6 minute read

Wagyu demand remains steady

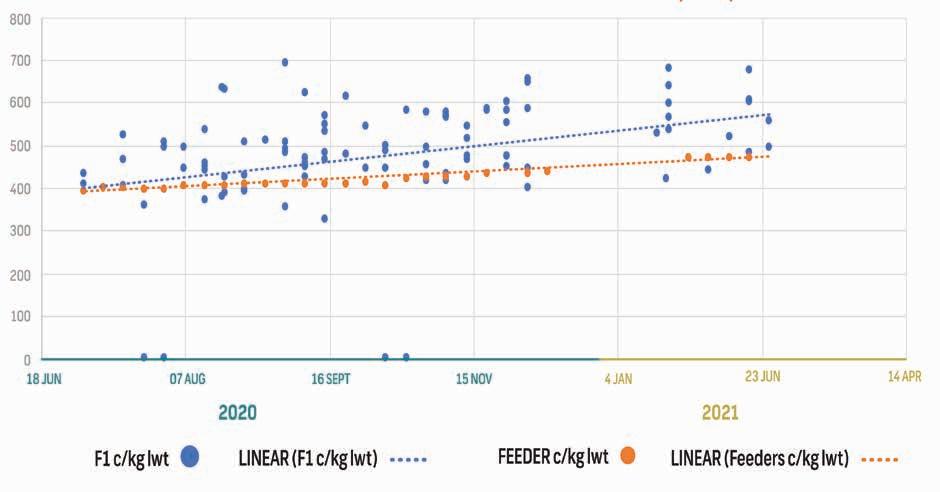

Twelve months ago, the hospitality and food service industries were in dire straits as restaurants right around the world closed doors overnight in the wake of COVID-19. With government support and the slow return to the new COVID normal, food service is showing some signs of recovery. The exception, are those heavily reliant on tourism such as hotels. While the fine dining sector has suffered, uptake through retail in local and export markets has stabilised premium beef markets. Quick service restaurants and locally owned restaurants have taken up much of the downturn. The recent increases in the Eastern Young Cattle Indicator have been an indication that cattle herds are rebuilding across the beef sector, helped in part with the recent rain. Although representing only a small fraction of F1 Wagyu feeder cattle sold to supply chains, the movement of F1 Wagyu through AuctionsPlus indicates that Australian Wagyu markets continue to strengthen. The MLA Lot Feeding Brief for the December 2020 quarter shows that the number of cattle on feed in NSW, Victoria and SA increased compared to the previous quarter, while Queensland remanded relatively steady. Wagyu F1 vs Feeder indicators (MLA) FY 2020 - 2021

Source: AuctionsPlus, MLA

The December 2020 quarter reports from ABARES indicate that exports for agriculture were down compared to 2019, but sit within the three year average. Two factors have contributed to overall decreases into China and Japan particularly, with the increased cost of beef production here in Australia, and the high exchange rate to the $US. For China, trade tensions continue to be challenging more so in commodity beef, while the Japanese government continues with subsidies for domestically produced product.

The F1 Wagyu sales since June 2020 on AuctionsPlus show a starting point at approximately 410 c/kg, while the feeder indicator sat slightly below 400 at the same time. At the end of February 2021, the F1 sales have trended upwards toward 560c/kg, compared to a slower trend increase for MLA heavy feeders closing out at around 420c/kg. Clearance of sales of F1s through AuctionsPlus has averaged around 73% for the same time frame.

<<< from page 47 CHINA

Rabobank expects that trade tensions between China and the US as well as between China and Australia will continue to hit the meat industry hard in 2021 but Angus Gidley Baird, Rabobank Senior Animal Protein Analyst says that there are still massive opportunities ahead for Australian exporters. “What has been interesting and will continue to be so is the mix of product going into China. We used to send a lot of forequarter cuts into that market, but they are now picking up on ground beef with increased westernisation as well as the very premium Wagyu and highly marbled beef,” Mr Gidley-Baird said. “While our overall beef exports to China dropped last year, our chilled exports actually increased nine per cent in volume terms.” A sentiment that Andrew Cox, International Business Manager, MLA agrees with. “The demand for Australian chilled grain fed beef actually grew in China, and it is likely that Wagyu in particular is performing well. While some suppliers may be experiencing difficulties with recent bans into China, the assumption is that other brands have filled the gap. What is difficult to gauge is whether the volume is reflective of demand or value; it will be interesting to see what the China statement, due out in April will be around export values.” UK, EU AND BREXIT

The final signing of the Brexit deal was completed late 2020 by the British government and for many industries, what that represents for market access into the UK and European Union is still to be negotiated.

According to Mr Gidley Baird, the intricacies are hidden in the details of how the quotas will be apportioned between the 27 countries within the EU and the UK.

“For Australia it means that for beef, we have a country specific quota for high quality beef which is 7,150 tonnes which was the quota into Europe so, based on the average of the last three years, 65 percent of that volume will be allocated to the UK and 35 percent to Europe.

“But we also supply into a global quota as well and that quota, based on volumes over the last three years, has a much higher volume going into Europe and it is this aspect that leads me to anticipate that there will be minimal change for our beef exports to these markets at the moment.

“The Australian Government is in the process of negotiating Free Trade Agreements with both the UK and the EU the terms of which, if favourable, could see increased access for our exporters in the future,” Mr Gidley-Baird said.

<<< from page 49

COMPETITORS AND OPPORTUNITIES

Brazil continues to grow globally and have the advantage of a lower price point to capture market share, however it is mostly in the commodity beef category, not in high value premium beef. For markets such as China, US Prime poses the greatest challenge to Australian Wagyu, said Andrew. “US production of Wagyu is not as high as it is in Australia, and domestically there is sufficient demand to utilise US Wagyu locally. “What you do see on the menu alongside Australian Wagyu brands, is US Prime at a similar price point. With China looking for new, competitive sources to fill the premium beef category, and the capacity to provide the cuts demanded, there is a threat. “On the flip side, any increase in US supply to China would create opportunities for Australia in markets such as Japan and Korea. And the US is not as strong in countries such as Indonesia, Malaysia, Vietnam and Thailand, providing opportunity to develop further in these markets. Strong economic growth and population forecasts across Southern Asia means that there will be an increasing number of households with money to spend.” Korea was not a huge market for tenderloins, but data suggests the country is taking more than Japan. With that, there has been a noticeable trend of retailers asking for support to show how to cut, cook and sell Australian product.

THE YEAR AHEAD

MLA forecasts for 2021 indicate that the national cattle herd is expected to increase with the rebuild phase, however slaughter levels may continue to fall as producers retain younger cattle. As a consequence, it is likely that beef production will be below 2019 levels, but similar to those seen in the last herd re-build of 2017. Export levels are expected to lift 2%, but will continue to be affected by demand in key markets and food service activity. As China’s recovery from African Swine Fever evolves, the protein deficit fulfilled with commodity beef may see those suppliers spill into other markets where Australia has considerable market share.

In the feedlot, the forecast is for a continued increase in numbers within the system. Currently feedlot cattle accounts for 37% of national slaughter. Long fed Wagyu now represents a greater proportion of cattle in feedlots and expected to increase with the lower cost in grain. “Given that Wagyu is found in fine dining and high-end food service, you would expect that export markets for the product would have suffered in 2020,” said Andrew. “It will be reassuring for Australian Wagyu producers that Wagyu has performed better than expected with many consumers still looking for high end meals and spending more time at home to prepare those meals. “The challenges in China and the uncertainty of Brexit trade negotiations will be ongoing, but with that there is clear evidence that Australian Wagyu has an opportunity to gain market share in new markets in South East Asia and Korea.”