AUTUMN 2023 EDITION 14 SPRAY CALIBRATION TIPS Industry 24 ORGANIC FARMER OF THE YEAR Strawberries 65 NITROGEN REMOVAL TRIALS Blueberries 89 YOUNG LEADERS EMERGING Rubus 100 AUSTRALIAN BERRY JOURNAL

NEWS FROM OUR VALUED PARTNERS

PARTNERS "The outstanding thing was the longevity of the produce." - Jim Rozaklis, strawberry grower, Bathurst NSW Contact your local Syngenta representative for more information. ® Registered trademark of a Syngenta Group Company. AD23/134

SILVER

Jenny Van de Meeberg

John Hay

Bronwyn Koll

Dr Anne-Maree Boland

Scott Wallace

Craig Shephard

Liam Southam-Rogers

Henry Hyde

Dave Farmer

Christopher Menzel

John Gray

Wherever you see this logo, the initiative is part of the Hort Innovation Blueberry, Strawberry and Raspberry and Blackberry Fund. Like this publication itself, it has been funded by Hort Innovation using the Blueberry, Strawberry and Raspberry and Blackberry R&D levy and contributions from the Australian Government. Some projects also involve funding from additional sources.

DISCLAIMER: Whilst every care has been taken in the preparation of this journal, the information contained is necessarily of a general nature and should not be relied upon as a substitute for specific advice. The advice and opinions in the articles published in Australian Berry Journal are essentially those of contributors and do not necessarily reflect the views of Berries Australia or the Editor. The advice is at the reader’s own risk, and no responsibility is accepted for the accuracy of the material presented. Inclusion of an advertisement in this publication does not necessarily imply endorsement of the product, company or service by Berries Australia or the Editor. Horticulture Innovation Australia Limited (Hort Innovation) makes no representations and expressly disclaims all warranties (to the extent permitted by law) about the accuracy, completeness, or currency of information in Australian Berry Journal. Reliance on any information provided by Hort Innovation is entirely at your own risk. Hort Innovation is not responsible for, and will not be liable for, any loss, damage, claim, expense, cost (including legal costs) or other liability arising in any way, including from any Hort Innovation or other person’s negligence or otherwise from your use or non-use of Australian Berry Journal or from reliance on information contained in the material or that Hort Innovation provides to you by any other means. Copyright © Horticulture Innovation Australia Limited 2022 Copyright subsists in Australian Berry Journal. Horticulture Innovation Australia Limited (Hort Innovation) owns the copyright, other than as permitted under the Copyright ACT 1968 (Cth). Australian Berry Journal (in part or as a whole) cannot be reproduced, published, communicated or adapted without the prior written consent of Hort Innovation. Any request or enquiry to use the Australian Berry Journal should be addressed to: Communications Manager, Hort Innovation, Level 7 | 141 Walker Street, North Sydney 2060, Australia | E: communications@horticulture.com.au | P: 02 8295 2300

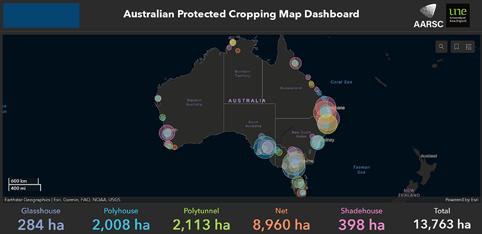

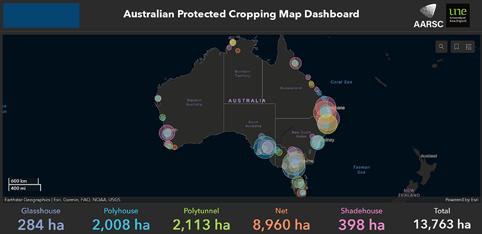

Emerging Leader: Tom Considine 85 Growing young horticulturalists at Costa Berries in Western Australia 86 Natural based systems in treating blueberry irrigation runoff: a best practice trial in NSW 89 Marketing Update 95 BLUEBERRIES Attracting and retaining staff starts with your business 14 NEW: Coir recycling and reuse project gets underway 17 Smart Farming Guide for Horticulture 19 Tasmania: Berry Sprayer Field Day 24 The future of berries: Are we doing enough to meet technology half-way? 28 Asia Fruit Logistica: Reflections on the Thai market 32 Area wide pest management: an essential approach to fruit fly management 38 NEW: Recovery & Resilience — A Berries Australia & Hort360 Project 40 National Agricultural Plastics Stewardship Scheme — Update 43 Australian Horticulture Statistics Handbook 2021/22 available online now 48 National map of Protected Cropping Systems now available in draft 49 Market Update: Fruit volume down in the wake of increased prices and supply issues 52 Energy Efficiency for Recovery and Resilience Case Studies 55 INDUSTRY Profile: Rainberry Farm, Tasmania 97 Profile: Jamie Pollen, Queensland Berries, Qld 100 RUBUS Hort Innovation Strawberry Levy: An Update 60 Strawberry growers to receive targeted climate information. 61 Queensland Strawberry farmer wins Australian Organic Farmer of the Year 65 Inconsistent quality under global warming dampens strawberry performance in SEQ 70 Out and about in the Victorian strawberry industry 75 Growing Strawberries in Scotland 81 STRAWBERRIES AUTUMN 2023 EDITION 14 AUSTRALIAN BERRY JOURNAL ADVERTISING For all Advertising & Partnership Enquiries Wendy Morris | 0491 751 123 | admin@berries.net.au All advertising and advertorial material is subject to review and approval prior to publication. DESIGN Sama Creative www.samacreative.com.au EDITOR Jane Richter TERES Communication 0431 700 258 jane@teres.com.au CONTRIBUTORS Rachel Mackenzie Anthony Poiner Simon Dornauf Andrew Bell Richard McGruddy Melinda Simpson Dr Angela Atkinson Mark Salter Helen Newman Aileen Reid Jen Rowling Dr Mark Bayley Meg Strang David Cordina Delaney Lang-Lemckert

Executive Director's Report

Rachel Mackenzie | 0408 796 199 | rachelmackenzie@berries.net.au

Welcome to the first Australian Berry Journal of 2023. We are fortunate to have horticulture communications specialist Jane Richter as the editor of this publication and a recent grower survey indicated that the journal is the preferred way for growers to obtain information. We are proud of the journal so it is encouraging that so many growers use it and appreciate it.

As I am sure most of you are aware, this journal is partly funded through levy funds matched by the Australian government. Funds raised through advertising also make up a significant proportion of the funding for the journal so I encourage you all to continue to support our advertisers and sponsors, so we can continue to support you.

We are currently negotiating the next iteration of the industry development and communications project and as part of that process we want to ensure that the project delivery meets the needs of the levy payers. There was consistent feedback across the growing regions that all growers were keen for more information on pest and disease management, ongoing access to agricultural chemicals and irrigation and nutrition information. These topics will form the backbone of the next project. It is important though to remember that this is an industry development project so we need to look at the broader issues that are coming over the hill, so to speak. Grower profitability is consistently raised as an issue and that covers off on issues such as increasing costs for agricultural inputs and labour, compliance costs as well returns to growers.

Increasing domestic consumption is one way of increasing returns. Marketing is one tool but also trying to ensure the consumer has the best possible eating experience every time they eat an Aussie berry is critical. When times are tough it is tempting (and sometimes unavoidable) to just think of making a dollar this season, but as an industry we need to safeguard our future and ensure our quality is as good as it can be year-round.

Export is another important mechanism increase consumption but we must remember that overseas consumers are wanting evidence of our ‘clean, green’ credentials so sustainability in all its forms will be a driver over the next few years. Our Export Manager Jenny Van de Meeberg will shortly be visiting growers across the country as part of the Joint Berry Export Trade Development project. If any growers are either exportcurious, or would like to further develop current export activity, please let your IDO know and we can arrange to have Jenny visit your farm during her time in your region.

To my mind, many people overlook the fact that profitability is a key element of sustainability, but we do need to move towards a scenario where we are not only doing the right thing but can demonstrate that we are. I strongly encourage growers in Northern NSW to undertake the Hort360 on-farm assessment which gives you a mechanism to benchmark your performance and identify areas of improvement. SEE PAGE 40.

The Varroa mite issue has meant I have spent a lot of time in Coffs lately but hopefully we should soon be in a position to enable pollination to occur and everyone will adapt to the new normal. I am planning to get around to other growing regions as the year progresses. Hopefully 2023 will be the year I finally get to Western Australia!

2 INDUSTRY BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

Chairman's Report

Anthony Poiner | 0412 010 843 | anthony@smartberries.com.au

As I write this column, it is the first day of autumn, and an opportunity to reflect on what has been an unusual and challenging summer for the Australian berry industry. That said, after a few years of pandemic combined with extreme weather events the challenges this year have been much more within the “normal” range of issues that we as growers encounter.

Ironically the weather in the Coffs region before Christmas was fantastic for growing berries. Whilst this would normally be a cause for celebration, the upshot was that we had a huge influx of rabbiteye entering the market that far exceeded forecasts. In addition to the sheer volume, disappointingly the quality was not great and consequently prices went way down.

In the last few weeks, we have seen the quality improving a great deal and consumers have rewarded us with a bounce back up in price. This is a clear and timely reminder of the importance of quality if we want to increase repeat purchases from families, and grow the market overall. Unlike extreme weather events and pandemics, we can actually fix this issue by having a strong focus on quality and overall profitability rather than just volume.

In general the impact of the rabbiteye flush and late crops of cherries and other fruits has made pricing more difficult for all berry categories. That said, I’ve

recently enjoyed eating a lot more sweet and clearly high quality strawberries on shelves lately. The shift towards developing a premium offering in strawberries mirrors the successful approaches taken overseas.

At this stage, I am not so sure that consumers are fully appreciating which are the sweeter packs and which are not, but I am sure the growers of those varieties will be undertaking strategies to differentiate their product in consumers’ minds. This bodes well for the strawberry industry.

In relation to Rubus, there is the prospect of a strong upcoming raspberry season. In general, the word I am hearing is that, although summer and autumn crops have been delayed, there is the anticipation that autumn crops might be strong in yield and potentially early. Obviously, there are challenges in the Coffs region around varroa, but I am also aware that the Berries Australia team is working hard to reduce the impact on growers in the region and at this stage there is no reason to think that yields will be affected. Please spare a thought for our New Zealand berry industry cousins. The impact of Cyclone Gabrielle in many berry growing regions has been nothing short of horrendous. We are thinking of you whilst you pick up the pieces and rebuild your farms.

Once again, thank you to the staff of Berries Australia, the IDO team and each of the peak bodies (SAI, ABGA, and RABA). Your commitment to the cause is appreciated and very important for the continued progress of our industry.

3

INDUSTRY

President's Report

Andrew Bell | 0422 234 124 | andrew@mountainblue.com.au

It is with great pleasure that I pen my first ABGA President’s report. It is not lost on me that I have very large shoes to fill as we have had fantastic leadership over the years. It is also humbling to have this platform to communicate to an industry that my father Ridley helped pioneer in the 1970s. A lot has changed since then – we’ve come from a place of zero production and no real awareness of what a blueberry is, to being a year round staple with 52% market penetration.

Since joining the ABGA committee in 2016, it’s always struck me how collaborative and functional the industry body is. Despite a voluntary levy, we have fantastic buy-in from the majority of industry and a common understanding on the objectives for the committee and the needs of growers. I hope to continue that tradition and whilst our finances remain strong, I would encourage people to continue with timely payment of levies so that we can continue the good work across marketing, R&D research, market access and the like. The establishment of Berries Australia in 2018 has only strengthened our capacity to support growers. As we move into a new phase with increased supply during certain windows, the need for export opportunities continues to be a big priority. Additionally, opening new markets allows us to grow the pie for everyone.

We are particularly excited about the prospect of Vietnam being open to blueberry growers in the near future. The Vietnamese blueberry market is currently modest in size but Vietnam’s potential for premium produce is enormous – since cherries were granted access in 2017,

Australian exports have increased five-fold from AUD$3 million to AUD$15 million. Similarly, since table grapes were granted access in 2016, Australian exports have leapt from AUD$18 million to AUD$38 million. This is rapid export growth in a relatively short period of time. ABGA is working hard to create new market access to Vietnam which will enable our industry to replicate this success for Australian blueberry growers.

It would be remiss of me not to highlight something close to my own heart and that is putting a product on the shelves that we can all be proud of. We’ve just come off the back of a record rabbiteye season, which should mean good things for consumers in terms of value for money. But value for money isn’t just about the lowest price and given the number of complaints I’ve received from consumers and berry lovers about the standard of fruit, we are certainly not delivering value for money. The damage to the category cannot be overstated. I would encourage all industry participants to keep the end consumer front of mind when making planting or harvesting decisions. The simplest way to drive demand for blueberries is to give consumers a positive experience and keep them coming back for more. The ABGA will continue to drive consumption through the marketing program but that investment cannot overcome a poor eating experience.

All in all, I see exciting times for the blueberry industry –with potential market access looming and our continued popularity with consumers. I would also like to extend my support to those growers caught up in the varroa response. I am aware that this is a challenging and uncertain time for you and I encourage you to continue to work closely with the Berries Australia team so they can help you.

4 BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

President's Report

Richard McGruddy | 0408 763 804 | richard@berryq.com.au

Welcome to 2023. It is hard to believe it is March already but here we are. Reports out of Tasmania indicate that there were high volumes of fruit over the summer season. Unfortunately this didn’t translate into high profits for growers as prices were lower than usual due to a combination of factors including a late cherry and summerfruit season. We were also not helped by the bumper crop of lower quality rabbiteye blueberries which impacted the whole berry basket.

The new Horticulture Statistics Handbook (SEE PAGE 48) was released recently which shows the trends for the year to 30 June 2022. After many years of exceptional growth, the Rubus category slowed in the 2021/22 financial year with production dropping by 13% and value dropping by 10%. That said, 2021 was a bumper year with 11,122 tonnes being grown.

The drop can be potentially explained by the flood and hail events that occurred in the Coffs Harbour region in early 2022. Interestingly the price/kg in 2021/22 averaged at $21.33 compared with $20.41/kg the year before. This contrasts with the impressive average of $25.30/kg in 2018. Household penetration sits at 27% (compared with 52% for blueberries).

The clear message from these statistics is that the committee needs to start work now to ensure a profitable future for the sector as supply will soon meet demand. One positive step towards increasing profitability is the levy reduction which will put more money back in your pockets. As discussed many times before, the levy will reduce from 12c/kg to 4c/kg and the indications from government are that it may be activated around October.

RABA, through the Berries Australia export project, is taking initial steps into developing an export capability for berries. This involves identifying some appropriate markets and starting the process for market access. Anyone who has been involved in export understands that these processes can take up to 15 years so it is certainly a good idea to start now. It will be interesting to see if markets in South-East Asia embrace Rubus in the same way they have taken to blueberries, so market education is also part of our strategy.

In addition to export, the industry really has to look at how to increase domestic consumption. We have been in the enviable position whereby the fruit has basically sold itself, but now we need to work to get more punnets in the trolley at a decent price point. Evidence from overseas indicates that a ‘berry basket’ approach to marketing is the best way to increase consumption rather than trying to cannibalise between berry types. With the removal of the mandatory marketing levy we will be floating the idea of a voluntary marketing levy to work alongside the blueberry marketing program. Like any industry association, RABA relies on the input from members to ensure we are on the right track. It is disappointing that we have limited representation from the Coffs Harbour region and we encourage any Rubus growers who wish to influence the future of the industry to consider joining the RABA committee.

I would like to give a big shout out to Tyler Schofield from Driscoll’s and Rachel Mackenzie from Berries Australia who have been working tirelessly on the varroa issue trying to get pollination for growers. The situation changes almost daily so there is no point in providing an update here as it will be outdated by the time you read it, but I would urge you to attend any of the information sessions being run by Berries Australia and keep abreast of the latest updates via our e-newsletter The Burst.

5

INDUSTRY

Chairman's Report

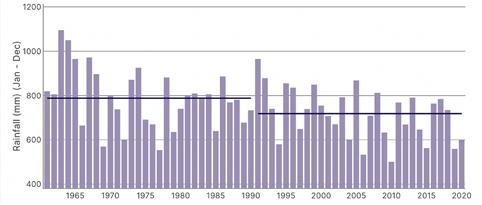

Simon Dornauf | 0408 681 206 | simon@hillwoodberries.com.au

The Tasmanian strawberry season over this last summer has been a difficult one, and I’m sure that the challenges have been felt across all summer production regions.

A delayed harvest due to the continuing La Niña weather conditions was followed by poor prices as a flow on effect from a huge volume of lower quality blueberries and a late influx of cherries and stonefruit. I believe we could also be facing a slow down in the demand for berries in general as a result of the rising cost of living, but at the time of writing, prices have picked up and we are hopeful that autumn will see good volumes, great quality and a consistent price for strawberries.

The Strawberries Australia committee has spent numerous meetings and out of session time over recent months working to gain an understanding of the implications of a levy shortfall due to an accounting error. There has been many a robust conversation with Hort Innovation on this subject but overall, the discussions have been positive with both parties committed to finding a solution. The committee are now comfortable that a solution has been found which will ensure the continuation of project funding through future levy accumulation and I’d like to thank Hort Innovation for working closely with industry to have this complex issue resolved. In particular I’d like to thank SAI Vice Chairman Jamie Michael for taking a deep dive into the financials, which has been invaluable for the SAI committee to better understand the implications and agree on preferred outcomes for the Australian strawberry industry.

On behalf of Strawberries Australia, I’d also like to welcome and congratulate Hort Innovation’s Adrian Englefield on his recent appointment to the position

of Industry Services and Delivery Manager for Berries. The SAI committee looks forward to working with you.

Recent changes to the Hort Award have proven difficult for growers, and many have switched to an hourly rate in response to these changes. As has long been the case, hourly rates generally lead to a reduction in productivity, with more strain added to the ever-increasing financial pressure on growers. We need to support growers in gaining a better understanding of the changes to the Award and how they can implement them as effectively as possible, without having to resort to modifications that have a much greater negative impact on the bottom line.

It was fantastic to have the opportunity to host a visit on farm early this year from John Gray of Angus Soft Fruits in Scotland. John is a Nuffield Scholarship recipient travelling Australia and New Zealand as part of the study program. He has been visiting growers in Victoria and Tasmania, and has provided great insight into how the berry industry in the UK is going, considering the maturity of the industry is around five years ahead of Australia.

Our industry can learn a lot from the UK’s response to the challenges associated with increased production, and increased labour and input costs SEE PAGE 81. From a Strawberries Australia perspective, this was a fantastic opportunity to discuss the Angus Soft Fruits breeding program, which develops new varieties of strawberries and raspberries. Partnering with international breeding programs may be something for Strawberries Australia to consider in future to provide growers with a wider choice of varieties, and John was a great source of information on the potential of this pathway for the Australian strawberry industry.

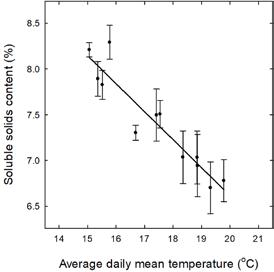

6 INDUSTRY BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

Victoria & South Australia

Dr Angela Atkinson, Berry Industry Development Officer 0408 416 538 | ido@vicstrawberry.com.au

In both Victoria and South Australia, the start of the berry season was delayed by the wet and cold spring and the cool start to summer. The crops are still catching up in many areas, with harvest two to three weeks behind previous years, and with some growers saying they are up to two months behind in some parts! We have generally seen better weather since Christmas, but have still received the occasional severe storm and rain event causing damage and affecting fruit quality. The end of summer has seen drier and warmer conditions, hopefully contributing to a good finish to the season going into autumn. Labour availability and management continues to be challenging for some businesses, as the industry adjusts to the new agreements now in place.

In November the Berries Australia IDO team from around Australia met in Melbourne for planning meetings, and we took the opportunity to visit some Victorian growers, runner growers in Toolangi and the strawberry runner certification authority, VSICA. We have included a summary of some of the innovations the team got to see on PAGE 75 of this journal edition.

In January the Managing Director of Angus Soft Fruits in Scotland, John Gray, visited Victoria as part of his Nuffield scholarship travels, which have taken him to New Zealand and Australia so far. John visited a number of berry growers in the Yarra Valley, as well as runner growers and VSICA in Toolangi, before heading to Tasmania. John’s Nuffield research is focusing on how berry growers can increase their share of the value chain, as he can see the berry industry in the UK facing problems with continued viability. John has contributed an article about the Scottish berry industry for this journal on PAGE 81, and will be sharing his Nuffield research with us in a future edition.

In this edition of the journal on PAGE 37, we also have an article from Bronwyn Koll, the Queensland Fruit Fly (QFF) regional coordinator in the Yarra Valley, about the importance of area wide management (AWM) in the management of fruit fly and other pests, and showcasing the successes of the Yarra Valley’s adoption of many of the components of AWM in keeping the YV fruit fly free. With ongoing outbreaks of fruit fly in South Australia, and continued pressure in the Yarra Valley from surrounding regions, there are some good take home messages and some ideas about how AWM for fruit fly and other pests can be implemented and funded.

On the topic of fruit fly, we are seeing increased detections of QFF in the Yarra Valley with the current warmer weather, so it is important that growers proactively put out bait and traps as a preventative measure. Keeping QFF out of the Yarra Valley also means growers don’t have to resort to using chemistries for QFF control that can disrupt IPM programs. For advice on types of traps and bait application speak to your local agronomist/chemical resellers.

Industry events have mostly been on-hold over the summer period, as everyone is busy with the berry harvest, but will begin again in March with a farm walk at the Wandin Research Farm for the temperate breeding program. We are also hoping to reinstate some of our berry industry social events this year, after missing out during the height of the pandemic.

Over summer, the Berries Australia team have been working on developing the next version of the industry development and communications project with Hort Innovation. Input from growers and industry has been important in determining the needs of industry and the scope of the project going forward. Thank you to everyone who gave their input through the grower needs analysis survey and focused workshops.

As always don’t hesitate to get in touch if I can be of assistance in any way.

7

Victorian Strawberry Industry Development Committee

INDUSTRY

Western Australia

Climate and crop

After an average start, spring 2022 had a cooler than average finish. This extended the Perth berry season later into summer making up for the delayed crop in the south. Cooler than average daytime temperatures and ongoing reduced solar radiation during December further slowed southern berry crops (across all categories). Blueberry crops that normally finish in December didn’t wrap up until early February; the strawberry crop was also about one month behind. Things started to warm up in January with above average daytime temperatures recorded along the west coast, northwards from Cape Leeuwin. The Perth region was particularly warm, where daily maximum temperatures exceeded 35 degrees, 16 times in the Bullsbrook area.

Looking ahead for the period from February to April 2023, drier than average conditions are expected to continue in WA berry growing regions and warmer than average temperatures are forecast. For growers in the Perth region, the anticipated warmer than average autumn weather is a good reminder to ensure irrigation systems are operating efficiently and distributing water evenly across the field. Good irrigation uniformity, coupled with monitoring and scheduling according to crop needs, will result in fewer heat-related plant illnesses and deaths.

Don’t be like the grower in Figure 1, DPIRD is offering $5000 vouchers for growers in the Wanneroo, Carabooda, Bullsbrook and Yanchep areas to engage qualified irrigation professionals to audit their properties, design efficient irrigation systems, and provide written

advice on technologies, soil amendments and cropping strategies to improve water use efficiency. Grants of up to $80,000 are also available for infrastructure (including poly tunnels, irrigation system upgrades and irrigation monitoring tools) and soil amendments that improve irrigation efficiency. Grant guidelines can be found on the DPIRD website www.agric.wa.gov.au/ horticulture/north-wanneroo-voucher-scheme

8 INDUSTRY BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

Figure 1. Poor irrigation uniformity is a symptom of poor irrigation design and/or operation. Incorrectly designed drip systems have similar patterns of poor uniformity to the sprinklers pictured here.

Aileen Reid & Helen Newman, Industry Development Team, Agricultural Produce Commission

Strawberry growers:

Poor sprinkler uniformity before planting leaves dry patches in the soil resulting in poor fumigant distribution; after planting, poor irrigation uniformity results in plant stress and deaths. Poorly designed drip systems often result in plant stress and deaths towards the ends and on the sides of rows.

Industry news

The WA Strawberry Industry Strategic Plan has been finalised and is available on the APC website https://apcwa.org.au/producers-committees/ strawberry. The APC Strawberry Producers Committee will meet soon to discuss projects to help deliver tactics outlined in the plan. If you would like to be involved in this process, contact Helen Newman or the committee chair.

There were plenty of online webinars again this quarter. RMCG delivered the findings of their research into coir alternatives for substrate growers; HARPS presented a technical webinar of HARPS Version 2.0; Freshcare held a session with financial counselling and mental health experts on recovery and rebuilding financial and mental wellbeing; Ausveg had a session forecasting the year ahead - what changes to expect in the cost of production, the weather, and the markets in the near future; Donna Mogg from Fair Farms closed the year off with information on how to plan for the silly season - substitution of public holidays, wage rates, and Christmas party issues. If you missed any of these, get in contact with your IDO for links to recorded sessions and information packs.

DPIRD held a research update in early December at the Wanneroo Tavern to share information and gather growers thoughts on some new research projects they have underway. Topics included soil amendments to improve nutrient and water holding capacity, using marginally saline irrigation water, bio-degradable mulch options, and soil moisture monitoring. Growers at the meeting were also encouraged to apply for the water use efficiency grants mentioned earlier in this article.

9

A new dawn. A new standard. There’s a new dawn in fungicide technology, powered by Miravis® . Call your Syngenta representative today. www.syngenta.com.au/miravis-prime ®Registered trademark of a Syngenta Group Company. © 2021 Syngenta. AD21-305 IS YOUR CROP PROTECTED? SCAN HERE

Queensland

Jen Rowling, Temporary Berry Industry Development Officer 0448 322 389 | berryido@qldstrawberries.com.au

Strawberry growers in the Sunshine Coast, Moreton Bay and Bundaberg regions have had a good run of weather over summer to prepare ground for the coming winter season. The majority of farms have their plastic down and growers are hopeful that the weather will be kind to them this year after what can only be described as one of the most challenging seasons experienced in 2022.

The summer production season for strawberries in Stanthorpe has seen good volumes and fruit size throughout spring. The summer heat has now caught up and production has slowed but should continue at a steady pace until its time to pull up stumps over winter.

In February, strawberry growers took advantage of pre-planting down time to attend a workshop prior to the Queensland Strawberry Growers Association AGM. There was good attendance by growers keen to spend some time getting updates on important industry issues and topics before plants start arriving in March. Representatives from DAF were on hand to provide those in attendance with an update on current projects and work being done to assist the berry industry in Queensland. With a new 5-year project now in place, Jodi Neale and Katie O’Connor from the Australian Strawberry Breeding Program (ASBP) spoke about the outcomes of the previous project and plans for the next 5 years.

Apollo Gomez presented on the status of DAF research for managing strawberry diseases. The extensive research work being carried out by DAF includes resistance breeding as part of the ASBP, research into a biocontrol agent for management of charcoal rot, BioClay™ for control of grey mould and the work being conducted on UVC light for powdery mildew. He also provided growers with an update on fungicides, with proposed spray schedules to address disease pressure associated with varying weather impacts whilst also taking resistance management into account.

Andrew Macnish rounded out the DAF discussion with a presentation about the progress of the supply chain monitoring work conducted last season with Queensland growers, and the plan for the project going forward.

Donna Mogg, Fair Farms Grower Engagement Officer with Growcom followed with an important presentation on the changes to Fair Work legislation and the impacts for employers.

Rachel Mackenzie and Jenny Van de Meeberg from Berries Australia (BA) also presented to growers, with Rachel providing an update on the activities conducted by the BA team in 2022 and Jenny reviewing the export action plan that has been developed for the strawberry industry as part of the Joint Berry Industry Trade Development project.

For those who were unable to make the February workshop, feel free to contact your Qld IDO who can forward on information and contact details for any of the presentations that you are interested in.

The Berries Australia team have been working in collaboration with Hort Innovation on the next iteration of the Industry Development and Communications project. Key to its success is input from industry which will ensure that the priorities for each growing region are met, and that it addresses the preferred methods of information delivery for growers. We received excellent levels of input from berry producers across the country via our survey and workshops – thank you to all of you who have participated.

We are now working through the design process with the aim to have the new project contracted and operational by mid-2023. As part of the new project we will be recruiting a new IDO for Queensland so watch this space.

10 INDUSTRY BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

Tasmania

Mark Salter, Berry Industry Development Officer

0400 100 593 | berryido@fruitgrowerstas.org.au

0400 100 593 | berryido@fruitgrowerstas.org.au

The Tasmanian berry harvest is now well underway throughout the state across all major berry categories. Crop harvest timings are running behind previous years, with early fruit development held back by mild and overcast spring conditions. This has been followed by a relatively mild summer in most areas, which has helped growers manage harvest labour but not let the crop catch up.

Unfortunately, the delayed strawberry harvest has meant growers missed out on the buoyant pre-Christmas period with an early season peak post Christmas. Strawberry growers are now on the cusp of new flushes which should see production increase over the next few weeks.

Raspberries and blackberries are continuing to deliver excellent quality fruit as production continues through the primacane/floricane cycle. Some growers are starting to focus on long cane production, to enable them to fill the gap in their primacane/floricane season. Blueberry growers have commenced harvest, most reporting volumes slightly up on last year. At the time of writing, they are experiencing lower than average prices due to plenty of supply still coming from mainland growing regions.

With most farms occupied with managing the harvest, there have been few industry events for growers to attend. One event that has taken place - organised by Fruit Growers Tasmania, Berries Australia, and the Tasmanian Institute of Agriculture - was an Orchard sprayer field day for small producers on 23 November 2022 at Millers Orchard in Hillwood. Presenting on the day was Dave Farmer from Croplands, who travels the country advising growers on how to maximise the effectiveness of spray units for their specific crop. SEE PAGE 24 for a more detailed report from this event.

Many growers also enjoyed a visit by berry grower John Gray, Managing Director of Angus Soft Fruits in Scotland (www.angussoftfruits.co.uk) who is visiting Australia and New Zealand under a Nuffield Scholarship to study “how we as growers can increase our share of the value chain”.

On his travels, John explained that UK growers have reached a crossroads, and many are struggling to remain viable, and strongly believes there will be a reshaping of the berry industry there. As such, John has travelled here to see how some of our more innovative Tasmanian growers operate their businesses. From his travels and conversations with growers across Australia, John sees the Australian berry industry facing similar pressures and following a similar path to the UK industry, with growers in the UK about 5-6 years further down this path. In particular, John notes that whilst the Australian domestic market is profitable now, he believes that as production increases over the next five years we will need to be developing potential export markets and embracing ways to improve business efficiency.

Given these pressures, John strongly encouraged growers to make sure they have a strong understanding of their costs of production, and to be proactive in making their businesses as lean and efficient as possible.

11

John Gray visiting Burlington Berries in Tasmania

INDUSTRY

Photo credit: Mark Salter

New South Wales

Melinda Simpson, Berry Industry Development Officer 0447 081 765 | melinda.simpson@dpi.nsw.gov.au

As we welcome 2023, we also welcome some changes with it. I have decided to take a temporary assignment within the NSW DPI as a team leader for the Varroa mite emergency response, particularly the Wild European Honeybee Management Program and will be working in the Newcastle region. Although I will miss working with everyone in the NSW berry industry and those Australia-wide, I know that the industry is left in good hands until I return.

We have an exciting new project starting here in NSW which has seen the employment of two additional people to work in the berry industry. You can find out more about the project on PAGE 41.

John Hay and Steve Norman will be available to help run through the benchmarking program Hort360 with you. Through a one-on-one facilitated process, you will be asked a series of questions relevant to your business. As you answer each question, the system tells you if you are ‘below’, ‘at’, or ‘above’ the industry standard for each practice.

If any practice is below the industry standard, John and Steve will be there to help you identify what changes you may need to make on-farm to reach the right level. The modules that we will be focussing on are irrigation, run-off, pesticide use, better business, and energy although there are a number of other modules that are available for completion, and all are free of charge for participating growers.

Thank you to the growers who took part in our recent survey which will help shape the next IDO and Communications Project.

For NSW growers, the top priorities that you would like to receive more information about were: pest and disease management, irrigation and nutrition management, new technology, waste management, different production systems and product quality management.

If there are any other key topics or issues that you would like workshops, field days or articles to cover in the next 12 months, please feel free to send me an email and I will have these incorporated into the plans as best I can.

The NSW Government opened the $20 million Farms of the Future grant program on 3 February 2023, which will provide grants of up to $35,000 to eligible farm businesses to purchase the latest Agtech equipment and connectivity solutions to address their farm needs. The grants program will be available for primary producers in the target Local Government Areas of Armidale, Ballina, Byron, Cabonne, Carrathool, Griffith, Leeton, Lismore, Moree Plains, Narrabri and Orange. Berries Australia is also seeking to have the Coffs Harbour shire included in the program. The grant is available to assist with purchasing approved connectivity solutions and digital Agtech devices with a level of co-contribution required to participate in the program. Producers will be able to choose from the Agtech Catalogue website of pre-approved Agtech suppliers, for devices supporting the four agricultural sector use cases, in accordance with the monitoring plan developed in the training program. More information can be found at www.dpi.nsw.gov.au/dpi/climate/ farms-of-the-future

On a final note, I would like to wish you all the best of luck over the next 6-12 months until I return. We have had a tough few years and I know how hard it has been for everyone. I hope that 2023 will be a much more pleasant year for you all. Take care.

12 INDUSTRY BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

BerryQuest International 2025

BQI25 IS HEADING TO MELBOURNE

Following the hugely successful BerryQuest International conference held on the Gold Coast in July 2022, plans are underway for the next event planned for 2025 which will be held in Melbourne.

You can expect a stunning line up of speakers both from Australia and overseas, as well as a full schedule of farm and facility tours in and around Melbourne.

VITAL STATISTICS

• 67 hectare site

• 330 fruit & vegetable trading stands

• 2,750 businesses use the Market as a base

• 2,000 buyers source produce direct from the Markets

• 12,500 m² of trading space & 120,000 m² of warehouse space

Visit Melbourne Markets which moved to its current location in Epping at the end of August 2015.

Visit Melbourne Markets which moved to its current location in Epping at the end of August 2015.

THE DATE — MELBOURNE

SAVE

Attracting and retaining staff starts with your business

Helen Newman, Berry Industry Development Officer, Agricultural Produce Commission (WA) This article has been written using content has been adapted from the Jobs & Skills WA website.

It’s easy to forget sometimes that employment is a two-way street; you choose the employee for the skills, experience and attitude that they can bring to your business, but they also have to actively choose your business based on what it can offer them. Recruiting and retaining the right employees for your business starts with understanding exactly what your business has to offer employees and ensuring that you use the tools available to communicate that offer clearly.

Employee attraction and retention tips

Attracting employees

Start by thinking about your competitive advantage.

Before recruiting you need to think about what employment benefits you can offer that would be attractive to prospective employees and remember it is often not only about the money. Develop a list of realistic benefits that you can offer such as:

• flexible work arrangements

• induction programs

• mentoring arrangements

• training and development opportunities

• competitive salaries

• a positive brand and business reputation in the community (including a positive workplace culture).

Look at what your competitors are offering.

Your business is more likely to attract the best and brightest if you can offer a better or different collection of benefits from those of your competitors. Ask your existing employees what it is about working in your business that they like; just be prepared to receive and listen to the feedback you get even if it isn’t 100% positive! Conversations like this can help you to understand what other factors people are looking for from an employer, like more flexible working arrangements for example, and give you the opportunity to make changes that can retain good staff as well as attract new ones.

What can you do to build your employer brand?

You need to start with a clear understanding of what your business is about; if you aren’t clear about this how can a potential employee understand it? This is often expressed in a Mission statement and a Vision statement:

Mission statements define your business's purpose and its primary objectives. They are set in the present tense, and explain why you exist as a business, both to members of your existing team and to people outside it. Mission statements tend to be short, clear and powerful. Vision statements also define your organisation's purpose, but they focus on its goals and aspirations. These statements are designed to be uplifting and inspiring. They're also timeless: even if the business changes its short-term strategy, the vision will often stay the same.

You can find lots of helpful resources about how to define these for your business by searching online.

It’s a good idea to involve your existing employees in the process so that the end result truly reflects your business, not just your opinion. Table 1 contains some tips on how to build a good employer brand.

14 INDUSTRY BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

OBJECTIVE HOW DOES IT LOOK? BENEFIT

Be clear on what your business is about

Match up your statements with action and visible evidence

Focus on the customer

Be dedicated to your promise

Get your message out

You have a good idea of what you do, how you do it and how you want to be seen by others, usually mission/vision/ values statement.

If you say your business stands for one thing when it does something different, your promise does not match your actions.

What your customer wants from you may reflect what you want from your employees. Consider displaying some policies that showyour commitment to customers and the community (such as a customer service charter).

Ensure that managers maintain the promises made to customers and employees. Doing things in line with the business promise can be difficult at times, but commitment to principles can pay off in the long run.

Make sure people know about what you do and how you do it.

Leverage internal communication through use of policy, newsletters, memos, training and people management processes. Make sure your public face clearly and consistently communicates your message –this could be on your website or your Company LinkedIn profile page.

Expand your employment pool –build a diverse workforce

The business case for diversity across your workforce is compelling. Given that the traditional pool of potential employees has significantly reduced, workforce diversity is an important component of long-term sustainability.

If you are having difficulty attracting employees, it may be timely to take a fresh look at groups that may not have previously seemed an obvious fit for your business. People from these groups may be qualified, capable, keen and well suited to perform work in your business. There are also financial subsidies and incentive programs provided by State and Commonwealth Governments to help businesses with the cost of taking on a new employee, apprentice or trainee.

Some of these groups include:

• First Nations Australians

• People from culturally and linguistically diverse backgrounds

You are able to check back to ensure that what you are doing or what you plan to do fits the organisation’s brand (how others see the business).

Your employees will receive clear cues from management behaviour, workplace policy and the way the business is portrayed to others.

If your employees are given the right tools (policies, procedures, training, and equipment) in line with your business promise, your customers will be satisfied.

People come to expect certain things from businesses.

They become comfortable with the way businesses act and how they treat their customers and employees.

Brand awareness depends on communication to an audience. Your brand will carry value and create certain expectations in the minds of those outside the business only if it is constantly and consistently applied in external and internal messages.

• recently arrived migrants

• apprentices and trainees

• people with a disability

• under-employed people

• people returning to work

• mature age workers

• phased retirees

Retaining employees

Understanding why employees choose to stay in your business may help you reduce staff turnover. Often the reasons that employees remain are the same reasons that first attracted them to your business.

A good place to start is to ask your existing employees what they like about working in your organisation, and don’t assume its all about the pay. A supportive working environment, job variety or the flexibility to work partly from home can also be powerful factors, for example.

15

Table 1. Tips to help you build a good employer brand.

Source:

June 2022

jobsandskills.wa.gov.au

Strategies or initiatives you may wish to consider to improve your retention of valued employees could include:

• flexible work arrangements such as working off site, varied hours and salary sacrifice for additional leave;

• practices that support employees to balance work and caring responsibilities;

• support for employees to pursue personal and professional development or study;

• providing a forum for staff to contribute new ideas and develop innovation in the workplace;

• providing high quality performance development, leadership opportunities, coaching and mentoring;

• employee assistance, workplace diversity, wellness and health programs;

• support for employees participating in local community and volunteering activities; and

• celebrations and recognition of organisational and personal achievements.

Why do employees stay?

Table 2 lists some of the core reasons revolving around the job itself, the workplace culture, personal reasons and the external environment that influence employee decisions to go or to stay in their current workplace.

CULTURE PERSONAL EXTERNAL

Challenging, interesting and meaningful work

Meets expectations in terms of salary and conditions

Offers training to upgrade skills in their workplace

Offers of career development and opportunities

Good work can be identified and recognised

Status of the position (particularly for management and senior roles)

Leave and superannuation benefits

Management perceived as competent Match with personal and family commitments

Supportive leadership and management style

Meets expectations in terms of co-workers

Provides recognition and rewards for good work

Gives a sense of security about the company

Company values match with personal values

Economic climate –how readily available other jobs are

Geographic location Competition from other industries

Confidence in own marketable skills and experience

Age (fit with workforce)

Health (impacts on and from the job)

Past good and bad employment experiences

Community view of industry, business and job

Source: jobsandskills.wa.gov.au

For more information on workforce planning including strategies to attract and retain staff, have a look at these websites:

Jobs & Skills WA – Developing your workforce jobsandskills.wa.gov.au/resources-employers/developing-your-workforce

Business Victoria - Create a desirable workplace (attracting and retaining staff) business.vic.gov.au/business-information/staff-and-hr/ staff-management/create-a-desirable-workplace w

Jobs Queensland – Workforce Planning Connect jobsqueensland.qld.gov.au/workforce-planning-connect/wpc-download/#toolkit

16 BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

Table 2. Why employees stay JOB

June

2022

New Project: Coir recycling and reuse

Mark Salter, Berry Industry Development Officer, Fruit Growers Tasmania

Tasmanian growers have experienced significant challenges with coir costs and freight supplies, prompting the industry to look at ways to reduce the volume of new coir needed each year.

To tackle these rising costs, Fruit Growers Tasmania are running a collaborative research project to explore options to recycle and reuse spent coir to extend its effective lifetime. Led by berry growers from Costa Berry Exchange, Hillwood Berries, and Tasmanian Berries and supported by Doris Blaesing and Jake Gaudion from research agency RMCG, the project will:

• explore options to manage coir physical degradation by incorporating other substrate materials

• trial different sterilisation treatments to address carry-over disease issues

• investigate how strawberry plants respond to the different substrate blends

• explore the productivity, labour and capital costs for coir recycling activities

Supported by the Tasmanian Government through the Agricultural Development Fund, the project will be delivered over the next three years.

What’s involved?

Activities will be delivered in four stages focusing on different elements of the project.

Stage one

Focused on defining the characteristics of alternate substrates, including pathogen load and physical characteristics, and whether it is feasible to use these materials in commercial horticultural production. Research will be based on and build upon previous literature reviews conducted by RMCG to determine the blend of local by-products in the mixed substrate (i.e., spent coir, pine bark, sand, perlite, biochar, crushed gravel, etc.).

At the end of this stage, the project team will understand the substrate characteristics needed, the materials and sterilisation processes available, as well as which options should be explored in practical research trials.

Stage two

This stage will involve small-scale trials with spent coir and the alternative substrates identified in stage one, to formulate a mixed substrate that produces yields comparable to the current practice (i.e., new coir). Findings from this stage will determine whether a mixed substrate is economically feasible in commercial horticultural production.

It is anticipated that there will be several small-scale trials during this phase to test a range substrate mixes, with spent coir to be sourced from industry partners, then sterilised, mixed with alternative substrates,

17

L-R Stephen Welsh (Costa), Simon Dornauf and Jason Barnes (Hillwood Berries) and Doris Blaesing (RMCG) discussing recycled coir combinations at Hillwood Berries

INDUSTRY

Photo credit: Mark Salter

and then trialed on a small-scale (0.5ha per farm). At the conclusion of this stage, the most effective substrate mixes will be documented, and a comparative emissions assessment will be carried out for each substrate mix.

Stage three

The mixed substrate identified in the previous stage of the project will be trialed within the industry partner’s production systems on a commercial scale.

Throughout these trials, industry partners will collect data on several variables (i.e., yield, growth rate, pathogen profile, physical structure, porosity) to be used in the economic analysis in stage four.

This stage will determine the feasibility of the mixed substrate on a commercial scale and feasibility for adoption by wider industry.

Stage four

The final stage will involve a thorough economic analysis to compare overall production costs between new coir and the mixed substrate using the trial data collected in stage three. This analysis will demonstrate the economic costs and benefits of incorporating coir recycling into production systems.

How can I find out more?

Growers will be invited to take part in a number of interactive field days to learn more about coir recycling, the materials and processes involved, as well as the economic factors at play.

In addition, fact sheets, reports, articles and case studies will be developed throughout the project and shared through the Fruit Growers Tasmania and Berries Australia websites, this journal and industry e-newsletters.

18 BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

Recycled coir combinations at Hillwood Berries.

Photo credit: Mark Salter

Smart Farming Guide for Horticulture

Liam Southam-Rogers & Henry Hyde, Applied Horticultural Research Project: (ST19023) Digital remote monitoring to improve horticulture’s environmental performance

What is smart farming?

Australian horticultural industries are facing increased challenges with climate variability, supply chain reliability and labour shortages. While no single measure can address all these challenges, farmers can adopt new technologies to optimise management and remotely monitor farm conditions to inform decision making.

Using sensors and technology to improve productivity and performance are at the core of smart farming, with remote monitoring of farm conditions assisting growers to use their resources more efficiently, from labour to other inputs.

This is already happening in some horticultural sectors, with trials underway that could also show promise for berry growers.

Improving the productivity and environmental performance of farming systems using sensors and technology is known as smart farming. For smart farming to work, sensors are located at various locations around the farm and remotely monitor key parameters. The data from the sensors is fed into a centralised management tool, known as a dashboard. The Hitachi Vantara Control Tower is an example of such a dashboard. In addition to the data feed from on-farm sensors, dashboards can also use models and other tools to increase the value of measured data.

Project overview

The National Landcare Program has funded four pilot smart farms in Queensland and is supporting development of the Control Tower, which provides growers with an integrated data platform to farm efficiently. The Control tower also demonstrates environmental best practice to customers and compliance bodies.

The Smart Farming Partnerships team consists of Applied Horticultural Research, Hitachi Vantara, Freshcare, Greenlife Industry Australia, AusVeg, Growcom, Australian Banana Growers’ Council and Hort Innovation.

The four pilot sites are Bartle Frere Bananas in Innisfail QLD, Golden Grove Wholesale Nursery in Torbanlea QLD and 2 separate areas at Austchilli Group in Bundaberg QLD, which hosts the avocado and vegetable smart farms. Each of the pilot farms are trialling different types of technology for their unique use needs and industry priorities. Videos from each of the four pilot smart farms are available on the AHR website at ahr.com.au/smart-farming

The suite of sensors at each pilot smart farm is designed to provide efficiency benefits and data that can satisfy remote audits of environmental management systems such as Freshcare Environmental and EcoHort.

Hitachi Vantara Control Tower

The Hitachi Vantara Control Tower is being developed to holistically measure farm productivity and environmental stewardship. The key approach to developing this system is to provide a single integrated platform that captures data from all key sensors used across a farm or nursery.

The integration of sensor data, weather forecasts and biophysical models can be collated and analysed. The data are then presented as simple user interfaces or actionable insights to enable users to make decisions regarding business operations.

Importantly, the Control Tower can also automate much of the Freshcare Environmental audit reports and provide decision support tools for managing nutrient runoff and leaching.

19

INDUSTRY

Technology

The project works with a range of technology providers that are prepared to share data from their proprietary software systems to the Control Tower, such as ICT International, Wildeye, Binary Tech, Eratos and Goldtec. Data is shared securely via the Application Programming Interface (API) standard to the Control Tower. There is a great benefit to working with companies who are willing to share sensor data because no farming business is locked into a single ecosystem, and growers retain the flexibility to select the best equipment for their needs, maintenance capability and budget.

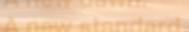

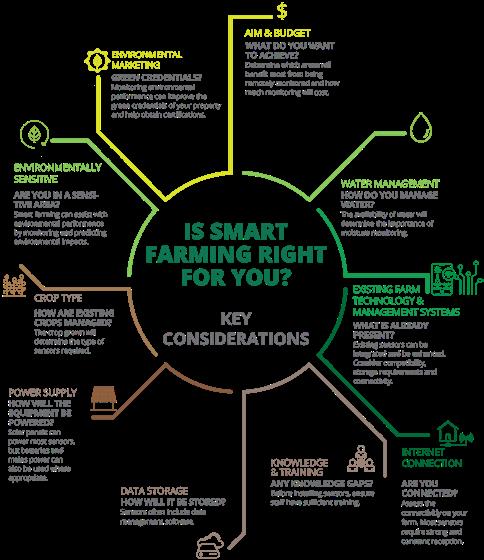

Is smart farming right for your property?

The term “Smart Farming” covers an extraordinarily large set of tools and practices. This can add to the daunting nature of working out where to start. The Smart Farming Technology Guide for Horticulture makes this a more manageable task with its Key Considerations chapter.

This section contains a list of easy to work through questions designed to help growers determine the smart farming practices and sensors that will offer the most benefit to their business.

The guide also points to external references for those looking to dig deeper into the topics covered.

Shorter ‘How To’ guides will soon be available in print versions, each focusing on different aspects of smart farming. An updated version of the document will be developed later in 2023 with an additional section discussing new methods for digital reporting for environmental management systems, such as Freshcare Environmental and EcoHort.

Those wishing to learn more about the project, or smart farming in general, can do so by visiting the project website www.ahr.com.au/ digital-remote-monitoring or by contacting Liam@ahr.com.au or Henry.Hyde@ahr.com.au.

You can also join the smart farm mailing list at eepurl. com/hLsoCD to be notified of relevant upcoming events, such as webinars and workshops.

20 BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

Control Tower in use at Austchilli in Bundaberg. Photo credit: Applied Horticultural Research

The Smart Farming Technology Guide for Horticulture contains detailed information on the technology used on the smart farms. Scan this QR code to find out more or visit www.ahr.com.au/ digital- remote-monitoring. Factsheets on each of the four pilot smart farms are also available.

21

Case Study: Smart Production Nursery

Golden Grove Wholesale Nursery is a 2ha citrus production nursery in Torbanlea, Queensland, producing and supplying commercial growers with containerised fruit-tree nursery stock for planting in orchards. Golden Grove is a pilot smart production nursery as part of the digital remote monitoring project.

Golden Grove is an innovative operation; recent additions to the production nursery include a new smart irrigation system and a redesigned growing container (pot) for horticultural tree stock. The nursery has had a range of technology installed to monitor productivity and environmental performance.

The technology installed at Golden Grove includes:

Technology Productivity Environmental BMP

Weather Station

Smartphone & Tablet

Weight-based irrigation system

Dam monitoring (pH, temperature, depth & EC)

Drain monitoring (pH & EC)

Pest cameras

Pot leachate monitoring (volume, pH, EC & temperature)

Desktop photometer

Stem dendrometer

Potting media moisture monitoring

On-site real time weather information, such as wind and rain

Reduced time required for audit forms

Overwatering can be minimised

Improved accuracy of audit forms

Improved irrigation management Overwatering can be minimised

Improved water quality management

Improved irrigation and nitrogen management

Improved pest management

Improve nutrient/water management

Improved nutrient management

Plant stress can be monitored more effectively

Improved irrigation management

Improved release water quality

Nutrient loss to environment can be minimised

Improved pesticide management

Improved release water quality

Nutrient loss to environment can be minimised

Overwatering can be minimised

Overwatering can be minimised

Spray records are automatically populated

EcoHort records are automated

Irrigation water use is recorded

Irrigation water quality is recorded

Release water quality is recorded

Sticky trap record is automatically filled

Release water quality is recorded

Release water quality is recorded

Nutrient management efficiency is increased

Irrigation water use is recorded

Weight-based monitoring at Golden Grove Nursery.

Acknowledgements

The smart technology installed at Golden Grove is helping to optimise operations and reduce costs. For example, the potting media moisture monitoring probes have helped improve irrigation management, leading to a 30% reduction in water usage. There have also been significant labour savings in water monitoring, as the nursery is now able to remotely access irrigation water quality data. Potting media EC and leachate monitoring sensors have allowed the nursery management team to optimise fertigation and reduce excess nutrient loss.

The Smart Farming How To guide has been developed as part of the project Digital remote monitoring to improve horticulture’s environmental performance (ST19023) funded through the Australian Government’s Landcare Smart Farming Partnerships program with contributions from the Vegetable, Nursery and Banana levies and delivered through Hort Innovation.

22

Photo credit: Applied Horticultural Research

23

Tasmania: Berry Sprayer Field Day

Mark Salter, Berry Industry Development Officer, Fruit Growers Tasmania & Dave Farmer, Croplands

Mark Salter, Berry Industry Development Officer, Fruit Growers Tasmania & Dave Farmer, Croplands

With Blueberry rust declared endemic in Tasmania and mandatory control restrictions on Blueberry rust now lifted, a number of organic or lowinput growers are having to use sprayers and develop protective spray programs for the first time. To help these growers get up to speed on sprayer technology, Fruit Growers Tasmania, Berries Australia, and the Tasmanian Institute of Agriculture held an Orchard sprayer field day on 23 November 2022 at Millers Orchard in Hillwood, Tasmania.

Attendees had the opportunity to discuss the relative strengths and drawbacks of different sprayer types, with three demonstration units also available for attendees to see in action; a Carraro™ sprayer designed for smaller berry growers, a small self-propelled MM® tunnel sprayer, as well as a larger 1500L Cropliner™ (Airblast) sprayer towed by a Kubota tractor.

Stuart Farrell from Sprayer Solutions demonstrated the Carraro™ unit which has its own petrol driven power plant and can be towed along by an ATV, whilst David Lindley from TASMAC demonstrated the MM® self-propelled unit which is primarily designed to spray the leg rows in poly tunnels but would be ideal for smaller growers.

Both the smaller spray units were demonstrated in the field giving growers an idea on their coverage and general performance. Note: Only water was used in the demonstrations.

Presenting on the day was Dave Farmer from Croplands, who travels the country advising growers on how to maximise the effectiveness of spray units for their specific crop. In his presentation, Dave talked attendees through how to match sprayer setup to the crop, how to calibrate the sprayer and check for suitable spray coverage and how to manage spray drift.

Sprayer setup

When setting up a sprayer, matching the sprayer setup to the crop is very important to ensure most of the spray hits the target crop without being be forced through the crop and on to surrounding crops or vegetation. To achieve this, growers should choose the correct nozzles for the job and focus on fan speed to supply the optimal air velocity and volume. This is particularly important for berries, as excessive air velocity may damage the crop.

24 INDUSTRY BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

Dave Palmer from TASMAC demonstrating the MM® self-propelled unit. Photo credit: Fruit Growers Tasmania

25

The self-propelled MM® tunnel sprayer unit that may suit small berry operations.

Photo credit: Fruit Growers Tasmania

CALCULATING WATER + CHEMICAL QUANTITIES

CHEMICALS REQUIRED (Litres or Kg) PER HA

AREA COVERED (HA)

TANK VOLUME OF MIXTURE REQUIRED (Litres)

CHEMICALS REQUIRED (Litres or Kg)

IMPORTANT

BE SURE TO MIX ONLY ENOUGH SPRAY MIXTURE TO COVER THE AREA REQUIRED. AVOID WASTAGE AND PROBLEMS OF NEEDLESS CHEMICAL DISPOSAL.

26 BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

Tank Volume (L) x Recommended Chemical Rate (L/ha) or (Kg/ha) Spray Application Rate (L/ha) EXAMPLE 3000 Litres x 5 (L/ha) ÷ 900 (L/ha) = 21.4 Litres or (Kg)

Tank Volume (Litres) Spray Application Rate (L/ha) EXAMPLE 3000 Litres ÷ 900 (L/ha) = 3.33 hectares

Area (ha) x Spray Application Rate (L/ha) or (Kg/ha) EXAMPLE 3.25 (ha) x 900 (L/ha) = 2,925 Litres

Tank Volume (Litres) x Recommended Chemical Rate (L or Kg per 100 Litres) 100 EXAMPLE 1500 (L) x 3 ÷ 100 = 45 Litres

Graphic produced with thanks to Croplands. Find out more www.croplands.com/au

Before spraying it is necessary to calculate the exact quantities of water + chemical needed to spray the required area of orchard.

Calibration

Once set up, growers should calibrate the sprayer to their production area. Regular calibration checking is also a requirement for any of the food safety certification schemes.

The typical calibration process is completed in 4 steps:

Step 1 Clean the unit

• Ensure there is no residual chemical in the tank

• Check that the nozzles are clean, not blocked and set correctly

Step 2 Check speed

• Half fill the tank with water

• Measure out 50 or 100m and time how long it takes to travel that distance

• Include uphill and downhill if you have a sloping block

• Calculate the km/min travelled by the machine

Step 3 Calculate total sprayer output

• Run both sides of the sprayer at normal pressure

• With 2 people + 2 jugs + timer + calculator, use the jug to capture output in 1 minute from each nozzle and combine to calculate the total L/min from the whole unit

• Ensure that you use the correct PPE to protect eyes, ears and skin

Step 4 Calculate L/ha output

• Using row width, total L/minute from the output calculation in Step 3 and speed from Step 2 you can calculate the L/ha output

Managing Drift

Spray drift was highlighted as a growing issue for the industry from both a regulatory and public awareness perspective. Dave provided numerous examples of spray drift reaching adjoining farms and property resulting in costly fines, and product becoming contaminated and unable to be marketed.

Late in 2022, a large-scale spray drift event hit up to 30,000 hectares of cotton on the eastern Darling Downs causing up to $100 million worth of damage.

Read more at https://ab.co/3jwjD5H

Spray drift can be caused by spraying when winds are too high or by having fine or very fine sized droplets that can be carried beyond the target crop and on to neighbouring vegetation or crops. Dave noted that key factors contributing to the formation of these droplets are pressure, nozzle type, the use of some adjuvants and simply not having machines set up correctly.

He also spoke about the benefits of air induction nozzles which are designed to deliver droplets to the target and not into the atmosphere.

Key considerations for managing spray drift include:

• Calibrate your spray unit and assess coverage before the start of the season

• Increase droplet size and use low drift nozzles

• Reconsider the use of wetters and particularly avoid non-ionic surfactants

• Keep detailed spray records and critical weather data particularly wind speed and direction at the times you are spraying

As Dave pointed out, keeping accurate records of spraying and accompanying weather data is not just a requirement for your food safety compliance program, its more and more possible that you may need to be able to produce your records for scrutiny if you end up in a legal battle from a spray drift issue.

Thank you to Croplands and Nufarm for your support of this Field Day.

27

The future of berries: Are we doing enough to meet technology half-way?

Jen Rowling, Project Manager, Berries Australia

At BerryQuest 2022, Jesse Reader, Commercial Manager for Ag Technology & Innovation at Costa Group gave a great presentation about how industry needs to step up to meet the new technology coming along if we want to see faster progress in the AgTech space. For those that missed his talk, this article summarises Jesse’s presentation.

The world of AgTech has boomed over the past couple of years. During the pandemic, money stopped flowing to millions of businesses and into most parts of the world but this was not the case for AgTech.

AgTech has previously been highly focussed on farm-centric hardware and software technology, but recently investment has shifted into agrifood technology. In 2021, $32.1 billion of the $51.7 billion invested in AgTech has been directed downstream into agrifood tech. The AgTech lens has essentially been stretched to include such diverse areas as provenance, traceability, and food delivery systems.

An example is a $3 billion e-Grocery AgTech deal done in 2021. This stretch of investment presents an 85% increase from 2020 and it’s exciting to see the continuing flow of funds coming into the AgTech sector.

What’s even more exciting is that the global berry industry hasn’t missed out.

• A vertical farming startup, Oishii received $50 million for bee-assisted carbon neutral strawberry cultivation

• A collaboration between Driscoll’s and Plenty in the vertical farming space continues to evolve with the addition of a $140 million investment

• Bowery Farming, the largest vertical farming company in the United States, has acquired Traptic, a company utilising computer vision, robotic arms and artificial intelligence (AI) to harvest fruiting, vine and other delicate crops, including strawberries

Despite the investment in AgTech and the companies out there that are working on this incredible technology, there is still an element of scepticism from our sector. The broader industry in Australia continues to question the validity of the technology being developed, whether it will work here, what it doesn’t do rather than what it does or could do, what it should be able to do but doesn’t yet and how long it is going to take! A very glass-half-empty attitude.

28 INDUSTRY BERRY AUSTRALIAN JOURNAL AUTUMN 2023 EDITION 14

What can we as growers and as an industry do to meet the technology companies half-way to achieve what we need for our industry?

Data

All roads lead to data! If we’re not collecting robust, reliable and meaningful data sets, access to technology becomes very challenging. There is considerable technology that we can’t actually use until we are able to build deep data sets.

Environment

What can we do to remove variability? In harvesting, for example, we have to think about all the things that technology companies are trying to do that we haven’t been able to overcome. These are things like controlling light and evening out maturation of fruit; the more consistent the maturing of fruit for harvest the easier it becomes to introduce the tech by taking the discretion out of selecting fruit for harvest.

Connectivity

Technology requires connectivity. Wireless updates and even the ability to do support and maintenance of technology remotely require reliable connectivity. When something goes down and its tech-enabled, what will Tier 1 support look like? Will we be able to resolve problems over the phone rather than over the air? Machine-to-machine communication also requires connectivity. Technology such as automated sprayers, fully automated tractor kits, electric selfdriving tractors and advanced robotics is all coming through, but autonomy needs supervision via someone with a tablet supervising the fleet. All this requires connectivity. There are no real excuses now (with some exclusions of course!) but there are some fantastic solutions in this space to ensure consistent connectivity to support the technology.

29

Varieties

In the development of new varieties, we should be thinking at least ten years ahead. What does a piece of fruit need to look like, how does it present on the plant and how firm does it need to be for a robot to be able to select and handle it whilst maintaining the integrity of the fruit during harvest?

There are considerable traits that need to be considered and plant breeders need to be working to incorporate these traits into the plant genetics in alignment with the tech companies developing the robotics. This will go a long way towards achieving the robotic harvesting needs of the industry.

Two-Way Engagement

If you want the solutions to come to you quicker, start working with the solution providers. Articulate the unmet needs that you have and help them to understand which part(s) you need a solution for. You will then develop a mutual acceptance of the limitations around what you are trying to do, and things can then move quicker. Rather than sitting and waiting for the solutions to magically appear why not co-create the solution by actively engaging and discussing, and understanding what can be achieved.

Plant Architecture

If we sat down to solve the harvest problem as a design exercise, with all blinkers off and using critical thinking, we may not grow the way we currently grow.

We are not meeting tech half-way in regard to plant architecture. We need Simple, Narrow, Accessible, Productive (SNAP) canopies. It doesn’t matter which crop we’re talking about; the aim is to present the fruit in a purposeful way.

What is your current production system optimised for?

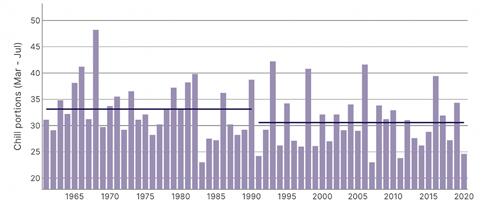

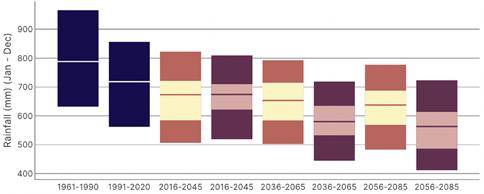

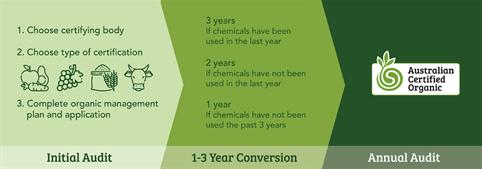

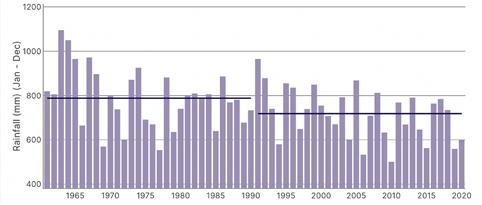

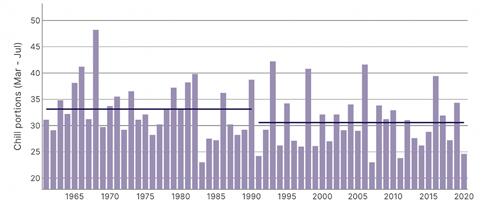

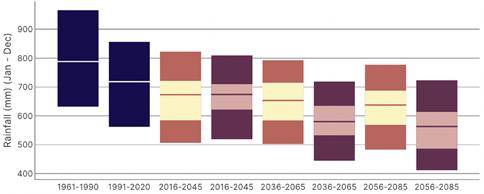

Is it yield; is it quality? Will we get to a point where it will be optimised for accessibility for robotic harvesting?