With an eye to exploring Mars and beyond, space agencies worldwide are

looking to mining to supply water, fuel and oxygen needed to send astronauts on longer missions. The target? Water on the moon in the form of tiny ice crystals. Sci-

With an eye to exploring Mars and beyond, space agencies worldwide are

looking to mining to supply water, fuel and oxygen needed to send astronauts on longer missions. The target? Water on the moon in the form of tiny ice crystals. Sci-

POLICY | New mines will be public-private partnerships with state control

entists see mining for water as a critical enabler of humanity’s pursuit of deep space exploration.

Once extracted from a fine, dusty 2-metre surface layer (regolith) on the moon, the water can be split into two valuable commodities in space using simple electrolysis — oxygen to sustain human presence and hydrogen, recombined with oxygen, becoming one of the most potent chemical propellants known to humanity.

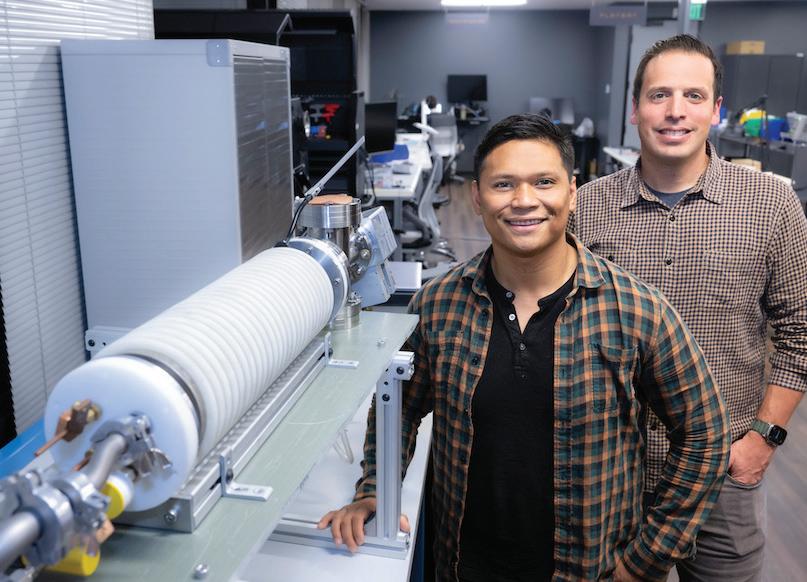

To get there, scientists want to adapt terrestrial mining methods for use on the moon. The Canadian Space Agency (CSA) has contracted the Sudbury, Ont.-based Centre for Excellence in Mining Innovation (CEMI) to help identify Earth-bound Canadian mining assets, capabilities and innovators that could help develop and establish a space mining industry.

The goal is to set up lunar infrastructure and a midway space staging area orbiting the moon, from which deep space travel can be explored.

According to Dale Boucher, who has been researching space mining technologies for more than two decades and is working with CEMI on the CSA project, mining on the moon will not resemble anything we’re used to on Earth.

However, he told an Apr. 13 CEMI-hosted webinar on the emerging space mining economy that the clock is ticking to find suitable mining methods applicable to the moon.

With the successful completion of NASA’s Artemis I moon flyby late last year, Canada is set to play an increasingly important role in space exploration and mineral extraction. In 2024, Canada is set

See MOON / 9

BY CECILIA JAMASMIEChile’s President Gabriel

Boric announced on Apr. 20 that his government would nationalize the country’s lithium, applying a model in which the state will partner with companies to develop the local industry.

The long-awaited policy in the world’s second-largest producer of the battery metal includes the creation of a national lithium company, Boric said on national television.

State copper giant Codelco, the world’s No. 1 producer of the metal, will be initially in charge of signing up partners for new contracts.

That role will then be undertaken by a dedicated national lithium company, whose mandate will be to develop the industry into a pillar for Chile’s economy while protecting its environment.

“This is an opportunity for economic growth that will be difficult to beat in the short term… We can’t afford to waste it,” Boric said.

The two lithium miners already operating in Chile, Albemarle (NYSE: ALB) and SQM (NYSE: SQM) will continue to do so until their contracts expire. Without naming them, Boric said he hoped that lithium miners already present in Chile would be open to negotiate state participation before the end of their contracts.

The contract for the world’s No. 1 producer, Albemarle, runs out in 2043, while the one for SQM, the second largest globally, ends in 2030.

The president noted that future lithium licences will be only issued

as public-private partnerships with state control.

Codelco and state miner Enami will be given exploration and extraction contracts in areas where there are now private projects before the national lithium company is formed.

In a statement, SQM said it was still analyzing the text of the new See CHILE / 10

PM40069240

How humanity’s conquest of space will depend on mining lunar water

MOON MINING | Off-world H20 becomes oxygen, hydrogen-based fuel

At press time on Apr. 25, Teck

Resources’ (TSX: TECK.A/ TECK.B; NYSE: TECK) was preparing for an Apr. 26 shareholder vote that could determine if it falls prey to a hostile takeover bid from Swiss miner and metals trader Glencore (LSE: GLEN).

In February, Teck proposed a split of its metallurgical coal assets and its base metals. Two-thirds of shareholders — both Class A shares, which count for 100 votes each, and Class B, which carry only one vote each — must approve the spinoff.

If they don’t, it will be seen as a signal to negotiate with Glencore, which has offered US$23.2 million for the company. If successful, Glencore would split the combined company’s assets into a base metals unit and a coal and oil unit that would include Glencore’s thermal coal assets as well as Teck’s metallurgical coal assets.

Ahead of the vote, Teck lined up support from shareholders that included Japan’s Sumitomo Metal Mining.

The company, one of Teck’s top shareholders, holds 18.9% of the Class A shares and 0.1% of the Class B shares of Teck. It also has a 49% stake in Temagami Mining, which itself holds 55% of Teck’s Class A shares.

Sumitomo and Teck have a decades-long partnership in mining, including the joint development and construction of the Pogo gold mine, in Alaska, and the Quebrada Blanca copper mine, in Chile.

But two influential shareholder advisory firms — ISS and Glass Lewis — have recommended against Teck’s strategy.

And at press time it wasn’t clear how Teck’s biggest B-shareholder with 10% of the shares, China Investment Corp., would vote.

Glencore has raised the prospect of improving its bid for Teck, pro vided that shareholders reject the Canadian miner’s plan to split the company in two companies, Teck Metals and metallurgical coal firm Elk Valley Resources.

In an open letter addressed to Teck’s Class B shareholders, who

own almost all of the equity but hold few of the votes, Glencore chief executive officer Gary Nagle said his company was open to talk improvements to its proposal.

“Glencore has never stated that its proposal is ‘best and final’ and that it is not willing to make changes and improvements,” Nagle said, adding the company would make an offer directly to Teck shareholders “if the proposed Teck separation does not proceed.”

Nagle warned that any potential future offers for spinoff metals unit Teck would likely look very different, given the friction costs, the complexity of the two companies, the time delay involved and the impact of two new management teams and boards.

Nagle also said that the Teck board had “consistently refused” to engage with Glencore.

“We believe that with engagement, we could improve our proposal’s terms and value, which would be in the best interests of all Teck shareholders,” he wrote.

The Canadian company quickly replied by saying that Teck has pre

Glencore’s initial bid represented a 20% premium to Teck’s Mar. 26 closing price, when it was privately made. JP Morgan analysts have said that Glencore could pay as much as US$27.2 billion.

This isn’t Glencore’s first attempt to acquire the Vancouver-based firm. Teck says that in 2020, the two companies engaged in “detailed” discussions about a merger and restructuring, but that the offer contained the same “structural flaws” as the current one. Teck says its separation plans offer better value to shareholders.

No “foreign predators”

Canadian mining legend Robert Friedland, has come out in defence of Teck. The billionaire urged the Canadian government and regulators to protect Teck from “foreign predators” and to ensure that strategic resources, particularly copper and zinc, remain in local hands.

The mining veteran warned on Apr. 17 through a series of tweets that investors should not take lightly the attempted takeover of a Canadian “champion.”

“Losing another quintessential

Canadian support mechanism to multinationals could corporatize and hollow out our unique ecosystem that has so successfully explored our vast landmass,” he said.

Friedland highlighted Teck’s history of supporting Canadian junior mining and exploration companies, including Diamond Field Resources (known today as DFR Gold) — the richest nickel discovery in the world in the last 50 years.

The magnate, who made his fortune from the Voisey’s Bay nickel project in eastern Canada in the 1990s and has been involved with some of world’s biggest recent copper discoveries, said that Glencore’s offer undervalues Teck and its assets, and noted that many investors, including himself, would be interested in buying the company or partnering with it post-split-up.

The 72-year-old has long been warning about the need to secure copper supplies. He believes the orange metal is so crucial in electrifying the global economy that finding enough of it has become a national security issue.

Friedland said he had “great respect” for Glencore as one of

the world’s leading metal trading houses and mining companies, but noted the company and Teck had “vastly different cultures” when it comes to exploration, mine development, and mining operations.

Michael Goehring, president and CEO of the Mining Association of British Columbia (MABC), on Apr. 17 expressed his concerns about the eventual takeover of Teck.

“The potential loss of B.C.’s long-standing mining champion and head office jobs in Vancouver is not in the best interests of British Columbians,” Goehring said. “We should be growing more local head office jobs in Vancouver, anchored by companies like Teck Resources, rather than see them go elsewhere.”

He called on the federal government to review the deal as the future of a “major Canadian critical minerals producer” is on the line.

Ross Beaty, founder and chair emeritus of Pan American Silver (TSX: PAAS; NYSE: PAAS) and chairman of Equinox Gold (TSX: EQX) also weighed in, saying that “it would be foolish to entertain proposals from a single interested party prior to separation.” TNM

iedmont Lithium (NAS-

DAQ: PLL; ASX: PLL) says its proposed US$600-million lithium hydroxide plant in Tennessee would pay for itself in less than

The project has an after-tax net present value of US$2.5 billion at an 8% discount rate, an internal rate of return of 32% and a payback period of 2.8 years, according to a feasibility study released on Apr. 20. The study assumes fixed prices of US$26,000 per tonne of lithium hydroxide and US$1,600 per tonne of spodumene concentrate over the project’s 30-year life.

Located about 265 km southeast of Nashville, the proposed 30,000-tonne-a-year plant would double current lithium hydroxide production in the U.S. on its own.

The project has pivoted to processing ore from Quebec, where the company owns a stake in Sayona Mining’s (ASX: SYA) operation, instead of from Piedmont’s delayed US$840-million open-pit project in North Carolina that has yet to secure all permits.

“Tennessee Lithium is positioned to be a key resource for

electric vehicle (EV) and battery manufacturers,” Piedmont president and CEO Keith Phillips said in a statement with the study. “We can source raw material from spodumene that we own or in which we have an economic interest, providing greater control of our feedstock while capturing the economics of integrated production.”

The North Carolina-based company plans to start construction of the Tennessee plant next year if it secures permits and financing, it said. It will benefit from a US$141.7 million government grant under last year’s Inflation Reduction Act, which the feasibility study assumes in its model.

“America’s pro-EV and battery manufacturing policies are providing an advantage to Piedmont at a time when many analysts are projecting lithium shortages to continue into the 2030s,” Phillips said.

While U.S. output of lithium for batteries is low at the moment, a Biden administration push for more production alongside similar policies in many Western countries is aimed at loosening China’s grip on processing the light metal. Canada alone has more than 400 mostly early-stage lithium projects, nearly

half in the hard-rock hotspot east of James Bay in Quebec, and large brine projects in Alberta, such as E3 Lithium’s (TSXV: ETL) Bashaw at prefeasibility stage.

On Apr. 20, another project in the U.S. was announced. Stardust Power, an unlisted company based in Greenwich, Conn., said it planned to start building a plant next year in an unnamed central state to produce 50,000 tonnes annually using material from brine operations.

Back at the Tennessee plant, Piedmont said it is arranging supplies from the Ewoyaa lithium project in Ghana, which it is developing with Atlantic Lithium (AIM: ALL; ASX: A11). A feasibility study is due on that project by the middle of this year, Piedmont said.

The Tennessee project already has off-take agreements with automaker Tesla and LG Chem. Phillips says the project will save money and be more environmentally friendly than some other lithium processors.

“With the Metso: Outotec flowsheet, we believe we can sustainably produce critical lithium materials on a cost-effective basis for a more responsible profile compared to producers utilizing sulphuric acid roasting,” he said. TNM

AutoMine® for Trucks continues to set the industry standard with autonomous seamless truck haulage from underground up to the surface. They help to reduce equipment damage and repair work, add the highest levels of efficiency and fleet utilization, giving a lower cost per ton and make your operation more productive and safer. They are scalable for different mining applications and can be supervised from remote locations.

Attending the CIM Convention in Montréal? Visit booth # 1707 & 3114

ROCKTECHNOLOGY.SANDVIK

/AUTOMINE-FOR-TRUCKS

MINING

GLOBAL

Mining runs on M&A — one of the only constants in a business that’s full of uncertainty. Still, it’s been painful to watch so many home-grown metals and mining companies disappear in recent years.

EDITOR-IN-CHIEF: Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

SENIOR STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PODCAST HOST: Adrian Pocobelli, MA (Engl) apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/

APPOINTMENT NOTICES/

CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

Toronto

Head Office 225 Duncan Mill Road, Suite 320 Toronto, ON, M3B 3K9 (416) 510-6789 tnm@northernminer.com

THE VIEW FROM ENGLAND: COLUMN | Famous gems being both flaunted and hidden

They include: Alcan, which Rio Tinto bought in 2007 for US$37.6 billion; Falconbridge, which was acquired by Xstrata in 2006 for US$17.4 billion; Inco, which went to Vale that same year in a deal worth US$17.2 billion; and Goldcorp, which Newmont paid US$10 billion for in 2019.

Soon, Vancouver-based Teck Resources, which is being pursued by Swiss-based Glencore, could join the list.

Teck’s board has rejected Glencore’s US$23.2-billion bid (mostly shares, with an up to US$8.2 billion cash component for shareholders who don’t want exposure to coal and oil), first made public in early April. But if Teck shareholders reject the company’s plan for a spinoff of its metallurgical coal assets in a vote scheduled for tomorrow, the board would need to sit down with Glencore, which has signalled it’s willing to pay more for the diversified miner.

The problem is, it takes time to build companies worth acquiring. Alcan was founded in 1902; Falconbridge in 1928, Inco in 1902, and Goldcorp in 1994. Teck celebrated its 100th anniversary in 2013.

Glencore already owns the historic Falconbridge assets, acquired via a US$31-billion takeover of Xstrata in 2013.

Canada builds great mining companies, but we can’t build them fast enough to keep up with demand.

And demand is high — mining M&A is at its highest level in a decade.

According to New York-based law firm White and Case, there were 288 deals worth US$88.2 billion last year. While that was down 2% in value from 2021, the firm noted in a March post that M&A in mining “massively outperformed” global aggregate M&A activity, which dropped 34% (measured by deal value).

The math is simple. Historic underinvestment in new mines over the past decade + long approval timelines for new projects + growing demand for minerals = more M&A to come. Rather than focus on finding or building new assets in recent years, miners have opted to spend their cash on share buybacks and upping dividends to shareholders; now they’re hungry for reserves.

“A mining company without ore reserves is an oxymoron,” said Teck’s chairman emeritus Norm Keevil in a letter to shareholders on Apr. 16, noting the company built or acquired 17 new mines over 30 years. “… Our previous best growth years resulted from a steady process of adding reserves over many years, one new mine at a time.”

Whether or not Glencore gets the prize, it seems certain that a merger with someone is in the cards for Teck. Teck has noted that it is open to a post-separation deal involving its base metals division, which includes a majority stake in its huge new Quebrada Blanca 2 copper mine in Chile, meaning shareholders could get a much better deal than what Glencore is offering. With no other Canadian companies of size left to digest such a deal, however, that someone is not likely to be Canadian. (International miners Vale, Anglo American and Freeport-McMoRan have all approached Teck, according to The Globe & Mail.)

Should that matter?

Perhaps the most interesting comparator to the play for Teck is the takeover that didn’t happen — BHP’s failed bid in 2010 for Potash Corp. of Saskatchewan, a one-time crown corporation established in 1975. (After merging with Calgary-based Agrium in 2018, it’s now Nutrien.) BHP’s nearly US$40-billion all-cash hostile offer was rejected by PotashCorp’s board. Saskatchewan’s former premier Brad Wall, who vehemently opposed the offer, said it provided no “net benefit” to Saskatchewan and Canada in terms of jobs and investment, Canadian control of an important Canadian resource, and provincial revenues.

“Do we want to add PotashCorp to that list of once-proud Canadian companies that are now under foreign control?” Wall asked at the time.

“In the past decade, promises about maintaining jobs, corporate headquarters and future investment have all been broken. We simply cannot take that risk with this valuable resource that belongs to the people of Saskatchewan.”

In the end, Tony Clement, industry minister in Stephen Harper’s Conservative federal government, used the Investment Canada Act to block the takeover, giving BHP 30 days to improve the offer. Understanding it would likely be futile, BHP withdrew the bid instead.

By now you should have received your invitation to the coronation of Charles III and his wife, Camilla, as king and queen of the United Kingdom and other Commonwealth realms. If you are at Westminster Abbey on May 6 (or watching, having mislaid your invitation) you will see a sparkling parade, but not the Kohi-noor diamond.

One of the world’s most famous gems, the 106-carat Koh-i-noor (Persian for ‘Mountain of Light’) will not be used by Camilla. Instead, Queen Mary’s crown will be modified using diamonds from Queen Elizabeth II’s personal collection, including three of the stones cut from the largest gem-quality diamond ever found (South Africa’s 3,106 carat Cullinan). This will allow Buckingham Palace to sidestep the controversy surrounding a gem acquired during the age of Empire (with Afghanistan, India, Iran and Pakistan all claiming ownership).

Charles will be the 40th monarch to be crowned at Westminster Abbey since 1066, but this is a slimmed-down version compared with his mother’s lavish ‘do’ in 1953. In a break with tradition, however, Charles is inviting other royals. Crowned heads from Europe will include (according to Tatler magazine); Philippe of Belgium, Anne-Marie of Greece, Grand-Duke Henri of Luxembourg, Albert II of Monaco, Willem-Alexander of the Netherlands, Felipe VI of Spain and Carl XVI of Sweden.

Royalty expected from outside Europe include the kings of Bhutan, Jordan, Lesotho, Malaysia and Tonga, the sultans of Brunei and Oman, and the emirs of Dubai and Qatar. Other royal families will also be represented, for example crown princes Frederik of Denmark, Fumihito of Japan and Haakon of Norway.

Diamonds on show aplenty, no doubt, but not the Koh-iNoor. Legend says that this stone was mined in the 13th century at the Kollur mine alongside the Krishna River in present-day Andhra Pradesh, India. There is no record of its original weight, but the diamond was one of many stones used in the ornate Peacock Throne of the Mughal dynasty in the early 17th century.

The diamond changed hands between various empires in south and west Asia before Britain’s East India Co. annexed the Punjab in 1849, and gifted the 191carat gem to Queen Victoria as a spoil of war. The diamond’s lacklustre appearance didn’t amuse the monarch and the stone was re-cut in 1852 (the significant loss of weight was also due to the discovery of several flaws).

Quite apart from the Koh-iNoor, diamonds have been in the news recently, with investment in a Canadian mine, a price rise, political threats and a record auction valuation.

2026. The investment is a boost for Yellowknife’s economy, which has relied on diamond mining for decades. Arctic Canadian Diamond Co. also plans to experiment with underwater mining crawlers to extend the life of the neighbouring Ekati mine.Meanwhile, diamond prices seem to be rising. London-listed Petra Diamonds reported a 13% increase in values at its tender during March compared with the previous one in December. Petra’s chief executive officer, Richard Duffy, attributed the increase to a recovery in demand from China, as well as stronger interest from major jewelry brands and a rise in orders for coloured stones. Another London-listed company, Gem Diamonds (owner of mines at Letšeng in Lesotho and Ghaghoo in Botswana), agreed that new demand in the short term was likely to come from China.

As The Northern Miner reported on Apr. 12, Botswana is threatening not to renew a five-decade sales agreement with De Beers if the diamond producer doesn’t offer a larger share of rough diamonds to the state’s gem-trading company, Okavango Diamond Co. De Beers and Botswana jointly own Debswana, which mines almost all of the country’s gems.

This political move comes after the southern Africa nation acquired a 24% stake in Belgian diamond-processing firm HB Antwerp. The company’s co-founder, Rafael Papismedov, was quoted by the Financial Times as saying that a revised deal would help Botswana “break free” from the current ‘colonial’ model that says you can only dig and wash diamonds. HB Antwerp recently opened a new facility in Gaborone that was described by Botswana president Mokgweetsi Masisi as having the potential to be a “game changer.”

Botswana’s gems are in the spotlight because of a rare pink diamond of “unparalleled colour and brightness.” De Beers announced at the end of March that a flawless 10.6-carat diamond, named The Eternal Pink, is expected to be sold at auction in June for over US$35 million. This would be the highest price per carat, US$3.3 million, for a gemstone ever sold at auction.

See EDITORIAL / 16 OIER/ADOBE IMAGES

The diamond was discovered four years ago at Debswana’s Damtshaa mine. The stone, originally weighing almost 24 carats, has been fashioned into a cushion cut to better showcase its colour, described as ‘bubble gum.’ Perhaps President Masisi should wear Eternal Pink at the coronation, there could hardly be a better showcase, or colonial statement. TNM

DEPARTMENTS Special Section: Far North 12 Professional Directory 17 Market News 18 Metal, Mining and Money 20 Stock Tables 20-23 COMPANY INDEX Adriatic Metals...................................................6 Albemarle 1 Aya Gold & Silver 6 B2Gold 13 Barrick Gold 5 BHP 8 Carlyle Commodities 6 Copper Mountain Mining 8 Endeavour Silver 11 Glencore 2 Great Boulder Resources 6 Greatland Gold 6 Green Technology Metals 11 HighGold Mining 14 Hudbay Minerals 8 Labrador Uranium 14 Li-FT Power 14 Lumina Gold 16 New Found Gold 6 Osino Resources 6 OZ Minerals 8 Piedmont Lithium 2 Probe Gold 6 Reunion Gold 6 Rupert Resources 14 Sabina Gold & Silver 13 Sayona Mining 11 Sitka Gold 14 SQM 1 Strategic Metals 15 Strategic Resources 15 Sunstone Metals 6 Teck Resources 2 The Metals Company 9 ValOre Metals 14 Vital Metals 13 West Red Lake Gold Mines 8 Western Alaska Minerals 15

Rio Tinto has announced plans to spend US$40 million to extend the life of its Diavik mine in the Northwest Territories to at least

ODDS ‘N’ SODS | The spectacular geology at the Iran gold project was overshadowed by a serious accident

BY RALPH RUSHTON

BY RALPH RUSHTON

Strolling around PDAC in March, I ended up in the core shack, perusing all of the world class, upper quartile tier 1 discoveries guaranteed to become a mine one day. Tucked away at one end was Barrick Gold’s (TSX: ABX; NYSE: GOLD) giant Reko Diq porphyry project in western Pakistan. The photos of the parched Baluchistan desert took me back to 1997 when I spent a couple of months there, prospecting for similar systems along the Afghan border. A year later in 1998, I was involved in planning the second phase of drilling at Anglo American’s (LSE: AAL) Zarshuran gold project in northern Iran and we sourced our drill rigs from Reko Diq, then owned by BHP (NYSE: BHP; LSE: BHP). The first Zarshuran drill program in 1996 was a slow grinding headache, (See Part 1 in the Mar. 6, 2023 issue) with only seven holes completed in three months. We couldn’t come to any firm conclusions about the project, so we started planning a follow up program for the summer of 1998.

We’d learned some tough lessons in Phase 1, and this time around we were going to be smarter. No more Iranian contractors. We’d use a modern, Western-owned, truck mounted top-drive rig with 1,500-ft. capacity to drill the project. Hopefully we’d get to a technical go/no-go decision ahead of the complex legal work needed for a major mining investment in Iran. But multipurpose rigs didn’t exist in Iran, so we needed to find a Western drill company ballsy enough to send one — along with experienced drillers — to Iran. Luckily, an Australian drill company — I’ll call them OzCo — had a suitable rig across the border in Pakistan at Reko Diq. The rig had finished its contract and OzCo wanted it earning revenue rather than sitting idle. OzCo’s drillers in Pakistan serviced the rig, stuck the rods and assorted widgets into shipping containers, loaded them onto flat beds and got ready to mobilize into Iran. All we had to do was drive it across the border at Taftan, fill in a few Iranian customs forms, and then drive it 1,900 km cross country to northern Iran. Simple.

And then everything stopped. OzCo called to say their gear was stuck at Reko Diq. The government had shut down western Baluchistan. Nothing was allowed on the main road across the province as a state of lockdown was imposed which dragged on for weeks. On May 28, all hell broke loose. The Pakistani government conducted five underground nuclear tests on top of a mountain in the Chagai hills just up the road from Reko Diq. Our rigs were stuck because of a nuclear test; something they never mention in corporate risk management classes.

Our convoy finally crossed the border mid-year under Iranian customs bond, and we were instructed to deliver everything to a customs yard in Tehran for inspection. There were dozens of police check points along the way, on the main roads into every town or city and random ones in the middle of nowhere, and every one of them wanted to stop my drill rigs to get a ‘”closer look at the paperwork” (read: shakedown for some cash) so the trip took weeks. At one point the convoy ground to a complete halt for four to five days in the middle of the desert. The road-

block cops were trying to watch Iran’s games in the world cup on an old black and white TV. Our logistics manager was sleeping under the drill rig truck in the desert heat by the side of a busy truck route nursing a bad case of piles, which he told me about in a tearful phone call to my hotel in Tehran one night. The cops were desperate for a new TV to watch the games and had randomly stopped dozens of trucks — all parked up in the wind-blown furnace — to see which driver would crack first and buy them a shiny new set as a bribe to get going again. One duly arrived out of a dust storm one day and the trucks all moved on to the next check point. Rinse and repeat.

I was holed up in a hotel in Tehran with four very unhappy OzCo drillers including a large Fijian chap who’d taken to punching holes in his bathroom wall. They’d been there for seven weeks, no booze, no clubs, no women; nothing to do but wait for their equipment to arrive at site. Eventually the rigs and containers arrived at Zarshuran, but a lot of stuff was gone — stolen while it sat in the customs yard in Tehran. Some vital parts had been removed from the rig’s diesel motor which now wouldn’t start and we faced more delays as replacement parts were sourced in Tehran and shipped to site.

When drilling finally kicked off I was presented with a new problem; the imported drillers really didn’t like each other. Two were experienced and two were on their first job as fully fledged drillers. The new boys were given the night shift by the drill manager, which ordinarily wouldn’t be too much of an issue, but hostility was quietly brewing away between the two factions. It came to a head one night when a local villager — working as an offsider — was nearly killed in what should’ve been a preventable accident but the day shift saw no reason why they should discuss any issues they might have faced on the day shift with the night shift crew. Apparently, they weren’t there to

teach them how to drill. So, when they did have a serious equipment issue one shift — the thread failed on locally made PQ drill rods when they were under torque — they said nothing. The thread had failed at the top of the hole at the connection between two rods, tearing them apart. The upper rod, which was connected to the top drive, broke off and whipped around at high speed, narrowly missing the driller. Unfortunately, the same thing

happened that night, but the night shift hadn’t been briefed by their colleagues on the potential issue. This time around, we weren’t so lucky. The PQ rod — 3 metres long and weighing close to 100 lb. — broke off under almost full torque, spun around at high speed and hit the offsider diagonally across his chest crushing him against the drill derrick. He was slammed against the hefty stilson wrench on the derrick which ruptured one of his kid-

neys, critically injuring him. Safely tucked away in my little camp office plugging in logging sheets to my laptop, I heard all sorts of anguished shouting drifting across the valley from where the rig was. I jumped into my truck and when I got to the rig, the offsider was unconscious and having seizures with bloody foam coming out of his mouth. He had to go to

See ODDS / 10

PearTree is a Canadian Securities Dealer and Investment Fund Manager advancing over (CAD) $500 million annually for resource exploration and mine development in a uniquely Canadian structure which results in as much as $2.00 of capital deployed for every $1.00 invested by global institutions and family offices.

Averaging $500M deployed through PearTree in 2021 and 2022 for the mineral exploration & development sector

Watch our video in English, Français, Deutsch and Español on our website

peartreecanada.com

OUR RIGS WERE STUCK BECAUSE OF A NUCLEAR TEST; SOMETHING THEY NEVER MENTION IN CORPORATE RISK MANAGEMENT CLASSES.

Our TNM Drill Down features highlights of the top gold assays of the past week. Drill holes are ranked by gold grade x width, as identified by our sister company Mining Intelligence.

The top gold assays for the week Apr. 14-21 come from the Americas and Australia. Reunion Gold (TSXV: RGD) leads the rankings with its Oko West project in Guyana. On Apr. 17, the Longueuil, Que.-based junior reported that hole OKWD23-243 returned 109.7 metres grading 5.59 grams gold per tonne from 433.3 metres depth for a grade x width value of 613. The high-grade mineralization in that and other holes drilled in the Kairuni zone at Oko West, cut higher-grade, structurally controlled mineralized shoots within Block 4. The results are among those from 25 diamond drill holes at Kairuni, an area in the northern part of Oko West that remains open along its 2.5-km strike length and at depth. Drilling there is part of a larger, 30,000-metre program that began at the start of 2023, and is expected to wrap up in May. The program is aimed at supporting an initial resource by mid-year, with a preliminary economic assessment planned for the end of 2023.

The second best assay of the week came from Greatland Gold’s (LSE: GGP) Ramses target, located 20 km southeast of the company’s flagship

Havieron gold-copper project in Western Australia. On Apr. 20, Greatland reported that diamond drill hole RAD002, cut 18.3 metres grading 22 grams gold from 924 metres depth, for a grade x width value of 402. That hole was drilled as part of its 2022 initial drill program at Ramses. Mineralization is open at depth, though the hole ended because of drilling limitations. Further structural and geochemical analysis, as well as a future downhole electromagnetic survey are needed to refine the potential for mineralization extending into shallower areas at

Rudall. “While recognising the high-grade intercept is at depth, the strong gold mineralisation and supporting pathfinder geochemistry in consistently altered and veined basement sediments continues to highlight the outstanding prospectivity within Greatland’s tenement package and the Paterson Province in general,” said managing director Shaun Day. Greatland received a A$200,000 ($180,920) grant from the West Australian government’s Exploration Incentive Scheme last May to co-fund its exploration program at Rudall.

The third best drill assay of the

week came from Carlyle Commodities’ (CSE: CCC) Newton project in central B.C., about 100 km west of Williams Lake. On Apr. 18, the company said that hole N23-091 cut 613.9 metres grading 0.53 gram gold from 18.1 metres for a grade x width value of 325. That hole, which went down 764 metres, has confirmed continuity of the well-mineralized main felsic volcanic domain, and that the main felsic zone extends to the west. It remains open at depth and in several directions. N23-091 was also the third and final hole in its first phase, 14-hole program

aimed at increasing the current resource. The diamond-drill program confirmed Newton hosts possibilities for expanding the inferred resource into untested zones. Carlyle is preparing plans for follow-up drilling to test those zones.

Newton is a low to intermediate-sulphidation epithermal gold deposit that saw almost 35,000 metres of drilling between 2009 and 2012. It hosts 861,400 oz. gold in 42.3 million inferred tonnes grading 0.63 gram gold per tonne, according to a resource estimate published last June. TNM

QUEBEC | Estimate update, prefeasibility study due this year

BY COLIN MCCLELLANDProbe Gold (TSXV: PRB) has reported scores of assays from its Pascalis deposit signalling a potential resource increase this year at the Novador gold project near Val-d’Or, Que.

More than 100 of the holes cut grades above the 0.4-gram-gold-pertonne cutoff used in a 2021 pit-constrained resource estimate, Probe said in a release on Apr. 18. The 111 holes drilled were split about evenly between expansion and infill drilling for a total of 18,100 metres.

“Probe continues to achieve a very high hit-ratio which bodes well for an increase in total resources and an upgrade of inferred resources to measured and indicated resources,” Barry Allan, a mining analyst for Laurentian Bank, wrote in a note on Apr. 18.

“Drill results greater than 0.4 gram per tonne are helping more accurately define a waste-ore boundary by converting waste material into ore, which is anticipated to lower the overall strip ratio when updating the project’s economic assessment.”

Toronto-based Probe plans to release an updated resource estimate and prefeasibility study this year for the 175-sq.-km Novador project, which holds the past-producing Beliveau, Bussière and

Monique mines. Novador used to be called Val-d’Or East and lies 25 km east of the Abitibi region town. The studies will follow the tripling of the indicated gold resource at the Monique deposit in January and more drill results from the Courvan deposit due within weeks.

Analyst sees sale Laurentian Bank’s Allan says drilling at Courvan is expected to convert inferred resources to measured and indicated, while there

may be a modest resource increase from Pascalis.

“We expect the prefeasibility study to incorporate a scope increase given that three previous pits outlined at Monique have now merged into one larger open pit, allowing for better economies of scale,” he said. “Ultimately, we anticipate the Novador project to be sold to an established mine builder with experience in the region (Agnico Eagle Mines or Eldorado Gold).”

Allan said selling Novador would allow Probe to focus on the La Peltrie project near Detour Lake, a copper-gold-silver-molybdenum deposit about 190 km north of Rouyn-Noranda in the Abitibi region. Probe is exploring it with Midland Exploration (TSXV: MD).

Allan has a buy rating on Probe shares and expects a “significant” increase in resources will offset higher project capital costs for a neutral impact on the stock’s valuation.

Probe shares gained almost 20% in the month before press time to trade at $1.67 apiece in Toronto, within a 52-week range of $1.09 and $2.25, valuing the company at $265.3 million.

Probe president and CEO David Palmer said the Pascalis drilling confirmed the continuity of gold zones and expanded near-surface mineralization within the 2021 resource estimate’s conceptual pits.

“We are converting what was waste into possible ore, and potentially reducing the strip ratios, and thus overall mining costs,” Palmer said. “Novador continues to exceed our expectations and we will be pushing hard on all fronts to maintain this momentum.”

Pascalis expansion drill hole PC-22-812 cut 19 metres grading 5.6 grams gold per tonne from 38 metres depth, including 1 metre at 96.8 grams gold from 53.2 metres down hole.

Infill drill hole PC-22-807 at Pascalis cut 59 metres grading 2.4 grams gold from 22 metres down hole, including 16 metres at 5.1 grams gold from 45.5 metres depth.

A July 2021 measured and indicated resources estimate for Novador — when it was called Val-d’Or East — showed 29.8 million tonnes grading 1.81 grams gold per tonne for 1.7 million oz. contained metal. TNM

reveals where the projects are and who owns them

BY ALISHA HIYATEWith last year’s record lithium prices spurring a boom in exploration for the energy metal that has persisted even as prices have retreated, The Northern Miner was curious where in Canada that activity is being channelled and who’s behind it.

To get a wide view on exploration activity, we turned to our sister company Mining Intelligence (www.miningintelligence.com).

According to the MI database, there are 409 active lithium projects in Canada, including very early stage properties where little work has been done (145 or 35% of the total).

Advanced projects with a significant amount of drilling, a resource, or any stage of economic study, construction or production) account for 106 or just over one quarter (25.9%) of the total.

Here’s a look at all projects by stage.

Who owns the projects?

The vast majority of Canada’s lithium projects — 293 or 86% — are held by Canadian companies. Australians hold 44, or close to 13%. Given Australia’s status as the world’s top lithium producer as well as its strength in mineral exploration, it’s no surprise to see that when we look at a subset of more advanced projects (37 in total as shown above), the share held by Canadian companies falls to 58% while the share held by Aussies rises to 36%.

WHERE ARE THE PROJECTS?

Quebec, which has had some historical production of lithium, by far hosts the greatest number of active lithium projects (see map above). Sayona Mining (ASX: SYA) and 25% partner Piedmont Lithium (NASDAQ: PLL; ASX: PLL) just restarted commercial spodumene production at the North American Lithium (NAL) project in Quebec last month.

The mining and exploration friendly province accounts for almost half of lithium exploration projects in the MI database. By comparison, Ontario, which has the second highest count, has just over a quarter of the total number of projects. TNM

HQ

In Quebec, advanced projects include the NAL mine plus two other feasibility-stage projects held by Sayona (Authier and Moblan); Allkem’s (TSX: AKE; ASX: AKE) James Bay project; Critical Elements Lithium’s (TSXV: CRE) Rose project; Livent’s (NYSE: LTHM) 50%-owned Whabouchi project; and Vision Lithium’s (TSXV: VLI) PEA-stage Sirmac project.

In Ontario, they include Rock Tech Lithium’s (TSXV: RCK) prefeasibility stage Georgia Lake; Frontier Lithium’s (TSXV: FL) PEA-stage PAK project, Green Technology Metals’ (ASX: GT1) Seymour; Avalon Advanced Materials’ (TSX: AVL) Separation Rapids; Gossan Resources’ (TSXV: GSS) neighbouring Separation Rapids; and Critical Resources’ (ASX: CRR) Mavis Lake.

Who’s working the projects?

Another way to look at ownership of active projects is by option agreements. According to MI data, options are held on 153 lithium projects, with the vast majority (over 72%) held by Canadian companies, just over 25% held by Australian companies, and 2% held by U.K.-based outfits.

Other advanced projects include E3 Lithium’s (TSXV: ETL) Bashaw prefeasibility stage lithium brine project, and LithiumBank Resources’ (TSXV: LBNK) Boardwalk lithium brine project, both in Alberta; the Tanco mine in Manitoba, held by China’s Sinomine; and Grounded Lithium’s (TSXV: GRD) PEA-stage Kindersley brine project in Saskatchewan.

Hudbay Minerals (TSX: HBM; NYSE: HBM) and Copper Mountain Mining (TSX: CMMC; ASX: C6C) have agreed to merge, creating a copper producing powerhouse with projects across the Americas, and Canada’s third largest copper producer with 330.7 million lb. of copper annually.

The all-share deal values Copper Mountain at US$439 million, or $2.67 per share. That represents a 23% premium to its shareholders based on both companies’ 10-day volume-weighted average share prices on Apr. 12, the day before the merger was announced. Hudbay and Copper Mountain shareholders will own about 76% and 24% of the combined company, respectively.

After the transaction, Hudbay will have three long-life operating mines with exploration upside, three large-scale development projects, and one of the largest resource bases among intermediate copper producers. The portfolio will have balanced exposure to North America (Canada and United States) representing 55% of net value, and South America (Peru) at 45% of net value.

“This transaction represents a unique opportunity to combine complementary assets and leverage our technical expertise to create value for the shareholders of both Hudbay and Copper Mountain,” said Peter Kukielski, Hudbay’s president and CEO in a release.

The merger came one week after Glencore’s (LSE: GLEN) unsolicited bid for Teck Resources (TSX: TCK.A/TCK.B; NYSE:

TECK), and just a couple of days after Newmont (TSX: NGT; NYSE: NEM) sweetened its bid for fellow gold miner Newcrest Mining (TSX: NCM; ASX: NCM)

In a note to clients, BMO Capital Markets analyst Jackie Przybylowski put her stamp of approval on the deal.

“Acquisition of Copper Mountain will improve Hudbay’s portfolio,” she wrote. “It rebalances geographic exposure, somewhat diluting the Peru risk that has depressed Hudbay’s valuation.”

Przybylowski noted that adding Copper Mountain’s cash flows to its balance sheet would help Hudbay fund and build its Copper World project in Arizona.

After the arrangement closes, the Hudbay board will include two seats for Copper Mountain representatives, and the Hudbay executive team will include select members from the Copper Mountain team.

In light of the transaction, Copper Mountain president and CEO Gil Clausen has postponed his retirement until the deal closes. Both companies’ officers and directors have entered into voting support agreements and will be voting their shares in favour of the merger.

The companies expect an estimated US$30 million annual operating savings at Copper Mountain’s eponymous mine in B.C., including US$20 million from applying Hudbay’s efficiencies at the Copper Mountain mine.

Shares in Copper Mountain had dipped to $2.60 apiece at press time in Toronto, in a 52-week window of $1.23 and $3.74, giving it a market capitalization of $555.9 million. TNM

BY CECILIA JAMASMIEWest Red Lake Gold Mines (TSXV: WRLG; US-OTC: WRLGF) has inked an agreement with Sprott Resource Lending Corp. and Pure Gold Mining to acquire all of the issued and outstanding shares of the struggling precious metals miner, which filed for creditor protection last fall.

The deal hands West Red Lake the Madsen gold mine (which Pure Gold renamed after the company) and associated land package, located in northwestern Ontario’s Red Lake district.

West Red Lake would pay $6.5 million in cash and 28.5 million shares. The agreement grants Pure Gold a 1% secured net smelter royalty (NSR), as well as up to US$10 million in deferred consideration payments.

“The acquisition of the Madsen mine is a major step, and positions us as a leader in Red Lake gold exploration and development,” said West Red Lake CEO Tom Meredith, in a release. “With a wealth of targets near the Madsen mine, alongside regional prospects and those within our existing Rowan project, we are confident that the brightest days for our consolidated portfolio are just ahead.”

Sprott is expected to receive the shares and NSR payment because a fund managed by Sprott is the company’s senior secured lender. The firm may nominate and appoint a director to West Red lake’s board of directors if Sprott or an associate owns 15% or more of the junior’s issued and outstanding shares.

Pure Gold Mining bought the historic Madsen gold mine in 2014. Madsen produced 2.5 million oz. of gold at an average grade of 9.7 grams gold per tonne between 1938 and 1999.

The company poured first gold at the operation by the end of 2020 and

announced the start of commercial production in August 2021.

The asset had a peak market capitalization of nearly $1.2 billion in 2021. Its last resource estimate tallied mineral resources at 1.7 million indicated gold oz. at 7.4 grams gold per tonne and 400,000 inferred oz. at 6.3 grams gold. The estimate is being treated as historical by the company.

Existing infrastructure on site includes an 800-tonne-per-day mill, double ramp access, significant underground mine development, a 1,275-metre shaft, tailings management infrastructure, and a water treatment facility. The operation has all the required permits to restart production.

Cash constraints

The mine was placed in care and maintenance last October, as Pure Gold failed to secure additional funds to keep it operational. In connection with the acquisition, West Red Lake has signed an engagement letter with Canaccord Genuity for a boughtdeal private placement of subscription receipts for $20 million, with an underwriter’s option of $5 million at 35¢ per subscription receipt. Mining investor Frank Giustra, an 18% shareholder in West Red Lake, is expected to provide a lead order for the financing.

The transaction is subject to certain conditions and the approval of the British Columbia Supreme Court in Pure Gold Mining’s ongoing proceedings pursuant to the Companies Creditors Arrangement Act proceedings.

Following the completion of the acquisition and concurrent financing, Sprott is expected to own roughly 24% of the company’s outstanding shares.

West Red Lake shares were down 13% in Toronto at press time, trading at 80¢ apiece in a 52-week window of 31¢ and 93¢. It has a market capitalization of $44.6 million. TNM

BHP (NYSE: BHP; LSE: BHP; ASX: BHP) said on Apr. 17 that the Federal Court of Australia had approved its A$9.6 billion (US$6.4 billion) takeover of copper-gold producer OZ Minerals (ASX: OZL), the miner’s biggest deal in more than a decade.

The court decision was the final hurdle for BHP to acquire OZ Minerals. It follows overwhelming support from the target company’s shareholders for the deal, with 98.33% of votes in favour of the transaction.

The takeover, BHP’s largest deal since the US$12.1-billion purchase of Petrohawk Energy in 2011, will boost the company’s exposure to copper and nickel, two metals that are essential for the transition to renewable energy and electric vehicles.

The figure is the third largest in global mining in recent months, right after Glencore’s (LSE: GLEN) US$22.5-billion bid for Teck Resources (TSX: TCK.A/ TCK.B; NYSE: TECK) and Newmont’s (TSX: NGT; NYSE: EM) US$19.5-billion offer for Newcrest Mining (TSX, ASX: NCM).

Chief executive Mike Henry said the acquisition was a strategic move to position BHP for longterm growth and value creation.

OZ Minerals owns two operating copper and gold mines in South Australia, Carrapateena and Prominent Hill, as well as the West Musgrave nickel and copper project in Western Australia.

The operations are located near BHP’s Olympic Dam copper hub and Nickel West, creating opportunities for operational synergies and cost savings.

Shares in OZ stopped trading in Sydney on Apr. 18. TNM

Despite opposition from environmental groups, the CEO of The Metals Company (NGS: TMC) — which has exclusive access to the Nori Clarion-Clipperton Zone (CCZ) polymetallic project ranked as the world’s biggest undeveloped nickel project — sees deep sea mining happening by the end of 2024.

Mining international waters is in the spotlight as companies and countries are looking at minerals concentrated on the ocean floor that can be used in batteries for smart phones and electric vehicles.

It is estimated that 21 billion tonnes of polymetallic nodules are resting on the ocean floor in the CCZ. Almost 20 international mining companies have contracts to explore the region which spans over 5,000 km and is considered the most prolific area for ocean mining.

The International Seabed Authority (ISA) said it will start accepting applications in July from companies that want to mine the ocean’s floor. The recent decision came after the UN body spent weeks debating standards for the practice.

“People think we are debating if this (deep sea mining) should happen or not, and that’s gone. It’s happening,” The Metals Company CEO Gerard Barron said in an interview.

“The International Seabed Au-

thority has been mandated to regulate this activity and put in place the exploration and the exploitation regulations while protecting the marine environment. The NGOs have been trying to use the legal method to oppose deep sea mining, to perpetuate a delay. How badly they’ve got it wrong.”

In 1994, the UN Convention on the Law of the Sea established the ISA to regulate the industrialization of the seabed in international waters and ensure effective marine environmental protection.

The ISA had been slowly developing the mining code. However, Nauru, a South Pacific island nation of 8,000 people, sped things up by triggering a two-year rule in

the Law of the Sea treaty. That provision required the ISA to complete the mining code by Jul. 9, 2023, or accept mining applications under whatever regulations existed at the time.

According to Barron, organizations like Greenpeace and the World Wildlife Fund have been trying to cast doubt over sea mining technology, and lobbying for a moratorium on deep sea mining.

“There is no legal framework to allow it, the convention of the Law of the Sea is really very flat,” Barron said.

Twelve nations, however, have expressed reservations supporting a ban, a moratorium, or “a precautionary pause” on the start of the

commercial exploitation of deep sea mineral resources.

“This is all just noise. Even the nations that are resistant, like France and Germany, have been working very hard over the last weeks to progress the code,” Barron said.

By the convention, only sovereign nations or contractors sponsored by a state can apply to explore the deep sea. The Metals Company has three sponsoring states, the Kingdom of Tonga, the Republics of Nauru, and of Kiribati.

The Metals Company’s NORI-D Project is the world’s most advanced, and is sponsored by the Republic of Nauru.

The company has said the nodule resource at its project, located 4,000 metres deep in the northeastern Pacific Ocean, is now estimated at 4 million measured tonnes with grades at 1.42% nickel, 1.16% copper, 0.13% cobalt and 32.2% manganese, plus 341 million indicated tonnes and 11 million inferred tonnes at similar grades.

Recently, a robotic collector vehicle on the seafloor in the CCZ pulled up about 3,500 tonnes of nodules through an airlift riser to the vessel.

The company plans to have an environmental impact statement as part of the application for a commercial license by the end of the year and start extracting by the end

of 2024.

“They talk about more science, but guess who’s doing the science?

It’s companies like us,” Barron said.

Chinese competition

While debating with environmental groups, western firms like The Metals Company are also facing competition from Asian enterprises.

Last month, China Daily reported that the country will make renewed efforts to join the race to mine the deep sea for critical minerals.

“There is no doubt that China will be fast on our heels. But they will be held to the same very high standards, and China also wants strong environmental regulations as well,” Barron said.

The Metals Company already has its first production vessel, the Hidden Gem, and plans to use an existing plant in Japan to process the wet nodules.

Despite a moratorium signed by Samsung, Volkswagen, RenaultNissan-Mitsubishi, BMW and Volvo Trucks to wait until more research is done on deep sea mining, companies like Tesla, BYD, CATL and General Motors did not sign.

According to Barron, automakers have shown interest in investing in the company.

“Steelmaking companies are interested too since most nickel and manganese go to the steelmaking industry,” he said. TNM

to send astronaut Jeremy Hansen to orbit the moon as part of Artemis II, the first crewed mission of the Artemis program.

“Thanks to our contribution of Canadarm3 to the Lunar Gateway, Canada has not only secured two astronaut flights to the moon’s orbit but also benefits from a range of opportunities to conduct cutting-edge lunar science, technology demonstration and commercial activities,” François-Philippe Champagne, the minister responsible for the CSA said in a December statement following the safe return of NASA’s Orion capsule after a 25.5day mission around the moon.

By December 2025, the Artemis III program expects to touch down on the moon, by which time the first iteration of prototypical moon mining equipment will need to be ready, according to Boucher.

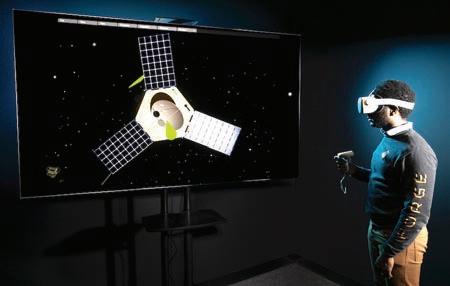

NASA’s Apr. 5 moon-to-Mars strategy aims to bridge the efforts made during the Artemis program, explained CEMI vice-president for business development and communications Charles Nyabeze.

“It aims to reach further down the space development timeline to Mars. It specifically refers to a lunar infrastructure goal to demonstrate the industrial scale of our mining capabilities in support of building that continuous human space presence and creating a robust lunar economy.”

Meanwhile, the United Nations International Space Exploration Coordination Group, or ICG, comprising 27 participating agencies, has developed a space development strategy roadmap.

“The ICG’s goal is to advance the global exploration strategy through coordination and their mutual efforts in space exploration. The global space exploration roadmap is a key deliverable, as well as in-situ resource utilization (ISRU) capabilities (also known as mining

Nyabeze says elements of mining are sprinkled throughout the timeline extending up to 2035. “We believe ISRU spanning the entire mineral value chain will become a key enabler of mankind incrementally building up infrastructure to support longer space expeditions.”

Lots of water

Boucher says the scientific community has found a surprising volume of water on the moon over the past few years. As of 2016 data, Boucher estimates that about 60 million tonnes of water is there.

“It’s not as dry as we thought it would be. It is mostly concentrated in the north and south poles,” he said.

The ice is said to be about 2 metres from the surface since that’s the maximum depth to which orbiting sensors can penetrate. Scientists don’t know what lies at depth.

“And that means that if we converted all that water into shuttle fuel, we could launch a shuttle per day for more than 2,000 years just using the water at the north pole. The south pole has a little more water, but I don’t have the numbers,” Boucher said.

However, the big question everyone is looking to answer is how to extract the water effectively — and

sustainably.

“The scale of the micro ice crystals are all sub-100 microns, and the average water concentration is about 5% by weight, which means that that is pretty good if it was gold. That’d be an awesome orebody; we certainly don’t get 5% gold per tonne in any of the gold mines in Canada,” he said.

According to Boucher’s backof-napkin calculations, we need around 50 tonnes of oxygen per mission to the moon, just gauging by NASA’s stated ambitions. “Now, that’s not an awful lot, but considering the 60 tonnes of water you’ve got to extract to produce the oxygen, that translates to about 5,000 tonnes of excavated regolith per year.”

“Suddenly, those numbers no longer apply to science experiments in laboratory tests. It can no longer be done in a beaker. It really needs some well-thought-out process to achieve these results at scale,” he said.

The space mining race is quickly evolving. AstroForge, an aster-

oid-mining startup, is preparing to launch the first of its two missions on Apr. 14. The main objective is to test the firm’s technique for refining platinum from a sample of asteroid-like material.

The company has placed a payload on SpaceX’s Falcon 9 rocket, pre-packed with elements similar to those in asteroids. Working in Earth orbit, the OrbAstro-built cubesat will attempt to vaporize and sort the materials into their elemental components.

While AstroForge intends to visit asteroids, the Artemis missions revolve around the moon and ultimately Mars. The idea is to extract minerals where they will be used, not to send them back to Earth. And how it will look is the stuff of science fiction.

Boucher suggests that sending a giant Caterpillar bulldozer to the moon is obviously out of the question. Instead, he proposes taking small steps in space, each representing a mighty technological achievement. “You can actually bootstrap your terrestrial market onto the moon,” he said.

He suggests that if the market

is there, the technology will find a way to tap it. He calculates there is already an existing potential market for 60 tonnes of water to supply NASA alone with its medium-term space chemical needs.

“The support required for this long-term human presence on the moon is going to drive a market for the development of larger volumes of product,” predicts Boucher. “And how do you make that sustainable? Again, we only know what’s down 2 metres below surface. It sounds a little bit like it would entail an open pit excavation. But who knows where we’re going to go with this?”

Douglas Morrison, president and CEO of CEMI, also highlighted that aside from finding the best moon mining technologies, there are other essential questions marks that need to be answered.

“There are outstanding issues regarding legal frameworks in space, security of tenure, property rights — simple things like the National Instrument 43-101: How do you do due diligence on the moon?” he asked. “How do you prove that you can actually extract this stuff? How do you stake a claim robotically, and if you can do it, is it defensible? How do you do automated assays on the moon? How do you manage your claim? How do you manage your communications?”

A further sticking point would be to consider how these polarbased moon mining operations will be powered when the water is only found in areas without direct sunlight. Are small modular nuclear reactors the answer?

“While these questions remain to be resolved, I see ample opportunities for the terrestrial mining sector to innovate and transpose their experience to space,” Morrison said. “Conversely, any technological advances on the moon stand to benefit the terrestrial industry directly.”

During Chrystia Freeland’s federal budget address to Parliament on Mar. 28, Canadians heard an unprecedented call to action for the new green economy.

“We’re going to build big things here in Canada — from a Volkswagen battery plant in Ontario, to the Galaxy lithium mine in Quebec, to the Trans Mountain expansion in Alberta, to the Atlantic Loop, to the LNG terminal in Kitimat, B.C.,” she declared.

Of course, with this big thinking comes big money.

Billions of dollars have been pledged to support critical mineral infrastructure and development. Meanwhile, the Canada Infrastructure Bank will pledge billions more to help kick start clean energy projects.

The government also upheld the Critical Mineral Exploration Tax Credit (CMETC) first announced in the April 2022 budget.

Exploration involving critical minerals, such as copper, nickel, lithium and cobalt, will now kick out a 30% tax credit (equivalent to a 60% tax deduction).

When the CMETC was first announced, for those of us in the charity flow-through share business were cheering from the sidelines. Because quietly, for the last 17 years, our structure has been supporting this cause. In fact, our industry has been responsible for billions in financing for Canadian junior mining.

Simply put, the flow-through share financing model, with an

ODDS from 5 hospital immediately — preferably to Tehran which was six hours away — or he might die; it wasn’t clear to us how bad he was hurt, but bloody foam at the mouth is never a good thing. The ambulance service in rural Iran is unreliable at best, so my Iranian colleague, Peyman, picked him up and stuck him in a truck and drove off at high speed to the local hospital. He was subsequently transferred to a specialist clinic in Tehran and spent weeks recovering from kidney damage.

That night I had a very panicked Australian driller in my office crying his eyes out. He was in mild shock from the accident and had convinced himself that he was going to a) be hung for killing an Iranian or b) spend the next 30 years in an Iranian prison making friends with people he wouldn’t ordinarily spend much quality time with. He begged to be taken to the border with Turkey so he could walk over to “safety,” but this wasn’t a viable option — the border is heavily patrolled — so I called our country manager in Tehran for some urgent advice. He told us to stay put and called the local police in Takab to report the accident. And then we waited. And waited. I was expecting a police visit or a session with the local health and safety inspector, but nobody came. We’d taped off the rig, worked out what had happened, and I’d reported it back to head office in London.

My conclusion was that the fault lay with the day shift driller. When I examined the accident site, I’d found two other rods with torn thread tucked under a tarp. Mr. Dayshift admitted he’d had the same problem with the poor-quality local rods but “it wasn’t his job

figure to 20.5%, and in the process, strike a significant blow to the mining industry, the very industry it seeks to grow.

If the new AMT is implemented in 2024, then the maximum flowthrough share purchase will decrease from our largest income buyers.

Flow-through shares, which were first introduced in 1954, offer high-taxed Canadians a 100% tax deduction for investing in junior mining stock.

hose, reducing the water supply. In basic terms, an increase in AMT will materially impact how much flow-through many of our clients can purchase. A good analogy would be if the government reduced the maximum RRSP limit, now at $30,000 per person, to $23,000, a 25% reduction.

Under this new rate of AMT, the tax benefit has been diluted.

cal minerals that are essential to our clean energy future — the world’s clean energy future. And I believe we have an incredible opportunity to work together to source and supply in North America everything we need for reliable and resilient supply chains.”

immediate liquidity provider, has been a stalwart for critical mineral exploration in Canada – and junior mining in general — with a significant amount of all financing coming through this trusted charity flow-through structure.

Think of us as the grassroots of Canadian mining — by giving junior mining the financial means to explore, and discover, it provides the water and fertilizer for industry to sprout, and grow.

Our industry was finally receiving some respect. Or so it seemed.

In March, I wrote a column about how the devil would be in the details for Canada’s critical mineral industry. Sadly, my words have become strangely prophetic.

Indeed, one small detail in the budget would throw a big wrench into the government’s lofty plans.

Alternate minimum tax (AMT) was first implemented in 1986 to limit tax deductions for high-income earners. And since then, AMT rates have remained steady at 15% — until now. As of 2024, the government plans to increase this

The shares are not held for long. The buyer can sell these shares almost instantly, at a discount, to a third party, or liquidity provider, and eliminate any stock market risk.

They can also be donated to a registered charity, which sells the shares, at the same discounted price, to investors with a long-term investment horizon. The buyer takes on the stock risk for the standard four-month private placement hold period.

Together, these tax policies allow our clients to give significantly more to charity due to the tax efficiency. It has been an enormous success story for Canada – a true example of innovation when it comes to tax policy.

AMT’s unforeseen impacts

In some ways, Canada’s critical mineral strategy is our true coming of age moment, almost 80 years in the making, from when flow-through shares were first introduced.

Then along came AMT, the first increase in almost 40 years. And the timing couldn’t be worse.

Instead of nurturing the roots of Canadian critical mineral financing, the government just stepped on the

Meanwhile, due to improved stock market optimism for critical minerals, we have seen a considerable increase in available flowthrough product — and that’s great news for Canada’s critical mineral strategy, right?

Well, only if we have the hightaxed Canadians to buy large amounts.

As an industry, we will have to work that much harder to find more Canadians to participate in each flow-through share financing, to bridge the gap. In times like these, when it’s a full court press to build our critical mineral pipeline, and future green economy, we should be making it easier for these companies to receive financing, not harder. The stakes are high.

“We learned the hard way, during the pandemic, when you rely on just in time supply chains, that circle the globe, there are significant vulnerabilities, disruptions and delays, and it drives up costs here at home, both Canada and the United States,” U.S. President Joe Biden said on Mar. 23 in his address to Parliament one week before the federal budget.

“There is a better way. Our nations are blessed with incredible natural resources. Canada in particular has large quantities of criti-

These remarks during Biden’s visit to Canada were met by a standing ovation and thunderous applause.

The President is absolutely correct. But to reach this shared future, we must all work together.

The government increased AMT to help boost tax revenue, ensuring every high-income Canadian pays his or her fair share. But did the government understand its impact on this grand vision for the future? I suspect not.

If AMT must be increased, an exception for flow-through shares should be explored. There is a middle ground here, where the government’s desire for more tax revenue can be balanced with a robust critical mineral strategy that everyone wants.

The 2023 budget truly underlines why agencies, the government and the private sector need to communicate more effectively, so the big ideas don’t get squashed by the little ones. TNM

Peter Nicholson is the president and founder of Wealth, Creation, Preservation and donation (WCPD) Inc. WCPD has generated more than $1 billion in flow-through financings for junior mining companies and helped raise over $300 million for charities across Canada.

lithium strategy alongside its current contract with Chilean development agency Corfo. It said it hoped the policy would boost lithium production in Chile.

Under Chile’s new lithium policy, there will be a unit in charge of advancing technology to minimize environmental impacts, including favouring direct lithium extraction (DLE) over evaporation ponds — the method currently used.

Applying DLE is expected to speed up production and avoid vaporizing billions of litres of water. The technique, however, is relatively untested at major scale, which could initially mean less output and profit.

turning more of their mined lithium into batteries and tapping into the EV manufacturing sector.

Jordan Roberts, battery raw materials analyst at Fastmarkets NewGen said the immediate impact of Boric’s announcement seemed to be “muted” as market participants digest the news and await Codelco’s plan to be released in the second half of the year.

“We do not expect any material impact to established producers... [but]...there may be some hesitation investing in Chile’s lithium space until further details have been released and companies are confident on stability and in how the public-private partnerships will operate,” Roberts said in an emailed statement.

to tell the other guys because they were grown ups.” My first instinct was to have him thrown off site but bringing in a replacement would’ve taken weeks; time which we didn’t have with the mountain winter drawing near. He stayed.

After three days, the tape flapped pointlessly in the wind and the hours dragged by. Eventually our manager called back. The local cops and the local municipality couldn’t care less. They were surprised we’d even bothered calling them. “It’s God’s will” was literally the response from the police chief. “Why did you call? Nothing to do with us.”

In the end, we completed a couple of dozen core and RC holes. The geology was spectacular and the gold grades locally excellent although with orpiment in the orebody, the arsenic levels were high. The program was a quali-

fied success, overshadowed by the accident, and we still didn’t have enough holes to properly evaluate the full strike length of the deposit. In early 1999 I was transferred to Anglo’s head office in London and spent the next three years raising two baby boys, compiling budgets and writing reports. Anglo finally abandoned Zarshuran — the Iranian government proved too hard to deal with — and it was put into production by a quasi-government mining company. TNM

—Ralph Rushton is a geologist and has worked at mines and exploration projects around the world including stints in South Africa, Turkey, Bulgaria, Yemen, Iran and Pakistan. He is currently the president of Aftermath Silver, a silver development company with projects in Chile and Peru. In his spare time, he writes about mining and exploration at urbancrows.com.

Canada’s Summit Nanotech Corp., which is developing a DLE technology, welcomed the government’s announcement and announced on Apr. 21 the opening of a facility to test its method in Santiago.

Chile’s move adds further pressure to electric vehicles (EV) makers, which are scrambling to secure supply of the battery metal.

It follows Mexico’s decision to nationalize its own lithium industry last year and which is now seeking to create a regional lithium association with Argentina, Bolivia and Chile. The three countries make up the so-called “Lithium Triangle,” which has about 65% of the world’s known resources of the metal and reached 29.5% of world production in 2020.

Argentina, Chile, Bolivia and Brazil, in turn, are exploring the creation of a lithium cartel of sorts in charge of expanding South America’s processing capacity,

Chile currently generates about 30% of the world’s supply, but it plans to double production by 2025 to about 250,000 tonnes of lithium carbonate equivalent.

Global demand for the metal, according to the government’s projections, will quadruple by 2030, reaching 1.8 million tonnes of lithium. Available supply by then is expected to sit at 1.5 million tonnes.

The country’s Atacama region, which is also home to vast copper mines, supplies nearly one-quarter of the globe’s lithium.

Last year, the state received more than US$5 billion from the sector, equivalent to 1.6% of its GDP, figures from the Autonomous Fiscal Council show.

Exports of lithium carbonate reached almost US$7.8 billion, an increase of 777% over 2021, according to the Chilean Central Bank.

It means that lithium carbonate surpassed salmon and fruits in the Chilean export basket. TNM

ASX-listed

Green Technol-ogy Metals (ASX: GT1) is working towards a feasibility study for its flagship Seymour lithium project in northwestern Ontario, and targeting production as soon as 2025.

The Perth-based company said on Apr. 12 it has completed more than two years of baseline data and project engineering in support of ongoing permit applications.

“We have successfully expanded our team to include experts in permitting, community consultation and project studies within the Ontario region,” said GT1 CEO Luke Cox, in a release. “Exploration will continue across the region as we develop our resources that will feed a centralized processing hub at Seymour and in parallel the team will continue to work through the environmental studies, permitting and development discussions with our Indigenous community partners.”

Green Tech has opened offices in Thunder Bay as well as in Toronto to support the progress of its preliminary economic assessment and feasibility study for Seymour, targeted for the first half of 2024.

According to a resource update from last June, the North Aubry deposit at Seymour hosts indicated resources of 5.2 million tonnes grading 1.3% lithium oxide (Li2O) and inferred resources of 2.6 million tonnes grading 0.9% Li2O. The South Aubry deposit hosts inferred resources of 2.1 million tonnes grading 0.5 Li2O. Green Technology has formally submitted its project definition for Seymour to the Ontario Mines Minister which will confirm its provincial environmental assessment requirements. Seymour is located just east of the township of Armstrong, and about 230 km north of Thunder Bay.

The company said it is also advancing the mining lease process

that will allow it to extract and sell minerals, subject to the lease terms.

99-ton sample

Green Tech has collected a 99-ton lithium-cesium-tantalum (LCT) pegmatite bulk sample from its North Aubry target. The sample was taken to the Saskatchewan Research Centre in Saskatoon, Sask. for metallurgical pilot test work to optimize the lithium converter process that is part of its integrated project study.

A total of 15,290 metres across 69 holes have been drilled at the Aubry and Pye East and West Limb targets of Seymour to date. At Pye West, the company noted near-surface high-grade intercepts of 13.9 metres grading 1.53% Li2O in hole GTDD22-0350 and 14.4 metres grading 1.38% Li2O in GTDD-22-0360.

In June, Green Technology plans to resume field exploration at Sey-

Sayona Mining (ASX: SYA) has released a definitive feasibility study for its 75%-owned North American lithium (NAL) mine in Quebec, a month after restarting commercial production of spodumene concentrate at the mine.

The study estimates an after-tax net present value (8% discount) of $1.4 billion, and an internal rate of return of 2,545%.

NAL, along with the nearby Authier lithium deposit, is expected to support a 20-year mine life with an average annual mill feed of 1.4 million tonnes. The plant has a capacity of 4,200 tonnes per day, and the average concentrate production during the first four years will be 226,000 tonnes. The all-in sustaining cost is estimated at $987 per tonne of concentrate.

Total capital costs of the mine

and mill restart are pegged at $375.3 million. Onsite total operating costs are $2.3 billion, or $597 per tonne of concentrate.

Sayona says proven and probable reserves are 21.7 million tonnes grading 1.08% lithium oxide (Li2O) for 235.5 million tonnes Li2O. Measured and indicated resources (inclusive of reserves) total 25 million tonnes at 1.23% Li2O for the pit constrained portion. The project hosts another 22 million inferred tonnes at 1.2% Li2O.