PLUS:

When Performance Contractors started in 1979, our focus was on bringing the highest standards for quality and safety to the industry in South Louisiana and along the Gulf Coast. After 43 years, we’ve diversified into new industries and spread our footprint across the country while never straying from these core pillars that forged our reputation right here at home. Our mission remains the same: to bring uncompromising safety, quality, and innovation to capital construction and maintenance projects for each client and at every job site.

Publisher: Julio Melara

Editorial Director: Penny Font

Editor: Sam Barnes

Contributing Photographers: Cheryl Gerber, Don Kadair, Terri Fensel

Sales Director: Kelly Lewis Senior Account Executives: Marielle Land-Howard, Account Executives: Gabi Bivins Porter, Meredith LaBorde, Angie Laporte, Matt Wambles, Connie Zaragoza Advertising Coordinators: Devyn MacDonald, Brittany Nieto, Cassidie Tingle

Director: Taylor Gast Multimedia Strategy Manager: Tim Coles Corporate Media Editor: Lisa Tramontana Content Strategist: Allyson Guay Account Executive: Judith LaDousa

Marketing & Events Coordinator: Taylor Falgout Training & Events Coordinator: Emma Dubuc Events: Abby Hamilton

PRODUCTION/DESIGN Production Manager: Jo Glenny Art Director: Hoa Vu Senior Graphic Designer: Melinda Gonzalez Graphic Designers: Emily Witt, Ashlee Digel

Business Manager: Tiffany Durocher Business Associate: Kirsten Milano Office Coordinator: Sara Hodge Receptionist: Cathy Varnado Brown

Audience Development Director and Digital Manager: James Hume Audience Development Coordinator: Ivana Oubre Audience Development Associate: Catherine Albano

Chairman: Julio Melara Executive Assistant: Brooke Motto Vice President: Penny Font Chief Operating Officer: Guy Barone Chairman Emeritus: Rolfe H. McCollister Jr.

SUBSCRIPTIONS/ CUSTOMER SERVICE 9029 Jefferson Highway, Suite 300 Baton Rouge, LA 70809 225-928-1700 • FAX 225-928-5019 1012industryreport.com email: circulation@businessreport.com Volume 7 - Number 1

© Copyright 2022 by Melara Enterprises, LLC. All

reserved by LBI. 10/12 Industry Report is

biannually by Louisiana Business Inc. Reproduction without permission is prohibited. Business address: 9029 Jefferson Hwy., Ste. 300, Baton Rouge, LA 70809. Telephone (225) 928-1700.

POSTMASTER: Send address changes to 1012 Industry Report, 9029 Jefferson Hwy., Ste. 300, Baton Rouge, LA 70809.

10/12 Industry Report cannot be responsible for the return of unsolicited material—manuscripts or photographs, with or without the inclusion of a stamped, self-addressed return envelope. Information in this publication is gathered from sources considered to be reliable, but the accuracy and completeness of the information cannot be guaranteed. No information expressed here constitutes a solicitation for the purchase or sale of any securities.

They’re the innovators of new approaches to old problems, and they’re out to change the world.

One company plans to use carbon-negative processes to produce polyethylene terephthalate plastic for packaging textiles, apparel, and other applications. Its technology platform will turn sustainable wood residues into useful chemical compounds while removing carbon from the atmosphere.

Another innovator is using a sustainable hydrogen fuel solution for inland towboats that will reduce both cost and emissions. This “future fuel,” which takes methanol and con verts it to hydrogen at the point of consumption, could one day serve as a test case for green inland waterway transportation and as an inspiration for other sectors.

And yet another company has deployed innovative AI-driven technology to measure and monitor energy usage and emissions to iden tify ways to reduce CO2 emissions and improve energy efficiency.

Originally designed for complex oil and gas facilities, the new digital technology is part of the company’s roadmap for reducing greenhouse gas emissions by up to 30% globally in just the next seven years.

Cutting across a wide swath of markets and geographies, these innovators are all seeking to build a better mousetrap for industry. And they all have—or plan to have—significant and substantial ties to the 10/12 corridor. Their stories begin on page 16.

There’s real momentum building in the offshore wind power market, and it’s attracting some rather inter esting partnerships—particularly the state’s oil and gas industry. If done right, this burgeoning form of renewable energy has promising job creating potential in the fabrication and offshore oil markets.

Still, economists and others say a lot must happen before that becomes a reality. In the meantime, other forms of renewable energy

such as biofuels and solar are further ahead in the game, as well as have their own potential as job creators.

Nevertheless, the move toward offshore wind in the Gulf of Mexico is advancing—and advancing fast. State legislation passed during the last session paves the regulatory way for offshore leasing, UNO just an nounced a new Wind Energy Hub at its campus, and some traditional oil and gas service companies—such as Danos in Gray, Louisiana—have launched new initiatives intended to position them for the eventuality of offshore wind power. Get the details on page 29.

More recently, Greater New Or leans Inc. and affiliate Greater New Orleans Development Foundation were awarded $50 million from the U.S. Economic Development Administration to create an offshore wind-powered hydrogen energy industry cluster in south Louisiana.

Dubbed H2theFuture, the project was among 21 to be selected for funding through the 2021 Ameri can Rescue Plan competitive grant program. The $1 billion Build Back Better initiative, which the U.S. Commerce Department describes as “the most impactful regional economic development competition in decades,” seeks to boost economic recovery and rebuild communities through “transformative invest ments” in regional industry clusters.

The winning Louisiana proposal creates a roadmap for decarbonizing Louisiana’s manufacturing sector

while creating new energy jobs. The federal grant will be supplemented by $24.5 million in matching funds from the state.

Ahmed Khattab and Rafael Hernandez are offering something distinctly unique at The University of Louisiana at Lafayette: a “smart oilfield” concentration for petroleum engineering majors. It’s the only one of its kind in the country, says Khattab, dean of the university’s College of Engineering—and will integrate his college’s existing subsurface expertise with smart drilling, machine learning and data analytics.

In effect, it’s preparing students for jobs in an oil and gas industry that relies increasingly on evolving technology for efficient, safe, and environmentally sound exploration and production.

The concentration features a blend of courses and labs that focus on coding, statistics, machine learning, automation, predictive capabilities, carbon capture, computational fluid dynamics, smart drilling and the economic feasibility of exploration in specific locations.

Local industry is getting in on the act by providing real-world guidance on advisory panels and offering donations of software, materials and money to support the concentration. Their hope is that it will ultimately make petroleum engineering grad uates a more desirable commodity. Read more on page 36.

There’s real momentum building in the offshore wind power market, and it’s attracting some rather interesting partnerships.

Louisiana is gearing up for another bubble of industrial construction.

That’s according to a Greater Baton Rouge Industry Alliance survey of member plant managers.

While many leaders at the 28 sites who responded forecast production, cap ital spending and employment to remain mostly steady over the next six months, the organization’s overall economic index derived from survey responses indicates an expanding economy.

Strong increases in hiring and spending following the pandemic low point have leveled off for now, though a spate of recent project announcements has the region’s industry gearing up for another increase in construction activity, says Connie Fabre, GBRIA’s president and CEO.

However, some plant leaders have expressed concerns about the potential for a recession, in addition to long-standing workforce and regulation worries as well as product demand.

The organization comprises more than 60 petrochemical, paper, pharmaceutical, storage terminal and other industrial facilities located in the seven parishes around Baton Rouge.

Here’s a look at the data:

How do

expect your plant’s

to change in the next

How do you expect your company’s

expenditures to change at

plant in the next

do you expect your plant’s

employment to change in the next 6 months?

the

As the nation shifts focus to rebuild better with safe, sustainable, and resilient infrastructure, steel production in America is more critical than ever. And how that steel is made matters. Nucor Corporation is delivering both safe and sustainable infrastructure solutions, beginning with its raw materials produced in south Louisiana

In At its state-of-the-art facility in St. James Parish, Nucor Steel Louisiana produces natural gas-based direct reduced iron—or DRI—which is blended with recycled scrap in Nucor’s steel mills to make higher grades of steel. Making new steel from DRI and scrap forms the foundation for the sustainable steel used to build onshore and offshore wind towers, solar installations, electric vehicle and other critical infrastructure for our modern American economy.

DRI is made from high-grade iron ore reduced by natural gas at extremely high temperatures to provide highly-metallicized

refined iron pellets. By using natural gas, our DRI plant emits only half of the CO2 compared to iron produced in blast furnaces at traditional integrated steel mills. Following production, DRI is shipped by barge on the Mississippi River from the St. James facility to Nucor steel mills nationwide.

“Producing DRI with natural gas allows Nucor to make the higher grades of steel increasingly demanded by our customers while maintaining our low carbon production advantage over competitors in Europe and Asia that make steel in high-emissions blast furnaces,” said Calvin Hart, General Manager, Nucor Steel Louisiana.

Nucor pioneered the process of making steel in the U.S. by recycling scrap metal in Electric Arc Furnaces (EAFs). Last year, Nucor recycled nearly 23 million tons of ferrous scrap metal to produce new steel that is 100% recyclable. The company is North America’s largest steel producer and its largest recycler of any type of material. Today, more than 70%

High-quality steel products require a pure iron source like Nucor’s DRI to be blended with scrap metal to meet stringent quality standards, for example:

• High strength sheet for safer, lighter automobiles

• Heavy gauge plate for offshore wind tower foundations

• Galvanized solar torque tube for to America’s expanding solar energy markets

• Armor plate for military Humvees, aircraft carriers, and destroyers; and

• High quality American steel products for heavy equipment, farming equipment,appliances, HVAC systems and other applications

of steel made in the U.S. is produced in EAFs, making this country the cleanest place in the world to produce steel.

Using EAFs, Nucor’s corporate-wide greenhouse gas emissions intensity is less than one-quarter the global average, and onefifth of traditional integrated steel producers, which make steel by burning iron ore and coking coal. As part of its environmental commitment, Nucor Corporation has invested over $350 million in environmental process equipment over the last decade to make its operations even safer and more efficient.

Nucor Corporation is also the largest buyer of renewable electricity among American steelmakers and is one of the largest corporate buyers overall.

“Our goal is to be the safest and most sustainable steel company in the world. Nucor has invested more than $15 billion dollars in the U.S. over the last decade to grow our portfolio of sustainably made steel products, and we are proud to be able to help our customers reduce their carbon footprint throughout the supply chain.” said Hart.

To learn more, visit nucor.com/sustainability.

LNG exporter Cheniere Energy Inc. says it will repair and replace equipment at its Louisiana terminal after tests showed it exceeded newly imposed hazardous emissions limits on certain known carcinogens. According to Reuters, testing indicated at least one of Cheniere’s turbines at its liquefied natural gas export terminal in Louisiana failed the new standards, while the turbines in Texas at the company’s only other U.S. LNG facility were meeting the rules. At issue is a rule under the

BASF Geismar is collaborating with LSU chemical engineers to better un derstand and predict its own production ebbs and flows using artificial intelli gence, or AI. BASF engineers asked LSU to develop AI and machine learning solutions to help organize its data and understand how changes in one produc tion unit might force different operating conditions in other, connected units. As part of the effort, BASF is asking SU to develop what it calls “soft sensors,” which are entirely driven by data.

U.S. Clean Air Act called the National Emissions Standards for Hazardous Pollutants, which imposes curbs on emissions of known carcinogens such as formaldehyde and benzene …

A floating liquefied natural gas port proposed for offshore Louisiana is gain ing new momentum as global demand for gas keeps soaring, pushed higher by the Ukraine war. In September, Hous ton-based pipeline company Delfin Mid stream reached a preliminary agreement with oil and gas producer Devon Energy, which plans to buy up to 2 million metric tons per year from Delfin LNG. The LNG project’s progress had stalled for years before the war in Ukraine sparked a global energy crunch and drove new interest in natural gas projects in Texas and Louisiana. Now, global buyers are reviewing LNG companies along the Gulf Coast, hunting for competitive pric es, low emissions, and proof of speedy execution as they decide on projects to which they can commit …

Australian energy major Woodside Energy has struck two binding LNG sales agreements with the Common wealth LNG export terminal project in Cameron Parish. The two sale and purchase agreements converted two previous non-binding heads of agree ment and cover the supply of up to 2.5-million tons a year of LNG over a 20-year period from Commonwealth’s export facility under development in Cameron Parish. First LNG deliveries are expected to start in mid-2026.

Chennault International Airport in Lake Charles has completed a $4 million air cargo facility that is now available for lease. In addition, Chennault will help secure specialized air cargo ground equipment and offers competitive incentives for air cargo activity. The adjacent aircraft parking apron is 127,000 square feet, able to accommodate large and small cargo aircraft. The facility was built to attract both domestic and international cargo, and the airport plans to work with industry partners to help certify the building for international cargo clearance.

“We are pleased that the Department of the Interior has finally offered the first offshore leases of this administration, but it is disappointing that it took 19 months and an act of Congress to get us to this point.”

COLE RAMSEY, vice president of upstream policy for the American Petroleum Institute

Short tons handled by the Port of Greater Baton Rouge in 2021, up 18% from the 13,355,767 short tons it handled in 2020. The facility ranked seventh in the nation for total tonnage in 2020 by the U.S. Army Corps of Engineers.

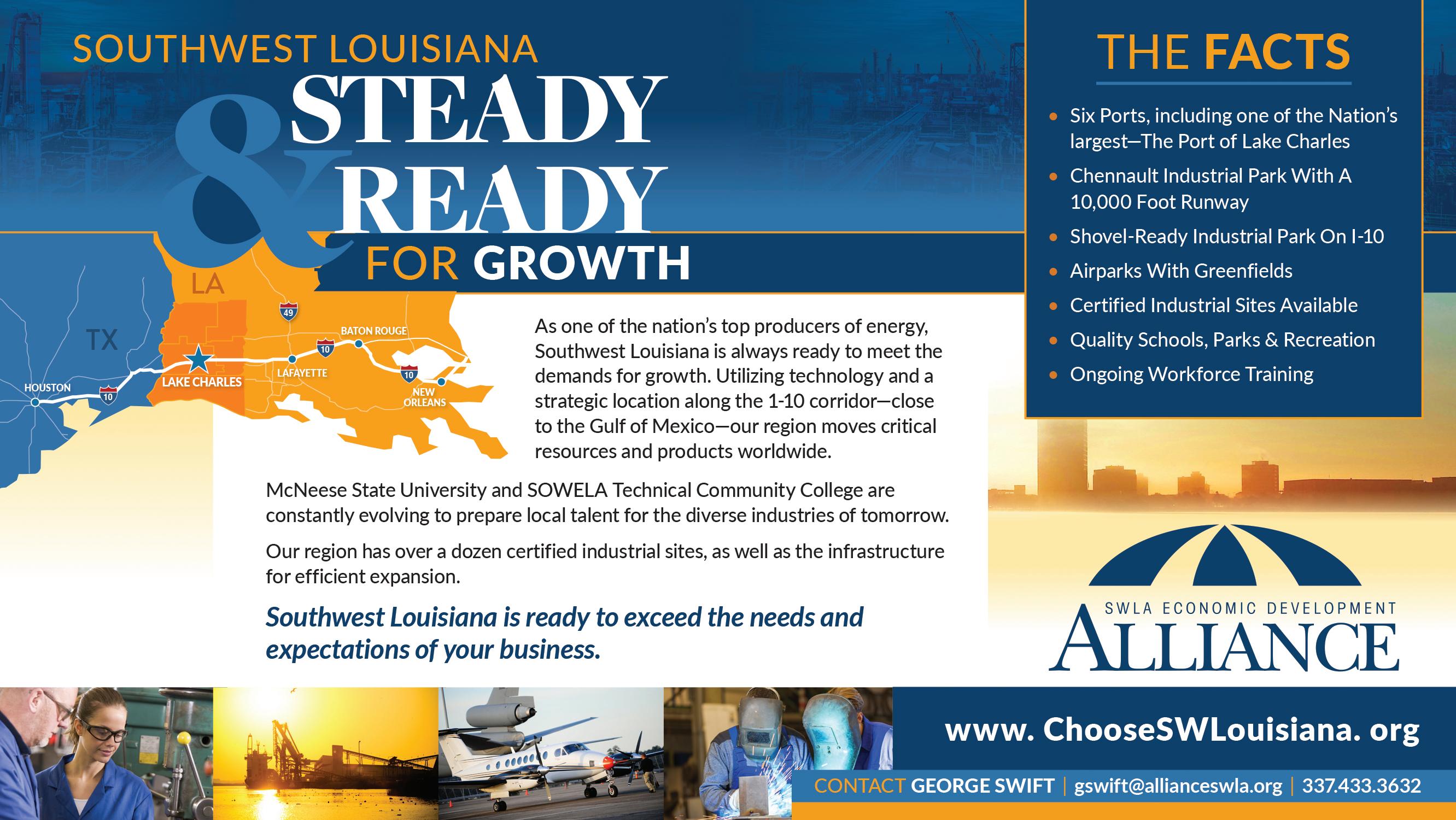

By providing residents of Southwest Louisiana with consistent employment through a pandemic and multiple natural disasters, local industry continues to be an economic driver for our region.

The almost 10,000 good-paying jobs with benefits for direct employees and contractors and another 17,000 associated jobs in the region that exist due to industries result in over $2 billion in annual earnings.

Local industries provide generous donations to education and non-profit organizations, and they are 17 of the top 20 property tax payers in Calcasieu Parish.

Lake Area Industry Alliance is the umbrella organization between its 24 industrial members and our local community, government officials, educators, business leaders and non-profit organizations.

With such a significant impact in our community, the work of LAIA is as important as ever. LAIA will continue to be a conduit of communication to enhance industrial advancements along with partnerships within the community.

Entergy Louisiana, Entergy New Orleans and Diamond Offshore Wind announced last week that they’re jointly evaluating the potential development of wind power generation in the Gulf of Mexico.

The agreement could put Entergy in a position to deliver another source of clean power to customers while also strengthening the region’s economic development.

The agreement provides a legal framework for Entergy and Diamond Offshore Wind to work toward the development of potential offshore wind demonstration projects located in Louisiana state waters and will focus in the near term on the evaluation of grid interconnection to determine the optimal size and locations of future offshore wind development.

“This is an important first step to possibly bring wind power to our Louisiana shores,” said Phillip May, Entergy Louisiana president and CEO. “While there remains work to be done before that happens, we are excited by the opportunity to begin this process.”

Entergy Louisiana currently has approximately 280 megawatts of renewable re sources, including the Capital Region Solar facility, which began delivering power to the grid in October 2020. Along with nuclear generation, nearly 30% of the company’s portfolio comes from renewable resources. In addition, the Louisiana Public Service Commission recently approved 475 megawatts of solar power with an additional 2,000 megawatts in the queue.

“You can be for it, you can be against it, and that’s your right. But one thing that’s not accurate: It’s not new technology. We’ve been drilling wells for 100 years here in Louisiana, we’ve been doing injections for over 40. And we’re good at it. We can do it well. We can do it with full oversight. And we can do it in a manner that is protective of human health and the environment.””

THOMAS HARRIS, secretary, Louisiana Department of Natural Resources, to Livingston Parish residents opposing a plan to pump carbon into the ground under Lake Maurepas

BY THE NUMBERS

BY THE NUMBERS

What H&E Equipment Services has agreed to pay in cash for Illinoisbased One Source Equipment Rental, which has 10 branches in the Midwest and South that provide nonresidential construction and industrial equipment. The transaction was expected to close in Q4. H&E’s rental operations will now extend across 117 branch locations in 28 states.

CITGO Lake Charles achieved record breaking safety and environmentaland environmental performance this year, while at the same time achieving the highest production rate in its 78-year history.

and support our local community. In this we take great pride.

Even as Paul Matthews worked in the banking industry at J.P. Morgan in Pineville, Louisiana, he was looking for a way back to southeast Louisiana. His eventual mentor, then-Port of New Orleans CEO Gary LaGrange, gave him that chance in 2012, hiring him on as community affairs manager.

It was a pivotal moment for Matthews, as it gave him his first real exposure to the maritime industry. “I fell in love with it over those five years,” he says.

Later, he continued to grow his skillsets as deputy port director downriver at the Plaquemines Port, where he led efforts on multimilliondollar projects and oversaw financing, operations, safety and security, grants, legal issues and more. “I am proud of my time there,” he adds. “We were able to finalize a deal on a $13 billion project for LNG with Venture Global, which almost doubled our revenues and had a huge impact to the region.”

He also helped attract a major container terminal operator to the Plaquemines Port, which facilitated the expansion of rail capacity and expanded infrastructure in the region.

In January, Matthews took the next step in his journey when he was named CEO of the Port of South Louisiana following the retirement of Paul Aucoin. “I cut my teeth at those ports,” he says. “Now, being at one of the largest ports in the Western Hemisphere, I’m hitting the ground running.”

What do you find most exciting about the port’s future?

I’m excited about the opportu nities. The sky is the limit in many ways. We still have not reached capacity—there are thousands of acres in undeveloped land at the port—and we have a strong board that wants to be aggressive, strategic, and focused. On top of that, we have the backing of a strong state and congressional delegation.

Right now, we have mostly bulk cargo, but there are opportunities for break bulk and ‘roll on/roll off’ cargo. We’re going to go after the big boys—the Samsungs, Teslas and

Amazons of the world—to tap into the advanced manufacturing and warehouse sector to create quality jobs, many of which can average $90,000 to $100,000 a year.

And we have the workforce to get it done, thanks to the vast industrial community here. From Plaquemines to Baton Rouge to the Northshore and down to the bayou, we see our selves as a major player and will do what’s best for south Louisiana.

What has been your toughest challenge since becoming CEO at the port?

Trying to keep up with changes in the market. Market forces have been volatile since the pandemic. We’ve had to change our master plan multiple times in the last six months, which creates delays. But at the same time, we’re implementing the plan even as we’re changing it.

We must look at what’s coming down the pike, and it’s coming very quickly. On a daily basis, we’re look-

ing at infrastructure needs, potential demands and opportunities for land to be developed all throughout the Port of South Louisiana to meet customer needs.

We’ve received more than $1 million recently from FEMA port security grants that will focus on cybersecurity and GIS mapping. That will create a safer atmosphere for business.

Additionally, the port has been awarded a project through the Biden administration to pave the way for E-methanol bunkering. As a result, we will be bunkering new E-methanol fuel for tugboats in the Mississippi River. It will be the first of its kind in the U.S. and only the second in the world.

We are just now seeing the be ginning of the energy transition at the Port of South Louisiana. We’re looking to attract new types of green energy, hydrogen, LNG etc. based upon our land availability. This, too, is in response to market forces and

demand, as many of the BCOs (Ben eficial Cargo Owners) are wanting to ensure that every part of their supply chain is green. There’s no reason why our port’s activities and an environmental focus can’t go hand in hand.

In the process, we see ourselves working with New Orleans, Baton Rouge, the Northshore down to Port Fourchon in a regional approach.

What has been the toughest challenge of your career?

Dealing with the unfortunate politics at the Plaquemines Port. It’s the only port in the state in which a local council is also the board for the port, so it can create a unique conflict of interest and lead to confusion. De spite all that, we were very successful in navigating through the harsh local politics and issues to accomplish some key objectives.

As for volunteer work, I serve on the United Way of Southeast Loui siana’s board of directors and GNO Inc.’s executive committee. I’m also chairman of the GNO Inc. NextGen Council and sit on the World Trade Center Transportation Committee.

While at home, if I’m not watching the Saints game or Tulane football, I’m spending time with my boys (ages 8 and 6) and wife. If I’m not on a baseball field somewhere in southeast Louisiana, I’m on a football field watching them play flag football. There’s always football, basketball or baseball going on in my backyard, depending on the season. As soon as I get home, I have to change out of my suit and go play some ball.

POSITION CEO COMPANY Port of South Louisiana HOMETOWN New OrleansBachelor’s degree in political science, Tulane University; master’s degree in business administration, University of Louisiana at Lafayette

The industrial market is changing, and some Louisianans are finding opportunities in that change. Economic volatility, environmental mandates, geopolitics and a variety of other factors are prompting them—and the companies that serve them—to innovate and adapt in order to survive.

But while innovation is necessary for longterm growth, taking it from conception to reality remains a stumbling block for many industrial owners. They’re simply unwilling to take the financial risk, despite any potential market share that might be gained.

For their part, state and federal entities have tried to spur things along. The U.S. Econom ic Development Administration’s $1 billion Build Back Better Challenge recently sought to promote “next generation” manufacturing, biotechnology and clean energy, and with some local success.

GNO Inc. and a consortium of academic and other entities landed $50 million of it to create a roadmap for decarbonizing Louisiana’s manufacturing sector. Additionally, the Port of South Louisiana is developing e-methanol bunkering, and other state ports are enhancing their cybersecurity with federal money.

For those companies along the 10/12 corridor who take the leap into innovation, their reasons are as varied as the products they produce and services that they offer. They’re investing in greener ways to manufacture their products, incorporating data analytics and AI into their processes, and incorporating the use of alternative fuels, along with other initiatives. Ultimately, they all share a common thread: a culture of change and resiliency.

In the following pages, 10/12 Industry Report highlights a few of these game changers who are seeking to transform the rules, and by doing so hope to gain a competitive advantage.

THE INNOVATION: Hydrogen-Fueled Towboat Maritime Partners saw an opportunity in 2018. An impending federal mandate requiring that all inland towboats be inspected annually by the U.S. Coast Guard—via the new Subchapter M requirement— meant that many of the nation’s aging inland vessels wouldn’t pass inspection.

That prompted the Metairie-based company to initiate a $500 million construction program in 2018 to build 158 new vessels across nine shipyards—its largest-ever investment. The eight-year-old company already owns some 1,600 tugboats and barges that it leases to operators up and down the Mississippi River and the length of the Intracoastal Waterway.

At the same time, founders Bick Brooks and Aus tin Sperry saw a chance to break new ground in the alternative fuels space, since marine transportation companies were actively exploring a range of greener power and propulsion solutions to help reduce vessel emissions. “They are true believers in the energy transition,” says Beau Berthelot, vice president of business development for Maritime Part ners, “and they were actively looking at the viability of a variety of alternative fuels.”

Maritime considered three primary criteria when evaluating these “future fuel” options: significant emissions benefits, cost competitiveness and strong performance. The end of their journey will come in 2023 with the launch of a new, more environmentally friendly towboat: Hydrogen One. The vessel will be the first of its kind to run on emissions-reducing methanol-to-hydrogen generator technol-

ogy. While hydrogen requires too much space as a fuel on its own, the technology enables ship operators to transport methanol, then convert it to hydrogen within a generator.

Designed by Seattle-based Elliott Bay Design Group, the towboat is currently being constructed at Intracoastal Iron Works in Bourg, Louisiana. Other key partners include technology providers e1 Marine in Bend, Oregon, and multinational engineering firm ABB. Once completed, the vessel will be operated by American Commercial Barge Line of Jeffersonville, Indiana.

“Essentially, a mix of methanol and deionized water will go into the reformer, which will in turn extract the hydrogen and send it to the fuel cell,” Berthelot says. “A chemical reaction will then gener ate electricity that will either be stored in a battery or used to turn propellers.” The technology comes with some obvious environmental benefits. Methanol has no diesel particulate matter, and since there’s no internal combustion, the process doesn’t produce nitrous oxide.

Another advantage: Methanol can be stored much like a conventional fuel because it is stable at normal atmospheric pressures and temperatures. While pure hydrogen can be difficult to carry in the quantities necessary, methanol is readily available and routinely carried on U.S. inland waterways; therefore, it can be bunkered from a truck or terminal through a hose, and doesn’t require any special permitting, unlike hydrogen, ammonia, or other alternative fuels.

Maritime Partners feels Hydrogen One will be a game changer, and it couldn’t come at a better time. The Port of South Louisiana and Port NOLA are both actively pursuing the development of alternative fuel bunkering stations.

“[Founders Bick Brooks and Austin Sperry] are true believers in the energy transition and they were actively looking at the viability of a variety of alternative fuels.”

BEAU BERTHELOT, vice president of business development, Maritime Partners

Over the last year, CF Industries has unveiled a cadre of carbon-reducing projects at its Donaldsonville plant. The investments should put a serious dent in its industrial carbon emissions and go a long way toward meeting corporate goals of reducing emis sions by 25 percent in 2030 and achieving net-zero by 2050.

It’s a bold but necessary move by the facility, which is currently one the largest ammonia manufacturing complexes in the world. The production of ammonia

can produce significant quantities of CO2.

The first project out of the gate, to be completed in 2023, will become the first commercial-scale green ammonia production facility in North America.

Once operational, a 20MW alkaline water electrolysis plant will produce green hydrogen that will be integrated into the plant’s existing ammonia synthe sis loop. It will produce some 20,000 tons of green ammonia a year.

Another $198.5 million is being spent to con struct a CO2 compression and dehydration unit at the plant that could potentially sequester about 2

million tons a year and enable the production of more than 1 million tons of low-carbon blue ammonia annually. “It will give us an opportu nity to evaluate this technology and determine its scalability as we move forward,” says Morris Johnson, general manager at the Donaldson ville plant.

But the biggest splash came in August when CF Industries announced a proposed $2 billion greenfield blue ammonia production facility, also to be built in Ascension Parish. The export-oriented project would be developed jointly by CF Industries and Mitsui & Co. Ltd. of Japan. By employing carbon capture and sequestration, the ammonia production process within the new facility would result in significantly lower carbon emissions than conventional ammonia processes, qualifying it as a “blue” process.

“This new greenfield ammonia capacity would leverage carbon capture and sequestra tion similar to what we’ll be doing in our existing plant,” Johnson says. “We’re expecting an FID (final investment decision) in 2023, with construction to be completed in 2027.”

Johnson is excited about the future potential of the ammonia market. Ener gy-intensive industries such as marine shipping and power generation are looking to ammonia as a potential source for clean energy because of its hydrogen content. The maritime industry, in fact, has established some rather aggressive goals for reducing emissions.

“Ammonia is one part nitrogen and three parts hydrogen, so it’s a very efficient way to transport hydrogen,” Johnson says. “Hydrogen itself must be stored at much lower temperatures, so ammonia could be used to transport it, then could be disassociated on the receiving end. It could also be used as a fuel itself.

“Being the world’s largest producer of am monia, we intend to be at the forefront of that demand,” Johnson says.

Additionally, hydrogen will need to meet 20 percent of the world’s energy needs by 2050; it’s currently supplying less than 1 percent.

“The scale of the need is daunting,” Johnson says, “but being the largest producer of ammonia and hydrogen, we feel like we have the expertise, logistics, experience and scale to be the logical leader in this space.”

“We have the expertise, logistics, experience and scale to be the logical leader in this space.”

MORRIS JOHNSON, general manager, CF Industries Donaldsonville plant

Andre Bonton, Sasol’s vice president of technical services, is excited about the potential of AI and advanced analytics at the company’s Lake Charles Chemical Complex. For the first time in the chemical space, Sasol will be deploying AI-driven technology in its ethylene unit to detect inefficiencies and help map out a game plan for reducing emissions.

Theycompay plans to use the resulting algorithms to measure and monitor existing data sources, then identify opportunities to reduce CO2 emissions and improve en ergy efficiency. Sasol chose “emis sions.AI,” a program produced by UK-based data analytics experts OPEX, to perform the work, marking the first time the company has used the technology outside of an oil and gas facility.

Bonton has prior experience with the analytics side of the busi ness and recognized the potential of AI at his plant.

“While OPEX had more exposure in the oil and gas space and had yet to apply the technology in the chemical space, I felt that we could make it work,” he adds. “It was clear that they could use the information we have here at our site to run the necessary

algorithms, advanced analytics and AI to find out if there were opportunities for us to operate more efficiently and reduce our carbon footprint.”

Upon completion of the process, Sasol plans to make tangible decisions that will improve its over all CO2 emissions—whether through operational changes or equipment modifications—in line with plans to reduce greenhouse gas emissions by 30 percent, globally, by 2030.

It’s currently in the early stages of the process, which will likely be expanded to other units following the pilot program. “There isn’t a lot of prep work required, since much of the data was already available,” he adds. “It’s just matter of retrieving the right data, running an analysis, and providing

feedback. Our folks on the ground will work with them, hand-in-hand, and once we have tangible information we’ll make concrete decisions on actions that need to take place.”

The initial pilot project will be conducted with in the plant’s ethylene unit, which is a recognized source of carbon emissions. Additionally, Sasol will deploy two of its technology engineers in the unit to facilitate the day-to-day process, and a senior manager will act as the liaison with OPEX.

Sasol will provide the data in a secured platform, then OPEX will in turn perform the analysis, using their proprietary technology to identify inefficiencies and create a plan for improving their overall emissions profile.

“In our discussions with OPEX, we began with the end in mind so that they understood what we wanted to get out of it,” Bonton says. “I don’t want to overpromise, but I think it’s a good opportunity to use innovation to identify ways that we can start making improvements.

“What excited me most about AI is that we’re learning from our past, and the fact that we can learn from what we’ve already done. It affords us an opportunity to really capture the essence of what we’ve done and make improvements to the way we do things in the future. Above all else, we want to start moving the needle toward our emissions reduction goals.”

“AI affords us an opportunity to really capture the essence of what we’ve done and make improvements to the way we do things in the future.”ANDRE BONTON, vice president of technical services, Sasol

Since 2014, CGI Technologies & Solutions’ research and technology innovations lab in Lafayette has advanced cutting-edge IT technologies such as cybersecurity, data analytics and visualization to enable digital transformations for its clients.

That’s of particular interest to oil, gas and petrochemical owners, as the industry increasingly moves toward smarter, more data-driven decision making. As a corporation, CGI has developed strong relationships with industry as it provides U.S. producers with innovative and flexible solutions for making cost-effective business decisions.

CGI also supports many of the oil and gas “majors” with cybersecurity development and implementation, as well as performs incident response exercises.

“We also do work in the government space that could ultimately streamline the permitting process,” says Wil LaBar, who leads the Montreal-based company’s program strategy from his office in Lafayette. “For example, we’re working with the Department of the Interior as they look at their data sources around land rights and grants in order to modernize data exchange processes across different parts of the agency.”

CGI came to Lafayette as part of a unique public-private partnership with Louisiana Economic Development, Lafayette Economic Development and the University of Louisiana at Lafayette. The goal: Curtail the outmigration of the university’s graduates.

For its part, CGI committed to hiring 400 employees within four years. Today, that number has grown to more than 700, with plans to add another 100 at CGI’s Onshore IT Center in ULL’s Research Park. “There were a lot of graduating students who couldn’t find employment in the tech sector, despite ULL having one of the finest computer science programs in the country,” LaBar says. “A lot of them were leaving the state.”

Today, many of CGI’s new hires are ULL students with undergraduate or graduate degrees, while others come from nontraditional back grounds. “In August, we completed the first-ever software development apprenticeship program in the state’s history,” he adds. “The apprentices come from nontraditional backgrounds and receive external training through a nonprofit partner. For 12 months, they go through on-the-job training and learn the trade of becoming a software developer.”

To spur further development, the state awarded

$4.5 million to ULL to triple the number of computer science graduates. It ultimate ly led to a new Informatics concentration, which CGI helped create. “We’ve been in the classroom with them over the last eight years,” LaBar says. “Last year, we mentored more than 40 students through the program. In the process, we’re giving them real-world problems, they’re using technology that our customers and our team use, and they build a product at the end of the semester.”

CGI and its employees are also strong promoters of STEM fields in the Lafayette area. Last summer, CGI volunteers sponsored a one-day STEM camp in partnership with LAGCOE. “Through our ‘STEM@CGI’ program, we have interacted with numerous schools in the region,” LeBar says. “We’re introducing and inspiring students who are typically underrepresented. That’s important to oil and gas because all of these skillsets are needed.”

“We’re introducing and inspiring students who are typically underrepresented. That’s important to oil and gas because all of these skillsets are needed.”

WIL LABAR, Vice President of Consulting Services, CGI Technologies & Solutions

Origin Materials’ new $750 million “Origin 2” biomass manufacturing facility in Ascension Par ish will go beyond mere carbon neutrality. In fact, the owners expect the plant to be carbon-negative once operational in mid-2025.

To make that happen, they’ll utilize sustainable wood residue to produce plant-based polyethylene terephthalate (PET), which will then be used in the manufacture of packaging, textiles, apparel and other applications. Hydrothermal carbon, which can be used in fuel pellets, also will be produced at the site.

The plant’s completion will mark the culmi nation of a multiyear journey that began when co-founders John Bissel and Ryan Smith were chemical engineering students at UC-Davis in

2008. That’s when they won the EPA’s People, Property and the Planet (P3) design competition for their proposed technology. Using the $75,000 in award money, they launched the company later that year. Success, however, would not come until several years later, and only after they had honed their business acumen and found the necessary capital to meet their objectives.

Bissel admits to being profoundly naïve in the early days of his company. If investors don’t understand the industry they’re not going to invest,” he adds. “We eventually found the right people who understood the problem we were solving, understand the technology and the mission. Over time, we were able to find patient, thoughtful investors and that helped us to become successful.”

While Origin’s technology has dramatically changed in the last 14 years, the mission is the same. The company researched other technologies and ultimately selected one “that we thought had legs and met the same objectives.” From there, they adapted the technology to meet their needs, then developed a strong in-house technology development group comprised of former engineers from ExxonMobil, Phillip 66, Dow and Dupont.

“We have one of the best research and development facilities in the chemicals industry,” he adds. “Over time, we’ve refined our view of what makes technol ogy successful in this industry and what doesn’t. You tend to learn things more deeply when you’re an entrepreneur.”

When scouting a location for the plant, Bissel was immediately

attracted to the existing industrial infrastructure already in place in Louisiana. “The easiest place for us to locate is at the intersection of forest products and chemical world,” he says. “We use feed stock form the forest products industry, but the rest of our infrastructure looks much like the chemical industry. Having access to an ethylene and hydrogen pipeline and relatively short distances form sawmills and pulp mills … that was the Goldilocks spot.”

The customers, as well as the necessary skilled labor force, were needed nearby as well. “When you’re a company of 250 people and you need to train up to 200 people to work at a site, that’s a big undertaking. So having a lot of people in the area that are already highly skilled is important. The corridor between Baton Rouge and New Orleans is one of the most highly skilled corridors on the planet—from an operating and construction perspective.”

Made with renewable feedstocks from Loui siana timber mills and forests, Origin’s patented technology platform is designed to reduce the carbon emitted during the production of widely used products ranging from food and beverage containers to parts for the automotive industry. The plant will be located on an LED Certified Site—the 150-acre Parks Geismar site in Ascension Parish—signifying that it has been deemed development-ready after an extensive review.

The company expects construction to begin in mid-2023 and for the plant to be mechanically completed and operational by mid-2025.

Origin has partnered with leading consumer brands including Danone, Nestlé Waters and PepsiCo in its creation of recyclable, plant-based PET plastic consumer products, as well as Ford Motor Co. and global chemical companies. This largestof-its-kind Geismar-based facility will join the company’s network of locations, including its West Sacramento-based pilot facility and its Ontario, Canada-based production site, which is currently under construction.

“The demand for ‘net zero’-enabling materials is extremely strong, and we believe this plant will be instrumental in addressing demand for our products in the U.S. and internationally,” Bissell says.

COMING SOON: A scene from Origin 1, Origin Materials’ first commercial scale facility under construction in Sarnia, Ontario. The planned Origin 2 in Geismar will be the company’s largest site.

COMING SOON: A scene from Origin 1, Origin Materials’ first commercial scale facility under construction in Sarnia, Ontario. The planned Origin 2 in Geismar will be the company’s largest site.

“We use feed stock form the forest products industry, but the rest of our infrastructure looks much like the chemical industry. Having access to an ethylene and hydrogen pipeline and relatively short distances form sawmills and pulp mills … that was the Goldilocks spot.”

JOHN BISSEL, co-founder and CEO, Origin Materials

10/12 Industry Report shines a light on regional companies and organizations that make an impact in their fields and in their communities.

SPECIALTY WELDING & TURNAROUNDS

CITY OF ST. GABRIEL

SPECIALTY WELDING & TURNAROUNDS

CITY OF ST. GABRIEL

When SWAT was founded in the summer of 2013, the company’s strategic plan for growth included adding service lines and retaining and acquiring the top talent in the industry. Since then, the company has accomplished that and a lot more with nearly 3,000 employees and offices across the country.

“We don’t have a company without our people,” says Vice President and Co-Founder Jimmy Quick. “They are the backbone of our business, along with our customers.”

A focus on people has driven SWAT to success over

the past nine years. With mechanical and catalyst services added and, most recently, the acquisition of Midwest Cooling Towers, they were able to diversify their offerings—and their pool of resources.

“We’re in a good spot, and we’ve grown even during COVID,” says Quick. “We went out and got talent when other companies were laying off.”

At its peak time this year, SWAT had 2,800 employees. Quick says that while the company has grown fairly large, it still feels small. “We don’t want anybody to ever feel like they’re a number,” he says. “We have an open-door policy.”

SWAT’s footprint covers 18 states from Louisiana to California and Alaska, with Gonzales as its hub. With so many employees and locations across the country, safety is paramount. “We’ve done over 4 million man hours to date without an OSHA reportable this year,” says Quick. “That’s unheard of in this industry.”

The last piece of the puzzle in SWAT’s success is its customers. Long-term partnerships with major refineries, chemical companies and, most recently, renewable projects mean repeat business. “The industry is changing, and we’re going to be at the forefront of that,” says Quick.

We’re in a good spot, and we’ve grown even during COVID. We went out and got talent when other companies were laying off.

JIMMY QUICK Vice President and Co-Founder

JIMMY QUICK Vice President and Co-Founder

The only piece of Iberville Parish divided by the mighty Mississippi River, the city of St. Gabriel may be one of the best-kept secrets in the Baton Rouge region. With a population of 6,433, St. Gabriel is the fastest-growing and largest local municipality in the parish. This small, 25-square-mile city has been transformed from a primarily agricultural economy to one that is now home to more than 10 industrial facilities.

It is the job of Mayor Lionel Johnson Jr. to keep the harmony between community and industry in St. Gabriel. With a background in the public education system, he keeps the lines of communication open between the community, local industry, educational partners and local government. He works closely

with industrial entities to help educate and develop St. Gabriel residents for careers with local industry, and under his administration, St. Gabriel has added multi-million-dollar sewer upgrades, a new police department, a new senior center, improvements to streets, drainage and outdoor recreation, and several residential developments.

Expansions and new projects are being announced regularly post COVID-19 in St. Gabriel. These include expansions of existing facilities, as well as additional, new technologies such as the green energy that will power the future. Additionally, there are plans to break ground on a new Council Chamber that will also be used as an emergency command center.

Nutrien, formally PCS Nitrogen, is set to retrofit and expand its facility to produce a lower carbon ammonia that is used to feed the world. Newly announced Plug Power is building a new facility that will capture the hydrogen from the atmosphere to liquefy it for hydrogen fuel cells that run forklifts inside the warehouses of Federal Express, WalMart and Amazon.

“Where there is industry, there is commerce ... where there is commerce, there is a steady, predictable tax base to benefit the residents of St. Gabriel,” Johnson says. “It’s not always easy, but it will always be more difficult if we don’t work together to solve the problems in our community. My hope is that we can become a model for other cities that have industry in their back yard.”

The race is on Momentum for offshore wind in the Gulf is building quickly, but much work remains.

BY SAM BARNESThe various parts and pieces needed to make offshore wind a reality in the Gulf of Mexico have come into sharper focus over the last year.

There has been an undeniable buildup in momentum, from the establishment of a state regulatory framework for leases to the creation of academic and private industry consortiums to actual corporate restructurings by those wanting to position themselves for the new reality.

James Martin, CEO of Gulf Wind Technology in Avondale, says a lot of people have been waiting for this moment.

“It’s exciting,” Martin says. “I think Louisiana has a real opportunity to be the sharp end of the stick, but it’s

a bit of a race. This is a big industry and there is a lot of potential, but we need to be sharp to stay ahead of the likes of Texas, or at least be ready to work in collaboration with them.”

Martin says the federal goal of 30 gigawatts of wind power by 2030 is undeniably bullish, but it will likely go a long way toward stimulating the market.

“Once you start looking at the workforce and infrastructure needed for that to happen, you realize quickly that it’s an aggressive target,” he adds. “Investment is key and that’s why you’re seeing the Depart ment of Energy and various states trying to figure out how to incentivize the process.”

In its role, Gulf Wind Technology develops technologies that make wind energy more economical in

complex wind conditions such as the Gulf. They’re currently collaborating with the GNO Wind Alliance, the University of New Orleans’ newly created Louisiana Wind Energy Hub and others to build a blueprint for the future of wind energy in Louisiana.

Martin feels actual deployment of offshore platforms in the Gulf could come as early as 2028. He also hopes that Gulf Wind’s facilities at the shuttered Avondale shipyard could one day be transformed into a man ufacturing and staging area for off shore wind. “We could have 10,000 jobs back at Avondale directly linked to offshore wind by 2030,” Martin says. “It’s a very realistic trajectory.”

Several hurdles first must be cleared. Primarily, the Gulf’s complex wind environment makes

other locations more appealing to investors. They’re hesitant to spend billions of dollars on assets that could be at risk from a hurricane— and absent a hurricane, the winds aren’t that strong.

“It’s not currently the low-hanging fruit for offshore wind in North America,” Martin says. “Therefore, it’s not an easily investible profile. If a hurricane hits a turbine field that is off-grid and dead in the water, there will likely be a lot of damage.”

Nevertheless, Martin is optimistic that those hurdles will be overcome. Louisiana’s ability to innovate and leverage its existing assets—offshore knowledge, fabrication facilities, ser vice capabilities and workforce—will determine its future success.

“Throughout my career, I’ve seen huge innovations in wind energy,”

Martin says. “The Gulf of Mexico market is very similar to the Asian market, which has low wind speeds and typhoons. New rotor technologies have been developed that perform better in those environments, so it’s only a matter of time before manufacturers develop turbine technology and companies such as ours bring solutions to the table that de-risk wind in the Gulf.”

Gulf Wind Technology can demonstrate the cost of new technologies with its Technology Demonstrator Program, which calculates the time, energy and cost required for a wind turbine system, from manufacturing to transporta tion to installation to operation and service.

Meanwhile, several state, academic and corporate groups aren’t waiting for the perfect moment to dip their toes in the water. They’re already

taking steps to position themselves for what they feel is the inevitabil ity of offshore wind in the Gulf of Mexico.

Rep. Jerome “Zee” Zeringue of Houma introduced a bill during the last legislative session to provide the Louisiana Department of Natural Resources with the authority to establish and conduct lease sales for offshore wind farms off the coast, as well as inland. Signed into law June 15, Act 443 was sparked by the heightened interest among oil and gas service companies in Zeringue’s district.

The legislator met with DNR Secretary Thomas Harris and others to discuss the best approach. “The goal is that within 12 to 18 months of the legislation’s passage to have first lease sale off the coast of Louisiana in state waters,” he says. “DNR says they believe it can happen, and they’re promulgating rules for the RFPs to set that up.”

The Houma/Thibodaux area is ideally positioned to tap into the new market. “Of the seven operating turbines off the coast of the U.S., five of the platforms were built here in Terrebonne Parish by Gulf Island Fabrication,” Zeringue says. “We have the technology, capabilities and infrastructure to benefit and support wind energy. If you can build an oil rig, you can definitely build a wind turbine.”

Eric Danos, owner and CEO of Danos Ventures, a subsidiary of oil and gas service company Danos in Gray, has begun actively positioning his company for that eventuality. In early 2021, Danos Ventures began taking a hard look at the organi zation to begin preparing for an evolving energy industry.

Danos is seeking to determine what alternative forms of energy might be relevant, or irrelevant, some 20 or 30 years from now. He then hopes to pinpoint opportu-

nities and develop a game plan for creating competencies to meet those needs, which could be through acquisitions and partnerships.

He’s paying a lot of attention to the offshore wind market in particular, as well as the support it’s receiving at the federal and state levels. “We’re looking at the underly ing economics, and how dependent the market will be on governmental subsidies,” he adds. “We worry about what happens when those go away. Will the underlying economics still be attractive to providers and consumers?”

Danos participates in a variety of groups that are studying the subject, ranging from academic to nonprofits to private industry. The company is also a member of the GNO Wind Alliance and has engaged the Tulane Energy Institute to assist in studying the market.

More recently, they’ve been in discussions with Shell to determine

“I think Louisiana has a real opportunity to be the sharp end of the stick, but it’s a bit of a race. We need to be sharp to stay ahead of the likes of Texas, or at least be ready to work in collaboration with them.”

JAMES MARTIN, CEO, Gulf Wind Technology in Avondale

GNO INC. TOOK an early leadership role in Lou isiana’s offshore wind movement when it created the GNO Wind Alliance in 2020. The alliance serves as a platform for lawmakers, companies and academia to discuss next steps for offshore wind deployment in the Gulf of Mexico.

Last summer, the organization took another giant leap forward by landing a $50 million grant from the U.S. Economic Development Adminis tration’s “Build Back Better Regional Challenge” to research the development of an offshore wind/ green hydrogen energy cluster in south Louisi ana.

Michael Hecht, president and CEO of GNO Inc., says the initiative will essentially merge two separate environmental solutions.

“Hydrogen is typically made from natural gas, but they’re needing a cleaner way of producing it,” Hecht says. “Extracting it from water using electrolyzers is one way to do that. What if off

shore wind could power those electrolyzers?”

In that scenario, water from the Gulf of Mexico would be extracted and desalinated, then sepa rated into hydrogen and pure oxygen by an elec trolyzer powered by an offshore wind turbine. The hydrogen would then be liquefied and piped to shore for use in the production of ammonia or in some other process.

GNO Inc. first vetted the idea with academics, industry partners and other economic devel opment organizations before creating the grant application.

“It became apparent that this was something that industry was interested in, and the technol ogy made it feasible,” Hecht says. “We’ve done a lot of work with the Economic Development Administration in the past, and when we saw this opportunity, we decided to create a proposal.”

The grant will fund five work streams: a research component under the direction of

UNO, LSU, ULL and Nichols State University; a collaborative space at UNO’s Louisiana Wind Energy Hub, managed by Nexus Louisiana; a business development component managed by GNO Inc. and the Baton Rouge Area Chamber; a workforce component managed by the Louisi ana Community & Technical College System; and a pilot project to construct the nation’s first e-methanol fueling barge at the Port of South Louisiana.

Hecht says the wind component is exciting, as there’s a real need for green hydrogen in Lou isiana. The state is the largest user of industrial hydrogen in the country.

“There’s definitely a customer base,” he adds. “We’ve got a federal administration focused on making green initiatives more attractive, combined with a state that’s set forth a set of climate goals for us to achieve … it seemed like a natural fit.”

LOUISIANA IS EXPLORING HOW WIND AND GREEN HYDROGEN MIGHT ONE DAY COMPLEMENT ONE ANOTHERCHERYL GERBER

GNO Inc. President and CEO Michael Hecht

how service providers can best position themselves to work in offshore wind. “A lot of our competencies already exist in the current supply chain,” he adds. “We’re watching closely to see how the market develops, and how the technologies develop to determine the best partnerships for us.”

As for the potential of offshore wind in general, Danos says it’s all in the timing. “There’s a whole supply chain that needs to be developed in Louisiana from top to bottom,” he adds. “There’s the regu latory framework, there’s the infra structure that needs to be completed to get the energy to shore … and it all needs to go through power stations and booster stations.”

Danos is quick to point out that his company has no plans to abandon the traditional energy industry, as there are still decades of opportunity there. “We’re simply looking to augment our portfolio by looking long-term,” he adds.

MEANWHILE, AT ‘THE BEACH’ Hoping to serve as a catalyst for

the state’s burgeoning wind energy ecosystem, the University of New Orleans launched the Louisiana Wind Energy Hub last summer at “The Beach,” its 30-acre research and technology park.

Rebecca Conwell, president and CEO of the UNO Technology and Research Foundation, says there are plans to “build out” about 15,000 square feet of office space in the park to serve as a collaborative area for engineering companies and af filiated industry groups in offshore wind.

Other key activities of the hub will include startup incubation support and services, wind innovation programming, seed technology commercialization grants, a UNO Wind Scholars Program, and offshore wind learning certificates for students.

“Part of the plan is to create graduate research space in the same area so that there’s this dynamic interaction between academia and industry to solve problems and educate this pipeline of employees that will be needed to sustain the

growth of offshore and on-shore wind,” Conwell says.

Early on, Shafin Khan, UNO’s vice president of external affairs and innovation, saw an opportunity to channel the university’s resources toward a common goal. “There are problems to solve that are unique to the Gulf of Mexico,” Khan says, “and when we connected the dots, we realized that UNO has all the assets to be an expert in the offshore wind space.”

Many of UNO’s existing departments—naval architecture and marine engineering, computer sciences, earth and environmental sciences—already have expertise in offshore environments “and that transfers easily to offshore wind.”

There are also a variety of UNO labs that can be used for structural testing or for mimicking offshore environments.

Khan feels Louisiana is well posi tioned to become a national leader in the offshore wind space, given its existing manufacturing, oil and gas, and port infrastructure. There are also several leading offshore engi-

neering companies already located in the New Orleans area.

He is meeting with private industry and others two to three times per week to gauge their expecta tions.

“Several UNO alumni working in offshore wind are interested in recruiting talent to work with them,” Khan adds. “We’ve having an ongoing conversation with industry, government, energy providers and regulators to ensure that there’s continuing communication.”

Conwell is excited about the po tential of the Wind Hub and how it will fit into the overall framework of an offshore wind energy future in Louisiana.

“What a remarkable opportunity to have your toes at the starting line of an emerging industry,” she adds.

“The New Orleans region, the state and all of its academic institutions are uniquely positioned to be at the forefront of this industry, and we hope to ensure that all of the wind initiatives are properly supplied with the expertise it needs to grow and thrive.”

CHERYL GERBER“What a remarkable opportunity to have your toes at the starting line of an emerging industry.”

REBECCA CONWELL, president and CEO, UNO Technology and Research Foundation, with Shafin Khan, UNO’s vice president of external affairs and innovation

Will Louisiana industry take a leadership role as the world transitions to alternative fuels and net-zero products?

Louisiana industry’s movement away from traditional forms of energy has begun. Biofuels, hy drogen, green ammonia, and the utilization of carbon dioxide are each getting their own attention, but the pace in which they’ll become reality is up for debate.

Demand will be the primary driver. There is a growing worldwide need for net-zero products, and new markets for alternative fuels are being developed at an accelerating pace. The marine industry, for exam ple, is already fabricating E-metha nol- and hydrogen-fueled watercraft, and ports such as the Port of South Louisiana are preparing themselves for the eventuality of e-methanol bunkering.

As a supplier, CF Industries in Donaldsonville has made significant recent investments in its operations to produce green ammonia to meet demand for low-carbon products in the agriculture industry, and to provide an alternative fuel for the maritime industry (hydrogen is a component of ammonia).

The company’s 20-megawatt alkaline water electrolysis plant will produce the green hydrogen, which it will use to produce 20,000 tons per year of green ammonia once the project is complete in 2023.

Greg Upton, associate professor of research at the LSU Center for Energy Studies, says there’s no turning back if local industry wants to remain competitive in this bold new future. The boom days of Louisiana’s

upstream oil market will likely never return, but the state will remain a prominent exporter of refined products, liquid fuels, chemicals and plastics. That means industry will need to take a leadership role as the world transitions to alternative fuels and net-zero products.

“While access to hydrocarbons might change over time, the manufacturing piece will remain,” Upton says. “It’s exciting to talk about hydrogen and ammonia and being able to get those things from a source that’s not hydrocarbon based. It could become a long-term economic stabilizer for our region.”

That only happens, though, if local industry can decarbonize at a pace consistent with the rest of the world. “If we’re unable to decarbon-

ize we’re not going to have a comparative advantage or see growth over the long term,” Upton says.

At the moment, south Louisiana industry seems to be on track—or even leading—the world in its efforts, with Upton pointing to biofuels, CCUS (Carbon Capture, Utilization and Storage) and green ammonia investments as the most prominent examples.

He expects the first Class 6 well permits to be issued for local CCUS projects later this year or in 2023, and hopes that the Louisiana Department of Natural Resources eventually will be given regulatory primacy over the permitting process in the same time frame.

Upton is confident that industry will eventually find more profitable

ways to achieve their net-zero goals. “Because of the policy climate, the investors and the fact that consumers are willing to pay a premium for low-carbon products … owners are pragmatically saying they need to do R&D in this energy transition.”

Upton cites Shell’s recent dona tion of some $27.5 million donation to LSU as an example. The money will, in part, create the LSU Institute for Energy Innovation, which “will bring together our energy-related efforts at the intersection of science, engineering, law, social science, and policy, creating a national model for energy-related collaboration,” according to an announcement.

Mark Zappi, executive director of the Energy Institute of Louisiana at the University of Louisiana at Lafay ette, says no matter what happens, Louisiana has a global reputation of resiliency “and that resiliency is going to be our biggest strength.

“The switch to hydrogen, for example. If we can get large enough volumes and can store it, that flip is not going to be particularly hard for Louisiana industry,” Zappi adds. “… I think we’re going to come out of this just fine. With our ports and transportation infrastructure, we’re the perfect state to lead many of these transitions.”

Still, Zappi says transitioning from carbon-based fuels will be an immense technical challenge.

“It’s not going to happen tomor row,” he adds. “Everybody is still getting in their cars and still flying, and our number one source of fuel is carbon based. That’s not going to

change dramatically fast. The biggest question is what can technology enable us to do and do affordably? Nevertheless, I feel if we don’t do this in Louisiana somebody else is going to do it for us. We have to move toward change.”

John Flake, department chair in LSU’s Department of Chemical Engineering, is most excited about the potential of CO2 as a low-cost fuel source.

Unfortunately, the focus to date has been on capturing and sequestering the industrial byproduct. The problem with that, he says, is in the cost and complexity of the process. The CO2 must first be captured, cleaned and compressed, then shipped somewhere for injection.

Flake is researching ways to utilize carbon dioxide as an alternative fuel in the conversion of ethane to ethylene, which is used in everything from plastic products to clothing to detergents and hand soaps.

“With ethane, you’re already using a fossil fuel (ethane is derived from natural gas), then you have to utilize a lot of energy to convert it to ethylene,” Flake says. “Guess where that energy comes from? You have to burn more natural gas, so for every kilogram of ethylene you make, you generate about a kilogram of CO2.”

The goal, therefore, should be to capture and utilize CO2 as a feedstock. While that currently is an expensive proposition, Flake says there could be other methods of utilization not necessarily derived

“Getting CO2 from the air could be another way to do it. … That wouldn’t be netzero; it would be net-negative.”

JOHN FLAKE, chair, LSU Department of Chemical Engineering COURTESYLSU

from an industrial process.

“Getting CO2 from the air could be another way to do it,” he adds. “In that case, to make a kilogram of ethylene you would need something like negative-3 kilograms of CO2 for every kilogram of ethylene. That wouldn’t be net-zero; it would be net-negative.”

In that case, industrial owners such as Dow in Plaquemine could potentially bypass the sequestration of its CO2 and instead pull it from the air to make ethylene, and still achieve carbon neutrality.

LSU recently received $5 million of a $50 million grant from the U.S. Economic Development Adminis tration grant to research and develop a clean hydrogen cluster in south Louisiana, of which Flake’s depart ment will receive about $3 million for researching CO2 utilization.

A big part of his research will focus on electrolysis in the ethaneto-ethylene conversion process, whereby two electrodes separate a compound into its more basic components. “We’ll have a water electrolyzer that will make hydrogen

and oxygen, and then a CO2 electro lyzer that will make products such as ethylene,” Flake says. All of these technologies could one day help achieve a 50% reduction in CO2 emissions within 30 years.

“We know how to do it … it’s just not competitively priced yet,” he adds. “The problem is that it takes a lot of electricity. You ramp that up to scale and you’re talking about millions of amps of current that you would need.”

And in Louisiana, some 85% of electricity is created with fossil fuels. “My hope is that Louisiana will turn more nuclear,” he adds. “We’ve had two nuclear plants in Louisiana that have run with no problems for more than 30 years. My feeling is that we’ll need a lot more to be able to electrify.”

LSU’s Petroleum Engineering Department will also receive a portion of the grant money to upgrade the technology at its Petroleum Engineering Research & Technology Transfer (PERTT) laboratory for the purpose of carbon testing. The department hopes to drill a new

Our name may have changed, but the relationships remain the same. You’ll still see the same friendly faces you’ve come to rely on, and we’ll still be making our banking decisions locally. You’ll also enjoy access to more banking services and lending options, plus the latest technology to make your life easier. bankplus.net/louisiana

“I think we’re going to come out of this just fine. With our ports and transportation infrastructure, we’re the perfect state to lead many of these transitions.”MARK ZAPPI, executive director, The Energy Institute of Louisiana at the University of Louisiana at Lafayette TERRI FENSEL

well and install a surface flow loop specifically tailored to CO2.

Research developed through testing at PERTT labs is designed to create an environment where LSU can safely test carbon capture and carbon sequestration methods. Carbon sequestration, especially subsurface carbon sequestration, is going to involve injecting CO2 gas into the subsurface and sealing it up in geological formations. Bottom of Form

Flake admits that despite the potential of CO2 utilization, most owners will rely primarily on sequestration—at least in the beginning— for meeting their carbon goals. No matter what happen, it could be a “boom” for industry.

“You have this economic oppor tunity of putting this (CO2) back,” he says. “In terms of construction jobs, the revenue from building these things, the revenue from converting CO2 … there’s this weird dynamic where both Republicans and Demo crats are behind it, but for different reasons.”

WORKING TOGETHER: This fall, Shell donated $27.5 million in part to create the LSU Institute for Energy Innovation, to bring together multiple disciplines and create a national model for energy-related collaboration. COURTESY LSUThere are voluminous amounts of data coming out of Louisiana’s oilfields, but not many companies are effectively putting it to use. The reasons for that are varied, but the biggest holdback, says Datagration Chairman and CEO Peter Bernard, is resistance to change.

Bernard, a 1985 ULL petroleum engineering graduate whose company is headquartered in Houston, says while nearly all oil and gas companies are on a “data journey” of some sort, most have only begun the process of capturing and storing the informa-

tion. That’s an important first step, he says, but it does little good if they’re not able to consolidate and interpret the data when making decisions.

Unfortunately, many are hesitant to take it to that level, either from lack of know-how, an unwillingness to change or both.

It’s not a simple process, as it rep resents a fundamental transformation in the way they do business. “Never theless, the next step in the evolution of a company is having the data easily accessible and applicable to their workflow processes,” Bernard says.

Datagration’s patented software, PetroVisor, takes data from multiple

sources and brings it together into a concise platform to help companies make operational and economic decisions. The company’s founder, Michael Steubner, recognized the need in 2010, and since purchasing the company Bernard and others on his team have modernized the product to make it more accessible and marketable.

“We combine all of those different data sources into one platform to en able owners to look at all their work processes and tie that with financial processes to help them make a decision as quickly as possible … and it’s all automated,” he adds. “We’re

BY SAM BARNESthe next step in the journey. We can automate the connection of the key data to actually drive business decisions.”

Most of Bernard’s customers are mid-sized oil and gas companies. One company with assets in Louisiana is currently looking to deploy the technology to enhance its operations “in every part of the operation.” An announcement is pending.

Regardless of the pace it might take, Bernard feels it’s inevitable that all Louisiana oil and gas companies

The energy industry embarks on a new ‘data journey.’

will one day see the need for a more digital approach to making decisions. Sheer competition will be the primary driver.

Seeing the need, the University of Louisiana at Lafayette launched a “smart oilfield” concentration this fall for its petroleum engineering majors.

Dr. Ahmed Khattab, dean of the University’s College of Engineering, says the smart oilfield concentration integrates the current program’s subsurface expertise with smart drilling, machine learning and data analytics.

It features a blend of courses and labs that focus on coding, statistics, machine learning, automation, pre dictive capabilities, carbon capture, computational fluid dynamics, smart drilling, and the economic feasibility of exploration in specific locations.

The new concentration was born

out of the 2015 oil bust. That’s when ULL’s Petroleum Engineering Department realized that oil and gas companies would soon have to co-exist with the suppliers of renewable energy. When that happens, oilfield data management will become a necessary part of the decision-mak ing process for oil and gas owners, in order to remain competitive.

“We began collecting information to determine the best approach,” says Rafael Hernandez, interim head of ULL’s Department of Petroleum Engineering. “We talked internally about the smart oilfield concentration, then took it to the university and their response was strong.”

They developed the curriculum based upon data-driven research, Hernandez says, with additional input from industry professionals via the department’s Industrial Advisory Board. Datagration’s Bernard played an important role in the meetings. “I’ve been active in helping them look at their curriculum and incorporate software technology and smart field technology to take them into the next realm of the industry … which

is digitization and digital technology,” Bernard says.

He and others in industry have donated their patented technologies to be used in educating the students.

“When you think about oilfield production in Louisiana and teaching petroleum engineering to ULL grad uates, they’re going to learn quickly that they have drilling data, produc tion data, geologic data, facilities data … and trying to pull all of that together is what oil companies will need to do to be successful.”

Bernard also helped Texas A&M launch a similar program.

The oil and gas industry might be a bit behind other sectors in manag ing its data, but it’s catching up fast. Khattab and Hernandez say that ULL is ready. “The realization is that there’s a lot of data that’s collected, but not being utilized by petroleum engineering companies in the field,” Hernandez says. “They need to make better use of the data to reduce cost, forecast performance of oil wells, to have a better handle on emissions

etc. Some of the new training we’re providing is addressing this need.”

According to U.S. Bureau of Labor Statistics, employment opportunities for petroleum engineers is projected to increase 8 percent through 2029.

And at a recent petroleum engineering conference, attendees there said they planned to advertise specif ically for “smart” petroleum engineer ing positions in the future.