

Executive: Governance, Legal, Compliance and Sustainability

Email: wesselsc@alexforbes.com

Telephone: +27 84 701 6212

If you are interested in finding out more about the Impact Advisory Corporate offering, please reach out to Lee Swan or Carina Wessels.

Alexforbes has consistently played a pivotal role in the South African financial landscape. Renowned for our brand synonymous with insight, advice, and impact, we aim to become the most impactful provider of financial advice, serving both institutional clients and individuals.

Aligned with this vision, the Alexforbes Impact Centre of Excellence (CoE) was established in 2023, reflecting the group’s commitment to sustainability.

Our position on climate change Alexforbes recognises climate change and its origins based on substantial scientific evidence. In steadfast support of the Paris Agreement, we aim to limit global temperature increases, recognising the substantial strategic risks posed by unaddressed climate change. Departing from business as usual, we commit to reviewing, adjusting, and adapting approaches to responsibly address climate change’s short, medium, and long-term implications. We remain dedicated to developing our understanding of climate change and creating meaningful plans to drive positive material change.

We focus on advocacy, collaboration, education, responsible business practices, responsible investing and meeting stakeholder expectations. These areas align with our values of integrity, customer first, care, and leadership, emphasising an inclusive, engaged approach rather than an exclusionary one.

Our board of directors is responsible for climate change within the business, with oversight delegated to our Social, Ethics and Transformation Committee (Setco) and our management Sustainability Committee. The Impact CoE oversees

We remain dedicated to developing our understanding of climate change and creating meaningful plans to drive positive material change.

the group-wide sustainability strategy, ensuring comprehensive governance around climate change risks and opportunities. The Audit and Risk Committee further reviews climate change-related aspects as part of its oversight in enterprise risk management.

Alexforbes aligns with reporting guidelines such as the JSE Sustainability and Climate Disclosure Guidelines and the IFRS S2 standard as it relates to the Task Force for Climate-related Financial Disclosure. We are committed to enhancing our climate-related disclosures and continuously evaluating reporting frameworks to bolster our efforts in addressing climate change.

Our climate change policy reflects a robust commitment to responsible corporate citizenship and sustainability, aligning with global climate goals and emphasising engagement, education, and collaboration to effect meaningful change into the future and shaping a tomorrow we can all connect with.

Our position on climate change is infused into our own operations as well as the insights and advice we provide to clients. With this in mind, and aligned with our group climate change policy, we have developed an additional policy to guide how climate change is taken into account in our investment management approach. A summary of our Investments Climate Change Policy is included on page 16 for reference.”?

Our Investments Climate Change Policy represents our strategic commitment to addressing the systemic risks climate change poses on our portfolio solutions. The policy integrates into our broader responsible investment philosophy, emphasising sustainability and risk-led ESG integration.

Recognising the national and global priority of climate change, our approach aligns with regulatory frameworks, embodying an active role in identifying, measuring, reporting, and managing associated risks and opportunities.

Our climate change policy seeks to enhance transparency around how we integrate climate-related considerations into our investment management processes.

Our overarching stance on climate change risk management centres on adhering to the policy environment that regulators establish. We actively engage with managers to lead to emission reductions in line with evolving regulations. Affiliations with global initiatives, including the PRI, CRISA, and the UN Global Compact, underscore our collective approach to systemic environmental risks.

We continue to monitor and evaluate the relevance of other initiatives and will sign up for other initiatives if they support our efforts around climate change.

Proxy voting emerges as a key tool, leveraging governance standards to actively manage and mitigate exposure to climate-related risks within investee companies.

Our proxy voting guidelines leverage governance standards and support us in managing climate risks with our appointed asset managers. By reviewing these votes and consistently engaging with asset managers, we can better understand the nuanced approaches taken in managing portfolio risks associated with climate change.

Our long-term engagement plan focuses on engaging with the investment industry and the corporate sector on issues such as:

• High-emitting companies

• transition and liability risk management

• approaches to the just transition

• emissions measurement

• stances and progress on the IFRS S2 as it relates to the TCFD and

• adaptation to material impacts of climate change.

Effective monitoring, measurement, and reporting of the strategies deployed in our portfolio solutions plays a crucial role in evidencing our own efforts toward being responsible asset owners. One of the significant contributors to climate change is carbon emissions. Monitoring, measuring and reporting on carbon-related risks entails the ongoing evaluation and oversight of how companies within our investment portfolios address and mitigate carbon emissions and related environmental concerns. By doing so, we can make more informed decisions in our investment process. Monitoring, measurement, and reporting mechanisms are crucial to the policy, evidencing our efforts towards responsible asset ownership. This includes assessing asset managers’ ESG risks and reporting on the impact of our private markets program.

Asset manager reportbacks, due diligences and surveys are used to assess asset managers’ top ESG portfolio risks and evaluate the progress on these matters. Climate-related resolutions tabled at annual general meetings and vote outcomes are also analysed.

Accurate measurement is crucial for assessing carbon risk mitigation practices and understanding their efficiency. Measurement also enables investors and stewards to track progress and identify areas for improvement or opportunity. This includes quantifying and evaluating the efforts of investee companies and investment portfolios in managing carbon emissions.

Measurement is done by:

• calculating the Weighted Average Carbon Intensity (WACI) of the equity component of our multimanaged solutions

• measuring the WACI of the top 10 emitters within our solutions, and

• engaging with appointed asset managers on portfolio risks.

Comprehensive reporting plays a key role in stewardship. Reporting on climate-related practices provides valuable information into the materiality of environmental factors in our portfolio solutions, and assessing climate factors can enable transparency, accountability and informed decision-making. We enhance our reporting through:

• proxy voting reporting on the top portfolios within our portfolio solutions

• annually disclosing the WACI metric of our flagship multi-managed solutions

• report on the impact of our private markets programme and where we contribute to the green transition.

Key climate change risks are related to physical, transition and liability risks. Addressing these risks shapes asset class assumptions and influences strategic asset allocations, manager research, and portfolio construction. Our investment team considers how asset managers adjust to climate-specific risks within their portfolios and how they engage with investee companies’ transition risk plans and report on them.

The policy emphasises capacity building and collaboration - we will promote awareness and understanding of climate-related issues among employees through training programmes, workshops and educational initiatives. These collaboration efforts will also extend to the industry and regulatory bodies to aim to share knowledge and develop innovative solutions. Moreover, we commit to contributing to policy discussions to enhance effective climate risk management.

By integrating climate change considerations into our investment practices, we can manage risks and capture opportunities aligned with a low-carbon economy. Our Investments Climate Change Policy positions us as a proactive participant in the global effort to mitigate climate change risks, contributing to a more resilient financial system while aligning with long-term investment goals.

If South African businesses don’t adapt to climate change, they will be left behind and ultimately become redundant in a netzero global economy. However, like any challenge, a host of opportunities await.

Any business is dependent on infrastructure. It needs functioning roads, railways, harbours and energy supply to grow and prosper. It’s also reliant on fast disaster management to bounce back above the bottom line.

South Africa’s infrastructure already faces a multitude of challenges – from the strain of a growing population to mismanagement and corruption. This has left the country susceptible to an array of disasters, be they natural or man-made. Climate change will only intensify this vulnerability – also referred to as physical risks.

municipalities to develop flood and fire disaster resilience through preventive measures. Since 2012, they have invested more than R100 million in helping 82 municipalities to better respond to the risk of fires and floods.

These seemingly altruistic acts are in the interest of insurance companies that have to pay out millions in the aftermath of disasters. But as the climate warms, these win-win partnerships offer a way forward.

Physical risks refer to risks associated with extreme weather events such as severe droughts, wind, flooding, rising sea levels and extreme heat. For businesses this could result in infrastructure damage, supply chain disruption, increased water shortages and rising insurance costs.

In the lead-up to COP26, global momentum for net-zero climate action is growing rapidly. Twenty-two countries and the EU have now formally adopted net-zero targets. More than 100 other countries have joined the Climate Ambition Alliance to work towards net-zero by 2050 or sooner. The leaders of China and Japan have also recently committed to climate-neutrality.

Ironically the current situation has prepared businesses for what is to come. The private sector already carries much of the burden of infrastructure, service delivery and disaster management as the government can’t close this gap. For example, the Eskom crisis has forced many companies to install their own power supply, mostly from renewables.

South African businesses must factor in the physical risks as well as how to remain relevant in the global market. Corporate South Africa’s response to climate change has to align with trade partners’ climate policies.

Insurance companies also have much to lose in a world of regular extreme weather events. Through its Partnership for Risk and Resilience programme, Santam partners with

Top export partners outside Africa have recently announced commitments to netzero, putting South African exports at risk if carbon border taxes or other measures are implemented. On the flip side, these are potentially lucrative markets for low-carbon commodities.

Although implementation is lagging, on paper more than 140 countries, including the biggest polluters –China, the United States, India and the European Union (EU) – have set a net-zero target for 2050. To achieve carbon neutrality, these countries need to ensure GHG emissions are cut along their supply chains. Low emissions or zero-emission products, such as electric vehicles, and services will get preference.

Volumes of South Africa’s exports to leading partners in 2018 (ZAR billion)

For example: EU plans to implement carbon border adjustment by 2023.

Carbon border tax planned

*The top three trade partners within the EU are Germany, the Netherlands and Belgium, and they are among those with the most aggressive targets.

The EU’s Carbon Border Adjustment Mechanism is a tool to put a price on the carbon emitted during the production of carbon-intensive goods – like cement, iron and steel, aluminium, fertilisers, electricity and hydrogen – that are entering the EU, and to encourage cleaner industrial production in non-EU countries.

Financial Challenge

Job Displacement

Business Profitability

Government and business cannot finance the transition.

The transition will result in substantial job losses in the coal-mining and energy-producing sector.

The transition will hurt the profitability of certain businesses.

Carbon neutrality poses a huge challenge for South Africa, as our economy is dependent on fossil fuels. We could be heavily taxed on our exports – for example, the EU launched the Carbon Border Adjustment Mechanism (see sidebar above) in October last year.

South Africa is in an unenviable position. We are a developing country, and also one of the largest emitters. South Africa doesn’t have sufficient funds to transition the economy away from fossil fuels without a considerable political, financial and social cost. But what we also don’t have is a choice. We have to find a solution.

South Africa could benefit from the climate challenge by aligning with climate goals and gaining access to international climate finance. South Africa has huge potential in renewable energy as well as in low-carbon transition-driven export sectors. Minerals, such as platinum (fuel cell vehicles) and manganese (batteries), could gain market share.

Missed Investment Opportunities

We will miss out on significant global investment in climate initiatives.

Trade Penalties

Global Lag

Source: National Business Initiative

Our exporters into the EU will be punished directly (through border taxes) and indirectly (loss of market access).

We will be left behind the rest of the world that is rapidly transitioning to alternative energy sources.

Government and businesses can collaborate to invest in renewable energy. These investments reduce emissions and create jobs. To date, the government’s Renewable Energy Independent Power Producer Procurement Programme has installed a grid capacity of 6 184 MW from 89 power plants and created more than 30 000 jobs. Another 51 projects are in the pipeline.

Foster a culture of innovation and research to develop sustainable technologies and solutions that drive economic growth while minimising environmental impacts. SA Breweries’ Project Imifino, part of their water stewardship strategy in Ibhayi, uses brewery waste water to grow spinach for the local community. The crops act as a “treatment plant”, absorbing nutrients and leaving the water relatively clean. This process enables the brewery to recover 90% of the water through its recycling plant, significantly enhancing water efficiency.

The Presidential Climate Commission has created the Just Transition Framework (JTF) – an ambitious roadmap towards a low-carbon economy. Businesses can consult and incorporate the principles of the JTF into their policies and decisions. The JTF serves as a guiding document to address climate change as well as inequality, job creation, poverty alleviation, and the restoration of natural systems for resilience.

Invest in skills development programmes that equip the workforce for green jobs and industries. Eskom’s decommissioned Komati power plant is being set up as a training facility – a first in Mpumalanga. The centres will focus on renewable energy skills, such as wind-turbine maintenance and installing solar photovoltaic systems.

As with the pandemic, the climate challenge cannot be solved in a silo. Business has to adapt, innovate and work together with government, academia and civil society to solve an issue that, if left unattended, will affect every living being on this planet.

We Mean Business, a coalition of organisations, invites companies to create a low-carbon revolution. Visit wemeanbusinesscoalition.org to get involved.

Climate Policy Initiative’s Understanding the impact of a low-carbon transition on

South Africa

Mail & Guardian: Renewable energy training ramps up at Komati power station

National Business Initiative’s A Guide to

Climate Change for South African CEOs

NERSA’s Report on the monitoring of performance of renewable energy power plants January to June 2023

News24: SAB turns waste water into spinach

UK Pact’s Transition Risk in TCFD

Reporting

423% increase in the number of deaths from natural disasters from 2016 to 2019.*

52 The number of local governments with risk-reduction strategies. This is much higher than most African countries.

13 The number of national and local disaster risk-reduction strategies that SA has adopted.

The Climate and Disaster Resilience Fund was established in 2020. This fund seeks to support efforts to ensure vulnerable communities are better prepared for disasters arising from climate change.

* No current data is available - the last study was done in 2019.

South Africa is one of only 17 countries, out of 193, that have submitted an updated National Adaptation Plan as required by the Paris Agreement.

Policy development is on track.

CO

2 emissions from fossil fuel combustion and cement production: Major challenges remain

CO

2 emissions embodied in fossil fuel exports: Challenges remain

CO

2 emissions embodied in imports: On track and maintaining SDG achievement

2019

The open access, online tool – named the Green Book – is launched. This climate risk-profiling and adaptation tool assists municipalities across South Africa in assessing climate risks.

2020

Sustainability Starts with Teachers, a UNESCO programme, is implemented. The programme supports teacher educators to prepare future teachers for teaching sustainability across the curriculum.

2023

Fundisa for Change develops online learning courses, including Climate Change Education for Geography and Climate Change Education for Natural Science.

Climate finance increased twofold in 2019/21 on 2017/18, to R131 billion from R62 billion. However, South Africa requires an average of R334 billion and R535 billion per year to meet its NDC by 2030 and net-zero goals by 2050, respectively.

South Africa has provided financial and technical support to other countries, reflective of its ‘fair share’ contribution to global climate efforts. In 2019, 2020 and 2021 South Africa committed an average of USD222 million in international climate finance. Of this, nearly two thirds went to other African countries.

At COP27, South Africa’s Just Energy Transition Investment Plan was viewed as a model framework that can assist other developing countries, like Indonesia, Vietnam, India and Brazil, with similar fossil fuel dependencies.

The University of Cape Town (UCT) established the Transforming Social Inequalities Through Inclusive Climate Action project. The project, with nodes in Ghana and Kenya, aims to build the foundations of an inclusive, interdisciplinary, Pan-African network of researchers and practitioners on climate change and inequality.

UCT’s Climate System Analysis Group addresses the knowledge needs of developing nations, delivering tailored information, building capacity within the continent, and engaging with users around adaptation, policy and impacts.

In 2015 the United Nations established its most important global call to action yet: the 17 Sustainable Development Goals (SDGs). These goals aim to tackle global challenges and inspire action in areas of critical importance for humanity and the planet. The goals were agreed upon by 193 member countries, including South Africa. Goal 13 contains climate action.

SDG achieved Challenges remain Significant challenges remain Major challenges remain

Score moderately improving, insufficient to attain goal.

Above

The amount of losses incurred by the fruit production sector in 2016 due to an ensuing drought in the Western Cape.

The number of jobs lost in the national agriculture sector in 2015 during the drought in the Western Cape, pushed an additional 50 000 people below the poverty line and accelerated consumer inflation and rising food prices.

In Africa, agricultural productivity growth has been reduced by 34% since 1961 due to climate change, more than any other region.

Risks associated with extreme weather events: floods, heat waves, sea level rise, winds, and droughts.

6814

The number of people left homeless after the 2022 floods in KwaZulu-Natal.

20 million

The amount in rands small scale and commercial farmers suffered in crop and infrastructural damages due to the floods.

In the past four decades, 196 heat emergencies have been reported globally. African statistics are scarce with only eight events reported. This is the number of deaths officially reported in South Africa related to severe heat.

Above 2°C of global warming, distribution and transmission of vector-borne diseases (malaria) is expected to increase. Heat-related deaths could also rise sharply placing strain on health and economic systems.

The number of people in Africa that could be exposed to sea level rise by 2030.

The development of new technology to support a low-carbon economy drives these risks. As electric cars become more affordable the demand for petrol and diesel will decline leading to the closure of filling stations and job losses.

As renewable energy, like solar and wind, becomes more affordable demand for energy from high emitters will decline leading to the early retirement of power stations and job losses.

Failure to comply with government climate regulations could lead to legal costs for high emitters.

Complying with government policies such as the Carbon Tax Act to curb emissions could lead to increased operational costs for coal power stations.

• Carbon Tax Act

• Climate Change Act

• Just Transition Framework

• Nationally determined contribution

Transition risks refer to the financial and economic risks as countries change, or transition, towards a low-carbon economy.

Climate change poses a significant financial threat to insurance companies that have to make larger and more regular payouts due to extreme weather events, like flooding.

High emitters could be seen in a negative light by the public. This could lead to less demand for their products and difficulty accessing capital for further development.

The European Union’s Carbon Border Adjustment Mechanism seeks to reduce greenhouse gas emissions by imposing a carbon border tax on imported carbon-intensive products such as cement, aluminum, fertilisers, electric energy production, hydrogen, iron and steel etc. This could put South African exports at risk.

www.alexforbes.com

The goals you set yourself to achieve define the impact you want and the impact you make. At Alexforbes, we know that doing this starts with a deep understanding of your needs and the best solutions and variables that can influence good outcomes.

We draw on a diverse and rich base of knowledge and insight we have nurtured over decades. We connect it to holistic and independent advice so that your decisions of today have the impact you want tomorrow.