Building

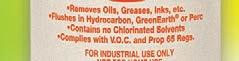

TarGo EF, our high performance, environmentally friendly P.O.G., removes oil-based stains from textiles. You’ll see the difference greases, inks, etc.

To remove stains easily, simply apply TarGo EF and major-solvent dryclean most difficult stains, TarGo EF can be used effectively on the spotting board.

TarGo EF contains no chlorinated solvents, is biodegradable, and meets California’s 2013

on the toughest oxidized oils, flush the stains out in your drycleaning wheel. On the VOC and Prop-65 regulations.

Use it with confidence!

To learn more, visit ALWilson.com or call 800-526-1188 A. L. WILSON CHEMICAL CO.

TarGo and the spot design are trademarks of A. L. Wilson Chemical Co. GreenEarth is a trademark of GreenEarth Cleaning, LLC.

TarGo and the spot design are trademarks of A. L. Wilson Chemical Co. GreenEarth is a trademark of GreenEarth Cleaning, LLC.

“The support from CBS was great. Even before we signed up, they were responsive and flexible in their approach. They have helped our team become more efficient.”

By now, I hope you’ve noticed that we’ve begun offering American Drycleaner as a digital edition you can read on your iPad or Android tablet. Readers love having the option of thumbing through our latest issue using Mirabel Technologies’ Magazine Central app (free from the App Store or Google Play). And we love having the opportunity to introduce special features for “e-readers.” For example, we now have the ability to link audio files to key stories to enhance your reading experience.

Publisher

Charles Thompson 312-361-1680

cthompson@american trademagazines.com

Editorial Director Bruce Beggs 312-361-1683

bbeggs@american trademagazines.com

Production Manager Roger Napiwocki

National Sales Director

Donald Feinstein 312-361-1682 dfeinstein@american trademagazines.com

Digital Media Director

Nathan Frerichs 312-361-1681 nfrerichs@american trademagazines.com

Main: 312-361-1700 Fax: 312-361-1685

See the microphone tag above? If you’re reading our digital edition, tap the icon now to listen to audio content available exclusively through the e-reader issue.

I’ve started the ball rolling with a special introduction this month. Watch for “Sounds of the Industry” tags to unlock content in future issues.

Remember, this special content is available only via the digital edition. If you’re reading this in our printed magazine, aren’t you at least a tiny bit curious to hear what I have to say? O

American Drycleaner (ISSN 0002-8258) is published monthly except Nov/Dec combined. Subscription prices, payment in advance: U.S., 1 year $39.00; 2 years $73.00. Foreign, 1 year $89.00; 2 years $166.00. Single copies $7.00 for U.S., $14.00 for all other countries. Published by American Trade Magazines LLC, 566 West Lake Street, Suite 420, Chicago, IL 60661. Periodicals postage paid at Chicago, IL and at additional mailing offices.

POSTMASTER, Send changes of address and form 3579 to American Drycleaner, Subscription Dept., 440 Quadrangle Drive, Suite E, Bolingbrook, IL 60440. Volume 81, number 1. Editorial, executive and advertising offices are at 566 West Lake Street, Suite 420, Chicago, IL 60661. Charles Thompson, President and Publisher. American Drycleaner is distributed selectively to: qualified dry cleaning plants and distributors in the United States. No material appearing in American Drycleaner may be reprinted without written permission. The publisher reserves the right to reject any advertising for any reason. © Copyright AMERICAN TRADE MAGAZINES LLC, 2014. Printed in U.S.A.

American Drycleaner, April 2014 www.americandrycleaner.com

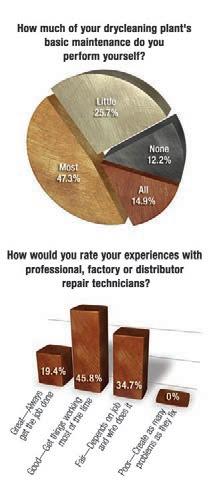

CHICAGO — To ensure their drycleaning operation is running like a well-oiled machine, the majority of dry cleaners (47.3%) say they do “most” of their plant’s basic maintenance tasks themselves, according to results of March’s American Drycleaner Your Views survey.

Almost 15% of respondents say they do “all” basic maintenance themselves, while roughly a quarter say they do “little,” and 12.2% say they do “none” of the basic maintenance tasks on their own.

Some dry cleaners perform minimal upkeep, like changing filters on a machine, while some are more hands-on.

“I have a degree in manufacturing maintenance [so] I do 95% of all my own work,” says one dry cleaner.

“I do all routine maintenance on all equipment, plus I do all emergency maintenance … except when it involves refrigeration or new wiring,” says another.

While some dry cleaners perform all maintenance tasks at their operation, others turn to a professional, factory or distributor repair technician for help, with the majority (45.8%) rating their experience as “good,” in that the technician “gets things working most of the time.”

Close to 35% say they usually

have a “fair” experience working with a professional technician, while 19.4% say they’ve had “great” experiences. No re spondents reported having a “poor” experi ence with a professional technician.

An even 63% of respondents say they have no formal, written maintenance sched ule for their plant, while 37% say they have one in place.

“Routine maintenance and required maintenance logs are crucial to a success ful drycleaning operation,” one respondent says. The majority stressed the importance of self-reliance when it comes to perform ing basic maintenance tasks.

“A n ew plant owner would be well served by creating a detailed inventory of his/her equipment … and create a mainte nance schedule to ensure you get around to servicing each piece of equipment on a reg ular basis,” a cleaner advises. “When you perform maintenance, log it in some way so you have some track record of service and work performed.”

“Get your hands dirty, take notes and get to know the factory technicians,” says another. “Many times, they can talk you through a problem without paying for a ser vice call.”

A third dry cleaner agreed, saying, “Learn to do much of [maintenance] yourself as possible, but seek professional advice/help often. You should build relationships with other cleaners so you have a group of opera tors to draw knowledge from.”

While American Drycleaner’s Your Views survey presents a snapshot of the trade audience’s viewpoints, it should not be considered scientific. Subscribers to American Drycleaner e-mails are invited each month to participate in a brief industry survey they can complete anonymously. O

American Drycleaner, April 2014

Topstories@www.AmericanDrycleaner.com forthe30daysendingMarch15

Top News sTories

1. Drycleaning Chemical Disclosure Rule Takes Effect in New York City 2. CRDN Hires Weaver as VP of Sales 3. In Memoriam: John Eckhardt, The E.J. Thomas Co. 4. DLI, NCA Convene for Annual Five-Star Brainstorming Conference 5. Brooklyn Officials Join KDCA of NY in Donating Clothing to Homeless

1. Spotting Tips: Pampering Fragile Garments 2. StatShot: 2013 Annual Sales Up in All Regions; Frosty January... Web eXCLUSIVe! 3. Point of Sale Point of View 4. Set Investing Odds in Your Favor 5. Score High with Drycleaning Customers Through Teamwork

Top sTories @ our sisTer siTes www.Americancoinop.com: 1. Protecting Customer Data

Miles City’s Quick Wash and Fido-Cleaning 3. Alliance Laundry to Acquire Primus Laundry Equipment Group www.AmericanlaundryNews.com: 1. Advances in Linen Distribution

Alliance Laundry to Acquire Primus Laundry Equipment Group 3. Crothall Healthcare Unveils Brand Refresh 4. How to Compare, Conquer Soils, Stains

www.americandrycleaner.com

THE U.S. ECONOMIC SITUATION remains static from February, according to the Bureau of Labor Statistics. The number of unemployed remains at 10.5 million, and the unemployment rate stands at 6.7%. Both numbers have decreased so far this year, with the number of unemployed down by 1.6 million, and the rate down a percentage point. However, those who have been without a job for 27 weeks or longer went up to 3.8 million in February.

ACCORDING TO THE 12 FEDERAL RESERVE DISTRICTS, the economy continues to improve. Eight districts showed improved activity, but most of the districts reported modest to moderate growth. Severe weather was blamed for lower numbers in the New York and Philadelphia districts. Most districts remain optimistic, says the report from the Federal Reserve’s Board of Governors.

DEBATE CONTINUES on raising the federal minimum wage to $10.10. Accord-

ing to the Economic Policy Institute, the wage boost would not only increase income for millions of Americans, it would help the current economic situation.

THE NATIONAL ASSOCIATION OF REALTORS reports gains in home sales in the South and Northeast, while numbers declined in the West and Midwest. The Pending Home Sales Index increased by 0.1% in January, but remains below the level it reached in January 2013. Weather was partly to blame, according to Lawrence Yun, chief economist. Despite the lower sales numbers, mortgage applications were up by 9.4% for the last week of February, says the Mortgage Bankers Association.

U.S. EXPORTS of goods and services increased again in January, rising to $192.5 billion, according to a statement by U.S. Secretary of Commerce Penny Pritzker. “U.S. exports are off to a solid start in 2014,” says Pritzker, “and we will build on that success in the

months and years ahead.”

ECONOMIC ACTIVITY in the non-manufacturing sector grew in February for the 49th straight month, according to a report from the Institute for Supply Management. And the International Council of Shopping Centers reports a gain of 2.7% in chain-store sales for February.

CONSUMER CONFIDENCE remained fairly static from January to February, reports Surveys of Consumers from Thomson Reuters and the University of Michigan. Weather had the greatest impact, with severe conditions increasing utility usage and cost. Younger consumers report greater confidence than those older than 65.

“While the harsh winter weather has kept consumers away from retail outlets,” says Surveys of Consumers Chief Economist Richard Curtin, “it has not had a detrimental impact on their outlook for future economic conditions.” O —Jean Teller

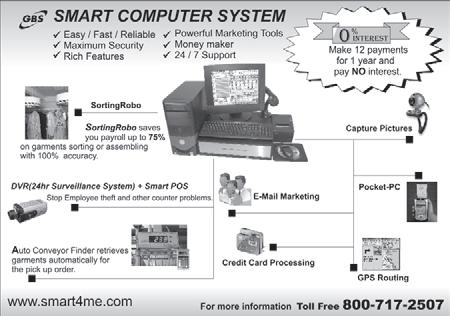

Our new generation of Point Of Sale system is designed for both small and larger cleaner stores. DryClean PRO Enterprise (DCPe) is even simpler to use than before. With user friendly screens and menus, DCPe will make your life easy. We offer, promise, and guarantee the best after sales support to our end users.

Save time and money and add to your profits by contacting existing clients and reaching out to new clients through DryClean PRO Enterprise’s built in MARKETING and EMAILING functionality. You’ll be able to send Thank You emails to new or Top 100 customers, Customers with overdue inventory, Customers that have not visited you for a while, Route customers & e-mail coupons to all your customers.

Call us about our new version of Uniform Tracker

Good or bad, your company has a brand. It’s the image it projects and the experience it delivers. Is doing good work enough? Probably not. How people perceive your drycleaning operation—in total—is your brand and affects how they respond to the services you offer.

Choose to play things low-key, say, by relying on the generic “DRY CLEANER” sign above the front door to attract business and you may find yourself trying to eke out a living in the shadow of your more notable competition.

Let’s take a look at a sampling of cleaners, both independent and franchise, and how they create name recognition and define their marketplace positioning for the greatest chance of success.

CORE VALUES. Kermit Engh is CEO of Fashion Cleaners, Omaha Lace Cleaners, and FRSTeam by Fashion Cleaners, all of Omaha, Neb. All are separate businesses that utilize the same production space (which earned an American Drycleaner Plant Design Award this year for Outstanding Renovation).

Lace Cleaners offers a good example of the power of branding, he says.

Engh acquired Fashion Cleaners 22 years ago and worked hard to build the company into a “premium brand, premium service, premium quality, and associated with that, premium value.” When he acquired Omaha Lace Cleaners 13 years ago, it was competing with Fashion for a share of the same retail drycleaning market but was better known for cleaning bridal gowns and heirloom items.

“Even though we don’t make any claims that the companies are completely different—a lot of people know of the common ownership—the wedding gown business specifically within our two companies is nearly 90% Omaha Lace and 10% Fashion, although Fashion by far is the bigger of the two brands. (Omaha Lace’s) reputation that’s been built over the years in bridal gown care has remained and is very strong.”

Fashion Cleaners and Omaha Lace Cleaners have independent marketing programs. The FRSTeam restoration business

caters to “a very narrow niche clientele,” and its services are not traditionally marketed directly to the consumer, Engh says.

It hasn’t been that long ago that Fashion Cleaners refreshed its brand after Engh put the company through a “lengthy exercise” to define its core values and beliefs.

“We were able to distill that down to three words that I think encompass the things that we do, both internally and also toward the public—the first one is passion, the second one is service, and the third one is innovation.”

Regarding the latter, he’s pushed his company to stay on the “leading edge of technology,” being the first to introduce a POS system, wet cleaning, automated assembly/bar coding, GreenEarth® and SolvonK4 to the Omaha market.

In an industry made up largely of family-owned businesses that keep financial information locked away, Engh favors the nontraditional open-book management approach. “My entire management team and a lot of my employees know exactly what our sales are, what makes up those sales, what our productivity is. The ▲

management team knows every single line item on our P&L, all the way down to our net profit.”

He believes he gets “greater buy-in and understanding” from his employees when they know how and why the company is being operated.

When it comes to service, there is internal training for customer service managers. They work a unique schedule: three 12hour days, then a four-day weekend, every week. Fashion Cleaners offers incentive programs, benefits, and a 401(k) program to keep employees engaged.

The “passion” is represented, Engh says, by “everything we do. Our people truly care about what it is that we do and how we do it.”

Once the soul-searching was completed, Fashion Cleaners made significant changes to its brand. “We changed our logo, our colors, our messaging. We changed everything to reflect what it was that we believe we are.”

While “branding” and “marketing” are related, the two terms are not interchangeable, according to Engh.

“Marketing is really the development of campaigns; advertising is a component of your marketing,” he says. “Branding, I think, gets more to the core essence of your company. Marketing reflects that, but I don’t think that it drives it.

“If the core values of your company are all screwed up, it doesn’t matter how good your marketing is. You can’t fix it.”

Wayne Wudyka knows a little something about brand development. Through his Clean Brands International LLC, he owns and operates Huntington Cleaners & Shirt Laundry, Huntington Woods, Mich.; Wesch Cleaners, Birmingham, Mich.; as well as the $100 million international franchise brand Certified Restoration Drycleaning Network (CRDN) and the newest franchise brand, bizzie powered by 1-800-DryClean.

“There are about 105 current franchisees through 1-800-DryClean,” says Wudyka. “We’ve added 14 new territories since the launch of bizzie … and we currently have a pipeline of about 15 to 20 new operations that are in various stages of approval and launching.”

When launched at the start of 2013, the bizzie brand presented an all-in-one cleaning solution that offered home/office laundry pickup and delivery, locker-based delivery, and on-location cleaning for window treatments and upholstery. As 2014 dawned, based on feedback from the marketplace as well as customers, bizzie introduced a new model based solely on

American Drycleaner, April 2014 www.americandrycleaner.com

locker-based delivery for dry cleaning and laundry.

“It took a better part of a year to figure out the right way to present to the drycleaning industry the solution that they were most interested in,” Wudyka says.

Dry cleaners operating within a franchise structure benefit collectively from the technology, training and leadership that none of them could provide on their own, he adds.

“Our industry as a whole is void of a national brand. I think we know that. What I’ve learned is on a local level, we have a lot of partners that have extremely strong local brands, and have done a fantastic job of developing their business. What we have done with CRDN, 1-800-DryClean and now bizzie is not to bury that local brand but to really provide it with some firepower to diversify and distinguish themselves further from competitors.”

Branding and marketing are not synonymous terms, Wudyka believes.

“Marketing is kind of what you do, branding is what you live. A brand lives through the experiences of its clientele.

Anybody can market. … Building a true brand creates loyalty with your customers, defines your services differently, causes an emotional attachment to the product or service.”

How important is leadership’s participation in the growth and development of a small-business brand? ▲

“Critical,” Wudyka says. “Without it, you might as well just hand someone else the keys.”

MAKING A PROMISE. Second-generation dry cleaner Edward Acosta Jr., owner of Acosta’s Cleaners in Middle Village, N.Y., equates branding with making a promise. He started his first delivery route in 1992 and built the business into a retail storefront that offers dry cleaning and wet cleaning, valet service, fire restoration and more, all out of a production space that barely exceeds 1,000 square feet.

“A brand is not having an attractive, user-friendly website with great information,” says Acosta, whose business was named Outstanding Package Plant in the 53rd annual American Drycleaner Plant Design Awards competition. “Simply put, it’s a promise to our customers, it’s a pledge, a philosophy which we live by as a team. For us, it’s a dedication to quality, service and consistency that allows us to reinforce the brand until it takes hold.”

He says his company’s brand permeates every aspect of his business, starting

with the logo and the trademarked tagline, “Pamper Your Clothes, with us.” Acosta credits his business success in part to his affiliation with the National Cleaners Association and its assistance in helping him and his staff stay informed about processing techniques and problem garments.

How can a small business measure the effectiveness of its branding efforts?

“Success. The numbers,” Acosta says. “If people are satisfied with your brand, they’re willing to pay for that brand, and they’re willing to repeat that business over and over.”

Branding your business is an ongoing endeavor, according to Acosta.

“It’s constantly reinforcing your brand until it takes hold. It’s about constantly doing the right things. Before you know it, you’ll have a brand that people associate themselves with, saying that you’re the go-to cleaners.”

START TO FINISH. Kevin Dubois is the president and CEO of Lapels Dry Cleaning, an environmentally friendly full-service franchise headquartered in Hanover, Mass. Started in 2000, the franchisor now boasts 53 U.S. stores and another 14 “in some form of build right now.”

“We were kind of built on the foundation of a hub-andspokes business model, with a really neat-looking store that sort of builds a lean and mean plant that can service three to five satellite stores,” says Dubois, who bought the franchisor from its founder two years ago.

“We look at ourselves as a way to offer a real high-quality

American Drycleaner, April 2014 www.americandrycleaner.com

cleaning at a typical, average price, creating a great value,” Dubois says. “We really like to be very much involved with the community. We’re just getting started with our Big Brother Big Sister clothing drive. It’s a way for our guys to get involved in the community.”

The Lapels brand touches everything in a franchisee’s operation, he says.

“Start to finish, it’s real important. And that’s everything from the signage above the storefront, to the look and feel of the call area, to the equipment in our plants, to the in-store programs that we run to the packaging of the garments.”

Lapels franchises like to be “very much involved with the community,” says CEO Kevin Dubois. Here, Tom Dresser, owner of Lapels stores in Freehold and Brick, N.J., poses in front of a truck carrying items for a 2013 Big Brother/ Big Sister clothing drive. (Photo: Lapels Dry Cleaning)

of the day, we feel like it’s got to be all of those things,” Dubois says. “Leadership has to push the other things forward.

Forbes magazine recently listed The Top 7 Characteristics of Successful Brands. Contributor Jayson Demers identified them as 1) Audience knowledge, 2) Uniqueness, 3) Passion, 4) Consistency, 5) Competitive ness, 6) Exposure and 7) Leadership.

“What’s most important about building a store, or building a brand, and at the end

“Our franchise owners are in the store day in and day out. Our stores are open 72 hours a week, and they’re making a lot of decisions … in terms of marketing and customer service. That leadership, whether it’s from our side pushing out new marketing ideas or PR, to the day-to-day decisions they’re making, I think it sets the table for the rest of those items.” O

O

h, those yellow stains. You cannot assume anything about a yellow stain with a quick glance. Inattention or inexperience can lead you down the wrong path in attempting stain removal. But, with proper technique and by knowing the things to look for, a cleaner can make the proper identification. Once the origin of the stain is confirmed, removal is a matter of applying the proper protocol. These yellow stains may look the same upon first glance, but they are not. Some of these stains are the result of sugar from fruit, a beverage turning dark over time, or with the application of heat. Some of these stains are the result of contact with a fresh beverage. Some are the result of light oils and greases being left untreated for a period of time. This last group of stains (oxidized oils) is one of the most difficult stains for a cleaner to remove.

A slice of apple, left uneaten, will turn dark if left exposed to air and heat. The sugar in the juice has caramelized. A clear beverage such as champagne will turn dark in the customer’s closet or during the drying portion of your

To find past Spotting Tips columns or share this month’s with your colleagues, visit www.americandrycleaner.com.

drycleaning cycle. The stain will seem to appear out of nowhere, but it was there all the time. Many times, espe cially in post-spotting, the area will be removed simply by applying steam over the vacuum nose of the spotting board.

The first step in wet-side spotting protocol is to flush with steam, apply neutral synthetic detergent (NSD) and light mechanical action, then flush with steam. In four out of five cases of caramelized sugar, the stain will need no further treatment. If there is a trace of the stain left, apply a tannin formula and light mechanical action, then flush the area over the vacuum nose of the board. In extremely old caramelized sugar, it may be necessary to spotbleach the last traces with hydrogen peroxide.

If after flushing the area with steam for the first time (as described above), there is little or no noticeable appearance change in the stain, the stain is probably not caramelized sugar and should be considered a classic tannin stain.

The wet-side protocol remains the same: flush with steam, NSD, flush with steam. Tannin stains will take a little more time to remove, but will eventually be broken down and removed by an acid-based tannin formula.

There are many chemical tools that can be used on a tannin stain. You should move from a mild tannin, to an aggressive tannin, to general formula, to oxalic acid. If traces of the tannin stain remain, neutralize the area with an alkali or protein formula and spot-bleach with hydrogen peroxide or sodium perborate.

An oxidized oil stain is recognizable by its unique shape. Look closely at the edge of the stain. If the edge looks ragged and forms “crosses” as it trails away from the stain, it is probably oxidized oil. These crosses are caused by the oil wicking along the yarns but unable to cross between them because of its thickness. The age of these stains makes them extremely difficult to remove.

The first step in removing oxidized oil is to treat it as a dry-side, chemically solu ble stain. Apply a POG to the stain over the solid portion of the spotting board and then tamp as vigorously as the fabric will allow. If this treatment results in improvement of the stain, repeat before dry cleaning. The stain has already become ”set” over time, so the heat of drying will have little, if any, further adverse effect. After dry cleaning, inspect the item for progress in removing the stain. Repeat the procedure until there is no identifiable improvement in removal. If you are one of those cleaners who still keeps “a little” VDS around, oxidized oil is the time and place to use it.

At this point, there are two further courses of action available. The most common action is to resort to bleaching. However, a mixture of butyl alcohol and potassium hydroxide has been shown to be highly effective on oxidized oil stains. This is commonly referred to as KOH solution.

This chemical tool is not commercially

(Photo: © iStockphoto/Romanchuck)Look closely at the edge of the stain. If the edge looks ragged and forms “crosses” as it trails away from the stain, it is probably oxidized oil.

available, so it must be formulated locally by mixing 9 grams of potassium hydroxide dissolved into a quart of normal butyl alcohol. The shelf life of the solution is almost indefinite, so once you mix the solution, it will last for the foreseeable future.

Apply the KOH solution to the stain on dry fabric. (KOH is a strong alkali; never apply KOH to fabric that is or may be wet.) Allow the solution to penetrate the stain for a period of six to eight minutes. You should see the stain begin to break down. Flush the area with a dry-side leveling agent and then dry clean.

Removing an oxidized oil stain is something many cleaners are not willing to attempt. Therefore, it gives you a chance to validate that you are just a little better than the other cleaners in your area. O

Martin L. Young Jr. has been an industry consultant and trainer for almost 20 years, and a member of various stakeholder groups on environmental issues. He grew up in his parents’ plant in Con cord, N.C., Young Cleaners, which he operates to this day. Contact him by phone at 704-786-3011, e-mail mayoung@vnet.net.

With EXPOdetergo Interna tional still several months away, the show’s organizers report that 200 companies have already signed up to exhibit during the Oct. 3-6 trade show in Fiera Milano, Italy.

A total of 14,000 square meters of floor space, or 85% of the two pavilions available, has already been spoken for.

“2014 is a turning point year for European laundry services,” says Luciano Miotto, president of EX POdetergo International. “In 2010, the year the last EXPOdetergo was held, we were still in the midst of the economic crisis. Now we are already in the post-crisis period, and compa nies are determined to regain their market share and are investing in innovation.”

Companies from 18 countries have reserved space to display tech nology for industrial laundering, dry cleaning, wet cleaning and ironing, plus chemistry, textiles, commercial delivery vehicles and more.

Preregistration is already avail able to industry professionals via the show’s website, www.expodetergo. com. O

April 25-27 Southwest Drycleaners As sociation Cleaners Showcase Trade Show. To be held in Fort Worth, Texas. Call 512873-8195.

April 30-May 3 Textile Care Allied Trades Association Annual Management and Edu cational Conference. To be held in Naples, Fla. Call 973-244-1790 to learn more.

May 14-15 Coin Laundry Association Ex cellence in Laundry Conference. To be held in Key Largo, Fla. Call 630-953-7920.

June 6-7 Ontario Fabricare Association & Eastern Canadian Launderers & Dry Clean ers Association Convention. To be held in Toronto, Ont. Call 416-733-2111.

June 20-22 South Eastern Fabricare As sociation Southern Drycleaners and Laun derers Show. To be held in Jacksonville, Fla. Call 877-707-7332.

June 25-26 Wisconsin Fabricare Institute Annual Convention. To be held in Mequon, Wis. Call 414-529-4707.

July 25-26 Mich. Institute of Laundering & Drycleaning Summer Convention. To be held in Gaylord, Mich. Call 877-390-6453.

August 22-24 California Cleaners As sociation Fabricare 2014 trade show and convention. To be held in Long Beach, Calif. Call 916-239-4070.

Oct. 3-6 EXPOdetergo Intl. To be held in Milan, Italy. Visit www.expodetergo.com

Oct. 18-19 Pennsylvania and Delaware Cleaners Association Drycleaning & Laun dry EXPO. To be held in Atlantic City, N.J. Call 215-830-8495. O

Post notices of your organization’s events on www.AmericanDrycleaner.com

American Drycleaner, April 2014 www.americandrycleaner.com

You’re in business for the long haul, probably. Ten, 20, even 30 years. One New England dry cleaner recently sold his business after 42 years. That’s a long time. Unfortunately, memory is short. So keep track of your performance on a yearly basis. Over the years, it will help you see where you have been and, more importantly, where you are going. What kind of figures should you keep? Well, annual sales, for one thing. Nothing tells you how your business is progressing like sales. But that isn’t the only story. Keep track of number of employees; break it down by full-time and part-time. Employing 10 full-timers is a lot different than two full-timers and eight part-timers. The total hours in these two situations is vastly different. Poundage is another helpful figure. How many pounds your shop produces states a lot about your plant efficiency.

If you do shirts in-house, that’s another figure to keep track of. After all, your shirt operation is a profit center (yes, you expect to make money on shirts) and you want to know where

To find past columns from Howard Scott or share this month’s with your colleagues, visit www.americandrycleaner.com.

you stand. Employee turnover is another important observation. How many people did you go through this year in order to fill your full complement of slots? Finally, it would be good to know the number of lost customers.

How do you obtain these figures? Sales will show up on the monthly books. You can get employees from the payroll statements. Poundage comes from your cleaning machine records. The shirt figure can be gotten by a computerized tallying of all appropriate pricing. For instance, if you price shirts at $1.95, gather all the $1.95 billings in a year. You have to calculate turnover by adding up total employees in the payroll records and contrasting that with positions. Admittedly, lost customers is a soft figure. It is less objective, but a good guess could be made each month. You could run a computerized list of the customers who haven’t been back in six months. This would provide you with a reliable “guestimate” of lost customers.

Where would you keep these figures? Something like a hardbound bookkeeping volume that you can buy at a stationery story would be best. After all, you’re taking a business history, and you will not want to lose

this book. But, if you prefer, a steno notebook is adequate. Whatever you do, don’t keep individual sheets of yearly totals that could disappear.

The benefit of this permanent effort will become apparent. The purpose is to compare/contrast, spot trends, catch weaknesses, and spot changes. And you only can do that with an analysis over time.

In fact, you might want to graph out results on empty pages of your book. You might discover things you had dreamed would never occur. For instance, 10 years ago, you went through 13 people to fill your nine slots. In the past two years, you’ve gone through 20 and 23, respectively. What has happened? Are you getting crotchety in your old age? Are workers less willing to work these days? Have the demands of the positions gotten

more stressful? Are you doing less training? Analyzing why individuals quit or were fired may point to the answer.

Why would you go through this work of keeping up figures? Don’t you have enough paperwork already, what with all the government compliance forms you deal with? You keep these records to remember and to understand. As we all know, it is easy to go along, year after year, running the business and as long as you’re making a living, just continue. After 10 years, you could be falling into destructive patterns of behavior. Keeping a record of stats forces you to confront reality. Hopefully, you’ll review these stats each year to make sense of what’s going on.

For instance, sales have steadily risen to $600,000 in the first eight years, but for the last three years have remained flat. ▲

Keeping a record of stats forces you to confront reality.

What happened? you ask. If sales rose for the first eight years, why aren’t they continuing to rise now? Is it because your drop store volume has declined? Are the area demographics changing? Has a new competitor gotten a stronger hold of the marketplace? Has employee turnover been overly high? Have you neglected to keep up your store appearance?

Of course, you know sales have be come flat without the help of your book (you live it and see business is flat every day), but examining the figures will give you perspective. Perhaps you didn’t realize (or have forgotten) that up until three years ago, sales had risen 20% every year. To go from a 20% increase to a zero increase is a major change; it can’t just be market saturation. Something must be wrong with the way you’re doing business.

You see that shirt production has gone down steadily over the last five years. Comparing those numbers to today, shirt production is exactly half of what it was. That’s terrible, and you are shocked that shirt numbers are so low. In fact, you might never have realized the decline was so severe unless you kept it charted.

You might now be at the point where doing your own shirts is no longer economically feasible. Possibly you should job out your shirt volume to a wholesaler. Or, conversely, pick up four or five wholesale accounts that will get your production back up. Your profit margin won’t be as high, but at least, you will be in profitable territory with your retail shirt volume.

You see over time that your employee turnover has gone from 1.3 to 2.5. Wow!

American Drycleaner, April 2014

For every slot, you have to go through 21/2 people. That’s a lot of firing and hiring and training. That’s also a lot of staff dissonance, through which your customers become annoyed at dealing with someone new every time they come in. That’s replacing someone almost every month either through firing or resignation.

Thinking back to last year, sure enough, there were six or seven people who walked out on you and never came back. Maybe you have gotten cranky. Perhaps you should step back and not be so intense. Possibly your people management skills are getting rusty when dealing with young staffers. Yes, you want things done right, but having to constantly bring in and train a new person is not a good thing. The point is, you need to get turnover down to where it was five years ago. Otherwise, you might become a burnout statistic.

Keeping track in a book is the way to keep your memory alive and not fall prey to acquiescence of the status quo. This book will help make you vigilant, or at least not let you forget as long as you review it from time to time.

And a final reason for keeping this book: At the end of your career, you can present this record to your grandchildren as your way of showing that you are proud of what you have accomplished. O

Howard Scott is a longtime industry writer and dry cleaning consultant, and an H&R Block tax prepar er specializing in small businesses. He welcomes questions and comments, and can be reached by writing Howard Scott, Dancing Hill, Pembroke, MA 02359, by calling 781-293-9027 or via e-mail at dancinghill@gmail.com.

Positioning one’s drycleaning business in the marketplace is a challenging and continual process. Done well, it can be your most valuable business asset; ignored, it can be your worst nightmare. Whether you actively design your brand positioning or passively allow it to just happen without your direction, your company’s image is in constant flux. Marketing gurus Al Ries and Jack Trout define positioning in their book,

Positioning: The Battle for Your Mind, as “a marketing method for creating the perception of a product, brand or company identity in the mind of the prospect.”

Operations that build name recognition and define their marketplace positioning stand to succeed more quickly than generic dry cleaners. Highly identifiable fabricare companies, whether independent or franchisees, have a distinct advantage in winning the battle for the minds of their target customers and in turn winning the battle for their wallets as well.

As this column is being written,

To find past Management Strategies columns or share this month’s with your friends, visit www.americandrycleaner.com.

a perfect example of this conversion of mind-to-wallet is occurring in theaters worldwide. Before and after the Oscars, the nominated movies enjoy a huge surge in ticket (and video streaming) sales. Two Best Picture nominations have been sold out the last five days in San Francisco. The buzz and sales resulting from the Academy Awards is a tremendous advantage for the film industry.

In the words of director Frank Capra, “The Oscar is the most valuable, but least expensive, item of worldwide public relations ever invented by an industry.” Wouldn’t you like your brand to be as recognizable and influential as that small gold statue?

Consider creating an award to be identified with your company. For instance, if you have a fashion institute or art academy in your market, create a competition for up-and-coming designers. By partnering with the schools and your retail community, you create tremendous visibility and goodwill among the fashion community, and you would be top of mind when they need or refer your services.

Their association is also an implied endorsement of your ability to care for fashion items, so the audience will seek you out as the cleaner that “gets it.” Since most owners of cleaning

companies are hesitant to do outreach, you will be a shining exception to the generally mediocre image most cleaners project in the minds of your prospects.

ASSESSING YOUR CURRENT MARKET POSITION. You project a specific image and position in your market today. It may or may not be the image you want to project.

Being objective yourself (which can be extremely difficult) or, more realistically, enlisting the aid of an objective friend or professional, a clear assessment of your current position is essential in your quest to improve your market position.

This objective assessment should be based on a number of factors:

• Your services list and service features

• Benefits those services provide to

your prospects

• Consumer needs and your solutions to meet those needs

• Perceived importance of the services and solutions you offer

• Comparison of alternatives available in the market (including non-professional)

• Emotional impact of your services on the customer

• Customer experience when utilizing your services and those of your competitors

• Awareness of your and competitors’ existence and expertise in the market

• Consumer’s perceived position of each alternative

Include the practical, the emotional and the experiential impact of your offerings from the prospects’ perspective. ▲

Ongoing mystery shopping of your company and competitors can determine your perceived market position and that of your competitors.

Periodic customer focus groups and surveys (of both customers and prospects) can provide insight and direction for future profitable growth.

The various approaches to market intelligence gathering will aid you in determining the overlap between your offerings and the solutions that customers and prospects value, to arrive at the optimal mix of services for your company. The same assessment will help you craft the appropriate image and message for your chosen position.

If you don’t target the lowest price niche, although it is challenging to identify and deliver the exceptional service for which the most discerning customers are searching and are willing to pay, it is well worth the effort. Lavishing additional attention on your best customers and their wardrobes will delight them and convert them to fans who will spread the word about your distinctive difference, thereby becoming your (free and effective) sales force.

CUSTOMER BENEFITS VS. FACTS. Customers and prospects want to know “What’s in it for me?” Answer that question first!

Example, the factual-route ad: “We pick up and deliver to your home or office two days a week.”

There is money to be made at the low end and at the high end of the market. The middle is more challenging...

PRICE VS. VALUE. Traditionally, the drycleaning and laundry industry has relied on price to define the market. Marketing has focused overwhelmingly on discounts. However, if price was the driving factor for all drycleaning consumers, there would not exist the wide array of successful niche cleaners that price themselves above the discounters. Some consumers are price-driven while others value different attributes.

If you are comfortable differentiating on price alone and battling on that margin field, go for it. There is money to be made at the low end and at the high end of the market. The middle is more challenging, as described by Christine Birkner’s The End of the Middle?, published in Marketing News.

The customer-focused ad might show a family having a picnic, or attending a sporting event or theater “while the laundry is being done.” Specific features and logistics can be detailed after the interest is created.

LUXURY VS. COMMODITY. Focusing on price makes our service appear to be a commodity. Nothing could be further from the truth.

Discerning customers know better than we do the importance of our service to them. An international speaker at a drycleaning conference, when asked about drycleaning services, initially sounded like a dream customer. He owns 15 sets of identical clothing that he wears when speaking, so the cleaners in the audience assumed that an issue with one garment was no problem because he had several back-ups.

They were totally defensive when he ▲

American Drycleaner, April 2014 www.americandrycleaner.com

said that “one broken button” would send him to a different cleaner—“no second chance.” His perspective is that he must look good and feel confident to be credible to his audience and earn his (extremely lucrative) living. He had no idea what price he paid for cleaning.

Especially discerning customers tend to be a challenge to staff, so many times your staff will shy away from them, or view them as too demanding or even spoiled by their wealth. This message is loud and clear to the customers, and results in statistics such as the often-quoted research by Michael LeBoeuf that “68% (of customers) quit because of indifferent attitude toward the customer by the staff.”

Based on U.S. census data, less than 10% of the population utilizes our industry’s services. If such a small segment of the market uses us, then we need to woo them.

Also, by default, our service is a luxury, defined as “an item that is desirable but not essential.” So how do we move our “luxury” service from non-essential to essential in the mind of the consumer?

EMOTIONAL EXPERIENCE VS. FEATURES. Instead of focusing on price or features, target the emotional and experiential aspects of wearing beautifully cleaned and pressed clothing; sleeping on luxurious sheets that have been professionally ironed; enjoying the feeling of arriving home to clean, neatly folded family laundry (or even better, laundry stored in the correct closet or appropriate drawer); or the gift of discretionary time that you provide.

These images appeal to both people who live with luxury and convenience now and to those who would like to live with

luxury and convenience. This segment of “aspirers” is looking forward to improved status in careers, social standing, financial position or other aspects of living.

They can be influenced by images representing the future that they would dream of. Examples might encompass leisure activities like yachting, great seats

Based on U.S. census data, less than 10% of the population utilizes our industry’s services. If such a small segment of the market uses us, then we need to woo them.

at the Super Bowl, a formal charity event in a designer gown, an impeccably dressed speaker at a lectern, etc. Let them envision themselves in the desired setting and demonstrate that you can help get them there.

Marketing segmentation companies can provide lists of these people in your market for you to target. They are much more valuable long-term prospects than the occasional customer who utilizes you only for discounts.

CONSISTENCY. Whatever the market position you decide to pursue, ensure that the message and image are consistent in all media, logo, tagline, marketing, décor, uniforms, stationery, vans and staff. Your success depends upon winning the battle for your customer’s mind. O

Diana Vollmer is managing director at Methods for Management (MFM) Inc., which has served the drycleaning and laundry industries with affordable management expertise for improved profitability since 1953. For assistance with positioning your brand and capitalizing on it to improve sales and profit, Vollmer can be reached at dvollmer@mfmi. com, 415-577-6544.

American Drycleaner, April 2014 www.americandrycleaner.com

By Carlo Calma, Editorial Assistant

By Carlo Calma, Editorial Assistant

Jacksonville, Fla., dry cleaner Demetrios “Jimmy” Kartsonis, who celebrates 50 years in the industry this month, has always had an industrious spirit.

In June 1955, when he was 15, Kartsonis, his father and older sister emigrated from Greece to Jacksonville, a decision made by his father due to their home country’s political instability after World War II. His mother and younger sister, meanwhile, stayed behind with his older brother, who had to finish serving his term in the Greek army. They would later emigrate and join the family three years later.

“It was one of those [situations where] you have no choice,” says Kartsonis. “If we stayed in Greece, things did not look good.”

After the death of his father in early 1959, Kartsonis, now barely a man at age 18, had to take on the responsibility of providing for his family, taking a job at a local dairy factory.

“My sister was 12 years old, my brother [did] not speak any English [and] my mother [was] not working,” he explains.

Though he admitted working in the truck’s freezers loading 300,000 gallons of ice cream a night was hard work, the job needed to be done.

“I had to work and make money,” he says. “At that time, I was pretty happy. I was making $150 to $170 a week, and for a youngster, in those days, it was good.”

go back to the restaurant?”

Upon his return to New York City, Kartsonis befriended a tailor in the city’s Washington Heights neighborhood, who told him about purchasing a local drycleaning store.

“I had an idea about pressing because when I first came into Jacksonville, I was working for my aunt who had a shoe repair shop, and in those years the shoe repair shops used to do a little (dry) cleaning on the side,” says Kartsonis. “When I went to Utah and worked for the Ajax company, I [learned] how the machinery works … I had a little bit of background, but not enough for me to get in the business by myself.”

After learning more about the business and making a down payment, Kartsonis took ownership of the store on April 15, 1964. Its previous owner, according to Kartsonis, was taking in 250 garments a week. A year after becoming owner, Kartsonis was processing 700 garments a week, he says.

Little did Kartsonis know at the time that he would take that same work ethic and gogetter attitude and build a prosperous career in the drycleaning business.

BREAKING INTO THE INDUSTRY. After working at the dairy factory, Kartsonis traveled to Utah and worked for the Ajax Pressing Equipment Co. in Salt Lake City for a year and a half. He then trekked to New York, where he found work as a short order cook at a restaurant.

In 1962, Kartsonis was drafted into the U.S. Army to serve a two-year term, spending one year in Korea.

“I finished my service [around] February of 1964, and I was honorably discharged, and I found myself again in a dilemma,” he says. “What am I going to do? Am I going to

“I was making money. I wasn’t a millionaire, but I was [able to] pay my employees, and … could take a little time off.”

In 1968, things were picking up. Kartsonis had gotten married in January, and by the end of the year, the store was processing 1,500 garments a week, enabling Kartsonis to pay the business off.

His older brother had also joined him, and the two were able to open a second location a couple of blocks away.

In 1974, Kartsonis faced a setback as a fire burned down the first store. “The fire took the whole block out. The landlord did not want to … renew my lease, so I lost the store.”

Operating solely out of their second location, Kartsonis and his brother would then face another obstacle: an armed robbery and shooting at the store in 1978. No one was

seriously injured, but now with a wife and children to support, the incident prompted Kartsonis to move them back to Jacksonville.

“My life was worth more, because if I’m dead, I cannot feed the family,” he explains.

SAN JOSE SQUARE CLEANERS. Leaving his brother to operate the store in New York, Kartsonis set out to Jacksonville in search of a new drycleaning business opportunity. After making several trips from New York to Jacksonville, Kartsonis had discovered San Jose Square Cleaners, which he officially acquired in September 1978.

The store has gone through three renovations since then; it now processes about 1,800 shirts a week from the 1,560-squarefoot business, according to Jimmy’s son, Athanasios “Tommy” Kartsonis, who now helps his father operate the plant.

“It’s very small, but … at one time [we were] doing 4,500 shirts a week [through wholesale work], so when you say you maximize space, you maximize space,” says the younger Kartsonis.

Though the store has faced many changes since, one constant remains—the sense of community and trust that Jimmy Kartsonis has been able to develop with his customers.

“When you have a customer for 20, 30 years, they’re not customers … we treat them like family,” he says. “When there’s a birthday [or] when there’s an anniversary that comes along, and we know about it, there’s a bottle of wine [for them].”

In looking back at the drycleaning industry as a whole, Kartsonis says it has changed for the better.

“As far as the EPA concerns, I’m glad they moved in and they did the clean-up,” he says, adding that he’s been able to reduce his store’s perc usage to about 25 gallons last

www.americandrycleaner.com

year. “The industry is better. The materials are better.”

Though smaller operations face competition from larger franchise cleaners, the larger cleaners don’t offer the same level of customer service, he believes. “They don’t have the people to take care of the customers the way they should,” asserts Kartsonis, stressing that customer service and trust are important.

KARTSONIS’ LEGACY. Looking back at his career, he says he would do it all over again.

“I have been enjoying it … I spent more time in the store than I spend with my wife, and I’ve been married for 46 years,” he says, playfully, adding that his spouse, Demetra, has been an instrumental part of his business success.

“I built this with my wife’s help. She was there every step of the way. She’s came in to help me sew, she’s came in to help me press,” he says. “She deserves more than I do.”

“When you have a customer for 20, 30 years, they’re not customers ... we treat them like family.”

“Without the business … I cannot do the things that needs to be done,” he adds. “I have five grandchildren, and believe me, those are things that you enjoy.”

And as far as his advice to young entrepreneurs, or those looking to get into the industry, Jimmy says, “The drycleaning business, just like any other business, you have to put your heart and soul behind it. You have to be honest with [customers] and you’ve got to give them 110%.” O

American Drycleaner, April 2014 35

By Fred S. Steingold

By Fred S. Steingold

During the course of running your drycleaning business, you may find yourself in need of legal services. Your lawyer may not automatically tell you everything you need to know about these services, and if you don’t ask questions, you may be in for some surprises.

Here are 10 things your lawyer may not tell you—unless you ask.

“I’VE NEVER DONE THIS BEFORE.” You’ve found some new space for your expanding drycleaning business. After stumbling through the dense verbiage in the landlord’s lease, you decide to have your

lawyer review the lease before you sign. Smart move.

But what if your lawyer has never reviewed a commercial lease before? Will he or she volunteer that information? Maybe not.

Legal ethics don’t require a voluntary disclosure. They only require a lawyer to become competent in a legal matter before proceeding. In theory, a lawyer can get up to speed by consulting with a colleague, reading professional books, and attending seminars.

But, given a choice between a novice and a lawyer who has checked out 50 commercial leases, wouldn’t you be more comfortable with the more experienced one?

If so, find out how much work of this type your lawyer has done.

“YOU DON’T NEED A LAWYER TO DO THIS.”

There are many law-related tasks you can do yourself—like getting a tax assessment reduced or suing in small claims court.

There are other things that can be accomplished by hiring non-lawyers who can work more effectively and charge less than a lawyer. For example, an accountant may be better and cheaper at sorting out a financial mess. A real estate broker may be better at negotiating a land purchase.

Some lawyers won’t tell you about less expensive options unless you ask.

“I CHARGE FOR FAXES, PHOTOCOPIES AND POSTAGE.” When you’re paying a lawyer $250 or $300 an hour—or even more—you may be shocked to find yourself nickeled and dimed as well. But it happens.

Some lawyers bill for the faxes they send or receive, for the photocopies they produce, and for postage and long-distance charges. Don’t assume your lawyer will be absorbing these expenses as a part of doing business.

Get a clear understanding up front about whether you’ll be hit with these incidental costs.

“MY PARALEGAL WILL BE HANDLING THIS.”

Paralegals—also called “legal assistants”—play an important role in a modern law office. Rightfully so. They’re usually well trained and capable of handling many routine transactions.

But what if your lawyer is planning to let the paralegal do all the work? You may want to know.

For one thing, you’ll want to make sure

the paralegal’s time is being billed at a substantially lower rate than the lawyer’s. In addition, you’ll want to make sure you’re comfortable with the amount of the lawyer’s supervision—or lack of it—that the paralegal will be receiving.

You may also want to meet the paralegal so you can have an effective working relationship.

“I’M ABOUT TO GO AWAY FOR SIX WEEKS.” Terror can grip your heart when you call your lawyer to ask a follow-up question, only to be told, “I’m sorry. Ms. Jones is on a long trip to Asia and can’t be reached.” Reasonable access is a reasonable expectation, especially in today’s digital world. You’d like to know in advance if your lawyer will be out of touch for an extended period.

To avoid rude surprises, inquire about the lawyer’s travel plans, and who will be handling the lawyer’s clients in his or her absence. Ask to meet the back-up person, and make sure that he or she will be fully briefed about your legal situation.

“FIGHTING FOR A PRINCIPLE IS EXPENSIVE.” If your chances of getting any real money in a lawsuit are somewhere between zip and zero, you’d like to know in advance—long before you sink thousands of dollars into a lawsuit.

Sure, you’d like to get even with the scoundrel who scammed your business, but it may cost you a bundle to duke it out in court—and you may still wind up empty-handed.

Ideally, your lawyer will give you a frank assessment of your odds of winning, your odds of collecting, and how much all of this will cost you. Sometimes the best advice is to put the matter behind you

American Drycleaner, April 2014 www.americandrycleaner.com

and forget about suing.

Some lawyers, however, may not level with you at first—perhaps out of fear that they’ll rile you if they suggest that maybe you don’t have such a great case. To get a straight story, you may need to ask the lawyer for brutally honest answers.

Most lawyers do most work for an hourly basis—but would be willing to do particular tasks for a flat fee. Trouble is, they may not volunteer this information.

“I DON’T LIKE THIS KIND OF WORK.” A lawyer who enjoys drafting corporate documents may abhor appearing at zoning hearings. A lawyer who likes to litigate may not like to take a matter to mediation.

You need a lawyer with a zest for your type of legal work. Someone who finds a certain kind of work distasteful may just go through the motions—not comforting when you need someone to aggressively champion your legal position.

But lawyers may be reluctant to refer you to someone else. They worry that if they do, they may never see you again. You can tactfully raise the subject by asking, “Is this really your cup of tea? Do you like doing this type of work?”

If you detect something less than enthusiasm in the lawyer’s response, follow up with, “Who in town specializes in these matters?”

“I’LL DO THIS FOR A FLAT FEE.” Most lawyers do most work for an hourly basis—but would be willing to do particular tasks for a flat fee. Trouble is, they may not volunteer this information. They worry that clients may take advantage of a flat fee by making endless demands on their time.

Still, they may be willing to draft a

business document or attend a meeting at City Hall for a flat fee.

“I BILL IN QUARTER-HOUR INCREMENTS.” That fiveminute phone call to your lawyer may cost you $75. Why? Because your $300-an-hour lawyer bills in increments of 15 minutes. That’s something you need to know in advance.

Billing is not a precise art, but increments of five or six minutes seem much more reasonable than quarter-hours.

To avoid getting burned, ask about the units the lawyer uses in billing. Maybe you’ll decide not to call the lawyer’s office quite as often.

“I STOPPED LEARNING THE DAY I LEFT LAW SCHOOL.” Some states don’t require lawyers to continue their education once they pass the bar—which means that a lazy lawyer may not be up-to-date on the latest legal changes.

A lawyer who ignores legal seminars or doesn’t read professional journals isn’t likely to brag about it. You may not find out until it’s too late that your lawyer was less than sharp on a crucial legal point.

Here’s where learning a lawyer’s reputation comes in handy. A lawyer who’s highly regarded by other lawyers in your community is probably doing his or her homework. O

Fred S. Steingold practices law in Ann Arbor, Mich. He is the author of Legal Guide for Starting and Running a Small Business and The Employer’s Legal Handbook, published by Nolo.

(Nor woman either.) American Drycleaner can now be viewed on tablets and other mobile devices – great ways to stay on top of the latest industry news and updates. www.americandrycleaner.com

consent of the IRS to change accounting methods as required by the new repair regulations.

By Mark E. Battersby

By Mark E. Battersby

Since the inception of the Internal Revenue Code, the Internal Revenue Service (IRS) and drycleaning businesses have been at odds over whether expenditures made are currently deductible or whether they must be capitalized and recovered through depreciation over time.

Now, after seven years of drafts and proposed rules, the IRS has issued final regulations addressing whether a cost is a deductible repair or a capital expenditure.

The IRS has also released a longawaited Revenue Procedure that details the procedures for obtaining the “automatic”

REPAIR OR IMPROVEMENT. Since the Reconstruction Era Income Tax Act of 1870, taxpayers have been prohibited from deducting amounts paid for new buildings, permanent improvements, or “betterments” to business property made to increase the value of business property. While this concept has been recognized as part of U.S. tax law almost from its inception, exactly what must be capitalized and what can be currently deducted as an expense has been at issue ever since.

The newly released IRS regulations provide guidance on a number of difficult

Some dry cleaners may benefit from ‘safe harbors’

questions, such as whether replacing a component of a building is a current deduction or whether it must be depreciated over 39 years. Expenditures that restore property to its operating state are, according to the IRS, a deductible repair. However, expenditures that provide a more permanent increment in longevity, utility, or worth of the property are more likely capital in nature.

If, for example, a dry cleaner rebuilds a van’s or truck’s engine, the IRS usually considers that expenditure to be a capital expense. In the agency’s view, rebuilding an engine increases the value of the vehicle (the unit of property) and prolongs its eco nomic useful life. By comparison, the IRS views regularly scheduled maintenance repairs as currently deductible, since they do not materially increase the vehicle’s value

or appreciably prolong its useful life.

In general, the new regulations distinguish between amounts paid to acquire or produce business property, equipment or machinery and amounts paid to improve existing property. When it comes to “improvements” to business property, capitalization is required if the expenditure is a betterment, restoration, or adaptation of the unit of property.

A drycleaning business must generally capitalize amounts paid to acquire or produce tangible property unless the property falls into the category of materials and supplies, or qualifies for the so-called “de minimis” safe harbor. The new guidelines cover the following:

• Materials and Supplies — Incidental materials and supplies may be deduct ed when purchased. Tax-deductible

materials or supplies are tangible personal property, other than inventory, that is used or consumed in the taxpayer’s operations. This includes fuel, lubricants, water, or similar items that can be reasonably expected to be consumed in 12 months or less.

It also includes:

1. Other property with an economic useful life of 12 months or less.

2. An item with an acquisition or production cost of $200 or less.

3. A component acquired to maintain, repair, or improve a unit of tangible property that is not acquired as part of another unit of property.

“Safe harbors” can best be compared to legitimate “loopholes” designed by our lawmakers to limit the full impact of a tax law or provision...

These are items for which records of consumption are not kept and where immediately deducting or expensing them will not distort the drycleaning operation’s income. Materials and supplies that do not fit these definitions are deducted when used or consumed.

• Rotatable and Temporary Spare Parts — A subset of materials and supplies, several alternative methods are allowed for spare and substitute parts:

1. The cost of rotatable and other spare parts is deducted only when they are disposed of,

2. Spare parts are capitalized and depreciated, or

3. The cost of spare parts can be deducted when first installed but record

income at fair market value when removed, continuing that process until claiming a final loss at disposition.

STAYING SAFE WITH SAFE HARBORS. “Safe harbors” can best be compared to legitimate “loopholes” designed by our lawmakers to limit the full impact of a tax law or provision that might be harmful to a particular group of taxpayers. Under the repair regulations, some dry cleaners might benefit from safe harbors such as the following:

• De Minimis Safe Harbor Election — A drycleaning business may elect a “de minimis” safe harbor to deduct amounts paid to acquire or produce property up to a dollar threshold of $5,000 per invoice (or per item in some cases, but only $500 for those not invoiced separately from a major asset).

• Small Taxpayer Safe Harbor — The regulations add a new safe harbor for drycleaning businesses with gross receipts of $10 million or less. The safe harbor is intended to simplify small taxpayers’ compliance with the rules requiring capitalization of building improvements. Qualifying small taxpayers can elect not to capitalize building improvements with an unadjusted cost basis of $1 million or less if the total amount paid during the year for repairs, maintenance and improvements does not exceed the lesser of $10,000 or 2% of the unadjusted cost basis of the building. The safe harbor is elected annually on a building-by-building basis.

• Routine Maintenance Safe Harbor — When it comes to expenditures for the routine maintenance performed

by so many dryclean ing businesses, there is another safe harbor. Routine maintenance includes the inspection, cleaning, and testing of the property, machinery or equipment and replacement with comparable and commercially available and reasonable replacement parts.

Unfortunately, in order to be considered “routine” maintenance, the dry cleaner has to expect to perform these services more than once during the class life (generally the same as for depreciation) of the property.

THE ELECTION TO CAPITALIZE. The final regulations include an entirely new option that allows a drycleaning business to treat amounts paid for repairs and maintenance to tangible property as amounts paid to improve that property. Thus, if the drycleaning business chooses, the amounts paid as property improvements become assets subject to depreciation—as long as the expenditures are business-related and the amounts are treated as capital expenditures on the operation’s books and records.

Another significant change in the new regulations allows a drycleaning business to take “retirement losses” on components. If, for example, a building’s roof is replaced and the old roof disposed of, the operation now has the option of taking a retirement loss for the old roof. Of course, the replacement roof must be capitalized but while the replacement must be capital-

ized, the retirement loss can be claimed on the roof replaced.

PROPERTY UNITS. Much of the guidance provided by the IRS revolves around what constitutes a “Unit of Property” (UOP). In general, the smaller the UOP being placed in service, repaired, or improved, the more likely it is that the UOP’s cost will have to be capitalized.

For example, work on an ozone generator is more likely to be classified as an expenditure that must be capitalized if the generator is classified a separate UOP rather than as part of an entire system.

ACCOUNTING METHOD CHANGES. The new repair regulations have been described as the most comprehensive changes to the issues of capitalization and write-off in more than 20 years. Some of the new regulation’s safe harbors and elections can be implemented on the drycleaning operation’s annual tax return. Unfortunately, since the IRS considers many of the provisions to be accounting methods, drycleaning businesses must file not one but numerous Forms 3115, Application for Change in Accounting Method.

A dry cleaner seeking to change to a method of accounting permitted under the final regulations must get IRS consent before implementing that new method. Under the automatic consent procedures, the IRS will consent when a Form 3115, Application for Change in Accounting Method, is attached to the drycleaning operation’s timely filed tax return for the year of

American Drycleaner, April 2014 www.americandrycleaner.com

A significant change allows a drycleaning business to take “retirement losses” on components.

change (with extensions). A signed copy must also be sent to the agency’s national office.

QUESTIONS ANSWERED. The question of capitalization vs. expensing of business property has long boiled down to a question of whether the expenditures maintain or restore property in or to its ordinarily efficient operating condition (expense), or appreciably prolong its life, materially increase its value, or adapt it to a different use (capitalization).

The tax strategies and methods used in the past may no longer be either feasible or advisable. Through newly created safe harbors and other taxpayer-favorable features, the new regulations will provide tax planning opportunities—and potential tax savings—for dry cleaners that will face fewer disputes with the IRS.

While the new repair regulations bring helpful clarity and order to the treatment of tangible property, and go a long way to answering the question of what is a repair and what is an expenditure that must be capitalized and depreciated, they pose considerable compliance risks for every drycleaning business. However, because many dry cleaners will soon discover they need to elect new tax strategies that require an application for an accounting method change, professional assistance may be a necessity. O

Information in this article is provided for education al and reference purposes only. It is not intended to provide specific advice or individual recom mendations. Consult an attorney or tax adviser for advice regarding your particular situation.

Mark E. Battersby is a freelance writer specializing in finance and tax topics. He is based in Ardmore, Pa.

E

very year in December, we mail all of our clients a half-pound of privately labeled coffee to thank them for their business. Our pre-holiday post office visits have been going on for eight years.

A long waiting line forms because the counterperson weighs each package individually, prints out the postage, and affixes it to the package. This year when we finished mailing, I gave the counterperson a package of our coffee and said, “I hope you like coffee. This is what you have been sending for us. Thank you for your help.”

Carolyn Nankervis

The counterperson thanked me, and I thought nothing more of the encounter.

At the end of the year, I needed some stamps and went back to the post office. The counterperson retrieved the stamps I needed and then asked me about my New Year’s plans. We chatted a bit about what we both were doing. As she returned my credit card, she looked at the name and said, “Thank you, Carolyn.” I felt as if I had entered a different dimension.

What just happened? I had been going to the same post office for eight years and this was the first time anyone had recognized me. I started thinking about my coffee gift to the

counterperson weeks earlier. Was this just a nice way of recognizing me? No, that wasn’t it. The person who struck up the conversation was not the person to whom I gave the coffee. Was this counterperson more outgoing or bubbly? No, she had waited on me over the years and was pretty disinterested in me and my mail needs. So happened and why?

The coffee we send has our logo and a tagline of “Mystery Shopping and More!” Could it be that the post office staff thought I was a post office mystery shopper? During my visit, she hit two key points that we stress for all CSRs:

• Establish conversation

• Use a customer’s name

I often hear from CSRs that the cus tomer doesn’t want or like to be called by name. That attitude is lazy and wrong. Recognizing me and using my name when I show up means that you place a value on me and my business. Every customer has a choice when it comes to purchasing drycleaning services. One choice may be not going to any dry cleaner. Other options might be Dryel, a washing machine, or new clothes. As drastic as these alternatives may sound, they are legitimate options and may be more appealing than being subjected to poor service and unexplained pricing.

Over the years, what I have seen at the drycleaning counter is that “regulars” get the “treatment.” The CSRs know “regu lars.” Their “treatment” is that they are recognized, joked with and called by name. Those customers feel valued and respected. That is one of the reasons why they come back. “Regulars” are the customers that owners count on to pay their bills.

New customers or “non-regulars” often are not treated the same. If CSRs don’t recognize that new customers are valuable, too, these patrons will never become regular customers. The customer experience just isn’t worth a new customer’s time or money. No one will return more than once if they see their receipt as one gigantic expense with no associated value. Or feel as if they shouldn’t have come in to the store

because no one acted interested in them or their items. Or the customer feels dumb because they don’t understand the difference between laundry and dry cleaning.

Using a new customer’s name, actively engaging in a little conversation, and knowledge of cleaning processes are the ways to create a regular customer out of someone who has entered a store for the first time.

How long does it take to become a regular? At my post office – it took eight years and a half-pound of coffee. O

Carolyn B. Nankervis is president of MarketWise Consulting Group, Appleton, Wis. A former direc tor of marketing, sports writer, radio announcer and TV producer, she is a frequent speaker on customer service and marketing topics. She can be reached at carolyn.nankervis@marketwi.com, 920-735-4970.

Wet Cleaning. NCA course, to be held April 6 in Miami. Call 212-967-3002 or e-mail ncaiclean@aol.com.

Radical Drycleaning/Stain Removal. NCA course, to be held April 7-11 (rescheduled) in Northvale, N.J. Call 212967-3002 or e-mail ncaiclean@aol.com.

Stain Removal. DLI course, to be held April 30-May 2 in Laurel, Md. Call 800638-2627 or visit www.dlionline.org.

Avoiding Claims: What You Need to Know About Fabrics & Stain Removal. NCA course, to be held May 18 in Tampa, Fla. Call 212-967-3002 or e-mail ncaiclean@aol.com.

Finishing with Tensioning Equipment. NCA course, to be held May 18 in Secaucus, N.J. Call 212-967-3002 or e-mail ncaiclean@aol.com.

Avoiding Claims: What You Need to Know About Fabrics & Stain Removal. NCA course, to be held June

7 in Dallas. Call 212-967-3002 or e-mail ncaiclean@aol.com.

Avoiding Claims: What You Need to Know About Fabrics & Stain Removal. NCA course, to be held July 13 in Seattle. Call 212-967-3002 or e-mail ncaiclean@aol.com.

DEC Certification. Two-day NCA course, to be held July 13 and July 20 in Nanuet, N.Y. Call 212-967-3002 or e-mail ncaiclean@aol.com.

Introduction to Drycleaning. DLI course, to be held July 14-18 in Laurel, Md. Call 800-638-2627 or visit www. dlionline.org.

Wet Cleaning. NCA course, to be held July 20 in Ohio. Call 212-967-3002 or e-mail ncaiclean@aol.com.

Advanced Drycleaning. DLI course, to be held July 21-Aug. 1 in Laurel, Md. Call 800-638-2627 or visit www.dlionline. org. O

Feature: Exhibit in Print

Don’t pass up this 2-for-1 deal! Your display ad appearing this month also reserves your company a spot in a unique advertisersonly product exhibition.

Editorial Submission Deadline — March 15

Feature: Addressing Customer Claims No drycleaning operation is perfect, so here are some pointers for how to deal most effectively with customer complaints and claims.

Editorial Submission Deadline — April 15

Feature: Plant Automation

Bar codes, RFID chips and automated conveyor systems are taking the hassles out of inventory control and assembly. Here’s how today’s plants are using these innovations to cut labor and maximize efficiency.

Editorial Submission Deadline — May 15

Feature: Distributors Directory Continuously updated, our easy-to-use annual directory issue lists distributors of equipment and supplies nationwide.

Editorial Submission Deadline — June 15

Feature: Marketing: Back to Basics

How to attract more customers using some tried-and-true promotional strategies.

Editorial Submission Deadline —July 15

Bruce Beggs, editorial director,

Phone: 312-361-1683 E-mail: bbeggs@americantrademagazines.com

Perhaps the most important of the many advantages of 401(k) retirement plans is that they are “tax-advan taged,” that is, they help to minimize the amount of money Uncle Sam can grab from you in the form of taxes, but only if you make some smart decisions. If you’re lucky enough to have a 401(k) or similar tax-deferred retirement plan, these tips will help you to gain maxi mum advantage from it: