While the bulk of our industry’s stores still base their self-service operations on coins, the share of stores using card-based payment systems is growing. For our cover story this month, I interviewed store owners from around the country to learn about their experiences, and they all had positive things to say about the various systems. My story starts on page 14.

Ever offered your customers a drink or a meal while they wait for their last load to dry? How about encouraging patrons to explore their artistic side by hosting drop-in workshops and classes?

This month, Carlo Calma visits with the owners of Harvey Washbangers, which combines soap and suds in their side-by-side Laundromat and restaurant/bar, and the owners of some New York City laundries that become “de facto community centers” for community-based summertime art programs. Look for his report starting on page 8.

You’ve got plenty to deal with in keeping your laundry on the right track, sure, but when was the last time you took a look at your signage? Howard Scott reminds that a store sign is like the suit on the man. Look good in that suit and you’ll have plenty of friends around. Look a little tattered and worn and your visitors may be few and far between. Read up on the four basic rules of signage on page 26.

And that’s just a taste of the top-notch content we have for you this month. For you digital-edition readers, don’t forget that select stories also feature exclusive audio content. Click on the microphone!

Bruce Beggs Editorial DirectorCharles Thompson, Publisher

E-mail: cthompson@ americantrademagazines.com Phone: 312-361-1680

Bruce Beggs, Editorial Director

E-mail: bbeggs@ americantrademagazines.com Phone: 312-361-1683

Roger Napiwocki, Production Manager

Jean Teller, Contributing Editor

Carlo Calma, Editorial Assistant

Nathan Frerichs, Digital Media Director

E-mail: nfrerichs@ americantrademagazines.com Phone: 312-361-1681

Donald Feinstein, Natl. Sales Director E-mail: dfeinstein@ americantrademagazines.com Phone: 312-361-1682

office information

Main: 312-361-1700 Fax: 312-361-1685 subscriptions 630-739-0900 x100 www.AmericanCoinOp.com

American Coin-Op (ISSN 0092-2811) is published monthly. Subscription prices, payment in advance: U.S., 1 year $39.00; 2 years $73.00. Foreign, 1 year $89.00; 2 years $166.00. Single copies $7.00 for U.S., $14.00 for all other countries. Published by American Trade Magazines LLC, 566 West Lake Street, Suite 420, Chicago, IL 60661. Periodicals postage paid at Chicago, IL and at additional mailing offices.

POSTMASTER, Send changes of address and form 3579 to American Coin-Op, Subscription Dept., 440 Quadrangle Drive, Suite E, Bolingbrook, IL 60440. Volume 55, number 5. Editorial, executive and advertising offices are at 566 West Lake Street, Suite 420, Chicago, IL 60661.

Charles Thompson, President and Publisher. American Coin-Op is distributed selectively to owners, operators and managers of chain and individually owned coin-operated laundry establishments in the United States. No material appearing in American Coin-Op may be reprinted without written permission. The publisher reserves the right to reject any advertising for any reason.

© Copyright AMERICAN TRADE MAGAZINES LLC, 2014. Printed in U.S.A.

Over all 41.62" W x 72" H x 38.5" D

* compressor unit needs 4" inches of "breather" room behind unit

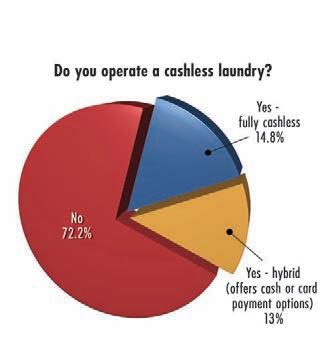

Roughly 28% of self-service laundry operators who responded to April’s American Coin-Op Your Views survey run cashless stores, while the majority (72.2%) of respondents run coin-based operations.

While 14.8% of respondents say their facility is “fully cashless,” roughly 13% say they operate a hybrid operation offering “cash or card payment options.”

The cost to convert to cashless payment systems is the main factor why coin laundry operators don’t pursue the change, with 41.3% of respondents saying it is “too expensive.” Other operators believe their customers “would rather use coins” (19.6%), while 15.2% say the store they bought is “an existing coin laundry.” Roughly 9% believe their clientele “wouldn’t be comfortable with the technology,” while 4.4% say they “don’t want to hire an attendant.”

Approximately 11% of respondents pointed to “other” reasons, with one saying, “When we built the store, there were no readers compatible with the vending machines.”

Regarding advantages of implementing cashless payment systems, “not worrying about collections” is the biggest draw for 56% of respondents, while 16% realize the technology’s “new marketing opportunities.” Equal shares of 8% are drawn to the advantage of advanced payment by customers, as well as “being able to change prices quickly.” Twelve percent of respondents listed “other” advantages, such as the “opportunity to have unattended hours.”

There will be a “higher percentage of cashless stores” five years from now, 37% of respondents believe. One-third believes there will be “about the same percentage of cashless stores,” while 20.1% of respondents believe there will be a “far higher percentage.”

Roughly 7% of respondents believe otherwise, saying there will be “a smaller percentage of cashless stores,” while a sliver of respondents (1.9%) believe there will be a “far smaller percentage of cashless stores” five years from now.

While American Coin-Op’s Your Views survey presents a snapshot of the audience’s viewpoints at a particular moment, it should not be considered scientific. Subscribers to American Coin-Op e-mails are invited to participate anonymously in an industry survey each month. (Due to rounding, percentages may not add up to 100%.)

The entire American Coin-Op audience is encouraged to participate, as a greater number of responses will help to better define owner/operator opinions and industry trends.

I’ve personally handled insurance for hundreds of coin laundries! I’ve already dealt with most any issue your business is likely to face. If you have any questions about insuring coin laundries, I can and will give you a prompt, clear answer. Skeptical? Call me with a question and find out for yourself.

There’s more: I’m just one member of a team of experts. NIE has been insuring fabricare business since 1915!

Anne

Anne

In the true spirit of entrepreneurship, Laundromat owners and operators are always thinking of ways they can grow business, both from an operational and financial standpoint.

While some operators offer extra services within the parameters of the industry—like wash-and-fold and dry cleaning—others have ventured outside the box and have sought unique ways to bring customers through the door.

A quick, 5-minute drive outside the main campus of Texas A&M University has led college students and locals alike to a place where they can “Eat. Drink. Do Laundry.”

Located at 1802 Texas Ave. South in College Station, Texas, Harvey Washbangers has been serving suds both in its Laundromat and bar/restaurant since 1998, according to Phyllis Lair, who coowns the establishment with husband, Pete, and son, Michael, general manager.

Michael Lair got his start at the company 12 years ago as the kitchen manager while

attending Texas A&M, but later left his post to attend culinary school.

The first Harvey Washbangers was situated in Nashville, Tenn., according to Phyllis, who officially took over the College Station franchise location in 1999, after its original owners walked away from the business.

A handful of other franchise locations had opened in the South and West Coast, she says, but the operations never took off and have since closed.

“It just seemed like a good, solid concept,” says Phyllis. “To us, there was a need there, obviously, for a laundry. And then, what else do you do during laundry? You need something to do [so] we provide a full-service restaurant.”

Operations are split “half and half” inside the 4,500-square-foot facility, says Phyllis, who manages the Laundromat side of the business.

“There are two separate entry doors; there’s one that takes you directly into the restaurant, there’s one that takes you into the laundry, and there is a connecting door

[inside],” she says.

The fully cashless Laundromat houses 40 washers and 40 dryers, and is attended from 9 a.m. to 11 p.m. Wash-and-fold service, drycleaning service (contracted and done off-site), and laundry supply vending machines make up the Laundromat’s other ancillary services.

A morning and evening attendant make up the Laundromat’s staff, while the restaurant employs three servers and three cooks, according to Phyllis.

“These two have never been divided; it’s lumped together,” she says. “When I do payroll, I’m paying both sides.”

“I’m not sure one person can do this, because it’s multifaceted,” adds Phyllis, who gives a lot of credit to her son, who came back in January 2012 to help manage the restaurant side.

“He really put the final twist to it and the restaurant has taken off even more,” she says.

“This was an eye-opening experience,” says Michael. “The amount of complexity involved in a full-service restaurant with all the things that could go wrong there, paired up with a full-service Laundromat

Every little hinge, hose and housing is engineered with long-lasting energy savings in mind.

**

The closer you look at Maytag® equipment, the more resourceful thinking you’ll see. Take the innovative TurboWash™ System, for instance, which allows our MFR30 washer to deliver impressive cleaning power—along with the potential to cut your water use by over 60%.*

Add to that extra-large capacity that helps you turn more profits per load, plus our 5-year warranty** on every single part. Visit mclaundry.com for digital brochures, or for more information, visit our website at maytagcommerciallaundry.com or call 800-662-3587.

*Average savings by using super cycle, compared to previous Maytag MFR washers; actual savings varies by model.

… was a level of complexity I couldn’t have dreamed of.”

Despite the complexities of managing a Laundromat/bar and restaurant, Michael explains that duties are split between him and his parents, who each have their own managerial strengths.

“My dad is phenomenal with machine maintenance; my mom handles the bookkeeping and the customer service in the laundry side [and] I can handle the restaurant,” he says. “Things just naturally fall into who can handle what issue the best.”

Delegating and finding staff with “complimentary skills sets” is key, adds Michael, who advises Laundromat owners with a similar set-up to learn the insand-outs of the entire establishment, not just a particular aspect.

“My parents have learned the laundry side of this incredibly well and I’m trying to catch up on that knowledge,” he says.

The extra-profit center has “grown considerably,” according to Michael, who says the challenge in developing the bar/restaurant side was breaking the mentality of customers who don’t associate a Laundromat with grabbing a bite to eat.

“That was always the biggest issue, was getting on people’s short list of restaurants, even though we’re in a Laundromat,” he says. “However, once you crack into that … and establish a reputation, that uniqueness starts to become a major attribute

… it starts to really benefit you up front [when] you prove that it’s worth going to a Laundromat to go eat.”

Phyllis agrees, saying that Harvey Washbangers’ biggest asset and liability is its unique set-up. “We’ve had to overcome the preconception about people wanting to come eat when they think it’s just a Laundromat.”

Though he says there is a “good amount of bleed-over” between laundry and restaurant customers, Michael has noticed that the establishment has separate clientele. To curb this, he emphasized the importance of selling convenience.

“A lot of people that come just for the food have their own washers and dryers [but we] sell them on bringing their com-

forters in, or possibly dropping off [laundry or dry cleaning] while they’re at lunch,” he says.

In addition to a loyalty program on the Laundromat side, another customer convenience is a light board in the restaurant for laundry customers that alerts them when their load in the washer or dryer is finished, according to Phyllis.

“It’s another draw for customers to stay in the facility, particularly on our busy times when we have people waiting for machines,” she says. “It’s good to have your laundry customers not leave.”

In running a Laundromat/bar and restaurant, operators may come to the realization that not only are they in competition with other laundries, but with chain restaurants, as well. The key to standing out?

“You really have to be better than the competition, because you have that mentality working against you [of] ‘I don’t want to go to a Laundromat to eat,’” says Michael.

He achieves this for Harvey Washbangers by periodically refreshing its menu, as well as strictly serving locally sourced craft beer.

“We have six taps that rotate constantly, and about 30 to 35 different Texas craft beer that we offer,” he explains.

Though he admits the atmosphere isn’t a “bar scene,” the emphasis on “local” has become a draw for customers.

“That’s been a huge benefit because local craft people are incredibly loyal to anybody that stocks their product,” he says. “There’s a big relationship there that gets you plugged in to the community and gets you a whole set of customers that will be very loyal.”

While some operators have established extra services with solely profit in mind, one New York-based non-profit organization is helping area Laundromat owners turn their stores into “de facto community centers,” through free, drop-in art workshops and classes.

Founded in 2005 by Risë Wilson, The Laundromat Project has set up various workshops and programs throughout Laundromats in the greater Manhattan, Bronx and Brooklyn areas, with the goal of bringing art education to those waiting for their clothes to finish in the rinse cycle.

“New York is notable in that Laundromats are ubiquitous, regardless of what your living circumstances are,” says Petrushka Bazin Larsen, program director.

The organization’s various programs resource local artists with a production budget and honorarium to create art projects and education in public places.

Among these programs is Works in Progress, which was established in 2009, and first offered at The Laundry Room in Harlem. Since its inception, the program has expanded to two other Laundromats: Fulton Street Laundry in the BedfordStuyvesant neighborhood, and at Lucky’s Laundromat in Hunts Point.

The Works in Progress workshops, offered every weekend from noon to 3 p.m., June through August, provides “intergenerational” art projects to customers, according to Larsen, like kaleidoscopemaking, kite flying and sidewalk art.

The art projects, Larsen says, affords those with downtime at the Laundromat a tool and outlet to express their inner creativity.

When it comes to forging relationships with area Laundromats, Larsen explains that owners and Laundromat customers recognize the value the program affords.

“Generally, Laundromats are associated with boredom and chores, but when you bring free art classes … it kind of transforms the regard for that space,” she says. “We’ve become, sort of, a mainstay in each of the neighborhoods where we work when people expect us to be there because we add this value to their experience in doing their laundry.”

Asa Nathanson, owner and operator of Fulton Street Laundry, recognizes this value.

“Parents always have the problem of what to do with their kids, especially on the weekends. They’re extremely busy … and kids get bored, so The Laundromat Project is there, and they just take care of the kids,” he says, adding that not only do parents appreciate the program, but his team of

attendants, as well, in terms of keeping the store managed.

Hosting The Laundromat Project at his facility allows him to create a “neighborhood club” atmosphere.

“My Laundromat is a community. People who come to my Laundromat know each other [and] something like The Laundromat Project … definitely [brings] a community activity.”

Nathanson says he and his customers are anticipating the return of the Works in Progress workshops this summer. If the program hadn’t existed, he would create something similar himself, which Larsen and her team encourages.

“Anybody can do this work. Anybody can be a neighbor,” says Larsen.

Adding an extra service requires a team effort, according to Michael Lair.

“From the very get-go, involve somebody that has that experience in the planning phase [and] in every step of the way, because jumping into something, whether it’s a bar, whether you’re serving food or not, [involves] an incredible amount of complexity.”

Lair adds that constant reinvention and flexibility is also of importance.

“If you’re going to be offering the same thing day-to-day, you’re at a significant disadvantage to the big-box chains and all the larger businesses out there,” he adds. “If you’re a mom-and-pop place, the good news is you can be flexible.”

By Bruce Beggs, Editorial Director

By Bruce Beggs, Editorial Director

While industry surveys continue to show that the vast majority of self-service laundries in the United States are coin-based, it’s clear that the share of cashless stores—“coinless” may actually be a more apt description in many cases—is growing larger by the year.

American Coin-Op interviewed store owners from around the country whose operations use cashless payment systems from some of the industry’s best-known vendors. Depending on the system, customers can transfer a dollar amount to a “store card” or “loyalty card” (using cash or a credit/debit card; systems vary) which is then used to start the vended washers/dryers in that store, or can use a credit, debit or EBT (electronic benefit transfer) card to start a machine. Some systems enable stores to accept coins, credit card, loyalty card, or any combination.

A card-based system may not be right for every laundry, but the store owners who were interviewed on this topic can’t see running their businesses any other way.

Kevin Beggs (no relation to the author) owns nine Brockton, Mass., area Superwash stores ranging in size from 1,600 square

feet to 3,300 square feet. He first used a cashless system in the 1990s and believes his was one of the first.

“It was probably a little too early to do that sort of thing, because the technology really hadn’t caught up with what people needed and how it really needed to work,” Beggs says.

He’s since shifted to using a Card Concepts Inc. (CCI) system, putting one in all nine of his unattended stores between 2007 and 2010. “We don’t have a coin slot anywhere,” he adds.

On the other end of the experience spectrum, Jay Bovarnick is new to the industry, having purchased and renovated his first selfservice laundry within the past six months.

Speedwash Laundromat in Buzzards Bay, Mass., opened under Bovarnick’s ownership in November (there had been a coin laundry at the site for decades, he says), and within three months he had transitioned the coin store to one based on an ESD card system.

“I absolutely love it,” says Bovarnick. “It seems like the coins were a generation ago for me.”

He elected to go the card route in part because he found coin collection to be a tiresome, time-consuming process. “I would have to be there every other day just to empty the large machines, because the coin box hasn’t changed in 50 years. You have a large machine that’s taking $8.75 [per cycle], you just can’t put that many washes in it before the coin box is overflowing.”

Indeed, dealing with fewer coins or none at all was frequently mentioned among the benefits that cashless systems offer these store owners. And they say this benefits customers as well.

Bruce Dixon co-owns the Big Wash Tub in Columbia, Tenn., with his father-inlaw Kenneth Cherry. A small staff works hard to keep the 32-year-old store looking brand-new, and they’ve offered a Setomatic Systems payment system since 2011. Credit card readers are on a little more than onethird of the 150 pieces of equipment—“on every size machine except top loaders,” he says—in the 4,500-square-foot store.

Aside from seeing cashless payment becoming a growing trend, the Big Wash Tub owners chose to install a system for ▼

These owners of cardbased vended laundries wouldn’t have it any other way

customer convenience, Dixon says.

“First of all, they have to make sure they have money in their pocket. They have to convert it to quarters. For some of the bigger machines, it takes as long to put the quarters in as it does your laundry and detergent. When you have a 100-pound washer, and you’re vending it for 12 and a quarter, it takes a long time to put all those quarters in there.”

Alan Stuart owns the New Scrub Board Laundromat & Car Wash in rural upstate New York (Stephentown is between Albany, N.Y., and Pittsfield, Mass.). His store uses an RFID-based IDX payment system installed three years ago.

Saving customers time and effort was part of the reason for the shift away from coins, but Stuart was also interested in making his life a little easier.

“That’s just more quarters you have to count all the time,” he says. “To be efficient, you gotta cut back where you can so you can spend more time making you money … Because we’re in a rural situation, the bank was 16 miles away, and I used to have to go a couple times a week. I only have to go once now. I don’t have all those quarters to lug off to the bank.”

Rob Sussman, coowner of Spin Spa Laundry, San Diego, Calif., was moving approximately $700 in quarters a month between coin receptacles so employees could use them to operate equipment for the store’s wash-andfold business. Installing the cashless system offered by Standard Change-Makers in partnership with BCC Payments eliminated that requirement, as employees now each have their own dedicated card.

“It seemed like the easier and better way to get the job done for us and our customers,” Beggs says of his decision to go completely cashless.

But adopting such a system, particularly in an established coin-based store, isn’t without its challenges. Implementing a card system requires extra effort to “sell” customers on its benefits and to help them learn how to use it, store owners say.

Brian Brunckhorst owns four Advantage Laundry stores in the San Francisco Bay area and is building out a fifth store. He utilizes a cashless payment system

offered by Standard Change-Makers/BCC Payments at his Pleasant Hill store, and a WashCard system on the larger machines at his Oakland store; the new store will feature a CCI system on all machines.

“Initially, the customers liked it. They liked the ability to pay with credit,” he says of the Pleasant Hill location. “It took them a little bit of time to get used to the functionality of the system, but it really wasn’t very difficult. We have attendants in the store who helped walk the customers through the process.”

Joe Silvaugh Jr.’s Soap Suds in York, Pa., utilizes a WashCard payment system, according to store manager Julia Sandridge. Having once housed a furniture store, the laundry just opened in January.

Sandridge makes a point to greet customers, exchange their quarters for dollar bills, and show them how to use a kiosk to place value on a store card.

“About 80% of the people that do come here absolutely love it,” she says. “They love the fact they don’t have to mess with any quarters. Then you have your oldtimers … they love their quarters, they’re ‘old school.’ ... They don’t want to learn another way and they walk out.”

One way that store owners soften the transition from coins to cards a bit is by offering a bonus when customers place value on a store card. For example, Bovarnick gives a customer placing $20 on a Speedwash Laundromat card an extra $2.

One distinct advantage of cashless payment systems is the ability to track and produce equipment usage and revenue data on command.

For Munim Yono, who owns a super-

market and liquor store besides Millennium Laundry in Lincoln Park, Mich., the management tools offered by his Greenwald Industries system help him keep track of things through just a few keystrokes.

“I can go to the system and look up each machine, what it did, what time, and how much money was generated,” Yono explains. “It makes life so much easier.”

Calculating turns per day at Big Wash Tub is now quick and painless for Dixon.

“We used to measure turns per day by machine by putting the quarters in a bucket and weighing the bucket,” he says. “We would estimate, based on the vend price, how many turns a day that machine, or that particular size machine … were doing. The system was so labor-intensive, we did that only maybe three times a year. Now I can do it in five minutes.”

He also uses his Setomatic system to track business and determine the best times to visit and “tidy up” the store.

Beggs’ store once experienced a drain overflow, and by using the data available through his CCI system, he was able to determine that the problem was caused when a customer started 14 washers simultaneously. He’s also used the system, in concert with his video surveillance system, to help customers track down lost items.

The store owners we spoke to acknowledge that deciding to install a cashless payment system requires a sizable investment, and the size and scope of a self-service laundry plays a factor in determining if the projected return on such an investment makes sense.

“I’ve always said that our particular business model may not work in every store,” Sussman says. “It’s really a caseby-case basis. As a general rule of thumb, with the way things are going these days, everything is cards ... Some laundry owners are operating on a really tight profit margin, so I can see why [the installation cost] might be a deterrent. But a lot of times, you have to think outside the box. You have to think, ‘Am I going to get increased business because of it?’”

Don’t expect the transition to happen overnight. “If you’re converting a [coin] store, expect a learning curve with your current customers,” Stuart says. “If you’re starting a new store, people won’t know what to expect when they come in anyway, so I think it will be much easier.”

Implementing a card system requires extra effort to “sell” customers on its benefits and to help them learn how to use it, store owners say.

“We have successfully converted over 400 dollar/ dollar token/quarter drops with Imonex® and we’ve experienced excellent results. We’re halfway through our conversion process and our coin jams have decreased dramatically. We spend less time servicing our machines so we can focus on serving our customers. We definitely recommend Imonex® to our friends in the laundry business.”

Gary D. Gray, CEO Fun Wash, Inc.

Imonex® is proud to serve the hard-working entrepreneurs in the Coin-Op Laundry industry. We are dedicated to helping this important community improve customer experiences, enhance ROI and increase uptime through our steadfast commitment to enhanced product development and friendly customer support.

Enhanced reliability and performance through advanced engineering.

• Patented Superior Coin Acceptance

• Multi-Coin in Single Drop

• Flexibility to Convert to Dollar/Quarter

• Converts Smart Card System Back to Coin

• Compatibility with Most Major Coin-Op Manufacturers

• Serving Both Domestic and International Markets

• Proudly Made in the U.S.A.

Our vertical geometric technology greatly reduces jams, increasing potential revenue. With our flexible options for multi-coin dollar, quarter and tokens, we allow customers the convenient payment options they expect. Plus, the higher denomination availability allows owners to reduce the frequency of coin box service visits.

Imonex Services Inc.

800.446.2719 979.885.3200 International 011.979.885.3200 www.imonex.com

may

3 Commercial Equipment Co.

Open House

Addison, Texas Info: 800-899-9379

6 Great Lake Commercial Sales

2014 Maytag Service School & Business Seminar Lansing, Mich. Info: 800-821-8846

10 Great Lake Commercial Sales 2014 Maytag Service School

& Business Seminar Wauwatosa, Wis. Info: 800-236-5599

12 Alco Washer Center Annual Equipment Show Mars, Pa. Info: 724-658-8808

13 Great Lake Commercial Sales

2014 Maytag Service School & Business Seminar Elmhurst, Ill. Info: 800-236-5599

14-15 Coin Laundry Association Excellence in Laundry Conference

Key Largo, Fla. Info: www.coinlaundry. org/excellence-in-laundry

15 Hermes Equipment Open House

Bloomington, Ill. Info: 309-827-4302

Visit www.AmericanCoinOp.com for more calendar listings!

By Mark E. Battersby

By Mark E. Battersby

Since the inception of the Internal Revenue Code, the IRS and laundry businesses have been at odds over whether expenditures made are currently deductible or whether they must be capitalized and recovered through depreciation over time.

Now, after seven years of drafts and proposed rules, the IRS has issued final regulations addressing whether a cost is a deductible repair or a capital expenditure.

The IRS has also released a long-awaited Revenue Procedure that details the procedures for obtaining the “automatic” consent of the IRS to change accounting methods as required by the new repair regulations.

The newly released IRS regulations provide guidance on a number of difficult questions, such as whether replacing a component of a building is a current deduction or whether it must be depreciated over 39 years. Expenditures that restore property to its operating state are, according to the IRS, a deductible repair. However, expenditures that provide a more permanent increment in longevity, utility or worth of the property are more likely capital in nature.

In general, the regulations distinguish

between amounts paid to acquire or produce business property, equipment or machinery and amounts paid to improve existing property. When it comes to “improvements” to business property, capitalization is required if the expenditure is a betterment, restoration, or adaptation of the unit of property.

A laundry business must generally capitalize amounts paid to acquire or produce tangible property unless the property falls into the category of materials and supplies, or qualifies for the so-called “de minimis” safe harbor. The new guidelines cover:

• Materials and Supplies — Incidental materials and supplies may be deducted when purchased. Tax-deductible materials or supplies are tangible personal property, other than inventory, that is used or consumed in the taxpayer’s operations. This includes fuel, lubricants, water, or similar items that can be reasonably expected to be consumed in 12 months or less.

It also includes:

1. Other property with an economic useful life of 12 months or less.

2. An item with an acquisition or production cost of $200 or less.

3. A component acquired to maintain, repair or improve a unit of tangible property that is not acquired as part of another unit of property.

These are items for which records of consumption are not kept and where immediately deducting or expensing them will not distort the laundry operation’s income. Materials and supplies that do not fit these definitions are deducted when used or consumed.

• Rotatable and Temporary Spare Parts

— A subset of materials and supplies, several alternative methods are allowed for spare and substitute parts:

1. The cost of rotatable and other spare parts is deducted only when they are disposed of,

2. Spare parts are capitalized and depreciated, or

3. The cost of spare parts can be deducted when first installed but record income at fair market value when removed, continuing that process until claiming a final loss at disposition.

“Safe harbors” can best be compared to legitimate “loopholes” designed by lawmakers to limit the full impact of a tax law or provision that might be harmful to a particular group of taxpayers. Under the repair regulations, some laundries might benefit from safe harbors such as the following:

• De Minimis Safe Harbor Election — A laundry business may elect a “de mini-

mis” safe harbor to deduct amounts paid to acquire or produce property up to a dollar threshold of $5,000 per invoice (or per item in some cases, but only $500 for those not invoiced separately from a major asset).

• Small Taxpayer Safe Harbor — The regulations add a new safe harbor for laundry businesses with gross receipts of $10 million or less. Qualifying small taxpayers can elect not to capitalize building improvements with an unadjusted cost basis of $1 million or less if the total amount paid during the year for repairs, maintenance and improvements does not exceed the lesser of $10,000 or 2% of the unadjusted cost basis of the building. The safe harbor is elected annually on a building-bybuilding basis.

to treat amounts paid for repairs and maintenance to tangible property as amounts paid to improve that property. Thus, if the laundry business chooses, the amounts paid as property improvements become assets subject to depreciation—as long as the expenditures are business-related and the amounts are treated as capital expenditures on the operation’s books and records.

Another significant change in the new regulations allows a laundry business to take “retirement losses” on components. If, for example, a building’s roof is replaced and the old roof disposed of, the operation now has the option of taking a retirement loss for the old roof. Of course, the replacement roof must be capitalized but while the replacement must be capitalized, the retirement loss can be claimed on the roof replaced.

tion’s annual tax return. Unfortunately, since the IRS considers many of the provisions to be accounting methods, laundry businesses must file not one but numerous Forms 3115, Application for Change in Accounting Method.

A business owner seeking to change to a method of accounting permitted under the final regulations must get IRS consent before implementing that new method. Under the automatic consent procedures, the IRS will consent when a Form 3115 is attached to the laundry operation’s timely filed tax return for the year of change (with extensions). A signed copy must also be sent to the agency’s national office.

While the new repair regulations bring helpful clarity and order to the treatment

• Routine Maintenance Safe Harbor —

When it comes to expenditures for the routine maintenance performed by so many laundry businesses, there is another safe harbor. Routine maintenance includes the inspection, cleaning and testing of the property, machinery or equipment and replacement with comparable and commercially available and reasonable replacement parts. Unfortunately, in order to be considered “routine” maintenance, the store owner has to expect to perform these services more than once during the class life (generally the same as for depreciation) of the property.

The final regulations include an entirely new option that allows a laundry business

Much of the guidance provided by the IRS revolves around what constitutes a “Unit of Property” (UOP). In general, the smaller the UOP being placed in service, repaired or improved, the more likely it is the UOP’s cost will have to be capitalized.

For example, work on an ozone generator is more likely to be classified as an expenditure that must be capitalized if the generator is classified a separate UOP rather than as part of an entire system.

The new repair regulations have been described as the most comprehensive changes to the issues of capitalization and write-off in more than 20 years. Some of the new regulation’s safe harbors and elections can be implemented on the laundry opera-

of tangible property, and go a long way to answering the question of what is a repair and what is an expenditure that must be capitalized and depreciated, they pose considerable compliance risks for every laundry business. However, because many store owners will soon discover they need to elect new tax strategies that require an application for an accounting method change, professional assistance may be a necessity. n

Information in this article is provided for educational and reference purposes only. It is not intended to provide specific advice or individual recommendations. Consult an attorney or tax adviser for advice regarding your particular situation.

Mark E. Battersby is a freelance writer specializing in finance and tax topics. He is based in Ardmore, Pa.

Gone are the days when business owners looked upon part-time workers as dispensable resources of little value to the enterprise. Today’s part-timers have become critical gears in the profit machine, performing many vital duties formerly handled by a trimmeddown permanent staff.

“The whole business world is going in the direction of shorter-term work assignments and the hiring of people for specific projects,” says Barbara Glanz, a management consultant based in Sarasota, Fla.

No secret why: Business owners are feeling the heat from rising labor and benefits costs. Why add more full-time workers, goes the reasoning, when part-timers can do the job just as well? And then there’s the advantage of greater flexibility: Employers can add or subtract part-timers in response to variable—and unpredictable—business activity levels.

Part-timers offer distinct advantages. And maybe you’re enthused about your own. But are they returning the favor? Are they happy about being in your workplace?

If the answers are negative, your profits may suffer. Bad attitudes are conta-

gious: Customers who encounter unhappy, unmotivated part-timers will take their business elsewhere. And part-timers are often the first—and only—contact the public has with your organization.

unhappy, leave home, you look at a recipe to see

“Customers don’t care whether an employee is part-time or full-time,” warns Glanz. “People judge your business by how well they are treated, not by how many hours the employees are putting in.”

How can you build a staff of happy parttimers? Start by hiring the right people in the first place.

“The most important decision you make is who to allow in the door to help you take care of customers,” says Mel Kleiman, director of Houston-based Humetrics, an employment consulting firm. “The biggest mistake business owners make is not taking part-time hiring as seriously as full-time hiring. You have to realize the importance of part-time positions and not short-circuit the hiring process. Do the same things for selecting part-timers as you do for selecting regulars.”

Smart hiring means not only curating the applicant pool, but also forming a clear vision of what you need.

“You don’t go grocery shopping without a list,” says Kleiman. “Before you

leave home, you look at a recipe to see what ingredients you need. Take the same approach when hiring part-timers: What key ingredients will you need to make your hire successful?”

And don’t wait until the last minute.

“It’s a mistake to go grocery shopping when you are hungry,” says Kleiman. “You end up buying the wrong food. In the same way, don’t just start looking for part-timers when you need them. When you are forced to make a fast decision, you end up hiring great applicants instead of great employees.”

There’s a critical difference between the two categories, he explains.

“Great applicants can start work today or tomorrow. Great employees are working someplace else and want to give their current employers notice.”

Attracting the best-quality part-timers is one thing. Making sure they don’t jump ship to a competitor is something else. It’s important to design a smooth transition into your workforce so the new arrival feels welcome, says Kleiman.

“Realize the new part-time worker is important and invest the time to bring the individual on board.”

Your goal is to make the new hire an

evangelist for your company, says Kleiman.

“Every new employee at end of the first day will be asked one question by everyone: ‘How was your day?’ We know what we want the answer to be: ‘It was terrific. It was the best decision I ever made. I would like to get a full-time job there.’”

Creating such enthusiasm begins with the arrival of the individual to your workplace.

“The first hour should not be just sitting in an office looking at videos and filling out paperwork,” says Kleiman. Instead, make the first conversation about the employee, discussing the individual’s goals. Remember that the very nature of a part-time worker involves two distinct duties: one to the job and a second to a personal life. Your job is to understand the latter and make sure the two loyalties do not end up in conflict.

ways. For example, you might say, “We are going to be flexible in work scheduling so you can attend classes you need to get your degree.” The part-timer will value this kind of assistance and will likely stick with your organization rather than take an alternative job that offers more money but less flexibility.

While getting off on the right foot is critical to success, you must also follow through. Make sure the new part-time workers quickly feel like part of the team. Start by erasing the imaginary wall that divides them from the rest of your staff.

“Your organization will be much healthier if you don’t make a distinction between full- and part-time workers,” says Glanz.

give the larger mission of your business: to improve the lives of customers.

This advice applies to employees throughout the ranks.

“The lowest-level jobs are often the most important ones in satisfying the customer,” says Kleiman. At these positions, it is especially vital to make sure the employee knows the answers to the question, “Why is what I do important?”

A thoroughly engaged part-time worker is a critical gear in any business machine. But to keep the machine running well, it has to be continually maintained: Follow through on your hiring and intake practices by continuing to take an interest in your part-time workers’ personal lives.

One way to bring the two into productive engagement is to deliberately involve families, whenever you can, in business activities.

“Part-time employees are probably giving up family time to put in hours that are needed,” says Glanz. “Find ways to involve the families in some way and show they are appreciated.”

Here’s an example: One employer sent a gift certificate to a worker’s family, explaining the importance of a certain project and how grateful the company was that the family member had contributed.

Try to help part-time workers reach their personal goals, even if they are not connected with work.

Suppose someone says, “I want to get my college degree.” Express admiration for the ambitious goal and offer to assist in specific

“Treat all of your employees like valuable team members. Change the mindset from ‘us versus them’ to ‘all of us together.’”

Promoting a sense of team engagement will keep your part-timers from feeling isolated and ineffectual.

“People need a sense of purpose, to feel that they are part of something bigger,” says Glanz.

Maybe being part of a team is essential. But does one individual’s job really make a difference? The answer is yes. And as a manager you need to communicate how each task contributes to the valuable mission of your organization.

“Don’t just tell people what they do and how to do it but why they do it,” says Kleiman. “We don’t do things for the what and how, we do things for the why.” The why is the value that the employee’s actions

Communicate with your part-timers regularly, obtaining feedback on their attitudes and soliciting suggestions on workplace improvements. Pay special attention to feedback during annual performance reviews when individuals may bring up issues that they have kept to themselves.

Remember that competing employers are looking to snap up the best workers from your part-time pool. Maintain open communications to preserve your investment in training and keep your peak performers on board.

“Employee engagement is not something that can be taken care of during one day or week,” says Glanz. “Employees want to be appreciated and engaged all year long.” n

Phillip M. Perry is a freelance writer based in New York City.

Signage counts. A driver passing your Laundromat fails to spot the place because of poor signage. Prospects avoid your store because the signage implies that the shop is closed. Your signage is so uninspiring that sidewalk strollers don’t even register that you are a Laundromat.

New residents choose a competitor because their signage is more inviting than yours. At night, drivers don’t notice your store because of the poor lighting.

I have seen all kinds of bad signage:

• A stand-alone building has signage in front, but neglects to put any identification on the side; this is foolish because a side street goes right by.

• A large sign says “Ma & Pa’s” but doesn’t identify the type of business, and so lots of people are left wondering.

• A sign displays “Laundromat” nice and clearly, but because there is no company name above or alongside it, the location feels impersonal.

• A sign has script lettering, but its blue and aqua “underwashes” make it difficult to read.

• A sign identifies a shop as “ABC Laundromat,” but it is so small and unassuming that the place appears to be a hole in the wall.

• A protruding sign is so dwarfed by neighbor signs on

both sides that the shop is often overlooked.

• The lack of a self-standing sign in the front parking lot means lots of drivers go by one store without noticing the building in the background.

Do any of these describe your situation?

As a starting point, re-examine your signage. I know you spent lots of time and money on the existing signs, but now is time for a reconsideration. Answer the following questions:

• Are your signs less than exciting?

• Do your signs unequivocally state who you are?

• Do your signs seem faded, timeworn, old-fashioned, rusty, cracked, or chipped?

• Do you have signs everywhere passersby look?

• Are your signs clearly visible at night?

• Could your signs be lower or higher to correspond with changes in the area?

• Is the lettering less than clear?

If you determine that you don’t score highly on some of these questions, now is the time to undergo a sign face lift. This is especially true if there have been changes in the area and perhaps traffic is rerouted, or new area stores have changed the atmosphere.

You’ve spent good money on your signs, I know, and there are a dozen other matters that need your attention. But your signs are the suit on the person. If the suit is shabby, then the person is less than appealing. If the person is less than appealing, people will not want to be around him.

The sign was needed when the store opened, but it is not so necessary now, you protest. After all, everyone in the area knows who you are. Truth be told, that’s poor thinking. It doesn’t take into account that you want/need a steady stream of new business. And while most area residents might know where you are, they might not choose your business because your signage

is shopworn, unattractive, or just plain old-fashioned.

Consider this. A new resident sees your less-than-immaculate sign followed by a cleanly lettered sign installation several blocks away. “This store looks like a brand-new shop,” she thinks. “I think I’ll go there. I’d rather clean my clothes in a spic-and-span Laundromat than an old neighborhood one.” She makes this decision without even checking out your store. Add another lost customer to the invisible ledger of lost opportunity.

Possibly, your “sign man” could take down the old signs and replace them with a new face. That way, there isn’t the expense of the sign hardware. Possibly he has a used sign in his shop that can be utilized. Or possibly he would switch your sign with a new one

attractive. For instance, blue and green go well with Laundromat décor. Perhaps you could create a wave border. Maybe your sign could feature a drawing of an old-fashioned dryer, a symbol of clean clothes.

offering some trade-in value. You never know unless you ask. But, even if you have to create a new sign, it will be worth the expense.

Let’s review the four basic rules of signage:

Simple block letters—in Ariel font—are the easiest to read. The words need to be spaced evenly apart. The letters should be centered between the top and bottom of the sign. The less adornment, the better. For example, Century font has edges at ends that takes away from clarity. Simple says boldness.

There is a Laundromat named The Bubblette in my area. Although it’s an interesting image, it doesn’t state that inside is a place for washing clothes. I have asked people in that town what the Bubblette is, and more than one person answered, “It’s a dog grooming shop.” Make sure your sign states exactly who you are.

By choosing appropriate colors, edges and borders, a sign can be

Make sure your sign(s) are easy to see. Walk around your premises to identify the best spots for signs, then drive around and do the same thing. Estimate what the best height for these signs are. Give yourself 100% visibility.

After you complete your signage, see where else signs will help. Would paper signs on front windows announcing specials turn heads? Would a sandwich sign out front announcing the offering of pick-up/delivery bring in trade? Could an around-the-corner sign pointing to free parking make it easier for customers to enter and leave? Does a sign above the rear entrance eliminate confusion?

The point of this column is not to get you to spend your money frivolously. My point is to assess your signage, and then to make changes so that your signs maximize visibility and say to passersby, “Come on in.” n

Howard Scott is a long-time business writer and small-business consultant. He has published four books. To read more Howard Scott columns, visit www.americancoinop.com

While most area residents might know where you are, they might not choose your business because

Wireless technology. Card payment systems. Wash alerts via e-mail. This isn’t your average, runof-the-mill, mom-and-pop Laundromat anymore. Welcome to the future of Laundromats in the digital age.

The advancements in technology, and the way in which Laundromats operate today, has changed significantly during the last 20 years, or even the last two years.

With millions of Internet users, technology innovations and advancements with wireless networks, to name a few, the laundry industry has adjusted to a more sophisticated investor and tech-savvy customer.

Just as the demands have increased for more technologically enhanced laundry equipment, so have the demands of the Laundromat investor. It’s estimated nearly two-thirds of store owners today do not consider owning a Laundromat a full-time job. In fact, this

is how they want it and why they chose to invest in Laundromats in the first place.

“It’s a matter of sheer convenience,” says Marvin Gokey, owner of Village Laundromat in Bath, N.Y. Gokey opened his first Laundromat in 2012 with his wife Melissa, calling the investment a “win-win.”

“We were looking for an investment opportunity where we would see positive financial results within the first year and at the same time allow us to pursue other passions. We’ve been fortunate to have a thriving business within the first year, while maintaining a healthy work-life balance.”

Many new investors are looking for a business they can operate on their own terms. Today’s cutting-edge technologies and control systems for washer-extractors and tumble dryers give store owners the freedom to run their business their way, while maximizing profitability. Revolutionary technology combines equipment controls and programming into one, full-store management system — helping owners adjust cost structure, reduce utility costs and increase revenue from any computer, anywhere in the world.

The more sophisticated software technology provides instant feedback and in-depth reporting, giving owners a comprehensive look at machine operations as well as valuable business information. The technology analyzes output average totals, turns per day and revenue details, allowing owners to make smart, informed business decisions to positively impact the bottom line.

Another added benefit in the advancement of technology is the ability to strategize a pricing structure. Time-of-day pricing technology allows owners to take advantage of peak laundry hours and boost usage during typically slower

periods. In some cases, owners can customize their price settings according to the traffic volume of their store. Machines are set to charge premium prices when the store is at its busiest and offer specialty rates during off-peak hours to further maximize revenue stream.

In addition, multi-level pricing allows the store owner to charge different prices for each wash cycle. A common example would be to charge different prices for hot, warm and cold washes. Less energy is used to heat the water, and utility bills are lowered overall when customers seek the less expensive cold wash cycle.

Another cost-saving measure is to choose a G-force spin speed option on washer-extractors. The faster extraction speed feature can remove excess water from the load—in some cases, up to a half-gallon of water—leading to shorter dry times and lower energy bills. This higher spin speed helps move customers through the store faster and cuts gas usage by as much as 15%.

As sophisticated as the new investor is, the new-age customer sets the technology bar even higher. For the customer, it’s all about flexibility and convenience. Equipping a Laundromat with the latest in wireless technology is one way for store owners to ensure loyalty from the current generation of tech-savvy customers.

There are many technology innovations targeting this new generation of customers. One example is a customized website that allows customers to see the status of their laundry, including wash cycles and time remaining. Another advancement allows customers to receive e-mail notifications when their laundry is done.

Cashless laundries are also convenient for owners, who no longer have to collect and transport large amounts of coins from their machines to the bank.

To attract more business and further improve profitability, it’s critical for a store owner to market a store in the Digital Age. Most people today obtain their information from the Internet. A simple solution: If a store owner doesn’t already have a website, they should invest in one. Owners can draw customers to their site by including the Web address on their local advertising pieces as well as social media outlets.

Not to be left behind in the growing social media movement, many Laundromat investors are starting the conversation using online tools such as Facebook, Twitter, Yelp and Foursquare. Opening a Facebook page to promote a store is easy and free. In many cases, social media sites are replacing typical marketing and advertising dollars as a low-cost alternative to getting the word out.

Gokey says starting a Facebook page was a great way to connect with his customer base.

“We realized that most of our customers find their news online. We needed an environment which was familiar to our customers and one they would frequent for our store promotions and news.”

Ensuring customer safety and encouraging loyalty because of its convenience are the two strongest factors in instituting a card payment system. Now customers don’t have to scrounge around for that one last quarter or head to the bank for another roll. Card payment systems allow customers to wash and dry loads with their debit or credit cards, or purchase a reloadable card through the Laundromat.

Combining leading technology with superior-quality laundry equipment works to ensure a Laundromat moves out of the dark ages and into a more sophisticated, tech-savvy environment. By implementing the latest technology innovations, from a wireless network to launching a social media site, store owners will have loyal customers long into the future. n

Dan Bowe is the national sales manager of Speed Queen’s® Commercial division. To learn more, visit the company’s website at www.speedqueen.com/coinop101, or call 800-590-8872.

IPSO® has upgraded its vended hard-mount washer-extractors with SmartWAVe water absorption verification technology to significantly reduce utility costs for Laundromat owners, the company says.

“According to recent industry surveys, high cost of utilities is the No. 1 issue vended laundry owners face, and our new, water-saving technology can help reduce operating costs and run stores at maximum efficiency,” says Kathryn Rowen, North American sales manager for IPSO.

SmartWAVe automatically senses a load’s water absorption level and adjusts water use accordingly at each stage of the wash cycle, reducing water and utility use without compromising wash quality. Instead of using standard linen weight to

determine the amount of water used in a laundry cycle, SmartWAVe focuses on the actual absorption levels of each material, which can result in water savings of up to 32%, according to the manufacturer.

Along with SmartWAVe technology, Cygnus vended controls allow for timeof-day pricing, enabling owners to choose between two price points and select hour blocks when different prices are in effect. There are five optimized wash cycles offered, with a pre-wash cycle modifier that can be added to any of the optimized cycles.

The control system also gives coin laundry owners the ability to modify programs from a laptop computer through an infrared connection. www.ipso.com | 800-USA-IPSO

Continental Girbau has unveiled the new ProfitPlus™ vended control—now standard on all ExpressWash™, MG- and M-Series Washer-Extractors. The ProfitPlus Control is also available as an upgrade kit for older-model ExpressWash, MG- and M-Series Washers.

“The Continental Vended Control has been among the most programmable and flexible on the market,” says Continental Vice President Joel Jorgensen. “It allowed the store owner to program washers for heightened efficiency and profitability, by controlling water levels, temperatures, cycle times and timeof-day pricing. The new ProfitPlus™ Control is even better.”

The ProfitPlus Control—which works seamlessly with card technology or coins—brings more washing options and cycle features to the customer, along with added programmability.

ProfitPlus offers primary cycle options for heavy soils; whites; colorfast and permanent press items; and colors. It also allows the customer to add an extra wash, rinse and/or delicate cycle.

It features graphic icons, accompanied by English and Spanish text, that clearly indicate operational instructions. Customers simply load washers, select the cycle, select extra optional cycles, add detergent and insert a card or coins.

It offers four individually modifiable programs that allow programmability of G-force extract, mechanical action, wash temperature (by degree), water levels and wash/rinse/extract time in each phase. The control’s flexibility allows multi-level vend pricing on the same machine depending on the wash program selected, time of day, or day of the week.

www.continentalgirbau.com | 800-256-1073

WASCO 185’s 220/1 & 220/3 $3,500

WASCO 184’s 220/1 & 220/3 $2,700

WASCO 125’s 220/1 & 220/3 $2,400

WASCO 124’s 220/1 & 220/3 $1,850

WASCO 74’s 110 v & 220/3 $ 975

WASCO 75’s 110 v & 220/3 $1,200

WASCO 620’s 110V $1,600

Our Parts Department has thousands of products on over an acre lot.

If we don’t have what you want, ask us, and we’ll find it for you.

From initial site inspections and recommendations to equipment purchase and installation, we are here to help with every aspect of your project.

We can help you with specifications, dimensions, illustrations of commercial and on-premise laundry equipment.

We are able to offer competitive rates and low, affordable monthly payments for financing coin laundry and laundromat facilities.

We have a coin laundry financing solution to meet the needs of new store owners, and veterans alike.

ACRES OF HARD TO FIND USED WASHER & DRYER PARTS WASHER & DRYER FRONT & SIDE PANELS ALL MAKES AND MODELS STARTING @ $50

WASHER DOOR $35 & UP COMPLETE DRYER DOOR $35 & UP COMPLETE ANY WASHER TUB 18#, 35#, 50#, WITH NEW BEARINGS $175 & UP WITH EXCHANGE ALL DRYER BASKETS $75 & UP ESD CARD READERS $150 EA

EMERALD SERIES COMPUTER BOARDS $575 EA

LET US REFURBISH YOUR PANELS ~ FRESHLY PAINTED PANELS IN EITHER ALMOND OR WHITE ... $70 EA

AC Power

Alco Washer Center 37

Borden Textiles 39

Card Concepts

Coin-O-Matic

Continental Girbau IBC

D&M Equipment 19

ESD Inc.

FrontecStore.com

Gold Coin Laundry Equipment 13

Great Lakes Commercial Sales 38

HHC Electronic Service

Huebsch

Standard_half_horz

FC, 23, 25, 27

Imonex Services 17 Laundry Concepts 33

LG

Maytag Commercial Laundry

Monarch Coin & Security 15

Mountain Electronics 38 n Supply 29

New York Laundry Equipment

NIE Insurance

R&B Wire Products

Royal Basket Trucks

Setomatic Systems IFC

Speed Queen FC

Super Computer Boards 38

Wells Fargo Insurance Services

Standard Change-MakerS addS Jeong to SaleS teaM

Standard Change-Makers has named Steve Jeong as its new regional sales representative for the Western U.S. territory, the company reports.

Jeong’s duties will involve dealing with distributors and customers in all industries served throughout the West, including Hawaii and Alaska, the company says. He will also serve as the regional sales representative for easyPAY Central Payment Systems, in association with BCC Payment Systems, the company’s partner in the system designed for the self-service laundry industry.

Continental girbau inC. now exCluSive u.S. provider of lg platinuM waSherS, dryerS

Continental Girbau Inc. has recently signed a partnership with LG Electronics to become the exclusive U.S. provider of LG Platinum front-load commercial washers and dryers for vended laundries, according to Continental President Mike Floyd.

“The LG domestic brand is powerful among consumers, and the No. 1 selling washer and dryer brand for the last three years,” says Floyd. “Now, Continental offers the LG product with an exclusive platinum finish and color represented by true commercial distributors.”

The LG Platinum washer can stand alone or be stacked with a matching vended LG Platinum dryer, and features “simple-touse” controls, allowing for programming and modifications to vend price, cycle time and spin speed. The dryer also offers “solid programmability,” according to Continental, allowing owners to control vend price, cycle time and drying temperatures.

u.S. Mint requeStS StakeholderS CoMMent on Coin Change iMpaCt The U.S. Mint has posted a Notice With Request For Comment following a meeting with coin industry stakeholders regarding the effects of changing the metal composition of circulating U.S. coinage.

The Coin Modernization, Oversight and Continuity Act of 2010 provides the Secretary of Treasury with research and development authority for alternative metallic coinage materials, according to the Federal Register.

In conducting research and soliciting input regarding the matter, the Secretary of Treasury is considering various factors, including the potential impact of any revisions and its effect on vending machines and commercial coin processing equipment, including coin-operated washers and dryers, “making certain … that any new coins work without interruption in existing coin acceptance equipment without modification.”

Previously, the U.S. Mint requested public comment on the metallic content of all circulating coins, and is now seeking written comments from coin industry stakeholders on the effects of chang-

ing qualities such as weight, color and electromagnetic signature of circulating coinage.

“Comments on other possible impacts are also welcome,” according to the U.S. Mint, “along with comments on possible environmental impacts and the length of time necessary for a transition and/or implementation period if coinage material were to be changed.”

The U.S. Mint is accepting stakeholder comments through June 10. Electronic comments may be submitted to Coin. StakeholdersResponse@usmint.treas.gov. Written comments may be sent to Coin Stakeholders Response, Office of Coin Studies, United States Mint, 801 9th Street NW, Washington, DC 20220.

fowler equipMent Co. earnS Maytag’S higheSt honor Distributor Fowler Equipment Co. recently received the Fred Maytag Award during Maytag Commercial Laundry’s 56th annual meeting in Tucson, Ariz., Maytag reports.

This marks the fifth time Fowler Equipment has received the award, with its first award win dating back to 1959, according to Bob English, general manager at Maytag Commercial Laundry.

“Fowler Equipment Co. has exceeded all expectations as a result of unwavering perseverance, hard work and dedication. Over the years, the company has developed a loyal customer base throughout the Northeast,” says English.

The award’s primary objective is to recognize a Maytag Commercial Laundry distributor for “outstanding achievements and remarkable performance,” the company says. Recipients emulate founder Fred Maytag’s marketing philosophy to distribute the company’s products with “professionalism and integrity.”

“We are honored to receive the prestigious Fred Maytag Award for a fifth time,” says Doug Fowler, president at Fowler Equipment Co. “Our nearly six-decade partnership with Maytag Commercial Laundry is a solid foundation on which we continue to expand and grow. We embody everything this award stands for and are proud to uphold the long-standing tradition associated with it.” n