THE STATE OF MINING IN ONTARIO

> The evolving narrative of critical minerals

> The world of mining is changing

- UNLOCKING CANADA’S MINING POTENTIAL

- UNDERSTANDING INSURANCE DYNAMICS IN MINING

> The evolving narrative of critical minerals

> The world of mining is changing

- UNLOCKING CANADA’S MINING POTENTIAL

- UNDERSTANDING INSURANCE DYNAMICS IN MINING

MINING IN ONTARIO

21 Navigating challenges and embracing opportunities in 2025.

24 Top critical mining projects in Ontario.

29 Alamos Gold expands Ontario footprint with Magino mine acquisition.

31 Dynasty Gold expands Thundercloud project.

34 From green dreams to strategic imperatives: The evolving narrative of critical minerals.

ESG/INTERNATIONAL MINING

36 Energy transition brings mining beneficiation into focus: Who wins?

TECHNOLOGY, EQUIPMENT, AND MAINTENANCE

19 Optimizing ventilation systems for underground mines.

38 Artificial Intelligence: How computer vision is shaping more productive and sustainable mining.

41 Sustainability and tailings management: The role of control valves in sustainable mining.

43 A revolutionary new lubricant can prevent hydrogen wear.

48 Inertial navigation paves the way for resilient mining.

TRAINING AND WORKFORCE

51 Increasing employee retention with robotic demolition machines.

53 Securing the future of Canadian mining: Attracting and retaining talent in a changing landscape.

55 Pay attention: The world of mining is changing.

60 Measuring success from conveyor maintenance and safety training.

HISTORY OF MINING

57 Mining and the idea of Canada.

4 EDITORIAL | Trumpy with a chance of tariffs.

6 FAST NEWS | Updates from across the mining ecosystem.

10 LAW AND REGULATORY | Unlocking Canada’s mining potential: Strategies to attract investment in the sector.

14 MIN(E)D YOUR BUSINESS | Understanding insurance dynamics in mining.

16 MIN(E)D YOUR BUSINESS | Attracting investment into Canadian mining projects.

Tamer Elbokl, PhD

n another recent interview on CBC Radio’s Labrador Morning, I mentioned that I was not surprised to see Trump slap on tariffs on steel and aluminum, as tariffs have been a talking point for months. The forecast has been “Trumpy with a chance of tariffs” for a while. This is déjà vu from what happened in 2018. Since its election in November, this U.S. administration has been threatening tariffs on Canada, Mexico, and on so many other countries.

Tariffs on steel imports to the U.S. will “trickle down” the supply chain, impacting the mining sector in Canada. Canada is a major producer of iron ore and nickel (in Sudbury, Ont. and Labrador), which are major components in steel manufacturing, so the Canadian mining sector will eventually see some upheaval. The silver lining is to diversify our markets.

For the mining sector in Canada, uncertainty will dominate the forecast for the next few weeks. Following a short-lived standoff between the two allies, the U.S. and Canada have agreed to postpone the global imposition of 25% tariffs on each other’s imports for 30 days, as of Feb. 3, 2025.

For Ontario, mining is a cornerstone of the province’s economy and plays a pivotal role in Canada’s natural resources sector. Ontario is Canada’s largest producer of nonfuel minerals, accounting for approximately 25% of the country’s total mineral production. The province’s mining sector is at a critical juncture, with its success closely tied to U.S. trade policy. While the province has the resources and expertise to lead in critical mineral production, tariffs could undermine its competitive advantage, disrupt supply chains, and deter investment. Policymakers in both Canada and the U.S. must tread carefully, ensuring that trade disputes do not derail North America’s ambitions to build a secure and sustainable mining and manufacturing ecosystem.

Ontario’s mining industry will need to work closely with the federal government to push for exemptions or alternative trade agreements that safeguard its access to the U.S. market. Collaboration with American automakers and policymakers will also be key in reinforcing the importance of Ontario’s minerals in strengthening North America’s clean energy transition.

How can we alleviate the impact of tariffs on the mining sector in Canada and specifically Ontario? We need to adopt some proactive measures. The regulatory approval process for projects related to non-renewable natural resources should be led by the provinces and their regulatory bodies. Canada’s current regulatory approval processes for building large projects is a mix of overlapping federal and provincial oversight. Regulatory overlap creates uncertainty. Eliminating regulatory overlap is one way to improve efficiency. The federal government must respect that provinces are competent regulators and capable of ensuring environmental protection associated with development of their resources within their borders. In my opinion, the federal government should completely opt out of the mining permitting and regulatory processes. Read the law column on page 10 of this February/March issue for more insight.

Additionally, articles on pages 21 to 35 provide updates on mining in Ontario. Flip to pages 51 to 62 for articles on latest topics related to training and workforce in mining as well as history of mining in Canada.

If you are planning to attend the Prospectors and Developers Association of Canada (PDAC) 2025 convention in Toronto, Mar. 2-5, please visit our booth # 808 to pick up a hardcopy of this issue.

Finally, our April issue will tie-in BEVs, mine electrification, and de-carbonization. Editorial contributions can be sent to the Editor in Chief until Mar. 7, 2025.

FEBRUARY/MARCH 2025

Vol. 146 – No . 1

69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief

Dr. Tamer Elbokl telbokl@canadianminingjournal.com

News Editor Joseph Quesnel jquesnel@canadianminingjournal.com

Production Manager Jessica Jubb jjubb@northernminer.com

Manager of Product Distribution Allison Mein 416-510-6789 ext 3 amein@northernminergroup.com

Publisher & Sales

Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group Anthony Vaccaro

Established 1882 Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published nine times a year by The Northern Miner Group. TNM is located at 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3. Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods: Phone: 1-888-502-3456 ext 3; E-mail: amein@northernminergroup.com

Mail to: Allison Mein, 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 We acknowledge the financial support of the Government of Canada.

“MAXIMIZE SAFETY AND PRODUCTIVITY BY PROVIDING REAL-TIME AIR QUALITY DATA AND EMERGENCY MESSAGES ON A LARGE DISPLAY THAT INTEGRATES WITH ANY NETWORK.”

Eliminate guesswork and know with confidence when it’s safe to move about the mine.

SuperBrite™ Marquee Display provides fail-safe, real-time data by ensuring only current information is displayed – preventing unsafe old data from display when network is off-line. Easily integrated into wireless or Ethernet network and written to directly from any Vigilante AQS™ or Zephyr AQS™ stations, SCADA, DCS, PLC or HMI control system.

The Canadian Mining Journal is honouring the life of mining giant Don MacLean on Jan. 11, 2024. The Journal is pleased to hear MacLean was inducted into the Canadian Mining Hall of Fame in October 2024.

Don Maclean is best known for founding his namesake mobile equipment manufacturing company in 1973 and over the past five decades of growth and product development, as well as helping to revolutionize safety in the underground mining industry globally. His legacy of safety innovation and service will live on through the employees of the company who will continue his lifelong mission of making the underground environment a safer place for miners.

MacLean Engineering pioneered the design and production of the scissor bolter to enhance the safety and efficiency of underground mining. They addressed the need for reliable ground support in challenging environments. There’s also the rubber-tire Long Tom pneumatic drill, the Blockholer and various electric vehicles.

He was also a man of contrasts; country music yet classical, jazz and Piaf, too; mucking about in the barn; but also dressing up. He was known for sporting fedoras that would draw praise on the streets.

January 2025 saw two important milestone agreements regarding the Ring of Fire in the Far North of northwestern Ontario. The Ring of Fire is an area rich in mineral deposits about 540 km northeast of Thunder Bay.

Fifteen First Nation groups and the federal Impact Assessment Agency of Canada finalized terms of reference for the conduct of the regional assessment in the Ring of Fire Area.

This marks yet another announcement on the long journey in securing Indigenous support for developing the mineral-rich region.

This latest step involves the formation of a working group involving the Impact Assessment Agency of Canada and community members from 15 First Nations in the region. The working group will now submit its final report within 30 months from now. This represents two and a half calendar years of waiting some observers in the mining world are concerned about given long running delays and problems in moving ahead on the historic project.

The Ontario government also announced a historic investment in roads and electricity transmission infrastructure for First Nations in the Ring of Fire region.

The Ontario government and Aroland First Nation signed an agreement to invest in key infrastructure for the Ring of Fire area in the far reaches of Northern Ontario. The first part of the investment is for upgrading Anaconda and Painter Lake Roads, which are important connections on the road to the Ring of Fire, as well as major new investments in infrastructure and energy transmission in the region.

Thunder Gold intersected high-grade gold from surface over broad intervals at its Tower Mountain property in Ontario, sending shares to a 12-month high.

The company reported drill results from 13 shallow holes, totalling 753.5 metres. These were done on its flagship property, 50 km from Thunder Bay, from late November to early December 2024.

CEO Wes Hanson called the results “the most significant drill hole results at Tower Mountain in 50 years.” He underlined the potential to match grades found along the western Tower Mountain Intrusive Complex (TMIC) contact.

MAKE YOUR MINE MORE EFFICIENT AND PROFITABLE.

In today’s challenging mining environment, maximizing productivity and cutting costs are critical. The right lubricant choice is essential to your success. Petro-Canada Lubricants offers a comprehensive range of products, including PRODURO™, DURON™, HYDREX™, and our specialized greases and open gear lubricants, all designed to enhance effi ciency and reliability in off-road applications. Choose Petro-Canada Lubricants for superior performance and peace of mind.

Ready to take your operations to the next level? Challenge us to show you the savings! Contact the Petro-Canada Lubricants team today and unlock potential with our Cost Savings Calculator.

petrocanadalubricants.com

Nova Scotia may open the province to uranium mining given recent encouraging remarks from Nova Scotia Premier Tim Houston.

The province has maintained a moratorium on uranium mining since 1981. However, in response to concerns over the expected U.S. tariffs on Canadian goods, Premier Houston raised possibilities over local natural resource development. Nova Scotia has imposed a ban on uranium mining.

The Mining Association of Nova Scotia has been a long advocate for uranium mining in the province. Nova Scotia’s mining and quarrying industry employs 5500 Nova Scotians, mainly in rural areas. The premier has not explicitly said he will left the moratorium on uranium mining, but many are interpreting his willingness to re-visit resource bans as an invitation to re-evaluate uranium mining.

Delivering fit-for-purpose solutions across the entire project life cycle

We are a world leader, boasting decades of experience delivering fit-for-purpose solutions across the minerals and mining industry.

No matter your commodity, we are positioned to serve as your trusted advisors on the ground reducing your supply chain risk. We invest in the latest equipment, continual training and ensure industry requirements are met at the global, regional, and local level.

Fortuna Mining reported record production of precious metals for the fourth quarter and full year 2024 from its five operating mines abroad. For the full year of 2024, Fortuna produced a record 369,637 ounces of gold and 3.7M ounces of silver for a record 455,958 gold equivalent ounces, including lead and zinc by-products. Fortuna is a Canadian mid-tier producer of precious metals with mining assets abroad.

Fortuna also released ambitious exploration plans in 2025. The mining company has a total mineral exploration budget of $41.0 million for 2025, compared to an estimated $44.0 million invested in 2024. Brownfields represents 53 percent, and greenfield initiatives, including $8.3 million for Diamba Sud, represents 47 percent of this year’s budget.

Artemis Gold announced the successful completion of its first gold and silver pour at the Blackwater mine in British Columbia. The company has targeted commercial production in the second quarter of this year. In December 2024, Artemis postponed first gold to January 2025 due to delays in final commissioning of the wet plant. Issues with the control circuit configuration and a lack of vendor specialists during the holidays caused the delay.

BMO Capital Markets noted, “Yesterday’s first gold pour at Blackwater is a positive, if expected, milestone after holiday startup delays.”

“Targeting commercial production in Q2 2025, Artemis stands out as a new, sizeable mine with the potential to produce ~500,000 oz/year in a top jurisdiction.”

Kirkland Lake Discoveries identified extensive gold mineralization now that it has completed its fall 2024 drill program at the Hargreaves shaft and the Jo zone on the Goodfish-Kirana claim group. Drilling teams completed a total of five diamond drill holes aggregating at 1,187 metres. The properties are located near the town of Kirkland Lake in northeastern Ontario.

The gold producer announced it had intersected anomalous gold at both the Jo Zone and Hargreaves shaft with highlights including: Jo zone (KLD24-27): Extensive gold mineralization across 37 metres throughout the drill hole independent of rock type, including intervals of 4.5 metres at 0.621 g/t gold, 13.66 metres at 0.287 g/t gold, 1.2 metres at 3.82 g/t gold, 5.6 metres at 0.894 g/t gold, 5.23 metres at 1.035 g/t gold and 7.29 metres at 1.334 g/t gold.

The Centre for Excellence in Mining Innovation (CEMI) – a Sudbury-based research initiative dedicated to accelerating technological innovation within the mining sector – has signed an agreement with DIGITAL to collaborate on fostering technical innovation and securing global opportunities for Canada’s mining sector and for mining technologies. Digital is known as an innovative tech cluster that has been expanding its mining portfolio significantly since 2018.

The memorandum of understanding signed between the two organizations intends to enhance the competitiveness, environmental performance, and profitability of the mining sector within Canada.

By David Hunter, Bernard Roth,

Canada is facing an investment and productivity crisis, and its onerous and lengthy regulatory approval processes are compounding the problem. There is a common misconception that shortening regulatory approval process timelines must come at the expense of environmental oversights and affected Indigenous groups. Canadian regulatory approval processes can and should be implemented in a way that allows projects to proceed in a timely manner, without sacrificing necessary environmental requirements and Indigenous interests.

Canada’s regulatory approval processes have been negatively impacting investment because they create uncertainty for investors and negatively affect the financial viability of proposed major projects. Investors will pursue a project if the net present value (NPV) exceeds the cost, but the longer the project timeline stretches, the more the NPV is eroded by inflation and the opportunity costs of foregoing other investments. Consequently, the longer a project timeline stretches, the higher the required return on investment to justify the delay. In a competitive global economy, regulatory delay is a significant barrier to investment.

The harm caused by Canada’s regulatory approval processes is not a matter of conjecture, it is supported by data. The chart below demonstrates that investors view investing in Canada as higher risk than the U.S. and Australia, which are Canada’s major competitors for mining and oil and gas investments. This perceived uncertainty is being reflected by fewer dollars being invested. For example, Canada’s estimated global share of min-

ing investment has fallen precipitously. In 2015, Canada accounted for 12% of global mining investment but this figure nearly halved to 7% in 2023.

Economic theorists have understood the positive correlation between investment and productivity for a long time. When investment stalls, productivity suffers. Relative to the U.S., Canada is second to last amongst G7 countries when it comes to productivity decline in recent decades.

Further, Canada’s relatively stagnant mining industry appears to conflict with its commitments to decarbonize the economy. Canada is rich in many critical minerals necessary to build a robust low-carbon economy, including copper, manganese, platinum, uranium, lithium, cobalt, indium, tellurium, and rare earth elements (REEs). Fatih Birol, the executive director of the International Energy Agency (IEA), has suggested he prefers that Canada be a world leader in critical mineral production because “there is rule of law, there is transparency, and there is accountability of government.” The problem with the IEA is that it has also suggested that there should be no investment in new

oil and gas production to achieve net-zero. Canada’s federal regulatory process has been used to curtail investment in the development of Canada’s natural resources. This comes at a significant cost to Canada’s economy and productivity.

Canada’s current regulatory approval processes for building large projects is a mix of overlapping federal and provincial oversight. Regulatory overlap creates uncertainty. Eliminating regulatory overlap is one way to improve efficiency.

Over the past decade, the federal government has involved itself in the approvals process for major projects like mines. This needs to change. The federal government should accept that provinces have strong environmental assessment and protection regimes, and its intervention is not needed to ensure high environmental standards are met.

The Impact Assessment Act (IAA) is the federal government’s primary tool to assess the impacts of major projects. Enacted in 2019, the IAA was supposed to offer streamlined regulatory timelines while maintaining stringent environmental and social standards. However, it was challenged by the province of Alberta as being ultra vires federal powers. Alberta’s challenge was motivated by the federal government’s use of the IAA to try to force the adoption of caps on climate change emissions. In reference to the Impact Assessment Act, the Supreme Court of Canada (SCC) ruled against the federal government and held that most of the IAA was unconstitutional. The Supreme Court’s decision brought into question the federal government’s jurisdiction to impose emissions caps on industry in a province.

As a result of the SCC’s ruling, some changes to the IAA were enacted in June 2024. The IAA reference decision does not bar the federal government from designing environmental legislation but emphasizes that any contemplated federal environmental legislation must respect the division of powers under the constitution. However, constitutional litigation is unlikely to solve the problem because the problem is not a legal one; it is a political one. To borrow a western idiom, legislation can continue to be amended, and lawyers can argue about constitutional jurisdiction until the cows come home, but what is truly needed is an attitude adjustment that sees the federal government respect that provinces are competent regulators and capable of ensuring environmental protection associated with the development of their resources within their borders.

The regulatory approval process for projects related to non-renewable natural resources should be led by the provinces and their regulatory bodies. Regulatory bodies are specialized in particular areas of the law and have the expertise and institutional knowledge necessary to adjudicate regulatory approval processes. Provincial governments and their regulatory bodies can implement requirements that are as stringent as those of the federal government and its regulatory bodies. The issue damaging Canada’s ability to attract capital to develop its resources is not overly stringent or restrictive environmental or social requirements, it is the uncertainty created by duplication in regulation and the perception that at the federal level, Canada is not interested in developing some of its most signifi-

cant resources. Legislative changes and constitutional challenges are unlikely to be an answer to the problem because they just bring more delay and continue the uncertainty. Again, what is needed is a change in attitude. The regulatory approval processes can be efficient without jeopardizing Canada’s environmental and social goals. Continuous conflict between the federal and provincial governments is highly unproductive.

Through various iterations of legislative change over past 30 years, the federal government has always had the ability to defer to provincial regulatory processes and accept their results in the interests of providing timely decisions and regulatory certainty. The federal government has recently indicated that it wants to change its approach, to achieve these objectives, but only in relation to what it considers to be “clean growth projects.” To be effective in creating the certainty needed to attract investment in Canada’s mining industry, the federal government can not be selective in its efforts to streamline its regulatory process. Regulatory certainty requires that all provinces and projects be subject to the same process.

Nowhere is this regulatory inefficiency more apparent than in process to permit a new mine in Canada, which involves both federal and provincial regulators under the IAA and provincial environmental assessment acts, such as B.C.’s Environmental Assessment Act. The duplication of regulatory oversight across a broad range of social, ethical, cultural, and economic impacts, in addition to environmental, health, and safety considerations, has left Canada with a process that can extend to 15 years. Recent recognition of the importance of securing domestic sources for the critical minerals essential for technologies like electric vehicles, renewable energy systems, and advanced electronics has drawn much needed attention from political and industry leadership. Presently, the Mining Association of British Columbia (MABC) is advocating for a new permitting strategy aimed at reducing mine permitting timelines to seven years. A key element of MABC’s strategy is convening joint project tables to streamline and align federal and provincial permitting and authorization processes for designated projects. Recently, both the provincial New Democratic Party and the Conservative Party have made commitments to expedite B.C.’s mine permitting process, reflecting a growing consensus of the need for a more efficient and streamlined permitting approval processes.

The importance of Indigenous equity partnerships

Indigenous partners can be important to the success of major projects in Canada. Affected Indigenous groups can significantly delay the regulatory approval process, but partnering with them on project development can significantly expedite the regulatory approval process and advance economic reconciliation. Successful business operations in Canada depend on the ability to adapt to the evolving relationship between federal and provincial governments and Indigenous partners, including First Nations communities.

Economic reconciliation, broadly speaking, is an initiative to include Indigenous peoples, communities, and businesses in economic activities. In Alberta and B.C., many Indigenous

groups are working together with industry to develop large projects as equity partners. Mining projects are well-suited to achieving economic reconciliation because they are geographically confined, allowing for the identification of a limited number of the most affected Indigenous groups to become partners in development.

The reconciliation process remains a priority for the Canadian government, which has demonstrated a willingness to take significant steps to address the matter. Increasingly, First Nations’ communities are seeking equity ownership rather than jobs, training opportunities and profit-sharing traditionally offered through impact benefit agreements (IBAs). Equity ownership is increasingly viewed by Indigenous communities as representing a step towards true economic self-determination.

Canadian courts have found that First Nations’ communities have inherent rights to lands demonstrated to be part of their traditional territories; however, First Nations’ communities have historically faced challenges in monetizing these rights. Recent government programs, such as loan guarantees, are addressing this gap by enabling First Nations to access capital for equity investments. These measures are instrumental in ensuring they can participate fully in major projects in their territory as equity stakeholders.

In its 2024 budget, the Canadian federal government announced a pledge to establish and fund a national Indigenous loan guarantee program up to $5.0 billion through a newly formed, wholly owned subsidiary of the Canada Development Investment Corporation: the Canada Indigenous Loan Guarantee Corporation. This initiative aims to provide First Nations’ communities with the financial tools necessary to participate as equity stakeholders in major projects, with the intent of fostering economic reconciliation and enhancing regulatory certainty.

Similarly, B.C.’s three-year fiscal plan, published in 2024, highlights the importance of meaningful project involvement and ownership opportunities for First Nations’ communities. To support this, B.C. introduced the First Nations Equity Framework in 2024, intended to facilitate participation projects through various mechanisms, including equity loan guarantees.

The First Nations Equity Framework establishes a First Nations Equity Financing special account, initially funded with $19.0 million to address capacity needs and provincial program costs for various projects. Additionally, the B.C. government has authorized guarantees for equity loans, capped at $1.0 billion to help First Nations’ communities acquire equity stakes in priority projects. Other provinces with loan guarantee programs in place include Alberta, Saskatchewan, and Ontario, through the Alberta Indigenous Opportunities Corporation, the Saskatchewan Indigenous Investment Finance Corporation, and the Aboriginal Loan Guarantee Program, respectively.

Equity partnerships, often structured as limited partnerships or joint ventures, provide First Nations’ communities with greater control, equity, and financial benefits compared to traditional IBAs. Limited partnerships are often the preferred model owing to potential tax advantages under Section 87 of the Indian Act. For example, income earned by an Indigenous

partner through a limited partnership connected to reserve lands may be tax-exempt because of its flow-through income structure, which enhances the financial viability of such arrangements. This structure is particularly effective when part of the business is conducted on-reserve, leveraging the tax exemptions to maximize net benefits. By contrast, lump-sum payments or revenue sharing from IBAs are fully taxable, diminishing their overall value.

While equity partnerships present substantial opportunities, several challenges remain. A notable issue is the ambiguity surrounding the legal status of “bands” under Canadian law, which contributes to uncertainty in partnership arrangements. As part of the reconciliation process, certain First Nations’ communities now possess the legal authority to exercise ownership over traditional lands, grant land rights and licences, manage natural resources and enact laws on those lands.

When pursuing Indigenous equity partnerships, one of the most difficult issues is to identify the groups to partner with. Project equity can be diluted, along with its effectiveness, if participation is too broad. This is a major challenge to linear infrastructure projects that can affect dozens of groups but is far less of an issue for mining projects that are able to be far more focused in their partnership arrangements. Mining projects can more realistically use economic reconciliation by adding equity to the benefits they offer to achieve informed consent from the most affected groups.

Ultimately, equity partnerships with Indigenous groups represent a valuable approach to resource development, combining economic reconciliation with long-term financial benefits and enhanced project certainty. By addressing challenges such as regulatory overlaps and providing robust financial support mechanisms, these partnerships can significantly advance Canada’s goals for inclusive growth and sustainable development.

Canada’s investment and productivity crises are being compounded by inefficient regulatory approval processes for major projects. Investors are wary of investing in Canada because there is too much uncertainty regarding project approvals and timelines relative to other comparable jurisdictions. As timelines increase, the economic viability of projects decreases, and investment dwindles. There are two primary changes that can make Canada more competitive internationally. First, the federal government needs to accept that provinces and their regulatory bodies can ensure the protection of the environment in the development of their natural resources. Second, project proponents can pursue Indigenous equity partnerships as a tool to both smooth the regulatory approval process and advance economic reconciliation.

David Hunter is a partner in Dentons Canada LLP’s corporate group. Bernard Roth is a partner in Dentons Canada LLP’s energy regulation group. Mary Su is an associate in Dentons Canada LLP’s corporate group. The authors would like to thank articling student, Ben Kriwokon, for his significant contribution to this article.

Mining incidents that capture headlines tend to cause an immediate reaction within the insurance industry, leading to proposed coverage changes that impact mining companies during their next insurance renewal cycle. Current trending topics shaping this landscape include business interruption volatility, accurate property values, waiting periods, heap leach and tailing facilities, underground exposure, strikes, riots, civil commotion, and malicious damage coverage.

Commodity price cycles are an area of concern for insurers in mining. The fluctuating exposure makes it difficult to determine appropriate premiums. Insurers do not want to be in a position of deploying capital at a fixed premium only to have the business interruption exposure double six months later because of a higher commodity price — without receiving adequate premium for the increased exposure that they are now at risk for. As such, although business interruption volatility and commodity price caps are not new to the mining industry, insurers are now pushing to have at least one of them included in the policy wording.

Mining companies should be reviewing the commodity prices

reported on the business interruption worksheets they provided to insurers as part of the underwriting submission, particularly if there is a business interruption volatility clause on the property and business interruption policy. A business interruption volatility clause applies a cap, typically a percentage, to the declared business interruption values either on a monthly or annual basis or both.

Mining companies should stress test the business interruption volatility percentage/commodity cap applied to their policy to ensure it is within their company’s risk appetite. If the insured requires a higher cap, this should be raised with their insurance broker to discuss with the markets who can provide options with the applicable premium associated with the increased coverage, and vice versa if a lower cap is required.

Another area of concern for insurers has been the accuracy of declared property values. This being due to a mix of inflation and insurers realizing losses that were higher than expected because replacement costs were higher than those declared by companies in their statement of values. As a result, insurers began pushing for margin clauses to be added to property policies and requiring updated property appraisals.

A margin clause limits the amount recoverable from a loss to a specific percentage of the property values declared at policy

inception. The intent of this clause is like a co-insurance clause where the insurers want the declared values to be as accurate as possible. If a mining company has had a recent property appraisal and has continued to apply credible indexes to their declared values, then typically a margin clause can be avoided.

The application of business interruption waiting period deductibles varies from policy to policy. Mining companies should be reviewing these thoroughly to ensure they understand and agree with what their company has accepted as risk retention on their balance sheet. For example, some waiting period language requires mining companies to deplete their inventory or stockpile prior to the commencement of the waiting period.

From some insurer’s perspective, once the inventory has been depleted that is when the business loss starts. However, from a mining company’s perspective that inventory or stockpile has a purpose, potentially for blending or to cover a production outage that is due to a turnaround.

If the mining company uses the stockpile during the business interruption waiting period, is this covered under the insurance policy? How is it credited in the insurance claim? Is the production cost to build the inventory back to where it was prior to the loss covered?

These are discussions mining companies should be having with their insurance broker prior to a loss to ensure there is understanding of how the policy responds and if changes to the policy wording are required.

The Çöpler mine disaster in Türkiye (2024), where a landslide occurred on a heap leach pad, has renewed insurer focus on these structures. Heap leaching, widely used in mining, involves stacking low-grade ore or waste material for extraction. While cost-effective, these facilities present unique risks because of their reliance on structural integrity, environmental safeguards, and effective governance.

Prior to offering any substantial limits for heap leach pads, insurers are required to review documentation, such as up to date third party engineering reports, including any recommendations and the mining company’s response to those recommendations and action plans, governance practices, safety measures, and technical guidelines.

A similar approach is applied to tailings management facilities, following several failures over recent years. Whether it be for property and business interruption coverage or environmental liability coverage, insurers need sufficient documentation to provide them with comfort surrounding the risk before they deploy any meaningful capacity.

As a result of claims history and the higher risk exposure, underground insurance coverage for mining operations is often difficult to secure and is typically subject to sub-limits when obtained. Coverage for underground floods, particularly for mines that are situated under a sizable water table, comes at a high premium cost if insurers are willing to offer it at all. To achieve any meaningful property and business interruption capacity, mining companies must provide sufficient documentation demonstrating best-in-class operations. Key evidence includes ground control procedures, maintenance plans, fire protection measures, redundancy or spare capacity for

critical equipment (notably de-watering systems), capital expenditures, and third-party engineering reviews.

Historically, strikes, riots, civil commotion, malicious damage, and terrorism coverage was offered under a property and business interruption insurance policy (typically with a sublimit). However, the recent increase in incidents and claims has prompted reinsurers to exclude these risks from property treaties. This has led to insurers removing such coverage from property and business interruption policies. For mining companies seeking protection, stand-alone coverage is available through the terrorism and political violence market. This market offers broader coverage than was previously provided under standard property and business interruption policies.

The Canadian mining insurance market is becoming more favourable for property, machinery breakdown, and business interruption coverage, as well as claims-free risks. There are new markets entering the mining space and increased capacity being offered by markets who have been long term players.

Canada is home to world-class mining operations with some of the highest standards in safety and environmental protection, and this continues to inspire confidence among insurers. If a Canadian mining company has operations outside of Canada, it should evidence to insurers that Canadian standards are also being applied to their mines abroad. Insurers tend to approach risks outside of Canada and the U.S. with caution because of different levels of mining standards.

Thorough, up-to-date documentation — particularly thirdparty engineering reports — is key to achieving meaningful mining coverage. Companies are advised to provide a comprehensive underwriting package well in advance of renewal (60 to 90 days before the policy renewal date).

In the unfortunate instance when a claim does occur, providing notice to the insurers as soon as it is evident that there may be an insurance claim is key to starting a positive claims process. This allows insurers time to properly respond and send adjusters to the location of the incident to gather relevant information to support the claim. Mining companies should develop a factual timeline of the events leading up to the claim, a root cause analysis of the incident, and a timeline of events that followed the loss. This factual storyline should strengthen a mining company’s position when negotiating a claim settlement.

Insurance is a relationship-driven industry. Mining companies should prioritize in-person meetings during renewal cycles and throughout the year to build rapport with insurers. Claims discussions typically go more smoothly when there has been rapport built between the individuals at the table, and with both parties wanting to continue the relationship they have developed over the years. Given the small size of the mining insurance community, maintaining strong ties with brokers, adjusters, risk managers, and service providers is fundamental to successful placements and claims handling.

As senior vice-president of risk management, Katherine Dawal brings her risk management expertise to the Complex Risk Solutions Group of NFP in Canada, with a specialization in mining.

By

With the globalization of investment dollars, the regulatory framework for a mineral exploration or mining project plays a key factor in the analysis both foreign and domestic investors make: Can a project get off the ground? Will permits be obtainable on a timely basis or at all? Who can object and what does that mean? And, perhaps most importantly, will the process be predictable? A regulatory system that functions as a patchwork as opposed to being harmonized lacks certainty and risks alienating capital.

“If you cannot grow it, you have to mine it” — the reality is simple, but the regulations are not.

Canada and its provinces acknowledge the importance of predictability in creating a well-functioning and regulated mining sector, including by publishing high-level strategies on critical mineral projects in their respective jurisdictions. The implementation of these government strategies requires significant action to achieve the desired results in a timely manner. This article considers the current regulatory and legal issues in Canada that may impact the ability of companies conducting mineral exploration, development, or production activities to attract investment.

Provinces govern exploration and extraction of mineral resources — they have their own legislation relating to operating and permitting mines, staking claims, and conducting other mineral exploration and development activities, and are generally the jurisdictional level which regulates business. All provinces other than Prince Edward Island further have developed strategies related to critical minerals, though some are clearly more welcoming than others of projects.

Saskatchewan has rich deposits of potash and uranium, along with 27 of the 34 critical minerals identified by the government of Canada, as well as gold. The provincial government has strongly supported the increase in exploration, development, and production, and specifically has set a goal to account for 15% of Canadian mineral exploration spending and double the number of critical minerals being produced by 2030. A 2023 survey of mining companies by the Fraser Institute indicated that Saskatchewan, followed by Quebec and then Manitoba, are the top Canadian jurisdictions for investment. Similarly, when assessing policy factors alone, Saskatchewan came out on top. British Columbia, discussed below, scored among the lowest of any Canadian jurisdiction. Saskatchewan is a jurisdiction that has been vocal about its priorities in promoting mineral projects, and both the industry and the investment community have clearly listened.

While well-known as a leading oil and gas producer, Alberta, like the rest of Canada, has deposits of critical minerals, including those produced as byproducts rather than targeted minerals. At present, there are no critical minerals mines in Alberta; however, the province has established the Minerals Strategy and Action Plan to enhance its profile as a possible producer and supplier of critical minerals on the world stage. One of Alberta’s priorities has been the establishment of more publicly available geoscientific information to attract investments by providing pre-exploration information. Further, Alberta identified the need for clarity and predictability when it comes to regulation and is attempting to streamline laws in this space through the Mineral Resource Development Act, which, among other things, has given authority to the Alberta Energy Regulator over minerals just as it did over oil, gas, and coal.

Ontario and Quebec have standing policies related to development of minerals and specifically critical and strategic minerals, and have, as discussed below, enticed exploration activities through tax credits. Ontario and the federal government have attempted to unlock the opportunity that the Ring of Fire region holds, but advancing projects in this area is complex, and has so far proven elusive. Ontario has an existing geological dataset that is publicly available to assist with pre-exploration activities, and Quebec is not only enhancing its geoscientific data but has also noted that it plans to use technology to make the dataset more meaningful. Quebec has noted a priority on acquiring new geoscientific knowledge and information as key to supporting exploration and specifically outlines that its data indicates that every dollar invested in such knowledge generates an average of five dollars in exploration work, in addition to reducing the risks for mineral exploration companies. Quebec has signalled its willingness to prioritize investment in the natural resources sector by promoting exploration, development, and production activities, with visible success, and establishing provincial tax credits for Quebec taxpayers on critical minerals exploration in the province. For context, Ontario currently boasts 36 active mining operations, and B.C. has 25 operating mines or quarries, while Quebec’s government notes that there are approximately 200 active mines, quarries, and sandpits located in the province, which include 20 metal mines.

B.C. published its “Phase 1” critical minerals strategy in January 2024, highlighting key priority areas, including infrastructure development. Development projects like the North Coast Transmission Line and Northwest B.C. Highway Corridor Improvements Project are needed to support critical mineral development and to enable electrification of mining projects in line with the province’s CleanBC plan. The province has also been focused on ensuring that the administration of the Mineral Tenure Act (MTA) is in line with its duty to consult. In September 2023, the Supreme Court of British Columbia held that the province’s online staking system for mineral claims was contrary to the province’s duty to consult Indigenous groups when registering mineral claims under the MTA within their traditional territories, which has the potential to impact Indigenous rights prior to any consultation occurring. While the MTA was constitutional, the court found that the administration of the tenure system was not. As such, the court sus-

pended its declaration for 18 months to allow the design of a system for the registration of claims. On January 7, 2025, the province announced its draft Mineral Claims Consultation Framework, designed to address the court order. Under the new framework, mineral claims will not be automatically registered on application but instead will be subject to a prior consultation process by the provincial government with potentially affected First Nations. Claim registrations may be subject to conditions or rejection based on the consultation process. The framework remains subject to several questions, including what protections there will be, if any, related to the intellectual property of explorers and miners, who will be obligated to disclose their claim areas prior to having any rights to the mineral claims or the land under which they exist. The province is also committed to modernising the MTA in line with the United Nations Declaration on the Rights of Indigenous People. The government has stated that it intends to engage with industry and First Nations regarding the modernization.

While mining activities are regulated at the provincial level, the federal regulatory environment is complex and includes Canada’s import and export laws (both generally and specifically for certain mined materials, such as the Import of Rough Diamonds Act), transportation laws, the environmental protection regime, which goes beyond the impact assessment process and includes navigable waters legislation, fisheries, migratory birds, and other areas. Beyond navigating the litany of regulations that might apply to a mining project, a significant source of uncertainty introduced because of this regulatory approach is uncertainty of timing — in short, delays.

These delays are exacerbated when federal and provincial processes are not harmonized, including with respect to the environmental assessment processes. While Canada and the B.C. are party to the Impact Assessment Cooperation Agreement between Canada and B.C., not all provinces have thus far entered into such cooperation agreements. Addressing parallel permitting requirements with environmental assessments continues to be a challenge, with duplication and inefficiencies common issues.

The length of time it takes to move through the review process can take 12 to 15 years, and the Minister of Energy and Natural Resources has noted that he believes it can be reduced to five, through conducting reviews for various permits concurrently instead of consecutively, increasing staffing to reduce backlogs, and supporting the development of infrastructure. Should the political willpower to achieve this timeline continue to exist, investors can hope for more efficient returns as projects would be able to become revenue generating much faster.

Since 2009, with the adoption of a national security regime, the federal government has used its authority under the Investment Canada Act (ICA) to review, alter, or prevent transactions that it views as injurious (or potentially injurious) to Canada’s national security. In 2022, the federal government put miners who rely on investments from China on edge, with the forced divestiture of three minority investments in Canadian companies involved in lithium mineral projects, two of whom had no projects in

Canada, which were held by Chinese investors. It appears that each investor may have been closely tied to, subject to influence from, or compellable to comply with extrajudicial direction from the People’s Republic of China (PRC). While the federal government never explicitly alleged publicly that these investors have any connections to the PRC, the government’s statement announcing these national security decisions included a direct electronic hyperlink to the government’s Critical Minerals Policy, which only applies to SOEs and investors that could be influenced or compelled by foreign governments.

Over the past several years, the federal government has refined its position on investment from China as well as increased its powers more generally through amendments to the ICA, which effectively allow the imposition of interim mitigation measures while a review is ongoing and will require pre-closing filings for investments in certain enumerated sectors, which we expect will include operations related to “critical minerals.” A pattern has emerged of lengthy reviews that can be well more than the 200-day period provided for in the ICA, and failures of deals either because of the length of time or possibly the requirements for approval being floated by government officials during their discussions with the applicants. This trend includes Solaris Resources Inc. abandoning its prospective $130 million minority investment by Zijin Mining Group, which a cynical observer might assume at least partially informed Solaris’ decision to exit Canada and relocate to Switzerland. A recent successful transaction, being Paladin Energy’s $1.14 billion takeover of Fission Uranium, demonstrates the circumstances in which overseas buyers with ties to China might be approved. Reuters reports that Paladin, an Australian company holding a Namibian project that was partially financed through an investment from a Chinese company, agreed not to use Chinese sourced finance to fund the project, or sell the uranium directly or indirectly to any Chinese customer other than China General Nuclear Power Group. Similarly, Canada’s approval of the sale of Pan American Silver’s La Arena project in Peru to a subsidiary of Zijin Mining Group was in part predicated on an agreement where the intention is to supply North American markets with the copper concentrate that will be produced.

Attracting Chinese or state sourced financing for Canadian companies will remain challenging for the foreseeable future. Investors will need to engage in a review process that may take seven to nine months, or potentially longer, and enter Westernfriendly restrictions on future sales and operations, while maintaining a Canadian decision-making structure.

Where Canada has been able to promote mining industry investments in an effective way, it has done so by promoting domestic capital through flow-through financing options, which allow tax deductions for certain exploration expenses incurred by mining companies to be transferred to investors, thereby reducing the real dollar cost of the investment. In addition to the flow-through deductions, the mineral exploration tax credit

(METC) provides investors with an added 15% non-refundable tax credit for early exploration, which is deductible from taxes payable. Other measures include a critical mineral exploration tax credit (CMETC) which effectively increases the METC tax credit to 30% if the company in question is primarily exploring for designated critical minerals, including copper, lithium, and nickel, and a clean technology manufacturing investment tax credit, which applied to investments in eligible property used in critical mineral extraction and processing.

In addition, the provinces may offer additional tax credits which apply to provincial income tax, and Quebec notably allows investors to deduct up to 120% of the cost of certain exploration expenditures, and Ontario has an Ontario focused flow-through share tax credit for mineral exploration projects in Ontario which provides a 5% credit.

Importantly, the METC and CMETC are not permanent features — the METC is currently slated to expire on March 31, 2025, and the CMETC is currently slated to expire on March 31, 2027.

Canada and its provinces, as jurisdictions for investment, have identified the priority areas and laws that would make it more attractive for mining investors, specifically policies aimed at increasing data available to exploration companies, incentivizing investment through the tax system, and reducing regulatory delay in the regulatory process for development stage and production stage mineral projects. The actual implementation of those policies is mixed. At present, different provinces are at different stages in creating a predictable environment for mining capital, and the federal government has not committed to permanent tax incentives for domestic capital, or found a replacement for the China-based capital that it has rejected as forming part of the funding needed for domestic critical minerals projects. Companies seeking to attract investors need to be realistic about the risks involved on a jurisdictional level, which vary based on both the province or territory the project is based in and on what the anticipated funding sources are. For exploration level projects seeking domestic capital, Canada’s flowthrough regime provides attractive options. For other projects, Saskatchewan’s objectives in aggressively increasing the number of projects, or Quebec’s history of shepherding projects from exploration through to production, might create attractive conditions for foreign investors (from the U.S. or the E.U.) wanting to take advantage of the stability of those jurisdictions in comparison to other international sources of minerals.

Mining is both Canada’s history and future. The competitiveness of our industry for investment will be tied to efficient regulation and a tax system that incentivizes exploration, and at present, there are some successes but many more opportunities to enhance mining activities in Canada.

Sasa Jarvis is a partner, mining, capital markets & securities; Cory Kent is an office management partner, based in Vancouver; and Sharon Singh is a partner and co-head of environment and Indigenous at McMillan LLP.

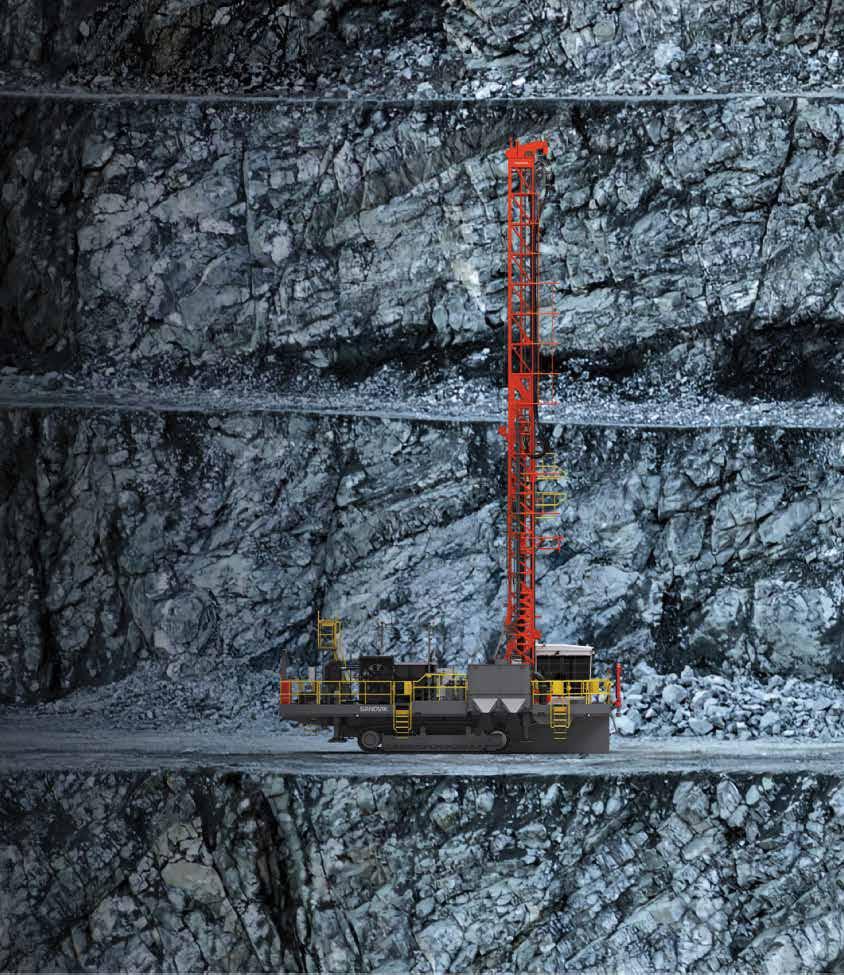

An underground mine’s ventilation system is an intricate series of drifts and raises connected to a main backbone designed to deliver fresh air throughout the mine while safely exhausting contaminated air to the surface. As mines expand deeper underground and further laterally, the ventilation system must work even harder to push fresh air to where it is needed. This increased demand could lead to higher costs — whether from installing larger fans, adding more equipment, or perhaps constructing a new vent raise, which could easily range from $200 to $300 million. With operational costs under constant scrutiny, mining companies are looking for smarter, more cost-effective solutions. Implementing ventilation control strategies offers a viable option for reducing energy consumption without compromising air quality. Given that ventilation accounts for roughly 50% of an underground mine’s overall energy consumption, implementing the right strategies could extend the system’s capacity, ensuring fresh air where it is required, essentially maximizing efficiency, and making the most of existing infrastructure.

Three key strategies for optimizing mine ventilation

Controlling fresh and exhaust air fans efficiently can significantly improve ventilation performance and reduce costs. Here

are three key strategies:

1) Scheduling: Fresh air requirements during regular operations are generally based on mobile diesel equipment airflow requirements or heating and cooling conditions. However, when blasting occurs, additional contaminants enter the airflow, requiring a clearing period that forces personnel to remain on the surface for two or more hours, cutting into valuable production time. By strategically scheduling and increasing

main fan airflow using variable speed drives (VSD s) on the main surface fans and remotely controlled starters on auxiliary fans, the blast clearing period can be reduced by up to 50%. This allows personnel to return underground sooner and resume mining operations more quickly.

2) Telemetry: Equipping personnel and mobile equipment with radio-frequency identification (RFID) tags allows for realtime tracking of underground activity per location by control room operators. These tags communicate via wireless signals, requiring additional

then provide the precise or general tag location, allowing auxiliary fans, when equipped with normal starters, two-speed starters or, in some cases, VSDs, to adjust airflow based on equipment type or operational needs in specific headings.

3) Environmental monitoring: Installing sensors throughout the underground mine to track airflow, temperature, and parts per million (ppm) concentrations from contaminants produced by diesel or other equipment enhances ventilation control. Regulations dictate airflow requirements based on diesel equipment horsepower and the presence of contaminants such as carbon monoxide (CO), diesel particulate matter (DPM), nitrogen oxides (NOx) and other hazardous gases. By monitoring air quality continuously, ventilation systems could be programmed to increase fresh air flow automatically when hazardous gases reach critical levels, ensuring a safer work environment.

No matter which ventilation control strategy is implemented, investing in automation enhances worker health and safety while optimizing infrastructure and equipment. The capital cost must be weighed carefully against potential energy savings, the fresh air requirements of different mine areas, production impacts, and the projected end-of-mine life.

Depending on the selected strategies, additional expertise in ventilation or automation may be required to support system upgrades.

Before implementing ventilation automation, a comprehensive assessment of current mining operations and infrastructure is essential to determine feasibility. Key factors to consider include the following:

Energy consumption: Estimating the ventilation system’s current energy use based on the total fan horsepower.

Mine plan: Evaluating long-term development leading to endof-mine life.

Operational schedules: Reviewing shift changes and blasting schedules to identify efficiency opportunities.

Ventilation model: Ensuring fresh air is available when and where it is needed.

Integrating ventilation control strategies is a proven way to lower operating costs, extend equipment efficiency, and gain deeper insights into system performance. It also enhances health and safety by reducing hazardous contaminants and improving real-time tracking of personnel and equipment using telemetry.

By taking a strategic approach, mining companies can achieve a more efficient, cost-effective, and safer underground environment.

Mark Lafontaine is BBA’s Sudbury office director.

ince joining the Ontario Mining Association (OMA) in the autumn of 2024 as president, I have had some time to reflect on its remarkable century-long commitment to bolstering the province’s mining industry. What strikes me is that we find ourselves at an inflection point in 2025 — one marked by unprecedented geopolitical and market challenges, as well as once-in-a-generation opportunities.

Factors such as rising global conflicts, post-pandemic renewal, and geopolitically driven trade defence measures, as well as growing demand for responsibly mined minerals linked to the energy transition, are reshaping the landscape of our sector. Recent global events and an emphasis on Environmental, Social and Governance (ESG) performance indicators have only reinforced Ontario’s competitive advantages: Vast mineral wealth, rule of law, a stable government, respect for human rights, a robust health and safety culture, a diverse ecosystem of service providers, and ample sources of clean energy position the province as a leading mining destination. Ontario was listed as this year’s lowest-risk jurisdiction globally in the MJI World Risk Report, a comprehensive evaluation of mining investment risk featuring assessments of 117 jurisdictions globally. The OMA is seizing this moment to engage proactively with the provincial government and key stakeholders to build on our advantages and carve out pathways for economic growth, placing the spotlight on the mining sector’s pivotal role in Ontario’s economy and ability to drive innovation.

The critical minerals strategy roadmap to success Ontario government has commendably prioritized the implementation of its Critical Minerals Strategy (CMS), which aims to establish the province as a leader in the sustainable production of essential minerals. These metals and minerals are vital for clean energy technologies, the digital economy, defence systems, and advanced manufacturing, among other sectors. The CMS goals are closely aligned with those in the “Driving Prosperity Phase 2” document, which aims to retool the automotive sector for electric vehicle production and facilitate the development of the battery supply chain. Additionally, they align with insights from the Critical Minerals Talent Strategy, released by the Ontario Vehicle Innovation Network, which serves as a roadmap to leverage Ontario’s skilled workforce for building a comprehensive electric vehicle supply chain. The findings in the Advanced Manufacturing Council’s 2024 Final Report further emphasize how Ontario can maintain its manufacturing leadership. This synergetic strategic vision is crucial

for optimizing our complete supply chain — from mining to manufacturing — thereby enhancing economic resilience, creating jobs, and boosting Ontario’s innovation capacity and leadership within the global clean technology landscape. It also underpins Ontario’s newly announced plan to accelerate strategic resource development to build a revitalized Canada-U.S. alliance, dubbed “Fortress Am-Can,” which aims to foster global stability, security, and long-term prosperity.

As Ontario makes clear our ambition to supply allied nations with critical minerals and be a global player in the clean technology market, the OMA applauds the commitment to facilitate electric vehicle infrastructure and production within the province. The investment of over $50 billion in downstream manufacturing over the past few years signals unwavering federal and provincial governmental support. However, existing gaps in funding upstream mining development pose significant challenges that we must collectively address to maintain Ontario’s competitive edge and harness our ability to lead.

While considerable momentum has been building for downstream manufacturing, it is crucial not to overlook the upstream mining operations fundamental to sustaining this growth. To paraphrase Canada Nickel CEO, Mark Selby, just as the farm-totable experience begins with seeding the crop, every step in our supply chain is essential for cultivating sustainable growth and success. While continued growth in the mining sector is critical for our economy, security, and environment, Ontario’s mines and smelters are currently grappling with significant challenges that threaten their profitability and long-term viability in an increasingly competitive market.

Our province is facing intense rivalry from international competitors in base metals markets, particularly given that Indonesia, the world’s leading nickel supplier, maintained ample supply through the second half of 2024, fuelled by a surge in Chinese smelting projects. As Indonesia continues to ramp up its nickel smelting capacity with 44 operations — as of September 2024, a staggering increase from just a decade prior — Ontario’s mines and smelters find themselves in a precarious position. As our major producers compete for global capital for local investment, de-risking new projects or expansions will require a whole-of-government approach to secure those necessary

investments in innovation, operational improvements, and mine life extension. This plan should feature diversified support mechanisms such as competitive energy pricing, strategic tax incentives, and concierge regulatory approvals to fortify the entire mining production spectrum.

The urgency of this initiative is intensifying, especially given the looming threat of potential US tariffs and retaliatory federal measures, which could raise the cost of doing business in Ontario. The challenges are compounded by the geographical remoteness of mining operations in Northern Ontario, which makes attracting talent difficult. Although the mining sector is a lead employer in the North, few employed in the sector are originally from the North, and some are recruited internationally. This means the sector must contend with attracting workers to the Northern region while competing with employers in more accessible locations, closer to where the bulk of the workforce resides. Housing pressures — and costs, even for modular housing — as well as lack of access to healthcare, education, digital connectivity, other essential infrastructure and certain cultural supports in Northern Ontario impede growth in the mining sector, once again highlighting the urgent need for a comprehensive, whole-of-government approach to find solutions. To truly support the industry, current strategies must be bolstered by investments that not only focus on advanced manufacturing but also enhance upstream exploration, mining operations, and processing facilities.

Elevating all commodities, with an emphasis on gold and key strategic minerals

We strongly believe that these government investments will yield significant benefits for all commodities mined in Ontario, particularly for strategically important minerals like gold. Gold serves as a vital hedge against inflation, currency devaluation, and economic uncertainty, especially in today’s unpredictable geopolitical climate. Gold also plays a crucial role in driving innovation and facilitating the transition to a green economy. It is an essential component in modern technologies, used in conductors, switch contacts, soldered joints, and various electronics like smartphones and televisions. In the medical field, gold is transforming diagnostic tools and treatments because of its biocompatibility and chemical stability. Additionally, its applications are expanding in defence and aerospace technologies. Gold mining can be a significant contributor to decarbonizing local economies in other ways. Ontario gold mines have been key in adopting innovative technologies to further decarbonization goals, often serving as the initial catalyst in bringing clean energy systems to remote locations. While the outlook for gold remains optimistic, Ontario mines are currently facing significant challenges, including a lack of a robust workforce pipeline for mining careers, rising labour costs, regulatory uncertainty, and other prevalent industry issues that the CMS seeks to remedy.

Recognizing these challenges, the OMA has proposed that gold be added to Ontario’s critical minerals list, following the precedent set by China and Japan, which are leading the world in recognizing gold as a critical mineral. Meanwhile, we continue to

underscore that Ontario must adopt an inclusive and whole-of-government approach across the mining production spectrum to uplift not just critical minerals, but also other commodities that remain central to Ontario’s economy. This collaborative strategy is crucial not only for enhancing employment opportunities and contributing to GDP, but also for fostering positive relationships with Indigenous communities and enabling us to build out the “Fortress Am-Can” strategic alliance.

Ontario’s mining sector stands poised for growth but requires strategic interventions to bridge the funding gap for upstream exploration, operations (including deep-level mining), and processing of critical minerals. In our 2025 pre-budget recommendations, we stressed the need to strike a better balance when it comes to supporting mineral development to ensure a successful battery and EV production future. Our submission encompasses enhancing geoscience data, bolstering domestic processing abilities and creating resilient local supply chains, reforming regulatory frameworks, and promoting innovation within the industry. Establishing a new Am-Can Critical Mineral Security Alliance is a positive start by the government, but this initiative must bear significant investments in upstream mine development and deliver on expanding processing capacity in the province to ensure the “Made in Ontario” supply chain can deliver on the increasing global demand for critical minerals.

Another significant component in strengthening Ontario’s mining sector is building economic development opportunities with Indigenous partners. We appreciate that the provincial government remains committed to implementing Resource Revenue Sharing (RRS) agreements, but there is a pressing need to broaden the geographic scope of these agreements to engage more Indigenous communities proximate to operating mines. For these agreements to be successful, it is so important for government to support Indigenous communities at every stage of RRS implementation to ensure that communities do not face financial and capacity constraints to a meaningful participation. To truly foster these partnerships, the government also needs to have a coordinated and expedited process to create more certainty with consultation procedures and accommodation, thus helping to reduce risk and move towards strategic mineral development while advancing economic reconciliation.

Furthermore, it is essential to tackle the lack of a robust workforce pipeline required to sustain current mining operations in Ontario and grow production of minerals and metals, in particular critical minerals, required to meet the 21st century demand and the energy transition. In April 2023, the OMA partnered with the Ontario Labour Market Partnerships (OLMP) program to address local economic and employment challenges in the mining sector. This partnership resulted in a

comprehensive labour market assessment and the implementation of a multi-partner information campaign aimed at improving workforce perception among Ontario youth (ages 16 to 28) regarding careers in mining. To date, results of the sustained, coordinated “This is Mine Life” (TIML) campaign have been outstanding. Both for the total reach of over 14 million and the level of engagement — both online and in-person — from youth and their career influencers, including educators, guidance counsellors, and parents. This level of engagement has been amplified with the significant enthusiasm and collaboration from our industry partners and career ambassadors representing our member companies. Moving forward, the OMA aims to sustain the TIML campaign, leveraging its successes and harnessing continued support for further initiatives from government, industry, and non-profit organizations that share similar mandates to address the labour shortage across the mining industry in Ontario and attract investment and people to Northern Ontario.

To maintain Ontario’s position as a global leader in mining, we must adopt a multi-faceted and sustained approach to develop a workforce that is not only aware of the mining industry’s opportunities and challenges but is also passionate about its role in shaping the future of this sector. The transition from a student

Ontario not only attracts but also retains a workforce equipped to excel and maintain our global leadership position in mining. Achieving this goal will necessitate ongoing collaboration and resource sharing among industry leaders, government agencies, educational institutions, and organizations with aligned objectives and a view to a concerted, generational-spanned, long-term approach to bridging the labour gap and creating a robust pipeline of talent that will support continued growth and innovation in Ontario’s mining industry.

As the state of mining in Ontario evolves and the government stresses the need to develop critical minerals, it becomes evident that a collaborative approach across all government levels is crucial for successful implementation of the CMS. National and subnational governments, stakeholders, civil society, and Indigenous communities must be single-minded in purpose to develop our upstream natural resources in a responsible fashion with benefits to local communities, or risk losing control of our supply chains, failing to meet our energy transition objectives, and undermining our national interests.

This concern about unmet objectives and missed opportunities is heightened

by the current competitive dynamics of the global marketplace, which poses significant challenges, including potential international tariffs and the pressing need to secure a reliable domestic supply of critical minerals within North America. To secure Ontario’s position as a key player in the global supply chain, it is essential to cultivate a robust and inclusive mining sector by forging strategic partnerships with Indigenous leaders, facilitating accessible educational programs, modernizing the regulatory framework, creating incentives for investment, and committing to ongoing research and development.

Seeding the way forward

The OMA is dedicated to collaborating with the government to achieve these vital objectives. The trajectory of Ontario mining depends on swift and strategic action —cultivating the seeds sown through the CMS will catalyse a resilient and innovative industry. By developing a robust supply chain anchored in a strong mining base, Ontario stands to not only boost its economic outlook and create safe, well-paying jobs but also set a global standard for responsible mining practices.

| NYSE:SKE www.skeenagoldsilver.com

The surging demand for electric vehicles (EVs) is breathing new life into Ontario’s mining industry. Several critical strategic mineral mines will produce the minerals required to manufacture EV batteries and renewable energy storage for the North American market.

The following are the top critical strategic minerals’ (CSM) mining projects in the development phase:

Canada Nickel is a Toronto-based company that is advancing the next generation of net-zero carbon nickel-cobalt projects with plans to supply the critical mineral to Canada’s EV battery industry. The company’s Crawford nickel sulphide project is the second largest nickel resource and reserve globally, with 3.8 million tonnes of proven and probable nickel contained. The project is expected to be the third largest nickel sulphide operation globally with an annual production of 48,000 t/y nickel, 800 t/y cobalt, 1.6 million t/y iron, and 76,000 t/y chrome during its peak 27-year period, and a total of 1.6 million tonnes of nickel over the project’s 41-year lifespan.

Located in the Timmins Nickel District and covering 900 km2, the project will be a large scale, open pit, bulk tonnage, nickel sulphide operation with the potential for zero carbon production. Canada Nickel’s feasibility study (FS), completed in Nov. 2023, showed that the project has a $3.5 billion after-tax net present value (NPV) (8%), an internal rate of return (IRR) of 17%, increasing to $3.69 billion after-tax NPV (8%), an IRR of

18%, and an initial capital expenditure of $2.70 billion.

The FS also showed that over the project’s lifecycle, it is projected to generate more than $89 billion in revenue, $9.93 billion in federal and provincial income tax, and $3.69 billion in provincial mining taxes, from a total investment of