FINANCING A LAUNDROMAT PROJECT IN UNCERTAIN TIMES LOWERING YOUR STORE’S WATER BILL DRIP BY DRIP REGISTRATION OPENS FOR 2022 CLEAN SHOW IN ATLANTA INSIDE: JULYINSIDE:2005APRIL 2022 WWW.AMERICANCOINOP.COM 2021-22 STATE OF THE INDUSTRY SURVEY: Bouncing Back from the Pandemic Plunge in a BIG Way

The Ultimate in Convenience GIRBAU continentalgirbau.com • (800) 256-1073 No need to manually load detergents Excellent, consistent cleaning in less time Faster cycle times and higher profits $ Add Express Clean Automatic Chemical Injection to Your Machines! If your vended laundry features washers, like Continental ExpressWash® washers with automatic chemical injection, it’s time to provide your customers with the ultimate in convenience. The Express Clean™ dispensing system perfectly combines detergents, brighteners and softeners and automatically injects them into the wash cycle. Customers simply load the washer, enter their desired cycle and press start while you enjoy increased revenue and profits.

REGISTRATION OPENS FOR 2022 CLEAN SHOW

After a year’s delay, the late summer exhibition will bring thousands of textile care professionals to Atlanta to discover the latest product developments, technology and more.

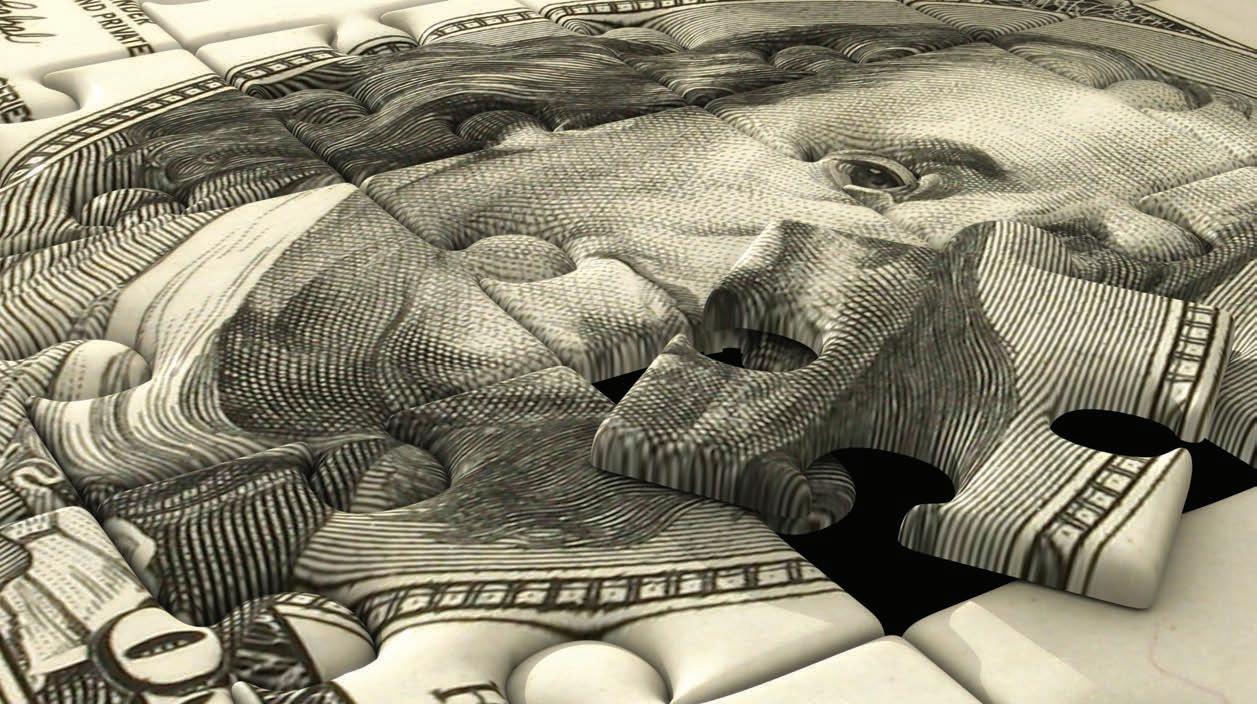

FINANCING A LAUNDROMAT IN UNCERTAIN TIMES

A panel of equipment manufacturer and commercial lender reps describe the state of lending today, how our industry has responded to the pandemic, and the best approach to take to get your laundromat financing approved.

SHOPPING CENTER DEVELOPER INVESTS IN VENDED LAUNDRIES

Red Mountain Group, which specializes in retail redevelopment, has developed Boulder Express Laundry Services stores in California and Nevada.

2021-22 STATE OF THE INDUSTRY

Gripped by the pandemic, certain laundry performance metrics reported in 2020 were their lowest in a decade. But what a difference a year makes! Nearly 87% of store owners polled in our annual survey say their total business improved in ’21, and optimism is high this year will be good, too!

COLUMNS

22 POINTERS FROM PAULIE B: LOWERING YOUR STORE’S WATER BILL DRIP BY DRIP

You may cringe when you open your water bill each month. After all, laundromats are such big consumers. Aside from suggesting you replace your older machines with new, more efficient models, retired multi-store owner Paul Russo offers a few tips and tricks that may help you conserve some drops here and there.

2 AMERICAN COIN-OP APRIL 2022 www.americancoinop.com

APRIL 2022 VOLUME 63 ISSUE 4

CONTENTS

(Cover image: Image licensed by Ingram Image)

INSIDE

12 14 25

6 COVER STORY DEPARTMENTS 4 VIEWPOINT 31 AD INDEX 30 CLASSIFIEDS DID YOU

American Coin-Op releases a new podcast on a different topic of interest every other month? Give it a listen at AmericanCoinOp.com/podcasts/archive.

KNOW...

BIG-TIME BOUNCE-BACK

Charles Thompson, Publisher

E-mail: cthompson@ATMags.com Phone: 312-361-1680

Donald Feinstein, Associate Publisher/ National Sales Director

E-mail: dfeinstein@ATMags.com Phone: 312-361-1682

Bruce Beggs, Editorial Director

E-mail: bbeggs@ATMags.com Phone: 312-361-1683

Mathew Pawlak, Production Manager

Nathan Frerichs, Digital Media Director

E-mail: nfrerichs@ATMags.com Phone: 312-361-1681

ADVISORY

With certain 2020 industry performance numbers reported at their lowest levels in a decade, I just knew we were in store for a big bounce-back in 2021.

And what a difference a year makes!

Our annual State of the Industry Survey features 2021 data and 2022 forecasting you can use to measure the performance of your business against others.

I analyzed survey results received from qualified respondents based around the country to develop a picture of 2021-22 business conditions, vend prices, equipment purchases, turns per day, and much more.

Where just 35.6% of operators polled by American Coin-Op saw their overall vended laundry business (in gross dollar volume) increase in 2020, nearly 87% say their total business improved in 2021. The average increase last year was 17%.

Majorities of respondents also reported year-over-year increases in drop-off service business, commercial business, and vending sales.

The uncertainty surrounding the coronavirus pandemic in its early stage clearly impacted 2020 industry performance. But as vaccines became available and consumers more comfortably navi gated life within a public health crisis, more and more pockets were spinning in 2021.

If you want to see where you stack up against other laundromats in vend pricing, wash/dry/fold pricing, turns per day or a dozen other metrics, flip to page 6 and dive into the numbers.

One thing is for sure: They’re a whole lot more attractive this year than last.

Bruce Beggs Editorial Director

Main: 312-361-1700

American Coin-Op (ISSN 0092-2811) is pub lished monthly. Subscription prices, payment in advance: U.S., 1 year $50.00; 2 years $100.00. Foreign, 1 year $120.00; 2 years $240.00. Single copies $10.00 for U.S., $20.00 for all other countries. Published by American Trade Magazines LLC, 650 West Lake Street, Suite 320, Chicago, IL 60661. Periodicals postage paid at Chicago, IL and at additional mailing offices.

POSTMASTER, Send changes of address and form 3579 to American Coin-Op, Subscription Dept., 125 Schelter Rd., #350, Lincolnshire, IL 60069-3666. Volume 63, number 4. Editorial, executive and advertising offices are at 650 West Lake Street, Suite 320, Chicago, IL 60661. Charles Thompson, President and Publisher. American Coin-Op is distributed selectively to owners, operators and managers of chain and individu ally owned coin-operated laundry establishments in the United States. The publisher reserves the right to reject any advertising for any reason.

© Copyright AMERICAN TRADE MAGAZINES LLC, 2022. Printed in U.S.A. No part of this publication may be transmitted or reproduced in any form, electronic or mechanical, without written permission from the publisher or his rep resentative. American Coin-Op does not endorse, recommend or guarantee any article, product, service or information found within. Opinions expressed are those of the writers and do not necessarily reflect the views of American Coin-Op or its staff. While precautions have been taken to ensure the accuracy of the magazine’s contents at time of publication, neither the editors, publish ers nor its agents can accept responsibility for damages or injury which may arise therefrom.

4 AMERICAN COIN-OP APRIL 2022

www.americancoinop.com VIEWPOINT

OFFICE INFORMATION

BOARD Douglas PrattTony Regan Sharon Sager Michael Schantz Andy Wray

SUBSCRIPTIONS

847-504-8175 ACO@Omeda.com www.AmericanCoinOp.com

Bruce Beggs

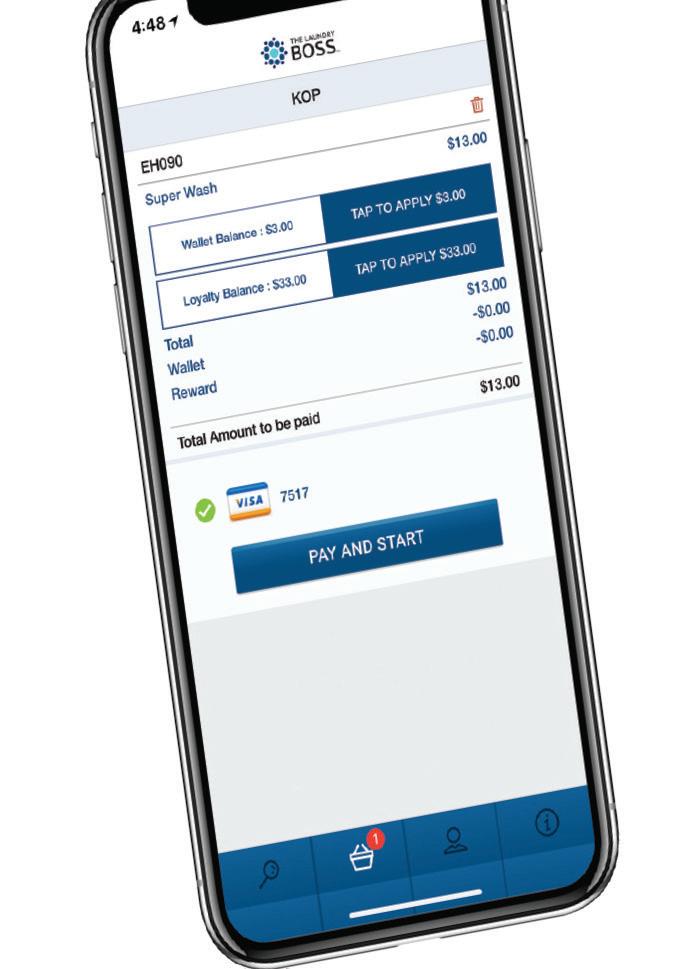

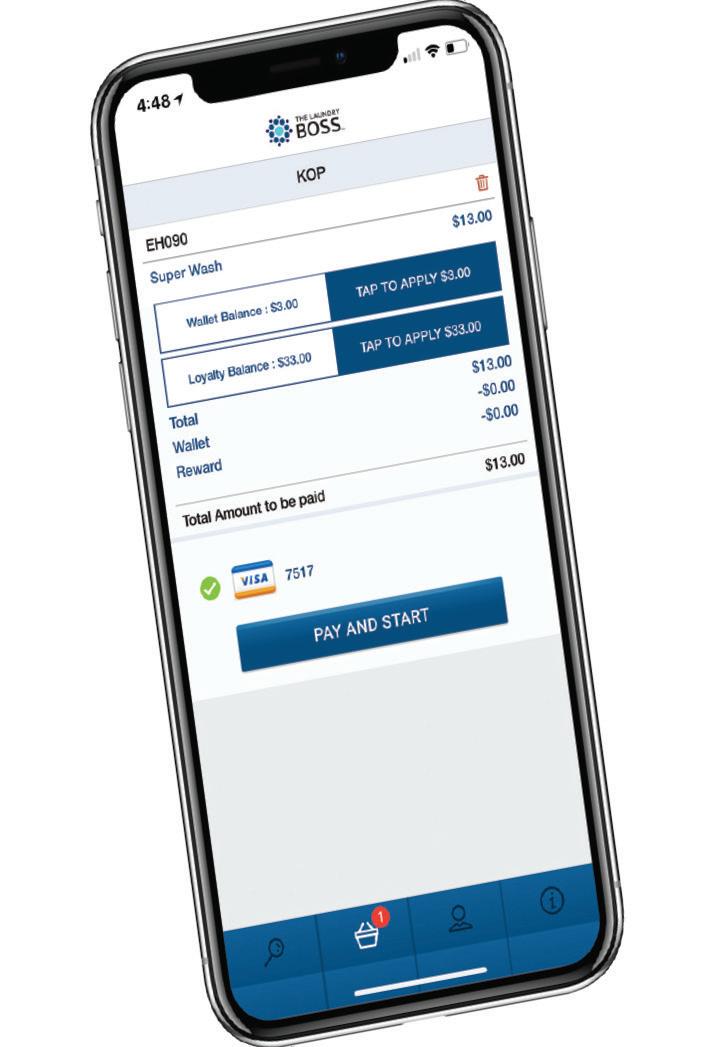

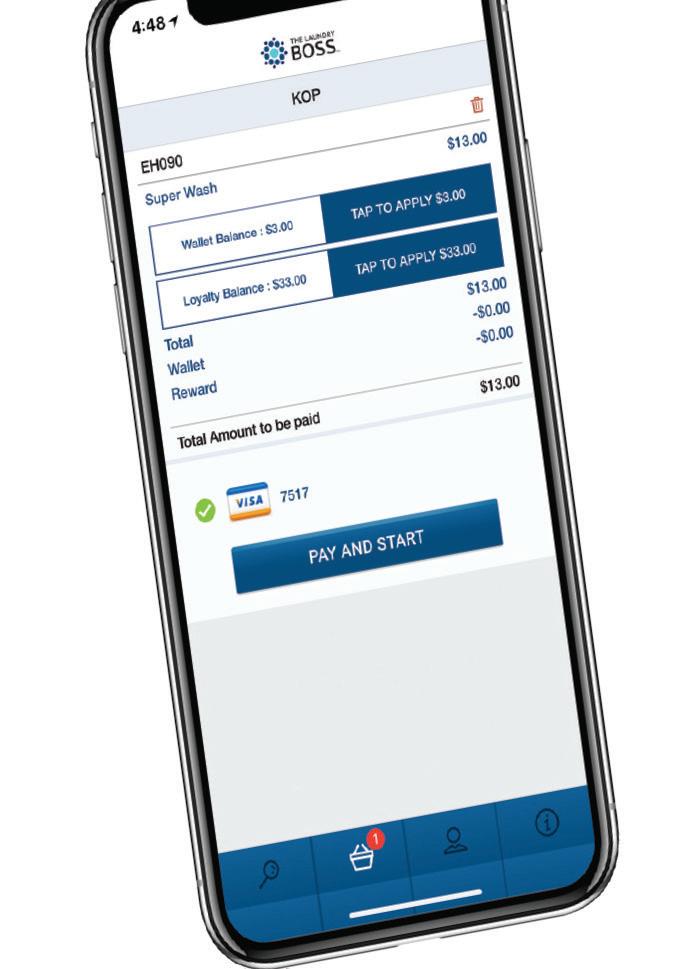

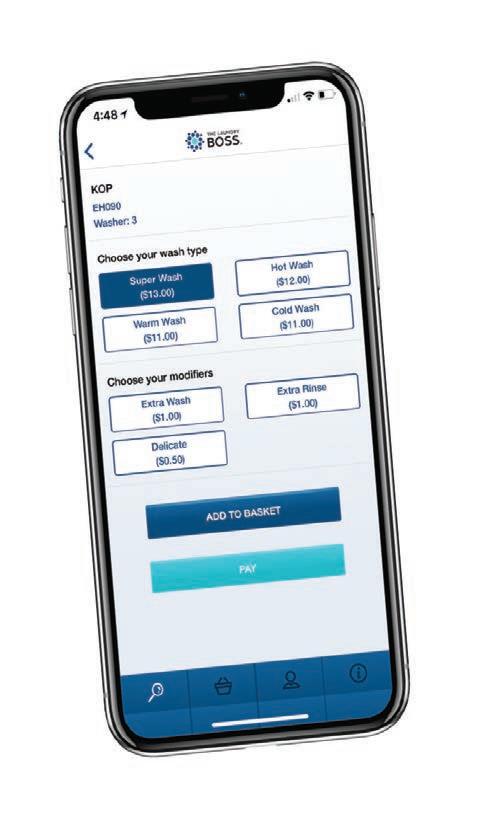

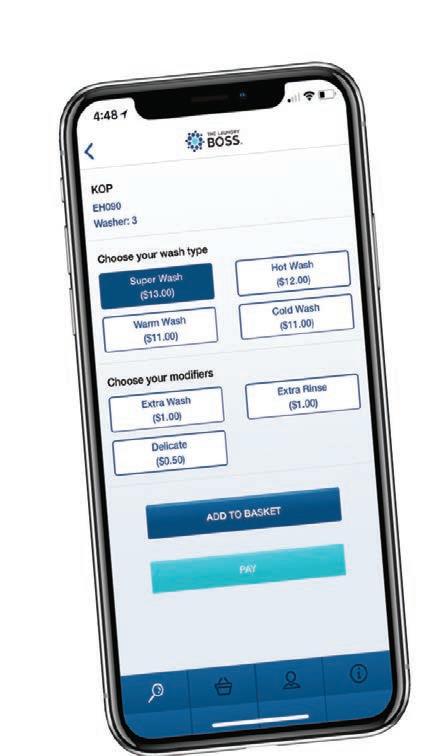

EASY TO USE Mobile apps for . REMOTE START MACHINES FROM ANYWHERE TO DELIVER THAT NEXT LEVEL CUSTOMER EXPERIENCE 4 central pay kiosks options that accept credit card, cash, coin & some eveN make change Just a reminder, NO LAUNDRY CARDS TO LOSE, EVER “Meet Your Customers Where They Are” The Laundry Boss is a uniquely innovative solution for Laundromat Owners and Route Operators, which gives your customers the payment options they deserve. 888.823.6782 www.bccpayments.com/laundryboss/ For more information email Sales@bccpayments.com or talk to your local distributor

Bouncing Back from the Pandemic Plunge in a BIG Way

Nearly 87% of operators polled say their business improved in 2021

by Bruce Beggs, Editorial Director

This time a year ago, the self-service laundry industry was feeling the effects of the coronavirus pandemic, an isolation-causing crisis that left many service businesses reeling. Certain industry performance numbers were the lowest they’d been in more than a decade.

But being in the valley makes it easy to see the next peak. Our industry bounced back in a big way in 2021, according to the results of American Coin-Op’s annual State of the Industry Survey, and nearly 87% of operators polled say their total business improved last year.

This State of the Industry Survey report provides a litany of statistics valuable to store owners and investors. This year’s survey focused on 2021-22 business conditions, pricing, equipment, turns per day and utilities cost.

When asked about their 2021 business results, respondents were given the opportunity to state whether their results were up, down or unchanged. (Surveys conducted prior to 2012 asked only if business was up or down, so keep this in mind if you’re making comparisons to results of that vintage.)

The survey is an unscientific, online poll of American CoinOp readers who operate stores. Some percentages may not equal 100% due to rounding or other factors.

6 AMERICAN COIN-OP APRIL 2022 www.americancoinop.com

2021-22 STATE OF THE INDUSTRY

(Image licensed by Ingram Image)

KNOW THE AUDIENCE

One-half of respondents polled this year own just one self-service laundry, while the other half are multi-store own ers (28.3% own two or three stores, 21.7% own four or more).

Approximately 36.7% of respondents own their store space, 48.3% rent their store space, and the remaining 15.0% say the arrangement varies by property.

Fully attended stores among the audi ence account for 41.7%. Roughly 32% are partially attended, and 16.7% are unattended. Among the remaining 10%, the arrangement varies by store.

More than 93% of laundry owners polled employ either part-time or full-time workers in their stores. Of these, 51.7% have four or more employees, 31.7% employ two or three, and 10% have only one employee.

On average, responding store owners have 5.8 full-time employees and 6.7 parttime employees (this calculation reflects averages by respondent, not by store).

As for payment types, 90% of respon dents say they offer coin, 50% offer card, and 18.3% offer other non-coin systems (store owners were asked to identify every type that applies to their operations). Roughly 53% of respondents offer cus tomers more than one type of payment, compared to 48% last year.

2021 BUSINESS VS. 2020

For 2021, a whopping 86.7% of opera tors say their overall self-service vended laundry business in gross dollar volume increased from that of 2020.

In our 2020-21 survey, just 35.6% reported an increase, while 74.6% report ed seeing sales growth in the survey prior. Beginning with the 2012-13 survey, between 54% and 81.5% of respondents had reported business increases annually until last year’s survey.

The average 2021 business increase was 17%, up from 7.1% in 2020. Other past average business increases have been 12.6% (2019), 9.9% (2018), 9.4% (2017), 11.2% (2016), 9.6% (2015),

8.9% (2014), 9.6% (2013), 11.7% (2012), 11.5% (2011) and 10.8% (2010).

Following is a breakdown of 2021 busi ness increases (the figures relate to those reporting increases, not all respondents):

• Operators with a business increase of less than 10%: 20.8%;

• Operators with a business increase of 10-14%: 24.5%;

• Operators with a business increase of 15% or more: 54.7%.

Less than 4% of operators polled faced a decrease in total business (in gross dol lar volume) in 2021, compared to roughly 58% in 2020. Results from previous years showed the following shares whose total business declined: 12% in 2019, 8% in 2018, 10% in 2017, 22% in 2016, 17% in 2015, 29% in 2014, 25% in 2013, 30% in 2012, 35% in 2011, and 58% in 2010.

The average 2021 business decrease was 20.0%, which nearly matched the 20.5% average decline reported for 2020. Other prior average decreases have been 7.5% (2019), 5.0% (2018), 6.7% (2017), 9.1% (2016), 16.3% (2015), 6.6% (2014), 8.7% (2013), 9.5% (2012), 10.2% (2011) and 11.2% (2010).

Among respondents who reported expe riencing decreased business in 2021, the decline was as low as 5% or as high as 35%.

Ten percent of respondents say their 2021 business was unchanged compared to 2020 business.

We asked: How have you adjusted your laundry operation due to the coronavirus pandemic, if at all? Among those who replied (nearly half of respondents didn’t), it was a coin flip if they adjusted or not: 50% yes, 50% no.

Most often, those who made adjust ments required masking and social dis tancing per local authority, implemented more extensive cleaning practices, and/or changed their hours of operation.

DROP-OFF SERVICE AND PRICING

Nearly 62% of operators surveyed reported that drop-off service business (in

gross dollar volume) increased for them in 2021, compared to 34% in 2020, 54% in 2019, 58% in 2018, 68% in 2017 and 61% in 2016.

The average increase in drop-off service business last year was 30.4%, compared to 14.2% in 2020, 21.0% in 2019, 29.8% in 2018, 26.1% in 2017 and 18% in 2016.

Just 2.6% of respondents saw a decrease in 2021 drop-off business, compared to 51% in 2020, 12% in 2019, 10% in 2018, 16% in 2017 and 6.5% in 2016.

Roughly 36% of respondents say their 2021 drop-off business was unchanged from the previous year. That compares to 20% for 2020, 34% for 2019, 32% for 2018, 16% for 2017 and 35% for 2016.

Current drop-off pricing (in dollars per pound) ranges from $1 to $3, based on the survey responses.

Following is a breakdown of the most popular drop-off service prices (per pound), followed by the percentage of operators who charge them:

1. $1.50 (19.4%)

2. $1.00 and $1.75 (tie, 11.1% each)

Overall, prices for drop-off service remain fairly consistent with previous years’ sur veys. In total, 17 different drop-off prices were reported in this year’s survey.

Sixty-five percent of operators who took the annual poll offer drop-off service, which closely matches the share from last year’s survey.

COMMERCIAL BUSINESS

Among store owners who offer commer cial laundry services (the share was 48.3% this year), 51.7% reported that business (in gross dollar volume) increased for them in 2021. The average increase was 24.3%.

No one taking the survey reported a decline in commercial laundry business. Roughly 48% of respondents say their 2021 business was unchanged from the previous year.

VENDING SALES

The share of respondents reporting their vending sales rose in 2021 was 65.3%, compared to 27.3% the previous year. The average vending sales increase last year was 14.0%.

Just 8.2% reported declines in vending sales in 2021, compared to 39% for 2020. The average decrease in 2021 was 26.3%.

Operators reporting no change for 2021 accounted for 26.5%, compared to 34.1% in the prior year’s survey.

www.americancoinop.com APRIL 2022 AMERICAN COIN-OP 7

▼ 17% Average business increase, 2021:

HOW MUCH FOR A WASH?

Respondents were asked to report how much they charge for a variety of washes.

Roughly 62% of operators, compared to 53% last year, offer top loaders at their store(s). The price range for a top-load wash is $1.75 to $4.25.

Here are the most popular top-load pric es, followed by the percentages of respon dents charging them:

1. $3 (26.5%)

2. $2 (20.6%)

3. $2.50 (17.6%)

These popular prices basically mirror those reported one year ago. The clear No. 1 this year is $3, which had tied with $2 as the top choice last year.

The most popular prices for some of the small front loaders are:

• 18 pounds: $3.00

• 20 pounds: $2.50

• 25 pounds: $3.50

The lowest price reported in this group was $1.75 (18 pounds) while the highest price was $5.25 (20 pounds).

The price range for a 30-pound wash is $3 to $6.50. Following are the most popular 30-pound prices, along with the percentages of operators who charge them:

1. $3.75 and $4.50 (tie, 14.6% each)

3. $5 (12.2%)

The price range for a 35-pound wash is $4.50 to $6.00, with the most popular price charged being $4.75.

The price range for a 40-pound wash is $4.25 to $7.50. Following are the most popular 40-pound prices, along with the percentages of operators who charge them:

1. $5 (16.3%)

2. $4.75 (14.3%)

3. $6 (12.2%)

The price range for a 50-pound wash is $4.50 to $8. Following are the most popular 50-pound prices, along with the

percentages of operators who charge them:

1. $5.50 (29.4%)

2. $5.75 and $6.25 (tie, 17.6% each)

Prices for a 55-pound wash currently range from $6.25 to $8.44.

Among all the washer capacities, the 20-pounder (15 different base prices), 40-pounder (17 prices) and 60-pounder (19 prices) have the broadest pricing.

The price range for a 60-pound wash is $5 to $9.50. Following are the most popular 60-pound prices, along with the percentages of operators who charge them:

1. $7.50 (20%)

2. $6.50 (12%)

3. $6.75 (10%)

Prices charged by operators for a 75-pound wash today range from $8.50 to $10.

The price range for an 80-pound wash is $7 to $12.50. Following are the most popu lar 80-pound prices, along with percentages of operators who charge them:

1. $8.50 (17.9%)

2. $10 (14.3%)

3. $9 (10.7%)

Prices charged by operators for a 90-pound wash today range from $10.25 to $15. For a 100-pound wash, the price range is $7.75 to $12.

Operators who respond to our unscien tific survey vary year to year, which could account for the variety of prices reported. Respondents were asked to provide prices for front loaders of 14 traditional capaci ties, plus had the option to list others.

DRYER PRICES

Operators were asked to list their current prices for their dryers as “25 cents for X minutes.” As in previous years, a variety of responses was reported.

Most popular among this year’s respon dents—at 27.5%—is 25 cents for 6 minutes (also the top choice in the previous five surveys). Second is 25-for-5 (26.1%), and third is 25-for-4 (10.1%). Missing from this year’s order of most popular dryer prices is 25-for-7, which was third in last year’s survey.

CHARGING MORE?

American Coin-Op asked respondents if they have already raised washer and/or dryer prices in 2022, or if they plan to do so before the end of the year.

Regarding washer prices, the majority of respondents (71.7%) say they have already raised prices, or intend to do so, by year’s end. Roughly 13% say they have no such plans, and the remaining 15% are unde cided.

As for dryer prices, 44.1% say they have not raised prices, nor do they plan to do so by the end of the year. Roughly 36% say they have raised, or plan to raise, their dryer prices. Roughly 17% are undecided, and the remaining 3.4% say the question doesn’t apply to them because they offer “free dry.”

TURNS PER DAY

per day refers to the number of cycles (turns) that each

store’s 8 AMERICAN COIN-OP APRIL 2022 www.americancoinop.com ▼ Most popular 40-pound front loader prices, current: 1. $5 2. $4.75 3. $6 71.7% have raised washer prices, or intend to by end of year: purchased at least one piece of equipment (washer, dryer, water heater, vending machine or other) in 2021 53.3% Average turns per day, current: Top loaders: 3.4 Front loaders: 4.6

Turns

of a

machines completes daily. For each machine class (top loader or front loader), you can calculate this using total cycles for a oneweek period divided by total number of machines in the class, then dividing by seven.

At present, the average turns per day for top loaders amongst respondents is 3.4, which is slightly higher than the average logged in last year’s survey. For front load ers, the average number is 4.6 turns per day, compared to 4.2 registered in 2021.

PURCHASED IN 2021

Slightly more than 53% of respondents purchased at least one piece of equip ment (washer, dryer, water heater, vending machine, or other) in 2021, which is sev eral percentage points higher than our last annual survey.

Following is a breakdown of 2021 purchases by respondent. (Editor’s note: Percentages do not total 100% because some buyers purchased equipment in mul tiple equipment categories.)

• 13.3% purchased at least one top loader, with the average buy being 10.6 machines.

• 45% purchased at least one front loader, with the average buy being 26.2 machines.

• 23.3% purchased at least one dryer (regular or stack), with the average buy being 42.7 machines. (Editor’s note: This accounting includes a small number of operators who each pur chased more than 100 machines last year.)

• 13.3% purchased a water heater.

• 6.7% purchased a vending machine. Ozone systems, water softeners, chang ers, payment systems, bulkheads and cam era systems were also listed as having been purchased.

2022 SHOPPING LIST

Operators were also asked if they have purchased, or plan to purchase, new equip ment in 2022.

Roughly 42% of respondents have

19.5% Average utilities cost (% of gross), 2021

added, or plan to add, some type of equip ment (washer, dryer, water heater, vending machine, or other) to their mix in 2022. By comparison, last year’s percentage was 34%.

Following is a breakdown of purchases that operators have already made in 2022, or plan to make by the end of the year (percentages do not total 100% because some buyers purchased or plan to purchase equipment from multiple categories):

• 6.7% of respondents have purchased, or plan to purchase, a new top loader this year, with the average buy being 37.5 machines. (Editor’s note: This accounting includes a small number of operators who intend to purchase more than 100 machines each this year.)

• 21.7% of respondents have purchased, or plan to purchase, a new front loader this year, with the average buy being 12.1 machines.

• 15% of respondents have purchased, or plan to purchase, a new dryer this year, with the average buy being 29.3 machines. (Editor’s note: This account ing includes a small number of opera tors who intend to purchase more than 100 machines each this year.)

BIGGEST CHALLENGES

Among challenges commonly faced by today’s self-service laundry operator, a shortage of good labor has been the most prominent in recent months, but does it top our list? (Editor’s note: The first three choices in this year’s poll match the first trio of last year.)

American Coin-Op offered a list of eight, plus the chance to write in “other” choices, and asked operators to select all that apply.

Here are the results:

1. High cost of utilities (56.7%)

2. Finding/keeping good employees (51.7%)

3. Labor costs (35%)

4. Rental costs (30%)

5. Maintenance costs (25%)

6. Equipment abuse/vandalism (13.3%)

7. Too much competition (10%)

8. Poor industry image, and “other” (tie, 3.3% each)

UTILITIES COST

Operators were asked about their 2021 utilities cost (as a percentage of gross). The responses ranged from 4.8% to 40%. Collectively, respondents paid an average of 19.5% for utilities, down slightly from 19.9% last year.

The most common individual response— as it was last year—was 20%. Whereas 69% of respondents reported a utilities cost of 20% or less last year, 57.5% reported the same this year.

For many operators, utilities account for their largest store expense, second only to rent or mortgage; 50% of respondents place it either first or second on their list of five common expenses (rent/mortgage, utilities, payroll, insurance, and loan pay ment for new equipment). Two-thirds of respondents place rent or mortgage first or second on the list.

Meanwhile, insurance is the smallest store expense, numbered four or five on the list by 73.3%.

FORECAST FOR 2023

Roughly 63% of respondents are opti mistic that their 2022 total business will be better than 2021’s. Thirty percent expect business to be about the same, while 6.7% say their business won’t perform as well in 2022 as it did in 2021.

10 AMERICAN COIN-OP APRIL 2022 www.americancoinop.com

ACO

Operator outlook: 2022 63.3% expect their total business to increase 30% expect their total business to be about the same as 2021 6.7% expect their total business to decrease in 2022

VISITOR REGISTRATION FOR CLEAN 2022 OPENS

Atlanta to host premier U.S. laundry exhibition after year’s delay

isitor registration is now open for The Clean Show 2022, the largest U.S. event for the laundry, drycleaning, textile care services, supplies, and equipment industry.

The exhibition scheduled for July 30 through August 2 in Atlanta will bring thousands of industry professionals from across the globe to conduct new business and discover the latest product develop ments, technology and more.

The show floor at the Georgia World Congress Center will feature hundreds of exhibiting companies representing a diverse group of providers of products, supplies and services.

“The Clean Show has proven to be the ideal exposition for industry leaders to find the latest innovations in textile care, ranging from industrial machinery and conveyor equipment to computer soft ware and business systems,” says Show

Director Greg Jira, of Messe Frankfurt North America. “The show offers a great opportunity for exhibitors and visitors to learn how the various products and services can help their businesses to thrive in today’s highly competitive market. We can’t wait to host the show this year.”

The 2022 edition will also feature live demonstrations, networking opportunities and educational sessions. Experts will share the latest technological advancements, trend predictions, growth and market expansion strategies, and insights on how to stay ahead of the competition.

Visitor information can be found on the show’s website—www.cleanshow. com—along with a direct link to the reg istration portal. Within the “Planning & Preparation” section, attendees can learn about the show dates/hours, venue, regis tration prices/deadlines, housing, and tips for exploring Atlanta during their visit.

The Clean Show is organized in col laboration with the Association for Linen Management (ALM), Coin Laundry Association (CLA), Drycleaning & Laundry Institute (DLI), Textile Care Allied Trades Association (TCATA) and TRSA, the association for linen, uniform and facil ity services.

Members of those associations may reg ister to attend Clean through June 29 for $119. The cost for non-members is $149. Beginning June 30, all registrations will be handled onsite only at a cost of $169.

Hotel reservations may be made through the show’s official housing agen cy, Connections Housing (https://www. connections-housing.com/LandingPage/ Clean2022.php). Messe Frankfurt has arranged for exclusive discounts and ame nities at a variety of Atlanta hotels, some of which are located within walking distance of the show. Nightly rates range from $175 to $259 and do not include local taxes.

The Clean Show still has exhibition opportunities available, Messe Frankfurt says, but space is almost sold out. Companies interested in reserving a booth should contact Jewell Kowzan (Jewell. Kowzan@usa.messefrankfurt.com) as soon as possible.

This summer’s event will mark the first Clean Show gathering since 2019’s in New Orleans; the coronavirus pandemic prompted Messe Frankfurt to postpone the scheduled June 2021 show until this year. Atlanta last hosted The Clean Show in 2015.

This will be the first Clean Show present ed by Messe Frankfurt; the Germany-based trade fair organizer purchased the exhibi tion in late 2018 from the associations that have sponsored the show for decades. ACO

V

NEWS 12 AMERICAN COIN-OP APRIL 2022 www.americancoinop.com

The show floor prepares to open on the first day of Clean 2019 in New Orleans. (Photo: Matt Poe)

Get started at PayRange.com *Terms and conditions apply. Please visit our website or call to learn more. PayRange is a trademark of PayRange Inc. Patent 8856045 and other Patents Issued and Pending. © 2022 PayRange Inc. Accept mobile payments. Your customers will love it! Simple to self-install and available for all brands of laundry machines, PayRange is the easiest way to add a mobile payment option to your laundromat. Still accept quarters and other familiar payment options, and introduce the option for your customers to pay with their phone. Only $14.95* per machine There’s no better time to get started with PayRange. Learn why we add 10+ new laundromats daily to our more than 2,500 current locations. NEW PayRange BluKey Pro

Financing a Laundromat in Uncertain Times

Tips to land all-important project funding in face of doubt

For small-business investors, especially those trying to get into the laundry industry for the first time, securing financing for a laundromat can be challenging under normal circumstances. When events like a public health crisis create economic doubts, the process takes on added weight.

This month, American Coin-Op polled a handful of manufacturers and commercial lenders on the state of lending today, how the laundry industry has responded to the 2-year-old pandemic, and the best approach to take to get your laundromat financing approved.

Q: What resources are available to vended laundry operators or investors when it comes to applying for funding?

Gary Corley, sales manager, Southwest Region, Whirlpool Commercial Laundry: Small Business Association (SBA) lenders and manufacturer lenders are the two most common sources of funding for a vended laundry project. SBA lenders will usually require you to put up home equity as collateral, whereas manufacturer-backed lenders will typically use the equipment as collateral.

For experienced owners, it is easier for the laundromat to obtain financing either through their own local commercial bank or one of the manufacturer-sponsored finance programs. Most manufacturers and equipment distributors have existing relationships with funding sources whom they can refer their customers to. These funding sources understand our industry and make it relatively easy to obtain funding.

For startup projects and new investors, the process will require more financial documentation. However, experienced lenders can provide competitive terms and rates to help fund the new project.

Jeff Harvey, underwriting manager, Alliance Laundry Systems:

Vended laundromat owners have a variety of resources available when it comes to applying for funding. Your local distributor is going to be a great resource to provide you with potential lending partners that you can work with. They have typically worked with a variety of lenders and can provide you with great recommendations. Additionally, they can assist you with how to get started.

Vended laundry operators can also look directly to manufacturer websites for assistance on applying for financing. These can provide information in current finance programs and what items a lender may require.

Matt Kluesner, director of portfolio management, Dexter Financial Services: There are multiple options for laundry operators or investors when it comes to funding a laundromat project. One would be an acquisition or equipment loan through a captive finance company. Other options would be a small-business loan through a local bank, credit union or directly through the SBA, or a lease/loan through an independent finance company. Each of these options have different requirements and guidelines for approval.

Marc Stern, executive vice president and chief lending officer, Eastern Funding: There are two captive finance companies, Alliance and Dexter, and one independent bank-owned company, Eastern Funding, that do most of the financing in this industry. The SBA, under the 7a and 504 programs, also offers financing.

Harvey: Two years into the coronavirus pandemic, we’re seeing strong demand and supply in small-business lending. We are seeing interest rate offerings increase, especially fixed rates, with the expectation that the Federal Reserve will raise the federal funds rate to combat inflation.

These trends have been prevalent in the laundromat industry

14 AMERICAN COIN-OP APRIL 2022 www.americancoinop.com

Q: How has the small-business lending market reacted to the coronavirus pandemic after two years?

(continued on page 18)

(Photo: © Aroma/Depositphotos)

Corley

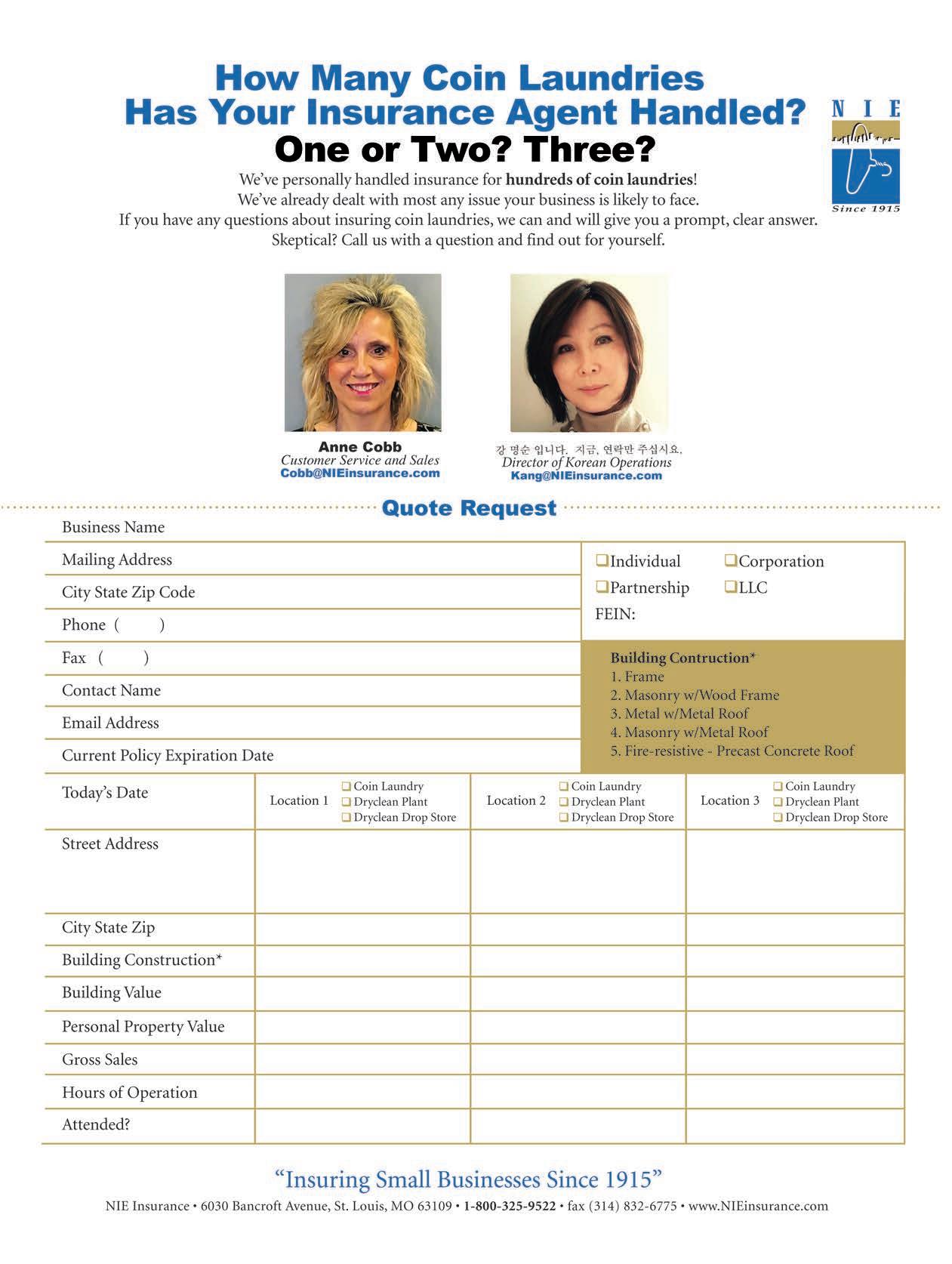

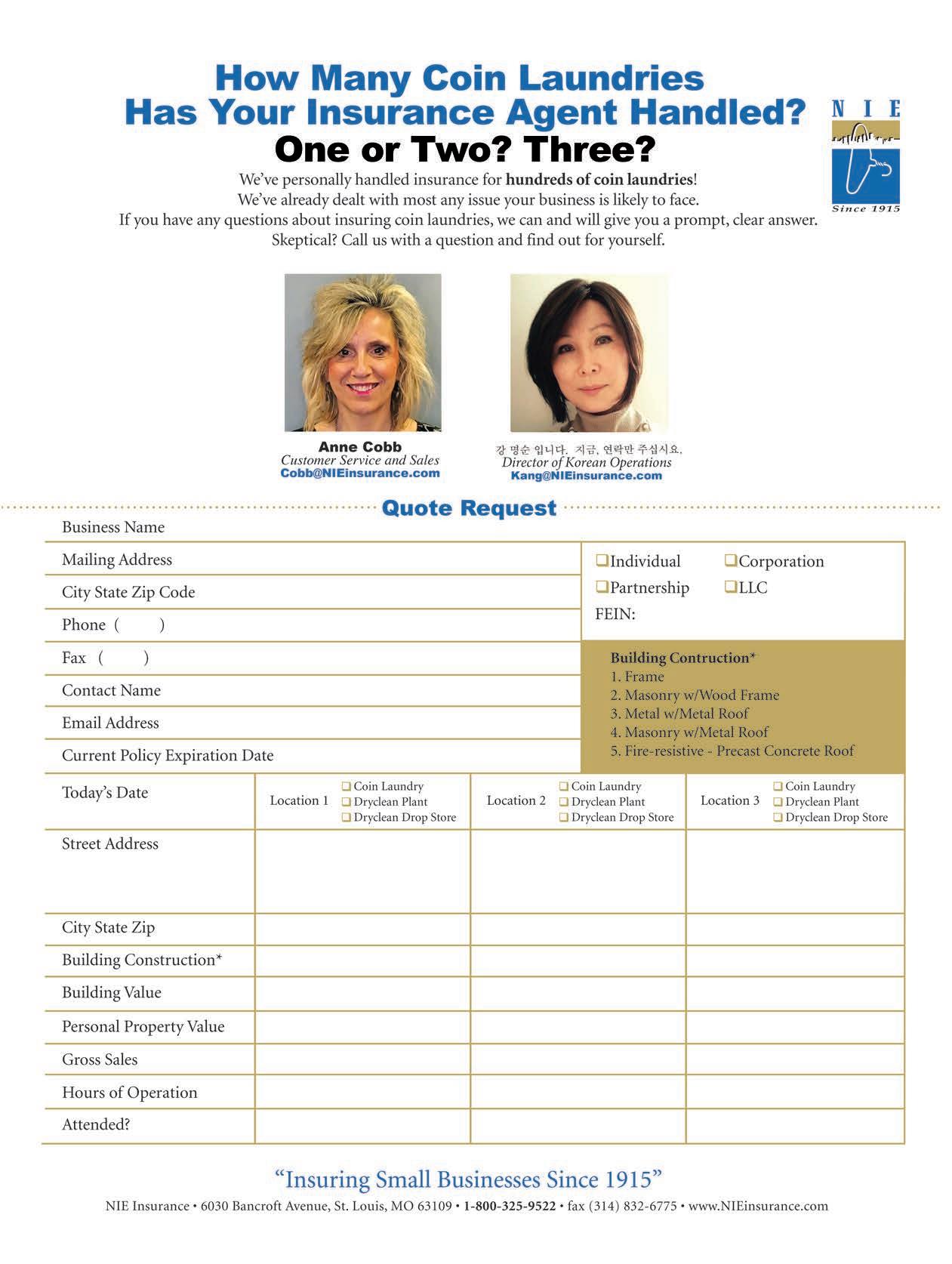

There’s more: We’re just two members of NIE’s team of experts. NIE has been handling fabricare insurance since 1915!

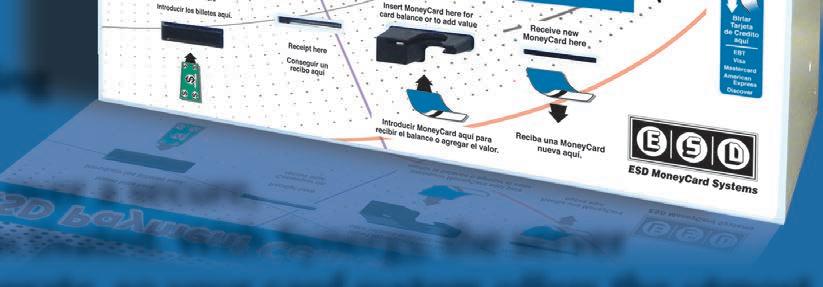

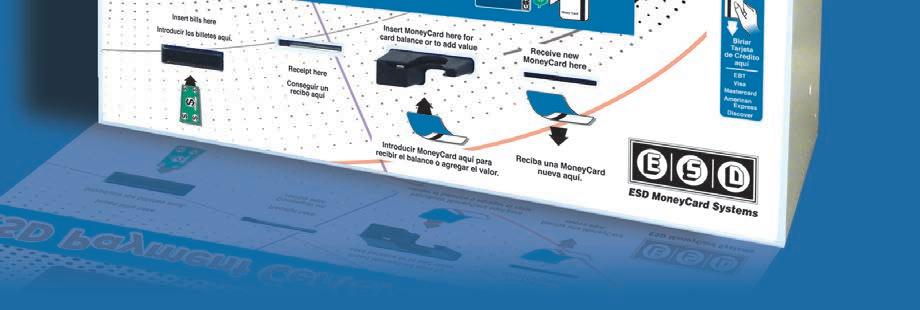

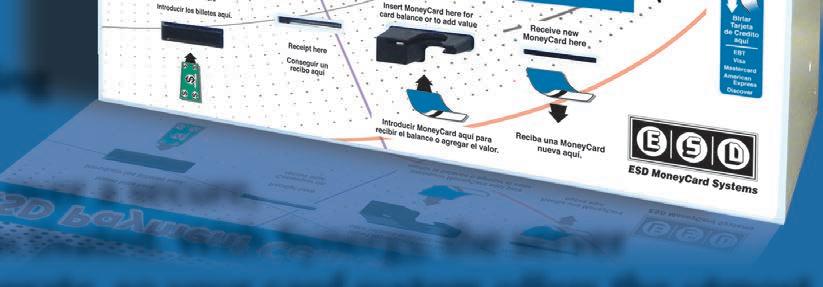

WIRELESS CARD SYSTEM ALL THE GREAT FEATURES OF MAGSTRIPE CARD READERS WITH WIRELESS CONNECTIVITY! Welcome to Synergy... An exciting magstripe technology that communication to locally connect card readers to an on-site wireless connectivity, installation is a breeze! Customers simply swipe their magstripe card and information wifi network to an on-site server. Information is verified and the is hosted on location. Synergy does not rely on an Internet connection reliability. Synergy provides wireless connectivity and incorporates with your logo. Synergy Visit us today at www.esdcard.com ©ESD Inc. All Rights Reserved SmartLink Reader CrossLinkTM Reader

READERS

uses wireless server. By utilizing information is transmitted over a secure, the machine is activated. With Synergy, the server connection to operate, so your card system offers the utmost incorporates customer loyalty cards that can be customized Synergy is reliable, simple to use, customizable and proven.

www.esdcard.com • email: sales@esdcard.com WIRELESS CONNECTION • ON-SITE SERVER EASY INSTALLATION • NO HUBS OR CABLING REQUIRED SmartLinkTM Reader

as well. Investor demand and funding supply are strong as the economy and laundromats continue to perform very well.

Kluesner: Speaking to our industry specifically, laundry opera tors have been very resilient throughout the coronavirus pandemic. While some areas did see declining revenues during the height of the pandemic, which led to repayment struggles for a period of time, the vast majority of customers saw little to no drop-off and were able to function normally. The majority of areas that did see a decline have rebounded back toward pre-pandemic performance.

New laundry projects and subsequent loan requests have remained at record levels throughout these past two years. Some lenders ini tially tightened guidelines during the pandemic to proactively miti gate increased risk and have since returned to normal standards. A larger issue has been project delays associated with labor shortages and supply chain constraints associated with COVID-19.

Stern: Since the laundry business was declared an essential business to stay open during the pandemic, lenders were and are still lending to the industry. The biggest issues now are increased equipment and constructions cost, supply chain delays, and rising interest rates.

Corley: Because the laundry business was considered an essential business, it fared much better during the pandemic when compared to other businesses. We didn’t see much change in the lending prac tices as a result.

Q: What records should a borrower gather or prepare to best support their application? Has anything changed in this regard because of the pandemic?

Kluesner: The standard documentation that most lenders will require is the last two years’ federal tax returns, the most recent three months of bank statements, and a completed personal finan cial statement. The tax returns and bank statements will be needed from both the individual guarantors and the operating business entity for the laundromat. This has remained pretty standard from prior to and during the pandemic.

Stern: For the borrower, we need to see last two years’ tax returns, a personal financial statement and last two months’ bank statements. We do run credit reports. This information has not

changed due to the pandemic.

Corley: For experienced owners with good credit, the paper work can be as simple as providing a one-page application for replacement orders up to $200,000.

For new investors looking to develop a new store, lenders will want to see a full financial package that includes the application, personal and business financial statements, copies of recent bank statements, and two years of tax returns.

For acquisitions, lenders will want to see financials from the seller documenting revenue and expenses. Lenders that offer acquisition financing will also want to see copies of the seller’s last 6 to 12 months of utility bills which will help them verify the stated revenues.

Harvey: Application package requirements typically vary based on the type of equipment financing a borrower is asking for. Many lenders typically only require a credit appli cation for most replacement equipment loan requests up to a certain threshold.

If you have derogatory credit history, it’s helpful to come pre pared to discuss any issues you may have had in the past. Above those thresholds, you may need to be prepared with bank state ments, tax returns, and a personal financial statement.

New investors should be prepared with bank statements, invest ment statements, and prior two years’ tax returns, and be prepared to complete a credit application and personal financial statement.

We are starting to see some easing in lending requirements for equipment financing in the laundromat industry.

Q: What general lending criteria must a borrower meet to gain approval?

Stern: They must have an acceptable net worth, cash to invest in the deal, and acceptable credit scores. They cannot have filed a bankruptcy within the last five years.

Corley: Operators should have creditworthiness, a good store location, and a cash investment. Typically, a new store project or acquisition of an existing store requires a 30-40% minimum down payment.

Harvey: Lenders are typically looking for borrowers to have a credit score around 675-700 or greater. Credit scores below that level may still qualify for approval, and I always highly encourage you to talk through your financial history with a potential lender to understand what you may qualify for.

For larger projects and new laundromats, lenders are looking at a borrower’s net worth to see if it’s comparable to the loan amount being requested. They will also review your bank statements to confirm it is adequate to cover the build-out costs for a new laun dromat and confirm you will have reserves available.

Kluesner: Every lender varies in their lending criteria … we look at several different factors when we are looking to approve a finance request. The key factors are:

• Creditworthiness of the individual guarantors. This will be determined through a review of their credit report history and their FICO scores.

• Capacity of the borrower and guarantors. This will be the determined by the amount of assets and capital there is on hand to be used for the project.

• Experience of the laundry operators or investors. We look

18 AMERICAN COIN-OP APRIL 2022 www.americancoinop.com ▼

(Photo: © AndreyPopov/Depositphotos)

(continued from page 14)

Harvey

TL IDLER KIT & BELT DRAIN VALVES 2IN 115V IGNITION CONTROL DRAIN VALVE 2IN 220V BELT SALE P/N 70367301PG KIT MOTOR 120V/60HZ P/N 201615P P/N 803292 RELAY KIT $124.99 Each. Please call for pricing. List Price $212.93 COIN ACCEPTOR $94.99 Each. List Price $235.80 GAS VALVE $136.99 Each. List Price $225.67 COIN IGNITION CONTROL AFTERMARKET CR MODELS $40.00 Each. List Price $123.00 KIT COIN SWITCH $8.60 Each. List Price $40.24 P/N 9732-174-001 P/N 9021-001-010 P/N 9857-134-001 P/N 9857-116-002G P/N 9732-126-001G P/N 959P3 P/N 803293 IGNITION CONTROL $95.99 Each. List Price $174.80 P/N 9857-116-003 DOOR SWITCH P/N F340200 TRUNNION KIT 30/35 P/N 70564803 KIT TRUNNION T45 P/N 70564805 $17.99 Each. List Price $54.80 SPZ-2137 BELT $12.99 Each. List Price $47.47 DRYER BELT $17.99 Each. List Price $63.87 P/N 70276201G P/N 300236G P/N 129288G 4L540 DL2X30 BELT $7.99 Each. List Price $29.53 P/N 9040-077-001G SPZ-1900 BELT $9.99 Each. List Price $24.72 P/N 129296G SPZ-1180 BELT 40%OFF LIST PRICE WWW.LCPARTS.COM (800) 845-3903 During A April, most orders received by 3pm CST will be shipped same day. Phone orders only. Up to 20 lbs. Does not include oversized items. WE SELL PARTS FOR : HUEBSCH, SPEED QUEEN, CONTINENTAL, DEXTER, ALLIANCE, WASCOMAT, GE, UNIMAC, MAYTAG AND MORE Call Us At 1-800-845-3903 | These Prices Are Also Available At Our Web Store www.lcparts.com | Open Monday - Friday 8am to 5pm | Sales price cannot be combined with any other o er *Free shipping excludes baskets, trunnions, some motors and oversized packages. Please call for details (Some sale items limited to quantities on hand) *Prices subject to change without notice, O er valid until April 30th $9.99 FLAT RATE SHIPPING EVERY THURSDAY SE HABLA ESPANOL All Orders Over $250 RECEIVE FREE DELIVERY UP TO 20 LBS* EXPIRES 04/30/2022 AP RI L 5L550 DL2X30 Belt $9.99 Each. List Price $41.98 P/N 9040-073-009G DEXTER

at both experience in the laundry industry as well as other business ownership experience.

• Debt service coverage. For this, we look at not only the revenue-generating potential from the specific laundry being funded but also the global cash flow of all related parties to ensure proper coverage.

Q: How can differences in project scope — funding an entire store vs. a few replacement machines, for example — affect the odds of funding success?

Corley: For equipment replacement of $200,000 or less, a credit check and answering some basic questions about the operator’s business is usually all that is required.

For a major store remodel and larger retools over $200,000, operators should expect to provide a full financial package. Keep in mind that lenders want to loan money for worthy projects and if the new equipment will help grow the laundromat’s revenues and lower their utility bills, it is still easy to obtain funding for borrow ers with a decent credit history.

Harvey: Differences in project scope tend to change the appli cation and financial requirements a lender may have. Projects of larger scope, such as a new laundromat, have additional applica tion and financial requirements than a borrower looking for a few replacement machines.

Kluesner: Smaller projects are considered application-only and require less documentation and therefore less analysis as a larger project will. We do not generally see a large difference in approval rates of different loan sizes. The operator or investor should be pre pared for a larger project taking considerably more time to navigate through the approval and funding process, but the odds of their approval remain just as likely as long as they have all of their financials in order.

Stern: For small replacement deals, we only need our one-page credit application, the equipment order, and a copy of the (bor rower’s) driver’s license. For larger deals, we need what (I listed previously).

Q: Can you list some “red flags” that lenders might look for when reviewing a loan application?

Harvey: Lenders will be looking at your credit to see if there is any derogatory credit such as delinquent payments and bankrupt cies. It’s important to be prepared to be open and discuss those items with your lender and how your circumstances may have changed since then.

Depending on the project scope, lenders may be reviewing bank statements and looking for any NSF [insufficient funds] charges and account balances that run near or below zero. Additional red flags would be a lack of income, either from W-2 or business ownership.

Kluesner: Poor credit history is something that most lenders will view as a “red flag.” How an operator or investor has repaid their prior debts is indicative of what might be expected in the future. Limited experience is another, as lack of industry knowledge can lead to operators or investors succumbing to pitfalls that experi enced operators or investors have learned to navigate.

Stern: Insufficient cash to do the deal. Poor payment history. Bankruptcy in the last five years. For new investors, not doing prop er due diligence about the laundry business and local competition.

Corley: A poor credit score, low net worth, lack of business experience, and a short lease are all red flags for lenders.

Q: An operator is approved for financing. What should be their next step?

Kluesner: They will need to work with the other various parties of their laundry project to bring it to completion. The financing is only one piece of the puzzle.

There may be new construction or renovation to be completed, which will typically include obtaining appropriate permitting and working with a licensed contractor. The operator will also need to work with their equipment provider to order the necessary equip ment ... and then coordinate its delivery and installation, as well as working out details with their landlord or mortgage holder and obtaining appropriate insurance coverage.

Stern: If buying a laundry, doing proper due diligence: reviewing the premise lease (and) utility bills, doing a coin count, (and) spend ing time in the laundry with the seller.

If retooling, get the equipment ordered as soon as possible, and hire the contractor, too, if you have not already done so.

Corley: If an operator hasn’t already done so, contacting a dis tributor is the next step. Distributors have a good understanding of the market and can provide the information and tools needed for success. A distributor is also a great resource for the things you will need to operate your store, such as parts, repair services, etc. The industry trade magazines can also help an operator with locating other vendors they will need, including soap suppliers, insurance companies, etc.

Harvey: We highly encourage investors to get pre-qualified for financing at the very beginning of their project. This typically is a quick assessment of what an investor would qualify for subject to finalizing their project. This is like how you would go about pur chasing a home. Most homeowners obtain a pre-qualification from their lender, then proceed to finding their home.

Once you are pre-qualified with a lender, you work with your local distributor to finalize your project and obtain your loan approval. After your approval, your next steps in the loan process will be to sign and provide your lender with the required loan documentations so that they are ready to issue loan proceeds … when you need to pay for the project.

Q: When an operator or investor is turned down for a loan, what are their other options?

Stern: If they are turned down by one finance company, chances are they will be turned down by others. The only option is to pay cash if this happens, the seller will finance the deal, or look for a different type of business.

Corley: If an operator is turned down for financing based on the business, don’t give up. They should look for a better location and keep trying. The applicant also has the right to know why they were turned down for an equipment or acquisition loan. Assuming the applicant was creditworthy, it may be possible to downsize the initial retool project or increase their cash investment into the project to help mitigate the lender’s exposure.

Harvey: If an investor is turned down for financing, they will receive an explanation as to why. I encourage talking with the lend er to understand why and what they can do to qualify in the future. An investor can then potentially work on improving those factors.

Another option is to apply with a different lending institution, as

20 AMERICAN COIN-OP APRIL 2022 www.americancoinop.com

Kluesner

institutions may have different underwriting requirements.

Kluesner: One option is to look for another partner that has the appropriate qualifications to help meet approval guidelines. If there is a certain area of the lending criteria that the operator or investor is deficient in that is causing the loan to be turned down, they can look to mitigate that deficiency by providing strong performance in another area. For example, if they are lacking in experience and have poor credit history, an operator or investor could mitigate that by providing sufficient capital into the project, which will also lower the loan amount required and improve debt service coverage.

Q: Aside from the information you’ve already shared, what advice do you have for current or prospective store owners who are seeking to finance a vended laundry project?

Corley: Contact the equipment distributor in your area. They know the market and can help with everything from finding a good location, demographic studies, store layout and design, and con tractors. Most importantly, they know the best finance companies for the laundry business.

Harvey: When it comes to financing, I highly encourage inves tors to talk with a lender who has experience in the industry. Having (such) a lender … gives you an extra resource when investing in the laundromat industry. Manufacturer-based finance

companies can be a great resource, as they typically are founded to provide an easy-to-use finance solution that helps investors obtain their product.

We encourage investors to look beyond their current project when working with a lender. You want to find a long-term partner that supports your current and future needs in order to streamline your financing needs.

Kluesner: For prospective owners, make sure to do your research. Fully knowing everything that your laundry project will entail is over half of the battle. Then you can decide what course of action to take and what will be required to best accomplish your goals. There are several experienced and successful laundry owners that would be more than happy to share tips and pointers to new owners getting into the business.

For current owners, I would say to be proactive. Staying on top of your equipment upkeep and being astute to when a machine is getting ready to need replacing is how you are able to operate with out a significant loss of revenue. This is especially important since the pandemic and subsequent supply chain issues have developed. The timeframe for getting new equipment has been extended ... and owners must be proactive in order to avoid downtime where a machine is not generating revenue.

Stern: When you submit your application, please submit every thing that the finance company has requested, and submit it in an organized and complete form. If this is done, the finance company’s job is easier, you will get an answer quicker and, most likely, get approved if you meet their lending criteria.

ACO

www.americancoinop.com APRIL 2022 AMERICAN COIN-OP 21

Stern

LOWERING YOUR STORE’S WATER BILL DRIP BY DRIP

You may cringe when you open your water bill. After all, laundromats are such big consumers. That said, there are a few ways that I think you could lessen your costs.

Washer manufacturers have been working for years to produce washers that use less water (and electric ity) to keep those rising costs down. New equipment does use less water than older machines, especially the top loaders.

If you have old, timer-based washers, you don’t have many options. Cutting a rinse on these machines is a very hard task, if not impossible for most. Cut a pre-wash and customers leave. Lower the water levels and customers leave.

So, consider retooling your mat with new equip ment. When chosen and programmed carefully, new equipment pleases existing customers and attracts new ones. Also, new washers require less maintenance, offer free parts for a limited time, provide a tax break, boost the value of your mat, and save water and electricity.

The older your washers are, the more you can save with new ones. First, by incorporating water-saving tricks, such as smaller sumps at the tub bottoms, or even no sumps at all. Most front-load tub sumps from years ago could hold around 2 quarts of water, if not more. If a washer fills only two baths, the sump can waste a gal lon with each cycle. More fills means even more waste.

Most manufacturers will ship their machines with cycles pre-set to impress you with their water use. Problem is, if the savings are too aggressive, your cus tomers may not like what they see. Customers want to see the water in the tubs.

Good news is, the new washers give you, the mat owner, much more flexibility in programming options. You can set them in a sweet spot where you can get significant water savings yet keep the customer happy with the results.

Yes, there are some tricks that can help save water. So what can be done?

Sell Your Old Machines — If you decide to install new, try selling your old washers. They may have some value if they aren’t too old, and are in good shape. You can email local laundromats about them.

If you can advertise your old machines while they can still be seen operating in your mat, you’ll get better responses. Try the classifieds section in industry trade magazines like this one.

A great thing about putting in new equipment is if you do it right, your customers will be pleased (provided you program them as I described) and your competitors will get caught flatfooted. Some distributors will be able to get you going in two to three days if it’s a simple one to install and, more importantly, the washers are in stock.

Putting in bigger washers can potentially save more but the job may take longer to install if you have to change the base, plumbing or electri cal service.

Cut the Number of Rinses — Cutting a rinse on a computer-controlled washer is a piece of cake, but it’s nearly impossible on a timer-based machine. If your washer has four to five baths, consider eliminating a rinse if your washer allows it. Customers always look for the first and last rinses, so your least toxic choice would be to eliminate the second rinse.

For me, the New York City Water Dept. obviously noticed the drop in volume because they came by and changed our meter! It was a nice savings.

By the way, if you don’t need to change a water meter, don’t. Water meters tend to have “slippage” as they grow older, allow ing some water to slip through undetected.

POINTERS

22 AMERICAN COIN-OP APRIL 2022 www.americancoinop.com

FROM PAULIE B

Paul Russo

(Photo: © NewAfrica/Depositphotos)

Raise Your Prices — If variable costs such as your water bill keep rising, and you don’t raise your prices, your mat will even tually fail. The more turns you get, the more out of pocket you spend. Therefore, at some point you must raise your prices or you’ll be left with a busy mat that makes no profit.

If fixed costs are high, at least they remain static so you can offer deals, sales, etc. without hurting your bottom line, as long as your variable costs allow you to make a clear profit on each vend.

If you raise your prices, you accomplish two things:

1. You make more profit on each vend, which is a must if your variable rates are rising.

2. You will probably lose some volume, which lowers your vari able costs even more. If you made your increases correctly, any volume that you lose should be more than made up with higher profits per vend.

Fix Your Leaks — This is, by far, the easiest, most cost-effective way to cut your water bills right away! I dare say that many mats have many leaks: washers, toilets, sinks, boiler (internally), etc.

Start with your water meter. Right before you close your mat at night, have someone take a photo of the meter readings. First thing the next morning, before anyone turns anything on, take another. The readings should match, but most mats will see disparities.

Now you know that you have leaks. You want to find them and stop them, but how?

You have to start narrowing them down, so you’ll be taking more open/closed photos with various washer banks shut off over night, or you can try to eyeball them (more on that later).

Since each washer bank should have its own shutoffs, start by first shutting off all your banks except one the second night. If the meter jumps again overnight, you know that there’s a leak or leaks in that bank.

Repeat each night until you’re happy that you found all your leaks.

One drop of water per second can add up to 5 gallons per day. Multiply this by, say, 20 drips and you’ll lose 100 gallons a day! Don’t forget that a single front-load washer can have at least fourfive water valves.

During your inspections, always be looking for leaks, and have your crew report any unusually high water levels. Any water that is not inside a washer should be checked out. It’s not just pres surized leaks from plumbing, you could have leaks underneath machines from loose connections.

Overfills can happen where a water valve won’t shut off or, more commonly, if a drain valve can’t hold the water in the tub due to some obstruction. When that happens, the washer will try to replace the water it’s losing by refilling the machine during the cycle. All of a sudden, a washer that consumes 20 gallons is now using 30 gallons just to maintain the water level. Newer washers can warn you of these leaks.

What’s important about these daytime leaks is that you’ll never know unless you actively look for them.

Now, you have to narrow things down.

An easy way to tell which washers are leaking hot water is to simply close the doors on all your washers when the mat closes for the night. In the morning, you will notice significant moisture

www.americancoinop.com APRIL 2022 AMERICAN COIN-OP 23 ▼ XPRESS-APP LAUNDRY EQUIPMENT FINANCING FROM Application-Only Financing Up To $500,000 for New Vended Laundry Equipment* • Simple, 1-Step Application • Get a credit decision in as little as 24 hours *The XPRESS-APP program o ered by Eastern Funding LLC requires a completed and signed credit application and valid state-issued photo identification prior to any credit decisions being rendered. Financing is available to qualified applicants only, and all transactions are subject to the Eastern Funding LLC credit policies, rules and regulations, as well as any and all applicable federal, state and local laws. In the event that an applicant does not qualify under the standard terms of the XPRESS-APP program, Eastern Funding LLC reserves the right to request and receive additional information necessary to complete the application process. 877.819.1764 Learn more at easternfunding.com/xpress-app IDEAL FOR RE-TOOLS! Scan here to learn more and apply online

POINTERS FROM PAULIE B

on the door glass of a “hot-water leaker.”

All your washer doors might fog up a little because the machines’ drain valves default to open when the machines are off, so moisture will rise up into them from the drain line. However, those with hot water will show a lot more water on the glass.

Another easy way to find a leaking washer is to look into the soap boxes when the machines are off. Since four out of five water valves on a washer shoot water through the soap box, you should be able to trace any trickles of water when carefully examining it. However, all washers have air gaps installed (some call them vacuum breakers) where a dripping valve may bypass the soap box and drip directly into the tub.

Here’s another easy method to tell which washer is leaking and whether the water is hot or cold. Open a washer door and shine a flashlight through the basket so you can visualize the tub drain opening through the holes in the basket. If any of its water valves are leaking, you should be able to see a small stream of water drip ping into the drain hole. This will catch 99% of leaking washers; only a tiny leak may go undetected.

A more labor-intensive way to check is to open the front panels of each washer when the machine is off, and pull off the drain hose to see if any water is coming through. Clean the drain valve.

Install Good Supply Hoses — A water hose popping off a wash er in the middle of the night—or any time, for that matter—is an emergency. It’s a shock hazard, slip hazard, and a water waster. Buy

good, heavy-duty hoses with solid brass fittings that will last. While you’re at it, buy 3/4-inch hoses so your washers can fill a little faster. I color-coded my hoses with red and blue tape for hot and cold.

Consider Ditching Your Top Loaders — Top loaders are not nearly the big water guzzlers of yesterday, but they still use more water than a good front loader of equivalent size. New ones now have a “spray rinse” rather than refilling the tub all the way up. Many also have selectable water level settings to match smaller loads.

Choosing replacements for top loaders will depend on your per sonal needs and goals, so it’s important to do your due diligence on this.

Thwart Customer Abuse — Some customers deliberately leave sink faucets on. Others will come to the sink to endlessly fill up containers of water in an attempt to boost the water levels in their washers (a real headache if your levels are too low). Replace standard faucets with either touchless faucets, or spring-loaded timed faucets.

Touchless faucets will shut off when the customer walks away … unless the customer (usually a “container customer”) covers the electric eye of the faucet so they can walk away while their contain ers are filling. They can’t do that to a spring-loaded faucet.

Seek Evaporation Credits — Did you know that some localities will give your mat a break on the sewer bills? Anywhere from 7% to 22%. This is based on the fact that mats don’t discharge all the incoming water registered on the meter into the sewer system, because some water is still in the laundry when the cycle stops. The rest is evaporated in the dryers.

Contact Your Local Politicians for Help — You never know if you don’t try. About 10 years ago, a Florida mat received help from a local council member who came up with a creative plan to give it wastewater credits and keep it open.

Tip: Whenever you have trouble getting satisfaction with any big organization, and asking for supervisors doesn’t help you, email the CEO (if a private company) or the Commissioner’s office (or its equivalent, if a public office). They all have staff to help you. Some will appreciate your concerns because they are so often insulated from what’s going on at the most basic levels.

Install a Water Alarm — This is yet another simple, easy thing to do that will alert you to any significant breakout leaks, as well as sewer backups.

Get a Hose Water Meter — I believe that most front loaders often use more water than their specifications, due to “wicking up” of water above the water level through laundry that is packed into a front loader. I put these meters on my washers to verify exactly how much water a machine really uses.

Dye, Leak, Dye — For toilets, you can put a toilet dye (from the big box stores) in the tank before closing. If the dye shows up in the bowl after several minutes, bingo! You have a leak.

Lowering water costs requires a laundry owner to be vigilant and stand ready to take action when needed. To borrow from a classic saying, “a drop saved is a penny earned.” ACO

Paul Russo owned and operated multiple Laundromats in New York City for more than 40 years before retiring in 2018. You’re welcome to direct any questions or comments for Russo to Editor Bruce Beggs at bbeggs@atmags.com.

24 AMERICAN COIN-OP APRIL 2022 www.americancoinop.com

(Photo: © ktsdesign/Depositphotos)

by Haley Jorgensen

Red Mountain Group, which specializes in retail redevelop ment, developed its first high-speed vended laundry—Boulder Express Laundry Services, in Garden Grove, California. Anchored by a Walmart store, the 3,800-square-foot laundry has garnered 10% month-over-month growth since startup, according to the owners.

In May 2020, Red Mountain expanded the Express Laundry brand—and business plan—to Las Vegas. Sales at that 4,600-squarefoot location grew even more quickly.

TESTING THE BUSINESS MODEL

Before diving into the laundry business, Red Mountain explored the industry throughly—conducting competitive analyses,

www.americancoinop.com APRIL 2022 AMERICAN COIN-OP 25

SHOPPING CENTER DEVELOPER INVESTS IN VENDED LAUNDRIES Red Mountain Group opens Express Laundry brand locations in California, Nevada PROFILE CALL US TODAY! 800.362.1900 77 Streamwhistle Dr., Ivyland, PA 18974 E: Info@acpowerco.com www.acpowerco.com THE BEST EQUIPMENT AVAILABLE AT THE BEST PRICES! The #1 Regional Distributor of Commercial Laundry Equipment, proudly serving businesses throughout Pennsylvania, New Jersey, Delaware, and Maryland for over 48-years! We are experts in Commercial Laundry Solutions. NOW HIRING! Contact us today. ▼ Boulder Express Laundry Services in Garden Grove, California, showcases a mix of 20-, 40-, 55- and 70-pound Continental ExpressWash® and G-Flex washers, with complementing ExpressDry® Dryers. (Photos: Continental Girbau)

running demographic studies and test ing business models, according to Tony Mendoza, Boulder Express director of sales and operations. All told, Red Mountain has developed and redeveloped approximately 5 billion square feet in retail and mixeduse real estate since 1991. Its goal? To transform struggling locations into thriving shopping centers positioned to support local neighborhoods.

Because connecting with laundry indus try experts was essential, Red Mountain partnered with full-service laundry equip ment distributor Continental Girbau West, in Santa Fe Springs, Calif. Tod Sorensen, the distributor’s vice president of sales, assisted with every aspect of store develop ment, including design, equipment mix, amenities and startup.

When it came time, he joined forces with Wayne Hoppal, of Reliable Commercial Equipment, in St. George, Utah, to help develop the Las Vegas location.

“They were amazing from day one,” Mendoza says. “From buildout to install and getting the laundries up and running,

they’ve helped us put all the pieces together.”

DIFFERENTIATION KEY TO SUCCESS

Positioned and equipped to stand apart from the competition, both stores are designed to ensure customers complete laundry quickly, earn loyalty points toward promotions and discounts, and enjoy a sanitized wash.

The Garden Grove and Las Vegas laun dries showcase a mix of 20-, 40-, 55and 70-pound Continental ExpressWash® and G-Flex washers, with complementing ExpressDry® Dryers.

The 20-pound ExpressWash machines feature an easy-to-install, freestanding design and generate extract speeds up to 400 G-force for maximum moisture remov al, according to the manufacturer. The remaining G-Flex Washers are hard-mount machines with medium-speed extract reaching 200 G-force.

Because they remove more moisture dur ing extract than lower-speed machines, they allow customers to wash, dry and fold their laundry in less time. Additionally, they con tribute to reduced natural gas consumption because dryers operate less often, according to Mendoza.

“Our customers love the fact that they can wash and dry laundry in 39 minutes,” he says.

Meanwhile, both locations benefit from quick customer turnover and low utility costs amounting to just 15% of gross revenue.

26 AMERICAN COIN-OP APRIL 2022 www.americancoinop.com

www.LaundryParts.com 800-640-7772 Your One Stop Laundry Distributor Since 1959 www.sudsy.com 24-7 PARTS ORDERING Vending Products • Fluff n Fold Paper Products • Attendant Items 60% UP TO OFF PARTS LIST PRICES

Ricky Salazar (left), manager of Boulder Express Laundry Services, and Director of Sales and Operations Tony Mendoza pose outside the Garden Grove, California, store.

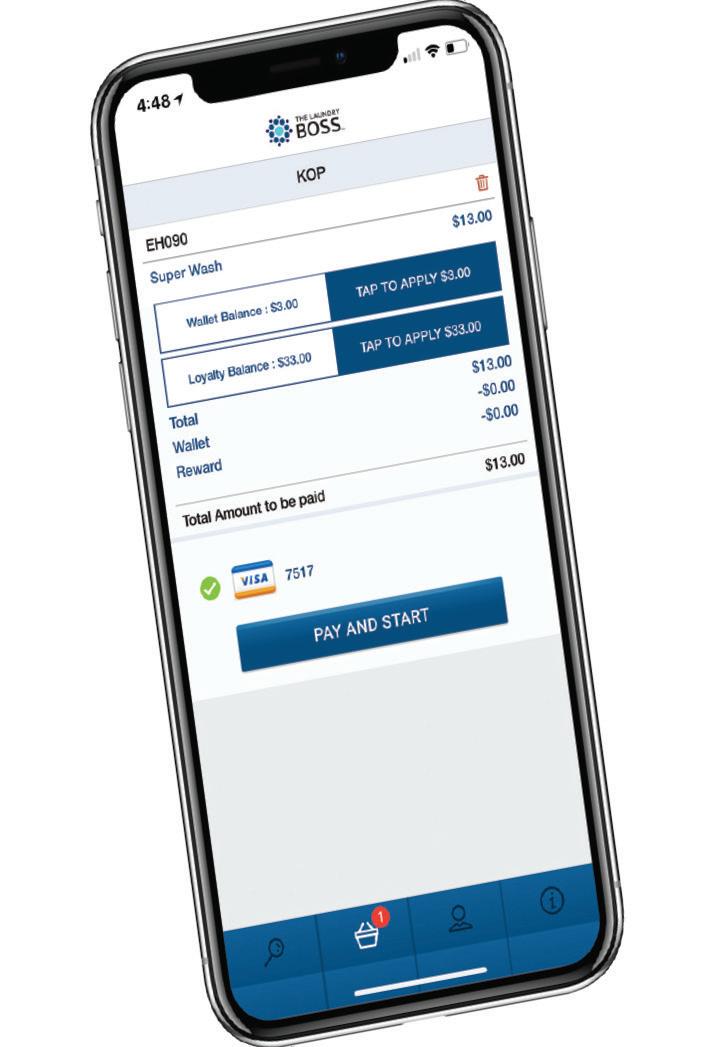

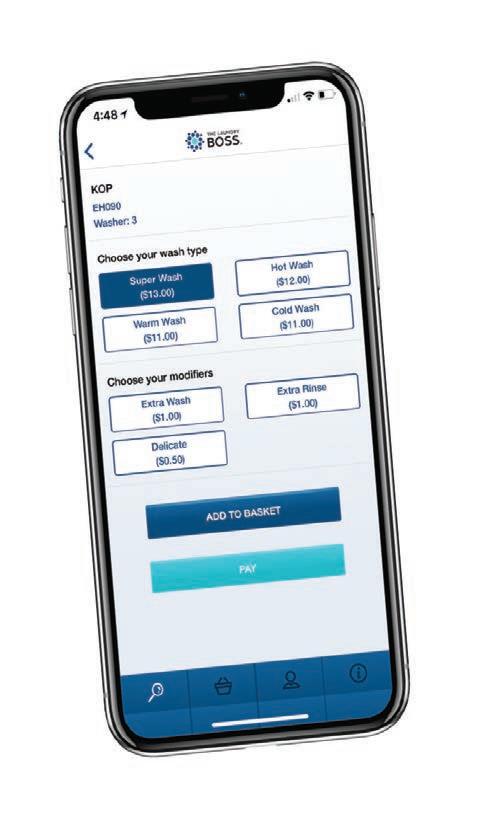

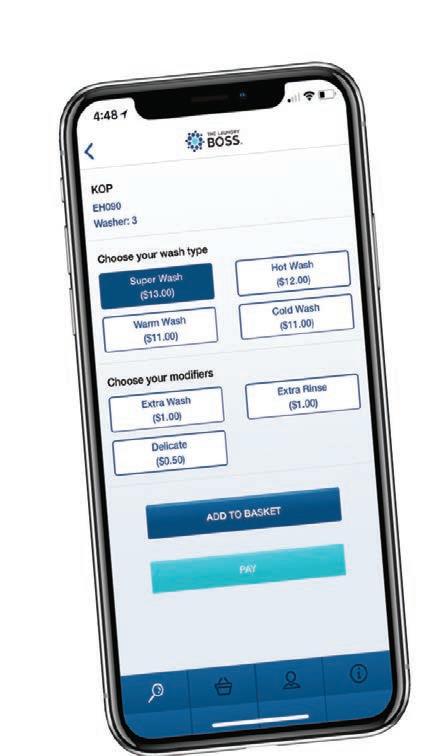

Moreover, thanks to a Card Concepts Inc. (CCI) payment system, customers enjoy multiple payment options while Mendoza benefits from remote store management of machine usage, store revenue, employee schedules, promotions and more.

“Customers really love our loyalty rewards program of $5 free after 500 points,” Mendoza says.

CUSTOMIZED WASH, AND SANITIZATION

Customers in the two stores also enjoy more control over how their laundry is washed, thanks to the ProfitPlus® Control, which is standard on all Continental wash ers. The control brings a variety of washing options and cycle features to the customer, with four primary cycle options, includ ing “Hot,” “Warm,” “Superwash,” and “Cold,” and optional extra cycles, includ ing “Extra Wash,” “Extra Rinse,” and/or “Extra Spin.”

Each time a customer selects an extra, it adds to total vend price, helping build store revenue. Overall, customers choose an extra 25% of the time, according to

Mendoza, “and after they do it once, they choose that extra every time.”

Perhaps even more powerful—especially in light of the recent COVID-19 pandem ic—is that every laundry load is sanitized. A San-O3-wash ozone system automatically injects ozone gas into each washer in order to effectively eradicate 99.9% of viruses, bacteria and molds in laundry. The result is customer safety and peace of mind. That investment has greatly impacted revenue.

“While other businesses in our shop ping centers shut down, we excelled,” says Mendoza. “We noticed a significant increase in sales over the first few months of COVID-19 because people were enam ored by ozone sanitizing. A massive influx of people washed household items, bedding and clothes. We’ve since become a mecca for sanitization.”

WDF WITH PICKUP AND DELIVERY

Sanitization also positively impacts full-service offerings, according to Red Mountain. Residential and commercial wash/dry/fold (WDF) already makes up

15-18% of gross revenue. While the Las Vegas location enjoys partnerships with a number of hotels to provide concierge laundry service for transplant construction workers and plumbers, the Garden Grove store serves the gamut, from restaurants and vacation rentals to small hotels.

“Next year, we expect wash/dry/fold sales to jump to 25-35%,” says Mendoza.

At both laundries, a cloud-based POS system from Curbside Laundries automati cally tracks the entire wash-and-fold pro cess, as well as over-the-counter sales. It’s easy for attendants to use and allows cus tomers to schedule orders online — making the process as efficient as possible.

With about 5,000 total customers, and a customer retention rate of 98%, the Boulder Express Laundry model is work ing, officials say; it’s sure to be applied at other Red Mountain Group properties into the future. ACO

Haley Jorgensen is a writer for Public Image, a marketing and PR company based in Wisconsin.

www.americancoinop.com APRIL 2022 AMERICAN COIN-OP 27

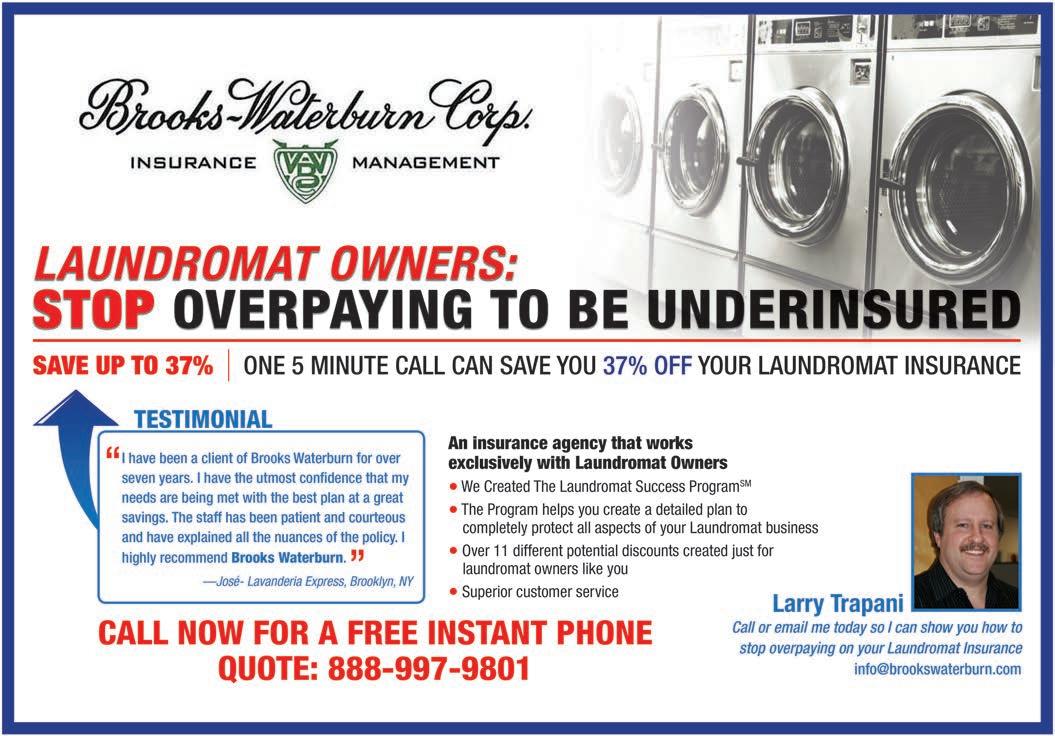

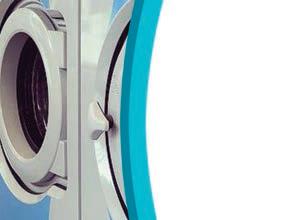

• 1105 Broadhollow Road Farmingdale,

11735 • Visit our

Brooks Waterburn Corp.

NY

website: www.brookswaterburn.com

Customers launder their clothes during a weekly free laundry event at Social Spin Laundromat, Mesa, Arizona, in fall 2020. FirstBank recently awarded Social Spin’s efforts to make a positive impact on its community during the COVID-19 pandemic with $5,000 in prize money plus $1,000 donated to a nonprofit of its choice. (Photo: Social Spin)

FIRSTBANK AWARDS SOCIAL SPIN $5K FOR ‘GOOD BUSINESS’

Social Spin Laundromat, with locations in Mesa and Phoenix, Arizona, is one of 10 businesses to have been awarded grants in a bank’s recent “Good Business” contest.

FirstBank selected Social Spin to receive $5,000 in prize money plus $1,000 donated to a nonprofit of its choice.

Entrants were asked to describe “your business and how your business made, and continues to make, a positive impact on your community, customers, or employees during the COVID-19 pandemic,” according to the contest’s official rules. Businesses in Colorado; Maricopa County, Ariz.; and Riverside County, California, were eligible to enter.

Christy Moore, MSW, is founder and owner of Social Spin. The Mesa location offers self-service, wash/dry/fold, and pickup and delivery in addition to its customer-driven community pro gramming.

Weekly, Social Spin provides free laundry to any neighbor in need and cultivates a “sharing environment” that includes a community refrigerator, clothing rack and little library.

“Our team of empathetic laundry lovers is our biggest asset,” said Moore in a July 2021 American Coin-Op article on com munity-focused, service-minded laundromats. “They enjoy con necting our customers to care and being a safe and trusted space for neighbors.”

LAUNDROMAT-BASED HEALTHCARE STARTUP’S PITCH HITS THE MARK

A Philadelphia-based startup that seeks to improve access to healthcare for people through strategic engagement at laundro mats was the big winner in a philanthropic foundation’s firstever “Pitch Competition.”

The Richard King Mellon Foundation selected Fabric Health as first-place winner and will invest $500,000 in the company, which plans to use the funding to expand its program into Pittsburgh.

Currently incorporated through The Laundry Cafe’s five loca tions in Philadelphia, Fabric Health works with healthcare part ners to facilitate healthcare coverage and wellness screenings for laundromat customers waiting for their laundry to finish.

“Fabric Health is meeting busy families where they are, in

the time they have: the laundromat,” the company said in describing itself for competition judges. “(Thirty-two million) Americans spend two hours a week waiting at laundromats. Instead of asking busy families to add more to their packed schedules, Fabric unlocks existing downtime bystacking social determinants of health interventions onto laundromats. Fabric primes laundromats with technology and staffing to improve health and well-being.”

“This is an interesting idea that addresses an important prob lem,” wrote one judge. “The founding team has demonstrated experience and expertise in the use of laundromats as a venue to deliver social and educational services.”

The Foundation’s investments made through its new SocialImpact Investment Program—in total, $3.39 million in 16 com panies—is not to make money but to utilize the creativity and scalability of publicly minded for-profit businesses to advance the philanthropic goals of its Strategic Plan.

More than 100 companies submitted pitches, and Foundation Director Sam Reiman characterized the competition as “Shark Tank without the sharks.”

UNIQUE ARTWORK DRAWS EYE TO LITTLE HAVANA LAUNDRY

Little Havana Laundry, Miami, recently added unique artwork by Ivan Roque and Heps Fury Productions representing the local culture and community.

The business worked with distributor Aaxon Laundry Systems in early 2021 and since then has taken several measures to add value for its customers.

Autumn Markley, who owns Little Havana Laundry, comes from a background in beauty and hair care and is an art enthu siast. She says she’s always been creative in her business and has enjoyed working with local artists.

Being in the heart of Little Havana gives her an opportunity to bring the community together, she believes, and it’s been her desire to create a curb appeal and beauty that has never been seen inside a laundromat.

Markley worked with Cuban artist Roque on the interior mural and with Heps Fury Productions on the exterior mural. The latter created a beautiful signature look for the front of the building, and Roque created a tropical scene inside that can be

NEWSMAKERS 28 AMERICAN COIN-OP APRIL 2022 www.americancoinop.com

Little Havana Laundry owner Autumn Markley recently commissioned artists to create images representing the Miami culture and community. Heps Fury Productions produced this signature look for the front of the building. (Photo: Aaxon Laundry Systems)

seen from the entire front and brings energy into the space.

“We have brought the history of the Cuban culture into the laundromat with pictures of old cars on the wall,” Markley says. “Letting the music play throughout the day and seeing people walk by enjoying the art, it’s a beautiful sight.

“Life is full of color. It’s the way you express your passion and love. Being a part of a community and having an essential busi ness, you have to embrace and support the ones around you.”

Since acquiring the laundromat, Markley has worked with Aaxon to replace old washers and dryers. Little Havana has also added workstations and Wi-Fi, allowing work-from-home pro fessionals to bring their laptops with them while doing laundry. Pickup and delivery laundry service is another new addition.

WHIRLPOOL NAMED TO FORBES’ LIST OF ‘AMERICA’S BEST EMPLOYERS’

Whirlpool Corp. has been named to Forbes’ list of the “America’s Best Employers 2022,” the equipment manufacturer reports.

The final list ranks 500 large and 500 mid-size American companies that are admired by employees for their dedication to their workforce and their unparalleled company culture.

“There is something profoundly unique about working at Whirlpool,” says Carey Martin, chief human resources officer for the company. “For over 110 years, families have relied on our products to take care of loved ones. Our employees around the world are the definition of resilient, and we’re proud to be building a special work environment where every person can feel right at home as they shape their careers.”

As part of its social efforts, Whirlpool has created consistent communications with employees through its annual Employee Engagement Survey. It helped facilitate the company’s ongoing response to COVID-19, including quickly implementing health and safety procedures to protect employees.

Whirlpool says it has strengthened its workforce development and engagement programs by offering online learning platforms and providing educational reimbursement to employees seeking to further their own development and improve on-the-job skills.

The company is focused on inclusion and diversity, including

www.americancoinop.com APRIL 2022 AMERICAN COIN-OP 29

(continued

page 32)

on

HOT-TOPIC TRIO: Events of Opportunity; Stats for Success; and Complaints to Kudos Taking Advantage of Seasonal Business Shifts Different times of year can bring new service opportunities, so long as a vended laundry is willing to change with the seasons. Multi-store owner Omer Khan explains. Demographics & More: Making Sense of the Numbers

Cuban artist Ivan Roque created a tropical scene inside Little Havana Laundry that can be seen from the entire front and brings energy into the space. (Photo: Aaxon Laundry Systems)

the North America laundromat/on-premises laundry

defines the term and explains its

laundry