41 minute read

THE INTERVIEW

VISIT MILWAUKEE is creating a new department aimed at drawing sporting evens to the Greater Milwaukee area. Marissa Werner is at the helm of the new initiative as director of sports development, having recently been promoted after a nine-year stint as senior sports and entertainment manager. BizTimes reporter Maredithe Meyer caught up with Werner about her plans to build on recent momentum in the local sports tourism market.

What’s the purpose of VISIT Milwaukee’s new sports division?

“We are kind of behind the ball, as you might say, in comparison to our competitive cities and their dedication to sports tourism. It’s been long overdue and very exciting that we have an executive team on board now that is supporting that vision of really creating a central place within Milwaukee for all sport tourism information, from professional sports to amateur to youth. We want to be that go-to place for all information.”

Why now?

“With the recent popularity of our own hometown teams – the Milwaukee Bucks and the Milwaukee Brewers – it’s really nice to pivot at this time, especially this year with some other banner events like the Ryder Cup, USA Triathlon Age Group National Championships, USA Ultimate Division I College Championships and USA Gymnastics American Cup. It’s really a banner year for sports (in Milwaukee and southeastern Wisconsin) and it just made sense to take that next step.”

Does Fiserv Forum help raise the city’s profile?

“Fiserv Forum is a first-class facility that cannot be beaten anywhere in the country at this time, so it has a natural draw just even with the leisure travelers and events. But with the success of the Bucks, they really are the main dog in the race as the main tenant. We look to fill in the holes where we can, but we have so many other top-notch facilities in the area, from the Pettit National Ice Center, The Rock Sports Complex in Franklin, Uihlein Soccer Park in Milwaukee … We focus on about 12 to 15 facilities within the Milwaukee County area.”

Is an NBA All-Star Game in Milwaukee’s future?

“It was so much fun watching some of our own players during the dunk contest (at the 2020 NBA All-Star Game in Chicago). We would love to have that in our own hometown … It’s on the forefront of our minds. We just haven’t found the right timing yet for it to work for all entities involved, but hopefully that should be coming down the pipeline.”

What’s the draw of youth sporting events?

“Our youth events probably bring in some of the largest economic impact … When families are traveling for sports, they tend to stay a day or two because this is their vacation, this is what they’re spending their money on. So, they tend to stay longer in our hotels, spending money in restaurants, experiencing our museums and overall boosting the economy.”

What’s ahead for the region’s golf tourism market, considering the date change of the PGA Championship from August to May?

“With the change of the PGA Championship, yes, it would make it more challenging for us to host (as Whistling Straits has in the past) but it doesn’t make it impossible and it doesn’t mean that the dates couldn’t change down the road again. Right now, I know that PGA has great support and respect for our courses here; same with USGA.” n

JAKE HILL PHOTOGRAPHY

Marissa Werner Director of sports development VISIT Milwaukee 648 N. Plankinton Ave., Suite 220 Employees: 34

MADE AND BUILT IN SOUTHEASTERN WISCONSIN

Recruit tomorrow’s workforce

Changing the image of careers in manufacturing and the skilled trades in Wisconsin.

A PRODUCT OF

MADE AND BUILT IN NORTHEASTERN WISCONSIN 2020

WHAT IS IT?

STUFF BLOWN UP page 14 Featuring Two Creeks Solar Park

WHO MAKES IT?

COST OF LIVING page 16 Personal budgets and fi nding a salary that works for you

COULD I MAKE A CAREER OF THIS?

CHECK OUT JOB PROFILES - PGS 29-39 TO LEARN ABOUT CAREER OPPORTUNITIES!

FC-BC STUFF NE WI 2020 All Editorial Pages.indd 1 2/28/20 4:24 PM

2019 Association Partner:

STATE OF WISCONSIN

Space reservations now open for STUFF Southeast

Participate in the 4th annual edition of STUFF Made & Built in SE Wisconsin to raise awareness and recruit employees – going directly to junior high, high school and college students as well as workforce centers throughout the region.

Southeast Edition: Publishes: August 2020 | Space Reservation: June 24

To reserve a profile, biztimes.com/stuff Contact Linda Crawford today at advertise@biztimes.com or 414-336-7112

Thank you to our 2019/2020 STUFF profile participants! THESE COMPANIES ARE HIRING!

A rendering of the 40,000-square-foot warehouse and office building planned for a site along I-43 in Glendale. .

New interest boosts long-planned project at prime I-43 site

REDGRAPHX LLC

IT IS NOT UNCOMMON for development projects to take a long time to move from the planning stage to completion, but it’s been nearly 15 years since Brian Monroe first started laying the groundwork for a development on a prime site along Interstate 43, in Glendale. The project has taken a few big steps recently and Monroe now says the first building is set to break ground this year. Monroe, managing partner of Mequon-based Earthbound Development LLC, controls a 5.4-acre parcel east of I-43 and a 16.9-acre site to the west. The land is situated north of Capitol Drive, between Green Bay Avenue and Port Washington Road.

A small portion of the site is actually in the city of Milwaukee, but the majority is in Glendale. The property owner is the Monroe-led Glendale Partners LLC.

At the eastern parcel, Monroe will develop a multi-tenant, 40,000-square-foot warehouse and office building. Monroe said he has serious interest from a tenant for 16,000 square feet, but wouldn’t name them until plans are final. The plan is to seek approvals from Glendale officials in May. Construction could commence shortly after approvals are granted, with completion slated for the end of this year or early 2021.

The larger parcel to the west, meanwhile, can accommodate a nearly 150,000-square-foot building. The site has recently drawn interest from a developer, he said.

FEATURED DEAL: FUTURE BUCYRUS CLUB BUILDING IN DOWNTOWN SOUTH MILWAUKEE

The city of South Milwaukee is the new owner of the building at 1919 12th Ave., which will soon be home to a banquet facility and museum.

Once occupied by Papa Luigi’s II restaurant and Salvatore’s Banquet Hall, the 26,000-squarefoot building was acquired from the former restaurant’s owners.

It will undergo a $3 million renovation to create the Bucyrus Club. Skyline Catering will run the banquet center, and the building will also house the South Milwaukee Industrial Museum. South Milwaukee Mayor Erik Brooks said the city’s goal is to eventually sell the building to Skyline. In the meantime, Skyline will be paying rent to the city.

This project will be coupled with the development of a city-owned public gathering space nearby, at 11th and Madison avenues. The two projects are receiving $2 million from the Bucyrus Foundation.

ADDRESS: 1919 12th Ave. BUYER: City of South Milwaukee SELLER: 1919 12th Ave LLC PRICE: $560,000

FIVE POINTS APARTMENT DEVELOPMENT

WORKSHOP ARCHITECTS

The city of Milwaukee has selected a team to develop a mixeduse building at a city-owned site, located at 3317-3349 N. Dr. Martin Luther King Jr. Drive, in the Five Points neighborhood.

Plans for the site include 57 housing units and a total of 12,000 square feet of commercial space. Drawings also depict a basketball court and playground. Plans for the commercial portion include a large makerspace and an area that can be divided into multiple “micro-retail” spaces, said Anthony Kazee of KG Development, a project co-developer.

Construction could begin in summer 2021, depending on whether the project is awarded low-income tax credits from the state, Kazee said.

DEVELOPERS: KG Development and Martin Luther King Economic Development Corp. SIZE: 75,350 square feet COST: $12.9 million

Small Business Awards Breakfast

7:00am – 9:45am // Milwaukee Marriott West – Waukesha May 8 th

, 2020

Event Sponsors

PREFERRED TABLES • Ixonia Bank • Waterstone Bank

18 / BizTimes Milwaukee MARCH 16, 2020 The vision for a development at the site first started with Monroe acquiring land in 2005. However, it is recent tenant and developer interest that could result in shovels in the ground in 2020.

Other events helping the project move forward include the funding of I-43 improvements last year, an extension in February from the Wisconsin Economic Development Corp. of a 2018 idle industrial site grant for $435,000 and Glendale approval of a new certified survey map for the site in January.

Monroe said his development will only benefit from the freeway project.

As part of I-43 rehabilitation work from Capitol Drive to Hampton Avenue, the Wisconsin Department of Transportation will remove the 57-year-old bridge that currently runs through the site, which will lower the roadway. Dan Sellers, a WisDOT spokesman, said the stretch of roadway will be the same height as it is now coming off the Capitol Drive interchange, and will slowly drop down as it heads north.

“Through much analysis, the department has determined that removing the bridge and building an earthen fill section with retaining walls is much more costeffective,” Sellers said in an email. Monroe said the end result will “greatly enhance” the development site’s visibility for the 95,000-plus vehicles that use I-43 daily.

WisDOT expects to begin construction work in 2021. It also plans to rebuild and expand a section of freeway to the north, starting at Silver Spring Drive.

Beyond these recent events, the site had to come a long way before Monroe could even ready detailed building plans. In fact, Monroe said Glendale officials “shook their heads” at some of the challenges when they first looked at the site about 20 years ago.

The project started with the acquisition of 19.5 acres from Chicago-based CMC Heartland Partners in November 2005. In the years following, Glendale Partners has worked to assemble and reconfigure the site, in part by making land swaps with neighboring landowners. The assemblage included acquiring a former rail line and incorporating part of it into the larger development site, giving it better access to Port Washington Road.

In all, Monroe completed eight different transactions to come up with the site that exists today.

Then there was the matter of getting permission from the U.S. Army Corps of Engineers and the state to fill existing wetlands, which he said was a six-year process on its own.

But the payoff will be the development of the last large piece of vacant land in Glendale, said city administrator Rachel Safstrom.

“This has some potential to definitely have prime development,” she said, noting it is the first Glendale property travelers see when heading north along the freeway.

Of course, the project hasn’t cleared all hurdles yet. It still needs final approvals from the city. But in reaching this far, Monroe noted his fortune in working with local officials and neighbors.

“It has been a long time coming,” Safstrom said. n

ALEX ZANK Reporter P / 414-336-7116 E / alex.zank@biztimes.com T / @AlexZank

Thursday, March 12th, 2020 7:00 - 11:00 AM | Milwaukee Marriott Downtown

Messages from our event sponsors:

Founded in 1834, Old National Bank (ONB) is a midwestern-focused community bank operating in six states with over $20 Billion in assets. When you work with ONB, you’ll have a deep bench of advisors who guide closely held companies for the long-term. Clients also benefit from the Old National Bank Center for Closely Held Business at Butler University’s Lacey Business School. A true community bank, we are one of only two US-based banks recognized as one of The World’s Most Ethical Companies ® - now for eight consecutive years. We’re also recognized as a Leading Disability Employer and Best Bank to Work. We know you have many choices when it comes to banking. That’s why the expertise, ethics and committed community members make all the difference at Old National Bank.

Thank you, Kevin Anderson Community Executive and Commercial Banking President

Event Partner: Reinhart Boerner Van Deuren is pleased to sponsor the BizTimes M&A Forum and contribute our perspective and insights to the rapidly evolving conversation surrounding mergers & acquisitions in today’s dynamic economy. Our attorneys are adept at managing the complex considerations that arise in the process of planning for and completing an M&A transaction, including regulatory, antitrust, business reorganization, banking, labor and employment, real estate, employee benefits, trusts and estates and tax issues. We are deal makers and problem solvers who have the experience, insight and connections to help you achieve your goals and add value at any stage in the life of your business or venture.

Sincerely, Jerry Janzer CEO Reinhart Boerner Van Deuren s.c. Taureau Group is pleased to sponsor the 2020 BizTimes M&A Forum. Moving into the new decade, we continue to see a strong M&A market but also face a year of questions, including coronavirus, tariffs, global economies, and, of course, the presidential election. While we here in Milwaukee focus on building our businesses in a strong manufacturing environment, we look forward to exploring topics around global growth dynamics and how mergers and acquisitions can lead or enhance such an objective. Taureau Group is an independent investment bank providing merger and acquisition services to middle-market companies. Principals have 100+ years of collective M&A experience and have successfully completed hundreds of transactions worth billions of dollars of aggregate value. M&A deals are complex, and you need an advisor with the experience and determination to realize the best outcome. To achieve this, Taureau Group conducts the right process, finds the right buyers/targets, and negotiates the right terms. We would be honored to talk to you about your transaction.

Thank you, Ann Hanna & Corey Vanderpoel Managing Directors & Owners Taureau Group

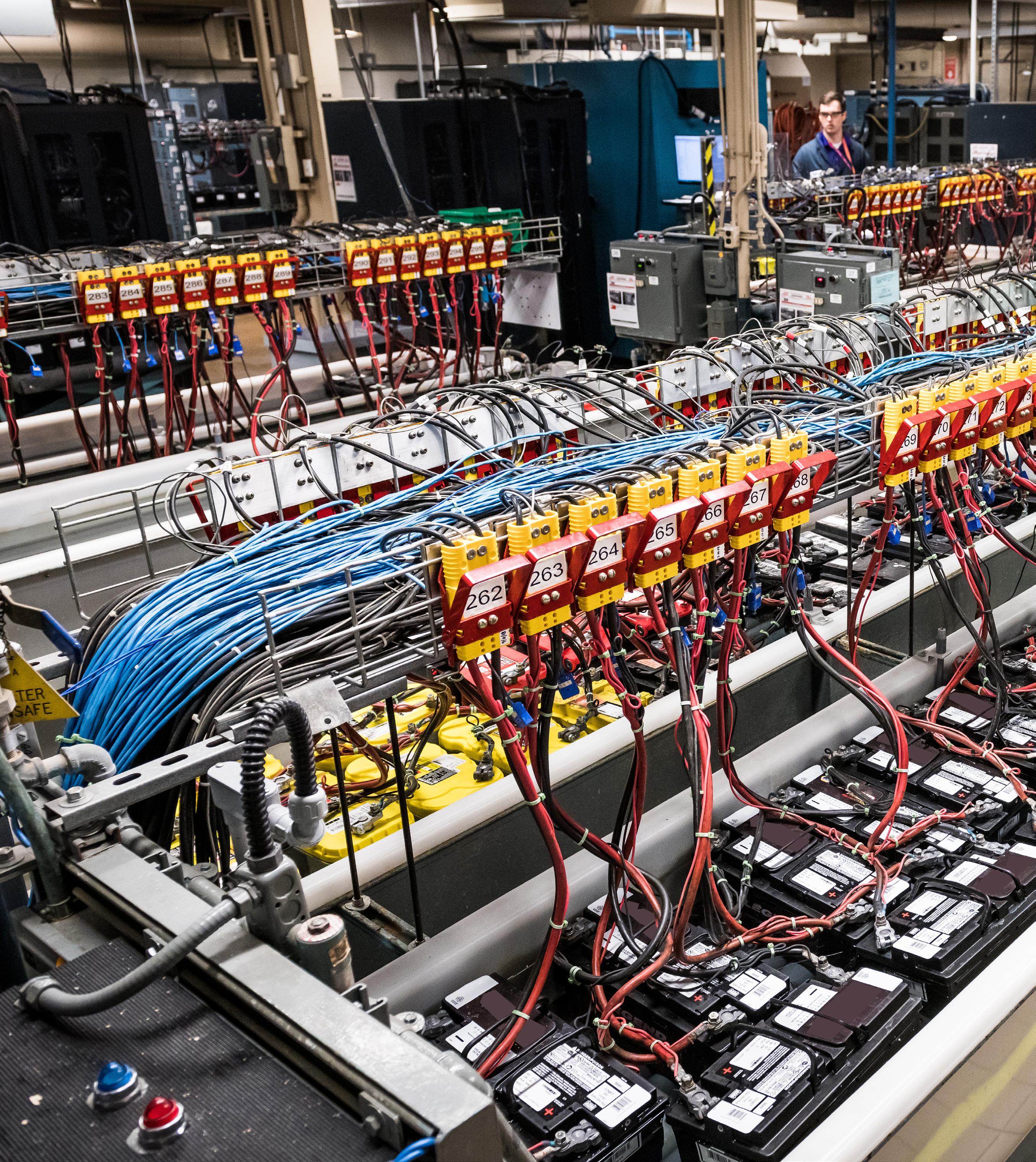

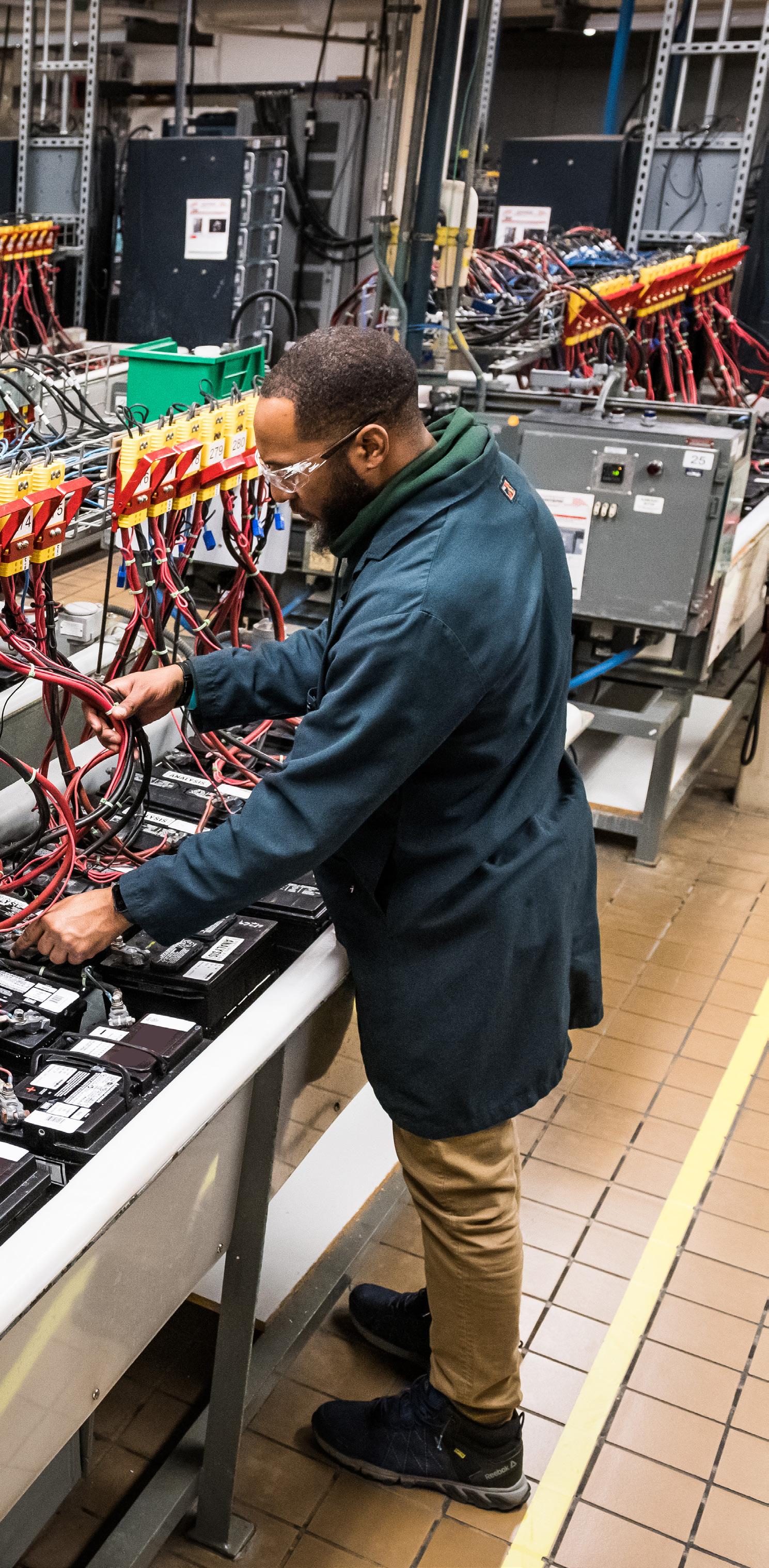

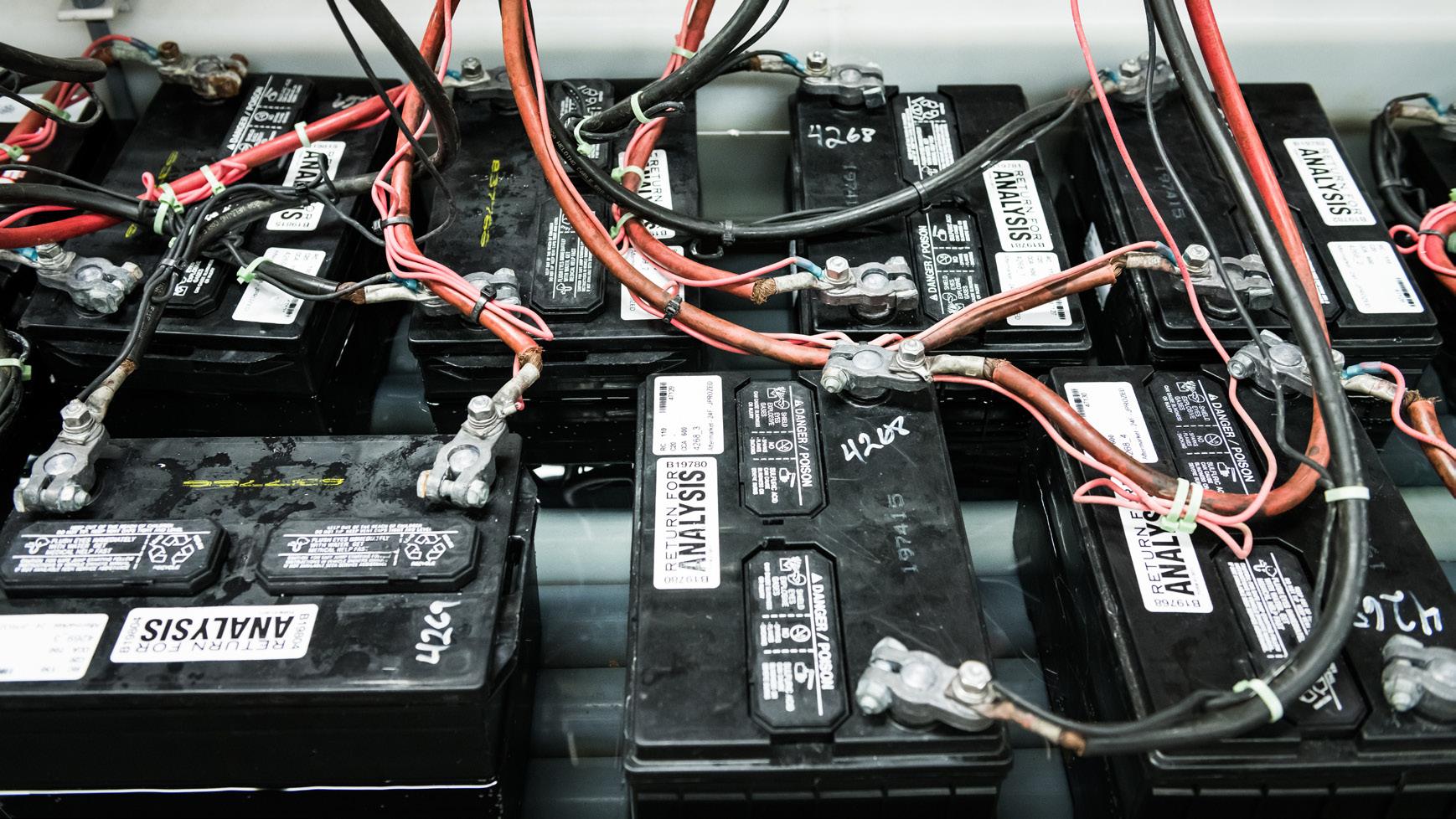

BY BRANDON ANDEREGG, staff writer undreds of car batteries are submerged in water on any given day inside the battery lab at Clarios, an automotive battery manufacturer based in Glendale. While it might seem unusual, it’s a method used to measure a 12-volt battery’s capacity, electrical testing and its initial current capability. Some baths are set to room temperature while others are raised to as high as 70 degrees Celsius to simulate the conditions under the hood of a vehicle, said Jason Fuhr, Clarios engineering director.

“By raising the temperature, we’re able to accelerate the life of the battery and understand their performance,” Fuhr said. “Even still, you’re accelerating it but you’re talking about months to years.”

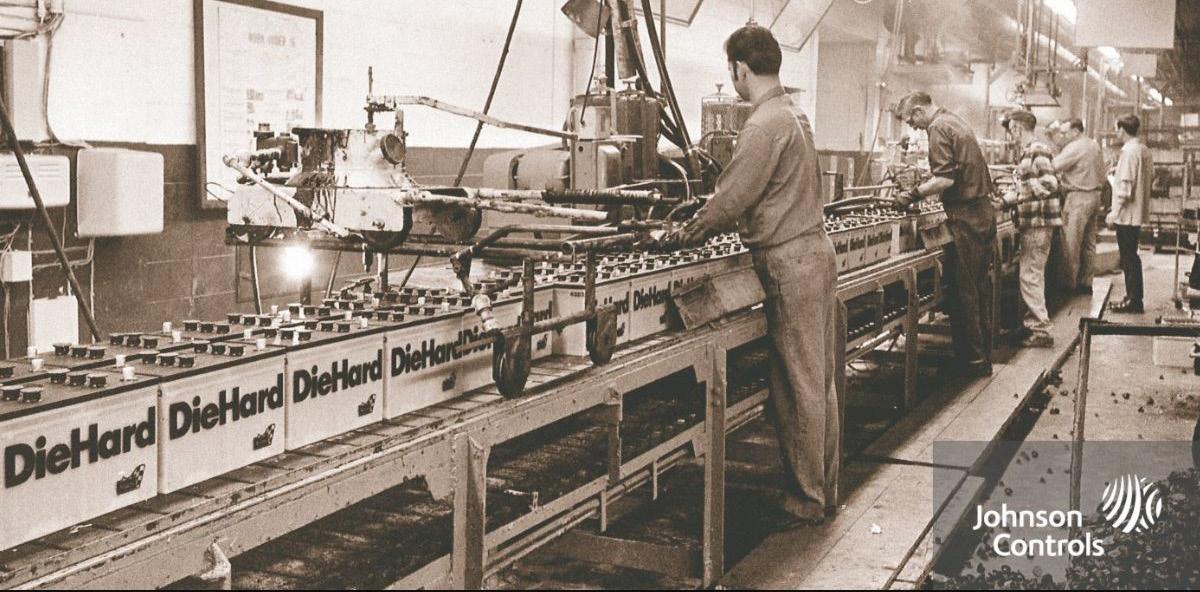

That’s because controlling and managing water temperature is a lot easier than air, allowing engineers and scientists to test the failure modes of batteries at a faster rate. Months to years is a considerably shorter timeframe when compared to the five- to seven-year life expectancy of a battery, Fuhr said. Clarios, formerly known as Johnson Controls Power Solutions, is the world’s largest automotive battery manufacturer and also one the oldest in the U.S., with its lineage tracing back to Sears and Roebuck catalog issues of the early 1900s. H AFTER SPLIT FROM JCI, CLARIOS CHARTS COURSE IN EVOLVING INDUSTRY JAKE HILL PHOTOGRAPHY L E A D I N G T H E C HA RG E

CONTRIBUTED

1. Craig Rigby, vice president of technology at Clarios.

2. The Globe-Union offices at 5757 N. Green Bay Ave. in 1973.

3. Entrance to Clarios Florist Tower at 5757 N. Green Bay Ave.

4. A look inside a Globe-Union battery plant in 1970. GlobeUnion would become part of Johnson Controls in 1978.

Since splitting from Johnson Controls International plc in May of 2019, Clarios has largely operated quietly from its Glendale campus. Now almost a year old, the company faces an evolving auto industry as it heads into the next decade under new leadership. At the center of the company’s 277,700-squarefoot headquarters is a large (69,000-square-foot) and expensive research battery lab where Clarios analyzes, develops and tests its products. Although the lab is one of 10 around the globe, it has several capabilities unique to the facility.

“We have the ability within this facility to analyze, develop and test all of our battery technologies – kind of leading the way towards new products in the market as well as the products our customers are asking for today,” Fuhr said.

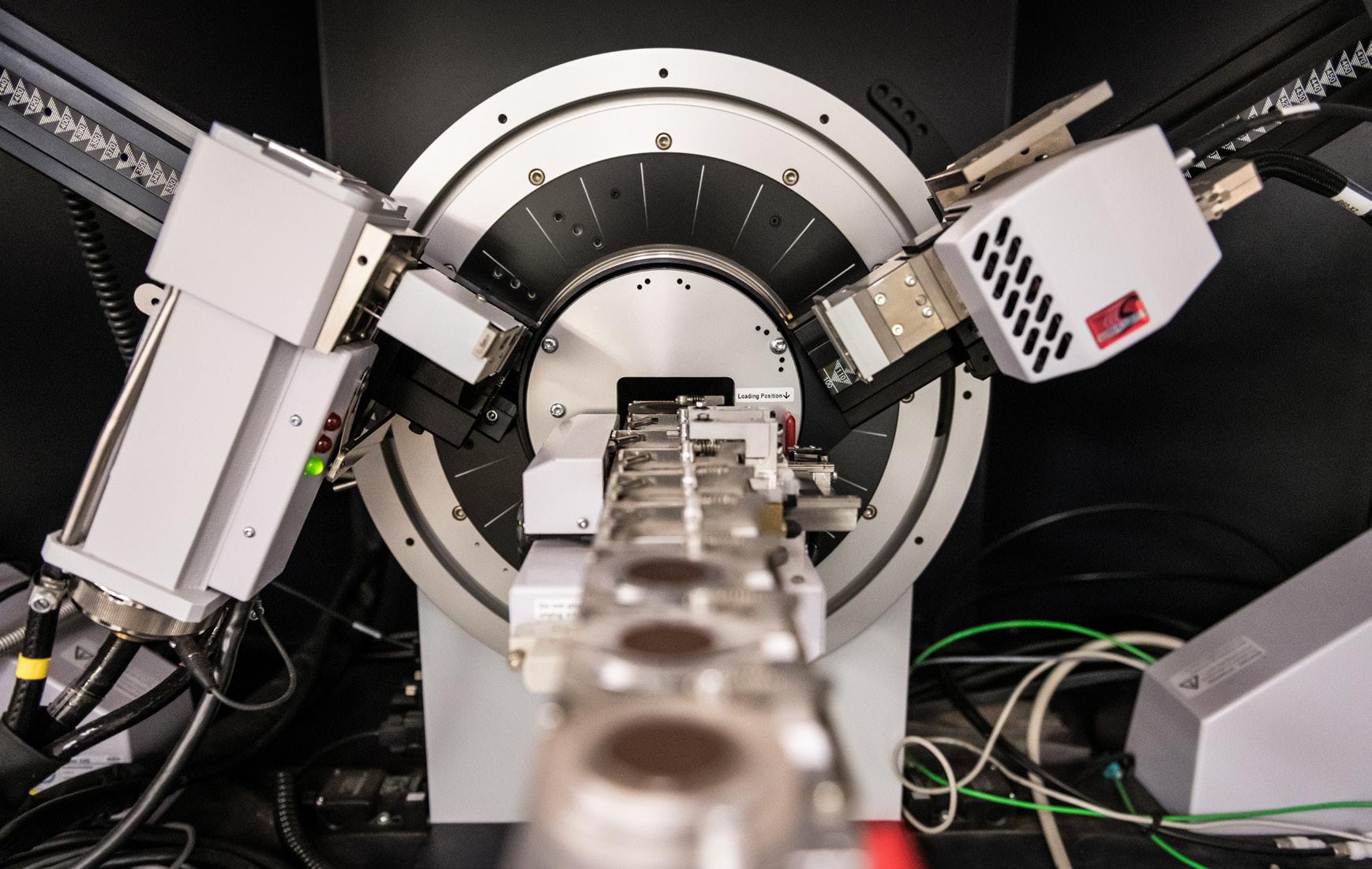

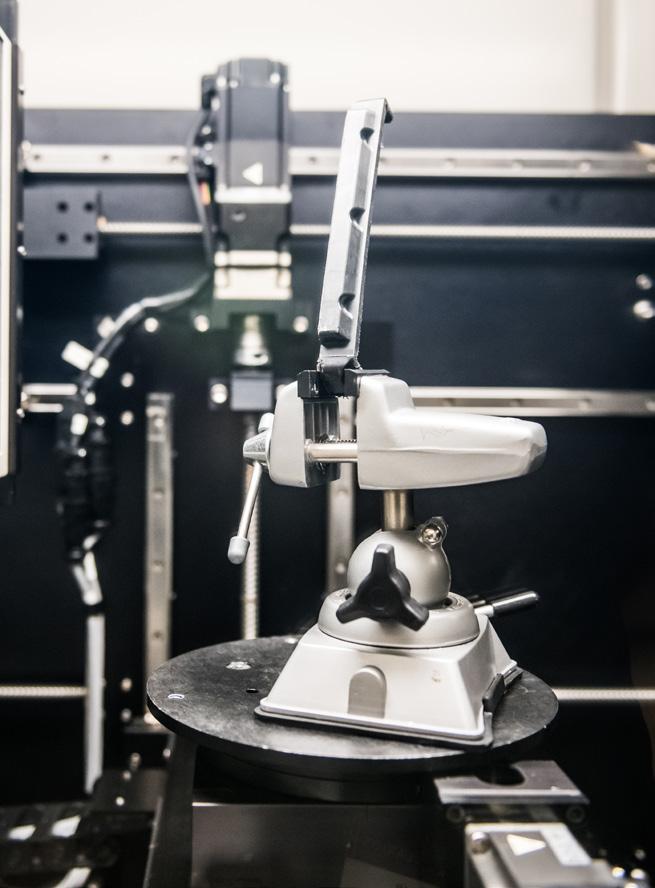

Scientists in the lab can conduct organic analysis or chromatography, which is the study of gases produced by chemical reactions within a battery. The battery lab is equipped with a Scanning Electron Microscope, which enables scientists to image small particle structures.

Clarios also has a vehicle lab where engineers conduct benchmark testing of its batteries on the newest vehicle models to understand how and if products meet the needs of auto manufacturers.

However, one of the company’s most essential testing tools is its CT scanner, which provides a non-destructive way of getting an inside look to understand how a battery may have failed. Clarios uses a lot of injection molding parts, so the CT scanner can locate voids in components, which can improve their own manufacturing processes and

2

1

that of their suppliers, Fuhr said.

“That has been really powerful with our customers because we may be able to go in and find something that historically our competitors would not be able to identify,” Fuhr said.

Clarios has a robust portfolio of battery technologies designed to power virtually every type of passenger, commercial and recreational vehicle, from conventional to fully electric. Its primary customers are global automakers, wholesale distributors, auto retailers and big box stores. In May 2019, JCI completed its $13.2 billion sale of its power solutions business to Brookfield Business Partners, a Canadian private equity firm, and Caisse de dépôt et placement du Québec, an institutional investor that manages public pension plans in Quebec.

In fiscal 2018, then Power Solutions generated approximately $8 billion in annual revenue and produced about 150 million batteries each year. The company now has 16,000 employees across 50 manufacturing, distribution and recycling locations

with 500 employees at its headquarters in Glendale. The brand of the company was changed throughout the facility overnight to reflect the new name, which former Clarios president Joe Walicki said is “about the idea that our path going forward is clear,” he previously told reporters on a call following the sale.

Clarios’ headquarters remains on the same corporate campus as Johnson Controls and although new security measures have been added to separate the two businesses’ operations, they still share some services, including a gym, a cafeteria and nurses’ station.

Walicki was named president and CEO following the sale, however, he retired in December 2019 after more than three decades with Johnson Controls. Clarios is currently led by Brookfield Business Partners executive John Barkhouse, who is interim CEO and also the board chairman.

The company has yet to replace its CEO, but expects to name a new leader in the coming months, Clarios spokeswoman Kari Pfisterer said.

Leading up to the sale, public equity investors had a difficult time valuing JCI’s Power Solutions business, said Timothy Wojs, Baird general industrial senior research analyst.

4

“On the one hand, you had a largely replacement-oriented legacy business around lead-acid batteries, where Power Solutions had a market leading position and that provided a fairly nice recurring revenue business,” Wojs said.

On the other hand, the ongoing transition toward hybrid and electric vehicles, which would require significant investments in new technology, could pose a threat to the legacy business over a longer period of time.

JCI pursued a strategic alternative for the business, ultimately selling it to BBP to focus on its core buildings business, Wojs said.

“It’s fairly consistent with what we’re seeing in the industrial world overall,” Wojs said. “This theme of deconglomeratization, where the sum of a company’s parts winds up being more valuable than the combined company, so it makes sense to split them apart.”

Although BBP manages a relatively diverse array of businesses, it is primarily focused on industrial and business service companies. Through

6

PHOTOS BY JAKE HILL PHOTOGRAPHY

5

7

this lens, the acquisition is aligned with the firm’s investment mandate, said Devin Dodge, BMO Capital Markets equity research analyst.

“What makes Clarios a bit unique versus its other investments was the size of the investment and (it) highlights the scale advantage of BBP relative to many other private equity firms,” Dodge said.

Dodge believes a number of factors led BBP to acquire Power Solutions, including its leading global market position, high barriers to entry and steady demand profile given that most if its sales are from the aftermarket.

However, under Johnson Control’s ownership, Power Solutions had fallen short of management’s targeted margin and profitability improvement, Dodge said.

“We suspect that the battery business may not have received the capital and management attention that it required, particularly in U.S. operations,” Dodge said.

Craig Rigby, vice president of technology at Clarios, described the transaction as atypical in terms of private equity acquisitions.

“Based on the results, Clarios was already a strong company,” Rigby said. “This wasn’t a turnaround situation in the sense that a lot of private equity things can be.”

Rigby said the transition has been positive, adding that BBP has given Clarios the freedom to consider how to add value to the company and how it should be run.

“They challenge us in many ways in which we weren’t being challenged before,” Rigby said. “Not only in our execution, but also in the way we think about the nature of the business and stretching into areas that maybe we wouldn’t have before.”

Johnson Controls’ Power Solutions business was born from JCI’s acquisition of Milwaukee-based Globe-Union Manufacturing Company, which long held the title as the largest automotive battery manufacturer in the world before becoming a JCI subsidiary.

Globe’s original business, which dated back to 1911, was manufacturing lighting equipment for farm, street and railway use. As the lighting equipment business dwindled in the early 1920s, the company switched gears to the production of automobile batteries, according to Johnson Controls’ website.

Globe was convinced the future was in automobiles, so the company negotiated a contract with Sears to provide batteries for its catalog business in 1924. A year later, Globe needed to meet the demand for batteries, so a company executive formed the Union Battery Company of Chicago.

The operations of Globe Electric and Union Battery were consolidated in 1929 to form GlobeUnion Manufacturing Company.

In 1978, Johnson Controls acquired GlobeUnion, Inc., becoming a leading domestic manufacturer of automotive batteries for the United States replacement market and the combined domestic replacement and original equipment market.

Around 2008, then JCI Power Solutions responded to a change in the automotive industry,

YOUR BANK FOR BUSINESS.

What’s Next. It’s not a question. It’s a plan.

Business banking isn’t just about the day-to-day transactions. It’s about preparing you for what’s ahead. It’s about finding trustworthy financial experts to help navigate the journey, and all the changes along the way. It’s about having the strength, stability and ethics of a dedicated banking partner in your corner—one who believes in your vision.

It’s about your goals and your future. It’s about what’s next. And it’s about you.

Let’s find solutions that work for your business. oldnational.com/business

Proud to Sponsor the M&A Forum oldnational.com/business | Member FDIC

in which certain parts of the world, such as Europe, saw tighter environmental regulations. Auto manufacturers were required to reduce emissions and improve fuel efficiency, and began implementing new technologies to meet their needs, such as “start-stop,” a feature that temporarily turns off a vehicle at a red light rather than sitting idle.

While certain types of lead-acid batteries can power a vehicle with start-stop capabilities, others are not equipped to do so over a long period of time. The composition of traditional lead-acid batteries is such that to charge and recharge the battery frequently (turning a car on and off) would considerably reduce the battery’s lifespan, Rigby said.

As auto manufacturers increase the complexity of vehicles, adding both computer technology and new features, Clarios has to follow suit, innovating its products to meet vehicle electrification and stringent fuel economy requirements.

“That has really forced us to develop a broader range of products that have evolved from the traditional starter battery to things like Absorbent Glass Mat or enhanced battery technology, which improve the capability to support things like startstop,” Rigby said.

It may seem counterintuitive to place so much emphasis on lead-acid battery technology as opposed to, for example, lithium ion technology, which is used as the primary source of power in electric vehicles. But Rigby says vehicle electrification is not happening as fast as it may appear, adding that large format lithium ion batteries have their challenges.

“The challenge on the larger format batteries, to be blunt, it’s a slowly evolving market despite all of the hype and all the articles about how everything’s changing,” Rigby said. “It is changing, but it’s changing much slower than what people think.” In 2019, a total of 17 million vehicles were sold in the U.S., compared to approximately 1.5 million EVs on the road total, according to the Edison Electric Institute, an association representing all U.S. investor-owned electric companies.

However, EVs are expected to grow in popularity over the next decade. By 2030, the number of EVs on U.S. roads will reach more than 18 million – or 7% of the 259 million vehicles (cars and light trucks) expected to be on U.S. roads in 2030, according to the EEI.

Still, Clarios is not betting all of its chips on the apparent shift to EVs. Instead, the company is doubling down on the growing demand for two emerging technologies in lead-acid. The first is Absorbent Glass Mat (AGM), which can support start-stop technology, and the second is enhanced flooded battery, which is built for an extended life and with a larger number of charging cycles.

“The reality is that 90% of the vehicles produced every year are still relying on engines and traditional battery or AGM battery technology to enable their power needs,” Rigby said.

A primary reason for the continued high demand for lead-acid products is that almost all EVs, whether Tesla, Ford, GM or BMW, have a large format lithium ion battery coupled with a 12-volt lead-acid battery and in many cases, an AGM battery produced by Clarios, Rigby said.

When a person walks back to their car, hits the remote and the car “wakes up,” the high voltage lithium ion battery of an EV still isn’t on; all that power is coming from a 12-volt battery. In EVs, it’s the 12-volt battery’s responsibility to both jumpstart the high-voltage battery to run the vehicle and at the same time, serve as its backup in case of malfunction.

“Even though one’s very big and, frankly, expensive and one’s much smaller, there’s a symbiotic relationship between what the 12-volt battery does to enable the high voltage battery,” Rigby said.

A lot of weight is placed on the reliability of lead-acid products and as vehicle manufacturers see advancements in technology, like autonomous vehicles, their role only becomes more significant. In the case of autonomous vehicles, it’s critical to ensure there is sufficient power. If there’s a malfunction, you can no longer count on the driver to bring the vehicle to the side of the road, he said.

We’re looking for companies who have their sights set on success.

APPLY TODAY FOR THE MMAC/COSBE FUTURE 50 AWARD!

VISIT MMAC.ORG/F50.HTML BY MARCH 13, 2020

The Future 50 Awards Program is a service of the Metropolitan Milwaukee Association of Commerce (MMAC) and its Council of Small Business Executives (COSBE).

Presenting Sponsor Media Partner For more info, contact Karen Powell at 414-287-4166 or kpowell@mmac.org

Our clients know. We get even the most complex deals done quickly and cost-effectively.

We leverage the collective experience, contacts and market insights of our attorneys to locate strategic partners, connect prospective purchasers and sellers, arrange necessary financing and negotiate the most favorable results for our clients.

reinhartlaw.com · 414.298.1000 MILWAUKEE · MADISON · WAUKESHA · CHICAGO · ROCKFORD · MINNEAPOLIS · DENVER · PHOENIX

“We don’t worry about the shift to EVs, to be honest with you, because we’re still going to sell our core products into those applications,” Rigby said. “It’s really about managing that transition with our customers in terms of how their needs evolve.”

At the same time, Clarios is exploring another segment of the low-voltage electrification space through a partnership with Toshiba. Together, the companies produce a dual-volt battery solution by pairing an AGM battery with a 12-volt lithium ion battery. The lithium ion part of the system powers vehicle functions, but doesn’t start the vehicle.

Despite its partnership with Toshiba, Clarios believes its lead-acid products can reach the same efficiency levels without the help of lithium ion technology, Rigby said.

“Even though it’s a small lithium battery, it’s not inexpensive; it’s still a challenging technology from a price perspective and a consumer perspective,” Rigby said. “If we can get 80% to 90% of that benefit with an improved lead-acid battery, that’s a much better value proposition to automakers and ultimately to consumers.”

Although Rigby doesn’t see the automotive battery industry through the lens of “lithium ion versus lead-acid,” Clarios prides itself on the closedloop circular economy of lead-acid battery prodBatteries that are slated to be tested in Clarios’ battery lab.

ucts in the U.S. In fact, 99% of lead-acid batteries in the U.S. are recovered and recycled, according to the Responsible Battery Coalition, a group focused on implementing sustainability metrics and tools for battery life-cycle management.

“When someone buys a new battery, that old battery goes into the system and is recovered, it’s processed through recycling and then 97% of the material in that battery is repurposed,” Rigby said. The lead is used to make more automotive batteries, the plastic is used to make new battery cases and the sodium sulfate is sold as a commodity and used in a variety of other industries such as glass manufacturing, detergent manufacturing

and paper pulping.

Clarios is a founding member of the RBC, which was established in 2017. As an automotive battery manufacturer, the company has adopted a philosophy to critically think about what it means to manage both its materials and products through their entire life cycle, Rigby said.

“As new technologies come to market, be it lithium ion, lead-acid or any new battery technologies, we should have the philosophy that if you can do it with lead-acid, you can do it anywhere,” Rigby said. “No battery should avoid being responsibly managed through its life cycle to the greatest extent possible.” n

NOMINATIONS OPEN FOR

NOTABLE RESIDENTIAL REAL ESTATE AGENTS

BizTimes Milwaukee is launching the BizTimes Media’s 2020 Notable Residential Real Estate Agents feature in the June 8 issue of BizTimes Milwaukee. This special editorial feature will profile residential real estate agents in the Milwaukee area. Your company, and its executives, are invited to submit a nomination that will help us determine this year’s honorees. The special section will run in print and online, recognizing the chosen individuals for their leadership and accomplishments.

Experience...We have it.

Principals of Taureau Group have over 100 years of collective M&A experience and have completed hundreds of transactions worth billions of dollars of aggregate value. Our proven process to transact companies begins by understanding our clients’ objectives and then leveraging our research skills and proprietary network to identify the best partners for a transaction.

HAS MERGED WITH

A Portfolio Company of

Taureau Group, LLC advised The C.A. Lawton Co. on this transaction

Securities-related services were performed by an una liated broker-dealer, Burch & Company, Inc.

MANUFACTURING

HAS BEEN ACQUIRED BY

Taureau Group, LLC advised Leick Home on this transaction

CONSUMER PRODUCTS

A CONFIDENTIAL COMPANY

HAS BEEN ACQUIRED BY

HAS ACQUIRED THE NORTH DAKOTA ASSETS OF

HAS BEEN ACQUIRED BY

HAS BEEN RECAPITALIZED BY

Taureau Group, LLC advised the seller on this transaction

Securities-related services were performed by an una liated broker-dealer, Burch & Company, Inc.

MANUFACTURING

Taureau Group, LLC advised Moore Engineering, Inc. on this transaction

BUSINESS & INDUSTRIAL SERVICES

Taureau Group, LLC advised Bradshaw Medical Inc. on this transaction

Securities-related services were performed by an una liated broker-dealer, Burch & Company, Inc.

MANUFACTURING

Taureau Group advised Color Craft Graphic Arts on this transaction

Securities-related services were performed by an una liated broker-dealer, Burch & Company, Inc.

PACKAGING & PAPER

To learn how Taureau Group can help, call 414-465-5555 or visit taureaugroup.com.

ANN HANNA

COREY VANDERPOEL

MIKE ERWIN TYLER CARLSON

MICHAEL SCHROEDER

BROCK CHILDERS

TOM VENNER TIM GRECI

TAMMY HALFMANN

FAITH GREENE

7Summits chief executive officer and founder Paul Stillmank.

7Summits CEO shares strategy behind company’s rapid growth

IMBUED IN THE FABRIC of Milwaukee-based 7Summits is the pun-intended phrase “shift happens,” an adage that chief executive officer Paul Stillmank said describes the company’s journey to becoming one of the fastest growing companies in America.

Stillmank, who founded 7Summits in 2009, built the Salesforce consulting firm on the premise that all kinds of organizations, both for-profit and nonprofit, would leverage online communities and data sets for growth. As a Salesforce platinum partner, the company uses data and predictive analytics to figure out where a business is stuck and how it can obtain more market share.

By 2012, 7Summits had $6 million in sales before reaching more than $11 million in 2013. That same year, the company received a growth equity investment from a private equity firm. In 2019, the company landed on the Inc. 5000 list for the fourth time in a decade. Today, the company has 200 employees across 30 states and works with companies internationally.

Stillmank recently spoke about his company’s success at BizTimes Media’s M&A Forum, an annual event that provides business leaders with insight and strategies to help them buy or sell a business. He advised the audience that companies seeking capital infusion, private equity partnerships or longer-term M&A outcomes should focus on scaling their company sustainably. BY BRANDON ANDEREGG, staff writer

Sustainable scale can be achieved through three core principles: a focused go-to market, a defined offering set and a predictable bookings motion, Stillmank said.

“You have to have a way of telling your story and going to market, but it can’t just stay the same; the market changes,” Stillmank said. “I’ve been doing this for 10 years and you can’t just keep saying the same thing.”

A focused go-to market not only means developing a story that clients can digest, but also a story that employees can deliver in a uniform way.

“We’ve built playbooks that help our teams go talk about what we sell and how a particular company in a particular industry can take advantage of it,” Stillmank said. “If you have a good go-to market and you have a very defined set of things you sell, your catalog, those are essential elements to build a business.”

Another early strategy Stillmank used was taking a snapshot of sales data every week and then building a historical picture of how his team’s sales data behaved over time. With this data, Stillmank can anticipate what sales will look like ahead of time and predict, for example, how long it will take a new hire to reach their quota.

“Not only are you growing leaps and bounds but you’ve got the data to tell me you’re going to keep doing it,” Stillmank said. “Not everybody has that so that’s why the predictable data piece is so important when you’re sitting in front of

M&A people.”

Over the past decade, 7Summits has had to reinvent itself, revamping its offering set and goto market to show that its strategies can be scaled and deployed for even the largest of companies. “We had to swap out the engine while this thing was in flight with a full team of folks with salaries and everything,” Stillmank said. “All these things were changing, but what held it together was the core tenets of the culture.” For Stillmank, culture isn’t just team-building activities and amenities in an office space. It’s ensuring that everyone on staff understands not only the company’s mission, but also its strategies for attracting clients, which leads back to his core principles.

“To me all of these things are cultural,” Stillmank said. “Core values, culture and purpose is all part of it. My entire staff understands this go-to market. They all live it, breath it, they all understand what it means to empower a customer or enable an employee.”

Stillmank began cultivating the company’s culture within the first two years of starting 7Summits. For example, he had the entire staff read the book “Mastering the Rockefeller Habits” and then applied those principles to shape important aspects of the company’s culture.

As a team, the company created a threeyear strategic plan and sized it down to annual, quarterly and even weekly priorities for the company and each individual. The entire team meets 15 minutes every day and for an hour each week to establish what Stillmank calls “a true rhythm to the business.”

When Stillmank started 7Summits, the first step he took was deciding to go “all in.” This meant investing a significant amount of money in the business, including hiring an accountant, a company to manage payroll and a law firm to formalize his business.

“A lot of times people are afraid to spend that money and take that big bite because you’re taking a risk,” Stillmank said. “But I believed in my idea.”

Fast forward four years, 7Summits was quickly growing and Stillmank needed to reassess how to manage his company’s growth. He also had a considerable amount of personal goals he wanted to achieve, including paying off his children’s college education and taking care of his son with autism.

He knew there were several routes 7Summits could take to maintain growth, such as venture capital, private equity or staying the course and growing from profits. Stillmank hired an attorney and a banker and consulted

7Summits senior vice president of experience design studio Bill O’Neil (left) and chief executive officer and founder Paul Stillmank.

with trusted executives from other companies to come up with a prospectus for his company. “To be honest with you, I would like to say

that I’m the smartest guy in the world that knew all of this, but I was peeling an onion,” Stillmank said. “I needed to go out to sample the market and see what’s possible here.”

7Summits ultimately partnered with San Francisco-based private equity firm Sverica International Management, LLC. Stillmank said he didn’t anticipate making that move when he started the company, but knew it was the right decision when the opportunity presented itself. “All of a sudden … a company is coming in and saying, ‘We really want you to stay and run this and grow it, but we’ll let you get some money off the table,’” Stillmank said. “But I maintained a major ownership stake with these new shareholders.”

Stillmank stressed the importance of doing thorough research before making these decisions. “There’s companies that are doing cool tech stuff in Milwaukee that don’t understand these steps and this is what this M&A Forum is about,” Stillmank said. “Do those individuals realize the value of what they’ve done and how that might turn into some private wealth for them and others?” n

Decades of Experience in Mergers and Acquisitions

has been sold to

a portfolio company of

SPECIALTY PACKAGING has acquired

PRECISION MACHINING has acquired

Moran Manufacturing and its subsidiaries

and

TRAILER MANUFACTURING

has acquired

TRANSPORTATION

has acquired

has been sold to

has acquired

a portfolio company of

has acquired

a portfolio company of

from National Coil Company

FOOD EQUIPMENT SPECIALTY PHARMACY THERMOFORMED PLASTICS INDUSTRIAL HVAC

See deal case studies and M&A whitepapers at bridgewoodadvisors.com

Strategic Acquisition Searches • Private Company Sales • Corporate Divestitures • M&A Negotiations DOUG MARCONNET Managing Director ROBERT JANSEN Managing Director ANNETTE KNOLL Vice President WARD WICKWIRE Senior Advisor

Andrea Bukacek

Sharad Chadha

Paul Grunau

Ryan Martin

Panelists share lessons from their own journeys at M&A Forum

GROWING UP around her family’s construction company, Andrea Bukacek always had a passion for the business she watched her grandfather and father build.

So, in September 2019, when she took over Racine-based Bukacek Construction Group Inc. as its third-generation owner and CEO, the acquisition was more than just a deal or transaction.

“I saw them take risks to move Bukacek Construction forward,” she said. “… I consider myself fortunate that I have been able to come home with the company that I grew up with.”

Bukacek Construction was founded in 1963 by Andrea’s grandfather, James Bukacek, and BY MAREDITHE MEYER, staff writer

was later owned by her father, Nick Bukacek. After 42 years of family ownership, Nick sold the company to his employees in 2001 and retired in 2005.

Andrea Bukacek bought the company last year from the employee stock ownership plan (ESOP) that bought it from her father.

The 2019 acquisition wasn’t the first time Andrea had the opportunity to buy back the family business. A few years prior, senior members of the ESOP were mapping out possible succession plans, knowing they needed to develop the next generation of leadership. Andrea and Nick considered re-joining, but the timing wasn’t right, she said.

B I Z T I m e S MKE PODCAST

A PODCAST ABOUT PEOPLE, ISSUES AND IDEAS.

The BizTimes MKE Podcast is designed to keep you informed and provide ideas and strategies to help improve your business. Each episode features thought-provoking insights and best practices from business and community leaders.

LISTEN EVERY WEEK ON:

CATCH UP ON RECENT EPISODES:

MARCH 9, 2020 David Lee | Leadership, development and arm wrestling advice

MARCH 2, 2020 James Hedrick | Developments in 3D printing

BIZTIMES.COM/PODCAST

FEBRUARY 24, 2020 Michael Sheppard | Driving diversity in financial services

“I always regretted not capitalizing on the opportunity, at that time,” she said. “Flash forward a few years later, and the opportunity presented itself again. This time, I knew I had to take it.”

Bukacek shared her business acquisition story as a panelist at the 13th annual BizTimes Media M&A Forum on March 12 at the Milwaukee Marriott Downtown hotel. The panel discussion included insights, perspectives and lessons learned from her and three other business leaders with a variety of experiences buying or selling a business.

One takeaway from Bukacek’s acquisition experience was the central role of the company’s employees during the deal process, and still today.

There was unanimous consent by all ESOP members to sell the company, which Bukacek said, was the “strongest endorsement anyone could have that the transition was the right direction forward,” both for her and the employees.

“The decision was made early on to maintain the current employee base,” she said.

For APi Group chief learning officer Paul Grunau, the way forward for his family’s business was letting go.

He and his wife Jeanie acquired Grunau Company Inc. from the Grunau family in 1999. The Oak Creek-based contracting firm was originally founded in 1920 by Paul’s great-grandfather.

Grunau sold the business to New Brighton, Minnesota-based APi Group in 2006, and stayed on as president for one year before joining APi as chief operating officer. As part of the deal, all 10 people on the Grunau Company’s leadership team signed five-year employment deals.

The decision to sell came at a prosperous time for Grunau Company. As personal guarantors of the business’s debt and bonds, the Grunaus couldn’t keep up with the amount of capital that needed to be borrowed to fund the company’s growth.

“We were going to become an obstacle for the company to grow, and did not want that,” Grunau said. “So, we looked for a partner that would respect the business and brand, and provide resources for us to grow and get better.”

Fourteen years later, the Grunau Company is more successful than it’s ever been, Grunau said. He gets to watch from a distance, remaining involved as an informal advisor and mentor to president Bill Ball and a number of employees.

“I try to be very mindful of giving the current leader space to lead the company,” he said.

The key to a successful buyer-seller relationship, especially when the original owners remain involved with the business, is a shared vision, said Ryan Martin, CEO of Midwest Composite Technologies.

The Hartland-based digital manufacturer was acquired by Chicago-based private equity firm CORE Industrial Partners in 2018. Up until it was acquired, MCT had been owned and operated by the Keidl family for 34 years. Chris Keidl and Toby Keidl remain involved as leaders, which was always part of the plan.

“The Keidl family wanted to partner with CORE to grow MCT through organic growth and acquisitions,” Martin said. “It was clear that Chris and Toby brought tremendous value to MCT’s next phase of growth, so we engaged them early in the process and made sure they were an instrumental part of the leadership team going forward.”

In the second half of last year, MCT made two acquisitions of its own: ICOMold, an Ohio-based company specializing in injection molding, and Fathom, an Oakland-based firm that combines additive and legacy manufacturing techniques.

Both acquisitions supported the original vision of growing MCT into a national player in additive manufacturing and enhancing the customer experience, said Martin. Taking a local business national was also what Sharad Chadha had in mind when he acquired Glendale-based Sprecher Brewing.

After founder Randy Sprecher told Chadha in late June that he planned to retire, Chadha quit his job at Samsung and spent the next seven months working on a deal that he originally thought would take about 60 days.

As CEO, Chadha leads an ownership group of prominent Milwaukee entrepreneurs including Andy Nunemaker, Peter Skanavis, owner of Homeowner Concept Realtors, and brewing industry veteran Jim Kanter, a former MillerCoors executive.

Putting together a credible team helped Chadha secure funding from Wauwatosa-based Silicon Pastures as an angel investor, West Bend-based Commerce State Bank, which funded the debt, and other local investors.

But Chadha also had to be prepared to tell his story and present a realistic plan for the venture.

“(Investors) look at three main things: Are you putting in your own money? Are you going to do it full time? Are your friends and family putting money into it?” he said. “If the answer of those three questions are good, then people will be more likely to listen.”

While the acquisition made headlines when it was announced in late January, Chadha believes the iconic local brand has not reached its full potential for national growth and recognition.

“It is my goal to make Sprecher the craft beverage icon of America,” he said.

Chadha also did his homework before the acquisition was final.

“I met with a lot of customers, networked and spoke with some key distributors and retail customers as well as brokers to ensure there is that potential and that this product has legs and can be taken to the next level,” he said. n

Considering a deal in 2020? We can help.

Wisconsin’s business leaders trust their strategic transactions to Godfrey & Kahn’s experienced M&A Team.

108 Corporate Transactions aggregate value of approximately $2.7 billion M&A transactions for a combined purchase price of over 69 $2.1 billion 2019 Deals