2 minute read

Silicon Valley Bank. Government Protection or Overreach?

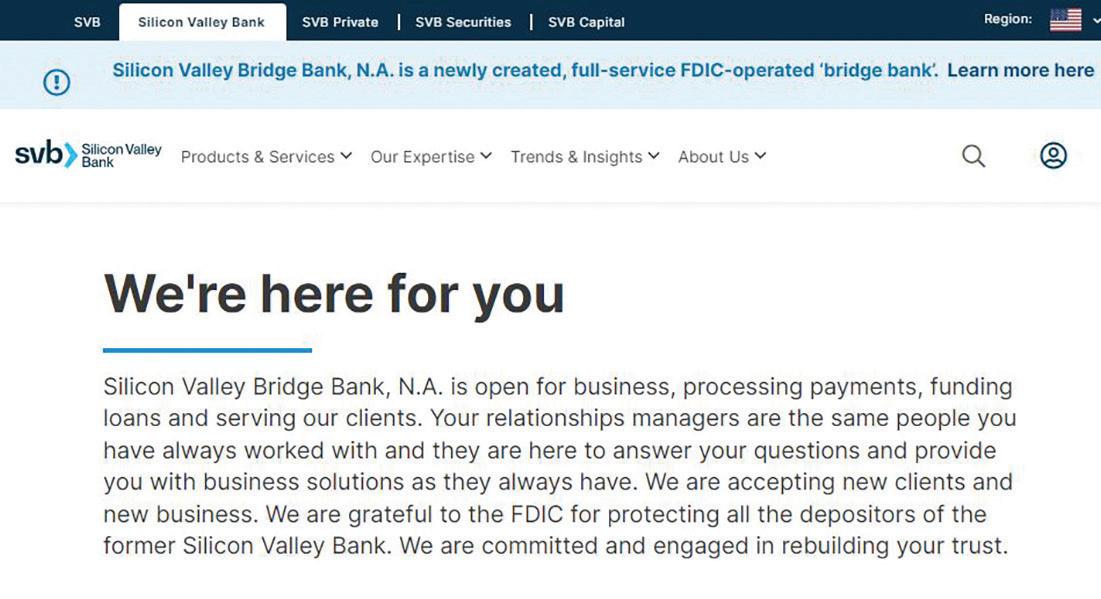

By now most everyone has heard about the second largest bank failure in US History, Silicon Valley Bank (SVB). This bank was taken over by regulators on March 10 after its depositors withdrew $42 billion dollars relatively overnight.

Of course, you probably also know that the government took action to secure 100 percent of the SVB’s deposits (including those of Signature Bank) on Monday, March 13.

The depositors of these two banks undoubtedly issued a huge sigh of relief and welcomed the help - and who wouldn’t! Those who represented our two main political parties lined up to applaud or condemn the action-no surprise here.

It seems that history will determine who made the right move but, for now, it seems that the short term crisis has been averted.

The long term debate will go on and the questions of too big to fail versus government overreach will continue to be raised.

The reality, from my perspective is, this move by the government was necessary to protect the economy from spiraling into a major crisis. There’s no doubt also that the costs of this effort, even though necessary in my opinion, will be borne by the taxpayers and probably be felt by mostly the poor due to increased or prolonged inflation. This will be caused by the inevitable increase in the monetary supply which will happen to cover the losses that these banks had at their demise.

I am a firm believer that the first and foremost job of any government is to protect its citizens, and the move by the Fed to secure these banks was motivated by this effort.

But, I also believe the government also needs to understand what got us into this mess and how to keep us from repeating it again and again. I liken it to a term called “helicopter parents.” Anyone with kids knows what this means. When we as parents protect our kids to the point of hurting them in the long run, that ultimately proves to be bad parenting. Our government (local, state and federal) need to know the difference between protection and overreach. Too much “protection” requires more overreach and that’s where we are today. Knowing where to cut the cord is the necessary challenge!

On a different, and much more positive note, March is Women’s History Month and we have highlighted some great businesses in this issue that are Woman-led or Woman-owned. It’s an honor to share their stories with our readers!

Also in this issue, we have made a slight change in one of Economic Indicators on page three. One of our area’s local realtors, Tony De La Vega, with Coldwell Banker Advantage, came to us to offer a more accurate assessment of our housing numbers. We had been reporting from Realtor.com data for the Fay- etteville MSA (Cumberland, Hoke and Harnett counties). Tony was kind, but also direct in stating that he didn’t believe our previous numbers depicted our market correctly. With Tony’s challenge, we are now getting our information directly from the Regional MLS, and we are not just looking at the Fayetteville MSA, but our entire readership area, which also includes Robeson, Sampson, Bladen and Moore counties. When we placed this data in the infographic on page three, you see some surprising details about where growth in new construction is happening in our region. We will have more details and stories about this in the coming months ahead!

As we see the first quarter of 2023 come to a close, I just want to thank all of our advertisers and sponsors. I am confident that your investment will continue to pay dividends for our community and your organizations.

God bless you and yours!