The weekly newspaper for air cargo professionals

No. 1,243 14 August 2023

Follow Us:

No. 1,243 14 August 2023

in just three to five working days.

Nabil Sultan, Divisional Senior Vice President, Emirates SkyCargo, said: “Building on the success that Emirates Delivers has established in the UAE, we are excited to achieve the next step in our broader e-commerce strategy by expanding to Kuwait. While the global e-commerce market continues to flourish, recent years have shown a clear uptick in markets which were not previously offered the same access and options, such as Kuwait and the wider Middle East. Now, more customers are searching for a reliable and trusted partner, not just to make the initial purchase from, but to handle the transportation of purchases. Leveraging Emirates’ global network, the frequency of flights, our wide body capacity, and the trust and longstanding relationships we’ve built with consumers in market, Emirates Delivers is well placed to answer this need.”

To utilise Emirates Delivers, customers first have to register free of charge on www.emiratesdelivers.com, where they will be given a unique shipping address in both the UK and the US. This allows users to immediately start shopping online from their favourite brands, using the unique address during check-out.

When the items arrive at the Emirates Delivers UK or US facility, specialist agents will review all purchases to ensure they arrived undamaged and take photos of the items, before repacking to ensure proper wrapping and protection for international delivery. With free storage of up to 30 days, Emirates Delivers allows customers to combine items from different retailers and vendors and consolidate their purchases into one package to further reduce the already-competitive shipping costs.

Using the “My Suite” option on the Emirates Delivers website, customers can then confirm shipping to Kuwait, with full tracking visibility from the time the items are received at the facility, through to delivery of the package at their door. Emirates Delivers takes care of all the hassle of shipping and customs clearance, making crossborder shopping simple. It offers the unique feature of providing all costs upfront, with no hidden or surprise costs.

EMIRATES Delivers, the e-commerce delivery platform of Emirates SkyCargo, has launched in Kuwait, facilitating fast, reliable, and cost-effective international delivery of items purchased from the UK and the US to shoppers in Kuwait.

Whether buying from a large e-commerce retailer or an online independent boutique, making savings during international sales like Black Friday or simply shopping from country-exclusive retail outlets, Emirates Delivers provides a seamless door-todoor transport solution with competitive shipping rates to bring customers the best e-commerce purchases from the UK and the US

Once the item has arrived in Kuwait, Emirates Delivers will complete all customs clearance activities and deliver the parcel directly to the customer. Harnessing the power of Emirates’ extensive global network which operates over 120 weekly flights to the UK and 96 weekly flights to the US, packages will be delivered in three to five working days.

Emirates Delivers first launched in 2019, bringing the best of US shopping to the UAE, before adding the UK to the service in 2022. Unlocking a world of international shopping, Emirates Delivers has been used by thousands of shoppers to transport apparel, cosmetics, toys and games, books, footwear, and accessories as well as vitamins and health supplements.

AIRBUS is making strides in the production of its flagship A350F aircraft as it looks to change the face of the air cargo industry with its ...

PAGE 2

PIONEERING SUSTAINABLE AND ... CHHATRAPATI Shivaji Maharaj International Airport (CSMIA) is seeking to solidify its position as a key player in the global air freight supply chain ...

SUSTAINABLE SOLUTION FOR ... PAGE 3

IN an increasingly complex logistics landscape, Challenge Group has presented an endto-end solution to simplify the process for customers ...

PAGE 4

ADVOCATING FOR AIR CARGO ...

THE Airforwarders Association (AfA) is making significant strides in advocating for investment in the air cargo in the United States...

PAGE 8

Page 6

AIRBUS is making strides in the production of its flagship A350F aircraft as it looks to change the face of the air cargo industry with its new generation freighter. Bringing the latest developments in terms of efficiency, Airbus looks to present its soon to be rolled out model as the “only choice for the future of the large widebody freighter market.”

The production is now in full swing, with Airbus having marked a major milestone recently, completing the manufacturing of the first part of the aircraft, showing the development process is underway.

“It’s really exciting,” Crawford Hamilton, Head of Freighter Marketing at Airbus, said. “It’s all gradually coming together.”

With rising demand for the freighters from seven customers so far, Airbus is keen to highlight the industry’s enthusiasm for their offering, with sustainability and fuel efficiency at the core of the aircraft’s design.

“We’re entering a new market. To come in and get that reception from seven customers now is absolutely amazing,” Hamilton added. “It’s a very tough market that our competitor has dominated for years and we want to come in there and start to make a difference.”

“Customers came to us and said ‘we want a choice,’ so this is a good start. The challenge in the days, months and years that are coming is to add to the order number in a substantial manner,” he continued.

The A350F looks to strike the perfect balance between having a high payload capacity, a sustainable set up and an impressive range. Leveraging the already deployed A350 platform, the carbon fibre construction and structural capability of the aircraft ensures reduced weight compared to older freighters. “You have to pick the right platform. That’s why we picked the A350-1000. It has the capability to be developed into a very good 100 tonne+ freighter,” Hamilton highlighted. “We’ve gone for carbon, which means we’re about 13 tonnes lighter compared to other manufacturers’ current aircraft. With that

Tel: +44 (0)1737 906107

• www.azfreight.com

Editor: Edward Hardy

Supplement Editor: James Graham

Associate Editor: Chris Lewis

Contributors: David Craik, Stuart Flitton, Neil Madden, Donald Urquhart

Director of Operations: Kim Smith

International Sales Director: Rosa Bellanca

International Sales Executive: Zainab Khalid

Finance Manager: Rachel Burns

Design & Production Manager: Alex Brown

Production Supervisor: Kevin Dennis

Website Consultant: Tim Brocklehurst

Directors: Norman Bamford • Dawn Jolley

weight saving and the most efficient engine in service today, you’ve got a great offering.”

This structure, combined with efficient engines and aerodynamics, such as its modern wing design, look to ensure optimal performance when it takes to the skies. Embracing customer preferences and seeking to present a modern alternative to traditional freighters, cargo operators have improved adaptability and flexibility with the A350F.

The global supply chain has suffered a series of shocks in recent years, delaying projects beyond their original deadline. Airbus has been mindful of this risk to their delivery dates, taking steps to ensure they are continually monitoring the situation, preparing contingency plans.

“It’s never easy when you’re designing an aircraft. It’s always very challenging but we have a great bunch of engineers. We are always speaking to the customers to make sure we are doing the right thing, so it’s all progressing very well,” Hamilton stated.

While having had to push back the expected delivery of the first A350F to 2026, Airbus is confident that they will be able to keep the project on track.

“There are supply chain challenges but we have a whole procurement department that keeps an eye on that all the time,” Hamilton explained. “Last year, all our widebody aircraft were delivered on time, so the supply chain is very much under control.”

While preventing delays is, arguably, the biggest challenge facing any company in the industry, there is another dilemma facing aircraft manufacturers directly: conversion vs new freighters.

With the airfreight market offering ever growing potential

and opportunity for carriers and cargo handlers, Airbus is looking to convince companies that new freighters are the best route forward.

“When you’re looking at converted freighters, I think they’re for different markets. It’s very much horses for courses, particularly with the large aircraft conversions,” Hamilton explained. “With the new aircraft, you get utilisation and you get reliability, that’s the two big things.”

The A350F doesn’t just look to provide customers with those two factors, it also has the ability to integrate easily into existing fleets due to its compatibility with other Airbus aircraft.

“Only with an Airbus do you get that. Kind of commonality in the modern market and you get it through all sizes of freighter,” Hamilton said. “That’s the big thing, so you can start to look at more integrated fleets and more integration of pilots.”

Beyond offering the latest technology around sustainability and efficiency, Airbus has placed significant emphasis around digitalisation and technological innovation in the A350F.

“What we want is to have something that can fit into the market, allow things like tracking, ambient condition monitoring and make sure airlines can start to really get the data that they haven’t had before,” Hamilton said.

Aiming to offer seamless integration with existing systems, the new aircraft will provide enhanced tracking and condition monitoring. This data-driven approach will look to aid airlines with the optimisation of their operations, allowing them to explore potential new areas to grow.

“They can enhance their products and start to look at new revenue streams and how they can be more profitable in a volatile market,” Hamilton continued. “Digitalisation is something that we believe can help them with that.

CHHATRAPATI Shivaji Maharaj International Airport (CSMIA) is seeking to solidify its position as a key player in the global air freight supply chain, offering seamless connectivity out of India. With its robust infrastructure, commitment to sustainability, and advanced technological solutions, CSMIA continues to elevate its cargo operations to new heights.

Connecting global trade through its extensive network, which spans five continents, CSMIA is a premier gateway for cargo transportation. The airport ensures fast, secure, and reliable connectivity for its diverse clientele, contributing significantly to the international airfreight market.

“CSMIA serves as a vital hub connecting to over 500 international destinations across 52 countries, whereas in India, CSMIA connects to 60 cities across the country,” a spokesperson for CSMIA said.

Rising potential

The Indian airfreight market holds immense promise for growth, driven by the country’s ambitious goal of becoming a $5 trillion economy by 2025. With increasing investments, the demand for efficient logistics solutions, including airfreight, is set to rise. Sectors like Pharmaceuticals, e-commerce, Electronics & Automobiles are witnessing significant growth, further contributing to the expansion of the Indian airfreight market.

CSMIA’s cargo facility handles an array of goods from various industries, including Automobiles, Pharmaceuticals, Electricals & Electronics, Agro, and Engineering Goods, supporting the movement of diverse goods both within India and beyond its borders.

“India’s strategic location connecting all the major countries and hubs gives a competitive advantage to promote International to International Transshipment,” the spokesperson explained. “With huge investments taking place in manufacturing supported by government initiatives like ‘Made in India’ & ‘Production Linked Incentive’, we can anticipate international and domestic cargo volumes to witness growth in the coming years.”

Pharma focus

CSMIA is keen to be at the forefront of the country’s pharmaceutical cargo handling, adhering to global standards such as IATA CEIV Pharma, Good Distribution Practices (GDP), and ISO 9001:2015 quality management system. These certifications ensure the integrity, safety, and quality of pharmaceutical shipments throughout the supply chain.

Its dedicated terminal for pharmaceutical supply chain operates under 24x7 security and CCTV surveillance. Expert staff follow stringent protocols and safety regulations to handle pharmaceutical cargo with utmost care. State-of-theart equipment, regular inspections, and strict quality control measures further ensure the integrity of pharma products throughout the processing and transportation stages.

“As a result, CSMIA continues to strengthen its position as a leading airport for pharmaceutical cargo, supporting the global air transport industry and meeting the stringent demands of pharmaceutical manufacturers,” the spokesperson said.

CSMIA’s cargo operations are a testament to the power of advanced technology solutions. By eliminating over 90% of paper transactions and embracing digital initiatives like e-Freight, e-Carting order, e-Gatepass, and more, the airport has achieved benchmarking timelines and significantly reduced dwell time for air cargo processing. The airport’s ‘AMAX’ and ‘Turant’ mobile applications provide real-time updates to stakeholders, enhancing efficiency and transparency.

“CSMIA was the first airport in India to implement digitisation drive in air cargo operations by introducing Cargo Management System [CMS] in the year 2006,” the spokesperson explained. Its innovative D-Cube (Digital Docket Delivery) has transformed import cargo clearances into a paperless and contactless process. As part of the airport’s digital drive, D-Cube, along with other initiatives, has streamlined import cargo processing, resulting in time and cost savings for stakeholders.

“The airport always emphasised in digital penetration that played a vital role in reduction of dwell time, enhancing operations efficiency, time and cost savings to the stakeholders. In addition to the above, digitisation also eliminated the manual data entry, long queues, data errors and assisted in enhancing the productivity of the resources and infrastructure at the airport,” the spokesperson highlighted.

IN an increasingly complex logistics landscape, Challenge Group has presented an endto-end solution to simplify the process for customers. With a focus on specialised and challenging shipments, the company offers a comprehensive suite of services that address unique delivery needs across various industries.

By partnering with trusted providers and maintaining control over the entire supply chain, Challenge Group has gained recognition for its ability to deliver seamless logistics solutions. “Our value proposition revolves around providing an end-to-end solution, and our goal is to achieve operational excellence,” Or Zak, Challenge Group’s CCO said.

Challenge Group specialises in handling a wide range of challenging shipments, having developed significant expertise in and catering to the specific requirements of niche elements of the airfreight market.

“65% of our business is based on complex verticals, such as temperature controlled, aerospace, automotive, heavy & oversize, live animals, with a particular emphasis on horses,” Zak highlighted.

To ensure operational excellence and comprehensive supply chain coverage in this area, Challenge Group has forged strategic partnerships. By leveraging subsidiaries within the group, they maintain control over the entire logistics process. Challenge Handling handles packaging, crating, sorting, and storing of goods, while Challenge Logistics focuses on customs clearance, distribution, and first/last mile delivery.

“We firmly believe that by maintaining control over the entire supply chain through our subsidiaries, and when necessary, partnering with top tier suppliers who meet our standards, we can effectively accomplish this objective,” Zak continued.

“We have full control which means we manage everything including network planning, loadmaster operations and handling. In addition to that, we are able to perform maintenance, which is one of the pain points when it comes to OTP. This can be carried out in-house by Challenge Technics, Challenge Group’s latest acquisition.”

Notable shift

Challenge Group’s end-to-end service covers a wide range of commodities, addressing their unique delivery requirements. “Challenge Group truly demonstrates its capability and expertise in handling the majority of shipments that fall under complex verticals. These shipments require specific tools and equipment, and it is in this domain that Challenge Group excels, showcasing its proficiency and expertise,” Zak said.

The demand for end-to-end services has seen a notable shift in recent years. During the COVID-19 pandemic, disruptions in the supply chain and congestion in sea freight prompted a switch to airfreight. However, freight forwarders faced difficulties in sourcing third-party providers for supplementary ancillary services. “Once Challenge Group had introduced its comprehensive end-to-end solution, industry stakeholders quickly recognised its value and expressed a reluctance to revert to the previous model. The old model was deemed less efficient, less sustainable, and more costly in comparison,” Zak added.

With this increased demand, Challenge Group has witnessed significant growth in its charter business. The department experiences high demand for time-critical shipments involving large and heavy equipment, as well as the transportation of sizeable livestock. “These shipments often require quick action, starting from promptly responding to initial enquiries, arranging operations, obtaining traffic rights, handling logistics, and ensuring efficient pick-up and delivery processes are in place,” he explained.

In an increasingly interconnected world, efficient cargo delivery is the linchpin of global trade. The airfreight forwarding business is no place for the faint-hearted. As an airfreight forwarder, you understand the stakes. Every cargo delivery must be swift, secure, and smooth. That’s where Cargonet, your dedicated neutral airfreight wholesaler, comes in.

For over a decade, Cargonet has served as a crucial link in the logistics chain, connecting airfreight forwarders with the resources they need to succeed. Our role? To ensure you, our valued customers, can meet and exceed the demands of your clients with unmatched efficiency.

This belief drives us to offer customised services that meet your specific needs and assist you in navigating any challenges you may face. A UK-based customer’s testimonial encapsulates this commitment perfectly, “Cargonet is our unwavering ally in airfreight. Their exceptional rates, wide-ranging capacity, and personalised customer service are unparalleled.”

As we help you serve your clients better, we don’t forget our responsibilities. In an industry where compliance and security are paramount, we take every measure to ensure that cargo entrusted to us is handled with the utmost care and strictly adheres to all regulations.

Furthermore, as a company deeply committed to the environment, we make it a priority to minimise our carbon footprint through sustainable practices. By choosing Cargonet, you’re not only choosing a service that benefits your business, but also one that contributes to a greener planet.

In essence, choosing Cargonet as your airfreight wholesaler means choosing to enhance your business’s efficiency, flexibility, and profitability. It means being able to promise your clients a service that is superior in its reliability and reach. It means gaining a competitive edge in the marketplace.

For more information:

We invite you to experience the difference that Cargonet can make to your airfreight business. Explore the services we offer by visiting our website at www.cargo-net.co.uk, or reach out to us directly at sales@cargo-net.co.uk to discuss a custom solution tailored to your needs.

With Cargonet your cargo is our commitment, your success, and our shared goal.

So, what makes an airfreight wholesaler like Cargonet the ideal choice for forwarders? It all starts with our offering of competitive rates and vast capacity options. These benefits directly translate into cost savings and flexibility for your business, helping you to deliver outstanding service to your clients while protecting your bottom line.

But that’s just the tip of the iceberg. Our global reach allows you to extend your services to every corner of the world. With our extensive network and strong partnerships with carriers, you’re able to guarantee your clients a truly global service.

At Cargonet, we pride ourselves on our customer-centric approach. We believe that every customer is unique and deserves personalised solutions and services.

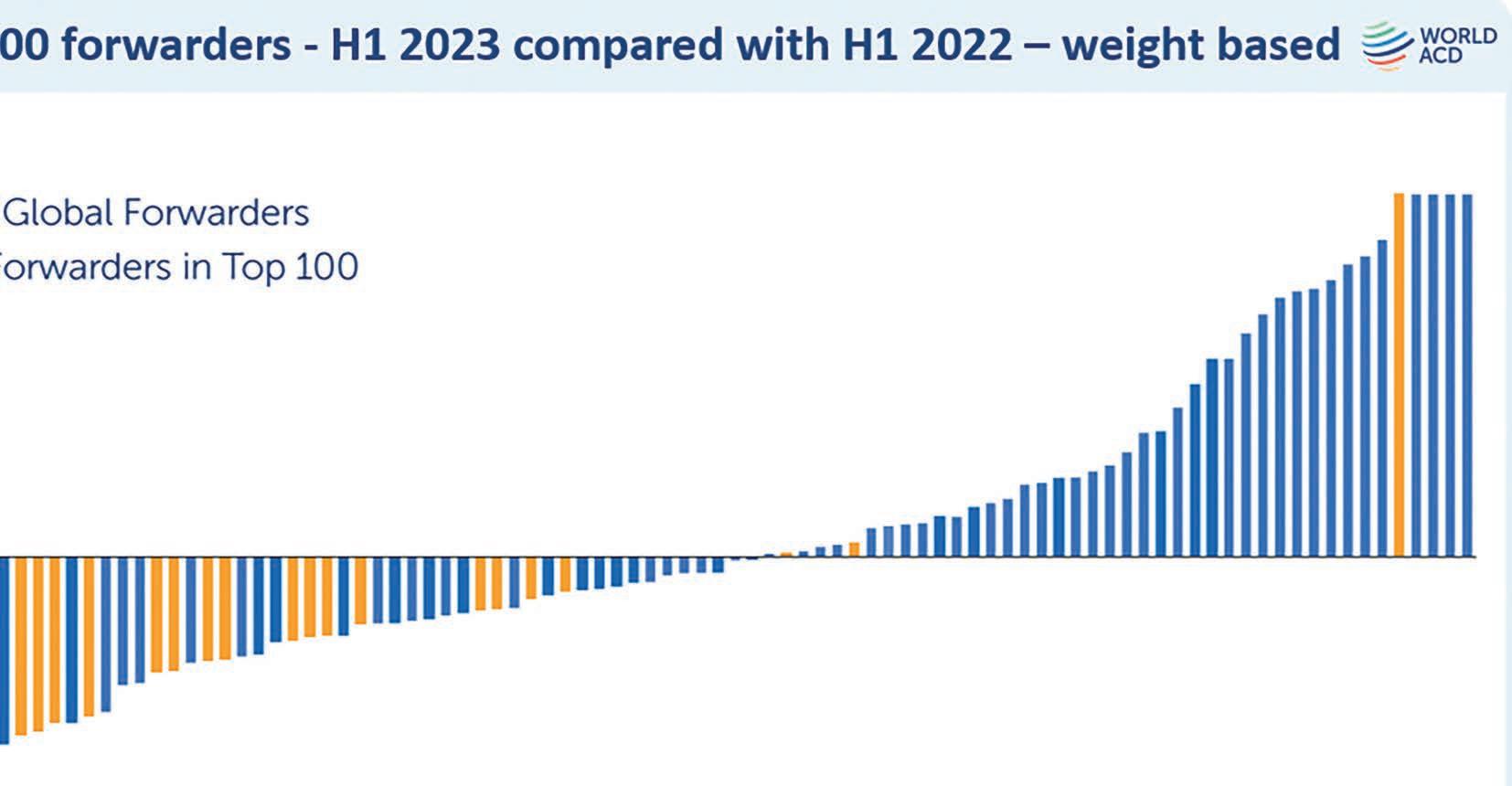

THE largest global airfreight forwarders have lost market share during the past year to their smaller competitors and to direct airline sales to shippers, according to fresh data and analysis by WorldACD Market Data, as the market adjusts to falling demand and prices and the return of passenger bellyhold capacity

Based on the two million monthly transactions covered by WorldACD’s data, which records cargo bookings between dozens of international airlines and thousands of freight forwarders and other customers, only one of the world’s top 20 global air freight forwarders achieved significant tonnage gains in the first half (H1) of 2023, compared with the same period last year, while two others recorded minimal growth in tonnages, whereas 17 of the top 20 forwarders recorded notable tonnage losses, mostly between -5% and -25%. In contrast, around half of the top 100 forwarders outside of the top 20 recorded tonnage growth, with many of those achieving double-digit percentage rises.

Comparing data from June 2023 and June 2022 sheds some further light on what has been taking place in the last year, and the relative competitive positions of forwarders of varying sizes. Our analysis indicates that the top 100 airfreight forwarders have seen their share of the market fall from 59.8% in June 2022 to 56.9% in June 2023. But the shift is more apparent when looking at the largest freight forwarders that operate global networks and businesses, with the top 30 air freight forwarding ‘global leaders’ seeing their share of the market fall quite significantly, from 45.5% in June 2022 to 41.4% in June 2023.

During that period, what WorldACD identifies as “global aspiring’ freight forwarders, the 30 next largest companies forming a second tier of international agencies with ambitions to build a global network, have seen their share drop slightly, from 6.8% in June 2022 to 6.5% in 2023. But a clearer shift is visible among the next tier of 40 freight forwarders identified as having a ‘regional focus’ – operations in multiple countries predominantly within one region of the world. This group has seen its share of the market grow from 7.5% in June 2022 to 9.0% in June 2023 – a rise

of 1.5 percentage points, and a 20% increase in that group’s share of the market.

Another interesting change during the last 12 months is an increase in direct sales by airlines to shippers, in which there is no forwarder intermediary, where the percentage has risen from 5.4% in June 2022 to 6.4% in June 2023. Although that rise of one percentage point is relatively small in overall market terms, it’s an increase of almost 20% in that transaction category.

Outside of the top 100, analysis by WorldACD indicates that the thousands of smaller freight forwarders around the world have also seen their combined market share rise in the last year, from 34.8% in June 2022 increasing to 36.8% in June 2023.

This comes at a time of continuing consolidation among freight forwarding and logistics companies, although there are some indications that higher interest rates may have slowed some mergers and acquisitions (M&A) markets in the last 12 months.

A full overview of M&As among smaller freight forwarders is hard to come by, but one factor in the relatively better performance of smaller over larger forwarders may be that consolidation has continued more strongly among smaller players. Other factors include whether a freight forwarder has been locked into longterm rates and capacity deals with carriers that in a falling rates environment have become uncompetitive compared with what Is available on the spot market. There are many recent reports of carriers and forwarders coming under pressure to renegotiate their capacity arrangements.

Whether forwarders prioritise market share over profitability is also a factor, which may reflect the level of flexibility of their cost base. In DSV’s Q2 2023 financial results announcements in late July, for example, the airfreight forwarder reported a 21% YoY drop in its airfreight tonnages in the second quarter. CEO Jens Bjorn Andersen explained that DSV “can accept a slightly lower yield than in the past”, but had “a policy not to participate where rates are at breakeven or loss-making. If you protect yields, you can see negative volumes; we put profit over growth.”

One interesting development analysis by WorldACD highlights in

Whether forwarders prioritise market share over profitability is also a factor, which may reflect the level of flexibility in their cost base.

the second quarter of 2023 has been a slight shift back in favour of contract rates. That follows a progressive trend over much of the last year in which customers bought an increasing share of their capacity via the spot market, after spot prices dropped below contract prices on many lanes by mid- 2022.

Although average spot prices remain somewhat below average contract rates (around 15% lower in June 2023, globally), the shift among forwarders towards favouring the spot market appears to have halted or paused since Q2, with a roughly 50-50 split now between spot and contract pricing, globally – although that split varies significantly according to trade lane.

On Asia-Pacific to Europe, the share of spot prices increased in the final quarter of 2022 well above 50%, peaking at more than 55% last November and remaining above 50% throughout Q1 2023. However, by Q2 of this year, that proportion had dropped significantly to around 45% of the market– as some customers look to return to the stability of more predictable capacity and pricing, now that contract rates have fallen sufficiently, in what is a still unpredictable geopolitical environment.

On transpacific markets, the picture is less clear in a morevolatile market that has seen big price disparities at certain times in the last 12 months between the levels of contract rates and spot rates. The data illustrates how customers have made greater use of the spot market during periods of particularly wide spreads between spot and contract pricing – for example, between October 2022 and January 2023, when the share of spot rates peaked at 74%. But that share has dropped somewhat this year as the price gap has narrowed, stabilising in Q2 at around two thirds of the market.

Another significant factor has been the relative availability of freighter and passenger belly capacity. Analysis by WorldACD underlines the extent to which the return of passenger belly capacity, along with reduced demand and pricing, has led to the withdrawal of freighter capacity from the market in the last year, and reduced its share of the available capacity market. In June 2022, freighters made up 52% of the available cargo capacity in the market, but that share had dropped -7 percentage points to 45% by June 2023, according to WorldACD analysis. During that

time, total available cargo capacity in the market rose by +9%, with total available tonne kms (ATKs) rising from 31 billion ATKs in June 2022 to around 34 billion ATKs in June 2023. Total available freighter capacity dropped by around - 5% (from 16.2bn ATKs to 15.4bn ATKs), while passenger belly capacity on international flights rose by around +25%.

That data is of interest in itself, but it may help provide further explanation for the relative success of smaller freight forwarders versus the biggest global agents. An air cargo market with relatively restricted capacity, particularly one dominated by freighters and with limited availability of belly hold capacity, is more likely to favour larger freight forwarding agents able to tender their own built units (BUPs), including maindeck units. But the return of greater lower-deck capacity provides more opportunity for forwarders to tender smaller shipments.

This is consistent with observations and analysis earlier this year by WorldACD, comparing various aspects of market dynamics in the first quarter (Q1) of 2023 with those in Q1 of 2022, including the demand profiles of different shipment weight bands. Although total chargeable weight in Q1 was -10% below that of the equivalent period last year, there were significant differences in the demand levels for smaller versus larger shipments: shipments up to 1000 kgs increased by +3%, YoY, whereas those in the 1,0005000 kgs bracket decreased by -6% and the total tonnage of shipments greater than 5,000 kgs decreased very significantly in Q1, by -22%, compared with last year.

Although there has been a long-term trend towards smaller and lighter shipments, consistent with the ongoing growth of e-commerce and towards special products rather than general cargo, airline cargo sources have indicated that the main reason behind the stronger performance of smaller versus the largest shipments this year has been the return of belly capacity and the normalising of the market. Whereas last year, freight forwarders were in some cases forced to tender large BUPs for transport on the only capacity available, widebody freighters, that has been less of a feature in the market this year, reopening a fuller range of capacity and routeing options to forwarders and their customers.

The return of greater lowerdeck capacity provides more opportunity for forwarders to tender smaller shipments.

THE Airforwarders Association (AfA) is making significant strides in advocating for investment in air cargo infrastructure in the United States. With the aid of senior lobbyist Michael Taylor, the association aims to raise awareness among influential Members of Congress about the urgent need for funding to address congestion and improve efficiency in airport cargo areas.

“Our goal is to identify key decision makers on Capitol Hill and raise their awareness of the challenges to air cargo and its importance in the logistics supply chain,” Brandon Fried, Executive Director of the Airforwarders Association, said.

The Airport Congestion Committee, established by the AfA, identified key focus areas and recommended solutions to address cargo congestion at airports. Challenges include communication and technology limitations, inadequate facilities and infrastructure, staffing issues, customer service, and government policies and regulations. The committee’s white paper offers a comprehensive list of recommendations, emphasising the importance of integrated solutions. Coordinated stakeholder engagement, efficient automation, communications technology, and appropriate policy frameworks are crucial in addressing congestion effectively.

Truck congestion at major US airports continues to pose a significant challenge despite airfreight volumes returning to pre-pandemic levels. The AfA’s key objective is to engage decision-makers on Capitol Hill and ensure they understand the importance of air cargo in the logistics supply chain.

“Airports are facing capital improvement requirements of over 120 billion dollars over the next five years, and the recent infrastructure act legislation would, at best, cover 20% of those requirements,” Fried stated. “Most of the monies allocated to airports will likely go to delayed passenger requirements and amenities, critical support services, safety, and security.”

Taylor, a seasoned Washington insider with extensive legislative and regulatory advocacy

experience, spearheads the AfA’s efforts. With a deep understanding of the industry’s impact on the supply chain and national commerce, Taylor brings relevant expertise to advocate effectively for air cargo infrastructure investment.

Key to the economy

The air cargo industry has proven to be a financial mainstay for the aviation industry, especially during the COVID-19 pandemic. As passenger traffic declined, air cargo operations expanded to meet the increased demand for time-sensitive shipments.

The industry’s efforts in facilitating the transportation of critical goods, including highvalue and time-sensitive items, contributed significantly to airport revenues. Increased freighter operations generated revenues through landing fees, fuel flowage fees, and other operating revenue, offsetting some of the losses experienced by airports and their partners.

“It is essential to understand that air cargo throughput impacts thousands of small businesses that depend on the timeliness of their expedited shipments. Lawmakers need to understand that these businesses and their constituents will benefit once improved,” Fried said.

The AfA is determined to convince Members of Congress about the urgent need for investment in air cargo infrastructure. By highlighting the impact on shipping costs, consumer prices, job creation, service improvement, carbon emissions reduction, and increased private investment, the association aims to build a compelling case for funding.

AfA’s efforts have gained traction in Congress. The association’s legislation regarding a General Accountability Office study was adopted during the FAA Reauthorisation bill’s amendment process in the U.S. House of Representatives committee.

“Once the full version of the legislation is complete, it will be voted on by the House, and then there will be a Senate version. Both pieces of legislation will be taken to a conference to iron out differences to produce the finished bill to be voted by both the House and Senate and sent to the President for signature,” Fried explained.