8 minute read

MARKETS

Renewable DieselRising

A projected spike in renewable diesel production, partnered with rising corn oil prices, presents a market opportunity for ethanol producers.

By Susanne Retka Schill

Renewable diesel capacity is poised to explode in the next few years. Biodiesel Magazine, Ethanol Producer Magazine’s sister publication, reports that at the end of 2020 there were four renewable diesel facilities in operation with a to-

tal capacity of 553 MMgy. Six more facilities are either expanding or under construction for an additional 2 billion gallons of capacity—a four-fold increase due to come online within a year or two. On top of that, at least five more projects are proposed. Altogether, the 15 facilities represent 5.5 billion gallons of potential new renewable diesel capacity, double the U.S. biodiesel industry’s current size.

Players in the large-scale oil refinery retrofits and new builds include familiar names like Marathon Petroleum and Valero Energy Corp., which both have ethanol assets, biodiesel producers Renewable Energy Group and World Energy, and petroleum refiners CVR Energy Inc., HollyFrontier Corp. and Phillips 66.

The hydrocarbon produced from renewable diesel is nearly identical to petroleum diesel, a big advantage. It handles the same, can be pipelined and has no blending limitation. Nearly all renewable diesel, however, is blended with conventional diesel in order to qualify for the on-again/ off-again blenders tax credit. The $1 per-gallon blenders tax credit is a major part of the equation driving biobased diesel (a term that encompasses both biodiesel and renewable diesel) growth. But it’s certainly not the only factor.

Demand Drivers

“I see it as a RIN play for some of the really big guys,” says Bill Pracht, CEO of East Kansas Agri-Energy. With a 4 MMgy renewable diesel plant colocated with EKAE’s 48 MMgy ethanol plant in Garnett, Kansas, Pracht follows market developments closely.

A renewable diesel producer may generate multiple RINs (renewable identification numbers used to demonstrate compliance with the Renewable Fuel Standard). Depending on the feedstock and process used, producers can generate advanced biofuel RINs (D5), biobased diesel RINs (D4) or conventional biofuel RINs (D6).

Along with the compliance flexibility that some can utilize, RIN markets add an incentive when prices are high. Pracht points out that renewable diesel generates 1.7 RINs per gallon and the current value per RIN is about $1.20, although not so long ago it was 40 cents.

The California Low Carbon Fuel Standard is another major driver for renewable diesel. At recent prices around $200 per ton, California carbon credits for a renewable diesel with a carbon intensity (CI) of 45 are valued at about $1.15 per gallon, Pracht says.

DCO Impact

DCO, with its relatively low CI score, is a favored feedstock for biobased diesel, but not the only one, and not the biggest one. Soybean oil supplies the biggest share of the biodiesel market. An analysis by Tristan Brown, “Biomass-Based Diesel: A Market and Performance Analysis,” published by the Fuels Institute in March 2020, breaks down feedstock shares: “U.S. biodiesel producers utilized 12 different lipid feedstocks in 2018, the largest of which were soybean oil (54% of the total), corn oil (15%), used cooking oil (12%), canola oil (9%), white grease (4%), and tallow (3%).”

Renewable diesel utilizes the same feedstocks as biodiesel—fats, oils and greases—but will likely result in a different mix because of the carbon intensities of the different feedstocks (soy oil being the highest) and the differences in pretreatment requirements. The renewable diesel process has fewer issues with the high free fatty acid content of used cooking oils and animal fats. DCO is fa-

U.S. biodiesel producers utilized 12 different lipid feedstocks in 2018

SOURCE: FUELS INSTITUTE

4% white grease

3% tallow 3% other

9% canola oil

12% used cooking oil

15% corn oil

54% soybean oil

vored because it’s easier to pretreat and is cheaper than soybean oil.

DCO is favored for biodiesel as well. “Biodiesel producers have benefited as the domestic production volume of corn ethanol has increased from 10,938 million gallons in 2009 to 16,061 million gallons in 2018,” the Fuels Institute paper reports. “DCO’s growing supply and persistent cost advantage, combined with a moderate free fatty acid content (10% to 20%) and ability to produce biodiesel with a low cloud point (27 degrees Fahrenheit), has contributed to corn oil’s growing share of the U.S. biodiesel feedstock mix.”

While DCO is seeing its share of the biodiesel feedstock mix grow, the surge in renewable diesel demand is still in the future.

“We have been watching the renewable diesel and industrial oil market,” says Jennifer Aurandt-Pilgrim, director of innovation and market development for Marquis Energy. “We know there’s a lot of renewable diesel plants coming online. DCO is a consistent feedstock that is a less expensive industrial oil as compared to soybean oil. In addition, they can use it with very little clean up. The problem is that so many renewable diesel plants will be online within the next three years that

XCELIS® Yeasts SYNERXIA® SAPPHIRE

The most powerful combination of yield, robustness and enzyme expression in a yeast.

www.xcelis.com

OIL MARKET EXPLOSION: East Kansas Agri-Energy’s renewable diesel plant converts 4 MMgy of corn oil using hydrogenation technologies similar to petroleum refineries. Renewable diesel production is expected to balloon in the next few years, presenting a market opportunity for corn oil.

PHOTO: EAST KANSAS AGRI-ENERGY

there is concern about the availability and pricing of the feedstock.”

That demand is not quite there yet, she points out, yet DCO prices have risen from the mid 30-cent-perpound range to 45 to 50 cents. Marquis’ corn oil marketer, Scott Martin, cites several factors behind the price increase: The palm oil crop, which vies with soybean oil as the world’s largest oil crop, was lower than expected, with stocks near 10-year lows; the demand for soybean exports to China are up, driving up soy markets and stimulating price increases for all oils and crops; and pandemic-reduced demand affected the supply of used cooking oil alongside lower DCO production as a result of lower ethanol production.

But even as the pandemic impacts lessen and crop production recovers, Aurandt-Pilgrim doesn’t see the demand for DCO going away. She cites a market analysis projecting a feedstock supply of 22 billion pounds by 2025 compared to projected demand of 45 billion pounds. “If you do the math of the plants that use DCO as a feedstock coming online and the market production of DCO, they show the biggest risk for any renewable diesel plant that is using oil is the feedstock, because there’s going to be such a demand and higher cost,” she says.

Pracht is seeing the impact of the DCO price increase. While EKAE produces a good portion of the DCO used in its 4 MMgy plant at the 48 MMgy ethanol plant, it also buys oil. “We’re at 44 cents per pound today, where in August we were paying 22 cents,” he says. “It takes a little over 7 pounds of corn oil to make a gallon of renewable diesel. At 20 cents a pound higher, that’s basically $1.50 a gallon more for just the corn oil.” Fortunately, he adds, the increased DCO price is being offset by higher diesel prices, alongside strong RIN prices and continued demand in the California market.

Feedstock Risk

Feedstock procurement and logistics is going to be the biggest challenge for the big producers, Pracht says. He compares it to destination ethanol plants that were located far from the Corn Belt with the idea that it’s cheaper to rail in corn to supply nearby markets for ethanol or distillers grains. “We’ve proven destination ethanol plants really didn’t work. It will be interesting

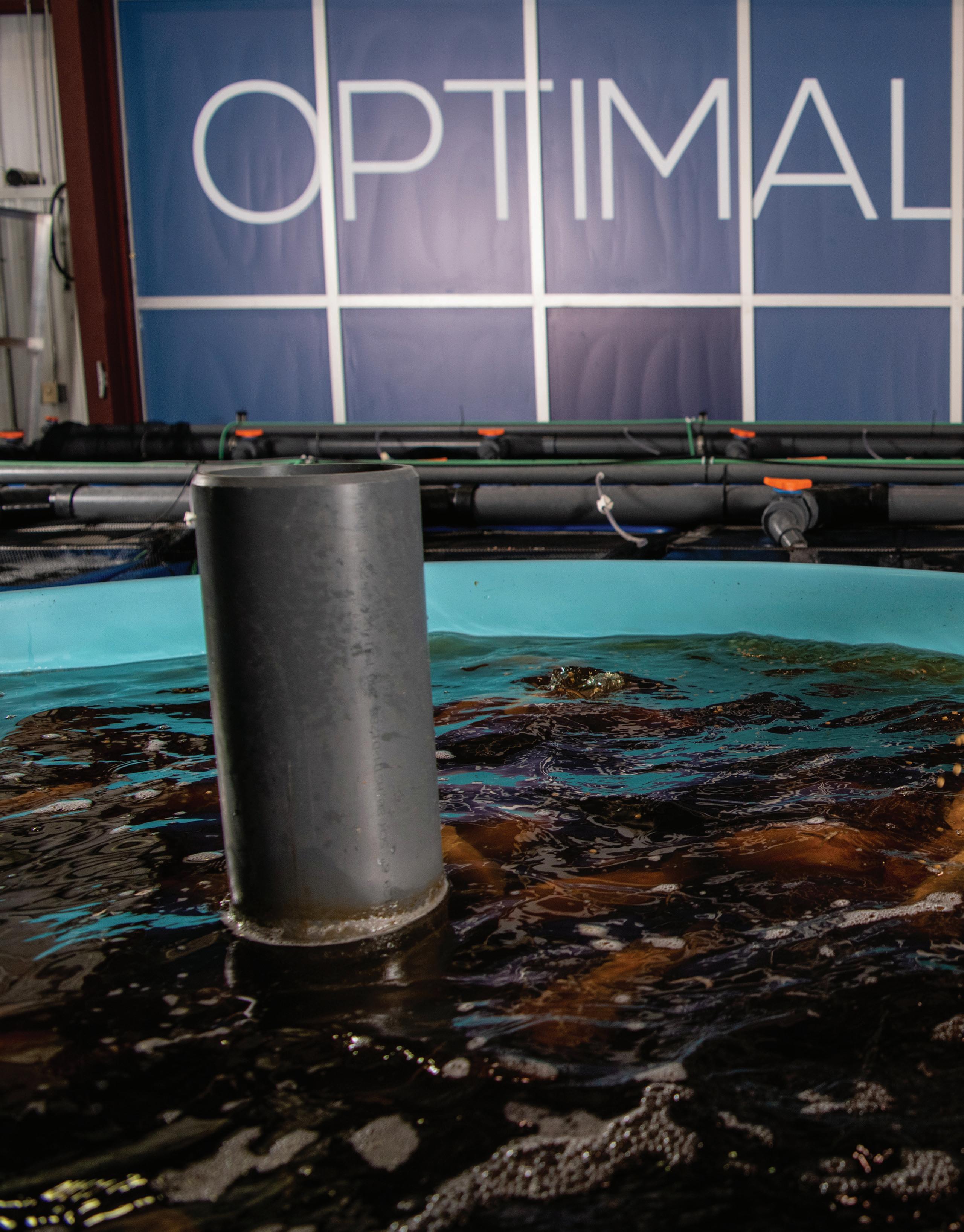

RENEWABLE REPLACEMENT: Hydrogen replaces oxygen in the oil molecules creating the diesel hydrocarbon at East Kansas Agri-Energy’s renewable diesel plant.

PHOTO: EAST KANSAS AGRI-ENERGY

to see if these destination renewable diesel plants will work.”

“While smaller facilities will be penalized on economies of scale, they will benefit enormously from economies of aggregation,” says Michele Rubino, a consultant working with Saola Energy LLC, the technology provider for EKAE’s small-scale facility. Used cooking oil, DCO and animal fats are all widely distributed feedstocks that are difficult and expensive to aggregate, he says. “When it comes to petrochemical resources, the more you want, the less you pay. When it comes to biobased resources, the more you want, the more you pay.”

Saola has partnered with Italy-headquartered NextChem to distribute their technology globally, looking at other regional feedstocks such as palm oil mill effluent and the tall oil waste from the pulp and paper industry. The value proposition, Rubino says, is to locate the production facility next to the feedstock, thus securing supply and capturing more of the value now being added by the middleman. “They’re leaving a lot of money on the table,” he says. “If they are selling corn oil at 40 cents a pound, the inherent value is more like 60 cents if they captured it themselves.”

The Saola model recommends 10 MMgy as an ideal size, which will require more feedstock than most individual ethanol plants produce. Thus, aggregation will be required even for a small-scale facility, as well as the refinery-scale renewable diesel plants in development. Aggregation of DCO already is the norm in the ethanol industry, however, because the volumes produced at individual plants are generally too small for unit train economics.

In addition, renewable diesel buyers want to buy from bigger players looking for consistency, Aurandt-Pilgrim says, “and consistency allows for optimized pretreatment of the oil to protect their catalyst.”

The spring’s strong oil market and news of a big new demand for renewable diesel is having one immediate impact in the ethanol industry, Aurandt-Pilgrim adds. “I think people are paying a little more attention to their oil extraction. It used to be they’d track production and say, ‘Oh we’re down.’ Now, it has more impact on return so the sentiment is, ‘We’re down, let’s figure out why.’”

Author: Susanne Retka Schill Freelance Journalist retkaschill@yahoo.com

XCELIS® Yeasts SYNERXIA® RUBY

The new standard in high yield yeast driving plants to the peak of performance.

www.xcelis.com