9 minute read

DIVERSIFICATION

UPCOMING USP: Aemetis Inc. in Keyes, California, is adding USP capacity, aiming for operation early next year. PHOTO: AEMETIS INC.

MOVE MARKET

Ethanol producers are investing in high-end alcohol production after seeing its value during the pandemic. By Lisa Gibson

As fuel ethanol producers scrambled to It’s clear that despite the long-term unknowns, the curprovide gallons and totes of alcohol to help satisfy the emergency need for hand sanitizer rent boom in the high-end alcohol market has spurred a wave of development. this year, ideas for longer-term opportuniFrom the Beginning ties were taking root. COVID-19 not only pointed President Donald Trump declared the coronavirus panemphatically at a diversification option, but it also illustrated demic a national emergency in March of 2020. Hand sanihow crucial diversification is, as fuel ethanol prices tanked to tizer supply quickly dwindled and ethanol producers’ answer around 80 cents per gallon. to the call has been well-publicized.

As the industry works to get its feet “Like many in the industry, the call to back underneath it, many producers are in'You look at action with the pandemic and the need for vesting in high-end alcohol production. It’s not just hand sanitizer; it encompasses other disinfectant products, as well as pharmaceuticals, fragrances, cosmetics and other industrial applications. airplanes, buses, bus terminals. COVID is definitely hand sanitizer really drove us to consider something we hadn’t considered in the past,” says Mike Jerke, CEO of Southwest Iowa Renewable Energy in Council Bluffs, Iowa. SIRE started supplying alcohol that

Homeland Energy Solutions in Lawler, going to reset met WHO standards to local hospitals, first Iowa, expects to have its USP-grade alcohol plant operational by the end of the year. Aemetis Inc. in Keyes, California, aims to produce USP-grade alcohol by the first quarter of 2021. Pacific Ethanol has announced it the bar as far as what level of sanitization is required. ' responders and other medical professionals. “SIRE is unique in that we’re located next to a fairly large metro area. While the pandemic has left no part of the country untouched, with the hospital infrastructure will increase its focus on high-end alcohol Kevin Howes and the population size, it seemed like we at its Pekin, Illinois, plant, which was modiHomeland Energy Solutions were seeing a lot of requests from what fied to produce and handle the product we would call our neighbors.” Nurses were earlier this year. Green Plains Inc. will add and upgrade to calling and showing up to load product into USP-grade alcohol at its Wood River, Nebraska, and York, the trunks of their cars, Jerke says. Nebraska, plants, respectively, for a total USP capacity of 75 “One thing led to another and we began to see some MMgy. ADM will expand its production of industrial alcohol opportunity for sales we had never envisioned, and quite in Clinton, Iowa, and Poet LLC announced in early August frankly, when we were dialing back plant operations, there that it will scale up production of industrial beverage-grade was nothing in my initial forecast for any kind of cash from alcohol at its Leipsic, Ohio, and Alexandria, Indiana, plants. hand sanitizer,” Jerke says. “It wasn’t a windfall, but every

CATCHING CARBON: The new carbon filters at Homeland Energy Solutions in Lawler, Iowa, were added to control odor in its USP-grade alcohol. PHOTO: HOMELAND ENERGY SOLUTIONS

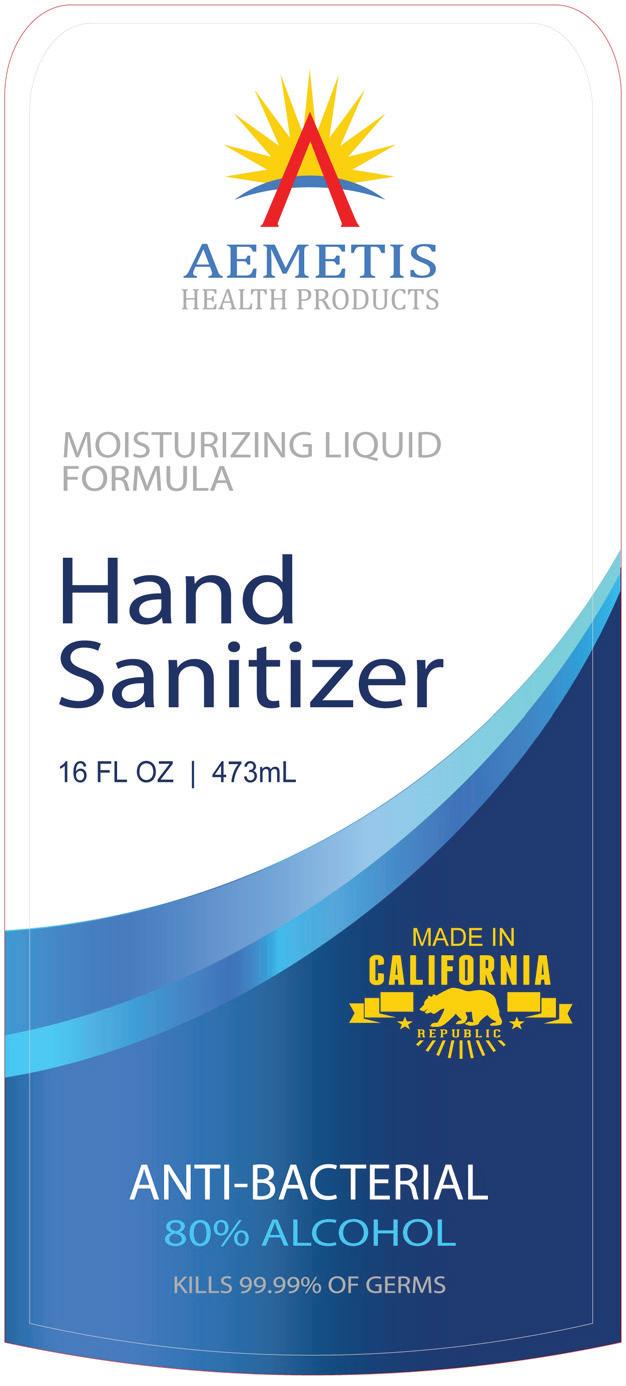

LOCAL LABEL: Aemetis Inc. will produce finished, bottled and branded hand sanitizer at its plant in California. PHOTO: AEMETIS INC.

nickel and dime was helpful in trying to make it through the crisis and keep everything intact.”

Kevin Howes, plant manager and chief operating officer of Homeland Energy Solutions, says the pandemic exposed the industry’s need to further diversify, and provided cause to do it quickly. “You can see what COVID did to the fuel supply, and the ethanol industry, idling almost 50 percent of capacity. The need for diversification definitely came to the surface”

Homeland will not focus solely on hand sanitizer markets for its USP, Howes says, instead following the demand. “Whatever the opportunities, we want to get into those markets.”

USP generally sells for double fuel ethanol’s price, and often higher.

Currently, the temporary FDA guidance for fuel ethanol producers supplying emergency alcohol for hand sanitizer expires at the end of this year. It’s uncertain whether that will be extended. Homeland is aiming for the end of this year for USP production, so it’ll be ready to continue supplying product with no interruption. “Timing is key,” Howes says. “You want to be one of the first; you don’t want to be one of the last.”

SIRE hasn’t finalized any concrete expansion plans, but, like many fuel ethanol producers, is analyzing potential markets and the expenses of installing equipment to manufacture USPgrade alcohol. Jerke says the plant has pursued a couple different strategies, zeroing in on one that it hopes to deploy relatively soon. “Once we cross that hurdle, we’ll start working on permanent changes that would need to be made.”

The main changes to a fuel ethanol plant required to produce USP-grade alcohol are in decarbonization, distillation, storage and loadout. The loadout is similar to that of fuel ethanol, but the trucks must be different, Howes says. It cannot be transported in a petroleum tanker, as even a thoroughly cleaned tank will still retain odor. “The end users do not want any type of petroleum-based gasoline, diesel fuel-type odor,” Howes says.

He adds he expects an ROI of less than a year, despite unknowns in hand sanitizer demand.

Continued Market

“The million-dollar question is how long will COVID continue to influence our lives?” Howes says, adding the reopening of the country will require more sanitization products. He cites schools that will host classes again on-site, and their needs for sanitization products.

When major league sports welcome fans back to stadiums, the sanitization needs there

will be enormous, as well, he says. “You look at airplanes, buses, bus terminals. COVID is definitely going to reset the bar as far as what level of sanitization is required. And that’s just one part of what USP could do.”

Like all markets, high-end alcohol prices fluctuate and have, of course, increased during the demand for sanitizer. “While we don’t expect this to last forever, we’re expecting it to last not only long enough to pay back our investment, but to provide a very nice return on our investment,” Howes says.

“Yes, a lot of this is unknown, but you don’t have to be a dreamer to see the potential,” he adds. “We stand ready. If we’ve got a USP-grade product ready to go and the hand sanitizer market dries up, it just got a little more competitive out there because there’s a lot more demand, but rather than getting dollars profit, you might have to settle for 20-cents-a-gallon profit. And 20 cents a gallon in the fuel ethanol world is still a good day.”

Destination Market

Aemetis, in Keyes, California, has been exploring the high-end alcohol market for about three years. Construction on the $15 million project started in January of this year, and operation is expected in the first quarter of next year, says Eric McAfee, chairman and CEO of Aemetis.

“We’ll have a full conversion of our distillation unit, adding two of the distillation columns that are required for the extraction of contaminants and reduction of acetaldehyde and acetols to below 10 parts per million allowed under the USP standard, as well as all other contaminants that need to be below 300 parts per million.”

Aemetis also is upgrading the heat exchanger to improve energy efficiency and switching from a molecular sieve to ceramic dehydration, McAfee says.

The system is coming to fruition during a pandemic and increased demand for highend alcohol. “Yes, it happens to be completely coincidental,” McAfee says. “We were in the installation process when the shutdown order came in. It definitely expanded the markets we can be a part of.”

The plant is expanding from 65 MMgy to 70 MMgy and will have the capacity to sell 100 percent of its production as USP. “USP was not our goal when we did these plans,” McAfee says. “Our goal was higher quality, lower cost. What the hand sanitizer market identified was if you get to this specific quality, then you have a particular market. So we committed to USP grade in the first quarter of this year.”

Aemetis is unique in its proximity to end users, rather than its proximity to corn. McAfee calls it destination ethanol, and it applies to high-end alcohol, too. “We saw a need in the western U.S. for a supplier that’s closer to customers.”

Aemetis is taking production a few steps further, bottling, branding and marketing its own Aemetis hand sanitizer for sale online, and at Walmart, Costco and other large retail chains, McAfee says. That strategy optimizes the value of the plant’s location, he says. “Let’s just go ahead and build the whole value chain all the way from bulk, to branded, packaged retail and online product and see if we can sell 70 million gallons worth.”

If 100 percent of Aemetis’ production can be sold as USP, that’s what it’ll produce, McAfee says.

The Right Thing

Howes, conversely, doesn’t anticipate Homeland will ever sell only high-end alcohol and no fuel ethanol. “At our core, I don’t see us ever deviating from a fuel ethanol plant,” he says. “But a year and a half from now, you could see Homeland providing five products.”

The plant is lucky to have a board of directors willing to make investments and evolve with the markets, Howes says. While investment involves risk, hopefully the reward follows, he says. And, Howes adds, sometimes it’s just the right thing to do.

“If we can make money and supply something that’s drastically needed, that makes you feel good all around.”

Author: Lisa Gibson Editor, Ethanol Producer Magazine 701.738.4920 lgibson@bbiinternational.com

LET'S GET STARTED...

DRIVING MORE PROFIT TO YOUR BOTTOM LI NE

There is no better time to change your financial picture for the upcoming year. Learn how you can optimize and diversify your revenue streams with Fluid Quip Technologies. We transform ethanol facilities to have more profitable bottom lines.

Let's get started

THE LEADER IN BIOFUEL AND BIOCHEMICAL TECHNOLOGY, ENGINEERING, AND PROCESS SOLUTIONS

FluidQuipTechnologies.com 319-320-7709