CLEAN MINING

> Mine waste biotechnology

> Clean solutions to the challenges in mine operations

LITHIUM IN LA BELLE PROVINCE

WASTE IS A FAILURE OF THE IMAGINATION

OCTOBER 2023 | www.canadianminingjournal.com | PM # 40069240

SUPPORTING MINING EXPLORATION FOR MORE THAN 20 YEARS www.helicopterespanorama.com Business Development Director jcarrier@panoramahelico.com 418-321-2097 Québec (Alma) 418 668-3046 | Nunavut (Iqaluit) 888 288-3046 | Alberta (Grande Prairie) 888-288-3046 SERVICES Mineral Exploration Aerial Construction Drill Moves Airborne Survey Geophysics Lake Sampling Thermography Photogrammetry Terrain Analysis And much more... FLEET AS 350 Series (5-6 passengers) D, BA, BA+, B2, SD2, B3 Bell 212HP BLR (14 passengers) Multiple drone platforms Infrared and long range cameras

FEATURES

CLEAN MINING/BATTERIES

12 Clean solutions to the challenges in mine operations: Interview with Zara Anderson, vice-president, mining, at Silixa.

14 Pathway to decarbonization.

17 Next generation low-cost technology for high-performance batteries: Interview with Li-Metal’s president, Dr. Srini Godavarthy.

22 Waste is a failure of the imagination.

32 Graphene lithium-ion batteries: Eco-friendly and sustainable.

35 Mine waste biotechnology: A differentiator for Canadian critical minerals.

MINING IN QUEBEC

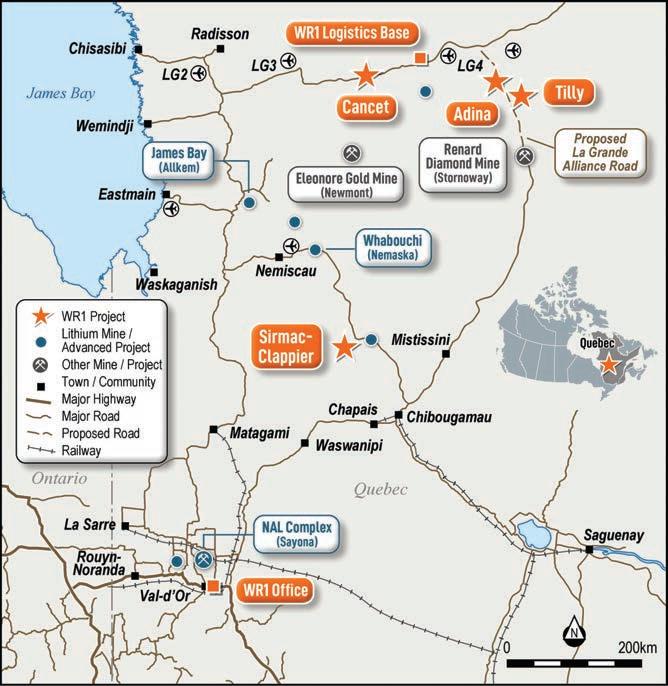

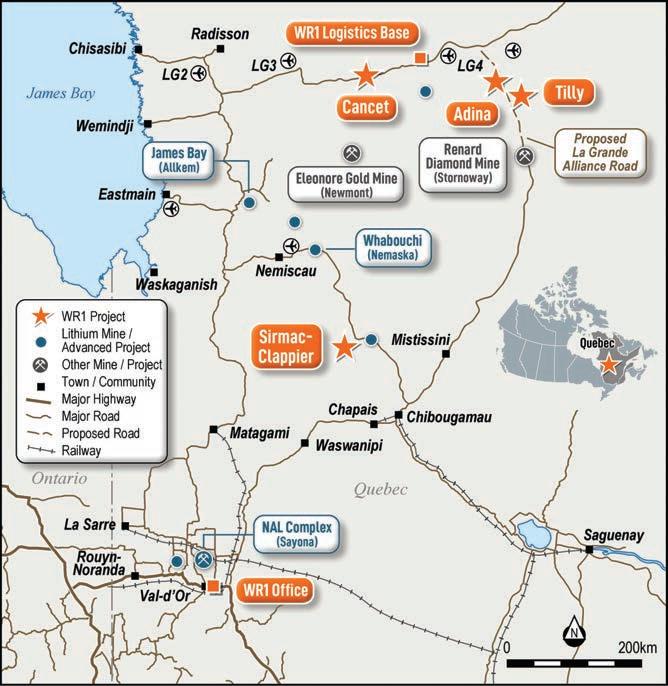

26 Canada’s lithium is in la belle province.

REBRANDING MINING

37 Crafting a fresh definition for modern mining.

SCREENS AND UNDERGROUND MINING

39 Managing fall maintenance: It is a small weld after all.

41 Resin injection in ground development.

HISTORY OF MINING

43 Unearthing Black history in the mining industry in Canada.

DEPARTMENTS

4EDITORIAL | A low-carbon future.

6FAST NEWS | Updates from across the mining ecosystem.

8 LAW | Driving sustainability: How electric vehicles, critical minerals, and governments are shaping the future of mobility.

10HEALTH & SAFETY | Discovering the human factor: Addressing psychological health and safety in mining.

45ON THE MOVE | Tracking executive, management, and board changes in Canada’s mining sector.

Coming in November 2023 Canadian Mining Journal’s November issue will focus on underground mining and tunneling, with featured reports on ventilation and communication.

For More Information

Please visit www.canadianminingjournal.com for regular updates on what’s happening with Canadian mining companies and their personnel both here and abroad. A digital version of the magazine is also available at https://www.canadianminingjournal.com/digital-edition/

www.canadianminingjournal.com 17 26 OCTOBER 2023 VOL. 144, N O .8

Front cover image: Komatsu’s new D475A-8 mining dozer in action. Image courtesy of SMS Equipment.

CANADIAN MINING JOURNAL | 3 39

A low-carbon future

Tamer Elbokl, PhD

Alow-carbon future for mining is the only option available for the sector. Over the last few issues, we discussed in several articles how having a profitable mining project is not enough to be successful. Mining projects also need to be respectful of the surrounding communities and the environment. New policies, practices, and technologies must be implemented during these projects’ development to be more profitable and environmentally sustainable.

In this issue, we shed some light on projects and technologies that are being developed to have access to cleaner energies and reduce carbon dioxide (CO2) emissions. Articles on pages 12 to 23 and pages 32 to 36 discuss several topics and state-of-the-art technologies related to clean mining, such as managing mining waste, reducing carbon emissions, and the latest in battery technology.

According to the Mining Association of Canada, mining is naturally connected to clean technology. Mined raw materials go full circle, being transformed into technology that will be used to assist mining operations in reducing environmental footprints and enhancing efficiency and reliability. These same raw materials are also enabling the world to transition to a low-carbon future.

Additionally, our feature article on “Mining in Quebec” on page 26 explains how Quebec’s supportive resource development sector, access to skilled labour, and its proximity to high-growth electric vehicle markets in North America and Europe are making the province a highly attractive investment destination for lithium production. The article also provides updates on active lithium projects and mines in la belle province. Unsurprisingly, while drafting this editorial, I became aware that Sweden’s Northvolt picked Quebec for its new multibillion-dollar EV battery factory.

On page 8, our regular law column discusses how electric vehicles, critical minerals, and governments are shaping the future of mobility. Finally, John Sandlos unearths Black history in the mining industry in Canada on page 34. If you are wondering, October is Black history month in Europe.

Canadian Mining Journal’s November issue will focus on underground mining and tunneling, with featured reports on ventilation and communication. Relevant editorial contributions can be sent directly to the Editor in Chief no later than Oct. 10th, 2023. CMJ

OCTOBER 2023 Vol. 144 – No . 08

225 Duncan Mill Rd. Suite 320, Toronto, Ontario M3B 3K9

Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief

Dr. Tamer Elbokl TElbokl@CanadianMiningJournal.com

News Editor Marilyn Scales mscales@canadianminingjournal.com

Production Manager

Jessica Jubb jjubb@northernminer.com

Advisory Board

David Brown (Golder Associates)

Michael Fox (Indigenous Community Engagement)

Scott Hayne (Redpath Canada)

Gary Poxleitner (SRK)

Manager of Product Distribution

Allison Mein 416-510-6789 ext 3 amein@glacierrig.com

Publisher & Sales

Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada

George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group

Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published 10 times a year by Glacier Resource Innovation Group (GRIG). GRIG is located at 225 Duncan Mill Rd., Ste. 320, Toronto, ON, M3B 3K9 Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891. Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods:

Phone: 1-888-502-3456 ext 3; E-mail: amein@glacierrig.com

Mail to: Allison Mein,

225 Duncan Mill Rd., Ste 320, Toronto, ON M3B 3K9

We acknowledge the financial support of the Government of Canada.

4 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

FROM THE EDITOR

For more than 40 years, we’ve been providing the labor, expertise and products to keep you mining.

WE’RE THERE WHEN YOU NEED US!

SERVICES INCLUDE:

•CONTRACT MINING

•CONTRACT LABOR

•SHAFT WORK

•SHOTCRETE WORK

•BACK & RIB BOLTING

•MILL SITE MAINTENANCE

•CONCRETE WORK

•GLUE & GROUT INJECTION

•MINE SEALS

• MOBILE SERVICE

GROUND CONTROL

PRODUCTS INCLUDE:

•SPLIT SETS / FRICTION BOLTS

•E XPANDABLE BOLTS

•WIRE MESH

•QUICK INSTALL PROPS

•STEEL CAN SUPPORTS

GMS Mine Repair & Maintenance • 705-845-0541 • www.gmsminerepair.com

EXPLORATION | Wesdome confirms continuity of Presqu’île zone, plans exploration ramp at Kiena gold mine

Wesdome Gold Mines says surface drilling has confirmed the continuity of the Presqu’île zone 1.3 km northwest of the Kiena mine complex near Val d’Or, Que. With the increased confidence comes the decision to develop an exploration ramp to further investigate the potential.

The recent drilling at Presqu’île is part of the company’s ongoing program to test underexplored, near-surface gold potential along strike from the Kiena deposit. The highlights of the most recent assays from the PR-2A and PR-2 zones include:

> PR-23-070: 32.5 g/t gold over 3.0 metres core length (30.0 g/t capped, 2.9 metres true width)

> PR-23-084: 14.0 g/t gold over 5.3 metres core length (14.0 g/t capped, 4.0 metres true width)

> PR-23-058A: 9.31 g/t gold over 4.6 metres core length (9.31 g/t capped, 4.3 metres true width)

These results support the decision to excavate and exploration ramp from surface to further test the down plunge extension of the deposit. Work is to begin before the end of the year once permits are received. The ramp can also be integrated with Kiena’s existing underground ramp network, providing more access to surface for ongoing operations and future mining of deposits such as Dubuisson from 33 level further to the east.

“The Presqu’île zone is just one of several zones having the potential to offer a supplementary source of mill feed near-surface or in the upper mine area for the underutilized Kiena mill,” Wesdome president and CEO Anthea Bath said in a

release. “Recent drilling results from the Shawkey and Dubuisson zones, both adjacent to the existing 33 level track drift development that extends over 3.0 km east of the Kiena mine shaft, further reinforces the potential of this area.

“As our exploration continues and the refinement of the geologic model increases, we are confident we will identify more zones of gold mineralization accessible from 33 level, as well as additional down plunge extensions similar to the Kiena Deep zone,” she added.

Wesdome has been drilling at Presqu’île since 2020 and identified five gold-rich zones crosscutting mafic and ultramafic rocks. Gold mineralization is associated with traces to 5% disseminated sulphides (pyrite, pyrrhotite, chalcopyrite, sphalerite and galena) and local gold grains occurring in quartz-chlorite-carbonate or quartz (grey) vein contacts as well as in moderately to strongly chloritized and biotitized host rocks.

The 2023 surface drill program is nearing completion. It has confirmed not only the continuity or the gold mineralization at Presqu’île and the validity of the geologic model, but also the potential for down-plunge extension to the east.

The Presqu’île zone has an indicated resource of 138,000 tonnes grading 8.2 g/t gold (37,000 contained oz.) and an inferred resource of 202,000 tonnes grading 7.4 g/t (48,000 contained oz.) as of Dec. 31, 2022.

Commercial production was declared on Dec. 1, 2022, at the reopened Kiena mine. CMJ

• NEW MINE | B2Gold says Goose gold project to pour first gold early next year

The Goose project in Nunavut is on track to pour its first gold in the first quarter of 2025. The mine is 100%-owned by B2Gold. It is located in the Back River gold district and was acquired as part of the Sabina Gold and Silver acquisition earlier this year.

All long lead items for the 2024 construction season have been received at the company’s freight consolidation point, prepped for ship transport, and the sealift is underway.

Construction capital expenditures remain in budget, with the June 2023 estimate of $800 million, plus an additional $90 million for accelerating the underground development. About $530 million have been spent on the project thus far. The sealift also includes 24 million litres of diesel fuel. The company is also evaluating the potential for wind power generation at Goose.

The fast-tracked underground mining plan will increase average gold production in the first five years of operation to over 300,0009 oz. per year. Underground development is taking place at the Umwelt deposit, and open pit mining at the Echo deposit is progressing, says B2Gold. The Echo pit will be mined out and the ore stockpiled prior to the commissioning of the mill in order to provide tailings storage capacity.

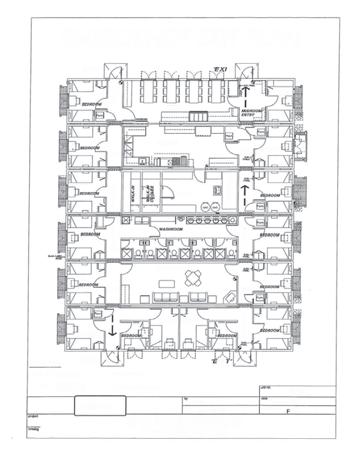

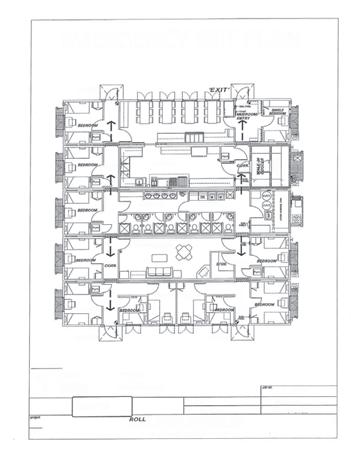

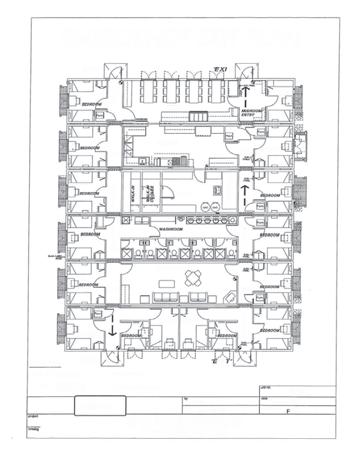

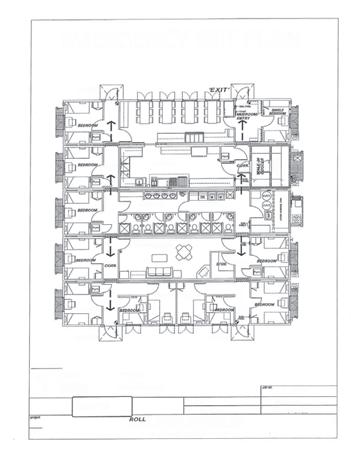

Phase one of the accommodation complex opened last month which consisting of 310 beds. There are another 160 beds at the existing exploration camp. Together they will

accommodate construction, mining, and exploration activities. Other surface infrastructure is underway, notably the earthworks necessary to extend the airstrip to 1,525 metres. Winter ice road preparations are also well underway. B2Gold teams plan to begin building the ice road in the middle and work simultaneously to each end, a plan that will allow the work to be completed earlier than in prior seasons. Structural steel is also going up for the mill building and truck shop.

B2Gold has also completed 11,000 metres of drilling in 44 holes this year. Drilling focused on testing the Umwelt and Llama deposits down-plunge for resource expansion. Various regional targets have also been drilled. CMJ

6 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

Goose gold project site overview, September 2023

Updates from across the mining ecosystem FAST NEWS •

CREDIT: B2GOLD

90 YEARS | Agnico Eagle marks 90th anniversary of Macassa

Agnico Eagle Mines marked the completion and commissioning of the No. 4 shaft at its Macassa mine in Kirkland Lake, Ontario, and commemorated the mine’s 90th anniversary.

“The completion of the #4 shaft is an important step in our plan to build a new Macassa mine for the future,” Andre Leite, Agnico Eagle VP, Ontario, said in a statement. “The new shaft will allow the team to increase production, improve unit costs, de-risk the mine, increase our exploration capacity and most importantly, significantly improve the working conditions for our employees.”

The Macassa team was joined at the celebration by Ontario Minister of Mines George Pirie.

“The new shaft, which has been under construction since 2019, is 6,395 feet [1,950 metres] deep and has a 216-feet [65 metres] tall concrete headframe that was constructed in just 11 days. With a total cost of approximately C$320M, the new shaft is a significant investment in Agnico Eagle’s Ontario operating platform and secures more than 1,000 direct jobs for the foreseeable future,” Pirie said.

In addition to celebrating the #4 Shaft project, Agnico Eagle announced a 10-year $3 million commitment to the Canadian Cancer Society to improve the lives of people affected by cancer living in rural and remote communities in Northern Ontario.

This includes improved facilitation of Northern Ontario Indigenous populations’ ability to source and receive culturally appropriate and relevant cancer resources and support. CMJ

• RARE EARTHS | Defense Metals updates

Wicheeda REE measured and indicated resources

Defense Metals has updated the resources estimate for its Wicheeda rare earth element (REE) deposit 80 km from Prince George, B.C. Roughly the earlier indicated and inferred resources were reclassified to measured and indicated.

The deposit is known to contain 6.4 million measured tonnes averaging 2.86% total rare earth oxide (TREO) and 27.8 million indicated tonnes at 1.84% TREO. (Compare this to the earlier estimate of 5 million indicated and 29.5 million inferred tonnes.) There is also an inferred resource of 11.1 million tonnes grading 2.02% TREO. The update used a cut-off of 0.5% TREO.

Calling Wicheeda one of North America’s most advanced REE projects, Defense CEO Craig Taylor said the overall resource has grown by 17%. CMJ

PROcheck is our signature, expert analysis beginning with our diagnostic tools. Pulse Vibration Analysis examines the health of any brand of vibrating screen, while our Pulse

OCTOBER 2023 CANADIAN MINING JOURNAL | 7 •

Schedule today! 1-800-325-5993 procheck@haverniagara.ca haverniagara.com/procheck See how PROcheck can maximize your operation.

YOUR PULSE.

CHECK

Impact Test prevents your screen from operating in resonance. HAVE R & BOECKE R NIAGAR A

Agnico Eagle’s Macassa gold mine celebrates 90 years of operation with the completion of the #4 shaft CREDIT: AGNICO EAGLE MINES

By Leanne C. Krawchuk and David Mikhaiel

As the world transitions toward a greater focus on ESG, the demand for critical minerals, essential for industries such as electric vehicle (EV) manufacturing, has grown exponentially. To address this challenge, partnerships between miners, car manufacturers and government entities are being forged to secure critical mineral supply chains.

Critical minerals

Critical minerals play a pivotal role in powering the future of transportation. Minerals such as lithium, cobalt, nickel and others have become increasingly vital due to their usage in EV batteries. Lithium, for instance, is a key component in the production of lithium-ion batteries, which are widely used in EVs. Cobalt and nickel are also critical elements in the battery chemistry, contributing to improved energy density and overall performance. The demand for these minerals has surged alongside the growing popularity of EVs, as they are essential for achieving longer driving ranges and faster charging times.

Partnerships and agreements

Car manufacturers have been actively engaging with mining companies to establish binding, long-term, offtake agreements for critical mineral supply. These offtake agreements often involve “take or pay” commitments from car manufacturers to purchase a certain guaranteed minimum volume of minerals over a specified period. In return, miners benefit from a guaranteed market for their products and potential investment in expanding their mining operations. These offtake agreements may also include significant advance payments, which foster the development of commercial production, thereby ensuring a sustainable supply of critical minerals.

Financial information for these agreements has not been publicly disclosed and pricing, for the most part, will be based on an agreed upon market-formula. The average length of these “long-term” offtake agreements ranges from five to six years, with some extending up to 11 years. The average tonnage specified in the agreements ranges from 4,000 up to nearly 20,000 tonnes of critical minerals per year. Lithium carbonate and lithium hydroxide are the primary critical minerals being pur-

chased, as these are essential components for lithium-ion batteries in EVs.

Geographically, these agreements are being entered into from North America, Australia and Europe. Notable locations include Nevada in the United States, where ioneer’s Rhyolite Ridge lithium-boron operation is located. General Motors is making a “multi-million dollar” investment in Australia’s Controlled Thermal Resources to bolster the mining company’s efforts to extract lithium from California’s Salton Sea geothermal Field. The California Energy Commission estimates the area could produce 600,000 tonnes of lithium carbonate annually, worth US$7.2 billion.

Germany’s Volkswagen has signed an agreement with Australia-listed lithium supplier, Vulcan Energy Resources. European Lithium (EUR) has signed its first ever offtake agreement, teaming up with BMW through EUR’s Austrian subsidiary ECM Lithium (ECM) to supply lithium hydroxide from the Wolfsberg lithium project. This includes an advance payment by BMW to ECM of US$15 million.

8 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

LAW

Driving sustainability: How electric vehicles, critical minerals, and governments are shaping the future of mobility

PHOTO: AFOTOSTOCK/ADOBE IMAGES

In Canada, Mercedes-Benz has entered into an agreement with Rock Tech Lithium, which will source its raw ore from the Georgia Lake region in Ontario, eventually planning to build five high-tech lithium conversion facilities in North America and Europe, for a total production capacity of 120,000 tonnes of lithium hydroxide annually by 2029. Finally, Ford Motor Company has established an agreement with Nemaska Lithium, whose project is planned to be the first to produce lithium hydroxide in Québec.

Government involvement

Governments are also involved in the auto-mining sector. In March 2023, the Ontario government proposed changes to the law governing approval of mining projects to boost Ontario’s production of minerals essential to EV batteries. The changes are intended to speed up the licensing of new mines and make it easier for companies to obtain permits to recover minerals from mine tailings and waste. These proposed amendments should save mining companies time and money by allowing more flexibility in the techniques used to rehabilitate mines, as well as create additional options for mining companies to pay

financial assurance.

In August 2022, Volkswagen entered a memorandum of understanding with the Canadian government to provide a reliable and sustainable supply chain for the increasingly scarce raw materials that go into EV batteries.

Finally, in March 2023, Honda welcomed the critical minerals agreement signed by the U.S. and Japan, which seeks to promote the adoption of EVs and strengthen and diversify supply chains.

Overall, these binding offtake agreements are crucial steps toward ensuring sustainable and secure access to critical minerals for auto manufacturers. These offtake agreements are also key for miners and the development of mines to achieve commercial production. As car manufacturers strive to meet the growing demand for EVs and sustainable energy technologies, strategic partnerships with mining companies and government entities will be key to reaching this goal. CMJ

OCTOBER 2023 CANADIAN MINING JOURNAL | 9 Zero. Zip. Zilch. We’re

on

excited to see the industry focus

net zero. Stantec is here to help you do right by the environment. stantec.com/net-zero-mining

LEANNE C. KRAWCHUK is the Canada co-chair and a global lead of Dentons’ mining group. David Mikhaiel is an associate in Dentons Canada’s corporate group in Edmonton.

By Rana Labban

DISCOVERING THE HUMAN FACTOR: Addressing psychological health and safety in mining

When thinking about the mining and metals sector, psychological health and safety seldom makes the headlines. Just as there are physical considerations to keep in mind when thinking about employee safety, mental health is equally as important.

According to a new study by the Workforce Institute at Ultimate Kronos Group (UKG), “for almost 70% of people, their manager has more impact on their mental health than their therapist or their doctor– and it is equal to the impact of their partner.” The mining and metals sector is essential in our current world. With the introduction of ISO 45003:2021 and the WHO’s Global Mental Health at Work Framework, psychological health and safety has become a global priority. Countries have been establishing regulatory requirements to incorporate psychological health and safety in the workplace over the past decade, in response to the increased strain declining worker mental health is placing on organizations and their communities.

In the mining and metals sector, organizations such as the International Council on Mining and Metals (ICMM) and the Mining Association of Canada (MAC) are introducing psychological health and safety to their standards to not only drive meaningful change but to provide guidance and support to organizations as well. Here are some leading considerations when thinking about psychological health and safety.

How do we integrate Psychological Health and Safety into the business?

Psychosocial risk factors are defined as “work conditions that that can have either a positive or negative effect on employee psychological health and safety”. Psychological health and safety is more than just the mental health of workers. It is composed of several psychosocial risk factors and how they interact with the people, systems, and environment within an organization. It is imperative that we understand the impact of our systems and work environment on workers’ psycho-

logical health and safety and that we integrate the management of psychological health and safety into all aspects of the employee experience.

One way for an organization to gain a better understanding of their current state when it comes to managing psychological health and safety is to assess the level of readiness to adopt psychological health and safety systems. Reviewing current systems can help shed light on the processes already in place that promote and protect psychological health and safety and where opportunities to improve may exist. Additionally, this process can help to identify what risk factors or hazards may require intervention or are adequately managed within the organization.

The National Standard of Canada for Psychological Health and Safety in the Workplace outlines a few guiding principles, including:

> Responsibility is necessarily shared by management, employees, and union;

> Mutually respectful relationships are foundational and need to be defined; and

> Everyone has a responsibility to do no harm to the psychological safety of others.

When managing psychological health and safety it is important to remember that the responsibility of establishing and maintaining a psychologically healthy and safe work environment is a collective effort where all individuals within the organization play a part.

How can work be a protective factor?

The workplace can become a protective factor when organizations consider upstream strategies including proactive and preventative solutions that optimize employee focus and energy to work successfully and safely. Examples of upstream strategies for the mining sector include:

> Enhancing belonging, such as establishing peer mentoring or buddy systems, especially on remote sites

> Supporting work-life balance, by providing safe and private spaces for remote workers to connect with their social, emotional, and health supports

> Building resilience, by providing con-

tinual opportunities for workers to share and learn about coping strategies to deal with stressors and challenges

> Encouraging seeking help, by having leaders normalize and model the behaviour by openly sharing their experiences in accessing help and resources

> Encouraging conversations about well-being, by making it safe to speak up about concerns without fear of reprisal and making it a part of everyday debriefs and team huddles

> Making the workplace accessible and inclusive, by providing secure, accessible, and safe facilities for all employees to access assistance where needed

By implementing upstream strategies, employers can benefit from improved recruitment and job retention, improved employee engagement, improved sustainability and resilience, and improved health and safety. Additionally, a supportive workplace can reduce the onset, severity, impact, and duration of a mental health disorder .

To effectively implement this approach within your organization, several key steps need to be taken. Firstly, it is crucial to understand the current state of your organization in terms of psychological health and safety. Once that is established, the next step is to integrate psychological health and safety into the everyday routines and operations of the organization. Additionally, it is important to prioritize continual improvement rather than relying on one-and-done strategies. Lastly, ensure that everyone within the organization is accountable for their impact on the psychological health and safety of others by promoting awareness, providing training and resources, and encouraging a culture of respect and empathy. By following these steps, your organization can create a conducive environment that prioritizes and safeguards the psychological well-being of its members. CMJ

RANA LABBAN is an associate partner and leads environment, health and safety for EY Canada’s climate change and sustainability services.

10 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

HEALTH AND SAFETY

Liebherr is a leader in proven low emission solutions, utilizing grid electrification. By 2030, fossil fuel free solutions will be established.

Liebherr strives for long-term sustainable solutions, providing different modular options centred on environmental sustainability, safety, cost, flexibility, and maintainability including:

Liebherr strives for long-term sustainable solutions, providing different modular options centred on environmental sustainability, safety, cost, flexibility, and maintainability including:

– 30 years experience in electric drive mining excavators with all machine models available ranging from 150 t to 800 t class

Trolley Assist option available on all Liebherr mining trucks

– Liebherr combustion engine compliant with Hydrogenated Vegetable Oil (HVO) fuel

– 30 years experience in electric drive mining excavators with all machine models available ranging from 150 t to 800 t class

Tier 4 Final certified engine available on trucks, excavators, and dozers

Trolley Assist option available on all Liebherr mining trucks

– Liebherr AC drive system on all truck models providing a modular platform for future powertrain technologies

– Liebherr combustion engine compliant with Hydrogenated Vegetable Oil (HVO) fuel

Tier 4 Final certified engine available on trucks, excavators, and dozers

Liebherr’s roadmap includes batteries, combustion engines using green fuels, and hybrids.

– Liebherr AC drive system on all truck models providing a modular platform for future powertrain technologies

Liebherr’s roadmap includes batteries, combustion engines using green fuels, and hybrids.

Liebherr is a leader in proven low emission solutions, utilizing grid electrification. By 2030, fossil fuel free solutions will be established.

–

–

Liebherr-Canada Ltd. • 1015 Sutton Drive • Burlington • ON • Canada • L7L 5Z8 • Phone: +1 905 319 9222 Committed to the future www.liebherr.ca Mining

–

–

Liebherr-Canada Ltd. • 1015 Sutton Drive • Burlington • ON • Canada • L7L 5Z8 • Phone: +1 905 319 9222 E-mail: info.lca@liebherr.com • Instagram: @LiebherrCanadaLtd • www.liebherr.ca Committed to the future www.liebherr.ca Mining

By Tamer Elbokl, PhD

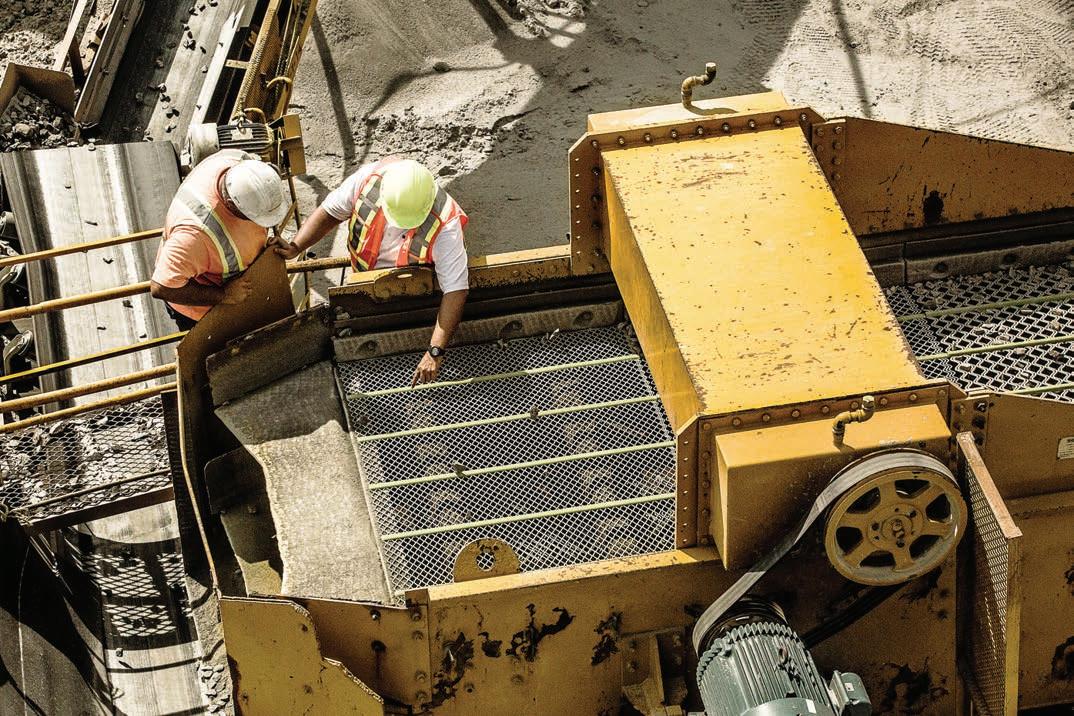

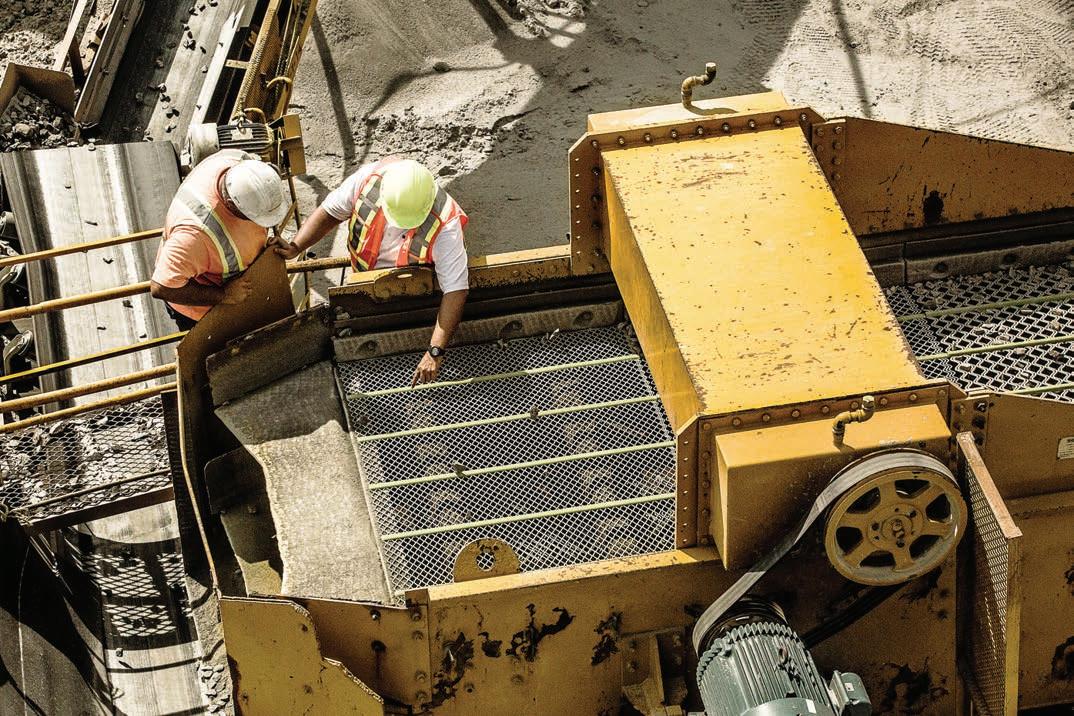

Clean solutions

to the challenges in mine operations

Interview with Zara Anderson, vice-president, mining, at Silixa

As a leading independent provider of fiber-optic-based distributed sensing solutions, Silixa strives to secure safer, more sustainable future for people and planet. The company is committed to accelerate innovation in the mining sector to make it safer, more productive, and energy efficient. By introducing modern technologies and solutions already proven in other industries, the company helps bridging a gap between the present and the future in the struggle for clean mining.

These future-proof industrial automation solutions have experienced signifi-

cant uptake over the past few years predominantly in minerals processing facilities and are poised for future growth. Recently, I had the opportunity to discuss the latest solutions, offered by Silixa to the wide range of challenges faced by the mining industry, with Zara Anderson (ZA), vice-president, mining, who is currently based in Kingston, Ont.

CLEAN MINING TECHNOLOGY

Right: Silixa’s intelligent Distributed Acoustic Sensor (iDAS) uses the phase of Rayleigh backscattered light to demodulate dynamic strain events along many kilometers of optical fiber cable, measuring seismicity and slow strain. CREDIT: SILIXA

Zara Anderson at a deep underground mine for the installation of a Carina Rockmass Response system. CREDIT: SILIXA

12 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

Initially deployed in mining processing plants across South America and Africa, Silixa solutions are set to play an increasingly crucial part in mining automation and digitalization.

CMJ: Can you talk to us briefly about the history of Silixa and how you became vice-president, mining? Why did you accept the challenge?

ZA: Silixa was established in 2007 to develop the next generation high-precision distributed fiber sensing interrogators. As Silixa expanded and served many industries, it was recognized that the mining industry can immensely benefit from the technology. So, Silixa established a dedicated mining business, and I joined the company to take part in this journey.

This was an exciting opportunity, bringing this technology to the mining industry at the right time, as the industry is on its journey towards net zero, improved productivity and safety, and enhancing ESG path, while it is also relied upon to supply the world with critical minerals required for renewable energy.

CMJ: What are you enjoying about this phase of your career, and what are some of the challenges?

ZA: It is exciting to be part of the mining industry now. We are making rapid changes to our ESG path, adopting new technologies to enhance safety and productivity, and we are a big part of the transition to renewable and green energy. The industry is facing a shrinking workforce, more remote mine operations, and increasingly higher costs. These circumstances can make it more challenging for mine operations to adopt and implement new technologies timely and efficiently. Recognizing some of these difficulties, Silixa has been partnering with several mine operators to design and implement solutions that fits the mines restrictions and requirements.

CMJ: What is the current portfolio of Silixa?

ZA: Silixa, an award-winning innovator, offers the complete portfolio of distributed sensing solutions across many sectors globally. Our end-to-end solutions allow high resolution temperature, strain, and acoustic measurements even in the most hostile settings. Silixa’s high-fidelity technology combined with our unique geosciences skillsets has allowed us to partner with government, research institutes, and various indus-

tries around the world in the journey to energy transition. Our technology and services apply to many environmental, geotechnical, and industrial settings, such as carbon capture and storage (CCS) and many natural and induced hazard monitoring like earthquakes, volcanoes, melting icecaps and shoreline erosion.

CMJ: What does Silixa have to offer to the mining sector? How can you help tackle the industry’s most pressing challenges?

ZA: As I mentioned, we offer a portfolio of proven distributed fiber optic sensingbased solutions to the mining industry. They enhance productivity, minimize, risks and ensure sustainability by providing more reliable and cost-effective means of geophysical assessment as well as asset and process monitoring. We have chosen four unique turn-key solutions across the life cycle of the mining industry:

1 Our DamPulse solution provides an integrated sub-surface platform for monitoring seepage, deformation, and seismic risk/imaging for tailings storage facilities. Statistics indicate that about 20 tailings dams fail every decade. By providing early alerts of potential problems, this dam monitoring solution helps mine operators tackle two of their biggest challenges: managing water in tailings dams and maintaining the safety of dams. The system can detect even the smallest changes in the dam structure that could otherwise go unnoticed with less sensitive, conventional technologies. This monitoring system addresses issues of dam stability, public safety, and environmental protection. Delivering ultra-HD quality distributed temperature, strain, and acoustic measurements in real time, the system offers early alerts of potential problems, minimizing the risk of dam failures.

2 A wide range of geotechnical and rockmass response monitoring solutions using our combined Carina/iDSS systems.

3 Seismic-based mineral exploration solutions using our iDAS and Carina sensing systems.

4 Finally, a unique DAS-based flow metering solution for process control. This non-intrusive flow metering solution enables the measurement of water flows across multiple points in a mine or plant. Real-time flow rate information helps operators better understand how water is being used, enabling them to minimize consumption.

CMJ: How can these technologies help the mining sector move to a low carbon future?

ZA: Our technology uses optical fiber cables as sensors. Since fiber optics is relatively low cost, and low usage of raw material while it allows for high-resolution monitoring of very large structures, it reduces the environmental footprint for the supply of sensors and infrastructure on site as well as the footprint for installation and post-install maintenance. Their ultra-high sensitivity enables them to deliver precise geophysical information with a much smaller environmental footprint than conventional technologies. The technology allows for real-time monitoring of remote operations, reducing traffic and material onsite. In seismic exploration applications, the disturbance to surface is significantly reduced, and the technology can acquire data using less disruptive seismic sources further reducing the environmental footprint. During process metering our non-intrusive FiberWrap solution not only optimizes processes and flow distribution, but also helps to achieve a sustainable balance between water supply, consumption, and environmental and operational risks. Engineered to reduce energy consumption, it requires no power at the flow measurement zones on site.

Most importantly, however, the output of our systems provides real-time high-resolution data that allows mines to make proactive decisions to reduce hazard and enhance productivity and process control.

CMJ: Finally, how does the future of the technology look like to you?

ZA: Distributed fiber optics technology is rapidly growing in many applications and is now widely recognized as a disruptive technology and a foundation for digital transformation. Silixa developed a reputation for revolutionizing multiple industries. As the only independent leading provider of CCS solutions, and a front runner in the mining sector, we will continue to partner with mines to implement unique solutions using dedicated teams with domain expertise in the industry. I believe Silixa will continue to grow and be relied upon by our clients as the world moves towards net zero carbon emission with the right technologies and partnerships. CMJ

OCTOBER 2023 CANADIAN MINING JOURNAL | 13

Pathway to decarbonization

A panel discussion from CIM 2023

Decarbonization is at the forefront of discussion in the mining industry as companies work to reduce their carbon emissions. Some companies have announced objectives to reduce emissions by up to 50% by 2030 and become carbon neutral by 2050, in line with the Paris Agreement. Other companies are currently establishing objectives while they research and plan. There are numerous decarbonization strategies across the industry, but building a flexible plan for future operations is a challenge unique to each company.

“Building trust to decarbonize the world” was the theme of the 2023 Canadian Institute of Mining, Metallurgy, and Petroleum (CIM) Convention and Expo in Montreal. At the convention, there was a panel discussion called “Pathway to decarbonization: navigating through risks and pitfalls,” moderated by Amanda Fitch, department manager for mining and metals at BBA. The panelists represented a diverse range of mining companies from across Canada: Chris Adachi, director of climate change at Teck Resources; Alexandre Belleau, chief operating officer at Champion Iron; Eric Desaulniers, president and CEO of Nouveau Monde Graphite; and Jean-François Gauthier, managing director at Rio Tinto Iron and Titanium. Each speaker shared strategies and challenges faced on the road to decarbonization, which made for engaging conversation and practical advice.

Decarbonization strategies

To begin the panel, the speakers described how their companies are currently undertaking decarbonization. As each company is unique, a variety of strategies was discussed.

a Planning: Planning is crucial for decarbonization. Like any other project, the first step is to determine what you are trying to achieve and why. “If you are just doing it for the sake of doing it or because others are doing it, chances are you are going to miss the boat,” Belleau stated. Companies should define specific goals, examine the inventory of their emissions, identify opportunities to reduce their carbon footprint, and prioritize these opportunities using different factors (such as feasibility and accessibility of technology). Then, they can develop a realistic plan that includes a way to measure progress.

b. New business opportunities: Companies cannot only decarbonize their own assets, but also help their customers decarbonize. New mining technologies (e.g., cleaner smelting processes and products with superior mechanical properties) can potentially be used by other producers and across other industries. Investing in the development of these new solutions can be beneficial for the mining company itself, its customers, the industrial ecosystem, and the planet. Another approach is focusing on critical minerals that will contribute to the energy transition. There are opportunities available to partner with the federal and provincial governments to make this happen. To be successful, mining companies should bring decarbonization to the heart of their business strategy.

c. Carbon neutral versus net-zero: Companies typically begin their decarbonization journey by avoiding and reducing emissions with the end goal of achieving carbon neutral-

14 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

Stoker CLEAN MINING

By Kesiah

Clockwise from L-R: Chris Adachi, Alexandre Belleau, Jean-François Gauthier, Eric Desaulniers.

ity or net-zero. But Desaulniers says that sequestration is an often-overlooked part of the equation: “Mining can play a very important role in the future by making sure we do compensation projects that focus on the sequestration of CO2 This is the real net-zero. If you do compensation projects with somebody else who is just reducing their emissions, that is not considered net-zero; that is carbon neutrality.” Developing sequestration projects to achieve a mathematical net-zero is not easy, and larger mines will need to scale up according to their output.

d. Context: Mining operations in Canada start with an advantage over international competitors because of access to low-carbon electricity. However, this also presents a challenge for Canadian operations looking to reach emission reduction targets, as operations in other countries can reach short-term targets easily by taking simpler actions (e.g., signing a good power purchase agreement). Mining companies should be aware of this context when discussing decarbonization and when marketing products. Additionally, companies should understand their scope 1, scope 2, and scope 3 emissions and find opportunities where decarbonization efforts can result in multiple wins.

Short-term versus long-term solutions

Decarbonization is not a straightforward switch to new technologies. Sometimes, those technologies are not yet de-risked or commercialized, or companies do not have the power supply in place to support them. To deal with these scenarios, companies use interim solutions, such as transitionary fuels (e.g., renewable diesel in B.C.) or trolley assist for haul trucks before switching to a full battery electric or hydrogen-powered fleet. Adachi explained how to prepare: “Part of our strategy is monitoring these [new] technologies, getting involved with them in early stages, and building out the infrastructure you are going to need.” Decarbonization can be viewed as a process with transitionary steps. “As [with] any other project, decarbonization is a journey,” Belleau said.

Although it is easier to discuss and achieve short-term targets (like 50% emission reduction by 2030), it is important to keep targets for 2050 in mind. Short-term solutions should still follow the trajectory to 2050 and ensure progress toward net-zero.

Thinking toward the future will affect the decisions made now. As Gauthier stated, “2030 is almost tomorrow, and 2050 will come very fast.” It might be better to prepare a flexible plan for a larger, long-term objective rather than locking into a plan now that will fall short of net-zero, even if that long-term plan is scrutinized in the interim.

Flexibility

Mine life extensions, future expansions, technological developments, and changing commodity prices can affect decarbonization plans. The panel discussed the flexibility built into their plans that allows them to adapt to potential changes.

Gauthier explained that Rio Tinto is developing several decarbonization technologies simultaneously, as the extent to which each technology will reduce emissions is unknown. These potential solutions are tested and demonstrated at a significant scale to determine their effectiveness. Then, a combination of solutions will be implemented to achieve emission reduction objectives. Rio Tinto also builds flexibility into its decarbonization plan by working with customers to develop critical minerals.

Some companies prefer a plan that does not rely on new technology. Belleau explained that the obvious solution for Champion Iron is to convert fixed emission points to electricity. Technology already exists. The only constraint is the availability of power, and the company is working with authorities and governments to get it. Companies can also build flexibility into their decarbonization plans by addressing how they consume energy. The mining industry consumes substantial amounts of energy, and historically, energy efficiency has not been optimized. After fixed emission points, the remaining bulk of emissions are from haulage, so future mines should be designed to avoid haulage as much as possible.

Feasibility and operations

When identifying the feasibility of decarbonization solutions, it is important to collaborate with technology providers and original equipment manufacturers (OEMs). Simply asking for zero-emission solutions may not work; you need the right partners to get you there. When working with OEMs on decarbonization, mining companies should first explain their specific situa-

OCTOBER 2023 CANADIAN MINING JOURNAL | 15 CONTINUED ON PAGE 16

Amanda Fitch, department manager for mining and metals at BBA, introducing panel members. CREDIT: BBA

tion, as every mine is different. Then, they can agree on a business solution that works long-term for both parties. Building a close relationship with the OEM is essential. According to Desaulniers, Nouveau Monde does this by having early learners of new equipment share feedback with the providers. This ensures that everyone is on the same page and opens further discussion. Each mining company will have specific solutions that work for them, but some OEMs focus on developing holistic solutions that will translate to other mines too.

The acceptance of decarbonization solutions may prove difficult when handed over to operations. Planning early in the process can help mitigate these issues. Adachi explained that the decarbonization team at Teck is specifically designed to include employees from operating roles: people who currently work or previously worked at the mines and have experience operationalizing projects. Early-stage evaluations are done centrally, as it makes more sense in terms of resource efficiency and capacity, but then the operations teams are brought in to guide decisions. For decarbonization projects, mining executives should be mindful about operationalization, consider the impacts on productivity and safety, involve the right people in project advancement and execution, and adopt a thorough transition plan. Integrating operations teams early and allowing them to own the procurement and operationalization processes can make for a smoother transition.

Financing decarbonization

Junior and mid-tier mining companies often have limited financial capacity to undertake decarbonization. Despite support from Canadian federal and provincial governments, it can be difficult to get significant financial backing in the mining industry. But decarbonization may present new opportunities.

In some industries, customers are willing to pay more for a product branded as “low-carbon” or “carbon neutral.” The panel discussed charging premiums for low-carbon mining products to finance decarbonization projects. The automotive industry is currently the most vocal when it comes to low-carbon products, but mining products go through a succession of customers, so the branding of “low-carbon minerals” does not yet move the dial for most end customers. Although buyers are happy to receive products from low-carbon mines, they are not paying more or increasing the price of their end products to compensate investments in decarbonization. Applying those costs to the product may not have much impact on prices downstream but would allow mining companies to be rewarded for their efforts. It may be possible to negotiate a five to 10% premium with customers; however, charging a premium is not always feasible.

The panel also discussed the opposing view that decarbonization is a responsibility and that companies should not expect a financial reward. “We need to rise to the occasion to find financially interesting solutions,” Gauthier said. “We cannot just forward the bill to our customers. How can we find solutions to differentiate ourselves?” Developing innovative technologies for decarbonization can give a mining company a competitive advantage and open new financial opportunities. New technologies may even improve productivity and allow for a discount on products.

Investors and senior managers may be hesitant about decarbonization because of the risks involved. Currently, the onus for reaching net-zero is being placed on mining companies, but capital providers also need to think about their investment decisions and risk tolerance. “What investors are giving you the direction to actually invest in these technologies to take on that risk?” Adachi said. Desaulniers is “dreaming of a world where industrials and miners will become carbon credit providers.” When carbon credit becomes a real business, managers who focus on financials will come on board.

Key takeaways

To conclude the panel, the speakers shared the following key takeaways:

> Mining companies have a responsibility to decarbonize and make a difference.

> Governments need transparent measures to incentive decarbonization for everyone from mines to customers.

With 50 years of experience, DUX offers a range of underground articulated four-wheel drive equipment designed to meet the needs of mining and tunnelling projects worldwide.

Contact DUX today for field-proven underground haulage, utility and scaling solutions.

> Companies should adopt a more holistic view of decarbonization and determine what role they can play in decarbonizing the industrial ecosystem.

> The mining industry has moved beyond hypothetical questions about decarbonization and is now navigating the deployment of new technologies. Many people are eager and passionate about decarbonization; it will only ramp up from here. CMJ

16 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

Kesiah Stoker is a multi-skilled freelance writer.

CLEAN MINING

DUX

(+1) 450 581-8341 I sales@duxmachinery.com

MACHINERY, 615 Lavoisier, Repentigny, QC, Canada J6A 7N2

UNDERGROUND

MINING EQUIPMENT WORLDWIDE

By Tamer Elbokl, PhD

Next generation

low-cost technology for high-performance batteries

Li-Metal’s founders, Maciej Jastrzebski and Tim Johnston, recognized that rapid electrification of transportation, and the adoption of next generation high-performance batteries (solid-state, lithium-sulphur, lithium-air, etc.) will require a vast expansion of lithium anode and lithium metal production.

Leveraging their respective engineering expertise in the metallurgical and lithium chemicals industries, they founded Li-Metal in response to this need.

Since its inception in 2018, the company has made dramatic progress in developing patented and patent-pending technologies that will allow the

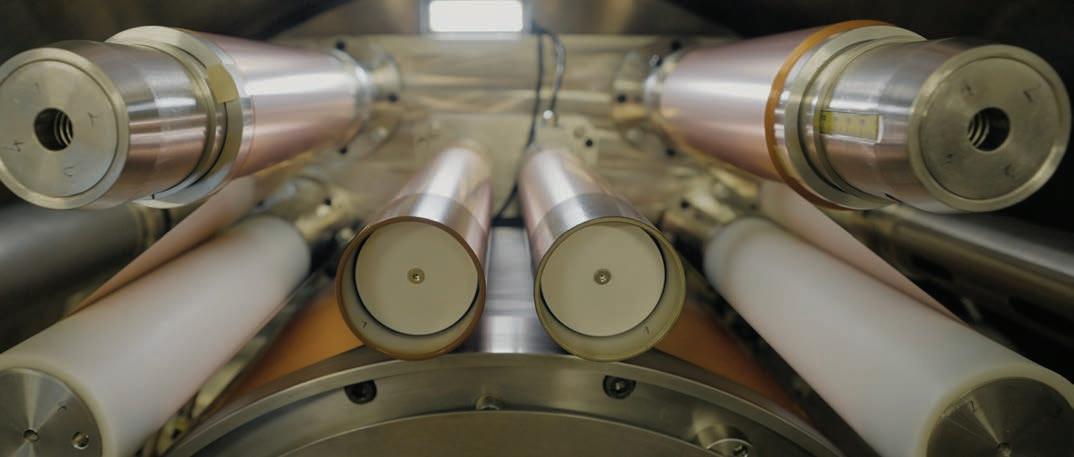

The technology

Lithium-Metal’s patented and patent-pending technology will help manufacturing lowcost metallic anodes for next generation batteries without using lithium foil.

Lithium anodes

Conventional metallic anodes are made of lithium foil – the properties of lithium make it difficult to produce foils in the wide and thin formats needed to maximize the performance of next generation batteries.

lithium anodes and lithium metal needed by next generation batteries to be produced from widely available feedstocks, at scale, and at a fraction of the cost of the conventional processes.

As the world moves away from oil-based fuels and toward renewable energy sources and battery-powered technology, the need for new lithium batteries and lithium foil anodes has become more prevalent.

Energy dense

Li-Metal anodes offer better energy density than foil anodes because they can be practically made thinner – no excess lithium.

Recently, I caught up with Li-Metal’s CEO, Dr. Srini Godavarthy (SG), to discuss the progress made by Li-Metal in the pursuit of next generation technology.

Cost efficient

Cost and quality improve with decreasing anode thickness leading to high battery cell energy density and reduced material use – exactly what is needed for highperformance batteries.

CONTINUED ON PAGE 18

Scalable

Underlying technology adapted from exceptionally large scale – no fundamental technology breakthrough needed for large-format battery anodes.

OCTOBER 2023 CANADIAN MINING JOURNAL | 17 CLEAN ENERGY/BATTERIES

Interview with Li-Metal’s CEO, Dr. Srini Godavarthy

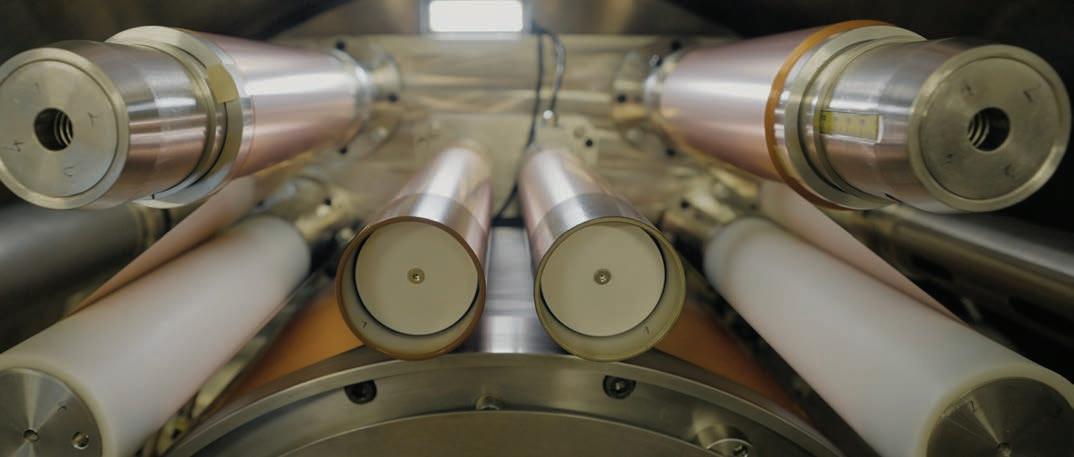

Li-Metal’s physical vapour deposition (PVD) equipment, which is used to produce next generation anode materials at the company’s pilot facility in Rochester, N.Y.

CREDIT: LI-METAL

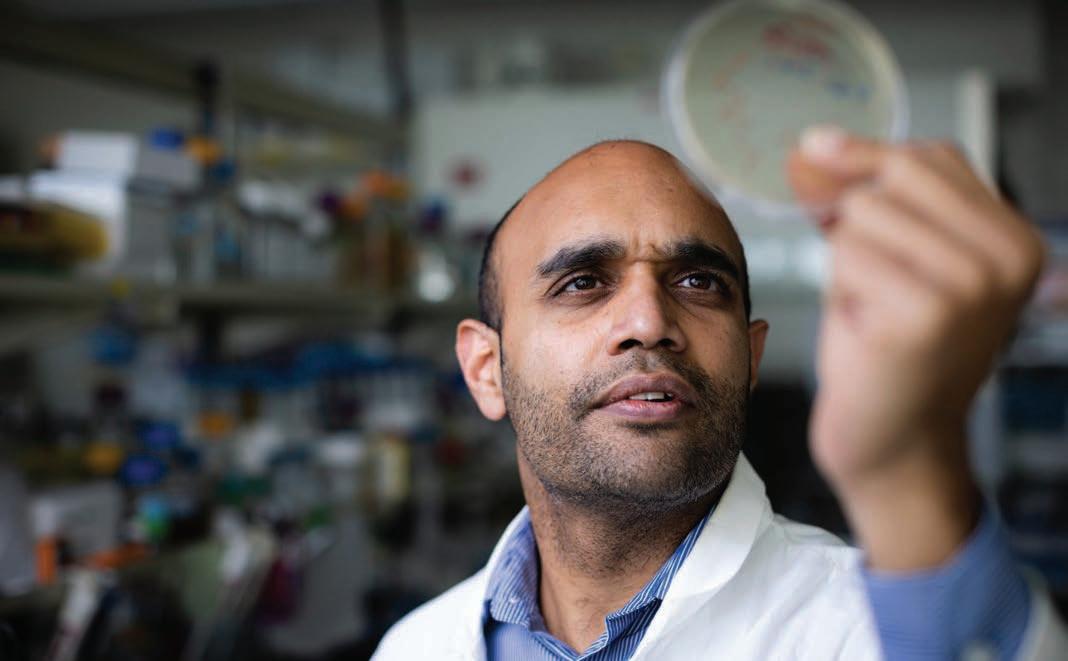

Dr. Srini Godavarthy, Li-Metal’s CEO

CMJ: As a conversation starter, could you please talk to us about the history of Li-Metal, your background, and how you became CEO?

SG: Li-Metal Corp. was founded in 2018 by Maciej Jastrzebski and Tim Johnston to address an emerging and prevailing underlying trend in the electrification of transportation – the transition from conventional lithium-ion batteries to next generation high-performance batteries, such as solid-state, hybrid liquid electrolyte, and lithium-sulphur. Tim and Maciej met at Hatch, one of the foremost engineering companies in Canada. Tim is a serial entrepreneur in the lithium space, and Maciej brought the technological innovation – what started out as a series of interesting lunchtime and coffee chats in Toronto, quickly gave birth to the concept for Li-Metal, which was technically developed and economically evaluated over the subsequent few months.

Fast forward to present day, Li-Metal is working at the forefront of the next generation battery supply chain, developing and commercializing production technologies to help produce lighter, cheaper, cleaner, and better-performing batteries for electric vehicles (EVs) and other transportation applications, such as electric aviation. We are working to become a leading domestic battery anode supplier to battery developers and automotive OEMs (original equipment manufacturers). We believe our ultra-thin high-performance anode materials for next generation batteries will play a key role in unlocking the future of electric transport.

Our vertically integrated process begins with lithium carbonate and ends with cost-effective, high-performance anodes ready to go into next generation battery cells utilizing two core technologies: a lithium metal technology and a next generation battery anode technology. We are currently engaged with 27 automakers and battery developers, with 15 leading next generation battery developers actively sampling our anode materials, as we continue to strengthen relationships with key players in the next generation battery ecosystem. We have also secured a recurring commercial order for our anode materials, which in addition to generating revenues provides us with the opportunity to further

validate our products and advance our anode business.

Li-Metal has an advanced anode pilot plant in Rochester, N.Y., capable of producing thousands of metres of anode material per year and a lithium metal pilot plant in Markham, Ont. At the same location as our lithium metal pilot plant, we also house an advanced anode lab and our corporate offices.

When I joined as CEO of Li-Metal earlier this year, I was confident in the opportunities in front of the business as we develop ground-breaking solutions that will shape the next generation of batteries. I hit the ground running as on my first day of the job we were granted our first patent for our lithium metal technology. In terms of my background, I bring more than two decades of commercial and operational experience with a specialization in chemicals and lithium battery materials.

Before joining Li-Metal, I led the lithium metals and specialty salts business at Albemarle Corp., the world’s top lithium producer. I started out my career at Huntsman International as an engineer and have always had a passion for chemicals. I earned my Ph.D. in chemical engineering from Oklahoma State University and my MBA in Finance from Colorado State University.

For some background for how I got to Li-Metal, Maciej,

18 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

CLEAN ENERGY/BATTERIES

Li-Metal’s pilot facility in Markham, Ont. CREDIT: LI-METAL

Li-Metal’s first lithium metal product, which was produced at the company’s facility in Markham, Ont. CREDIT: LI-METAL

Li-Metal’s previous CEO and now our CTO, recognized the benefits of installing a CEO to lead the company through its next phase of growth while he focused his efforts on leading the innovation, product development, and R&D, which is core to the success of any technology enterprise. I am really excited about the road ahead as we look to reach commercial scale anode production capabilities as soon as 2024.

where lithium metal (which we plan to produce ourselves) or a combination of materials is deposited. This is then collected on the product roll, to produce the final anode product, which can be used directly in new battery cells. In other words, using a vacuum environment, we apply vaporized lithium metal on a copper substrate to build these anode materials from the “bottom up.”

CMJ: Conventional lithium anodes are made of lithium foils, can you please explain why this is a problem, and what is the solution offered by Li-Metal’s technology to this problem?

SG: Before Li-Metal, the existing technologies for producing next generation anodes faced significant challenges, as conventional anodes are typically made by extruding and rolling lithium metal into thick foils.

To increase the penetration of EVs, the industry is focused on attaining cost parity compared to internal combustion engines (ICE). The battery plays a significant role in this, and the industry is targeting battery costs of $100/kwh. In Li-Metal’s experience and discussions, many of our customers are focused on the goal of getting to cost and performance parity (range) with ICEs. However, given the cost of lithium metal, the use of thick lithium foils as anodes makes their technology more expensive.

A core challenge with foil extrusion, as a production method, is that it is difficult to scale, especially as the foil gets very thin, a critical requirement to reduce the cost of anodes. Furthermore, because it is difficult to customize the thickness of foils, the energy density (and the range of the vehicle) is reduced. To add to all these challenges, excess lithium in the battery, because of combining traditional cathodes with thick lithium anodes, contributes to increased risk of a fire, impacting safety requirements.

Li-Metal is focused on solving these challenges with our innovative roll-to-roll PVD (physical vapour deposition) anode technology. PVD is a ubiquitous technology, and anything that looks metallic but made of plastic is likely made from a PVD process, such as the shiny metallic coating inside a bag of potato chips. This technology, in other industries, has been able to produce millions of square metres of low-cost materials for decades, and we are applying this proven technology platform to produce advanced anode materials for the next generation battery industry.

Technically speaking, we use a one-pass double-sided roll-toroll deposition approach as micron-scale material starts on a substrate roll, unwinds, then passes through a treatment zone

Using our PVD approach to anode production is the opposite of the traditional approaches, as instead of squeezing, flattening, or pressing a piece of lithium metal down to the thickness we want, we build it up by depositing it directly on a copper substrate. By building these lithium metal films from the bottom up, we minimize the amount of lithium metal used in our process, which reduces excess lithium to improve safety. This also increases the cost effectiveness of our process by limiting waste of a highly valuable feedstock. Not only does our process allow us to minimize the amount of lithium used, but it also allows us to co-deposit other materials to enhance the performance of our anode materials, as we eliminate the need for graphite in battery anodes.

At our advanced anode pilot plant in Rochester, we have proven our ability to produce lithium metal anode products with lithium thickness between 3 and 25 micrometres, as we continue to customize our offerings to meet customer demand. Furthermore, through our work in Rochester, we believe we are operating one of the highest intensities PVD lithium metal anode processes in the industry. In other words, we believe our PVD process operates at an unmatched efficiency rate in the next generation battery industry. As of June 2023, the team has produced more than 5,787 metres of sample lithium metal anode material, compared to 4,200 metres in 2022.

We believe our work with PVD technology is just getting started, as this highly flexible technology platform can be upgraded to accommodate unique combinations of materials to optimize cost and electrochemical performance, unlocking a suite of future product development opportunities.

As we continue to advance our anode business, my short-term goal for Li-Metal is to approach 0.5 GWh of anode capacity as quickly as possible, or the equivalent of 4 million to 5 million m2 of anode material per year. To support the growth of our anode business, we are evaluating options for the best location for a future anode facility in addition to government incentives to help us scale up faster to meet accelerating customer demand.

CMJ: So, what are the advantages of Li-Metal’s new technology?

CONTINUED ON PAGE 20

majorcanada@majordriling.com

OCTOBER 2023 CANADIAN MINING JOURNAL | 19 GLOBAL LEADER IN SPECIALIZED DRILLING

SG: Li-Metal’s vertically integrated technology platform offers many distinct advantages for producing high-performance anode materials compared to traditional and alternative methods on the marketplace.

First, our ability to produce lithium metal ourselves is a key differentiator for our business, as it enables us to secure a reliable and sustainable domestic supply to feed our anode operations. Traditionally, lithium metal has been produced using lithium chloride as feedstock, which generates approximately five tonnes of harmful chlorine gas by-product for every tonne of lithium metal produced. Lithium chloride is typically made by treating lithium carbonate; however, Li-Metal’s patented carbonate-to-metal lithium metal technology can eliminate this costly conversion step by producing metal directly from lithium carbonate. Of note, to our knowledge, conversion capacity to produce lithium chloride from carbonate is limited, and significant capital investment would be required to meet the added demand for lithium metal. Given past experience in the lithium industry, these types of expansion projects could take at least four to five years from design to production. This means that it is highly unlikely that traditional lithium metal production processes will be able to be scaled up quickly to meet the growing needs of the next generation battery industry in North America and Europe.

With the demand for lithium metal expected to increase by 10 to 12 times to more than 40,000 tonnes per year by 2030, our cleaner, cost-effective, and energy efficient lithium metal production process that avoids producing toxic by-products will be key. We have had great momentum with our lithium metal technology as in May of this year, Li-Metal successfully produced lithium metal directly from lithium carbonate. We believe Li-Metal is the first company in the world to do this and we accomplished this metallurgical process breakthrough at our facility in Markham, Ont.

For our next generation battery anodes, as mentioned, by using our highly flexible and scalable PVD technology platform, we can produce lithium metal anodes from the “bottom up” compared to the traditional or alternative “top down” approaches. This minimizes the amount of lithium metal used in our process compared to other processes, which reduces excess lithium to

improve safety and limits waste. Furthermore, our PVD platform allows us to customize our anode materials to fit the specifications of our customers, which is a key advantage, as we can be flexible to meet the unique needs of our growing customer base.

SG: As we position ourselves as a leading domestic battery anode supplier and battery materials innovator to the next generation battery supply chain, we continue to expand and strengthen our relationships with key battery developers and automotive OEMs. Currently, we have ongoing discussions with 27 battery developers and automakers, 15 of which are sampling our anode materials in next generation batteries to qualify our technology. We have also secured a recurring commercial order for our anode materials. As protecting our customers is a key priority for Li-Metal, currently, we have not publicly disclosed many of the names of the battery industry leaders we are working with.

We do have one publicly disclosed relationship, as we have a joint development and commercialization agreement with Blue Solutions, the largest commercial producer of solid-state batteries, to advance the development of next generation batteries. Blue Solutions, a subsidiary of the US$14 billion French conglomerate Bollere, is the largest commercial manufacturer in the market, supplying an all-solid-state lithium metal battery for real-life applications running on every continent. Blue Solutions has been working on solid-state batteries for decades, and their batteries power Mercedes Benz electric buses in Europe. The partnership combines our technologies with the know-how of a proven battery solid state battery producer to advance solid-state batteries for passenger EVs.

CMJ: Last April, Li-Metal signed an exclusive agreement with Mustang Vacuum Systems, why are agreements like this important, and what does this specific agreement mean to you and to Li-Metals?

20 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

CMJ: Were you able to partner with the battery industry leaders to commercialize the technology at this point?

CLEAN ENERGY/BATTERIES

Li-Metal’s physical vapour deposition (PVD) equipment. CREDIT: LI-METAL

SG: Our strategic binding agreement with Mustang Vacuum Systems for the exclusive supply of high performance PVD machines and services to produce anode materials is expected to be a key development for our anode business.

Mustang Vacuum Systems is a leading global manufacturer of industrial scale PVD equipment, and this agreement helps advance our position as the preeminent domestic anode supplier. When it comes to PVD as a technology platform, the equipment plays a key role in the productivity of the technology. Securing the right equipment and partner to support us on the manufacturing side opens the door for us to really maximize the potential of our novel roll-to-roll PVD anode technology. It is a key step in the roadmap for our anode business and enables us to continue to focus on scaling our capabilities, enhancing our technological advantage, and focus on supporting our customers with the confidence that we have the right machine building partner backing us.

Furthermore, through this strategic partnership, we expect to collaborate on additional commercial business opportunities for providing lithium-based anode materials to current and prospective customers. Mustang Vacuum Systems is also expected to become a Li-Metal shareholder, which further strengthens our alignment and collaboration.

CMJ: How do you intend to use the recent $1.4 million grant sponsored by the government of Ontario?

SG: We were awarded more than $1.4 million in non-dilutive grant funding from various programs sponsored by the government of Ontario to develop and commercialize our lithium metal production technology. The funding consisted of funding from the Ontario Vehicle Innovation Network (OVIN) and the Critical Minerals Innovation Fund (CMIF).

We plan to use the funds from OVIN to support scale-up of our production and refining capabilities for battery-grade lithium metal. We will also use these funds to advance the piloting of new lithium metal products, such as specialty lithium alloy ingots for next generation batteries.

We plan to use funds from the CMIF to advance our environ-

mentally friendly and patented lithium metal production technology to help support the development of battery supply chain in Canada.

Scaling up our metal business helps further differentiate Li-Metal in the market as a vertically integrated domestic anode supplier and helps advance the development of our anode business by securing a cost-effective and sustainably produced feedstock. The funding from the government of Ontario validates our technology and endorses the role we are poised to play in building a sustainable battery supply chain in Canada.

CMJ: Finally, how does the future of batteries manufacturing in Canada look like to you?

SG: We are pleased to see major players in the battery ecosystem set up shop in Canada, such as Volkswagen, LG Energy Solution, Umicore, and many more. Furthermore, Canada has a substantial amount of potential upstream – or the raw materials – to help create a prosperous battery supply chain. Although the Inflation Reduction Act in the U.S. has been making many of the headlines, we are excited about some of the initiatives the Canadian government has taken to support our own battery materials supply chain and the opportunities that have followed suit.

Even though Canada continues to make great strides for electrifying our transportation system, it is essential that we do not overlook the emerging next generation battery supply chain. The Canadian next generation battery ecosystem has made progress; however, the U.S. continues to maintain the highest concentration of key players. If Canada does not divert more attention towards supporting the development, and the supply chain, of these better batteries, then we will be left behind.

Not only the future of the EVs lies within these battery technologies that are under development, but also the future of transportation more broadly. Lighter and more powerful batteries are the future, and it is important that Canada starts to focus its attention on the battery supply chain of tomorrow not the current lithium-ion battery supply chain, which will eventually become obsolete. Canada is a natural leader in innovation, it is time for us to really get in the game. CMJ

OCTOBER 2023 CANADIAN MINING JOURNAL | 21

A Li-Metal employee using the company’s physical vapour deposition (PVD) technology and equipment to produce anode materials for next generation batteries CREDIT: LI-METAL

waste

The atmosphere contains 2,200 gigatonnes of carbon dioxide (CO2). Each year, 58 gigatonnes from this reservoir are sequestered by earth’s processes. At the same time, 63 gigatonnes of CO2 are emitted by all human activities and natural phenomena. For much of the planet’s existence, the rates of emission and sequestration of CO2 have been balanced. The current push toward net-zero is an attempt to reset the balance. Humanity has no future if we fail to do so.

Internal combustion engine (ICE) vehicles cumulatively emit approximately 6 gigatonnes of CO2 each year. Widespread replacement of gasoline guzzlers with electric vehicles (EVs) could reduce global CO2 emissions by 3 gigatonnes. That is 60% of our 5 gigatonnes target! The production of more EVs means more mining.

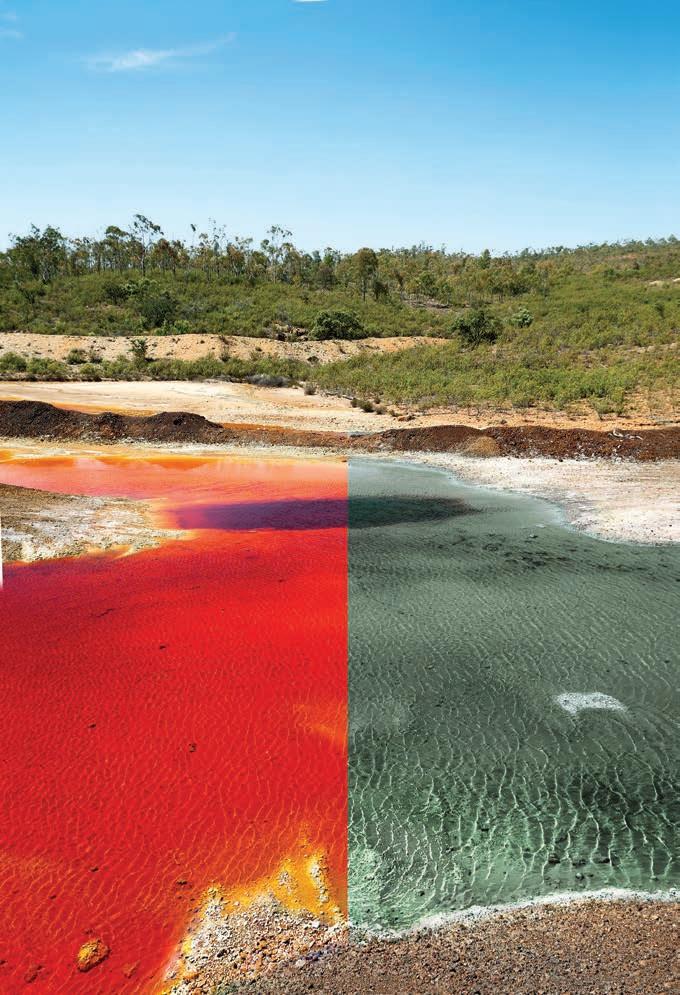

Then, what is the issue? Several. For starters, new mines are increasingly difficult to find, permit, and develop. Declining ore grades means they are less productive and are more expensive to operate. We desperately need larger, more enriched sources of metals. More

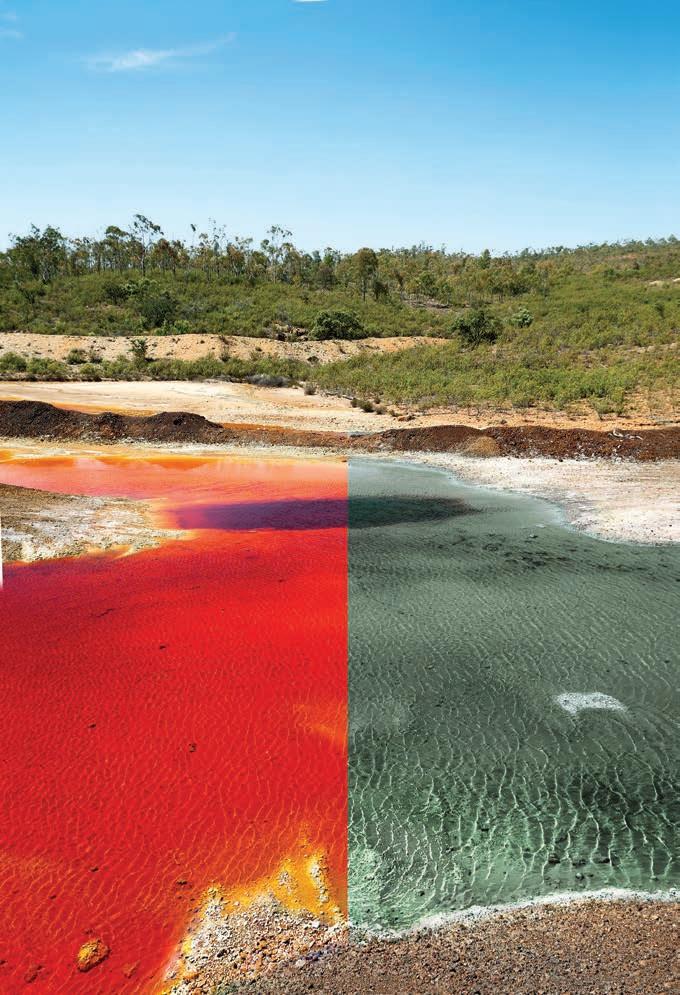

mining also means more waste rock and more tailings ponds. The current global inventory of tailings exceeds 200 billion tonnes and 200 trillion litres of water reside in tailings ponds. In many cases, mining waste directly contributes to the generation of acid rock drainage (ARD), which is a significant environmental challenge with a particularly high carbon penalty. Tailings and ARD are also leading contributors to the mining industry’s attached liabilities.

What if I were to tell you that one of the problems is a solution to the other?

Consider the example of copper: The global reserves of copper are estimated to be 880 million tonnes. A quarter of these reserves – 200 million tonnes – reside in Chile. In fact, every report cites Chile as holding the largest reserves of copper in the world. It is a contentious claim. Did you know that 200 million tonnes of copper also sit in tailings around the world, a vast majority of which are in acidic ponds? Imagine if one were to mine these waste sources rather than expend significant resources to store or neutralize them. There now exists a net-zero technology that can extract valuable metals from the

water in tailings ponds and tailings reprocessing facilities and simultaneously treat and condition the water. It is called TersaClean, and field testing of the technology is expected to commence next summer.

TersaClean is the brainchild of Tersa Earth Innovations, a biotechnology company that is developing decarbonized processes for metal recovery and water treatment solutions for the mining industry. Tersa has developed technologies for ARD treatment, direct lithium extraction, and even PFAS (polyfluoroalkyl substances) remediation.

TersaClean combines three distinct goals: metal recovery, water treatment, and carbon abatement, into a single process. TersaClean is a two-stage, continuous process. The first stage comprises a stack of flow-based microbial fuel cells (MFCs) that selectively recover metals from mine-impacted water. The water is further processed in the second stage using microbial carbonate precipitation (MCP) and conditioned to a state that meets environmental regulations for discharge and recycle.

MFC is a self-powered electrochemical

22 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

CLEAN MINING

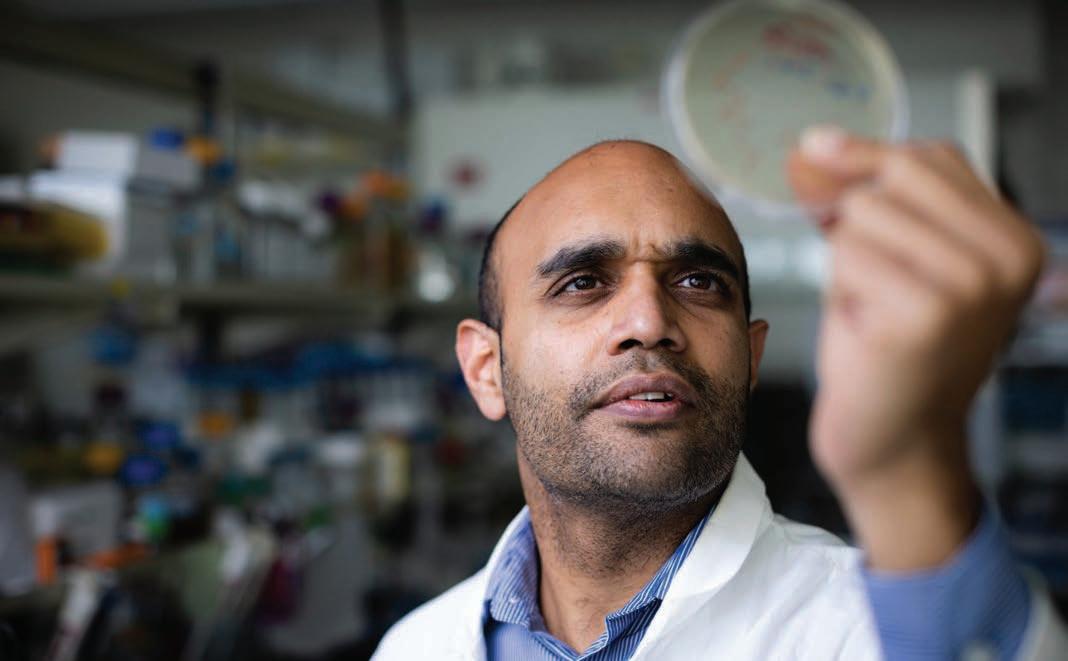

By Vikramaditya G. Yadav

is a failure of the imagination

Vikramaditya Yadav at the lab. CREDIT: TERSA

cell – a bacteria-driven battery – that consists of cathodic (reducing) and anodic (oxidizing) chambers sandwiching an ion exchange membrane. Natural or engineered exoelectrogenic (electron generating) bacteria at the anode generate an electric current through the oxidation of an organic substrate such as glucose, acetate, or lactate. The current is relayed to the cathode, where it is consumed in reduction reactions that deposit metals in solution onto the cathode. The phase of the deposited metal is influenced by the pH and temperature of the solution and is guided by Pourbaix diagrams. Metals such as gold, silver, iridium, platinum, and palladium are deposited in their pure, elemental forms. Copper deposits in the pure form under acidic pHs. Contaminants such as arsenic deposit in the oxidized form, whereas selenium is recovered in its elemental form under typical conditions. MFCs operate on the simple premise of allowing bacteria to do what they have evolved to do best – oxidize sugars and respire. In the case of exoelectrogenic bacteria, the respiratory products are electrons. This fact, along with separation of the redox couple, delivers higher rates that are independent of concentration of the metals in solution. Flow-based MFCs drive this advantage several steps forward.