March

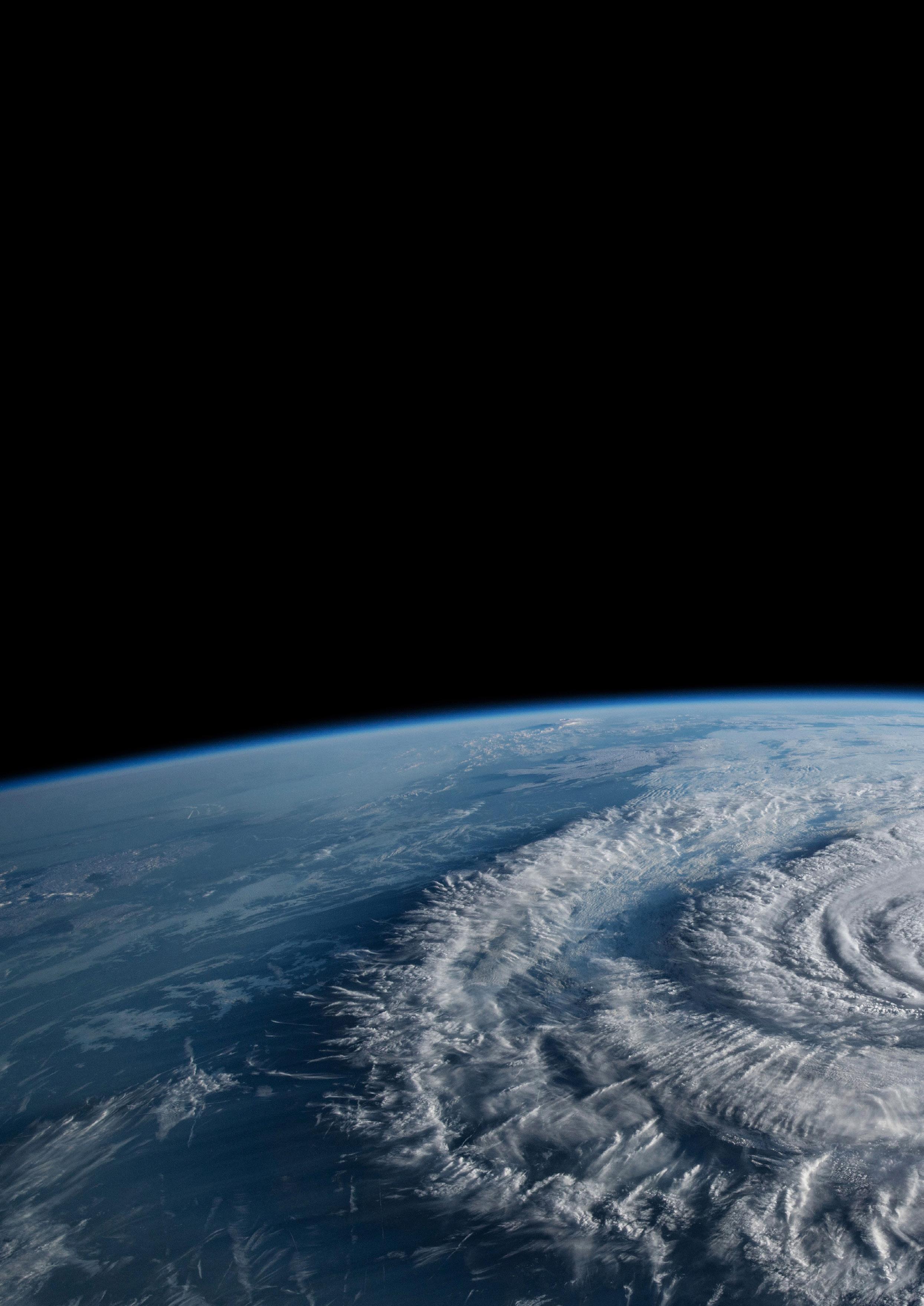

Cyclone and floods redefine New Zealand risk

March

Beyond the physical realities, there is the damage to infrastructure including power, cell networks and roads. This has added to a feeling of anxiety and helplessness for many whether they be victims or family and friends trying to make contact.

There have been accounts of truly appalling behaviour through looting and taking advantage of the vulnerable and isolated. We have been promised this will not be tolerated and that a firm stance will taken on those who choose this path.

As always, through the hardest of times, there are heart-warming stories of survival, support, and community spirit. They remind us that collectively we care and are cared about. They give hope to those facing the worst and remind them they are not alone.

As the size of the rebuild continues to unfold we will inevitably look to local and central government for leadership as well as timely and critical decision-making for now and the future.

Our thoughts are with everyone still impacted by the flooding and devastation from recent weather events, especially those who have lost family and friends, their homes, and livelihoods.

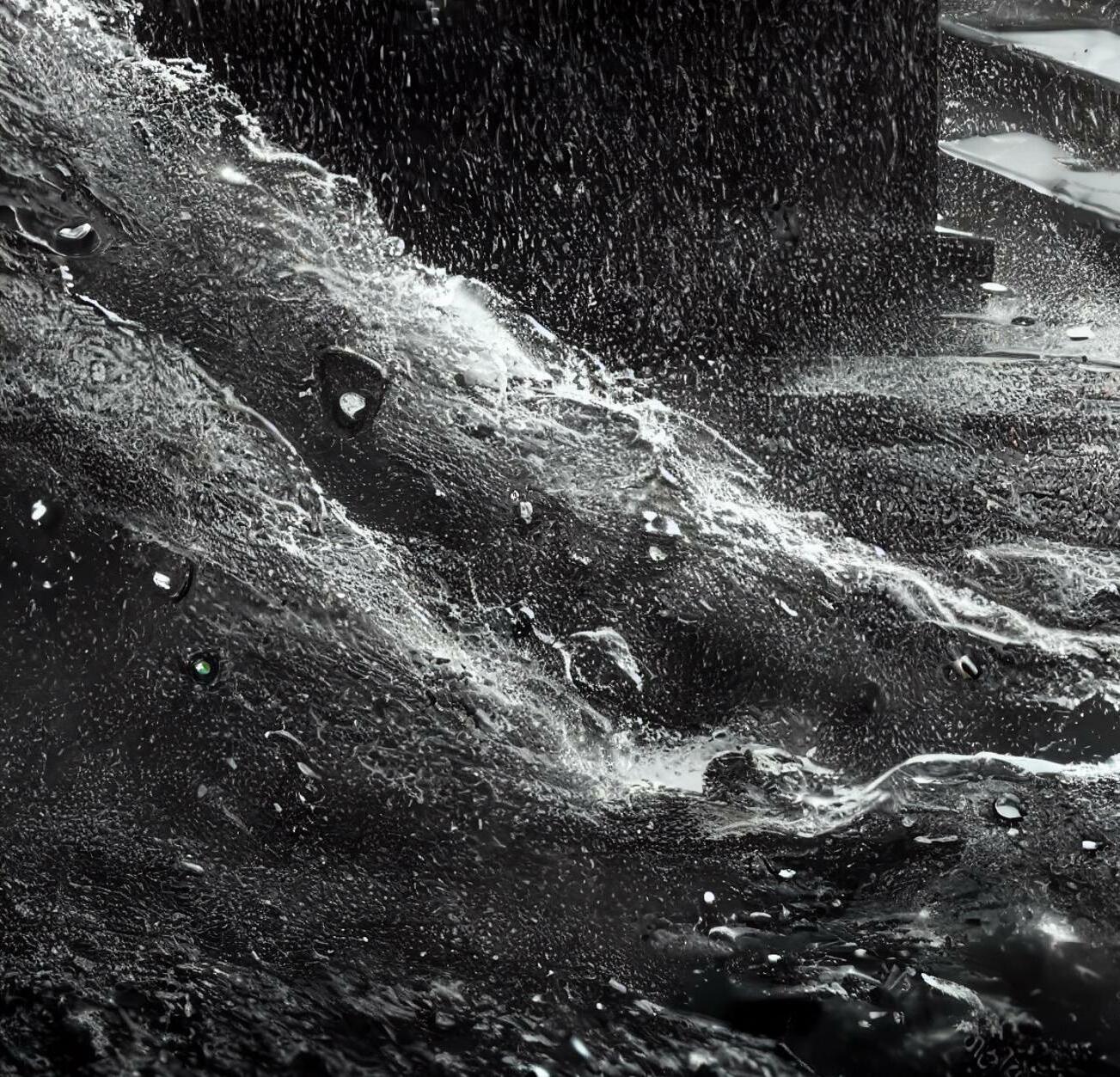

Visually, the scars are confronting, even if only seen through the media.

The vastness of affected regions and the brutality of the damage is difficult to comprehend. As is the contrast of some areas, buildings or houses in close proximity to one another that have either been destroyed or hardly touched.

I have spoken to many brokers over the last few weeks about these events, some of whom have been personally impacted. Without exception, all are elevating their clients' needs, lodging claims and advocating on their behalf to ensure that they are being looked after and supported.

Dependencies and resilience will need to be at the forefront of their minds as they seek to plan and rebuild in ways that not only take account of what we have seen to date but also what is expected to come from climate change.

Viability of existing land use, structures, construction methods, roading routes and power infrastructure will no doubt dominate their thinking as they look to restore the confidence and wellbeing of New Zealanders.

IBANZ has been advocating for this for some time and is well placed and willing to provide support to government from our experiences when catastrophes occur.

We proactively contribute to discussions on these subjects and are keen to continue to be involved in discussions and planning for the future.

Welcome to this edition of CoverNote in which we focus on these events from an industry perspective including the scale, expected impact on insurance and reinsurance markets, how brokers are responding, and how they will adapt to their clients’ evolving needs.

Melanie Gorham CEO, IBANZ10. AMI, State and NZI receive more than 21,000 flood claims

12. Tower slashes earnings and dividend in wake of North Island floods and Cyclone Gabrielle

20. Tower provides NZX update on floods

26. IAG Group provides update amid North Island floods

30. North Island floods largest motor claims event in AA history

35. Double award win for

CoverNote is the official publication of IBANZ and is distributed FREE on a quarterly basis (March, June, September, December) to members throughout New Zealand and associated companies. Additional copies are available at a cost of $7.50 per copy, or 12 month (4 issues) subscriptions at $30.00, inclusive of postage and packaging. The articles or opinions featured within this magazine are not necessarily the opinions of the publishers or IBANZ, and they do not accept responsibility for the content of articles featured within the publication. No part of this publication may be reproduced without the written permission of the publisher. The publishers do not accept responsibility for loss or damage to unsolicited photographs or manuscripts.

IBANZ enquiries should be made to: Melanie Gorham, Chief Executive, IBANZ.

Email: mel@ibanz.co.nz

IBANZ National Office located at: Unit 4D, 2B William Pickering Drive, Rosedale, Auckland 0632

PO Box 302504, North Harbour, Auckland 0751 Telephone 09-306-1732.

Website: www.ibanz.co.nz

Advertising/Editorial:

Robert Johnson, Benefitz

Telephone 09 477 4702, Mobile 027 4970 712, Email: robert@benefitz.co.nz

Design/Production: Craig Burkett, Benefitz

Imaging: CTP by Benefitz

Produced for IBANZ by: Benefitz, 5-11 Parkway Drive, Mairangi Bay, Auckland 0632. PO Box 33-1630 Takapuna.

Telephone 09 477 4700, Fax 09 477 4799

Advertising Deadlines:

Bookings 10th of the month prior to publication, material 15th of the month prior to publication.

ISSN 2815-9268

Manybusiness owners will require resilience to recover from the effects of recent flooding in New Zealand's largest city, according to Nick Meister, executive manager, business at Vero Insurance.

He promoted safety first and a practical cleanup strategy in the wake of the catastrophic weather events.

Meister said Vero had seen a steady influx of business and corporate claims, some of which had sizeable reserves because commercial areas were also affected by flooding. Stock, building plant and business interruption claims were expected.

“The repair cost could be significant for some of our customers' buildings and contents. We’ve seen business premises, vehicles, stock and equipment that have had

water flooding up to 1.5 metres or have been totally immersed. Due to ongoing supply chain issues and the demand this event will have on trade services, it could take many months for some repairs to be done and claims to be settled.”

He said small businesses were the backbone of the economy and the city's suppliers, so it would be a priority for the insurer to assist in getting customers trading again.

“The Auckland floods have demonstrated the resilience of Kiwis in the face of a natural disaster.

New Zealand business owners are also showing that resilience and are wanting to get on with cleaning up and returning to work.”

“We’re committed to maintaining the livelihoods of you and your employees. It is what we do. We’re here to help.”

If you want the free dom and flexibility to run your own G eneral or Life Insuranc e Advis ory Business, then sp eak to the team at PSC Conne ct NZ.

B eing part of PSC Conne ct comes with a range of b enefits, including: • Buying p ower of the PSC Group which has a gross premium of $2bn

If you want the free dom and flexibility to run your own G eneral or Life Insuranc e Advis ory Business, then sp eak to the team at PSC Conne ct NZ. B eing part of PSC Conne a range of b enefits, including: • Buying p ower of the PSC Group which has a gross premium of $2bn • Full ad ministrative and omplianc e supp ort • Ac c ess to markets and sp e cialist agencies including Lloyds • Agile op erating systems

Climate change is having a real and tangible impact on New Zealanders' lives, as the frequency and severity of extreme weather events increased during this summer's devastating floods. The events are set to have a significant impact on the insurance sector.

Following the unprecedented and widespread damage caused by the Auckland Anniversary Weekend flooding in the North Island and Cyclone Gabrielle, it is expected that insurance premiums will continue to increase. The major events have followed years of heavy flooding across Aotearoa, with the South Island and West Coast badly hit in recent times.

Insurance providers have reported significant claims numbers following these devastating events, exacerbating the market conditions, testing claims resources and response capacity. Accordingly, insurance providers are asking for patience as they work through the recovery.

The summer’s devastating North Island floods and Cyclone Gabrielle will change the insurance sector for good, writes Angela Cuming

“The insurance industry continues to experience very challenging market conditions, which will be with us for the foreseeable future,” says Paul Munton, executive general manager - broking branches at Rothbury Insurance Brokers.

“This is primarily being driven by current environmental factors, such as the rising frequency and severity of extreme weather events, general inflationary pressures and supply chain disruptions, none of which will abate in the short term.”

As the insurance market is

significantly influenced by the claims experience, it is expected that insurance providers will determine their own level of comfort and for many, this will mean reducing their risk appetite.

Given current market conditions, insurance providers are seeking to limit their exposure to natural catastrophe due to the reduction in reinsurance capacity, escalating the price of property catastrophe reinsurance, and increasing frequency and severity of losses, says Munton.

But that’s not all. In fact, Munton says the recent extreme weather events are likely to test the willingness of insurance providers to even offer or accept business in areas exposed to natural disasters.

The implications are significant, and property investors should exercise caution and undertake due diligence in terms of the insurability prior to any commitment, Munton adds.

According to Munton, brokers and clients need to work more closely together than ever to ensure New

Zealanders are adequately covered, prepared, and protected.

“We all recognise the challenge of affordability today and clients now more than ever need personal service and quality advice about their insurance. We work hard to ensure our clients access appropriate insurance solutions to best protect their assets, securing the right combination of risk, coverage and cost. Know your client, know your market, and know your worth” says Munton.

Claire Holt, a financial adviser at SHARE, says the immediate impact

of the Auckland floods and Cyclone Gabrielle will be in the large volume of claims lodged by customers.

“This affects everyone in our industry, especially our broking staff, loss adjusters and insurer claims staff. It’s been an extremely hard start to the year with the extreme weather events but it’s our job to look after our clients first and foremost and to make this a priority.”

As of the end of February, the Insurance Council of NZ – Te Kāhui Inihua o Aotearoa says more than 40,000 claims from the Auckland

Anniversary Weekend floods have been processed, with that number “rising fast”.

For Cyclone Gabrielle, it is still early days and the ICNZ doesn’t yet have a to-date number on how many claims have been lodged.

“But clearly, this is a major event and there will be many, many thousands of claims,” says chief executive Tim Grafton. “So far, some members have given claims numbers totalling a few thousand, but that will clearly grow. We do know the total claims for extreme weather events for

Insurance of course is only one part of the equation. As a country we need to adapt our approaches and improve our infrastructure to help protect communities.Tower chief executive Blair Turnbull

2022 totalled about $350 million and it is clear already that the Auckland Anniversary Weekend event and Cyclone Gabrielle will exceed that.”

IAG, which owns the AMI, State and NZI Insurance brands, says it has received 2300 claims so far from property owners from Cyclone Gabrielle, in addition to more than 21,000 claims already received for the Auckland Anniversary Weekend floods.

Tower says it had so far received about 6000 claims for both weather events and expected to receive hundreds more.

Holt expects to see insurance rates increase due to the two extreme weather events.

“The insurance industry has learnt lessons from previous events in terms of resilience but there is still room for improvement,” she says. “Going forward I would expect rate increases but this will be a year or so down the track once costs are accounted for so it’s not an immediate concern.”

In addition to the expected rate increases, Holt says the recent extreme weather events will lead to

wholesale changes in the industry over the next few years.

It will be “most likely” that insurers will be seriously considering whether to offer flood as an optional addon to policies rather than it being automatically included in the cover as it is now, she says. “This is common in Australia already (and) I would expect insurers to look more closely at homes with adverse environmental risks such as on cliff tops and waterfront properties. I hope that it doesn’t come to this but can see it being on the cards.”

Then there are insurance premiums. The devasting nature of the two most extreme weather events in New Zealand have created several profitability challenges for insurers with flow-on effects for those insured.

So, will the impacts of Cyclone Gabrielle mean premiums will rise? The short answer is yes, says Tower chief executive Blair Turnbull.

“Insurance pricing is based on a range of factors, and we work hard to ensure our premiums are competitive and provide value. For example, Tower has invested in technology and in streamlining our operations which

enables us to absorb cost increase.”

The last two years of Covidrelated inflation, however, has been challenging for everyone, the insurance industry included, he says. “Inflation coupled with the increase in weather events we are seeing will inevitably result in higher premiums.”

Turnbull praises New Zealand’s high rates of insurance, with more than 90% of homes having coverage.

“This is something to be very proud of and is certainly something we want to continue. New Zealand has a strong and resilient insurance industry and it’s critical that it stays that way.”

Tower is actively managing climate change risks to its business by continuing to expand its riskbased pricing strategy to include more climate-related hazards, says Turnbull, including implementing risk-based pricing for coastal and landslide risks this year in addition to its existing inland flood risk model.

“We are budgeting for increasing large events in our planning to manage financial impacts and we have a robust reinsurance programme to provide protection from financial volatility.”

Tower is also developing new products and models to support communities through climate change, like its Cyclone Response Cover in Fiji - a parametric insurance product that provides a rapid cash pay-out when a customer is impacted by cyclone, regardless of damage and without the need for an insurance assessor’s signoff.

“Insurance of course is only one part of the equation. As a country we need to adapt our approaches and improve our infrastructure to help protect communities,” says Turnbull.

While one of the top effects of severe and frequent extreme weather events will be to push up insurance premiums, it is widely expected that the reinsurance market will also be affected.

Suncorp has already warned that the Auckland Anniversary Weekend floods and Cyclone Gabrielle could trigger its reinsurance cover, and now Tower says it is “likely” the same will happen to them.

“Tower has previously disclosed that the Auckland and upper North Island weather event will predominantly be covered by

our catastrophe reinsurance, and we believe it is likely that Cyclone Gabrielle will also trigger our catastrophe reinsurance cover,” says Turnbull. “We are currently working with reinsurers on reinstating our reinsurance arrangements to ensure we have full levels of catastrophe cover going forward.”

The severe weather events both here in New Zealand and globally mean that reinsurers will be increasingly selective about which insurers they choose to underwrite, says Turnbull.

“Reinsurers have been attracted to Tower’s robust risk management capabilities and strong underwriting, including our approach to risk-based pricing, and our dynamic rating capability. We are pleased to have strong relationships with an excellent reinsurance panel, and we are working closely with our reinsurers as we respond to these events.”

Meanwhile, Holt says there are opportunities to improve client resilience by learning from the summer’s events and keeping New Zealanders better informed.

“We’ve seen first-hand a mismatch

in advice to clients about mitigating their losses and the steps they can take now, especially where the client is directly insured or through a non-adviser intermediary - they appear to have no idea of where to start nor have they had any advice,” she says.

“We’ve got more to do collectively as an industry to provide the insured in general with advice. A collective solution across both the intermediated and direct market, including industry organisations such as ICNZ, insurers and IBANZ, to all clients as to what to do in events such as large-scale flooding would be helpful, as all insurers would benefit from insureds being able to mitigate loss immediately following large scale events.”

Until then it’s “business as usual” for brokers, says Holt. “We will be looking to work with insurers more closely in the future in aligning ourselves with their suppliers and building relationships with them to get the best outcomes for our clients. I can also see cluster groups forming direct relationships with suppliers to look after our clients first and foremost.”

By February 14, AMI, State, and NZI had received over 21,000 claims from the summer’s North Island floods, as the devastating weather events continued.

According to IAG, 57% of claims were for homes, 21% for contents, 6% for commercial and business, and 16% for motor vehicle insurance.

Amanda Whiting, CEO of AMI, State and NZI, said the recent flooding, and now the arrival of Cyclone Gabrielle, had been heartbreaking and extremely disruptive for those affected.

“These weather events are what we plan for and what we do – it’s why we exist.

“We are working our way through the flooding claims as quickly as possible, while also processing claims from those affected by Cyclone Gabrielle. As always, our number one focus is supporting our customers and communities through this really tough time.

“Some claims will be settled quickly, if not already, but some will take time as each customer’s situation is unique. But no matter how long it takes, we will be here for our customers.

“We also know that these weather events will put significant pressure on the building industry and associated suppliers. We are actively working with our partners to minimise these challenges, however, there may be some delays as we work through this.

“In the last two weeks, we’ve paid out over $23 million in claims.

“The size and scale of these events are something we haven’t seen since the Kaikoura earthquakes. We have pulled in help from right across our business - we currently have 316 teams of builders on the ground stripping out homes, and we are focussed on expediting the claims process and closing claims for our customers as soon as we possibly can.

“Last week, I visited a few of our customers’ properties. The disruption to people’s lives was hard to see, but I was also heartened to hear the many stories of community resilience and to witness people pitching in to help each other.

“Our team is working extremely hard to support our customers and will continue to do so until every last claim is closed.

“Please be assured that paying claims and getting New Zealanders back on their feet is what we are here to do.”

Flooding followed by a cyclone: NZ’s summer weather explained

Dr Bruce Buckley, an AMI, State, and NZI meteorologist, said said the weather on the North Island this summer was a classic example of warmer tropical seas feeding greater quantities of moisture into extremely damaging, heavy rainbands.

“While New Zealand’s physical location means it has always been susceptible to systems with tropical moisture influences, the effects of climate change and the current and future La Niña patterns means they are likely to have higher impacts when they occur.

“Typically, tropical cyclones transition into extratropical cyclones before reaching our shores, but they can still carry damaging winds and intense rainfall. New Zealand will become more susceptible to stronger storms, because having warmer, more tropical seas means there’s less opportunity for the systems to weaken before reaching New Zealand.”

In a poll conducted by AMI, State, and NZI Insurance in the latter part of last year, 82% of New Zealanders said they thought wild weather was becoming more severe and frequent.

Tower reduced its forecast for annual profits and dividends following the North Island floods and Cyclone Gabrielle.

The insurance company now expects net profit after tax of between $18 million to $23 million, down from a previously estimated range of $27 million to $32 million.

Tower said it had taken proactive steps to position itself for the future. It increased its large events allowance from $30 million to $40 million and took steps to restore its reinsurance arrangements.

The insurer made a downward revision to its dividend forecast. It now expects a dividend of 5 cents per share for the full year, rather than a 6.5 cents per share dividend.

Tower reiterated its strong solvency position.

The company will decide whether or not to distribute an interim dividend once its half-year results are ratified.

Tower chief executive Blair Turnbull said the business was in a good position to assist customers and communities during the recovery.

He said the individual and financial effects of the summer’s weather events underlined the essential role of the insurance sector.

Tower said there had been a significant increase in claims between early to mid-February.

As of February 17, the underwriter reported that approximately 4850 claims had been made.

According to a Tower estimate, the total cost of the weather-related incidents in Auckland and the Upper North Island will range between $95m and $125m.

The insurer has received approximately 945 claims for damage caused by Cyclone Gabrielle and the firm is still estimating the financial impact.

Tower expects a further rise in claims from affected regions as people return to their homes.

The group stated that it lacked information to calculate the ultimate cost of Cyclone Gabrielle, but that the event would most likely trigger its catastrophe reinsurance, which had an excess of $11.875 million.

We are committed to helping our broker and adviser partners succeed, now and in the future. We know that ongoing industry education is an area of increasing importance for the insurance industry – in fact research shows

*TNS Intermediated Survey Dec 21

48%* of brokers and advisers are actively seeking this. For more information on our future focused set of initiatives, tools, insights and content check out vero.co.nz/overandabove or ask your Vero contact for more details.

Meet Toby Lancaster, NZI’s new electrical inspector, who’s come on board with a clear and important mission: to help protect businesses against some of the leading causes of commercial electrical fires.

with anything electrical can be frightening for some people, and for good reason. Toby Lancaster, on the other hand, discovered his passion at a young age after following in his father's footsteps into the trade.

2006 was Toby’s official start in the electrical industry. Seventeen years and one extensive hands-on career later, Toby has joined NZI to play a key role in identifying customers’ electrical hazards which are proven to be key contributors to commercial fires.

Toby is one of NZI’s new electrical experts, who are part of the wider risk consulting team. While Toby will

be travelling the length of the South Island to provide electrical insurance assessments and hazard prevention information to customers, Zak Dean will look after the North Island.

“Commercial fires affect hundreds of businesses every year, and NZI has seen this first hand, with a notable increase of large loss fires within its commercial customers. Half of these are due to electrical faults, but some of these hazards can be mitigated by simply choosing a proactive approach. And that’s where I come in.”

role with strong purpose

If you asked Toby years ago if he ever thought about working at an

insurance company, he might have wondered how his trade would even fit. This has taken a 180-degree turn.

“When I first saw the role advertised, I was fascinated at the idea of using my skills and electrical knowledge to make positive change in the world.

“I was also ready to shift the direction of my career to make a difference in electrical safety, and it’s the best decision I’ve ever made. There’s so much that can be done to help identify some of the electrical hazards that lead to fire.”

Toby and Zak's goal is to provide key insights to NZI customers, protect them from asset and property loss, and, most importantly, save lives.

“This will be an exciting year for my colleague Zak and I, as we will be out and about visiting customer’s sites, identifying their electrical fire hazards, and providing recommendations to help prevent these from happening in the first place.”

Until now, Toby and Zak have been busy analysing NZI’s historic claims data, and have been able to identify some of the common electrical fire hazards by industry, as well as ways

it’s something you can’t see, but it’s a necessity, which is why we need to look after it and take the right level of precaution. And with the world going more electric, this also brings new challenges that we need to be aware of,” adds Toby.

Toby considers himself a handson person and is always busy finding new things he can fix and build, or something exciting he can tackle.

“I’ve always had an interest in electronics and everything electrical – my dad played a big part in that. He was also an electrician and qualified electrical inspector, and very handy at doing things around the house. Growing up I would always help him on his house projects and learned a lot from him.

faults could be detected ahead of time.

“Switchboards can be a common cause of electrical fire. These are the central point for electrical loads and a place where cables and electrical equipment are concentrated.

“Once switchboards are installed, people may 'set and forget’ and don’t think about them until they stop working. A lot of customers aren’t getting regular electrical maintenance done, when in fact this is critical.”

Experiencing a fire can be a significant disruption for a business. They might not be able to operate for an extended period of time, not to mention loss of revenue and the impacts to their staff. This is where a proactive approach can make a difference.

“Generally speaking, doing electrical maintenance at least every two years minimum is key. Some businesses, especially those linked to the woodworking industry, are at higher risk, so the more often professional maintenance is done, the better.

“Electricity can be dangerous as

“I love doing things on my own and spending time in my garage. I work on my own cars and do all the maintenance. I have a Subaru WRX and I take it to the track every now and then for fun. I also repair my kids’ toys and I’ve just finished building our deck.”

And when the opportunity comes to pass on his wisdom, Toby is happy to become a teacher.

“I have two girls, Brooke (six) and Natalie (nearly four). Brooke has been showing interest in the things I do and loves helping me in the garage. She likes building and fixing things too – this passion hasn’t skipped a generation, and it makes me so happy to be able to show her what I do.”

Aside from this passion, Toby has been playing football since he was five and is currently part of a winter and summer league in Christchurch.

“Brooke will be starting football this year and that brings another smile to my face.”

2023 is set out to be an exciting year for Toby’s passions both at work and at home. Keep an eye out for useful resources coming from NZI’s team of electrical experts later this month.

Andy Beven, liability & cyber underwriting manager at NZI, breaks down common cyber security myths that could be holding businesses back.

Many business owners are unaware of the growing threat of cyber-attacks and are uncertain when it comes to setting up their own cyber security processes, leaving them vulnerable to an attack.

As a result, a lot of businesses are vulnerable to unidentified dangers that could have significant effects. By not putting the right precautions

by Andy Beven, liability & cyber underwriting manager at NZIin place, they can be risking their finances, sensitive data, and reputation.

Year on year, the national Computer Emergency Response Team, CERT NZ, has been recording higher numbers of cybercrime. Broken down, the data reveals a 13% increase in reported cybercrime and a direct financial loss of almost $17m in 2021.

As it becomes more important for businesses to be prepared and protected, let’s consider some of the common misconceptions that are possibly holding them back.

Myth #1: Most businesses don’t need cyber insurance

Cyber criminals aren’t usually targeting individual businesses –it’s a very opportunistic type of crime with millions of emails sent and attackers hoping some will be clicked on.

Myth #2: It’ll never happen to Me

Nowadays, most (if not all) businesses rely on technology in some form or another. Even something that may sound as simple

as sending out an invoice from a work email or storing data in the cloud carries a potential cyber risk.

Myth #3: cyber-attacks don’t result in Much loss

A cyber incident can be a costly event, running into the tens of thousands of dollars. It can be scary, time consuming, put businesses into panic mode, place their reputations on the line and also impact their customers.

Myth #4: cyber incidents are few and far between

There were almost nine thousand cyber incidents reported to CERT NZ last year, and the numbers continue to rise. Scams and fraud accounted for almost $12 million of the total financial loss reported.

Myth #5: once a cyber-attack has happened, there’s not Much that can be done

A key factor during a cyber-attack is time – the way a business responds during the early minutes and hours can dictate how it will play out. For businesses insured with NZI, early notification is essential. Our expert

team will then begin the investigation and engage with a panel of forensic experts to get systems up and running quickly.

There are a number of ways businesses can protect themselves, one of them is NZI’s UpGuard tool, which analyses a company’s cyber security. This can help businesses better understand their cyber risks, and identify any vulnerabilities in their security.

Asof February 9, Tower received 4810 claims relating to the floods that hit hit the upper North Island on Auckland Anniversary weekend.

The NZX-listed insurer noted that 2660 of the claims were for home insurance, 740 were for motor vehicle damage, and the remaining claims, mostly for contents, were down to flood damage and landslides.

Blair Turnbull, the chief executive of Tower, stated that the business had solid reinsurance coverage and a healthy balance sheet.

“Tower continues to invest in sophisticated underwriting capabilities and risk-based pricing which enhance our rating agility and accuracy and help to deliver sustainable margins.”

Although the financial effects of the event were still being evaluated, according to Tower CFO Paul Johnston,

the company anticipated that the event would trigger Tower's catastrophe reinsurance coverage.

Tower has an excess of $11.875 million for catastrophe events — meaning it will pay that amount before its reinsurance coverage comes into effect.

According to Johnston, the excess was within the $30 million Tower had budgeted for large events in its fiscal year 2023.

He said that in order to maintain its full level of catastrophe protection, the company would probably buy reinstatement cover, with the costs being paid for within the current fiscal year.

The NZX-listed company did not say how much it would cost to purchase the cover but said its guidance remained unchanged.

Star Prestige is elite vehicle insurance for high-end luxury and prestige marques. Discerning drivers choose Star because we offer unparalleled insurance that is tailored to each owner’s specific needs. Our policies provide the best, most comprehensive coverage possible, including the highest standard of repairs that maintain the manufacturer’s warranty of your client’s car.

For extraordinary insurance designed for your client’s vehicle, choose Star Insure.

Given the significant impact we have seen across parts of the country from Cyclone Gabrielle, it is no surprise that one of the biggest challenges facing the domestic insurance market right now is the impact of climate change. The effect of climate change on our weather patterns, and the resultant natural catastrophes, are incredibly significant insurance events.

We’ve experienced a number of major weather events within a matter of weeks, and this has had devastating consequences for our communities and our economy (which was already under pressure). It will certainly have a long-lasting impact on the New Zealand insurance industry.

The insurance industry must maintain an immediate focus on responding to tens of thousands of claims that are now coming though, and on ensuring that we as an industry are delivering on our promises in an effective and compassionate manner. However, there will also be a significant impact on the profitability of the domestic general insurance sector. This will also be seen at a global level, as the global reinsurance market sitting behind our local carriers is hit by an increasing number of climate change-related extreme weather events.

The longer-term challenge for us as an insurance community is how we can continue to provide sustainable solutions for our customers that reflect a realistic picture of what the future risk landscape looks like. The fact is that historic models have, to some degree, gone out the window and so we rapidly need to revise our predictive models to ensure we can more accurately pick future risk exposures.

Beyond climate change driven weather events there are no shortage of other challenges that the industry is going to keep grappling with over the coming period including increased regulatory scrutiny, more complex cyber exposures, talent shortages and digital evolution just to name a few.

New Zealand reinsurance capacity will almost certainly shrink as a result of Cyclone Gabrielle and the flooding earlier in February. In fact, we are already seeing a major reinsurance crunch. According to a recent report by Howden called “The Great Realignment” - which I highly recommend – we have already seen the biggest reinsurance capital squeeze since 2008 with roughly a 15% reduction in available reinsurance capital since 2021.

On top of that, the recent round of 1st January reinsurance renewals has resulted in some staggering increases, with Global Property (Catastrophe) reinsurance costs increasing 37% on prior. This is the largest increase since 1992.

It is likely that these are long-term structural shifts in the market. Ongoing natural catastrophes such as those experienced recently in NZ will only serve to underpin this hardening cycle.

These factors are going to create significant challenges for local insurance companies, who will need to manage dramatically higher reinsurance costs. This will likely result in insurers taking more risk, and a greater focus coming onto risk selection, breadth of coverage grants, and of course pricing – which in the current market can only go in one direction.

Sustainability and climate change are massive considerations for Delta. One of our key strategic pillars is ESG, which encompasses environmental, social and governance factors. We have an internal team across the three countries in which we operate (NZ, Australia and Singapore), and they are responsible for driving this strategic focus alongside the Boards of our Group and operating companies.

We are a strong believer that we all – both as a company and as individuals – have a role to play in doing our bit to address the climate change. This feeds into other areas, such as Delta’s efforts to manage and reduce its waste. For many of us at Delta, we are facing the same challenge in our personal lives – trying to reduce our household waste. Some of the initiatives that we have in place and are in the process of implementing include reducing the number of waste baskets in our offices to encourage staff to think sustainability, introducing and encouraging the use of re-usable coffee cups for takeaway coffee, waste separation, and recycling.

Delta encourages a hybrid working model, which enables staff to regularly work from home, reduce their commute hours, and lower our environmental impact. We have also implemented carbon offsetting for our corporate travel.

We have hosted several volunteering activities, including a beach clean-up in November of last year, and just last week a volunteering day at Mototapu Island in the Hauraki Gulf. We have another volunteering day planned later this month.

From an insurance perspective we also have an innovative suite of Environmental Impairment policies, which provide an insurance response to enable our customer to fund environmental and pollution clean-up.

This insurance has a key role to play in enable private business to remediate any environmental damage that they cause.

You recently won an award for your underwriting policy, which takes ESG concerns into account. Can you explain how ESG informs your underwriting decisions?

Delta’s organisational vision is to “embrace change to make the world a safer place”. To support this ambition, we have taken proactive steps to ensure that we are actively contributing towards driving positive change for the greater good of the industry, the world and humanity.

One critical step that we can take is ensuring that we are supporting the right customers, and importantly that we are not supporting the wrong customer segments, i.e. those who are responsible for negative environmental and social impacts.

We launched an ESG Underwriting Policy in 2021 to support Delta’s strategy to insurance a sustainable and greener future. It is also designed to promote international best practice standards that help ensure that potentially adverse ESG impacts are adequately managed and reduced.

This underwriting policy prohibits Delta from underwriting businesses that are participating in carbon intensive industries or activities, for example, companies involved in the exploration or drilling of oil & gas, coal mining, or thermal coal-related activities.

We’ve also identified a number of socially sensitive industries, which we also avoid because of their potentially negative impact. This includesnuclear energy, palm oil production, animal testing, betting and gambling organisations, and firearms manufacturers, amongst others.

Will ESG become a bigger consideration for underwriters, and how should brokers adapt to this change?

These issues are going to become more pronounced as time goes on. For instance, we’ve seen a massive global uptick in regulatory and shareholder actions against companies and their directors and officers relating to ESG risks. This is a clear indicator of the trend of increased social and environmental expectation on businesses, and in turn their professional advisors, including their insurance brokers.

In my opinion, ESG matters are a critical part of the risk management assessment that brokers undertake. The reality is that many ESG risks are not insurable by nature, but there are steps that can be taken by businesses to manage and reduce their exposures. It is certainly becoming a key risk consideration for product lines such as D&O, and brokers need to be across this.

Of course, some segments such as oil & gas, and certain mining activities, will be increasingly under the spotlight of underwriters. We expect the supply of insurance to those segments to diminish over time.

What changes or improvements would you like to see in the NZ market that would change the sector for the better?

There are a number of things that could be raised here, but the one single thing that stands out to me is

our people. The insurance industry is all about people and we are currently facing a talent crisis. This is partly driven by regulatory changes requiring advisers to be appropriately qualified and its impact is being felt across the industry. I’m a firm believer that education and continuous development are critical to ensure the growth and sustainability of professional standards within our industry.

We must also ensure a diversity of long-term career pathways for people working within the industry. Although they do present some immediate challenges that must be overcome in the short term, my perspective is that the regulatory changes are great for the industry in the long term.

One area that the industry, including Delta, needs to focus on collectively is bringing young new talent into the industry, for example through graduate programs . A united focus is needed across the sector ensure we have an strong talent pipeline of smart and dynamic people who are hungry to develop their career within insurance.

There are a host of initiatives that Delta is working on to ensure that we continues to remain an attractive and interesting place to work. A key part of this is is ensuring we are pan equal opportunity employer, and that we maintain a continual focus on key areas such as diversity and inclusion, mental health and wellbeing, and ensuring we have a supportive and encouraging team. This is especially important given bullying continues to be an issue of contention within our industry.

It is one of Delta’s fundamental priorities to provide our junior and senior staff alike with opportunities to grow and progress in their careers, and this in turn fosters and engaged, happy workforce who take pride in their work.

In my opinion, this is what makes Delta so successful.

How important is the tripartite relationship between insurers, brokers and clients, and do you think it will change and evolve over time?

In the intermediated space, this tripartite relationship is sacred. With the increasing impact of digitisation, we are going to see an eventual shift in client needs and how they access insurance solutions. With that said, there will always be a need for high quality advice, particularly for sophisticated clients or clients with complex risk exposures.

Being able to deliver on client needs in the intermediated segment fundamentally hinges on a high level of trust being developed and maintained between clients, brokers and their insurer partners. Without trust, the whole value-chain breaks down. This is no good for anyone, least of all the client.

While the way brokers and insurers interact is changing, for example through digital trading, online portals, and technology-supported claims services, the need for a strong tripartite relationship is unlikely to change.

Insurance Australia Group provided a market update as it dealt with the impact of late January’s floods across the North Island.

IAG expects its first-half profit after tax to be A$468 million, while gross written premiums are expected to grow by 10%.

“Our strong top-line growth over the half reflects significant premium increases and new customer growth,” Nick Hawkins chief executive, said.

“Premium rates continue to increase in response to claims inflation and in anticipation of additional reinsurance and natural perils costs.”

Natural perils costs for 1H23 are expected to rise to A$524 million, A$70 million higher than the allowance for the period, according to IAG, due to the Auckland weather event.

IAG conducted an initial assessment of expected claims. Natural perils cost impact, net of reinsurance, would be at the $236 million retention level, it said.

“The Auckland event, combined with the escalation in supply chain inflation, has delayed our ability to fully demonstrate our strategic and operational progress in FY23,” Hawkins added.

IAG noted inflationary impacts, particularly in motor claims. Together with natural perils costs, the firm’s increased loss ratio would rise to 70.8%, up 2% from last year.

Hawkins anticipated "strong improvement in the underlying margin" during H2 and noted early indications that supply chain inflation impacts on claims costs had stabilised.

Are

insurance professional looking to take your career to the next level?

Thinking about starting your own business? or perhaps you’re already an experienced insurance adviser looking to make a change.

We’re here to help. Insurance Advisernet has compliance systems in place to help you manage your own licence, or, choose to operate under ours.

Either way, you’ll be able to focus on what you do best – looking after clients and giving professional advice.

For a con dential conversation please contact Travis, David or Sue today or visit insuranceadvisernet.co.nz to nd out more.

Suncorp sent an additional team of claims specialists and assessors from its Australian insurance operations to New Zealand as communities in the North Island dealt with more severe weather, including heavy rain and gale-force winds, off the back of ex-Cyclone Gabrielle.

The CEO of Suncorp Group, Steve Johnston, said the devoted resources would assist local teams in helping customers who were impacted by the country's weather system as well as those who were still recuperating from the recent flood event that affected Auckland and the surrounding areas.

“As a trans-Tasman insurance company with strong capability in responding to extreme weather events, Suncorp Group is well-equipped to throw its full support behind its customers in New Zealand,” Mr Johnston said.

“Our teams in New Zealand have been doing a fantastic job in assisting impacted Vero and AA Insurance customers at this challenging time. However, given the scale of the flooding event and the follow up rain and cyclonic winds, all available Suncorp Group resources will be deployed to speed up the claims process,” he said.

“We currently have a team of around 100 specialists from Australia dedicated to the New Zealand event recovery efforts, including resources based in Australia and on-the-ground support.

“Our thoughts are with all of our customers experiencing further adverse weather, and we urge all of our customers and team members to prioritise their safety and follow the advice of local emergency authorities.

“We encourage impacted customers to lodge their insurance claim once it is safe to do so and to also take photos of the damage when it is safe.”

Johnston confirmed that the Suncorp Group was well protected due to its robust reinsurance programme, which provided additional coverage for New Zealand losses.

“In addition to losses from the Auckland flooding event being capped at NZ$50 million, net of reinsurance cover, the retained cost of any potential second declared event in New Zealand is NZ$25m.”

As of February 13, Suncorp’s Vero and AA Insurance brands had received approximately 11,500 claims in response to the Auckland flood event that occurred at the end of January 2023.

Award-winning underwriting agency Delta Insurance Group is amalgamating its property business into Delta Insurance New Zealand, as it seeks to further its superior insurance services to its New Zealand-based clients and policyholders under a single entity.

Collectively, Delta Property Insurance and Delta Insurance New Zealand insure over 24,000 risks in New Zealand.

The amalgamation, which should take effect on 31 March 2023, will position the company for significant growth as a unified organisation, requiring new senior roles that play to the strengths of existing leadership. Delta Property Insurance Managing Director Andrew Beaton will become CEO of Delta Insurance New Zealand under the new structure, while Delta Insurance New Zealand Managing Director Dinesh Murali will move into the newly created position of General Manager, Portfolio and Distribution.

Delta Insurance Group CEO, Kent Chaplin says there are several key outcomes of the merger. The most important is a greater cohesion between the internal team of more than 45 employees, resulting in improved customer experience.

“The merger will unite the businesses under our common brand, linking them with a unified strategy and service proposition under a single leadership and management team,” he says.

“This has many positive outcomes for the business as well as customers, including an increased ability to scale our services as the business grows, greater internal efficiencies and the amalgamation of boards into a single committee with reduced governance and operational costs.

“For our coverholding partners, this will see reduced reporting requirements, and fewer but larger and more diversified transactional aspects. In turn, this will provide Delta Insurance New Zealand with the ability

to diversify and expand to offer a broader range of cover policies and products under a single entity.

Ultimately, it’s our customers and partners who will benefit most – as they should,” he says.

“There will also be benefits for our people, who will see new opportunities and career pathways open to them. This will provide the chance for secondment and professional growth within a larger organisation with a wider range of specialities.”

Delta Insurance Group’s Executive Director –Underwriting, Craig Kirk says a seamless amalgamation will mean customers and brokers will notice little difference in the way they work with the new entity initially.

“In the short-term all contact points for our customers and brokers remain the same for our existing customers and policyholders. Brokers will no longer be required to submit multiple closings or send separate premium remittances, reducing their back-end administrative requirements. It will be easier for customers with multiple policies: as the amalgamation matures, our existing customers and policyholders will be pleased with the shift to a single point of contact across our insurance product lines. Once that has been introduced, our customers will only need to contact one person if they want to make a claim or discuss their policies. Effectively, the amalgamation will establish a multi-line underwriting capability,” says Craig Kirk.

“For Delta, this is about greater organisational cohesion with our singular goal to deliver exceptional customer service in new or specialised insurance areas, underpinned by transparency and integrity. Operating under a single administrative team and a single claims team increases our efficiency and enables us to diversify our product lines into new areas.

“This makes it easier for us to scale in the long term, and it makes it much easier for our partners and customers to transact with us. Ultimately, that is what has driven the change – one vision, one team,” he says.

Two

AA Insurance expected the January storms to be the largest motor claims event in its history.

As of February, with claims numbers expected to rise, AA had received more than 5300 claims in total. Around 2300 were home claims, 1500 contents claims, and 1500 are vehicle claims.

A week after the devastating summer floods, AA insurance reported it had settled close to 60% of 1500 motor claims received.

Beau Paparoa, head of motor claims, said: “We know that losing a vehicle can impact heavily on our customers’ lives – disrupting their ability to get to work, drop kids off at school or childcare, and other family commitments.

“Due to the nature of the flooding, we are assessing most flood-damaged vehicles as a total loss - which means we can settle these claims quickly and get money to our customers’ hands, so they can move fast to source a replacement vehicle and get back on the road.”

With most new cars featuring complex electronics, flood damage led to a significant number of write-offs.

Paparoa said: “Once water reaches a certain level, your car’s electronics might continue to work for a while, but there’s a chance they will stop working eventually, and the last thing anyone needs is for their car’s safety features to stop working when they are halfway down the motorway.

“That is why we are writing these vehicles off and focusing on getting money into the customer’s hands, this approach will also help our customers overcome another potential challenge on the horizon – the ongoing supply chain issues for motor vehicles, which could further impact the availability of vehicles for purchase over the coming months,” he added.

The Insurance Council of New Zealand urged landlords to contact their insurers to assess rental cover and temporary accommodation benefits in the wake of Auckland’s floods.

The severe flooding left many homes across the Super City uninhabitable, and ICNZ chief executive Tim Grafton called on landlords to contact their insurers to review their options, particularly for tenants left without a home.

"The priority has to be people having a safe and dry place to stay," said Grafton. "If you have house or contents insurance and your house is unable to be lived in, contact your insurer or broker as you may be able to claim for a temporary accommodation benefit. Likewise, many property owners will have taken out landlord insurance that includes loss of rent cover as an option."

Grafton warned that insurance companies could be overwhelmed due to the summer’s events.

"While it is good that temporary accommodation benefits are in place for many insured tenants and owner occupiers alike, there is clearly very high demand for claims to be processed right now.”

The ICNZ said landlords should start the cleaning process once given the all-clear by Auckland Council and their insurers. They advised landlords to wear appropriate protective equipment to dry out their homes, starting with carpets and furnishings and beds, while using air conditioners, dehumidifiers and ventilation systems.

"It’s in the best interest of tenants, property owners and insurers to get on with drying out homes and getting them back to normal as soon as possible. However, given the scale of damage we are seeing across much of Tāmaki Makaurau Auckland and the rest of the Te Ika-a-Māui The North Island, we can expect this to take longer than normal. Aotearoa New Zealand’s insurers are in this for the long haul.”

Nearly half of Auckland residents do not have home insurance, according to a startling new study from global price comparison site Finder.

In the wake of Auckland’s devastating summer floods, new research reveals that 45% of Auckland homes are without home insurance — higher than the national average of 39%.

The lack of coverage leaves homeowners exposed to huge losses following the devastating weather events of January and February.

According to Finder, insurance coverage is higher among those who have a mortgage. Only 10% of people with home loans said they did not have home insurance. Finder’s nationally representative survey of 1,114 respondents revealed that 77% of Kiwis living in Auckland

have car insurance. This is slightly lower than the national average of 80%.

Angus Kidman, Finder’s editor at large in New Zealand, said the floods could be devastating for people without insurance coverage.

“Some Kiwis are not taking out insurance because they simply can’t afford it,” Kidman said. “Following the recent run of natural disasters, consumers are facing rising premiums which can put too much pressure on the household budget.

“But insurance is one of those costs that can be short term pain, long term gain – especially since the recent run of natural disasters in New Zealand. If you’re yet to take out home and contents insurance, this is a reminder of its importance.”

Delta Insurance co-founder Craig Kirk was named NZ Insurance Industry Leader of the Year at the Australian and New Zealand Institute of Insurance and Finance Awards, as the firm secured the Underwriting Agency of the Year prize.

The niche insurer secured the latter award for the fifth consecutive year. Additionally, senior underwriter Miro Dordevich made it to the finals in the Young Professional of the Year category.

The ANZIFF awards recognise the outstanding achievements of individuals and companies across all sectors of insurance and celebrate the positive impact they have made on the community.

Kirk, Delta’s group executive director for underwriting, said he was humbled by the honour.

“With the quality of leadership across ANZ in this industry, I am humbled by receiving this award. I’d like to acknowledge my peers and the entire Delta Insurance company. We work together as a team and we win as a team.”

Judges recognised Kirk for his work in reviewing Delta’s underwriting policy, aligning it with the company’s vision of embracing change, making the world a safer place, and its core value of doing the right thing.

Kirk said Delta was keen to drive positive change.

“Our company is willing to forgo business opportunities for the sake of protecting the Delta brand; across all lines of business, our underwriting decisions take into consideration the potential reputational implications of any unmitigated ESG concerns,” he explains.

Kirk acknowledged the tough year ahead.

“We’ve faced and overcome serious hurdles within our business over recent years which haven’t been easy on our team or our leadership group. I’ve certainly learnt a huge amount throughout this period, and I want to thank our amazing team for believing in our vision and plan as we transition into the next chapter of our journey.”

Delta said young professional finalist Dordevich was recognised for his unique approach to underwriting and commitment to working with broker partners and clients in a tripartite alliance.

Dordevich said: “In niche insuring, maintaining close contact with all parties achieves the best results. We can only offset risk if we engage closely, understand clearly, and build relationships of trust. Our clients are always innovating, and as insurers sharing the risks involved on the cutting edge, we play a part in driving the world forward. After all, innovation and risk go hand in hand; when organisations and individuals can offset risk with insurance, their horizons expand.”

IAG took home the Excellence in Workplace Diversity and Inclusion award and General Insurance Claims team of the Year accolade at the 10th New Zealand Insurance Industry (ANZIIF) Awards.

Louise Harvey-Wills, executive general manager of business partnering at IAG, said diversity, inclusion and belonging were fundamental to the company’s purpose.

“We know that when different voices are embraced and included, we create meaningful workplaces, higher performing organisations, and an equitable society.”

“We’re absolutely delighted to receive this acknowledgement of the exceptional environment we’ve created for our people.”

The Excellence in Workplace Diversity and Inclusion Award recognised organisational excellence and achievement in diversity and inclusion in the workplace

and the wider NZ insurance industry.

Executive general manager of claims Wayne Tippet added: “I’m so proud of what the claims team has achieved, and this industry recognition as General Insurance Claims team of the year is the icing on the cake.”

“It recognises the commitment and dedication of our people, who consistently deliver excellence - including during the significant weather events New Zealand has endured - and the outstanding mahi the team delivers to look after our customers every day.”

The General Insurance Claims Team of the Year category was introduced at the ANZIIF awards for the first time this year and recognised claims teams that demonstrated excellent technical skills, strong claims results and outstanding customer service during 2021.

One day it discovered an employee had stolen company property, including property owned by the company’s clients. As a result of the theft, the company lost several clients and income from hiring out the stolen items.

The company made a claim to the insurer for the theft and financial loss. The insurer accepted the theft claim and paid the company $25,763. However, it declined the financial loss claim, saying employee theft didn’t trigger consequential loss cover under the policy.

The company disputed the insurer’s decision, because it believed it should be covered.

The IFSO Scheme found that, under the policy, the consequential loss cover was only triggered by a claim under the general, statutory, or employer’s

liability covers, and the theft claim was accepted under the fidelity cover. In addition, the policy exclusion stated there was no specific consequential loss cover following a claim under the fidelity cover.

Therefore, under the terms of the policy, the financial loss was not covered by the policy, as it wasn’t a result of one of the defined events.

The IFSO Scheme found that the insurer could rely on the policy to decline the financial loss claim, as it was outside the policy’s scope of cover.

It is so important for a consumer to understand the scope of cover long before a claim is made. The IFSO Scheme often has to deal with consumers who are unhappy, because their expectations haven’t been met. Good communication is key to ensuring consumer satisfaction.

Mandy* arranged insurance for her property maintenance business. In March 2021, Mandy’s property maintenance company secured a new contract to replace a roof. When it was identified that the roof consisted of asbestos, Mandy contacted a specialist asbestos removal company, and they told her that she could remove the asbestos cladding herself. While removing the roof, a workplace health and safety regulator prohibited further work until the asbestos had been removed by a licensed removalist.

Mandy explained to her insurance advisers that due to the roof being partly removed the ceiling had collapsed. Further, roofing iron had been stolen from the site, and the hired trailer was stranded on site, increasing rental costs. Mandy lodged a claim with her insurer for the cost of the damage, which was approximately $85,000.

The insurer declined Mandy’s claim because her policies did not cover costs associated with asbestos removal, as asbestos cover is a specialist type of cover that Mandy had not sought.

Mandy believed that her insurance advisers should have suggested she obtain asbestos cover, but the advisers disagreed. Mandy complained to FSCL.

Mandy did not believe that the adviser asked enough relevant questions to ensure that the policies recommended were appropriate for her business.

The adviser said that they could not predict

the need for asbestos cover. Mandy’s property maintenance company was not an accredited asbestos removal company. Further, the scope of work included in the renovation contract was outside the business activities described to the adviser when Mandy last updated her business details.

Mandy’s policies had exclusion clauses for asbestos-related risk so did not cover Mandy’s claim. The issue was whether the adviser reasonably should have offered an asbestos-specific insurance policy.

When Mandy updated her business activities in July 2020, she told the adviser that she would be doing maintenance work on residential properties. The adviser said that Mandy did not mention asbestos removal as part of her intended work. Further, as the business was not accredited to deal with asbestos removal, the adviser did not know that Mandy would do any asbestos-related work.

FSCL noted that the advisers could have had a more in-depth discussion about Mandy’s work but it was not reasonable to expect them to anticipate or ask about asbestos cover due to asbestos removal work being outside the scope of work described by Mandy.

FSCL recommended that Mandy discontinue her complaint.

Mandy agreed to discontinue her complaint.

The more information consumers share about their needs the better equipped insurance advisers will be to place appropriate cover. Insurance advisers should also take the time to properly understand their client’s needs. However, insurance will not cover all risks and, if a risk is remote, consumers may choose not to take out and pay for additional cover.

We have a claim where a settlement offer is to be based on indemnity value.

The item damaged is an artificial bowling green and the costs to reinstate include a number of different elements that make up the quote, being materials, labour, equipment hire, project management costs etc.

The wording notes the definition of indemnity value as :

Indemnity Value:

the value of insured property at the time of loss or damage, sufficient to place the insured back in the

STEVE KEALLInteresting issue.

In this case the insurer proposes an "across the board" rate of depreciation. This is a global assessment of the full cost of reinstatement which does not differentiate between plant & materials that would usually be subject to a straight-line depreciation (i.e., a fixed percentage for each year of age) and labour & incidental costs, which by their nature do not depreciate.

Insurer proposes conventional straight line depreciation which takes a starting (all inclusive) value (call that value A) and divides that number by the years of life of the assets in question (value B), and then multiplies that by the number of years left for those assets (value C).

The difficulty with this approach is that the insurer is not comparing apples with apples. A traditionally nondepreciable element like labour does not have years of life. So, computationally, this does not work.

The policy caters for depreciation-it is inherent in the concept of indemnity. So, it must be taken into account. Depreciation is not given a defined meaning.

same financial position to that immediately prior to the loss or damage.

The insurer's offer of settlement is based on the full costs to reinstate divided by the lifespan (20yrs) x the remaining life (9yrs) So the depreciation is 55% across the board on all elements.

Our question is about the depreciation calculation. On materials that wear we expect depreciation however should the elements of labour and machinery hire etc. also be subject to depreciation?

Could you provide some insight into what is able to be depreciated by the insurer?

In these circumstances, I think the correct approach is to fall back on conventional valuation methods. "Straight line" depreciation is as described above, for which you would leave out labour and machine hire.

It may well be the case that the insurer has catered for the "non-depreciable" elements by enlarging the lifespan.

Intuitively, a lifespan of 20 years sounds like it is on the long side for an artificial surface: which is good for your customer. The shorter the life, the higher the depreciation rate amount, given that 11 years have passed. For example, if the lifespan was say 15 years then the depreciation rate would be 73. And if the lifespan were say 11 years then the residual value would be nil.

In terms of practical steps, you might want to contact the insurer to confirm its methodology. If it has catered for non-depreciable elements by using a generous, 20 year, time-frame, then in economic terms it would probably not make sense to make any challenge. If you did, it follows that it would use a shorter asset timeframe for the strictly depreciable elements to yield the same outcome.

Do you have a question for our experts?

A garage door was damaged when a third party accidentally drove into it.

The owner of the damaged property is a limited liability company.

The third party was driving the company director's private vehicle, the vehicle is insured in the personal name of the director with another insurer. A motor claim has been made on the motor insurer.

The insurer of the damaged property has advised they can not pursue recovery as the owner of the vehicle and the owner of the damaged property are the same.

The issue here is negligence by the DRIVER of the vehicle (although the owner can be vicariously liable as well in some situations).

If so, visit iNavigator, www.inavigator.co.nz, or the IBANZ website, www.ibanz.co.nz - and let us know.

My argument to them is that the owner of the damaged property, being a company, is a separate legal entity to the director and thus he and the insured are not the same person and recovery can be made against him.

Who is correct?

Is it correct to say this is considered a "fee"?

The insurer has said: "On the basis that the sum refunded reflects the sums charged/on charged to the claimant, we consider these to be fees."

Thanks!

The subrogated insurer of the garage door wishes to sue, in the insured company's name, the driver. As the driver must be a different legal entity to the insured company, this is possible. The insured company is not suing itself.

Our client's vehicle hit a third party (no dispute —it was our client at fault).

Our client's policy excluded U25's and an U25 was driving, so our client is liable for the third party damage.

PAV of the TP vehicle $29K, repair estimate $10K - for some reason (possibly because the TP didn't want an accident damaged vehicle back) the TP Insurers agreed to write it off and paid their insured the full $29K.

Vehicle salvage costs received by the TP Insurer $4K.

TP Insurer now holding our client liable for $25K ($29K

CROSSLEY GATESThe amount the owner of the damaged TP vehicle can recover from your client in negligence is determined by the law of damages. One of the principles of that law is that a victim must mitigate his or her loss. A victim can't take advantage of the situation to recover more from the negligent

less $4K salvage).

What is our client's actual liability? Is it the $25K being sought?

Should it be the $10K repair estimate as that was the actual damage they caused?

If it's the $10K where does the $4K salvage amount come into play (or doesn't it?)?

Surely the write off was a decision made (for whatever reason) by the TP Insurer and their actions shouldn't increase the amount our client is liable for, they are only liable for the value of the actual damage they caused?

As the vehicle was clearly more economic to repair, the victim can only recover the 10k in accordance with the obligation to mitigate. A subrogated insurer cannot be in any better position than its insured, so it can't recover more than the 10k either.

The TP's insurer's generosity doesn't change any of this.

Do you have a question for our experts?

Hello, I have had a client lodge a claim for frozen food that has defrosted in their freezer at home.

The insured advises that the freezer had power on, the light shows up so there hasn't been a power failure. However, something has happened to it, it's stopped freezing and the food has rotted on the inside.

The insurer has agreed to cover the food, but I am curious about the freezer itself.

Under the policy, there is no cover for the freezer arising from mechanical issues. Plus, theoretically, the freezer could be repaired if the issue was just this.

However, in this instance, the freezer is unhygienic, and cannot be reinstated. So, is there a reasonable argument here that the rotten food has caused resultant damage to the freezer and therefore, the insurer should replace it?

CROSSLEY GATESThe damage to the food and the damage to the freezer, while both contents, must be addressed separately under the policy. As far as I am aware, no contents policy expressly covers

damage consequential to damage to food. Therefore, what was the proximate cause of the freezer failing? This needs to be determined before any coverage for it can be considered.

An internal water valve starting leaking sometime between 5th December (when the Insured went on holiday) and the 14th December, when they returned and found the resultant damage to ceilings, carpets etc, some of which already had mould on them.

So max 10 days for the leak - the insurer is classing that as gradual damage and relying on that exclusion to decline the claim in its entirety.

Is there case law on what constitutes gradual damage?

To the layperson 10 days seems an incredibly harsh interpretation of the exclusion.

CROSSLEY GATESAs far as I am aware, there is no case law on the interpretation of the words 'gradual damage' in an insurance policy.

However, the law relating to contract interpretation applies and that law says that interpreting words not specially defined in the policy starts with giving them their ordinary dictionary meaning. The dictionary defines 'gradual' as:

If so, visit iNavigator, www.inavigator.co.nz, or the IBANZ website, www.ibanz.co.nz - and let us know.

taking place, changing, moving, etc., by small degrees or little by little: gradual improvement in health.

I suggest the damage that occurs over 10 days is relatively quick damage and hasn't happened little by little. The speed of its spread may vary from item to item, but some of it (e.g. wetting of GIB board) may have happened quite quickly.

MARCH 2023 - ALL WEBINARS ARE HELD AT 10.30am - 11.30am

March 1 | Introduction to Surety Bonding | Tony Parkes

Performance and Surety Bonds and Guarantees are becoming a more frequent requirement as part of a contractual undertaking.

March 2 | Outlook Email: 10 Tips To Free Up 20 Minutes A Day | Debbie Mayo-Smith

Boost your 2023 productivity and reduce stress with these 10 must know Outlook top tips.

March 8 | Fabulous Time Saving Money Making Tricks for Databases & Lists | Debbie Mayo-Smith

If you want to learn easy, unforgettable clever tips and tricks to improve the way you set up and work with your database and lists, then you must attend this webinar. It doesn’t matter if you store your data in another program. You are going to learn how to use Excel to clean, de-duplicate, fix and create consistencies. You can then then import your data back into other programs.

March 9 | BI for Beginners Part 2 | Mark Anderson

This is Part 2 of a 2 Part presentation for those new to commercial broking and who have had little to no exposure to business interruption insurance.

March 16 | Broking in a Hard Market | Simon Moss

The current hard market shows no sign of let-up for most product lines. The way successful brokers respond in a hard market needs to adapt to the increasingly difficult circumstances..

March 22 | Email: Write More Business and Keep On Topt | Debbie Mayo-Smith

Very often Outlook Contacts, Calendar and Tasks play second fiddle or aren’t even looked at. Yet they offer stunning integrated benefits with all of MS Office. Wouldn’t you like to learn how you can better use these three programs with the direct benefit of strategies to never lose an opportunity and create systems to write more business?

APRIL 2023 - ALL WEBINARS ARE HELD AT 10.30am - 11.30am

April 6 | MS Word Magic | Debbie Mayo-Smith

Learn many of the hidden secrets of working with Word Documents. your outcome is saving a significant amount of time by learning secrets and shortcuts for formatting; creating and working with templates and documents.

April 19 | RMA Changes/Impact on Statutory Liability Policies | Sophie Curlett (Robertsons Law)

The government is proposing to introduce a new regime for Environmental and Resource Management. These changes to the Resource Management legislation may influence your clients’ coverage under their Statutory Liability policies. This webinar will discuss the changes and how they may impact on Statutory Liability Insurance.

April 20 | Increasing your online presence | Leanne Coste

Online presence is more important than ever so that people can find you online, and you create enough trust that prospects take the next step to do business with you. In this webinar you’ll learn free and paid strategies to improve your online presence so that you can attract more online engagement and sales.

April 26 | Best Practice Complaint Processes | Andrew Gunn

The IFSO Scheme conducted a scan of 99 IFSO Scheme Participants websites, specifically to review their complaint information and processes. The webinar will delve into the data and provide our findings, conclusions, and recommendations to assist Participants provide a better website experience to customer - when they wish to complain.

April 27 | Duties under FMCA (Conduct and Ethics Topic) | Crossley Gates

This webinar will help you to understand when you have duties under the FMCA and how they vary for wholesale and retail clients.

MAY 2023 - ALL WEBINARS ARE HELD AT 10.30am - 11.30am

May 2 | Powerfully Persuasive: How To Win More Clients. Motivate Others. | Debbie Mayo-Smith

Would you like your emails, proposals, conversations and presentations to be read and acted upon?. Being persuasive in conversations or written communication requires being able to express your ideas and points clearly, concisely, and interestingly. Good communication skills are vital to succeed in your workplace.

May 3 | Obligations of FAPs and Practical Implications | Tracey Berry and Erin Hutchings (Mosaic)

This session will discuss the responsibilities and obligations of a FAP, including good practice and real examples where required standards have not been achieved.

May 4 | Code of Professional Conduct for Financial Advice Services (Conduct and Ethics Topic) | Angus Dale-Jones