6 minute read

John Burns Realty Housing Outlook: The Stage is Set for a Strong 2021 in Orange County

Scot Wild

The Stage Is Set For A VP, John Burns Real Estate Consultant, So Cal Expert Strong 2021 In Orange County

At the outset of the COVID-19 pandemic, the Orange County housing market nearly ground to a halt. New home sales plummeted from more than 100 per week at the beginning of March to just 9 net sales in the last week of the month. With the economy in lockdown, Orange County had lost 260K jobs by April 2020. Some home builders walked away from land deals and cut staff as they prepared for a prolonged market downturn.

And then the housing market came roaring back. Many of the job losses proved to be temporary and concentrated on renter segments more than home buyers in Orange County. Weekly new home sales topped 100 again in September 2020. The new home community count dropped 21% year over year in Orange County as projects sold out faster than anticipated. Home builders are in fierce competition for land deals to refill their project pipelines.

We recently described this as a high-risk and highreward portion of the housing cycle. In this article we will examine some trends that present opportunities and risks for the Orange County housing market in 2021. Near-Term Drivers Of The Orange County Housing Market

Historically low rates are motivating current renters to buy their first home and mature buyer segments to lock a low rate on the homes they plan to retire in. New home communities targeting mature buyers could see a surge in sales as safety concerns related to the pandemic abate.

All-time low supply in the resale market. Buyers are often frustrated as they attempt to navigate an intensely competitive resale market. 1.1 months of supply in the Orange County resale market represents a 42% decline over the last 12 months. As supply dwindles, homes often sell above their asking prices and buyers are becoming fatigued with the process. One of the strongest advantages new home builders can offer right now is the promise that “we have a home for you.”

Strong demographics are driving demand for homes, namely the 21–40-year-old cohort, including the Sharers born in the 1980s who are in their prime home buying years and the 1990s Connectors in prime household formation years. Surging home equity is also fueling demand from move-up buyers.

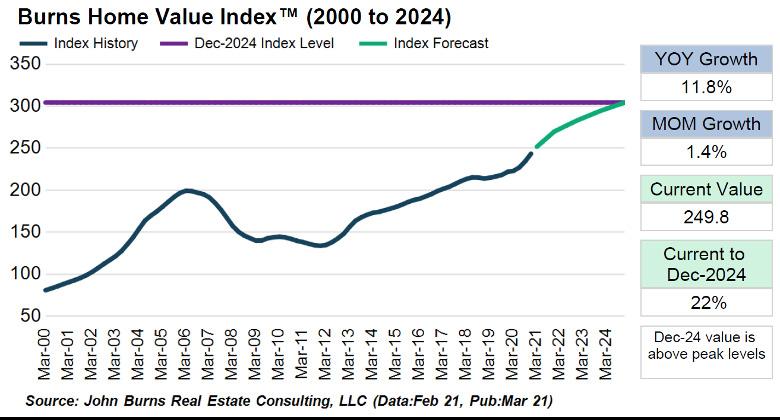

Low supply and strong demographics are pushing prices higher. The Burns Home Value Index™ (BHVI) provides our view of home value trends in existing single-family homes. Each month’s BHVI is based on an “electronic appraisal” of every home in the market, rather than just actual transactions, removing the influence of shifts in mix of home sales. The BHVI has increased 11.8% over the last 12 months in Orange County. We expect home values to increase by 10.9% in 2021.

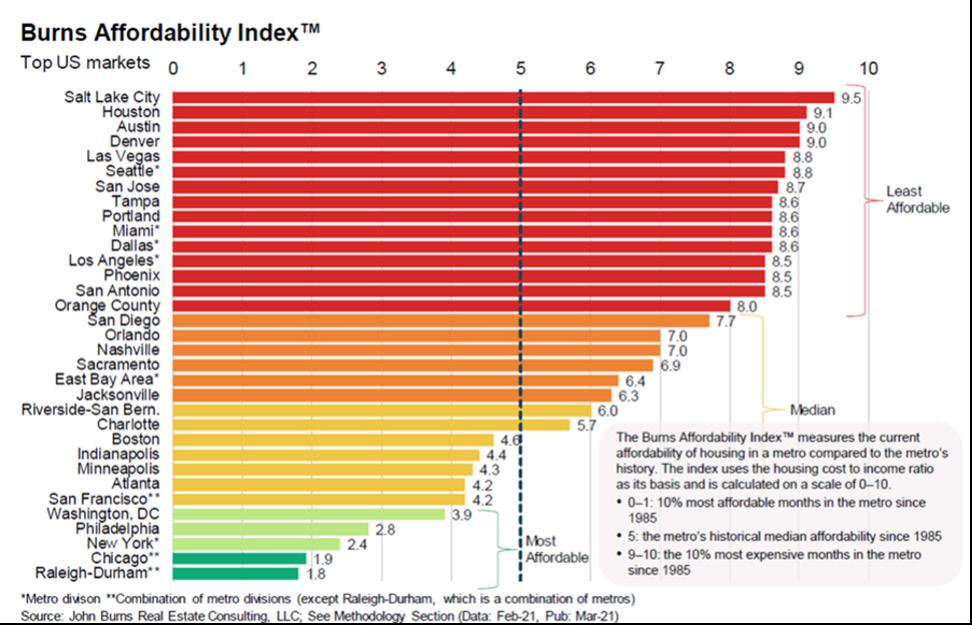

Surging home equity is fueling the move-up market. An all-time high stock market is boosting confidence to spend on a new homes and home improvements. A projected strong economic recovery (with the highest forecasted GDP growth in 15 years) will likely get stronger with significant government stimulus. Eroding Affordability. Affordability (monthly payments/income) conditions are now worse than usual in Orange County and most US markets— despite the historically low interest rates. The Burns Affordability Index compares a market to its own historical average affordability level, which is defined as the mid-point (5.0) on the scale shown below. Orange County is currently rated 8.0 in the least affordable tier. Mortgage interest rates are already trending upwards, and this should continue over the next few years. Price appreciation coupled with rising rates will make homes less affordable at all prices points if incomes do not keep pace.

Expect fewer international buyers. This is particularly impactful in Orange County, where buyers coming from China were driving sales for luxury homes more than in any other Southern California market. Some builders have already pivoted away from the luxury market to more affordable sectors targeting a broader demographic.

Some households are leaving high-cost California markets, including Orange County. This trend can be overstated in the media, but it is real. Families are fleeing to more affordable locations farther from the coast like the Inland Empire or to states with lower costs like Arizona, Texas, and Idaho.

All that said, Orange County remains an economic powerhouse and a place where people want to live— if they can afford to do so. Demand for homes will

Southern CaliforniaBUILDER

continue to outpace supply in Orange County. Builders who can provide homes at attainable prices will continue to find a huge pool of buyers waiting for them.

Orange County Is Poised For A Strong 2021. Here Are Some Strategies For Success:

Target first-time buyers with higher density product. First-time buyers are often considering resale homes built 30–40 years ago (or more) in Orange County. These homes are much less efficient and come with significant routine maintenance requirements. New homes offer greater energy efficiency, more sustainable building practices, and healthier in-home environments. New homes are also much easier to maintain, particularly attached homes, which is ideal for first-time buyers. Attainable pricing will overcome most objections regarding density, yard space, and parking.

Be nimble. Look at smaller projects in infill locations. Many of Orange County’s established suburban neighborhoods have seem little new home development recently. Get creative in where you look for land. Local planning agencies can often guide you to where they see opportunities for redevelopment.

Find a master planned community. Two Orange County master plans made our list of the Top-50 MPCs in the nation for 2020: Irvine Ranch (#14) and The Great Park-Irvine (#32). Rancho Mission Viejo should return to this list as they break open new phases in 2022 and 2023. Orange County master plans offer state-of-the-art community amenities and offer builders the opportunity to target a wide range of buyer segments, from entrylevel to age-qualified 55+.

Stay informed! Stay at the head of the pack by acknowledging risks and opportunities as they emerge. Get involved with the Orange County BIA! Sign up for JBREC’s newsletters at realestateconsulting.com and connect with one of our local experts.

Outdoor Dimensions would like to celebrate General William Lyon by honoring his many years of service to our country and industry. OUTDOOR DIMENSIONS

We are proud to have worked alongside both him and his company for many years

@OutdoorDimensions CSL# 1042246 714.578.9555

info@outdoordimensions.com OutdoorDimensions.com

Community Development Planning Specific Plans Model Homes Streetscapes Park Planning Athletic Field Planning Inclusive Playgrounds Skateparks