4 minute read

A STEP AHEAD

Au To Launch First Financial Technology Program Of Its Kind In The Region

| BY KEELEY MEIER ‘20

In Fall 2023, Augustana will launch its newest academic program, Augustana University Fintech Program by Pathward™. With the support of Augustana’s key strategic partner, Pathward™, N.A., (formerly MetaBank, N.A.), the major will be the first of its kind in the region.

“Through this innovative new academic program, students will gain a thorough understanding of both traditional financial services and the core technologies driving the fintech revolution,” said President Stephanie Herseth Sandlin. “In addition to attracting undergraduates interested in the fintech major, we look forward to providing professionals already working in the financial industry with the opportunity to upskill through certificate programs and microcredentials.”

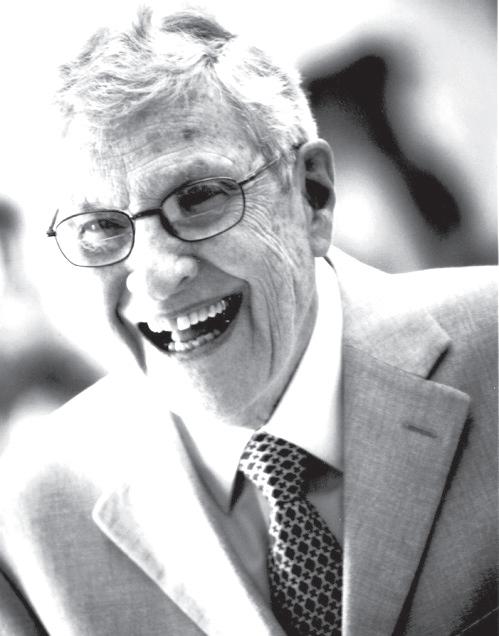

Dr. Raymond Leach, assistant professor of computer science and business administration, is the program’s inaugural director.

“Dr. Leach is a fantastic teacher,” said Dr. Colin Irvine, provost & executive vice president. “He’s able to convert problems, possibilities and ideas into curricula that are experiential, that take data sets, issues and problems from these intersecting fields and convert them into open-ended, authentic student learning experiences.”

Prior to Augustana, Leach served as a research associate at the Claremont Institute for Economic Policy Studies and statistics instructor at California State University, Los Angeles. Leach earned a Ph.D. and Master of Arts in economics from Claremont Graduate University and Bachelor of Science in economics and statistics from the University of Wisconsin-La Crosse. He also earned a certificate in machine learning from Stanford University.

“Fintech is the use of technology to make financial services better, faster and more convenient,” said Leach.

Fintech consists of four verticals or specializations: payments space or the process of transferring money electronically; lending, which includes peer-to-peer and micro loans; wealth management or optimizing portfolios, as well as buying and selling stocks and assets; and blockchains, which are public ledgers of cryptocurrency transactions that exist across a network.

The Augustana University Fintech Program by Pathward major will be interdisciplinary; students will take accounting, finance, computer science, statistics and economics courses. Students will also complete an internship, arranged by Augustana, with local companies.

In addition, Leach developed three courses specific to the program — the introductory course, Principles of Fintech, will be an overview of the four verticals. The other courses, Financial Institutions and Banking as a Service, will take an in-depth look at the functions of commercial banks, regulations of banking services and emerging bank technologies.

“The program is immediately going to stand out and appeal to students who are looking for practical knowledge that applies to the workforce,” said Leach. “The skill sets and tools we’re going to be able to teach them — that specific bundling of computer programming and data analytics, and the topics specific to fintech, along with internships — are going to be huge.”

The first Augustana University Fintech Program by Pathward course is set to be offered in the fall, and the first cohort is projected to graduate in 2027.

CONTINUED ON PAGE 16

CONTINUED FROM PAGE 15

A Key Partner

As a bank that has relationships with many fintechs through its Banking as a Service strategic business line, Pathward said it supports the opportunity to collaborate with Augustana and provide students with the ability to learn about the banking and payments industry.

“Sioux Falls has a strong banking and fintech presence,” Pathward Executive Vice President and Chief Financial Officer Glen Herrick said. “With Augustana’s close proximity and reputation for producing highquality graduates, the program is a natural alliance.

“The fintech and banking segment have many opportunities for talent development and growth, and Augustana Fintech students will be well-positioned to take advantage of these opportunities. With the knowledge and confidence they gain through the program, we expect they will hit the ground running upon graduation.”

Augustana University Fintech Program by Pathward is supported by a team of corporations serving on an advisory board — MarketBeat, The Bancorp, CAPITAL Services, Goal Solutions, PREMIER Bankcard and Central Payments, as well as Pathward.

Fintech Coursework

Course Title

Principles of Accounting I

Principles of Accounting II

Principles of Finance

Advanced Finance Investment Fundamentals

Ethical Issues in Technology

Management Information Systems I

Computer Science I

Computer Science II

Principles of Microeconomics

Principles of Macroeconomics

Intro to Stats Using R

Principles of Fintech Financial Institutions

Banking as a Service

For The Greater Good

When Henry Sule ‘24 heard that Augustana would be adding the Augustana University Fintech Program by Pathward, he said it was perfect timing. The finance and computer information systems double major sees fintech, or financial technology, first and foremost as a way to serve and educate others.

“When I started, I didn’t really know a lot about finance, so I realized technology could be a way to bridge that (knowledge) gap,” Sule said. “That was how I learned about fintech. I know there are different routes you can take with fintech, but I see it as a potential tool to help other people.”

Although Sule won’t graduate with a fintech major due to his status as an upperclassman, he plans to make the most of the upcoming fintech curriculum with Leach’s help.

“(My majors) are intentional,” Sule said. “I was interested in fintech, but there was no major at the time. So, I thought finance and computer information systems would be the best way because of conversations with Dr. Leach. He’s been helping me, as my advisor, tailor my (majors) to get fintech experiences without the actual major.”

Sule hopes to take the skill sets he gains from the fintech courses and bring them home to Jos, Nigeria.

“Back home, a lot of people are not enrolled in formal banking systems or financial institutions,” said Sule. “I see using (fintech) as a way to give power to everyday users because you can only have banks situated in major cities, whereas you can have fintech platforms on your phone, regardless of where you are. I see it as an opportunity to uplift the majority of the population, as opposed to just the urbanized areas.”

And, Sule knows he’s not the only student excited about the upcoming program.

“I know a lot of students who are looking for that technical computer science background with finance, accounting or management,” said Sule. “It’s become apparent how important technology is, regardless of which field you are in. And, I think this sets Augustana apart.” n