The platinum group metal (PGM) market economics continue to ebb and flow.

In June, the world of precious metals met in Orlando for its annual conference with several renowned platinum group metal (PGM) experts discussing, and sometimes debating, the nearly two-year dip in catalytic converter recycling volumes, PGM prices, and the outlook for the future of each. Continued inflation, higher interest rates, the strong dollar, and the everincreasing Federal Reserve Rate, combined with uncertainty in the world, are bad for PGM demand and consumers that want to buy vehicles. The low PGM basket price amidst increased mining costs, skilled labor shortages, a weakened Rand, increased energy demands, and depleted PGM stockpiles shows that supply will remain sideways for the near future.

Various reasons were given for understanding the downturn in PGM recycling volumes, namely from scrap catalytic converter recycling, a 20-30% decrease in 2022, and another 25% decrease in 2023. The reasons cited include declining prices leading to “hoarding” or stockpiling converters, market saturation or depletion of supply coming from end-of-life vehicles, economic pressures of inflation leading to the public holding their cars longer, vehicle durability resulting in longer vehicle life, and policy implications such as restrictive converter recycling

laws leading to less converters entering the supply chain.

One “a-ha” explanation given for the shrinking recycling volume was that since the last financial crisis, nearly 20 million less vehicles were produced, nine million during COVID alone, resulting in 20 million cars that will never be deregistered, or 40 million catalytic converters that will never be recycled. However, the U.S. car parc, or number of registered vehicles year-overyear (YoY), which considers new and used vehicles sales and deregistered vehicles, has grown consistently by 3.5 percent YoY.

What we do know is that PGM prices have changed in the past two years: platinum fluctuating up and down 10%, palladium down 67% since its peak in 2021, and rhodium down 84% since its peak in March 2021. Although some recyclers may be holding some inventory in hopes of a higher price, that is unlikely to materialize in the next few years. The majority of scrap metal recyclers, especially commodity-driven, public companies, with month over

month revenue targets, are selling scrap catalytic converters into the supply chain. We also know that electric vehicle sales are increasing, but so are hybrid vehicles which is positive for PGM demand. It appears as car manufacturers trade their net zero mandates for higher emission standards, electric and hybrid vehicles are here to stay but so are vehicles with internal combustion engines. Finally, we know that PGM recycling volumes are set to double in the next 15 years, but if demand does not increase, prices will remain soft.

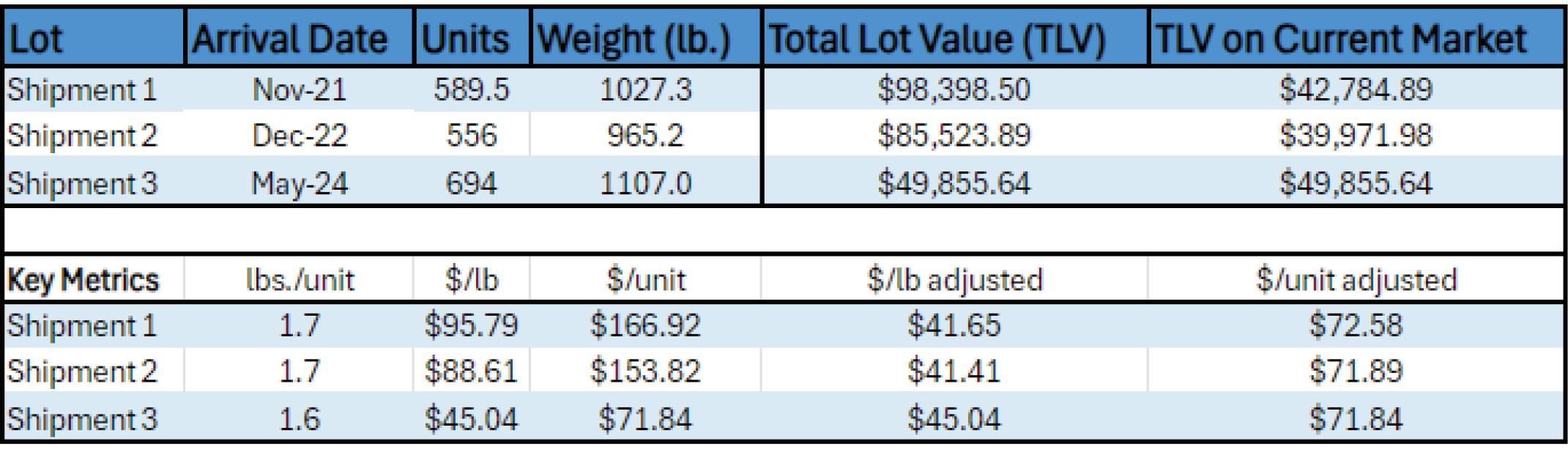

PRICES: The outlook above does not appear overly rosy, and the average converter price has come down in the past two years. That said, it can be hard for recyclers to temper expectations and to get excited about converter sales again. A recent supplier review to look at three loads recycled in the past three years on recovery, or assay, yielded very insightful data when adjusted for current markets. See data table above.

From this data it can be concluded that this recycler’s profile of the vehicles

Becky Berube has served the recycling community for over thirty years. Based in Greenville, South Carolina as President of United Catalyst Corporation, she writes a monthly educational column for the industry, and serves on several ARA and ReMa committees. She is a newly appointed Advisor on the US Industry Trade Advisory Committee on Critical Minerals.

She was a recipient of a 2023 South Carolina Women in Business Award and is a mentor in the Women in PGMs program. Additionally, Becky serves as an At-Large Director of the ReMa Southeast Board, Co-Chair of the IPMI Preventing Auto Catalyst Theft Committee, and is on the Board of Directors of the International Precious Metals Institute (IPMI), where she is a past President.

it recycles has not changed very much in the past three years. The average weight per converter is similar. Note that extensive research shows converters are getting smaller in the past 12 years, trending downward from 2.2 pounds per converter to nearly 1.5 pounds today, while parts per million (PPMs) are trending upward with stricter emission standards and cold start requirements for hybrids. Most telling on this chart is that the price per pound and the price per unit are near one another, or in a close price range, when adjusted to current market prices. This exercise or review can aid recyclers in both checking the assay or refining results and in checking their own expectations of price.

ADVANCEMENTS THAT MITIGATE RISK: Although the current market value of catalytic converters may no longer be a top-line revenue item, the VIN to converter data

ALTHOUGH SOME RECYCLERS MAY BE HOLDING SOME INVENTORY IN HOPES OF A HIGHER PRICE, THAT IS UNLIKELY TO MATERIALIZE IN THE NEXT FEW YEARS.

can be a powerful resource to mitigate risk when buying vehicles. Most technology platforms for car parts can effectively price 70-80 percent of the vehicle, leaving 20-30 percent to a plug

or fluff number made up mostly of a guesstimate on the number and value of the catalytic converters.

Depending on the number of vehicles a recycler buys and how competitive their market for salvaged cars, this data can be a game changer. This data is currently available as a stand-alone solution, as well as an integration with ScrapRight and URG Cores, with many more industry integrations coming. Companies can also inquire about API integrations for their custom enterprise solutions.

For daily updates on the PGM markets, subscribe to the United Catalyst Corporation daily e-newsletter, the 60-Second Report, TEXT Daily to 844-713-PGMs (7467). To learn more about recycling converters on assay or the United Ecosystem Bid Tool, you can also call an Account Executive at 864-824-2003 or email a specialist at sales@unitedcatalystcorporation.com. TB

Properly draining fluids not only meets certain protocols, but it is the right thing to the do for the environment and the industry’s quest for a circular economy.

Time and money. Something we auto recyclers weigh in addition to our available resources when determining any course of action. Is the prospective endeavor worth the time and is it worth the cost? What kind of effort will it require and what collateral impact will this decision have on the business? Are there regulations that must be followed in pursuant of this venture? These are some great questions we all ask ourselves on a daily basis. For some potential business opportunities, the answers are readily available, and the results of these decisions are easily measured in terms of monetary means. When done properly, crushing a load of cars, buying more or newer vehicles at the auction, or revising your core program, are all documented profitable directions we can choose to go in. These prospects can be clearly

calculated to determine whether they are worth our efforts. But what about the business undertaking that is not instantly gratifying or is not an easy cash grab? What about an opportunity such as addressing the fluid evacuation process at your facility and maximizing its benefits? This may not be the sexiest of suggestions but let’s pull the cover off on this, look inside and see what we can drain out of it.

NEW VIEW ON FLUID EVACUATION: Everyone drains their fluids, so I’m told. A better statement would be, “All auto recyclers drain all of the fluids from all of their vehicles and all of their inventory.” Why is this statement superior? Well besides the “atta boy” I can hope to get from Elizabeth and the team at Vet Environmental Engineering LLC, it is because it is proper protocol. Draining all fluids from each vehicle and each part is the best practice and is the compliant thing to do. This seemingly mundane

requirement may not be the fast lane to the Forbes 500 list. However as auto recyclers, the ones who strive to strengthen their stature and resolve within the automotive industry, this is as fundamental as it is foundational to what we are trying to exemplify. The case to solidify and standardize your depollution practices needs to be made.

Society’s perception of wanting to be environmentally focused and friendly is leading to increased regulations, desired transition towards decarbonization and the promotion of circular economic practices. So, why not view this as an opportunity that we can literally capitalize on? We must remain ahead of the curve if we can. Let’s figure out how to continue to put production and pride into our process and procedures. We can profit from compliance, that is juice worth the squeeze. Not only are we doing our part to preserve our environment and better prepare for EPA spot checks, but by

doing so we can create different revenue streams. The best part is that this act of compliance is all within our control, we determine the risk. Draining all the fluids affords us a means of conserving capital while pouring more of it into our business. Here’s how.

WHAT IS RIGHT IS OFTEN NOT EASY: Why do we drain our fluids? Silly question, right? Couldn’t we save more time and money by just draining the oil and fuel? Do not confuse shortcuts with laziness or streamlining with noncompliance. Oil on the dirt is an unacceptable dust control practice and rainbows belong in the sky, not in puddles on the ground. The point is, auto recyclers should be empowered to do what is right and not what is easy. We spend measured time and money to save and create more of both in the future. We drain fluids from the vehicles to alleviate health, fire and environment hazards and liabilities. Fluids are drained to depollute our vehicles and to keep them stored in an environmentally conscientious state.

However, when we look closer at draining the fluids, we can see that Mother Nature and Lady Liberty are not the only beneficiaries of these practices.

WE DRAIN THE FLUIDS AS A PART OF OUR DEPOLLUTION AND INVENTORY PROCESSES: We should not move forward without complete draining. As a part of the inventory process, draining the fluids helps better inspect the state in which our potential usable parts are in. Sometimes this is the tell between a sellable and a scrap part, a grade A unit, and a sellable core, and potentially, what is worth fixing and what is condemned. The time and money saved and potentially earned, only increases with our better attention to detail. Draining fluids properly has the potential to better assess and grade the inventory, and help make pricing decisions and determine markets in which to sell the parts in. By removing all drain plugs and observing the conditions of its contents, we can more efficiently, effectively, and profitably do our jobs.

Recyclers can accurately account for the state our parts are in, report them and market them to the best suitable market. We should do the same with the fluids we have drained, and if we have yet to do this, then we need to start thinking in this direction.

OUR PARTS ARE GRADED AND MARKETED ACCORDINGLY, SO OUR FLUIDS SHOULD BE DONE THE SAME: If you are not optimizing your good waste oil for heat, or filtering your fuel for your fleet vehicles, then you need to start. These two commodities are literally the lifeblood of our vehicles. They are used to keep these vehicles going and they must be reused to fuel and heat our operations. But just like grading and accurately describing our parts, it is just as imperative that we inventory the contents of these fluids to the best of our abilities. We must make sure we filter, contain, maintain, and keep separate all like fluids and use them for their appropriate designations. Bleeding and cleaning out waste oil burners

Let’s figure out how to continue to put production and pride into our process and procedures. We can profit from compliance, that is juice worth the squeeze.

and blowing up yard cars are not ways to save or make more time and money. Filtering fuel and reusing it in your fleet vehicles saves on the monthly expenses as does heating your buildings with your own waste oil. The time spent draining your vehicles properly saves far more time and money than you may potentially spend on replacing or refunding inadequately inventoried parts, paying noncompliance fines or ever-increasing utility bills, and picking up spills later in the vehicle’s life cycle at your facility.

SELLING IS THE SOLUTION: If your operation is not set up for the above processes or you have excess of these fluids, you still can continue to capitalize

on this process. Just do what we do best. Sell, sell, sell! Make sure you have the following: Proper collection tools and equipment, correct storage containers and spill kits, complying with proper storage management regulations and proper signage while maintaining the correct SDS sheets (chemical ingredient and warning sheets) for all fluids you have on site. Licensed repair facilities can buy your AC and other fluids, while walk-in and regular customers can purchase filtered washer fluid and antifreeze if it can be tested. Waste oil and fuel can be sold, too, however check with your state and local regulations as to how to follow best practices for fuel sales and transportation.

In summary, always do your research and continue to do what is right over what is easy. Talk to a fellow recycler or reach out to anyone at ARA, your local state chapter, or VET Environmental. All of them will gladly give you some insight as to how to modify your fluid evacuation process and potentially tailor it to your operation’s needs. Software such as Dismantle Pro can track your commodities and help customize your draining protocols. Depollution Supplies and Equipment can be seen at the ARA’s 81st Convention in Reno in October or viewed at the local trade shows and online. Use these tools to make the best decisions as to how to proceed. Pull every drain plug and take off every cover. Drain all your fluids and you can pour these metaphorical golden liquids back into your business to help further fuel and finance its operations. Create your own plan to capitalize on your compliance, and it will prove a program worthy of investing your time and money. TB

Taking the time to establish correct LTL quotes will save your company time and money in the long run.

When a customer is ready to purchase but needs to confirm shipping costs, accurate LTL quotes are essential. Both you and your customer must provide detailed information to ensure accuracy. Here’s what you need to ask: What is the name of the company that is receiving the shipment?

What is the receiving company’s complete shipping address?

Who is responsible at that company for receiving the shipment, including their first name and last name? What is the phone number and email (if possible) for this person?

ASK SPECIFICALLY: Is this shipping address a commercial address? The answer is YES or NO. If they can’t answer “yes” without hesitating, then this is a residential shipment and needs to be designated as such on the Bill of Lading (BOL). Note that residential delivery (or pick-up) is always an additional charge from all LTL carriers.

ASK SPECIFICALLY: Do you have a dock or a forklift for unloading? The answer again is YES or NO. If they can’t answer “yes” to one or the other or both, then you need to make sure when you quote the shipment that you include

Liftgate Delivery. Again, Liftgate Delivery and Pick-Up is always an extra fee from all LTL carriers.

ASK SPECIFICALLY: Will you require any other services beyond the truck arriving and you getting the shipment off the carrier’s truck? Additional services that will add cost to a shipment include but are not limited to: Appointment Fee, Inside Delivery, Limited Access, Farm Delivery, and many others. If you don’t know what all of these are, consult with your shipping expert.

Once your customer has provided you with this information, provide accurate details on your end:

What is the pallet or unit size being shipped? Dimensions must include all the outside dimensions of everything in or on your shipment. Note, the carrier doesn’t want exact dimensions, they want rounded up dimensions. For example, let’s say the exact dimensions of your shipment including the pallet/unit and the part being shipped are 47.5”x39.5”x30.2”. The dimensions that the carrier needs to see on the Bill of Lading (BOL) are 48”x40”x31”. Note that any dimension over 0.0… rounds up to the next highest number, so 0.1, 0.2, 0.3, 0.4, 0.5, 0.6, 0.7, 0.8, and 0.9 all round up to the next whole number, in this case 1.0.

Tony Jenkins grew up in the salvage business (Birmingham Auto Parks, Birmingham, MO) and his family still owns a salvage yard in Kansas City. After spending 25 years in corporate America, in 2020 Jenkins started InXpress 308. Today, the majority of the business for InXpress 308 is with salvage dealers and other related industries. InXpress 308 is the only place where you can ship blinker fluid, flux capacitors, and muffler bearings for free. To learn more about Jenkins and his background, visit https://www.linkedin.com/in/asjenkins.

WE RECOMMEND THAT ALL YARDS THAT SHIP HAVE A COMMERCIAL SCALE TO WEIGH YOUR SHIPMENTS. IF YOU DON’T WANT TO INVEST IN A LARGE COMMERCIAL SCALE, AT LEAST GET A SCALE THAT CAN HOOK ON TO YOUR FORKLIFT.

More examples: 40.4 equals 41; 38.2 equals 39; 20.1 equals 21. You should be aware that nearly all carriers today have laser measuring devices in their terminals and the vast majority of all shipments are re-dimensioned by the carrier, so if your dimensions are off, you will receive corrections and anytime you receive a correction to a BOL, it will cost you money. What is the weight? Be as close to exact as possible. Like dimensions, the vast majority of all LTL freight is re-weighed. We recommend that all yards that ship have a commercial scale to weigh your shipments. If you don’t want to invest in a large commercial scale, at least get a scale that can hook on to your forklift. There are options that cost less than $50. This investment can save you hundreds of dollars over time in reweighs. We have seen reweighs that range from 10 pounds to over 5000 pounds. What is the NMFC number and class of the item that you are shipping? If you understand the NMFC system, call me, I’d like to talk to you. The NMFC system is as clear as mud. It’s old, it doesn’t make sense, but the industry still uses it. Incorrect NMFC numbers and classifications generally cost shippers the most money. We have seen many times over the years, a customer doesn’t put the NMFC number and/or class into the quote or BOL correctly. For example: Uncrated used motors NMFC number is 120790-01 and their class is 85. We had a customer ship a motor and they put 120790 and class 85. Because they didn’t put “120790-01” the carrier charged that customer to not only update the NMFC and class but they also reclassed the freight to a generic NMFC number and a class of 150. Because of this, the shipper is getting hit with an NMFC and class correction charge and, in most cases, a different transportation rate altogether.

One final recommendation, quote your customer at least $50 more than the quote you get from your TMS or broker. Over time, if you have issues where there are rebills from the carrier, if you can’t collect the extra charges from your customer after the fact, you have covered yourself on any future rebills. TB

The complexities of the two avenues of auto recycling help define how today’s auto recycling businesses operate.

In the auto recycling world, there are two types of customer-oriented business models, full-service, and self-service. They perform the same basic business of recycling end-oflife automobiles, by taking old cars off the road, selling the parts, and turning the rest into scrap metal. Automobiles are the most recycled product in the world. Because the automotive industry ranks consistently in the top 10 largest industries worldwide, automotive recycling businesses plays a key role in the global economy. Approximately 40% of new steel is made with recycled metal. Annually, automotive recyclers recycle more than 14 million tons of just steel alone from processing of end-of-life vehicles. That is more than 13 million cars! While full-service and self-service operations may look alike from 10,000 feet, there are important differences –starting with our revenue models. A full-service business is a low volume/ high margin operation. They buy a few late model vehicles and make thousands of dollars on each one. A self-service business buys many cars and makes a few hundred dollars on each one. We are both making money from selling parts and scrap, however, the primary source of income for a full-service yard comes from selling parts. The self-service model makes 66%-75% of their revenue by selling the metals from the vehicle.

Another major difference between the two, is the customer base. The late model/full-service business is primarily a wholesale business selling to body shops and repair shops which perform insurance company repairs. The self-service business is exclusively selling as retail. If another business wants to buy parts, they must pull it themselves and pay the same price as a regular customer. Retail customers are also willing to buy more parts off the vehicles and accept a used part. The self-service business also relies on an ever-changing global metals market. When the main source of income depends on the world economy, you do pay more attention to the price

of tea in China. However, I would argue that relying on a business customer to buy parts as a source of income is not as reliable as the global scrap markets. The price of steel may go up and down, but it will always be worth something.

The secret to making money in the self-service business is don’t crush the ZORBA, which is the non-ferrous scrap generated from shredding automobiles, mostly aluminum and copper. Crushed cars are priced at about $.10 per pound. Aluminum is priced at closer to $.60 per pound and copper is closer to $2.00 per pound. We never leave all the non-ferrous metals in the cars when they get crushed because we would be giving away hundreds of dollars per car. If recyclers can find a way to pull out, process and package all the non-ferrous metals efficiently, they can be sold on a global market; thus, greatly expanding the profit earned as a result.

In other words, mastering the art of harvesting non-ferrous metals from crushed cars results in making more money than what you paid for the car, just from the scrap. This means a recycler is making a profit on each vehicle, regardless of its condition. Any parts that your retail customer buys go right to the bottom line.

Finally, it is just a matter of getting the cars in and getting the metals out. Easy right!? TB

Founder and CEO of YardSmart, Troy Webber, created a new paradigm for the auto recycling industry, due to an ability to predict what was needed, in order for his business to survive. YardSmart is the only cloud based software of its kind, worldwide. As a result of his background and experience, he successfully designed custom yard management software for the industry, beta tested it with his competitors for two years and now operates a SaaS company offering YardSmart. He is proud to be the third generation to own the auto recycling business and hopes one day to pass it on to the fourth generation to help serve the industry that his grandfather created in Richmond, VA 75 years ago.

URG’s “On-the-Go Podcast” offers plenty of great content from experts in the industry.

Like clockwork every month, for years now, I write an article in this magazine in the last two years, I always finish each article with, “See you on the next podcast.” Some readers may not know, I am proud to be the co-host of URG’s, “On-the-Go Podcast” with Amanda Morrison, the Director of Member and Vendor Relations with URG, and works with our guests each week that participate in the podcast. In today’s market, if we don’t continue getting better, we start to go backward. Plus, it is so easy to hear each URG podcast.

We are living in a content-driven world. If you have a smartphone, tablet, or computer, you can access the podcast without much effort. Your phone or tablet has an active podcast app built right in, but if it does not, it is a few clicks to add it to your device.

With a computer, you can type the word “podcast” into Google, and the first few results will give you several choices. The best thing is our podcast is free.

If you want to “up” your recycling game, you should listen in. Why? Lots of our listeners are multitasking while driving, cleaning or working at the office, or while they are working out. Since our podcasts are archived, anyone can hear them anytime, day or night.

The URG “On-The-Go Podcast,” has great guests on the podcast that have shared how they became successful in this industry. Let me name a few of them. Doug Williams is from Eagle Auto Parts in West Virginia. His tips on working with personnel were phenomenal. I enjoyed the interview with Matt Carman from New Jersey, both on and off the air. We spoke about how others have helped Lentini Auto Salvage become very successful. Matt tells the story of his

great family and how they started back in 1941 when they embarked on a truly wonderful exploration of the automotive recycling world, and it paid off, too.

We have the thoughts of many dynamic leaders, such as Dan Snyder who started in the cotton fields and climbed to the top of an automotive empire. It’s one of the most listened to podcasts that we have published. As we have mentioned, all episodes are archived so you can listen to them more than once.

How about J.C. Cahill? J.C. is a renowned figure in the industry as he shares his trailblazing journey since moving on from New England Auto & Truck alongside his wife, Holly. Together, they have been steering family-run recycling operations toward unmatched operational efficiency. This episode is a treasure trove of insights from the innovative VIN Match Pro to the resilience of the challenges we have during these times. J.C. Cahill and Dan Snyder have also both spoken at URG and at ARA conferences.

Speaking of ARA, let me remind you to be in Reno, Nevada October 23-26, 2024 for the 81st Annual Convention & Exposition. If you go online to A-R-A. org/convention you will see all of the information. Here are the sponsors: eBay Motors, Solera/Hollander, Amwins Program Underwriters, Car-Part. com, United Recyclers Group, LLC, Copart, Cyclic Materials, EZ-Suite, OVB

Holdings LLC dba OverBuilt, PMR, Inc., VIN Match Pro, and PGM of Texas. Whew! Now that’s a mouth full. You’ll want to see all the vendors in person, which we listed at a-r-a.org/convention.

If you are a company that services this industry, you need to be at this convention. Your presence is a must. All booths are first come, first serve, so you better hurry and get yours today.

Now, here’s another short list of other guests that are on the podcast. The industry guru, Rob Rainwater and his friend for years, Mike Kunkel. These notable men are true gifts to this industry.

My favorite is a dear friend, Paul D’Adamo from RAS; and one that is listened to as much as Dan Snyder is Dalan Zartman who is from Energy Security Agency.

As if they weren’t enough, we’ve also had Andy Latham, Brian Riker, Matt Hamlin, Chris Daglis, and one you will listen to again and again, Ryan Falco and Lee Worman. Plus we have had Mike Lambert, Bid Buddy. We have certainly interviewed some impressive guests!

Can you tell that I love co-hosting this podcast? If you hear just one, you’ll be hooked. You’ll want to listen to all the episodes. So, tell your friends about it!

I hope to see you in Reno for the ARA Convention & Exposition, October 23-26. Come and grow your business and benefit from ARA’s excellent content. As always, see you on the next podcast. TB

Drive the future by contributing to the circular economy.

To meet the projected demands and growth of EVs, the battery recycling industry is rapidly evolving. It is predicted that EVs could account for 86 percent of global vehicle sales in 20301, and the International Energy Agency anticipates that every other car sold globally by 2035 is set to be electric 2. In this ever-changing market, flexibility and adaptability sit at the forefront of the approach to electric vehicle battery recycling.

Batteries contain corrosive materials and hard metals, and when disposed of incorrectly it can be harmful to the environment, making it even more critical to dispose of batteries properly so they can be reused to benefit you, and the planet. As electric vehicles become more prevalent in society, and there is an increased demand for batteries, this issue becomes even more important.

Electric vehicle batteries are complex due to the variety of materials used and different assembly methods adopted by each automotive OEM. Utilizing recycling technologies currently in the marketplace gives you options to retain the best economic value for your scrap and end-of-life batteries, while providing the most material back into the value chain.

From the beginning to the end of the battery recycling process, safe and compliant practices is paramount to the handling of EV batteries. There are many factors that go into this process:

• BATTERY IDENTIFICATION AND CONSULTING: Prior to recycling your materials, it’s imperative to understand DOT compliance, the chemistry make-up of the battery and evaluating your scrap for any batteries that may be damaged. Combined, this helps to determine how to best use the recovered materials in new batteries.

• PACKAGING EVS FOR TRANSPORT: Nowadays, lithium and lithium-ion batteries are designed with some safety measures to help reduce risks, however, it is still crucial to properly package scrap and used EV batteries for transportation. To further mitigate risks, battery-centric transportation teams leverage fire suppression systems, but following packaging instructions is key to adhering to compliance and safety procedures.

• SAFE PACKAGING FOR DAMAGED EV BATTERIES: Damaged EV batteries can have significant thermal risks and deteriorated mechanical integrity. It is more difficult to identify damage to an EV battery due to its position in the vehicle. Automotive scrap experts may identify a damaged battery by burn or scorch marks around connector areas, dents to the outer casing or the outer casing coming apart due to swollen components. Experienced battery recycling companies can work with your team on how to package and transport your damaged batteries while meeting the highest safety standards.

• ON-SITE DISASSEMBLY AND MANAGEMENT: Experienced disassembly technicians will oversee the management and disassembly process to ensure EV batteries and damaged ones are handled accordingly to all safety and compliance guidelines, and the critical materials are extracted fully to be put back into the supply chain to meet the demand.

Auto recyclers and battery recycling companies can collaborate to recycle scrap and end-of-life batteries using more sustainable technological advancements to supply the industry with enough battery-grade materials to manufacture new batteries.

There is an enormous opportunity today to build a domestically sourced supply chain that will positively impact generations to come. There is a large focus today on securing critical minerals domestically. All facets of the supply chain – from automotive OEMs to automotive recyclers and battery recycling facilities – can work together to create a closed loop supply chain that integrates the recycling of these materials to secure these critical minerals and meet the projected demands. TB

1https://www.automotivedive.com/news/evs-reach-86-percent-global-vehiclesales-2030/695319/

2https://www.iea.org/news/the-worlds-electric-car-fleet-continues-to-growstrongly-with-2024-sales-set-to-reach-17-million

Cirba Solutions is a leader in battery recycling materials and management, creating a closed-loop business model to support the growing EV industry to help OEMs, cell manufacturers and battery material producers plan for this demand to support the growth and sustainability aspects throughout the battery lifecycle.

With more than 30 years of battery recycling experience, Cirba Solutions has the largest operational footprint in North America, with coast-to-coast facilities in:

• Arizona

• South Carolina

• California (coming soon)

• Michigan

• British Columbia,

• Ohio Canada

Leading reverse global logistics provider for batteries

Damaged, Defective & Recalled Battery Specialist Packaging

The catalytic converter recycling market has experienced significant fluctuations over the past few years. From soaring metal prices to the infiltration of organized crime, the industry has seen both incredible profits and unprecedented challenges. In this article, we will explore the key developments in the market, the current state of affairs, and what the future might hold for this crucial industry.

In recent years, the prices of palladium and rhodium, key metals used in catalytic converters, surged dramatically. This price increase resulted in significant profits for those involved in the recycling business. The catalytic converter market appeared to be an easy way to make money, with some individuals doubling their investments in a matter of weeks. Businesses rapidly expanded their operations, hiring more staff and investing in new equipment to keep up with the booming demand.

However, this lucrative market also attracted negative attention. The high prices of certain types of converters drew in thieves and even organized crime, leading to a surge in catalytic converter thefts. Vehicles parked on streets, in driveways, and in parking lots became prime targets for criminals looking to make a quick profit by selling stolen converters to unscrupulous buyers. This illegal activity not

only caused significant financial losses for vehicle owners but also posed challenges for legitimate recycling businesses, which had to contend with the influx of stolen goods entering the supply chain.

The industry’s explosive growth during these boom years created a highly competitive environment. Prices for converters could fluctuate wildly based on supply and demand dynamics, often leading to bidding wars. This intense competition made it difficult for smaller players to survive without taking significant risks. Despite the financial gains, the volatility and uncertainty of the market required businesses to be highly adaptable and quick to respond to changing conditions. As the market transitions to a new phase, the lessons learned during these boom years will be crucial for navigating future challenges and opportunities.

At a certain point, the catalytic converter recycling market hit a wall. Palladium, which had peaked at around $3,000, began a steep decline, eventually settling at approximately $950. Similarly, rhodium prices dropped dramatically from $27,000 to about $4,500. This sharp decline in prices had a profound impact on the market, disrupting the previously lucrative business environment. The once high margins that made the industry so attractive dwindled, leading to a challenging landscape for those heavily invested in the sector.

For over 40 years, Edmund Schwenk has excelled in the processing, refining, and manufacturing of precious metals. His career began with training as an assayer, analyzing ore and Dore’ using classical techniques. Advancing in the late 1980’s to Senior Vice President of refinery operations at Pure Metals Corporation, he oversaw hydro/pyro metallurgical refinery procedures, and fabricated high-purity sputter target products for defense contractors. As founder and Chief Executive Officer of Noble6 his expertise guided the company engaged in automotive precious metal recycling to success. He has been awarded two United States Patents as well as several overseas Patents. Recently, he directed the commercialization of a robotic process line for the recovery of Iridium/Platinum metals from spark plugs. Schwenk remains actively involved in the industry through Noble6 and their podcast, Noble6 Talks.

THE COMBINATION OF REDUCED PRICES AND LOWER PROCESSING VOLUMES HAS CREATED A TOUGH ENVIRONMENT, FORCING MANY TO REEVALUATE THEIR STRATEGIES AND OPERATIONS TO SURVIVE IN THE NEW MARKET CONDITIONS.

The significant price drop made it increasingly difficult for businesses to turn a profit. Many collectors and processors, who had expanded their operations during the boom years, are now struggling to stay afloat. The investments made in new equipment, additional staff, and larger facilities were based on the expectation of sustained high prices. As the market corrected itself, these businesses found themselves with high overhead costs and reduced revenue, leading to financial strain and, in some cases, business closures. The market’s volatility required rapid adaptation, but the extent of the decline caught many off guard.

Moreover, the decline in prices not only affected profit margins but also reduced the volume of catalytic converters being processed. With lower prices, fewer converters are being recycled, as the economic incentive for vehicle owners and scrapyards diminishes. This decrease in volume further compounds the difficulties faced by businesses in the sector. The combination of reduced prices and lower processing volumes has created a tough environment, forcing many to reevaluate their strategies and operations to survive in the new market conditions.

The industry has taken significant steps to address the influx of illegal activities that have plagued the catalytic converter recycling market. One of the primary strategies has been the implementation of strict Know Your Customer (KYC) and Anti-Money Laundering (AML) programs. These programs require businesses to thoroughly vet their suppliers and customers, ensuring that they are dealing with legitimate entities. By maintaining detailed records and conducting rigorous checks, companies can identify and block suspicious transactions, effectively disrupting the flow of stolen catalytic converters into the legitimate market. This heightened scrutiny has made it increasingly difficult for thieves and organized crime groups to offload stolen goods, thereby reducing the incentive for catalytic converter thefts.

In addition to KYC and AML measures, the industry has also fostered greater collaboration with law enforcement agencies and policymakers to enhance regulatory frameworks and enforcement mechanisms. By working together, industry stakeholders and authorities have been able to

close loopholes that previously allowed illicit activities to flourish. Enhanced penalties for theft and the illegal sale of catalytic converters have also been introduced, serving as a deterrent to potential offenders. These concerted efforts have not only helped to curb the illegal trade but also restored some level of trust and stability in the market. As a result, legitimate businesses are better protected, and the overall integrity of the catalytic converter recycling industry has been significantly strengthened.

Looking ahead, the catalytic converter recycling market is expected to stabilize, albeit at lower price points. Industry insiders predict that the prices of palladium and rhodium will continue to decrease, reflecting a shift away from the extraordinary highs seen in recent years. Rather than hoping for a return to the peak prices of the past, businesses must prepare for a new reality where palladium prices could drop to around $600$700 and rhodium prices might settle at $2,500-$3,000 over the next few years. This anticipated price decline is driven by various factors, including changes in supply and demand dynamics, technological advancements, and shifts in the automotive industry towards alternative materials and technologies. Despite these lower prices, there is a promising silver lining. The number of catalytic converters being recycled

is expected to triple by 2030. This substantial increase in volume offers a significant opportunity for the industry. With more converters entering the recycling stream, businesses can leverage economies of scale to offset the impact of lower metal prices. The projected growth in recycled units will stem from various factors, such as stricter environmental regulations, increased vehicle scrappage rates, and advancements in recycling technologies that make it easier and more cost-effective to process converters. This influx of recyclable material will help stabilize the market and provide a more predictable supply chain for recyclers.

Furthermore, the increased volume of recycled converters will create new opportunities for innovation and efficiency improvements within the industry. Companies that invest in advanced processing technologies and streamlined operations will be better positioned to capitalize on the growing supply of converters. By focusing on optimizing their processes and reducing operational costs, businesses can maintain profitability even in a lower pricing environment. Additionally, the growth in recycling volumes will support broader environmental goals by reducing the need for virgin material extraction and minimizing the overall carbon footprint of the automotive industry. As the market evolves, staying ahead of these trends and embracing new technologies will be crucial for long-term success in the catalytic converter recycling sector.

Metal prices for palladium and rhodium have seen dramatic rises and falls.

The boom period attracted thieves and organized crime to the market.

Current lower prices make it harder to turn a profit, requiring expertise in buying and processing converters.

KYC and AML programs are helping to reduce illegal trade.

The number of recycled converters is expected to triple by 2030, offering a silver lining for the industry.

To stay informed about the latest trends and insights in the catalytic converter recycling industry, visit noble6.com for comprehensive resources and expert analyses. The Noble 6 website offers in-depth articles, market updates, and guides to help you navigate the complexities of this dynamic field. Additionally, subscribe to our YouTube channel for engaging video content, where we break down industry developments, provide practical tips, and share interviews with leading experts. Don’t miss out on the knowledge you need to stay ahead – explore noble6 today and join our community of informed professionals! TB

Each year, the Automotive Recyclers Association (ARA) Annual Convention & Expo draws attendees from across the globe. This year’s gathering is a sure bet for professional growth and productive networking as ARA celebrates 81 years of representing the industry in beautiful Reno, Nevada. We hope you will join ARA on October 23-26, 2024, at the recently renovated Peppermill Resort & Casino!

As usual, ARA has put together an exciting lineup of speakers and topics, using feedback from last year and reviewing proposals submitted earlier in the year.

Throughout the day on Friday and Saturday, nearly 50 automotive recyclers and industry experts will be sharing their insights on topics that YOU, past attendees, have requested. Topics such as parts preparation and shipping, wheel stands, cyber security, EV battery handling, process standardization,

increasing efficiencies, 2024 market changes and leveraging opportunities in your control, and more! ARA also welcomes several new speakers this year that you have not seen elsewhere.

The always popular Tech Talks will continue, this year interspersed throughout the educational program to allow time for more attendees to take advantage of these focused timeslots dedicated to providing insight into new vendor tools or more efficient ways of using tools you currently have.

Attendees can benefit from the ARA Expo, a highlight each year and one of the largest in the industry worldwide. It offers the unique opportunity to interact with 80+ industry vendors face-to-face and learn about innovative products and technologies to enhance your business.

“The valuable insights from peers and the relationships built at ARA

Conventions are priceless” says Sandy Blalock, ARA Executive Director.

“Attendees have told us that they get a lot out of the educational sessions, but the biggest assets to attending are the long-term relationships built and the invaluable insight shared between industry colleagues – not only what does work, but what doesn’t as well! The return on investment of attending an ARA Convention is immeasurable.”

Since networking is so beneficial, ARA provides several opportunities to encourage further sharing of ideas.

Start your day off right at our daily prayer meetings hosted by ARA Lifetime Achievement Award recipient, Mike French (also founder of ToolboxTM).

Our international delegates will benefit from Global Best Practices session on Friday afternoon, and an International Networking Reception on Thursday night following the close of the Exposition. This provides an opportunity for conversations about

the similarities and differences in the market for recycled parts experienced by our friends from around the globe.

The Ladies of Automotive Recycling Association (LARA) will again host a LARA Wine & Cheese social prior to the Friday night Awards Dinner – we hope all ladies in attendance will join us for the special event.

Keeping in line with our location –this year’s theme for the Friday night Networking & Awards Dinner is Cowboy Casino Royale! Don your western wear, bling it out, be James Bond or somewhere in between – it’s your night, your choice! This popular event is relaxed and fun! Celebrate your colleagues as the 2024 STAR Award winners as are recognized.

Closing out this year’s event will be our new “Afterglow Party.” This is your chance to relax, share last minute tidbits with colleagues, enjoy some tunes from our DJ, dance and just enjoy the night.

As we enter into this convention, this marks the end of an era as ARA says “Thank you” to Executive Director Sandy Blalock and Meeting Planner Kim Glasscock as they return to the consulting sector – so come celebrate with them and thank them for their years of service and dedication to ARA!

WHY GAMBLE WITH YOUR FUTURE?

Increase your odds for future success! Come learn, network, and celebrate with us at ARA’s 81st annual Convention and Exposition AND YOU’LL BE THE BIG WINNER!

ARA’s 81st Annual Convention & Expo Sponsors

You, too, Can Be a Sponsor of ARA! Contact Kim@a-r-a.org to learn more!

PREMIERE: eBay Motors • Solera/ Hollander

DIAMOND: Amwins Program

Underwriters • Car-Part.com •

United Recyclers Group, LLC

SILVER: Copart

BRONZE: Cyclic Materials • EZ-Suite • OVB Holdings LLC dba OverBuilt • PMR, Inc. • VIN Match Pro

ASSOCIATE: PGM of Texas

Hotel Information

Go to https://book.passkey. com/e/50689190 to book a room!

ARA’s convention is being held at the Peppermill Resort Reno. Meetings, educational sessions and the Exposition will take place at the hotel unless otherwise noted. ARA Room Rates:

$129/night Peppermill Tower

$149/night Tuscany Tower

The ARA room block will close on September 14, 2024.

Should you wish to call the hotel to secure accommodations, you must indicate you are with the Automotive Recyclers Association Annual Meeting, code AARAC24 to receive our group rate. In an effort to reduce last minute cancellations and the liability this creates for ARA, all reservations will require a 1-night non-refundable deposit.

Note: No third-party company is hired to assist and/ or proactively reach out to auto recyclers in any way.

For full agenda, go to www.a-r-a. org/convention and follow links.

Opening Keynote: A Conversation with Keith Webster, J.D. Power

Recycler Keynote: Amber Kendrick

Is the U.S. Facing a Shredded Scrap Shortage

Tech Talks: Buddy Automotive/VIN Match Pro Hollander Car-Part eBay/Power DB

EZ-Suite

Smart Cycle, Auto Bid Live Hotlines

Battery Registry Panel

When, Not If: Strategies for Cyber Incident Preparedness

Mastering Extended Warranties: Crafting Effective Programs and Sales Strategies

The Do’s and Don’ts of Dismantling: How to Maximize Your Factory

CAR Technical Session: Safety & Stormwater Compliance

LARA: Wine & Cheese Social Networking & Awards Dinner

Afterglow Party

Interchange Contest

Carbon Credits Panel: Opportunities for the Recycler

Self-Service Panel: Hybrid Operations

Gold Seal Quality Assurance Program

2024 Market Changes and What’s in My Control

Opportunities and Resources for Today’s Independent Operator

MORE TO COME!

Among the automotive recycling industry are dedicated professional women who make significant contributions to the success of the business.

Afriendly face at the ARA Conventions and affiliate events for the last decade has been Julie Cain, sales representative for Buddy Automotive Innovations. She recently celebrated her 10-year anniversary with the company, for which she does marketing, journal publications, website updates and management, promotional products, regional and national shows. She is the customer service representative to everyone east of the Mississippi River.

“I am able to work from home in Dunedin, FL. Our corporate office is in Colorado, where owner Mike Lambert lives, and our co-owner John Johnson, Jr., lives in Connecticut,” she said. “Bid Buddy is an auction bidding software solution that uses your yard management data to buy cars. Inventory Buddy is a tablet you can use to whole manage vehicles and manage your existing inventory, and you can take pictures of each part or vehicle. In loose parts you can manage your existing inventory by stock numbers, parts tags, location, part codes and OEM

Coleen

is

of Speedway Auto Parts,

Cain Sales Representative, Buddy Automotive Innovations Manitou Springs, CO

number. It’s an easy-to-use, electronic data transfer system.”

Like many people, Julie came to her job through a circuitous route. She grew up in Howell, MI, not far from Lansing, where her father was a union electrician and her mother was a nurse. Julie graduated from Michigan State University in 1990 with a degree in horticulture. She married and moved to Yuma, where she had her children, Catie and Nick, who are now 26 and 23 years old. She moved back to Michigan, but then made the move to Florida after a vacation to Orlando. “I hate winters,” she said. “Let’s come here.”

Julie moved to Lakeland, FL and worked for Commercial Forms for three years and

went to school to learn computer software. She had taken a course at Michigan State –in DOS – and wanted to improve her skills. Then fate intervened.

“After my dad died, my mom, sister, and I planned a trip to Las Vegas. While we were there, as luck would have it, I ran into Mike Lambert of Buddy Automotive. We got to talking, and by the time I left Vegas, Mike had offered me a sales job. I can’t believe it’s been 10 years already.”

She might not have used her degree in horticulture, but Julie remains an avid gardener and has a nice orchid collection. Julie is an avid boater and diver, and belongs to the Freedom Boat Club, where members can use boats maintained by the club. She goes out boating most weekends. She has gone diving in Aruba, Tahiti and Bora Bora, Playa del Carmen, Cozumel, and Cancun in Mexico, and in the Bahamas. Her biggest underwater thrill, she said, was diving near a giant manta ray in Bora Bora.

Julie enjoys a balanced life mixing family, professional attainment, and the outdoors. Be sure to say hello the next time you see her at an auto recycling convention.

IL. She is a marketing and communications expert working previously with Acrelec Maerica, as well as Governors State University and other educational institutions. She has extensive experience building marketing plans and budgets for B2B technology companies within the food, telecom, and transportation industries.

“

Sandra Blalock Executive Director, ARA

As a woman working in the industry, I was the ONLY woman in my state running a professional automotive recycling facility and I thought it was important to find opportunities to empower women and encourage them to seek nontraditional roles in our industry. So often we see women filling backoffice roles rather than front-line roles that I feel they are more capable of handling than many would have thought. In fact, one young lady who was working for me eventually became my top salesperson when I recognized her skills in talking with customers and handling difficult situations.

LARA – Ladies of the Automotive Recyclers Association seeks to promote automotive recycling as a career choice to women and open pathways to enter and thrive in a fulling career within this business community. LARA also provides networking and educational events, usually held at the annual convention of the ARA. If you interested in participation, contact staff@a-r-a.org to find out more on LARA. You can also email Coleen Krause at ColeenKrause@comcast.net to be featured here in a future column of “Women of the Industry.” TB

LARA was created to give all working women in our industry a resource to share, collaborate and learn how to continue to grow in their companies and seek more opportunities for advancement in their careers in recycling. If you would like to learn more about LARA and its membership, please contact Sandy@a-r-a.org.

Over 50 travelers enjoyed this year’s adventure, chosen by ARA Immediate Past President, Shan Lathem. The group traveled on the Royal Caribbean Voyager of the Seas on a 13-day tour including: Barcelona, Spain; Nice, France; Rome and Naples, Italy; Malta, Turkey; Rhodes, Santorini, Mykonos, and ending in Athens, Greece. Coordinated by Lezlie Wright (Stadium Auto Parts), the vacation and networking trip was a huge success. Facility tours were graciously provided by Gruas Sant Jordi in Masquefa, Spain, and Reciclauto in Barbera del Valles, Spain, making this one incredible experience for our recycling family! TB

“Recyclers are like family, and from my experience this holds true no matter what continent we are on.” –SHAN

LATHAM

EXCERPT FROM FADRA’S FACEBOOK PAGE

What a memorable convention. And no, not just because of the overheated meeting room.

From new speakers Miranda Wroten, Michael Miskey and Chris Sauls to industry favorites Lee Worman and Sue Schauls, the educational lineup knocked it out of the park.

This was definitely Green Star Auto Recyclers’ time to shine. The Yard Tour and Barbecue was a smash; their staff showed the facility and service in their best light and owner Neal Harrow was the Proud Papa. His keynote speech on Friday helped us enter the often strange world of 1960s used auto and parts sales in New York and New Jersey, and Orlando in the early in 1970s, often hilariously.

Several people said they could have listened to his stories for much longer. And Green Star’s Vinny Priolo won two door prizes and the Special Membership drawing at the Intergalactic Gala.

The Cat Drive and Last Member Standing fundraisers brought in far more than expected, thanks to Jason Grady and RAS for the former and a standoff between Miranda Wroten and Brian Parrish of Foster Crushing that threatened to go on for an hour before we decided to award a championship belt to both of them.

Thanks to the FADRA leadership team, exhibitors and sponsors, whose support makes the work of the organization and education of members possible.

If you missed it, make sure to come to the newly renovated Sheraton Sand Key Resort in Clearwater Beach next July for FADRA’s 50th anniversary convention.

“We are visiting some of the best automotive recycling businesses in North America as we head towards Reno for the 2024 ARA Convention,” says Andy Latham, Salvage Wire. “See first hand how U.S. recyclers operate, the standards they work to, sales operations, vehicle storage, dismantling, parts distribution and more; meet U.S. auto recyclers in their businesses and network with a select group of U.K., European and U.S. auto recyclers on the trip. ARA Convention offers one-of-a-kind opportunities to discover new products and services, experience outstanding educational sessions, and network with colleagues.”

Latham says recyclers are meeting in Sacramento on Sunday, October 20 for three nights. The days will be spent visiting yards across the area including many full service and self-service yards along with a Tesla specialist. Also, they will spend time at Rancho Cordova

where around 30 recyclers operate from Recycle Road, Hydraulics Drive and Dismantle Court.

Evenings will find the group at a western themed steak and rib restaurant and at the Old Sacramento Waterfront and State Railroad Museum.

Recyclers will then travel to Reno on Wednesday, October 23, after visiting an LKQ facility and a truck dismantler on route to Reno for the ARA Convention.

For more details, contact : Terry Charlton, 0-783-673-8560, terry@charltonautoparts. co.uk, or Andy Latham, 0-771-087-7411, andy@salvagewire.com. All are welcome! TB

BY RECYCLERS FOR RECYCLERS

IMPORTANT: RENEW YOUR SUBSCRIPTION AT https://autorecyclingnow.com/toolbox/subscribe THIS IS REQUIRED TO CONTINUE RECEIVING THE TOOLBOX!

The Automotive Recycling ToolBox™ Edition delivers peer-to-peer articles with information that you would get while networking at industry events and trade shows. Our mission is to be current, educational and inspirational. We bring you:

• Educational and instructional “how-to” articles written by fellow recyclers, top industry professionals, leaders & trade show speakers.

• Information from providers of industry-related products and service you typically find at industry events and trade shows.

PUBLISHED 6 TIMES A YEAR AutoRecyclingNow.com/Toolbox

AUTOMOTIVE RECYCLERS ASSOCIATION OFFICERS

YOUR TOOLBOX TEAM

Published by Driven By Design LLC

EDITOR

Caryn Smith, Toolbox@a-r-a.org

ART DIRECTOR

Jessie Sharon

ADVERTISING SALES

Jay Mason, ToolboxAds@a-r-a.org

ARA OPERATIONS

EXECUTIVE DIRECTOR

Sandy Blalock

Automotive Recyclers Association Sandy@a-r-a.org

SENIOR DIRECTOR OF ASSOCIATE OPERATIONS

Jessica Andrews, Jessica@a-r-a.org

SENIOR DIRECTOR OF MEMBER SERVICES

Kelly Badillo, Kelly@a-r-a.org

VICE PRESIDENT OF STRATEGY AND GOVERNMENT AND REGULATORY AFFAIRS

Emil Nusbaum, Emil@a-r-a.org

DIRECTOR OF MEMBER RELATIONS

Vince Edivan, Vince@a-r-a.org

PROGRAM MANAGER

Kaitlyn Gatti, Kaitlyn@a-r-a.org

EVENT MANAGER

Kimberly Glasscock (615) 476-4501 kglasscock@awardwinningevents.com

CERTIFICATION CONSULTANT

Sue Schauls, Sue@a-r-a.org (319) 290-7843

PRESIDENT Nick Daurio Daurio Auto Truck Pueblo, CO nick@daurioauto.com

1ST VICE PRESIDENT Eric Wilbert Wilbert’s U-Pull-It, LLC Williamson, NY eric.wilbert@wilberts.com

2ND VICE PRESIDENT/TREASURER Shannon Nordstrom Nordstrom’s Automotive, Inc. Garretson, SD shannon@nordstromsauto.com

SECRETARY Sean Krause Speedway Auto Parts, Ltd. Joliet, IL sean.krause@speedwayap.com

IMMEDIATE PAST PRESIDENT Shan Lathem Cocoa Auto Salvage Cocoa, FL shan@cocoaautosalvage.com

ARA CONTACT INFORMATION

ARA Headquarters Manassas, VA (571) 208-0428 staff@a-r-a.org www.a-r-a.org

To reach readers with print & digital advertising, email ToolboxAds@a-r-a.org For editorial contributions, e-mail Toolbox@a-r-a.org or call (239) 225-6137