15 minute read

Top Electric Car Predictions for 2022

It felt like 2021 was the year of the EV crossover.

Tesla’s Model Y quietly dethroned its Model 3 sedan as the best-selling electric car in the U.S. Three new entrants jumped into the top five EV sellers: the VW ID.4, Ford Mustang Mach-E and the Chevy Bolt EUV. Perhaps it should not surprise us, because Americans love their crossover SUVs.

But Americans love their pickup trucks more. I predict 2022 will be the year of the EV truck.

Why? The top-selling vehicle model across 30 states in 2021 was the Ford F-Series, and the numbers we’re talking about are five times what the Model Y has done.

That makes the F-150 Lightning the most important EV introduction in history. This is a mainstream vehicle that will do more to establish—for better or worse—the reputation of EVs in the minds of most Americans. That includes my wife, who placed her pre-order for the F-150 Lightning months ago, after turning up her nose at every offering from Tesla to date.

The Rivian R1T pickup truck and Tesla Cybertruck are interesting to watch as well, but they aren’t growing the EV buyer demographics and geographic reach in the same way as the F-150.

This got me thinking about 2022 and what we should expect to see this year. To help us look to the future, I asked some of the smartest, savviest EV insiders I know to share their top predictions for 2022:

Simona Onori is a Stanford University assistant professor of energy resources engineering and electrical engineering

Stacy Noblet is senior director of transportation electrification and a senior fellow with the Climate Center at ICF, a global consulting firm

Sahas Katta is founder and CEO of Smartcar, a company that enables the integration of apps and services with connected electric cars.

Esther Perman is head of product at Recurrent. Prior to this role, Perman co-founded a startup that focused on driving EV adoption and was on the founding team for Zillow Offers.

Noblet’s Prediction: Used EVs Make Electric Mobility More Accessible

One of the reasons EVs have not yet reached mainstream adoption at scale is because of the upfront costs associated with them. While EVs mean operational cost savings compared to fully gas-powered vehicles, the initial price tag is what gets most of a purchaser’s focus. Because of this, continued increase in EV adoption will rely on the second and third ownership market.

In 2022, we’ll see more consumers seeking out used EVs, and EVs finding their way to more middle and low-income households. As supply chain issues persist, the availability of used EVs will help soften the impact of vehicle shortages and provide all of the benefits of new ones, but at a lower price point, making electrification more accessible for more consumers.

Katta’s Prediction: Software and Connectivity Will Personalize the EV Experience

EV owners are generally early adopters and ahead of the curve compared to other traditional vehicle owners. If you drive an EV, there’s a higher likelihood that you see the OEM app on your phone as an extension of the driving experience and you look for third-party apps to enhance it.

Nearly all EVs shipped today offer connected services and, with 5G emerging, we’ll see faster connections and less latency. This makes it easier to enable more complex APIs to become available, opening the doors for developers to build even richer and more creative apps for cars and their drivers.

Perman’s Prediction: New EV Shoppers Will Keep Demand for Leased and Used EVs High

The next wave of new EV models adds more variety and options for early adopters, as well as the early majority. But for many of the “EV curious” shoppers, the perfect EV to match their lifestyle is still a year or two away. That won’t stop them from looking now, however; add in federal and state pricing incentives and increasing awareness of the environmental impact, and I predict shoppers—especially two-car households—will be willing to dip their toes into electric driving with leases and cheaper used models.

Onori’s Prediction: LFP Bounces Back in a Big Way

Major automotive players—Tesla, VW and Ford, both in the U.S. and China—will increasingly lean towards lithium-iron-phosphate (LFP) for EV batteries, to replace the higher energy density nickel-cobalt-based counterparts (NCA and NMC). This will bring down prices for the consumers and accelerate mass EV production worldwide.

LFP is a dated technology invented in the 1990s with lower energy density than NMC or NCA, but 2022 will be the comeback year of LFP battery technology, as a push to reduce the amount of cobalt used in batteries—to decrease global reliance on supply from the Democratic Republic of the Congo and address human right issues related to child labor in mines.

Reducing cobalt content could be done at the expense of higher nickel content, but that would be a recipe for thermal stability reduction and increased risk of explosion. LFP is cheaper, safer—higher thermal stability—cobalt-free, has less environmental impact, is fast-charge friendly and has a much longer useful lifetime.

Drawback? Because of their lower energy density, they offer a slighter shorter range. In my opinion, a small price to pay to accelerate the race for sustainability!

See Electric Car, Page 34

Audi Genuine Parts make your repair easier

• Large Inventory of Audi Genuine Collision Parts Updated Daily • Fast, Dependable Twice Daily Deliveries throughout Georgia •

Professional, Knowledgeable, Attentive Staff Ready to Help Competitive Pricing and Discounts Always

Mon-Fri 7:30am-6pm

Audi Gwinnett

3180 Satellite Blvd., Duluth, GA 30096 Parts Direct: (678) 258.2535 Fax: (770) 476.9311 parts@audigwinnett.com www.audigwinnett.com

Sponsored by: The CAR Coalition

Car ownership has long been a symbol of independence and personal freedom in American society. Thanks to the work of the independent auto care industry, which employs 4.7 million people and includes independent manufacturers, distributors, repair shops, and parts stores, car owners can feel confident making repairs and investing in the longevity of their car. However, due to embargoed technology solutions and anti-competitive behaviors within the marketplace, local auto repair shops and some dealerships are feeling the pressure of high costs and unnecessary burdens as a result of car repair restrictions. Reform is critical to restoring competition in the marketplace. Six automakers were among the top 20 U.S. design patent recipients in 2020. These automakers have drastically increased the number of design patents they’ve applied for and been granted over the past 20 years – roughly 250% in at least one case!

Original equipment manufacturers (OEMs) are increasingly using a range of tactics, like patent thickets, controlling telematics data, position statements, repair procedures, and trademarks, to force repair shops and dealerships to use OEM parts and to steer more business to their preferred repair networks. These practices not only severely limit consumer choice, but cause economic ripple effects for businesses nationwide.

Repair restrictions on cars and other items have been skyrocketing in recent years due to OEMs increasingly misusing design patents to crowd out competitors in the marketplace. On top of that, OEMs are tightening their grip on vehicle data. These restrictions make it harder for businesses to offer alternative parts during the car repair process.

While some states, like Massachusetts and Illinois, have made promising strides in the growing automotive right to repair movement recently, there’s still work to be done.

One national solution is the bipartisan Save Money on Auto Repair Transportation (SMART) Act (H.R. 3664), which would allow for greater choice of quality, safe, and affordable aftermarket car parts – putting business owners and consumers alike back in control. The SMART Act would:

• Reduce from 15 years to 2.5 years the time that car manufacturers can enforce design patents on collision repair parts, such as fenders, quarter panels and doors, against alternative parts manufacturers; and • Maintain business owners and consumers’ right to choose from a multitude of brands, prices, and products when purchasing parts and making repairs.

Importantly, the SMART Act maintains appropriate intellectual property rights for automakers by upholding the existing patent period in which automakers can enforce design patents against other automakers. affordable automobile collision repair parts,” says Justin Rzepka, Executive Director of the CAR Coalition. “It’s time for Congress to get serious about solutions, including the SMART Act, to ensure businesses can offer the auto repairs their customers want.”

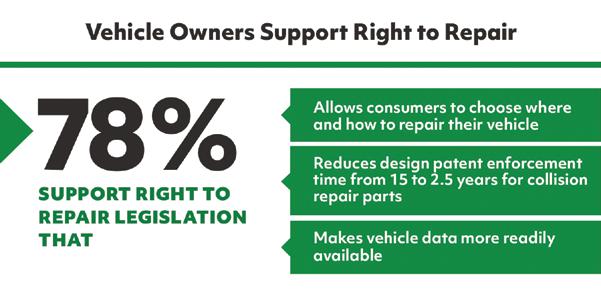

The good news is that an overwhelming majority (78%) of vehicle-owning voters support federal right to repair legislation that protects against design patent abuse in the automotive industry, such as the SMART Act. And only 25% of voters believe that design patents should be used for common car items, like side mirrors and bumpers.

The SMART Act is currently sitting before the House Committee on the Judiciary, as local businesses cope with stress due to the pandemic and while inflation continues to drive up vehicle maintenance costs. Alternative parts are 26-50% less expensive than OEM parts, while also helping to decrease the cost of OEM parts by 8% through competition. These are reasons why the SMART Act will not only increase choice, but will also translate to lower prices for car repair parts.

In addition to the CAR Coalition, which includes American Property Casualty Insurance Association (APCIA), Automotive Body Parts Association (ABPA), AutoZone, and LKQ, the SMART Act is supported by the Consumers for Auto Reliability and Safety Coalition, National Association of Mutual Insurance Companies (NAMIC), Auto Care Association, RetireSafe, AARP, and more.

Last year was one of the biggest years for right to repair, thanks to hard work from businesses, advocacy groups, consumers, and government officials alike. In 2022, it’s time to build on the momentum to protect your right to repair America’s vehicles. Learn more about the SMART Act and get involved today: www.carrepairchoice.org/ take-action.

4. Best Practices for Two-Sided Bumper Repair Using Adhesives 5. Best Practices for Using 2K Epoxy Primer

Here is Toby Chess’s newsletter:

On Oct. 15, Dana Caldwell wrote an article for Repairer Driven News about why people pick the collision repair shops they do. The results were an eye opener.

You would think insurance driven would be No. 1, but in fact it was last in the survey. Sixteen percent choose their auto body shop due to word of mouth.

As you know, I spend a lot of time in body shops for I-CAR welding tests and most of us are reactive instead of proactive. How many of you have a written SOP for checking in a vehicle? How many have a written SOP for keeping your customer informed? How many have a written SOP to do a 48- to 72-hour followup after the car has been picked up? How many have signed job descriptions for each position in your shop?

With some people choosing word of mouth, we need to do things better, and the easiest way to accomplish this is the use of written SOPs. I have more than 75 SOPs, and I will be adding 50 more over the next couple of months.

I have three example stories to drive my point home.

This was a used door from a well-known wrecking yard. The dent at the molding reduced the price by $50. I put my PDR light on it and asked the owner “Do you think that is a one-hour dent?” His answer was, “Probably not, more like two hours.” I used my light to circle all the dents—five more.

I asked him who is going to pay for the additional labor, prime and materials for the door. That door needed between five and six hours of repair. His tech made $50, he lost a couple hundred dollars of sales and he increased his cycle time because the tech was not working on the customer’s door but a used door instead.

I have an SOP on handling used sheet metal in the future, so this does not occur again.

Moving on, the next example I would the highlight is aluminum dent repair using a weld-on pulling pin.

I received a call from Erik Spitznagel, owner of Dent Fix Equipment. He sold an aluminum repair station to a shop in the Midwest. The body shop was trying to pull out a dent on a cab corner on a 2017 Ford F-150. The problem was the pins would not stick and they were “blowing” holes in the aluminum.

I called the shop owner and asked him what procedures he was using. He did not know, but got his tech on the line. The technician said he sanded the panel to bare aluminum using a 120 grit DA sander. When the pin did not stick, he increased the voltage and blew a hole in the panel. He did another one with the same results.

I told him the recommended steps. First and foremost, the aluminum needs to be cleaned with a stainless steel brush, to prevent galvanic corrosion. I explained the small brush works the best to remove aluminum oxide from the weld site. Next, the site needs to be cleaned with good wax and grease remover.

Step three is to apply one silicon stud and one magnesium stud, turn the power setting to 3 and see which one sticks the best. After destemming the proper stud, load a pin into the gun, pushing it down with end of the stainless steel brush. Grease on your finger will contaminate the pin and it will not stick. I told the tech to make sure the pin was perpendicular to the metal.

I asked the manager if he would like a best practice sheet on the proper steps needed for aluminum stud installation and removal, and he said sure. He also said if there was a problem, he would call, which he never did. I have included this best practice as an attachment.

My third example deals with plastic repair using adhesives.

Recently, I received a call from a Kent Automotive sales representative. One of his shops called and told him the bumper repair they performed failed.

I made an appointment with the shop and I arrived a couple of days later. I asked the gentleman who repaired the bumper what steps and products he used. He gave an abbreviated version and I explained I needed the step by step process he used.

He said he removed the paint from the front side of the bumper with a 120 DA sander, but not the back side. He then cleaned the front and back side of the bumper with Prep-Sol.

I explained to him that using a solvent-based wax and grease remover is designed to remove adhesives. The solvent will wick into the raw plastic and when the adhesive is applied, the solvent wax and grease remover will not allow the adhesive to stick. I explained a water-based wax and grease remover needs to be used.

I also told him he needed to sand the backside with 80 grit DA to abrade the plastic so the adhesive would adhere to it. He showed me the product he used for the back side, which was the wrong material. He used another manufacturer’s product for the front, and that manufacturer requires an adhesion promoter before the application of the adhesive, which he did not use.

We went into the shop and I did a clinic on plastic repair. He brought me a water-based wax and grease remover from a different manufacturer. I explained to him that is probably OK but he needs to use one manufacture’s system, and using or mixing other companies’ products may interact and cause the repair to fail.

I have included this best practice as an attachment. If you want a bumper repair clinic on adhesives or nitrogen welding, I would be more than happy to come to your shop and conduct a clinic. There is not charge for this service. Just call 310-9957909 or send me an email at tcspeedster@gmail.com.

In conclusion, if the three shops had SOPs in place and they were followed, these failures would not have happened.

My next column will deal with creating your own SOPs.

One final request: please let know what are your thoughts on this or if you have ideas that you want to share.

P H : M-F 7:30 -5:30 8530 I B . C , NC 28262

Over 2 Million in Inventory Professionally Trained Wholesale Parts Specialists with 200+ Years Combined Experience Deliveries and Local Hot Shot Deliveries Competitive Pricing and Discounts

S T :

R C : 6038 Z W : 6040

Your Source for OEM GM Parts in North Carolina.

P D :

800-722-3994

D : 704-598-4020 F : 704-596-9989 . .

D H : 6044 T S : 6036

SHEDDING LIGHT ON MOPAR® HEADLAMPS AND TAIL LAMPS.

Mopar® replacement lighting is 100% factory original, so you can count on assemblies correctly lining up, proper sealing and exceptional quality. Customers will appreciate no premature yellowing and no diminished light output. Choosing Mopar lighting means no splicing or rewiring for your installers, and clear performance for your customers. And that casts a nice bright light on your business.

BEAMAN CHRYSLER DODGE JEEP RAM WHOLESALE PARTS

615 Davidson St. Nashville, TN 37213

Call us for all your Mopar parts needs (615) 386-1100 (800) 624-6587 Brittney Pugh ...... ext. 132 - bpugh@beamanauto.com Les Siscoe ......... ext. 134 - lsiscoe@beamanauto.com Jesse Sliepenbeek ... ext. 136 - jsliepenbeek@beamanauto.com Jimmy Helms ....... ext. 133 - jhelms@beamanauto.com Richard South ...... ext. 135 - rsouth@beamanauto.com

MoparRepairConnection.com

©2021 FCA US LLC. All Rights Reserved. Chrysler, Dodge, Jeep, Ram and Mopar are registered trademarks of FCA US LLC.