5 minute read

Single-Family Construction Slowdown Less Pronounced in Lower Density Markets

By Jesse Wade

While single-family home building has slowed significantly from pandemic-fueled highs because of higher interest rates and construction costs, the slowdown is less pronounced in lower density markets. On the other hand, multifamily market growth remained strong throughout much of the nation, according to the latest findings from the National Association of Home Builders (NAHB) Home Building Geography Index (HBGI) for the first quarter of 2023.

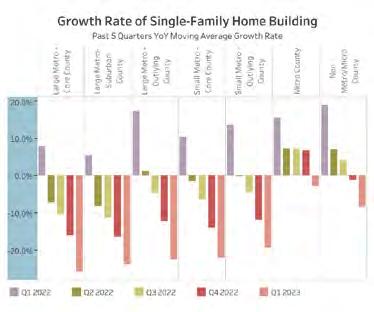

Across the singlefamily market, the 4-quarter moving average of the year-over-year growth rates have all fallen to negative levels from one year ago. The largest decrease in the growth rate was in Large Metro – Outlying Counites which fell from 17.4% in the first quarter of 2022 to -22.3% in the first quarter of 2023. All markets had a negative growth rate in the first quarter of 2023 with Micro Counties being the highest at -2.9% and Large Metro –Core Counties having the lowest rate at -25.6%.

Over the past four years rural markets have exhibited particular strength. The rural (Micro Counties and Non Metro/Micro Counties) single-family home building market share has increased from 9.4% at the end of 2019 to 12.0% by the first quarter of 2023. The largest decrease in singlefamily market share between the end of 2019 and the first quarter of 2023 was in Large Metro – Core Counties, which fell 2.7 percentage points from 18.4% to 15.7%. The combined Large Metro areas (Core, Suburban and Outlying) market share has fallen for seven consecutive quarters to a share of 49.7%. This is the first time the combined Large Metro market share has fallen below 50.0% market share since the inception of the HBGI.

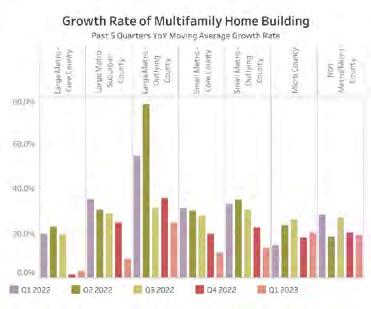

Meanwhile, the multifamily construction market remains strong with all HBGI markets having positive growth rates in the first quarter of 2023.

Large Metro – Core Counties had the lowest multifamily growth rate at 3.2%, up from 1.5% from the fourth quarter of 2022. For the 7th consecutive quarter, Large Metro – Outlying Counties had the highest growth rate at 24.5%.

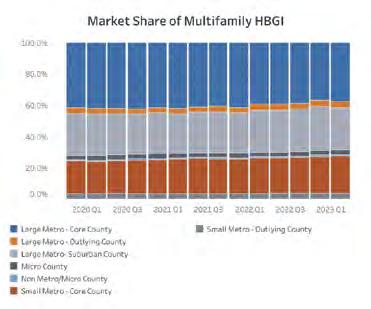

The multifamily market share for Large Metro – Core Counites increased in the first quarter of 2023 after losing market share for all of 2022, now standing at 37.5%.

Since the first quarter of 2020, Small Metro –Core Counties market share has increased 3.0 percentage points from 20.6% to 23.6%. This was the largest increase between the first quarter of 2020 and 2023 for any of the HBGI markets. Over the same period, the largest decrease in market share was in Large Metro – Core Counties which fell 4.7 percentage points.

The first quarter of 2023 HBGI data can be found at https://nahb. org/hbgi.

Pensacola Energy sponsored a fantastic and well-attended event at the Calvert’s, a popular restaurant with a English themed pub style. A special thanks to Jill Grove, Marketing Manager at Pensacola Energy and her excellent team for putting this great night together.

Building Materials Prices Fall for Second Month Straight

By David Logan

According to the latest Producer Price Index report, the prices of inputs to residential construction less energy (i.e., building materials) decreased 0.1% in May 2023 (not seasonally adjusted), following a 0.2% drop in April. The index has gained 0.3%, year-todate, a stark contrast from the 10.2% and 4.9% YTD increases seen in 2021 and 2022, respectively.

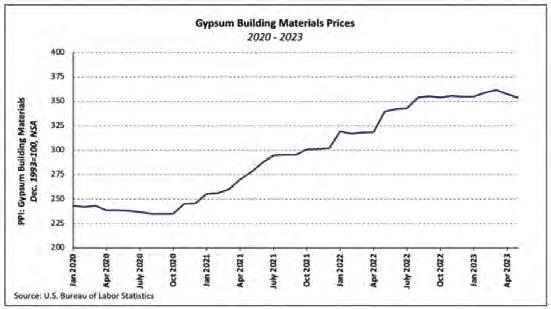

The PPI for gypsum building materials fell 1.1% for the second month straight and is down 0.4%, year-to-date. Gypsum building materials prices are 4.0% higher than they were a year ago but at the lowest level since July 2022.

Softwood Lumber increase in nearly a year. RMC prices have risen 2.8% YTD—the same increase seen through May 2022—and are up 13.0% over the past 12 months.

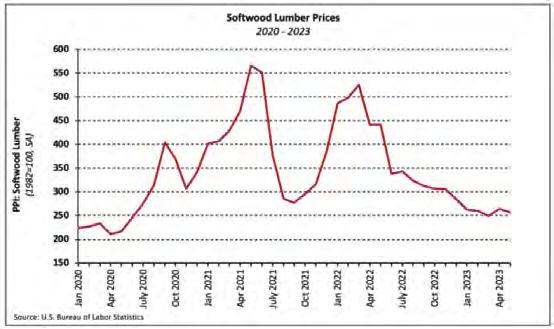

The PPI for softwood lumber (seasonally adjusted) decreased 3.1% after increasing 6.2% the prior month. Softwood lumber prices have declined 10 of the past 12 months and are 41.9% lower than they were one year ago.

Steel Mill Products

Steel mill products price growth continued to accelerate in May as the index rose 5.2%. This comes on the heels of 3.5% and 1.0% increases in April and March, respectively. after climbing 3.1% in February and March combined. The PPI for steel mill products declined eight consecutive months ending in January, falling 27.9% over that span. However, prices have climbed 12.4% in the four months since.

Despite a Cooling Housing Market, Home Prices and Rents Remain High

Ready-Mix Concrete

Ready-mix concrete (RMC) prices were revised down for April in the latest release. As a result, prices declined last month for the first time since March 2022. Unfortunately, price growth returned in May as the RMC index increased 1.6%–the largest monthly

The PPI for goods inputs to residential construction, including energy, declined 0.5% as energy prices drove the index lower. The index has declined 2.7% over the past 12 months but is 36.0% higher than it stood in January 2020.

Gypsum Building Materials

Services

The price index of services inputs to residential construction decreased 1.0% in May after rising 0.5% in April. Prices have declined 12.4% over the past year but have been relatively stable in 2023, down just 0.5% through May.

The annual State of the Nation’s Housing report from the Harvard Joint Center for Housing Study (JCHS) highlights the growing housing affordability crisis, despite a slowdown in housing prices.

“Rent growth slowed over the past year, and home prices declined in a number of areas,” said Daniel McCue, a JCHS senior research associate, in a press release. “Nonetheless, housing costs remain well above pre-pandemic levels thanks to the substantial increases over the last few years.” continuesonpage16

McCue noted that although home prices grew 1%, compared to 21% in 2022, they are still nearly 40% over prepandemic prices. Rent growth followed a similar pattern, with 4.5% growth in 2023 compared to 15% in 2022, but up 24% since the pandemic.

Higher interest rates have also eroded housing affordability in the past year, with payments on the medianpriced home increasing from $2,500 to $3,000. As a result, mortgages originated to first-time home buyers dropped 22% in 2022, including a 40% year-over-year drop in the fourth quarter.

Despite a Cooling Housing Market, Home Prices and Rents Remain High

from page 15

Inventory has also had an impact on home prices, as single-family housing starts dropped 10.8% last year. Although multifamily construction has remained strong, the JCHS report indicates that rising vacancy rates, along with higher interest rates and tighter lending standards, suggest a forthcoming slowdown in multifamily construction.

NAHB Chief Economist Robert Dietz highlighted the key factors contributing to these issues in a recent press release.

“Shelter cost growth is now the leading source of inflation, and such costs can only be tamed by building more affordable, attainable housing – for-sale, forrent, multifamily and single-family,” he stated. “By addressing supply chain issues, the skilled labor shortage, and reducing or eliminating inefficient regulatory policies such as exclusionary zoning, policymakers can play an important and muchneeded role in the fight against inflation.”

Panelists during JCHS’ report release event also echoed these messages with a call not only to invest in housing and the skilled labor shortage, but to address burdensome regulations that may prevent or hinder development.

“Housing crises don’t just naturally happen,” stated California Sen. Scott Wiener. “The housing crisis in California was engineered because of layers of bad policy.”

“Housing is a crucial engine of economic growth, and investments in this important sector pay broader dividends,” Chris Herbert, JCHS managing director, noted. “As the pandemic highlighted, high-quality, stable, and affordable housing is foundational to widespread well-being and, as such, both merits and necessitates greater public attention.”

More details, including the full report, are available at jchs.harvard.edu.