CELEBRATING 100 YEARS WITH A REIGNITED VISION

CELEBRATING 100 YEARS WITH A REIGNITED VISION

Breads | Buns

Cookies | Crackers

Cakes | Muffins

Pastries | Pizzas

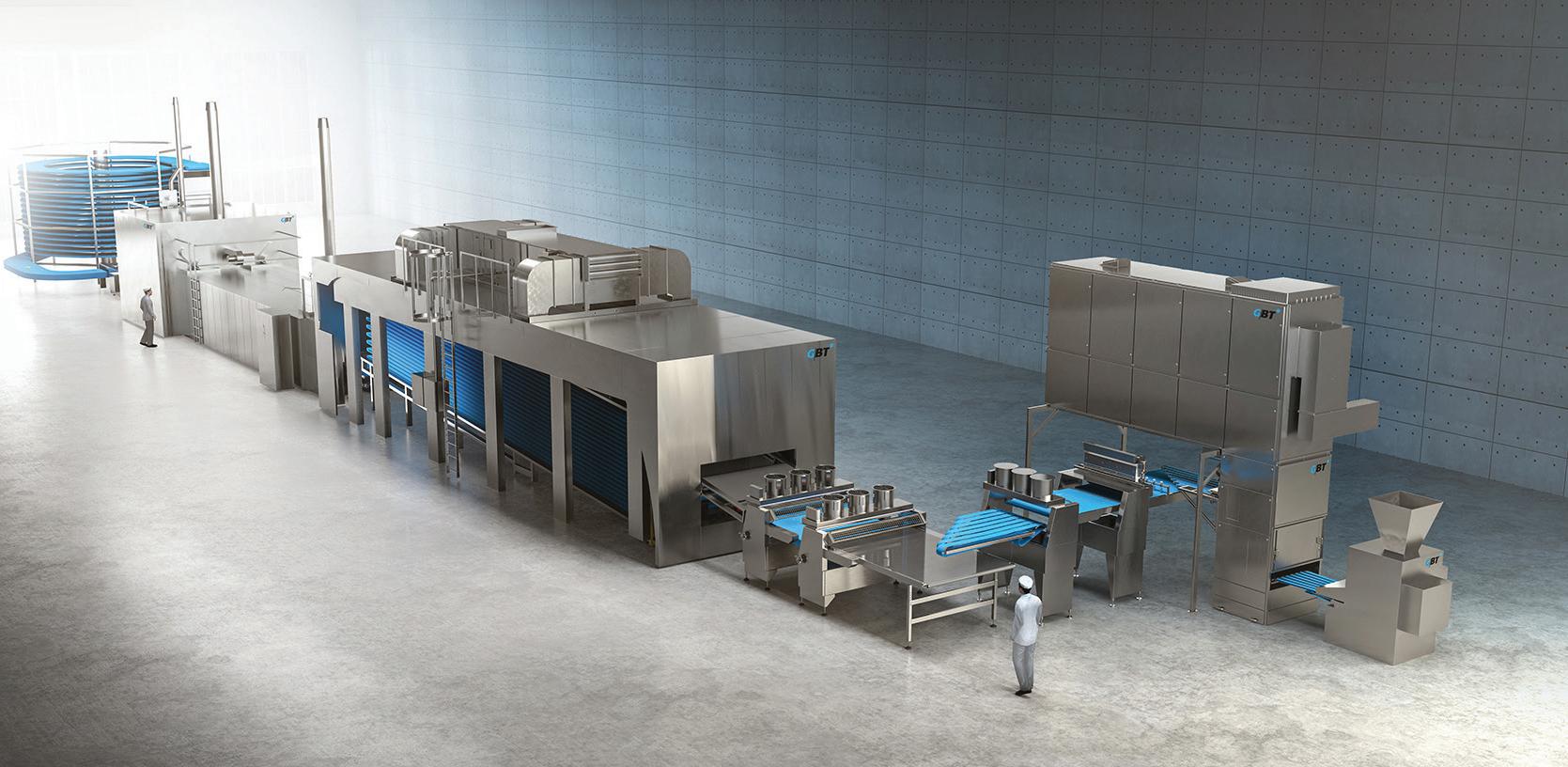

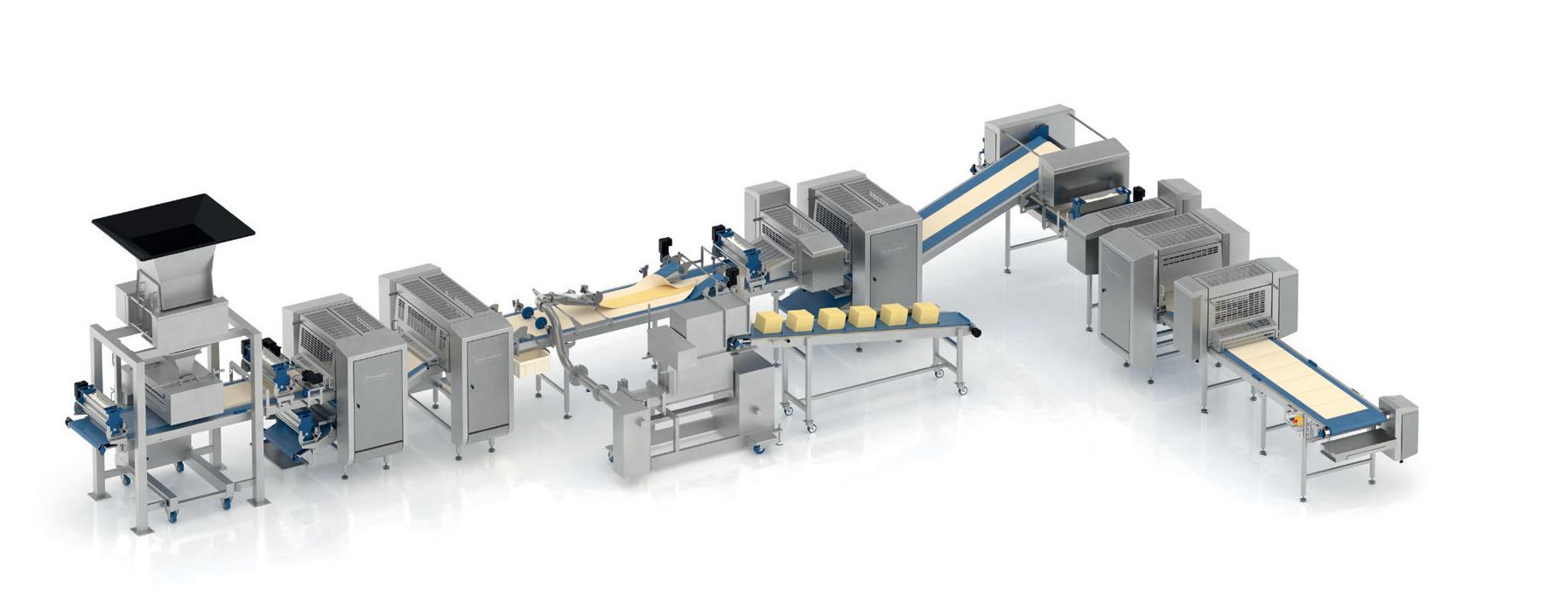

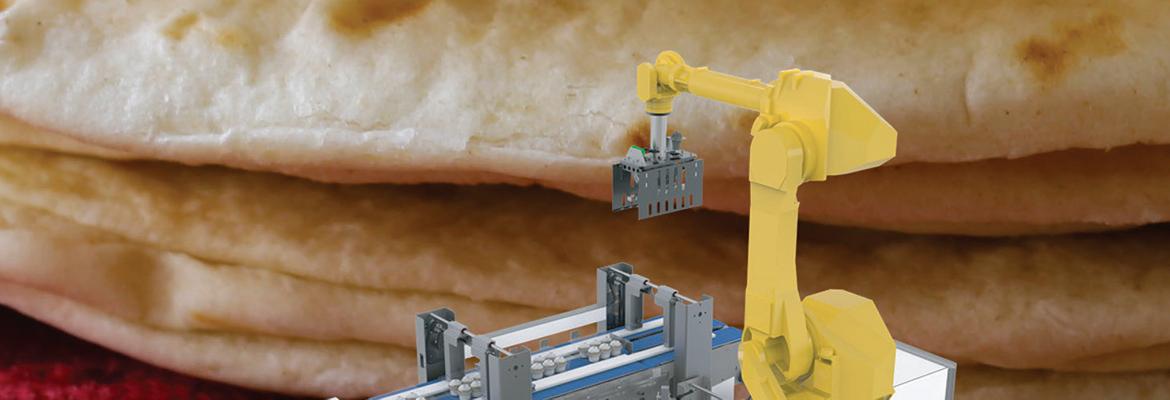

We welcome GBT GmbH Bakery Technology to our portfolio of complete baking solutions.

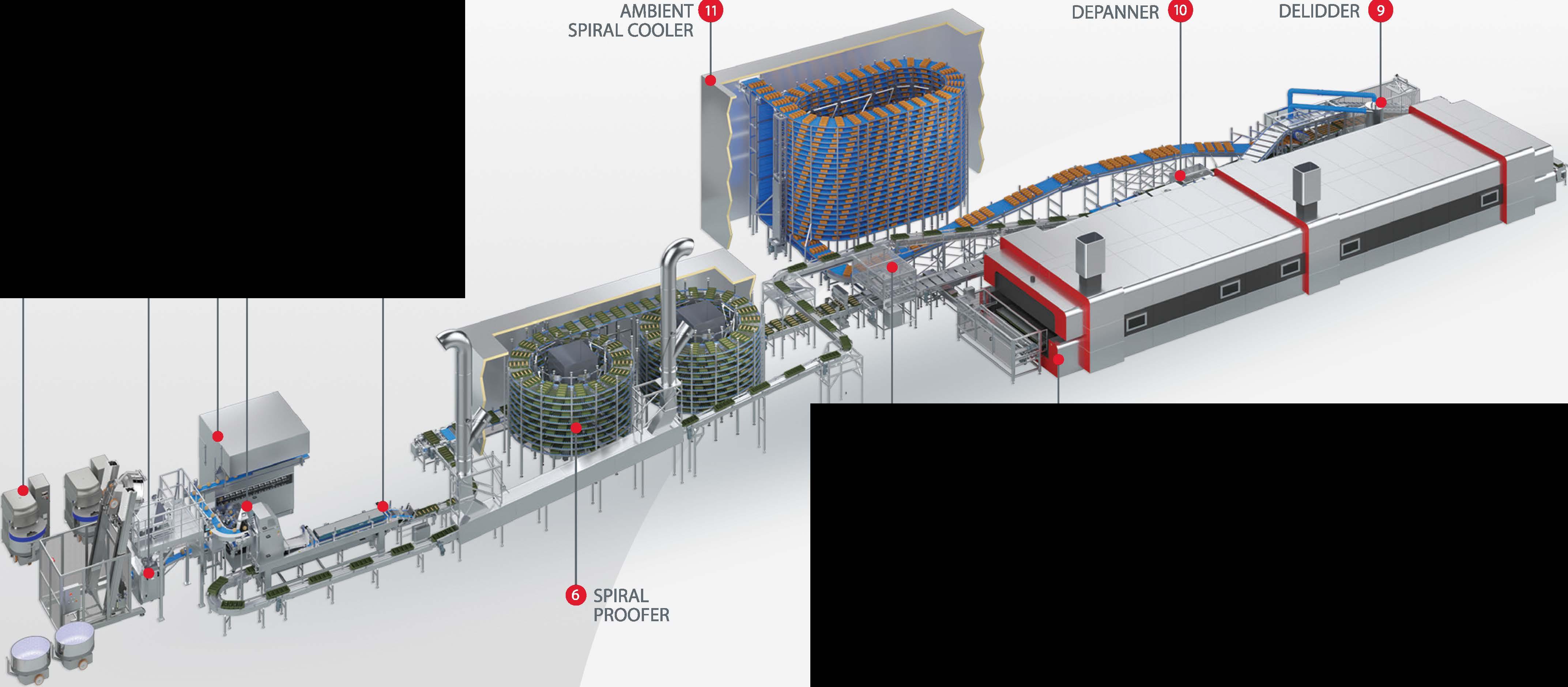

GBT baking experts have decades of experience in high performance, large volume product systems for artisan and flat breads, sweet pastries, pizzas and other baked goods. The team develops full baking system solutions with make-ups, proofers, tunnel ovens, and conveyors based on robust German technologies for large industrial bakers around the world.

Paul Lattan

President - Principal

Steve Berne Vice President - Principal

Joanie Spencer Director of Content - Partner

Paul Lattan

Publisher | paul@avantfoodmedia.com

Steve Berne

Director of Media | steve@avantfoodmedia.com 816.605.5037

Erin Zielsdorf

Account Executive | erin@avantfoodmedia.com 937.418.5557

Joanie Spencer

Editor-in-Chief | joanie@avantfoodmedia.com 913.777.8874

Mari Rydings

Editorial Director | mari@avantfoodmedia.com

Jordan Winter

Creative Director | jordan@avantfoodmedia.com

Olivia Siddall

Multimedia Specialist | olivia@avantfoodmedia.com

Annie Hollon

Digital Editor | annie@avantfoodmedia.com

Evan Bail

Associate Editor | evan@avantfoodmedia.com

Beth Day | Maggie Glisan Contributors | info@commercialbaking.com

Commercial Baking considers its sources reliable and verifies as much data as possible, although reporting inaccuracies can occur. Consequently, readers using this information do so at their own risk. Commercial Baking is distributed with the understanding that the publisher is not liable for errors and omissions. Although persons and companies mentioned herein are believed to be reputable, neither Avant Food Media nor any of its employees accept any responsibility whatsoever for their activities. Commercial Baking magazine is printed in the USA and all rights are reserved.

No part of this magazine may be reproduced or transmitted in any form or by any means without written permission of the publisher. All contributed content and advertiser supplied information will be treated as unconditionally assigned for publication, copyright purposes and use in any publication or digital product and are subject to

Baking ’s right to edit.

Engineered to the highest sanitary design standards, the SFA Artisan Bread Line by AMF Tromp delivers a wide range of artisan bread and roll products like baguettes, ciabatta, batard, and sourdough breads on a single, high-speed production line. For quick product changeover and simple sanitation, AMF Tromp's low-stress sheeting lines ensure shorter cleaning times, reduced water usage, and toolless cleaning options while delivering premium, artisan-style products.

42 Emerging Brand: Legally Addictive

22 Table Talk Pies: Iconic and Innovative

53

Critical Issues: Corporate Sponsorships

36 Bill Quigg: Loving Every Minute of It

61

Product Development: Portion Sizes

To meet consumer demand in the better-for-you space, you need an ingredient that offers more while still tasting great. Introducing Ancient Grains Plus™ Baking Flour Blend, our new gluten-free blend of quinoa, buckwheat and chickpea flours that’s balanced for PDCAAS1 to bring more quality protein than traditional wheat flours, plus a mild flavor designed for wide consumer appeal. Harness the power of alternative grains to make better-for-you products backed by our unmatched expertise. Together, let’s move food

See how “better-for-you” can be so much better at ardentmills.com/QualityProtein

JOANIE SPENCER Editor-in-Chief | joanie@avantfoodmedia.com

JOANIE SPENCER Editor-in-Chief | joanie@avantfoodmedia.com

WATCH NOW:

Past, present and future. Joanie Spencer talks about why the baking industry needs to rely on all three.

Sponsored by Bundy Baking Solutions.

At the end of February, we celebrated 100 years of the American Society of Baking (ASB) during BakingTECH, its annual event.

Historically, ASB and BakingTECH have been known for remaining rooted in tradition. But in recent years, a new generation has taken on leadership in the association and the BakingTECH planning committee, and they’re heading full-force into the future … while also respecting the past (the conference may be heading to Orlando next year, but the Baking Hall of Fame isn’t going anywhere).

Look around, and you’ll see this is where we are as an industry: Organizations are using time-honored traditions as the foundation for innovation.

It’s a theme you’ll see throughout this issue. A pie company springboarding innovation in its centennial year; the leader of the oldest family-owned cookie/cracker bakery modernizing workforce culture; iconic brands engaging in sponsorships in all-new ways.

Just a few years ago, the boomers and millennials were duking it out. Now, the millennials are showing Gen Z the ropes while boomers and Gen Xers calculate their succession plans.

While we live in a time of “innovate or die,” we also must accept that there’s no future without the past. The key, my friends, is balance. This is now a four-generation industry. Let’s take advantage of this priceless point in history and tap into one another’s experience, expertise and new perspectives … before AI does it for us.

®

Using Synova’s release agents and applicator along with a Pan Glo® pan service plan, your bakery can take control of oil usage and ensure pans are always achieving their best and longest release life, all while saving on costs!

Wide range of formulas designed for optimal release and available in allergen-free, clean label, gluten-free, GMO-free, and water-based options.

Improved application and release with Synova’s AccuTech Pan Oiler through advanced design and recipe-driven programming.

Pan Service Plans extend pan life, reduce oil usage, and save up to 30% versus buying new.

Partnering with the Bundy team means that, together, we are developing a plan to make your bakery as successful as possible. We stand behind our products and are committed to the success of every project and every bakery, every day.

937.652.2151

info@bundybakingsolutions.com bundybakingsolutions.com |

"Ourtrustisearnedthroughperformanceand Handtmann® hasearneditwithverypositive experienceswiththeirteam fromourinitialevaluationprocessthroughcommissioning andnowwithourongoing operation. Quick responsetimes foranyquestionorissuewithoutefficientproblem-solving ismoreofthesame. Handtmannmakesadifferenceforus."

“We know that 56 percent of our shoppers report they are still extremely concerned about inflation, so that means a lot of choices are being made about discretionary categories. We expect to see that throughout the rest of the year.”

Alex Trott | director of insights | 84.51° On consumer shopping behaviors during The Food Institute Podcast with Chris Campbell

“Vulnerability is a key factor in resilience.”

Kristen Spriggs | executive director | American Society of Baking During a keynote address for the Society of Bakery Women

“I think it will be a more robust workforce within the baking industry. It will be an industry that people will want to go into because of the longevity and the uniqueness.”

Liliana Economakis | division VP, customer development non-commercial | Aspire Bakeries

On the impact of the American Bakers Association’s strategic five-year plan for groups like ABA’s NextGen Baker

“Whether you are suppliers in this industry or bakers, you help feed our communities and feed America, and that really should get you going in the morning.”

Bill Bundy | president, global manufacturing | Bundy Baking Solutions During opening remarks at BakingTECH 2024

Still making huge

“Half the world gets 50 percent of their calories from grains, and if you’re in a developing country, it’s more than that.”

Julie Miller Jones, PhD, LN, CNS | Scientific Advisory Board member | Grain Foods Foundation From Season 10 of the Troubleshooting Innovation podcast

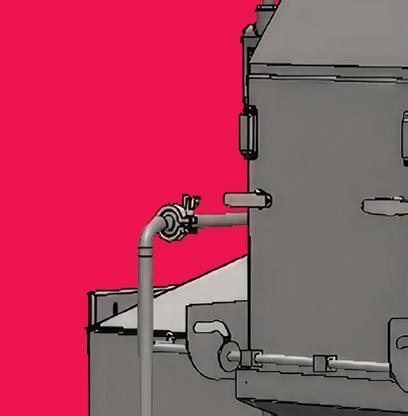

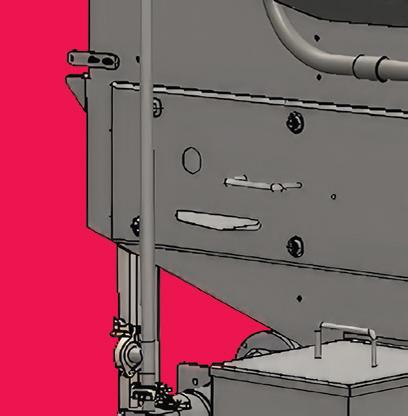

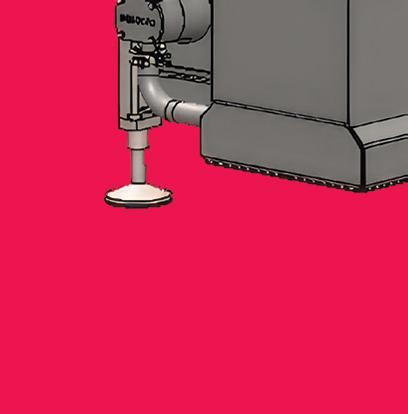

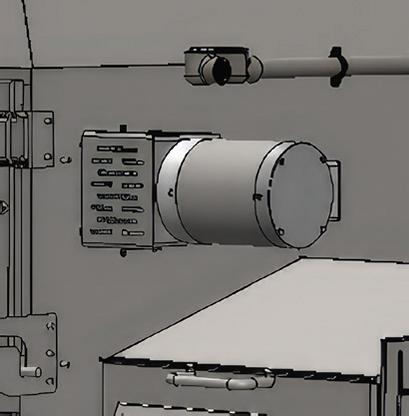

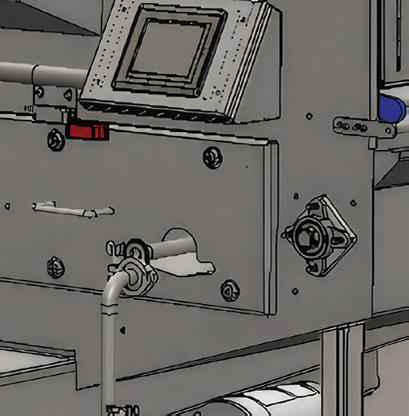

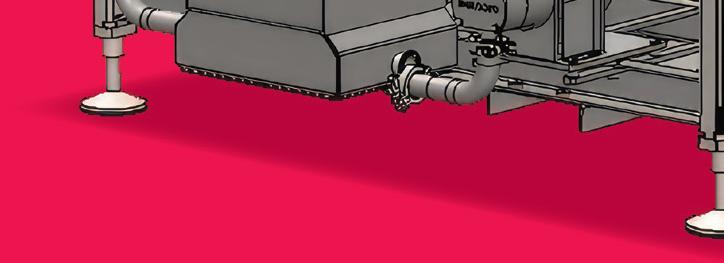

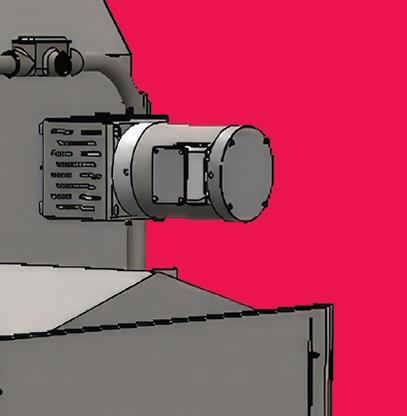

The Provident is the latest in depanner sanitary design and compliance!

Our depanner offers a complete washdown system for the conveyor, depanner and vacuum chamber; JSD auto vacuum control; remote low profile vacuum module; and works-in-a-drawer vacuum blower/motor accessibility.

The Provident is built to meet:

•FDA, USDA and ANSI 50.2 standards!

•BRC Global Standard for Food Safety!

• Vacuum chamber and conveyor system IP69K Washdown rating!

No one else in the industry offers one. Call us at 877.222.7929, we can show you the future of baking now!

“It won’t happen overnight, but regenerative agriculture can be a longer-term solution for restoring soil health.”

Clint Brauer | CEO | Greenfield Inc. Via LinkedIn

“Fear is the fear of loss.”

Kenyon Salo | motivational speaker

On how fear can impact trying new things

“Let’s continue to support today’s people who are giving a sense of purpose and value to the members of this beautiful industry that we all treasure.”

Catherin Herrera | director of baking technology | Bimbo Canada

Upon receiving the Rising Baker Award from the American Society of

Baking

“If you’re invested in your work and invested in the team with whom you ’ re working, you ’ re going to keep a safer environment, you ’ re going to pay more attention to what’s going on, and you ’ re going to make sure the baker next to you is safe.”

Josh Allen | founder | Companion Baking

Discussing

“This is an industry that finds solutions that are going to change the food system, so we’re the growth mindset industry.”

Angi Rassi | CMO

| Red’s All Natural Discussing the power of brand partnerships at Natural Products Expo West 2024

“I think today the most powerful brands are truly authentic brands. I think consumers want to connect with brands; they want to understand that there’s a real story.”

Alex Malamatinas | founder and managing partner | Melitas Ventures

Discussing how startups can scale up at Natural Products Expo West 2024

Fully electric, no compressed air

Rexfab’s Pan Stacker-Pan Unstacker is the perfect recipe-driven pan stacking or pan unstacking solution that handles up to 40 pans/minute in a compact footprint.

• Fast yet gentle vertical motion of the head, offers precise and accurate pan pick-up and drop points, translates into less jams and extends pan life expectancy.

• Reduces noiseemission.Itismuchappreciatedbyoperators.

•Using electromagnets allows to put « intelligence » in the system such as being able to use pans with different carbon content (regular, E pans, E2 pans). It allows to minimize jams before calling an operator by trying 3 times to lift pans before calling an alarm. Each of the 3 times uses a different magnetic force.

•Using electromagnets for both stacking and unstacking minimizes any type of metal shavings generated by the conventional « banging » of pans to release from a permanentmagnet.

•The system has no chain. Chains will stretch unevenly creating jams with stacks moving up or down. s. Chainswillstretchunevenlycreatingjamswithstacksmovingup ordown.

CONTACT US TO AUTOMATE SMARTER

—Lef t

When it started in 1924, Table Talk Pies produced bread by day and handmade pies by night. Today, it produces almost 300 million pies each year in various flavors and sizes.

The dichotomy between icon and innovation is an interesting one, especially for bakers. Classic brands are steeped in nostalgia and enjoy a deeply loyal fan base. But tradition can take sales only so far. To remain relevant and profitable, bakeries must capture the attention of new generations that may have different tastes and behaviors, and that often requires strategic ideation.

Worcester, MA-based Table Talk Pies has purposefully positioned itself squarely in the middle of this dichotomy. While the iconic brand prepares to celebrate its 100th anniversary later this year, it is also moving forward with a vision to grow beyond its traditionally pie-centric portfolio.

“People in the Northeast grew up eating mini Table Talk Pies in their lunchboxes,” said Isaac Long, the company’s president. “It’s a very nostalgic brand and item for people here, and we make our everyday pies really well. But for us to be successful, we’ve got to grow in a sustainable manner while making sure we don’t disrupt the core of the business, which is what we’re really about.”

That Table Talk Pies can focus on growth is a testament to its beloved status in New England. The bakery has had its share of struggles over the years, but it could be considered somewhat of a comeback kid.

Greek immigrants Theodore Tonna and Angelo Cotsidas started Table Talk Pies in 1924. They baked bread by day and handmade pies by night, eventually growing the business to the point they pivoted to just pies. The pair operated the company until 1965 when they sold it to Beech-Nut. After changing hands many times, Table Talk went bankrupt in 1984 and closed its doors. It looked like the end of an era.

The brand may have been down, but it wasn’t out. The next year, Tonna’s son-in-law Christo Cocaine, who had worked closely with his father-in-law at the bakery for 20 years, bought the company out of bankruptcy and pumped new life into it. Harry Kokkinis, Cocaine’s son, eventually took the reins as the third-generation president and successfully led the company for 20 years.

Financial challenges reemerged in 2022, and Table Talk was once again on the brink of bankruptcy. A group of private investors with an appreciation of the company’s rich heritage stepped in. Long joined as a strategic advisor and was named president in June 2023, succeeding Kokkinis, who transitioned into the role of executive chair of the board.

“It was a couple of tough years for everyone who was working here, especially during the pandemic,” Long said. “There was a lot of

pent-up energy for getting Table Talk back to the strength it had a few years before. With new investors backing the company and providing capital, we’ve been able to go after opportunities we see in front of us.”

Those opportunities include exploring untapped markets and distribution channels and ramping up R&D with the goal of expanding Table Talk product offerings beyond pies.

“[On day one], we started a five-year plan for the company,” Long shared. “We started thinking about where we wanted to go in the industry and what else was out there instead of just focusing on the orders we were making or how to get through the current pie season.”

With three production facilities in Worcester — Bowditch, Southgate and Gardner, named after the streets on which they reside — Table Talk sells almost 300 million whole dessert pies

“For us to be successful, we’ve got to grow in a sustainable manner while making sure we don’t disrupt the core of the business, which is what we’re really about.”Isaac Long | president | Table Talk Pies

and mini snack pies each year in all 50 states, Canada, Mexico, the Dominican Republic and other Caribbean nations.

It added a fourth production facility last year when it acquired then-bankrupt Patisserie Gaudet, a shuttered Canadian pie and tart manufacturer in the small town of Acton Vale, Quebec.

“We restarted production last fall,” Long said. “Right now, [the bakery] primarily serves major Canadian grocery chains. It has one line, which is our tenth production line. The reception has been pretty strong, and it’s helped us sell our mini pies in Canada because investing in a Canadian business has been a helpful talking point. And it’s a town of about 7,000 people, so having jobs back in the area is certainly helpful as well.”

Of the three Worcester facilities, the 40,000-square-foot Bowditch Street facility on the Worcester-Shrewsbury border is the oldest. It opened in 2015

and runs two lines, one for single-crust dessert pies and one for 4-inch mini snack pies. It is also the dedicated bakery for pies containing potential allergens such as pecans.

Five miles away in Worcester proper is Southgate, a 50,000-square-foot facility built brand new in 2017. Its three production lines are dedicated to 4-inch mini snack pie production. Cold storage and internal logistics are housed next door, and a new warehouse is under construction close by.

Just two blocks away from Southgate is the 135,000-squarefoot Gardner Street bakery, which opened in 2022. Here, production is dedicated to whole dessert pies ranging in size from 8 to 10 inches. On a typical day, three production lines create, bake, cool and freeze up to 150,000 pies per day. A fourth production line is slated to go online later this year.

“We make our own recipes for our dough formulas,” said Sydrick Speight, Table Talk’s production floor supervisor. “They have been in the family forever. People say it’s nothing to make a pie, but it takes a lot of work to make these pies. We make them from scratch, from the dough to the fillings. The pie line is our engine, and all the people making the dough and making the filling are our tires.”

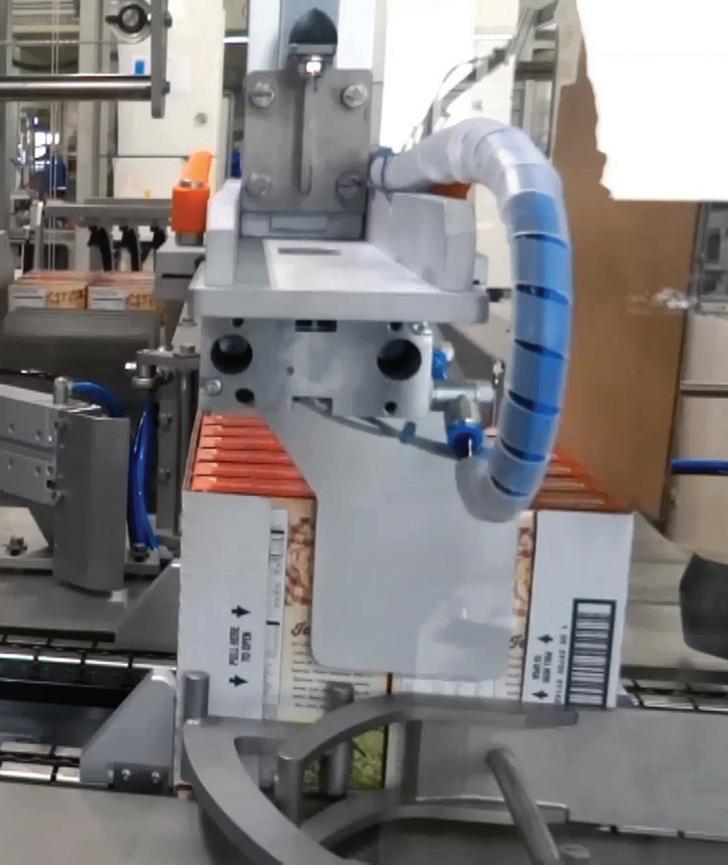

To optimize efficiencies and output at the new bakery, Table Talk invested in a state-of-the-art, 90-foot, custom-built C.H. Babb tunnel oven, Italian dough mixers, CBF Bakery spiral coolers, JBT spiral freezers and a Syntegon cartoner system that forms the pie boxes.

“Before, we had box openers, box closers, people who put the pies in the boxes, and packers,” Speight said. “Now we only have a person who feeds boxes to the machine, a person who puts pies in the boxes and a person who steps in when help is needed. The positions rotate every two to three hours so one person doesn’t stay in the same spot for too long.”

Investing in R&D capabilities is also part of Table Talk’s long-term strategy to move beyond “just pie.” A new, larger test kitchen and internal lab has opened up opportunities, allowing the R&D team to flex its creative muscles and explore ways to grow in — and beyond — the pie category.

“We now have the space to move very quickly on projects,” said Jeff Warren, Table Talk’s R&D technical director. “We also love to develop new products with our customers. Sometimes, the customer comes into the test kitchen to develop with us.”

Our line of pie production covers the entire production process, from mixing to make-up.

Convertible hand load or fully automated carton filling solutions that can give you endless capabilities.

Case packers, multipackers, erectors and sealers. All sized to integrate with our standard primary packaging equipment.

Advanced robotics with payloads exceeding 300 pounds - invaluable for case loading, palletizing and strach wrapping tasks.

The R&D lab is the sweet spot, where the iconic and the innovative meet.

“The core pie is still going to be apple, blueberry, cherry, pumpkin, pecan; that’s unlikely to change if you look at consumer behavior,” Long said. “Opportunity for growth isn’t in trying to sell more apple pies because the demand is relatively steady. As consumer preferences change, we have to diversify our business beyond the core. We have flour, sugar, shortening, ovens and freezers — there’s a lot of different products we can make on the same equipment.”

One such product is the new Brownie Lava Pie, Table Talk’s version of the popular molten lava cake. It features a pie crust base topped with a brownie and chocolate ganache.

“The Brownie Lava Pie is a great example of innovation,” Warren noted. “We can do so much more with this concept. We’re just scratching the surface.”

WATCH NOW:

Isaac Long shares how his team balances core offerings with new product development.

The bakery also recently released its first non-pie product offering — crumb cake — in blueberry, cinnamon and a New York-style, which features a heavier crumb, the preferred version of Northeasterners.

“With the crumb cakes, we wanted to move beyond the mindset of ‘just pies,’” Warren explained. “We worked with an ingredient company and found that for low capital investment, we can make anything in a square or different-shaped

“When considering a new idea, we always ask, ‘Is this a viable product that we can make, first, with quality, and second, with equipment we already have?’”

Jeff Warren | R&D technical director | Table Talk Pies

dish where we deposit batter or filling into it. The sky’s the limit.”

To reach that capstone, Warren and his team draw inspiration from many sources.

“We gather trend data from ingredient companies, flavor companies, Nielsen data and other sources,” he shared. “We also enjoy talking with our customers to learn about what trends they are seeing at the retail store level. And I love going into the store and seeing what trends are happening. Sometimes that leads me back to the lab, where I’ll start working on something. Sometimes, I just wake up, think of something and have to try it.”

LISTEN NOW:

Jeff Warren describes how he moved from oven attendant to head of R&D.

Possible new projects evolve out of those ideas as well as in formal ideation sessions at the leadership level and hallway conversations.

“There is a lot of creativity within the company,” Warren said. “When considering a new idea, we always ask, ‘Is this a viable product that we can make, first, with quality, and second, with equipment we already have?’ We talk about a lot of different factors before we move forward with commercialization. Sometimes we start with one idea, and during testing it turns out to be something so much better. That’s what I love about starting the process from the ground floor.”

The R&D team has been heavily involved in the party planning for Table Talk’s weeklong 100th anniversary

celebration slated for June, tasked with creating a special mini cake-pie for the local community.

“It’s half pie and half cake,” Warren said. “The bottom part is pie dough, then we deposit buttercream filling and bake a birthday cake with sprinkles on top of it. It’s definitely innovative and something you won’t see anywhere else. If it does well locally, we may expand it to our customers.”

While the new product will help kick off the June celebration, Table Talk intends to extend the recognition with other community events, including a “Pie-K” road race scheduled for September.

Whether it’s investing in upgraded equipment, professional training, or product development, one thing is clear: Table Talk’s employees are always top of mind.

“This isn’t a traditional private equity turnaround that’s driven by numbers,” Long said. “The benefit of spending a few months as a strategic advisor was I got to meet all the people and see the culture. Table Talk Pies is very people-centric, and the culture is a big part of this turnaround working. We are very much like a family, and that’s a testament to the leadership for the past 100 years, to have built and protected that. Many of the company’s employees live within short walking distance of the various facilities, and the area supports a vibrant immigrant community. In fact, nearly 10 different languages are spoken on the production floors.”

Table Talk has been fortunate in that it hasn’t experienced some of the labor issues that have plagued the baking industry in recent years. However, the inherent seasonality of the pie business comes with its own set of workforce challenges. During pie season, Table Talk must bring in surge labor to be able to run all lines and keep up with demand.

“We are always looking for skilled workers in the areas of production, industrial engineering and equipment maintenance,” Long said. “We are a very equipment-intensive business, and we are always looking forward to ensure we adapt to market trends and customer needs and maintain our position in the industry to keep the company around for another one hundred years.”

He views automated technology on the pie lines as one way to solve the labor challenge because it allows the bakery to scale up or down quickly and maintain and train its existing teams.

A MEMBER OF:

At CBF Bakery Systems, our focus is on delivering fully customizable, and expert engineered solutions aimed at reducing labor, space, and waste to optimize your bakery’s productivity.

Custom designed configurations providing continuously controlled separation of the product, pan, and optional lid flows at high-speed capacities.

Custom designed to handle pan or products with enhanced productivity, mobility, and synchronization to up and downstream equipment.

Custom designed to store, retrieve, and meter pans or lids with multiple configurations, long lifetimes, short product changeover times and no coating damages.

Proofing,

Custom designed to emphasize o e pha z a compact footprint, reduced m manual labor & more efficient production process with an advanced Climate Control System.

Adding data-driven, robust tools to help proactively manage the business and the investment in a new ERP system will also help.

“Real-time visibility and transparency will assist in automating our batch processes and, in turn, drive more accuracy and consistency for our production teams,” Long added.

Table Talk’s new leadership team knew it would take more than a significant capital investment in facilities and R&D to revive the brand and fulfill its vision. They knew it would also require employee buy-in and a significant culture change. They were prepared to tackle both.

“When you look at where Table Talk Pies was a year and a half ago, the thing missing was a cohesive strategic vision and a coalesced management team to provide people with a direction,” Long said. “We needed to align the energy and the efforts of people who have a common vision. People can get on board with a unified vision when it makes sense to them.”

It’s that vision — and a renewed focus on culture — that has placed Table Talk Pies squarely in the middle of iconic and innovative.

“Everybody’s here to do the same thing,” Long said. “When you get everyone marching in the same direction, it becomes culture. People understand it, and it becomes normal. The challenge was a culture overhaul. Today, the company is vibrant, and people are excited.”

Vibrant and excited … two words that describe exactly what’s needed to celebrate the past, present and future of a beloved brand. CB

Across its three US production facilities, Table Talk Pies produces about 300 million pies every year. The Gardner Street bakery, the company’s newest and largest facility, features some of the latest investments in automation. Below is a list of suppliers that will keep pies, crumb cakes and new products coming for another 100 years.

Bearing Specialties conveyor parts

Colborne Foodbotics pie machines

W.T. Beck kettles and filling tanks

CBF Bakery Systems oven loaders/ unloaders, spirals cooling systems

C.H. Babb tunnel ovens

JBT Corp. spiral freezers

MTG Inc. conveyor frames

Northstar Refrigeration freezer compressor system

Specialty Packaging wrappers, tape machines

Syntegon cartoner system

Videojet Technologies ink jet printers

Monitor key metrics used to identify changes in equipment operating parameters.

Maintain consistent belt tension between sanitation cycles.

Remotely monitor multiple spirals at different plants in real time.

Experience first-hand how ingredient automation, dough technology and process management from the Coperion Food, Health & Nutrition brands can benefit your needs. As the industry leaders in ingredient handling and mixing technologies, learn how we can help with your industrial automation needs.

Anyone who knows Bill Quigg is either a friend or a family member. But make no mistake: His circle is not small.

“I’m so fortunate to do what I do,” Quigg said. “This is a great industry, and there are just so many amazing people I’ve gotten to know over the years. It’s really fantastic.”

Quigg is not only president and CEO of Richmond, IN-based Richmond Baking Co. and its subsidiary, Versailles, KY-based More Than A Bakery, but he’s also the fourth generation of leadership in the country’s oldest family-owned cookie/ cracker bakery. While his roots run deep in the industry, he’s not afraid of doing things a little differently.

That comes from a foundational work ethic that was instilled by a combination of nature and nurture.

“This is something I’ve wanted to do since my dad would take us to the bakery on the weekends,” he recalled. “I was just a little kid, and I was already begging him for a job.”

That chance came the summer he was 12 years old and the code date function on the cartoner broke. The shift needed someone to manually stamp the boxes before they went onto the production line.

While some kids balk at working summers in their family business, Quigg was thrilled.

“I was working for minimum wage, and I was loving every minute of it,” he said. “That’s what set the die for me. I knew then it was what I wanted to do.”

Growing up in the bakery, personally and professionally, Quigg eventually embarked on a journey to take the company in a new direction … south to Versailles. Richmond Baking was expanding in terms of

“The best thing we can do for the industry is enhance communication and knowledge sharing. What are our strengths as individual organizations? How do we accentuate those separately while working together to make the industry stronger?”

Bill Quigg | president and CEO | Richmond Baking

capacity, and when the company landed on 112 acres that formerly housed a horse ranch, Quigg saw something more: a vision for More Than A Bakery.

This four-generation family bakery had a values-driven foundation, and Quigg has used those values to create a modern culture unlike anything the industry had ever seen.

“Creating More Than A Bakery — even the name — was a challenge,” he said. “It was a challenge to become more than what anyone else would expect, what anyone else would have as a job or even a career. We realized we had a clean slate to make this culture whatever we wanted it to be. It was a challenge for us, internally. Could we create a culture that’s unexpected and different? Could we challenge the norms?”

Shortly after the More Than A Bakery operation started up, Quigg questioned the traditional notion of work shifts and instead launched “school shifts,” allowing employees — Family Members, as they’re called in Versailles — the option to work 8:30 a.m. - 4 p.m., enabling parents to get their kids to and from school. It’s especially helpful for single working parents, a demographic that often walks a tightrope between work and childcare.

“A lightbulb came on,” Quigg said. “We realized that shift constraints were essentially excluding a whole group of awesome people. This change allows people to live their lives outside of the bakery and still feel happy and satisfied at work.”

Quigg’s propensity to lead differently comes from a simple philosophy: Life is short.

“We are only given so many heartbeats; that’s all God’s given us,” he said. “Let’s help everyone make the best of those.”

That philosophy is not just a way to cultivate belonging in the workplace. The idea that life is short impacts how Quigg thinks about the operation, including quality and food safety. Food manufacturing involves a level of risk that must be mitigated, every minute of every hour of every shift. By treating employees as family members — and, more importantly, human beings — Quigg believes it fosters transparency that perpetuates a culture of food safety and operational excellence.

“Not only do we genuinely care about the people who work here, but they also genuinely care about us and this place,” he said. “They care about their jobs, and they care about the products and our customers. And we want to make sure that when challenges occur, we’re open to talking about them. Rather than making people feel like they’re ‘in trouble’ for something, we talk through it and figure out solutions together to ensure our food is up to quality standards and as safe as it possibly can be.”

Quigg is quick to credit his father, Jim Quigg, for the values he instilled in him not only while growing up, but also throughout his career. They have played an integral role in one of his most important tasks, writing and maintaining the company’s mission, vision and value statements, which he’s been responsible for throughout the bulk of his career.

These family values go beyond the direct lineage from father to son. The best leaders surround themselves with greatness, and that is how Quigg views his wife, Felicia, who is VP of family pride for Richmond and More Than A Bakery, and his three daughters.

“While Dad had a tremendous influence on me, the family Felicia and I have built around our daughters, Cailyn, Lorelei and Brecklyn, that’s my support structure,” he said.

The instillment of core values came full circle a few years ago, when Quigg chose to step back from the statements and put them in the hands of the Richmond Baking leadership team. It was time for the team to collectively script the values they found to be the most important to them and for the company.

“I told them I would have ‘veto power’ because I didn’t want the company to have values that I didn’t personally stand for,” Quigg said. “And in the end, we came up with a set of values we could all stand behind, and I didn’t veto a single one. In fact, they wrote the value I wanted most — integrity — before I even asked for it.”

Just as his father had taught him integrity for the business, he has passed that on to the current leadership team.

Improve your product line with GEA Bake Depositor MO: a whole new design studied to reduce the pneumatic air consumption up to 83% from the previous model, while dosing or injecting according to the chosen configuration.

Having that alignment has allowed Quigg to let go of daily tasks and use his role as president and CEO more holistically. With a trusted team in place, he can work on dozens of big-picture items that require collaboration and creative thinking.

There’s a murmur throughout the industry that Quigg is a company president who doesn’t use an office, and stories circulate among More Than A Bakery Family Members about the “good guy” who operates more like Undercover Boss than a member of the c-suite.

The reality is that Quigg wears the same uniform as the entire workforce, and he does his best thinking in More Than A Bakery’s open spaces like the break area. In fact, during lunch breaks, he can usually be found noshing on a sandwich at the tables with the rest of the bakery team.

LISTEN NOW:

Bill Quigg describes an organizational structure that resembles the rings of a tree trunk.

“The most important thing I can do is interact with Family Members and show them I’m someone they’d want to work with,” he said. “The more people can get to know me, the better off everyone is. That can’t happen if I’m holed up in an office. I like plopping down in the break room and eating lunch or having a snack with everyone because they’re the most important people here. It’s all about being real with people and establishing authentic relationships, rather than a transactional employer-employee relationship.”

Quigg is devoted to his company’s people, products and customers, but

it’s more than that. He’s also devoted to the industry, taking on leadership roles throughout the cookie and cracker production space. Quigg is a former board president for the Cookie and Snack Bakers Association (CASBA), for which his family’s business has played an integral role for decades, and board chair of the former Biscuit & Cracker Manufacturers Association (B&CMA), which merged with the American Bakers Association (ABA) in 2016.

He was also the first baker member of the BEMA board of directors.

Now, Quigg is taking the next step in his lifetime of industry service as ABA board chair, a two-year term that begins this month. For Quigg, the way to ride the momentum ABA has been building for the past two years is by bringing lessons from his days with CASBA and B&CMA. It’s all about collaboration.

“There are a number of great organizations in our industry,” he said. “The best thing we can do for the industry is enhance

communication and knowledge sharing. What are our strengths as individual organizations? How do we accentuate those separately while working together to make the industry stronger?”

Inside the Versailles bakery, Quigg’s teammates are Family Members, and in the industry, his colleagues are also his friends. That’s because for him, it always begins with finding common ground.

The strength of associations comes from the ability to set competition aside and work for the good of the industry, and that is foundational for Quigg in his tenure as ABA board chair and his hopes for the industry’s future.

“Collaboration makes sense,” he said. “It’s all about being stronger and thinking about the good of the industry. I think my background — not only from my business but also from my family and what my parents have taught me — has prepared me to understand and value differences and properly accentuate them for the betterment of our industry.” CB

QUICKLY, AND WITH GENTLE HANDLING.

BROUGHT TO LIFE WITH SCHUBERT.

Fresh, crispy baked goods are delicious, But they tend to crumble during packaging. Our solution: gentle robotic hands and a 3D scanner to monitor quality. In a machine that adapts to a wide variety of products in no time at all, Packaging them fully automatically in sustainable materials. In line with our Mission Blue: Only if it’s good for the planet, it’s good enough for our customers. www.schubert.group/en/bakery-packaging/

How

Entrepreneurship is not a linear path. It’s often full of unexpected circumstances, and for some entrepreneurs, it takes an unforeseen turn of events to bare the next opportunity. For Laura Shafferman, co-founder of Asheville, NC-based Legally Addictive, the story of her cracker cookie brand and entrepreneurial journey began bound in legal tape.

Shafferman worked in real-estate development marketing in New York City for more than a decade until she was laid off in 2015, a situation that triggered a non-compete agreement that locked her out of the industry for a year.

“Losing my job to no fault of my own and being held to this non-compete — that they would not let me out of — I was like ‘What am I going to do with my life?’” Shafferman said. “After over ten years in an industry, I’m just supposed to all of a sudden change industries? It’s not very easy to do that.”

During that time, an opportunity opened the door to an industry she had not initially sought out: food. A friend who ran Etsy’s holiday markets in New York City — multi-day events in Chelsea and Williamsburg featuring handmade goods — encouraged Shafferman to sell the cracker cookies she often brought to parties. Shafferman agreed to try selling them at the event, and the first domino fell for her new venture.

All photos courtesy of Legally Addictive

While simple in concept, Legally Addictive’s products are elevated through unique spices and toppings.

All photos courtesy of Legally Addictive

While simple in concept, Legally Addictive’s products are elevated through unique spices and toppings.

“The holiday market was a huge success,” Shafferman said. “The cookies sold out the first and second day. Now that I’ve been in business for a little over six years, I know that’s not necessarily proof of concept. But it was enough to give me the confidence to go out and try to make this into a business.”

While the type of cookie Legally Addictive makes is not a complicated baked good — saltine or graham crackers, toffee and chocolate are the primary ingredients — Shafferman found that no one was producing them on a commercial level. This discovery gave way for her to enter this niche category.

“I figured out that nobody was actually making this product anywhere else, or selling it with shelf stability, so I was like, ‘I’m going to make it my mission to create a shelf-stable version of this product using better ingredients,’” she shared.

Shafferman’s early success sparked her confidence to go all in on her new venture, even though she had no experience in the food space. Yet, in contrast to the 9-to-5, spreadsheet-filled grind she’d been living, the creative opportunities it offered were too good to pass up.

“In the beginning, this was really such a microbusiness powered by my credit card,” Shafferman said, revealing she worked five jobs to keep the business afloat in the early days of Legally Addictive. “We’re talking really early on when my only expenses were ingredients, raw materials, rent, insurance, packaging — the basics.”

Business went on like that until 2017, when Shafferman met her co-founder and future husband, Seth Eisman, a former television producer for programs such as Chopped

While the type of cookie Legally Addictive makes is not a complicated baked good ... Shafferman found that no one was producing them on a commercial level. This discovery gave way for her to enter this niche category.

“Between his organizational skills and my creative side, this was a perfect match,” Shafferman recalled. “It couldn’t have been better complementary skills.”

The pair was scrappy in building the brand, operating on a skeleton budget and not paying themselves for several years. The name came to Shafferman in the weeks ahead of the Etsy holiday market, and she established the LLC in 2015. She shared that believing in the concept played a major role in keeping the business in motion.

“Entrepreneurs have to be a little bit delusional in that you have to believe that whatever idea you have is going to pan out, and in order to move forward, there’s no other choice [but to believe that] because the amount of businesses that fail very quickly is extremely high,” she said. “To have that belief that you can make this happen and go against the odds is incredible.”

Legally Addictive’s financing has since extended past what Shafferman called “credit card dreams” with a Small Business Administration loan. The brand also recently participated in Mondelez International’s SnackFutures CoLab, a 12-week incubator program that included a $20,000 grant. Legally Addictive is currently also raising outside capital.

While building a business requires faith and tight purse strings at the start, the payoff comes in more than dollar signs.

“Looking back, this was a wild and challenging time, and it was also really exciting getting the product in the hands of people for the first time, and the reaction they would have gave us a lot of encouragement,” Shafferman said. “That positive, immediate feedback was extremely gratifying, and I absolutely loved it.”

Scaling up production is an ongoing process that is constantly evolving. In 2018, as output increased, Shafferman nabbed a cozy 900-squarefoot facility in New York City with 300 square feet of production space.

In July 2022, the brand moved to a 6,800-square-foot space in North Carolina to scale the business. The larger space includes more ovens, a copper toffee boiler, and a large tempering machine that automates the process of enrobing chocolate as well as dispensing sea salt.

“We started figuring out this process early on, but it wasn’t until we moved down here that we realized we could really do something about automation and scaling in this space” Shafferman said.

Whereas the homemade recipe may use a simple syrup-like mixture for the toffee and chocolate chips, Legally Addictive’s version elevates the cookie by using real toffee, ethically sourced chocolate and sea salt.

“… It was also really exciting getting the product in the hands of people for the first time, and the reaction they would have gave us a lot of encouragement.”

Laura Shafferman | co-founder | Legally Addictive

Given that Shafferman’s main goal with Legally Addictive is to make a product that tastes good, improving the base ingredients for the cookies is a small change that makes a major difference.

“Our name is pretty bold,” she said. “You have to have something that tastes really good to have a name like that, so we try to over-promise and over-deliver.”

Each Legally Addictive flavor name and profile has a story behind it, from the flagship O.G. to Surprise Party. The brand collaborated with Spicewalla, a North Carolina spice brand, to create spice-based variants Chai Masala and Mexican Hot Chocolate. The Everything variety, which has a cult following and features garlic and onion, stemmed from Shafferman’s commercial kitchen days when she found inspiration in cream cheese-filled croissants topped with everything bagel seasoning.

Legally Addictive’s reach spans nationwide and includes a contract with KeHE Distributors to supply its biggest customer, Foxtrot Market, as well as launch into premium grocery this year. The brand is looking to grow in other channels such as specialty grocers, gift shops, airports, hospitality, retail stores and direct-to-consumer.

“Our name is pretty bold. You have to have something that tastes really good to have a name like that, so we try to over-promise and over-deliver.”

Laura Shafferman | co-founder | Legally Addictive

During the brand’s early years, Shafferman focused on distributing Legally Addictive in local NYC stores. Now, the company’s distribution is coast-to-coast.

“We’re in stores all over the country, but most of them are in the Midwest, the South and all over the East Coast,” she said. “We have a smattering on the West Coast but not as many due to shipping [constraints].”

Now located in the South and with a much wider reach, she’s intent on saturating the Southeast with Legally Addictive.

“Southerners are the perfect customer,” she said. “They are people who love to entertain, and they will never show up at your house without a gift. I was raised in the South, and I love that culture.”

Beyond the perks of southern hospitality, expanding in this region makes good business sense in terms of shipping. Given the company’s North Carolina operations, products ship within two days to about 50% of the country, which is critical during the summertime when chocolate is involved.

As the brand celebrates its six-year anniversary, Shafferman eyes a future where her cookies find their place next to household brands like OREO and Tate’s Bake Shop. Once Legally Addictive is in the specialty grocery channel for a couple of years, the plan is to

expand into more conventional grocery stores and anchor with a retail partner.

“We eventually would like some help with the company, somebody who really can take this to the next level,” Shafferman stated.

When it comes to her greatest takeaway in building Legally Addictive, Shafferman’s main insight is a nod to Nike’s signature slogan.

“I still have to remind myself every single day that things don’t have to be perfect, I just have to get out and do it,” Shafferman said. “As women, sometimes we can be extremely hard on ourselves and we think that everything has to be perfect before it goes out, and it doesn’t have to be. You have to keep at it, you cannot stop.” CB

Honey is the sweetener of choice in the United States.

63%

of consumers say honey positively impacts their food purchasing decisions.

37%

of consumers say they would spend more for products with honey.

Honey is the preferred sweetener in:

• Snack Bars

sweetener in: products with honey.

35%

of

bee friendly

•Sweet Baked Goods

• Sweet

•Ice Cream & Frozen Yogurt

• Ice

•Chocolate Confections

• Chocolate

•Flavored Water

• Flavored

And, 21 other categories!¹

79% of consumerswillbuyaproductthatsupports

48% of consumers willpaymoreforaproductthatpromotes

bee friendly causes²

Contact keith@honey.com to learn more about formulating products with honey.

As a global leader in the food industry, Puratos USA collaborates with commercial bakers, retailers, foodservice companies and distributors to develop the on-trend and innovative products consumers want.

Puratos has the knowledge and expertise to help mid- and large-size baking companies navigate evolving consumer behaviors, complex regulatory requirements and labeling demands, with customized solutions that help their businesses stay competitive, relevant and moving forward.

At Puratos, R&D experts continuously explore emerging consumer trends, ingredients and technologies, always looking for ways to push the boundaries of what’s possible for customers.

From commercial bread and cake enzymes to fruit fillings and clean label alternatives, Puratos offers a full range of ingredient solutions to help commercial bakers create one-of-kind, high-quality products that are cost effective and easy to manufacture.

• Acti — This range of clean-label, enzyme-based solutions can help extend the natural freshness of muffins, cake donuts, brownies and other baked goods. They can also decrease batter cost by reducing the need for expensive ingredients such as eggs.

• Intens Fresh — This freshness enzyme keeps breads fresher nearly 50% longer than previous technology and nearly four times longer than breads without freshness enzymes.

• Intens Puraslim — This enzyme-based innovation offers a solution for reducing expensive fat in recipes. It imparts a soft texture and short bite for the ultimate eating experience.

• Topfil and Vivafil — These bake-stable fruit fillings can help extend the shelf life of baked goods. They come in a range of flavors, textures and formulations, and are available in pouches, pails, drums and totes.

Whether it’s clean label requirements, no-no lists or ingredient bans, Puratos’ experts understand the impact each can have on commercial bakers. They help customers make the best decisions to address consumer needs when navigating a complex regulatory environment.

Puratos’ seven Innovation Centers in the US feature state-of-the-art manufacturing equipment and dedicated spaces for bakery, sweet goods and chocolate innovation. Through decades of manufacturing and technology investments, the company has refined its processes to ensure consistency at scale for every batch. Bakers and food executives can explore their creativity and trial new solutions alongside teams of expert researchers and technical advisors.

To support its growing customer base, Puratos plans to open a dedicated bakery glaze plant on its Pennsauken, NJ, campus by 2025. It will be the first such plant in the US. The company recently expanded its West Coast operations to include a new manufacturing line at its Rancho Dominguez, CA, facility and relocation to a state-of-the-art warehouse and distribution facility in Gardena, CA.

Puratos is relentless when it comes to collecting fresh, in-depth consumer trend data that gives bakeries a global perspective on where the food industry is now … and where it will be tomorrow. Companies that partner with Puratos can tap into this data to develop their next product innovation.

Taste Tomorrow , Puratos’ proprietary research program, is the largest consumer insights ecosystem in the world. The company engages several sources to compile its Taste Tomorrow data, including:

• A quantitative study conducted in 50 countries with over 20,000 consumers

• Qualitative research with foodies and industry experts

• Global and local consumer behaviors; attitudes; and choices in bakery, sweet goods and chocolate

• Consumer conversations tracked across social media, search engines and blogs using always-on semantic artificial intelligence for a real-time view of what’s trending, just emerging or going viral

With products and services in more than 100 countries, Puratos has its finger on the pulse of scaled-up innovation.

More flexibility for continuous processes es

PERFECTLY PREPARED DOUGHS FOR FERMENTATION

¡ Consistent acidity, PH value and temperature quality

¡ Reliable weighing and perfect dosing

¡ Simple maintenance due to modular design

¡ Optimal production of pumpable starters and sourdoughs

www.zeppelin-systems.com/us

For bakeries looking to increase brand awareness, attract a new consumer demographic or maintain a loyal fan base, engaging in a corporate sponsorship can be an effective strategy for companies of all sizes. But it’s not as simple as signing on the dotted line and sending a check. These types of business-to-business relationships need time to reach their full potential and require thoughtful preplanning and a commitment to playing the long game.

Paul Zindrick, VP of corporate sponsorships for Brand Activation Maximizer (BAM), a sports and entertainment marketing agency, advises companies considering a corporate sponsorship to think about three things.

“First, how much do you want to spend for the sponsorship and activation?” he suggested. “Second, how are you going to leverage the sponsorship against your corporate strategies? In other words, why are you doing this? And third, what does success look like and how are you measuring it?”

This is advice Horsham, PA-based Bimbo Bakeries USA (BBU) took to heart six years ago when it was further developing its shopper marketing program. As part of that effort, the baking company explored how to partner with its largest grocery customer, The Kroger Co., and the grocer’s NASCAR racing team.

“Sports marketing and consumer marketing play together from a sense of ‘How can we surprise and delight our shoppers on a regular basis with the brands they love and create excitement?’” said Ken Gronholm, senior sales director and Kroger team lead for BBU. “We thought it would be a good idea, as a joint partnership, to see the benefits on both sides. Being a part of this race partnership is one way we’ve been able to do that.”

The partnership is a collaboration between BBU, Kroger, the race team and BAM, with the agency bringing everything together.

From the start, BBU understood that optimizing the partnership meant full participation.

“We didn’t want to just check a box with the partnership,” Gronholm said. “We decided that if we were going to invest, we were going to be all-in and make sure we were getting value out of it. We’ve worked with BAM to develop the program over time with the goal of being best-in-class and becoming the benchmark for success. One of the keys to elevate our game was working hard on the division activation plan. This has evolved over time and brings us the ability to activate locally and get more ‘personal’ with the shoppers leveraging our world-class DSD system.”

Engaging the help of an agency or brand consulting firm with experience in navigating large-scale corporate sponsorships has its benefits.

“Having a trusted guide within this world is really important,” Zindrick said. “We understand the landscape and are experts in helping negotiate sponsorship packages. We know how to guide companies based on strategic initiatives, what to suggest and then couple that with the activation side of things.”

On the flip side, Dayton, OH-based The Killer Brownie Co. proved it’s possible to successfully negotiate and activate a large-scale sponsorship using just internal resources. The company entered into a multi-year partnership with the Cincinnati Bengals NFL team in 2022.

It’s where we began. For the past century, Brolite has created a variety of naturally fermented cultured flavors. Designed to give bakers a handcrafted taste in no time, these flavors are a great addition to any formula.

Our sours range from strong and pungent to sublte and delicate flavors giving the baker an exact flavor profile needed. Brolite ferments various flours for specific amounts of time, then dehydrates the custom flavor before it is finally milled into a fine, easily handled, free-flowing powder.

Unique artisan flavors made easy for any baker and any baking application.

“We paid for the intellectual property and the use of the Bengals’ marks to be able to promote our brand,” said Chimene Ross, president of The Killer Brownie Co. “It was really up to us to decide how to blow it up. You have to be willing to commit the time, energy, resources and money to activate it. If you don’t have the resources — or a plan to get the resources — to activate a sponsorship, then it’s probably a waste of money.”

The company’s four-person marketing team developed and implemented a fullscale activation strategy.

“We did a lot to activate the sponsorship, and it was all really scrappy,” said Jessica Uttinger, director of marketing and creative for The Killer Brownie Co. “Our biggest investment was in wrapped buses with banners that said, ‘Official Brownie of the Bengals,’ with a massive picture of our brownie and the Bengals stripes on the side. Everything else was just what we could pull off in-house.”

Whether a sponsorship is activated internally or with the help of a third party, one factor rings true: the ROI runway is long.

“You have to be in it for the long haul,” Zindrick said. “There’s no point of just putting a logo on something and hoping that somebody buys something. The longevity and brand recognition are important. The longer you’re in it, the better it should perform for you.”

The upfront expenditure of time, money and resources can be substantial. Clearly defining long-term goals and keeping those in mind during the process are essential.

“It’s a marketing play for the long-term,” Uttinger said. “We could start to see some lift within our contract period, but it

“It’s a marketing play for the long-term. We could start to see some lift within our contract period, but it was really about building our brand story over the next 10 to 20 years that made the investment absolutely worth it. It’s really for the future.”

Jessica Uttinger | director of marketing and creative | The Killer Brownie Co.

was really about building our brand story over the next 10 to 20 years that made the investment absolutely worth it. It’s really for the future.”

For similar reasons, Torrance, CA-based King’s Hawaiian recently partnered with the Toronto Maple Leafs NHL team. One of its expected long-term outcomes is to increase brand awareness in the Canadian market. The sponsorship includes advertising in and around Scotiabank Arena, the hockey team’s home base, and a branded concession stand, the King’s Hawaiian Junction.

“Since our brand first came to Canada in 2018, we have set out to cement King’s Hawaiian’s role in Canadian food culture,” said Holger Kraetschmer, the bakery’s CMO. “We’ve also set out to drive trial and hope that after consumers try [our product] at the King’s Hawaiian Junction eatery, they purchase the rolls at their grocery stores.”

That doesn’t mean all metrics are on hold, just that companies may need to broaden their definition of success in the short term.

LISTEN NOW:

BAM’s Paul Zindrick shares how BBU incentivized its NASCAR sponsorship to enhance workplace safety.

“There are a lot of different ways a company can measure the effects of its sponsorship that are outside of the traditional measurement tactics,” Zindrick shared.

For The Killer Brownie Co., ROI revealed itself quickly after activation — and in a completely unexpected way.

“While the sponsorship legitimized our brand outside of the company, it also strengthened the culture within it,” Uttinger shared. “People felt like they were stepping up to this other level. It was something I totally didn’t expect. But just seeing how all of the employees responded to the sponsorship, it just felt they had so much pride in it. So that alone, I think, is another great reason to do it.“

Defining the “why” in a corporate sponsorship agreement is just as important as defining the budget and metrics for success.

“A successful partnership shouldn’t just create value for the two brands involved but should also create a better experience for consumers,” Kraetschmer said.

“Additionally, it’s critical that both parties are clear on a shared goal for the partnership, and balance flexibility with maintaining their own authenticity during the collaboration.”

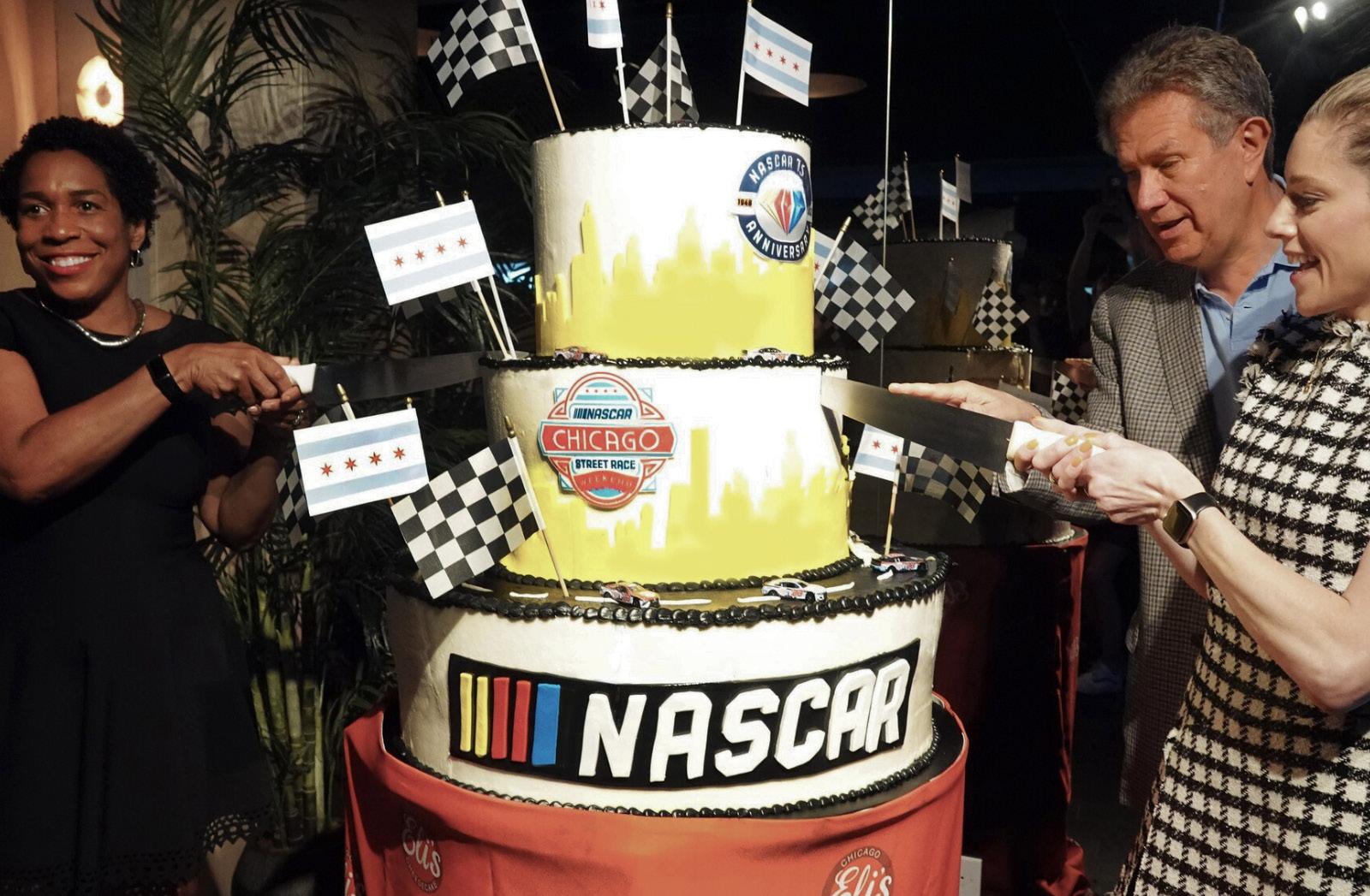

Chicago-based Eli’s Cheesecake Co. has engaged in various sponsorships for more than 40 years and knows a thing or two about making sure the “why” makes sense for everyone involved. The company has been a corporate sponsor of Taste of Chicago since 1985 and is often tapped to create specialty desserts for big events in and around Chicago. For example, last year, the Chicago Sports Commission asked Eli’s to create a 500-pound cheesecake to help welcome NASCAR to the city for the first time. Eli’s sponsorships go beyond special events.

The company also provides desserts to more than 400 organizations every year.

“It’s about being really strategic about who you partner with,” said Elana Schulman, director of special projects at Eli’s Cheesecake. “Does it actually connect back to who you’re trying to target with your brand? Does it add value on both sides? Does it align with your company’s values?“

A corporate sponsorship can be an effective way to increase brand awareness and grow market share when it’s developed thoughtfully. By establishing clear goals and outcomes, working with a partner with similar goals and values, and committing to go all-in on participation, it can take a brand to new — even unexpected — heights. CB

2025 is a critical year in terms of sustainability because many companies have made commitments to make their packaging more sustainable by the end of the year. Some of these commitments include designing 100% of their packaging to be recyclable, compostable or reusable; and incorporating a minimum of 30% post-consumer recycled (PCR) content.

Being able to incorporate recycled content in direct food contact applications does not come without challenges, but there are commercial products available in the market today, both in North America and Europe. St. Johns Packaging launched the first polyethylene bread bag incorporating 30% PCR content in the UK market in 2021 and in the US market in 2023. These products are being manufactured using PCR resins from mechanical or chemical recycling processes, depending on the regulations in each region. St. Johns Packaging has also invested time and resources to find the right sources of PCR materials to guarantee quality and consistency in the final product, a critical factor in this space.

The bags with PCR content provide an improved environmental footprint vs. traditional bags and allow brands to contribute towards their sustainability goals, offering more sustainable packaging solutions to consumers. They are still recyclable, offer reductions in the use of fossil-based materials and lower the carbon footprint of the packaging. In addition, the performance of these bags is very similar to that of traditional bags, minimizing the impact on the filling/ bagging equipment.

However, one of the many challenges faced by the recycling industry is a lack of investment due to the limited uses of recycled plastics. Brands have an opportunity to

incentivize the recycling industry by utilizing recycled materials in their products and creating a driving force at the end of the supply chain, fostering investment and growth in this critical industry. If companies with sustainable packaging commitments stay true to their pledges, demand for recycled plastics is expected to grow as we approach 2025, and it will therefore be more and more challenging to source those materials. The opportunity is here today for more brands to join the movement and be part of the circular economy.

With a focus on the bakery market, St. Johns Packaging is truly committed to developing sustainable and economically viable packaging solutions for the baking industry, while at the same time reducing food and plastic waste. The incorporation of recycled content is essential in the journey towards circularity and Net-Zero.

We design, deliver and support innovative and customized solutionsfor thefood processingindustry, helpingyou bring any type offood product to themarket. INTERMEDIAL

LONG

Affordability, freshness and reduced food waste are a few reasons consumers are gravitating toward smaller portions.

BY MAGGIE GLISAN

The American diet has changed drastically over the past 50 years. Gone are the days when three square meals were the standard. With today’s active lifestyles and varied diet preferences, what the average person eats in a day is anything but one-size-fits-all. Perhaps that’s why portion sizes are no longer standard as bakers offer more diverse portion options to reflect this shift.

Single-portion and individually wrapped items are in greater demand as the trends toward higher-quality desserts and smaller sizes continue. Pillsbury recently introduced Single-Serve Brownies to help foodservice operators tap into that need. They come in Molten Chocolate Ganache and Molten Caramel varieties and are baked in craft paper liners that give a more premium “made-in-house” appearance.

According to the “2022 Life Through the Lens of Bakery” study from the American Bakers Association (ABA), 64% of shoppers make room in their budgets for an occasional baked treat. Betsy Kelly, consumer insights associate for the bakery channel at General Mills Foodservice, said indulgence is one of the key trends driving innovation.

“Everyone needs a moment of reprieve; a moment to indulge themselves,” Kelly said. “Baked goods are often a delicious and approachably priced way to indulge. Combine that with an individually portioned product, and you check the box for a balanced diet as well.”

Affordability, freshness and more adventurous eating are a few of the other factors sparking consumer desire for smaller or individually packaged bakery items, according to Kelly.

“An individually packaged item allows consumers to purchase just the amount they need,” she said. “It allows them to consume the product while it’s fresh. Individual items also allow consumers to try a greater variety of items, with a smaller commitment to one flavor or variety.”

Recent research from Rich Products confirms that line of thinking. A sentiment tracking survey found that smaller and more affordable products like cookies, cake slices and morning sweets can lower purchase barriers and encourage personal indulgence, exploration and more. A complementary shopper segmentation study from Rich’s identified a segment of consumers it calls “Special Treat Seekers,” people who look for value and find that fresh items from the bakery can feel special. For this group, there is increased interest in smaller-sized options in baked goods that emphasize value.

Los Angeles-based Otis Spunkmeyer, an Aspire Bakeries brand, is innovating similarly in this space. It recently debuted a 3-ounce individually wrapped brownie geared toward foodservice, in-store bakeries, c-stores and vending.

Paul Stippich, director of marketing for Otis Spunkmeyer, underscored the importance of quality when it comes to individually packaged products — especially those looking to capitalize on consumers looking to indulge.

“We see the willingness to spend on single-serve bakery items diminish when the options for impulse purchases are low-quality choices,” Stippich said.

More active lifestyles, on-the-go eating occasions and the expanded role of snacking — or “snackification” of the American diet — are also key

“For consumers who are looking for single-serve portions … muffins, loaf cakes, pies, cakes, pastries and parfaits all have a place as a single-serve.”Paul Stippich | director of marketing | Otis Spunkmeyer

factors impacting innovation in portion sizes and what kinds of foods best lend themselves to smaller or singleserve iterations.

“Bakery products that have a sturdy structure, are handheld and leave minimal mess make for great single-serve items,” Kelly said. “Nobody wants their baked good to fall to crumbs in their lap or leave their fingers sticky. Brownies and bars fit all these requirements.”

Stippich echoed this notion, sharing that oftentimes, on-the-go consumers who want a sweet treat will look to single-serve bakery products such as cookies and brownies.

“For consumers who are looking for single-serve portions for other reasons — to pack in a lunchbox, to practice portion control, or to eat in a setting where a fork or spoon is handy or where crumbs won’t matter — muffins, loaf cakes, pies, cakes, pastries and parfaits all have a place as a singleserve,” he said.

According to Mondelez International’s “2022 State of Snacking” report, 61% of consumers already take the time to portion treats before eating them, and 78% say they take time to savor indulgent snacks, suggesting plenty of opportunity to expand product offerings in this area of permissible indulgence.

“True indulgence continues to outpace the other snacking segments, particularly in better-for-you/wellness and permissible indulgence,” said Christine Cochran, SNAC International president and CEO, during an August 2023 webinar hosted by ABA and SNAC International. The webinar also cited Circana data indicating 62% of consumers want snacks to be fun and indulgent.

61% of consumers portion treats before eating them.Source: Mondelez International

Multipacks and variety SKUs may also offer bakers a way to tap into the snacking behaviors of consumers. Per Circana data, 49% of shoppers seek multipacks, with 32% noting they like them for portion control and 29% reporting they prefer them for less food waste.

Although 100-calorie packs are nothing new — they were launched by Kraft in 2004 — bakers still innovate in the space with new SKUs that reflect this ongoing consumer demand. For example, Pasadena, CA-based Nature’s Bakery recently released Fig Bar Minis, a 100-calorie snack-size version of its classic bar.

Other bakers are also capitalizing on consumers’ interest in having “just a bite.”

In 2023, Wexford, PA-based Nonni’s Bakery debuted Nonni’s Bites, bite-size biscotti or “biscottini,” a more snackable version of its full-size cousin. Islip, NY-based Cake Bites has found success with an ever-expanding line of grab-and-go mini cakes; and Islandia, NY-based Entenmann’s, a Bimbo Bakeries USA (BBU) brand, recently launched Brownie Drizzle Drops, a pack of eight

individually wrapped bite-size brownies. This year, Shelby Township, MI-based Ethel’s Baking Co. revamped its dessert bar packaging to showcase the product and its new portion sizing, giving consumers a much clearer picture of what’s inside.

When it comes to the bread aisle, smaller loaves are becoming increasingly popular in response to changing consumer behaviors. Some shoppers are trying to scale back on gluten or carbs, so smaller portions serve as a form of permissible indulgence. Others prefer to purchase half loaves more frequently to ensure the freshest bread possible. More still are conscientious of food waste and are even willing to spend a little more if it means throwing away less food.

Within the past five years, a number of bakeries have introduced “thin slice” or “small slice” versions of their traditional sliced bread loaves, and more continue to follow suit as a way to appeal to health-minded consumers looking to incorporate bread in smaller portions as part of a balanced diet.

Our solid and perforated steel belts have helped bakeries produce premium quality products for almost 100 years.

Flat, straight, durable and easy to clean, they provide a baking surface that’s ideal for everything from rich, chewy all butter cookies to traditional biscuits and crackers.

We can also support you with a wide range of conveyor components covering everything from tensioning, drive stations and drums to tracking systems, break points and graphite stations. Talk to your local IPCO service team and we’ll work with you to improve the performance, productivity and reliability of your oven through process enhancement and system upgrades.

SeeusatBakeryChina

Shanghai · 21-25 May · Hall 21 · Stand C27

SeeusatFispal

High productivity wide belts up to 3500 mm.

Sao Paulo · 18-21 June · Stand H140 – bake

Maximum versatility – bake more on an IPCO steel belt.

Energy efficient – lighter belt means lower carbon footprint.

High power laser cleaningfaster, cleaner and greener than traditional cleaning.

Installations, upgrades (mesh replacement), repair, maintenance and spare parts.

Arnold, Brownberry and Oroweat Breads, under the BBU umbrella, have smaller-slice formats of their signature Oatnut and 100% Whole Wheat varieties; Milwaukie, OR-based Dave’s Killer Bread, a Flowers Foods brand, offers thin-sliced versions (which clock in at 60 to 70 calories a slice) of all seven of its sliced loaves; and Petaluma, CA-based Alvarado St. Bakery has a thin-sliced line of its freshly sprouted wheat breads.

Kansas City, MO-based Farm to Market Bread Co. has been selling half loaves of its popular Grains Galore whole grain bread since the company’s early days more than 30 years ago but more recently started offering half loaves of its Cinnamon Raisin bread as well.

“Our breads are all-natural; we don’t use any artificial preservatives, and they have short shelf lives,” said John Friend, president and CEO Farm to Market Bread. “So having the smaller size allows people to finish their loaves before they go bad.”

Historically, the bakery’s 1.5-pound sliced Grains Galore bread has been its second-best seller (behind its classic sourdough), but in the past three years, the smaller .875-pound halfloaf has surpassed it in sales. Friend contributes the shift to a greater effort on the part of consumers to reduce food waste, which according to Kerry Group’s “Left on the Shelf” global food waste study, is on the mind of 97% of North American consumers.

“Our breads aren’t going to last five days, and [the half-loaves] just make them easier to finish,” Friend said.

Because of the increase in demand for smaller-size breads, Friend suggested it might be time to consider expand -

ing the option to other varieties (like its sourdough) but noted the crumbto-crust proportions would need to be considered.

“Sourdough is a really crusty bread, so you’re going to lose a lot of the crumb when you bake a smaller size,” he said. “You have to think about what lends itself best to sliced bread.”

Sustainability and packaging can also affect food waste efforts. Any progress that might be made on the food waste front could ultimately be negated by the impact generated by more packaging to accommodate an increased number of SKUs.

Excessive packaging is also a turn-off for an increasing number of consumers for whom reducing waste is a top priority. Per Mondelez’ report, seven out of 10 shoppers say they usually reach for snacks that have less packaging.

Stippich said sustainability is a key tenet of Aspire Bakeries’ Corporate Social Responsibility strategy, so in developing

products that require extra packaging, such as single-serve foods, the company works to minimize the impact.

“The Otis Spunkmeyer individually wrapped brownie has a very thin packaging material which adds about two percent to the total weight of the package and cookie,” Stippich said. “Compared to other types of material such as a paper-based or plastic wrap with a label, this is an example of ‘light-weighting.’”

As consumer consciousness and environmental concerns grow, bakers who make a commitment to sustainability through more efficient packaging — even as portion sizes change and diversify — can go a long way in building brand loyalty.

The consumer appetite for single-serve baked goods, smaller bread loaf sizes and individually wrapped treats, whether it be for portion control, affordability or reducing food waste, is growing. And it’s bringing along the opportunity to get creative in the bakery. CB

Cavanna provides both hermetically sealed and one end open flow wrapping solutions for sliced bread.

Both options can utilize a re-closeable feature your consumer’s demand.

These hermetically sealed flow wrapped loaves can allow for a significant increase in shelf life and tamper evidence compared to a premade bread bag.

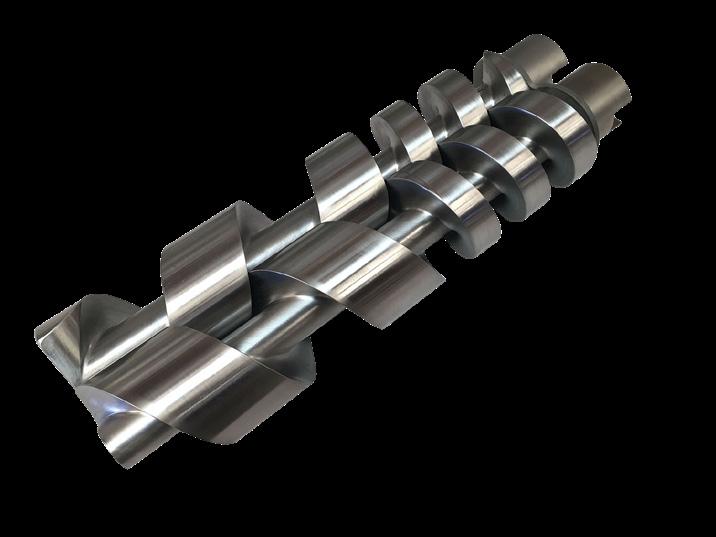

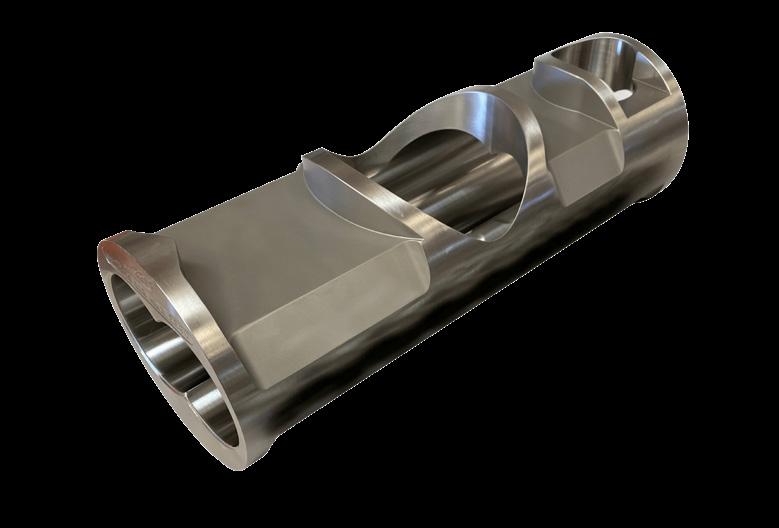

Some of the baking industry’s best innovation comes from a combination of deep roots and new ideas. That’s a perfect way to describe Henry & Sons, a family-owned manufacturer of VEMAG replacement parts and new technology.

The company was founded in 1980 by Dave Henry, an industry veteran who got his start working with Roger Reiser. When Dave launched Henry & Sons, his first priority was simply servicing existing machinery for customers. But Dave’s commitment to quality and stellar customer relationships led to a demand for the company to make VEMAG replacement parts. That began the 44-year journey of this innovative family business, led today by Dave’s son, Mark Henry, who serves as president. Today the third generation — Mark’s son, Morgan Henry — is now on the team.

With more than 2,000 replacement parts and patented original equipment designs all made in the USA, Henry & Sons is heading toward the future with quality in mind and service at the heart of all we do.

Henry & Sons understands that replacing VEMAG parts is not a quick fix. The team takes time to identify and refine problematic parts and incorporate improved design and materials to yield a more dependable, longer-lasting part. This is not a “one size fits all” solution.

More than 2,000 VEMAG replacement parts

Patented Zero Contact Technology

Industry-Changing ERGO Housing

All stainless-steel combinations result in superior food s afety and longer lasting parts

All parts made in the USA