SUMMER 2022 EDITION 13 NEW CHAIR ANTHONY POINER Industry 4 WHAT’S WITH THE WEATHER Industry 46 UVC ADVANCES IPM Strawberries 98 NEW IPM PROJECT Rubus 106 AUSTRALIAN BERRY JOURNAL

Varroa mite –where are we at? 14

Fair Farms welcomes Australian horticulture to inaugural conference 16

NEW: Raising Awareness of Nutrition and Berry Benefits with Healthcare Professionals 20

BQI22 Insights: Berries… retail insights from the world stage 22

Scams affecting the Agriculture Sector 33

Tasmania: Pre-Season Berry Field Day 36 Victoria: Berry Biosecurity Field Day 38 Soilless mixes – what’s important and why? 42

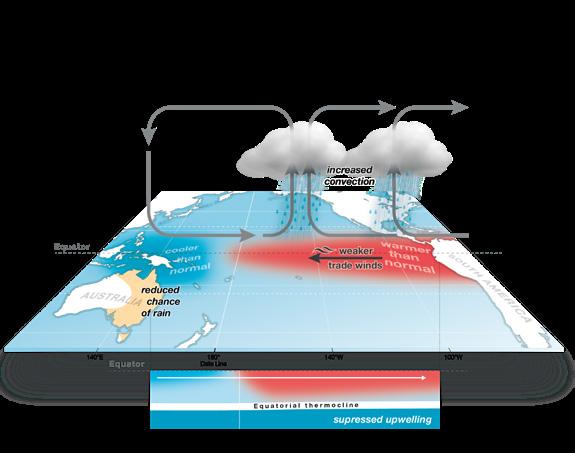

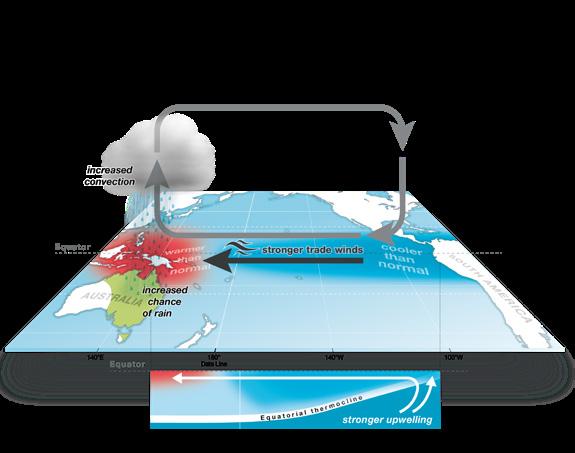

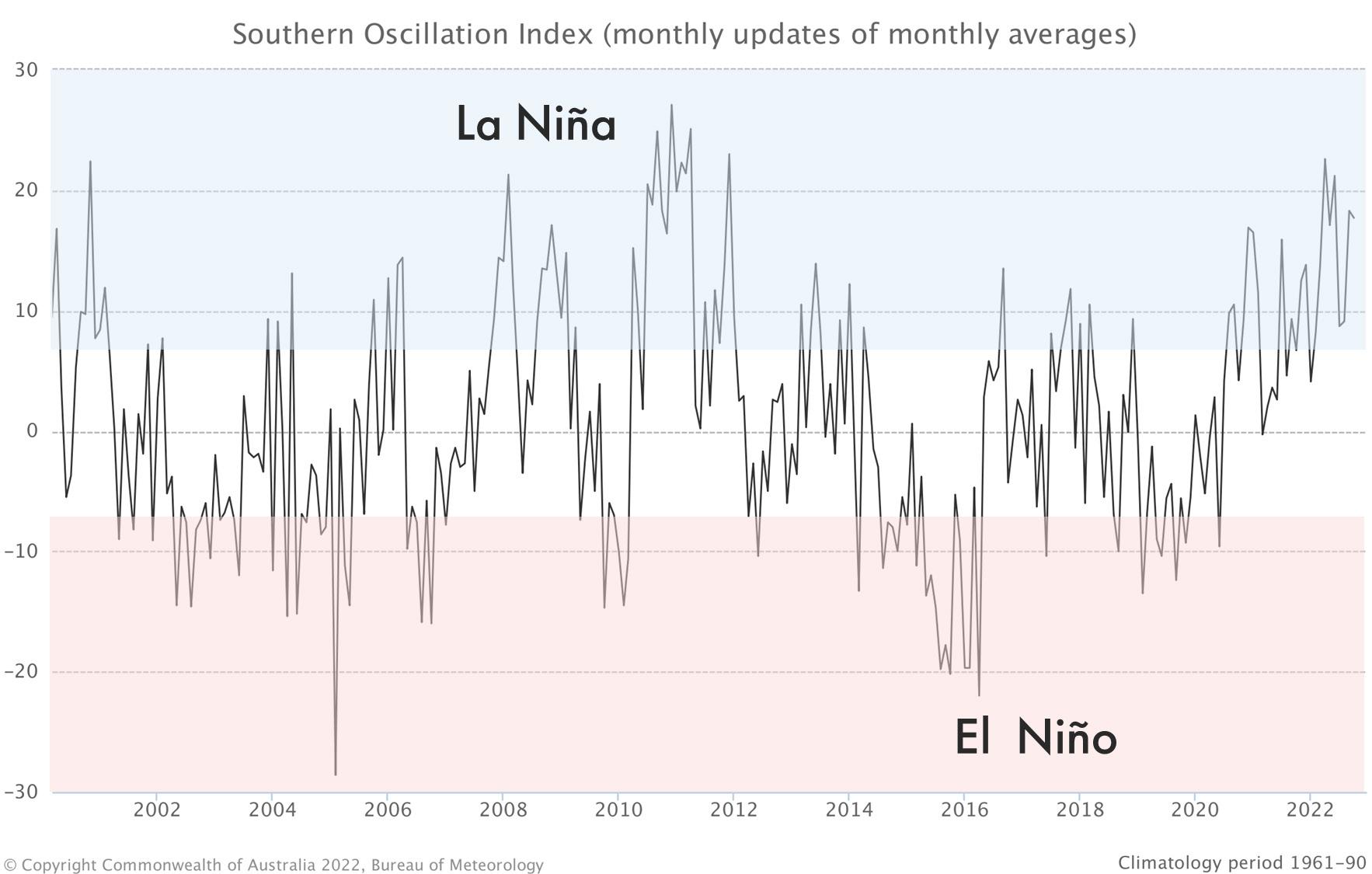

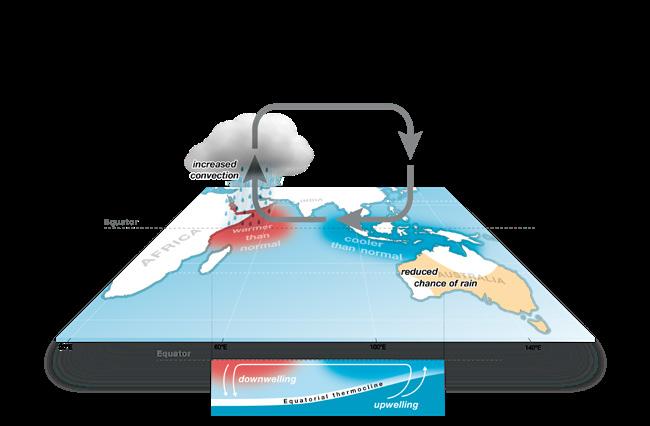

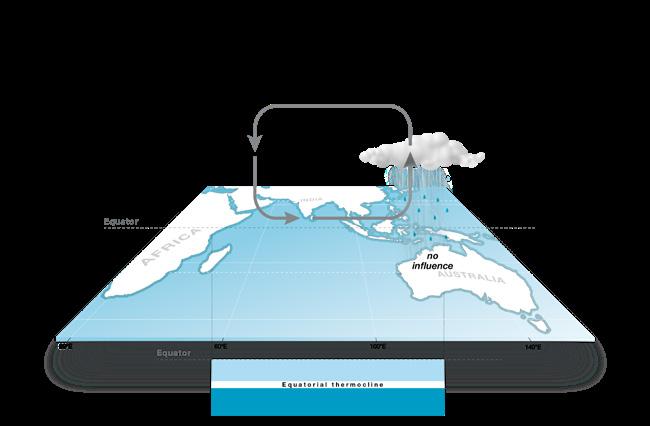

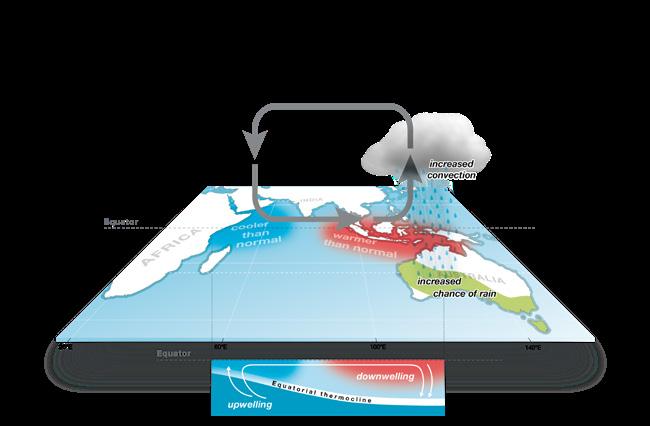

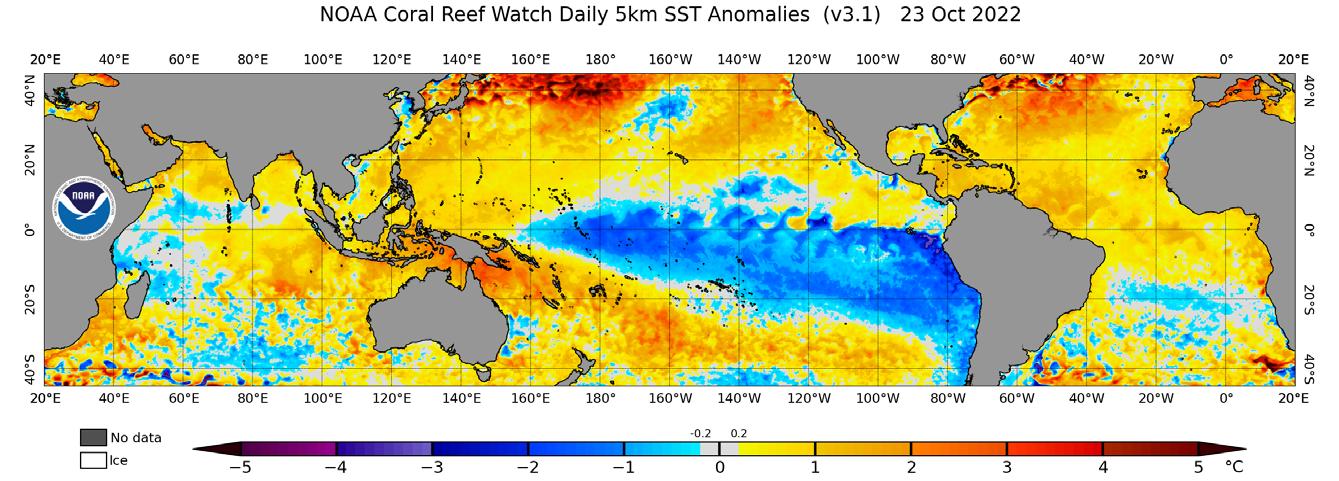

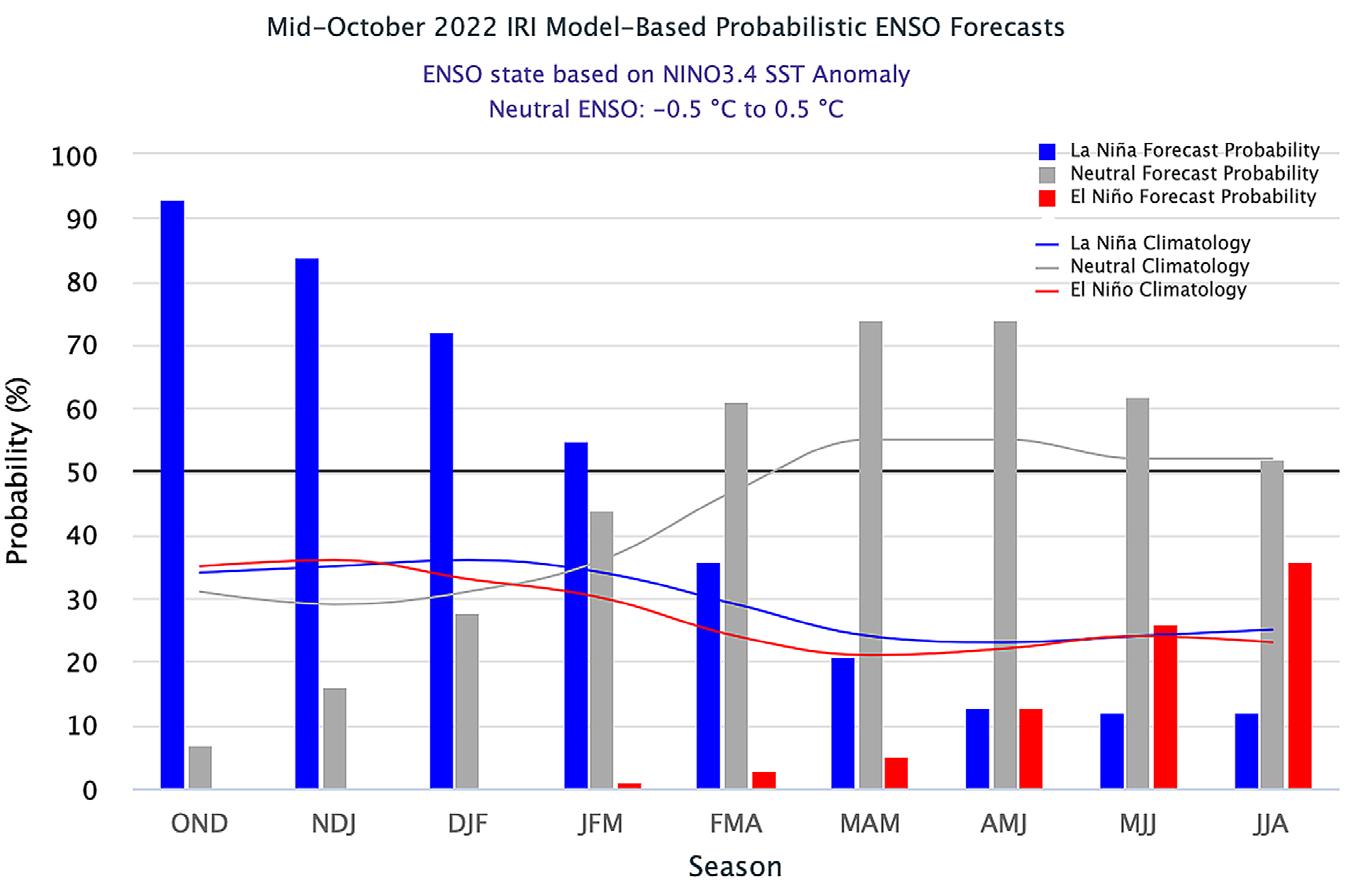

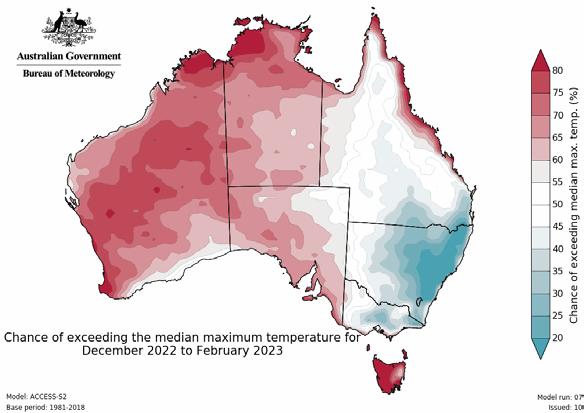

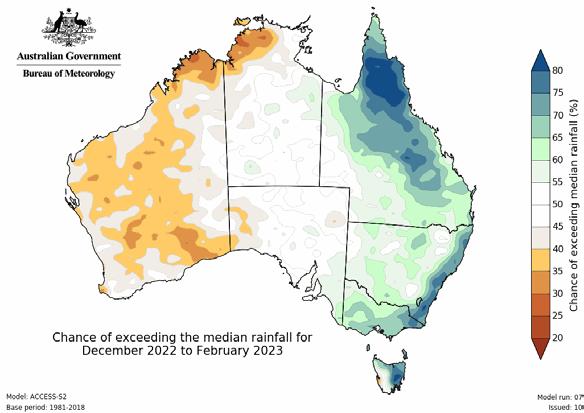

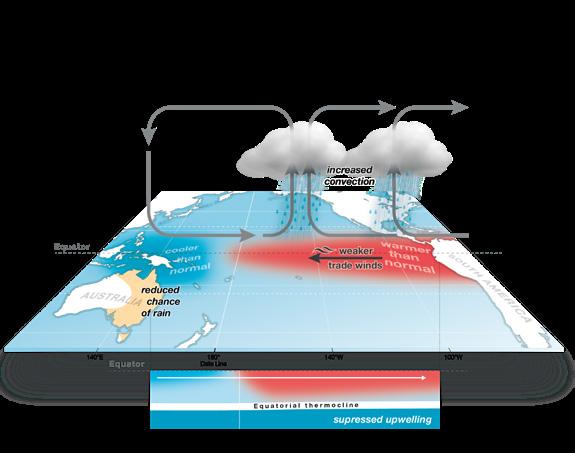

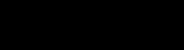

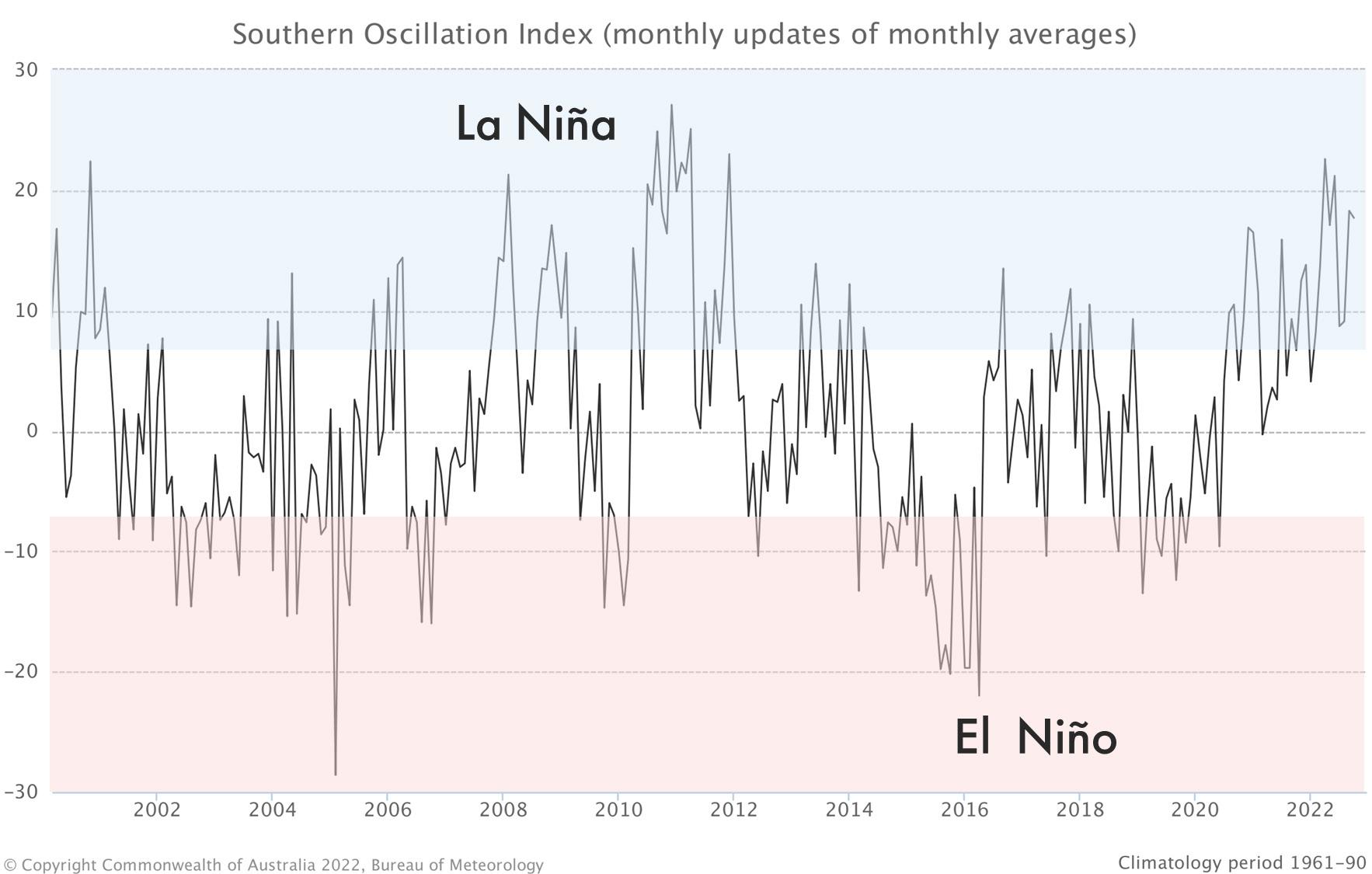

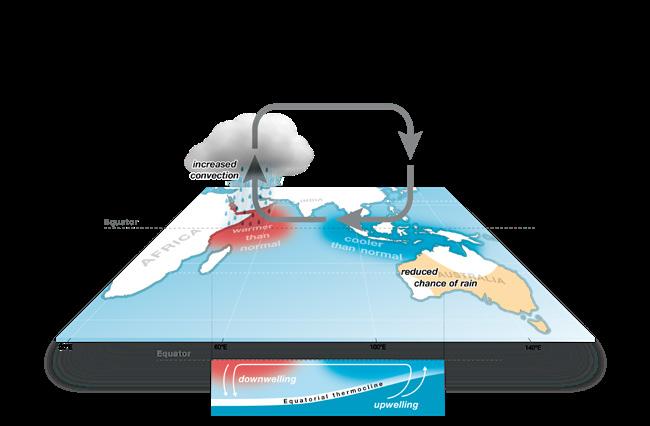

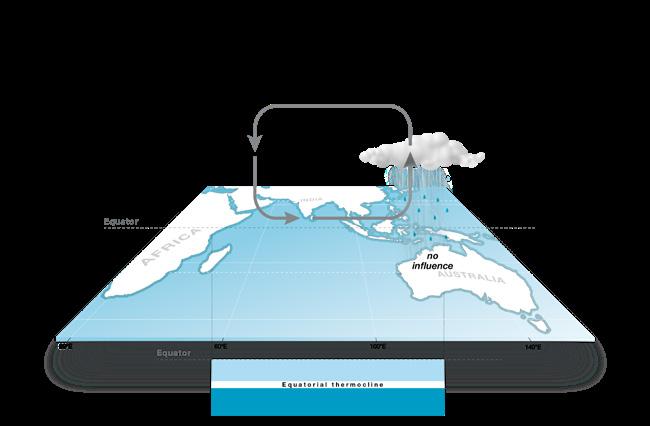

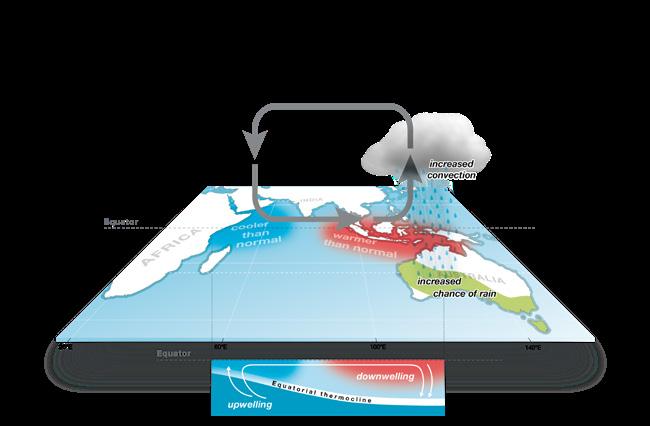

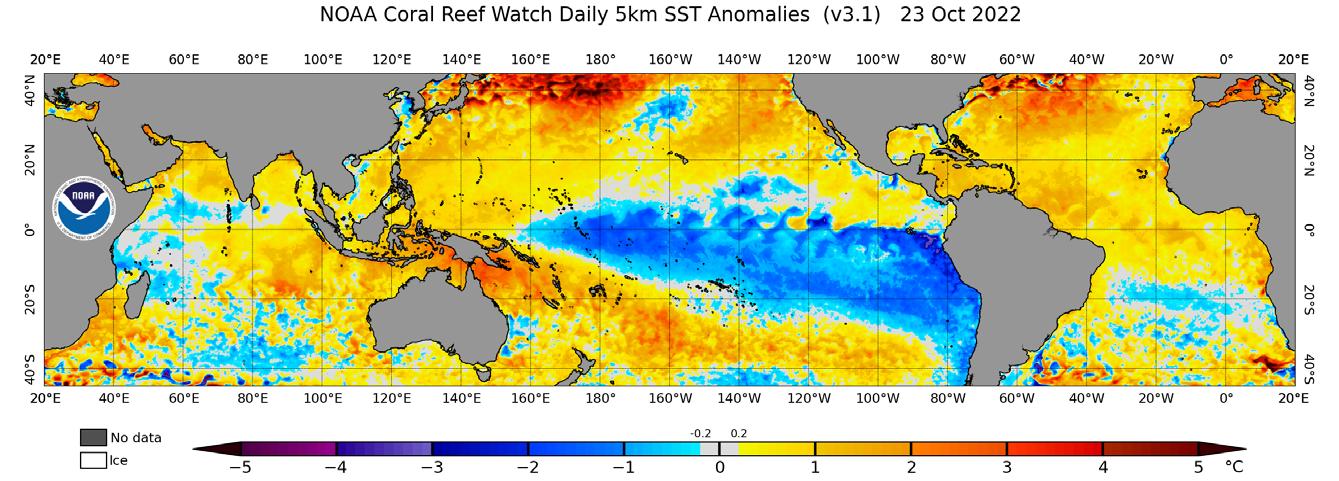

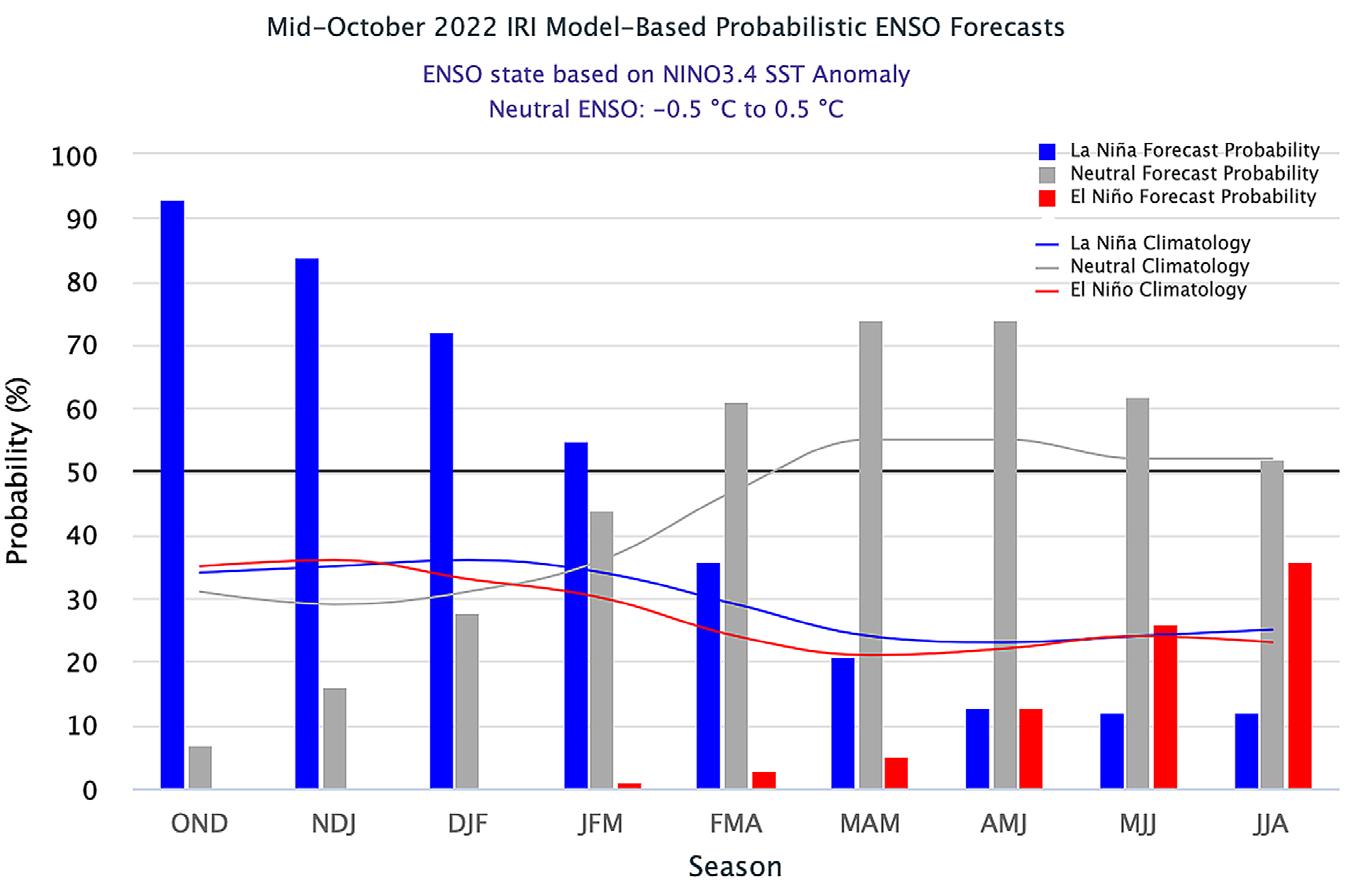

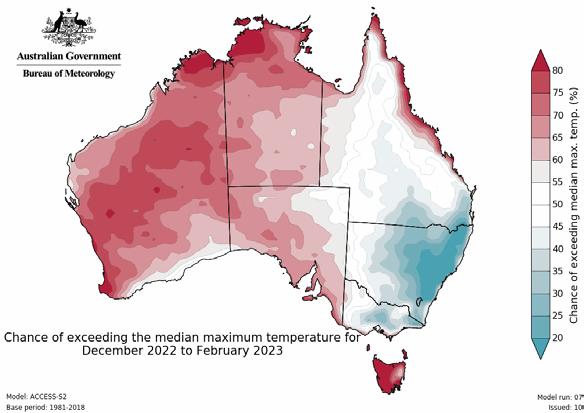

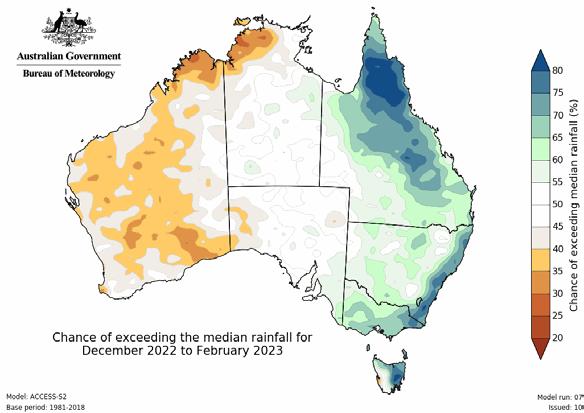

BQI22 Insights: High Impact Meteorology - Using models to help predict future weather events 46

New mandatory food safety rules for Berries 56

HARPS Version 2.0 is now live 58

Biosecurity: Be alert for Cane Toads in NSW 61

Export: Australian Berry Growers get a feel for export at Asia Fruit Logistica 2022 64

INDUSTRY SUMMER 2022 EDITION 13 AUSTRALIAN BERRY JOURNAL ADVERTISING For all Advertising & Partnership Enquiries Wendy Morris | 0491 751 123 | admin@berries.net.au All advertising and advertorial material is subject to review and approval prior to publication. DESIGN Sama Creative www.samacreative.com.au EDITOR Jane Richter TERES Communication 0431 700 258 jane@teres.com.au Wherever you see this logo, the initiative is part of the Hort Innovation Blueberry, Strawberry and Raspberry and Blackberry Fund. Like this publication itself, it has been funded by Hort Innovation using the Blueberry, Strawberry and Raspberry and Blackberry R&D levy and contributions from the Australian Government. Some projects also involve funding from additional sources. DISCLAIMER: Whilst every care has been taken in the preparation of this journal, the information contained is necessarily of a general nature and should not be relied upon as a substitute for specific advice. The advice and opinions in the articles published in Australian Berry Journal are essentially those of contributors and do not necessarily reflect the views of Berries Australia or the Editor. The advice is at the reader’s own risk, and no responsibility is accepted for the accuracy of the material presented. Inclusion of an advertisement in this publication does not necessarily imply endorsement

Journal

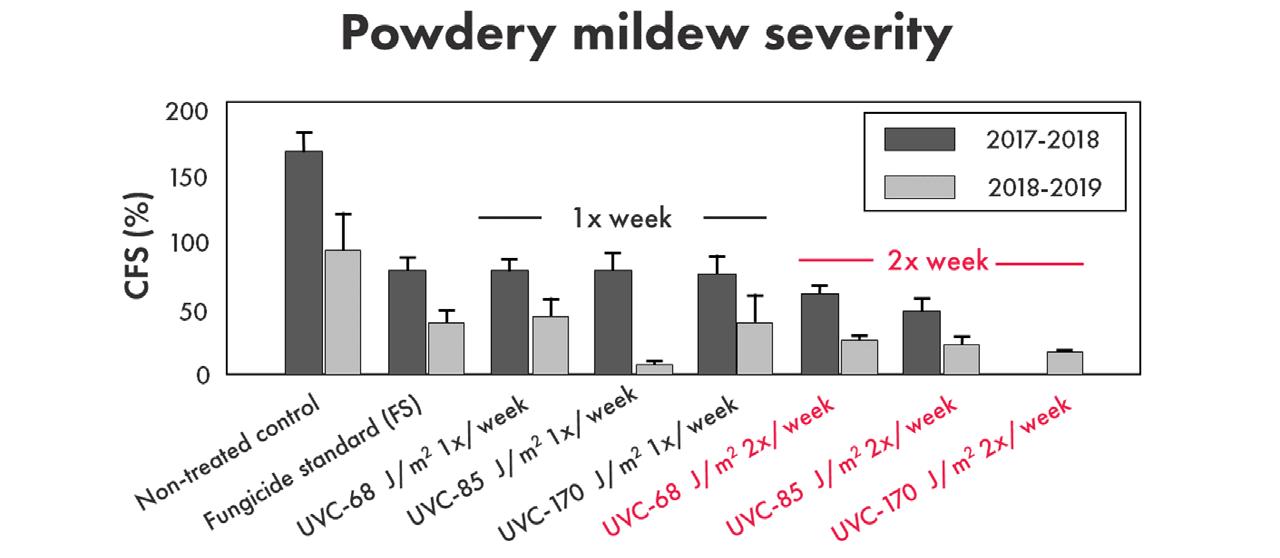

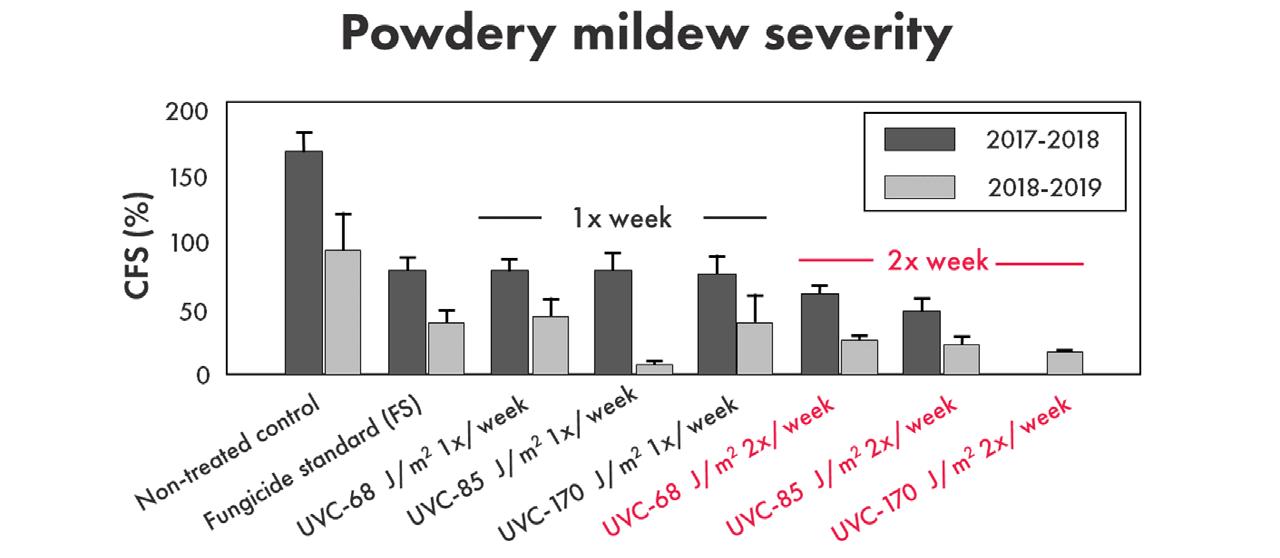

7 | 141 Walker Street, North Sydney 2060, Australia | E: communications@horticulture.com.au | P: 02 8295 2300 CONTRIBUTORS Michele Buntain Dr Jonathan Finch Dr Stephen Quarrell Christopher Menzel Sam Chadwick Delaney Lang-Lemckert Steve Maginnity Farhana Momtaz Professor Giles Hardy Kirsty Bayliss Jodi Neal Katie O’Connor Dr Doris Blaesing Jane Richter Rachel Mackenzie Anthony Poiner Simon Dornauf Jonathan Shaw Richard McGruddy Melinda Simpson Dr Angela Atkinson Mark Salter Helen Newman Aileen Reid Jen Rowling Sachin Ayachit Jutta Wright BLUEBERRIES Pest: Elephant weevil management in blueberries ......................................................................................... 71 Marketing Update — ABGA & Wavemaker 2022 Campaign .................................................................... 74 Using native bees as pollinators in Berries .................................................................................................... 79 RUBUS NEW: Alternative growing media for hydroponic Rubus production 105 NEW: $2.4 million boost for Rubus pest management 106 Profile: Roly & Jemma Mackinnon, Mountford Berries, Tasmania 109 STRAWBERRIES Impact of global warming on the yields of strawberry in southern Queensland......................................... 81 Cold-plasma mediated control of postharvest strawberry pathogens. ....................................................... 87 Latest Update from the Australian Strawberry Breeding Program ............................................................... 92 UVC as a non-chemical alternative for managing strawberry diseases ..................................................... 98

of the product, company or service by Berries Australia or the Editor. Horticulture Innovation Australia Limited (Hort Innovation) makes no representations and expressly disclaims all warranties (to the extent permitted by law) about the accuracy, completeness, or currency of information in Australian Berry Journal. Reliance on any information provided by Hort Innovation is entirely at your own risk. Hort Innovation is not responsible for, and will not be liable for, any loss, damage, claim, expense, cost (including legal costs) or other liability arising in any way, including from any Hort Innovation or other person’s negligence or otherwise from your use or non-use of Australian Berry Journal or from reliance on information contained in the material or that Hort Innovation provides to you by any other means. Copyright © Horticulture Innovation Australia Limited 2022 Copyright subsists in Australian Berry Journal. Horticulture Innovation Australia Limited (Hort Innovation) owns the copyright, other than as permitted under the Copyright ACT 1968 (Cth). Australian Berry Journal (in part or as a whole) cannot be reproduced, published, communicated or adapted without the prior written consent of Hort Innovation. Any request or enquiry to use the Australian Berry

should be addressed to: Communications Manager, Hort Innovation, Level

Executive Director's Report

Rachel Mackenzie | 0408 796 199 | rachelmackenzie@berries.net.au

Welcome to our last journal for 2022. It has been a jam-packed year for the Berries Australia team and whilst we finally seemed to get out of the shadow of COVID-19, the combination of La Niña and Varroa mite has made it a difficult year for growers and kept us busy.

Looking back, 2022 was the year that the piece rate changed, we got a new Federal government, growing areas were flooded at least once, there was a major biosecurity incursion along with significant pest and disease pressure, and many consumers woke up to the fact that there is not an endless supply of cheap fruit and vegetables.

The piece rate change is the single biggest workplace shake-up the industry has seen since the introduction of the modern Award. Whilst it is tempting to go back over the unacknowledged challenges the new system presents, I am pleased to hear reports from the Fair Work Ombudsman that compliance in berry growing regions has improved over the last few years. I commend those of you who have embraced the new rules and thank those of you who took the time to attend our information seminars. The bottom line is that no matter what we think of them, the new rules are a legal obligation and you must comply.

As a sector we were potentially less impacted by flooding than some other horticulture commodities which was a combination of fortunate timing and geographic location. That said, I am not diminishing the impact on production from low light levels and increased pest and disease, and I am aware that some growers were very badly hit. Hopefully, 2023 brings with it perfect growing conditions.

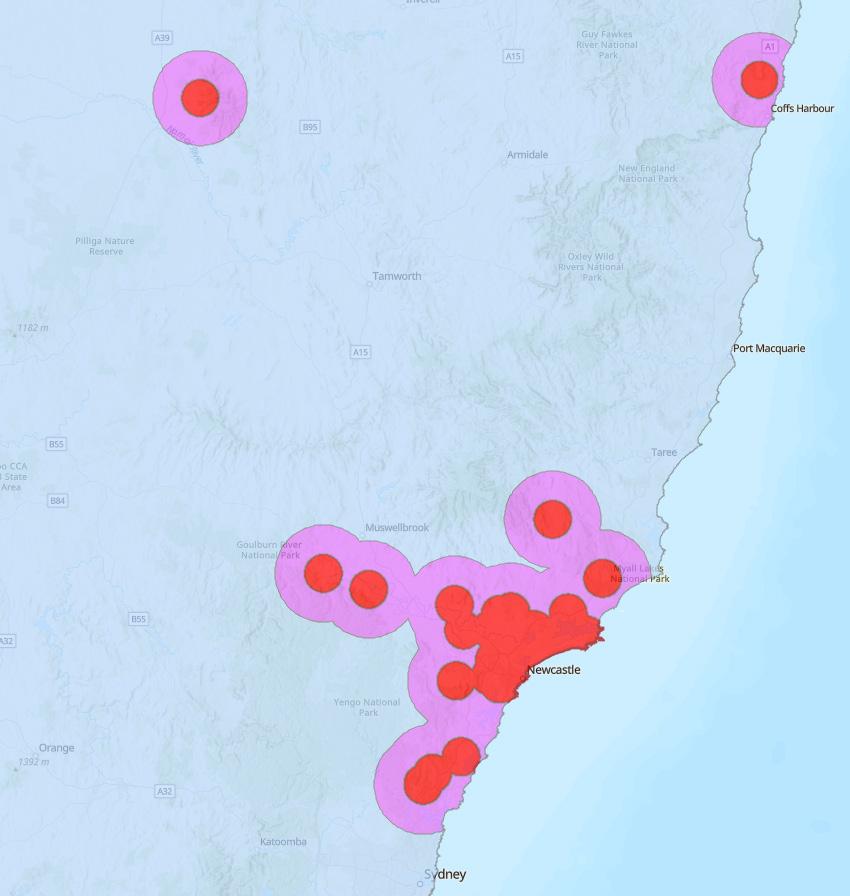

The Varroa mite incursion and associated response had the potential to devastate a huge proportion of Australia’s blueberry and Rubus production. Fortunately, the Coffs Harbour area incursion seems to have been confined to a single hive and we are working closely with NSW DPI to maximise the opportunity for pollination for red zone growers and also support growers in the purple zone. You will note there is an article on HARPS v2 on PAGE 58 of this journal with information provided by the HARPS team. It is important that you understand the new version, but I also want to make clear that Berries Australia and other industry associations are calling for greater transparency as to how decisions within HARPS are made, particularly those that increase the cost and compliance burden to growers.

It has not been all doom and gloom. BerryQuest was a major success with more than 500 attendees from around the world. The team worked incredibly hard to put on a great show and the feedback from those who attended has been nothing short of exceptional. The next BerryQuest is scheduled for February 2025 in Melbourne, and I hope we can get a great turn out from growers all over Australia. As an outcome of the Emerging Leaders Program held at BerryQuest we are hoping to build more leadership activities into the next iteration of the Industry Development and IDO team.

Finally, I would like to thank Peter McPherson the outgoing Chair of Berries Australia and Jonathan Shaw the outgoing President of the ABGA. Both Peter and Jonathan have supported me personally in my time at Berries Australia, but more importantly they have been great advocates and supporters of the whole berry industry.

I wish you all a happy festive season and a productive 2023.

2 INDUSTRY BERRY AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13

Chairman's Report

Anthony Poiner | 0412 010 843 | anthony@smartberries.com.au

This is my first column as the new Chair of Berries Australia. It is certainly a privilege to be taking on this role after three years of excellent leadership from Peter McPherson. Thank you to the Peak Industry Body (PIB) Committee members for putting your faith in me.

I would like to acknowledge Peter McPherson’s contribution both to Berries Australia, and to the berry industry over the past decades. Peter, you have been a strong and relentless champion for our industry for a long period, and for that we are all deeply appreciative.

For those of you I haven’t met, I am Co-Chair of Fresh Produce Group, Smart Berries is our berry division. We grow blueberries and raspberries in Queensland, Tasmania, and Western Australia. I have served on the ABGA, RABA and BA Committees in various capacities over the past years and have had the pleasure of meeting many of you in that time.

Your BA Board has representatives from each PIB (Strawberries Australia, ABGA and RABA), and I can assure you each is passionate and forceful in advocating for the needs of each berry type. We all see the significance of the category, and the importance of representing growers first and foremost. We are all growers ourselves.

We have an experienced full-time team at BA, ably led by Rachel Mackenzie as Executive Director, Jen Rowling as Projects Manager and Wendy Morris as our membership and administration officer. We also have our network of five berry industry development officers located across the states. This team is very focused on connecting with growers in each region through this journal, the Burst e-newsletter, field days, our

BerryQuest conference, and simply getting to know each of you personally. The team is there to support with technical knowledge, and help growers navigate compliance requirements associated with food safety, labour, chemical usage and more. Rachel also has Jenny Van de Meeberg leading the effort to open new export protocols so we can enter new markets, mostly in Asia. Berries is now the largest fruit category by value in Australia, and a core part of the future growth of horticulture for one simple reason; we grow high quality berries that consumers want to eat more and more. Interestingly, Agriculture in Australia is tipped to become a $100 billion industry, with horticulture and berries being an important part of that growth. However, this will require expanding into new markets, because there will be a limit to how many berries Australian households will consume (and pay growers a fair price). It is for this reason that Berries Australia has put such a high priority on developing new export markets. All this points to a rosy future, and it can be. But we have to acknowledge that the past period has brought plenty of challenges. COVID-19 may increasingly seem to be in our past, but we still have challenges hiring enough labour for harvest. And almost everywhere in Australia the weather is dealing us a harsh hand. Only 3 weeks ago a hail storm tore through one of my own farms in Queensland, doing plenty of damage, and I have heard many unfortunate stories across the industry of similar challenges. Berry growers are a resilient lot, by necessity I am afraid. If in need, please do reach out to Rachel and our team, and we will support in any way we can.

Please enjoy this journal, I wish you all a happy Christmas, and a bountiful next harvest.

3 INDUSTRY

GET TO KNOW YOUR BOARD MEMBERS

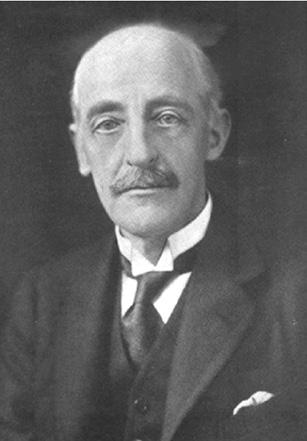

Following the Berries Australia AGM held on 13 October 2022, we are pleased to confirm the new board members and positions. Peter McPherson has retired from the board and Anthony Poiner has stepped into the Chair role. We also welcome Gavin Scurr who has joined the board as a new member.

NEW BERRIES AUSTRALIA BOARD APPOINTMENTS

Anthony Poiner

Anthony is the Executive Director of Fresh Produce Group (FPG). FPG was established in 1991 and is a business committed to sourcing, growing and distributing the freshest quality produce in Australia. The business is one of Australia’s largest and most innovative produce suppliers and includes farming operations producing grapes, citrus and berries. Anthony has over 10 years’ experience in the fresh produce industry and has represented both his business and the wider industry in a number of industry roles, including as Treasurer for the Australian Blueberry Growers’ Association and as a Committee Member for Raspberries and Blackberries Australia.

Gavin Scurr

The newest member of the Berries Australia board is Gavin Scurr from Pinata Farms based in Wamuran, Queensland. Piñata Farms is now Australia’s largest pineapple producer and the only one to supply fresh pineapples all year. They are also proud to be among Australia’s leading producers of summer and winter strawberries. Pinata Farms holds the rights to grow and market specialty Honey Gold mangoes between November and March. Along with joint venture partner, BerryWorld Group, Pinata Farms produces specialty berries for BerryWorld Australia. Gavin is the Managing Director and a seasoned fresh produce grower and industry leader respected for farming innovation and commitment to quality. He is a former chairman of the Australian Mango Industry Association (AMIA), a Committee Member of Raspberries and Blackberries Australia (RABA) and an active member of the Australian Fresh Produce Alliance (AFPA).

CURRENT BERRIES AUSTRALIA BOARD MEMBERS

4

Gavin Scurr, Pinata Farms Richard McGruddy, Queensland Berries

Simon Dornauf, Hillwood Berries Jamie Michael, Ti Produce

Andrew Bell, Mountain Blue Christian Parsons, Costa Group

President's Report

Jonathan Shaw | 0418 758 268 | president@abga.com.au

This is my last column as President of the ABGA having stepped down from the committee at our October AGM. I know my successor Andrew Bell will slot seamlessly into the role, but I wanted to take this opportunity to reflect on my time with the ABGA and the blueberry industry.

I first came onto the committee ten years ago at the invitation of Peter McPherson and Ridley Bell to drive the Association’s market access activities. China was then seen as the market access priority and a major export opportunity. Despite the warnings from other industries that gaining market access was a slow process, I launched myself into the project with full expectations that we would achieve re-opening of Japan and gain China within five years. Whilst China and Japan are still closed to us, for the first time we are now an active negotiation priority in a key Asian market (Vietnam). This is a testament to the advocacy and investment by the ABGA and Berries Australia on market access and I am told export may start by 2024 at the earliest. This is a very exciting development for the industry.

Whilst developing overseas markets is important, increasing domestic consumption is critical to the success of the sector. The ABGA continues to lead a successful marketing campaign, which will continue through to 2023. The goal of the campaign is to drive consumption without impacting price. Whilst this season has seen lower supply, the marketing campaign is taking a long-term view on building customer loyalty.

Ensuring high quality berries is also a key component of driving consumption and consumer loyalty, and this is perhaps an area of focus in future years.

One of the major changes in my tenure was the establishment of Berries Australia. I am firmly of the belief that we can achieve far more by working together and Berries Australia has enabled all of the berry categories to lift their game in terms of advocacy and service delivery. Whilst it is sometimes easy to question the value of industry associations, we need them to fight for us and communicate with us during difficult times such as the COVID-19 pandemic and recent Varroa mite incursion.

I have very much valued my time at the ABGA, particularly the camaraderie of my fellow committee members. It is a myth that the Association is dominated by the “big end of town”. As a smaller grower myself I have valued the expertise of the bigger players but have also observed their whole-of-industry focus and I have certainly made the needs of smaller growers front and centre of discussion. It is easy to throw rocks from the sidelines, and so I strongly encourage growers of all sizes to become active in the committee.

I leave at a time when the Association is in excellent shape, with strong membership, a very healthy balance sheet and financial position, strong engagement with growers and a highly talented, dedicated and knowledgeable committee and executive ready to take the Association forward to meet tomorrow’s challenges.

I wish the new committee the very best of success in promoting the interests of Australian blueberry growers and I also wish all growers ongoing success in their farming businesses.

5 INDUSTRY

President's Report

Richard McGruddy | 0408 763 804 | richard@berryq.com.au

Here we are in AGM season, and I am pleased to once again serve the Rubus industry as the President of Raspberries and Blackberries Australia (RABA). At this year’s AGM we welcomed Rob King from Costa and farewelled Christian Parsons. I would like to thank Christian for all his efforts on behalf of the broader industry.

This has been a big year for RABA which included holding the ballot to amend the levy from 12c to 4c per kilo and, of course, dealing with Varroa mite.

The levy amendment is working its way through the system, and we are about to make the formal recommendation to the Minister and commence the thirty-day objection period. I feel confident that we have consulted thoroughly, but if anyone does not support the levy amendment then this is your chance to make a formal objection. In terms of when the new levy will be implemented, the best-case scenario is that it will begin from next financial year, but the amendment requires ratification in Federal Parliament which can be a slow process.

Varroa mite has been another area of significant activity with Berries Australia representing RABA as part of the formal response process. I understand that it has been a very stressful period for the growers in the red zone, but I am pleased that through the hard work of Tyler Scofield, Rachel Mackenzie and Melinda Simpson we were able to facilitate a solution with native bees. RABA also made a financial contribution to supporting the native bee solution.

We will continue to work closely with the NSW DPI to minimise business disruption from the Varroa response. In conjunction with the AGM, the RABA committee also participated in a joint meeting with Hort Innovation and the Rubus Strategic Investment Advisory Panel (SIAP). It was a productive meeting but with more than $4 million of unmatched funds sitting in the levy fund we are keen to push for more projects on the ground delivering back to the levy payers. Berries Australia is working on a new consultation system with Hort Innovation to streamline consultation and fast-track project delivery.

I am really pleased to note that we have had Mark Salter - our Rubus IDO - in place for a year now. It is great to get our own technical specialist and I am hopeful that in the next iteration of the project Mark can get around to all of the Rubus growing regions and identify areas that need extra support.

Obviously, a wrap-up of the year would not be complete without mentioning BerryQuest. It was a great event with high quality speakers and excellent networking opportunities. Some of my team were fortunate to receive a bursary to attend and participate in the Emerging Leaders Program (funded by RABA) which they really valued. I know the Berries Australia team is looking to expand the leadership program for the next BerryQuest and it would be great to get more emerging leaders from Rubus involved.

It has been a tough few years across the board for horticulture and I wish all of our growers a relaxing and not too wet Christmas and a great year in 2023.

6 INDUSTRY BERRY AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13

Chairman's Report

Simon Dornauf | 0408 681 206 | simon@hillwoodberries.com.au

It is hard to believe that this is the last journal edition for 2022 and that we are heading toward Christmas. I know La Niña has made for challenging growing conditions across the country and we would all like it to be a bit warmer and a bit less wet, especially over the festive season.

The Strawberries Australia (SAI) committee has worked hard this year on behalf of our members particularly in relation to how we work with Hort Innovation to ensure the effective spend of growers’ levy funds. Historically the levy spend has been managed by Hort Innovation with advice from the Strategic Investment Advisory Panel (SIAP) and SAI has been at arm’s length.

The new leadership at Hort Innovation is working to ensure that peak industry bodies (PIB) have much greater involvement and oversight which is to be commended. Unfortunately, this coincided with Hort Innovation informing us that the levy has been over-committed due to an accounting error which included royalty funds into the levy closing balance.

SAI is now working with Hort Innovation to review levy expenditure over the longer term and ensure that the industry is spending within its means. This may require hard decisions to be made such as scaling back the breeding program.

I would particularly like to thank Vice President Jamie Michael for his forensic evaluation of the financials and the rest of the committee for their time and effort in grappling with this issue. I would also like to thank Brett Fifield and the team at Hort Innovation for their efforts to work with us to try and resolve this issue.

It is my sense that the move toward giving PIBs greater scrutiny will mean that issues like this will be more quickly identified and rectified.

On a more positive note, we are making good progress with our export aspirations, and it was encouraging to hear that Australian berries were very popular at Asia Fruit Logistica. You can see more about the Australian berry presence at this event on PAGE 64.

I am also encouraged by the positive feedback we are getting regarding the work of the team of Industry Development Officers (IDO). It is great to have a truly national team so that every berry grower has a go-to IDO. The work of this team was showcased at BerryQuest which was truly a fantastic event with heaps of relevant and useful speakers as well as plenty of good quality networking opportunities.

The committee is aware that plant quality remains an issue and we will continue to try and identify practical options for ensuring the best quality plants are available to growers at the same time remembering that the vagaries of the weather can impact all parts of the supply chain.

My family business recently expanded into Queensland which brought home to me that despite regional differences we all face similar challenges and that working together is the best way to take the industry forward.

I would like to give a big thank you to the SAI committee who have had to work through some challenging discussions over the past year. Everyone has acted professionally and with regard for the greater good and I am hopeful that we can continue to deliver back to our growers.

I wish all growers across the country a safe, prosperous and peaceful festive period.

7 INDUSTRY

Western Australia

Aileen Reid & Helen Newman, Industry Development Team, Agricultural Produce Commission

Climate

Winter 2022 delivered close to average rainfall and temperature conditions to most WA berry growing regions. The number of rainy days in the Perth region was also average, 48 days compared with 57 last winter, which came as a relief to those needing to spray. Spring kicked off with average conditions in Perth, but warmer and drier than normal conditions in the south. October was cooler and drier than normal in most areas, except Albany which received above average rainfall and average temperatures. Looking ahead for the period from November to January, the forecast is for warmer than average temperatures and slightly drier than average conditions across most WA berry growing regions.

The crop

Harvest of new season strawberries in the southern region commenced in September and came into steady production in November. Production in the Perth region started winding down in early November as temperatures warmed up and prices dropped. Harvest will continue at some sites until early December depending on temperatures and prices. For those that didn’t experience plant losses early in the season, yields and quality were comparable with previous years.

Raspberries in the Perth region had a disappointing season this year because of the heat experienced after planting. The southern raspberry season is also a little delayed, expected to commence in early December. Blackberries that were impacted by chilli thrip in the Perth region came back into production in midNovember after losing their autumn crop to the pest. Blueberries generally appear to be following their normal schedule in the greater Perth region expected to finish up in November/December. Crops in the south are a little delayed but are expected to peak around November.

Industry events

The Draft WA Strawberry Industry Strategic Plan was sent to stakeholders in November as part of the industry consultation process. The plan has a focus on improving the productivity and profitability of WA growers, improving fruit quality and consumer acceptance and providing leadership on market issues that impact profitability and sustainability. A copy of the plan can be found on the APC website: apcwa.org.au/producers-committees/strawberry

The Climate Services for Agriculture team visited WA in August to get grower feedback on an online climate tool they are developing. The tool will allow growers to search weather and climate patterns by location and commodity, to assist with medium to long-term decision making. Representatives from Costa Berries participated in the discussion alongside other horticultural industries at a small event in West Gingin. You can see the online climate tool at: climateservicesforag.indraweb.io

Strawberry growers participated in two field walks; one in August and the other in October, to look at the national breeding program variety trial in Bullsbrook with plant breeder Jodi Neal from the Queensland Department of Agriculture and Fisheries (DAF). Participants were able to provide feedback on the current selections and flag those with favourable traits. Apollo Gomez, Senior Plant Pathologist at DAF, and Jodi Campbell, Supply Chain Innovations Project Leader at DAF, also visited in October to discuss the Serviced Supply Chains II project (AM21000) and give local exporters an opportunity to participate in supply chain monitoring.

Also in October, Anthony Yewers (Berry Sweet) hosted a group of horticulture students from South Metropolitan TAFE to show them how berry production systems work and to raise the profile of careers in the industry. Lachlan Chilman (Biological Services) also spoke to the students about the berry industry and use of IPM.

8 INDUSTRY BERRY AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13

The students were blown away at the advanced systems in use and the potential job opportunities as well as Anthony’s entertaining personality.

In the online environment, a webinar was held in August for WA blueberry growers and nurseries who wanted to learn more about Blueberry Rust. A big thank you to Melinda Simpson, Blueberry IDO, and Maurizio Rocchetti, Plant Supply Manager for Costa in NSW, for presenting and answering questions from the audience.

Kirsten Hall, Exports Co-Ordinator at Quarantine WA, also spoke about the ICA-31 procedure for sending fruit to South Australia and how it works in WA.

There have been several other interesting online events delivered nationally through the Berries Australia communications project, and other providers. If you have missed any of these events, get in contact with your IDO for links to recorded sessions and information packs.

9

(L) Anthony Yewers showing Horticulture students from South Metropolitan TAFE the tools he uses to manage irrigation and nutrition in his raspberry crop and (R) how tabletop strawberry production works. Photo credit: Helen Newman

(L) Hua and Truc Hoang of Hoang Le’s Strawberries participating in the national breeding program variety field walk with plant breeder Jodi Neal. Photo credit: Helen Newman

Victoria & South Australia

Dr Angela Atkinson, Berry Industry Development Officer 0408 416 538 | ido@vicstrawberry.com.au

It has been a very wet and cold start to the season in both Victoria and South Australia. Both states have recorded higher than average rainfalls, with many parts of Victoria subject to record level floods. The cool temperatures have seen the season delayed in both states by up to 2-3 weeks. Wet conditions on farms have meant growers have had difficulty getting into paddocks, and there have been limited opportunities to carry out spray routines. Growers in the Adelaide Hills have also suffered extensive damage from hail storms recently.

The widespread flooding throughout Victoria has led the Commonwealth and State governments to make available a primary producer flood recovery package. Assistance includes Primary Producer Recovery Grants of $75,000 to support clean-up, relief and recovery efforts, a Rural Landholder Grant of up to $25,000 for small-scale enterprises, concessional loans up to $250,000 to restore or replace damaged assets, and support for transport costs for farmers with livestock.

The grants are available through Rural Finance, and growers are encouraged to get in contact on 1800 260 425 if they are unsure if they’re eligible. The grant guidelines are very broad and cover a range of activities.

For more information go to: www.ruralfinance.com. au/Industry-programs/victorian-primary-producerflood-recovery-package

Since the last edition of the Berry Journal, we have held a couple of events for berry growers in Victoria.

Unfortunately, the Women in Industry Dinner planned for September had to be cancelled, but we will hopefully run a similar event at the end of the season.

On Thursday 29 September a native bee pollination forum was held at Alowyn Gardens in Yarra Glen, in conjunction with Melbourne Water and Northern Yarra Landcare Network. The forum included presentations by Prof. Saul Cunningham (ANU) on the challenges of crop pollination and food production, Dr Julian Brown (University of Melbourne) on native bees in the Victorian landscape, Yolanda Hanusch (Sydney University) on promoting functional diversity of flowerfeeding insects in agricultural landscapes, and a citizen science discussion led by Ana Guizman. The forum was well attended, and very timely given the current Varroa mite incursion in NSW, and the threat to European honey bees as pollinators.

A berry biosecurity field day was held at Fresh Berry Co on Wednesday 14 September, with a wide range of presentations and demonstrations on topics such as on-farm biosecurity planning, biosecurity preparedness and pest and disease management. For more information on the day SEE PAGE 38.

The Victorian Strawberry Growers’ Association AGM was held on Friday 7 October at The Orchard at Montague, in Narre Warren. After the AGM growers got a behind-the-scenes tour of the state-of-the-art apple and stone-fruit processing facility, which was definitely an ‘eye-opener’. This new facility can process more than 280 million pieces of fruit each year, and is almost entirely automated, including a robotics controlled cold room that operates without staff.

Hopefully we will start to get a bit more sunshine, and a lot less rain, as the season gets underway, and as always get in touch if you need any help or information.

10 INDUSTRY BERRY AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13

Victorian Strawberry Industry Development Committee

Queensland

Jen Rowling, Temporary Berry Industry Development Officer

0448 322 389 | berryido@qldstrawberries.com.au

The winter production season for strawberries in South-East Queensland has wrapped up and growers are no doubt breathing a sigh of relief. The combination of inclement La Niña weather conditions, the resulting disease pressure, spiraling input costs and labour shortages all contributed to yet another challenging year.

Overall, it was the wettest winter in Queensland since 2016, and the cooler-than-average daytime temperatures combined with overcast days in between regular rain events meant production was slow and disease pressure was continuously high.

The milder temperatures in Queensland towards the end of the season did see many growers extending harvest by a good month or so, overlapping with the beginning of the summer harvest season in the Granite Belt and southern states. With further La Niña weather patterns predicted over summer and potentially into autumn and winter next year, growers will no doubt be reviewing plant numbers and also the choice of plant varieties for next season based on this years experiences.

Work continues identifying and further developing control measures for the disease problems that arose during the season such as Neopestalotiopsis sp. (Neo P). Samples received from growers continue to be analysed and have also been shared with the University of Florida. Strawberry producers in the Florida growing region of the United States have experienced several outbreaks of Neo P in recent years, so a collaboration between Qld DAF and the University of Florida will hopefully provide greater insight into the pathogen and potential control measures in preparation for future wet growing seasons.

On a much more positive note, it’s fantastic to see the community support for the industry in Queensland’s key growing regions. The Sandstone Point Strawberry & Dessert Festival was held in September and welcomed thousands of sweet, strawberry and dessert loving

patrons with strawberry eating competitions, dessert food trucks, dessert cooking and cocktail making demonstrations, live music, fireworks, kid’s rides and much more. The Comiskey Group, who own the Hotel and many more incredible venues across Queensland, have been major supporters of the strawberry industry in the Moreton Bay region for many years. The first strawberry festival of its kind was held at Sandstone Point in 2015 and the event has continued to be a major drawcard to the venue over the years since.

At the time of writing, the 2nd Annual Stanthorpe Berry Festival is about to take place to celebrate the summer strawberry harvest on the Granite Belt. With accommodation sold out across Stanthorpe, its shaping up to be a huge event with celebrity chefs, farmer pop-up sales of fresh berries, berry delights of all kinds, live music and much more.

Blueberry and Rubus production in Queensland have been going well in the face of difficult conditions. Despite the humidity in tunnels generated by the wet weather and the subsequent disease pressure, the volume and quality of raspberries has been high, and blackberry production is currently booming. Blueberry production has also been good, but challenges continue including management of the labour force during adverse weather periods and, in some regions, securing an adequate supply of accommodation is problematic.

For anyone affected by the South-East Queensland Rainfall and Flooding event between 22 February and 5 April 2022, an extension has been approved for grant applications of up to $75,000 for clean-up, re-instatement activity and emergency measures. You now have until 10 March 2023 to get your application in. For more information about eligibility and how to apply, visit qrida.qld.gov.au

I’d like to wish all Queensland berry growers and the broader national berry industry a wonderful festive season and look forward to what we hope will be a stress-free season in 2023.

11 INDUSTRY

Tasmania

Mark Salter, Berry Industry Development Officer 0400 100 593 | berryido@fruitgrowerstas.org.au

The Tasmanian berry harvest is now underway throughout the state and most growers are reporting good fruit quality at this early stage despite the adverse weather. As with many areas on Australia’s east coast, Tasmanian growers have been impacted by above average rainfall, which has resulted in regional flooding and damage to infrastructure in some areas. The ongoing inclement weather although not resulting in direct losses is having significant effects on timing of the crop, which is being held back due to cool, overcast conditions.

It has been a busy time in the last few months for the Tasmanian Berry industry with lots of events happening including:

• Growers gathered at “Berried In Tas” on 2 September for a pre-season berry field day. Pest and disease management was the main theme for the day with presentations on pest and disease control, new crop protection chemicals, IPM and pollination. The event was well attended with over 40 growers enjoying the day. You can read more about this field day on PAGE 36.

• Klaas Plas from the Netherlands hosted a Strawberry Flower Mapping webinar on 20 September aimed at improving yield forecasting in strawberries. Klaas outlined the flower mapping process, which included yield predictions, truss development as well as number, height, and position of trusses.

• A Blueberry Growers Workshop was held on 23 September in Campbell Town. NSW Berry IDO Melinda Simpson travelled to Tasmania to talk on Blueberry Rust identification and prevention.

Other presenters included Jeff Harrison from NutrienAg who spoke on spray programs for blueberries and his work on defoliation trials.

Kara Barry from the Tasmanian Institute of Agriculture (TIA) outlined the latest in R&D for Blueberry Rust prevention. Andrew Bishop from Biosecurity Tasmania outlined a number of support packages which are on offer to blueberry growers including free diagnostics for suspected Blueberry Rust, promotion of benefits/profile of Tasmanian blueberries, continued research and development by TIA and provision of advice for accessing markets and property inspections to meet market access requirements.

• Jake Gaudion from RMCG held a webinar on 3 November to outline and discuss the results from a desktop review into current and emerging substrates for hydroponics including the potential for using wood fibre products as an alternative. This project will be a lead into a new 3-year research project into coir recycling and reuse. Supported through the Tasmanian Government’s Agriculture Development Fund, this project will see Dr Doris Blaesing, Jake Gaudion and the team from RMCG as the research partners working alongside Costa, Hillwood Berries, Tasmanian Berries and Exchange as industry partners. Read more on PAGE 105.

12 INDUSTRY BERRY AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13

Events 8 December: Strawberry Runner Field Day at JCLM Farming, Ouse.

growers will be able to see some of the latest temperate varieties grown at Jack Beattie’s runner nursery.

Upcoming

Strawberry

New South Wales

melinda.simpson@dpi.nsw.gov.au

Following the euthanasia and destruction of recreational and commercially managed hives within the Nana Glen Varroa mite Eradication Emergency Zone, the next phase in the eradication of Varroa mite requires the complete removal of wild European honey bees from the Varroa mite Eradication Emergency Zone.

Euthanasia of wild European honey bees will be completed using a commonly available insecticide called Fipronil. Fipronil bait stations will be located and operated by NSW DPI within the 10-kilometre zone around each of the premises where Varroa mite was detected (the Varroa mite red eradication emergency zone).

Bait stations were deployed in the Nana Glen area in October, and these will be operational from late October for approximately 6 months. There will be a minimum 2 km buffer area between bait stations and the purple surveillance emergency zone, to reduce the risk of European honey bees from outside the eradication zone interacting with the bait stations. You can read the full Varroa mite update on PAGE 14.

In light of the eradication of European honey bees I ran a native bee management workshop in Coffs Harbour with Steve Maginnity from the Australian Native Bee Company.

Some of the key messages from this workshop included:

• position hives North East to take advantage of the morning sun;

• non-specific insecticides should not be used while native bees are foraging on the crop;

• not all fungicides are safe to use whilst bees are present;

• night time spraying AFTER the bees have finished foraging for the day is best practice.

For more information refer to the article ‘Using native bees as pollinators in Berries’ on PAGE 79. On another note, public exhibition for the updated North Coast Regional Plan 2041 has recently closed. The draft plan is the 20-year strategic blueprint that sets the framework, vision and direction for land-use planning on the North Coast. The draft plan aims to diversify the economy, create vibrant communities and plan for a sustainable future. It recognises the two distinctive subregions of the Northern Rivers and the Mid North Coast to ensure that they have the right homes, jobs and infrastructure in place. You can read the draft regional plan at: pp.planningportal.nsw.gov.au/North-Coast-RP

Available grants

• The Australian government netting program was released for NSW primary producers on Monday 24 October. Unfortunately, this funding has now been fully exhausted and so has been closed to new applications. You can register your interest to receive a notification from the RAA should any future rounds be announced at: industrynsw. tfaforms.net/f/RAA-Hort-Netting-Waitlist

• Special Disaster Grants: The NSW and Australian Governments have announced Special Disaster Grants of up to $75,000 for primary producers who have been impacted by severe weather and flooding from February 2022 onwards. You can apply at: www.raa.nsw.gov.au/disasterassistance/storm-and-flood-programs/sdgfebruary-2022

• Critical Producer Grants: the NSW and Australian Governments have announced additional funding to support producers in targeted industry sectors to rebuild and recover in the medium to longer term, with the aim of supporting job security, future resilience and enabling future production. This program is designed to complement the Special Disaster Grant. You can apply at: www.raa.nsw. gov.au/disaster-assistance/storm-and-floodprograms/critical-producer-grants

13 INDUSTRY

Melinda Simpson, Berry Industry Development Officer 0447 081 765 |

Varroa mite –where are we at?

Melinda Simpson, Industry Development Officer, NSW DPI

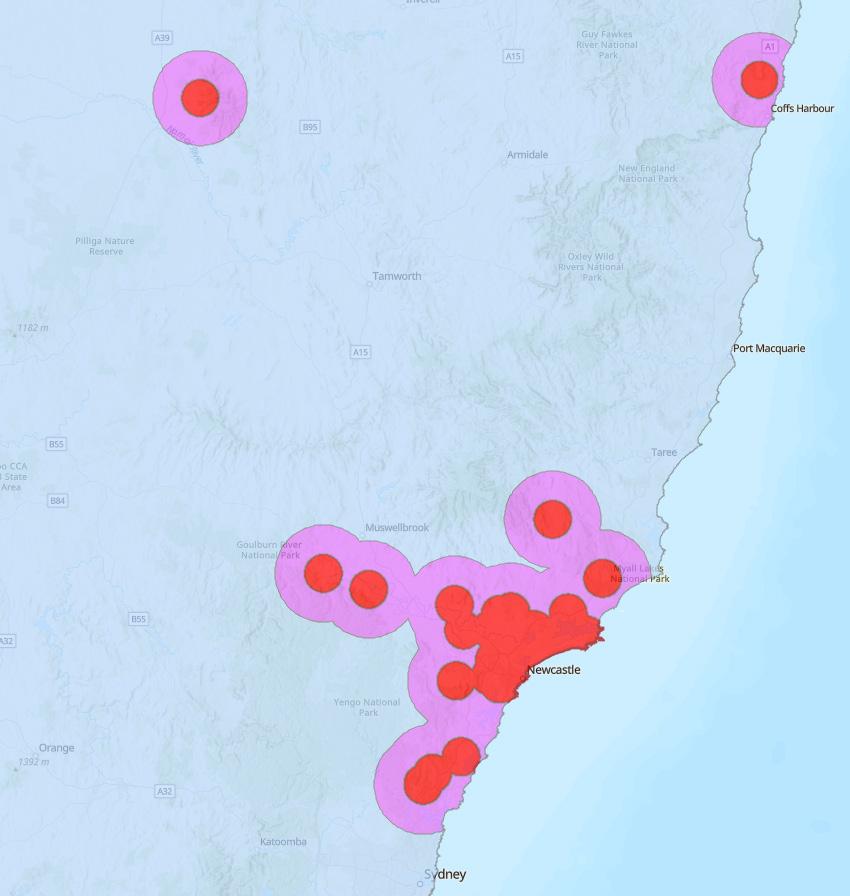

On 22 June 2022 Varroa destructor (Varroa mite) was detected in two of six sentinel hives at the Port of Newcastle in NSW, as a result of routine surveillance. All six hives were euthanised and inspected for mites. Three private hives in the vicinity of the sentinel hives were also euthanised.

Since the initial detection, other infected hives have been found through surveillance and tracing, and at the time of writing there are 103 infected premises in NSW. All confirmed cases, however, have clear links to the original detections through hive movement, or are geographically related. That said, the most recent infested premises (24 November) extends the boundary of the eradication zone as it was found in the surveillance zone in the Newcastle/Hunter area. Industry and government representatives are still confident Varroa mite can be eradicated at this stage, although there are ongoing conversations about costs.

All hives in the original eradication emergency zones areas have been euthanised and euthanasia operations continue in the remainder of the Newcastle/Hunter emergency zone areas.

The situation is changing rapidly, and information is constantly being updated on the NSW DPI website www.bit.ly/VM-NSW This is the best place to find information about, and apply for, Emergency Permits and Hive Movement Declarations to allow hive movement.

Growers using pollination services under the Hive Movement Declaration system must ensure that the commercial beekeepers they are using have the appropriate permits in place, as there are hefty fines for both the beekeepers and the growers if this procedure is not followed.

Nana Glen Wild European Honey Bee Management Plan

Following on from the euthanasia and destruction of recreational and commercially managed hives within the Nana Glen Varroa mite Eradication Emergency Zone, the next phase in the eradication of Varroa mite requires the complete removal of wild European honey bees from the Varroa mite Eradication Emergency Zone. Euthanasia of wild European honey bees will be completed using a commonly available insecticide called Fipronil. Fipronil bait stations will be located and operated by NSW DPI within the 10-kilometre zone around each of the premises where Varroa mite was detected (the Varroa mite red eradication emergency zone).

14 BERRY AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13 INDUSTRY

Varroa mite emergency zone map. Photo credit: NSW DPI

To ensure the safety of people, animals, livestock and the environment this work is strictly controlled by NSW DPI, in accordance with an Australian Pesticide and Veterinary Medicines Authority permit [PER84929]. The Fipronil bait stations are designed to exclude other animals and insects, and to prevent contamination of soil and water. While the bait stations are in active use the baited area will be supervised by trained staff.

Rollout of the plan – Nana Glen

The bait stations in the Nana Glen area will be operational from late October for approximately 6 months. NSW DPI have notified registered beekeepers within proximity to where bait stations will be deployed and have directly contacted landholders where bait stations are being installed.

As per the Biosecurity Act 2015, landholders are required to allow property entry to authorised biosecurity officers to place Fipronil baits in the red eradication emergency zone if requested to do so. There will be at minimum a 2km buffer area between bait stations and the purple surveillance emergency zone, to reduce the risk of European honey bees from outside the eradication zone interacting with the bait stations.

What actions do people need to take?

All bait stations will be clearly marked with signage as per the requirements of the APVMA permit, including instructions for persons to not tamper with bait station equipment.

We encourage people to help protect Australia’s food security by contacting NSW DPI if they see European honey bee hives in the Varroa mite red eradication emergency zone at any time over the next 12 months.

Call the Biosecurity Helpline 1800 680 244 or complete the online form found at www.dpi.nsw.gov.au/varroa

Blueberry Plants

commercial growers nurseries wholesalers hobby farmers

having supplied the industry with blueberry plants for over thirty years, we can offer a large number of varieties including Northern Highbush, Southern Highbush and Rabbiteye types.

Talk to us today about how we can fulfill your requirements on plants@moonblue.com.au moonblue.com.au

pre-order winter 2023

delivery

for

Fair Farms welcomes Australian horticulture to inaugural conference

Sachin Ayachit, Fair Farms National Program Manager

Given our current labour market, there has never been a better time to come together to discuss the state of workplace relations in Australian horticulture. In October we did just that with growers, retailers, auditors, politicians, and peak industry bodies coming together for the inaugural Fair Farms National Conference & Awards.

I never would have imagined that what started out as a small concept idea for celebrating the Fair Farms program with just our growers, would grow into something involving the greater horticulture industry. Several months of planning and engaging with the industry led to a stunning roster of 13 speakers, delegates from all around Australia and a conference program that delivered on getting vital information to members of the horticulture industry.

From the moment our wonderful MC Richard Shannon started off the conference with a bang, to our first lot of speakers which included The Honourable David Littleproud MP, Executive Director of Enforcement FWO Steve Ronson, Dr James Cockayne NSW Anti-Slavery Commissioner, Rachel Mackenzie of Berries Australia –the conference room was abuzz with excitement at what was to be an informative and fun event. Special thanks to our incomparable keynote speaker Steven Bradbury for bringing energy and enthusiasm to a room full of delegates who were simultaneously amused with your humour and inspired by your story.

As topics such as audit fees, red tape, consumer demands, global pressures, lack of labour and compounded compliance were discussed, it was important to acknowledge that although we may have come from various viewpoints on the topic, fundamentally there were two things we could all agree on:

A grower perspective from the conference was this: It is a shame that growers who do everything right have to prove their behaviour with a certificate of audit. It’s an added burden and cost that we could all do without. But it’s an even greater shame that the few growers who don’t do things right, spoil the reputation of all those who do. These growers detract from our workforce and unfairly price their produce, it’s not a level playing field. These growers forced us into this space, and they need to be forced out. We need to reboot the reputation of horticulture.

It was for these very reasons Fair Farms was developed by Queensland’s peak industry body, Growcom. It is the only Australia-wide training and certification program for fair and ethical employment practices on farm.

Finally, a special congratulations to our inaugural award winners - Shane Stirling and Rachel Mackenzie who both received the first-ever Fair Farms Recognition Awards and Fair Farms Certified Growers Sunripe who took out the Fair Farmer of the Year Award. All our winners had contributed to the betterment of the program and industries approach to horticulture workplace relations and were, therefore, more than deserving of recognition.

16 INDUSTRY

Australia’s horticultural industry must have a reliable workforce

BERRY AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13

The reputation of the horticultural industry must be improved

17

L-R Sunripe owners Luke & Samara De Paoli, Growcom Chair Belinda Frentz, Steven Bradbury & Growcom CEO Rachel Chambers

L-R The Honourable David Littleproud MP, Executive Director of Enforcement FWO Steve Ronson & Dr James Cockayne NSW Anti-Slavery Commissioner

I would like to thank our sponsors for supporting the Fair Farms vision. Thank you to our Gold Sponsors AUSVEG and TĀTOU, our silver sponsors Holding Redlich and Agri Talent, and our Bronze Sponsors Southern Cross Certified, Integrity Compliance Solutions, Driscoll’s, and Berries Australia.

I would like to thank our speakers – all of whom have taken time out of their day to deliver exceptional presentations and once again, thank you to our delegates for attending the event. We look forward to welcoming everyone to the 2023 Fair Farms National Conference & Awards at a date and location to be announced soon.

The Honourable David Littleproud MP L-R Sachin Ayachit, Rachel Chambers & Steven Bradbury

Group

Horticulture Group provides innovative product solutions to the

horticulture industry through its trading companies,

and GreenLife Structures (GLS).

trusted

partners for

in

Horticulture Group is an

that designs, manufactures and installs exceptional quality commercial

span shade structures and protective netting, as well

the

H o r t icu l t u r e SMART SOLUTIONS FOR PROTECTED CROPPING Tapex

Australasian

Polygro (Australia)

With

global brand

over 20 years

horticulture sector, Tapex

Australian-owned-and-operated company

greenhouses, cable-

as other non-chemical protective cropping solutions to

protected cropping industry.

and

• Premium Greenhouse

Shade Structures.

and Design Certified.

Sales, Design, Fabricate, Install and Service. e:

w:

p:

• National Supplier of Horticultural Products. • Tunnels, Crop Protection, Netting and Film, Landscaping products, Growbags and Accessories. e: sales@polygro.com.au w:

p:

6000 Tapex Horticulture Group 200 Kingsgrove Road, Kingsgrove NSW 2208, Australia +61 2 9502 6000 | rvallett@tapexhortgroup.com.au | www.tapexgroup.com.au

• Australian made, Engineered

•

sales@greenlifestructures.com.au

greenlifestructures.com.au

+61 2 6686 7321

polygro.com.au

+61 2 9502

Raising Awareness of Nutrition and Berry Benefits with Healthcare Professionals

Jutta Wright, Project Manager, Nutrition Research Australia (NRAUS)

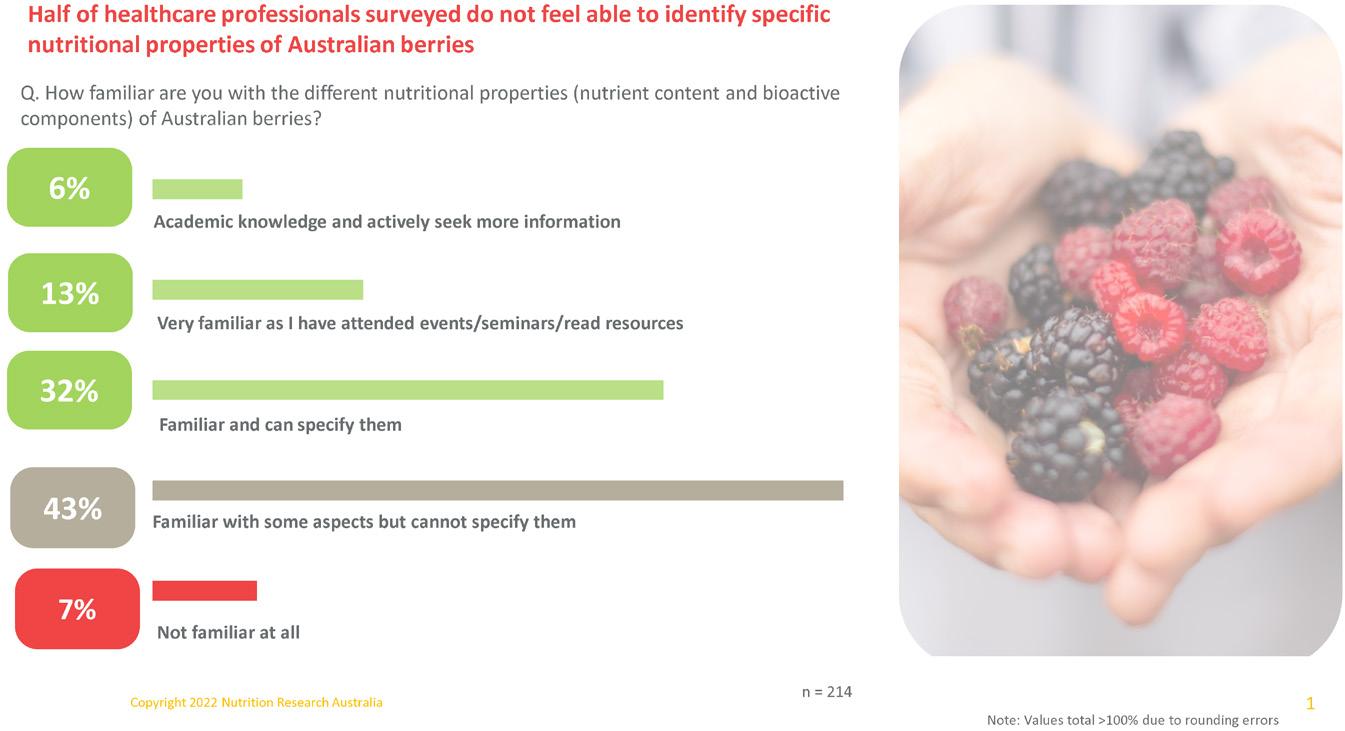

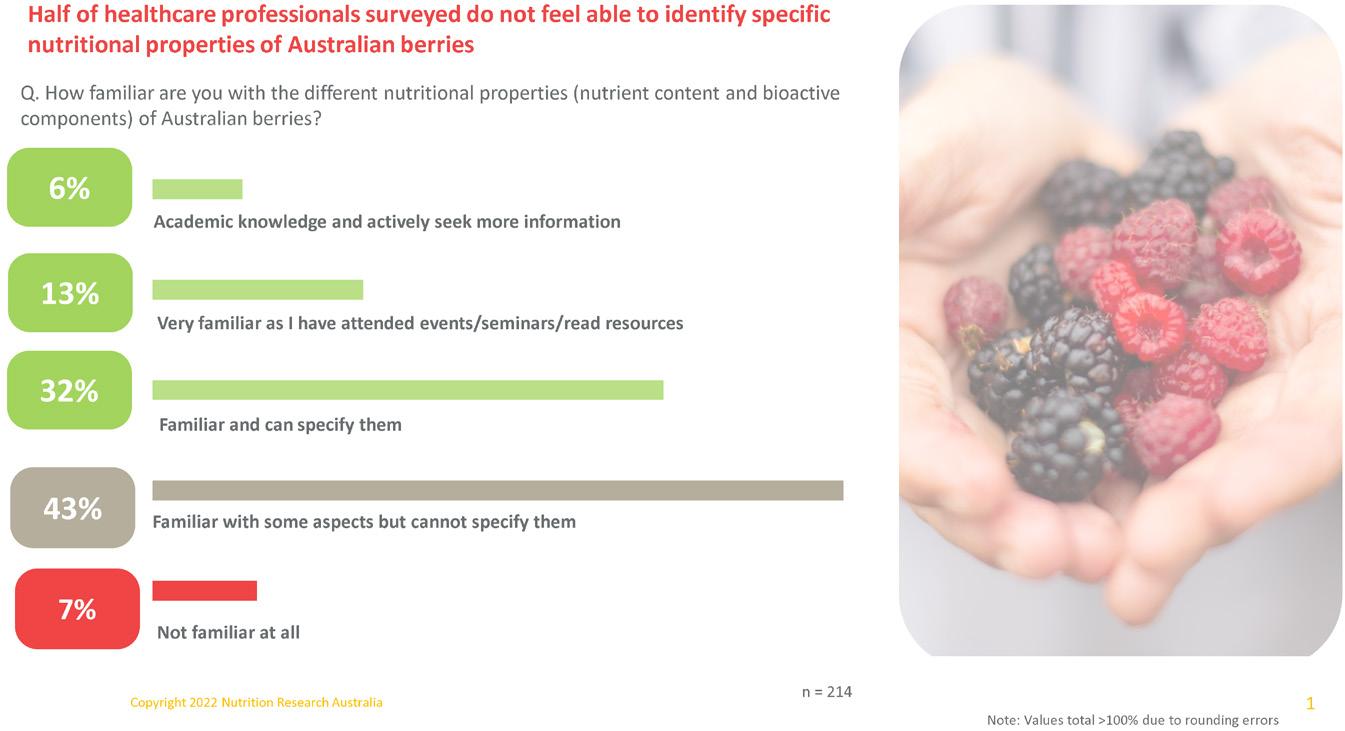

In February 2022, Nutrition Research Australia (NRAUS) kicked off a 2-year strategic levy investment project, Health and Nutrition Information for the Berry Industry (MT21000) funded by Hort Innovation using the Blueberry, Raspberry and Blackberry Funds and contributions from the Australian Government.

Why do we need this project?

Not only are berries a nutritional standout, rich in vitamins, minerals, and dietary fibre, they are also a source of numerous non-nutritive and colourful “bioactives”, compounds which give fruit and other plant foods colour, but also give us additional health benefits including reduced risk of chronic diseases. One bioactive getting more attention of late are polyphenols. Berries are one of the highest dietary sources of polyphenols and have an impressive nutrition story to tell.

Health care professionals (HCP) are a trusted source of nutrition information, that can increase awareness of both their specific health benefits and culinary uses. However, the specific therapeutic effects, bioactives, and the doses required to achieve these is not common knowledge among health-care professionals.

There is an opportunity to educate health care professionals on the latest berry nutrition science, and their culinary uses to make it relevant and practical, thereby ensuring berries are top of mind and support client recommendation.

What has been accomplished so far?

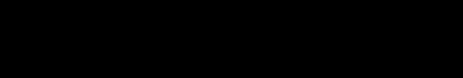

In May 2022, NRAUS launched their Berries healthcare professional Market Research Survey. The survey sought to obtain baseline data on perceptions and attitudes to be used as a benchmark for project evaluation at project end as part of monitoring & evaluation, plus gain market insights to help tailor key message development and adjust the communication plan. The survey of over 200 respondents found whilst the majority of HCPs rate themselves as confident discussing the benefits of berries, aside from being able to specify they contain vitamin C and more generally bioactives, more than half were not able to specify any other nutrients or specific bioactive types. Nearly half (42%) of respondents are not regularly recommending berries to their clients and when they do, a mix of berries or blueberries are most common, with very few specifically recommending blackberries or raspberries. Nutritional and health benefits and taste and convenience are key drivers. Not being top of mind (40%) and lack of nutritional and health knowledge for 1 in 4 are the key barriers to recommendation. Cost was reported as an issue for only a small subset of respondents (15%). Most are not familiar with growing practices of Australian berries with a large proportion (25%) not familiar at all and they yearn for more information on how growing affects nutritional quality.

20 INDUSTRY BERRY AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13

The NRAUS science team, led by Dr Michelle Blumfield, undertook a comprehensive, referenced ‘deep dive’ literature review in the first half of 2022 to investigate ‘What are the health effects of Australian berries (strawberries, blueberries, raspberries and blackberries)?’ Its aim was to provide an evidence base to inform key messages in the education campaign. It highlighted berries to provide unique nutrition benefits, that differ between berry type.

One of the key findings was that berry consumption was associated with positive health effects linked to vascular health, brain health, exercise recovery, weight and ageing, and reduced risk of cardiovascular disease and type 2 diabetes. Current focus is now on planning and activating the communication and education campaign.

What is to come?

Engaging collateral is to be developed including infographics, facts sheet and an animation, all to be freely available via an NRAUS dedicated ‘Berries hub’. In December, an exciting and exclusive key opinion leader (KOL) online event is planned.

It aims to build a healthcare professional KOL ambassador and influencer network that can communicate and amplify project key messages throughout the project via their health-care professional and consumer community.

Other planned educational activities include a webinar, and dietitian and GP conferences.

21

Berries… retail insights from the world stage

BerryQuest 22 international keynote speaker, Dr David Hughes gives an overview of how recent world events have impacted fresh produce retail. Jen Rowling, Berries Australia

BerryQuest 2022 welcomed the always insightful, engaging and entertaining Dr David Hughes as international keynote speaker for the conference held in July this year at the Gold Coast. Dr Hughes is an Emeritus Professor of Food Marketing at Imperial College London, and Visiting Professor at the Royal Agricultural University, U.K. Also known as “Dr. Food”, he is a much sought-after speaker at international conferences and seminars on global food industry issues, particularly consumer and retail trends. This is a summary of his presentation from the conference.

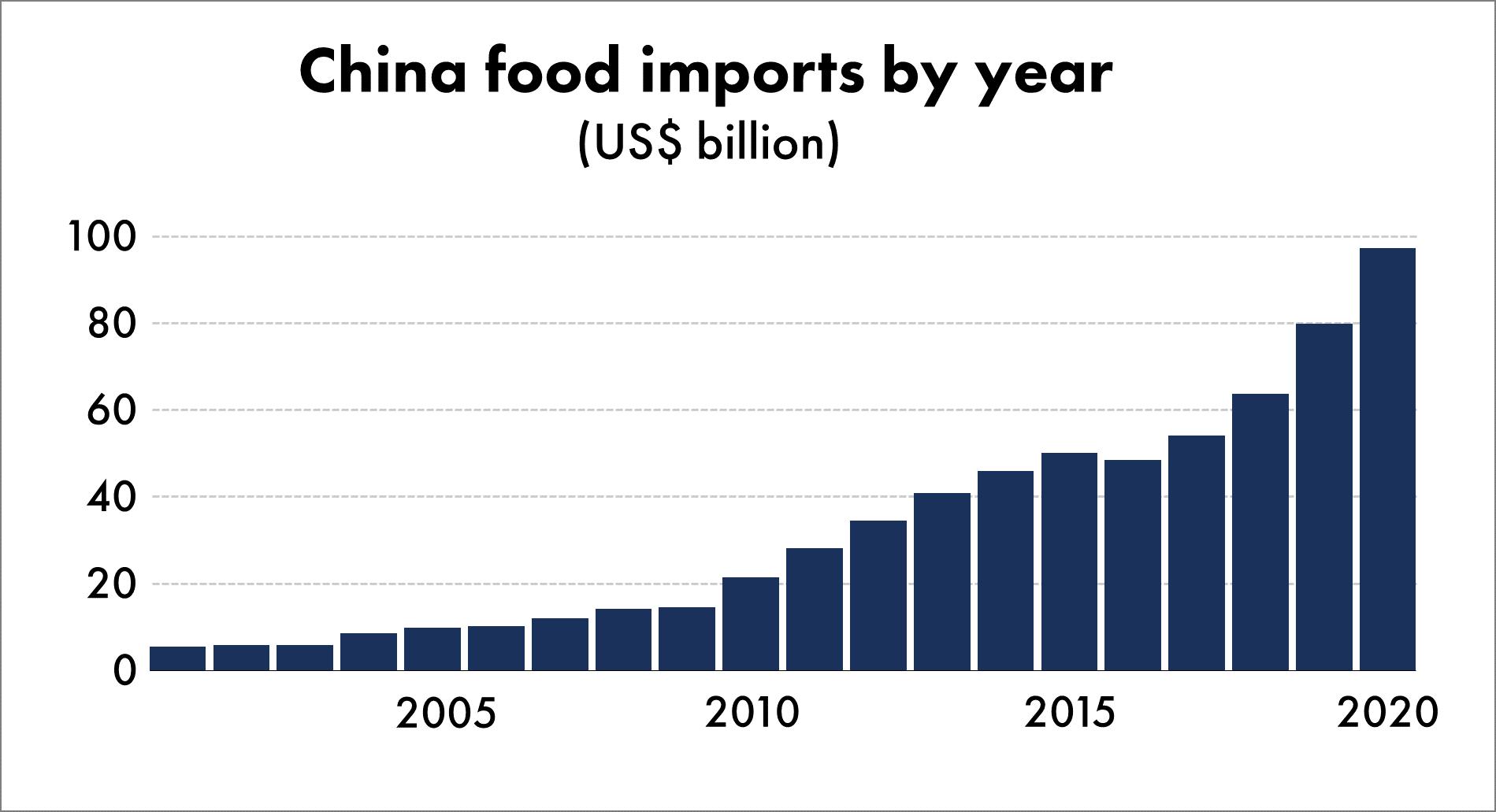

Dr Hughes is an expert on the effect that global events have on food supply and prices. The last two to three years have seen a pandemic, the invasion of Ukraine and record food price inflation, but Dr Hughes was quick to point out that these events are not unprecedented. A pandemic wiped out one-third of Europe some 400 years ago. Russia annexed Crimea from Ukraine in 2014 and food price inflation is currently at a similar level to what it was around 1973. The increase this year has been quite spectacular at 23% higher in June 2022 than it was in June 2021, but not unprecedented. It will come down, but it will happen again.

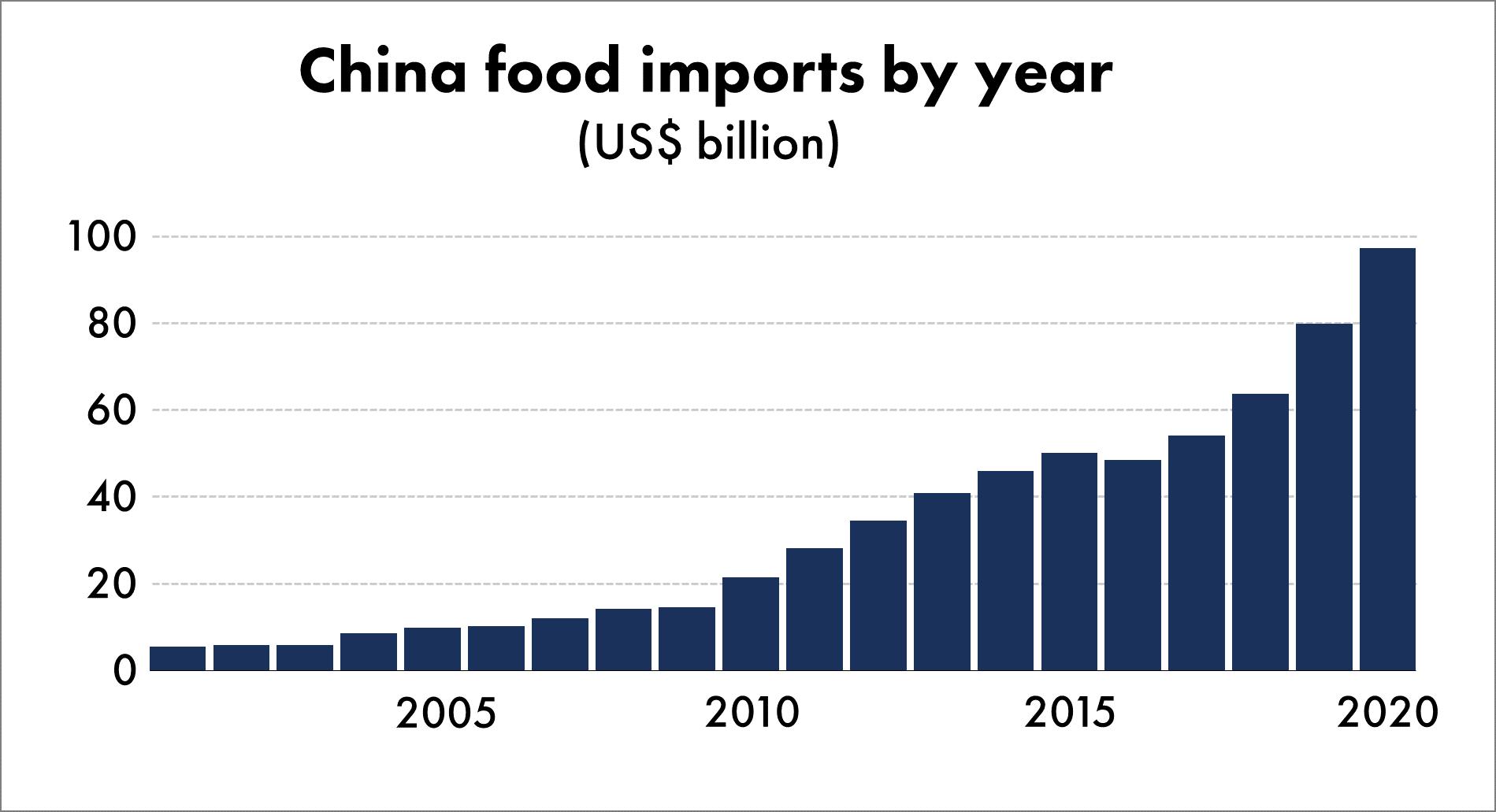

Prices have been driven upwards partly due to the pandemic and partly due to the war in Ukraine, but it has also been affected by China who continue to increase their share of food imports. This may not directly relate to berries, but a food price inflation rate of anything over 15% will have a significant impact on all commodities.

Food price inflation is also being heavily impacted by the increase in farm input costs (fertiliser and fuel), food ingredient prices and general production costs. In the UK, farm input inflation has reached 24% with production expected to reduce as a result. Inflation is also being exacerbated by more than 23 countries who have imposed export restrictions in an attempt to protect food prices within their own country.

The significant increase in gas and electricity prices means that a high proportion of households in colder countries will be forced to decide whether they heat or eat. And spikes in food prices tend to signal political turmoil with new governments formed during food crisis events, particularly in emerging countries where over half the household income is spent on food.

What does food price inflation bring at a retail level?

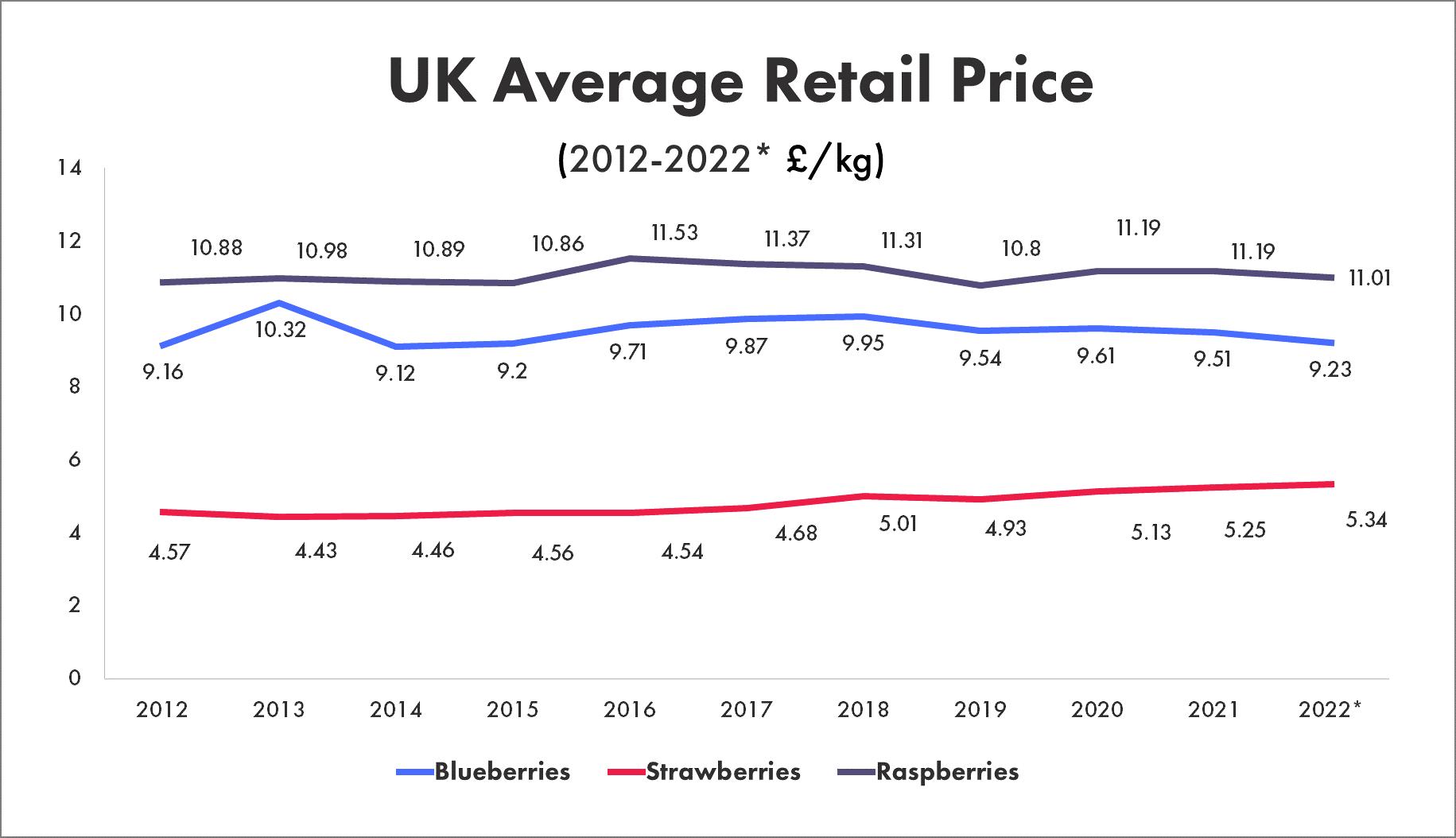

Competition is intense at a retail level in the UK. The UK has one of the most competitive grocery markets in the world, with over 12 major retailers. In Australia the situation is dramatically different where Woolworths and Coles combined have 66% share of the total grocery market, with Aldi rapidly gaining ground. In the UK, the big supermarkets are on a price offensive to prevent loss of market share to the hard discounters such as Aldi and Lidl. The big retailers are matching the prices of the hard discounters on selected products including berries, which then puts price pressure on suppliers. Retailers are resisting putting up prices despite the major escalation in input costs at the farm level. This is not sustainable, but it will hurt suppliers in the meantime. In Figure 2 from Dr Hughes’ presentation, you can see the trends occurring in the UK in fruit retail value market share for a major supermarket (Tesco) versus two of the hard discounters (Aldi and Lidl). Tesco’s market

22 INDUSTRY BERRY AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13

Figure 2. Fruit retail value market share comparison for leading retailer Tesco with hard discounters Aldi & Lidl.

Source: Kantar UK, *52 weeks to 12 June 2022

23

Figure 1. China food imports by year. Source: General Administration of Customs of China

share value has dropped a little, whilst the two hard discounters have increased and are expected to continue this increase over the next 2 to 3 years up to a combined 25% of the fresh fruit market, which will in turn put more pressure on suppliers.

Big supermarkets require sales growth. Without sales growth, they will fall over and major supermarkets are concerned about income-constrained shoppers converting to hard discounters such as Aldi.

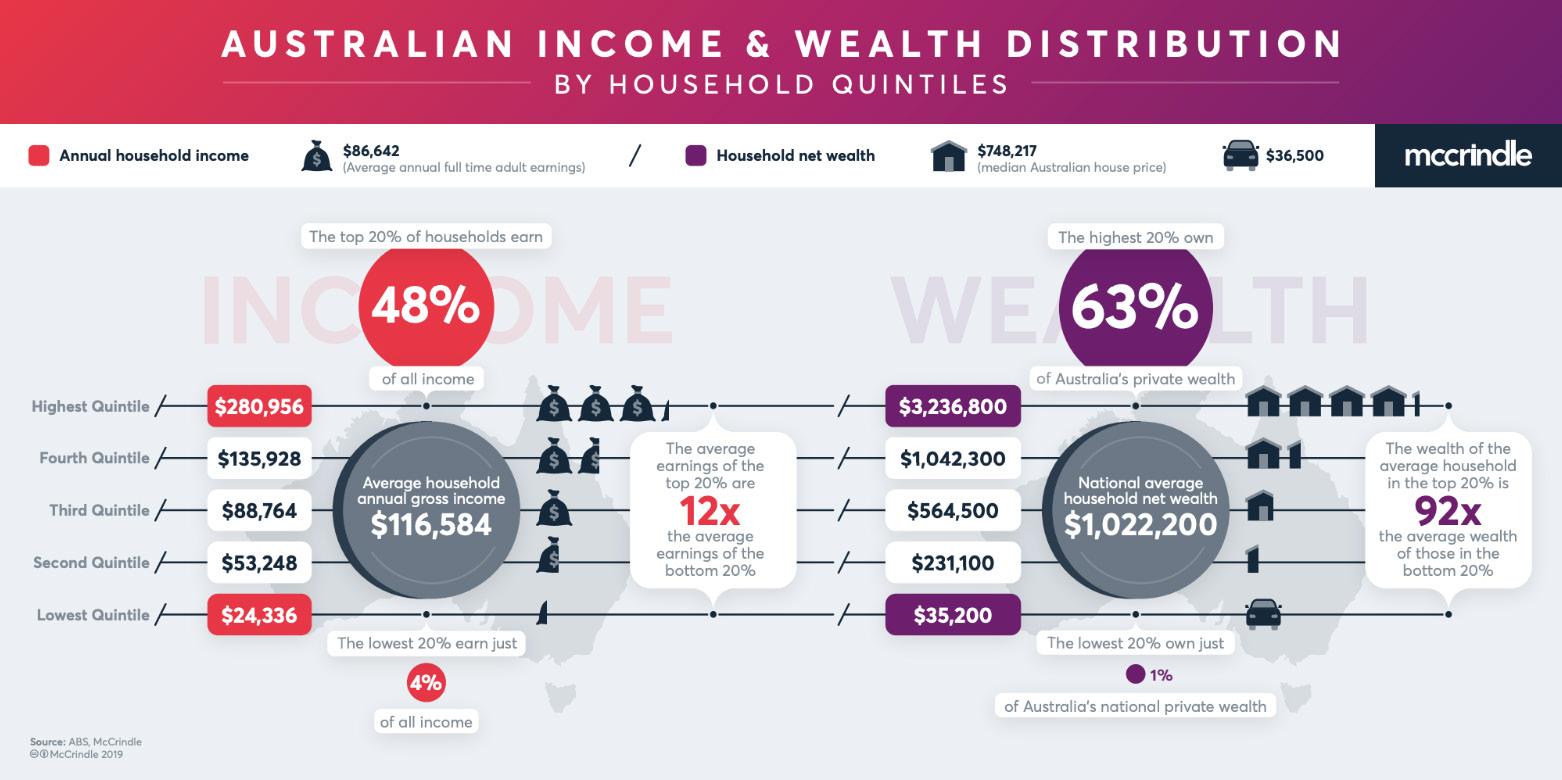

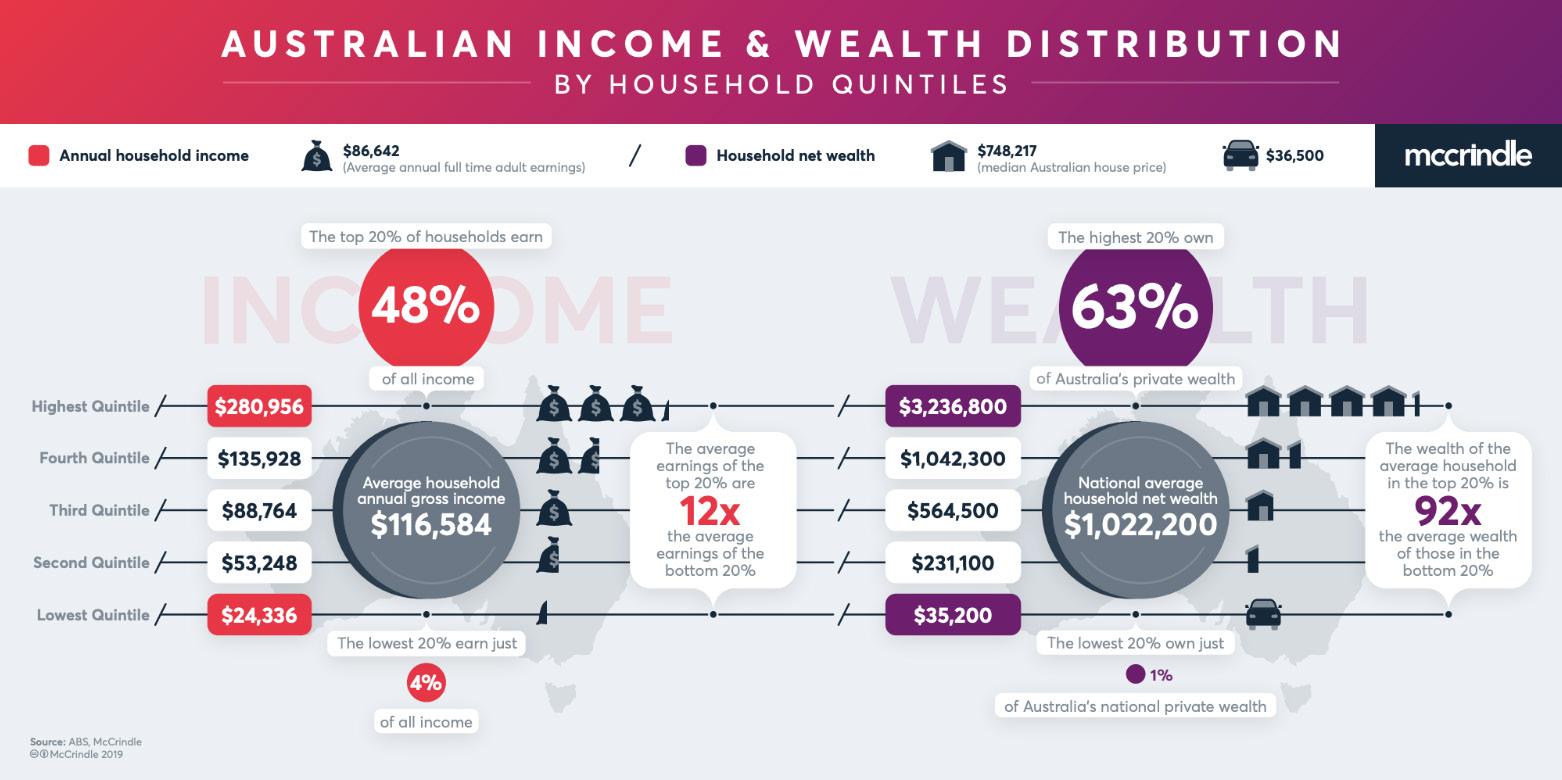

In Figure 3, you can see that the average household income of the highest 20% is $280,956. The lowest 20% is just $24,336 – a big difference. Over the next 12 months, it is expected that a minimum of 40% of Australian households will be struggling and our major supermarkets do not want to lose these customers to Aldi.

At a recent Conference that Dr Hughes attended in Slovenia for the European Bakery Industry, he came across a number of key takeaways that can be applied to the fresh fruit market which shows the very similar issues being faced across the globe and across industries:

1. Just-in-case inventory management is emerging, rather than just-in-time. In pre-covid times, inventory management was all about the efficiency of the supply chain i.e. as things ran out, it was efficiently re-stocked. Now, due to food insecurity and supply chain problems, efficient re-stocking is not happening, so additional stock has to be ordered just-in-case.

2. There has been a reduction of single source suppliers, to ensure that options are available for supply should a problem from another supplier be encountered.

3. Shorter and more local supply chains are being used.

4. Retailers are reducing the breadth of product range for many categories.

5. There has been an acceleration of rationalisation of smaller/artisan bakeries, which has the potential to happen for smaller berry growers.

6. Hollowing out of the middle market. There is strong demand in the low-cost, value segment but top income earners still want the good stuff and may in fact buy more. This, in effect, may squeeze out the middle market.

Figure 3. Infographic which explains the current distribution of incomes and wealth across Australian Households.

Source: ABS, McCrindle

24 BERRY AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13

Changes in shopping trends

In the UK, some of the key shopping trends for 2022 include:

Divided shoppers Reactive shopping

The ‘Haves’ and ‘Have-Nots’

More shopping around looking for good prices; even high-income households are on the lookout for good deals on the products that they choose to consume

Growth of disruptors Value for time Do it for me

New routes to the consumers which have emerged at an accelerated rate

Faster, more convenient solutions for shopping

Show me what action you’re taking on sustainability and health

16% of groceries are now purchased online in the UK but with online shopping consumers often order the same thing that they did last week. They don’t browse for new ideas and different things as they would in-store. This makes products such as new or premium lines somewhat difficult to sell.

India has introduced a great concept where people can shop online for fresh fruit and vegetables, but then choose the items themselves from a grocery van that will pull up in front of their house (Figure 4).

Figure 4. The VegEase service has recently been launched in Delhi, India with plans to franchise the concept across the country. Photo credit: VegEase

Technology in grocery retailing has accelerated over the past five years, and high-tech shopping systems like ‘Amazon Go’ will continue to roll out and improve.

Another new concept which is very popular in the UK is 15-minute grocery delivery, which is predominantly being used by younger people for small quantities of products. As Dr Hughes describes “they are likely to use this service to order a bottle of wine and an avocado, or some berries”.

This trend may not have taken off in Australia as it has done in London, but it is worth tracking the progress of all these methods of shopping to ensure we are prepared for the changes in shopping trends that will continue to evolve.

25

‘Amazon Go’ is a chain of convenience stores in the USA and the United Kingdom, operated by the online retailer Amazon. The stores are cashier-less, thus partially automated, with customers able to purchase products without being checked out by a cashier or using a self-checkout station.

Figure 5. Gorillas, the rapid delivery grocery start-up, has teamed up with Tesco to offer a 15-minute grocery delivery service. Under the partnership, Gorillas will set up “micro-fulfillment” sites at five large Tesco London stores, where workers will pick, pack and deliver to customers on electric bikes. Photo credit: Gorillas, The Times.

Consumers are also becoming far more aware that their food purchase decisions can have a much wider impact on our world, for a healthier person and a healthier planet.

The pandemic was seen as an opportunity to eat healthier and exercise more, however it seems average body weights have actually increased, particularly in Australia and New Zealand! As a result, governments may have to start to push consumers towards healthier products for weight loss of the population, which would be a great opportunity for fruit and vegetable producers.

Across Europe, there has been the arrival of ‘Nutri-Scores’, a traffic light system to rate the healthiness of products (Figure 6). Fruit and vegetables will obviously be highly rated and over the next few years, this type of nutritional scoring system will become mandatory, as governments cannot afford the medical costs associated with an overweight population. The health benefits of berries need to be promoted as much as possible. Berries are up in the top 10 commodities for health benefits, so we need to ensure that this remains top-of-mind for the consumer.

Another traffic light system being trialed in Europe are ‘Eco-Scores’, which rate the impact that your product has on the environment (Figure 6). Three of the top four supermarkets in the UK are currently trialing eco-scores and organisations such as Compass Group will roll out eco-labels across workplace catering sites. These systems of scoring will become mandatory.

Major supermarkets everywhere are starting to make big statements about reducing their carbon impact. But 97% of the carbon impact for supermarkets is in the food supply chain which means it will be the growers who will be put under pressure from the majors to make the necessary changes to become carbon neutral. They’re also strongly promoting food that’s healthy for you and healthy for the world, including reducing water and the use of plastic packaging.

How are berries doing globally?

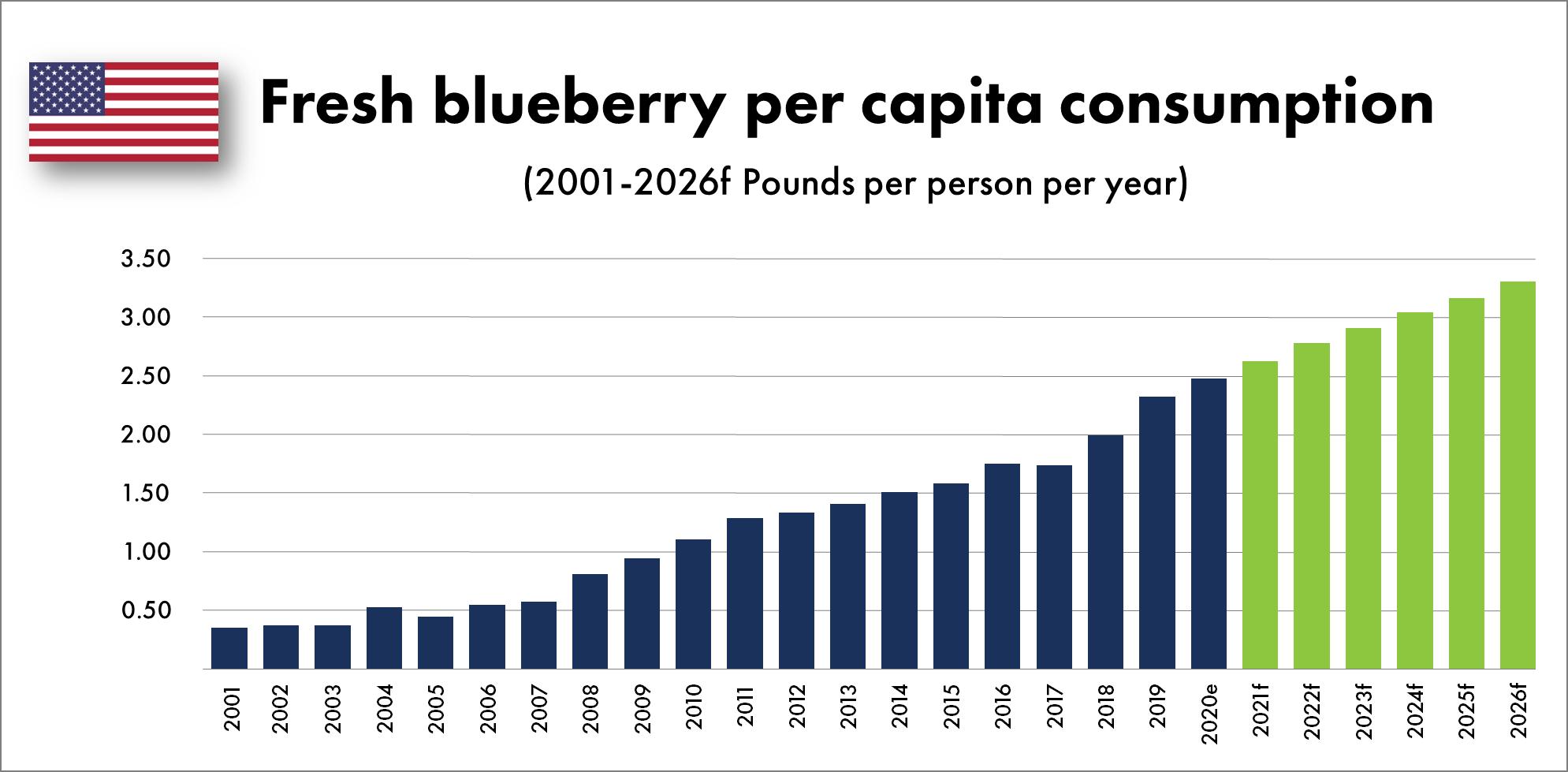

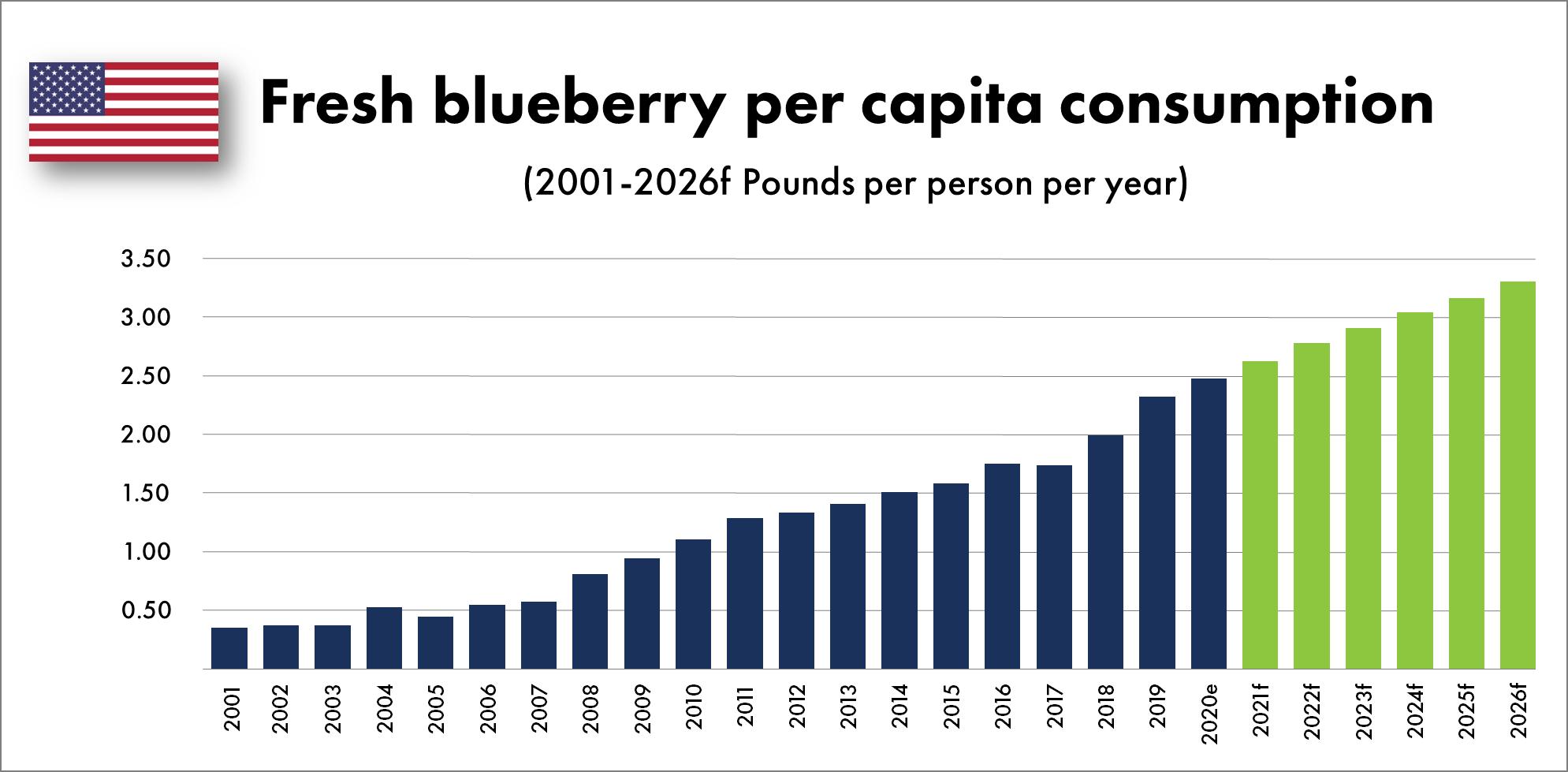

Blueberries are a huge area of growth, particularly in the USA. In 2022, USA per capita blueberry consumption is approx. 1kg (30% higher than in the UK) and the expectation is that this will keep increasing (Figure 7). Interestingly, market penetration for blueberries is higher in Australia than for both the UK and the USA.

Figure 6. (TOP) The Nutri-Score traffic light system for use on food packaging to communicate the healthiness and (BOTTOM) the Eco-Score allows consumers to consider the environmental impact of a product when shopping. Photo credit: openfoodfacts.org

26 BERRY AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13

Figure 7. Consumption of blueberries in the USA has increased significantly since 2001.

Source: USDA/ERS, Rabobank estimates 2021

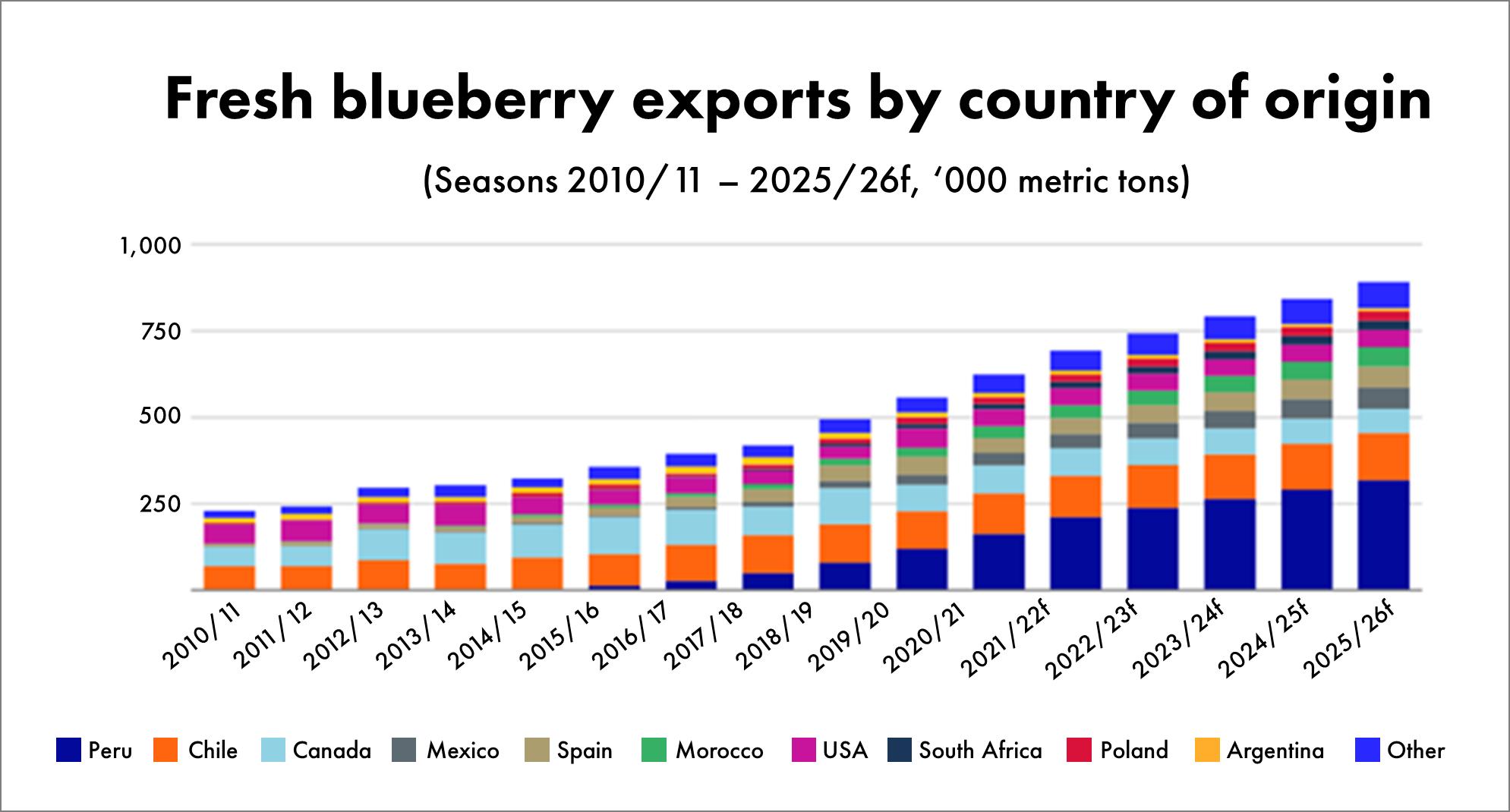

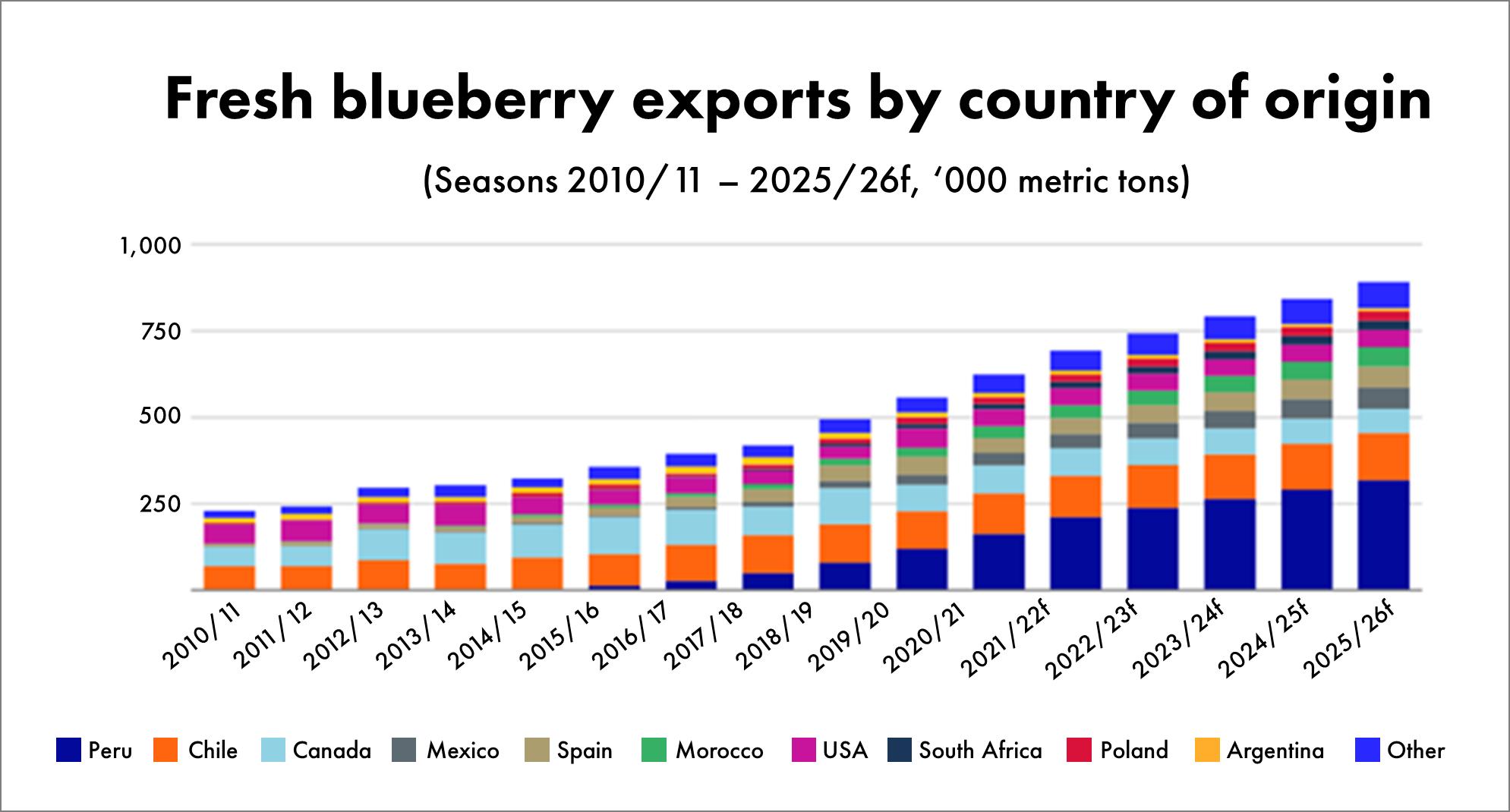

Where are all these blueberries coming from? Figure 8 shows the countries of origin for blueberries hitting markets across the world.

Figure 8. Origin country of fresh blueberry exports.

Source: Trade Map, Customs Chile, Customs Peru, Customs Mexico, Rabobank estimates 2021

27

In the USA, the consumer response to price changes varies by types of fruit and vegetables. Research has shown that from a price perspective berries are relatively inelastic, meaning that if prices go up, consumers will still continue to purchase fresh berries.

Figure 9. Research by IRi in the USA shows that price changes on berries causes a relatively lower impact on volume purchased than many other fresh produce products. Source: IRi

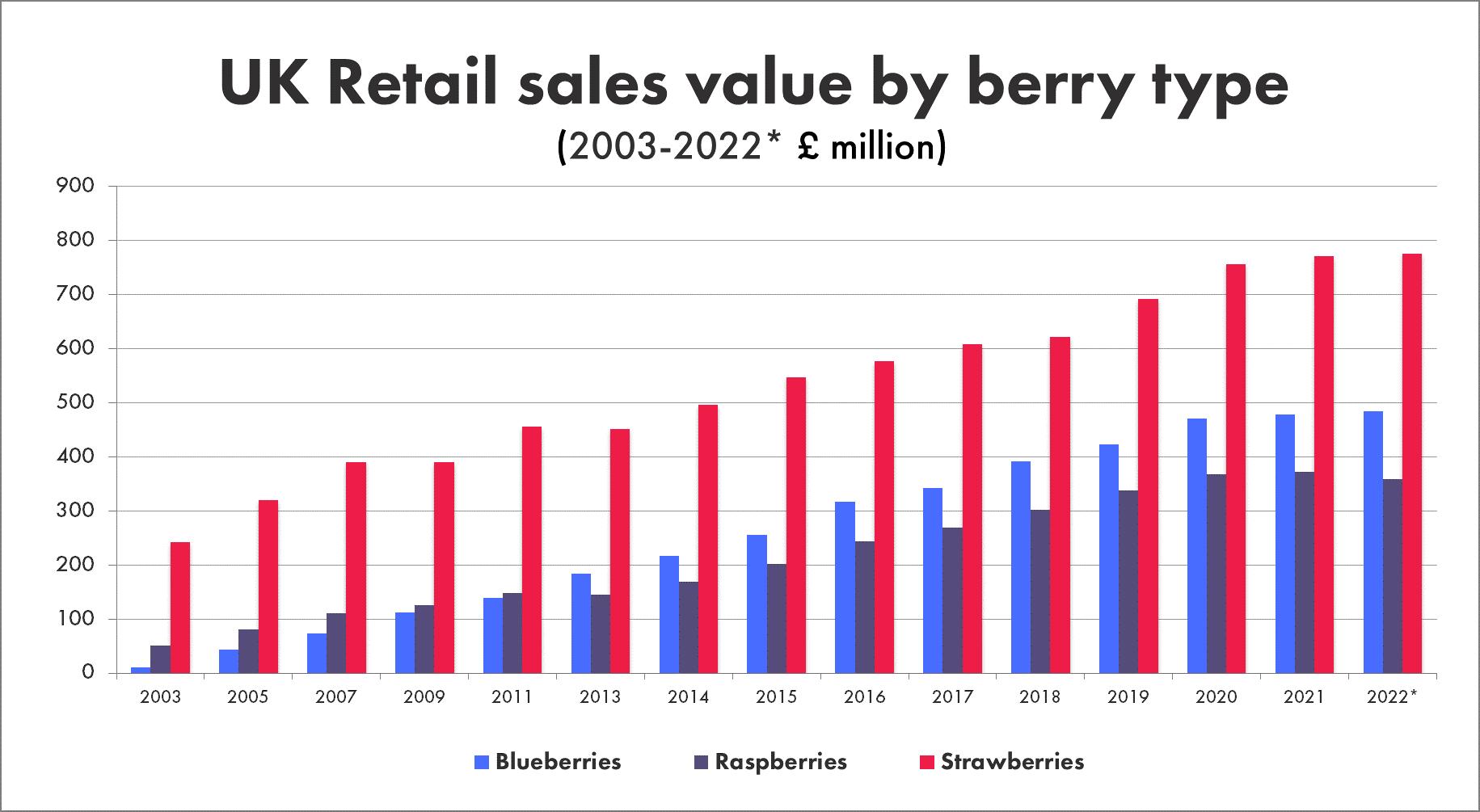

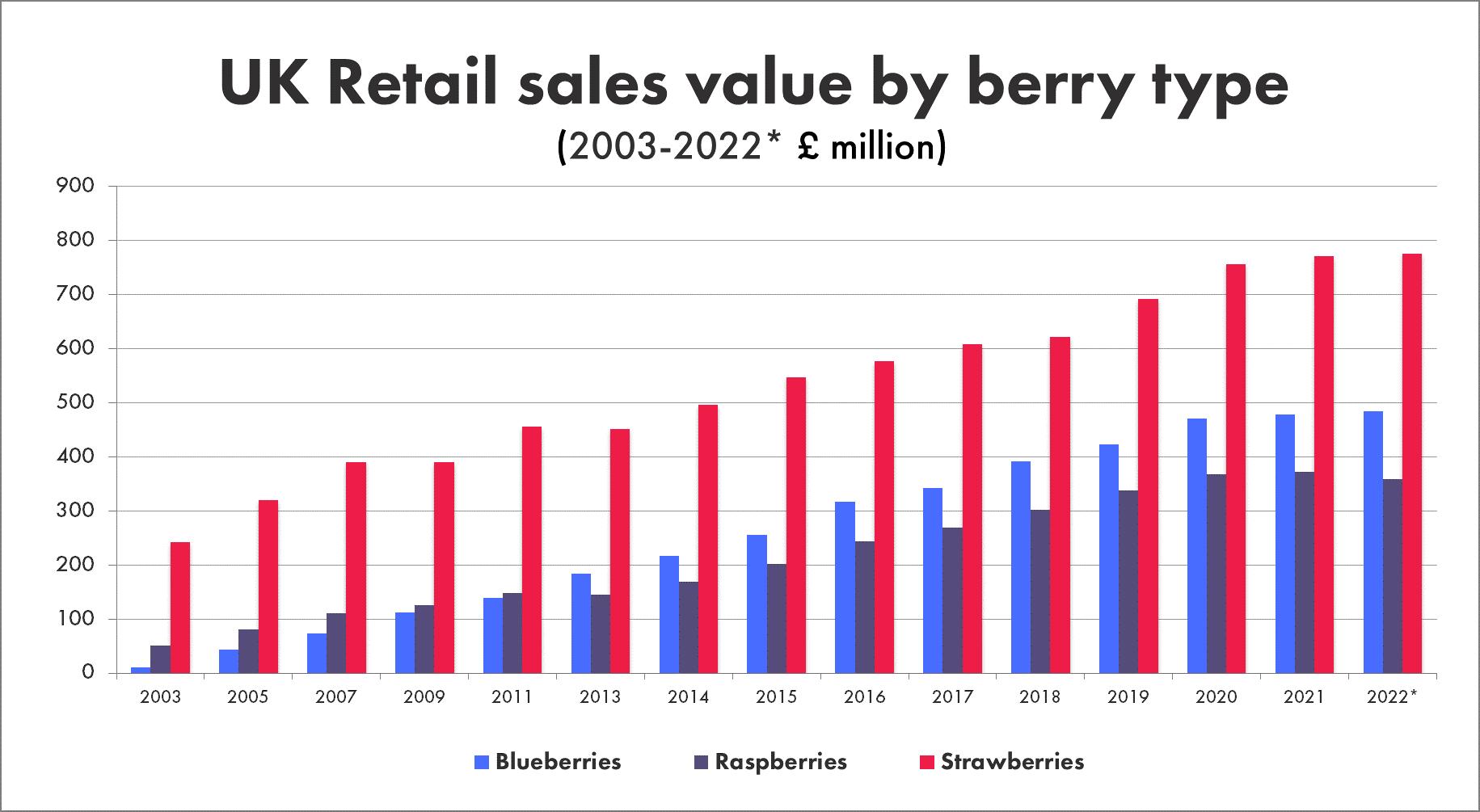

In the UK, there has been a continual rise in fresh berry sales. Table 1 shows the value share of the UK retail fruit bowl 2007 vs 2022, with berries overtaking apples to take almost 28% share.

RETAIL FRUIT VALUE 2007

£3,671 million % Apples 18.7 Berries 18.3 Bananas 15.7 Citrus 14.2 Grapes 12.5 Tropical Fruit 9.2 Stone Fruit 6.8 Pears 4.6

Average Weekly Household Spend on Fruit £2.80 (AUD $4.90)

RETAIL FRUIT VALUE 2022 £6,112 million % Berries 27.7 Apples 15.5 Citrus 13.9 Grapes 14.2 Bananas 9.6 Tropical Fruit 9.6 Stone Fruit 5.9 Pears 3.6

Average Weekly Household Spend on Fruit £4.30 (AUD $7.50)

Table 1. Value Share of the UK Retail Fruit Bowl 2007vs 2022. Source: Kantar Worldpanel UK (July 2021/June 2022 for 2022 figs.)

BERRY

28

AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13

Figure 10. After strong growth in the last two decades, strawberry sales have stabilised, but blueberries continue to grow. Source: Kantar WorldPanel (UK) *52 weeks to 12 June 2022

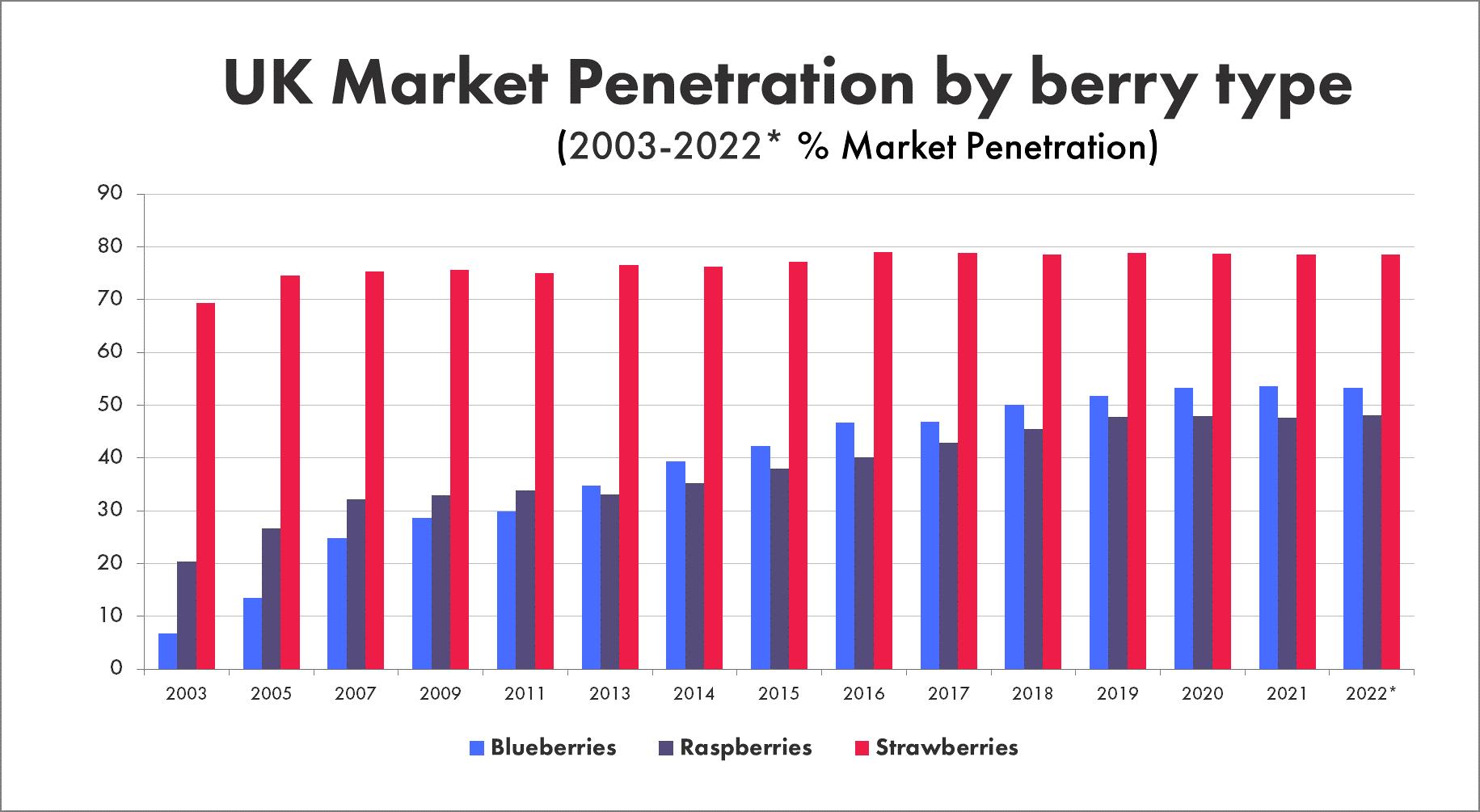

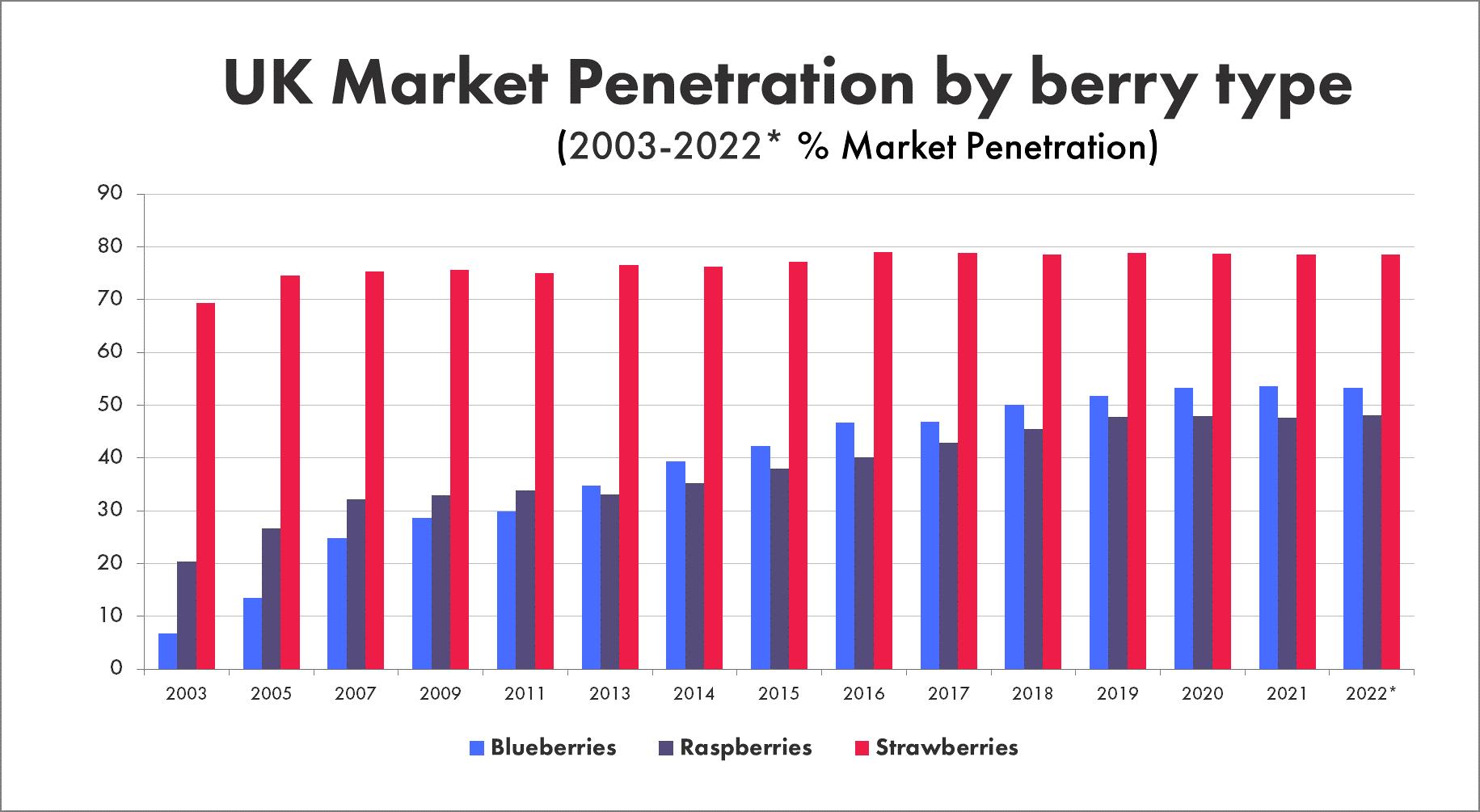

In terms of growth in retail sales, strawberries and raspberries have experienced good growth but now levelling off, whereas there is continued growth in blueberries. Market penetration for strawberries in the UK has stayed consistently between 70 – 80%, but you can clearly see the rise of blueberries from 2003 to 2022 and again, it is expected that this market penetration will continue to increase (Figure 11).

Figure 11. Strawberries have been a household staple for three-quarters of UK households some some time, but blueberries have only just topped 50% market penetration. Source: Kantar WorldPanel (UK) *52 weeks to 12 June 2022

29

Table 2. Latest figures for blackberries in the UK. Source: Kantar WorldPanel (UK) *52 weeks to 12 June 2022

Figure 12. For 10 years Retail blueberry & raspberry prices have been flat as pancakes! However, UK field labour hourly costs have increased by 50%. Source: Kantar WorldPanel (UK) *52 weeks to 12 June 2022

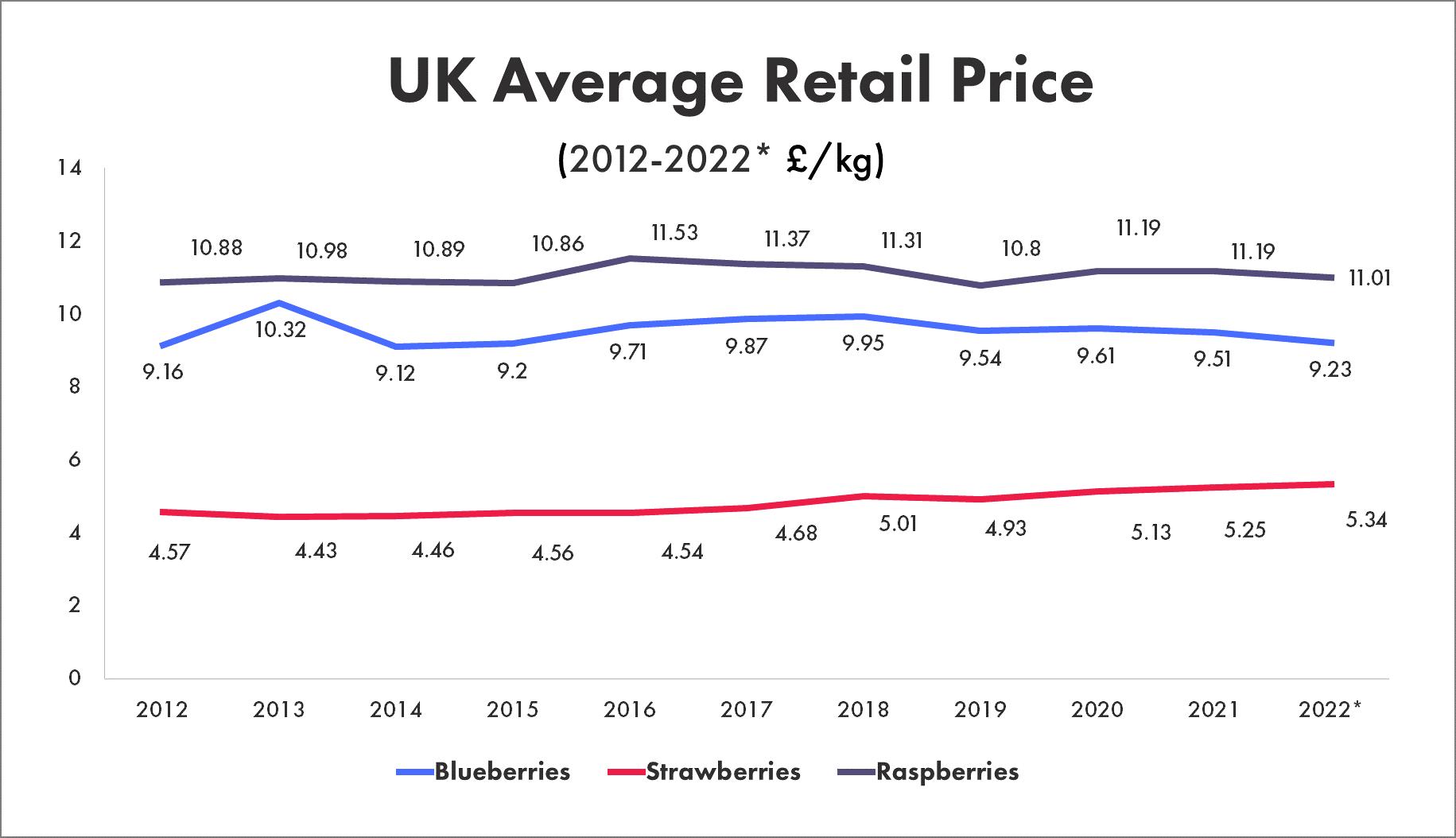

The real concern however, is that the average price for berries has gone nowhere, despite increasing labour costs and overall cost of production (Figure 12).

Over the last two years in the UK, the cost of production for strawberries has increased by an average of $1,000 AUD per ton. As for raspberry production, the increase is around $2,000 AUD per ton with no increase in retail prices. Damage is being done and as a result, we will unfortunately see growers leaving the industry.

30 BERRY AUSTRALIAN JOURNAL SUMMER 2022 EDITION 13

So, what about blackberries? Table 2 shows the increases in value, penetration and frequency experienced by blackberries in the last five years, but average retail price has decreased.

BLACKBERRIES 2017 2022* Retail Value £m 37 47 Market Penetration % 12.5 13.2 Frequency of Purchase (times per year) 4.3 6.0 Average Retail Price £/kg 11.79 11.33 AUD$2.50/125g

Marketing of berries

In terms of marketing, Dr Hughes believes there is currently insufficient product differentiation. You can’t clearly see the good, the better and the best of berries. There is not enough choice for the Haves and the Have-Nots and this needs to be improved.

Pink Lady® Apples do this well and are able to market their apples year-round at four times the price of the cheapest apple on the market (with the help of a substantial marketing budget of course).

Zespri™ is also an exceptional brand with best in class R&D partnerships to develop unique varieties, global brand development, a strong focus on consumer health particularly in Asia, supply chain management excellence and 52 week availability. There is a lot that we can learn from the best performers.

The Australian grocery market is much more concentrated with an absence of import competition from major overseas suppliers. In the UK, every week of the year, fresh berries from Africa, Spain, Latin America are available in the market and at “knock down” prices. Fresh berry demand is strong, and it will be serviced by fewer, larger suppliers.

• There is a hyper-competitive grocery retail market as supermarket chains go head-to-head with hard discounters

• Private label focus of fresh produce retailers (e.g. Tesco label) gives few suppliers branding opportunities

• Fresh berry quality and year-around availability has improved substantially over the past 2 decades

• Only limited successful berry product differentiation (e.g. Good, Better, Best) through the years

• Where there has been differentiation via varietal uniqueness (e.g. Driscoll’s Maravilla raspberries), the catch up time of competitor varieties is shortening

• Overall, the quality bar for fresh berries has moved up but berry retail prices haven’t!

• Taxpayer subsidies fuelled the early move to tunnel and table berry production in the EU. In turn, this accelerated the rationalisation of the berry producer base as capital investment to improve productivity increased sharply and labour costs increased inexorably

• Since 2020, berry input cost inflation has increased substantially further accelerating producer rationalisation

• This combination of events is accelerating consolidation of berry supply management and marketing powerhouses

• Stronger berry marketers will have the capacity to invest more in varietal R&D, brand development, productivity-enhancing technology (e.g. robots) and new production systems

31

In summary, Dr Hughes concluded his presentation with some thoughts on UK Berry Market Developments and relevance to Australia:

Frequently, as an industry, we have failed to communicate fresh berry product value to consumers. = ROUTINELY AFFORDABLE FRESH BERRIES ARE LOVELY BUT A BIT EXPENSIVE $5 = $5

And

finally… the price-value perception challenge

We are proud to be associated members of: Our materials are proudly UK and EU sourced. www.elitetunnels.com Ross Watt ross@elitetunnels.co.uk Mobile: +44 (0) 7841 532 652 Office: +44 (0) 1356 648 598 Australian agent James Downey jdowney@polygro.com.au Mobile: 0400 893 250 Office: +61 2 9502 6000 WE’VE GOT YOU COVERED Elite Tunnels is an established British manufacturer and global supplier of field-scale multi-span polytunnels, substrate gutter growing systems, and ancillary parts. For projects of any scale, our familyrun business will professionally handle your order – with a personal touch! Visit our NEW website to see details of our products and view drone footage of our Australian polytunnel projects! We hold stock of a variety of ancillary parts, including: C-clips • hinge-clamps sheeting-rope • rope-pullers We also stock ample rolls of plastic.

Scams affecting the Agriculture Sector

Jane Richter

• The ACCC’s Scamwatch has observed a rise in agriculture scams since the COVID-19 pandemic. According to the 2021 targeting scams report, farmers and small businesses lost over $1.5 million to scammers targeting the agriculture industry in 2021.

• An estimated one third of victims do not report scams to the ACCC and therefore the actual losses are believed to be higher.

• Scams cause great emotional distress and trauma. Anyone who suspects they have given money or details to a scammer should talk to someone they trust or seek professional support.

How tractor scams work

Fake tractor website scams

Scammers create fake websites that look like genuine online shops selling agricultural machinery.

They may use sophisticated designs and layouts, photos and brand logos taken from other websites, a ‘.com.au’ domain name and even an Australian Business Number (ABN) taken from a legitimate business.

The websites often have a physical business address listed on the website which are vacant blocks or belong to another business.

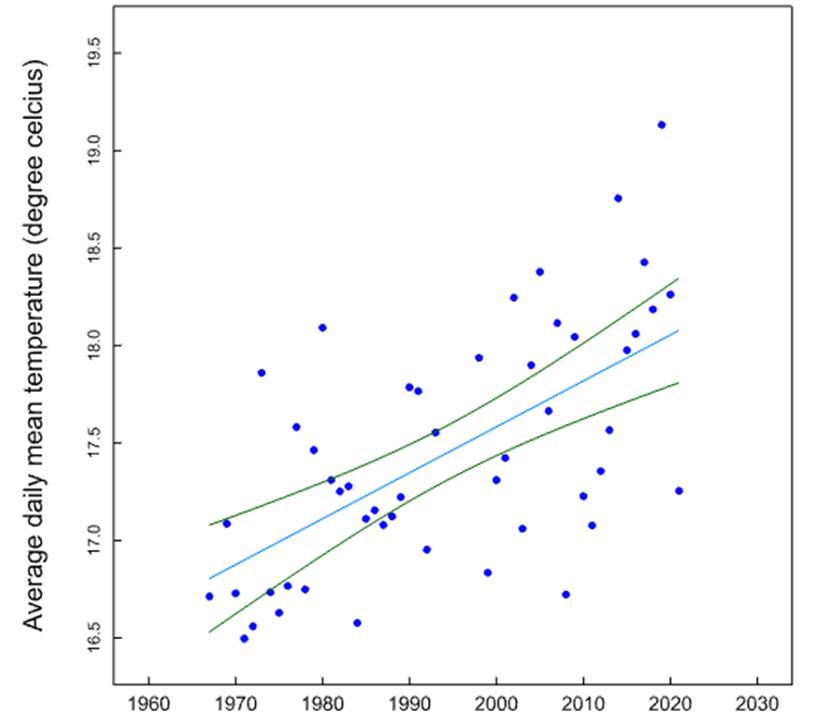

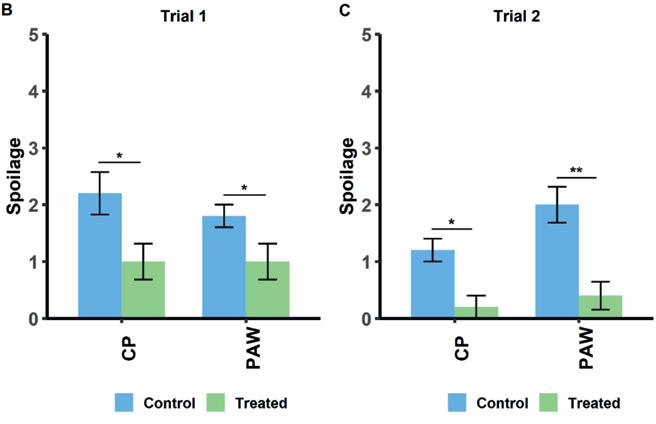

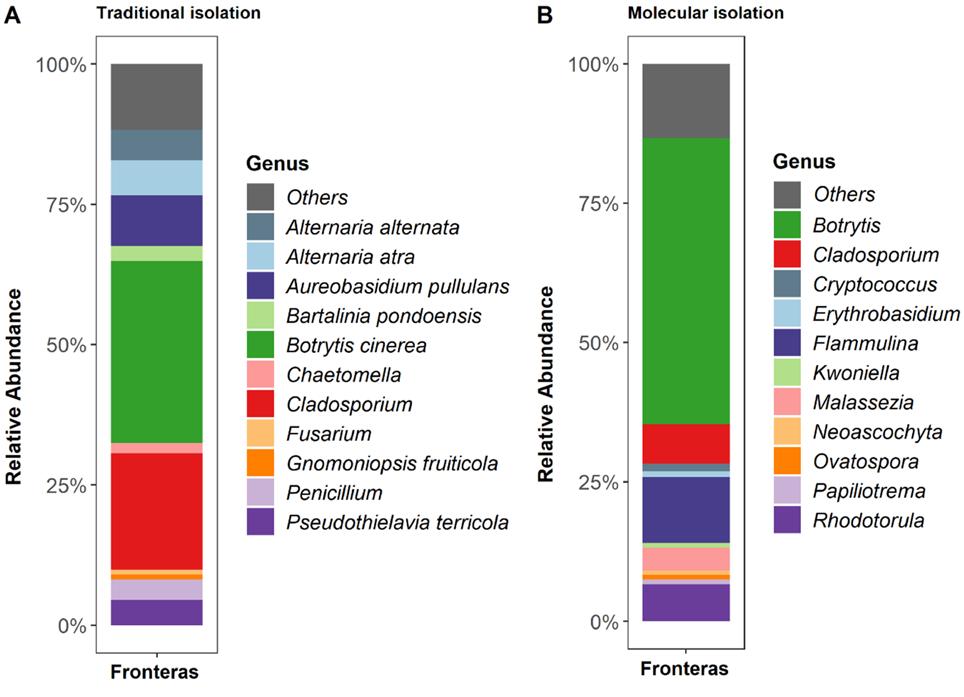

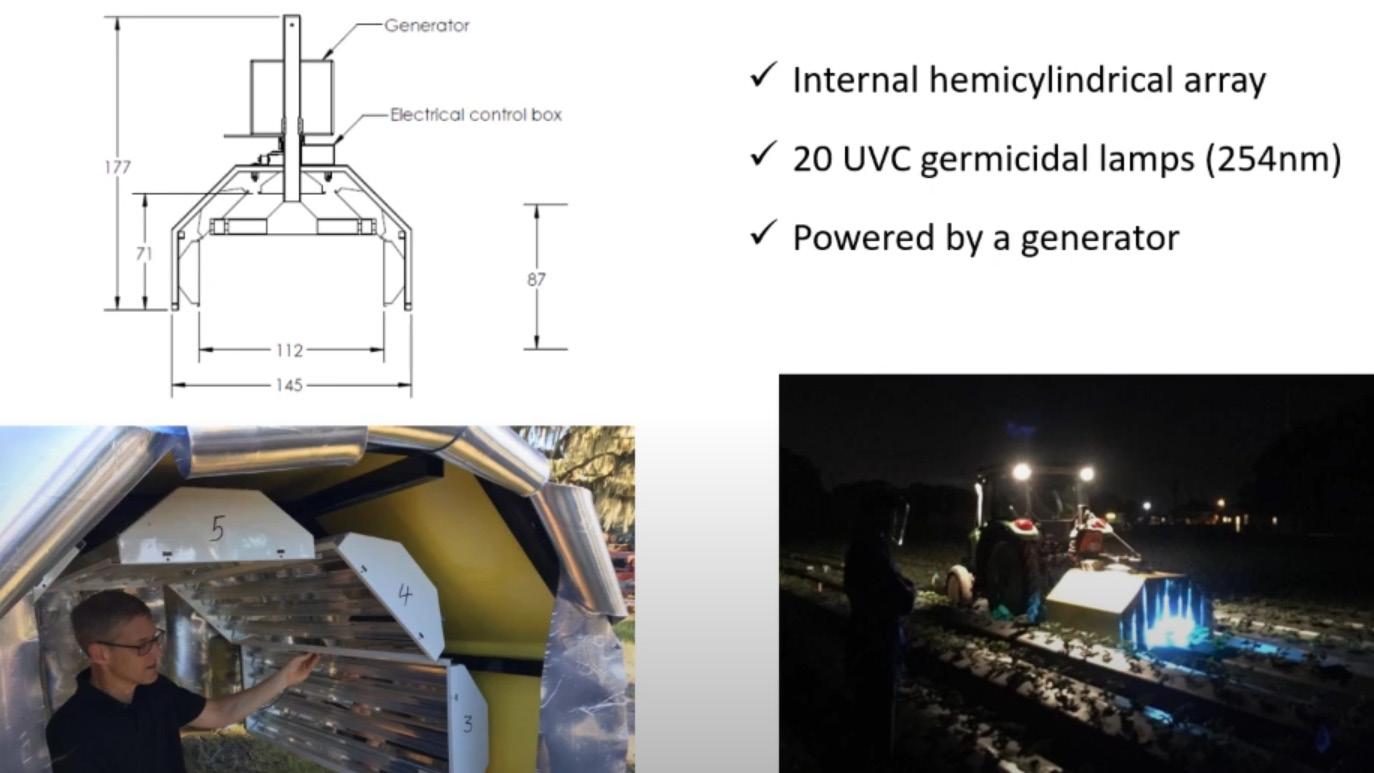

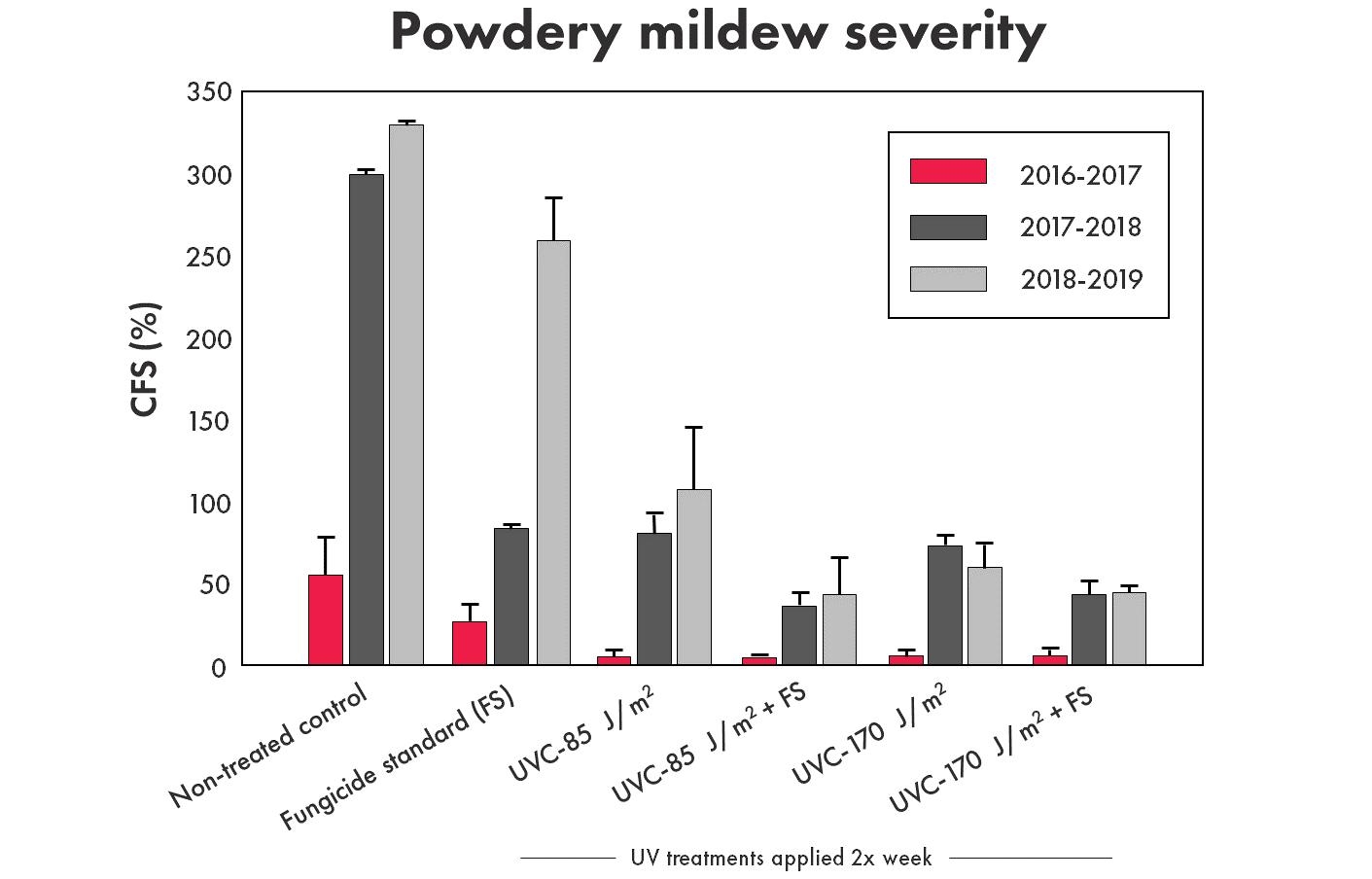

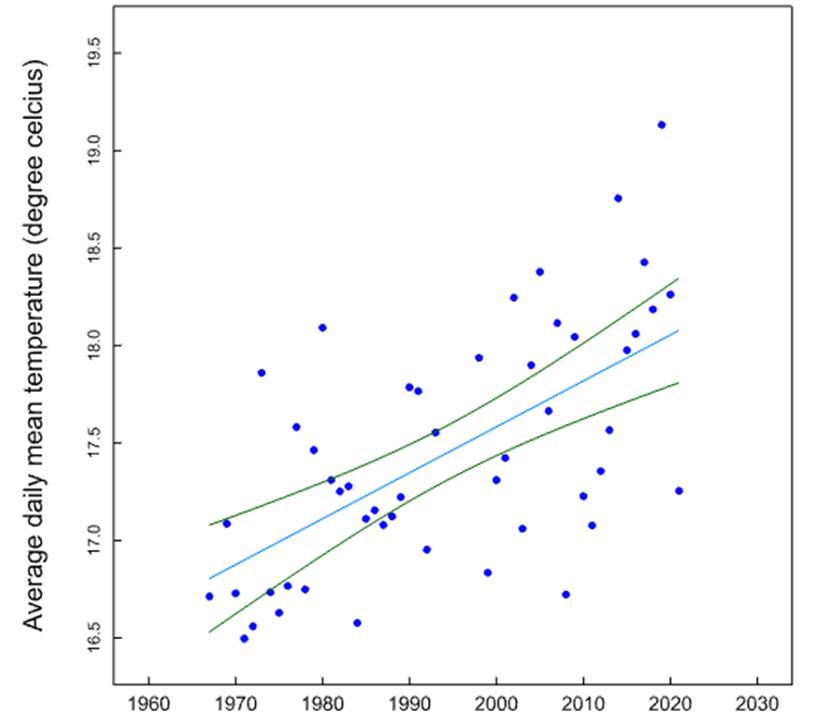

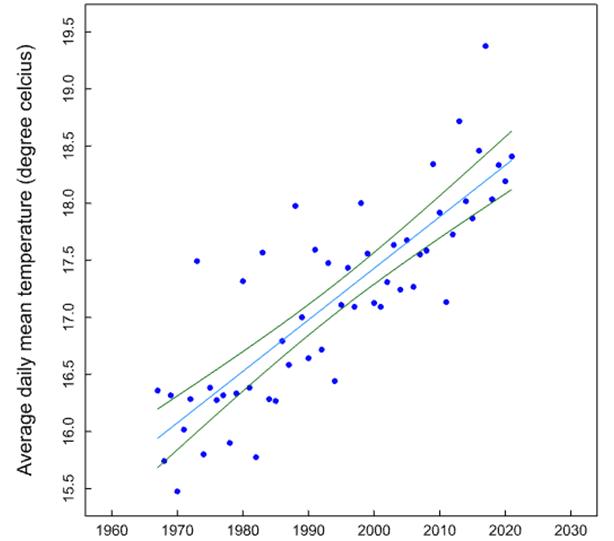

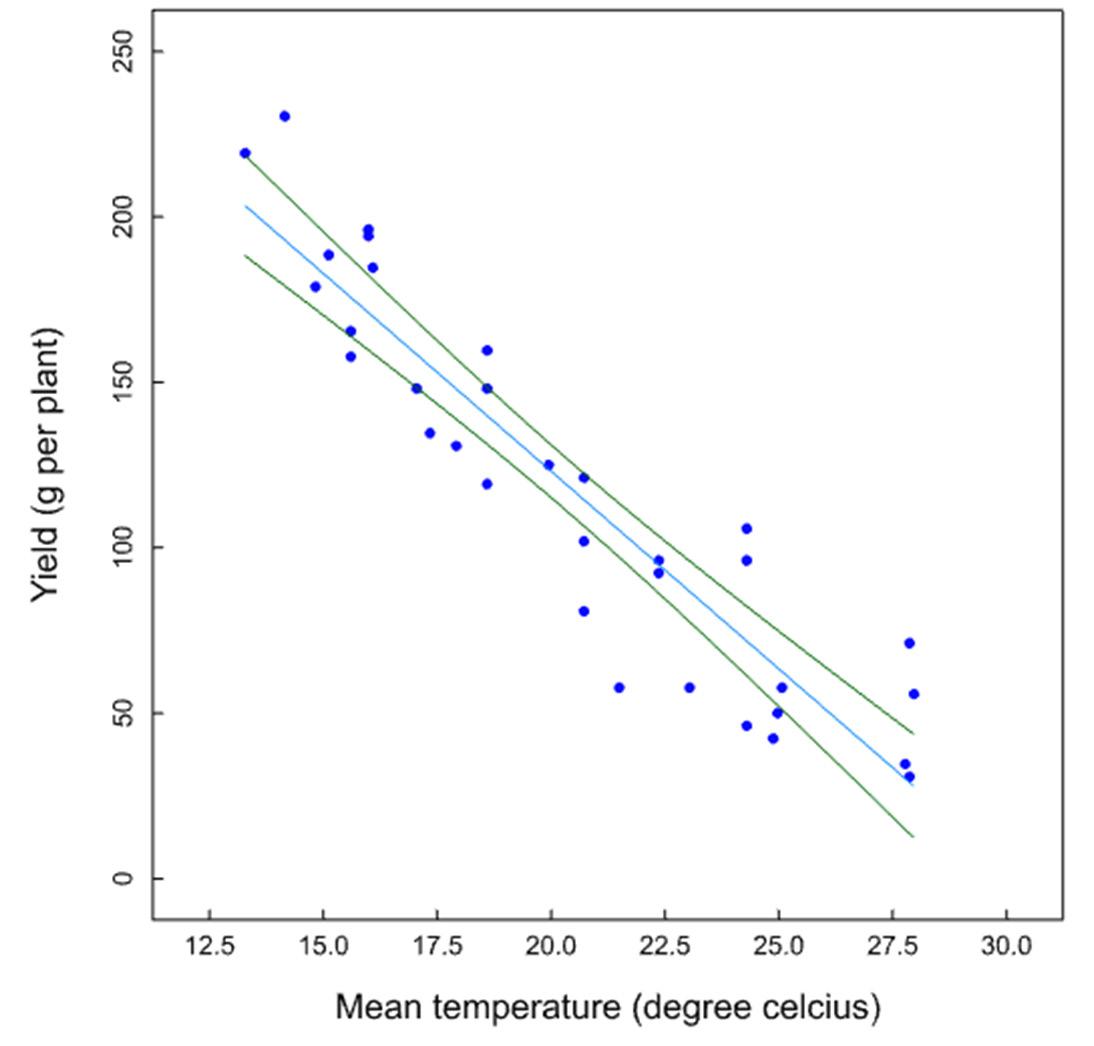

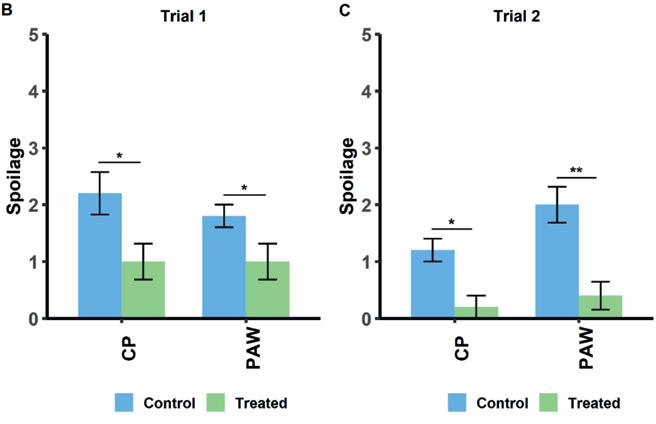

Between January 2021 and August 2022, the ACCC’s Scamwatch has received 533 reports about tractor and heavy machinery scams, including total losses of $2.6 million.